UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Year Ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Transition Period From To

Commission file number 001-13795

AMERICAN VANGUARD CORPORATION

| | |

Delaware | | 95-2588080 |

(State or other jurisdiction of Incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

4695 MacArthur Court, Newport Beach, California | | 92660 |

(Address of principal executive offices) | | (Zip Code) |

(949) 260-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.10 par value | | AVD | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☒ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock of the registrant held by non-affiliates is $503.9 million. This figure is estimated as of June 30, 2023 at which date the closing price of the registrant’s Common Stock on the New York Stock Exchange was $17.87 per share. For purposes of this calculation, shares owned by executive officers, directors, and 5% stockholders known to the registrant have been deemed to be owned by affiliates. The number of shares of $0.10 par value Common Stock outstanding as of June 30, 2023, was 34,643,674. The number of shares of $.10 par value Common Stock outstanding as of March 5, 2024 was 28,795,082.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2024 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant’s definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

AMERICAN VANGUARD CORPORATION

ANNUAL REPORT ON FORM 10-K

December 31, 2023

AMERICAN VANGUARD CORPORATION

(Dollars in thousands, except per share data)

PART I

Unless otherwise indicated or the context otherwise requires, the terms “Company,” “we,” “us,” and “our” refer to American Vanguard Corporation and its consolidated subsidiaries (“AVD”).

Forward-looking statements in this report, including without limitation, statements relating to the Company’s plans, strategies, objectives, expectations, intentions, and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties. (Refer to Part I, Item 1A, Risk Factors and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, included in this Annual Report.)

All dollar amounts reflected in the consolidated financial statements are expressed in thousands, except per share data.

ITEM 1 BUSINESS

American Vanguard Corporation (“AVD”) was incorporated under the laws of the State of Delaware in January 1969 and operates as a holding company. Unless the context otherwise requires, references to the “Company” or the “Registrant” in this Annual Report refer to AVD. The Company conducts its business through its principle operating subsidiaries, including AMVAC Chemical Corporation (“AMVAC”) for its domestic business and AMVAC Netherlands BV (“AMVAC BV”) for its international business.

The operating subsidiaries in the U.S. include: AMVAC, GemChem, Inc. (“GemChem”), Envance Technologies, LLC (“Envance”), TyraTech Inc. (“TyraTech”) and OHP Inc. (“OHP”).

Internationally, the Company operates its business through the following subsidiaries: AMVAC BV, AMVAC Hong Kong Limited (“AMVAC Hong Kong”), AMVAC Mexico Sociedad de Responsabilidad Limitada (“AMVAC M”), AMVAC de Costa Rica Sociedad de Responsabilidad Limitada (“AMVAC CR Srl”), Grupo AgriCenter (including the parent AgriCenter S.A. and its subsidiaries) (“AgriCenter”), AMVAC do Brasil Representácoes Ltda (“AMVAC do Brasil”), AMVAC do Brazil 3p LTDA (“AMVAC 3p”), American Vanguard Australia PTY Ltd (“AVD Australia”), AgNova Technologies PTY Ltd (“AgNova”), and the Agrinos group entities (“Agrinos”).

The Company has one reportable segment.

AMVAC is a California corporation that traces its history from 1945 and is a manufacturer of chemical, biological and biorational products that develops and markets solutions for agricultural, commercial and consumer uses. It synthesizes and formulates chemicals and ferments and extracts microbial products for crops, turf, ornamental plants, and human and animal health protection. These products, which include insecticides, fungicides, herbicides, soil health, plant nutrition, molluscicides, growth regulators, soil fumigants, and biorationals, are marketed in liquid, powder, and granular forms. AMVAC primarily synthesizes, formulates, and distributes its own proprietary products or custom manufactures, formulates or distributes for others. In addition, the Company has carved out a leadership position in closed delivery systems, currently offers certain of its products in SmartBox, Lock ‘n Load and EZ Load systems, and its most recent commercial high technology packaging system known as SIMPAS (see “Intellectual Property” below) which permits the delivery of multiple products (from AMVAC and/or other companies) at variable rates in a single pass. AMVAC has historically expanded its business through both the acquisition of established chemistries, the development and commercialization of new formulations or compounds through licensing arrangements, the expansion of its global distribution network to gain broader market access, and self-funded research and development of precision application technology. Beginning in 2021, we have commenced basic molecular research and development of intellectual property related to our green solutions portfolio.

AMVAC BV is a Netherlands Corporation that was established in 2012 and is based in the Netherlands. AMVAC BV sells products both directly and through its network of subsidiaries in various international territories.

Below is a description of the Company’s acquisition/licensing during 2023. There were no acquisitions in 2022.

On October 5, 2023, the Company completed the purchase of all the outstanding shares of Punto Verde, a well-established distributor of agricultural products, located in Guayaquil, Ecuador. The acquired assets included product registration, trade names and trademarks, customer lists, workforce, fixed assets, and existing working capital.

On January 4, 2023, the Company completed the purchase of certain assets from American Bio-Systems, Inc. related to the proprietary-formula microbial cleaning products BioMopPlus® and DrainGel®. The assets acquired include end-use registrations, trademarks, formulation know-how, and books and records.

Seasonality

The agricultural chemical industry, in general, is cyclical in nature. The demand for AVD’s products tends to be seasonal. Seasonal usage, however, does not necessarily follow calendar dates, but more closely follows growing patterns, weather conditions, geography, weather related pressure from pests and customer marketing programs. Further, growing seasons vary by geographical region; thus, there is no single seasonal cycle affecting our sales. Rather, multiple seasons transpire over the course of the calendar year.

Backlog

AVD primarily sells its products based on purchase orders. The purchase orders are typically fulfilled within a short time frame. As a result, backlog is not considered a significant factor of, or a valid metric for, AVD’s business. The 2022 year, however, did end with a significantly larger than normal backlog of orders, primarily resulting from supply chain challenges on one specific product line in the last three months of 2022. This situation was fully rectified by the end of 2023.

Customers

The Company’s largest three customers accounted for 15%, 14% and 8% of the Company’s sales in 2023; 18%, 13% and 8% in 2022; and 17%, 14% and 8% in 2021.

Distribution

In the U.S. AMVAC predominantly distributes its products through national distribution companies and buying groups or co-operatives, which purchase AMVAC’s goods on a purchase order basis and, in turn, sell them to retailers/growers/end-users.

Internationally, AMVAC BV has sales offices or wholly owned distributors in Central America, Mexico, Brazil, Australia, and India, and sales force executives or sales agents in several other territories. The Company’s domestic and international distributors and agents typically have long-established relationships with retailers/end-users, far-reaching logistics and transportation capabilities, and/or customer service expertise. The markets for AVD’s products vary by region, target crop, use and type of distribution channel. AVD’s distributors and agents are experienced at addressing the needs of these various markets.

Competition

In its many marketplaces, AVD faces competition from both domestic and foreign manufacturers. Many of our competitors are larger and have substantially greater financial and technical resources than AVD. AVD’s capacity to compete depends on its ability to develop additional applications (including delivery systems and precision application technologies) for its current products and/or expand its product lines and customer base. AVD competes principally based on quality, product efficacy, price, technical service and customer support. In some cases, AVD has positioned itself in smaller niche markets, which are no longer addressed by larger companies. In other cases, for example in the Midwest corn and soybean markets, the Company competes directly against larger competitors.

Manufacturing

Through its six manufacturing facilities (see Item 2, Properties), AVD synthesizes many of the technical grade active ingredients that are in its end-use products. Further, the Company formulates and packages its end-use products at four of its own facilities or at the facilities of third-party formulators in the U.S. and at various international locations. Furthermore, the Company owns and operates two biological fermentation sites, one site in the U.S. and one in Mexico, and, in addition, has a certain biological product manufactured under a long-term arrangement at a third-party facility in India.

Raw Materials

AVD utilizes numerous companies to supply the various raw materials and components used in manufacturing its products. Many of these materials are readily available from domestic sources. In instances where there is a single source of supply, AVD seeks to secure its supply by either long-term (multi-year) arrangements or purchasing on long lead times from its suppliers. Further, where the availability or cost of certain raw materials may be subject to the effect of tariffs and/or supply chain disruption, the Company may order goods at times or in volumes out of the ordinary course to optimize pricing and to ensure supply.

