UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 001-41503

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania

(State or other jurisdiction of incorporation) | | 23-2507402

(IRS Employer Identification No.) |

| | | |

720 Pennsylvania Drive, Exton, Pennsylvania

(Address of principal executive offices) | | 19341

(Zip Code) |

(610) 646-9800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock par value $.001 per share | | ISSC | | Nasdaq Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer ¨ | | Accelerated filer ¨ |

| | Non-accelerated filer x | | Smaller reporting company x |

| | | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of March 31, 2023 (the last business day of the registrant’s most recently completed second quarter) was approximately $95.2 million (based on the closing sale price of the registrant’s common stock on the Nasdaq Stock Market on such date). Shares of common stock held by each executive officer and director and by each person who owns 10% or more of the registrant’s outstanding common stock have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of January 12, 2024, there were 17,459,983 outstanding shares of the registrant’s common stock.

Documents Incorporated by Reference

See “Explanatory Note” below.

Auditor Name GRANT THORNTON LLP Auditor Firm ID 248 Auditor Location Philadelphia, Pennsylvania

EXPLANATORY NOTE

Innovative Solutions and Support, Inc. is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) to our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 (the “Form 10-K”), which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 12, 2024, to provide the information required by Part III of Form 10-K. This information was previously omitted from the Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in Part III to be incorporated in the Form 10-K by reference from our definitive proxy statement (such definitive proxy statement, when filed, the “Proxy Statement”) if such Proxy Statement is filed no later than 120 days after end of our fiscal year. We are filing this Amendment No. 1 to include Part III information in our Form 10-K because we do not expect to file the Proxy Statement within 120 days after the end of the fiscal year covered by the Form 10-K. This Amendment No. 1 amends and restates in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Form 10-K. In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, currently dated certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are filed hereto as Exhibit 31.3 and Exhibit 31.4, respectively, under Item 15 of Part IV.

No other changes have been made to the Form 10-K other than those described above. This Amendment No. 1 does not reflect subsequent events occurring after the original filing date of the Form 10-K or modify or update in any way the financial statements, consents or any other items or disclosures made in the Form 10-K in any way other than as required to reflect the amendments discussed above. Accordingly, this Amendment No. 1 should be read in conjunction with the Form 10-K and the Company’s other filings with the SEC subsequent to the filing of the Form 10-K.

References in this Amendment No. 1 to the “Company,” “we,” “us,” or “our” refer to Innovative Solutions and Support, Inc. unless the context clearly requires otherwise.

TABLE OF CONTENTS

PART III

Item 10. Directors, executive officers and corporate governance.

BOARD OF DIRECTORS

As of the date of this Amendment No. 1, our directors are as follows:

| | | | | Director | | Current | | |

| Name | | Age | | Since | | Term Expires | | Positions with the Company |

| Shahram Askarpour | | 66 | | 2022 | | 2024 | | Director, Chief Executive Officer |

| Glen R. Bressner | | 63 | | 1999 | | 2024 | | Director, Chairman of the Board |

| Roger A. Carolin | | 68 | | 2016 | | 2024 | | Director |

| Stephen L. Belland | | 66 | | 2022 | | 2024 | | Director |

| Parizad Olver (Parchi) | | 44 | | 2022 | | 2024 | | Director |

Directors

Shahram Askarpour. Dr. Askarpour joined the Company as Vice President of Engineering in 2003, was promoted to President in March 2012, and was appointed as the Company’s Chief Executive Officer, and joined the Company’s Board, in January 2022. Dr. Askarpour has more than 40 years of aerospace industry experience in managerial and technical positions. Prior to joining the Company, he was employed by Smiths Aerospace (a division of Smiths Group plc), Instrumentation Technology, and Marconi Avionics. He holds a number of key patents in the aviation field. Dr. Askarpour received his engineering education in the United Kingdom, and received an undergraduate degree in Electrical Engineering from Middlesex University, a post graduate Certificate of Advanced Study in Systems Engineering, and a PhD in Automatic Control from Brunel University London. He was awarded the title of Associate Research Fellow for three consecutive years by Brunel University and has published numerous papers in leading international, peer reviewed journals. In addition, he has completed management courses at Carnegie Mellon University and finance courses at the Wharton School of the University of Pennsylvania.

Glen R. Bressner. Mr. Bressner is the co-founder and Managing Partner of Activate Venture Partners, an early-stage focused venture capital firm that has evolved from a series of affiliated venture funds that he is a co-founder of, beginning in 1985. Mr. Bressner has been a board director of several companies, including IQE plc (LSE: IQEP), where he was a member of its Audit Committee, and Tabula Rasa Healthcare (NASDAQ: TRHC), where he chaired its Nomination Committee. He is also a shareholder and a director on the board of Alum-a-Lift, Inc., a family-owned manufacturer of precision material handling solutions. From 1996 to 1997, Mr. Bressner served as the chairman of the Board of the Greater Philadelphia Venture Group. Mr. Bressner holds a Bachelor of Science, cum laude, in Business Administration from Boston University and a Masters of Business Administration degree from Babson College.

Roger A. Carolin. Mr. Carolin is currently a Venture Partner at SCP Partners, a position he has held since 2004. Mr. Carolin works to identify attractive investment opportunities and assists portfolio companies in the areas of strategy development, operating management, and intellectual property. Mr. Carolin co-founded CFM Technologies, Inc., a global manufacturer of semiconductor process equipment, and served as its Chief Executive Officer for 10 years, until the company was acquired. Mr. Carolin formerly worked for Honeywell, Inc. and General Electric Co., where he developed test equipment and advanced computer systems for on-board missile applications. Mr. Carolin is also a director of Amkor Technology, Inc. (NASDAQ: AMKR), a supplier of outsourced semiconductor assembly and test services. Mr. Carolin holds a B.S. in Electrical Engineering from Duke University and an M.B.A. from the Harvard Business School.

Stephen L. Belland. Mr. Belland is the Co-Founder and Chief Executive Officer at Integrated Connection, LLC and a Principal at Clear Rock Advisors. Prior to Clear Rock Advisors, he has held various executive positions at Rockwell Collins including Technical Director, Vice President of Program and Product Management, Vice President of Strategy and Marketing and most recently Vice President of Corporate Development. Mr. Belland received his B.S. in Electrical Engineering from Michigan Technological University and has attended executive programs at the Kellogg School of Management, the Wharton School of the University of Pennsylvania, and INSEAD.

Parizad Olver (Parchi). Ms. Olver is currently the Founder and Managing Partner of Panorama Aero, a U.S.-based special mission aerospace lessor and end-to-end logistics provider which she founded in 2018. Ms. Olver previously served on the board of directors of Semper Paratus Acquisition Corporation (NASDAQ: LGST) until June 2023. From 2009-2018, Ms. Olver held numerous leadership positions during her time at Cowen Inc., including President and CEO of Cowen Aviation Finance, Head of International Strategy and Managing Director. Prior to Cowen, Ms. Olver held senior positions at Fortress Investment Group, Ramius Capital Group and Morgan Stanley. She received an M.B.A. from Columbia University, an M.B.A. from London Business School and a B.S. from University of California, Berkeley (Haas School of Business).

Director Qualifications

The Board believes that each of the directors listed above have the sound character, integrity, judgment, and record of achievement necessary to be a member of the Board. In addition, each of the directors have exhibited, during their prior service as directors, the ability to operate cohesively with the other members of the Board, and to challenge and question management in a constructive way. Moreover, the Board believes that each director brings a strong and unique background and skillset to the Board, giving the Board, as a whole, competence and experience in diverse areas, including corporate governance and board service, finance, management, and aviation. Set forth below are certain specific experiences, qualifications, and skills that led to the Board’s conclusion that each of the directors listed above are qualified to serve as a directors.

