As filed with the Securities and Exchange Commission on August 10, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the Quarterly Period Ended | | June 30, 2020 |

| Or | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from__________to__________ | | |

Commission File No. 001-34148

Match Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 59-2712887 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

8750 North Central Expressway, Suite 1400, Dallas, Texas 75231

(Address of registrant’s principal executive offices)

(214) 576-9352

(Registrant’s telephone number, including area code)

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.001 | | MTCH | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of July 31, 2020, there were 260,016,024 shares of common stock outstanding.

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET (Unaudited)

| | | | | | | | | | | |

| | June 30, 2020 | | December 31, 2019 |

| | | |

| (In thousands, except share data) | | |

| ASSETS | | | |

| Cash and cash equivalents | $ | 129,294 | | | $ | 465,676 | |

| | | |

| Accounts receivable, net of allowance of $613 and $578, respectively | 186,447 | | | 116,459 | |

| | | |

| Other current assets | 136,007 | | | 97,850 | |

| Current assets of discontinued operations | — | | | 3,028,079 | |

| Total current assets | 451,748 | | | 3,708,064 | |

| | | |

| Property and equipment, net of accumulated depreciation and amortization of $151,393 and $147,669, respectively | 101,647 | | | 101,065 | |

| Goodwill | 1,240,302 | | | 1,239,839 | |

| Intangible assets, net of accumulated amortization of $14,419 and $13,744, respectively | 222,792 | | | 228,324 | |

| Deferred income taxes | 252,021 | | | 192,496 | |

| | | |

| Other non-current assets | 66,222 | | | 64,232 | |

| Non-current assets of discontinued operations | — | | | 2,830,783 | |

| TOTAL ASSETS | $ | 2,334,732 | | | $ | 8,364,803 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES | | | |

| | | |

| Accounts payable | $ | 11,959 | | | $ | 20,191 | |

| Deferred revenue | 232,108 | | | 218,843 | |

| | | |

| Accrued expenses and other current liabilities | 214,975 | | | 182,250 | |

| Current liabilities of discontinued operations | — | | | 588,896 | |

| Total current liabilities | 459,042 | | | 1,010,180 | |

| Long-term debt, net | 3,527,660 | | | 2,889,626 | |

| Income taxes payable | 12,811 | | | 30,295 | |

| Deferred income taxes | 17,634 | | | 18,285 | |

| | | |

| Other long-term liabilities | 25,579 | | | 26,158 | |

| Non-current liabilities of discontinued operations | — | | | 447,414 | |

| Redeemable noncontrolling interests | (156) | | | 44,527 | |

| Commitments and contingencies | | | |

| SHAREHOLDERS’ EQUITY | | | |

| Common stock; $0.001 par value; authorized 1,600,000,000 shares; 241,617,096 and 0 shares issued; and 241,617,096 and 0 shares outstanding at June 30, 2020 and December 31, 2019, respectively | 242 | | | — | |

| Former IAC common stock; $0.001 par value; authorized 1,600,000,000 shares; 0 and 263,229,724 shares issued; and 0 and 78,889,779 shares outstanding at June 30, 2020 and December 31, 2019, respectively | — | | | 263 | |

| | | |

| Former IAC Class B convertible common stock; $0.001 par value; authorized 400,000,000 shares; 0 and 16,157,499 shares issued ; and 0 and 5,789,499 shares outstanding at June 30, 2020 and December 31, 2019, respectively | — | | | 16 | |

| | | |

| Additional paid-in capital | 7,180,181 | | | 11,683,799 | |

| Retained (deficit) earnings | (8,764,286) | | | 1,689,925 | |

| Accumulated other comprehensive loss | (124,312) | | | (136,349) | |

| Treasury stock; 0 and 194,708 shares, respectively | — | | | (10,309,612) | |

| Total Match Group, Inc. shareholders’ equity | (1,708,175) | | | 2,928,042 | |

| Noncontrolling interests | 337 | | | 970,276 | |

| Total shareholders’ equity | (1,707,838) | | | 3,898,318 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 2,334,732 | | | $ | 8,364,803 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| | | | | | | |

| | (In thousands, except per share data) | | | | | | |

| Revenue | $ | 555,450 | | | $ | 497,973 | | | $ | 1,100,092 | | | $ | 962,598 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenue (exclusive of depreciation shown separately below) | 148,853 | | | 126,665 | | | 292,747 | | | 246,889 | |

| Selling and marketing expense | 90,801 | | | 94,888 | | | 215,291 | | | 213,551 | |

| General and administrative expense | 68,204 | | | 63,267 | | | 147,523 | | | 118,467 | |

| Product development expense | 41,929 | | | 32,680 | | | 85,699 | | | 76,954 | |

| Depreciation | 9,669 | | | 8,752 | | | 19,063 | | | 17,045 | |

| Amortization of intangibles | 400 | | | 412 | | | 6,803 | | | 823 | |

| Total operating costs and expenses | 359,856 | | | 326,664 | | | 767,126 | | | 673,729 | |

| Operating income | 195,594 | | | 171,309 | | | 332,966 | | | 288,869 | |

| Interest expense | (45,647) | | | (33,545) | | | (88,296) | | | (60,997) | |

| Other income, net | 17,410 | | | 2,538 | | | 21,264 | | | 1,050 | |

| Earnings from continuing operations, before tax | 167,357 | | | 140,302 | | | 265,934 | | | 228,922 | |

| Income tax (provision) benefit | (34,436) | | | (21,076) | | | 16,311 | | | 7,986 | |

| Net earnings from continuing operations | 132,921 | | | 119,226 | | | 282,245 | | | 236,908 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (Loss) earnings from discontinued operations, net of tax | (34,611) | | | 27,565 | | | (366,578) | | | 22,868 | |

| Net earnings (loss) | 98,310 | | | 146,791 | | | (84,333) | | | 259,776 | |

| Net earnings attributable to noncontrolling interests | (31,869) | | | (33,324) | | | (60,266) | | | (57,614) | |

| Net earnings (loss) attributable to Match Group, Inc. shareholders | $ | 66,441 | | | $ | 113,467 | | | $ | (144,599) | | | $ | 202,162 | |

| | | | | | | |

| Net earnings per share from continuing operations: | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.52 | | | $ | 1.21 | | | $ | 1.04 | |

| Diluted | $ | 0.51 | | | $ | 0.45 | | | $ | 1.10 | | | $ | 0.90 | |

| Net earnings (loss) per share attributable to Match Group, Inc. shareholders: | | | | | | | |

| Basic | $ | 0.36 | | | $ | 0.62 | | | $ | (0.79) | | | $ | 1.11 | |

| Diluted | $ | 0.32 | | | $ | 0.55 | | | $ | (0.80) | | | $ | 0.97 | |

| | | | | | | |

| Stock-based compensation expense by function: | | | | | | | |

| Cost of revenue | $ | 969 | | | $ | 676 | | | $ | 2,136 | | | $ | 1,941 | |

| Selling and marketing expense | 1,295 | | | 1,330 | | | 2,442 | | | 2,726 | |

| General and administrative expense | 10,634 | | | 13,290 | | | 21,515 | | | 23,061 | |

| Product development expense | 9,242 | | | 6,719 | | | 17,219 | | | 22,284 | |

| Total stock-based compensation expense | $ | 22,140 | | | $ | 22,015 | | | $ | 43,312 | | | $ | 50,012 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE OPERATIONS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| | | | | | | |

| (In thousands) | | | | | | |

| Net earnings (loss) | $ | 98,310 | | | $ | 146,791 | | | $ | (84,333) | | | $ | 259,776 | |

| Other comprehensive income, net of tax | | | | | | | |

| Change in foreign currency translation adjustment | 22,633 | | | 1,097 | | | (3,460) | | | 2,406 | |

| Change in unrealized gains and losses on available-for-sale securities | 11 | | | (6) | | | (1) | | | (5) | |

| Total other comprehensive income (loss) | 22,644 | | | 1,091 | | | (3,461) | | | 2,401 | |

| Comprehensive income (loss) | 120,954 | | | 147,882 | | | (87,794) | | | 262,177 | |

| Components of comprehensive income attributable to noncontrolling interests: | | | | | | | |

| Net earnings attributable to noncontrolling interests | (31,869) | | | (33,324) | | | (60,266) | | | (57,614) | |

| Change in foreign currency translation adjustment attributable to noncontrolling interests | (3,677) | | | — | | | 1,089 | | | (316) | |

| Change in unrealized gains and losses of available-for-sale debt securities attributable to noncontrolling interests | — | | | — | | | — | | | 1 | |

| Comprehensive income attributable to noncontrolling interests | (35,546) | | | (33,324) | | | (59,177) | | | (57,929) | |

| Comprehensive income (loss) attributable to Match Group, Inc. shareholders | $ | 85,408 | | | $ | 114,558 | | | $ | (146,971) | | | $ | 204,248 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (Unaudited)

