UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to _________________

Commission File Number: 001-41904

Fidelity® Wise Origin® Bitcoin Fund

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware | 86-6606379 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

245 Summer Street V13E Boston, MA | 02210 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 343-3548

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Fidelity® Wise Origin® Bitcoin Fund Shares | | FBTC | | Cboe BZX Exchange, Inc |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☒ |

| Smaller reporting company |

| ☒ |

| | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant had 172,950,000 outstanding shares as of May 6, 2024

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) contains “forward-looking statements” that generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Quarterly Report that address activities, events or developments that will or may occur in the future, including such matters as movements in the digital asset markets and indexes that track such movements, Fidelity Wise Origin Bitcoin Fund’s (the “Trust”) operations, FD Funds Management LLC’s (the “Sponsor”) plans and references to the Trust’s future success and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and are difficult to predict, that could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors we identify in this Quarterly Report and in our filings with the Securities and Exchange Commission (the “SEC”).

Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this Quarterly Report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this Quarterly Report are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of its Shares.

Should one or more of these risks discussed in this Quarterly Report or other uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those described in forward-looking statements. Forward-looking statements are made based on the Sponsor’s beliefs, estimates and opinions on the date the statements are made and neither the Trust nor the Sponsor is under a duty or undertakes an obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Moreover, neither the Trust, the Sponsor, nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Investors are therefore cautioned against placing undue reliance on forward-looking statements.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Fidelity Wise Origin Bitcoin Fund

Statements of Assets and Liabilities

(unaudited)

| | | | | | | | |

(Amounts in 000’s of US$, except for share and per share data)

| | March 31, 2024 | | | December 31, 2023 | |

Assets | | | | | | |

Investment in bitcoin, at fair value (cost $7,587,410 and $0) | | $ | 10,215,701 | | | $ | — | |

Cash | | | — | | | | — | |

Receivables from issuance of capital shares | | | 68,150 | | | | — | |

Total Assets | | $ | 10,283,851 | | | $ | — | |

Liabilities | | | | | | |

Payable for purchases of bitcoin | | | 68,150 | | | | — | |

Total Liabilities | | $ | 68,150 | | | $ | — | |

Commitments and Contingencies (Note 6) | | | | | | |

Net Assets | | | | | | |

Shares, no par value (unlimited shares authorized) 165,475,000 and 1 share(s) issued and outstanding at March 31, 2024 and December 31, 2023, respectively | | $ | — | | | $ | — | |

Paid-in-Capital | | | 7,587,461 | | | | — | |

Total Distributable Earnings (Loss) | | | 2,628,240 | | | | — | |

Total Net Assets | | | 10,215,701 | | | | — | |

Net Asset Value per share (165,475,000 and 1 share(s) issued and outstanding as of March 31, 2024 and December 31, 2023, respectively) | | $ | 61.74 | | | $ | 40.00 | |

Any values shown as $0 in the Statements of Assets and Liabilities may reflect amounts less than $500.

The accompanying notes are an integral part of these financial statements

Fidelity Wise Origin Bitcoin Fund

Statement of Operations

(unaudited)

| | | | | |

(Amounts in 000’s of US$) | | | Three Months Ended March 31, 2024 | |

Investment income: | | | | |

Investment income | | | $ | — | |

Expenses: | | | | |

Sponsor fee, related party | | | | 2,828 | |

Total expenses before waiver | | | | 2,828 | |

Sponsor fee waived | | | | (2,828 | ) |

Net expenses | | | | — | |

Net Investment Income (Loss) | | | $ | — | |

Net Realized and Unrealized Gain (Loss) from: | | | | |

Net realized gain (loss) on investment in bitcoin | | | | (51 | ) |

Net change in unrealized appreciation (depreciation) on investment in bitcoin | | | | 2,628,291 | |

Net Realized and Unrealized Gain (Loss) on Investment in Bitcoin | | | $ | 2,628,240 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | $ | 2,628,240 | |

The accompanying notes are an integral part of these financial statements

Fidelity Wise Origin Bitcoin Fund

Statement of Changes in Net Assets

(unaudited)

| | | | | |

(Amounts in 000’s of US$, except for shares)

| | | Three Months Ended March 31, 2024 | |

Operations: | | | | |

Net investment income (loss) | | | $ | — | |

Net realized gain (loss) on investment in bitcoin | | | | (51 | ) |

Net change in unrealized appreciation (depreciation) on investment in bitcoin | | | | 2,628,291 | |

Net increase (decrease) in net assets resulting from operations | | | $ | 2,628,240 | |

Capital share transactions: | | | | |

Shares issued | | | $ | 7,589,010 | |

Shares redeemed | | | | (1,549 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | | 7,587,461 | |

Total increase (decrease) in net assets | | | | 10,215,701 | |

Net Assets, beginning of period | | | | — | |

Net Assets, end of period | | | $ | 10,215,701 | |

Changes in shares outstanding: | | | | |

Shares outstanding, beginning of period | | | | 1 | |

Shares issued | | | | 165,500,000 | |

Shares redeemed | | | | (25,001 | ) |

Net increase in shares | | | | 165,474,999 | |

Shares outstanding, end of period | | | | 165,475,000 | |

The accompanying notes are an integral part of these financial statements

Fidelity Wise Origin Bitcoin Fund

Statement of Cash Flows

(unaudited)

| | | | |

(Amounts in 000’s of US$) | | Three Months Ended March 31, 2024 | |

Cash flows from operating activities: | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 2,628,240 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities: | | | |

Payments for purchases of bitcoin | | | (7,520,860 | ) |

Proceeds from bitcoin sold | | | 1,549 | |

Net realized (gain) loss on investment in bitcoin | | | 51 | |

Net change in unrealized (appreciation) depreciation on investment in bitcoin | | | (2,628,291 | ) |

