As filed with the U.S. Securities and Exchange Commission on April 23, 2021

Registration No. 333-253006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Protagenic Therapeutics, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | | 7389 | | 06-1390025 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S Employer Identification No.) |

149 Fifth Avenue

New York, New York 10010

Telephone: 212-994-8200

(Address, including zip code, and telephone number,

including area code, of principal executive offices)

Garo Armen

Executive Chairman

Protagenic Therapeutics, Inc.

149 Fifth Avenue

New York, New York 10010

Telephone: 212-994-8200

(Address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

| Dean M. Colucci, Esq. | | Sara L. Terheggen, Esq. |

| Michelle Geller, Esq. | | The NBD Group, Inc. |

| Kelly R. Carr, Esq. | | 350 N. Glendale Avenue, Ste B522 |

| Duane Morris LLP | | Glendale, California 91206 |

1540 Broadway New York, NY 10036 | | Telephone: (310) 890-0110 |

| Telephone: (973) 424-2020 | | |

Approximate date of proposed sale to public: As soon as practicable on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and smaller reporting company’ in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated filer | [ ] | Accelerated filer [ ] |

| | | |

| Non-accelerated filer | [ ] | Smaller reporting company [X] |

| (Do not check is a smaller reporting company) | Emerging Growth Company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate Offering Price (1)(2) | | | Amount of Registration Fee (3) | |

| Units consisting of: | | | | | | | | |

| (i) Common Stock, par value $0.0001 per share | | $ | 12,750,000 | | | $ | 1391.02 | |

| (ii) one Warrant to purchase one share of common stock, par value $0.0001 per share (4) | | $ | | | | | | |

| Shares of common stock, par value $0.0001 per share underlying warrants | | $ | 13,197,000 | | | $ | 1439.79 | |

| Total Registration Fee | | | | | | | 2,830.81 | |

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of Units that may be purchased by the underwriters pursuant to their option. |

| (3) | The Company previously paid a registration fee of 3,293.46 in connection with a prior filing of the Registration Statement. |

| (4) | In accordance with Rule 457(i) under the Securities Act, no separate registration fee is required with respect to the warrants registered hereby. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED April 23, 2021

2,650,000 Units

Each unit of consisting of one share of Common Stock and one Warrant to Purchase one share of Common Stock

This is a firm commitment public offering of 2,650,000 units, each unit consisting of one share of our common stock and one warrant, for a total of 2,650,000 shares of our common stock and 2,650,000 warrants to purchase up to an aggregate 2,650,000 shares of our common stock. The units have no stand-alone rights and will not be certified or issued as stand-alone securities. Each share of our common stock is being sold together with a warrant to purchase one share of our common stock. Each warrant is exercisable to purchase one share of common stock at an exercise price of $4.98 per share (120% of the public offering price of the unit). The warrants will be exercisable at any time from the date of issuance through the fifth anniversary of the date of this prospectus, unless earlier redeemed. Beginning 90 days after the date of this prospectus, the warrants will be redeemable at our option, in whole or in part, at a redemption price equal to $0.025 per warrant upon 30 days’ prior written notice, at any time after the date on which the closing price of our Common Stock has equaled or exceeded $7.26 per share (175% of the public offering price of the units) for at least five consecutive trading days. The shares of our Common Stock and the warrants are immediately separable and will be issued and tradeable separately, but will be purchased together as a unit in this offering.

Our common stock currently trades on the OTCQB, where it is listed under the symbol “PTIX.” As of April 19, 2021, the last sale price of our common stock as reported on OTCQB was $4.82 per share. We currently estimate that the per unit public offering price will be between $4.13 and $4.17. We have assumed a per-unit public offering price of $4.15, which is the midpoint of the estimated public offering price range. There is a limited public trading market for our common stock. The final public offering price will be determined through negotiation between us and the underwriters in the offering and will take into account the recent market price of our common stock, the general condition of the securities market at the time of the offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The assumed public offering price used throughout this prospectus may not be indicative of the actual offering price. Prior to this offering, there has been no public market for our warrants on the OTC Markets or any other trading market. Prices of our common stock as reported on the OTCQB may not be indicative of the prices of our common stock if our common stock were traded on Nasdaq. We have applied to list our common stock and warrants on the Nasdaq Capital Market, under the symbol “PTIX”and “PTIXW”, respectively.

We believe that upon completion of the offering contemplated by this prospectus, we will meet the standards for listing on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing our common stock on the Nasdaq Capital Market.

We are a “smaller reporting company” under applicable Securities and Exchange Commission rules and are subject to reduced public company reporting requirements for this prospectus and future filings.

Our business and an investment in our common stock involve significant risks. Please see “Risk factors” beginning on page 10 of this prospectus.

| | | | Per Unit | | | | Total | |

| Public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| Proceeds to Protagenic, before expenses | | $ | | | | $ | | |

| (1) | Does not include a non-accountable expense allowance equal to 1.0% of gross proceeds of this offering payable to the representative of the underwriters. The underwriters will also receive compensation in addition to the underwriting discount, including shares of common stock to be issued to the representative of the underwriters, which we refer to herein as the “representative shares.” See “Underwriting” on page 76 of this prospectus for a description of the compensation arrangements. |

The Company has granted the underwriters an option for a period of 45 days to purchase up to an additional 397,500 units from us at the public offering price, less the underwriting discount.

The underwriters expect to deliver the units to investors on or about , 2021.

Sole Book-Running Manager

KINGSWOOD CAPITAL MARKETS

division of Benchmark Investments, Inc.

Co-Manager

BROOKLINE CAPITAL MARKETS

a division of Arcadia Securities, LLC

The date of this prospectus is , 2021

TABLE OF CONTENTS

Neither we, nor the underwriters have authorized anyone to provide you with information other than that contained in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This is an offer to sell only in jurisdictions where it is lawful to do so. The information contained in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or warrants or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements, which involve risks and uncertainties. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “project,” “anticipate,” “expect,” “seek,” “predict,” “continue,” “possible,” “intend,” “may,” “might,” “will,” “could,” would” or “should” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our product candidates, research and development, commercialization objectives, prospects, strategies, the industry in which we operate and potential collaborations. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date of this prospectus. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the Securities Exchange Commission, or SEC, as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. All forward-looking statements are based upon information available to us on the date of this prospectus. The factors set forth below under “Risk Factors” and other cautionary statements made in this prospectus should be read and understood as being applicable to all related forward-looking statements wherever they appear in this prospectus.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition, business and prospects may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition, business and prospects are consistent with the forward-looking statements contained in this prospectus, those results may not be indicative of results in subsequent periods. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus.

RISK FACTOR SUMMARY

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under “Risk Factors” in this Registration Statement. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider carefully the risks and uncertainties described under “Risk Factors” of this Registration Statement as part of your evaluation of the risks associated with an investment in our securities.

Risks Related to Our Financial Condition and Capital Requirements

● The Company’s financial statements have been prepared on a going concern basis, and do not include adjustments that might be necessary if the Company is unable to continue as a going concern.

● If we continue to incur operating losses and fail to obtain the capital necessary to fund our operations, we will be unable to advance our development programs, complete our clinical trials, or bring products to market, or may be forced to reduce or cease operations entirely. In addition, any capital obtained by us may be obtained on terms that are unfavorable to us, our investors, or both.