Three Months Ended June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Match Group Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Common Stock $0.001 Par Value | | | | Former IAC Common Stock $0.001 Par Value | | | | Former IAC Class B Convertible Common Stock $0.001 Par Value | | | | | | | | | | | | | | | | |

| | Redeemable

Noncontrolling

Interests | | | $ | | Shares | | $ | | Shares | | $ | | Shares | | Additional Paid-in Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | Total Match Group Shareholders’ Equity | | Noncontrolling Interests | | Total

Shareholders’

Equity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | (In thousands) | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2020 | $ | 42,431 | | | | $ | — | | | — | | | $ | 264 | | | 263,502 | | | $ | 16 | | | 16,157 | | | $ | 11,412,142 | | | $ | 1,478,885 | | | $ | (157,285) | | | $ | (10,309,612) | | | $ | 2,424,410 | | | $ | 1,030,414 | | | $ | 3,454,824 | |

| Net (loss) earnings for the three months ended June 30, 2020 | (608) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 66,441 | | | — | | | — | | | 66,441 | | | 32,477 | | | 98,918 | |

| Other comprehensive (loss) income, net of tax | (785) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 18,967 | | | — | | | 18,967 | | | 4,462 | | | 23,429 | |

| Stock-based compensation expense | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 61,560 | | | — | | | — | | | — | | | 61,560 | | | 41,777 | | | 103,337 | |

| Issuance of Former IAC common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | — | | | 181 | | | — | | | — | | | (14,002) | | | — | | | — | | | — | | | (14,002) | | | — | | | (14,002) | |

| Issuance of Former Match Group and ANGI Homeservices common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (72,705) | | | — | | | 225 | | | — | | | (72,480) | | | (1,963) | | | (74,443) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment of redeemable noncontrolling interests to fair value | 2,389 | | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,389) | | | — | | | — | | | — | | | (2,389) | | | — | | | (2,389) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of Former Match Group and ANGI Homeservices treasury stock | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (67,077) | | | — | | | — | | | — | | | (67,077) | | | — | | | (67,077) | |

| Retirement of treasury stock | — | | | | — | | | — | | | (184) | | | (184,340) | | | (10) | | | (10,368) | | | 194 | | | (10,309,612) | | | — | | | 10,309,612 | | | — | | | — | | | — | |

| Exchange Former IAC common stock and Class B common stock for Match Group common stock and completion of the Separation | (43,583) | | | | 184 | | | 183,749 | | | (80) | | | (79,343) | | | (6) | | | (5,789) | | | (4,745,520) | | | — | | | 13,781 | | | — | | | (4,731,641) | | | (498,792) | | | (5,230,433) | |

| Acquire Former Match Group noncontrolling interest | — | | | | 58 | | | 57,868 | | | — | | | — | | | — | | | — | | | 608,110 | | | — | | | — | | | — | | | 608,168 | | | (608,168) | | | — | |

| Other | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (132) | | | — | | | — | | | — | | | (132) | | | 130 | | | (2) | |

| Balance as of June 30, 2020 | $ | (156) | | | | $ | 242 | | | 241,617 | | | $ | — | | | — | | | $ | — | | | — | | | $ | 7,180,181 | | | $ | (8,764,286) | | | $ | (124,312) | | | $ | — | | | $ | (1,708,175) | | | $ | 337 | | | $ | (1,707,838) | |

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (Unaudited) (Continued)

Three Months Ended June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Match Group Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | |

| | | | | Former IAC

Common Stock

$0.001

Par Value | | | | Former IAC

Class B Convertible Common Stock $0.001

Par Value | | | | | | | | | | | | | | | | |

| | Redeemable

Noncontrolling

Interests | | | $ | | Shares | | $ | | Shares | | Additional Paid-in Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | Total Match Group Shareholders’ Equity | | Noncontrolling Interests | | Total

Shareholders’

Equity |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | (In thousands) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2019 | $ | 71,914 | | | | $ | 263 | | | 262,629 | | | $ | 16 | | | 16,157 | | | $ | 11,868,424 | | | $ | 1,347,489 | | | $ | (126,719) | | | $ | (10,309,612) | | | $ | 2,779,861 | | | $ | 791,475 | | | $ | 3,571,336 | |

| Net earnings for the six months ended June 30, 2019 | 6,946 | | | | — | | | — | | | — | | | — | | | — | | | 113,467 | | | — | | | — | | | 113,467 | | | 26,378 | | | 139,845 | |

| Other comprehensive (loss) income, net of tax | (335) | | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,091 | | | — | | | 1,091 | | | 335 | | | 1,426 | |

| Stock-based compensation expense | 35 | | | | — | | | — | | | — | | | — | | | 22,890 | | | — | | | — | | | — | | | 22,890 | | | 39,494 | | | 62,384 | |

| Issuance of Former IAC common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | 160 | | | — | | | — | | | (18,112) | | | — | | | — | | | — | | | (18,112) | | | — | | | (18,112) | |

| Issuance of Former Match Group and ANGI Homeservices common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | — | | | — | | | (99,811) | | | — | | | (77) | | | — | | | (99,888) | | | 2,281 | | | (97,607) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of redeemable noncontrolling interests | (2,939) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment of redeemable noncontrolling interests to fair value | (104) | | | | — | | | — | | | — | | | — | | | 104 | | | — | | | — | | | — | | | 104 | | | — | | | 104 | |

| Noncontrolling interests created in an acquisition | 5,009 | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of exchangeable note hedges | — | | | | — | | | — | | | — | | | — | | | (303,428) | | | — | | | — | | | — | | | (303,428) | | | — | | | (303,428) | |

| Equity component of exchangeable senior notes, net of deferred financing costs and deferred tax liabilities | — | | | | — | | | — | | | — | | | — | | | 321,128 | | | — | | | — | | | — | | | 321,128 | | | — | | | 321,128 | |

| Issuance of warrants | — | | | | — | | | — | | | — | | | — | | | 166,520 | | | — | | | — | | | — | | | 166,520 | | | — | | | 166,520 | |

| Other | (24) | | | | — | | | — | | | — | | | — | | | (172) | | | — | | | — | | | — | | | (172) | | | 173 | | | 1 | |

| Balance as of June 30, 2019 | $ | 80,502 | | | | $ | 263 | | | 262,789 | | | $ | 16 | | | 16,157 | | | $ | 11,957,543 | | | $ | 1,460,956 | | | $ | (125,705) | | | $ | (10,309,612) | | | $ | 2,983,461 | | | $ | 860,136 | | | $ | 3,843,597 | |

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (Unaudited) (Continued)

Six Months Ended June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Match Group Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Common Stock $0.001 Par Value | | | | Former IAC Common Stock $0.001 Par Value | | | | Former IAC Class B Convertible Common Stock $0.001 Par Value | | | | | | | | | | | | | | | | |

| | Redeemable

Noncontrolling

Interests | | | $ | | Shares | | $ | | Shares | | $ | | Shares | | Additional

Paid-in

Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | Total Match Group Shareholders’ Equity | | Noncontrolling Interests | | Total

