- AEON Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

AEON Biopharma (AEON) S-1/AIPO registration (amended)

Filed: 22 Nov 23, 9:48pm

As filed with the Securities and Exchange Commission on November 22, 2023

Registration No. 333-274094

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AEON Biopharma, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | 2834 | | 85-3940478 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

5 Park Plaza, Suite 1750

Irvine, California 92614

(949) 354-6499

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Alex Wilson, Chief Legal Officer

c/o AEON Biopharma, Inc.

5 Park Plaza, Suite 1750

Irvine, California 92614

(949) 354-6499

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

B. Shayne Kennedy

Drew Capurro

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, California 92626

Telephone: (714) 540-1235

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ | |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

Emerging growth company | ☒ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion - Preliminary Prospectus dated November 22, 2023.

PROSPECTUS

AEON Biopharma, Inc.

Up to 47,384,851 Shares of Common Stock

Up to 5,279,999 Private Placement Warrants

This prospectus relates to (i) the resale of 20,177,178 shares of Class A common stock, par value $0.0001 per share (the “Common Stock”) issued in connection with the Business Combination (as defined below) by certain of the securityholders named in this prospectus (each a “Registered Holder” and, collectively, the “Registered Holders”) at an equity consideration value of $10.00 per share, (ii) the resale of 1,075,000 shares of Common Stock issued pursuant to the New Money PIPE Subscription Agreements (as defined elsewhere in this prospectus) at a price of $7.00 per share, (iii) the resale of 6,275,000 shares of Common Stock issued pursuant to the FPA Funding Amount PIPE Subscription Agreements (as defined elsewhere in this prospectus) at a price of $10.63 per share, (iv) the resale of up to 988,764 shares of Common Stock issuable pursuant to the FPA Funding Amount PIPE Subscription Agreements at a price of $7.00 per share (or such reduced purchase price as calculated in accordance with the Forward Purchase Agreements (as defined elsewhere in this prospectus)), (v) the resale of 1,000 shares of Common Stock issued pursuant to the Round Lot Holder Subscription Agreements (as defined elsewhere in this prospectus) at a price of $7.00 per share, (vi) the issuance and resale of up to 4,013,282 shares of Common Stock reserved for issuance upon the exercise of options to purchase shares of Common Stock or settlement of restricted stock unit awards into shares of Common Stock, with an exercise price of $10.00 per share as repriced in connection with the Business Combination, (vii) the issuance of up to 374,628 shares of Common Stock reserved for issuance upon the exercise of options to purchase shares of Common Stock or settlement of restricted stock unit awards into shares of Common Stock, with an exercise price of $10.00 per share, and (viii) the issuance by us of up to 14,479,999 shares of Common Stock upon the exercise of outstanding warrants to purchase our Common Stock (the “Warrants”), originally issued by Priveterra Acquisition Corp. (“Priveterra”) as part of (a) Priveterra’s initial public offering of units at a price of $10.00 per unit, with each unit consisting of one share of Priveterra Class A common stock and one-third of one warrant, and (b) its concurrent private placement (the “Private Placement”). This prospectus also relates to the resale of up to 5,279,999 of our outstanding Warrants, originally issued in the Private Placement (the “Private Placement Warrants”) at a price of $1.50 per warrant, by the holders thereof.

We may receive up to an aggregate of approximately $166.5 million from the cash exercise of the Warrants. The exercise price of each of our Warrants is $11.50 per warrant. However, the last reported sales price of our Common Stock on November 21, 2023 was $4.70. The likelihood that holders of Warrants will exercise their Warrants, and therefore any amount of cash proceeds that we may receive, is dependent upon the trading price of our Common Stock. If the trading price for our Common Stock continues to be less than $11.50 per share, we do not expect holders to exercise their Warrants. Additionally, the Private Placement Warrants may be exercised on a cashless basis and we would not receive any proceeds from such exercise. We expect to use the net proceeds from the exercise of such securities, if any, for general corporate and working capital purposes. We will have broad discretion over the use of any proceeds from the exercise of such securities. Any proceeds from the exercise of such securities would increase our liquidity, but we are not currently budgeting for any cash proceeds from the exercise of Warrants when planning for our operational funding needs. For further information regarding our operational funding needs, see the section of this prospectus titled “Risk Factors — Risks Related to Our Business Operations and Financial Position – Our management has concluded that uncertainties around our ability to raise additional capital raise substantial doubt about our ability to continue as a going concern. We will require additional financing to fund our future operations. Any failure to obtain additional capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our operations.”

We are registering the securities for resale pursuant to the Registered Holders’ registration rights under certain agreements between us and the Registered Holders. Among the securities registered for resale pursuant to this prospectus are (i) 5,279,999 shares of Common Stock that underlie Private Placement Warrants purchased by Priveterra Sponsor, LLC (the “Sponsor”) in the Private Placement at a price of $1.50 per warrant and (ii) 6,900,000 shares of Common Stock (fifty percent (50%) of which are subject to certain time and performance-based vesting provisions as described in this prospectus) purchased by the Sponsor for $0.004 per share prior to Priveterra’s initial public offering. Our registration of the securities covered by this prospectus does not mean that the Registered Holders will offer or sell any of the shares of Common Stock or Warrants. The Registered Holders may offer, sell or distribute all or a portion of their shares of Common Stock or Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Registered Holders may sell the shares of Common Stock or Warrants in the section titled “Plan of Distribution.” Additionally, as of the date of this prospectus, shares of our Common Stock held by the Sponsor and shares received by former holders of capital stock of AEON Biopharma Sub, Inc. (f/k/a AEON Biopharma, Inc.) prior to the consummation of the Business Combination (“Old AEON”) as a result of the Business Combination remain subject to lock-up restrictions as described herein. See the section of this prospectus titled “Description of Our Securities – Transfer and Vesting Restrictions.”

The sale of securities being offered in this prospectus could result in adverse effects on the market for our Common Stock, including increasing volatility, limiting the availability of an active market, or resulting in a significant decline in the public trading price of our Common Stock. Even if the prevailing trading price of our Common Stock is at or significantly below the price at which the units were issued in Priveterra’s initial public offering, some of the Registered Holders may still be able to profit on sales due to the lower price at which they purchased their shares compared to public investors. Public securityholders may not experience a similar rate of return on the securities they purchase due to differences in the purchase prices and the current trading price. See “Risk Factors – Risks Related to Being a Public Company and Ownership of Our Securities — Sales of a substantial number of our securities in the public market by the Registered Holders or by our other existing securityholders could cause the price of our Common Stock and Warrants to fall.”

