- RY Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

424B2 Filing

Royal Bank of Canada (RY) 424B2Prospectus for primary offering

Filed: 20 Dec 24, 2:43pm

| Registration Statement No. 333-275898 Filed Pursuant to Rule 424(b)(2) |

Pricing Supplement Pricing Supplement dated December 18, 2024 to the Prospectus dated December 20, 2023, the Prospectus Supplement dated December 20, 2023 and the Product Supplement No. 1A dated May 16, 2024 | $1,000,000

Royal Bank of Canada | |

Royal Bank of Canada is offering Enhanced Return Barrier Notes (the “Notes”) linked to the performance of an equally weighted basket (the “Basket”) consisting of the common stock of The AES Corporation, the common stock of Advanced Micro Devices, Inc., the common stock of Amazon.com, Inc., the common stock of Carrier Global Corporation, the common stock of Digital Realty Trust, Inc., the common stock of Equinix, Inc., the ordinary shares of Eaton Corporation plc, the Class A common stock of Alphabet Inc., the Class A common stock of Meta Platforms, Inc., the common stock of Microsoft Corporation, the common stock of NextEra Energy, Inc., the common stock of NVIDIA Corporation, the common stock of QUALCOMM Incorporated, the common stock of The Southern Company, the American depositary shares of Taiwan Semiconductor Manufacturing Company Limited, the Global X Uranium ETF and the common stock of Vistra Corp. (each, a “Basket Underlier”).

| · | Enhanced Return Potential — If the Final Basket Value is greater than the Initial Basket Value, at maturity, investors will receive a return equal to 102% of the Basket Return. |

| · | Contingent Return of Principal at Maturity — If the Final Basket Value is less than or equal to the Initial Basket Value, but is greater than or equal to the Barrier Value (90% of the Initial Basket Value), at maturity, investors will receive the principal amount of their Notes. If the Final Basket Value is less than the Barrier Value, at maturity, investors will lose 1% of the principal amount of their Notes for each 1% that the Final Basket Value is less than the Initial Basket Value. |

| · | The Notes do not pay interest. |

| · | Any payments on the Notes are subject to our credit risk. |

| · | The Notes will not be listed on any securities exchange. |

CUSIP: 78017KEP3

Investing in the Notes involves a number of risks. See “Selected Risk Considerations” beginning on page P-7 of this pricing supplement and “Risk Factors” in the accompanying prospectus, prospectus supplement and product supplement.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission or any other regulatory body has approved or disapproved of the Notes or passed upon the adequacy or accuracy of this pricing supplement. Any representation to the contrary is a criminal offense. The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other Canadian or U.S. governmental agency or instrumentality. The Notes are not bail-inable notes and are not subject to conversion into our common shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act.

Per Note | Total | |

| Price to public(1) | 100.00% | $1,000,000 |

| Underwriting discounts and commissions(1) | 3.35% | $33,500 |

| Proceeds to Royal Bank of Canada | 96.65% | $966,500 |

(1) We or one of our affiliates may pay varying selling concessions of up to $33.50 per $1,000 principal amount of Notes in connection with the distribution of the Notes to other registered broker-dealers. Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their underwriting discount or selling concessions. The public offering price for investors purchasing the Notes in these accounts may be between $966.50 and $1,000.00 per $1,000 principal amount of Notes. See “Supplemental Plan of Distribution (Conflicts of Interest)” below.

The initial estimated value of the Notes determined by us as of the Trade Date, which we refer to as the initial estimated value, is $950.59 per $1,000 principal amount of Notes and is less than the public offering price of the Notes. The market value of the Notes at any time will reflect many factors, cannot be predicted with accuracy and may be less than this amount. We describe the determination of the initial estimated value in more detail below.

RBC Capital Markets, LLC

Enhanced Return Barrier Notes Linked |

KEY TERMS

The information in this “Key Terms” section is qualified by any more detailed information set forth in this pricing supplement and in the accompanying prospectus, prospectus supplement and product supplement.

| Issuer: | Royal Bank of Canada | |||

| Underwriter: | RBC Capital Markets, LLC (“RBCCM”) | |||

| Minimum Investment: | $1,000 and minimum denominations of $1,000 in excess thereof | |||

| Basket Underliers: | The common stock of The AES Corporation (the “AES Stock”), the common stock of Advanced Micro Devices, Inc. (the “AMD Stock”), the common stock of Amazon.com, Inc. (the “AMZN Underlier”), the common stock of Carrier Global Corporation (the “CARR Stock”), the common stock of Digital Realty Trust, Inc. (the “DLR Stock”), the common stock of Equinix, Inc. (the “EQIX Stock”), the ordinary shares of Eaton Corporation plc (the “ETN Stock”), the Class A common stock of Alphabet Inc. (the “GOOGL Stock”), the Class A common stock of Meta Platforms, Inc. (the “META Stock”), the common stock of Microsoft Corporation (the “MSFT Stock”), the common stock of NextEra Energy, Inc. (the “NEE Stock”), the common stock of NVIDIA Corporation (the “NVDA Stock”), the common stock of QUALCOMM Incorporated (the “QCOM Stock”), the common stock of The Southern Company (the “SO Stock”), the American depositary shares of Taiwan Semiconductor Manufacturing Company Limited (the “TSM Stock”), the Global X Uranium ETF (the “URA Fund”) and the common stock of Vistra Corp. (the “VST Stock”).

We refer to each of the AES Stock, AMD Stock, AMZN Stock, CARR Stock, DLR Stock, EQIX Stock, ETN Stock, GOOGL Stock, META Stock, MSFT Stock, NEE Stock, NVDA Stock, QCOM Stock, SO Stock, TSM Stock and VST Stock as a “Basket Stock Underlier.” | |||

| Basket Underlier | Bloomberg Ticker | Initial Basket Underlier Value(1) | Basket Weighting | |

| AES Stock | AES UN | $12.50 | 1/17 | |

| AMD Stock | AMD UW | $121.41 | 1/17 | |

| AMZN Stock | AMZN UW | $220.52 | 1/17 | |

| CARR Stock | CARR UN | $67.03 | 1/17 | |

| DLR Stock | DLR UN | $176.96 | 1/17 | |

| EQIX Stock | EQIX UW | $926.38 | 1/17 | |

| ETN Stock | ETN UN | $335.12 | 1/17 | |

| GOOGL Stock | GOOGL UW | $188.40 | 1/17 | |

| META Stock | META UW | $597.19 | 1/17 | |

| MSFT Stock | MSFT UW | $437.39 | 1/17 | |

| NEE Stock | NEE UN | $70.52 | 1/17 | |

| NVDA Stock | NVDA UW | $128.91 | 1/17 | |

| QCOM Stock | QCOM UW | $153.05 | 1/17 | |

| SO Stock | SO UN | $81.50 | 1/17 | |

| TSM Stock | TSM UN | $195.56 | 1/17 | |

| P-2 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

| URA Fund | URA UP | $27.80 | 1/17 | |

| VST Stock | VST UN | $132.89 | 1/17 | |

| (1) With respect to each Basket Underlier, the closing value of that Basket Underlier on the Trade Date | ||||

| Trade Date: | December 18, 2024 | |||

| Issue Date: | December 23, 2024 | |||

| Valuation Date:* | December 18, 2029 | |||

| Maturity Date:* | December 21, 2029 | |||

| Payment at Maturity: | Investors will receive on the Maturity Date per $1,000 principal amount of Notes:

· If the Final Basket Value is greater than the Initial Basket Value, an amount equal to:

$1,000 + ($1,000 × Basket Return × Participation Rate)