Dr. Askarpour, as Chief Executive Officer of the Company and a longstanding member of the Company’s management team, provides the Board with a comprehensive knowledge of the Company, its history, and its businesses. In addition, Dr. Askarpour brings the Board his insight into the aerospace industry from over 40 years of experience in managerial and technical positions at aviation companies, including Smiths Aerospace (a division of Smiths Group plc), Instrumentation Technology, and Marconi Avionics.

Mr. Bressner brings the Board a wealth of experience managing financial investments from his service at venture capital firms. Mr. Bressner provides the Board with a thorough understanding of capital markets and other financial issues. Mr. Bressner’s experience in managing investments also provides him with extensive finance and accounting knowledge, and he applies this expertise in his service on the Nominating & Corporate Governance Committee of the Board (the “Nominating and Governance Committee”) (as Chairman) and the Audit Committee. Mr. Bressner is also an audit committee financial expert, as defined by SEC rules and regulations. His prior service as a member of the board of directors of numerous other entities, including public entities, provides him with valuable experience in corporate governance matters.

Mr. Carolin has over a decade of experience in private equity investing, previously worked in advanced computer systems and on-board missile applications, and has a significant understanding the Company’s industry and its business. He possesses specific knowledge and experience in technology, new business opportunities, operations, management, and finance, all of which are relevant and important to the Company’s business, and he capitalizes on these strengths in his service on the Audit Committee of the Board (the “Audit Committee”) (as Chairman), the Investment Committee of the Board (the “Investment Committee”) (as Chairman), and the Compensation Committee of the Board (the “Compensation Committee”).

Mr. Belland has over 37 years of experience in the Aerospace and Defense Industry. Mr. Belland provides the board with familiarity with IS&S product lines and operations. He has also developed numerous successful plans for market strategy, product development, brand management, business optimization, acquisition strategy, as well as team building strategy. Some key successes included developing and capturing over 15 new aircraft cockpit positions, as well as positioning his corporation for becoming a leader in business jet cabin electronics. In addition, Mr. Belland has advised on over 500 M&A transactions and joint ventures, including being published in Corporate Executive Board materials. Mr. Belland applies his experience and expertise to IS&S in his service on the Compensation Committee (as Chairman), the Investment Committee, and the Audit Committee. Mr. Belland is also a private pilot and a member of various industry organizations, such as the National Business Aviation Association.

Ms. Olver brings over two decades of experience in financial markets and investing across special situations and aerospace related assets. She has a background in aviation, as well as experience with special mission operations which will strengthen the Board. Ms. Olver’s expertise is applicable to her service on the Nominating and Governance Committee.

EXECUTIVE OFFICERS

Certain other information relating to the Executive Officers of the Company appears in Item 4A to Part I of the Form 10-K under the heading “Executive Officers of the Registrant” and is incorporated herein by reference.

Set forth below is a table identifying the Company’s current executive officers who are not identified in the tables above. Biographical information for Dr. Askarpour is set forth above.

| Name | | Age | | Position with the Company |

| Shahram Askarpour | 66 | | President and Chief Executive Officer |

| Relland Winand | 69 | | Interim Chief Financial Officer |

Relland Winand. Mr. Winand previously served the Company as Chief Financial Officer from December 2014 until his retirement in July 2022, after serving as the Company’s Controller from September 2014 to December 2014. Previously, Mr. Winand has served in a number of executive financial capacities with public companies, including Chief Financial Officer of ECC International, Corp, a manufacturer of computer controlled maintenance simulators primarily for the Department of Defense and Vice President Finance and Administration of Traffic.com, Inc., a leading provider of accurate, real-time traffic information in the United States. Immediately prior to joining Innovative Solutions and Support, Inc., Mr. Winand was Chief Financial Officer of Orbit/FR, Inc., an international developer and manufacturer of sophisticated microwave test and measurement systems for aerospace/defense, wireless, satellite, and automotive industries, from 2008 to 2013. From January 2014 until September 2014, Mr. Winand served as a consultant for Solomon Edwards Group LLC. He has over 30 years’ experience in financial management and reporting for both public domestic and international manufacturing companies. Mr. Winand received a B.S. in Accounting from Drexel University and an M.B.A. in Finance from Widener University.

RELATIONSHIPS AND ARRANGEMENTS

There is no family relationship between any of Company’s directors or executive officers and, to the best of our knowledge, none of our directors or executive officers has, during the past ten years, been involved in any legal proceedings which are required to be disclosed pursuant to the rules and regulations of the SEC. There are no arrangements between any director or executive officer of the Company and any other person pursuant to which he/she was, or will be, selected as a director or executive officer, respectively.

CORPORATE GOVERNANCE

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our ordinary shares and other equity securities. Specific due dates for these reports have been established, and the Company is required to report any failure to comply therewith during the fiscal year ended September 30, 2023. To our knowledge, based solely on a review of the reports filed electronically with the SEC during the Company’s most recent fiscal year and, where applicable, written representations that no other reports were required, we believe that all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with in a timely manner during September 30, 2023, except that: the Estate of Geoffrey S. M. Hedrick filed one late Form 3 with respect to one transaction, Glen Bressner filed four late Forms 4 with respect to five transactions, Parizad Olver filed one late Form 4 with respect to one transaction, Stephen Belland filed one late Form 4 with respect to one transaction, Roger Carolin filed one late Form 4 with respect to one transaction, and Winston Churchill filed one late Form 4 with respect to three transactions.

Code of Ethics

The Company maintains a Code of Business Conduct and Ethics (the “Code of Ethics”) applicable to its directors, its principal executive officer and principal financial and accounting officer, and persons performing similar functions. In addition, the Code of Ethics applies to all of the Company’s employees, officers, agents, and representatives. The Code of Ethics is posted on the Company’s website, www.innovative-ss.com, under the heading “Investor Relations.” If the Company amends or grants a waiver of one or more of the provisions of our Code of Ethics, we intend to satisfy the requirements under Item 5.05 of Form 8-K regarding the disclosure of amendments to or waivers from provisions of our Code of Ethics that apply to our principal executive officer, principal financial officer and principal accounting officer (or persons performing similar functions) by posting the required information on the Company’s website at www.innovative-ss.com. The information found on the website is not part of this Form 10-K.

Director Nominations

No material changes have been made to the procedures by which stockholders may recommend nominees to our Board of Directors.

Audit Committee

The members of the Audit Committee are currently Mr. Carolin (Chairman), Mr. Bressner, and Mr. Belland. On January 28, 2024, the Board of Directors determined that Ms. Olver did not meet the heightened independence requirements for service on the Audit Committee as required by the rules and regulations of the SEC and, as a result, the listing standards of the Nasdaq Stock Market (“Nasdaq”) applicable to audit committee members. Upon making this determination, the Board of Directors removed Ms. Olver from the Audit Committee and appointed Mr. Belland to take her place. The Audit Committee is composed solely of independent members, as independence for audit committee members is defined by the applicable Nasdaq listing standards. In addition, the Company is required to certify to Nasdaq that the Audit Committee has, and will continue to have, at least one member who has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background that results in the individual’s financial sophistication. The Board has determined, in its business judgment, that each member of the Audit Committee is financially literate, and that Mr. Bressner and Mr. Carolin satisfy Nasdaq’s definition of financial sophistication and each also qualifies as an “audit committee financial expert,” as defined under rules and regulations of the SEC.

On January 29, 2024, the Company notified Nasdaq of the Company’s inadvertent non-compliance with Nasdaq’s audit committee composition requirements set forth in Nasdaq Listing Rule 5605(c)(2), which requires, among other things, an audit committee to consist of at least three members, each of whom is independent. The non-compliance was a result of Parizad Olver Parchi, a member of the Audit Committee at the time, not qualifying as independent pursuant to Nasdaq Listing Rule 5605(c)(2)(A)(ii) and Rule 10A-3(b)(i) under the Securities Exchange Act of 1934, as amended (the “Act”), as a result of a wholly owned subsidiary of the Company having paid a consulting fee of $72,990 in November 2023 to a company in which Ms. Olver is the managing partner and has an ownership interest for services provided in connection with the sale of the Company’s 2008 Super King Air B200GT SN BY-50.

