0000100334ck0000100334:C000189745Member2017-04-102017-04-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-00816 |

| |

| AMERICAN CENTURY MUTUAL FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 10-31 |

| |

| Date of reporting period: | 10-31-2024 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a)

ANNUAL SHAREHOLDER REPORT

Balanced Fund

| | | | | |

| Investor Class (TWBIX) | October 31, 2024 |

This annual shareholder report contains important information about Balanced Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021. This report describes changes to the fund that occurred during the reporting period.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $99 | 0.89% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Balanced Fund Investor Class returned 23.41% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth and current income by investing approximately 60% of its assets in equity securities and the remainder in bonds and other fixed-income securities. |

| • | Financials was the leading contributor to returns, with capital markets stocks driving results. Investment bank Morgan Stanley benefited from an improving environment for mergers and acquisitions. Lower rates and a steeper yield curve (a graphic representation of bond yields at different maturities) also helped. |

| • | Insurance and consumer finance also drove results in the sector. Progressive was a leading contributor in insurance as consumers moved to providers that offer lower rates. Strong consumer spending helped American Express. |

| • | Information technology detracted from performance. Software giant Microsoft, one of the poorer-performing members of the so-called Magnificent Seven, hurt relative results. The overall energy sector also lagged as U.S. natural gas prices declined. Automobile components were a source of weakness in consumer discretionary, as the automobiles industry was hit with a slowdown in sales. |

| • | The bond allocation rose amid a decline in inflation and bond yields.The Federal Reserve also cut short-term interest rates for the first time in four years during the period. In addition, it was beneficial to underweight Treasury bonds in favor of higher-yielding corporate debt. Corporate bonds benefited from solid earnings growth and investor demand for yield. |

| | |

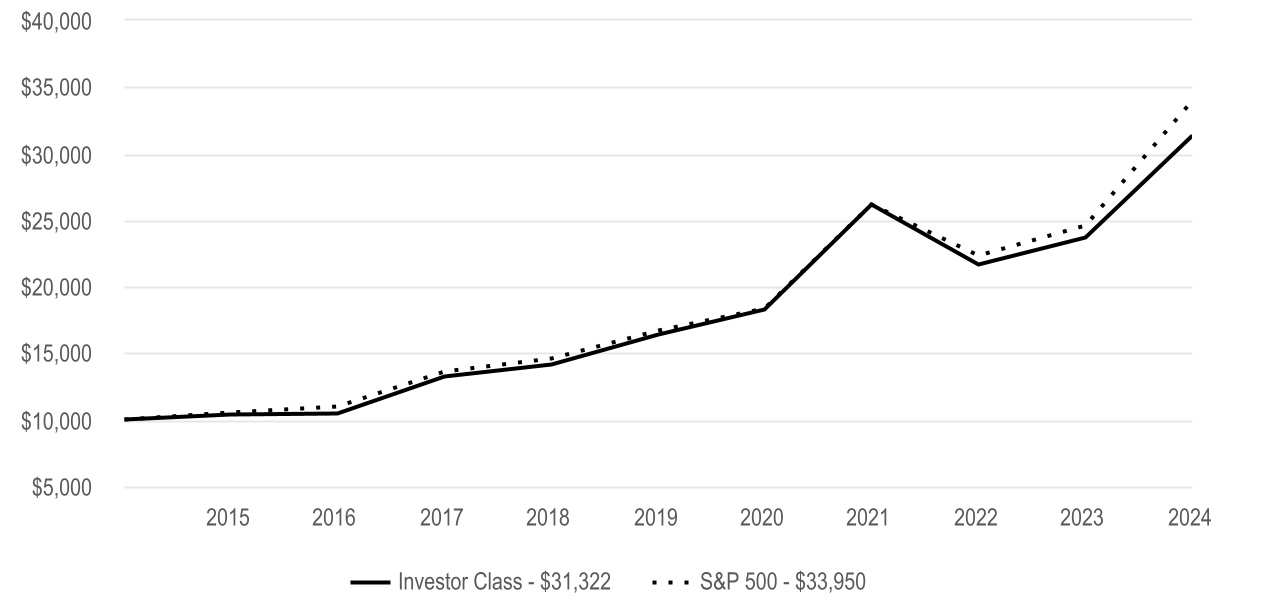

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| Investor Class | 23.41% | 7.42% | 6.79% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| S&P 500 | 38.02% | 15.27% | 13.00% | | | |