· If the Final Basket Value is less than or equal to the Initial Basket Value, but is greater than or equal to the Barrier Value: $1,000

· If the Final Basket Value is less than the Barrier Value, an amount equal to:

$1,000 + ($1,000 × Basket Return)

If the Final Basket Value is less than the Barrier Value, you will lose a substantial portion or all of your principal amount at maturity. All payments on the Notes are subject to our credit risk. | |||

| Participation Rate: | 102% | |||

| Barrier Value: | 90, which is 90% of the Initial Basket Value | |||

| Basket Return: | The Basket Return, expressed as a percentage, is calculated using the following formula:

Final Basket Value – Initial Basket Value | |||

| Initial Basket Value: | Set equal to 100 on the Trade Date | |||

| Final Basket Value: | The Final Basket Value will be calculated as follows:

100 × [1 + (the sum of, for each Basket Underlier, its Basket Underlier Return times its Basket Weighting)]

| |||

| Basket Underlier Return: | With respect to each Basket Underlier, the Basket Underlier Return, expressed as a percentage, is calculated using the following formula:

Final Basket Underlier Value – Initial Basket Underlier Value | |||

| Final Basket Underlier Value: | With respect to each Basket Underlier, the closing value of that Basket Underlier on the Valuation Date | |||

| Calculation Agent: | RBCCM | |||

* Subject to postponement. See “General Terms of the Notes—Postponement of a Determination Date” and “General Terms of the Notes—Postponement of a Payment Date” in the accompanying product supplement.

| P-3 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together with the prospectus dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior Global Medium-Term Notes, Series J, of which the Notes are a part, and the product supplement no. 1A dated May 16, 2024. This pricing supplement, together with these documents, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours.

We have not authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this pricing supplement and the documents listed below. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. These documents are an offer to sell only the Notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in each such document is current only as of its date.

If the information in this pricing supplement differs from the information contained in the documents listed below, you should rely on the information in this pricing supplement.

You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the documents listed below, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299520/d645671d424b3.htm

| · | Prospectus Supplement dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299523/d638227d424b3.htm

| · | Product Supplement No. 1A dated May 16, 2024: |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324006777/dp211286_424b2-ps1a.htm

Our Central Index Key, or CIK, on the SEC website is 1000275. As used in this pricing supplement, “Royal Bank of Canada,” the “Bank,” “we,” “our” and “us” mean only Royal Bank of Canada.

| P-4 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

HYPOTHETICAL RETURNS

The table and examples set forth below illustrate hypothetical payments at maturity for hypothetical performance of the Basket, based on the Barrier Value of 90% of the Initial Basket Value and the Participation Rate of 102%. The table and examples are only for illustrative purposes and may not show the actual return applicable to investors.

| Hypothetical Basket Return | Payment at Maturity per $1,000 Principal Amount of Notes | Payment at Maturity as Percentage of Principal Amount |

| 50.00% | $1,510.00 | 151.000% |

| 40.00% | $1,408.00 | 140.800% |

| 30.00% | $1,306.00 | 130.600% |

| 20.00% | $1,204.00 | 120.400% |

| 10.00% | $1,102.00 | 110.200% |

| 5.00% | $1,051.00 | 105.100% |

| 2.00% | $1,020.40 | 102.040% |

| 0.00% | $1,000.00 | 100.000% |

| -5.00% | $1,000.00 | 100.000% |

| -10.00% | $1,000.00 | 100.000% |

| -10.01% | $899.90 | 89.990% |

| -20.00% | $800.00 | 80.000% |

| -30.00% | $700.00 | 70.000% |

| -40.00% | $600.00 | 60.000% |

| -50.00% | $500.00 | 50.000% |

| -60.00% | $400.00 | 40.000% |

| -70.00% | $300.00 | 30.000% |

| -80.00% | $200.00 | 20.000% |

| -90.00% | $100.00 | 10.000% |

| -100.00% | $0.00 | 0.000% |

| Example 1 — | The value of the Basket increases from the Initial Basket Value to the Final Basket Value by 2%. | |

| Basket Return: | 2% | |

| Payment at Maturity: | $1,000 + ($1,000 × 2% × 102%) = $1,000 + $20.40 = $1,020.40 | |

In this example, the payment at maturity is $1,020.40 per $1,000 principal amount of Notes, for a return of 2.04%.

Because the Final Basket Value is greater than the Initial Basket Value, investors receive a return equal to 102% of the Basket Return. | ||

| Example 2 — | The value of the Basket decreases from the Initial Basket Value to the Final Basket Value by 5% (i.e., the Final Basket Value is below the Initial Basket Value but above the Barrier Value). | |

| Basket Return: | -5% | |

| Payment at Maturity: | $1,000 | |

| In this example, the payment at maturity is $1,000 per $1,000 principal amount of Notes, for a return of 0%. | ||

| P-5 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

| Because the Final Basket Value is greater than the Barrier Value, investors receive a full return of the principal amount of their Notes. |

| Example 3 — | The value of the Basket decreases from the Initial Basket Value to the Final Basket Value by 50% (i.e., the Final Basket Value is below the Barrier Value). | |

| Basket Return: | -50% | |

| Payment at Maturity: | $1,000 + ($1,000 × -50%) = $1,000 – $500 = $500 | |

In this example, the payment at maturity is $500 per $1,000 principal amount of Notes, representing a loss of 50% of the principal amount.

Because the Final Basket Value is less than the Barrier Value, investors do not receive a full return of the principal amount of their Notes. | ||

Investors in the Notes could lose a substantial portion or all of the principal amount of their Notes at maturity.

| P-6 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

SELECTED RISK CONSIDERATIONS

An investment in the Notes involves significant risks. We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the Notes. Some of the risks that apply to an investment in the Notes are summarized below, but we urge you to read also the “Risk Factors” sections of the accompanying prospectus, prospectus supplement and product supplement. You should not purchase the Notes unless you understand and can bear the risks of investing in the Notes.

Risks Relating to the Terms and Structure of the Notes

| · | You May Lose a Portion or All of the Principal Amount at Maturity — If the Final Basket Value is less than the Barrier Value, you will lose 1% of the principal amount of your Notes for each 1% that the Final Basket Value is less than the Initial Basket Value. You could lose a substantial portion or all of your principal amount at maturity. |

| · | The Notes Do Not Pay Interest, and Your Return on the Notes May Be Lower Than the Return on a Conventional Debt Security of Comparable Maturity — There will be no periodic interest payments on the Notes as there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. The return that you will receive on the Notes, which could be negative, may be less than the return you could earn on other investments. Even if your return is positive, your return may be less than the return you would earn if you purchased one of our conventional senior interest-bearing debt securities. |

| · | Payments on the Notes Are Subject to Our Credit Risk, and Market Perceptions about Our Creditworthiness May Adversely Affect the Market Value of the Notes — The Notes are our senior unsecured debt securities, and your receipt of any amounts due on the Notes is dependent upon our ability to pay our obligations as they come due. If we were to default on our payment obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire investment. In addition, any negative changes in market perceptions about our creditworthiness may adversely affect the market value of the Notes. |

| · | Changes in the Value of One Basket Underlier May Be Offset by Changes in the Values of the Other Basket Underliers — A change in the value of one Basket Underlier may not correlate with changes in the values of the other Basket Underliers. The value of one Basket Underlier may increase, while the values of the other Basket Underliers may not increase as much, or may even decrease. Therefore, in determining the value of the Basket as of any time, increases in the value of one Basket Underlier may be moderated, or wholly offset, by lesser increases or decreases in the values of the other Basket Underliers. |

| · | Any Payment on the Notes Will Be Determined Based on the Closing Values of the Basket Underliers on the Dates Specified — Any payment on the Notes will be determined based on the closing values of the Basket Underliers on the dates specified. You will not benefit from any more favorable values of the Basket Underliers determined at any other time. |

| · | The U.S. Federal Income Tax Consequences of an Investment in the Notes Are Uncertain — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the Notes, and significant aspects of the tax treatment of the Notes are uncertain. Moreover, the Notes may be subject to the “constructive ownership” regime, in which case certain adverse tax consequences may apply upon your disposition of a Note. You should review carefully the section entitled “United States Federal Income Tax Considerations” herein, in combination with the section entitled “United States Federal Income Tax Considerations” in the accompanying product supplement, and consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the Notes. |