We are an “emerging growth company” and “smaller reporting company” for purposes of federal securities laws and are subject to reduced public company reporting requirements. Accordingly, the information in this prospectus may not be comparable to information provided by companies that are not emerging growth companies or smaller reporting companies.

Our Common Stock and Warrants are listed on the New York Stock Exchange American (“NYSE American”) under the symbols “AEON” and “AEON WS,” respectively. On November 21, 2023, the closing price of our Common Stock was $4.70 and the closing price for our Warrants was $0.048.

We will bear all costs, expenses and fees in connection with the registration of the shares of Common Stock and Private Placement Warrants. The Registered Holders will bear all commissions and discounts, if any, attributable to their sales of the shares of Common Stock or Private Placement Warrants.

Our business and investment in our Common Stock and Warrants involve significant risks. These risks are described in the section titled “Risk Factors” beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

TABLE OF CONTENTS

| | |

| ii | |

| iii | |

| 1 | |

| 9 | |

| 10 | |

| 61 | |

| 62 | |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED COMBINED FINANCIAL INFORMATION | | 63 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 75 |

| 97 | |

| 126 | |

| 132 | |

| 147 | |

| 156 | |

| 158 | |

| 168 | |

| 179 | |

| 182 | |

| 183 | |

| 184 | |

| F-1 |

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the United States Securities and Exchange Commission, or the SEC, using a “shelf” registration process. We will not receive any proceeds from the sale by the Registered Holders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Common Stock issuable upon the exercise of the Warrants. We will not receive any proceeds from the sale of shares of Common Stock underlying the Warrants pursuant to this prospectus, except with respect to amounts received by us upon the exercise of the Warrants for cash.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

Neither we nor the Registered Holders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Registered Holders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. We and the Registered Holders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains, and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. We believe this information is reliable as of the applicable date of its publication, however, we have not independently verified the accuracy or completeness of the information included in or assumptions relied on in these third-party publications. In addition, the market and industry data and forecasts that may be included in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any post-effective amendment and the applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

We own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business. In addition, our name, logos and website name and address are our trademarks or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

On July 21, 2023 (the “Closing Date”), we consummated the previously announced business combination pursuant to that certain Business Combination Agreement, dated as of December 12, 2022 (as amended, the “Business Combination Agreement”), as amended on April 27, 2023 by and among AEON Biopharma, Inc. (f/k/a Priveterra Acquisition Corp.) (“AEON”), AEON Biopharma Sub, Inc. (f/k/a AEON Biopharma Inc.) (“Old AEON”), and Priveterra Merger Sub, Inc., a Delaware corporation (“Merger Sub”), pursuant to which Merger Sub merged with and into Old AEON, with Old AEON surviving the merger as a wholly-owned subsidiary of AEON (the “Business Combination” and, collectively with the other transactions described in the Business Combination Agreement, the “Transactions”). On the Closing Date, and in connection with the closing of the Transactions (the “Closing”), we changed our name to AEON Biopharma, Inc.

Unless otherwise stated, in this prospectus, when we refer to “AEON,” the “Combined Company,” “New AEON,” “we” or “us” we mean the entity that remains following the Business Combination. Additionally, unless otherwise stated, in this prospectus, when we refer to “Old AEON” or “Priveterra”, we are referring to each respective entity before the consummation of the Business Combination.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations.

These forward-looking statements speak only as of the date of this prospectus and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the risks, uncertainties and assumptions described under the section in this prospectus titled “Risk Factors.” These forward-looking statements are subject to numerous risks, including, without limitation, the following:

| ● | the projected financial information, anticipated growth rate, and market opportunities of AEON; |

| ● | the ability to maintain the listing of Common Stock and the Warrants on NYSE American; |

| ● | AEON’s public securities’ potential liquidity and trading; |

| ● | AEON’s ability to raise financing in the future; |

| ● | AEON’s success in retaining or recruiting, or changes required in, officers, key employees or directors, or; |

| ● | factors relating to the business, operations and financial performance of AEON, including: |

| ● | the initiation, cost, timing, progress and results of research and development, or R&D, activities, preclinical studies or clinical trials with respect to AEON’s current and potential future product candidates; |

| ● | AEON’s ability to identify, develop and commercialize its main product candidate, botulinum toxin complex, ABP-450 (prabotulinumtoxinA) injection, or ABP-450; |

| ● | AEON’s ability to obtain a Biologics License Application, or BLA, for therapeutic uses of ABP-450; |

| ● | AEON’s ability to advance its current and potential future product candidates into, and successfully complete, preclinical studies and clinical trials; |

| ● | AEON’s ability to obtain and maintain regulatory approval of its current and potential future product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; |

| ● | AEON’s ability to obtain funding for its operations; |

| ● | AEON’s ability to obtain and maintain intellectual property protection for its technologies and any of its product candidates; |

| ● | AEON’s ability to successfully commercialize its current and any potential future product candidates; |

| ● | the rate and degree of market acceptance of AEON’s current and any potential future product candidates; |

| ● | regulatory developments in the United States and international jurisdictions; |

iii

| ● | potential liability, lawsuits and penalties related to AEON’s technologies, product candidates and current and future relationships with third parties; |

| ● | AEON’s ability to attract and retain key scientific and management personnel; |

| ● | AEON’s ability to effectively manage the growth of its operations; |

| ● | AEON’s ability to contract with third-party suppliers and manufacturers and their ability to perform adequately under those arrangements, particularly the Daewoong Agreement (as defined in this prospectus); |

| ● | AEON’s ability to compete effectively with existing competitors and new market entrants; |

| ● | potential effects of extensive government regulation; |

| ● | AEON’s future financial performance and capital requirements; |

| ● | AEON’s ability to implement and maintain effective internal controls; |

| ● | the impact of supply chain disruptions; and |

| ● | the impact of the COVID-19 pandemic on AEON’s business, including its preclinical studies, clinical studies and potential future clinical trials. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment and a competitive industry. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make in this prospectus. As a result of these factors, although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise.

You should read this prospectus completely and with the understanding that our actual future results may be materially different from our expectations. We qualify all of our forward-looking statements by these cautionary statements. You should read this prospectus and the documents that have been filed as Exhibits hereto with the understanding that the actual future results, levels of activity, performance, events and circumstances of AEON may be materially different from what is expected.

iv

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that may be important to you in making your investment decision. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 10 and our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our Common Stock or Warrants.