Net cash provided by (used in) operating activities | | $ | (7,519,311 | ) |

Cash flows from financing activities: | | | |

Proceeds from issuance of capital shares | | $ | 7,520,860 | |

Cash paid for redemption of capital shares | | | (1,549 | ) |

Net cash provided by (used in) financing activities | | $ | 7,519,311 | |

Cash | | | |

Net increase (decrease) in cash | | $ | — | |

Cash, beginning of the period | | $ | — | |

Cash, end of the period | | $ | — | |

The accompanying notes are an integral part of these financial statements

Fidelity Wise Origin Bitcoin Fund

Schedule of Investment

March 31, 2024

(unaudited)

| | | | | | | | | | | | | | |

(Amounts in 000’s of US$, except for quantity of bitcoin and percentages) |

Investments (a) | | Quantity of Bitcoin | | | Cost | | | Fair Value | | | Percentage of Net Assets |

Investment in bitcoin, at Fair Value | | | | |

| | |

| | | |

Global | | | | |

| | |

| | | |

Bitcoin | | | 144,704.48094252 | | | $ | 7,587,410 | | | $ | 10,215,701 | | | |

Total Investment in bitcoin, at Fair Value | | | | | $ | 7,587,410 | | | $ | 10,215,701 | | | 100.00% |

Total Net Assets | | | | | $ | 7,587,410 | | | $ | 10,215,701 | | | 100.00% |

(a) Non-income producing investment

The accompanying notes are an integral part of these financial statements

Fidelity Wise Origin Bitcoin Fund

Notes to the Financial Statements

Note 1: Organization

Fidelity Wise Origin Bitcoin Fund (the “Trust”) is a Delaware Statutory Trust that was formed on March 17, 2021 pursuant to the Delaware Statutory Trust Act. The Trust issues common units of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of the Trust. The Trust’s investment objective is to seek to track the performance of bitcoin, as measured by the performance of the Fidelity Bitcoin Reference Rate (the “Index”), adjusted for the Trust’s expenses and other liabilities. The Index is designed to reflect the performance of bitcoin in United States (U.S.) dollars. The Trust is sponsored by FD Funds Management LLC (the “Sponsor”), a wholly-owned subsidiary of FMR LLC. Delaware Trust Company is the trustee of the Trust (the “Trustee”). The Trust will operate pursuant to a Second Amended and Restated Trust Agreement (the “Trust Agreement”).

The Trust is passively managed. The Shareholders of the Trust do not have control or involvement in the management of the Trust. The Trust, the Sponsor, and the Trust’s service providers do not loan or pledge the assets of the Trust or use those assets as collateral for any loan or similar arrangement unless required to facilitate transaction settlement.

Prior to January 9, 2024, the Trust had no operations other than matters relating to the sale and issuance of 1 seed share of the Trust to an affiliate for an aggregate purchase price of $40 on November 30, 2023. On January 9, 2024, the seed share was redeemed for cash and the Seed Capital Investor purchased 500,000 Shares at a per-Share price of $40.00 (the “Seed Baskets”). Total proceeds to the Trust from the sale of the Seed Baskets were $20,000,000. On January 10, 2024, the Trust was declared effective. On January 11, 2024, the Trust commenced operations and Shares commenced trading on Cboe BZX Exchange, Inc. (the “Exchange”).

Note 2: Significant Accounting Policies

The following is a summary of the significant accounting and reporting policies used in preparing the financial statements.

Basis of Presentation

The financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and are stated in United States (“US”) dollars. The Trust qualifies as an investment company for accounting purposes pursuant to the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. The Trust uses fair value as its method of accounting for bitcoin in accordance with its classification as an investment company for accounting purposes. The Trust is not a registered investment company under the Investment Company Act of 1940.

In the opinion of the Trust, the accompanying unaudited condensed financial statements contain all adjustments, consisting of only normal recurring adjustments, necessary for the fair presentation of financial statements for the periods presented. The statement of assets and liabilities at December 31, 2023, was derived from audited annual financial statements but does not contain all of the footnote disclosures from the annual financial statements.

Use of Estimates

The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Actual amounts may ultimately differ from those estimates and the differences could be material.

Bitcoin Assets

Bitcoin is a type of digital asset based on an open‐source cryptographic protocol existing on a Bitcoin network. Digital assets are defined broadly as digital records that are made using cryptography for verification and security purposes, on a distributed ledger and may be characterized by their ability to be used as a medium of exchange, a representation to provide or access goods or services, or as a financing vehicle, such as a security. The Trust identifies bitcoin as an “other investment” in accordance with ASC Topic 946.

Investment Valuation

Due to the Trust’s classification as an investment company, investments in bitcoin are recorded on the financial statements at their estimated fair value in accordance with ASC Topic 820 Fair Value Measurement (“ASC 820”). ASC 820 requires the determination of the Trust’s principal market or, in the absence of a principal market, the most advantageous market (principal market) and the assumption that bitcoin is sold in their principal market. The Trust determines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants using the principal market on the measurement date and, therefore, the principal market used must be accessible to the Trust on that date. The Trust determines its principal market price for GAAP reporting and utilizes an exchange-traded price from that principal market as of 11:59:59 p.m., EST, on the financial statement measurement date.

GAAP establishes the following fair value hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The inputs are categorized in one of the following levels:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Trust is able to access at the measurement date.

Level 2 – Inputs, other than quoted prices included in Level 1, that are observable either directly or indirectly. These inputs may include (a) quoted prices for similar assets or liabilities in active markets, (b) quoted prices for identical or similar assets or liabilities in markets that are not active, (c) inputs other than quoted prices that are observable for the asset or liability, or (d) inputs derived principally from or corroborated by observable market data by correlation or other means.

Level 3 – Inputs that are unobservable (including the Trust’s own data and assumptions based on the best information available) and significant to the entire fair value measurement.

To the extent that investments are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Investments traded on inactive markets or valued by reference to similar instruments are generally categorized in Level 2 of the fair value hierarchy.

The availability of valuation techniques and observable inputs can vary across investment and is affected by various factors, including the nature of the investment, whether the investment is new or unestablished in the marketplace, market liquidity and other investment specific characteristics. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, determining fair value requires more judgment. Because of the uncertainty inherent in valuation, those estimated values may be materially higher or lower than the values that would have been used had a ready market for the investments existed. Therefore, the degree of judgment exercised by management in determining fair value is greatest for investments categorized in Level 3.

