Filed Pursuant to Rule 433 of the Securities Act of 1933

Issuer Free Writing Prospectus dated May 24, 2021

Relating to Preliminary Prospectus dated May 24, 2021

Registration No. 333-255709

Investor Presentation May 2021 1

Free Writing Prospectus We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates . The registration statement has not yet become effective . Before you invest, you should read the preliminary prospectus in that registration statement (including the risk factors described therein) and other documents that we have filed with the SEC for more complete information about us and this offering . You may access these documents for free by visiting EDGAR on the SEC Web site at http : //www . sec . gov . The preliminary prospectus, filed on May 13 , 2021 is available on the SEC Web site at http : //www . sec . gov . Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you contact Think Equity, a division of Fordham Financial Management, Inc . , Prospectus Department, 17 State Street, 22 nd Floor, New York, New York 10004 , telephone : ( 877 ) 436 - 3673 or e - mail : prospectus@think - equity . com . 2

Disclaimer Forward Looking Statements This presentation contains forward - looking statements that are based on our management’s beliefs and assumptions and on information currently available to us . All statements other than statements of historical facts are forward - looking . These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements . Forward - looking statements include, but are not limited to, statements about : • our ability to consummate the acquisition of Appliances Connection; • the synergies that we expect to experience resulting from the acquisition; • our ability to successfully integrate Appliances Connection’s business with our existing business; • the impact of the COVID - 19 pandemic on our operations and financial condition; • our goals and strategies; • our future business development, financial condition and results of operations; • expected changes in our revenue, costs or expenditures; • growth of and competition trends in our industry; • our expectations regarding demand for, and market acceptance of, our products; • our expectations regarding our relationships with investors, institutional funding partners and other parties with whom we collaborate; • our expectation regarding the use of proceeds from this offering; • fluctuations in general economic and business conditions in the markets in which we operate; and • relevant government policies and regulations relating to our industry. In some cases, you can identify forward - looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pr oject” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward - looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in the registration statement that we have filed with the SEC. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward - looking statements. No forward - looking statement is a guarantee of future performance. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date on which the statements are made in this presentation, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. The forward - looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation. Although we have ongoing disclosure obligations under United States federal securities laws, we do not intend to update or otherwise revise the forward - looking statements in this presentation, whether as a result of new information, future events or otherwise. Non - GAAP Financial Measures While the Company reports financial results in accordance with accounting principles generally accepted in the United States, this presentation includes certain non - GAAP measures, which are not presented in accordance with GAAP or substitutes for GAAP measures. Non - GAAP measures have various limitations as analytical tools, and the recipient should not consider them in isolation, or as a substitute for analysis of the Company’s results as reported under GAAP. Further, because not all companies use identical calculations, the presentation herein of non - GAAP measures may not be comparable to other similarly titled measures reported by other companies. For a reconciliation of non - GAAP measures to the comparable GAAP measures, see the ”EBITDA Reconciliation” page. Market & Industry Data This presentation also contains estimates and other statistical data made by independent parties and by us relating to market - size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Neither we nor our affiliates, advisors or representatives makes any representation as to the accuracy or completeness of that data or undertake to update such data after the date of this presentation. 3

Offering Summary IssuerTicker / Exchange Securities OfferedOffering Size Warrant TermsOver-AllotmentOptionPre-Offering Common Shares OutstandingUse of ProceedsLock-up Period Sole Book-Runner 1847 Goedeker Inc. NYSE American /GOEDUnits consisting of one common stock and one warrant to purchaseone share of common stock$205 million (100% primary)Exercisable immediately, exercise price equal to the public offering price and expire five years from the date of issuance. The shares of common stock and warrants contained in the units are immediately separable and will be issued separately. We have applied for the listing of the warrants on NYSE American under the symbol"GOEDW."15% of Offering (100% primary)6,111,200For payment of cash portion of the purchase price for the proposed acquisition. Any remaining proceeds will be used working capital and general purposes.90-day lock-up for the Company, officers and directors ThinkEquity, a division of Fordham Financial Management,Inc.