Shareholders’

Equity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | (In thousands) | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2019 | $ | 44,527 | | | | $ | — | | | — | | | $ | 263 | | | 263,230 | | | $ | 16 | | | 16,157 | | | $ | 11,683,799 | | | $ | 1,689,925 | | | $ | (136,349) | | | $ | (10,309,612) | | | $ | 2,928,042 | | | $ | 970,276 | | | $ | 3,898,318 | |

| Net (loss) earnings for the six months ended June 30, 2020 | (2,070) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (144,599) | | | — | | | — | | | (144,599) | | | 62,336 | | | (82,263) | |

| Other comprehensive loss, net of tax | (686) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,372) | | | — | | | (2,372) | | | (403) | | | (2,775) | |

| Stock-based compensation expense | 15 | | | | — | | | — | | | — | | | — | | | — | | | — | | | 73,059 | | | — | | | — | | | — | | | 73,059 | | | 86,363 | | | 159,422 | |

| Issuance of Former IAC common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | 1 | | | 453 | | | — | | | — | | | (34,518) | | | — | | | — | | | — | | | (34,517) | | | — | | | (34,517) | |

| Issuance of Former Match Group and ANGI Homeservices common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (212,270) | | | — | | | 628 | | | — | | | (211,642) | | | (11,405) | | | (223,047) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of redeemable noncontrolling interests | (3,165) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Adjustment of redeemable noncontrolling interests to fair value | 4,807 | | | | — | | | — | | | — | | | — | | | — | | | — | | | (4,807) | | | — | | | — | | | — | | | (4,807) | | | — | | | (4,807) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of Former Match Group and ANGI Homeservices treasury stock | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | (187,735) | | | — | | | — | | | — | | | (187,735) | | | — | | | (187,735) | |

| Retirement of treasury stock | — | | | | — | | | — | | | (184) | | | (184,340) | | | (10) | | | (10,368) | | | 194 | | | (10,309,612) | | | — | | | 10,309,612 | | | — | | | — | | | — | |

| Exchange Former IAC common stock and Class B common stock for Match Group common stock and completion of the Separation | (43,583) | | | | 184 | | | 183,749 | | | (80) | | | (79,343) | | | (6) | | | (5,789) | | | (4,745,520) | | | — | | | 13,781 | | | — | | | (4,731,641) | | | (498,792) | | | (5,230,433) | |

| Acquire Former Match Group noncontrolling interest | — | | | | 58 | | | 57,868 | | | — | | | — | | | — | | | — | | | 608,110 | | | — | | | — | | | — | | | 608,168 | | | (608,168) | | | — | |

| Other | (1) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (131) | | | — | | | — | | | — | | | (131) | | | 130 | | | (1) | |

| Balance as of June 30, 2020 | $ | (156) | | | | $ | 242 | | | 241,617 | | | $ | — | | | — | | | $ | — | | | — | | | $ | 7,180,181 | | | $ | (8,764,286) | | | $ | (124,312) | | | $ | — | | | $ | (1,708,175) | | | $ | 337 | | | $ | (1,707,838) | |

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (Unaudited) (Continued)

Six Months Ended June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Match Group Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | |

| | | | Former IAC Common Stock $0.001 Par Value | | | | Former IAC Class B Convertible Common Stock $0.001 Par Value | | | | | | | | | | | | | | | | |

| Redeemable

Noncontrolling

Interests | | | $ | | Shares | | $ | | Shares | | Additional Paid-in Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury Stock | | Total Match Group Shareholders’ Equity | | Noncontrolling Interests | | Total

Shareholders’

Equity |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (In thousands) | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2018 | $ | 65,687 | | | | $ | 262 | | | 262,303 | | | $ | 16 | | | 16,157 | | | $ | 12,022,387 | | | $ | 1,258,794 | | | $ | (128,722) | | | $ | (10,309,612) | | | $ | 2,843,125 | | | $ | 708,676 | | | $ | 3,551,801 | |

| Net earnings for the six months ended June 30, 2019 | 5,895 | | | | — | | | — | | | — | | | — | | | — | | | 202,162 | | | — | | | — | | | 202,162 | | | 51,719 | | | 253,881 | |

| Other comprehensive (loss) income, net of tax | (149) | | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,086 | | | — | | | 2,086 | | | 464 | | | 2,550 | |

| Stock-based compensation expense | 77 | | | | — | | | — | | | — | | | — | | | 43,055 | | | — | | | — | | | — | | | 43,055 | | | 86,731 | | | 129,786 | |

| Issuance of Former IAC common stock pursuant to stock-based awards, net of withholding taxes | — | | | | 1 | | | 486 | | | — | | | — | | | (23,023) | | | — | | | — | | | — | | | (23,022) | | | — | | | (23,022) | |

| Issuance of Former Match Group and ANGI Homeservices common stock pursuant to stock-based awards, net of withholding taxes | — | | | | — | | | — | | | — | | | — | | | (258,769) | | | — | | | 931 | | | — | | | (257,838) | | | 12,373 | | | (245,465) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of redeemable noncontrolling interests | (6,121) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment of redeemable noncontrolling interests to fair value | 10,138 | | | | — | | | — | | | — | | | — | | | (10,138) | | | — | | | — | | | — | | | (10,138) | | | — | | | (10,138) | |

| Noncontrolling interests created in an acquisition | 5,009 | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of exchangeable note hedges | — | | | | — | | | — | | | — | | | — | | | (303,428) | | | — | | | — | | | — | | | (303,428) | | | — | | | (303,428) | |

| Equity component of exchangeable Senior Notes, net of deferred financing costs and deferred tax liabilities | — | | | | — | | | — | | | — | | | — | | | 321,128 | | | — | | | — | | | — | | | 321,128 | | | — | | | 321,128 | |

| Issuance of warrants | — | | | | — | | | — | | | — | | | — | | | 166,520 | | | — | | | — | | | — | | | 166,520 | | | — | | | 166,520 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Other | (34) | | | | — | | | — | | | — | | | — | | | (189) | | | — | | | — | | | — | | | (189) | | | 173 | | | (16) | |

| Balance as of June 30, 2019 | $ | 80,502 | | | | $ | 263 | | | 262,789 | | | $ | 16 | | | 16,157 | | | $ | 11,957,543 | | | $ | 1,460,956 | | | $ | (125,705) | | | $ | (10,309,612) | | | $ | 2,983,461 | | | $ | 860,136 | | | $ | 3,843,597 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

MATCH GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

| | | | | | | | | | | |

| | Six Months Ended June 30, | | |

| | 2020 | | 2019 |

| | | |

| | (In thousands) | | |

| Cash flows from operating activities attributable to continuing operations: | | | |

| Net earnings from continuing operations | $ | 282,245 | | | $ | 236,908 | |

| Adjustments to reconcile net earnings from continuing operations to net cash provided by operating activities attributable to continuing operations: | | | |

| Stock-based compensation expense | 43,312 | | | 50,012 | |

| Depreciation | 19,063 | | | 17,045 | |

| Amortization of intangibles | 6,803 | | | 823 | |

| | | |

| Deferred income taxes | (21,025) | | | (39,332) | |

| | | |

| Other adjustments, net | 41,319 | | | 13,827 | |

| Changes in assets and liabilities | | | |

| Accounts receivable | (69,228) | | | (61,414) | |

| Other assets | (10,144) | | | (13,591) | |

| Accounts payable and other liabilities | (13,349) | | | (4,757) | |

| Income taxes payable and receivable | (16,242) | | | (9,787) | |

| Deferred revenue | 13,133 | | | 15,483 | |

| Net cash provided by operating activities attributable to continuing operations | 275,887 | | | 205,217 | |

| Cash flows from investing activities attributable to continuing operations: | | | |

| Net cash used in business combinations | — | | | (3,759) | |

| Capital expenditures | (18,124) | | | (20,851) | |

| Net cash distribution related to Separation of IAC | (2,448,749) | | | — | |

| | | |

| | | |

| | | |

| Other, net | (118) | | | 1,118 | |

| Net cash used in investing activities attributable to continuing operations | (2,466,991) | | | (23,492) | |

