Filed Pursuant to Rule 424(b)(4)

Registration No. 333-255043

18,000,000 Shares

Class A Common Stock

The selling stockholders named in this prospectus are offering 18,000,000 shares of our Class A common stock. We are not selling any shares under this prospectus and we will not receive any proceeds from the sale of shares by the selling stockholders.

Our Class A common stock is listed on The Nasdaq Global Select Market, or the NASDAQ, under the symbol “MRVI”. On April 7, 2021, the last reported sales price of our Class A common stock on The Nasdaq Global Select Market was $32.46 per share.

Immediately after this offering, funds controlled by our principal stockholder, GTCR, LLC (“GTCR”), will control approximately 66.2% of the combined voting power of our outstanding shares of Class A common stock and Class B common stock (or 65.2% if the underwriters’ option to purchase additional shares is exercised in full). As a result, we will continue to be a “controlled company” within the meaning of the corporate governance standards of The Nasdaq Stock Market. See “Management—Corporate Governance—Controlled Company Status.”

Maravai LifeSciences Holdings, Inc. is an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, has elected to comply with certain reduced public company reporting requirements for this prospectus.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 11 to read about factors you should consider before buying shares of our Class A common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| | | | | | | | |

| | | Per share | | | Total | |

Public offering price | | | $31.25 | | | | $562,500,000 | |

Underwriting discounts and commissions(1) | | | $1.09375 | | | | $19,687,500 | |

Proceeds, before expenses, to the selling stockholders | | | $30.15625 | | | | $542,812,500 | |

| (1) | See “Underwriters” for additional information regarding underwriting compensation. |

The underwriters have the option to purchase up to an additional 2,700,000 shares of our Class A common stock from the selling stockholders at the public offering price less the underwriting discounts and commissions for a period of 30 days after the date of this prospectus. We will not receive any proceeds from the sale of additional shares of Class A Common Stock by the selling stockholders.

The underwriters expect to deliver shares of Class A common stock against payment in New York, New York on or about April 12, 2021.

| | | | |

| MORGAN STANLEY | | JEFFERIES | | GOLDMAN SACHS & CO. LLC |

| | | | |

| | |

| BOFA SECURITIES | | CREDIT SUISSE | | UBS INVESTMENT BANK |

| | | | | | |

| | | |

| BAIRD | | WILLIAM BLAIR | | STIFEL | | KEYBANC CAPITAL MARKETS |

| | | | | | |

| | | |

| ACADEMY SECURITIES | | LOOP CAPITAL MARKETS | | PENSERRA SECURITIES LLC | | TIGRESS FINANCIAL PARTNERS |

Prospectus dated April 7, 2021

TABLE OF CONTENTS

Neither we, the selling stockholders, nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in or incorporated by reference in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission (the “SEC”). Neither we, the selling stockholders, nor the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or the date of the applicable document incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations, and prospects may have changed since such dates. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference into this prospectus) the statement in the document having the later date modifies or supersedes the earlier statement.

For investors outside of the United States, neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

i

BASIS OF PRESENTATION

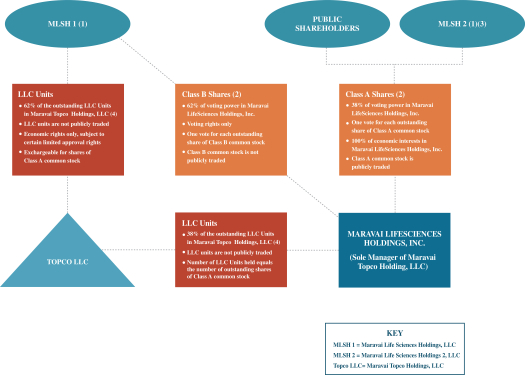

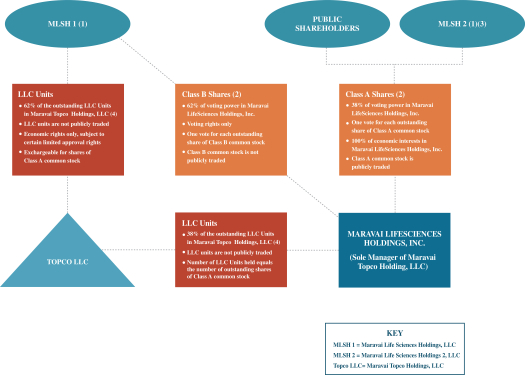

In connection with our initial public offering (“IPO”) in November 2020, we effected certain organizational transactions. Unless otherwise stated or the context otherwise requires, all information in this prospectus reflects the consummation of the organizational transactions, including the IPO, which we refer to collectively as the “Organizational Transactions.” See “Prospectus Summary—Ownership and Organizational Structure” for a description of the Organizational Transactions and a diagram depicting our structure after giving effect to the Organizational Transactions.

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “our business,” “the Company” and “Maravai” refer to and similar references refer: (1) on or following the consummation of the Organizational Transactions, including the IPO, to Maravai LifeSciences Holdings, Inc. and its consolidated subsidiaries, including Topco LLC, and (2) prior to the consummation of the Organizational Transactions, including the IPO, to Topco LLC and its consolidated subsidiaries. The term “GTCR” or “our Principal Stockholder” refers to GTCR, LLC, our principal stockholder, and the term “Topco LLC” refers to Maravai Topco Holdings, LLC.

We are a holding company and the sole managing member of Topco LLC and our sole asset is LLC Units of Topco LLC. Maravai LifeSciences Holdings, Inc. operates and controls all of the business and affairs and consolidates the financial results of Topco LLC. Topco LLC is the predecessor of Maravai LifeSciences Holdings, Inc. for financial reporting purposes. The Organizational Transactions are considered transactions between entities under common control. As a result, the consolidated financial statements for periods prior to the IPO and the Organizational Transactions have been adjusted to combine the previously separate entities for presentation purposes.

Unless stated otherwise, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information included in this prospectus or incorporated by reference herein concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from independent industry analysts and publications, as well as our own estimates and research.

Our estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. We have not had this information verified by any independent sources. The independent industry publications used in this prospectus or incorporated by reference in this prospectus were not prepared on our behalf. While we are not aware of any misstatements regarding any information presented in this prospectus or incorporated by reference herein, forecasts, assumptions, expectations, beliefs, estimates and projects involve risk and uncertainties and are subject to change based on various factors, including those described under the headings “Forward-Looking Statements” and “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference

TRADEMARKS AND TRADENAMES

This prospectus includes our trademarks and service marks, “Maravai LifeSciences,” “TriLink BioTechnologies,” “Glen Research,” “Cygnus Technologies,” “Vector Laboratories,” “CleanCap®,” and “MockV™,” which are protected under applicable intellectual property laws and are the property of Maravai LifeSciences Holdings, Inc. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and in the documents incorporated by reference into this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus and the documents incorporated by reference herein, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes. Some of the statements in this prospectus and in the documents incorporated by reference herein are forward-looking statements. See “Forward-Looking Statements.” Unless otherwise stated, this prospectus assumes no exercise of the underwriters’ option to purchase additional shares of Class A common stock.