Intellectual Property

AVD’s proprietary product formulations are protected, to the extent possible, as trade secrets and, to a lesser extent, by patents. Certain of the Company’s closed delivery systems are patented, and the Company has both pending and issued patents relating to its equipment portfolio, particularly with respect to its SIMPAS and ULTIMUS technology. In addition, the Company owns multiple issued patents relating to both its low-impact Envance solutions as well as its Agrinos biological and microbial solutions. The Company believes that AVD’s trademarks bring value to its products in both domestic and foreign markets. AVD considers that, in the aggregate, its product registrations, trademarks, licenses, customer lists and patents constitute valuable assets. While it does not regard its current business as being materially dependent upon any single product registration, trademark, license, or patent, it believes that patents will play an increasingly important role in its precision application technologies and green solutions portfolio.

EPA Registrations

In the U.S., AVD’s products also receive protection afforded by the terms of the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”), pursuant to which it is unlawful to sell any pesticide in the U.S., unless such pesticide has first been registered by the U.S. Environmental Protection Agency (“USEPA”). Most of the Company’s products that are sold in the U.S. are subject to USEPA registration and periodic re-registration requirements and are registered in accordance with FIFRA. This registration by USEPA is based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment, when used according to approved label directions. In addition, each state requires a specific registration before any of AVD’s products can be marketed or used in that state. State registrations are predominantly renewed annually with a smaller number of registrations that are renewed on a multiple year basis. Foreign jurisdictions typically have similar registration requirements by statute.

In addition, certain of the Company’s biological products are labeled organic under the Organic Materials Review Institute (“OMRI”), Washington State Department of Agriculture (“WSDA”) and/or California Department of Food and Agriculture (“CDFA”) and, as such, are subject to the requirements of those certification standards, including with respect to raw materials and processes. As is the case with synthetic products, these biological products are also subject to specific labeling requirements that may vary from state to state.

The USEPA, state, and foreign agencies have required, and may require in the future, that certain scientific data requirements be performed on registered products sold by AVD. AVD, on its own behalf and in joint efforts with other registrants, has furnished, and is currently furnishing, required data relative to specific products. Under FIFRA, the federal government requires registrants to submit a wide range of scientific data to support U.S. registrations, including in the case of adding labeled uses. This requirement results in operating expenses in such areas as regulatory compliance, with USEPA and other such bodies in the markets in which the Company sells its products. In addition, at times, the Company is required to generate new formulations of existing products and/or to produce new products in order to remain compliant. The Company expensed $21,833, $18,081 and $16,643, during 2023, 2022 and 2021, respectively, on these activities. The costs are included in operating expenses in the Company’s consolidated statements of operations.

| | | | | | | | | | | | |

| | 2023 | | | 2022 | | | 2021 | |

Registration | | $ | 14,498 | | | $ | 11,979 | | | $ | 10,687 | |

Product development | | | 7,335 | | | | 6,102 | | | | 5,956 | |

Total | | $ | 21,833 | | | $ | 18,081 | | | $ | 16,643 | |

Environmental

American Vanguard is committed to be a part of the global solution to reduce the overall impact on the environment through our focused improvement efforts that minimize energy consumption, greenhouse gas emission, waste generation, and water consumption at our manufacturing and laboratory facilities. We cover our commitment and the specifics of our environmental stewardship program in our 2023 Corporate Sustainability Report, which can be found on the Company's website.

With respect to specific matters involving environmental considerations, during 2023, AMVAC continued activities to address environmental issues associated with its facility in Commerce, CA. (the “Facility”). An outline of the history of those activities follows.

In 1995, the California Department of Toxic Substances Control (“DTSC”) conducted a Resource Conservation and Recovery Act (“RCRA”) Facility Assessment (“RFA”) of those facilities having hazardous waste storage permits. In March 1997, the RFA culminated in DTSC accepting the Facility into its Expedited Remedial Action Program. Under this program, the Facility was required to conduct an environmental investigation and health risk assessment. This activity then took two paths: first, the RCRA permit closure and second, the larger site characterization.

With respect to the larger site characterization, soil and groundwater characterization activities began in December 2002 in accordance with the Site Investigation Plan that was approved by DTSC. Additional activities were conducted from 2003 to 2014, with oversight provided by DTSC. In 2014, the Company submitted a remedial action plan (“RAP”) to DTSC, under the provisions of which, the Company proposed not to disturb sub-surface contaminants, but to continue monitoring, maintain the cover above affected soil, enter into restrictive covenants regarding the potential use of the property in the future, and provide financial assurances relating to the requirements of the RAP. In January 2017, the RAP was circulated for public comment. DTSC responded to those comments and, on September 29, 2017, approved the RAP as submitted by the Company. The Company continues to conduct groundwater monitoring and maintain the existing cover above affected soil and throughout the Site. In 2022, the Company recorded land use covenants on certain affected parcels. In September 2023, DTSC approved the Company’s Remedial Action Completion Report and requested the Company prepare an estimate of costs for ongoing operations and maintenance to maintain the existing cover and conduct semi-annual groundwater monitoring. In 2024, DTSC requested the Company to prepare an Operations & Maintenance Plan (“O&M Plan”) to detail long-term monitoring requirements for the Site. After DTSC review and approval of the O&M Plan and associated cost estimate, the Company will be required to establish an approved financial assurance mechanism. At this stage, the Company does not believe that costs to be incurred in connection with the RAP will be material and has not recorded a liability for these activities.

AMVAC is subject to numerous federal and state laws and governmental regulations concerning environmental matters and employee health and safety at its six manufacturing facilities. The Company continually adapts its manufacturing process to the latest environmental control standards of the various regulatory agencies. The USEPA and other federal and state agencies have the authority to promulgate regulations that could have a material impact on the Company’s operations.

AMVAC expends substantial effort to minimize the risk of discharge of materials in the environment and to comply with the governmental regulations relating to protection of the environment. Wherever feasible, AMVAC recovers and recycles raw materials and increases product yield in order to partially offset increasing pollution abatement costs.

The Company is committed to a long-term environmental protection program that reduces emissions of hazardous materials into the environment, as well as to the remediation of identified existing environmental concerns.

Human Capital Resources

We believe that, beyond being essential to our operations, our people have inestimable worth independent of our business. As outlined in our Human Rights Policy (see, www.american-vanguard.com under ESG tab), we believe that it is fundamental to our corporate responsibility and, indeed, to our humanity, that we recognize, respect and nurture the freedom and dignity of all persons. Accordingly, we have insinuated that belief throughout the fabric of our operations in our approach toward our employees. Indeed, the first two core values underlying our commitment to sustainability (see, Update to Corporate Sustainability Report, www.american-vanguard.com under ESG tab) are “Safety First” – which is a culture that begins with highly-regulated manufacturing plants, continues into the design of science-backed products and extends into market-leading delivery systems – and “Making a Difference” – under which, by rewarding achievement and giving our employees a voice, we attract diverse employees who want to make a difference in their careers, in the company and in the communities that we serve.

During 2023, the Company hired its first Senior Vice President of Human Resources who will lead our Human Capital program, which consists of the following elements:

•Board Oversight – through our Nominating and Corporate Governance Committee (“N&CG”), our board of directors oversees human capital-related risks and opportunities. Annually, the N&CG Committee requires that management provides an update on succession planning for key executives, emphasizing a forward-looking approach with a commitment to fostering diversity, equity, and inclusion in future leadership planning. We are developing Human Capital programs that drive a culture of performance and engagement.

•Strategy – the Company’s human capital strategy has two primary elements: employee engagement and providing them with competitive benefits (including an outstanding health benefits plan). As we have covered in our Update to Corporate Sustainability Report, our Company is a destination for highly qualified employees who are drawn to a workplace where they can make a difference. Our management philosophy prioritizes collaborative and consistent execution to fulfill our commitments, fostering a performance-driven culture. This strategic approach has empowered the company to optimize retention, even amidst the challenges of a competitive employment market.