Overview

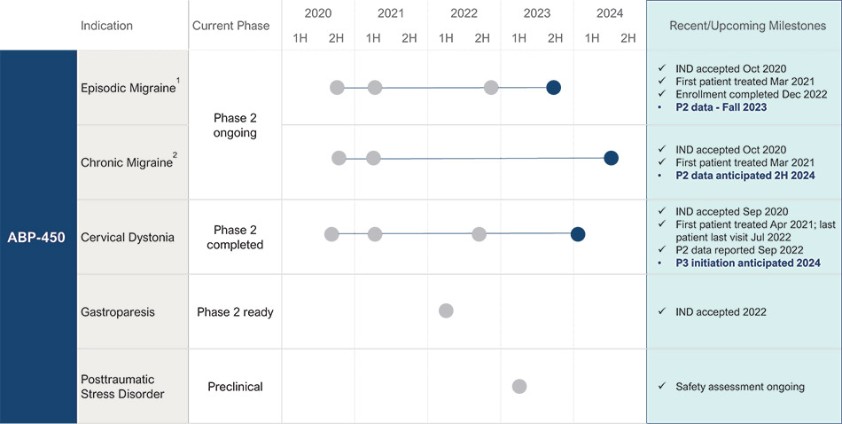

AEON is a clinical stage biopharmaceutical company focused on developing a proprietary botulinum toxin complex, or ABP-450, for debilitating medical conditions, with an initial focus on the neurology and gastroenterology markets. AEON plans to develop ABP-450 to address the estimated $3.0 billion global therapeutic botulinum toxin market, which is projected to grow to $4.4 billion in 2027. ABP-450 is the same botulinum toxin complex that is currently approved and marketed for cosmetic indications by Evolus, Inc. under the name Jeuveau. ABP-450 is manufactured by Daewoong (as defined in this prospectus) in compliance with current good manufacturing practices, or cGMP, in a facility that has been approved by the United States Food and Drug Administration, or the FDA, Health Canada, and the European Medicines Agency, or the EMA. AEON has exclusive development and distribution rights for therapeutic indications of ABP-450 in the United States, Canada, the European Union, the United Kingdom, and certain other international territories. AEON has built a highly experienced management team with specific experience in biopharmaceutical and botulinum toxin development and commercialization.

Botulinum toxins have proven to be a highly versatile therapeutic biologic, with over 230 therapeutic uses documented in published scientific literature and nine approved therapeutic indications in the United States. AEON’s initial development programs for ABP-450 are directed at migraine, cervical dystonia and gastroparesis. AEON selected these initial indications based on a comprehensive and proprietary product assessment screen designed to identify indications where AEON believes ABP-450 can deliver significant value to patients, physicians and payors and where its clinical, regulatory and commercial characteristics suggest viability. AEON believes that ABP-450 has application in a broad range of indications and we plan to continue to explore additional indications that satisfy AEON’s product assessment screens.

Background

We were incorporated as Priveterra Acquisition Corp. on November 17, 2020. On July 21, 2023, we closed the Business Combination with Old AEON, as a result of which Old AEON became a wholly-owned subsidiary of ours, and we changed our name to AEON Biopharma, Inc. We are the legal acquirer of Old AEON in the Business Combination, and have been deemed to be the accounting acquirer of Old AEON. Old AEON is considered a variable interest entity, or a VIE, and we will be considered the primary beneficiary as our ownership will provide the power to direct the activities that most significantly impact AEON’s performance and the obligation to absorb the losses and/or receive the benefits of AEON that could potentially be significant to AEON.

At the effective time of the Business Combination, or the Effective Time, (i) each outstanding share of Old AEON common stock (on an as-converted basis after taking into effect the conversion of the outstanding warrants of Old AEON exercisable for shares of Old AEON preferred stock, the conversion of the shares of Old AEON preferred stock into Old AEON common stock in accordance with the governing documents of Old AEON as of the Effective Time, the conversion of the outstanding convertible notes of Old AEON into Old AEON common stock in accordance with the terms of such convertible notes and after giving effect to the issuance of Old AEON common stock in connection with the merger of ABP Sub, Inc. with and into Old AEON, or the Subsidiary Merger) issued and outstanding immediately prior to the Effective Time converted into the right to receive approximately 2.328 shares of our Common Stock. In addition, each share of Priveterra Class B common stock, or the Founder Shares, par value $0.0001 per share, issued and outstanding immediately prior to the Effective Time converted into one share of Common Stock (of which 3,450,000 Founder Shares are subject to certain vesting and forfeiture conditions).

Committed Financing Agreements

Between January 2023 and June 2023, Old AEON issued a series of interim notes to Alphaeon 1 LLC (“A1”) and Daewoong Pharmaceutical Co., Ltd. (“Daewoong”), in an aggregate principal amount of $40.0 million, pursuant to committed financing agreements with such parties. The proceeds from the interim notes were used to fund Old AEON’s operations through the

1

consummation of the Business Combination. At the consummation of the Business Combination, all of the aggregate principal amount of interim notes, along with accrued interest, converted into an aggregate of 5,797,611 shares of Common Stock.

Transactions with Atalaya and Polar

The following describes a series of transactions that Priveterra entered into with Old AEON, certain entities affiliated with Atalaya Capital Management LP (“Atalaya”) and Polar Multi-Strategy Master Fund (“Polar”) in connection with the Business Combination. Among the reasons that Priveterra and Old AEON entered into the transactions with Atalaya and Polar, including the Forward Purchase Agreements (defined below), were (i) to obtain the $7.0 million in proceeds obtained from the New Money PIPE Subscription Agreements described below, the proceeds of which were available immediately and without restriction to AEON upon the Closing, and (ii) to have access to potential proceeds that may be provided under the Forward Purchase Agreements and related FPA Funding Amount Subscription Agreements (defined below). Specifically, the proceeds from the New Money PIPE Subscription Agreements helped ensure satisfaction of the $40 million minimum cash condition under the Business Combination Agreement, as well as the listing standards of NYSE American, including with respect to the sufficiency of AEON’s liquidity. While the New Money PIPE Subscription Agreements and the FPA Funding Amount Subscription Agreements represent independent and distinct instruments, and are not expressly cross-conditioned on each other, the Company does not believe Atalaya or Polar would have entered into the New Money PIPE Subscription Agreements without also entering into the Forward Purchase Agreements and related FPA Funding Amount Subscription Agreements. From the Sellers’ perspective, the Forward Purchase Agreements are designed to limit the Sellers’ exposure to downside economic risk. For example, we will only recover any amount of the Prepayment Amount to the extent the Sellers sell their shares of our Common Stock, which we would not expect to occur at a price equal to or less than the applicable Reset Price; however, the Forward Purchase Agreements provide for time-based and milestone-based downward adjustments to the Reset Price (without contemplating subsequent upward adjustments that would be favorable to us). At the time the Forward Purchase Agreements and related subscription transactions were negotiated and consummated, no material relationships existed between Atalaya and Polar or their affiliates, on the one hand, and Priveterra, Priveterra Sponsor, LLC (“Sponsor”), Old AEON or their affiliates, on the other hand.