OVERVIEW

We are a leading life sciences company providing critical products to enable the development of drug therapies, diagnostics, novel vaccines and support research on human diseases. Our more than 5,200 customers as of December 31, 2020 include the top 20 global biopharmaceutical companies ranked by research and development expenditures according to industry consultants, and many other emerging biopharmaceutical and life sciences research companies, as well as leading academic research institutions and in vitro diagnostics companies. Our products address the key phases of biopharmaceutical development and include complex nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

Our businesses principally address high growth market segments in biopharmaceutical development that are growing at a weighted average blended rate of 20% per annum. In particular, the field of cell and gene therapy has emerged as one of the fastest growing treatment modalities to address a host of human conditions. There are more than 400 cell and gene therapies in development or launched and sales in this category are expected to grow more than tenfold by 2024, according to industry consultants and management estimates. Our portfolio offers key products for each stage of the cell and gene therapy development lifecycle. For example, our mRNA products are used in drug development to assist in the production of immune-activating antigens; our CleanCap® technology is used to stabilize mRNA and streamlines mRNA manufacturing; and we expect our upcoming plasmid DNA products will be used as templates for the production of our RNA products. We also provide biologics safety testing technology used to ensure the safety of the biological drug manufacturing process and drug products.

mRNA is at the core of our capabilities. We developed our expertise in mRNA with a belief in its potential as a therapeutic modality. The first clinical trial for an mRNA therapeutic agent occurred in 2016. More than 30 clinical trials have occurred since then, principally focused on vaccines against viruses and cancer vaccines. With the COVID-19 pandemic, mRNA has shown its potential for more rapid vaccine design and manufacture when compared to traditional techniques involving culturing inactivated virus to elicit an immune response.

For a description of our business, financial condition, results of operations and other important information regarding us, see our filings with the SEC incorporated by reference in this prospectus. For instructions on how to find copies of the filings incorporated by reference in this prospectus, see “Where You Can Find More Information.”

1

RECENT DEVELOPMENTS

Preliminary Results for the Three Months Ended March 31, 2021

Although our results of operations for the three months ended March 31, 2021 are not yet final, the following unaudited information reflects our preliminary expectation with respect to such results based on information currently available to management.

The preliminary financial information included in this registration statement reflects management’s estimates based solely upon information available to us as of the date of this filing and is the responsibility of management. The preliminary consolidated financial results presented are not a comprehensive statement of our consolidated financial results for the three months ended March 31, 2021. In addition, the preliminary consolidated financial results presented below have not been audited, reviewed, or compiled by our independent registered public accounting firm, Ernst & Young LLP. Accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information. The preliminary financial results presented below are subject to the completion of our financial closing procedures, which have not yet been completed. Our actual results for the three months ended March 31, 2021 are not available. During the course of the preparation of the respective consolidated financial statements and related notes, additional items that would require material adjustments to be made to the preliminary estimated consolidated financial results presented below may be identified. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. See “Forward-Looking Statements.”

Preliminary Unaudited Total Revenue and Revenue by Segment for the Three Months Ended March 31, 2021

Subject to quarter-end closing adjustments, we expect that total revenue will be approximately $147.8 million for the three months ended March 31, 2021, as compared to $51.0 million for the same period in 2020 and $98.4 million compared to the three months ended December 31, 2020, representing a period-over-period increase of 190% and a sequential increase of 50%, respectively. These increases are primarily attributable to increase in revenue from our Nucleic Acid Production segment driven by increased demand for our proprietary CleanCap® analogs, which principally serve the growing mRNA vaccine and therapeutic markets, ongoing demand for highly modified RNA products, particularly mRNA, and increased demand for molecular diagnostic test components.

We expect total revenue by segment as follows:

| | | | | | | | | | | | | | | | |

(in millions) | | Three Months Ended

March 31, | | | | | | | |

| | | 2021 | | | 2020 | | | $ Change | | | % Change | |

Nucleic Acid Production | | | 123.6 | | | | 30.5 | | | | 93.1 | | | | 305 | % |

Biologics Safety Testing | | | 17.6 | | | | 14.3 | | | | 3.3 | | | | 23 | % |

Protein Detection | | | 6.6 | | | | 6.2 | | | | 0.4 | | | | 6 | % |

| | | | | | | | | | | | | | | | |

Total Revenue | | $ | 147.8 | | | $ | 51.0 | | | $ | 96.8 | | | | 190 | % |

| | | | | | | | | | | | | | | | |

Preliminary Unaudited Income from Operations for the Three Months Ended March 31, 2021

We expect that Income from Operations will be within a range of $80.0 million to $100.0 million for the three months ended March 31, 2021, as compared to $34.8 million for the same period in 2020 and $31.2 million compared to the three months ended December 31, 2020, representing a period-over-period increase of 129.9% - 187.4% and a sequential increase of 156.4% - 220.5%, respectively. These increases are primarily attributable to increase in revenue, partially offset by increase in cost of revenue.

2

OUR PRINCIPAL STOCKHOLDER

We have a valuable relationship with our principal stockholder, GTCR. Founded in 1980, GTCR is a leading growth-oriented private equity firm focused on investing in growth companies in the Healthcare, Financial Services & Technology, Technology, Media & Telecommunications and Growth Business Services industries. The Chicago-based firm pioneered The Leaders Strategy™—finding and partnering with management leaders in core domains to identify, acquire and build market-leading companies through transformational acquisitions and organic growth. Maravai is an example of the Leaders Strategy™, whereby GTCR partnered with Carl Hull and Eric Tardif to build and grow a leading life sciences platform. Since its inception, GTCR has invested more than $20.0 billion in over 250 companies.