•Compensation – as highlighted in our strategy, compensation is a pivotal component of our human capital approach. We consistently motivate our workforce through competitive compensation and comprehensive welfare benefits. Additionally, we proactively educate our employees on the totality of their compensation, encompassing wages, stock options, health benefits, and paid time off.

•Employee Engagement –our management style is to solicit good ideas from employees, involve them in implementation and give them recognition for ideas that succeed. For example, personnel from virtually any department (be it sales, technology, product development or otherwise) can submit ideas to our Innovation Review Committee (“IRC”) for consideration and potential funding. The IRC continues to be a source of new product ideas that has enabled us to launch several new formulations and other solutions on an annual basis. Similarly, our Beekeeper platform is a company-only social media channel on which employees anywhere in the world can report on their accomplishments, commendations of others and local developments.

•Diversity, Equity and Inclusion (“DEI”) – the Company is actively broadening its DEI program, incorporating Employee Resource Groups like the AMVAC Women Network to serve as a support group for professional development. Three of nine members (33%) of our board of directors are female and two of nine (22%) are from underrepresented groups (LGBTQ and Latinx). Based upon the Company’s most current EEO-1 (“Equal Employment Opportunity”) Report, representation of African Americans in our domestic workforce exceeds the prevalence of that group in the national population, while representation of Hispanic personnel is slightly below the national average. Our average employee age is 43 and our gender diversity is at 27% female and 73% male.

The Company employed 845 employees as of December 31, 2023, and 822 employees as of December 31, 2022. From time to time, due to the seasonality of its business, AVD uses temporary contract personnel to perform certain duties primarily related to packaging of its products. None of the Company’s employees are subject to a collective bargaining agreement. The Company believes it maintains positive relations with its employees.

Domestic operations

AMVAC is a California corporation that was incorporated under the name of Durham Chemical in August 1945. The name of the corporation was subsequently changed to AMVAC in January 1971. As the Company’s main operating subsidiary, AMVAC owns and/or operates the Company’s domestic manufacturing facilities. AMVAC manufactures, formulates, packages and sells its products in the U.S. and is a wholly owned subsidiary of AVD.

GemChem is a California corporation that was incorporated in 1991 and was subsequently purchased by the Company in 1994. GemChem sells into the pharmaceutical, cosmetic and nutritional markets and, in addition, purchases key raw materials for the Company. GemChem is a wholly owned subsidiary of AVD.

2110 Davie Corporation ("DAVIE") owns real estate for corporate use only. The site is the home to the Company’s research center and provides accommodation for the Company’s production control team. DAVIE is a wholly owned subsidiary of AVD.

On October 2, 2017, AMVAC purchased substantially all the assets of OHP, a domestic distribution company specializing in products for the turf and ornamental market. OHP markets and sells end use products for third parties, either under third-party brands or else as its own label products.

Envance is a Delaware Limited Liability Company that was formed in 2012 by AMVAC and joint venture partner TyraTech. Envance and TyraTech became wholly owned subsidiaries of the Company on November 9, 2018. Envance has the rights to develop and commercialize pesticide products and technologies based on TyraTech’s intellectual property. Products are made from natural oils and are marketed in global consumer, commercial, professional, crop protection and seed treatment markets. Envance is taking products to market primarily by licensing its intellectual property to third parties.

International operations

AMVAC BV is a registered Dutch private limited liability company that was formed in July 2012 to manage foreign sales on behalf of the Company. AMVAC BV is located in the Netherlands and is a wholly owned subsidiary of AMVAC Hong Kong. AMVAC Hong Kong is a wholly owned subsidiary of AMVAC. During 2023 and 2022, the international business sold the Company’s products in 45 countries.

AMVAC M is a wholly owned subsidiary of AMVAC BV and was originally formed in 1998 (as Quimica Amvac de Mexico S.A. de C.V and subsequently changed to AMVAC Mexico Sociedad de Responsabilidad Limitada “AMVAC M”) to conduct the Company’s business in Mexico.

On October 27, 2017, AMVAC BV purchased 100% of the stock of AgriCenter with subsidiaries located in Costa Rica, Panama, Nicaragua, Honduras, the Dominican Republic, Mexico, Guatemala, and El Salvador. AgriCenter markets, sells and distributes end-use chemicals, including the Company’s own products, and biological products throughout Central America primarily for crop applications.

On January 10, 2019, AMVAC BV acquired 100% of the stock of Agrovant and Defensive, two distribution companies based in Brazil. Agrovant and Defensive marketed and distributed crop protection products and micronutrients with focus on the fruit and vegetable market segments throughout Brazil. On December 31, 2020, Agrovant and Defensive merged and the Company renamed the resulting entity AMVAC 3p.

On October 8, 2020, AVD Australia acquired 100% of the stock of AgNova, an Australian company that sources, develops, and distributes specialty crop protection and production solutions for agricultural and horticultural producers, and for selected non-crop users.

On October 2, 2020, the Company’s principal operating subsidiary, AMVAC, completed the purchase of all outstanding shares of Agrinos and certain intellectual property rights. Agrinos is a fully integrated biological input supplier with proprietary technology, manufacturing, and global distribution capabilities and has operating entities in the U.S., Mexico, India, Brazil, China, Ukraine, and Spain.

On July 27, 2023, AgNova established a new subsidiary in New Zealand called AgNova Technologies NZ Limited (“AgNova NZ”). This new entity is a wholly owned subsidiary of AgNova and was created to expand our business in the Australasia region.

On October 5, 2023, AgriCenter acquired Punto Verde, an Ecuadorian company that distributes crop protection products primarily in Ecuador.

The Company classifies as international sales all products bearing foreign labeling shipped to a foreign destination.

| | | | | | | | | | | | |

| | 2023 | | | 2022 | | | 2021 | |

International sales | | $ | 234,855 | | | $ | 244,282 | | | $ | 215,439 | |

Percentage of net sales | | | 40.5 | % | | | 40.1 | % | | | 38.6 | % |

Risk Management

The Company’s Environmental, Social and Corporate Governance (“ESG”) strategy is fully described on our website at https://www.american-vanguard.com/esg.

Available Information

The Company makes available free of charge (through its website, www.american-vanguard.com), its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (“SEC”). All reports filed with the SEC are available free of charge on the SEC website, www.sec.gov. Also available free of charge on the Company’s website are the Company’s Audit Committee, Compensation Committee, Finance Committee and Nominating and Corporate Governance Committee Charters, the Company’s Corporate Governance Guidelines, the Company’s Code of Conduct and Ethics, and the Company’s Employee Complaint Procedures for Accounting and Auditing Matters. Beneath the ESG tab at that site, you will also find links to the Company’s Corporate Sustainability Reports, Climate Change Commitment and Human Rights Policy. The Company’s Internet website and the information contained therein or incorporated therein are not intended to be incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

Supply Chain/Regulatory/Geopolitical/Tax Risks

Disruption in the global supply chain is creating delays, unavailability and adverse conditions for our industry. Despite improvement in container availability and freight costs, the global supply chain continues to present risk. At present, military activity in the Red Sea is disrupting shipping routes within that region. While not directly affecting the Company, there is no guarantee that this or other supply chain conditions will materially improve any time soon or that the Company will avoid material disruption. Such disruption could have a material adverse effect on the Company’s financial performance in future reporting periods.

The regulatory climate remains challenging to the Company’s interests both domestically and internationally. Various agencies within the U.S. (both federal and state) and foreign governments continue to exercise increased scrutiny in permitting continued uses (or the expansion of such uses) of many chemistries, including several of the Company’s products and, in some cases, have initiated or entertained challenges to these uses. The challenge of the regulatory climate is more pronounced in certain geographical regions (outside the U.S.) where the Company faces resistance to the continued use of certain of its products. For example, the European Union (“EU”) employs a hazard-based analysis when considering whether product registrations can be maintained; under this approach, EU regulatory authorities typically do not weigh benefit against risk in their assessments and routinely cancel products for which a safer alternative is available, notwithstanding the benefit of the cancelled product. There is no guarantee that this regulatory climate will change in the near term or that the Company will be able to maintain or expand the use of many of its products in the face of such regulatory challenges.