● Unstable market and economic conditions may have serious adverse consequences on our ability to raise funds, which may cause us to cease or delay our operations.

● Covid-19 could adversely impact our business, including our clinical trials, and financial condition.

Risks Related to Clinical Development and Regulatory Approval

● Our results to date provide no basis for predicting whether any of our product candidates will be safe or effective, or receive regulatory approval.

● We may not be able to initiate and complete preclinical studies and clinical trials for our product candidates which could adversely affect our business.

● If we experience delays or difficulties in the enrollment of subjects to our clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented, which could materially affect our financial condition.

● If the market opportunities for our current and potential future drug candidates are smaller than we believe they are, our ability to generate product revenues will be adversely affected and our business may suffer.

Risks Related to Our Reliance on Third Parties

● We have no experience in sales, marketing and distribution and may have to enter into agreements with third parties to perform these functions, which could prevent us from successfully commercializing our product candidates.

● Data provided by collaborators and other parties upon which we rely have not been independently verified and could turn out to be inaccurate, misleading, or incomplete.

● We rely on third parties to conduct our non-clinical studies and our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize our current product candidates or any future products, on a timely basis or at all, and our financial condition will be adversely affected.

Risks Related to Commercialization of Our Product Candidates

● We have no experience as a company in commercializing any product. If we fail to obtain commercial expertise, upon product approval by regulatory agencies, our product launch and revenues could be delayed.

● We may not be able to gain market acceptance of our product candidates, which would prevent us from becoming profitable.

● We may not be able to manufacture our product candidates in clinical or commercial quantities, which would prevent us from commercializing our product candidates.

● Disputes under key agreements or conflicts of interest with our scientific advisors or clinical investigators could delay or prevent development or commercialization of our product candidates.

Risks Related to Our Intellectual Property

● We may not be able to maintain our exclusive worldwide license to use and develop PT00114 which could materially affect our business plan.

Risks Related to Our Business Operations and Industry

● If we are not able to retain our current senior management team and our scientific advisors or continue to attract and retain qualified scientific, technical and business personnel, our business will suffer.

● We may encounter difficulties in managing our growth, which could adversely affect our operations.

● Healthcare reform measures could adversely affect our business.

● Our business and operations are vulnerable to computer system failures, cyber-attacks or deficiencies in our cyber-security, which could increase our expenses, divert the attention of our management and key personnel away from our business operations and adversely affect our results of operations.

● Failure to comply with health and data protection laws and regulations could lead to government enforcement actions (which could include civil or criminal penalties), private litigation or adverse publicity and could negatively affect our operating results and business.

● If we, our CROs or our IT vendors experience security or data privacy breaches or other unauthorized or improper access to, use of, or destruction of personal data, we may face costs, significant liabilities, harm to our brand and business disruption.

● If we do not comply with laws regulating the protection of the environment and health and human safety, our business could be adversely affected.

Risks Associated to our Common Stock

● Our common stock is a “Penny Stock” subject to specific rules governing its sale to investors that could impact its liquidity.

● There is no recent trading activity in our common stock and there is no assurance that an active market will develop in the future.

● Our ability to list on Nasdaq will require raising significant capital; failure to qualify to trade on Nasdaq will make it more difficult to raise capital.

● The market price of our common stock may be volatile, which could lead to losses by investors and costly securities litigation.

● If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud. Consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our stock.

● Investors may experience dilution of their ownership interests because of the future issuance of additional shares of our common stock.

● Our common stock is controlled by insiders.

● We do not intend to pay dividends for the foreseeable future and may never pay dividends.

● Our certificate of incorporation allows for our board to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock.

MARKET AND INDUSTRY DATA

This prospectus contain statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. While we believe the industry and market data included in this prospectus are reliable and are based on reasonable assumptions, these data involve many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections titled and “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” included in this prospectus.

PROSPECTUS SUMMARY

This summary highlights certain information presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making an investment decision. You should read the entire prospectus carefully, including the information under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our condensed consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before investing. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Concerning Forward-Looking Statements.” Unless the context otherwise requires, references to “Protagenic Therapeutics,” “Protagenic,” the “Company,” “we,” “us” and “our” refer to Protagenic Therapeutics, Inc. and its subsidiaries.

Our Company

Overview

We are a biopharmaceutical corporation specializing in the discovery and development of therapeutics to treat stress-related neuropsychiatric and mood disorders utilizing synthetic forms of endogenous brain signaling peptides that can dampen overactive stress responses.