Pursuant to Rule 10A-3(b)(ii)(A) under the Act, a director will not be deemed independent for purposes of service on a company’s audit committee if the director has received any compensatory fee, whether directly or indirectly. To address this matter, effective as of January 28, 2024, the Company removed Ms. Olver from the Audit Committee and appointed Mr. Stephen Belland to take her place.

The notification to Nasdaq was made in accordance with Nasdaq Rule 5625, which requires a company with common securities listed on Nasdaq to report any noncompliance of Nasdaq’s Rule 5600 series.

Stock Ownership Policy

The Company has adopted a Stock Ownership and Retention Policy that applies to its non-employee directors. Each non-employee director is required to own shares of common stock with an aggregate value equal to three times such director’s annual cash base retainer (exclusive of retainers for committee service or leadership roles). Compliance with the minimum share ownership requirement is determined annually as of December 31 each year and commenced December 31, 2023. Individuals who have not yet attained the minimum share ownership requirement must retain 50% of his or her shares acquired upon the (i) vesting of restricted stock or restricted stock units, (ii) if applicable, the exercise of options, reduced by shares retained or tendered to cover taxes or the exercise price of options.

Anti-Hedging and Anti-Pledging Policies

The Company maintains an Insider Trading Policy which prohibits Company employees, directors and related parties from engaging in hedging transactions absent prior approval from the Chief Compliance Officer. The Insider Trading Policy also prohibits Company employees, directors and related parties from purchasing Company securities on margin, holding Company securities in a margin account or pledging Company securities.

Item 11. Executive compensation.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides an overview of the Company’s executive compensation program and a description of the material factors underlying the decisions that resulted in the compensation provided to the Company’s President and Chief Executive Officer and Chief Financial Officer for the fiscal year ended September 30, 2023 (referred to herein as our “named executive officers”). The names of the Company’s 2023 named executive officers, together with their titles during the 2023 fiscal year, are:

| · | Shahram Askarpour—President and Chief Executive Officer |

| · | Michael Linacre—Chief Financial Officer (Former) |

Consistent with the SEC’s rules, compensation information for Mr. Linacre is included even though Mr. Linacre resigned on November 8, 2023 because Mr. Linacre served as a named officer during the 2023 fiscal year.

Objective of the Company’s Executive Compensation Program

The objective of the Company’s executive compensation program is to attract and retain exceptional individuals as executive officers and to provide key executives with motivation to perform to the full extent of their abilities to maximize the performance of the Company and deliver enhanced value to the Company’s shareholders.

What the Company’s Executive Compensation Program is Designed to Reward

Overall, the Company’s executive compensation program is designed to reward the contributions of each individual executive officer, to ensure that each executive officer’s interest is aligned with those of the Company’s shareholders, and to provide sufficient incentives to executive officers to ensure their dedication to the Company. As discussed further below, the Company seeks to achieve these goals by providing sufficient base salaries to compensate executives for the day-to-day performance of their duties and awarding cash bonuses when the executive attains the annual personal or corporate goals and objectives established by the Company. Also, from time to time, the Company grants equity-based awards when it believes that such equity awards will further align the interests of executive officers with those of the Company’s shareholders and provide an additional incentive to executive officers to contribute to the achievement of the Company’s financial and strategic objectives.

GENERAL EXECUTIVE COMPENSATION POLICIES

Process for Setting Total Compensation

Generally, upon hiring or promoting a named executive officer, the Compensation Committee sets the executive’s initial level of base salary and other compensation on the basis of subjective factors, including experience, individual achievements, and level of responsibility assumed at the Company, and may consider market compensation practices from time to time. Actual base salaries, cash bonuses, and equity-based awards for each named executive officer may be adjusted from year to year based upon each named executive officer’s annual review and level of attainment of personal and corporate goals and objectives, including Company financial performance, shareholder return, and such other factors as the Compensation Committee deems appropriate and in the best interests of the Company’s shareholders.

Each named executive officer’s annual review is a subjective process whereby the Chief Executive Officer or the Compensation Committee (as applicable, as described below) evaluates various factors relevant to the named executive officer’s contributions to the Company, such as the executive’s role in the development and execution of strategic plans, leadership skills, motivation, and involvement in industry groups. The weight given to such factors may vary from one named executive officer to another.

The Compensation Committee seeks recommendations from the Chief Executive Officer regarding changes to the overall compensation level or any particular element of compensation for the other named executive officers. In addition, the Chief Executive Officer is principally responsible for reviewing each other named executive officer’s performance, and for making recommendations for the Company’s compensation plan for such executive officer for the following fiscal year. The Compensation Committee reviews the recommendations of the Chief Executive Officer in light of his proximity to the other executives and his knowledge of their contributions to the Company. The Compensation Committee independently reviews the performance of the Company’s Chief Executive Officer.

In 2022 and 2023, the Compensation Committee engaged FW Cook to advise the Compensation Committee with respect to best practices, competitive market data based on comparison companies and trends in the area of executive compensation, as well as ongoing regulatory considerations. The Compensation Committee has determined that FW Cook, which does not perform any work for the Company other than its services for the Compensation Committee, is independent and that its services do not raise any conflict of interest with the Company or any of the Company’s executive officers or directors.

Consideration of Shareholder Advisory Vote on Executive Compensation

Based upon the vote of the Company’s shareholders at the 2023 annual meeting of shareholders, the Company currently provides its shareholders with the opportunity to cast an advisory vote on executive compensation (a “say-on-pay proposal”) once every three (3) years. At the Company’s annual meeting of shareholders held in 2023, over 98% of the votes cast on the say-on-pay proposal at that meeting were voted in favor of the proposal. The Compensation Committee believes that this voting result affirms shareholders’ strong support of the Company’s approach to executive compensation The Compensation Committee will consider the outcome of the 2023 say-on-pay vote when making future compensation decisions for the named executive officers. The next time the Company is scheduled to hold a say-on-pay vote is at the Company’s annual meeting of shareholders to be held in 2026.

Elements of Compensation

The Company’s executive compensation program consists of the following elements of compensation, each described in greater depth below:

| · | Equity-based Compensation; and |

In determining the different elements of compensation to provide to the named executive officers, the Compensation Committee does not adhere to a specific allocation between short-term and long-term compensation, or between cash and non-cash compensation. Instead, the Compensation Committee determines the elements of compensation in a manner designed to reward strong financial performance, provide overall compensation opportunities that are sufficient to attract and retain highly skilled named executive officers, and ensure that named executive officers’ interests are aligned with those of the Company’s shareholders. This may result in the named executive officers receiving all cash compensation in some years (through base salary and annual bonuses) and a combination of cash and equity-based compensation in other years (through base salary, annual bonuses and equity awards).

Base Salary

The Company pays base salaries to named executive officers because the Company believes that base salaries are essential to recruiting and retaining qualified executives. In addition, base salaries create an incentive for named executive officers to make meaningful contributions to the Company’s success because they are subject to increase based on the executive’s performance. The Compensation Committee sets the initial base salary level upon the hire or promotion of a named executive officer. Base salary levels are determined initially based on the named executive officer’s previous experience and employment, and the named executive officer’s expected duties and responsibilities with respect to the Company and considering market data provided by the Company's independent compensation consultant. Thereafter, the Compensation Committee may increase a named executive officer’s base salary each year based on the results of the named executive officer’s annual review (which is conducted by the Chief Executive Officer for each of the other named executive officers and by the Compensation Committee for the Chief Executive Officer), and based on the Compensation Committee’s subjective assessment of the Company’s overall performance during the preceding year.

Annual Bonus

The Compensation Committee retains discretion to grant bonus compensation to the named executive officers and other employees of the Company. From time to time, the Company may award discretionary annual bonuses to the named executive officers and may agree, in hiring or promoting a named executive officer, to a target bonus opportunity, expressed as a percentage of base salary, in any case, to be paid only if the Company determines that the Company has attained its financial performance goals or other objectives.