Forward Purchase Agreements and Related Subscription Agreements

On June 29, 2023, Priveterra and Old AEON entered into (a) separate agreements (each a “Forward Purchase Agreement,” together, the “Forward Purchase Agreements,” and the transactions contemplated thereby the “OTC Equity Prepaid Forward Transactions”) with each of (i) ACM ARRT J LLC and (ii) Polar (each of ACM ARRT J LLC and Polar, individually, a “Seller” and together the “Sellers”) and (b) separate subscription agreements (the “FPA Funding Amount Subscription Agreements”) with each of the Sellers.

Pursuant to the terms of the respective FPA Funding Amount PIPE Subscription Agreements, the Sellers purchased an aggregate of 6,275,000 shares of Priveterra’s Class A Common Stock, par value $0.0001 per share (“Priveterra Class A Common Stock”) for aggregate consideration of $66.7 million concurrently with the Closing, along with 236,236 shares of Priveterra Class A Common Stock purchased by ACM ARRT J LLC from third parties through a broker in the open market prior to the Closing, for which all redemption rights were irrevocably waived (such shares, the “Recycled Shares”). The Seller held such Recycled Shares as freely tradeable shares prior to the Closing, and the proceeds to the Company provided by such Recycled Shares were netted against the $3.5 million that an affiliate of one of the Sellers was otherwise obligated to pay the Company under its respective New Money PIPE Subscription Agreement. The Sellers have the right, but not the obligation, to purchase up to an aggregate of an additional 988,764 shares of Common Stock following the Closing, provided that no Seller is required to purchase an amount of shares of Common Stock that would result in that Seller owning more than 9.9% of the total shares of Common Stock outstanding immediately after giving effect to such purchase, unless such Seller, at its sole discretion, waives such 9.9% ownership limitation. The number of shares of Common Stock subject to a Forward Purchase Agreement is subject to reduction following a termination of the Forward Purchase Agreements with respect to such shares as described in the respective Forward Purchase Agreements. In accordance with the Forward Purchase Agreements, on July 21, 2023, we were obligated to repay $66.7 million (the “Prepayment Amount”), which represented the maximum amount we could receive under the Forward Purchase Agreements if the sale price were the initial $10.63 per share, from the proceeds from the purchase of shares of Priveterra Class A Common Stock pursuant to the FPA Funding Amount Subscription Agreements.

Prior to a Valuation Date (as defined below), when the Sellers sell shares of our Common Stock pursuant to the Forward Purchase Agreements, they are obligated to repay us a portion of the sale proceeds equal to the then current reset price (initially the redemption

2

price of $10.63 per share, the "Reset Price") multiplied by the number of shares sold. The Sellers retain any amount above the Reset Price. As a result, we would not expect the Sellers to sell shares of Common Stock at a price that is equal to or less than the then current Reset Price. Beginning 90 days after the Closing, the Reset Price became subject to monthly resets, to be the lowest of (a) the then-current Reset Price, (b) $10.63 and (c) the 30-day volume-weighted average price of our Common Stock immediately preceding such monthly reset. The monthly resets of the Reset Price are subject to a floor of $7.00 per share (the “Reset Price Floor”); however, if during the term of the Forward Purchase Agreements, we sell or issue any shares of Common Stock or securities convertible or exercisable for shares of Common Stock at an effective price of less than the Reset Price (a “Dilutive Offering”), then the Reset Price would immediately reset to the effective price of such offering and the Reset Price Floor would be eliminated. Elimination of the Reset Price Floor may result in the Sellers selling the shares covered by the Forward Purchase Agreements at lower prices and in us receiving less of the Prepayment Amount. Additionally, in the event of a Dilutive Offering, the maximum number of shares available under the Forward Purchase Agreements could be increased if the Dilutive Offering occurs at a price below $10.00 per share. The maximum number of shares would be reset to equal 7,263,764 divided by a number equal to the offering price in the Dilutive Offering divided by $10.00.

Prior to a Valuation Date (as defined below), based on the Reset Price as of November 21, 2023 of $7.00 per share and assuming the Sellers do not purchase additional shares beyond the 9.9% ownership-limited aggregate of 6,275,000 shares, the maximum proceeds we could receive from the Prepayment Amount is $43,925,000. If a Seller decides to sell any shares above $7.00 per share, the Seller would retain any proceeds above such Reset Price. For example, if the Sellers sold all 6,275,000 shares at $8.00 per share, the Sellers would receive $6,275,000 and the Company would receive $43,925,000. The “Valuation Date” will be the earlier to occur of

(a) July 21, 2025, the two-year anniversary of the Closing Date;

(b) the date specified by Seller after the occurrence of any of the following:

(i) the volume weighted average price per share of our Common Stock (as reported on the relevant Bloomberg Screen “PMGM AQR SEC” (or any successor thereto), the “VWAP Price”) for any 20 trading days during a 30 consecutive trading day-period, is below $2.50 per share (a “VWAP Trigger Event”),

(ii) the date on which our Common Stock ceases to be listed on a national exchange or a Form 25 is filed with respect to the delisting of our Common Stock (a “Delisting Event”), or

(iii) a failure to provide and maintain an effective registration statement regarding the resale of the shares in accordance with the Forward Purchase Agreement (a “Registration Failure”); and

(c) 90 days after delivery by AEON of a written notice in the event that for any 20 trading days during a 30 consecutive trading day-period that occurs at least 6 months after the Closing Date, the VWAP Price is less than the current Reset Price Floor of $7.00 per share.

After a Valuation Date, if the shares purchased pursuant to the FPA Funding Amount Subscription Agreements were settled at the last reported sales price of our Common Stock on November 21, 2023, or $4.70, we would receive a cash amount equal to (A) (i) the number of shares to be sold by the Sellers multiplied by (ii) $4.70, less (B) the product of (i) such number of shares sold by the Sellers multiplied by (ii) $2.00; in other words, the Sellers would be obligated to pay us $2.70 per share sold by the Sellers. If the Sellers were to sell all 6,275,000 shares of Common Stock, the Company would receive an aggregate of $16,942,500 in proceeds, based on such sales price of $4.70. However, if the shares are neither registered for resale under an effective resale registration nor transferable without any restrictions pursuant to an exemption from the registration requirements of Section 5 of the Securities Act, including pursuant to Rule 144 (the “Unregistered Shares”), such Unregistered Shares would not be included in the calculation of the Settlement Amount and the Seller would not be obligated to pay us any amount, but we would still be obligated to pay such Seller the Settlement Amount Adjustment of $2.00 per share. In such a scenario, if all 6,275,000 shares of Common Stock purchased by the Sellers at the Closing were Unregistered Shares as of the Valuation Date, which could be accelerated upon a VWAP Trigger Event, Delisting Event or Registration Failure, we would potentially owe the Sellers an aggregate of approximately $12.6 million. Any of the above scenarios may adversely affect our liquidity and capital needs.

