As filed with the Securities and Exchange Commission on March 15, 2023

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AI TRANSPORTATION ACQUISITION CORP

(Exact name of registrant as specified in its charter)

| Cayman Islands | | 6770 | | N/A |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

10 East 53rd Street, Suite 3001

New York, NY 10022

+ (86) 1350 1152063

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Yongjin Chen

Chief Executive Officer

AI TRANSPORTATION ACQUISITION CORP

10 East 53rd Street, Suite 3001

New York, NY 10022

+ (86) 1350 1152063

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Debbie A. Klis, Esq. Juan J. Grana, Esq. Rimon, P.C. 1990 K. Street, NW, Suite 420 Washington, DC 20006 Telephone: (202) 935-3390 | | Mitchell S. Nussbaum, Esq.

David J. Levine, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, NY 10154 Telephone: (212) 407-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | | |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION DATED MARCH 15, 2023 |

$50,000,000

AI TRANSPORTATION ACQUISITION CORP

5,000,000 Units

AI TRANSPORTATION ACQUISITION CORP is a newly incorporated blank check company incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our initial business combination. We have not selected any potential business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any potential business combination target with respect to an initial business combination with us.

While we may pursue a target in any industry, section or geography, we intend to focus our search for a target business in the transportation field, including but not limited to logistics, new energy vehicles, smart parking, on-board chips and AI algorithms, automotive services and related areas of intelligent transportation. Artificial intelligence is shaping the future of humanity across nearly every industry; it is already the main driver of emerging technologies like big data, robotics and IoT (i.e., Internet of Things), and we believe it will continue to act as a technological innovator for the foreseeable future. We seek to identify, acquire and operate an intelligent transportation business using AI that may provide opportunities for attractive risk-adjusted returns, with a particular focus on opportunities aligned with these industries. Global population growth and continuing improvement in global living standards, particularly in developing nations, is expected to drive ongoing growth in demand for intelligent transportation through AI and AI-powered technologies both for commercial and personal uses.

We intend to source initial business combination opportunities through our management team’s extensive network of automotive and automotive-related sector business owners, public and private company executives and board members, investment bankers, private equity and debt investors, high net worth families and their advisors, commercial bankers, attorneys, management consultants, accountants and other transaction intermediaries. We believe this approach, as well as our management team’s recognized track record of completing acquisitions across a variety of subsectors within the automotive and automotive-related sector will provide meaningful opportunities to drive value creation for shareholders.

This is an initial public offering of our securities. Each unit has an offering price of $10.00 and consists of one ordinary share, three-quarters of one redeemable warrant and one right entitling the holder thereof to receive one-tenth (1/10) of one ordinary share of upon consummation of our initial business combination, subject to adjustment as described in this prospectus. Each whole warrant entitles the holder thereof to purchase one ordinary share at a price of $11.50 per unit, subject to adjustment as described herein. Only whole warrants are exercisable. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. The warrants will become exercisable 30 days after the consummation by the Company of our initial business combination and will expire five years after the completion of our initial business combination or earlier upon redemption or our liquidation, as described in this prospectus. The underwriters have a 45-day option from the date of this prospectus to purchase up to an additional 750,000 units to cover over-allotments, if any.

We will provide our public shareholders with the opportunity to redeem all or a portion of their ordinary shares upon the completion of our initial business combination, subject to the limitations described herein. If we are unable to complete our initial business combination within 12 months from the closing of this offering (or up to 18 months by means of up to six one-month extensions after the closing of the offering by depositing into the trust account, for each one-month extension, $166,500, or $191,475 if the underwriters’ over-allotment option is exercised in full ($0.0333 per unit in either case)), we will redeem 100% of the public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us to pay our taxes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, subject to applicable law and certain conditions, as further described herein. In addition, we intend to issue a press release the day after the applicable deadline announcing whether the funds have been timely deposited. Public shareholders, in this situation, will not be offered the opportunity to vote on or redeem their shares.

Our Sponsor, AI TRANSPORTATION CORP, a newly-formed British Virgin Islands company, has agreed to purchase an aggregate of 309,000 placement units (or 335,250 placement units if the over-allotment option is exercised in full) at a price of $10.00 per unit, for an aggregate purchase price of $3,090,000 ($3,352,500 if the over-allotment option is exercised in full). Each placement unit will be identical to the units sold in this offering, except as described in this prospectus. The placement units will be sold in a private placement that will close simultaneously with the closing of this offering. Our Sponsor and certain of our officers and directors own an aggregate of 1,437,500 founder shares, up to 187,500 shares of which are subject to forfeiture depending on the extent to which the underwriters’ over-allotment option is exercised.

Our Sponsor and members of our Board of Directors and management have significant business ties to and are based in the People’s Republic of China (the “PRC” or “China”). We may consider a business combination with an entity or business with a physical presence or other significant ties to China which may subject the post-business combination business to the laws, regulations and policies of China (including Hong Kong and Macao). In addition, given the risks and uncertainties of doing business in China discussed elsewhere in this prospectus, the location and ties of our Sponsor and members of our Board of Directors and management to China may make us a less attractive partner to a target company not based in China, which may thus increase the likelihood that we will consummate a business combination with a target company that is located in China. Further, our initial shareholders, including our Sponsor, will own approximately 20% of our issued and outstanding shares following this offering. As a result, we may be considered a “foreign person” under rules promulgated by the Committee on Foreign Investment in the United States (CFIUS), and may not be able to complete an initial business combination with a U.S. target company since such initial business combination may be subject to U.S. foreign investment regulations and review by a U.S. government entity such as CFIUS), or ultimately prohibited. As a result, the pool of potential targets with which we could complete an initial business combination may be limited. See “Risk Factors — We may not be able to complete an initial business combination with a U.S. target company if such initial business combination is subject to U.S. foreign investment regulations and review by a U.S. government entity such as the Committee on Foreign Investment in the United States (CFIUS), or ultimately prohibited.” on page 73 of this prospectus. However, we will not conduct an initial business combination with any target company that conducts operations through variable interest entities (“VIEs”), which are a series of contractual arrangements used to provide the economic benefits of foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies.

As a result of our absolute position against doing a business combination with a company that conducts operations through a VIE, it may limit the pool of acquisition candidates we may acquire in the PRC, in particular, due to the relevant PRC laws and regulations against foreign ownership of and investment in certain assets and industries, known as restricted industries. Furthermore, this may also limit the pool of acquisition candidates we may acquire in the PRC relative to other special purpose acquisition companies that are not subject to such restrictions, which could make it more difficult and costly for us to consummate a business combination with a target business operating in the PRC relative to such other companies. See “Risk Factors — We will not conduct an initial business combination with any target company that conducts operations through VIEs, which may limit the pool of acquisition candidates we may acquire in the PRC and make it more difficult and costly for us to consummate a business combination with a target business operating in the PRC” on page 73.