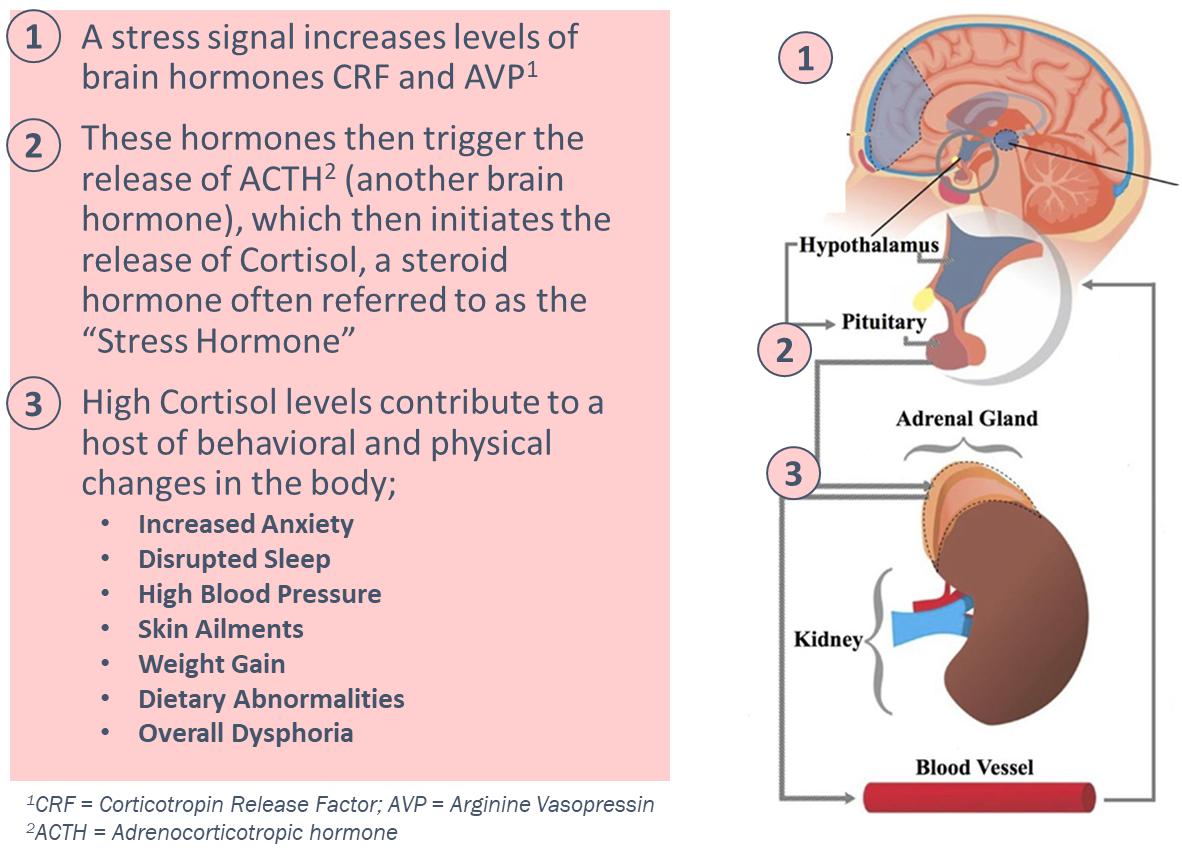

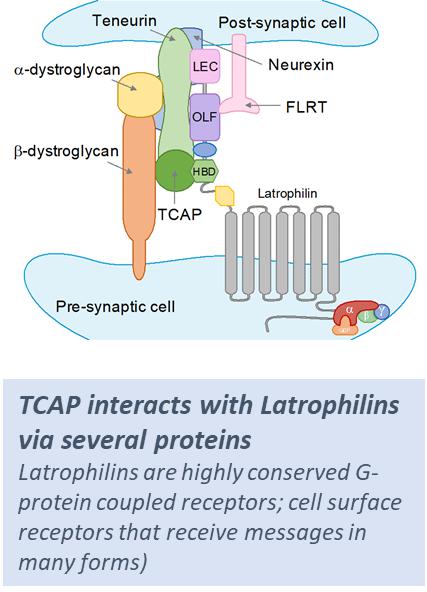

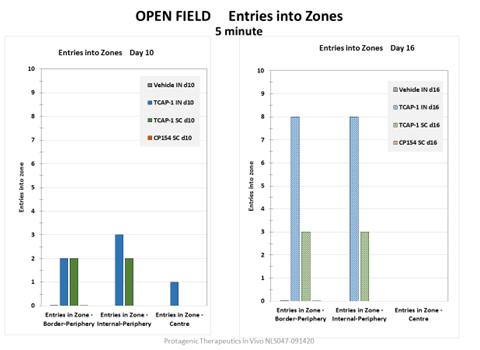

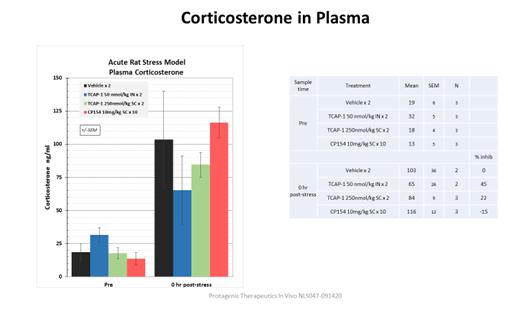

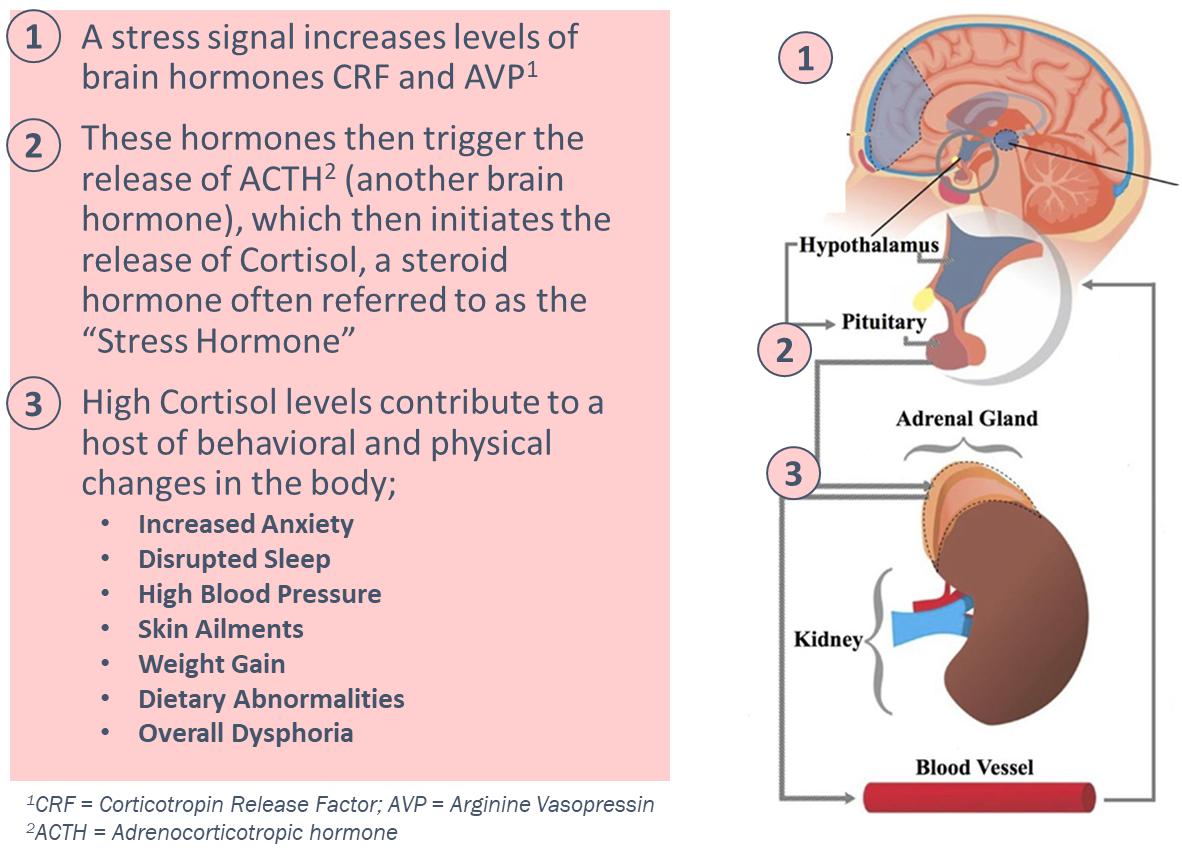

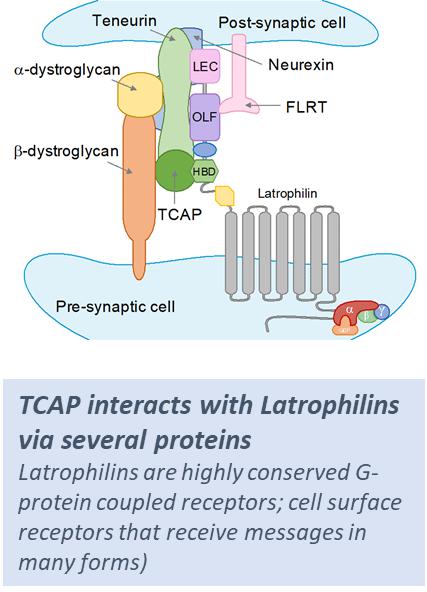

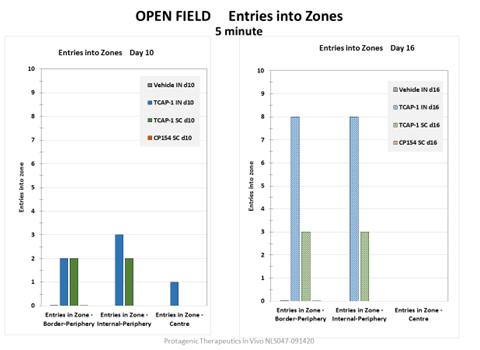

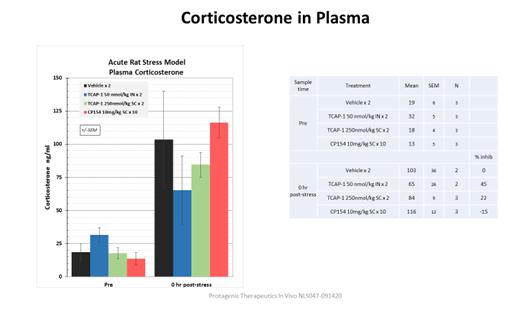

The mechanism by which we will target these stress-related disorders is based on over 15 years of work elucidating the role of Teneurin Carboxy-terminal Associated Peptide (“TCAP”), which has been found to have a central role in maintaining healthy brain signaling. TCAP is an endogenous counterbalance to the negative effects of stress and its criticality is underscored by a high degree of evolutionarily preservation. TCAP signaling counteracts the effects of Corticotropin Releasing Factor on the Hypothalamic-Pituitary-Adrenal axis, thus reducing the stress hormone cortisol. We intend to bring novel forms of TCAP into human clinical development as a treatment for stress-related neuropsychiatric disorders. Our lead compound – PT00114 – is a 41-residue peptide synthetic form of TCAP that can be administered subcutaneously, sublingually, or intra-nasally. In addition, we have a portfolio of earlier stage neuropeptides targeting the TCAP pathway that are in preclinical evaluation.

Our strategy is to develop TCAP neuropeptide-based drug candidates, beginning with PT00114, in stress-related indications, including, but not limited to: treatment resistant depression (“TRD”), which is a subgroup of major depressive disorder (“MDD”); addiction, recidivism, or substance use disorder (“SUD”); anxiety, including generalized anxiety disorder (“GAD”), and post-traumatic stress disorder (“PTSD”).

We intend to complete IND-enabling studies of PT00114 and to enter first-in-human Phase I/II studies in the third quarter of 2021. We will be initiating our clinical program with a 42-patient basket trial in collaboration with Dr. Maurizio Fava, the Psychiatrist-in-Chief of the Massachusetts General Hospital and co-principal investigator of STAR*D, the largest research study ever conducted in depression. We will enroll a healthy human cohort and four stress-related neuropsychiatric disorders: TRD, SUD, GAD, and PTSD. We will be using this study for both safety and preliminary efficacy signal-finding to prioritize indications for later stage development. we’ve chosen these four indications for multiple reasons, including direct linkage to the mechanism of TCAP in reducing biological stress signals, preclinical evidence of efficacy in animal models of these disorders, and the high unmet need in these patient populations, which creates significant market opportunity.

Our Strategy

| ● | Rapidly advance our lead product candidate, PT00114, through clinical trials in treatment resistant depression, substance use disorder, generalized anxiety disorder, and/or post-traumatic stress disorder. |

| ● | Develop our follow-on TCAP product candidates to build out a broad pipeline of assets with differentiated features using our unique expertise with this mechanism and leveraging our robust TCAP-related IP estate. |

| ● | Explore efficacy in additional stress-related neuropsychiatric and mood disorders beyond initially targeted indications. |

| ● | Facilitate long-term growth by building a nimble R&D, operational, clinical and commercial team. |

| ● | Selectively partner our programs to enhance our value after key inflection milestones. |

Competitive Landscape

The pharmaceutical and biotechnology industries are highly competitive and characterized by rapidly evolving technology and intense research and development efforts. We expect to compete with companies, including major international pharmaceutical companies, and other institutions that have substantially greater financial, research and development, marketing and sales capabilities and have substantially greater experience in undertaking preclinical and clinical testing of products, obtaining regulatory approvals and marketing and selling biopharmaceutical products. We will face competition based on, among other things, product efficacy and safety, the timing and scope of regulatory approvals, product ease of use and price.

While we believe that our lead candidate, PT00114, presents several competitive advantages over competing products, there are a number of competing drug classes including, SSRI/SNRI’s, opioid receptor modulators, atypical antipsychotics, ketamine/esketamine and NMDA receptor modulators.