3

We did not have access to any portion of the Prepayment Amount immediately following the Closing, have not had access to any portion of the Prepayment Amount since the Closing, and, depending on the manner of settlement for the transactions covered by the Forward Purchase Agreements, may have limited or no access to any portion of the Prepayment Amount in the future, particularly if our Common Stock continues to trade below the prevailing Reset Price. Since the Closing, the Sellers have not received any proceeds or securities pursuant to the Forward Purchase Agreements. Additionally, the Prepayment Amount is not held in any bankruptcy-protected account, escrow account, trust account, or any similar arrangement, and there is no requirement for the Sellers to hold such Prepayment Amount separate or apart from any other funds of the Sellers prior to the settlement of the transactions pursuant to the Forward Purchase Agreements. The lack of any such bankruptcy-protected arrangement subjects us to further risk that we may never have access to the Prepayment Amount if the Sellers fail to make payments when due, default under the Forward Purchase Agreements, become insolvent or declare bankruptcy. In the event of certain bankruptcy or insolvency relating to the Company or certain sale of the Company for consideration other than stock of another entity, each Forward Purchase Agreement (or a portion thereof that is affected by the relevant event, as applicable) would be cancelled and any obligations due thereunder (as determined by the Seller) would be accelerated. In the event of a tender offer or a sale of the Company for consideration consisting solely of stock of another company, the terms of the respective Forward Purchase Agreements would be adjusted by the Seller in its capacity as a calculation agent (the “Calculation Agent”) to account for the economic effect of such tender offer or such sale transaction or, if the Calculation Agent determines that no such adjustment would produce a commercially reasonable result, the respective Forward Purchase Agreements would be subject to cancellation. Any or all of these consequences could have material adverse consequences for us or the Sellers.

New Money Subscription Agreements

On June 29, 2023, Priveterra also entered into separate subscription agreements (the “New Money PIPE Subscription Agreements”) with each of ACM ASOF VIII Secondary-C LP and Polar (each, a “New Money PIPE Investor” and collectively, the “New Money PIPE Investors”). Pursuant to the New Money PIPE Subscription Agreements, the New Money PIPE Investors purchased from Priveterra on Closing Date an aggregate of 1,000,000 shares of Priveterra Class A Common Stock for a purchase price of $7.00 per share, for aggregate gross proceeds of $7.0 million.

Pursuant to its New Money PIPE Subscription Agreement, Priveterra issued 75,000 shares of Priveterra Class A Common Stock to Midtown Madison Management LLC, an affiliate of ACM ASOF VIII Secondary-C LP, which are subject to a lock-up period of 180 calendar days immediately following the Closing, as a structuring fee in consideration of certain services provided by it in the structuring of its Forward Purchase Agreement and the transactions described therein.

Letter Agreements

On June 29, 2023, the Sponsor also entered into separate letter agreements (each, a “Letter Agreement” and collectively, the “Letter Agreements”) with each of ACM ASOF VIII Secondary-C LP and Polar.

Pursuant to the Letter Agreements, in the event that the average price per share at which shares of Common Stock purchased pursuant to the New Money PIPE Subscription Agreements that are transferred during the period ending on the earliest of (A) June 21, 2025, (B) the date on which the applicable Forward Purchase Agreement terminates and (C) the date on which all such shares are sold (such price, the “Transfer VWAP”, and such period, the “Measurement Period”) is less than $7.00 per share, then (i) ACM ASOF VIII Secondary-C LP and Polar shall be entitled to receive from Sponsor a number of additional shares of Common Stock that have been registered for resale by us under an effective resale registration statement pursuant to the Securities Act, under which ACM ASOF VIII Secondary-C LP and Polar may sell or transfer such shares of Common Stock in an amount that is equal to the lesser of (A) a number of shares of Common Stock equal to the Make-Whole Amount divided by the VWAP (measured as of the date the additional shares are transferred to ACM ASOF VIII Secondary-C LP or Polar, as applicable) and (B) an aggregate of 400,000 shares of Common Stock (the “Additional Shares”) and (ii) Sponsor shall promptly (but in any event within fifteen (15) business days) after the Measurement Date, transfer the Additional Shares to ACM ASOF VIII Secondary-C LP or Polar, as applicable.

“Make-Whole Amount” means an amount equal to the product of (A) $7.00 minus the Transfer VWAP multiplied by (B) the number of Transferred PIPE Shares. “VWAP” means the per share volume weighted average price of the Common Stock in respect of the five consecutive trading days ending on the trading day immediately prior to the Measurement Date. “Measurement Date” means the last day of the Measurement Period.

4

Additional PIPE Subscription Agreements

On June 28, 2023, Priveterra entered into 10 separate subscription agreements (the “Round Lot Holder Subscription Agreements”) with certain counterparties, each for the subscription of 100 shares of Priveterra Class A Common Stock at a purchase price of $7.00 per share, for an aggregate purchase price of $7,000.

Lock-Up Restrictions

We amended our bylaws in connection with the Business Combination to, among other things, provide that, subject to certain exceptions, each of the stockholders of Old AEON immediately prior to the Business Combination and the former directors, officers and employees of Old AEON as of the Closing that had restricted stock units, stock options or other equity awards outstanding as of immediately following the Closing (collectively, the “Lock-up Holders”) may not sell, assign, or transfer any shares (the “Lock-up”) of Common Stock issued to such Lock-up Holders as consideration in the Business Combination (the “Lock-up Shares”), subject to certain permitted transfers, until the earliest of (i) the one year anniversary of the Closing and (ii) the date upon which there occurs the completion of a liquidation, merger, stock exchange, reorganization or other similar transaction that results in all of the public stockholders of AEON having the right to exchange their Common Stock for cash, securities or other property, except that (i) 50% of such shares held by certain stockholders of Old AEON that entered into support agreements with Old AEON (“Old AEON Supporting Stockholders”) are subject to early release from the Lock-up if the volume weighted average price of Common Stock exceeds $12.50 for 20 trading days within any 30-trading day period beginning 150 days following the Closing Date, and (ii) the remaining 50% of such shares held by the Old AEON Supporting Stockholders are subject to early release from the Lock-up if the volume weighted average price of Common Stock exceeds $15.00 for 20 trading days within any 30-trading day period beginning 150 days following the Closing Date. In addition, concurrently with the execution of the Business Combination Agreement, the Sponsor and certain Priveterra insiders party thereto entered into a sponsor agreement, or the Sponsor Agreement, pursuant to which fifty percent (50)% of the 6,900,000 Founder Shares, or the contingent founder shares, are subject to certain time and performance-based vesting provisions. With certain exceptions, the Sponsor agreed that it will not transfer any Founder Shares until the one-year anniversary of the Closing, consistent with the provisions under Section 7.14 of our bylaws.