The named executive officers’ 2023 target annual bonus opportunities were as follows:

| Named Executive Officer | | Annual Bonus Opportunity as a

% of Base Salary | |

| Shahram Askarpour | | | 75 | % |

| Michael Linacre | | | 40 | % |

66% of the potential annual incentive opportunity was based on the achievement of financial performance targets and the remaining portion of the annual incentive was based on a qualitative assessment of performance. In 2023, the Company chose Revenue and Operating Income as its financial performance metrics. In the case of Dr. Askarpour, the qualitative assessment took into account organic growth, progress on mergers and acquisitions, progress on autonomous flight initiatives, increased strategic partnerships and investor relations activities. In the case of Mr. Linacre, the qualitative assessment considered investor relations activities, quality of financial accounting, mergers and acquisitions support, and progress toward additional financing.

| Performance Measures | | Target 100% | | | Maximum 150% | | | Weight (%) | |

| Revenue ($) | | $ | 27,748,000 | | | $ | 41,622,000 | | | | 33 | % |

| Operating Income ($) | | $ | 4,353,193 | | | $ | 6,529,789 | | | | 33 | % |

| Qualitative | | | -- | | | | -- | | | | 33 | % |

In 2023, the Company achieved $29,361,916 in adjusted revenue and $6,964,804 in adjusted operating income, and the Compensation Committee determined that each of Dr. Askarpour and Mr. Linacre achieved their qualitative goals at 100%. As a result, the Compensation Committee approved annual incentive bonuses of $355,816 and $118,605 for Dr. Askarpour and Mr. Linacre, respectively.

The 2023 annual cash incentives were paid to Dr. Askarpour on November 12, 2023 and to Mr. Linacre on December 12, 2023. The payments are listed as 2023 compensation in the Summary Compensation Table in the column labeled “Non-Equity Incentive Plan Compensation.”

Equity-based Compensation

The Company awards equity-based compensation to named executive officers in order to provide a link between the long-term results achieved for its shareholders and the rewards provided to named executive officers, thereby ensuring that such officers have a continuing stake in the Company’s long-term success (see the section titled “Equity Compensation Plan Information” below). Such awards are made at the discretion of the Compensation Committee and are not timed or coordinated with the release of material, non-public information.

In 2023, we granted 200,000 option shares and 100,000 RSUs to Dr. Askarpour and 12,210 option shares to Mr. Linacre as part of the annual equity grant. 50% of Dr. Askarpour’s option shares vested immediately upon the date of grant, and the remaining shares vest on a quarterly basis such that the entire award will be fully vested one year from the date of grant. 25% of Dr. Askarpour’s RSUs vested immediately upon the date of grant, and the remaining RSUs vest on a quarterly basis such that the entire award will be fully vested on the third anniversary of the date of grant. Mr. Linacre’s option shares were scheduled to vest in equal quarterly installments such that they would be fully vested on the fourth anniversary of the date of grant.

To reward Mr. Linacre for his performance during his first year of employment and incentivize him to continue his performance, the Compensation Committee approved an additional award of 6,082 restricted stock units and 12,164 option shares for Mr. Linacre on August 21, 2023. Both the restricted stock units and option shares were scheduled to vest annually at a rate of 25% on each anniversary of the date of grant commencing with the first anniversary, subject to his continued employment on the applicable vesting date. Upon Mr. Linacre’s resignation effective November 8, 2023, all of his unvested option shares and restricted stock units were forfeited.

General Benefits

The following are standard benefits offered to all eligible Company employees, including the named executive officers.

Retirement Benefits. The Company maintains a tax-qualified 401(k) savings plan for all eligible employees, including the named executive officers, known as the Innovative Solutions and Support 401(k) Plan (the “Savings Plan”). The Savings Plan is a voluntary contributory plan under which employees may elect to defer compensation for federal income tax purposes under Section 401(k) of the Code. The Company makes a matching contribution to the Savings Plan at one half of each participant’s deferral rate, limited to a maximum contribution of 4% of base salary and subject to limitations imposed by the Internal Revenue Code.

Medical, Dental, Life Insurance, and Disability Coverage. The Company makes available medical, dental, life insurance, and disability coverage to all active eligible employees, including the named executive officers.

Other Paid Time-Off Benefits. The Company provides vacation and other paid holidays to all employees, including the named executive officers.

EMPLOYMENT AGREEMENTS

It is the Company’s general philosophy that all of the Company’s employees should be “at will” employees, thereby allowing both the Company and the employee to terminate the employment relationship at any time and without restriction or financial obligation.

However, in certain cases, the Company has determined that, as a retention device and a means to obtain non-compete arrangements, employment agreements or other contractual agreements are appropriate.

The Company entered into an amended and restated employment agreement with Dr. Askarpour on April 14, 2022 in connection with his appointment as Chief Executive Officer of the Company on January 14, 2022. The initial term of the employment agreement began on April 14, 2022 and will end on April 13, 2024. Pursuant to the terms of the agreement, the term extends for one additional year each subsequent April 14, unless either party provides written notice to the other party at least 30 days prior to the expiration of the then-current term that the term will not be renewed. The agreement provides for a base salary of $400,000 per year, which the Company determined to be appropriate given Dr. Askarpour’s increased duties and responsibilities as Chief Executive Officer. If Dr. Askarpour’s employment is terminated by the Company without “cause” or by Dr. Askarpour for “good reason,” then, subject to Dr. Askarpour’s execution and non-revocation of a release of claims in favor of the Company, the Company will continue to pay Dr. Askarpour his base salary at the rate then in effect for a period of twelve (12) months following his termination date, during which period the Company will also pay Dr. Askarpour’s COBRA premiums. The employment agreement contains covenants restricting Dr. Askarpour’s ability to compete with the Company or solicit its employees, other service providers, or current, former, or prospective customers for twelve (12) months after the cessation of Dr. Askarpour’s employment. The employment agreement also contains standard confidentiality, assignment of invention, and non-disparagement provisions.

The Company entered into an offer letter agreement with Mr. Linacre on June 1, 2022 in connection with his hiring as the Chief Financial Officer of the Company. The offer letter provided for a base salary of $230,000 per year, an annual target bonus amount equal to 30% of his base salary, a grant of restricted common stock of the Company (as described in the section titled “Equity-based Compensation” above) and certain relocation benefits. If Mr. Linacre’s employment had been terminated by the Company without “cause,” then, subject to Mr. Linacre’s execution and non-revocation of a release of claims in favor of the Company, the Company would continue to pay Mr. Linacre his base salary at the rate then in effect for a period of six (6) months following his termination date in addition to a pro-rata bonus for the year of termination based on the actual bonus he would have been paid absent such termination. The offer letter contained covenants restricting Mr. Linacre’s ability to compete with the Company or solicit its employees, other service providers, or current, former, or prospective customers for twelve (12) months after the cessation of Mr. Linacre’s employment. The offer letter also contained standard confidentiality, assignment of invention, and non-disparagement provisions.

As previously disclosed, Mr. Linacre resigned from his position as Chief Financial Officer effective November 8, 2023.