Mission Our mission is to change the way people buy appliances Strategy • Relentless focus on customer experience • Wide selection across easy to navigate websites • Expert - staffed call centers to guide customer journey • Efficient fulfillment platforms • Competitive pricing • Purpose - built, data - driven platforms drive customer conversion and upsell ACG refers to thecombined entity of Goedeker and Appliances Connection, a pendingacquisition. 5

Industry Leading Product Assortment Over 51,000 SKUs, leveraging tight vendor relationships Outdoor C o mme r ci a l C o o king Dishwashers Air Conditioning Refrigeration Lau n d ry 6

Brand Expansion to Satisfy the Needs of Any Customer (Core, Premium, Luxury) Select Goedeker Brands Acquisition of Appliances Connection Adds Key Premium Brands Appliances Connection listed #1 on USA Today’s “Top 7 Places to Buy Appliances Online” 7

Key Operating Metrics – Pro - Forma Combined Entity of Goedeker and Appliances Connection F Y 202 0 O r d e r s $590.1M 87.9%+YoY F Y 202 0 R e v e nu e * $367.7M 34.8%+YoY FY 2020 Adj. EBITDA $14.4M 3 . 9 % A d j . EB I T D A Margin Q1 2021 Orders $199.3.0M 105 % + Y o Y Q1 2021 Revenue $123.0M 84 . 2 % + Y o Y Q1 2021 Adj. EBITDA $14.7M 11 . 9 % A d j . E B I T D A Margin FY 2020 Net Income $(6.4M) Q 1 202 1 Net Income $13.0M * Q 1 202 0 re v enue s w er e 18 % o f t o t a l re v enue s fo r F Y 2020. Q1 2021 represents the period from January 1, 2021 through March 31, 2021 FY 2020 represents the period from January 1, 2020 through December 31, 2020 Figures reflect pro - forma combined figures of Goedeker and Appliances Connection, not calculated under Article 11. 8

Secular Shift in the Industry Billions in Revenue is Shifting Online Large, Addressable Market Growing Each Year • According to Statista, revenue in U.S. household major appliances market (excluding small appliances) is projected to reach $22. 5 billion in 2021 Tailwind from Millennials Beginning to Enter the Category • According to the U.S. Census Bureau, there are ~193 million individuals between the ages of 20 and 64 in U.S., many of whom are accustomed to purchasing goods online • As younger generations age, start new families and move into new homes, online sales of household appliances are expected to increase Older Generations Purchasing Online More • Online household appliances market are expected to further grow as older generations of consumers become increasingly comfortable purchasing online, particularly if the process is easy and efficient Source: Statista, US Census Bureau, Epsilon. 100 , 000 110 , 000 120 , 000 130 , 000 2 0 00 2 0 01 2 0 02 2 0 03 2 0 04 2 0 05 2 0 06 2 0 07 2 0 08 2 0 09 2 0 10 2 0 11 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2 0 17 2 0 18 2 0 19 2 0 20 Pandemic Drives New Household Formation New Household Formation Since 2000 (000’s) Ho useh o ld s Number of Households 9

Household Appliances is a $21BN Online Market • 5,000+ store fronts • Assortment focuses on Core, very limited selection; discount - driven • No Luxury assortment available • 2,000+ store fronts • Focus on Core brands with some Premium offerings • 3 major storefronts (Appliances Connection, Goedeker, AJ Madison) • Assortment emphasizes Premium, with strong Luxury representation E - Commerce INDEPENDENT DEALERS AND SMALLER CHAINS CONSOLIDATED AT THREE RETAILERS Big box stores focused on selling Core appliances – Premium and Luxury more fragmented Source: Statista, SICCode. 10

Digital Economy is Transforming Appliance Buying (1) Salesforce 360, 9 Stats About the Retail Customer Journey in 2019, 4/12/19. (2) Mintel Survey, Major Household Appliances, 4/4/21. 8 7 % 55 % of shoppers begin their hunt in digital channels (1) of consumers compare appliance prices online (2) 11