The members of our Board of Directors and management team are located in China, they are citizens of China and/or their assets are located in China, and following completion of a business combination, we may conduct most of our operations in China and most of our assets may be located in China. As a result, it may be difficult for you to effect service of process upon us or those persons residing in mainland China. Even with service of process, there is uncertainty as to whether courts in China would (i) recognize or enforce judgments of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States or (ii) entertain original actions brought in China against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States.

Recognition and enforcement of foreign judgments are provided for under China’s Civil Procedure Law. China’s courts may recognize and enforce foreign judgments in accordance with the requirements of the Civil Procedures Law based either on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. There are no treaties between China and the United States for the mutual recognition and enforcement of court judgments, thus making the recognition and enforcement of a U.S. court judgment against us or our directors or officers in China difficult. See “Risk Factors — Risks Related to Acquiring or Operating Businesses in the PRC” under the subheading “You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against us or our management and directors named in the prospectus based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China” on page 76.

The members of our Board of Directors that reside in China are Yongjin Chen, our Chief Executive Officer, Chairman of the Board of Directors and Executive Director and Yun Wu, our Chief Financial Officer and Executive Director. Our three independent director nominees, Wong Ping Kuen, Ka Cheong Leung and Dick Wai Mak, reside in Hong Kong.

We are also subject to other risks and uncertainties about any future actions of the PRC government, which may result in a material change in operations of a target business. PRC laws and regulations are sometimes vague and uncertain, and therefore, these risks may result in a material change in operations of a target business, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas that use a VIE structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation-making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on a China-based target company’s daily business operation, the ability to accept foreign investments and list on a U.S. or other foreign exchange. Additionally, if we effect our initial business combination with a business located in the PRC, the laws applicable to such business will likely govern all of our material agreements and we may not be able to enforce our legal rights. There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations which may have a material adverse impact on the value of our securities. If we enter into a business combination with a target business operating in China, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to any future PRC subsidiaries via capital contribution or shareholder loans, as the case may be. All these risks could result in a material change in our or the target company’s post-combination operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Furthermore, the PRC government has significant authority to exert influence on the ability of a China-based company to conduct its business, make or accept foreign investments or list on a U.S. stock exchange. For example, if we enter into a business combination with a target business operating in China, the combined company may face risks associated with regulatory approvals of the proposed business combination between us and the target, offshore offerings, anti-monopoly regulatory actions, cybersecurity and data privacy. The PRC government may also intervene with or influence the combined company’s operations at any time as the government deems appropriate to further regulatory, political and societal goals.

The PRC government has recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding any industry that could adversely affect our potential business combination with a PRC operating business and the business, financial condition and results of operations of the combined company. Any such action, once taken by the PRC government, could make it more difficult and costly for us to consummate a business combination with a target business operating in the PRC, result in material changes in the combined company’s post-combination operations and cause the value of the combined company’s securities to significantly decline, or in extreme cases, become worthless or completely hinder the combined company’s ability to offer or continue to offer securities to investors. See “Risk Factors” beginning at page 44 and specifically at page 42 under the sub-heading “Risks Related to Acquiring or Operating Businesses in the PRC.”

If we decide to consummate our initial business combination with a China-based company, the combined company may make capital contributions or extend loans to any future PRC subsidiaries through intermediate holding companies subject to compliance with relevant PRC foreign exchange control regulations. From our inception to the date of this prospectus, no dividends or distributions have been made. After the initial business combination, the combined company’s ability to pay dividends, if any, to the shareholders and to service any debt it may incur will depend upon dividends paid by any future PRC subsidiaries. Under PRC laws and regulations, PRC companies are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to offshore entities. In particular, under the current PRC laws and regulations, dividends may be paid only out of distributable profits. Distributable profits are the net profit as determined under Chinese accounting standards and regulations, less any recovery of accumulated losses and appropriations to statutory and other reserves required to be made.

A PRC company is required to set aside at least 10% of its after-tax profits each year to fund certain statutory reserve funds (up to an aggregate amount equal to half of its registered capital). As a result, the combined company’s PRC subsidiaries may not have sufficient distributable profits to pay dividends to the combined company. Furthermore, if certain procedural requirements are satisfied, the payment in foreign currencies on current account items, including profit distributions and trade and service related foreign exchange transactions, can be made without prior approval from the State Administration of Foreign Exchange, or SAFE, or its local branches. However, where Renminbi (“RMB”), the legal currency of the PRC, is to be converted into foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies, approval from or registration with competent government authorities or its authorized banks is required. The PRC government may take measures at its discretion from time to time to restrict access to foreign currencies for current account or capital account transactions.

If the foreign exchange control regulations prevent the PRC subsidiaries of the combined company from obtaining sufficient foreign currencies to satisfy their foreign currency demands, the PRC subsidiaries of the combined company may not be able to pay dividends or repay loans in foreign currencies to their offshore intermediary holding companies and ultimately to the combined company. We cannot assure you that new regulations or policies will not be promulgated in the future, which may further restrict the remittance of RMB into or out of the PRC. We cannot assure you, in light of the restrictions in place, or any amendment to be made from time to time, that the PRC subsidiaries of the combined company will be able to satisfy their respective payment obligations that are denominated in foreign currencies, including the remittance of dividends outside of the PRC.

For a detailed description of risks associated with the cash transfer through the post combination organization if we acquire a China-based target company, see “Transfers of Cash to and from our Post Business Combination Subsidiaries” on page 115 and “Risk Factors — Risks Related to Acquiring or Operating Businesses in the PRC” under the subheadings “Cash-Flow Structure of a Post-Acquisition Company Based in China” on page 77 and “Exchange controls that exist in the PRC may restrict or prevent us from using the proceeds of this offering to acquire a target company in the PRC and limit our ability to utilize our cash flow effectively following our initial business combination” on page 78. To date, we have not pursued an initial business combination and there have not been any capital contribution or shareholder loans by us to any PRC entities, we do not yet have any subsidiaries, and we have not received, declared or made any dividends or distributions.

Pursuant to the Holding Foreign Companies Accountable Act (“HFCA Act”), the Public Company Accounting Oversight Board (United States) (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in (1) mainland China of the PRC because of a position taken by one or more authorities in mainland China and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations.