Corporate Information

We are a Delaware corporation with one subsidiary, Protagenic Therapeutics Canada (2006) Inc., a corporation formed in 2006 under the laws of the Province of Ontario, Canada. Our principal offices are located at 149 Fifth Avenue, New York, New York 10010. Our telephone number is (212) 994-8200. Our web address is www.protagenic.com. Information contained in or accessible through our web site is not, and should not be deemed to be, part of this prospectus.

Convertible Note Offering

From November 2019 through August 2020, we completed a convertible note offering consisting of eight closings and gross proceeds of $2.0 million (the “Convertible Note Offering”). The Notes will be due on November 6, 2023 (the “Maturity Date”). They accrue simple interest at an annual rate of 6% on the aggregate unconverted and outstanding principal amount, payable annually, which began on October 31, 2020. The Company will pay (a “PIK Payment”) the interest due by adding such interest (including interest at the Default Rate, as defined below, if any) to the then-outstanding principal amount of the Notes on each interest payment date and on the Maturity Date. Holders may convert their Notes (including accrued interest) at their option, in whole or in part, at any time prior to the Maturity Date, at a conversion price of $1.25 per share of the Company’s common stock. The Conversion Price is subject to adjustment for any stock dividend, stock split, combination or other similar recapitalization event. On the Maturity Date, the Company is required to repay the Notes (including accrued interest) in their entirety in cash or, at its option, in shares of common stock at the Conversion Price.

Recent Developments

COVID-19

On March 11, 2020, the World Health Organization (“WHO”) declared the Covid-19 outbreak to be a global pandemic. In addition to the devastating effects on human life, the pandemic is having a negative ripple effect on the global economy, leading to disruptions and volatility in the global financial markets. Most U.S. states and many countries have issued policies intended to stop or slow the further spread of the disease. Covid-19 and the U.S. response to the pandemic are significantly affecting the economy. There are no comparable events that provide guidance as to the effect the Covid-19 pandemic may have, and, as a result, the ultimate effect of the pandemic is highly uncertain and subject to change. We do not yet know the full extent of the effects on the economy, the markets we serve, our business, or our operations.

THE OFFERING

| Securities offered by the Company | | 2,650,000 units, each unit consisting of one share of our common stock and one warrant to purchase one share of common stock, for a total of 2,650,000 shares and 2,650,000 warrants to purchase up to an aggregate of 2,650,000 shares of common stock. The shares of our common stock and the warrants are immediately separable and will be issued and tradeable separately, but will be purchased together as a unit in this offering. |

| | | |

| Warrants | | The warrants will be exercisable at any time from the date of issuance through the fifth anniversary of the date of this prospectus, unless earlier redeemed. Each warrant is exercisable to purchase one share of common stock at an exercise price of $4.98 per share (120% of the public offering price of the unit). Beginning 90 days after the date of this prospectus, the warrants will be redeemable at our option, in whole or in part, at a redemption price equal to $0.025 per warrant upon 30 days’ prior written notice, at any time after the date on which the closing price of our common stock has equaled or exceeded $7.26 (175% of the public offering price of the units) for at least five consecutive trading days. |

| | | |

| Common Stock to be outstanding after this offering | | 13,250,603 shares |

| | | |

| Option to purchase additional shares | | The Company has granted the underwriters a 45-day option to purchase up to 397,500 additional units. |

| | | |

| Use of Proceeds | | We estimate that our net proceeds from the sale of 2,650,000 units in this offering will be approximately $9,567,700, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use our net proceeds for enrolling up to 42 patients in a “basket” style Phase I/II clinical trial, to make key hires, to pay for additional development-related expenses, and for working capital and general corporate purposes. |