Change in Control Benefits

The Compensation Committee has the authority to accelerate the vesting of Company equity awards granted to named executive officers under the Company’s 2019 Stock-Based Incentive Compensation Plan (the “2019 Plan”) upon a change in control of the Company (except for certain transactions that are expressly carved out under the 2019 Plan). The Company believes that such accelerated vesting is essential to maintaining the commitment and dedication of its key employees throughout a potential change in control of the Company. Unless otherwise determined by the Compensation Committee or provided in an award agreement, “change in control” is generally defined for these purposes as:

| · | the acquisition in one or more transactions during any 12-month period by any “person” (as such term is used for purposes of section 13(d) or section 14(d) of the Exchange Act) but excluding, for this purpose, the Company or its subsidiaries or any employee benefit plan of the Company or its subsidiaries, of “beneficial ownership” (within the meaning of Rule 13d-3 under the Exchange Act) of thirty percent (30%) or more of the combined voting power of the Company’s then outstanding voting securities; |

| · | a change in the composition of the Board during any 12-month period such that the individuals who at the beginning of such period constituted the Board cease to constitute a majority of the Board; |

| · | the consummation of a merger or consolidation involving the Company, if the shareholders of the Company, immediately before such merger or consolidation, do not own, directly or indirectly, immediately following such merger or consolidation, more than seventy percent (70%) of the combined voting power of the outstanding voting securities of the corporation resulting from such merger or consolidation; or |

| · | a complete liquidation or dissolution of the Company or a sale or other disposition of all or substantially all of the assets of the Company. |

Under Dr. Askarpour’s amended and restated employment agreement, in the event of a “change in control,” if a successor to the Company fails or refuses to either materially assume the Company’s obligations under Dr. Askarpour’s employment agreement or enter into a new employment agreement with Dr. Askarpour on terms that are materially similar to those provided under his employment agreement, then Dr. Askarpour may terminate his employment with “good reason” and, subject to his execution and non-revocation of a release of claims in favor of the Company, the Company will continue to pay Dr. Askarpour his base salary at the rate then in effect for a period of twelve (12) months following his termination date, during which period the Company will also pay Dr. Askarpour’s COBRA premiums. For purposes of Dr. Askarpour’s employment agreement, “change in control” is generally defined for these purposes as:

| · | a “person” (as such term is used for purposes of section 13(d) or section 14(d) of the Exchange Act) but excluding, for this purpose, any employee benefit plan of the Company or its subsidiaries, is or becomes a “beneficial owner” (within the meaning of Rule 13d-3 under the Exchange Act) of forty percent (40%) or more of the combined voting power of the Company’s then outstanding voting securities; |

| · | a change in the composition of the Board during any 2-year period such that the individuals who at the beginning of such period constituted the Board cease to constitute a majority of the Board; |

| · | the consummation of a merger or consolidation involving the Company, if the shareholders of the Company, immediately before such merger or consolidation, do not own, directly or indirectly, immediately following such merger or consolidation, at least seventy-five percent (75%) of the combined voting power of the outstanding voting securities of the corporation resulting from such merger or consolidation; or |

| · | a complete liquidation or dissolution of the Company or a sale or other disposition of all or substantially all of the assets of the Company. |

Stock Ownership/Retention Requirements

The Company has adopted a Stock Ownership and Retention Policy that applies to its Section 16 officers. We believe that the Stock Ownership and Retention Policy aligns the interests of our management team, directors and shareholders.

The ownership requirement for our CEO and our executive officers is calculated as a multiple of base salary, as noted below:

| Position | | Minimum Ownership of Common Stock (as multiple of base salary) |

| CEO | | 3x |

| Other Section 16 Officers | | 1x |

Compliance with the minimum share ownership requirement is determined annually as of December 31 each year and commenced December 31, 2023. Individuals who have not yet attained the minimum share ownership requirement must retain 50% of his or her shares acquired upon the (i) vesting of restricted stock or restricted stock units, (ii) if applicable, the exercise of options, reduced by shares retained or tendered to cover taxes or the exercise price of options.

Qualifying shares that count toward the ownership requirement include:

| · | Shares owned outright (including shares held through an IRA, 401(k) account, spouse or dependent children, or shares held in trust for the benefit of the owner, his or her spouse, or his or her dependent children); |

| · | Shares underlying equity awards that are deferred shares; |

| · | Shares underlying vested options. |

Tax and Accounting Considerations

The Company considers tax and accounting implications in determining all elements of its executive compensation program. Section 162(m) of the Code generally denies a federal income tax deduction for compensation exceeding $1,000,000 paid in a taxable year to the Chief Executive Officer, the Chief Financial Officer or any of the three highest compensated officers (other than the Chief Executive Officer and Chief Financial Officer). The Compensation Committee considers the impact of this deductibility limitation on the compensation that it intends to award, and may pay compensation that is not deductible if it determines that doing so is in the best interest of the Company and consistent with the Company’s executive compensation program.

The Compensation Committee considers the impact of various forms of compensation on the Company’s financial results. In particular, the Compensation Committee considers the potential impact on current and future financial results of all equity compensation that it approves.

SUMMARY COMPENSATION TABLE

This Summary Compensation Table provides information on the total compensation earned by each named executive officer for fiscal years ended September 30, 2023, 2022 and 2021.

| | | | | | Salary | | | Bonus | | | Non-Equity Incentive Plan Compensation | | | Option Awards | | | Stock Awards | | | All Other Compensation | | | Total | |

| Name and Principal Position | | Year | | | | $ | | | | $ | | | | $ | | | | $(2) | | | | $(2) | | | | $(1) | | | | $ | |

| Shahram Askarpour | | 2023 | | | | 400,000 | | | | - | | | | 355,816 | | | | 852,000 | | | | 819,000 | | | | 12,592 | | | | 2,439,408 | |

| Chief Executive Officer | | 2022 | | | | 369,616 | | | | 300,000 | | | | - | | | | - | | | | - | | | | 6,585 | | | | 676,201 | |

| | | 2021 | | | | 300,000 | | | | - | | | | - | | | | - | | | | - | | | | 5,700 | | | | 305,700 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael Linacre | | 2023 | | | | 233,770 | | | | - | | | | 118,605 | | | | 111,264 | | | | 49,994 | | | | 162,491 | | | | 676,124 | |

| Former Chief Financial Officer | | 2022 | | | | 53,077 | | | | 25,000 | | | | - | | | | - | | | | 49,997 | (3) | | | - | | | | 128,074 | |

| 1. | The amounts set forth in this column represent (i) for Dr. Askarpour, contributions to the his Savings Plan account for the applicable fiscal year, and (ii) for Mr. Linacre, $154,761 in relocation benefits and $7,730 in contributions to his Savings Plan account for the applicable fiscal year. |

| 2. | These amounts represent the aggregate grant date fair value determined in accordance with the valuation guidelines of ASC Topic 718 “Stock Compensation” with respect to the options granted to the named executive officers in the applicable year. See also Note 3, under the heading “Share-Based Compensation,” in the Company’s audited financial statements as filed in the Annual Report. The values do not correspond to the actual value that will be recognized by the named executive officers at the time such awards vest. |

| 3. | This award was inadvertently excluded from the Company’s 2022 proxy statement; however, the details of the award have been previously disclosed on Form 4. |

GRANTS OF PLAN-BASED AWARDS

The following table sets forth information about non-equity and equity awards granted to the named executive officers in the fiscal year ended September 30, 2023.

| | | | Estimated Future Payouts under

Non-Equity Incentive Plan Awards | | | All other

stock awards: | | | All other option

awards: | | | Exercise | | Grant date

fair value of |

| Name | | Grant Date | | Threshold

($) | | | Target

($) | | | Maximum

($) | | | Number of

shares of

stock or units (#) | | | Number of

securities

underlying

options (#) | | | price of

option

awards

($/Sh) | | stock and

option

awards ($)