The rights of holders of our Common Stock and Warrants are governed by our amended and restated certificate of incorporation (the “certificate of incorporation”), our amended and restated bylaws (the “bylaws”), and the Delaware General Corporation Law (the “DGCL”), and, in the case of the Warrants, the Warrant Agreement, dated as of February 8, 2021, between Priveterra Acquisition Corp. and Continental Stock Transfer & Trust Company (the “Warrant Agreement”). See the section titled “Description of Our Securities.”

Recent Clinical Study Data

In October 2023, we announced topline results from our Phase 2 clinical trial of ABP-450 for the preventive treatment of episodic migraine. The Phase 2 clinical trial for episodic migraine did not meet its primary endpoint, though it did show statistical significance on multiple secondary and exploratory endpoints, including the percentage of patients achieving a reduction from baseline of at least 50% in monthly migraine days and 75% in monthly migraine days during the weeks 21 to 24 of the treatment period and improvements on certain patient and rating scales.

Risk Factors

The following is a summary of the principal risks to which AEON’s business, operations and financial performance is subject. Each of these risks is more fully described in the individual risk factors set forth under “Risk Factors” in this prospectus. Unless the context otherwise requires, all references in this subsection to the “Company,” “we,” “us” or “our” refer to the business of AEON.

Risks Related to Our Business Operations and Financial Position

| ● | We have a limited operating history and have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. If we ever achieve profitability, we may not be able to sustain it. |

| ● | Our future success currently depends entirely on the successful and timely regulatory approval and commercialization of our only product candidate, ABP-450. The development and commercialization of pharmaceutical products is subject to |

5

| extensive regulation, and we may not obtain regulatory approvals for ABP-450 in any of the indications for which we plan to develop it on a timely basis or at all. |

| ● | Enrollment and retention of patients in clinical studies is an expensive and time-consuming process and could be delayed, made more difficult or rendered impossible by multiple factors outside our control. If we experience delays or difficulties in enrolling patients in clinical studies, our receipt of necessary regulatory approval could be delayed or prevented. |

| ● | We require additional financing to fund our future operations, and a failure to obtain additional capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our operations. |

| ● | We have concluded that we do not have sufficient cash to fund our operations and to meet our obligations as they become due within one year from the date that our consolidated financial statements are issued and as a result, there is substantial doubt about our ability to continue as a going concern. |

| ● | We may not have the funds necessary to satisfy our future obligations under the Forward Purchase Agreements, and uncertainties with respect to our obligations under the Forward Purchase Agreements could materially and adversely affect our ability to raise capital, our liquidity position, our ability to operate our business and execute our business strategy, and the trading volatility and price of our securities. |

| ● | Sales of a substantial number of our securities in the public market by the Registered Holders or by our other existing securityholders could cause the price of our Common Stock and Warrants to fall. |

| ● | ABP-450 may cause undesirable side effects or have other properties that could delay or prevent its regulatory approval in any of our proposed therapeutic indications, limit its commercial potential or result in significant negative consequences following any potential marketing approval. |

| ● | Interim or preliminary data from our clinical studies that we may announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data. |

| ● | Due to our limited resources and access to capital, we must prioritize development of certain therapeutic uses of ABP-450; these decisions may prove to be wrong and may adversely affect our business. |

| ● | We may not be successful in obtaining an original BLA that contemplates exclusively therapeutic uses of ABP-450. |

| ● | Even if ABP-450 receives regulatory approval for any of our proposed indications, it may fail to achieve the broad degree of market acceptance by physicians, patients, third-party payors and others in the medical community necessary for commercial success. |

| ● | Even if we receive marketing approval, coverage and adequate reimbursement may not be available for ABP-450 in any currently proposed or future therapeutic indications, which could make it difficult for us to sell the product profitably, if approved. |

| ● | ABP-450, if approved in any currently proposed or future therapeutic indications, will face significant competition and our failure to effectively compete may prevent us from achieving significant market penetration and expansion. |

| ● | If we are unable to establish sales and marketing capabilities on our own or through third parties, we will be unable to successfully commercialize ABP-450, if approved in any proposed therapeutic indication, or generate product revenue. |

| ● | We will need to grow the size of our organization, and we may experience difficulties in managing this growth. |

6

| ● | Our employees, independent contractors, consultants, commercial collaborators, principal investigators, vendors and other agents may engage in misconduct or other improper activities, including non-compliance with regulatory standards and requirements. |

| ● | If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of ABP-450. |

| ● | If we fail to attract and keep senior management and key scientific personnel, we may be unable to successfully develop ABP-450 in any of our proposed therapeutic indications, conduct our clinical studies and commercialize ABP-450. |

Risks Related to Our Reliance on Third Parties

| ● | We rely on our License & Supply Agreement, effective as of December 20, 2019, as amended, with Daewoong, or the Daewoong Agreement, to provide us exclusive rights to commercialize and distribute ABP-450 in certain territories. Any termination or loss of significant rights, including exclusivity, under the Daewoong Agreement would materially and adversely affect our development or commercialization of ABP-450. |

| ● | We currently rely solely on Daewoong to manufacture ABP-450, and as such, any production or other problems with Daewoong could adversely affect us. The manufacture of biologics is complex and Daewoong may encounter difficulties in production that may impact our ability to provide supply of ABP-450 for clinical studies, our ability to obtain marketing approval, or our ability to obtain commercial supply of our products, which, if approved, could be delayed or stopped. |

| ● | A material breach by us of the terms of our license and settlement agreement with Medytox, Inc. could have a material adverse effect on our business. |

| ● | We rely, and will continue to rely, on third parties and consultants to conduct all of our preclinical studies and clinical studies. If these third parties or consultants do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for ABP-450. |