| | | |

| Proposed Nasdaq Symbol | | Our common stock currently trades on the OTCQB under the symbol “PTIX.” In conjunction with this offering, we have applied to list our common stock and warrants on the Nasdaq under the symbol “PTIX” and “PTIXW,” respectively. We anticipate being able to list on Nasdaq upon the completion of this offering; however, we can provide no assurances that we will be approved for such a listing. |

| | | |

| Risk Factors | | An investment in our company is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| | | |

| Lock-Up | | We and each of our officers, directors, and certain affiliates have agreed, subject to certain exceptions, including, without limitation, not to sell, offer, agree to sell, contract to sell, hypothecate, pledge, grant any option to purchase, make any short sale of, or otherwise dispose of or hedge, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of capital stock, for a period of one-hundred eighty (180) days after the date of this prospectus, without the prior written consent of Kingswood Capital Markets, division of Benchmark Investments, Inc. See “Shares Eligible For Future Sale” and “Underwriting” for additional information. |

The number of shares of our common stock to be outstanding immediately after the consummation of this offering is based on shares of common stock outstanding as of April 15, 2021, which does not reflect the potential issuance of up to 1,255,000 shares of common stock upon the exercise of outstanding stock options under our 2006 Equity Compensation Plans and up to 4,342,861 shares of common stock upon the exercise of outstanding stock options under our 2016 Equity Compensation Plan.

Unless otherwise indicated, this prospectus reflects and assumes the following:

��

| | ● | a per-unit public offering price of $4.15, which is the midpoint of the estimated public offering price range. |

| | | |

| | ● | no exercise by the underwriters of their option to purchase additional shares from us and excluding the shares of common stock issuable upon the exercise of the warrant to be issued to the Representative of the underwriters. |

| | | |

| | ● | no exercise of the warrants purchased in this offering |

RISK FACTORS

An investment in our common stock is speculative and illiquid and involves a high degree of risk including the risk of a loss of your entire investment. You should carefully consider the risks and uncertainties described below and the other information contained in this prospectus before purchasing shares of our common stock. The risks set forth below are not the only ones facing us. Additional risks and uncertainties may exist that could also adversely affect our business, operations and prospects. If any of the following risks actually materialize, our business, financial condition, prospects and/or operations could suffer. In such event, the value of our common stock and warrants could decline, and you could lose all or a substantial portion of the money that you pay for our units.

Risks Related to Our Financial Condition and Capital Requirements

The Company’s financial statements have been prepared on a going concern basis, and do not include adjustments that might be necessary if the Company is unable to continue as a going concern.

The Company’s consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As of December 31, 2020, the Company had incurred significant operating losses since inception, and continues to generate losses from operations, and has an accumulated deficit of $17,698,936. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements included in this prospectus do not include any adjustments relating to the recoverability and classification of asset amounts or the classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

We have a history of losses and expect that losses may continue in the future.

We have generated net losses since we began operations, including $2,548,735 and $1,750,911 for the years ended December 31, 2020 and December 31, 2019, respectively. As of December 31, 2020, we had an accumulated deficit of $17,698,936. We have no approved products and have generated no product revenue. We expect that product development, preclinical and clinical programs will increase losses significantly over the next five years. In order to achieve profitability, we will need to generate significant revenue. We cannot be certain that we will generate sufficient revenue to achieve profitability. We anticipate that we will continue to generate operating losses and negative cash flow from operations and our current cash position is sufficient to fund our current business plan at least until the second quarter of 2024. We cannot be certain that we will ever achieve, or if achieved, maintain profitability. If our revenue grows at a slower rate than we anticipate or if our product development, marketing and operating expenses exceed our expectations or cannot be adjusted accordingly, our business, results of operation and financial condition will be materially adversely affected, and we may be unable to continue operations.

We will not be able to generate product revenue unless and until one of our product candidates successfully completes clinical trials and receives regulatory approval. As our most advanced product candidates are at an early proof-of-concept stage, we do not expect to receive revenue from any product candidate for the foreseeable future. We may seek to obtain revenue from collaboration or licensing agreements with third parties. We currently have no such agreements which will provide us with material, ongoing future revenue and we may never enter into any such agreements. Even if we eventually generate revenues, we may never be profitable, and if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We need to obtain financing in order to continue our operations.

On a prospective basis, we will require both short-term financing for operations and long-term capital to fund our expected growth. We have no existing bank lines of credit and have not established any definitive sources for additional financing. Additional financing may not be available to us, or if available, then it may not be available upon terms and conditions acceptable to us. If adequate funds are not available, then we may be required to delay, reduce or eliminate product development or clinical programs. Our inability to take advantage of opportunities in the industry because of capital constraints may have a material adverse effect on our business and our prospects. If we fail to obtain the capital necessary to fund our operations, we will be unable to advance our development programs and complete our clinical trials.

In addition, our research and development expenses could exceed our current expectations. This could occur for many reasons, including:

| | ● | some or all of our product candidates fail in clinical or preclinical studies and we are forced to seek additional product candidates; |

| | ● | our product candidates require more extensive clinical or preclinical testing than we currently expect; |

| | ● | we advance more of our product candidates than expected into costly later stage clinical trials; |

| | ● | we advance more preclinical product candidates than expected into early stage clinical trials; |

| | ● | we are required, or consider it advisable, to acquire or license rights from one or more third parties; or |

| | ● | we determine to acquire or license rights to additional product candidates or new technologies. |

While we expect to seek additional funding through public or private financings, we may not be able to obtain financing on acceptable terms, or at all. In addition, the terms of our financings may be dilutive to, or otherwise adversely affect, holders of our common stock and warrants. We may also seek additional funds through arrangements with collaborators or other third parties. These arrangements would generally require us to relinquish rights to some of our technologies, product candidates or products, and we may not be able to enter into such agreements, on acceptable terms, if at all. If we are unable to obtain additional funding on a timely basis, we may be required to curtail or terminate some or all of our development programs, including some or all of our product candidates.

If we continue to incur operating losses and fail to obtain the capital necessary to fund our operations, we will be unable to advance our development programs, complete our clinical trials, or bring products to market, or may be forced to reduce or cease operations entirely. In addition, any capital obtained by us may be obtained on terms that are unfavorable to us, our investors, or both.

Developing a new drug and conducting clinical trials and the regulatory review processes involves substantial costs. We have projected cash requirements for the near term based on a variety of assumptions, but some or all of such assumptions are likely to be incorrect and/or incomplete, possibly materially in an adverse direction. Our actual cash needs may deviate materially from those projections, changes in market conditions or other factors may increase our cash requirements, or we may not be successful even in raising the amount of cash we currently project will be required for the near term. We will need to raise additional capital in the future; the amount of additional capital needed will vary as a result of a number of factors, including without limitation the following:

| ● | receiving less funding than we require; |

| ● | higher than expected costs to manufacture our product candidates; |

| ● | higher than expected costs for preclinical testing; |

| ● | an increase in the number, size, duration, and/or complexity of our clinical trials; |

| ● | slower than expected progress in developing PT00114, or other product candidates, including without limitation, additional costs caused by program delays; |

| ● | higher than expected costs associated with attempting to obtain regulatory approvals, including without limitation additional costs caused by additional regulatory requirements or larger clinical trial requirements; |

| ● | higher than expected personnel, consulting or other costs, such as adding personnel or industry expert consultants or pursuing the licensing/acquisition of additional assets; and |

| ● | higher than expected costs to protect our intellectual property portfolio or otherwise pursue our intellectual property strategy. |

When we attempt to raise additional financing, there can be no assurance that we will be able to secure such additional financing in sufficient quantities or at all. We may be unable to raise additional capital for reasons including, without limitation, our operational and/or financial performance, investor confidence in us and the biopharmaceutical industry, credit availability from banks and other financial institutions, the status of current projects, and our prospects for obtaining any necessary regulatory approvals. Potential investors’ capital investments may have shifted to other opportunities with perceived greater returns and/or lower risk thereby reducing capital available to us, if available at all.