(1) |

| | | | | | | | | | | | | | | | | | | | | | |

| Shahram Askarpour | | | | - | | | | 300,000 | | | | 450,000 | | | | | | | | | | | | | |

| | | 1/11/2023 | | | | | | | | | | | | | | 100,000 | | | | | | | | | 819,000 |

| | | 1/11/2023 | | | | | | | | | | | | | | | | | | 200,000 | | | 8.19 | | 852,000 |

| Michael Linacre | | | | - | | | | 100,000 | | | | 150,000 | | | | | | | | | |

| | | 1/11/2023 | | | | | | | | | | | | | | | | | | 12,210 | | | 8.19 | | 54,945 |

| | | 8/21/2023 | | | | | | | | | | | | | | | | | | 12,164 | | | 8.22 | | 56,319 |

| | | 8/21/2023 | | | | | | | | | | | | | | 6,082 | | | | | | | | | 49,994 |

| 1. | The amounts included in this column are the dollar amounts representing the grant date fair value of each restricted stock unit or option share, as applicable, calculated in accordance with FASB ASC Topic 817, and do not represent the actual value that may be recognized by the named executive officers upon vesting of restricted stock units or options. |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table provides outstanding equity awards for the named executive officers as of the end of fiscal year 2023:

| | | Option Awards | | | Stock Awards | |

| Name | | Number of securities

underlying unexercised options

(#) exercisable | | | Number of

securities

underlying

unexercised

options (#)

unexercisable | | | Option

exercise

price ($) | | | Option

expiration date | | | Number of shares or units of

stock that have not vested (#) | | | Market value of

shares or units

of stock that

have not vested ($) | |

| Shahram Askarpour | | | 150,000 | (1) | | | 50,000 | | | | 8.19 | | | | 1/11/2033 | | | | 62,500 | (2) | | | 475,000 | |

| Michael Linacre | | | - | | | | 12,210 | (3) | | | 8.19 | | | | 1/11/2033 | | | | 6,082 | (4) | | | 46,223 | |

| | | | - | | | | 12,164 | (4) | | | 8.22 | | | | 8/21/2033 | | | | 5,915 | (5) | | | 44,954 | |

| 1. | The award becomes vested according to the following schedule: 50% at the date of grant, and the remaining 50% on a quarterly basis, becoming fully vested on the first anniversary of the date of grant. |

| 2. | The award becomes vested according to the following schedule: 25% at the date of grant, and the remaining 75% on a quarterly basis, becoming fully vested on the third anniversary of the date of grant. |

| 3. | The award becomes vested according to the following schedule: 1/16th on each anniversary of the date of grant, becoming fully vested on the fourth anniversary of the date of grant. |

| 4. | The award becomes vested according to the following schedule: 25% on each anniversary of the date of grant, becoming fully vested on the fourth anniversary of the date of grant. |

| 5. | The award becomes vested according to the following schedule: 25% on the first anniversary of the date of grant, and the remaining 75% on a quarterly basis, becoming fully vested on the fourth anniversary of the date of grant. |

OPTION EXERCISES AND STOCK VESTED

The following table provides information on the value of stock options that were exercised and stock awards that vested during the fiscal year ended

September 30, 2023 for each of our named executive officers:

| | | Option Awards | | | Stock Awards | |

| | | | | | Value | | | Number of | | | Value | |

| | | Number of | | | Realized on | | | Shares | | | Realized on | |

| | | Shares Acquired | | | Exercise | | | Acquired on | | | Vesting | |

| Name | | on Exercise | | | $ | | | Vesting | | | ($) | |

| Shahram Askarpour | | | - | | | | - | | | | 37,500 | | | | 297,000 | |

| Michael Linacre | | | - | | | | - | | | | 1,972 | | | | 15,184 | |

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

Dr. Askarpour’s amended and restated employment agreement provides that if his employment is terminated by the Company without “cause” or by Dr. Askarpour for “good reason,” then, subject to his execution and non-revocation of a release of claims in favor of the Company, the Company will continue to pay Dr. Askarpour his base salary at the rate then in effect for a period of twelve (12) months following his termination date, during which period the Company will also pay Dr. Askarpour’s COBRA premiums. If Dr. Askarpour’s employment were terminated by the Company without “cause” or for “good reason” on September 30, 2023, the total amounts payable to Dr. Askarpour would be $429,126. For purposes of Dr. Askarpour’s employment agreement, “cause” generally means (a) the commission by or conviction of Dr. Askarpour, or plea of guilty or nolo contendere to, a felony or any crime involving dishonesty, disloyalty, or moral turpitude; (b) Dr. Askarpour’s willful misconduct or willful failure substantially to perform the duties of his position or his willful refusal to comply with the lawful directives of the Board; (c) a breach by Dr. Askarpour of his employment agreement or any written policies of the Company applicable to Dr. Askarpour; (d) any act or omission by Dr. Askarpour constituting dishonesty, fraud or embezzlement, or an intentional violation of Dr. Askarpour’s duty of loyalty to the Company under law; (e) Dr. Askarpour’s gross negligence in the performance of his duties; or (f) Dr. Askarpour’s poor job performance or other improper conduct not otherwise described above, except that cause shall not exist based solely on clauses (e) or (f), unless the Company has given Dr. Askarpour written notice of its intent to terminate his employment for cause, and allowed Dr. Askarpour thirty (30) days to cure such alleged poor job performance or other improper conduct. For purposes of Dr. Askarpour’s employment agreement, “good reason” generally means (a) a material reduction of Dr. Askarpour’s duties, responsibilities or authority; (b) a reduction of Dr. Askarpour’s base salary; (c) failure or refusal of a successor to the Company to either materially assume the Company’s obligations under Dr. Askarpour’s employment agreement or enter into a new employment agreement with Dr. Askarpour on terms that are materially similar to those provided under his employment agreement, in any case, in the event of a “change in control”; (d) a relocation of Dr. Askarpour’s primary work location that results in an increase in his one-way commute by more than twenty-five (25) miles; or (e) a material breach of Dr. Askarpour’s employment agreement by the Company. See the section titled “Compensation Discussion and Analysis” for additional information.

Mr. Linacre’s offer letter provided that if his employment is terminated by the Company without “cause,” then, subject to his execution and non-revocation of a release of claims in favor of the Company, the Company would continue to pay Mr. Linacre his base salary at the rate then in effect for a period of six (6) months following his termination date in addition to a pro-rata bonus for the year of termination based on the actual bonus he would have been paid absent such termination. If Mr. Linacre’s employment were terminated by the Company without “cause” on September 30, 2023, the total amounts payable to Mr. Linacre would have been $235,490. For purposes of Mr. Linacre’s offer letter, “cause” generally means (a) the indictment or conviction of Mr. Linacre, or plea of guilty or nolo contendere to, a felony or any crime involving moral turpitude or dishonesty; (b) Mr. Linacre’s intentional action or an act of fraud, dishonesty or theft affecting the property, reputation, or business of the Company or its affiliates; (c) Mr. Linacre’s willful and persistent neglect of his duties and responsibilities; (d) Mr. Linacre’s failure or refusal to carry out the lawful directives of the Board; (e) Mr. Linacre’s diverting any business opportunity of the Company or its affiliates for his own personal gain; (f) Mr. Linacre’s omission of or misrepresentation of a significant fact on his employment application or resume; or (g) Mr. Linacre’s misuse of alcohol or drugs affecting his work performance. See the section titled “Compensation Discussion and Analysis” for additional information.

As previously disclosed, Mr. Linacre resigned from his position as Chief Financial Officer effective November 8, 2023. He did not receive any payments in connection with his termination of employment.

The Company’s Compensation Committee has the authority to accelerate the vesting of Company stock options granted to named executive officers under the 2019 Plan upon a change in control of the Company. See the section titled “Compensation Discussion and Analysis” for additional information.