In December 2020, Congress enacted the HFCA Act, and the SEC released interim final amendments that begin to address the components of this Act. In November 2021, the SEC approved PCAOB Rule 6100, which establishes a process for determining which registered public accounting firms the board is unable to inspect or investigate completely. In December 2021, the SEC adopted amendments to finalize its rules under the HFCA Act that set forth submission and disclosure requirements for commission-identified issuers identified under the Act, specify the processes by which the SEC will identify and notify Commission-Identified Issuers, and implement trading prohibitions after three consecutive years of identification.

In December 2022, Congress passed the omnibus spending bill and the President signed it into law. This spending bill included the enactment of provisions to accelerate the timeline for implementation of trading prohibitions from three years to two years. Separately, on December 15, 2022, the PCAOB published its determination that in 2022, the PCAOB was able to inspect and investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. This determination reset the now two-year clock for compliance with the trading prohibitions for identified issuers audited by these firms. The amendment had originally been passed by the U.S. Senate in June 2021, as the “Accelerating Holding Foreign Companies Accountable Act.”

Our auditor, MaloneBailey, LLP, is a United States accounting firm and is subject to regular inspection by the PCAOB. MaloneBailey, LLP is not headquartered in mainland China or Hong Kong and was not identified as a firm subject to the PCAOB’s Determination Report announced on December 16, 2021. As a result, we do not believe that HFCA Act and related regulations will affect us. Nevertheless, trading in our securities may be prohibited under the HFCA Act if the PCAOB determines that it cannot inspect or fully investigate our auditor, and that as a result an exchange may determine to delist our securities. Moreover, on August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China – the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with U.S. law. The Statement of Protocol is intended to grant to the PCAOB complete access to the audit work papers, audit personnel, and other information it needs to inspect and investigate any firm it chooses, with no loopholes and no exceptions.

Currently, there is no public market for our units, ordinary shares, warrants or rights. We intend to apply to have our units approved for listing on The Nasdaq Capital Market (“Nasdaq”) under the symbol “AITRU” on or promptly after the date of this prospectus. We expect the ordinary shares, warrants and rights comprising the units will begin separate trading on the 52nd day following the date of this prospectus (or if such date is not a business day, the following business day) unless EF Hutton, informs us of its decision to allow earlier separate trading, subject to our filing a Current Report on Form 8-K with the Securities and Exchange Commission containing an audited balance sheet reflecting our receipt of the gross proceeds of this offering and issuing a press release announcing when such separate trading will begin. Once the securities comprising the units begin separate trading, we expect that the ordinary shares, warrants and rights will be listed on Nasdaq under the symbols “AITR,” “AITRW,” and “AITRR” respectively.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will be subject to reduced public company reporting requirements. Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 44 for a discussion of information that should be considered in connection with an investment in our securities. Investors will not be entitled to protections normally afforded to investors in blank check offerings by Rule 419 under the Securities Act of 1933, as amended. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

No offer or invitation to subscribe for securities is being made to the public in the Cayman Islands.

| | | Per Unit | | | Total | |

| Public offering price | | $ | 10.00 | | | $ | 50,000,000 | |

| Underwriting discounts and commissions(1) | | $ | 0.55 | | | $ | 2,750,000 | |

| Proceeds, before expenses, to AI TRANSPORTATION ACQUISITION CORP | | $ | 9.45 | | | $ | 47,250,000 | |

| (1) | Includes $0.30 per unit, or $1,500,000 (or $1,725,000 if the over-allotment option is exercised in full) in the aggregate, payable to the underwriters for deferred underwriting commissions to be placed in a trust account located in the United States as described herein. The deferred commissions will be released to the representative of the underwriters only on completion of an initial business combination, as described in this prospectus, which does not include certain fees and expenses payable to the underwriters in connection with this offering. In addition, designees of the representative of the underwriters will receive an aggregate of 50,000 ordinary shares (or up to 57,500 ordinary shares if the over-allotment option is exercised in full), which we refer to herein as the “representative shares” as compensation in connection with this offering. See the section of this prospectus entitled “Underwriting” beginning on page 181 for a description of compensation and other items of value payable to the underwriters. |

Of the proceeds we receive from this offering and the sale of the placement units described in this prospectus, $51,000,000 or $58,650,000 if the underwriters’ over-allotment option is exercised in full ($10.20 per unit in either case), will be deposited into a segregated trust account located in the United States with JP Morgan Chase and with Continental Stock Transfer & Trust Company acting as trustee.

Except with respect to interest earned on the funds held in the trust account that may be released to us to pay our taxes, our amended and restated memorandum and articles of association will provide that the proceeds from this offering and the sale of the placement units, will not be released from the trust account until the earliest of (a) the completion of our initial business combination; and (b) the redemption of all of our public shares if we have not completed our initial business combination within 12 months from the closing of this offering (subject to six one-month extensions after the closing of the offering by depositing into the trust account, for each one-month extension, $166,500, or $191,475 if the underwriter exercises the overallotment in full). The proceeds deposited in the trust account could become subject to the claims of our creditors, if any, which could have priority over the claims of our public shareholders.

The underwriters expect to deliver the units to the purchasers on or about ________, 2023.

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus is ________, 2023

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give to you. We are not, and the underwriters are not, making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

Trademarks

This prospectus contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this prospectus may constitute “forward-looking statements.” Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

| | ● | our ability to complete our initial business combination; |

| | | |

| | ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| | | |

| | ● | our ability to consummate an initial business combination due to the uncertainty resulting from the COVID-19 pandemic; |

| | | |

| | ● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination; |

| | | |

| | ● | our potential ability to obtain additional financing to complete our initial business combination; |

| | | |

| | ● | our pool of prospective target businesses; |

| | | |

| | ● | the ability of our officers and directors to generate a number of potential investment opportunities; |

| | | |

| | ● | our public securities’ potential liquidity and trading; |

| | | |

| | ● | the lack of a market for our securities; |

| | | |

| | ● | negative interest rate for securities in which we invest the funds held in the trust account; |

| | | |

| | ● | the use of proceeds not held in the trust account or available to us from interest income on the trust account balance; |

| | | |

| | ● | the trust account not being subject to claims of third parties; or |

| | | |

| | ● | our financial performance following this offering. |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the section of this prospectus entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

SUMMARY

This summary only highlights the more detailed information appearing elsewhere in this prospectus. You should read this entire prospectus carefully, including the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before investing.