In addition, any additional financing might not be available, and even if available, may not be available on terms favorable to us or our then-existing investors. We will seek to raise funds through public or private equity offerings, debt financings, corporate collaboration or licensing arrangements, mergers, acquisitions, sales of intellectual property, or other financing vehicles or arrangements. To the extent that we raise additional capital by issuing equity securities or other securities, our then-existing investors will experience dilution. If we raise funds through debt financings or bank loans, we may become subject to restrictive covenants, our assets may be pledged as collateral for the debt, and the interests of our then-existing investors would be subordinated to the debt holders or banks. In addition, our use of and ability to exploit assets pledged as collateral for debt or loans may be restricted or forfeited. To the extent that we raise additional funds through collaboration or licensing arrangements, we may be required to relinquish significant rights (including without limitation intellectual property rights) to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If we are not able to raise needed funding under acceptable terms or at all, then we will have to reduce expenses, including the possible options of curtailing operations, abandoning opportunities, licensing or selling off assets, reducing costs to a point where clinical development or other progress is impaired, or ceasing operations entirely.

We have a limited operating history, expect to incur significant operating losses, and have a high risk of never being profitable.

We commenced operations in February 2016 through a reverse merger and have a limited operating history of less than five years. Therefore, there is limited historical financial or operational information upon which to evaluate our performance. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations. Many if not most companies in our industry at our stage of development never become profitable and are acquired or go out of business before successfully developing any product that generates revenue from commercial sales or enables profitability.

As of December 31, 2020, we have incurred an accumulated deficit of $17,698,936. We expect to continue to incur substantial operating losses over the next several years for the clinical development of our current and future licensed or purchased product candidates.

The amount of future losses and when, if ever, we will become profitable are uncertain. We do not have any products that have generated any revenues from commercial sales, and do not expect to generate revenues from the commercial sale of products in the near future, if ever. Our ability to generate revenue and achieve profitability will depend on, among other things, successful completion of the development of our product candidates; obtaining necessary regulatory approvals from the FDA and international regulatory agencies; establishing manufacturing, sales, and marketing arrangements with third parties; obtaining adequate reimbursement by third-party payers; and raising sufficient funds to finance our activities. If we are unsuccessful at some or all of these undertakings, our business, financial condition, and results of operations are expected to be materially and adversely affected.

As a recently established public reporting company, we are subject to SEC reporting and other requirements, which will lead to increased operating costs in order to meet these requirements.

Unstable market and economic conditions may have serious adverse consequences on our ability to raise funds, which may cause us to cease or delay our operations.

From time to time, global and domestic credit and financial markets have experienced extreme disruptions, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. Our financing strategy will be adversely affected by any such economic downturn, volatile business environment and continued unpredictable and unstable market conditions. If the equity and credit markets deteriorate, it may make a debt or equity financing more difficult to complete, costlier, and more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms will have a material adverse effect on our business strategy and financial performance, and could require us to cease or delay our operations.

Our financial and operating performance may be adversely affected by the coronavirus pandemic.

The recent outbreak of a strain of coronavirus (Covid-19) in the U.S. has had an unfavorable impact on our business operations. Mandatory closures of businesses imposed by the federal, state and local governments to control the spread of the virus is disrupting the operations of our management, business and finance teams. In addition, the Covid-19 outbreak has adversely affected the U.S. economy and financial markets, which may result in a long-term economic downturn that could negatively affect future performance. The extent to which Covid-19 will impact our business and our consolidated financial results will depend on future developments which are highly uncertain and cannot be predicted at the time of the filing of this prospectus, but is expected to result in a material adverse impact on our business, results of operations and financial condition.

Covid-19 could adversely impact our business, including our clinical trials, and financial condition.

We are subject to risks related to public health crises such as the global pandemic associated with Covid-19. In December 2019, a novel strain of coronavirus, was reported to have surfaced in Wuhan, China. Since then, Covid-19 has spread to most countries and all 50 states within the United States, including countries and states in which we have planned or active clinical trial sites. As Covid-19 continues to spread around the globe, we have and/or will likely experience disruptions that could severely impact our business and clinical trials, including:

| | ● | delays or difficulties in enrolling patients in our clinical trials; |

| ` | ● | delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; |

| ● | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| ● | interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others or interruption of clinical trial subject visits and study procedures, the occurrence of which could affect the integrity of clinical trial data; |

| ● | risk that participants enrolled in our clinical trials will acquire Covid-19 while the clinical trial is ongoing, which could impact the results of the clinical trial, including by increasing the number of observed adverse events; |

| ● | limitations in employee resources that would otherwise be focused on the conduct of our clinical trials, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; |

| ● | delays in receiving authorizations from local regulatory authorities to initiate our planned clinical trials; |

| ● | delays in clinical sites receiving the supplies and materials needed to conduct our clinical trials; |

| ● | interruption in global shipping that may affect the transport of clinical trial materials, such as investigational drug product used in our clinical trials; |

| ● | changes in local regulations as part of a response to the Covid-19 pandemic which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether; |

| ● | interruptions or delays in preclinical studies due to restricted or limited operations at our research and development laboratory facilities; |

| ● | delays in necessary interactions with local regulators, ethics committees and other important agencies and contractors due to limitations in employee resources or forced furlough of government employees; and |

| ● | refusal of the FDA to accept data from clinical trials in affected geographies outside the United States. |

Numerous state and local jurisdictions have imposed, and others in the future may impose, “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of Covid-19. Starting in mid-March 2020, the governor of New York, where our corporate operations are based, issued “shelter-in-place” or “stay at home” orders restricting non-essential activities, travel and business operations for an indefinite period of time, subject to certain exceptions for necessary activities. Similar orders and restrictions have been imposed in California and Massachusetts, and such orders or restrictions have resulted in our office closing, work stoppages, slowdowns and delays, travel restrictions and cancellation of events, among other effects, thereby negatively impacting our operations. In addition, even after the “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of Covid-19 are lifted, we may continue to experience disruptions to our business.

The global pandemic of Covid-19 continues to rapidly evolve. The extent to which Covid-19 may impact our business, including our clinical trials, and financial condition will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the pandemic, travel restrictions and social distancing in the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease.

Risks Related to Clinical Development and Regulatory Approval

Our results to date provide no basis for predicting whether any of our product candidates will be safe or effective, or receive regulatory approval.