PAY VERSUS PERFORMANCE

In accordance with rules adopted by the Securities and Exchange Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive compensation and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the fiscal years shown.

| PAY VERSUS PERFORMANCE | |

| Year | | | Summary

Compensation

Table Total for

PEO(1) | | | Compensation

Actually Paid to

PEO(1),(2),(3) | | | Average Summary

Compensation Table

Total for Non-PEO

NEOs(1) | | | Average

Compensation

Actually Paid to

Non-PEO

NEOs(1),(2),(3) | | | Value of Initial

Fixed $100

Investment

Based on TSR(4) | | | Net

Income

($MM) | |

| 2023 | | | $ | 2,439,408 | | | $ | 2,394,368 | | | $ | 676,259 | | | $ | 661,666 | | | $ | 124.64 | | | $ | 6.02 | |

| 2022 | | | $ | 676,201 | | | $ | 676,201 | | | $ | 188,028 | | | $ | 206,087 | | | $ | 122.93 | | | $ | 5.52 | |

| 1. | The Principal Executive Officer (“PEO”) in 2022 and 2023 is Shahram Askarpour. The Non-PEO NEOs for whom the average compensation is presented in this table for 2022 are Michael Linacre, Geoffrey S.M. Hedrick and Relland Winand, and for 2023 is Michael Linacre. |

| 2. | The amounts shown as Compensation Actually Paid have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually realized or received by the Company’s NEOs. These amounts reflect total compensation as set forth in the Summary Compensation Table for each year, adjusted as described in footnote 3 below. |

| 3. | Compensation Actually Paid reflects the exclusions and inclusions for the PEO and NEOs set forth below. Amounts excluded, which are set forth in the Exclusion of Stock Awards columns below, represent the Stock Awards amounts from the applicable Summary Compensation Table. Amounts included in the Inclusion of Equity Values column below are the aggregate of the following components, as applicable: the fair value as of the end of the fiscal year of unvested equity awards granted in that year; the change in fair value during the year of equity awards granted in prior years that remained outstanding and unvested at the end of the year; and the change in fair value during the year through the vesting date of equity awards granted in prior years that vested during that year, less the fair value at the end of the prior year of awards granted prior to the year that failed to meet applicable vesting conditions during the year. Equity values are calculated in accordance with FASB ASC Topic 718. |

| 4. | Dollar values assume $100 was invested in the Company for the cumulative period from September 30, 2021 to September 30, 2023, and reinvestment of the pre-tax value of dividends paid. Historical stock performance is not necessarily indicative of future stock performance. |

ADJUSTMENTS MADE TO DETERMINE COMPENSATION ACTUALLY PAID

| | | | | | 2023 | | | 2022 | |

| Summary Compensation Table Total | | PEO | | | $ | 2,439,408 | | | $ | 676,201 | |

| | | Average Non-PEO NEOs | | | $ | 676,259 | | | $ | 188,028 | |

| Deduction for amounts reported under the “Stock Awards” and “Option Awards” columns in the Summary Compensation Table | | PEO | | | $ | 1,671,000 | | | | -- | |

| | | Average Non-PEO NEOs | | | $ | 161,258 | | | $ | 49,997 | |

| Fair value as of the end of the covered year of awards granted during year that remain unvested as of year-end | | PEO | | | $ | 689,560 | | | | -- | |

| | | Average Non-PEO NEOs | | | $ | 154,923 | | | $ | 68,056 | |

| Increase/Deduction for change in fair value from prior year-end to current year-end of awards granted prior to that year that were outstanding and unvested as of year-end | | PEO | | | | -- | | | | -- | |

| | | Average Non-PEO NEOs | | | $ | (6,092 | ) | | | -- | |

| Increase for fair value as of the vesting dates for awards granted during year that vest during the year | | PEO | | | $ | 936,400 | | | | -- | |

| | | Average Non-PEO NEOs | | | $ | -- | | | | -- | |

| Increase/Deduction for change in fair value from prior year-end to vesting date of awards granted prior to that year that vested during year | | PEO | | | | -- | | | | -- | |

| | | Average Non-PEO NEOs | | | $ | (2,030 | ) | | | -- | |

| Deduction for fair value of awards granted prior to year that were forfeited during year | | PEO | | | | -- | | | | -- | |

| | | Average Non-PEO NEOs | | | | -- | | | | -- | |

| Compensation Actually Paid | | PEO | | | $ | 2,394,368 | | | $ | 676,201 | |

| | | Average Non-PEO NEOs | | | $ | 661,666 | | | $ | 206,087 | |

Description of Relationship Between NEO Compensation Actually Paid and Total Shareholder Return (“TSR”)

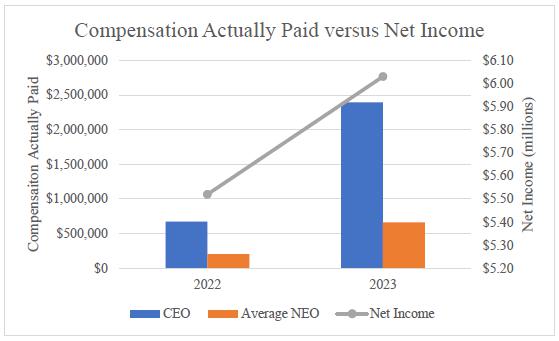

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our other NEOs, and the Company’s cumulative TSR over the fiscal two-year period from 2022 through 2023.

Description of Relationship Between NEO Compensation Actually Paid and Net Income

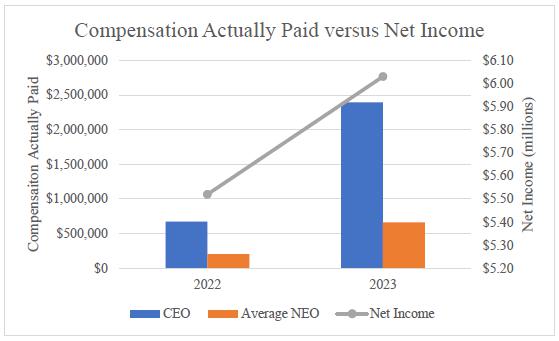

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our other NEOs, and our net income during fiscal 2022 through 2023.

DIRECTOR COMPENSATION

Compensation of Directors

The Company’s compensation program for non-employee directors for 2023 consisted of three elements of compensation: meeting fees, restricted stock or restricted stock unit awards, and an annual retainer. All cash fees were paid quarterly in arrears. Each non-employee director was entitled to a fee of $1,500 for each Board meeting attended and $1,500 for each committee meeting that is not held on the same day as a Board meeting. The Chairman of the Board received $35,000 per year in addition to the meeting fees and restricted stock or restricted stock awards. Mr. Bressner served as Chairman of the Audit Committee until June 2023 and received $3,000 per quarter. Mr. Carolin became Chairman of the Audit Committee in June 2023 and received $3,000 per quarter in addition to the meeting fees and restricted stock or restricted stock unit awards. The Chairman of the Compensation Committee received $5,000 per year in addition to the meeting fees and restricted stock or restricted stock unit awards. Each non-employee director, including the Chairman of the Board, was also paid an annual retainer of $25,000.

The Company also makes annual awards of restricted stock or restricted stock units, with each such unit representing a contingent right to receive one share of common stock upon vesting, to non-employee directors under the 2019 Plan. The target value of such annual awards was $50,000 for each non-employee director for 2023. The number of shares underlying such annual awards are calculated based upon the price of the Company’s common stock at the close of business on the date of the Company’s annual meeting and such shares vest on the first anniversary of the date of grant. A director who resigns during the course of the year will vest in and receive a pro rata portion of the shares that he or she otherwise would have vested (in the case of restricted stock) or received (in the case of restricted stock units) had no such resignation occurred, based on the number of days served during the applicable calendar year.

With respect to the fiscal year ended September 30, 2023, the Company’s common stock closed at a price of $8.10 per share on January 3, 2023. Because the Company transitioned from a calendar year grant period to a one-year grant period beginning at each annual meeting, each non-employee director received (i) a grant of 1,742 restricted stock units on January 3, 2023 vesting 100 days following the date of grant, and (ii) a grant of 6,868 restricted stock units on April 13, 2023 vesting one year following the date of grant.

In addition, all directors are reimbursed for reasonable travel and lodging expenses actually incurred in connection with required attendance at Board and committee meetings.

