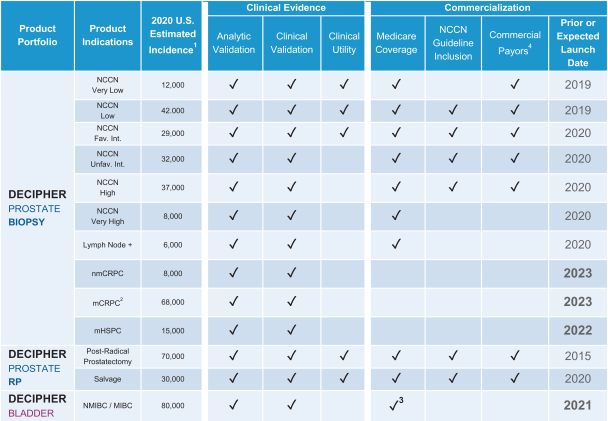

| 2 | Represents patients who are eligible for new drug therapy, including first-, second-, and third-line therapies. Includes patients at diagnosis and patients that progress from BCR to mCRPC, mHSPC to mCRPC, and nmCRPC to mCRPC. |

| 3 | Draft LCD DL38647 published 5/21/2020, expected to be final and effective in 2021. |

| 4 | Decipher is covered by numerous regional and select international payors and is actively pursuing additional coverage. |

Decipher Biosciences Merger

On February 2, 2021, we entered into an Agreement and Plan of Merger, or Merger Agreement, with Delight Merger Sub I, Inc., a Delaware corporation and wholly owned subsidiary of ours, or Delight Merger Sub I, Delight Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of ours, or Delight Merger Sub II, Decipher, and Fortis Advisors LLC, as the stockholders’ agent.

Pursuant to the terms of the Merger Agreement, Delight Merger Sub I will merge with and into Decipher and Decipher shall survive and become a wholly owned subsidiary of ours, which we refer to as the First Merger. Promptly following consummation of the First Merger, Decipher will merge with and into Delight Merger Sub II, with Merger Sub II surviving as a wholly owned subsidiary of ours, which, together with the First Merger, we refer to as the Merger.

We have agreed to acquire Decipher for $250.0 million in cash and up to $350.0 million in shares of our common stock. The number of shares of our common stock to be issued in the Merger is based on a fixed price of $54.30 per share, resulting in a maximum issuance of approximately 6.45 million shares of our common stock. However, without changing the total consideration paid at closing, we have the option, at our sole discretion, until the earlier of March 15, 2021 and the fourth business day following the closing of this offering, to substitute cash in lieu of shares in any amount up to the entire stock consideration of $350 million. We have agreed to register the stock consideration, if any, on a Registration Statement on Form S-4 to be filed by March 1, 2021. The purchase price for the Merger is subject to customary adjustments for Decipher’s transaction expenses, cash, indebtedness and the aggregate exercise price of Decipher’s outstanding stock options.

The Merger Agreement contains customary representations, warranties, covenants and agreements of Decipher and Veracyte. The closing of the transaction contemplated by the Merger Agreement is anticipated to occur by May 2021 and is subject to customary closing conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The Merger Agreement also provides customary termination rights to each of the parties.

Tina S. Nova, Ph.D., the President and Chief Executive Officer of Decipher, was previously a member of our board of directors. Dr. Nova was not involved in our deliberations regarding the transaction and has resigned from our board of directors in connection with the transaction. Upon the closing of the Merger, we anticipate that Dr. Nova will serve as the general manger for our urologic cancers business unit.

Preliminary Unaudited Financial Update

Veracyte

On February 3, 2021, we announced that we expect to report that we generated total revenue of between $34.0 million and $35.0 million, and that our product and testing volume was 13,130 tests, in each case for the three months ended December 31, 2020. We also expect to report total revenue of between $117.0 million and $118.0 million, and product and testing volume of 44,489 tests, in each case for the full year ended December 31, 2020.

These total revenue amounts are preliminary, have not been audited and are subject to change in connection with the completion of our financial statements for the year ended December 31, 2020. In addition, our independent