GENERAL CORPORATE INFORMATION

We completed our IPO on November 19, 2020, and our Class A common stock commenced trading on The Nasdaq Global Select Market. Our principal executive offices are located at 10770 Wateridge Circle Suite 200, San Diego, California, 92121. Our telephone number is (858) 546-0004. Our website address is www.maravai.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our Class A common stock. We are a holding company and all of our business operations are conducted through, and substantially all of our assets are held by, our subsidiaries.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earlier of (1) December 31, 2025, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the date on which we are deemed to be a large accelerated filer (this means the market value of common that is held by non-affiliates exceeds $700.0 million as of the end of the second quarter of that fiscal year), or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies until they no longer qualify as an emerging growth company. These provisions include, but are not limited to:

| | • | | not being required to comply with the independent registered public accounting firm attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| | • | | only required to present two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and related management’s discussion and analysis of financial condition and results of operations; |

| | • | | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| | • | | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

3

We have elected to take advantage of certain of the reduced disclosure obligations regarding financial statements and executive compensation in this prospectus and expect to elect to take advantage of other reduced burdens in future filings until we no longer qualify as an emerging growth company. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Under the JOBS Act emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial accounting standards. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies, which may make comparison of our financials to those of other public companies more difficult.

OWNERSHIP AND ORGANIZATIONAL STRUCTURE

Maravai LifeSciences Holdings, Inc. is a Delaware corporation that was formed to serve as a holding company and holds an interest in Topco LLC. Maravai LifeSciences Holdings, Inc. has not engaged in any business or other activities other than in connection with its formation, the Organizational Transactions, the IPO and this offering.

Immediately prior to the consummation of our IPO, we and the other direct and indirect unitholders of Topco LLC, effected a series of transactions that resulted in (i) Maravai LifeSciences Holdings, Inc. becoming the ultimate parent company of Topco LLC and (ii) the then-current unitholders in Topco LLC exchanging their interests in Topco LLC for Class A common stock of Maravai LifeSciences Holdings, Inc. We refer to these transactions as the “Organizational Transactions.”

| | • | | We amended and restated Topco LLC’s existing operating agreement (the “LLC Operating Agreement”) to, among other things, (i) modify Topco LLC’s capital structure by replacing the membership interests currently held by Topco LLC’s existing owners (beneficially owned through Maravai Life Sciences Holdings, LLC (“MLSH 1”)) with a new class of LLC Units held initially by MLSH 1 and (ii) appoint Maravai LifeSciences Holdings, Inc. as the sole managing member of Topco LLC. |

| | • | | Certain of the entities (the “Blocker Entities”) through which GTCR and other existing members of MLSH 1 held their ownership interests in MLSH 1 formed Maravai Life Sciences Holdings 2, LLC (“MLSH 2”) and engaged in a series of transactions (the “Blocker Mergers”) that resulted in each of the Blocker Entities merging with and into Maravai LifeSciences Holdings, Inc., with Maravai LifeSciences Holdings, Inc. remaining as the surviving corporation. As a result of such transactions, (i) the former unitholders of the Blocker Entities became members of MLSH 2 and (ii) MLSH 2 exchanged all of the equity interests in the Blocker Entities for (x) shares of Class A common stock and (y) the right to receive payments pursuant to the Tax Receivable Agreement. |

| | • | | We entered into an exchange agreement (the “Exchange Agreement”) with MLSH 1 pursuant to which MLSH 1 is entitled to exchange LLC Units, together with an equal number of shares of Class B common stock, for shares of Class A common stock on a one-for-one basis or, at our election, for cash, from a substantially concurrent public offering or private sale (based on the price of our Class A common stock in such public offering or private sale). |

| | • | | We entered into a tax receivable agreement (the “Tax Receivable Agreement”) with MLSH 1 and MLSH 2 that provides for the payment by Maravai LifeSciences Holdings, Inc. to MLSH 1 and MLSH 2, collectively, of 85% of the amount of cash savings, if any, in U.S. federal, state and local income |

4

| | taxes (computed using simplifying assumptions to address the impact of state and local taxes) we actually realize (or, under certain circumstances are deemed to realize in the case of an early termination payment by us, a change in control or a material breach by us of our obligations under the Tax Receivable Agreement, as discussed below) as a result of (i) certain increases in the tax basis of assets of Topco LLC and its subsidiaries resulting from purchases or exchanges of LLC Units, (ii) certain tax attributes of the Blocker Entities, Topco LLC and subsidiaries of Topco LLC that existed prior to the IPO and (iii) certain other tax benefits related to our entering into the Tax Receivable Agreement, including tax benefits attributable to payments that we are required to make under the Tax Receivable Agreement. |

The diagram below depicts our current organizational structure. This diagram is provided for illustrative purposes only and does not purport to represent all legal entities owned or controlled by us, or owning a beneficial interest in us.

| (1) | Upon completion of this offering, GTCR will continue to control the voting power in Maravai LifeSciences Holdings, Inc. as follows: (i) approximately 56.5% through its control of MLSH 1, or 55.6% if the underwriters exercise in full their option to purchase additional shares, and (ii) approximately 9.7% through its control of MLSH 2, or 9.6% if the underwriters exercise in full their option to purchase additional shares. See “Principal and Selling Stockholders” for additional information about MLSH 1 and MLSH 2. |

| (2) | Shares of Class A common stock and Class B common stock vote as a single class. Each outstanding share of Class A common stock and Class B Common stock is entitled to one vote on all matters to be voted on by stockholders generally. The Class B common stock does not have any right to receive dividends or distributions upon the liquidation or winding up of Maravai LifeSciences Holdings, Inc. In accordance with the Exchange Agreement entered into in connection with the Organizational Transactions, MLSH 1 is entitled to exchange LLC Units, together with an equal number of shares of Class B common stock, for |

5

| | shares of Class A common stock determined in accordance with the Exchange Agreement or, at our election, for cash from a substantially concurrent public offering or private sale (based on the price of our Class A common stock in such public offering or private sale). |

| (3) | Upon completion of the IPO, we awarded options to purchase an aggregate of 1,522,100 shares of Class A common stock and, since completion of the IPO, we have awarded additional options to purchase an aggregate of 131,235 shares of Class A common stock, in each instance issued pursuant to the 2020 Omnibus Incentive Plan (the “2020 Plan”) and with a weighted average exercise price of $27.58. |

| (4) | Upon completion of this offering, (i) the holders of Class A common stock will have 43.5% of the voting power in Maravai LifeSciences Holdings, Inc., (ii) MLSH 1, through ownership of the Class B common stock, will have 56.5% of the voting power of Maravai LifeSciences Holdings, Inc., (iii) MLSH 1 will own 56.5% of the outstanding LLC Units in Topco LLC and (iv) Maravai LifeSciences Holdings, Inc. will own 43.5% of the outstanding LLC Units in Topco LLC. |

Our corporate structure, as described above, is commonly referred to as an “Up-C” structure, which is commonly used by partnerships and limited liability companies when they undertake an initial public offering of their business. Our Up-C structure together with the Tax Receivable Agreement allows the existing owners of Topco LLC to continue to realize tax benefits associated with owning interests in an entity that is treated as a partnership, or “passthrough” entity, for income tax purposes. One of these benefits is that taxable income of the Topco LLC that is allocated to such owners will be taxed on a flow-through basis and therefore will not be subject to corporate taxes at the entity level. Additionally, because the LLC Units that the existing owners continue to hold are exchangeable for shares of our Class A common stock or, at our option, for cash, from Topco LLC, the Up-C structure also provides the existing owners of Topco LLC potential liquidity that holders of non-publicly traded limited liability companies are not typically afforded. See “Description of Capital Stock.”