Unless otherwise stated in this prospectus, or the context otherwise requires, references to:

| | ● | “Companies Act” are to the Companies Act (Revised) of the Cayman Islands, as the same may be amended from to time; |

| | | |

| | ● | “company” are to AI TRANSPORTATION ACQUISITION CORP; |

| | | |

| | ● | “directors” are to our current directors and our independent director nominees named in this prospectus; |

| | | |

| | ● | “equity-linked securities” are to any debt or equity securities that are convertible, exercisable or exchangeable for our ordinary shares issued in connection with our initial business combination including but not limited to a private placement of equity or debt; |

| | | |

| | ● | “founder” are to Mr. Yongjin Chen, Chief Executive Officer, Chairman of the Board of Directors and Executive Director of the company; |

| | | |

| | ● | “founder shares” are to the 1,437,500 ordinary shares initially issued to our sponsor in a private placement prior to this offering, which include up to an aggregate of 187,500 ordinary shares subject to forfeiture by our insiders to the extent that the underwriters’ over-allotment option is not exercised in full or only in part (for the avoidance of doubt, the founder shares will not be “public shares”); |

| | | |

| | ● | “initial shareholders” are to our sponsor and any other holders of our founder shares prior to this offering (or their permitted transferees); |

| | | |

| | ● | “insiders” refer to our officers, directors, our sponsor and any future holder of our founder shares; |

| | | |

| | ● | “letter agreement” refer to the letter agreement, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part; |

| | | |

| | ● | “management” or “management team” are to our executive officers, directors, director nominees, and to our advisors unless otherwise specified; |

| | | |

| | ● | “memorandum and articles of association” are to our amended and restated memorandum and articles of association to be in effect upon the effectiveness of this offering; |

| | | |

| | ● | “ordinary shares” are to our ordinary shares, par value $0.0001; |

| | | |

| | ● | “period to consummate the initial business combination” are to the period of within 12 months from the closing of this offering subject to extension to a maximum of 18 months by up to six one-month extensions as specifically set forth in our proxy statement; |

| | | |

| | ● | “placement rights” are to our rights which are included within the placement units being purchased by our sponsor in the private placement; |

| | | |

| | ● | “placement shares” are to our ordinary shares included within the placement units being purchased by our sponsor in the private placement; |

| | | |

| | ● | “placement units” are to the units being purchased by our sponsor, with each placement unit consisting of one placement share, three-quarters of one placement warrant and one placement right to acquire 1/10 of one ordinary share; |

| | ● | “placement warrants” are to the warrants included within the placement units being purchased by our sponsor in the private placement and to the warrants included within the units issued upon conversion of working capital loans, if any; |

| | | |

| | ● | “private placement” are to the private placement of 309,000 placement units at a price of $10.00 per unit, for an aggregate purchase price of $3,090,000 (or up to 335,250 units for an aggregate purchase price of up to $3,352,500 if the over-allotment option is exercised in full), which will occur simultaneously with the completion of this offering; |

| | | |

| | ● | “public rights” are to the rights sold as part of the units in this offering (whether they are subscribed for in this offering or acquired in the open market; |

| | | |

| | ● | “public shares” are to our ordinary shares sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market); |

| | | |

| | ● | “public shareholders” are to the holders of our public shares, including our sponsor and management team to the extent our sponsor and/or members of our management team purchase public shares, provided that our sponsor’s and each member of our management team’s status as a “public shareholder” will only exist with respect to such public shares; |

| | | |

| | ● | “public warrants” are to our redeemable warrants sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market); |

| | | |

| | ● | “representative” are to EF Hutton, division of Benchmark Investments, LLC, which is the representative of the underwriters in this offering; |

| | | |

| | ● | “representative shares” are to the 50,000 ordinary shares to be issued (or 57,500 ordinary shares if the over-allotment option is exercised in full) to the representative and/or its designees in connection with this offering; |

| | | |

| | ● | “rights” are to our rights, which include the public rights as well as the placement rights to the extent they are no longer held by the initial purchasers of the placement units or their permitted transferee; |

| | | |

| | ● | “sponsor” are to AI TRANSPORTATION CORP, a British Virgin Islands company, of which our Chief Executive Officer, Yongjin Chen, is a beneficial owner; |

| | | |

| | ● | “trust account” are to the segregated trust account located in the United States with JP Morgan Chase and with Continental Stock Transfer & Trust Company acting as trustee, into which we will deposit certain proceeds from this offering and the sale of the placement units; |

| | | |

| | ● | “underwriter” are to EF Hutton, division of Benchmark Investments, LLC, the representative of the underwriters of this offering; |

| | | |

| | ● | “warrants” are to our public warrants; and |

| | | |

| | ● | “we,” “us,” “Company” or “our company” are to AI TRANSPORTATION ACQUISITION CORP, a Cayman Islands exempted company. |

Any forfeiture of shares described in this prospectus will take effect as a surrender of shares for no consideration of such shares as a matter of Cayman Islands law. Any conversion of the founder shares described in this prospectus will take effect as a compulsory redemption of founder shares and an issuance of ordinary shares as a matter of Cayman Islands law. Any share dividends described in this prospectus will take effect as share capitalizations as a matter of Cayman Islands law. Unless we tell you otherwise, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option and that our sponsor will forfeit 187,500 founder shares following the closing of this offering.

GENERAL

Overview

We are a newly organized blank check company incorporated as a Cayman Islands exempted company formed for the purpose of effecting a merger, capital share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses, which we refer to throughout this prospectus as our “initial business combination.” We intend to focus our search for a target business in the AI transportation industry, specifically focused on logistics, new energy vehicles, smart parking, on-board chips, AI algorithms, automotive services, and other types of “intelligent transportation.” We believe that deep learning, reinforced learning, big data, cloud computing, IoT, and other cutting-edge technologies, such as that promoted by the Institute for AI Research in the field of AI+Transportation, which focuses on self-driving, smart traffic network and cooperative vehicle infrastructure, will facilitate overcoming key technological obstacles to building intelligence into cities’ transportation network, restructuring the smart transportation ecosystem, and realizing safer, greener, more comfortable and efficient travel. To date, our efforts have been limited to organizational activities as well as activities related to our offering. We have not selected any potential business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any potential business combination target.

Our Objective

Mobility is the lifeblood of communities but it is not just about building roads, transport is about creating thriving communities and propelling economies. We see transport quickly evolving, adapting and shaping megatrends, from urbanization to climate change to digital transformation. Transport, data, and income are growing inseparable. Already, we see this in ride sharing and the doorstep delivery of goods purchased online. GPS is driving GDP in a very real sense. No vision for mobility is transformative or possible if it does not encompass the world’s most pressing challenges.