In some circumstances, the inputs used to measure fair value might be categorized within different levels of the fair value hierarchy. In those instances, the fair value measurement is categorized in its entirety in the fair value hierarchy based on the lowest level input that is significant to the fair value measurement.

Investment Transactions and Related Investment Income

The Trust records investment transactions in bitcoin on a trade date basis. For financial reporting purposes, the Trust’s investment holdings and Paid-In-Capital include trades executed through the end of the last business day of the period. The Trust’s purchases are recorded at cost, including transaction fees, and are subsequently fair‐valued in accordance with the Trust’s fair valuation policy. Changes in fair value are reflected as the net change in unrealized appreciation (depreciation) on investments in bitcoin. Realized gains and losses from investment transactions are determined on the basis of identified cost and reflected as net realized gain (loss) on investments in bitcoin.

Cash

Cash consists of a demand deposit held with a financial institution. At times, deposits may be in excess of federally insured limits. The Trust has not experienced any losses and does not believe it is exposed to any significant credit risk on such deposits.

Income Taxes

The Trust intends to be classified as a “grantor trust” for US federal income tax purposes. As a result, the Trust itself should not be subject to US federal income tax. Instead, the Trust’s income and expenses should “flow through” to the Shareholders, and the Trustee will report to Shareholders and the Internal Revenue Service on that basis.

The Sponsor evaluates tax positions taken or expected to be taken in the course of its tax treatment, and its tax reporting to its shareholders, of these positions to determine whether the tax positions are “more-likely-than-not” to be sustained by the applicable tax authority. Tax positions not deemed to meet that threshold would be recorded as an expense in the current year. The Trust is required to analyze all open tax years. Open tax years are those years that are open for examination by the relevant income taxing authority. As of March 31, 2024, the 2023 tax year remains open for examination. There were no examinations in progress at period end.

Expenses

Expenses are recorded as accrued. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known. Expenses included in the accompanying financial statements reflect the expenses of the Trust and do not include any expenses paid by the Sponsor or related entities outside of the Trust.

New Accounting Pronouncement

In December 2023, the FASB issued Accounting Standards Update (“ASU”) No. 2023-08, “Intangibles-Goodwill and Other-Crypto Assets (Subtopic 350-60): Accounting for and Disclosure of Crypto Assets” (“ASU 2023-08”). ASU 2023-08 requires entities to subsequently measure certain crypto assets at fair value, and changes in fair value must be recorded in net income in each reporting period. In addition, entities are required to provide additional disclosures about the holdings of certain crypto assets. ASU 2023-08 is effective for annual and interim reporting periods beginning after December 15, 2024. Early adoption is permitted for both interim and annual financial statements that have not yet been issued or made available for issuance. The Trust is currently evaluating the impact the adoption of this new accounting standard update will have on its financial statements and related disclosures but does not expect it will have a material impact on the Trust’s financial statements as the requirements of ASU 2023-08 generally align with the accounting requirements under ASC Topic 946.

Note 3: Related Party Agreements and Transactions

Administrator

Fidelity Service Company, Inc. serves as the Trust’s administrator (the “Administrator”). Under the Administration Agreement, the Administrator provides necessary administrative, tax and accounting services and financial reporting for the maintenance and operations of the Trust, including valuing the Trust’s bitcoin and calculating the net asset value (“NAV”) per Share of the Trust (“Trust’s NAV”) and supplying pricing information to the Sponsor for the relevant website. In addition, the Administrator makes available the office space, equipment, personnel and facilities required to provide such services. All fees and expenses incurred by the Trust related to services performed by the Administrator are borne by the Sponsor.

Custodian

Fidelity Digital Asset Services, LLC, an affiliate of the Sponsor, serves as the Trust’s bitcoin custodian. Under the Custodian Agreement, Fidelity Digital Asset Services, LLC is responsible for safekeeping all of the bitcoin owned by the Trust. Fidelity Digital Asset Services, LLC was selected by the Sponsor. The Sponsor is responsible for opening an account with Fidelity Digital Asset Services, LLC that holds the Trust’s bitcoin (the “Bitcoin Account”), as well as facilitating the transfer or sale of bitcoin required for the operation of the Trust. All fees and expenses incurred by the Trust related to services performed by the custodian are borne by the Sponsor.

Distributor

Fidelity Distributors Company LLC (“FDC” or the “Distributor”) is responsible for reviewing and approving the marketing materials prepared by the Sponsor for compliance with applicable Securities and Exchange Commission (“SEC”) and the Financial Industry Regulatory Authority, Inc. (“FINRA”) advertising laws, rules, and regulations pursuant to a marketing agreement with the Trust. FDC is a broker-dealer registered under the Securities Exchange Act of 1934 (the “1934 Act”) and a member of FINRA. All fees and expenses incurred by the Trust related to services performed by the Distributor are borne by the Sponsor.

Index Services

Fidelity Product Services LLC (the “Index Provider”) is responsible for the methodology and oversight of the Index. Coin Metrics, Inc. is the third-party, independent calculation agent for the Index. All fees and expenses incurred by the Trust related to services performed by the Index Provider are borne by the Sponsor.

Sponsor Fee

Pursuant to the terms of the Trust Agreement, dated December 28, 2023, the Sponsor entered into a Sponsor Agreement, dated December 14, 2023, whereby the Trust has contractually agreed to pay the Sponsor an annualized unified fee of 0.25% of the Trust's net assets. The Sponsor Fee is paid by the Trust to the Sponsor as compensation for services performed under the Trust Agreement. The Sponsor is obligated to assume and pay all fees and other expenses incurred by the Trust in the ordinary course of its affairs, excluding taxes, but including: (i) the fees of the Trust’s third-party service providers including Distributor, the Administrator, any custodian, the transfer agent, the Index Provider and the Trustee, (ii) the fees and expenses related to the listing, quotation or trading of the Shares on the Exchange (including customary legal, marketing and audit fees and expenses), (iii) ordinary course, legal fees and expenses, (iv) audit fees, (v) regulatory fees, including, if applicable, any fees relating to the registration of the Shares under the 1933 Act or the 1934 Act, (vi) printing and mailing costs, (vii) costs of maintaining the Trust’s website and (viii) applicable license fees (each, a “Sponsor Expense” and collectively, the “Sponsor Expenses”), provided that any expense that qualifies as an Extraordinary Expense will be deemed to be an Extraordinary Expense and not a Sponsor-paid Expense. There is no cap on the amount of Sponsor-paid Expenses. The Sponsor has also assumed all fees and expenses related to the organization and offering of the Trust and the Shares.