MLSH 1 holds a number of shares of our Class B common stock equal to the number of LLC Units it owns. Holders of our Class A common stock and Class B common stock are each entitled to one vote per share on all matters on which stockholders are entitled to vote.

Maravai LifeSciences Holdings, Inc. holds LLC Units, and therefore receive benefits on account of its ownership in an entity treated as a partnership, or “passthrough” entity, for income tax purposes. As Maravai LifeSciences Holdings, Inc. purchases LLC Units from MLSH 1 under the mechanism described above, it will obtain a step-up in tax basis in its share of the assets of Topco LLC and its flow-through subsidiaries. This step-up in tax basis will provide Maravai LifeSciences Holdings, Inc. with certain tax benefits, such as future depreciation and amortization deductions that can reduce the taxable income allocable to Maravai LifeSciences Holdings, Inc. Pursuant to the Tax Receivable Agreement, Maravai LifeSciences Holdings, Inc. agreed to pay MLSH 1 and MLSH 2, collectively, 85% of the value of these tax benefits; however, the remaining 15% of such benefits is available to Maravai LifeSciences Holdings, Inc. Due to the uncertainty of various factors, we cannot precisely quantify the likely tax benefits we will realize as a result of LLC Unit exchanges and the resulting amounts we are likely to pay out to LLC Unitholders pursuant to the Tax Receivable Agreement; however, we estimate that such payments may be substantial.

Generally, Maravai LifeSciences Holdings, Inc. will receive a pro rata share of any distributions (including tax distributions) made by Topco LLC to its members. Tax distributions will be calculated without regard to any applicable basis adjustment under Section 743(b) of the Internal Revenue Code (the “Code”) and will be based upon an assumed tax rate, which, under certain circumstances, may cause Topco LLC to make tax distributions that, in the aggregate, exceed the amount of taxes that Topco LLC would have paid if it were a similarly situated corporate taxpayer. Funds used by Topco LLC to satisfy its tax distribution obligations will not be available for reinvestment in our business.

6

THE OFFERING

| | |

Class A common stock offered by the selling

stockholders in this offering | |

18,000,000 shares. |

| |

Option to purchase additional shares of Class A common stock from the selling stockholders | |

The underwriters have the option to purchase up to an additional 2,700,000 shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus. |

| |

Class A common stock to be outstanding immediately after this offering | |

112,008,218 shares (or 114,312,474 shares if the underwriters’ option is exercised in full). If all outstanding LLC Units (together with the same number of shares of our Class B common stock) held by MLSH 1 were exchanged for newly-issued shares of Class A common stock on a one-for-one basis, 257,620,644 shares of Class A common stock would be outstanding |

| |

Class B common stock to be outstanding immediately after this offering | |

145,612,426 shares (or 143,308,170 shares if the underwriters’ option is exercised in full). |

| |

Use of proceeds | | The selling stockholders will receive all of the net proceeds from this offering and we will not receive any proceeds from the sale of shares of Class A common stock in this offering. See “Use of Proceeds”. |

| |

Risk factors | | Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

| |

Voting power held by holders of Class A common stock immediately after this offering | |

43.5% (44.4% if the underwriters’ option is exercised in full) |

| |

Voting power held by holders of Class B common stock immediately after this offering | |

56.5% (or 55.6% if the underwriters’ option is exercised in full) |

| |

Symbol for trading on The Nasdaq Global Select

Market | |

“MRVI.” |

The number of shares of Class A common stock to be outstanding following this offering is based on 96,646,515 shares of Class A common stock outstanding as of December 31, 2020, and excludes:

| | • | | 160,974,129 shares of Class A common stock that may be issuable upon exercise of redemption and exchange rights held by MLSH 1, as of December 31, 2020; |

| | • | | 5,152,513 shares of Class A common stock, plus future increases, reserved for issuance under our 2020 Employee Stock Purchase Plan (the “ESPP”), as of December 31, 2020; and |

7

| | • | | 25,762,064 shares of Class A common stock reserved for future issuance under the 2020 Plan, including (i) options to purchase 1,522,100 shares of Class A common stock issued to certain employees upon completion of the IPO and, since completion of the IPO, we have awarded additional options to purchase an aggregate of 131,235 shares of Class A common stock issued pursuant to the 2020 Plan, in each instance that vest in accordance with the schedule described in “Executive and Director Compensation” and with a weighted average exercise price of $27.58 and (ii) 71,112 restricted stock units (“RSUs”) that may be settled for an equal number of shares of Class A common stock that were issued to our six independent directors upon completion of the IPO and that vest annually over three years, each as of December 31, 2020. |

Unless otherwise indicated, all information in this prospectus assumes:

| | • | | no exercise of outstanding options or issuance of shares of Class A common stock upon vesting and settlement RSUs after December 31, 2020; and |

| | • | | no exercise by the underwriters of their option to purchase up to 2,250,000 additional shares of Class A common stock from any of the selling stockholders. |

8

SUMMARY HISTORICAL FINANCIAL AND OTHER DATA

The following tables summarize our consolidated financial data. The summary consolidated statement of operations data for the years ended December 31, 2020, 2019 and 2018 and the summary consolidated balance sheet data as of December 31, 2020 and 2019 are derived from our audited consolidated financial statements that are incorporated by reference into this prospectus.