The Company’s proprietary portfolio of five new neuropeptide hormones are in various stages of research and preclinical evaluation and their risk of failure is high. It is impossible to predict when or if any of our neuropeptide hormones will prove effective or safe in humans or will receive regulatory approval. These compounds may not demonstrate in patients the chemical and pharmacological properties ascribed to them in laboratory studies, and they may interact with human biological systems or other drugs in unforeseen, ineffective or harmful ways. If we are unable to discover or successfully develop drugs that are effective and safe in humans, we will not have a viable business.

We may not be able to initiate and complete preclinical studies and clinical trials for our product candidates which could adversely affect our business.

We must successfully initiate and complete extensive preclinical studies and clinical trials for our product candidates before we can receive regulatory approval. Preclinical studies and clinical trials are expensive and will take several years to complete and may not yield results that support further clinical development or product approvals. Conducting clinical studies for any of our drug candidates for approval in the United States requires filing an IND and reaching agreement with the FDA on clinical protocols, finding appropriate clinical sites and clinical investigators, securing approvals for such studies from the independent review board at each such site, manufacturing clinical quantities of drug candidates, supplying drug product to clinical sites and enrolling sufficient numbers of participants. We cannot guarantee that we will be able to successfully accomplish all of the activities necessary to initiate and complete clinical trials.

As a result, our preclinical studies and clinical trials may be extended, delayed or terminated, and we may be unable to obtain regulatory approvals or successfully commercialize our products.

The drug development and approval process is uncertain, time-consuming and expensive.

The process of obtaining and maintaining regulatory approvals for new therapeutic products is lengthy, expensive and uncertain. It also can vary substantially based on the type, complexity, and novelty of the product. We must provide the FDA and foreign regulatory authorities with preclinical and clinical data demonstrating that our products are safe and effective before they can be approved for commercial sale. Clinical development, including preclinical testing, is a long, expensive and uncertain process. It may take us several years to complete our testing, and failure can occur at any stage of testing. Any preclinical or clinical test may fail to produce results satisfactory to the FDA. Preclinical and clinical data can be interpreted in different ways, which could delay, limit or prevent regulatory approval. Negative or inconclusive results from a preclinical study or clinical trial, adverse medical events during a clinical trial or safety issues resulting from products of the same class of drug could cause a preclinical study or clinical trial to be repeated or a program to be terminated, even if other studies or trials relating to the program are successful.

The regulatory approval process is costly and lengthy and we may not be able to successfully obtain all required regulatory approvals.

The preclinical development, clinical trials, manufacturing, marketing and labeling of pharmaceuticals are all subject to extensive regulation by numerous governmental authorities and agencies in the United States and other countries. We must obtain regulatory approval for each of our product candidates before marketing or selling any of them. It is not possible to predict how long the approval processes of the FDA or any other applicable federal or foreign regulatory authority or agency for any of our products will take or whether any such approvals ultimately will be granted. The FDA and foreign regulatory agencies have substantial discretion in the drug approval process, and positive results in preclinical testing or early phases of clinical studies offer no assurance of success in later phases of the approval process. Generally, preclinical and clinical testing of products can take many years and require the expenditure of substantial resources, and the data obtained from these tests and trials can be susceptible to varying interpretations that could delay, limit or prevent regulatory approval. If we encounter significant delays in the regulatory process that result in excessive costs, this may prevent us from continuing to develop our product candidates. Any delay in obtaining, or failure to obtain, approvals could adversely affect the marketing of our products and our ability to generate product revenue. The risks associated with the approval process include:

| | ● | failure of our product candidates to meet a regulatory agency’s requirements for safety, efficacy and quality; |

| | ● | limitation on the indicated uses for which a product may be marketed; |

| | ● | unforeseen safety issues or side effects; and |

| | ● | governmental or regulatory delays and changes in regulatory requirements and guidelines. |

Even if we receive regulatory approvals for marketing our product candidates, if we fail to comply with continuing regulatory requirements, we could lose our regulatory approvals, and our business would be adversely affected.

The FDA continues to review products even after they receive initial approval. If we receive approval to commercialize any product candidates, the manufacturing, marketing and sale of these drugs will be subject to continuing regulation, including compliance with quality systems regulations, good manufacturing practices, adverse event requirements, and prohibitions on promoting a product for unapproved uses. Enforcement actions resulting from our failure to comply with government and regulatory requirements could result in fines, suspension of approvals, withdrawal of approvals, product recalls, product seizures, mandatory operating restrictions, criminal prosecution, civil penalties and other actions that could impair the manufacturing, marketing and sale of our potential products and our ability to conduct our business.

Even if we are able to obtain regulatory approvals for any of our product candidates, if they exhibit harmful side effects after approval, our regulatory approvals could be revoked or otherwise negatively impacted, and we could be subject to costly and damaging product liability claims.

Even if we receive regulatory approval for our product candidates, we will have tested them in only a small number of patients during our clinical trials. If our applications for marketing are approved and more patients begin to use our product, new risks and side effects associated with our products may be discovered. As a result, regulatory authorities may revoke their approvals; we may be required to conduct additional clinical trials, make changes in labeling of our product, reformulate our product or make changes and obtain new approvals for our and our suppliers’ manufacturing facilities. We might have to withdraw or recall our products from the marketplace. We may also experience a significant drop in the potential sales of our product if and when regulatory approvals for such product are obtained, experience harm to our reputation in the marketplace or become subject to lawsuits, including class actions. Any of these results could decrease or prevent any sales of our approved product or substantially increase the costs and expenses of commercializing and marketing our product.

If we experience delays or difficulties in the enrollment of subjects to our clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented, which could materially affect our financial condition.

Identifying, screening and enrolling patients to participate in clinical trials of our product candidates is critical to our success, and we may not be able to identify, recruit, enroll and dose a sufficient number of patients with the required or desired characteristics to complete our clinical trials in a timely manner. The timing of our clinical trials depends on our ability to recruit patients to participate as well as to subsequently dose these patients and complete required follow-up periods.

In addition, we may experience enrollment delays related to increased or unforeseen regulatory, legal and logistical requirements at certain clinical trial sites. These delays could be caused by reviews by regulatory authorities and contractual discussions with individual clinical trial sites. Any delays in enrolling and/or dosing patients in our planned clinical trials could result in increased costs, delays in advancing our product candidates, delays in testing the effectiveness of our product candidates or in termination of the clinical trials altogether.

Patient enrollment may be affected if our competitors have ongoing clinical trials with products for the same indications as our product candidates, and patients who would otherwise be eligible for our clinical trials instead enroll in our competitors’ clinical trials. Patient enrollment may also be affected by other factors, including:

| | ● | coordination with clinical research organizations to enroll and administer the clinical trials; |

| | ● | coordination and recruitment of collaborators and investigators at individual sites; |

| | ● | size of the patient population and process for identifying patients; |

| | ● | design of the clinical trial protocol; |

| | ● | eligibility and exclusion criteria; |

| | ● | perceived risks and benefits of the product candidates under study; |

| | ● | availability of competing commercially available therapies and other competing products’ clinical trials; |

| | ● | time of year in which the trials are initiated or conducted; |

| | ● | severity of the diseases under investigation; |

| | ● | ability to obtain and maintain subject consents; |

| | ● | ability to enroll and treat patients in a timely manner; |

| | ● | risk that enrolled subjects will drop out before completion of the trials; |

| | ● | proximity and availability of clinical trial sites for prospective patients; |

| | ● | ability to monitor subjects adequately during and after treatment; and |

| | ● | patient referral practices of physicians. |

Our inability to enroll a sufficient number of patients for clinical trials would result in significant delays and could require us to abandon one or more clinical trials altogether. Enrollment delays in these clinical trials may result in increased development costs for our product candidates, which could materially affect our financial condition.