Risks Relating to the Initial Estimated Value of the Notes and the Secondary Market for the Notes

| · | There May Not Be an Active Trading Market for the Notes; Sales in the Secondary Market May Result in Significant Losses — There may be little or no secondary market for the Notes. The Notes will not be listed on any securities exchange. RBCCM and our other affiliates may make a market for the Notes; however, they are not required to do so and, if they choose to do so, may stop any market-making activities at any time. Because other dealers are not |

| P-7 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which RBCCM or any of our other affiliates is willing to buy the Notes. Even if a secondary market for the Notes develops, it may not provide enough liquidity to allow you to easily trade or sell the Notes. We expect that transaction costs in any secondary market would be high. As a result, the difference between bid and ask prices for your Notes in any secondary market could be substantial. If you sell your Notes before maturity, you may have to do so at a substantial discount from the price that you paid for them, and as a result, you may suffer significant losses. The Notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Notes to maturity.

| · | The Initial Estimated Value of the Notes Is Less Than the Public Offering Price — The initial estimated value of the Notes is less than the public offering price of the Notes and does not represent a minimum price at which we, RBCCM or any of our other affiliates would be willing to purchase the Notes in any secondary market (if any exists) at any time. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the values of the Basket Underliers, the internal funding rate we pay to issue securities of this kind (which is lower than the rate at which we borrow funds by issuing conventional fixed rate debt) and the inclusion in the public offering price of the underwriting discount, our estimated profit and the estimated costs relating to our hedging of the Notes. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. Assuming no change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your Notes prior to maturity may be less than your original purchase price, as any such sale price would not be expected to include the underwriting discount, our estimated profit or the hedging costs relating to the Notes. In addition, any price at which you may sell the Notes is likely to reflect customary bid-ask spreads for similar trades. In addition to bid-ask spreads, the value of the Notes determined for any secondary market price is expected to be based on a secondary market rate rather than the internal funding rate used to price the Notes and determine the initial estimated value. As a result, the secondary market price will be less than if the internal funding rate were used. |

| · | The Initial Estimated Value of the Notes Is Only an Estimate, Calculated as of the Trade Date — The initial estimated value of the Notes is based on the value of our obligation to make the payments on the Notes, together with the mid-market value of the derivative embedded in the terms of the Notes. See “Structuring the Notes” below. Our estimate is based on a variety of assumptions, including our internal funding rate (which represents a discount from our credit spreads), expectations as to dividends, interest rates and volatility and the expected term of the Notes. These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Notes or similar securities at a price that is significantly different than we do. |

The value of the Notes at any time after the Trade Date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a result, the actual value you would receive if you sold the Notes in any secondary market, if any, should be expected to differ materially from the initial estimated value of the Notes.

Risks Relating to Conflicts of Interest and Our Trading Activities

| · | Our and Our Affiliates’ Business and Trading Activities May Create Conflicts of Interest — You should make your own independent investigation of the merits of investing in the Notes. Our and our affiliates’ economic interests are potentially adverse to your interests as an investor in the Notes due to our and our affiliates’ business and trading activities, and we and our affiliates have no obligation to consider your interests in taking any actions that might affect the value of the Notes. Trading by us and our affiliates may adversely affect the values of the Basket Underliers and the market value of the Notes. See “Risk Factors—Risks Relating to Conflicts of Interest” in the accompanying product supplement. |

| · | RBCCM’s Role as Calculation Agent May Create Conflicts of Interest — As Calculation Agent, our affiliate, RBCCM, will determine any values of the Basket Underliers and make any other determinations necessary to calculate any payments on the Notes. In making these determinations, the Calculation Agent may be required to make discretionary judgments, including those described under “—Risks Relating to the Basket Underliers” below. In making these discretionary judgments, the economic interests of the Calculation Agent are potentially adverse to your interests as an |

| P-8 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

investor in the Notes, and any of these determinations may adversely affect any payments on the Notes. The Calculation Agent will have no obligation to consider your interests as an investor in the Notes in making any determinations with respect to the Notes.

Risks Relating to the Basket Underliers

| · | You Will Not Have Any Rights to Any Basket Underlier or the Securities Composing the URA Fund — As an investor in the Notes, you will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to any Basket Underlier or the securities composing the URA Fund. |

| · | The URA Fund and the Underlying Index Are Different — The performance of the URA Fund will not exactly replicate the performance of the Underlying Index (as defined below). The URA Fund is subject to management risk, which is the risk that the investment strategy for the URA Fund, the implementation of which is subject to a number of constraints, may not produce the intended results. The URA Fund’s investment adviser may have the right to use a portion of the URA Fund’s assets to invest in securities or other assets or instruments, including derivatives, that are not included in the Underlying Index. In addition, unlike the Underlying Index, the URA Fund will reflect transaction costs and fees that will reduce its performance relative to the Underlying Index. |

The performance of the URA Fund may diverge significantly from the performance of the Underlying Index due to differences in trading hours between the URA Fund and the securities composing the Underlying Index or other circumstances. During periods of market volatility, the component securities held by the URA Fund may be unavailable in the secondary market, market participants may be unable to calculate accurately the intraday net asset value per share of the URA Fund and the liquidity of the URA Fund may be adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares in the URA Fund. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares of the URA Fund. As a result, under these circumstances, the market value of the URA Fund may vary substantially from the net asset value per share of the URA Fund.

| · | The Notes Are Subject to Risks Relating to Non-U.S. Securities with Respect to the ETN Stock — Because the issuer of the ETN Stock is incorporated in Ireland, an investment in the Notes involves risks associated with Ireland. The prices of securities of non-U.S. companies may be affected by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic and fiscal policies and currency exchange laws. |

| · | The Notes Are Subject to Risks Relating to Non-U.S. Securities with Respect to the TSM Stock — Because the issuer of the TSM Stock is incorporated in the Republic of China, an investment in the Notes involves risks associated with the Republic of China. The prices of securities of non-U.S. companies may be affected by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic and fiscal policies and currency exchange laws. |

| · | The Equity Securities Composing the URA Fund Are Concentrated in the Uranium Sector — All or substantially all of the equity securities composing the URA Fund are issued by companies whose primary line of business is directly associated with uranium mining, exploration and technologies related to the uranium industry. As a result, the value of the Notes may be subject to greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting this industry than a different investment linked to securities of a more broadly diversified group of issuers. The uranium sector is exposed to risks related to the uranium mining industry, the exploration industry, the oil, gas and consumable fuels industry and the energy sector. The uranium mining industry can be significantly subject to the effects of competitive pressures in the uranium mining industry and the price of uranium. The exploration and development of mineral deposits involve significant financial risks over a significant period of time. Few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to establish reserves by drilling and to construct mining and processing facilities at a site. In addition, mineral exploration companies typically operate at a loss and are dependent on securing equity and/or debt financing, which might be more difficult to secure for an exploration company than for a more established counterpart. Companies in this sector are subject to substantial |

| P-9 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

government regulation and contractual fixed pricing, which may increase the cost of business and limit these companies’ earnings.