Effective January 9, 2024, the Trust and the Sponsor entered into a Fee Waiver Agreement in which the Sponsor agreed to waive the entirety of the Sponsor Fee (the “Waiver”). The Waiver will continue for a period at least through July 31, 2024 (the “Initial Waiver Period”); provided however, the Sponsor may elect to extend the Waiver beyond the Initial Waiver Period at its sole discretion.

The Trust may incur certain extraordinary, nonrecurring expenses that are not Sponsor Expenses, including, but not limited to, brokerage and transactions costs associated with the sale or transfer of bitcoin to pay the Trust’s expenses and liabilities, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the interests of shareholders, any indemnification of the Custodian or other agents, service providers or counterparties of the Trust, extraordinary legal fees and expenses, including any legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters (collectively, “Extraordinary Expenses”).

The Administrator calculates the Sponsor Fee in respect of each day by reference to the Trust’s NAV as of that day. The Sponsor Fee accrues daily and is payable monthly in bitcoin or cash. To the extent the Trust does not have cash readily available, the Sponsor will cause the transfer or sale of bitcoin in such quantity as may be necessary to permit the payment of Trust expenses and liabilities not assumed by the Sponsor. The amount of bitcoin transferred or sold may vary from time to time depending on the actual sales price of bitcoin relative to the Trust’s expenses and liabilities.

Note 4: Fair Value Measurement

The Trust’s assets recorded at fair value have been categorized based upon a fair value hierarchy as described in the Trust’s significant accounting policies in Note 2. The following table presents information about the Trust’s assets measured at fair value as of March 31, 2024:

| | | | | | | | | | | | | | | | |

| | March 31, 2024 | |

(Amounts are in 000’s) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investment in bitcoin | | $ | 10,215,701 | | | $ | — | | | $ | — | | | $ | 10,215,701 | |

Total Investments | | $ | 10,215,701 | | | $ | — | | | $ | — | | | $ | 10,215,701 | |

Geographic location as well as industry/strategy classification for all investments is detailed in the accompanying Schedule of Investment. There were no purchases or transfers into or out of Level 3 during the period ended March 31, 2024.

Note 5: Capital

The Trust is an exchange-traded product. The Trust plans to continuously offer baskets consisting of Shares to Authorized Participants. The number of outstanding Shares is expected to increase and decrease from time to time as a result of the creation and redemption of Baskets. The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of bitcoin or cash represented by the Trust’s NAV of the Baskets being created or redeemed. The total amount of bitcoin required for the creation of Baskets will be based on the combined net assets represented by the number of Baskets being created or redeemed.

Shares represent fractional undivided beneficial interests in and ownership of the Trust. Shares issued by the Trust are registered in a book entry system and held in the name of Cede & Co. at the facilities of the Depository Trust Company (“DTC”), and one or more global certificates issued by the Trust to DTC evidences the Shares. Shareholders may hold their Shares through DTC if they are direct participants in DTC (“DTC Participants”) or indirectly through entities (such as broker-dealers) that are DTC Participants.

Note 6: Commitments and Contingencies

In the normal course of business, the Trust enters into certain contracts that provide a variety of indemnities, including contracts with the Sponsor and affiliates of the Sponsor, and its officers, directors, employees, subsidiaries and affiliates, and the Custodian as well as others relating to services provided to the Trust. The Trust’s maximum exposure under these and its other indemnities is unknown. However, no liabilities have arisen under these indemnities in the past and, while there can be no assurances in this regard, there is no expectation that any will occur in the future. Therefore, the Sponsor does not consider it necessary to record a liability in this regard. The risk of material loss from such claims is considered remote.

Note 7: Concentration Risk

Unlike other funds that may invest in diversified assets, the Trust’s investment strategy is concentrated in a single asset within a single asset class. This concentration maximizes the degree of the Trust’s exposure to a variety of market risks associated with bitcoin and digital assets. By concentrating its investment strategy solely in bitcoin, any losses suffered as a result of a decrease in the value of bitcoin can be expected to reduce the value of an interest in the Trust and will not be offset by other gains if the Trust were to invest in underlying assets that were diversified.

Note 8: Financial Highlights

The Trust is presenting the following financial highlights related to investment performance and operations of a Share outstanding for the period January 11, 2024 (inception) through March 31, 2024. The total return, at net asset value is based on the change in NAV of a Share during the period and the total return, at market value is based on the change in market value of a Share on the Exchange during the period. An individual investor’s return and ratios may vary based on the timing of capital transactions.

| | | | |

| | For the period January 11, 2024 (inception) through March 31, 2024 | |

Per Share Activity | | | |

Net Asset Value, beginning of period | | $ | 40.00 | |

Net increase (decrease) in net assets from investment operations: | | | |

Net investment income (loss) (1) | | | — | |

Net realized and unrealized gain (loss) | | | 21.74 | |

Net increase (decrease) in net assets from operations | | | 21.74 | |

Net Asset Value, end of period | | | 61.74 | |

Market Value per Share, beginning of period | | | 40.00 | |

Market Value per Share, end of period | | $ | 62.06 | |

Total Return, at Net Asset Value (1) | | | 54.35 | % |

Total Return, at Market Value (2) | | | 55.15 | % |

Ratios to average net assets | | | |

Net investment income (loss) (3) | | | 0.00 | % |

Expenses, gross (3) | | | 0.25 | % |

Expenses, net of waivers (3) | | | 0.00 | % |

(1) Based on average shares outstanding during the period.