Risks Related to Intellectual Property

| ● | If we or any of our current or future licensors, including Daewoong, are unable to maintain, obtain or protect intellectual property rights related to ABP-450 and any future product candidates we may develop, or if the scope of any protection obtained is not sufficiently broad, we may not be able to compete effectively in our market. |

| ● | Third-party claims of intellectual property infringement, misappropriation or violation, or challenges related to the invalidity or unenforceability of any issued patents we may obtain or in-license may prevent or delay our development and commercialization efforts or otherwise adversely affect our results of operations. |

| ● | Our rights to develop and commercialize ABP-450 and future product candidates are subject, in part, to the terms and conditions of licenses granted to us by others, including Daewoong. If we fail to comply with our obligations in the agreements under which we license intellectual property rights from third parties or otherwise experience disruptions to our business relationships with our licensors, we could lose license rights that are important to our business. |

| ● | We may be subject to claims that our employees, consultants or independent contractors have wrongfully used or disclosed confidential information of third parties or asserting ownership of what we regard as our own intellectual property. |

Corporate Information

We were incorporated under the laws of the state of Delaware on November 17, 2020 under the name Priveterra Acquisition Corp. Upon the closing of the Business Combination, we changed our name to AEON Biopharma, Inc. Our Common Stock and Warrants are listed on NYSE American under the symbols “AEON” and “AEON WS,” respectively. Our principal executive offices are located at 5 Park Plaza, Suite 1750, Irvine, California 92614, and our telephone number is (949) 354-6499. Our website address is

7

www.aeonbiopharma.com. The information contained in, or accessible through, our website does not constitute a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote of stockholders on executive compensation, stockholder approval of any golden parachute payments not previously approved and having to disclose the ratio of the compensation of our chief executive officer to the median compensation of our employees. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of Priveterra’s initial public offering. However, if (i) our annual gross revenue exceeds $1.235 billion, (ii) we issue more than $1.0 billion of non-convertible debt in any three-year period or (iii) we become a “large accelerated filer” (as defined in Rule 12b-2 under the Exchange Act of 1934, as amended, or the Exchange Act) prior to the end of such five-year period, we will cease to be an emerging growth company. We will be deemed to be a “large accelerated filer” at such time that we (a) have an aggregate worldwide market value of common equity securities held by non-affiliates of $700.0 million or more as of the last business day of our most recently completed second fiscal quarter, (b) have been required to file annual and quarterly reports under the Exchange Act, for a period of at least 12 months and (c) have filed at least one annual report pursuant to the Exchange Act.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have elected to use the extended transition period for complying with new or revised accounting standards. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

8

THE OFFERING

| | |

Shares of Common Stock offered by us |

| 18,867,910 shares issuable upon exercise of Warrants and options or settlement of restricted stock units. |

| | |

Shares of Common Stock offered by the Registered Holders | | 32,066,841 shares. |

| | |

Shares of Common Stock outstanding prior to the exercise of all Warrants, options referenced above | | 37,159,600 shares (as of November 21, 2023). |

| | |

Warrants offered by the Registered Holders | | 5,279,999 Warrants. |

| | |

Warrants outstanding | | 14,479,999 Warrants (as of November 21, 2023). |

| | |

Exercise price per share pursuant to the Warrants | | $11.50 |

| | |

Use of proceeds | | We will not receive any proceeds from the sale of shares by the Registered Holders. We will receive the proceeds from any exercise of the Warrants or options for cash, which we intend to use for general corporate and working capital purposes. We may receive up to an aggregate of approximately $166.5 million from the cash exercise of the Warrants. The exercise price of each of our Warrants is $11.50 per Warrant. However, the last reported sales price of our Common Stock on November 21, 2023 was $4.70. The likelihood that holders of Warrants will exercise their Warrants, and therefore any amount of cash proceeds that we may receive, is dependent upon the trading price of our Common Stock. If the trading price for our Common Stock continues to be less than $11.50 per share, we do not expect holders to exercise their Warrants. Additionally, the Private Placement Warrants may be exercised on a cashless basis and we will not receive any proceeds from such exercise, even if the Private Placement Warrants are in-the-money. See “Use of Proceeds” on page 61 for additional information. |

| | |

Risk factors | | You should carefully read the “Risk Factors” beginning on page 10 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our Common Stock or Warrants. |

| | |

NYSE American symbol for our Common Stock | | “AEON” |

| | |

NYSE American symbol for our Warrants | | “AEON WS” |

9

RISK FACTORS

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making an investment in our Common Stock or Warrants. Our business, financial condition, results of operations, or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our Common Stock and Warrants could decline and you could lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors, including those set forth below.

Risks Related to Our Business Operations and Financial Position

We have a limited operating history and have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. If we ever achieve profitability, we may not be able to sustain it.

We are a clinical stage biopharmaceutical company with a limited operating history. Pharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. Old AEON was originally incorporated in 2012 but did not begin focusing its efforts and financial resources on the clinical development and regulatory approval of ABP-450 for therapeutic indications until 2019. The operating history upon which investors must evaluate our business and prospects is limited. Consequently, any predictions about our future success, performance or viability may not be as accurate as they could be if we had a longer operating history or a history of commercial operations. In addition, as an organization, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in the biopharmaceutical market. To date, we have not obtained any regulatory approvals for ABP-450 or generated any revenue from product sales relating to therapeutic uses of ABP-450.

Because we have not yet received regulatory approvals, we are not permitted to market ABP-450 for therapeutic use in the United States or in any other territory, and as such, we have not generated any revenue from sales of ABP-450 to date. We have recorded losses from operations of $48.4 million and $65.8 million for the years ended December 31, 2022 and 2021, respectively, and we recorded net loss of $38.0 million (with respect to Old AEON for the period from January 1, 2023 to July 21, 2023), net income of $43.9 million (with respect to AEON for the period from July 22, 2023 to September 30, 2023) and net loss of $18.0 million (for the nine months ended September 30, 2022). As a result of our ongoing losses, as of September 30, 2023, we had an accumulated deficit of $423.1 million. We expect to continue to incur losses for the foreseeable future, and we anticipate these losses will increase as we continue to seek regulatory approval for, and begin to commercialize, ABP-450, if approved. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. Our prior losses and expected future losses have had and will continue to have an adverse effect on our stockholders’ equity (deficit) and working capital. Because of the numerous risks and uncertainties associated with drug development, we are unable to accurately predict the timing or amount of increased expenses, or when, if at all, we will be able to achieve profitability. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our prior losses, combined with expected future losses, may adversely affect the market price of Common Stock and our ability to raise capital and continue operations.

Our management has concluded that uncertainties around our ability to raise additional capital raise substantial doubt about our ability to continue as a going concern. We will require additional financing to fund our future operations. Any failure to obtain additional capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our operations.