| · | The Notes Are Subject to Risks Relating to Non-U.S. Securities Markets with Respect to the URA Fund — The equity securities composing the URA Fund are issued by non-U.S. companies in non-U.S. securities markets. Investments in securities linked to the value of such non-U.S. equity securities involve risks associated with the securities markets in the home countries of the issuers of those non-U.S. equity securities, including risks of volatility in those markets, governmental intervention in those markets and cross shareholdings in companies in certain countries. Also, there is generally less publicly available information about companies in some of these jurisdictions than there is about U.S. companies that are subject to the reporting requirements of the SEC, and generally non-U.S. companies are subject to accounting, auditing and financial reporting standards and requirements and securities trading rules different from those applicable to U.S. reporting companies. The prices of securities in non-U.S. markets may be affected by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic and fiscal policies and currency exchange laws. |

| · | The Notes Are Subject to Risks Relating to Emerging Markets with Respect to the URA Fund — Some of the equity securities composing the URA Fund have been issued by companies based in emerging markets. Emerging markets pose further risks in addition to the risks associated with investing in foreign equity markets generally. Countries with emerging markets may have relatively unstable financial markets and governments; may present the risks of nationalization of businesses; may impose restrictions on currency conversion, exports or foreign ownership and prohibitions on the repatriation of assets; may pose a greater likelihood of regulation by the national, provincial and local governments of the emerging market countries, including the imposition of currency exchange laws and taxes; and may have less protection of property rights, less access to legal recourse and less comprehensive financial reporting and auditing requirements than more developed countries. The economies of countries with emerging markets may be based on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Local securities markets may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times. Moreover, the economies in such countries may differ unfavorably from the economy in the United States in such respects as growth of gross national product, rate of inflation, capital reinvestment, resources, self-sufficiency and balance of payment positions. The currencies of emerging markets may also be less liquid and more volatile than those of developed markets and may be affected by political and economic developments in different ways than developed markets. The foregoing factors may adversely affect the performance of companies based in emerging markets. |

| · | The Value of the URA Fund Is Subject to Currency Exchange Risk — Because the securities composing the URA Fund are denominated in non-U.S. currencies and are converted into U.S. dollars for purposes of calculating the value of the URA Fund, the value of the URA Fund will be exposed to the currency exchange rate risk with respect to each of those non-U.S. currencies relative to the U.S. dollar. An investor’s net exposure will depend on the extent to which each of those non-U.S. currencies strengthens or weakens against the U.S. dollar and the relative weight of the securities denominated in those non-U.S. currencies. If, taking into account the relevant weighting, the U.S. dollar strengthens against those non-U.S. currencies, the value of the URA Fund and the value of the Notes will be adversely affected. |

| · | We May Accelerate the Notes If a Change-in-Law Event Occurs — Upon the occurrence of legal or regulatory changes that may, among other things, prohibit or otherwise materially restrict persons from holding the Notes or a Basket Underlier or its components, or engaging in transactions in them, the Calculation Agent may determine that a change-in-law-event has occurred and accelerate the Maturity Date for a payment determined by the Calculation Agent in its sole discretion. Any amount payable upon acceleration could be significantly less than any amount that would be due on the Notes if they were not accelerated. However, if the Calculation Agent elects not to accelerate the Notes, the value of, and any amount payable on, the Notes could be adversely affected, perhaps significantly, by the occurrence of such legal or regulatory changes. See “General Terms of Notes—Change-in-Law Events” in the accompanying product supplement. |

| · | Any Payment on the Notes May Be Postponed and Adversely Affected by the Occurrence of a Market Disruption Event — The timing and amount of any payment on the Notes is subject to adjustment upon the occurrence of a market |

| P-10 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

disruption event affecting a Basket Underlier. If a market disruption event persists for a sustained period, the Calculation Agent may make a discretionary determination of the closing value of any affected Basket Underlier. See “General Terms of the Notes—Reference Stocks and Funds—Market Disruption Events,” “General Terms of the Notes—Postponement of a Determination Date” and “General Terms of the Notes—Postponement of a Payment Date” in the accompanying product supplement.

| · | Adjustments to the URA Fund or to the Underlying Index Could Adversely Affect Any Payments on the Notes — The investment adviser of the URA Fund may add, remove or substitute the component securities held by the Underlier or make changes to its investment strategy, and the sponsor of the Underlying Index may add, delete, substitute or adjust the securities composing the Underlying Index, may make other methodological changes to the Underlying Index that could affect its performance or may discontinue or suspend calculation and publication of the Underlying Index. Any of these actions could adversely affect the value of the URA Fund and, consequently, the value of the Notes. |

| · | Anti-dilution Protection Is Limited, and the Calculation Agent Has Discretion to Make Anti-dilution Adjustments — The Calculation Agent may in its sole discretion make adjustments affecting any amounts payable on the Notes upon the occurrence of certain events with respect to an Basket Underlier that the Calculation Agent determines have a diluting or concentrative effect on the theoretical value of a Basket Underlier. However, the Calculation Agent might not make adjustments in response to all such events that could affect a Basket Underlier. The occurrence of any such event and any adjustment made by the Calculation Agent (or a determination by the Calculation Agent not to make any adjustment) may adversely affect the market price of, and any amounts payable on, the Notes. See “General Terms of the Notes—Reference Stocks and Funds—Anti-dilution Adjustments” in the accompanying product supplement. |

| · | Reorganization or Other Events Could Adversely Affect the Value of the Notes or Result in the Notes Being Accelerated — If the URA Fund is delisted or terminated, the Calculation Agent may select a successor fund. In addition, upon the occurrence of certain reorganization or other events affecting a Basket Underlier, the Calculation Agent may make adjustments that result in payments on the Notes being based on the performance of (i) cash, securities of another issuer and/or other property distributed to holders of that Basket Underlier upon the occurrence of that event or (ii) in the case of a reorganization event in which only cash is distributed to holders of that Basket Underlier, a substitute security, if the Calculation Agent elects to select one. Any of these actions could adversely affect the value of the affected Basket Underlier and, consequently, the value of the Notes. Alternatively, the Calculation Agent may accelerate the Maturity Date for a payment determined by the Calculation Agent. Any amount payable upon acceleration could be significantly less than any amount that would be due on the Notes if they were not accelerated. However, if the Calculation Agent elects not to accelerate the Notes, the value of, and any amount payable on, the Notes could be adversely affected, perhaps significantly. See “General Terms of the Notes—Reference Stocks and Funds—Anti-dilution Adjustments—Reorganization Events” and “General Terms of the Notes—Reference Stocks and Funds—Discontinuation of, or Adjustments to, a Fund” in the accompanying product supplement. |

| P-11 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

INFORMATION REGARDING THE BASKET UNDERLIERS

Each Basket Stock Underlier is registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Companies with securities registered under the Exchange Act are required to file financial and other information specified by the SEC periodically. Information provided to or filed with the SEC by the issuer of each Basket Underlier can be located on a website maintained by the SEC at https://www.sec.gov by reference to that issuer’s SEC file number provided below. Information from outside sources is not incorporated by reference in, and should not be considered part of, this pricing supplement. We have not independently verified the accuracy or completeness of the information contained in outside sources.