Our Direct - to - Consumer Foundation and Strong Digital Platform • Simple & easy online shopping experience • Ease of navigation through diverse product range • Stress free order - by - phone convenience • Sales representatives on stand - by to assist customer needs • Talking to people before and after they buy INSTALLATION AND HAUL - AWAY SERVICES FREE SHIPPING AND WHITE GLOVE DELIVERY EASY, Z E R O - I N T E R E S T FINANCING ON - DEMAND EXPERT SUPPORT • On - demand experienced sales representative • Real - time chat overlay 12

L UXUR Y PREMIU M Carries Top 10 Brands in Each Categories Many are 3rd Party Sellers, not Brand - sponsored or approved products Limited In - Store Selection Per Brand C ORE We Offer More Inventory and a Wider Assortment of Categories Compared with Competitors 13

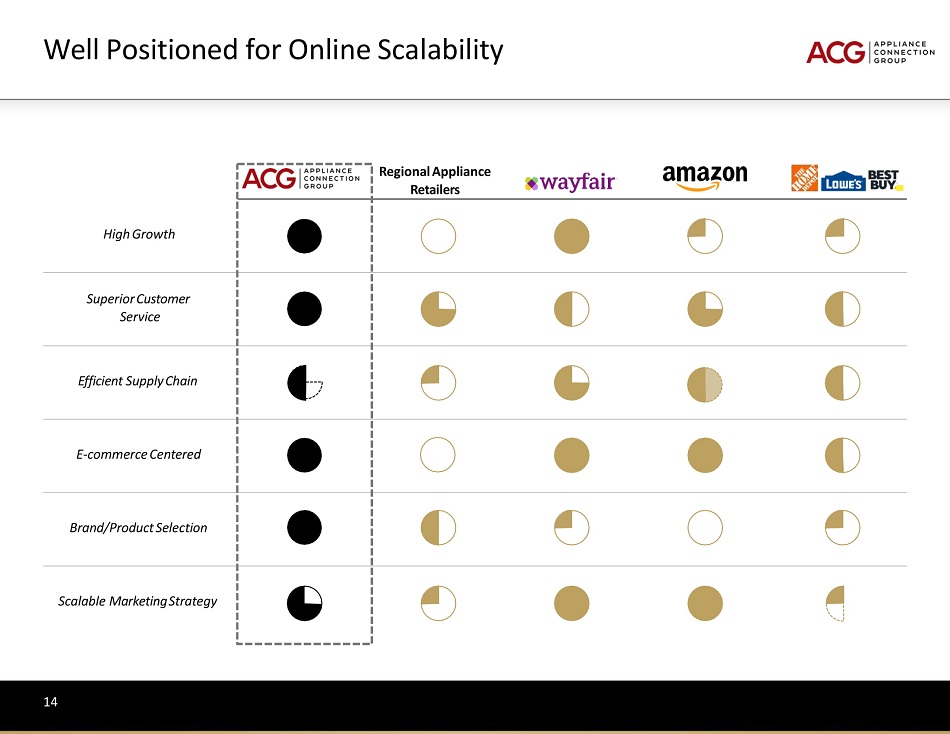

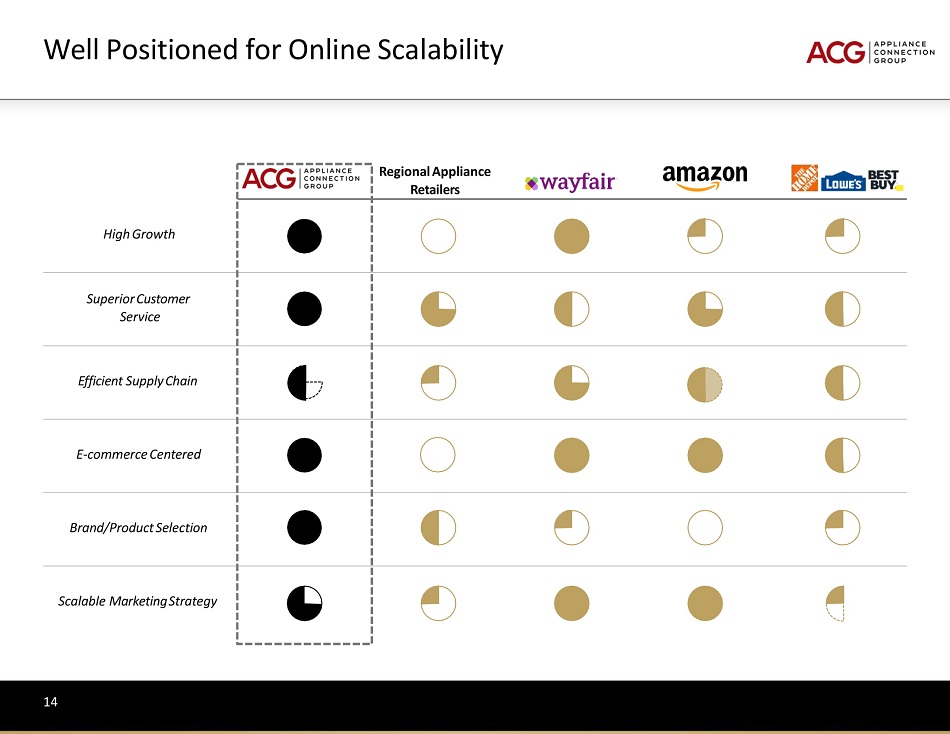

Regional Appliance Retailers High Growth Superior Customer Service Efficient Supply Chain E - commerce Centered Brand/Product Selection Scalable Marketing Strategy Well Positioned for Online Scalability 14

ACG Fulfillment Model Today ACG Fulfillment Capabilities • Asset light model optimizes operational capabilities • Expanded cross - docking capabilities improve order - to - shipment times • Speed of delivery drives conversion, retention and reduced costs • Control over delivery times enables seamless customer experiences • Additional fulfillment centers provide proximity to suppliers and customers St. Louis, MO Trenton, NJ 15