Our management team believes that the AI era will not only profoundly change and influence the consumer sector, but also revolutionize it. Under the persistent influence of disruptive technologies, aspects of society can improve through new levels of efficiency, productivity and convenience. Presently, AI is the main trend of future scientific and technological development.1 Many in the transportation sector have already identified the infinite potential of AI, with the global market forecast to reach $3,870,000,000 by 2026.2 Transportation is fundamental to supporting economic growth, creating jobs and connecting people to essential services such as healthcare or education. But in many developing countries, the benefits are not being realized, as more than one billion people still live more than 2 kilometers from an all-weather road, where lack of access is inextricably linked to poverty and one in six women globally do not look for jobs out of fear of harassment in transit.3 Road crashes claim more than 1.35 million lives annually, however 93% of the deaths occur in developing countries.4 There is also an urgent need to reduce the climate impact of transport, as domestic and international transport already contribute to more than 23% of global greenhouse gas (“GHG”) emissions.5 As populations, economies, and the need for mobility grow, GHG emissions from transport could increase by as much as 60% by 2050 if left unchecked.6

When it comes to transportation, developing countries face a dual challenge: ensuring everyone has access to efficient, safe, and affordable mobility, and doing so with a much smaller climate footprint. Ambitious investments in solutions such as high-quality public transport, well-connected cities, non-motorized transport options, and cleaner technologies can help achieve development progress and climate targets simultaneously.7

1 The Future of AI: How Artificial Intelligence Will Change the World | Built In

2 AI In Transportation Market | Size, Share, Growth | 2022 to 2027 (marketdataforecast.com)

3 WBTransportNarrative.pdf (worldbank.org)

4 Global Road Safety Facility | GRSF

5 Decarbonising Transport initiative | ITF (itf-oecd.org)

6 See Id.

7 Global Facility to Decarbonize Transport (GFDT) (worldbank.org)

Our management team, as well as industry experts, believe that technological innovation through intelligent transportation has endless possibilities with a pressing need to decrease congestion, increase efficiency, transition to the use of sustainable materials, reduce contribution to pollution and increase transportation availability to those in underserved communities. The application of AI in the transportation industry can be seen as a process from internet technology to operational technology to evolutionary technology. Initially, the transportation industry must invest significant resources to realize informationization and digitization, in order to mine data value, export products and services, and form a standardized operation process and model in order to achieve intelligence. Digitalization, intelligence and automation are the main themes of global industrial development and the mainstream trends in the digital information era. Our management team believes that future investment, construction and application of the intelligent transportation to this industry will need comply with this trend.

Global population growth and continuing improvement in global living standards, particularly in developing nations, is expected to drive ongoing growth in demand for AI and AI powered technologies, including in the automobile sector, both for commercial and personal uses. In light of this, we intend to capitalize on the team’s broader experience and connections in the AI and technology industries to identify, acquire and operate a business that may provide opportunities for attractive risk-adjusted returns, with a particular focus on opportunities aligned with AI, technology and transportation. Our management team believes this area of focus represents a growing, favorable and highly fragmented market opportunity to consummate a business combination.

We have not identified any particular geographical area or country in which we may seek a business combination. However, our sponsor and members of our Board of Directors and management have significant business ties to and are based in China. We may consider a business combination with an entity or business with a physical presence or other significant ties to China, including Hong Kong and Macau, which may subject the post-business combination business to the laws, regulations and policies of China. Any target for a business combination may conduct operations through subsidiaries in China. The legal and regulatory risks associated with doing business in China discussed in this prospectus may make us a less attractive partner in an initial business combination than other special purpose acquisition companies that do not have any ties to China. As such, our ties to China may make it harder for us to complete an initial business combination with a target company without any such ties. Further, our initial shareholders, including our Sponsor, will own approximately 20% of our issued and outstanding shares following this offering. As a result, we may be considered a “foreign person” under rules promulgated by the Committee on Foreign Investment in the United States (CFIUS), and may not be able to complete an initial business combination with a U.S. target company since such initial business combination may be subject to U.S. foreign investment regulations and review by a U.S. government entity such as CFIUS), or ultimately prohibited. As a result, the pool of potential targets with which we could complete an initial business combination may be limited. In addition, we will not conduct a business combination with any target company that conducts operations through variable interest entities (“VIEs”), which are a series of contractual arrangements used to provide the economic benefits of foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies. As a result, this may limit the pool of acquisition candidates we may acquire in the PRC, in particular, relative to other special purpose acquisition companies that are not subject to such restrictions, which could make it more difficult and costly for us to consummate a business combination with a target business operating in the PRC relative to such other companies.

If we were to complete a business combination with a Chinese entity, we could be subject to certain legal and operational risks associated with or having the majority of post-business combination operations in China. PRC laws and regulations governing PRC based business operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of any post-business combination subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer, or continue to offer, our securities to investors, including investors in the United States. Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. These recently enacted measures, and new measures which may be implemented, could materially and adversely affect the operations of any post-business combination company which we may acquire as our initial business combination.

Our Management Team

Our management team is led by Yongjin Chen, Chief Executive Officer, Chairman and Executive Director, and Yun Wu, Chief Financial Officer and Executive Director.

Yongjin Chen, Chief Executive Officer, Chairman and Executive Director. Mr. Chen resides in Beijing, China, and brings more than two decades of experience in finance and technology. He is currently a partner at UniTHU Capital (Beijing) Investment Management Co., Ltd., where he has served since July 2017. At UniTHU Capital, Mr. Chen has worked with investors in the technology space. Prior to that, Mr. Chen was a founding partner responsible for fundraising, investment management and other aspects of funds at Beijing D&S Capital Management Co., Ltd., where he served from February 2014 to July 2017. From November 2015 to December 2016, Mr. Chen was the CEO of Beijing Heima Financial and a Managing Partner at the Beijing Heima Fund. From November 2014 to November 2015, he was an Executive Director at Yajie Angel Investment Management (Beijing) Co., Ltd. Mr. Chen started his career as the founder and general manager of HanYu Century (Beijing) Information Technology Co., Ltd. where he developed and operated a web-based virtual community called “Giant Bubble” from January 2007 to November 2014.

Mr. Chen holds a Bachelor’s Degree from Tsinghua University’s School of Mechanical Engineering (2000), an MBA from Peking University’s Guanghua School of Management (2015) and a Master’s Degree from Peking University’s Guanghua School of Management (2022).