| Basket Stock Underlier | Exchange Ticker | Exchange | SEC File Number |

| AES Stock | AES | New York Stock Exchange | 001-12291 |

| AMD Stock | AMD | Nasdaq Stock Market | 001-07882 |

| AMZN Stock | AMZN | Nasdaq Stock Market | 000-22513 |

| CARR Stock | CARR | New York Stock Exchange | 001-39220 |

| DLR Stock | DLR | New York Stock Exchange | 001-32336 |

| EQIX Stock | EQIX | Nasdaq Stock Market | 001-40205 |

| ETN Stock | ETN | New York Stock Exchange | 000-54863 |

| GOOGL Stock | GOOGL | Nasdaq Stock Market | 001-37580 |

| META Stock | META | Nasdaq Stock Market | 001-35551 |

| MSFT Stock | MSFT | Nasdaq Stock Market | 001-37845 |

| NEE Stock | NEE | New York Stock Exchange | 001-08841 |

| NVDA Stock | NVDA | Nasdaq Stock Market | 000-23985 |

| QCOM Stock | QCOM | Nasdaq Stock Market | 000-19528 |

| SO Stock | SO | New York Stock Exchange | 001-03526 |

| TSM Stock | TSM | New York Stock Exchange | 001-14700 |

| VST Stock | VST | New York Stock Exchange | 001-38086 |

According to publicly available information:

| · | The AES Corporation is a power generation and utility company that provides energy through a portfolio of renewable and thermal generation facilities and distribution businesses. |

| · | Advanced Micro Devices, Inc. is a semiconductor company that primarily offers server microprocessors (CPUs), graphics processing units (GPUs), accelerated processing units (APUs), data processing units, Field Programmable Gate Arrays (FPGAs), Smart Network Interface Cards, Artificial Intelligence accelerators and Adaptive System-on-Chip (SoC) products for data centers; CPUs, APUs and chipsets for desktop, notebook and handheld personal computers; discrete GPUs and semi-custom SoC products and development services; and embedded CPUs, GPUs, APUs, FPGAs, Systems on Modules and Adaptive SoC products and that, from time to time, may also sell or license portions of its intellectual property portfolio. |

| · | Amazon.com, Inc. serves consumers through its online and physical stores; manufactures and sells electronic devices; develops and produces media content; offers subscription services; offers programs that enable sellers to sell their products in its stores and to fulfill orders using its services; offers developers and enterprises a set of technology services, including compute, storage, database, analytics and machine learning, and other services; offers programs that allow authors, independent publishers, musicians, filmmakers, Twitch streamers, skill and app developers and others to publish and sell content; and provides advertising services to sellers, vendors, publishers, authors and others, through programs such as sponsored ads, display and video advertising. |

| · | Carrier Global Corporation provides heating, ventilating and air conditioning, refrigeration, fire, security and building automation technologies as well as building services including audit, design, installation, system integration, repair, maintenance and monitoring. Digital Realty Trust, Inc. owns, acquires, develops and operates data centers that exchange, process and store data for digital communication, disaster recovery purposes, transaction processing and housing corporation IT application. |

| P-12 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

| · | Equinix, Inc. is a digital infrastructure company with a platform that includes data center offerings, interconnection offerings and digital offerings. |

| · | Eaton Corporation plc, an Irish company, is a power management company that offers a range of power products for the data center, utility, industrial, commercial, machine building, residential, aerospace and mobility markets. |

| · | Alphabet Inc. is a collection of businesses, the largest of which is Google Inc., which (i) offers products and platforms through which it generates revenues primarily by delivering both performance advertising and brand advertising and (ii) provides cloud services to businesses. |

| · | Meta Platforms, Inc. (formerly known as Facebook, Inc.) builds products that enable people to connect and share through mobile devices, personal computers, virtual reality and mixed reality headsets and wearables. |

| · | Microsoft Corporation is a technology company that develops and supports software, services, devices and solutions. |

| · | NextEra Energy, Inc. is an electric power and energy infrastructure company in the renewable energy industry. |

| · | NVIDIA Corporation is a full-stack computing infrastructure company with data-center-scale offerings whose full-stack includes the CUDA programming model that runs on all of its graphics processing units (GPUs), as well as domain-specific software libraries, software development kits and Application Programming Interfaces and whose data-center-scale offerings include compute and networking solutions that can scale to tens of thousands of GPU-accelerated servers interconnected to function as a single giant computer. |

| · | QUALCOMM Incorporated develops and commercializes technologies for the wireless industry, with technologies and products used in mobile devices and other products. |

| · | The Southern Company is a holding company that, through its subsidiaries, (1) generates, wholesales and retails electricity in the southeastern United States, (2) develops, constructs, acquires, owns and manages power generation assets, including renewable energy projects, and (3) distribute natural gas through the natural gas distribution utilities. |

| · | Taiwan Semiconductor Manufacturing Company Limited, a Taiwanese company, is a foundry that manufactures semiconductors using its manufacturing processes for its customers based on proprietary integrated circuit designs provided by them. |

| · | The Global X Uranium ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index (the “Underlying Index”). The Underlying Index is a modified market capitalization-weighted index that is designed to track the performance of international companies that have or are expected to have business operations or exposure in the uranium industry. |

| · | Vistra Corp. is an integrated retail electricity and power generation company that generates and provides electricity and natural gas to residential, commercial and industrial retail customers. |

All information contained in this pricing supplement regarding the URA Fund has been derived from publicly available information, without independent verification. This information reflects the policies of, and is subject to change by, Global X Management Company LLC (the “Adviser”). The URA Fund trades on NYSE Arca, Inc. under the ticker symbol “URA.”

The URA Fund is an exchange-traded fund of Global X Funds®, a registered investment company, that seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index (the “Underlying Index”). The Underlying Index is a modified market capitalization-weighted index that is designed to track the performance of international companies that have or are expected to have business operations or exposure in the uranium industry. For more information regarding the Underlying Index, please see Annex A below.

The Adviser uses a “passive” or indexing approach to try to achieve the URA Fund’s investment objective. The URA Fund generally will use a replication strategy. A replication strategy is an indexing strategy that involves investing in the securities of the Underlying Index in approximately the same proportions as in the Underlying Index. However, the URA Fund may utilize a representative sampling strategy with respect to the Underlying Index when a replication strategy might be detrimental or disadvantageous to shareholders of the URA Fund, such as when there are practical difficulties or substantial

| P-13 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

costs involved in compiling a portfolio of equity securities to replicate the Underlying Index, in instances in which a security in the Underlying Index becomes temporarily illiquid, unavailable or less liquid, or as a result of legal restrictions or limitations (such as tax diversification requirements) that apply to the URA Fund but not the Underlying Index.

Tracking error is the divergence of the URA Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities and other instruments held in the URA Fund’s portfolio and those included in the Underlying Index, pricing differences (including differences between a security’s price at the local market close and the URA Fund’s valuation of a security at the time of calculation of the URA Fund’s net asset value), transaction costs incurred by the URA Fund, the URA Fund’s holding of uninvested cash, size of the URA Fund, differences in timing of the accrual of or the valuation of dividends or interest, tax gains or losses, changes to the Underlying Index or the costs to the URA Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the URA Fund incurs fees and expenses, while the Underlying Index does not. Exchange-traded funds that track indices with significant weight in emerging markets issuers may experience higher tracking error than other exchange-traded funds that do not track such indices.

Information provided to or filed with the SEC by the Global X Trust pursuant to the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, can be located by reference to SEC file numbers 333-151713 and 811-22209, respectively, through the SEC’s website at http://www.sec.gov.