Our historical results are not necessarily indicative of the results that may be expected in the future. You should read the summary historical financial data below in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes appearing in our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference into this prospectus.

| | | | | | | | | | | | |

| | | Year Ended

December 31, | |

| | | 2020 | | | 2019 | | | 2018 | |

| | | (in thousands, except share and unit amounts and

per share and per unit amounts) | |

Revenue | | $ | 284,098 | | | $ | 143,140 | | | $ | 123,833 | |

Operating expenses | | | | | | | | | | | | |

Cost of revenue | | | 79,649 | | | | 66,849 | | | | 60,765 | |

Research and development | | | 9,304 | | | | 3,627 | | | | 4,499 | |

Selling, general and administrative | | | 94,245 | | | | 48,354 | | | | 41,194 | |

Change in estimated fair value of contingent consideration | | | — | | | | 322 | | | | 939 | |

Gain on sale and leaseback transaction | | | (19,002 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

Total operating expenses | | | 164,196 | | | | 119,152 | | | | 107,397 | |

| | | | | | | | | | | | |

Income from operations | | | 119,902 | | | | 23,988 | | | | 16,436 | |

Other income (expense) | | | | | | | | | | | | |

Interest expense | | | (30,740 | ) | | | (29,959 | ) | | | (27,399 | ) |

Loss on extinguishment of debt | | | (7,592 | ) | | | — | | | | (5,622 | ) |

Other income | | | 126 | | | | 118 | | | | 87 | |

| | | | | | | | | | | | |

Income (loss) before income taxes | | | 81,696 | | | | (5,853 | ) | | | (16,498 | ) |

Income tax expense (benefit) | | | 2,880 | | | | (652 | ) | | | 417 | |

| | | | | | | | | | | | |

Net income (loss) | | | 78,816 | | | | (5,201 | ) | | | (16,915 | ) |

Net (loss) attributable to noncontrolling interests | | | (10,156 | ) | | | (731 | ) | | | (12,443 | ) |

| | | | | | | | | | | | |

Net income (loss) attributable to Maravai LifeSciences Holdings, Inc. | | $ | 88,972 | | | $ | (4,470 | ) | | $ | (4,472 | ) |

| | | | | | | | | | | | |

Net income (loss) per Class A common share/unit attributable to Maravai LifeSciences Holdings, Inc.: | | | | | | | | | | | | |

Basic | | $ | 7.43 | | | $ | (0.03 | ) | | $ | (0.07 | ) |

Diluted | | $ | 2.36 | | | $ | (0.03 | ) | | $ | (0.07 | ) |

Weighted average number of Class A common shares/units outstanding: | | | | | | | | | | | | |

Basic | | | 10,351,137 | | | | 253,916,941 | | | | 253,916,941 | |

Diluted | | | 28,907,979 | | | | 253,916,941 | | | | 253,916,941 | |

9

| | | | | | | | |

| | | As of December 31,

2020 | | | As of December 31,

2019 | |

| | | (in thousands) | |

Consolidated Balance Sheet Data: | | | | | | | | |

Cash | | $ | 236,184 | | | $ | 24,700 | |

Working capital(1) | | | 200,820 | | | | 30,990 | |

Total assets | | | 1,270,691 | | | | 577,796 | |

Long-term debt, less current portion | | | 528,614 | | | | 334,783 | |

Total liabilities | | | 1,115,945 | | | | 433,169 | |

Total member’s/shareholders’ equity | | | 154,746 | | | | 144,627 | |

| (1) | We define working capital as current assets less current liabilities. |

10

RISK FACTORS

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as the risks and uncertainties set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, which is incorporated by referenced herein, together with all of the other information included or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes thereto, before making a decision to invest in our Class A common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our Class A common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Class A Common Stock and This Offering

GTCR controls us, and its interests may conflict with ours or yours in the future.

Immediately following this offering, investment entities affiliated with GTCR will control approximately 66.2% of the voting power of our outstanding common stock, or 65.2% if the underwriters exercise in full their option to purchase additional shares, which means that, based on its percentage voting power controlled after the offering, GTCR will continue to control the vote of all matters submitted to a vote of our stockholders. This control enables GTCR to control the election of the members of our board of directors (the “Board”) and all other corporate decisions. Even when GTCR ceases to control a majority of the total voting power, for so long as GTCR continues to own a significant percentage of our common stock, GTCR will still be able to significantly influence the composition of our Board and the approval of actions requiring stockholder approval. Accordingly, for such period of time, GTCR will have significant influence with respect to our management, business plans and policies, including the appointment and removal of our officers, decisions on whether to raise future capital and amending our charter and bylaws, which govern the rights attached to our common stock. In particular, for so long as GTCR continues to own a significant percentage of our common stock, GTCR will be able to cause or prevent a change of control of us or a change in the composition of our Board and could preclude any unsolicited acquisition of us. The concentration of ownership could deprive you of an opportunity to receive a premium for your shares of Class A common stock as part of a sale of us and ultimately might affect the market price of our Class A common stock.

In addition, in connection with our IPO, we entered into a Director Nomination Agreement with GTCR that provides GTCR the right to nominate to the Board a number of designees equal to at least: (i) 100% of the total number of directors comprising the Board, so long as GTCR beneficially owns shares of Class A common stock and Class B common stock representing at least 40% of the total amount of shares of Class A common stock and Class B common stock it beneficially owned as of the date of the IPO, (ii) 40% of the total number of directors, in the event that GTCR beneficially owns shares of Class A common stock and Class B common stock representing at least 30% but less than 40% of the total amount of shares of Class A common stock and Class B common stock it owned as of the date of the IPO, (iii) 30% of the total number of directors, in the event that GTCR beneficially owns shares of Class A common stock and Class B common stock representing at least 20% but less than 30% of the total amount of shares of Class A common stock and Class B common stock it owned as of the date of the IPO, (iv) 20% of the total number of directors, in the event that GTCR beneficially owns shares of Class A common stock and Class B common stock representing at least 10% but less than 20% of the total amount of shares of Class A common stock and Class B common stock it owned as of the date of the IPO and (v) one director, in the event that GTCR beneficially owns shares of Class A common stock and Class B common stock representing at least 5% of the total amount of shares of Class A common stock and Class B common stock it owned as of the date of the IPO. The Director Nomination Agreement provides that GTCR may assign such right to a GTCR affiliate. The Director Nomination Agreement prohibits us from increasing or decreasing the size of our Board without the prior written consent of GTCR. See “Certain Relationships and Related Party Transactions—Director Nomination Agreement” for more details with respect to the Director Nomination Agreement.

11

GTCR and its affiliates engage in a broad spectrum of activities, including investments in our industry generally. In the ordinary course of their business activities, GTCR and its affiliates may engage in activities where their interests conflict with our interests or those of our other stockholders, such as investing in or advising businesses that directly or indirectly compete with certain portions of our business or are suppliers or customers of ours. Our certificate of incorporation provides that none of GTCR, any of its affiliates or any director who is not employed by us (including any non-employee director who serves as one of our officers in both his or her director and officer capacities) or its affiliates has any duty to refrain from engaging, directly or indirectly, in the same business activities or similar business activities or lines of business in which we operate. GTCR also may pursue acquisition opportunities that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us. In addition, GTCR may have an interest in pursuing acquisitions, divestitures and other transactions that, in its judgment, could enhance its investment, even though such transactions might involve risks to you or may not prove beneficial.