Yun Wu, Chief Financial Officer and Executive Director. Ms. Wu resides in Beijing, China and brings more than two decades of experience in finance, e-commerce and technology companies. She is currently an accounting supervisor at UniTHU United (Beijing) Investment Management Co., Ltd., where she has served since April 2018 establishing and improving the company’s accounting management and financial management system, preparing and summarizing financial statements and working with audits. At UniTHU, Ms. Wu has also undertaken the due diligence review of government guide funds and has formulated tax financial plans for the company. Prior to that, she was a general ledger accountant at Beijing Dong Qiu Di Technology Co., Ltd. from August 2015 to April 2018, where she was responsible for the financial processing of the e-commerce department, amongst other duties.

At Beijing Dong, Ms. Wu also handled and maintained financial aspects of the business including high-tech management and subsequent maintenance and annual audits and tax settlements of domestic and foreign companies. From March 2015 to July 2015, Ms. Wu was a finance supervisor at Beijing Tiantian Fresh Technology Co., Ltd. and from March 2010 to February 2015, she was a finance supervisor at Reisi Interactive (Beijing) Consulting Co., Ltd. At Beijing Tiantian, Ms. Wu was responsible for improving the company’s financial system and sales performance rules, daily business transaction contracts, and daily accounting treatment, among other obligations. At Reisi Interactive, Ms. Wu was responsible for the daily tax work of the company, outsourcing project financial analysis and preparing annual, quarterly and monthly cash flow budgets, among other obligations.

Ms. Wu holds a Bachelor’s Degree from Nanjing University (2006) and various accounting certificates, including an intermediate accounting qualification certificate (2022), a fund qualification certificate (2018), an accounting primary qualification certificate (2013) and an accounting professional qualification certificate (2012).

Our Independent Director Nominees

Wong Ping Kuen (Ricky), Independent Director Nominee and Chair of the Audit Committee. Mr. Kuen resides in Hong Kong and is currently the Managing Director at Ceres Asset Management Limited, where he has been in charge of information systems since September 2019. Mr. Kuen is also currently a Managing Director of Credito Capital Group, which he founded in September 2015, and which manages various funds, including Beijing Credito Capital Investment Fund Management Co Ltd. and Nanjing Credito Capital Investment Fund Management Co Ltd. Nanjing Credito Capital established, managed and exited a semiconductor early stage fund and Credito Capital Consulting and Appraisal Limited, another one of Credito Capital Group’s entities, provides bond issuances, IPOs, M&A and restructuring consulting for clients in China, Hong Kong and the US. From December 2011 to July 2014, Mr. Kuen was a financial controller at Sunz (China) Holdings Group, where he was involved on various M&A projects, and from September 2008 to November 2011, he was a Senior Associate at Deloitte Touche Tohmatsu. At Sunz, Mr. Kuen also sourced, analyzed and executed various merger and acquisition projects, and at Deloitte, Mr. Kuen engaged in statutory assurance services for public and private companies including Hong Kong-listed and multinational corporations in China.

Mr. Kuen holds a Bachelor of Business Administration in Accounting and Information Science from The Hong Kong University of Science and Technology (2008), an MBA from Peking University (2013), an MBA from National University of Singapore (2015) and is a Certified Public Accountant of the Hong Kong Institute of Certified Public Accountants (since 2011).

Ka Cheong Leung (Alex), Independent Director Nominee and Chair of the Compensation Committee. Mr. Leung resides in Hong Kong and is currently the Chief Operating Officer of Ceres Asset Management Limited, where he has been since September 2021. As the COO of Ceres, Mr. Leung manages and supervises daily fund operations, procedures and risk control guidelines and oversees middle office and funds control along with the company’s investment team. Prior to that, Mr. Leung was the Vice President of Beijing Credito Capital Investment Fund Management Limited, from August 2018 to September 2021, where he conducted research and performed due diligence on investment targets and consulted and advised on business strategy and investments. From January 2017 to July 2018, Mr. Leung was a corporate finance analyst at Cypress House Capital Limited where he advised on transactions under Hong Kong Listing Rules and Codes on Takeovers and Mergers. At Cypress House, Mr. Leung also structured and executed corporate finance engagements for Hong Kong listed companies. Mr. Leung was also an assistant manager for audit financial services at KPMG from April 2015 to January 2017 and a senior associate at PricewaterhouseCoopers from September 2012 to April 2015.

Mr. Leung holds a Bachelors of Business Administration in Professional Accounting from The Hong Kong University of Science and Technology (2012) and is a qualified member of the HKICPA (2017).

Dick Wai Mak (David), Independent Director Nominee and Chair of the Corporate Governance and Nominating Committee. Mr. Mak resides in Hong Kong and is currently the Chief Operating Officer of Yao Teng Investment Fund SPC where he has been since April 2020. At Yao Teng, a mutual fund established in the Cayman Islands, Mr. Mak is involved in the operation of the fund in collaboration with the investment manager, fund administrator and fund advisor. Mr. Mak is also responsible for identifying potential projects, valuation and structure investment. Mr. Mak is also currently an external consultant and Senior Vice President at Credito Capital Group, where he has been since April 2017. Credito focuses on setup and management of industry specific private equity funds in logistics, technology and smart retails. Mr. Mak is responsible at Credito for identifying potential projects, valuation and fundraising strategy.

From March 2014 to February 2017, Mr. Mak was the Chief Operating Officer at KIDBOT, an interactive content, service and technology product provider for children. At KIDBOT, Mr. Mak was in charge of education hardware development and business channel networks in China and Hong Kong. Prior to that, Mr. Mak was the Managing Director at Wisefield Consulting Group Ltd. and Nippon Circuits Ltd., from November 2010 to February 2014 and May 2003 to October 2010, respectively. At Wisefield Consulting, Mr. Mak implemented marketing strategy and channel sales programs to support clients, among other roles, and at Nippon Circuits, Mr. Mak and his team successfully developed major global EMS (Electronics Manufacturing Services) and OEM (Original Equipment Manufacturer) accounts, including for many technology companies.

Mr. Mak holds a Bachelor’s Degree in Economics from the University of San Diego (1994) and a Master of Science in Financial Management from the University of London (2003).

We believe that our independent director nominees will provide public company governance, executive leadership, operational oversight, private equity investment management and capital markets experience. Our directors have experience with acquisitions, divestitures and corporate strategy and implementation, which we believe will significantly benefit us as we evaluate potential acquisition or merger candidates as well as following the completion of our initial business combination.

We believe our management team is well positioned to take advantage of the growing set of acquisition opportunities focused on the intelligent transportation sector and that our contacts and relationships, ranging from owners and management teams of private and public companies, private equity funds, investment bankers, attorneys, to accountants and business brokers will allow us to generate an attractive transaction for our shareholders.

In addition, our sponsor has engaged the services of ARC Group Limited to provide financial advisory services to our sponsor in connection with this offering, which services include an analysis of markets, positioning, financial models, organizational structure and capital requirements as well as assistance with the public offering process including assisting in the preparation of financial information and statements.