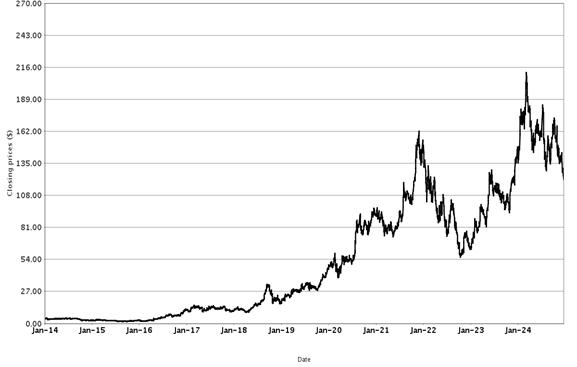

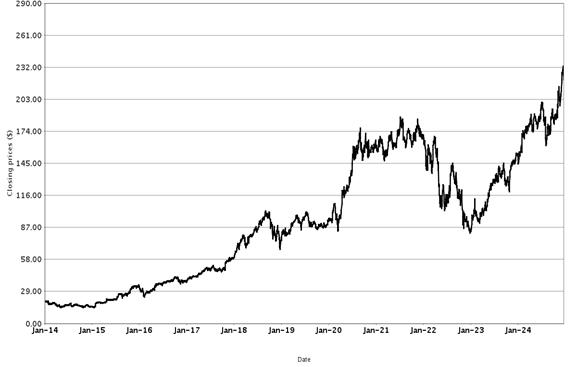

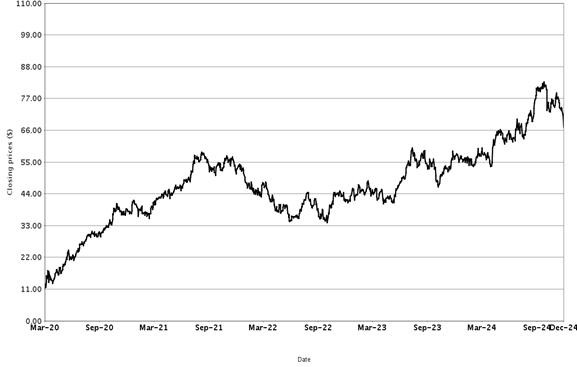

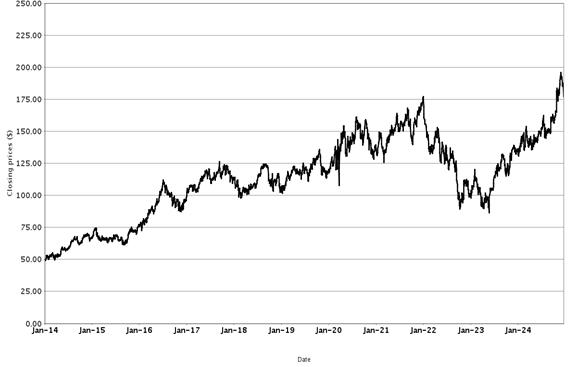

Historical Information

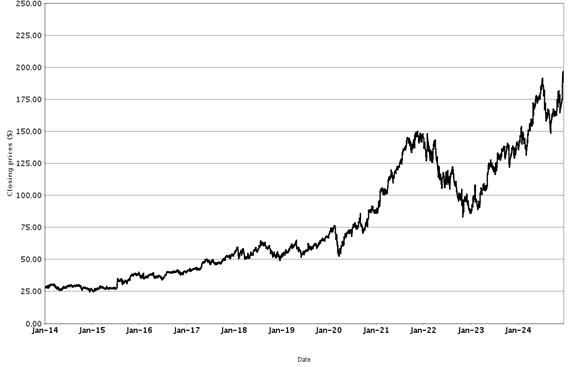

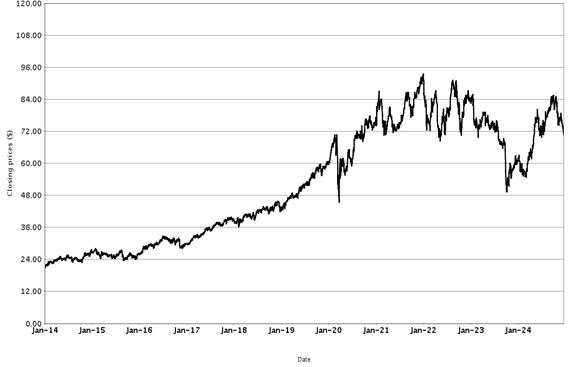

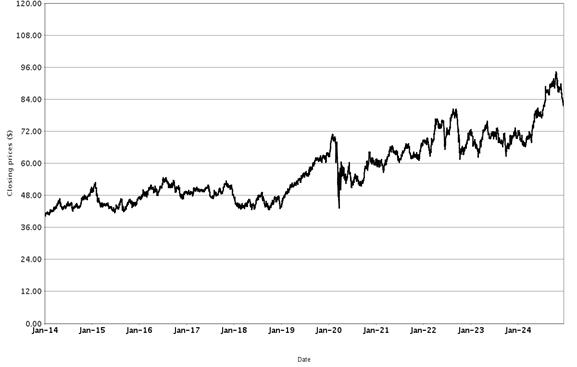

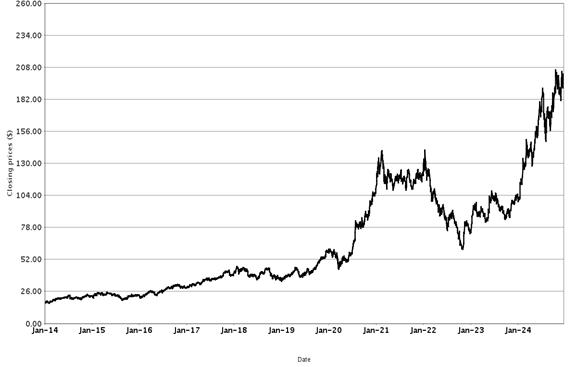

The following graphs set forth historical closing values of the Basket Underliers for the period from January 1, 2014 (or from the initial listing date, if later) to December 18, 2024. We obtained the information in the graphs from Bloomberg Financial Markets, without independent investigation. We cannot give you assurance that the performance of the Basket Underliers will result in the return of all of your initial investment.

Common Stock of The AES Corporation

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-14 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Advanced Micro Devices, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-15 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Amazon.com, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-16 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Carrier Global Corporation

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-17 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Digital Realty Trust, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-18 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Equinix, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-19 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Ordinary Shares of Eaton Corporation plc

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-20 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Class A Common Stock of Alphabet Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-21 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Class A Common Stock of Meta Platforms, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-22 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of Microsoft Corporation

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-23 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of NextEra Energy, Inc.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-24 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of NVIDIA Corporation

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-25 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of QUALCOMM Incorporated

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

| P-26 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Common Stock of The Southern Company

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-27 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

American Depositary Shares of Taiwan Semiconductor Manufacturing Company Limited

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-28 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

Global X Uranium ETF

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-29 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

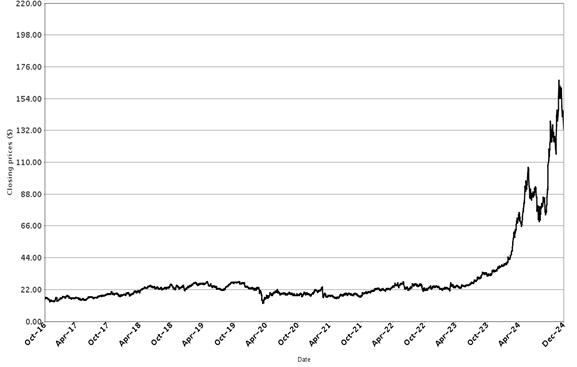

Common Stock of Vistra Corp.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| P-30 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

You should review carefully the section in the accompanying product supplement entitled “United States Federal Income Tax Considerations.” The following discussion, when read in combination with that section, constitutes the full opinion of our counsel, Davis Polk & Wardwell LLP, regarding the material U.S. federal income tax consequences of owning and disposing of the Notes.