We have concluded that we do not have sufficient cash to fund our operations and to meet our obligations as they become due within one year from the date that our consolidated financial statements are issued and as a result, there is substantial doubt about our ability to continue as a going concern.

Our ability to continue as a going concern is an issue raised as a result of ongoing operating losses and a lack of financing commitments to meet cash requirements, and is subject to our ability to generate a profit or obtain appropriate financing from outside sources, including obtaining additional funding from the sale of our securities or obtaining loans from third parties where possible. While the Business Combination provided some capital, it is unlikely to be sufficient to remove the doubt about our ability to continue as a going concern and we will need to raise additional capital to fund our operations. We cannot assure you that we will be able to

10

raise additional capital on commercially reasonable terms or at all. The perception that we may not be able to continue as a going concern may materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise and no assurance can be given that sufficient funding will be available when needed to allow us to continue as a going concern. This perception may also make it more difficult to operate our business due to concerns about our ability to meet our contractual obligations. If we cannot continue as a going concern, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our financial statements, and it is likely that our stockholders may lose some or all of their investment in us.

We expect that we will continue to expend substantial resources for the foreseeable future in order to complete development of and seek regulatory approval for ABP-450 for the treatment of migraine, cervical dystonia and gastroparesis, identify future potential therapeutic applications for ABP-450 and establish sales and marketing capabilities to commercialize ABP-450 across any approved indications.

The net proceeds from the Business Combination, along with our cash and committed financings, are sufficient to fund our operating plan through mid-December 2023. We have based these estimates, however, on assumptions that may prove to be wrong, and we could spend our available capital resources much faster than we currently expect or require more capital to fund our operations than we currently expect. Our future capital requirements depend on many factors, including:

| ● | the timing of, and the costs involved in, obtaining regulatory approvals for ABP-450 in our proposed therapeutic indications; |

| ● | the scope, progress, results and costs of researching and developing ABP-450, and conducting preclinical and clinical studies, including any determination we make as to whether to cease its migraine open label extension study; |

| ● | the cost of commercialization activities if ABP-450 is approved in any of our proposed therapeutic indications for sale, including marketing, sales and distribution costs; |

| ● | costs under our third-party manufacturing and supply arrangements for ABP-450 and any products we commercialize; |

| ● | the degree and rate of market acceptance of ABP-450 or any future approved products; |

| ● | the emergence, approval, availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and competing products; |

| ● | costs associated with any acquisition or in-license of products and product candidates, technologies or businesses, and the terms and timing of any strategic collaboration or other arrangement; |

| ● | the timing and terms of any cash settlement payments under the Forward Purchase Agreements, which are influenced by our stock price performance through the second anniversary of the Closing and which in certain circumstances may require payments by us to the Sellers under the Forward Purchase Agreements; and |

| ● | costs of operating as a public company. |

If we raise additional capital through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish certain valuable rights to our product candidate(s), technologies, future revenue streams or research programs or may have to grant licenses on terms that may not be favorable to us. If we raise additional capital through public or private equity offerings or offerings of securities convertible into our equity, the ownership interest of stockholders will be diluted and the terms of any such securities may have a preference over our Common Stock. Debt financing, receivables financing and royalty financing may also be coupled with an equity component, such as warrants to purchase our capital stock, which could also result in dilution of our existing stockholders’ ownership, and such dilution may be material.

Additionally, the Forward Purchase Agreements may negatively impact our ability to raise additional capital through equity or debt financings, due to the potential substantial dilution to our stockholders that could occur during the term of the instruments (which will be no more than two years from the date of the Closing), or may negatively affect our ability to obtain favorable or acceptable

11

terms in connection with any such equity or debt financing. Under the Forward Purchase Agreements, the reset price (the “Reset Price”) was initially the redemption price per share of $10.63 per share. Beginning 90 days after the Closing, the Reset Price became subject to monthly resets, to be the lowest of (a) the then-current Reset Price, (b) $10.63 and (c) the 30-day volume-weighted average price of our Common Stock immediately preceding such monthly reset. The monthly resets of the Reset Price are subject to a floor of $7.00 per share (the “Reset Price Floor”); however, if during the term of the Forward Purchase Agreements, we sell or issue any shares of Common Stock or securities convertible or exercisable for shares of Common Stock at an effective price of less than the Reset Price (a “Dilutive Offering”), then the Reset Price would immediately reset to the effective price of such offering and the Reset Price Floor would be eliminated. Elimination of the Reset Price Floor may also result in the Sellers selling the shares covered by the Forward Purchase Agreements at lower prices and in us receiving less of the Prepayment Amount. Additionally, in the event of a Dilutive Offering, the maximum number of shares available under the Forward Purchase Agreements could be increased if the Dilutive Offering occurs at a price below $10.00 per share. The maximum number of shares would be reset to equal 7,263,764 divided by a number equal to the offering price in the Dilutive Offering divided by $10.00. As of November 21, 2023, the Reset Price is equal to $7.00 per share and the closing price for our Common Stock was $4.70. Depending on the Reset Price over the 24 months following the Closing (which may be impacted by the price at which shares of our Common Stock could be sold through a potential public or private equity offering) and the manner in which the Forward Purchase Agreement transactions are settled, we may never have access to the Prepayment Amount, which may adversely affect our liquidity and capital needs. Additionally, the Prepayment Amount is not held in any bankruptcy-protected account, escrow account, trust account, or any similar arrangement, and there is no requirement for the Sellers to hold such Prepayment Amount separate or apart from any other funds of the Sellers prior to the settlement of the transactions pursuant to the Forward Purchase Agreements. The lack of any such bankruptcy-protected arrangement subjects us to further risk that we may never have access to the Prepayment Amount if the Sellers fail to make payments when due, default under the Forward Purchase Agreements, become insolvent or declare bankruptcy.

Furthermore, if we raise additional capital through debt financing, we will have increased fixed payment obligations and may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt or making capital expenditures to meet specified financial ratios, and other operational restrictions, any of which could restrict our ability to commercialize ABP-450 in our proposed therapeutic indications or to operate as a business and may result in liens being placed on our assets. If we were to default on any of our indebtedness, we could lose such assets. Additional funding may not be available on acceptable terms, or at all. The global credit and financial markets have experienced volatility and disruptions recently, including diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. If the equity and credit markets deteriorate, it may make any necessary debt or equity financing more difficult, more costly or more dilutive.

Our future success currently depends entirely on the successful and timely regulatory approval and commercialization of our only product candidate, ABP-450. The development and commercialization of pharmaceutical products is subject to extensive regulation, and we may not obtain regulatory approvals for ABP-450 in any of the indications for which we plan to develop it on a timely basis or at all.