The past performance of the members of our management team, our sponsor’s financial advisor or their affiliates is not a guarantee that we will be able to identify a suitable candidate for our initial business combination or of success with respect to any business combination we may consummate. You should not rely on the historical record of the performance of our management team or any of its affiliates’ performance as indicative of our future performance.

Each of our officers and directors may become an officer or director of another special purpose acquisition company with a class of securities intended to be registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, even before we have entered into a definitive agreement regarding our initial business combination. For more information, see the section of this prospectus entitled “Management — Conflicts of Interest” and see “Risk Factors.”

Market and Industry Opportunity

The transportation industry has undergone multiple changes and revolutions over the last few hundred years—and we are now at the stage where major breakthroughs are being achieved in the form of AI in transportation. Whether via self-driving cars for more reliability, road condition monitoring for improved safety, or traffic flow analysis for more efficiency, AI is catching the eye of transportation bosses around the world. Transportation is becoming increasingly intelligent as automobile companies, cities and infrastructure have begun to deploy technology and data in order to achieve better products, services and utilization. These trends are propelling shifts and the formation of new and exciting trends in the industry, including new types of vehicle manufacturers, sensor technology that mimics and surpasses human capabilities, and much more.

We believe that our integrated AI transportation industry opportunities include:

Smart city construction involves AI. AI in the promotion and development of smart transportation products in various application fields. From the start of intelligent transportation construction, to the expansion of smart transportation concepts, the industry application has gradually become deeper and more comprehensive. Smart cities take in data from every available input— intelligent sensors, microphones, traffic signals, cameras, embedded devices on public transit—then analyze the data with AI and share it through open data pools. This creates a constant awareness of conditions that can be used for traffic management, route planning, public safety, and emergency response.

Together, these intelligent sensors, microphones, and cameras can power a model of what’s happening on a city’s streets, highways, and rail lines in near-real time. With the help of AI, this awareness can transform passive traffic management into active intelligent transportation systems. These systems can anticipate congestion, automatically reroute traffic, retime lights, and apply dynamic tolling to help keep the city moving. The city of Bangkok, Thailand, is saving more than 51,000 commuter hours a year and reducing traffic delays up to 24.5 percent with just three smart intersections.8

AI technology helps industry intelligence to upgrade. The transportation products in smart cities has been continuously improved, and digital monitoring technology has become increasingly mature. The large-scale application of AI technology in the transportation market has promoted the upgrading of traditional transportation industrialization and further promoted the scale of the AI transportation industry. In the AI transportation industry chain, upstream software algorithms are the basis for the development of AI transportation based on the development of AI technology.

AI transportation information safety issues will become key targets. In the context of global network integration, the use of new generation information technologies such as big data, the Internet of Things and AI has made the world enter the information age, and information security issues have gradually attracted the attention of countries, enterprises and individuals. The protection of information security has become an important key factor in the development and construction of intelligent transportation. In the future, as technologies such as AI, big data and information security gradually mature, the construction and development of intelligent transportation will become safer and more stable.

Intelligent transportation is a new generation of smart civil infrastructure that integrates IoT, big data, AI, advanced sensing technologies, automated piloting, green energy, and sustainable and resilient materials working together to achieve high-quality road service and efficient operations. As a future trend, it will significantly change the form of traditional transportation infrastructures. Intelligent transportation systems involve advanced applications that aim to provide innovative services relating to different modes of transport and traffic management and enable users to be better informed and make safer, more coordinated, and “smarter” use of transport networks.

Key Technologies for Upgrading Urban Mobility

| | ● | Embedded Smart City Devices and Systems – Cities already collect massive amounts of data through existing systems like traffic and public safety cameras. Incremental upgrades can transform them into intelligent nodes in a smart city fabric. |

| | | |

| | ● | Everywhere AI – To function in near-real time, intelligent transportation systems need immediate insight and analysis. That requires processing AI workloads at the edge, on a smart device itself, or on a nearby AI appliance. |

| | | |

| | ● | Faster, More-Reliable Connectivity – 5G promises to speed cellular data transfer rates and improve stability. Software can help orchestrate and manage edge network services for even better performance. |

8 Intel. “Paving the Way Forward.” May 2020.

| | ● | Open, Integrated Data Pools – Smart city and intelligent transportation data isn’t worth much if citizens, first responders, and businesses can’t access it. Ingesting, cleaning, aggregating, and sharing data through a single shared pool is critical to improving mobility and reducing congestion and pollution. |

| | | |

| | ● | Hardware-Based Data Security – As intelligent technologies spread and interconnect, cities have to secure thousands of embedded devices and protect public and private data as it moves through the system. Hardware-based security protocols harden systems and help protect data. |

However, due to the high complexity of intelligent transportation systems, the challenges are also tremendous. The basic theories, key methods, and technologies are still developing. The construction of a large-scale, usable, and complete intelligent transportation systems are still being explored. To promote such processes, the cross-disciplinary cooperation, complex system simulation and control, ultra-large-scale data communication and processing, and distributed management will be highly involved.