(2) Percentages are not annualized.

(3) Percentages are annualized.

Note 9: Subsequent Events

In preparation of the financial statements, management has evaluated the events and transactions subsequent to March 31, 2024, and determined that there are no subsequent events or transactions that would require adjustments to or disclosures in the Trust’s financial statements.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our unaudited financial statements and related notes included elsewhere in this Quarterly Report, which have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). The following discussion may contain forward-looking statements based on assumptions we believe to be reasonable. Our actual results could differ materially from those discussed in these forward-looking statements.

Overview of the Trust

Fidelity Wise Origin Bitcoin Fund (the “Trust”) is a Delaware statutory trust, formed on March 17, 2021, pursuant to the Delaware Statutory Trust Act. The Trust is an exchange-traded product that issues Shares that trade on the Cboe BZX Exchange, Inc. (the “Exchange”) with ticker symbol FBTC. The Trust’s investment objective is to seek to track the performance of bitcoin, as measured by the performance of the Fidelity Bitcoin Reference Rate (the “Index”), adjusted for the Trust’s expenses and other liabilities. The Index is constructed using bitcoin price feeds from eligible bitcoin spot markets and a volume-weighted median price (“VWMP”) methodology, calculated every 15 seconds based on VWMP spot market data over rolling sixty-minute increments. The Index is designed to reflect the performance of bitcoin in U.S. dollars. In seeking to achieve its investment objective, the Trust will hold bitcoin and will value its Shares daily based on the same methodology used to calculate the Index.

The Trust is passively managed and does not pursue active management investment strategies, invest in derivatives, or loan or pledge its assets. FD Funds Management LLC (the “Sponsor”) believes that the Shares are designed to provide investors with a cost-effective and convenient way to invest in bitcoin without purchasing, holding and trading bitcoin directly. The Trust sells and redeems Shares only with Authorized Participants in exchange for cash and only in blocks of 25,000 Shares. The Shareholders of the Trust take no part in the management or control, and have no voice in, the Trust’s operations or business. Except in limited circumstances, Shareholders have no voting rights under the Trust Agreement.

Valuation of Bitcoin and Computation of Net Asset Value

For purposes of calculating the Trust’s net asset value (“Trust’s NAV”) per Share, the Trust’s holdings of bitcoin are valued using the same methodology as used to calculate the Index. The Trust’s NAV per Share is calculated by:

•taking the fair market value of its total assets based on the volume-weighted median price of bitcoin used for the calculation of the Index;

•subtracting any liabilities; and

•dividing that total by the total number of outstanding Shares.

The Administrator calculates the Trust’s NAV once each Exchange trading day. The Trust’s NAV for a normal trading day is released after 4:00 p.m. Eastern time (“EST”). Trading during the core trading session on the Exchange typically closes at 4:00 p.m. EST. However, Trust NAVs are not officially struck until after 4:00 p.m. EST. The pause after 4:00 p.m. EST provides an opportunity for the Sponsor to algorithmically detect, flag, investigate, and correct unusual pricing should it occur. The Sponsor has established a Valuation Committee to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Valuation Committee. If the Valuation Committee determines in good faith that the Index does not reflect an accurate bitcoin price, then the Valuation Committee instructs the Administrator to employ an alternative method to determine the fair value of the Trust’s assets. In determining an alternative fair value method, the Valuation Committee generally considers such criteria as observable market-based inputs, including market quotations and last sale information from third-party pricing services and/or trading platforms on which bitcoin are traded. The Valuation Committee’s selection of third-party pricing services used considers the qualifications, experience, and history of the pricing services and whether their valuation methodologies and procedures are reasonably designed to produce prices that reflect fair value under the prevailing market conditions.

In addition, a third-party financial data provider will calculate and disseminate throughout the core trading session on each trading day an updated intraday indicative value (“IIV”). The IIV will be calculated based on the Trust’s bitcoin holdings and any other assets expected to comprise that day’s Trust NAV calculation. The third-party financial data provider will use the Blockstream Crypto Data Feed Streaming Level 1 as the pricing source for the spot bitcoin. The Blockstream Crypto Data Feed Streaming Level 1 calculates an average of current bitcoin price levels of the bitcoin trading platforms that are available on its feed. The Trust will provide an IIV per Share updated every 15 seconds, as calculated by the Exchange or a third-party financial data provider during the Exchange’s regular trading hours of 9:30 a.m. to 4:00 p.m. EST (“Regular Trading Hours”). The IIV disseminated during Regular Trading Hours should not be viewed as an actual real-time update of the Trust NAV, which will be calculated only once at the end of each trading day as described herein.

Critical Accounting Policies and Estimates

Principal Market and Fair Value Determination

The Trust’s periodic financial statements are prepared in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 820, “Fair Value Measurements and Disclosures” (“ASC Topic 820”). ASC Topic 820 requires the fair value measurement of bitcoin to assume that transactions take place in the principal market or, in the absence of a principal market, the most advantageous market, for bitcoin that the Trust has access to. The Trust may buy and sell bitcoin through brokered, dealer, over-the-counter, exchange or other markets. The Sponsor determines in its sole discretion the valuation sources and policies used to prepare the Trust’s financial statements in accordance with GAAP. The Trust engaged a third-party pricing service to obtain an exchange-traded price from a principal market for bitcoin, which was determined and designated based on its consideration of several exchange characteristics, including oversight, and the volume and frequency of trades. The exchange-traded price from the principal market on the periodic financial statements is as of 11:59:59 p.m. EST on the Trust’s financial statement measurement date.

Results of Operations

The Trust’s inception of operation was January 11, 2024. The Trust has not had any operations prior to January 11, 2024, other than matters relating to its organization and the registration of the Shares under the Securities Act of 1933 (the “1933 Act”).