• Continue to improve customer acquisition efficiency through data - driven targeting and differentiated digital engagement • Deepen vendor relationships to obtain widespread favored partner status and pricing, improving product selection and availability • Optimize supply chain and fulfillment center footprint to accelerate delivery cycle, driving stronger customer satisfaction and retention • Remove sales friction by offering competitive financing plans to customers • Extend into contractor, developer, designer market with tailored offering, attractive pricing and bespoke customer service • Selectively pursue accretive acquisitions to strengthen reach, capabilities and delivery times Growth Strategies – Combined Goedeker and Appliances Connection 16

Q1 2021 Financial Highlights ( in millions) Orders $30.7 $168.6 $199.3 Fill rate 44.6% 64.8% 61.7% Revenue $13.7 $109.3 $123.0 Gross profit $2.6 $29.5 $32.2 Gross profit margin 19.0% 27.0% 26.2% Operating income (loss) ($3.3) $17.5 $14.2 Net income (loss) ($3.5) $19.5 $13.0 2 Adjusted EBITDA ($3.1) $19.9 $14.7 3 1847 Goedeker Inc. Appliances Connection Combined Company 1 1. Figures reflect combined figures of Goedeker and Appliances Connection, not calculated under Article 11 for the 3 month period ending March 31, 2021 2. Includes pro - forma adjustment of - 3.1 million 3. See Q1 2021 Adjusted EBITDA calculation on slide 24 Quarter Ended March 31, 202 1 17

$367. 7 $590 . 1 $55. 1 $312. 6 $123 . 2 $466 . 9 Growth in Orders and Revenues 2019 - 2020 Current Goedeker and Appliances Connection Revenues and Orders 2020 ACG Combined Revenues and Orders in Millions for the Period January 1 – December 31 in Millions for the Period January 1 – December 31 2019 A 2020 A 2020 A Goedeker Revenues Goedeker Orders Goedeker Revenues Goedeker Orders Appliances Connection Revenues Appliances Connection Orders Combined Combined 2020 15% 99% 43% 85% 6x 4x ACG Combined Revenues ACG Combined Orders Appliances Connection Revenues Appliances Connection Orders $47 . 6 $219. 3 $61 . 8 $252 . 3 18