We are a “controlled company” within the meaning of the rules of NASDAQ and, as a result, we qualify for, and rely on, exemptions from certain corporate governance requirements. You will not have the same protections as those afforded to stockholders of companies that are subject to such governance requirements.

After completion of this offering, GTCR will continue to control a majority of the voting power of our outstanding common stock. As a result, we continue to be a “controlled company” within the meaning of the corporate governance standards of NASDAQ. Under these rules, a company of which more than 50% of the voting power for the election of directors is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including:

| | • | | the requirement that a majority of our Board consist of independent directors; |

| | • | | the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| | • | | the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| | • | | the requirement for an annual performance evaluation of the nominating and corporate governance and compensation committees. |

Following this offering, we will continue to utilize these exceptions. As a result, we may not have a majority of independent directors on our Board, our compensation and nominating and corporate governance committees may not consist entirely of independent directors and our compensation and nominating and corporate governance committees may not be subject to annual performance evaluations. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of NASDAQ.

For so long as we are an “emerging growth company”, we will not be required to comply with certain public company reporting requirements, which could make our Class A common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we are eligible for certain exemptions from various public company reporting requirements. These exemptions include, but are not limited to, (i) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, (ii) reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements, (iii) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved and (iv) not being required to provide five

12

years of Selected Consolidated Financial Data in this prospectus. We could be an emerging growth company for up to five years after the first sale of our Class A common stock in our IPO, which fifth anniversary will occur in 2025. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we would cease to be an emerging growth company prior to the end of such five-year period. We have made certain elections with regard to the reduced disclosure obligations regarding executive compensation in this prospectus and may elect to take advantage of other reduced disclosure obligations in future filings. As a result, the information that we provide to holders of our Class A common stock may be different than you might receive from other public reporting companies in which you hold equity interests. We cannot predict if investors will find our Class A common stock less attractive as a result of reliance on these exemptions. If some investors find our Class A common stock less attractive as a result of any choice we make to reduce disclosure, there may be a less active trading market for our Class A common stock and the market price for our Class A common stock may be more volatile.

The JOBS Act also permits an emerging growth company like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We previously elected to take advantage of this extended transition period for complying with new or revised accounting standards provided for by the JOBS Act. We will therefore comply with new or revised accounting standards when they apply to private companies. As a result, our financial statements may not be comparable with companies that comply with public company effective dates for accounting standards.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an “emerging growth company.”

As a public company, we incur legal, accounting and other expenses that we did not incur before our IPO. We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Sarbanes-Oxley Act, the listing requirements of NASDAQ and other applicable securities rules and regulations. Compliance with these rules and regulations will continue to increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and continue to increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires that we file annual, quarterly and current reports with respect to our business, financial condition, results of operations, cash flows and prospects. The Sarbanes-Oxley Act requires, among other things, that we establish and maintain effective internal controls and procedures for financial reporting. Furthermore, the need to establish the corporate infrastructure demanded of a public company may divert our management’s attention from implementing our growth strategy, which could prevent us from improving our business, financial condition, results of operations, cash flows and prospects. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations as a public company. However, the measures we take may not be sufficient to satisfy our obligations as a public company. In addition, these rules and regulations increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, these rules and regulations make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur substantial costs to maintain the same or similar coverage. These additional obligations could have a material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance

13

practices. We intend to continue to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of our management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us and there could be a material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

Provisions of our corporate governance documents could make an acquisition of us more difficult and may prevent attempts by our stockholders to replace or remove our current management, even if beneficial to our stockholders.

Our certificate of incorporation and bylaws and the Delaware General Corporation Law (the “DGCL”) contain provisions that could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our stockholders. Among other things:

| | • | | these provisions allow us to authorize the issuance of undesignated preferred stock, the terms of which may be established and the shares of which may be issued without stockholder approval, and which may include supermajority voting, special approval, dividend, or other rights or preferences superior to the rights of stockholders; |

| | • | | these provisions provide for a classified board of directors with staggered three-year terms; |

| | • | | these provisions provide that, at any time when GTCR controls, in the aggregate, less than 40% of the outstanding shares of our Class A common stock, directors may only be removed for cause, and only by the affirmative vote of holders of at least 662/3% in voting power of all the then-outstanding shares of our stock entitled to vote thereon, voting together as a single class; |

| | • | | these provisions prohibit stockholder action by written consent from and after the date on which GTCR controls, in the aggregate, less than 35% in voting power of our stock entitled to vote generally in the election of directors; |

| | • | | these provisions provide that for as long as GTCR controls, in the aggregate, at least 50% in voting power of our stock entitled to vote generally in the election of directors, any amendment, alteration, rescission or repeal of our bylaws by our stockholders will require the affirmative vote of a majority in voting power of the outstanding shares of our capital stock and at any time when GTCR controls, in the aggregate, less than 50% in voting power of all outstanding shares of our stock entitled to vote generally in the election of directors, any amendment, alteration, rescission or repeal of our bylaws by our stockholders will require the affirmative vote of the holders of at least 662/3% in voting power of all the then-outstanding shares of our stock entitled to vote thereon, voting together as a single class; and |

| | • | | these provisions establish advance notice requirements for nominations for elections to our Board or for proposing matters that can be acted upon by stockholders at stockholder meetings; provided, however, at any time when GTCR controls, in the aggregate, at least 10% in voting power of our stock entitled to vote generally in the election of directors, such advance notice procedure will not apply to GTCR. |

We opted out of Section 203 of the DGCL, which generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with any interested stockholder for a period of three years following the date on which the stockholder became an interested stockholder. However, our certificate of incorporation contains a provision that provides us with protections similar to Section 203, and prevents us from engaging in a business combination with a person (excluding GTCR and any of its direct or indirect transferees and any group as to which such persons are a party) who acquires at least 85% of our common stock for a period of three years from the date such person acquired such common stock, unless board or stockholder approval is obtained prior to the acquisition. See “Description of Capital Stock—Anti-Takeover Provisions.” These

14

provisions could discourage, delay or prevent a transaction involving a change in control of our company. These provisions could also discourage proxy contests and make it more difficult for you and other stockholders to elect directors of your choosing and cause us to take other corporate actions you desire, including actions that you may deem advantageous, or negatively affect the trading price of our Class A common stock. In addition, because our Board is responsible for appointing the members of our management team, these provisions could in turn affect any attempt by our stockholders to replace current members of our management team.