The Trust’s net assets increased from $40 on December 31, 2023 to $10.2 billion on March 31, 2024. The change in the Trust’s net assets resulted from an increase in outstanding Shares, which rose from 1 on December 31, 2023 to 165,475,000 on March 31, 2024 as a result of 165,500,000 Shares (6,620 Baskets) being created and 25,001 Shares (1 Basket) being redeemed during the quarter and an increase in the price of bitcoin, which rose 53.62% from $45,956.16 on January 11, 2024 (inception) to $70,596.99 on March 31, 2024.

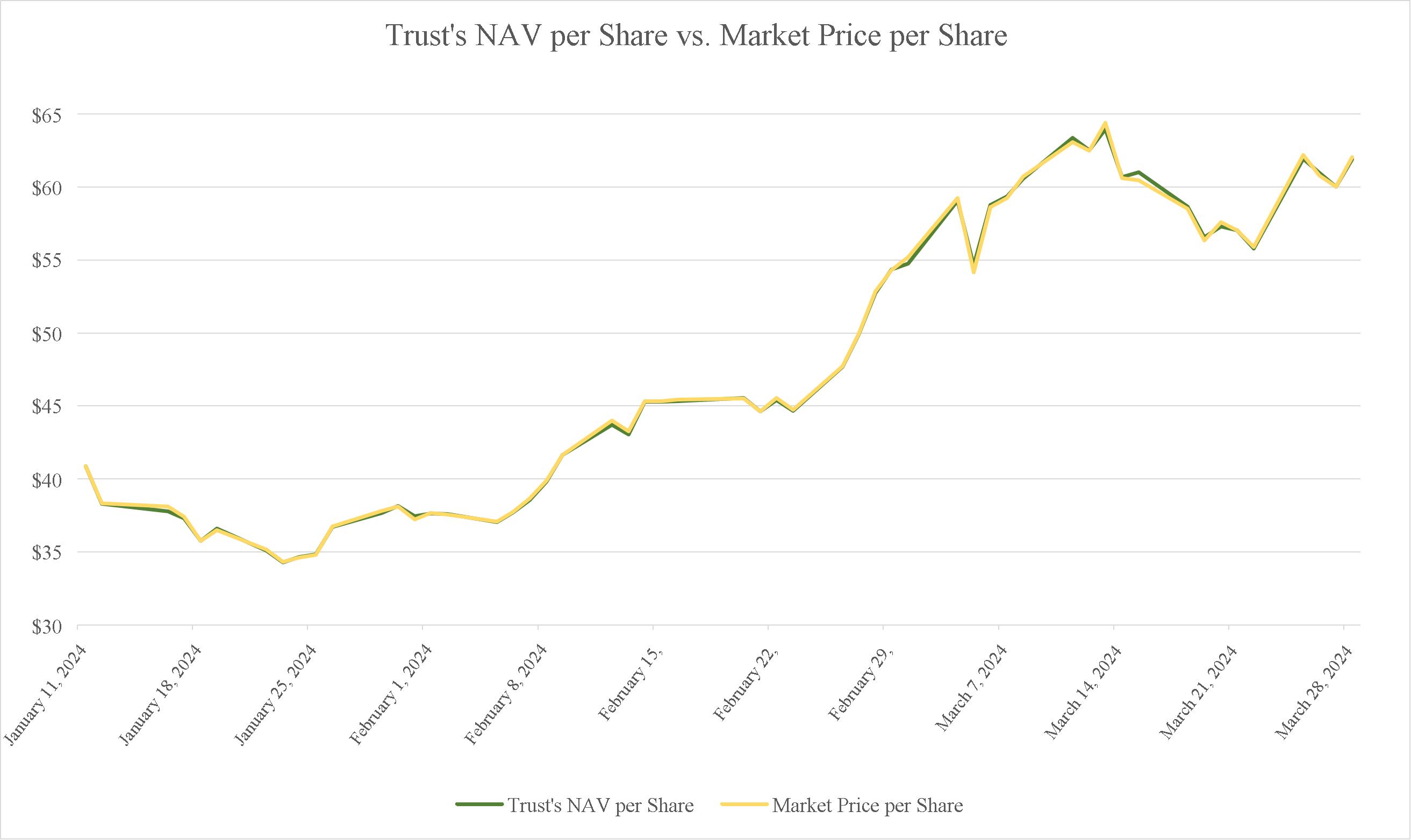

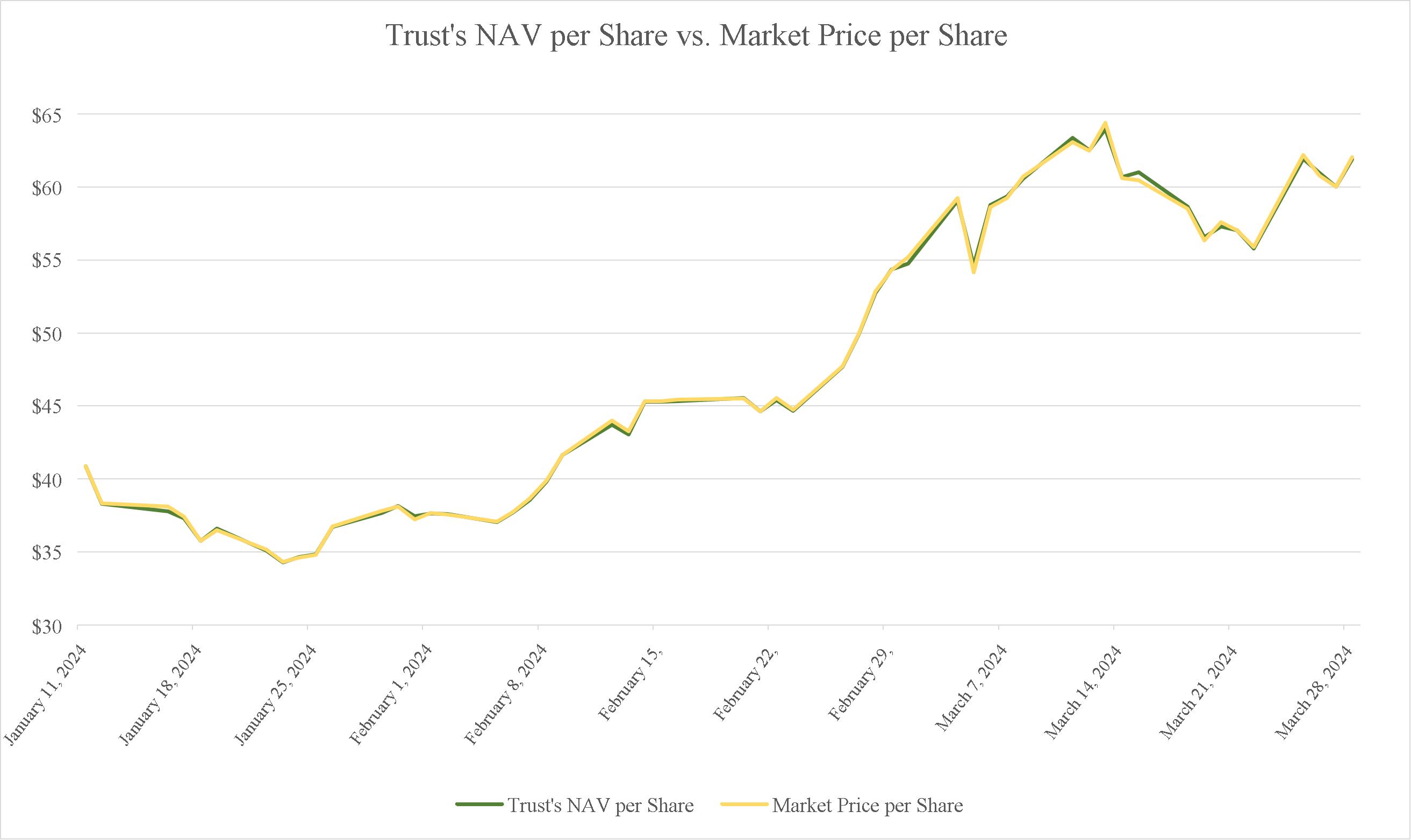

The Trust’s NAV per Share increased 54.75% from $40.00 on December 31, 2023 to $61.90 on March 28, 2024 (last business day).

The Trust’s NAV per Share of $63.97 at March 13, 2024 was the highest during the quarter, compared with a low of $34.28 at January 23, 2024.

During the quarter ended March 31, 2024, the quantity of bitcoin owned by the Trust and held by the bitcoin custodian increased from 0 on December 31, 2023 to 144,704.48094252 on March 31, 2024. The increase in quantity resulted from using cash proceeds received from creation transactions to purchase bitcoin.

The net increase in net assets resulting from operations for the quarter ended March 31, 2024 was $2.6 billion, resulting from an unrealized gain on investment in bitcoin of $2.6 billion and a net realized loss of $51 thousand from the sale of the investment in bitcoin for the redemption of Shares.

Effective January 9, 2024, the Trust and the Sponsor entered into a Fee Waiver Agreement in which the Sponsor agreed to waive the entirety of the Sponsor Fee (the “Waiver”). The Waiver will continue for a period at least through July 31, 2024 (the “Initial Waiver Period”); provided however, the Sponsor may elect to extend the Waiver beyond the Initial Waiver Period at its sole discretion.

Cash Resources and Liquidity

The Trust does not hold a cash balance except in connection with the creation and redemption of Baskets or to pay expenses not assumed by the Sponsor. To the extent the Trust does not have available cash to facilitate redemptions or pay expenses not assumed by the Sponsor, the Trust will sell bitcoin. When selling bitcoin on behalf of the Trust, the Sponsor endeavors to minimize the Trust’s holdings of assets other than bitcoin. As a consequence, the Sponsor expects that the Trust will have an immaterial amount of cash flow from its operations and that its cash balance will be insignificant at the end of each reporting period. The Trust’s only sources of cash are proceeds from the sale of Baskets and bitcoin. The Trust will not borrow to meet liquidity needs.