| Cash flows from financing activities attributable to continuing operations: | | | |

| Borrowings under the Credit Facility | 20,000 | | | 40,000 | |

| | | |

| Proceeds from Senior Notes offerings | 1,000,000 | | | 350,000 | |

| Proceeds from Exchangeable Notes offerings | — | | | 1,150,000 | |

| Principal payments on Credit Facility | — | | | (300,000) | |

| Principal payments on Senior Notes | (400,000) | | | — | |

| Purchase of exchangeable note hedges | — | | | (303,428) | |

| Proceeds from issuance of warrants | — | | | 166,520 | |

| Debt issuance costs | (13,195) | | | (26,361) | |

| | | |

| Withholding taxes paid on behalf of employees on net settled stock-based awards of Former Match Group | (209,698) | | | (138,465) | |

| | | |

| Purchase of Former Match Group treasury stock | (132,868) | | | (76,086) | |

| Purchase of noncontrolling interests | (15,827) | | | — | |

| | | |

| | | |

| Other, net | (12,745) | | | 27 | |

| Net cash provided by financing activities attributable to continuing operations | 235,667 | | | 862,207 | |

| Total cash (used in) provided by continuing operations | (1,955,437) | | | 1,043,932 | |

| Net cash provided by operating activities attributable to discontinued operations | 20,031 | | | 150,590 | |

| Net cash used in investing activities attributable to discontinued operations | (963,420) | | | (109,180) | |

| Net cash used in financing activities attributable to discontinued operations | (110,959) | | | (65,435) | |

| Total cash used in discontinued operations | (1,054,348) | | | (24,025) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (1,152) | | | 361 | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | (3,010,937) | | | 1,020,268 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 3,140,358 | | | 2,133,685 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 129,421 | | | $ | 3,153,953 | |

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

NOTE 1—THE COMPANY AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Match Group, Inc., through its portfolio companies, is a leading provider of dating products available globally. Our portfolio of brands includes Tinder®, Match®, Meetic®, OkCupid®, Hinge®, Pairs™, PlentyOfFish®, and OurTime®, as well as a number of other brands, each designed to increase our users’ likelihood of finding a meaningful connection. Through our portfolio companies and their trusted brands, we provide tailored products to meet the varying preferences of our users. Our products are available in over 40 languages to our users all over the world. Match Group has 1 operating segment, Dating, which is managed as a portfolio of dating brands.

Separation of Match Group and IAC

On June 30, 2020, the companies formerly known as Match Group, Inc. (referred to as “Former Match Group”) and IAC/InterActiveCorp (referred to as “Former IAC”) completed the separation of the Company from IAC through a series of transactions that resulted in two, separate public companies—(1) Match Group, which consists of the businesses of Former Match Group and certain financing subsidiaries previously owned by Former IAC, and (2) IAC/InterActiveCorp, formerly known as IAC Holdings, Inc. (“IAC”), consisting of Former IAC’s businesses other than Match Group (the “Separation”). See “Note 6—Shareholders’ Equity” for additional information about the series of transactions.

As used herein, “Match Group,” the “Company,” “we,” “our,” “us,” and similar terms refer to Match Group, Inc. and its subsidiaries after the completion of the Separation, unless the context indicates otherwise.

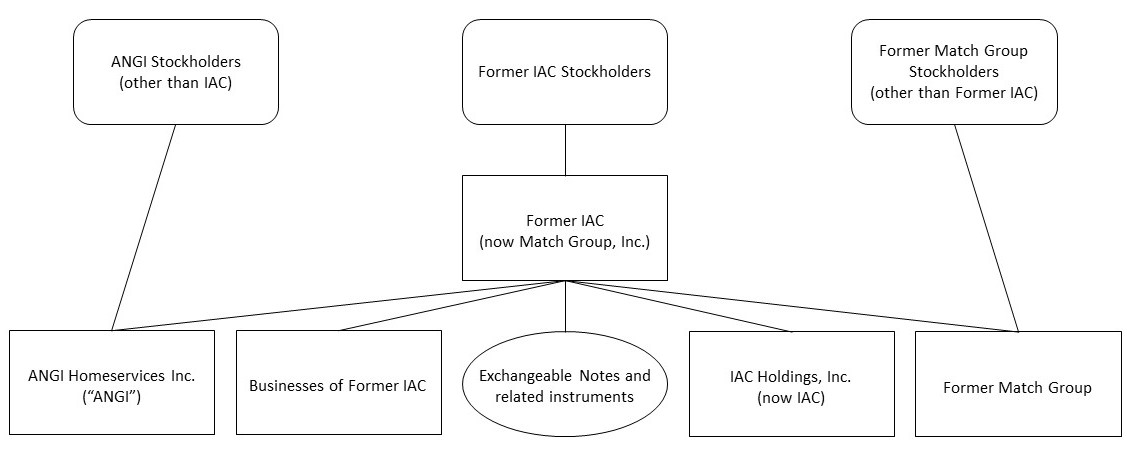

The following diagram illustrates the simplified organizational and ownership structure immediately prior to the Separation.

Under the terms of the Transaction Agreement (the “Transaction Agreement”) dated as of December 19, 2019 and amended as of April 28, 2020 and as further amended as of June 22, 2020, Former Match Group merged with and into Match Group Holdings II, LLC (“MG Holdings II”), an indirect wholly-owned subsidiary of Match Group, with MG Holdings II surviving the merger as an indirect wholly-owned subsidiary of Match Group. Former Match Group stockholders (other than Former IAC) received, through the merger, in exchange for each outstanding share of Former Match Group common stock that they held, 1 share of Match Group common stock and, at the holder’s election, either (i) $3.00 in cash or (ii) a fraction of a share of Match Group common stock with a value of $3.00 (calculated pursuant to the Transaction Agreement). As a result of the merger and other transactions contemplated by the Transaction Agreement, Former Match Group stockholders (other than Former IAC) became stockholders of the Company.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

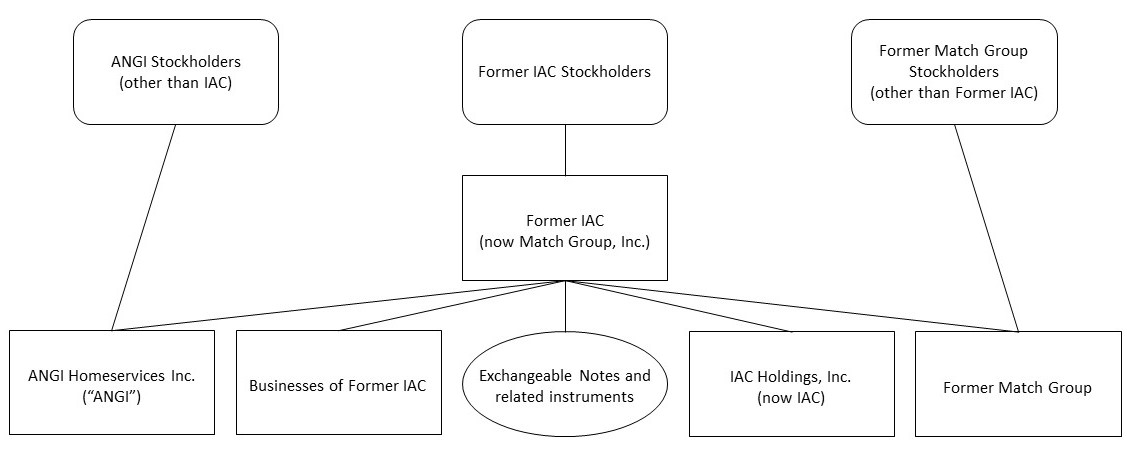

The following diagram illustrates the simplified organizational and ownership structure immediately after the Separation.