Generally, this discussion assumes that you purchased the Notes for cash in the original issuance at the stated issue price and does not address other circumstances specific to you, including consequences that may arise due to any other investments relating to the Basket Underliers. You should consult your tax adviser regarding the effect any such circumstances may have on the U.S. federal income tax consequences of your ownership of a Note.

In the opinion of our counsel, it is reasonable to treat the Notes for U.S. federal income tax purposes as prepaid financial contracts that are “open transactions,” as described in the section entitled “United States Federal Income Tax Considerations—Tax Consequences to U.S. Holders—Notes Treated as Prepaid Financial Contracts that are Open Transactions” in the accompanying product supplement. There is uncertainty regarding this treatment, and the Internal Revenue Service (the “IRS”) or a court might not agree with it. A different tax treatment could be adverse to you. Generally, if this treatment is respected, subject to the potential application of the “constructive ownership” regime discussed below, (i) you should not recognize taxable income or loss prior to the taxable disposition of your Notes (including upon maturity or an earlier redemption, if applicable) and (ii) the gain or loss on your Notes should be treated as short-term capital gain or loss unless you have held the Notes for more than one year, in which case your gain or loss should be treated as long-term capital gain or loss.

Even if the treatment of the Notes as prepaid financial contracts is respected, purchasing a Note could be treated as entering into a “constructive ownership transaction” within the meaning of Section 1260 of the Internal Revenue Code (“Section 1260”). In that case, all or a portion of any long-term capital gain you would otherwise recognize upon the taxable disposition of the Note would be recharacterized as ordinary income to the extent such gain exceeded the “net underlying long-term capital gain” as defined in Section 1260. Any long-term capital gain recharacterized as ordinary income would be treated as accruing at a constant rate over the period you held the Note, and you would be subject to a notional interest charge in respect of the deemed tax liability on the income treated as accruing in prior tax years. Due to the lack of direct legal authority, our counsel is unable to opine as to whether or how Section 1260 applies to the Notes.

We do not plan to request a ruling from the IRS regarding the treatment of the Notes. An alternative characterization of the Notes could materially and adversely affect the tax consequences of ownership and disposition of the Notes, including the timing and character of income recognized. In addition, the U.S. Treasury Department and the IRS have requested comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar financial instruments and have indicated that such transactions may be the subject of future regulations or other guidance. Furthermore, members of Congress have proposed legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the Notes, possibly with retroactive effect.

Non-U.S. Holders. As discussed under “United States Federal Income Tax Considerations—Tax Consequences to Non-U.S. Holders—Dividend Equivalents under Section 871(m) of the Code” in the accompanying product supplement, Section 871(m) of the Internal Revenue Code and Treasury regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding tax on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S. equities or indices that include U.S. equities. The Treasury regulations, as modified by an IRS notice, exempt financial instruments issued prior to January 1, 2027 that do not have a “delta” of one. Based on certain determinations made by us, our counsel is of the opinion that Section 871(m) should not apply to the Notes with regard to Non-U.S. Holders. Our determination is not binding on the IRS, and the IRS may disagree with this determination.

We will not be required to pay any additional amounts with respect to U.S. federal withholding taxes.

| P-31 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the Notes, including possible alternative treatments and the potential application of the “constructive ownership” regime, as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

The Notes are offered initially to investors at a purchase price equal to par, except with respect to certain accounts as indicated on the cover page of this pricing supplement. We or one of our affiliates may pay the underwriting discount as set forth on the cover page of this pricing supplement.

The value of the Notes shown on your account statement may be based on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market in the Notes (which it is not obligated to do). That estimate will be based on the price that RBCCM may pay for the Notes in light of then-prevailing market conditions, our creditworthiness and transaction costs. For a period of approximately twelve months after the Issue Date, the value of the Notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the Notes at that time. This is because the estimated value of the Notes will not include the underwriting discount or our hedging costs and profits; however, the value of the Notes shown on your account statement during that period may initially be a higher amount, reflecting the addition of the underwriting discount and our estimated costs and profits from hedging the Notes. This excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Notes, it expects to do so at prices that reflect their estimated value.

RBCCM or another of its affiliates or agents may use this pricing supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing supplement in a market-making transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

For additional information about the settlement cycle of the Notes, see “Plan of Distribution” in the accompanying prospectus. For additional information as to the relationship between us and RBCCM, see the section “Plan of Distribution—Conflicts of Interest” in the accompanying prospectus.

STRUCTURING THE NOTES

The Notes are our debt securities. As is the case for all of our debt securities, including our structured notes, the economic terms of the Notes reflect our actual or perceived creditworthiness. In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under structured notes at a rate that is lower than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. The lower internal funding rate, the underwriting discount and the hedging-related costs relating to the Notes reduce the economic terms of the Notes to you and result in the initial estimated value for the Notes being less than their public offering price. Unlike the initial estimated value, any value of the Notes determined for purposes of a secondary market transaction may be based on a secondary market rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with RBCCM and/or one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, volatility and the tenor of the Notes. The economic terms of the Notes and the initial estimated value depend in part on the terms of these hedging arrangements.

See “Selected Risk Considerations—Risks Relating to the Initial Estimated Value of the Notes and the Secondary Market for the Notes—The Initial Estimated Value of the Notes Is Less Than the Public Offering Price” above.

| P-32 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada LLP, as Canadian counsel to the Bank, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the Bank in conformity with the indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the indenture and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the Notes is a matter governed by the laws of the Province of Ontario or Québec, or the federal laws of Canada applicable therein, will be valid obligations of the Bank, subject to the following limitations: (i) the enforceability of the indenture may be limited by the Canada Deposit Insurance Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization, receivership, moratorium, arrangement or winding-up laws or other similar laws of general application affecting the enforcement of creditors’ rights generally; (ii) the enforceability of the indenture is subject to general equitable principles, including the principle that the availability of equitable remedies, such as specific performance and injunction, may only be granted at the discretion of a court of competent jurisdiction; (iii) under applicable limitations statutes generally, including that the enforceability of the indenture will be subject to the limitations contained in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find any provision of the indenture to be unenforceable as an attempt to vary or exclude a limitation period under such applicable limitations statutes; (iv) rights to indemnity and contribution under the Notes or the indenture which may be limited by applicable law; and (v) courts in Canada are precluded from giving a judgment in any currency other than the lawful money of Canada and such judgment may be based on a rate of exchange in existence on a day other than the day of payment, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada applicable therein. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the opinion letter of such counsel dated December 20, 2023, which has been filed as Exhibit 5.3 to the Bank’s Form 6-K filed with the SEC dated December 20, 2023.

In the opinion of Davis Polk & Wardwell LLP, as special United States products counsel to the Bank, when the Notes offered by this pricing supplement have been issued by the Bank pursuant to the indenture, the trustee has made, in accordance with the indenture, the appropriate notation to the master note evidencing such Notes (the “master note”), and such Notes have been delivered against payment as contemplated herein, such Notes will be valid and binding obligations of the Bank, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions or applications giving effect to governmental actions or foreign laws affecting creditors’ rights, provided that such counsel expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or stay law or (ii) the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion involves matters governed by the laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we understand that you are relying upon, the opinion of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, set forth above. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the authentication of the master note and the validity, binding nature and enforceability of the indenture with respect to the trustee, all as stated in the opinion of Davis Polk & Wardwell LLP dated May 16, 2024, which has been filed as an exhibit to the Bank’s Form 6-K filed with the SEC on May 16, 2024.

| P-33 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

ANNEX A

The Solactive Global Uranium & Nuclear Components Total Return Index

All information contained in this pricing supplement regarding the Solactive Global Uranium & Nuclear Components Total Return Index, including, without limitation, its make-up, method of calculation and changes in its components, has been derived from publicly available information, without independent verification. This information reflects the policies of, and is subject to change by, Solactive AG (“Solactive”). The Solactive Global Uranium & Nuclear Components Total Return Index is calculated, maintained and published by Solactive. Solactive has no obligation to continue to publish, and may discontinue publication of, the Solactive Global Uranium & Nuclear Components Total Return Index.

