See also the undertakings set out in response to Item 17 herein.

Item 15. Recent Sales of Unregistered Securities

We have issued and sold the following securities since January 1, 2018:

(i) In June 2018, we issued warrants exercisable for up to 501,946 shares of our common stock at a price of $0.10 per share to five accredited investors (including certain holders of 5% or more of our capital stock and entities affiliated with certain of our directors).

(ii) In June 2018, we issued $22,815,231 in principal amount of convertible promissory notes to a total of eight accredited investors (including certain holders of 5% or more of our capital stock, entities affiliated with certain of our directors and Christoph Scharf, M.D., one of our directors until his resignation on June 10, 2020), which notes were subsequently amended and converted into an aggregate of 1,884,565 shares of our Series D convertible preferred stock at a price of $13.33 per share.

(iii) In July 2018, we issued warrants exercisable for up to 26,998 shares of our Series C convertible preferred stock at a price of $16.67 per share. These warrants were subsequently automatically converted to warrants to purchase up to 26,998 shares of our Series D convertible preferred stock at a price of $16.67 per share.

(iv) In May 2019, we issued warrants exercisable for up to 419,992 shares of our Series C convertible preferred stock at a price of $16.67 per share to two accredited investors (including certain holders of 5% or more of our capital stock and entities affiliated with certain of our directors). These warrants were subsequently automatically converted to warrants to purchase up to 419,992 shares of our Series D convertible preferred stock at a price of $16.67 per share.

(v) In May 2019, we issued $37,000,000 in principal amount of convertible promissory notes to a total of seven accredited investors (including certain holders of 5% or more of our capital stock and entities affiliated with certain of our directors), which notes were subsequently converted into an aggregate of 2,223,913 shares of our Series D convertible preferred stock at a price of $16.67 per share.

(vi) In June 2019, we sold an aggregate of 4,091,819 shares of our Series D convertible preferred stock at a price of $16.67 per share for an aggregate purchase price of $68,198,650.

(vii) On June 18, 2019, we entered into an acquisition agreement under which we acquired all of the stock of Rhythm Xience, Inc. Pursuant to that agreement, in February 2020 we issued 119,993 shares of our Series D convertible preferred stock with an implied value of $2,197,199 to the former owners of Rhythm Xience, Inc. in connection with the achievement of certain regulatory and revenue milestones.

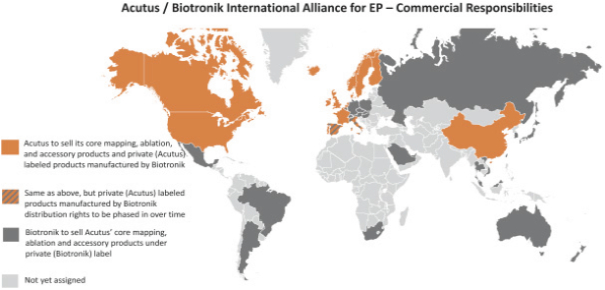

(viii) On July 2, 2019 we entered into a license agreement with Biotronik SE & Co. KG and VascoMed GmbH. Pursuant to that agreement, we issued 273,070 shares of our Series D convertible preferred stock, with an implied value of $5,000,000, to Biotronik in February 2020.

(ix) From January 1, 2018 through August 5, 2020, we granted to certain employees, consultants and directors options to purchase an aggregate of 2,998,107 shares of our common stock under our 2011 Plan and 2020 Plan at exercise prices ranging from $9.72 to $18.00 per share.

(x) From January 1, 2018 through August 5, 2020, we issued an aggregate of 213,190 shares of our common stock upon the exercise of options granted under our 2011 Plan and 2020 Plan, at exercise prices ranging from $1.85 to $13.38 per share, for an aggregate exercise price of $792,196.

II-2