Discontinued Operations

As a result of the Separation, the operations of Former IAC businesses other than Match Group are presented as discontinued operations. See “Note 3—Discontinued Operations” for additional details.

Basis of Presentation and Consolidation

The Company prepares its consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”). The consolidated financial statements include the accounts of the Company, all entities that are wholly-owned by the Company and all entities in which the Company has a controlling financial interest. Intercompany transactions and accounts have been eliminated.

In management’s opinion, the unaudited interim consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and reflect, in management’s opinion, all adjustments, consisting of normal and recurring adjustments, necessary for the fair presentation of our consolidated financial position, consolidated results of operations and consolidated cash flows for the periods presented. Interim results are not necessarily indicative of the results that may be expected for the full year. The accompanying unaudited consolidated financial statements should be read in conjunction with the consolidated and combined statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Accounting Estimates

Management of the Company is required to make certain estimates, judgments, and assumptions during the preparation of its consolidated financial statements in accordance with GAAP. These estimates, judgments, and assumptions impact the reported amounts of assets, liabilities, revenue, and expenses and the related disclosure of contingent assets and liabilities. Actual results could differ from these estimates.

On an ongoing basis, the Company evaluates its estimates and judgments including those related to: the fair values of cash equivalents, the carrying value of accounts receivable, including the determination of the

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

allowance for credit losses; the determination of revenue reserves; the carrying value of right-of-use assets; the useful lives and recoverability of definite-lived intangible assets and property and equipment; the recoverability of goodwill and indefinite-lived intangible assets; the fair value of equity securities without readily determinable fair values; contingencies; unrecognized tax benefits; the valuation allowance for deferred income tax assets; and the fair value of and forfeiture rates for stock-based awards, among others. The Company bases its estimates and judgments on historical experience, its forecasts and budgets, and other factors that the Company considers relevant.

Accounting for Investments and Equity Securities

Investments in equity securities, other than those of our consolidated subsidiaries, are accounted for at fair value or under the measurement alternative of the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Update (“ASU”) No. 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, following its adoption on January 1, 2018, with any changes to fair value recognized within other expense, net each reporting period. Under the measurement alternative, equity investments without readily determinable fair values are carried at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for identical or a similar investment of the same issuer; value is generally determined based on a market approach as of the transaction date. A security will be considered identical or similar if it has identical or similar rights to the equity securities held by the Company. The Company reviews its equity securities for impairment each reporting period when there are qualitative indicators or events that indicate possible impairment. Factors we consider in making this determination include negative change in industry and market conditions, financial performance, business prospects, and other relevant events and factors. When indicators of impairment exist, the Company prepares quantitative assessments of the fair value of our equity securities, which require judgment and the use of estimates. When our assessment indicates that the fair value of the security is below the carrying value, the Company writes down the security to its fair value and records the corresponding charge within other income (expense), net.

Revenue Recognition

Revenue is recognized when control of the promised services are transferred to our customers, and in the amount that reflects the consideration the Company expects to be entitled to in exchange for those services.

Deferred Revenue

Deferred revenue consists of advance payments that are received or are contractually due in advance of the Company's performance. The Company’s deferred revenue is reported on a contract by contract basis at the end of each reporting period. The Company classifies deferred revenue as current when the term of the applicable subscription period or expected completion of our performance obligation is one year or less. The current deferred revenue balance as of December 31, 2019 was $218.8 million. During the six months ended June 30, 2020, the Company recognized $208.2 million of revenue that was included in the deferred revenue balance as of December 31, 2019. The current deferred revenue balance at June 30, 2020 is $232.1 million. At June 30, 2020 and December 31, 2019, there was 0 non-current portion of deferred revenue.

Practical Expedients and Exemptions

As permitted under the practical expedient available under ASU No. 2014-09, Revenue from Contracts with Customers, the Company does not disclose the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less, (ii) contracts with variable consideration that is allocated entirely to unsatisfied performance obligations or to a wholly unsatisfied promise accounted for under the series guidance, and (iii) contracts for which the Company recognizes revenue at the amount which we have the right to invoice for services performed.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

Disaggregation of Revenue

The following table presents disaggregated revenue:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| | | | | | | |

| | (In thousands) | | | | | | |

| Direct Revenue: | | | | | | | |

| North America | $ | 284,318 | | | $ | 251,499 | | | $ | 547,665 | | | $ | 489,272 | |

| International | 262,423 | | | 235,801 | | | 533,900 | | | 451,990 | |

| Total Direct Revenue | 546,741 | | | 487,300 | | | 1,081,565 | | | 941,262 | |

| Indirect Revenue (principally advertising revenue) | 8,709 | | | 10,673 | | | 18,527 | | | 21,336 | |

| Total Revenue | $ | 555,450 | | | $ | 497,973 | | | $ | 1,100,092 | | | $ | 962,598 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Recent Accounting Pronouncements Adopted by the Company

The Company adopted ASU No. 2016-13 effective January 1, 2020. ASU No. 2016-13 replaces the “incurred loss” approach with an “expected loss” model, under which companies will recognize allowances based on expected rather than incurred losses. The Company adopted ASU No. 2016-13 using the modified retrospective approach and there was 0 cumulative effect arising from the adoption. The adoption of ASU No. 2016-13 did not have a material impact on the Company's financial statements.

The Company adopted ASU No. 2019-12 effective January 1, 2020, which simplifies the accounting for income taxes, eliminates certain exceptions within ASC 740, Income Taxes, and clarifies certain aspects of the current guidance to promote consistency among reporting entities. Most amendments within ASU No. 2019-12 are required to be applied on a prospective basis, while certain amendments must be applied on a retrospective or modified retrospective basis. The Company adopted ASU No. 2019-12 on January 1, 2020 using the modified retrospective basis for those amendments that are not applied on a prospective basis. The adoption of ASU No. 2019-12 did not have a material impact on the Company’s consolidated financial statements.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

NOTE 2—INCOME TAXES

At the end of each interim period, the Company estimates the annual effective income tax rate and applies that rate to its ordinary year-to-date earnings or loss. The income tax provision or benefit related to significant, unusual, or extraordinary items, if applicable, that will be separately reported or reported net of their related tax effects are individually computed and recognized in the interim period in which they occur. In addition, the effect of changes in enacted tax laws or rates, tax status, judgment on the realizability of beginning-of-the-year deferred tax assets in future years or unrecognized tax benefits is recognized in the interim period in which the change occurs.

The computation of the estimated annual effective income tax rate at each interim period requires certain estimates and assumptions including, but not limited to, the expected pre-tax income (or loss) for the year, projections of the proportion of income (and/or loss) earned and taxed in foreign jurisdictions, permanent and temporary differences, and the likelihood of the realization of deferred tax assets generated in the current year. The accounting estimates used to compute the provision or benefit for income taxes may change as new events occur, more experience is acquired, additional information is obtained or our tax environment changes. To the extent that the estimated annual effective income tax rate changes during a quarter, the effect of the change on prior quarters is included in the income tax provision in the quarter in which the change occurs.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) was signed into law. The CARES Act provides opportunities for additional liquidity, loan guarantees, and other government programs to support companies affected by the outbreak of a novel coronavirus (“COVID-19”) and their employees. Based on our analysis of the CARES Act, Match Group expects to avail itself of the following:

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

•a $20.8 million refund of federal income taxes due to a five-year carryback of net operating losses incurred in 2019;

•accelerated depreciation deductions;

•a relaxation of limitations on interest expense deductions; and

•a deferral of 2020 employer social security payroll taxes.

The Company continues to review and consider worldwide government programs related to the COVID-19 pandemic; however, the Company does not expect the impacts of these programs to be material.

For the three months ended June 30, 2020 and 2019, the Company recorded an income tax provision of $34.4 million and $21.1 million, representing effective tax rates of 21% and 15%, respectively. The effective tax rates in both three-month periods benefited from excess tax benefits generated by the exercise and vesting of stock-based awards. For the three months ended June 30, 2020, this benefit was offset by a non-recurring increase in the valuation allowance for foreign tax credits. For the six months ended June 30, 2020 and 2019, the Company recorded an income tax benefit of $16.3 million and $8.0 million, respectively, as a result of excess tax benefits generated by the exercise and vesting of stock-based awards, with the 2020 period partially offset by a non-recurring increase in the valuation allowance for foreign tax credits.