In exchange for the Sponsor Fee, the Sponsor has agreed to assume most of the expenses incurred by the Trust. The Sponsor contractually waived the Sponsor Fee until July 31, 2024, and will accrue at an annual rate of 0.25% of the Trust’s net assets after the Initial Waiver Period.

Off Balance Sheet Arrangements and Contractual Obligations

The Trust has not used, nor does it expect to use in the future, special purpose entities to facilitate off balance sheet financing arrangements and has no loan guarantee arrangements or off balance sheet arrangements of any kind other than agreements entered into in the normal course of business, which may include indemnification provisions related to certain risks service providers undertake in performing services for the Trust. While the Trust’s exposure under such indemnification provisions cannot be estimated, these general business indemnifications are not expected to have a material impact on a Trust’s financial position.

Sponsor Fee payments made to the Sponsor are calculated as a fixed percentage of the Trust’s net assets. As such, the Sponsor cannot anticipate the payment amounts that will be required under these arrangements for future periods as the Trust’s net assets are not known until a future date.

Selected Operating Data

| | | | |

| | March 31, 2024 | |

Price of bitcoin on principal market (1) | | $ | 70,596.99 | |

NAV per Share (2) | | $ | 61.74 | |

(1) The Trust performed an assessment of the principal market at 11:59:59 p.m., EST, on March 31, 2024.

(2) The NAV per Share was calculated using the fair value of bitcoin based on the principal market price at 11:59:59 p.m., EST, on March 31, 2024, the last day of the quarter.

| | | | |

| | March 28, 2024 | |

| | (Last Business Day) | |

Index price (3) | | $ | 70,783.27 | |

Trust’s NAV per Share (3) | | $ | 61.90 | |

(3) The Trust’s NAV per Share is derived from the Index Price as represented by the Index as of 4:00 p.m., EST, on the last business day of the quarter. The Trust’s NAV per Share is calculated using a non-GAAP methodology. Refer to the “Overview of the Trust” and “Valuation of Bitcoin and Computation of Net Asset Value” sections of Item 2 herein for a description of the Index methodology and calculation of the Trust’s NAV per Share. The bitcoin spot markets included in the Index as of March 31, 2024 were Bitstamp, Coinbase, Gemini, itBit, Kraken, and LMAX Digital.