These and other provisions in our certificate of incorporation, bylaws and Delaware law could make it more difficult for stockholders or potential acquirers to obtain control of our Board or initiate actions that are opposed by our then-current Board, including actions to delay or impede a merger, tender offer or proxy contest involving our company. The existence of these provisions could negatively affect the price of our Class A common stock and limit opportunities for you to realize value in a corporate transaction.

For information regarding these and other provisions, see “Description of Capital Stock.”

Our certificate of incorporation designates the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation that may be initiated by our stockholders and the federal district courts of the United States as the exclusive forum for litigation arising under the Securities Act, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us.

Pursuant to our certificate of incorporation, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for any claims in state court for (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, (3) any action asserting a claim against us arising pursuant to any provision of the DGCL, our certificate of incorporation or our bylaws or (4) any other action asserting a claim against us that is governed by the internal affairs doctrine; provided that for the avoidance of doubt, the forum selection provision that identifies the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation, including any “derivative action,” will not apply to suits to enforce a duty or liability created by the Securities Act, the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Our certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the federal district courts of the United States shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. Our certificate of incorporation further provides that any person or entity purchasing or otherwise acquiring any interest in shares of our capital stock is deemed to have notice of and consented to the provisions of our certificate of incorporation described above. See “Description of Capital Stock—Forum Selection.” The forum selection provisions in our certificate of incorporation may have the effect of discouraging lawsuits against us or our directors and officers and may limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us. If the enforceability of our forum selection provisions were to be challenged, we may incur additional costs associated with resolving such challenge. While we currently have no basis to expect any such challenge would be successful, if a court were to find our forum selection provisions to be inapplicable or unenforceable with respect to one or more of these specified types of actions or proceedings, we may incur additional costs associated with having to litigate in other jurisdictions, which could have an adverse effect on our business, financial condition, results of operations, cash flows and prospects and result in a diversion of the time and resources of our employees, management and board of directors.

An active, liquid trading market for our Class A common stock may not be sustained, which may limit your ability to sell your shares.

Our IPO occurred in November 2020. Therefore, there has only been a public market for our Class A common stock for a short period of time. Although our Class A common stock was listed on The Nasdaq Global Select Market under the trading symbol “MRVI,” there is a very limited trading history and an active trading market for our Class A common stock may not be sustained. The public offering price was determined by

15

negotiations between the selling stockholders and the underwriters and may not be indicative of market prices of our Class A common stock that prevail in the open market after the offering. A public trading market having the desirable characteristics of depth, liquidity and orderliness depends upon the existence of willing buyers and sellers at any given time, such existence being dependent upon the individual decisions of buyers and sellers over which neither we nor any market maker has control. The failure of an active and liquid trading market to continue would likely have a material adverse effect on the value of our Class A common stock. The market price of our Class A common stock may decline below the public offering price, and you may not be able to sell your shares of our Class A common stock at or above the price you paid in this offering, or at all. An inactive market may also impair our ability to raise capital to continue to fund operations by issuing additional shares of our Class A common stock or other equity or equity-linked securities and may impair our ability to acquire other companies or technologies by using any such securities as consideration.

Our operating results and stock price may be volatile, and the market price of our Class A common stock after this offering may drop below the price you pay.

Our quarterly operating results are likely to fluctuate in the future. In addition, securities markets worldwide have experienced, and are likely to continue to experience, significant price and volume fluctuations, including as a result of the COVID-19 pandemic. This market volatility, as well as general economic, market or political conditions, could subject the market price of our Class A common stock to wide price fluctuations regardless of our operating performance. Our operating results and the trading price of our Class A common stock may fluctuate in response to various factors, including:

| | • | | market conditions in our industry or the broader stock market; |

| | • | | actual or anticipated fluctuations in our quarterly financial and operating results; |

| | • | | introduction of new products or services by us or our competitors; |

| | • | | issuance of new or changed securities analysts’ reports or recommendations; |

| | • | | sales, or anticipated sales, of large blocks of our stock; |

| | • | | additions or departures of key personnel; |

| | • | | regulatory or political developments; |

| | • | | litigation and governmental investigations; |

| | • | | any coordinated trading activities or large derivative positions in our Class A common stock, for example, a “short squeeze” (a short squeeze occurs when a number of investors take a short position in a stock and have to buy the borrowed securities to close out the position at a time that other short sellers of the same security also want to close out their positions, resulting in surges stock prices, i.e., demand is greater than supply for the stock sold shorted); |

| | • | | changing economic conditions; |

| | • | | investors’ perception of us; |

| | • | | events beyond our control such as weather, war and health crises such as the COVID-19 pandemic; and |

| | • | | any default on our indebtedness. |

These and other factors, many of which are beyond our control, may cause our operating results and the market price and demand for our Class A common stock to fluctuate substantially. Fluctuations in our quarterly operating results could limit or prevent investors from readily selling their shares of Class A common stock and may otherwise negatively affect the market price and liquidity of our shares of Class A common stock. In addition, in the past, when the market price of a stock has been volatile, holders of that stock have sometimes instituted securities class action litigation against the company that issued the stock. If any of our stockholders

16

brought a lawsuit against us, we could incur substantial costs defending the lawsuit. Such a lawsuit could also divert the time and attention of our management from our business, which could significantly harm our profitability and reputation.

In addition, the stock markets in general, and the markets for pharmaceutical, biopharmaceutical and biotechnology stocks in particular, have experienced extreme volatility, including as a result of the COVID-19 pandemic, that has often been unrelated to the operating performance of the issuer.

A significant portion of our total outstanding shares of Class A common stock are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our Class A common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our Class A common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares of Class A common stock intend to sell shares, could reduce the market price of our Class A common stock. After this offering, we will have 112,008,218 outstanding shares of Class A common stock (114,312,474 if the underwriters’ option is exercised in full) based on the number of shares outstanding as of December 31, 2020. This includes shares of Class A common stock that the selling stockholders are selling in this offering, which may be resold in the public market immediately unless purchased by one of our affiliates.