Several of the Company’s organophosphates are subject to a petition to revoke tolerances under the FFDCA which, if granted, could result in the limitation and/or cancellation of one or more registrations for such products. Presently, several of the Company’s organophosphate products are under registration review before the USEPA and, at the same time, subject to a petition to revoke tolerances under the Federal Food, Drug, and Cosmetic Act ("FFDCA"). The Company continues to provide data and other analysis to USEPA in support of its registrations and in response to that agency’s requests for clarification. Pursuant to a petition filed by NGOs NRDC and PANNA in 2007, USEPA revoked tolerances for chlorpyrifos (an OP not sold by the Company) finding that food residues from that product could not be deemed with reasonable certainty to cause no harm. Consequently, the agency cancelled the registrations for chlorpyrifos. The cancellation was appealed and subsequently overturned by the Eighth Circuit Court of Appeal in 2023, which noted that the agency had exceeded its authority in canceling even uses that had been shown to be within applicable safety tolerances. That said, there is no guarantee that USEPA will not make a similar finding with respect to one or more of the Company’s OPs, and that some or all uses of the Company’s OP products could be limited or cancelled. Accordingly, the Company intends to take all action necessary to defend its registrations. Such limitations and/or cancellations could have a material adverse effect on the Company’s financial performance in future reporting periods.

USEPA has issued a proposed final decision (“PFD”) to cancel PCNB. In mid-2022, the USEPA issued a “proposed final decision” (a variety of agency action theretofore unknown to registrants) to cancel the fungicide PCNB, which is registered by the Company for use on golf courses and potatoes, among other things. The basis for its PFD was the agency’s initial contention that the product is persistent, bioaccumulative and toxic (“PBT”). In light of further analysis and Company input, the agency has suggested that the compound may merely have characteristics of a PBT. At any rate, then, the Company must meet a truncated schedule for defending this product, all of which is posted on a public docket. The Company has submitted proposed mitigation measures, and discussion with the program office continues. There is no guarantee that the Company will succeed in persuading USEPA not to cancel the PCNB registration. AMVAC is the sole registrant of PCNB which it manufactures at its own facility. Loss of this product could have a material adverse effect on the Company's financial performance in future reporting periods.

The Company is dependent upon sole source or a limited number of suppliers for certain of its raw materials and active ingredients. There are a limited number of suppliers of certain important raw materials used by the Company in a number of its products. Certain of these raw materials are available solely from single or very few sources either domestically or overseas. In connection with supply chain disruptions in 2022 phosphorus and related compounds were increasingly difficult to source for our entire industry; ensuring a continuous supply required extraordinary efforts both with respect to sourcing and production planning. Similarly, in the first half of 2023, DCPA, the active ingredient in one of the Company’s high-margin herbicides, was unavailable from its overseas supplier. There is no guarantee that any of our suppliers will be willing or able to supply products to the Company reliably, continuously and at the levels anticipated by the Company or required by the market. If these sources prove to be unreliable and the Company is not able to supplant or otherwise second source these products, it is possible that the Company will not achieve its projected sales which, in turn, could have a material adverse effect on the Company’s financial performance in future reporting periods.

Public statements made by USEPA regarding their preliminary findings in connection with the registration review of the Company’s products could adversely affect product sales and/or commercial viability. Registrations for the Company’s products are subject to registration review by the USEPA from time to time. In the course of the review, the Company submits, and the USEPA reviews, data studies. At any stage in the course of the review, USEPA may reach preliminary findings that could impair the commercial viability of a product. For example, in connection with USEPA’s review of the DCPA registration, based upon a comparative thyroid assay study (which is comparatively rare and quite complex), based upon limited data points, the USEPA found an adverse effect upon neonate rodents. Consequently, in June 2023, the agency published preliminary findings, noting its concern that based upon current, permitted use patterns, the product could have an adverse effect upon human health and, in particular, pregnant women. At the same time, the agency invited the Company to examine mitigation measures to allay their concerns, which the Company has done. There is no guarantee that mitigation measures or additional data proffered by the Company will be sufficient to overcome USEPA’s conclusions. Further, it is possible that the agency could take more drastic measures to either reduce the use or cancel the registration of the product. Regulatory activities of this nature, whether in connection with DCPA or other products of significance, could have a material adverse effect on the Company’s financial performance in future reporting periods.

The Company benefits from customer early pay in meeting its working capital needs. As is the case with other companies in this industry, the Company receives cash from certain major customers at year-end in exchange for granting discounts on the Company’s products during the first half of the following year. The Company typically uses this cash to pay down secured debt and for other working capital needs. This flow of cash obviates the need for additional borrowing, which, in turn, preserves borrowing capacity used in part for paying customer programs at the end of the calendar year and, consequently, reduces interest expense. There is no guarantee that the Company’s customers will continue to support the early pay program at current levels. Further a material change in this program could have an adverse effect on the Company’s liquidity and its ability to meet working capital demands.

Product liability judgments on glyphosate and cases involving other pesticides by domestic courts present a litigation risk to companies in this industry. Multiple judgments have been rendered by domestic courts in product liability cases against Bayer/Monsanto in connection with injuries allegedly arising from exposure to the herbicide product, glyphosate. The basis was purported carcinogenicity based largely upon the findings of a certain international organization, despite significant scientific evidence to the contrary. While the Company does not sell glyphosate, the theory of these results could put one or more of the Company’s products at risk. There is no guarantee that one or more product liability actions would not be brought against the Company on a similar basis, and it is possible that adverse rulings in any such actions could have a material adverse effect on the Company’s financial performance in future reporting periods.

The trend of passing pesticide “ban-bills” in various states could put one or more of the Company’s products at risk. In certain states, including Maryland and New York, state and/or local legislatures have passed legislation banning the use of specific pesticides, such as chlorpyrifos, or pesticide in general, in spite of valid registrations at USEPA and/or the equivalent state agency. While the Company does not sell chlorpyrifos products, there is no guarantee that one or more of its registered products will not be targeted in state or local legislation of this nature. Further, such legislation could have a material adverse effect on the Company’s financial performance in future reporting periods.

Use of the Company’s products is subject to continuing challenges from activist groups. Use of agrochemical products, including the Company’s products, is regularly challenged by activist groups in many jurisdictions under a multitude of federal, state and foreign statutes, including FIFRA, the Food Quality Protection Act, Endangered Species Act (“ESA”) and the Clean Water Act, to name a few. These challenges typically take the form of lawsuits or administrative proceedings against the USEPA and/or other federal, state or foreign agencies, the filing of amicus briefs in pending actions, the introduction of legislation that is inimical to the Company’s interests, and/or adverse comments made in response to public comment invited by regulatory agencies in the course of registration, re-registration or label expansion. The most prominent of these actions include a line of cases under which environmental groups have sought to suspend, cancel or otherwise restrict the use of pesticides that have been approved by USEPA on the ground that that agency failed to confer with the National Marine Fishery Service and/or the Fish and Wildlife Service under the ESA with respect to biological opinions relating to the use of such products. While industry has been active in defending registrations and proposing administrative and legislative approaches to address serious resource issues at the affected agencies, these cases continue to be brought. It is possible that one or more of these challenges could succeed, resulting in a material adverse effect on the Company's financial performance in future reporting periods.

The distribution and sale of the Company’s products are subject to governmental approvals and thereafter ongoing governmental regulation. The Company’s products are subject to laws administered by federal, state and foreign governments, including regulations requiring registration, approval and labeling of its products. The labeling requirements restrict the use of, and type of, application for our products. More stringent restrictions could make our products less available, which would adversely affect our revenues and profitability and cash flows. Substantially all the Company’s products are subject to the USEPA (and/or similar agencies in the various territories or jurisdictions in which we do business) registration and re-registration requirements and are registered in accordance with FIFRA or similar laws. Such registration requirements are based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment when used according to approved label directions. All states, where any of the Company’s products are used, also require registration before products can be marketed or used in that state. Governmental regulatory authorities have required, and may require in the future, that certain scientific data requirements be fulfilled on the Company’s products. The Company, on its behalf and also in joint efforts with other registrants, has furnished, and is currently furnishing certain required data relative to its products. There can be no assurance, however, that the USEPA or similar agencies will not request that certain tests or studies be repeated, or that more stringent legislation or requirements will not be imposed in the future. The Company can provide no assurance that any testing approvals or registrations will be granted on a timely basis, if at all, or that its resources will be adequate to meet the costs of regulatory compliance.