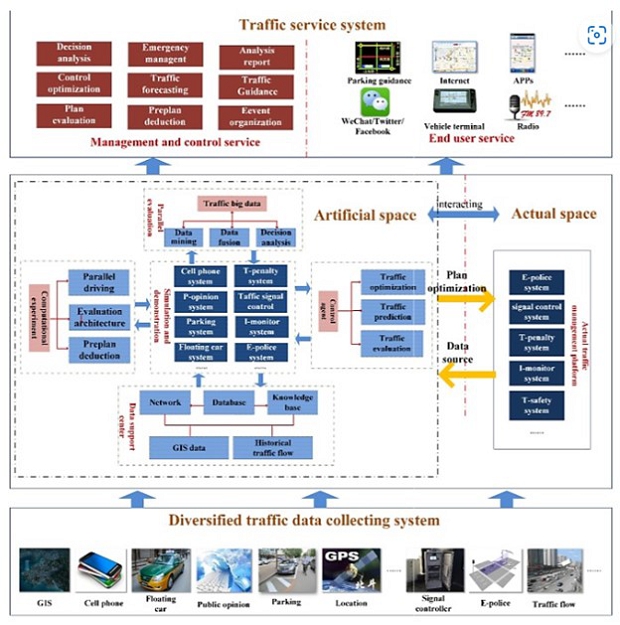

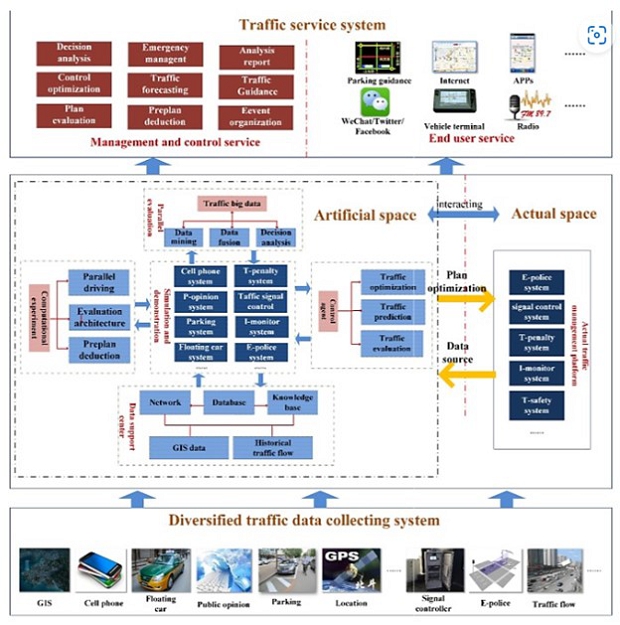

Mobility is one of the greatest challenges for smart cities. While technologies like the IoT have paved the way for intelligent transportation systems that leverage data and sensors to create smart mobility solutions, gaps still remain. Leveraging the capabilities of IoT-enabled intelligent transportation systems with Virtual Reality (“VR”) and predictive analytics, a team in China combined the artificial and physical elements of a transportation system to develop a Parallel Transportation System (“PTS”) aimed at transforming how city planners approach urban mobility. These IoT-driven systems have already made headway in many cities. They connect physical assets, such as connected vehicles, traffic systems, and infrastructure elements, and also connect social systems, such as economic development, emergency management, and urban planning.

Leveraging these deep sensing capabilities, the team’s PTS creates an artificial or virtual model of a city’s physical transportation system that runs and interacts parallel to the actual system. Instead of having the artificial model follow the physical system, like in most transportation simulations, the team’s approach instead opts for the physical transport system to live up to the artificial one. By conducting computational experiments, the team is able to predict changes in mobility and evaluate traffic control plans. Not only does this improve current transportation management, but it also expands the opportunities for building smarter and better connected cities.

Outline of the Architecture of the Parallel Transportation System

As with any intelligent transportation systems, IoT acts as the main driving force for seamlessly integrating the physical world with the virtual one. In the physical world, sensors around the city or embedded in mobile devices communicate with each other to form a distributed sensor network that collects regional traffic information, including traffic flow, occupancy, average speed, vehicle trajectory, and more.9 Data is also collected from social sensors, signals, and networking platforms such as Facebook and Twitter, where citizens share information in real-time. The data collected from the surrounding environments is then used to build an accurate representation in the virtual world using VR and AI. Creating artificial traffic scenarios also allowed the team to generate and experiment with extensive virtual data, saving them time and minimizing costs when compared to the relatively “small” information collected from a city’s physical transport system.

North America is expected to dominate the intelligent transportation systems market in the next few years due to the development of various regulations to ensure safety, compliance and accountability. Strong economic conditions and high disposable income in North America are also dominant factors in the industry’s growth including with a source of funding for research and development. To ensure the safety of passengers, some new features are becoming mandatory in car manufacturing that involve intelligent transportation systems, which means the AI market is expected to grow in the next few years.

9 Creating Smarter Cities Using Artificial Transportation Systems | Innovate (ieee.org)

Analysis and market development in the United States show that robots and AI have unlimited economic potential globally, especially for the European Union (“EU”). The latest 2019-2024 edition of the Non-European Cost Map estimates that the efficiency of the European economy could increase by $20.6 billion by 2025 if appropriate EU policies are introduced to promote and regulate AI technologies. The latest report by the McKinsey Global European Commission Institute estimates that the various high-impact technologies with net economic impact on the EU through 2030 will shape Europe’s economy and society with a possible value of 2.2 billion cumulative additional GDP or an increase of 14.1% compared to 2017. Many of these high-impact technologies are critical to artificial intelligence and robotics in the transportation sector. Examples of technologies and infrastructure include AI, big data analytics, the internet of things and the internet and infrastructure (such as 5G and above), while examples of high-impact application technologies include autonomous mobility and smart cities.10

Key trends and areas of development include:

| | ● | Autonomous Driving — AD technology aims to minimize human negligence and errors to create safer roads. Comprehensive AI algorithms aim to take over the task of driving with advanced driver assistance systems (“ADAS”) to push the industry towards fully autonomous vehicles. AI, combined with smart sensors accelerate advancements in the mobility industry. |

| | | |

| | ● | Internet of Things — Vehicles exchange data with a central hub, as well as each other, through cellular, Wi-Fi, and satellite communications. There are various ways to enable connectivity in mobility, for example, “built-in” with embedded original equipment manufacturer, or OEM, solutions or “brought-in” with smartphone-based apps. IoT connectivity enables easy tracking of vehicular data for various use cases such as insurance, driver safety, predictive maintenance, and fleet management. |

| | | |

| | ● | Electric Mobility Advancements — To accelerate the growth of e-mobility and promote sustainable mobility, advances have to be spurred in electric drive solutions, electric vehicle, or EV, charging, and infrastructure, as well as data analytics and security. Despite the numerous benefits of EVs to the environment, there still remain many hurdles for their adoption. Startups globally develop solutions to enable the widespread adoption of EVs by providing efficient batteries and charging infrastructure. At the same time, emerging companies are manufacturing electric vehicles of all sizes to streamline the logistics sector and reduce harmful emissions. |

| | | |

| | ● | Mobility as a Service — Integrating various modes of transportation into a single mobility service presents a user-centric approach to mobility. Mobility-as-a-Service, or MaaS, offers value-added services through the use of a single application to adopt and maintain a user-centric approach. Customers use a sole payment channel instead of multiple ticketing and payment operations, allowing for convenience and efficient planning. MaaS also introduces new business models to operate different transport options, reduce congestion and remove capacity constraints. Among the multiple benefits that MaaS offers, easy route planning and simplified payments are the keys that make this an emerging mobility trend. According to Emergen Research, the Global Mobility as a Service Market will reach $523.61 billion by 2027, driven by the convergence and the growth of the telecom sector and the transportation industry. Transport authorities, governments, customers, and businesses have started understanding the ample potential for unlocking various opportunities. There has been a surge in the awareness for the adoption of a user-centric approach to look at the mobility opportunities provided to customers as a part of a wider, integrated system. |

| | | |