As of 4:00 p.m., EST, on the last business day of the quarter ended March 31, 2024, the Trust’s total value of bitcoins based on the Index Price (non-GAAP methodology) was $10,242,656,345 and the total market value of the Trust’s bitcoins based on the price of a bitcoin at 4:00 p.m., EST, in the principal market was $10,251,005,793.

Analysis of Price Movements

Investors should understand the relationship between the Index Price (non-GAAP measurement of the price of bitcoin), the Trust’s NAV per Share (non-GAAP measurement of the price of bitcoin affected by non-bitcoin net assets, such as the Sponsor Fee), FBTC’s market price per share, and bitcoin’s principal market price. Investors should also be aware that past movements are not indicators of future movements. Movements may be influenced by various factors, including, but not limited to, government regulation, security breaches experienced by service providers, as well as political and economic uncertainties around the world.

The following chart illustrates the movement in the Index Price, the principal market price, and the Trust’s NAV per Share from January 11, 2024 (date the first Basket of the Trust was created) to March 31, 2024.

The following table illustrates the movements in the Index Price from January 11, 2024 to March 31, 2024. During such period, the Index Price has ranged from $39,198.82 to $73,153.50, with the straight average being $54,669.45 through March 31, 2024. The Sponsor has not observed a material difference between the Index Price and average prices from the constituent bitcoin spot markets individually or as a group.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | High | | Low | | | | | | |

Period | | Average | | | Index Price | | | Date | | Index Price | | | Date | | End of Period | | | Last Business Day | |

January 11, 2024 to March 31, 2024 | | $ | 54,669.45 | | | $ | 73,153.50 | | | March 13, 2024 | | $ | 39,198.82 | | | January 23, 2024 | | $ | 70,976.84 | | | $ | 70,783.27 | |

The following table illustrates the movements in the market price of bitcoin, as reported on the Trust’s principal market, from January 11, 2024 to March 31, 2024. During such period, the price of Bitcoin has ranged from $39,631.40 to $73,308.46, with the straight average being $54,632.28 through March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | High | | Low | | | | | | |

Period | | Average | | | Bitcoin Market Price | | | Date | | Bitcoin Market Price | | | Date | | End of Period | | | Last Business Day | |

January 11, 2024 to March 31, 2024 | | $ | 54,632.28 | | | $ | 73,308.46 | | | March 13, 2024 | | $ | 39,631.40 | | | January 23, 2024 | | $ | 70,596.99 | | | $ | 70,458.45 | |

Shares trade in the secondary market on the Exchange. Shares may trade in the secondary market at prices that are lower or higher relative to the Trust’s NAV per Share. The amount of the discount or premium in the trading price relative to the Trust’s NAV per Share may be influenced by various factors, including the number of Shareholders who seek to purchase or sell Shares in the secondary market and the liquidity of bitcoin. The following chart sets out the historical closing prices for the Shares as reported by the Exchange and the Trust’s NAV per Share from January 11, 2024 to March 28, 2024 (last business day).

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

As a smaller reporting company, the Trust is not required to provide the information required by this item.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

In accordance with Rules 13a-15(b) and 15d-15(b) of the Securities Exchange Act of 1934, as amended, we, under the supervision and with the participation of our President (principal executive officer) and Treasurer (principal financial officer), carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) of the Exchange Act) as of the end of the period covered by this Quarterly Report and determined that our disclosure controls and procedures are effective as of the end of the period covered by the Quarterly Report.

(b) Changes in Internal Controls Over Financial Reporting

There have been no changes in our internal control over financial reporting that occurred during our most recently completed fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II—OTHER INFORMATION

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors.

In addition to the other information set forth in this report, you should carefully consider the risk factors disclosed in our registration statement on Form S-1, filed with the SEC on October 17, 2023, as amended on January 11, 2024.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

(a) On January 9, 2024, the Trust sold 500,000 Shares to FMR Capital, Inc., an affiliate of the Sponsor, for $40 per Share in a transaction exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended. Proceeds from such sale were used to purchase bitcoin. No further sales of unregistered securities are contemplated.

(b) Not applicable.

(c) The Trust does not purchase Shares directly from its shareholders. The following table summarizes the redemptions by Authorized Participants during the three months ended March 31, 2024:

| | | | | | | | | | |

Title of Securities Registered* | | Date | | Total Number of Shares Redeemed | | | Average Price

Per Share | |

Fidelity® Wise Origin® Bitcoin Fund | | | | | | | | |

Shares | | | | | | | | |

| | 01/01/2024 to 1/31/2024 | | | — | | | | — | |

| | 02/01/2024 to 2/29/2024 | | | — | | | | — | |

| | 03/01/2024 to 3/31/2024 | | | 25,000 | | | $ | 61.96 | |

* The registration statement covers an indeterminate amount of securities to be offered or sold.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not Applicable.

Item 5. Other Information.

None.

PART IV

Item 6. Exhibits.

Listed below are the exhibits, which are filed as part of this quarterly report on Form 10-Q (according to the number assigned to them in Item 601 of Regulation S-K):

* Filed herewith.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned in the capacities* indicated, thereunto duly authorized.

| | | |

|

| FIDELITY WISE ORIGIN BITCOIN FUND |

|

|

|

|

Date: May 9, 2024 |

| By: | /s/ Cynthia Lo Bessette |

|

| Name: | Cynthia Lo Bessette |

|

| Title: | President (Principal Executive Officer) |

| | |

|

| FIDELITY WISE ORIGIN BITCOIN FUND |

|

|

|

|

Date: May 9, 2024 |

| By: | /s/ Heather Bonner |

|

| Name: | Heather Bonner |

|

| Title: | Treasurer (Principal Financial and Accounting Officer) |

* The registrant is a trust and the persons are signing in their capacities as officers of FD Funds Management LLC, the Sponsor of the registrant.