New federal laws or regulations on drug importation could make lower cost versions of our future products available, which could adversely affect our revenues, if any.

The prices of some drugs are lower in other countries than in the United States because of government regulation and market conditions. Under current law, importation of drugs into the United States is generally not permitted unless the drugs are approved in the United States and the entity that holds that approval consents to the importation. Various proposals have been advanced to permit the importation of drugs from other countries to provide lower cost alternatives to the products available in the United States. In addition, the MMA requires the Secretary of Health and Human Services to promulgate regulations for drug re-importation from Canada into the United States under some circumstances, including when the drugs are sold at a lower price than in the United States.

If the laws or regulations are changed to permit the importation of drugs into the United States in circumstances that are currently not permitted, such a change could have an adverse effect on our business by making available lower priced alternatives to our future products.

Failure to obtain regulatory and pricing approvals in foreign jurisdictions could delay or prevent commercialization of our products abroad.

If we succeed in developing any products, we intend to market them in the European Union and other foreign jurisdictions. In order to do so, we must obtain separate regulatory approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and can involve additional testing. The time required to obtain approval abroad may differ from that required to obtain FDA approval. The foreign regulatory approval process may include all of the risks associated with obtaining FDA approval and additional risks associated with requirements particular to those foreign jurisdictions where we will seek regulatory approval of our products. We may not obtain foreign regulatory approvals on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. We and our collaborators may not be able to file for regulatory approvals and may not receive necessary approvals to commercialize our products in any market outside the United States. The failure to obtain these approvals could materially adversely affect our business, financial condition and results of operations.

It is uncertain whether product liability insurance will be adequate to address product liability claims, or that insurance against such claims will be affordable or available on acceptable terms in the future.

Clinical research involves the testing of new drugs on human volunteers pursuant to a clinical trial protocol. Such testing involves a risk of liability for personal injury to or death of patients due to, among other causes, adverse side effects, improper administration of the new drug, or improper volunteer behavior. Claims may arise from patients, clinical trial volunteers, consumers, physicians, hospitals, companies, institutions, researchers, or others using, selling, or buying our products, as well as from governmental bodies. In addition, product liability and related risks are likely to increase over time, in particular upon the commercialization or marketing of any products by us or parties with which we enter into development, marketing, or distribution collaborations. Although we are contracting for general liability insurance in connection with our ongoing business, there can be no assurance that the amount and scope of such insurance coverage will be appropriate and sufficient in the event any claims arise, that we will be able to secure additional coverage should we attempt to do so, or that our insurers would not contest or refuse any attempt by us to collect on such insurance policies. Furthermore, there can be no assurance that suitable product liability insurance (at the clinical stage and/or commercial stage) will continue to be available on terms acceptable to us or at all, or that, if obtained, the insurance coverage will be appropriate and sufficient to cover any potential claims or liabilities.

If the market opportunities for our current and potential future drug candidates are smaller than we believe they are, our ability to generate product revenues will be adversely affected and our business may suffer.

Our understanding of the number of people who suffer from stress-related indications, including, but not limited to: treatment resistant depression (“TRD”), which is a subgroup of major depressive disorder (“MDD”); addiction, recidivism, or substance use disorder (“SUD”); anxiety, including generalized anxiety disorder (“GAD”), and post-traumatic stress disorder (“PTSD”) is based upon estimates. These estimates may prove to be incorrect, and new studies may demonstrate or suggest a lower estimated incidence or prevalence of this condition. The number of patients in the U.S. or elsewhere may turn out to be lower than expected, may not be otherwise amenable to PT00114 treatment, or treatment-amenable patients may become increasingly difficult to identify and access, all of which would adversely affect our business prospects and financial condition.

Risks Related to Our Reliance on Third Parties

We may not be able to obtain and maintain the third party relationships that are necessary to develop, commercialize and manufacture some or all of our product candidates.

We expect to depend on collaborators, partners, licensees, clinical research organizations, manufacturers and other third parties to support our discovery efforts, to formulate product candidates, to conduct clinical trials for some or all of our product candidates, to manufacture clinical and commercial scale quantities of our product candidates and products and to market, sell, and distribute any products we successfully develop.

We cannot guarantee that we will be able to successfully negotiate agreements for or maintain relationships with collaborators, partners, licensees, clinical investigators, manufacturers and other third parties on favorable terms, if at all. If we are unable to obtain or maintain these agreements, we may not be able to clinically develop, formulate, manufacture, obtain regulatory approvals for or commercialize our product candidates, which will in turn adversely affect our business.

We expect to expend substantial management time and effort to enter into relationships with third parties and, if we successfully enter into such relationships, to manage these relationships. In addition, substantial amounts of our expenditures will be paid to third parties in these relationships. However, we cannot control the amount or timing of resources our contract partners will devote to our research and development programs, product candidates or potential product candidates, and we cannot guarantee that these parties will fulfill their obligations to us under these arrangements in a timely fashion, if at all.

We have no experience in sales, marketing and distribution and may have to enter into agreements with third parties to perform these functions, which could prevent us from successfully commercializing our product candidates.

We currently have no sales, marketing or distribution capabilities. To commercialize our product candidates, we must either develop our own sales, marketing and distribution capabilities, which will be expensive and time consuming, or make arrangements with third parties to perform these services for us. If we decide to market any of our products on our own, we will have to commit significant resources to developing a marketing and sales force and supporting distribution capabilities. If we decide to enter into arrangements with third parties for performance of these services, we may find that they are not available on terms acceptable to us, or at all. If we are not able to establish and maintain successful arrangements with third parties or build our own sales and marketing infrastructure, we may not be able to commercialize our product candidates which would adversely affect our business and financial condition.

Data provided by collaborators and other parties upon which we rely have not been independently verified and could turn out to be inaccurate, misleading, or incomplete.

We rely on third-party vendors, scientists, and collaborators to provide us with significant data and other information related to our projects, clinical trials, and business. We do not independently verify or audit all of such data (including possibly material portions thereof). As a result, such data may be inaccurate, misleading, or incomplete.

In certain cases, we may need to rely on a single supplier for a particular manufacturing material or service, and any interruption in or termination of service by such supplier could delay or disrupt the commercialization of our products.

We rely on third-party suppliers for the materials used to manufacture our compounds. Some of these materials may at times only be available from one supplier. Any interruption in or termination of service by such single source suppliers could result in a delay or disruption in manufacturing until we locate an alternative source of supply. There can be no assurance that we would be successful in locating an alternative source of supply or in negotiating acceptable terms with such prospective supplier.

We rely on third parties to conduct our non-clinical studies and our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize our current product candidates or any future products, on a timely basis or at all, and our financial condition will be adversely affected.

We do not have the ability to independently conduct non-clinical studies and clinical trials. We rely on medical institutions, clinical investigators, contract laboratories, collaborative partners and other third parties, such as contract research organizations or clinical research organizations, to conduct non-clinical studies and clinical trials on our product candidates. The third parties with whom we contract for execution of our non-clinical studies and clinical trials play a significant role in the conduct of these studies and trials and the subsequent collection and analysis of data. However, these third parties are not our employees, and except for contractual duties and obligations, we have limited ability to control the amount or timing of resources that they devote to our programs.