At Separation, the Company became the parent of the Former IAC consolidated tax group. As a result, we will allocate to IAC a portion of the tax attributes related to the consolidated federal and state tax filings pursuant to the Internal Revenue Code and applicable state law. This allocation requires that the Company’s net deferred tax asset be adjusted in the year of the Separation with a corresponding adjustment to additional paid-in capital. The allocation of attributes that was recorded as of June 30, 2020 is preliminary and subject to adjustments. An allocation of additional tax attributes will be made at the close of the tax year on December 31, 2020 as an adjustment to additional paid-in capital, as well as upon the filing of the 2020 tax return and potential tax audits in the future. See “Note 12—Related Party Transactions” for amounts outstanding under the tax matters agreement entered into with IAC at Separation.

The Company recognizes interest and, if applicable, penalties related to unrecognized tax benefits in the income tax provision. Accruals for interest and penalties are not material.

Match Group is routinely under audit by federal, state, local and foreign authorities in the area of income tax. These audits include questioning the timing and amount of income and deductions, and the allocation of such income and deductions among various tax jurisdictions. The Internal Revenue Service (“IRS”) has substantially completed its audit of the Company’s federal income tax returns for the years ended December 31, 2010 through 2016, resulting in reductions to the manufacturing tax deduction and research credits claimed. The IRS began an audit of the year ended December 31, 2017 in the second quarter. The statute of limitations for the years 2010 through 2012 has been extended to May 31, 2021, and the statute of limitations for the years 2013 to 2016 has been extended to March 31, 2021. Returns filed in various other jurisdictions are open to examination for tax years beginning with 2009. Income taxes payable include unrecognized tax benefits considered sufficient to pay assessments that may result from examination of prior year tax returns. We consider many factors when evaluating and estimating our tax positions and tax benefits, which may not accurately anticipate actual outcomes and, therefore, may require periodic adjustments. Although management currently believes changes in unrecognized tax benefits from period to period and differences between amounts paid, if any, upon resolution of issues raised in audits and amounts previously provided will not have a material impact on the liquidity, results of operations, or financial condition of the Company, these matters are subject to inherent uncertainties and management’s view of these matters may change in the future.

At June 30, 2020 and December 31, 2019, unrecognized tax benefits, including interest and penalties, are $40.6 million and $55.5 million, respectively. Unrecognized tax benefits, including interest and penalties, at June 30, 2020 decreased by $14.9 million due primarily to the effective settlement of certain prior year tax positions with the IRS relating to the manufacturing tax deduction and research credits. If unrecognized tax benefits at June 30, 2020 are subsequently recognized, $36.4 million, net of related deferred tax assets and interest, would reduce income tax expense. The comparable amount as of December 31, 2019 was $51.9 million. The Company believes that it is reasonably possible that its unrecognized tax benefits could decrease by $4.1

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

million by June 30, 2021 due to settlements and expirations of statutes of limitations, all of which would reduce the income tax provision.

NOTE 3—DISCONTINUED OPERATIONS

On June 30, 2020, as part of the Separation described in “Note 1—The Company and Summary of Significant Accounting Policies,” the operations of Former IAC businesses other than Match Group are presented as discontinued operations.

The components of assets and liabilities of discontinued operations in the accompanying consolidated balance sheet at December 31, 2019 consisted of the following:

| | | | | |

| December 31, 2019 |

| (In thousands) |

| Cash and cash equivalents | $ | 2,673,619 | |

| Marketable securities | 19,993 | |

| Accounts receivable, net | 181,875 | |

| Other current assets | 152,592 | |

| Total current assets in discontinued operations | $ | 3,028,079 | |

| |

| Property and equipment, net | $ | 270,288 | |

| Goodwill | 1,614,623 | |

| Intangible assets, net | 350,150 | |

| Long-term investments | 347,976 | |

| Other non-current assets | 247,746 | |

| Total non-current assets in discontinued operations | $ | 2,830,783 | |

| |

| Current portion of long-term debt | $ | 13,750 | |

| Accounts payable, trade | 74,166 | |

| Deferred revenue | 178,647 | |

| Accrued expenses and other current liabilities | 322,333 | |

| Total current liabilities in discontinued operations | $ | 588,896 | |

| |

| Long-term debt, net | $ | 231,946 | |

| Income taxes payable | 6,410 | |

| Deferred income taxes | 28,751 | |

| Other long-term liabilities | 180,307 | |

| Total long-term liabilities in discontinued operations | $ | 447,414 | |

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

The key components of loss from discontinued operations for the three and six months ended June 30, 2020 and 2019 consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| | | | | | | |

| (In thousands) | | | | | | |

| Revenue | $ | 726,361 | | | $ | 688,684 | | | $ | 1,410,485 | | | $ | 1,329,903 | |

| Operating costs and expenses | (840,902) | | | (705,683) | | | (1,840,178) | | | (1,384,589) | |

| Operating loss | (114,541) | | | (16,999) | | | (429,693) | | | (54,686) | |

| Interest expense | (1,555) | | | (3,661) | | | (3,772) | | | (7,352) | |

| Other income (expense) | 51,244 | | | 43,435 | | | (2,503) | | | 45,573 | |

| Income tax benefit | 30,241 | | | 4,790 | | | 69,390 | | | 39,333 | |

| (Loss) earnings from discontinued operations | (34,611) | | | 27,565 | | | (366,578) | | | 22,868 | |

NOTE 4—FINANCIAL INSTRUMENTS

Equity securities without readily determinable fair values

At both June 30, 2020 and December 31, 2019, the carrying value of the Company’s investments in equity securities without readily determinable fair values totaled $5.1 million and is included in “Other non-current assets” in the accompanying consolidated balance sheet. The cumulative downward adjustments (including impairments) to the carrying value of equity securities without readily determinable fair values, since the adoption of ASU 2016-01 on January 1, 2018 through June 30, 2020, were $6.1 million. For both the six months ended June 30, 2020 and 2019, there were 0 adjustments to the carrying value of equity securities without readily determinable fair values.

For all equity securities without readily determinable fair values as of June 30, 2020 and December 31, 2019, the Company has elected the measurement alternative. As of June 30, 2020, under the measurement alternative election, the Company did not identify any fair value adjustments using observable price changes in orderly transactions for an identical or similar investment of the same issuer.

Fair Value Measurements

The Company categorizes its financial instruments measured at fair value into a fair value hierarchy that prioritizes the inputs used in pricing the asset or liability. The three levels of the fair value hierarchy are:

•Level 1: Observable inputs obtained from independent sources, such as quoted market prices for identical assets and liabilities in active markets.

•Level 2: Other inputs, which are observable directly or indirectly, such as quoted market prices for similar assets or liabilities in active markets, quoted market prices for identical or similar assets or liabilities in markets that are not active, and inputs that are derived principally from or corroborated by observable market data. The fair values of the Company’s Level 2 financial assets are primarily obtained from observable market prices for identical underlying securities that may not be actively traded. Certain of these securities may have different market prices from multiple market data sources, in which case an average market price is used.