The manufacturing of the Company’s products is subject to governmental regulations. The Company currently owns and operates six manufacturing facilities which are located in Commerce, California; Axis, Alabama; Hannibal, Missouri; Marsing, Idaho; Clackamas, Oregon; and Etchojoa, Mexico (the “Facilities”). The Facilities operate under the laws and regulations imposed by relevant country, state and local authorities. The manufacturing of key ingredients for certain of the Company’s products occurs at the Facilities. An inability to renew or maintain a license or permit, or a significant increase in the fees for such licenses or permits, could impede the Company’s manufacture of one or more of its products and/or increase the cost of production; this, in turn, would materially and adversely affect the Company’s ability to provide customers with its products in a timely and affordable manner.

A change in tax laws, treaties or regulations, or their interpretation or application, could have a negative impact on our business and results of operations. We operate in many different countries and in many states within the United States, and we are subject to changes in applicable tax laws, treaties or regulations in the jurisdictions in which we operate. A material change in these tax laws, treaties or regulations, or their interpretation or application, could have a material adverse effect on the Company’s financial performance in future reporting periods.

Climate Change may adversely affect the Company’s business. Over the course of the past several years, global climate conditions have become increasingly inconsistent, volatile and unpredictable. Many of the regions in which the Company does business have experienced excessive moisture, cold, drought and/or heat of an unprecedented nature at various times of the year. In some cases, these conditions have either reduced or obviated the need for the Company’s products, whether pre-plant, at-plant, post-emergent or at harvest. Further, climate change could disrupt our operations by causing loss of human life, impacting the availability and cost of materials needed for manufacturing, causing physical damage and partial or complete closure of our manufacturing sites or distribution centers, temporary or long-term disruption in the manufacturing and supply of products and services and disruption in our ability to deliver products and services to customers. In addition, these events and disruptions could increase insurance and other operating costs, including impacting our decisions regarding construction of new facilities to select areas less prone to climate change risks and natural disasters, which could result in indirect financial risks passed through the supply chain or other price modifications to our products and services.

The Company’s business may be adversely affected by weather effects and commodity prices. Demand for many of the Company’s products tends to vary with weather conditions and weather-related pressure from pests. Adverse weather conditions, then, may reduce the Company’s revenues and profitability. In light of the possibility of adverse seasonal effects, there can be no assurance that the Company will maintain sales performance at historical levels in any particular region. Similarly, demand for the Company’s products used in row crops tends to vary with the commodity prices of those crops, for instance, corn, soybeans and cotton. These prices may be driven in part by weather, pest pressure, the domestic farm economy and international markets (e.g., yield and pricing from similar crops grown in Brazil). There is no guarantee that the farm economy and row crop commodity prices will maintain sufficient strength and stability to support the Company’s products at or above historical levels.

The Company may be subject to environmental liabilities. The Company is fully committed toward minimizing the risk of discharge of materials into the environment and to complying with governmental regulations relating to protection of the environment, its neighbors and its workforce. Nevertheless, federal and state authorities may seek fines and penalties for any violation of the various laws and governmental regulations. In addition, while the Company continually adapts its manufacturing processes to the latest environmental control standards of regulatory authorities, it cannot entirely eliminate the risk of accidental contamination or injury from hazardous or regulated materials. In short, the Company may be held liable for significant damages or fines relating to any environmental contamination, injury, or compliance violation which could have a material adverse effect on the Company’s financial performance in future reporting periods.

Acquisition/Investment Risks

Newly acquired businesses or product lines may not generate forecasted results. While the Company conducts due diligence using a combination of internal and third-party resources and applies what it believes to be appropriate criteria for each transaction before making acquisitions, there is no guarantee that a business or product line acquired by the Company will generate results that meet or exceed results that were forecasted by the Company when evaluating the acquisition. There are many factors that could affect the performance of a newly acquired business or product line. While the Company uses assumptions that are based upon due diligence and other market information in valuing a business or product line prior to concluding an acquisition, actual results generated post-closing could vary widely from the Company’s forecast and, as such, could have a material adverse effect on the Company’s financial performance in future reporting periods.

The Company’s investment in foreign businesses may pose additional risks. With the expansion of its footprint internationally, the Company now carries on business at a material level in some jurisdictions that have a history of political, economic or currency-related instability and customers with a potentially higher risk profile regarding accounts receivable collectability, as compared to the Company’s legacy business. While such instability may not be present at the current time, there is no guarantee that conditions will not change in one or more jurisdictions quickly and without notice, nor is there any guarantee that the Company would be able to recoup its investment in such territories in light of such changes and potential losses due to political factors, economic factors, devaluation of local currencies, or the collectability risk from customers. Adverse changes of this nature could have a material adverse effect on the Company’s financial performance in future reporting periods.

The Company’s investment in technology may not generate forecasted returns. The Company has had a history of investing in technological innovation, including with respect to precision application technologies (such as SIMPAS and Ultimus), natural oil technology and biologicals, as part of its growth strategy. These investments are based upon the premise that new technology will allow for safer handling or lower overall toxicity profile of the Company’s product portfolio, appeal to regulatory agencies and the market we serve, gain commercial acceptance, and command a return that is sufficiently in excess of the investment. However, there is no guarantee that a new technology will be successfully commercialized, generate a material return or maintain market appeal. Further, many types of development costs must be expensed in the period in which they are incurred. This, in turn, tends to put downward pressure on period profitability. There can be no assurance that these expenses will be recovered through successful long-term commercialization of a new technology.

The Company’s growth has been fueled in part by acquisitions. Over the past few decades, the Company’s growth has been driven by acquisitions and licensing of both established and developmental products from third parties. There is no guarantee that acquisition targets or licensing opportunities meeting the Company’s investment criteria will remain available or will be affordable. If such opportunities do not present themselves, then the Company may be unable to duplicate historical growth rates in future years.

The Company faces competition from generic competitors that source product from countries having lower cost structures. The Company continues to face competition from competitors around the globe that may enter the market through either offers to pay data compensation, or similar means in foreign jurisdictions, and then subsequently source material from countries having lower cost structures (typically India and China). These competitors typically tend to operate at thinner gross margins and, with low costs of goods, tend to drive pricing and profitability of subject product lines downward. There is no guarantee that the Company will maintain market share and pricing when facing such generic competitors, or that such competitors will not offer generic versions of the Company’s products in the future.

The Company’s key customers typically carry competing product lines and may be influenced by the Company’s larger competitors. A significant portion of the Company’s products are sold to national distributors in the U.S., which also carry product lines of competitors that are much larger than the Company. Typically, revenues from the sales of these competitor product lines and related program incentives constitute a greater part of our distributors’ income than do revenues from sales and program incentives arising from the Company’s product lines. With the recent consolidation among domestic distribution companies, these considerations have become more pronounced. In light of these facts, there is no assurance that such customers will continue to market our products aggressively or successfully, or that the Company will be able to influence such customers to continue to purchase our products instead of those of our competitors.

Industry consolidation may threaten the Company’s position in various markets. The global agricultural chemical industry continues to undergo significant consolidation. Many of the Company’s competitors have grown or are expected to grow through mergers and acquisitions. As a result, these competitors will tend to be in position to realize greater economies of scale, offer more diverse portfolios and thereby exert greater influence throughout the distribution channels. Consequently, the Company may find it more difficult to compete in various markets. While such merger activity may generate acquisition opportunities for the Company, there is no guarantee that the Company will benefit from such opportunities. Further, there is a risk that the Company’s future performance may be hindered by the growth of its competitors through consolidation.