In connection with this offering, Morgan Stanley & Co. LLC, Jefferies LLC and Goldman Sachs & Co. LLC, as representatives of the several underwriters of our IPO, have agreed to release the restrictions under the lock-up agreements that were executed in connection with our IPO with respect to up to 20,700,000 shares of our Class A common stock to be sold in this offering that are held by the selling stockholders, which includes shares beneficially owned by our directors and executive officers or entities with which they are affiliated; provided, however, that the release of shares of our common stock held by the selling stockholders is limited to the shares actually sold in this offering. Morgan Stanley & Co. LLC, Jefferies LLC and Goldman Sachs & Co. LLC, as representatives of the several underwriters of our IPO, may, in their sole discretion, from time to time permit our stockholders to sell additional shares and waive the contractual lock-up prior to the expiration of the lock-up agreements.

In addition, subject to certain exceptions described in the section titled “Underwriters,” our directors and executive officers and GTCR have entered into lock-up agreements with the underwriters of this offering pursuant to which they have agreed that subject to certain exceptions, they will not directly or indirectly sell or dispose of any shares of Class A common stock or any securities convertible into or exchangeable or exercisable for shares of Class A common stock for a period of 90 days after the date of this prospectus. See “Underwriters” and “Shares Eligible for Future Sale” for more information.

All of these shares will, however, be able to be resold after the expiration of the lock-up period, as well as pursuant to customary exceptions thereto or upon the waiver of the lock-up agreement by the representatives on behalf of the underwriters. We have registered shares of Class A common stock that we may issue under our equity compensation plans. Such shares can be freely sold in the public market upon issuance. As restrictions on resale end, the market price of our stock could decline if the holders of currently restricted shares of Class A common stock sell them or are perceived by the market as intending to sell them.

Because we have no current plans to pay cash dividends on our Class A common stock for the foreseeable future, you may not receive any return on investment unless you sell your Class A common stock for a price greater than that which you paid for it.

We do not anticipate paying any cash dividends on our Class A common stock for the foreseeable future. Any decision to declare and pay dividends in the future will be made at the discretion of our Board and will depend on, among other things, our results of operations, financial condition, cash requirements, contractual restrictions and other factors that our Board may deem relevant. In addition, our ability to pay dividends is, and

17

may be, limited by covenants of existing and any future outstanding indebtedness we or our subsidiaries incur, including under the Credit Agreement that we entered into on October 19, 2020 (the “New Credit Agreement”). Therefore, any return on investment in our Class A common stock is solely dependent upon the appreciation of the price of our Class A common stock on the open market, which may not occur. See “Dividend Policy” for more detail.

If securities or industry analysts do not publish research or reports about our business, if they publish unfavorable research or reports, or adversely change their recommendations regarding our Class A common stock or if our results of operations do not meet their expectations, our stock price and trading volume could decline.

The trading market for our shares is influenced by the research and reports that industry or securities analysts publish about us or our business. We do not have any control over these analysts. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline. Moreover, if one or more of the analysts who cover us downgrade our stock, or if our results of operations do not meet their expectations, our stock price could decline.

We may issue shares of preferred stock in the future, which could make it difficult for another company to acquire us or could otherwise adversely affect holders of our Class A common stock, which could depress the price of our Class A common stock.

Our certificate of incorporation authorizes us to issue one or more series of preferred stock. Our Board has the authority to determine the preferences, limitations and relative rights of the shares of preferred stock and to fix the number of shares constituting any series and the designation of such series, without any further vote or action by our stockholders. Our preferred stock could be issued with voting, liquidation, dividend and other rights superior to the rights of our Class A common stock. The potential issuance of preferred stock may delay or prevent a change in control of us, discouraging bids for our Class A common stock at a premium to the market price, and materially adversely affect the market price and the voting and other rights of the holders of our Class A common stock.

18

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. All statements other than statements of historical fact included in this prospectus or incorporated by reference herein are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

| | • | | our history of losses, the risk that we may continue to incur losses in the future and our ability to generate sufficient revenue to achieve or maintain profitability; |

| | • | | the fluctuation of our operating results, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide; |

| | • | | our dependence on a limited number of customers for a high percentage of our revenue; |

| | • | | the use of certain of our products in the production of vaccines and therapies that represent relatively new and still-developing modes of treatment, which may experience unforeseen adverse events, negative clinical outcomes or increased regulatory scrutiny; |

| | • | | the impact of COVID-19 and any pandemic, epidemic or outbreak of infectious disease; |

| | • | | changes in economic conditions; |

| | • | | our dependence on customers’ spending on and demand for outsourced nucleic acid production, biologics safety testing and protein detection research products and services; |

| | • | | competition with life science, pharmaceutical and biotechnology companies who are substantially larger than we are and potentially capable of developing new approaches that could make our products, services and technologies obsolete; |

| | • | | the ability of our products and services to perform as expected and the reliability of the technology on which our products and services are based; |

| | • | | the complexity of our products and the fact that they are subject to quality control requirements; |

| | • | | our reliance on a limited number of suppliers or, in some cases, sole suppliers, for some of our raw materials and our inability to find replacements or immediately transition to alternative suppliers; |

| | • | | our dependence on a stable and adequate supply of quality raw materials from our suppliers, and the risk of adverse impacts from price increases or interruptions of such supply; |

| | • | | disruptions at our sites; |

| | • | | our ability to manufacture in specific quantities; |

| | • | | natural disasters, geopolitical unrest, war, terrorism, public health issues such as COVID-19 or other catastrophic events that could disrupt the supply, delivery or demand of products and services; |

| | • | | our ability to secure additional financing for future strategic transactions; |

| | • | | our reliance on third-party package delivery services and adverse impacts arising from significant disruptions of these services, damages or losses sustained during shipping or significant increases in prices; |

19

| | • | | our ability to continue to hire and retain skilled personnel; |

| | • | | our ability to successfully identify and implement distribution arrangements and marketing alliances; |

| | • | | the market acceptance of our life science reagents; |

| | • | | the market receptivity to our new products and services upon their introduction; |

| | • | | our ability to implement our strategies for revenue growth; |

| | • | | the accuracy of our estimates of market opportunity and forecasts of market growth included in this prospectus; |

| | • | | product liability lawsuits; |

| | • | | the application of privacy laws, security laws, regulations, policies and contractual obligations related to data privacy and security; |

| | • | | our ability to efficiently manage our growth; |

| | • | | the success of any opportunistic acquisitions; |

| | • | | the integrity of our internal computer systems; |

| | • | | the impact of export and import control laws and regulations; |

| | • | | risks related to Brexit; |

| | • | | changes in political, economic or governmental regulations; |

| | • | | financial, operating, legal and compliance risks associated with global operations; |

| | • | | risks associated with our acquisitions; |

| | • | | impacts from foreign currency exchange rates; |

| | • | | the risk that our products could become subject to more onerous regulation in the future; |