•Level 3: Unobservable inputs for which there is little or no market data and require the Company to develop its own assumptions, based on the best information available in the circumstances, about the assumptions market participants would use in pricing the assets or liabilities.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

The following tables present the Company’s financial instruments that are measured at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | |

| | June 30, 2020 | | | | | | |

| | Quoted Market

Prices in Active

Markets for

Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | | | Total

Fair Value

Measurements |

| | | | | | | |

| | (In thousands) | | | | | | |

| Assets: | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 2,277 | | | $ | — | | | | | $ | 2,277 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | December 31, 2019 | | | | | | |

| | Quoted Market

Prices in Active

Markets for

Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | | | Total

Fair Value

Measurements |

| | | | | | | |

| | (In thousands) | | | | | | |

| Assets: | | | | | | | |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 150,865 | | | $ | — | | | | | $ | 150,865 | |

| Time deposits | — | | | 30,000 | | | | | 30,000 | |

| Total | $ | 150,865 | | | $ | 30,000 | | | | | $ | 180,865 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Assets measured at fair value on a nonrecurring basis

The Company’s non-financial assets, such as goodwill, intangible assets, property and equipment, and right-of-use assets, are adjusted to fair value only when an impairment charge is recognized. The Company’s financial assets, comprised of equity securities without readily determinable fair values, are adjusted to fair value when observable price changes are identified or an impairment charge is recognized. Such fair value measurements are based predominantly on Level 3 inputs.

As of December 31, 2019, the net book value of both the Match brand in the UK and the Meetic brand in Europe approximated their fair values. An impairment of $4.6 million, which is included within amortization, was recognized on these brands during the six months ended June 30, 2020, as the outbreak of COVID-19 placed additional pressure on projected 2020 revenues at these brands.

Financial instruments measured at fair value only for disclosure purposes

The following table presents the carrying value and the fair value of financial instruments measured at fair value only for disclosure purposes.

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2020 | | | | December 31, 2019 | | |

| Carrying Value | | Fair Value | | Carrying Value | | Fair Value |

| | | | | | | |

| (In thousands) | | | | | | |

| | | | | | | |

Long-term debt, net (a) | $ | (3,527,660) | | | $ | (4,797,393) | | | $ | (2,889,626) | | | $ | (3,904,406) | |

______________________

(a)At June 30, 2020 and December 31, 2019, the carrying value of long-term debt, net includes unamortized original issue discount and debt issuance costs of $384.8 million and $402.9 million, respectively.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

At June 30, 2020 and December 31, 2019, the fair value of long-term debt, net, is estimated using observable market prices or indices for similar liabilities, which are Level 2 inputs.

NOTE 5—LONG-TERM DEBT, NET

Long-term debt consists of:

| | | | | | | | | | | |

| June 30, 2020 | | December 31, 2019 |

| | | |

| (In thousands) | | |

| Credit Facility due February 13, 2025 | $ | 20,000 | | | $ | — | |

| Term Loan due February 13, 2027 (the “Term Loan”) | 425,000 | | | 425,000 | |

| | | |

| 6.375% Senior Notes due June 1, 2024 (the “6.375% Senior Notes”); interest payable each June 1 and December 1 | — | | | 400,000 | |

| 5.00% Senior Notes due December 15, 2027 (the “5.00% Senior Notes”); interest payable each June 15 and December 15 | 450,000 | | | 450,000 | |

| 4.625% Senior Notes due June 1, 2028 (the “4.625% Senior Notes”); interest payable each June 1 and December 1, commencing December 1, 2020 | 500,000 | | | — | |

| 5.625% Senior Notes due February 15, 2029 (the “5.625% Senior Notes”); interest payable each February 15 and August 15 | 350,000 | | | 350,000 | |

| 4.125% Senior Notes due August 1, 2030 (the “4.125% Senior Notes”); interest payable each February 1 and August 1, commencing August 1, 2020 | 500,000 | | | — | |

| 0.875% Exchangeable Senior Notes due October 1, 2022 (the “2022 Exchangeable Notes”); interest payable each April 1 and October 1 | 517,500 | | | 517,500 | |

| 0.875% Exchangeable Senior Notes due June 15, 2026 (the “2026 Exchangeable Notes”); interest payable each June 15 and December 15 | 575,000 | | | 575,000 | |

| 2.00% Exchangeable Senior Notes due January 15, 2030 (the “2030 Exchangeable Notes”); interest payable each January 15 and July 15 | 575,000 | | | 575,000 | |

| Total debt | 3,912,500 | | | 3,292,500 | |

| | | |

| Less: Unamortized original issue discount | 336,069 | | | 357,887 | |

| Less: Unamortized debt issuance costs | 48,771 | | | 44,987 | |

| Total long-term debt, net | $ | 3,527,660 | | | $ | 2,889,626 | |

Term Loan and Credit Facility

In connection with the Separation, Former Match Group was merged into and with MG Holdings II. MG Holdings II replaced Former Match Group as borrower under the Credit Agreement and assumed its obligations thereunder and under the Term Loan and Credit Facility.

MG Holdings II, an indirect wholly-owned subsidiary of the Company, entered into the Term Loan under a credit agreement (the “Credit Agreement”) on November 16, 2015. On February 13, 2020, the Term Loan was amended to reprice the outstanding balance to LIBOR plus 1.75% and extend its maturity from November 16, 2022 to February 13, 2027. At both June 30, 2020 and December 31, 2019, the outstanding balance on the Term Loan was $425 million and the interest rate of the Term Loan was 2.18% and 4.44% as of those dates, respectively. Interest payments are due at least quarterly through the term of the loan. The Term Loan provides for annual principal payments as part of an excess cash flow sweep provision, the amount of which, if any, is governed by the secured net leverage ratio contained in the Credit Agreement.

On February 13, 2020, the Credit Facility was amended to, among other things, increase the available borrowing capacity from $500 million to $750 million, reduce interest rate margins by 0.125%, and extend its maturity to February 13, 2025. At June 30, 2020 the outstanding balance was $20.0 million and at December 31, 2019, there were 0 outstanding borrowings under the Credit Facility. The annual commitment fee on undrawn funds, which was 25 basis points as of June 30, 2020, is based on the current leverage ratio. Borrowings under

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

the Credit Facility bear interest, at MG Holdings II’s option, at a base rate or LIBOR, in each case plus an applicable margin, based on MG Holdings II’s consolidated net leverage ratio. At June 30, 2020, the interest rate of the Credit Facility was 1.48%. The terms of the Credit Facility require MG Holdings II to maintain a consolidated net leverage ratio of not more than 5.0 to 1.0.

The Credit Facility and Term Loan contain covenants that would limit the ability of MG Holdings II to pay dividends, make distributions, or repurchase MG Holdings II’s stock in the event MG Holdings II’s secured net leverage ratio exceeds 2.0 to 1.0, while the Term Loan remains outstanding and, thereafter, if MG Holdings II’s consolidated net leverage ratio exceeds 4.0 to 1.0, or in the event a default has occurred. There are additional covenants under these debt agreements that limit the ability of MG Holdings II and its subsidiaries to, among other things, incur indebtedness, pay dividends or make distributions. Obligations under the Credit Facility and Term Loan are unconditionally guaranteed by certain MG Holdings II wholly-owned domestic subsidiaries and are also secured by the stock of certain MG Holdings II domestic and foreign subsidiaries. The Term Loan and outstanding borrowings, if any, under the Credit Facility rank equally with each other, and have priority over the Senior Notes to the extent of the value of the assets securing the borrowings under the Credit Agreement.

Senior Notes

In connection with the Separation on June 30, 2020, MG Holdings II replaced the Former Match Group as issuer of each of the Senior Notes and assumed its obligations thereunder and under the indentures governing each of the Senior Notes, respectively.

The 4.625% Senior Notes were issued by MG Holdings II on May 19, 2020. The proceeds from these notes were used to redeem the outstanding 6.375% Senior Notes, to pay expenses associated with the offering, and for general corporate purposes. At any time prior to June 1, 2023, these notes may be redeemed at a redemption price equal to the sum of the principal amount, plus accrued and unpaid interest and a make-whole premium set forth in the indenture governing the notes. Thereafter, these notes may be redeemed at redemption prices set forth in the indenture governing the 4.625% Senior Notes, together with accrued and unpaid interest to the applicable redemption date.