The Company is dependent on a limited number of customers, which makes it vulnerable to the continued relationship with and financial health of those customers. Our top three customers accounted for 37% of the Company’s sales in 2023, and 39% of the Company’s sales in both 2022 and 2021. The Company’s future prospects may depend on the continued business of such customers and on our continued status as a qualified supplier to such customers. The Company cannot guarantee that these key customers will continue to buy products from us at current levels. The loss of a key customer could have a material adverse effect on the Company’s financial performance in future reporting periods.

General Risks

The carrying value of certain assets on the Company’s consolidated balance sheets may be subject to impairment depending upon market trends and other factors. The Company regularly reviews the carrying value of certain assets, including long-lived assets, inventory, fixed assets and intangibles. Depending upon the class of assets in question, the Company takes into account various factors including, among others, sales, trends, market conditions, cash flows, profit margins and the like. Based upon this analysis, where circumstances warrant, the Company may leave such carrying values unchanged or adjust them as appropriate. There is no guarantee that these carrying values can be maintained indefinitely, and it is possible that one or more such assets could be subject to impairment which, in turn, could have a material adverse effect on the Company’s financial performance in future reporting periods.

The Company’s computing systems are subject to cyber security risks. In the course of its operations the Company relies on its computing systems, including access to the internet, the use of third-party applications and the storage and transmission of data through such systems. While the Company has implemented security measures to protect these systems, there is no guarantee that a third-party will not penetrate these defenses through hacking, phishing or otherwise and either compromise, corrupt or shut down these systems. Further, in the event of such incursion it is possible that confidential business information and private personal data could be taken and operations, including procurement, customer service, finance, and manufacturing, could be compromised. Such an event could adversely affect both the Company’s ability to operate, its reputation with key stakeholders and its overall financial performance.

Reduced financial performance may limit the Company’s ability to borrow under its credit facility. The Company has historically grown net sales and net income through the expansion of current product lines, the acquisition of product lines from third parties and the acquisition of both domestic and international distributors with strong niche market positions. In order to finance such acquisitions, the Company has drawn upon its senior credit facility. However, the Company’s borrowing capacity under the senior credit facility depends, in part, upon its satisfaction of a negative covenant that sets a maximum ratio of borrowed debt to earnings (as measured over the trailing 12-month period). There is no guarantee that the Company will continue to generate earnings necessary to ensure that it has sufficient borrowing capacity to support future acquisitions or that, when necessary, the lender group will amend the senior credit facility to provide for such borrowing capacity. Further, despite the Company’s long-standing relationship with its lenders, in light of the uncertainties in global financial markets, there is no guarantee that the Company’s lenders will be either willing or able to continue lending to the Company at such rates and in such amounts as may be necessary to meet the Company’s working capital needs.

To the extent that capacity utilization is not fully realized at its manufacturing facilities, the Company may experience lower profitability. While the Company endeavors continuously to maximize utilization of its manufacturing facilities, our success in these endeavors is dependent upon many factors, including fluctuating market conditions, product life cycles, weather conditions in our key markets, availability of raw materials, manufacturing equipment performance, retention of the workforce and regulatory constraints, among other things. There can be no assurance that the Company will be able to maximize the utilization of its manufacturing facilities. Underutilization of such manufacturing resources could have a material adverse effect on the Company’s financial performance in future reporting periods.

The Company’s continued success depends, in part, upon a limited number of key employees. Within certain functions, the Company relies heavily on a small number of key employees to manage ongoing operations and to perform strategic planning. In some cases, there are no internal candidates who are qualified to succeed these key personnel in the short term. In the event that the Company were to lose one or more key employees, there is no guarantee that the Company could replace them with people having comparable skills. Further, the loss of key personnel could adversely affect the operation of our business.

Domestic and regional inflation trends, increased interest rates and other factors could lead to the erosion of economies and adversely impact the Company. Both the US and many other countries are experiencing inflation, which, in turn, is leading to increased costs in multiple industry segments, including agriculture and related industries. The persistence of inflation has led central bankers to increase interest rates within their regions. There is no guarantee that these measures will arrest the inflationary trend. Further, these factors, taken together with reduced productivity and constraints on the labor supply, could lead to recessionary periods in the regions in which the Company does business. While the Company takes measures within its control to manage the effects of inflation, higher interest rates and other factors, ultimately, they are outside of the Company’s control. Further, the persistence and/or severity of one or more of them could have a material adverse effect on the Company’s financial performance in future reporting periods.

None

ITEM 1C. CYBERSECURITY

Risk Management & Strategy. AVD has adopted a comprehensive set of controls and processes to encourage a high level of awareness of, and responsiveness to, cybersecurity threats. The foundational document outlining the program is embodied in Registrant’s Enterprise Information Security Policy (the “REIS Policy”). The REIS Policy establishes a framework for the continuous monitoring of its computing resources, the maintenance and reporting of audit logs and the assessment of events that could form the basis of a threat. In addition, the REIS Policy sets forth requirements for employee awareness training, user authentication, software usage restrictions and boundary protection, among other things. The policy also establishes an incident response plan, including back-up hosting, alternate processing and system recovery, along with assignment of responsibility and resources for those activities. Within the exhibit of the REIS Policy, management either working alone or, in case of greater complexity, with consultants, will assess an incident or series of incidents for materiality, taking into account the nature of the incident,, duration, the nature of data compromised, and the nature of damages (including with respect to reputational, third party, share price, and business interruption) and all within the context of the Company's financial performance during the affected reporting period(s).

Furthermore, AVD has taken measures to prevent cybersecurity breaches, to minimize threats and, to the extent possible, to anticipate trends and identify vulnerabilities before arising to the level of an incident. In short, AVD is pro-active in its approach and has formulated a specific plan to investigate, respond and minimize loss of functionality or other damage from an incident. There are no cybersecurity threats, including as a result of prior incidents, that have materially affected the Company, including our business strategy, results of operations or financial condition as of the date hereof to our knowledge.

Governance. The REIS Policy has been drafted in collaboration with one of the largest IT solutions providers in the field and was modeled after NIST standards relating to governance, documentation and processes. The Company is implementing the REIS Policy through its Cyber and Privacy Risk Steering Committee (the “CPRSC”), which is chaired by the Chief Administrative Officer (who is also AVD’s Risk Manager) and includes cross functional business process owners from operations, sales, marketing, finance and Human Resources, as well as our Director of Information Technology, who alone has over 30 years’ experience in IT-related security and whose staff collectively has over 50 years’ experience in this area. In addition, the committee is advised by a virtual Corporate Information Security Officer who works with the third-party solutions provider.

AVD's Board of Directors maintains oversight of cybersecurity planning, response and reporting as follows. The Lead Director, Scott Baskin, who also serves as Chair of the Risk Committee and member of the Audit Committee, is Cybersecurity Liaison to AVD’s management team. The Chair of the CPRSC reports on cybersecurity preparedness, issues and incidents to the Cybersecurity Liaison regularly. Through this reporting structure, the cybersecurity team has direct interaction with the highest level of the Board and with both the Risk and Audit Committees. Cyber risk has been a subject of regular review and discussion at the Risk Committee for several years. With the advent of the CPRSC, the delineation of governance and responsibility has become that much more focused.

ITEM 2 PROPERTIES

AMVAC owns in fee the Facility constituting approximately 152,000 square feet of improved land in Commerce, California (“Commerce”) on which its West Coast manufacturing, some of its warehouse facilities and some of its manufacturing administrative offices are located.

DAVIE owns in fee approximately 72,000 square feet of warehouse, office and laboratory space on approximately 118,000 square feet of land in Commerce, California, which is leased to AMVAC. In 2013, the Company made a significant investment in the Glenn A. Wintemute Research Center, which houses the Company’s primary research laboratory supporting synthesis, formulation and other new product endeavors.