Director Compensation Table

The following table provides information on the total compensation earned by each non-employee director of the Company for the fiscal year ended September 30, 2023:

| | | | | | | | | | | | | | | Change in | | | | | | | |

| | | | | | | | | | | | | | | Pension Value | | | | | | | |

| | | | | | | | | | | | | | | and | | | | | | | |

| | | Fees Earned | | | | | | | | | Non-Equity | | | Non-qualified | | | | | | | |

| | | or Paid in | | | Stock | | | Option | | | Incentive Plan | | | Deferred | | | All Other | | | | |

| | | Cash | | | Awards | | | Awards | | | Compensation | | | Compensation | | | Compensation | | | Total | |

| Name | | $ (1) | | | $ (2) | | | $ | | | $ | | | Earnings | | | $ | | | $ | |

| Glen R. Bressner | | | 82,241 | | | | 64,109 | | | - | | | - | | | - | | | - | | | 146,350 | |

| Winston J. Churchill(3) | | | 43,250 | | | | 14,110 | | | - | | | - | | | - | | | - | | | 57,360 | |

| Roger A. Carolin | | | 73,750 | | | | 64,109 | | | - | | | - | | | - | | | | | | 137,859 | |

| Stephen L. Belland | | | 53,667 | | | | 64,109 | | | | | | - | | | - | | | - | | | 117,776 | |

| Parizad Olver (Parchi) | | | 47,500 | | | | 64,109 | | | | | | - | | | - | | | - | | | 111,609 | |

1. The amounts reported in this column include fees paid for attendance of Board and Board committee meetings and annual retainer for each non-employee director for the year ended September 30, 2023.

2. The amounts reported in this column represent the grant date fair value, computed based on the compensation cost recognized for financial reporting purposes by the Company in accordance with the valuation guidelines of Accounting Standards Codification (“ASC”) 505-50, “Equity-Based Payments to Non-Employees” and ASC 718 “Compensation—Stock Compensation” with respect to the stock awards granted to each non-employee director during the fiscal year ended September 30, 2023. See also Note 3, under the heading “Share-Based Compensation,” to the Company’s audited financial statements as filed in the Annual Report, which sets forth the material assumptions used in determining the compensation cost to the Company with respect to such awards. In addition, as of the close of the fiscal year ended September 30, 2023, none of the non-employee directors held outstanding options to purchase stock of the Company.

3. Mr. Churchill was a member of the Board until April 13, 2023.

Item 12. Security ownership of certain beneficial owners and management and related stockholder matters.

SECURITY OWNERSHIP OF PRINCIPAL SHAREHOLDERS

The following table sets forth certain information with respect to the beneficial ownership, as of January 12, 2024, of each person whom the Company knew to be the beneficial owner of more than 5% of its common stock. To the knowledge of the Company, each of the shareholders named below has sole power to vote or direct the vote of such shares of common stock or the sole investment power with respect to such shares of common stock, unless otherwise indicated. The information provided in the table is based on the Company’s records, information filed with the SEC and information provided to the Company.

| | | Common Stock | |

| Name of Beneficial Owner | | Number of Shares | | | Percent of Class (1) | |

| Estate of Geoffrey S. M. Hedrick (2) | | | 1,673,155 | | | | 9.6 | % |

| Christopher Harborne (3) | | | 2,506,322 | | | | 14.4 | % |

| Wealth Trust Axiom, LLC (4) | | | 1,157,040 | | | | 6.6 | % |

| Norman H. Pessin (5) | | | 861,825 | | | | 4.9 | % |

| Central Square Management LLC (6) | | | 875,417 | | | | 5.0 | % |

| 1. | As used in this table, beneficial ownership means the sole or shared power to vote or direct the voting of a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose, or direct the disposition, of a security). A person is deemed as of any date to have beneficial ownership of any security that such person has the right to acquire within 60 days after such date. Percentage ownership is based upon 17,459,983 of common stock outstanding as of January 12, 2023. |

| 2. | Based solely on the Schedule 13D/A filed on August 11, 2023 filed by the Estate of Geoffrey S. M. Hedrick (the “Estate”) and Christopher Scott Ginieczki, as Personal Representative of the Estate of Geoffrey S. M. Hedrick (“Mr. Ginieczki”). According to the Schedule 13D/A, this amount includes 1,652,207 shares of common stock owned by the Estate and 20,948 shares of common stock owned by the Ginieczki Family Trust, of which Mr. Ginieczki is a co-trustee. According to the Schedule 13D/A, the Estate has shared voting and dispositive power as to 1,652,207 shares of common stock and Mr. Ginieczki has shared voting and dispositive power as to 1, 673,155 shares of common stock. The address for the Estate is c/o Innovative Solutions and Support, Inc., Attn: Christopher Scott Ginieczki, Personal Representative of Estate, 720 Pennsylvania Drive, Exton, PA 19341. Mr. Ginieczki’s address is 2788 San Tomas Expressway, Santa Clara, CA 95051. |

| 3. | Based solely on Schedule 13D/A filed on February 17, 2023 by Christopher Harborne (“Mr. Harborne”) and Klear Kite LLC (“Klear Kite”), Klear Kite and, by virtue of being the sole member of Klear Kite, Mr. Harborne, each beneficially owns 2,506,322 shares of common stock, which are held directly by Klear Kite. Based on the 13D/A, Klear Kite and Mr. Harborne share voting and investment power over all such shares. Christopher Harborne’s address is 23F M Thai Tower, All Seasons Place, 87 Wireless Road, Bangkok 10300 Thailand. |

| 4. | Based solely on Schedule 13G/A filed on February 3, 2022. WealthTrust Axiom LLC’s address is 550 Swedesford Road, Suite 110, Wayne, PA 19087. |

| 5. | Based solely on Schedule 13D/A filed on September 12, 2022. Norman H. Pessin’s address is 400 East 51st, PH 31, New York, NY 10022. |

| 6. | Based solely on Schedule 13G/A filed on September 10, 2014. Central Square Management LLC’s address is 1813 N. Mill Street, Suite F, Naperville, IL 60563. |

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership, as of January 12, 2024, of (i) each director, (ii) the chief executive officer, the chief financial officer and the Company’s other executive officers during the fiscal year ended September 30, 2023, and (iii) all the current directors and executive officers as a group. Unless otherwise indicated, each of the shareholders named below has sole voting and investment power with respect to such shares, and the address of each of the shareholders named below is c/o Innovative Solutions and Support, Inc., 720 Pennsylvania Drive, Exton, Pennsylvania 19341. The information provided in the table is based on the Company’s records, information filed with the SEC, and information provided to the Company.

| | | Common Stock |

| Name of Beneficial Owner | | Number of Shares | | Percent of Class (1) |

| Shahram Askarpour | | 442,458 | | 2.5% |

| Michael Linacre | | 2,465 | | * |

| Glen R. Bressner | | 85,089 | | * |

| Roger A. Carolin | | 45,922 | | * |

| Stephen L Belland | | 5,293 | | * |

| Parizad Olver | | 4,938 | | * |

| | | | | |

| All current executive officers and directors as a group (6 persons) | | 586,165 | | 3.3% |

* Less than 1%.

| 1. | As used in this table, beneficial ownership means the sole or shared power to vote or direct the voting of a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose, or direct the disposition, of a security). A person is deemed as of any date to have beneficial ownership of any security that such person has the right to acquire within 60 days after such date. Percentage ownership is based upon 17,453,983 shares of common stock outstanding as of January 12, 2024. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about Company common stock that may be issued upon the exercise of options and pursuant to other awards under all of the Company’s existing equity compensation plans and arrangements as of September 30, 2023, including the 2019 Plan.

| | | | | | | | | Number of securities |

| | | | | | | | | remaining available for |

| | | | | | | | | future issuance under |

| | | Number of securities | | | Weighted-average | | | equity compensation |

| | | to be issued upon exercise | | | exercise price of | | | plans (excluding |

| | | of outstanding options, | | | outstanding options, | | | securities reflected in the |

| Plan Category | | warrants, and rights | | | warrants, and rights | | | first column) |

| Equity compensation plans approved by security holders | | | 326,342 | | | $ | 8.19 | | | 262,187 |