Select E-Commerce Industry Public ComparablesCompany(Ticker)MarketCap1EnterpriseValue11Q2021Revenue1Q2021Adj.EBITDA22020Revenue2020Adj.EBITDA22020EV /Adj.EBITDA2020EV /Revenue(figures in millions, except formultiples)Wayfair Inc. (NYSE: W)$32,370$33,656$3,478$206$14,145$94735.5x2.4xOverstock.com, Inc. (NASDAQ: OSTK)$3,277$2,887$660$34$2,550$8832.8x1.1xPurple Innovation, Inc.(NASDAQ: PRPL)$1,924$1,930$186$23$648$8821.9x3.0xThe Lovesac Company (NASDAQ: LOVE)5$1,143$1,064-4-4$321$2838.0x3.3xMean32.1x2.5x1847 Goedeker Inc. (NYSE American: GOED)3$3006$3016$123$14.7$368$14.420.9x0.8x*Provided for informational purposes only and there's no certainty of an increase in value or increase in multiple of Adj. EBITDA or Revenue. Investors may view other factors asmore relevant to the company's valuation.1)Market Caps and Enterprise Values from CapitalIQ as of close 5/21/212)Adj. EBITDA as reported by each company3)Combined Pro-Forma Goedeker and Appliances Connection Results for 2020 and pro-forma Market Cap and Enterprise Value following the offering and the issuance of the acquisition consideration4)Not yet reported by the company5)Company reports fiscal year end as of Jan 31, 2021; therefore Revenue and Adj. EBITDA numbers include January6)Assuming no exercise of the warrants being offered in this offering

Capitalization Common shares outstanding 1 6,111,200 Common shares to be issued for the acquisition of Appliances Connection 2 2,333,333 $21 million of common shares 1 Excluding 555,000 options at an exercise price of $9.00 per share and 455,560 warrants at a weighted average exercise price o f $11.91 per share. 2 The purchase price consists of (i) $180,000,000 in cash, (ii) 2,333,333 shares of our common stock and (iii) a number of shar es of our common stock that is equal to (A) $21,000,000 divided by (B) the average of the closing price of our shares of common stock (as reported on NYSE American) for the 20 trading days imm edi ately preceding the 3rd trading day prior to the closing date of the acquisition. 3 We have entered into a non - binding engagement letter with a commercial bank for the provision of a senior secured credit facilit y involving a term loan in the expected principal amount of $60 million, which will be used to pay a portion of the cash portion of the purchase price, and a revolving loan in the expec ted principal amount of $10 million, which will be used for general corporate and working capital purposes. Pro forma cash excludes restricted cash of approximately $7 million. Net Proceeds from this Offering $189.6 million Term Loan 3 $56.5 million Revolving Loan 3 $10 million Appliances Connection cash purchase price $180 million Pro forma cash and cash equivalents for working capital and general purposes 3 $40.1 million Summary Sources & Uses Capitalization Table 20

Distinguished Pure Play Appliance - Focused Online Platform Within a Fragmented Marketplace Consistent Positive Customer Experience Highly Productive Customer Representatives with Extensive Product Knowledge Accessible Through Website, Phone and Chat Native to Digital. Vertically Integrated. Capitalizing on Inherent Advantages in the Current Environment Key Investment Highlights 1 5 2 6 Working Capital Efficiency / Asset Light Business Model Extensive Core, Premium & Luxury Product Offerings 3 4 21