In 2001, AMVAC completed the acquisition of a manufacturing facility (the “Axis Facility”) from E.I. DuPont de Nemours and Company (“DuPont”). The Axis Facility was one of three such units located on DuPont’s 510-acre complex in Axis, Alabama. The acquisition consisted of a long-term ground lease of 25 acres and the

purchase of all improvements thereon. The facility is a multi-purpose plant designed for synthesis of active ingredients and formulation and packaging of finished products. In 2018, FMC Corporation acquired from DuPont a business unit, which held, among other things, the Axis Facility. Prior to expiration of the lease, AMVAC and FMC negotiated the terms of a new lease, which has a term of 15 years and the option to renew for two, 5-year periods.

On December 28, 2007, AMVAC purchased certain manufacturing assets relating to the production of Thimet and Counter and located at BASF’s multi-plant facility situated in Hannibal, Missouri (the “Hannibal Site”). Subject to the terms and conditions of the Agreement, AMVAC purchased certain buildings, manufacturing equipment, office equipment, fixtures, supplies, records, raw materials, intermediates and packaging constituting the “T/C Unit” of the Hannibal Site. The parties entered into a ground lease and a manufacturing and shared services agreement, under which BASF continues to supply various shared services to AMVAC for the Hannibal Site.

On March 7, 2008, AMVAC acquired from Bayer CropScience Limited Partnership, (“BCS LP”), a U.S. business of Bayer CropScience GmbH, a facility (the “Marsing Facility”) located in Marsing, Idaho, which consists of approximately 17 acres of improved real property. The Marsing Facility is engaged in the blending of liquid and powder raw materials and the packaging of some of the Company’s finished goods inventory in liquid, powder and pelletized formulations which are sold both in the U.S. and internationally. In addition, during 2019, the Company purchased approximately three acres of unimproved real estate immediately adjacent to the Marsing Facility for potential storage and operational use in the future.

On October 2, 2020, AMVAC completed the purchase of all outstanding shares of Agrinos which is a fully integrated biological input supplier with proprietary technology, internal manufacturing, and global distribution capabilities. Its High Yield Technology® product platform works in conjunction with other nutritional crop inputs to increase crop yield, improve soil health and reduce the environmental footprint of traditional agricultural practices. Agrinos has two primary biological production facilities, a state-of-the-art microbial fermentation facility based in Clackamas, Oregon, and a facility in Sonora, Mexico. The Clackamas and Sonora facilities are used as both manufacturing sites and operational centers for global supply chain and logistics.

AVD regularly adds chemical processing equipment to enhance or expand its production capabilities. The Company believes its facilities are in good operating condition, are suitable and adequate for current needs and have flexibility to change products. Facilities and equipment are insured against losses from fire as well as other usual business risks. The Company knows of no material defects in title to, or encumbrances on, any of its properties except that substantially all of the Company’s assets are pledged as collateral under the Company’s credit facility agreements with its lender group. For further information, refer to Note 3 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

AVD owns approximately 42 acres of unimproved land in Texas for possible future expansion.

AVD leases approximately 19,953 square feet of office space located at 4695 MacArthur Court in Newport Beach, California. In 2020, the lease was amended and was extended to June 30, 2026. The premises have served as the Company’s corporate headquarters since 1995.

The facilities occupied by GemChem, OHP, Envance and TyraTech (Envance and TyraTech are co-located), AMVAC BV, AMVAC M, AMVAC CR Srl, AgNova, Agrinos, AMVAC 3p and AgriCenter, consist of administration, development centers (in the case of Envance and TyraTech) and/or sales offices which are leased. In addition, AMVAC 3p leases warehouse space in Jaboticabal, Brazil.

ITEM 3 LEGAL PROCEEDINGS

Please refer to Note 5 – Litigation and Environmental of the Notes to the Consolidated Financial Statements in Part II, item 8 of this Annual Report on Form 10-K.

ITEM 4 MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5 MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Effective March 7, 2006, the Company listed its $0.10 par value common stock (“Common Stock”) on the New York Stock Exchange under the ticker symbol AVD. From January 1998 through March 6, 2006, the Common Stock was listed on the American Stock Exchange under the ticker symbol AVD. The Company’s Common Stock traded on The NASDAQ Stock Market under the symbol AMGD from March 1987 through January 1998.

Holders

As of March 5, 2024, the number of stockholders of the Company’s Common Stock was approximately 10,089, which includes beneficial owners with shares held in brokerage accounts under street name and nominees.

Dividends

The Company has issued a cash dividend in each of the last twenty-seven years dating back to 1996. Cash dividends declared during the past three years are summarized in the table below.

| | | | | | | | | | | | |

Declaration Date | | Record Date | | Distribution Date | | Dividend

Per Share | | | Total

Paid | |

December 15, 2023 | | December 29, 2023 | | January 12, 2024 | | $ | 0.030 | | | $ | 834 | |

September 12, 2023 | | September 22, 2023 | | October 6, 2023 | | | 0.030 | | | | 834 | |

June 12, 2023 | | June 28, 2023 | | July 14, 2023 | | | 0.030 | | | | 848 | |

March 13, 2023 | | March 24, 2023 | | April 14, 2023 | | | 0.030 | | | | 851 | |

Total 2023 | | | | | | $ | 0.120 | | | $ | 3,367 | |

December 12, 2022 | | December 28, 2022 | | January 11, 2023 | | $ | 0.030 | | | $ | 851 | |

September 12, 2022 | | September 23, 2022 | | October 7, 2022 | | | 0.025 | | | | 715 | |

June 6, 2022 | | June 24, 2022 | | July 8, 2022 | | | 0.025 | | | | 742 | |

March 14, 2022 | | March 25, 2022 | | April 15, 2022 | | | 0.025 | | | | 736 | |

Total 2022 | | | | | | $ | 0.105 | | | $ | 3,044 | |

December 13, 2021 | | December 27, 2021 | | January 10, 2022 | | $ | 0.020 | | | $ | 594 | |

September 13, 2021 | | October 1, 2021 | | October 15, 2021 | | | 0.020 | | | | 594 | |

June 8, 2021 | | June 24, 2021 | | July 8, 2021 | | | 0.020 | | | | 600 | |

March 10, 2021 | | March 15, 2021 | | April 15, 2021 | | | 0.020 | | | | 596 | |

Total 2021 | | | | | | $ | 0.080 | | | $ | 2,384 | |

Share Repurchase Programs

The Company periodically repurchases shares of its common stock under board-authorized repurchase programs through a combination of open market transactions and accelerated share repurchase (“ASR”) arrangements. The Company did not repurchase any of its common stock during the three months ended December 31, 2023.

Pursuant to Amendment Number Six to the Third Amended Loan and Security Agreement, effective November 7, 2023, the Company is currently prevented from making stock repurchases.

Securities Authorized for Issuance under Equity Compensation Plans

| | | | | | | | | | | | |

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants, and rights | | | Weighted average

exercise price of

outstanding options,

warrants, rights | | | Number of securities

remaining available for

future issuance under

equity compensation plans | |

Equity compensation plans approved by security holders | | | 146,679 | | | $ | 11.49 | | | | 1,376,610 | |