| Bloomberg U.S. Aggregate Bond | 10.55% | -0.23% | 1.49% | | | |

| Performance Index | | | | | | |

| 60% S&P 500/40% Bloomberg U.S. Aggregate Bond | 26.44% | 9.13% | 8.52% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $925,571,309 |

| Management Fees (dollars paid during the reporting period) | $7,915,947 |

| Portfolio Turnover Rate | 72 | % |

| Total Number of Portfolio Holdings | 615 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | | | | | |

| Common Stocks | 60.4% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Mortgage-Backed Securities | 12.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds | 9.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury Securities | 8.7% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Mortgage Obligations | 2.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset-Backed Securities | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Loan Obligations | 1.2% | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stocks | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial Mortgage-Backed Securities | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Securities | 0.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Municipal Securities | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Sovereign Governments and Agencies | 0.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.9)% | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Fund Changes |

|

|

| Beginning October 2024, the total eligible investments required to qualify for a waiver of the annual account maintenance fee changed from $10,000 to $25,000. Such fee will also be waived for any accounts for which the shareholder has elected to receive electronic delivery of all fund/account documents. |

|

|

|

|

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083742

ANNUAL SHAREHOLDER REPORT

Balanced Fund

| | | | | |

| I Class (ABINX) | October 31, 2024 |

This annual shareholder report contains important information about Balanced Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| I Class | $77 | 0.69% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Balanced Fund I Class returned 23.70% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth and current income by investing approximately 60% of its assets in equity securities and the remainder in bonds and other fixed-income securities. |

| • | Financials was the leading contributor to returns, with capital markets stocks driving results. Investment bank Morgan Stanley benefited from an improving environment for mergers and acquisitions. Lower rates and a steeper yield curve (a graphic representation of bond yields at different maturities) also helped. |

| • | Insurance and consumer finance also drove results in the sector. Progressive was a leading contributor in insurance as consumers moved to providers that offer lower rates. Strong consumer spending helped American Express. |

| • | Information technology detracted from performance. Software giant Microsoft, one of the poorer-performing members of the so-called Magnificent Seven, hurt relative results. The overall energy sector also lagged as U.S. natural gas prices declined. Automobile components were a source of weakness in consumer discretionary, as the automobiles industry was hit with a slowdown in sales. |

| • | The bond allocation rose amid a decline in inflation and bond yields.The Federal Reserve also cut short-term interest rates for the first time in four years during the period. In addition, it was beneficial to underweight Treasury bonds in favor of higher-yielding corporate debt. Corporate bonds benefited from solid earnings growth and investor demand for yield. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| I Class | 23.70% | 7.64% | 7.00% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| S&P 500 | 38.02% | 15.27% | 13.00% | | | |

| Bloomberg U.S. Aggregate Bond | 10.55% | -0.23% | 1.49% | | | |

| Performance Index | | | | | | |

| 60% S&P 500/40% Bloomberg U.S. Aggregate Bond | 26.44% | 9.13% | 8.52% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $925,571,309 |

| Management Fees (dollars paid during the reporting period) | $7,915,947 |

| Portfolio Turnover Rate | 72 | % |

| Total Number of Portfolio Holdings | 615 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | | | | | |

| Common Stocks | 60.4% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Mortgage-Backed Securities | 12.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds | 9.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury Securities | 8.7% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Mortgage Obligations | 2.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset-Backed Securities | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Loan Obligations | 1.2% | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stocks | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial Mortgage-Backed Securities | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Securities | 0.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Municipal Securities | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Sovereign Governments and Agencies | 0.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.9)% | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083734