Appendix 22

FY 2020 Adjusted EBITDA Reconciliation Operating (Loss) Income $19 .4 ( $1 4 . 4) $5 .0 % of Sales 6 . 2% ( 2 6 . 2 % ) 1 . 4% Other income (expense) Interest income $ 1 . 0 $ 0 . 0 ( $ 1 . 0) $ 0 . 0 Financing costs $ 0 . 0 ( $ 0 . 8) - ( $ 0 . 8) Interest expense ( $ 0 . 7) ( $ 0 . 9) ( $ 3 . 9) ( $ 5 . 4) Loss on extinguishment of debt - ( $ 1 . 8) - ( $ 1 . 8) Adjustment in value of contingency - ( $ 0 . 1) - ( $ 0 . 1) Write - off of acquisition receivable - ( $ 0 . 8) - ( $ 0 . 8) Change in fair value of warrant liability - ( $ 2 . 1) - ( $ 2 . 1) Other income $ 0.4 $ 0.0 - $ 0.4 Total Other Income (Expense) $ 0 .7 ( $ 6 . 4) ( $ 4 . 9) ( $ 10 . 6) Income (Loss) Before Income Taxes $ 20 . 1 ( $ 2 0 . 9) - ( $ 5 . 7) Income tax Benefit / (Expense) - ( $ 0 . 7) - ( $ 0 . 7) Net Income (Loss) $20 .1 ( $2 1 . 6) ( $4 . 9) ( $6 . 4) Income tax - $ 0 . 7 - $ 0 . 7 Depreciation and amortization $ 0 . 8 $ 0 . 5 - $ 1 . 3 Financing costs - $ 0 . 8 - $ 0 . 8 Interest expense $ 0 . 7 $ 0 . 9 $ 3 . 9 $ 5 . 4 Sales tax accrual (Non - GAAP) $ 5 . 1 $ 2 . 6 - $ 7 . 7 One - time non - operational events: Loss on extinguishment of debt (Non - GAAP) - $ 1 . 8 - $ 1 . 8 Adjustment in value of contingency (Non - GAAP) - $ 0 . 1 - $ 0 . 1 Write - off of acquisition receivable (Non - GAAP) - $ 0 . 8 - $ 0 . 8 Change in fair value of warrant liability (Non - GAAP) - $ 2 . 1 - $ 2 . 1 Adjusted EBITDA $26 .7 ( $1 1 . 3) ( $1 . 0) $14 .4 Pro Forma Adjusted EBITDA Reconciliation Year Ended December 31, 2020 ($ in millions) Pro Forma Appliances Connection 1847 Goedeker Inc. Adjustments Pro Forma Condensed 23

Q1 2021 Adjusted EBITDA Reconciliation Operating (Loss) Income $ 17.5 ( $ 3.3 ) $14.2 % of Sales 1 6 . 0 % ( 24.0 %) 1 1.6 % Other income (expense) Interest income $0.2 $ 0.0 $(0.2) $ 0 . 0 Financing costs - - - - Interest expense $(0.2) $(0.2) $ ( 1.0 ) $ ( 1.4) Loss on extinguishment of debt - - - - Adjustment in value of contingency - - - - Write - off of acquisition receivable - - - - Change in fair value of warrant liability - - - Other income $2.0 $ 0.0 ($1.9) $ 0.1 Total Other Income (Expense) $ 2.0 ($0.2) ( $3.1) ($1.3) Income (Loss) Before Income Taxes $ 19.5 ( $3.5) ($3.1) $13.0 Income tax Benefit / (Expense) - - - - Net Income (Loss) $ 19.5 ( $ 3.5) ( $ 3.1 ) $ 13.0 Income tax - - - - Depreciation and amortization $ 0 . 2 $ 0. 1 - $0.3 Financing costs - - - - Interest expense $ 0 . 2 $ 0. 2 $1.0 $1.4 Sales tax accrual (Non - GAAP) - - - - One - time non - operational events: Loss on extinguishment of debt (Non - GAAP) - - - - Adjustment in value of contingency (Non - GAAP) - - - - Write - off of acquisition receivable (Non - GAAP) - - - - Change in fair value of warrant liability (Non - GAAP) - - - - Adjusted EBITDA $19.9 ( $ 3.1 ) ( $ 2.1 ) $14 . 7 Pro Forma Adjusted EBITDA Reconciliation Quarte r Ended March 31, 202 1 ($ in millions) Pro Forma Appliances Connection 1847 Goedeker Inc. Adjustments Pro Forma Condensed 24