The Solactive Global Uranium & Nuclear Components Total Return Index is reported by Bloomberg L.P. under the ticker symbol “SOLURANT.”

The Solactive Global Uranium & Nuclear Components Total Return Index is a modified market capitalization-weighted index that is designed to track the performance of international companies that have or are expected to have business operations or exposure in the uranium industry. This particularly includes uranium mining, exploration, uranium investments and technologies related to the uranium industry. The Solactive Global Uranium & Nuclear Components Total Return Index has a base date of January 1, 2018.

Composition of the Solactive Global Uranium & Nuclear Components Total Return Index

Selection of Index Components

The composition of the Solactive Global Uranium & Nuclear Components Total Return Index is adjusted twice a year on the last trading day in January and July (the “Adjustment Day”). On the tenth business day before an Adjustment Day (a “Selection Day”), Solactive provides the “Selection Pool” which, in respect of a Selection Day, consists of the companies that fulfill the following conditions:

| 1. | Primary listing in one of the countries that are part of the Developed Markets and Emerging Markets (excluding China, India and Taiwan) as defined by the Solactive Country Classification; |

| 2. | Significant business operations in the uranium industry (particularly in uranium mining and exploration for uranium) (“Pure Play Companies”) or those that conduct business operations that are related to the uranium industry (particularly in uranium mining, exploration for uranium, physical uranium investments and technologies related to the uranium industry) and in which they generate large absolute revenues (“Non-Pure Play Companies”); |

| 3. | Free float market capitalization of at least US$50 million for companies that are not currently included in the Solactive Global Uranium & Nuclear Components Total Return Index on the Selection Day or at least US$30 million for companies that are currently included in the Solactive Global Uranium & Nuclear Components Total Return Index on the Selection Day; |

| 4. | Average daily trading volume over all national exchanges within the listed country in the three months prior to the Selection Day (or, in the case of a company that has completed a significant initial public offering (“significant IPO”) less than three months prior to the Selection Day, i.e. an IPO with a company level total market capitalization greater than the company level total market capitalization of at least 50% of the current Index Components as of the previous Selection Day, the period from the security’s first trading day to the Selection Day) expressed in U.S. dollars (the “Relevant Trading Volume”) of at least US$100,000 for companies that are not currently included in the Solactive Global Uranium & Nuclear Components Total Return Index on the Selection Day or at least US$50,000 for companies that are currently included in the Solactive Global Uranium & Nuclear Components Total Return Index on the Selection Day; and |

| P-34 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

| 5. | Initial public offerings with less than three calendar months of trading history as of the Selection Day must have been listed at least 10 calendar days prior to the Selection Day, if considered as significant IPO, and three calendar months prior to the Selection Day, in the case of other IPOs. |

The overall number of Non-Pure Play Companies and Nuclear Component Producer Companies (in aggregate) will be capped at 15, with preference given to current “Index Components” first and then prioritized in by free float market capitalization. Otherwise, all members of the Selection Pool are included as Index Components. The selection of the Index Components is fully rule-based and no discretionary decisions can be made.

Weighting of Index Components

On each Selection Day, the weights of the selected Index Components are determined by applying an effective market capitalization weighting scheme that accounts for liquidity in determining final weights.

| 1. | The weight of a selected Index Component will be determined based on the lesser of free float market capitalization and average daily trading volume multiplied by 2000. |

| 2. | Non-Pure Play Companies and Nuclear Component Producer companies will be capped at 2.00%. |

| 3. | The maximum weight of a Pure Play Company is 22.50%. |

| 4. | The aggregate weight of all Pure Play Companies with a weight larger than or equal to 5.00% will be capped to 47.50%. |

| 5. | All remaining Pure Play Companies are capped at 4.75%. |

| 6. | The aggregate weight of all Index Components structured as Investment trusts which provide exposure to physical uranium is capped at 10%. Any excess weight resulting from this procedure will be redistributed to all the remaining constituents which are not capped on a pro-rata basis |

Quarterly Diversification Review

On each Monitoring Selection Day (as defined below), the Index Components will be reviewed for a breach of the following criteria:

| 1. | The maximum weight of the top Index Component must not be larger than 25%. If this criterion is breached, the stock is capped at 22% and the excess weight is redistributed to other non-capped stocks. |

| 2. | The maximum aggregate weight of the top 5 Index Components must not exceed 60%. If this criterion is breached, the stocks will be proportionally capped at 55% and the excess weight is redistributed to other non-capped stocks. |

| 3. | The maximum weight of Index Components with a market liquidity below 250,000 shares traded (monthly average of the previous 6 months or available history if shorter) and US$25 million monthly average daily traded value (monthly average of the previous 6 months or available history if shorter) must not exceed 30%. If this criterion is breached, the stocks with a market liquidity below 250,000 shares traded (monthly average of the previous 6 months or available history if shorter) and US$25 million monthly average daily traded value (monthly average of the previous 6 months or available history if shorter) will be proportionally capped at 25% and the excess weight is redistributed to other non-capped stocks. |

| 4. | The maximum weight of Index Components with a market capitalization below US$100 million must not account for more than 10%. If this criterion is breached, stocks with market capitalization below US$100 million will be proportionally capped at 9% and the excess weight is redistributed to other non-capped stocks. |

| P-35 | RBC Capital Markets, LLC |

Enhanced Return Barrier Notes Linked |

This reweighting process will be repeated until none of the constraints are breached. In the event that the above criteria cannot be satisfied using the buffers described above, the weighting will be reviewed by the Index Committee. After the review, the decision will be announced publicly.

The “Monitoring Selection Day” is the business day that is ten business days before the Monitoring Adjustment Day, disregarding any potential changes to the Monitoring Adjustment Day. The “Monitoring Adjustment Day” is the last trading day in January, April, July and October.

Calculation of the Solactive Global Uranium & Nuclear Components Total Return Index

The Solactive Global Uranium & Nuclear Components Total Return Index is calculated as a net total return index. A net total return index seeks to replicate the overall return from holding a portfolio consisting of the Index Components. In order to achieve this aim, a net total return index considers payments, such as dividends, after the deduction of any withholding tax or other amounts an investor holding the Index Components would typically be exposed to.

The Solactive Global Uranium & Nuclear Components Total Return Index’s index level on a given business day is calculated as the sum of the market capitalization of the Index Components divided by the divisor, which is a mathematical factor defined at the inception of the Solactive Global Uranium & Nuclear Components Total Return Index. The divisor is adjusted by certain corporate actions and index rebalances. Additionally, dividends paid by any Index Component are applied across the entire basket by changing the divisor.

For intraday calculation of the Solactive Global Uranium & Nuclear Component Total Return Index, prices of Index Components not in U.S. dollars are converted using the current Intercontinental Exchange spot foreign exchange rate. If there is no current price available for an Index Component, the most recent price or the trading price for the preceding trading day is used in the calculation. For the daily index closing value calculation, trading prices of Index Components not in U.S. dollars are converted using the 4pm London time WM Fixing quoted by Reuters. If there is no 4pm London time WM Fixing for the relevant business day, the last available 4pm London time WM Fixing will be used for the index closing value calculation.