Total | | | 146,679 | | | $ | 11.49 | | | | 1,376,610 | |

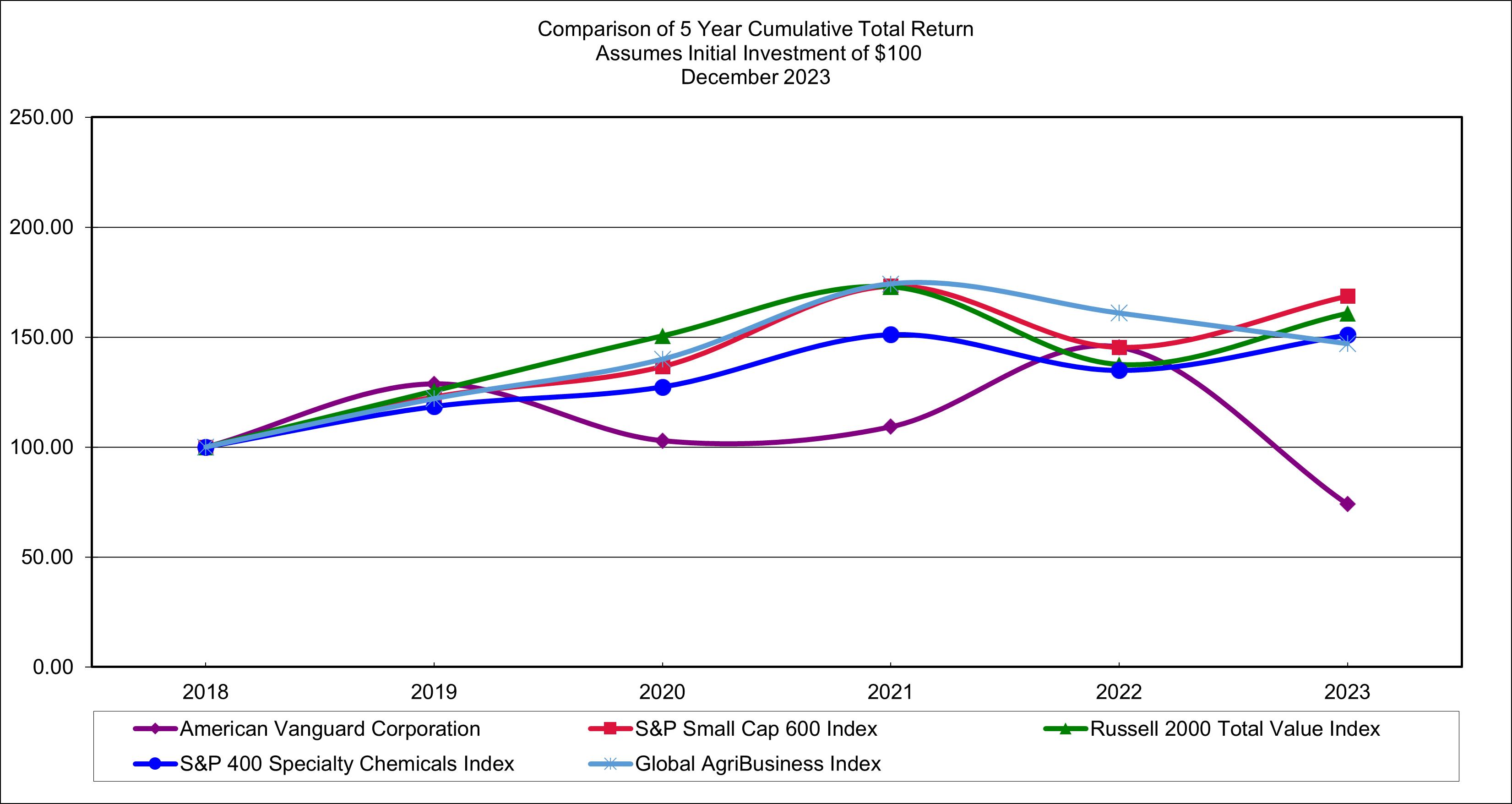

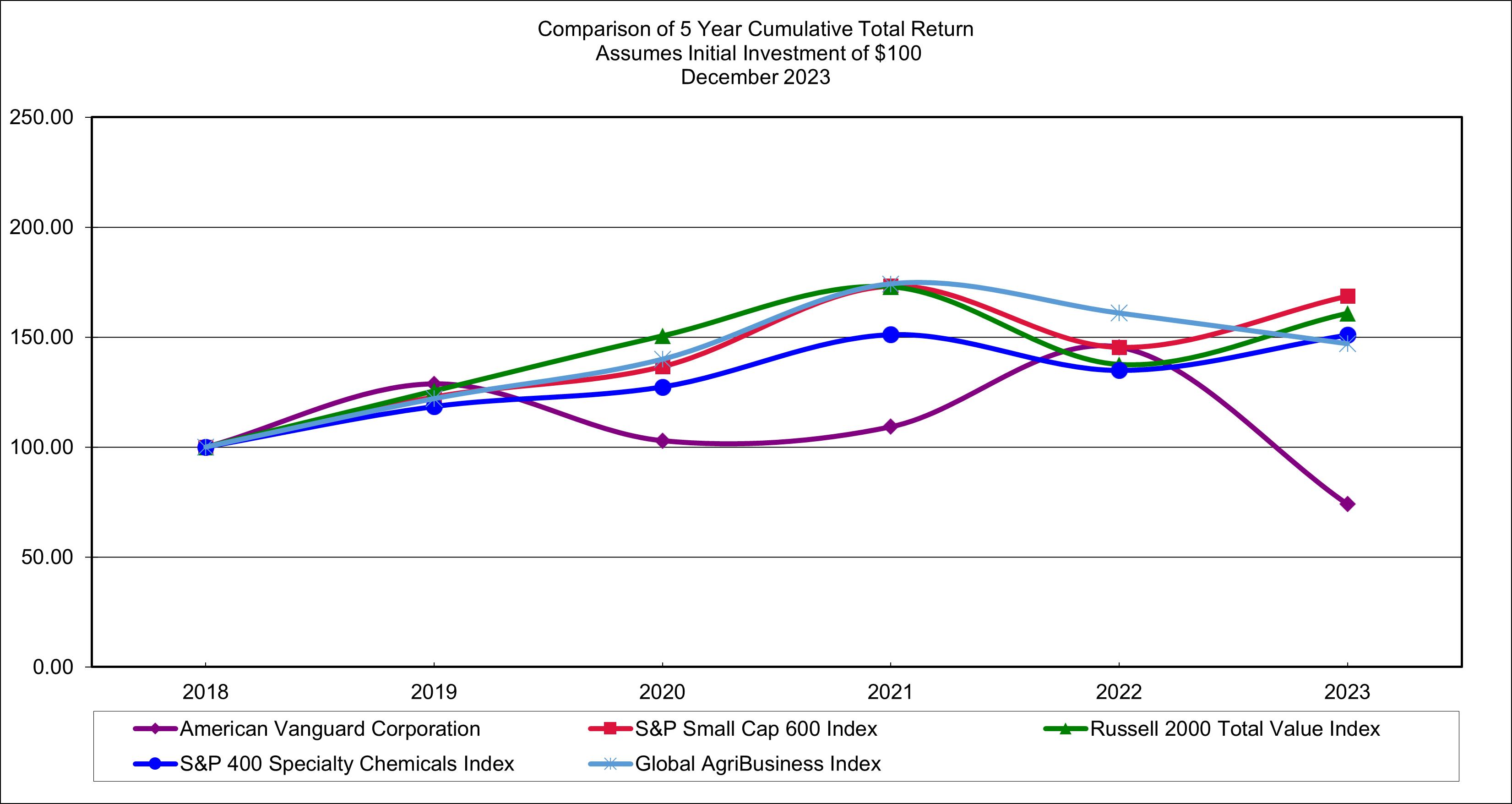

Stock Performance Graph

The following graph presents a comparison of the cumulative, five-year total return for the Company, the Russell 2000 Stock Index, and a peer group (S&P 400 Specialty Chemical Industry). The graph assumes that the beginning values of the investments in the Company, the Russell 2000 Stock Index, and the S&P 400 Specialty Chemical Index (a peer group of companies) each was $100 on December 31, 2018. All calculations assume reinvestment of dividends. Returns over the indicated period should not be considered indicative of future returns.

ITEM 6 RESERVED

Not applicable

ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS/RISK FACTORS:

The Company, from time-to-time, may discuss forward-looking statements including assumptions concerning the Company’s operations, future results and prospects. Generally, “may,” “could,” “will,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue” and similar words identify forward-looking statements. Forward-looking statements appearing in this Report are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on our current expectations and are subject to risks and uncertainties that can cause actual results and events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions contained in the entire Report. Such factors include, but are not limited to: product demand and market acceptance risks; the effect of economic conditions; weather conditions; changes in regulatory policy; the impact of competitive products and pricing; changes in foreign exchange rates; product development and commercialization difficulties; capacity and supply constraints or difficulties; availability of capital resources; general business regulations, including taxes and other risks as detailed from time-to-time in the Company’s reports and filings filed with the U.S. Security and Exchange Commission (“SEC”). It is not possible to foresee or identify all such factors. We urge you to consider these factors carefully in evaluating the forward-looking statements contained in this Report.