The 4.125% Senior Notes were issued by MG Holdings II on February 11, 2020. The proceeds from these notes were used to fund a portion of the $3.00 per common share of Former Match Group that was payable in connection with the Separation. At any time prior to May 1, 2025, these notes may be redeemed at a redemption price equal to the sum of the principal amount, plus accrued and unpaid interest and a make-whole premium set forth in the indenture governing the notes. Thereafter, these notes may be redeemed at redemption prices set forth in the indenture governing the 4.125% Senior Notes, together with accrued and unpaid interest to the applicable redemption date.

The 5.625% Senior Notes were issued by MG Holdings II on February 15, 2019. The proceeds from these notes were used to repay outstanding borrowings under the Credit Facility, to pay expenses associated with the offering, and for general corporate purposes. At any time prior to February 15, 2024, these notes may be redeemed at a redemption price equal to the sum of the principal amount, plus accrued and unpaid interest and a make-whole premium set forth in the indenture governing the notes. Thereafter, these notes may be redeemed at redemption prices set forth in the indenture governing the 5.625% Senior Notes, together with accrued and unpaid interest to the applicable redemption date.

The 5.00% Senior Notes were issued by MG Holdings II on December 4, 2017. At any time prior to December 15, 2022, these notes may be redeemed at a redemption price equal to the sum of the principal amount, plus accrued and unpaid interest and a make-whole premium set forth in the indenture governing the notes. Thereafter, these notes may be redeemed at redemption prices set forth in the indenture governing the 5.00% Senior Notes, together with accrued and unpaid interest to the applicable redemption date.

The 6.375% Senior Notes were redeemed on June 11, 2020 with proceeds from the 4.625% Senior Notes. The related call premium of $12.8 million and $2.9 million of unamortized original issue discount and debt issuance costs related to the 6.375% Senior Notes are included in “Other (expense) income, net” in the consolidated financial statements.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

The indentures governing the 5.00% Senior Note contain covenants that would limit MG Holdings II’s ability to pay dividends or to make distributions and repurchase or redeem MG Holdings II’s stock in the event a default has occurred or MG Holdings II’s consolidated leverage ratio (as defined in the indentures) exceeds 5.0 to 1.0. At June 30, 2020, there were no limitations pursuant thereto. There are additional covenants in those indentures that limit the ability of MG Holdings II and its subsidiaries to, among other things, (i) incur indebtedness, make investments, or sell assets in the event MG Holdings II is not in compliance with certain financial ratios set forth therein, and (ii) incur liens, enter into agreements restricting the ability of MG Holdings II’s subsidiaries to pay dividends, enter into transactions with affiliates and consolidate, merge or sell substantially all of their assets. The indentures governing the 4.125%, 4.625%, and 5.625% Senior Notes are less restrictive than the indentures governing the 5.00% Senior Notes and generally only limit MG Holdings II’s and its subsidiaries’ ability to, among other things, create liens on assets, and our ability to consolidate, merge, sell or otherwise dispose of all or substantially all of our assets.

The Senior Notes all rank equally in right of payment.

Exchangeable Notes

During 2017, Match Group FinanceCo, Inc., a direct, wholly-owned subsidiary of the Company, issued $517.5 million aggregate principal amount of its 2022 Exchangeable Notes. During 2019, Match Group FinanceCo 2, Inc. and Match Group FinanceCo 3, Inc., direct, wholly-owned subsidiaries of the Company, issued $575.0 million aggregate principal amount of its 2026 Exchangeable Notes and $575.0 million aggregate principal amount of its 2030 Exchangeable Notes, respectively.

The 2022, 2026, and 2030 Exchangeable Notes (collectively the “Exchangeable Notes”) are guaranteed by the Company but are not guaranteed by MG Holdings II or any of its subsidiaries.

Following the Separation, the number of shares of the Company’s common stock into which each $1,000 of principal of the Exchangeable Notes is exchangeable and the approximate equivalent exchange price per share were adjusted under the terms of each of the respective Exchangeable Notes to reflect the conversion of each from Former IAC amounts to Match Group amounts. The following table presents details of the exchangeable features under the amended Match Group terms:

| | | | | | | | | | | | | | | | | |

| Number of shares of the Company’s Common Stock into which each $1,000 of Principal of the Exchangeable Notes is Exchangeable(a) | | Approximate Equivalent Exchange Price per Share(a) | | Exchangeable Date |

| 2022 Exchangeable Notes | 22.7331 | | $ | 43.99 | | | July 1, 2022 |

| 2026 Exchangeable Notes | 11.4259 | | $ | 87.52 | | | March 15, 2026 |

| 2030 Exchangeable Notes | 11.8739 | | $ | 84.22 | | | October 15, 2029 |

______________________

(a)Subject to adjustment upon the occurrence of specified events.

The Exchangeable Notes are exchangeable under the following circumstances:

(1) during any calendar quarter (and only during such calendar quarter), if the last reported sale price of the Company's common stock for at least 20 trading days during the period of 30 consecutive trading days during the immediately preceding calendar quarter is greater than or equal to 130% of the exchange price on each applicable trading day;

(2) during the five-business day period after any five-consecutive trading day period in which the trading price per $1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of the Company's common stock and the exchange rate on each such trading day;

(3) if the issuer calls the notes for redemption, at any time prior to the close of business on the scheduled trading day immediately preceding the redemption date; or

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

(4) upon the occurrence of specified corporate events as further described under the indentures governing the respective Exchangeable Notes.

On or after the respective exchangeable dates noted in the table above, until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may exchange all or any portion of their Exchangeable Notes regardless of the foregoing conditions. Upon exchange, the Company, in its sole discretion, has the option to settle the Exchangeable Notes with any of the three following alternatives: (1) shares of the Company’s common stock, (2) cash or (3) a combination of cash and shares of the Company's common stock. It is the Company’s intention to settle the Exchangeable Notes with cash equal to the face amount of the notes upon exchange; any shares issued would be offset by shares received upon exercise of the Exchangeable Note Hedges (described below).

The Company’s 2022 Exchangeable Notes were exchangeable as of June 30, 2020; during the three and six months ended June 30, 2020, no notes were exchanged. Any dilution arising from the 2022 Exchangeable Notes would be mitigated by the 2022 Exchangeable Notes Hedge. The Company’s 2026 and 2030 Exchangeable Notes were not exchangeable as of June 30, 2020, however, their if-converted value exceeds their respective principal amount.

The following table presents the if-converted value that exceeded the principal of each note based on the Company’s stock price June 30, 2020 and December 31, 2019, respectively. The amounts for June 30, 2020 represent the exchange occurring under the Match Group terms and for December 31, 2019 represent the exchange occurring under Former IAC terms.

| | | | | | | | | | | |

| June 30, 2020 | | December 31, 2019 |

| | | |

| (In millions) | | |

| 2022 Exchangeable Notes | $ | 706.6 | | | $ | 329.6 | |

| 2026 Exchangeable Notes | $ | 108.6 | | | N/A |

| 2030 Exchangeable Notes | $ | 135.4 | | | N/A |

Additionally, each of Match Group FinanceCo 2, Inc. and Match Group FinanceCo 3, Inc. may redeem for cash all or any portion of its applicable notes, at its option, on or after June 20, 2023 and July 20, 2026, respectively, if the last reported sale price of the common stock underlying the respective notes has been at least 130% of the exchange price then in effect for at least 20 trading days (whether or not consecutive), including at least one of the five trading days immediately preceding the date on which the notice of redemption is provided, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the applicable issuer provides notice of redemption, at a redemption price equal to 100% of the principal amount to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date.

The Company separately accounts for the debt and equity components of the Exchangeable Notes, and therefore, the Company recorded an original issue discount and corresponding increase to additional paid-in capital, which is the fair value attributed to the exchange feature of each series of debt at issuance. The Company is amortizing the original issue discount and debt issuance costs utilizing the effective interest method over the life of the Exchangeable Notes. The effective interest rates for the 2022, 2026, and 2030 Exchangeable Notes are 4.73%, 5.35%, and 6.59%, respectively.

MATCH GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) (Continued)

The following tables sets forth the components of the Exchangeable Notes:

| | | | | | | | | | | | | | | | | |

| June 30, 2020 | | | | |