ANNUAL SHAREHOLDER REPORT

Balanced Fund

| | | | | |

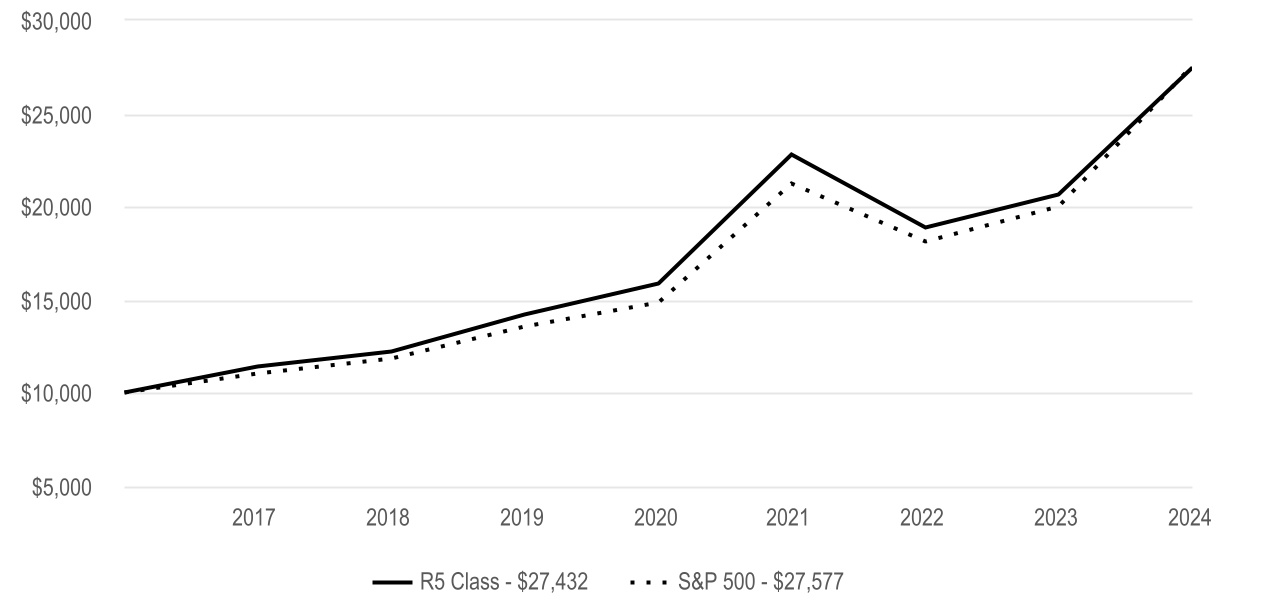

| R5 Class (ABGNX) | October 31, 2024 |

This annual shareholder report contains important information about Balanced Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R5 Class | $77 | 0.69% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Balanced Fund R5 Class returned 23.64% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth and current income by investing approximately 60% of its assets in equity securities and the remainder in bonds and other fixed-income securities. |

| • | Financials was the leading contributor to returns, with capital markets stocks driving results. Investment bank Morgan Stanley benefited from an improving environment for mergers and acquisitions. Lower rates and a steeper yield curve (a graphic representation of bond yields at different maturities) also helped. |

| • | Insurance and consumer finance also drove results in the sector. Progressive was a leading contributor in insurance as consumers moved to providers that offer lower rates. Strong consumer spending helped American Express. |

| • | Information technology detracted from performance. Software giant Microsoft, one of the poorer-performing members of the so-called Magnificent Seven, hurt relative results. The overall energy sector also lagged as U.S. natural gas prices declined. Automobile components were a source of weakness in consumer discretionary, as the automobiles industry was hit with a slowdown in sales. |

| • | The bond allocation rose amid a decline in inflation and bond yields.The Federal Reserve also cut short-term interest rates for the first time in four years during the period. In addition, it was beneficial to underweight Treasury bonds in favor of higher-yielding corporate debt. Corporate bonds benefited from solid earnings growth and investor demand for yield. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| April 10, 2017 through October 31, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| R5 Class | 23.64% | 7.63% | | 7.83% | 4/10/17 | |

| | | | | | |

| Regulatory Index | | | | | | |

| S&P 500 | 38.02% | 15.27% | | 14.35% | — | |

| Bloomberg U.S. Aggregate Bond | 10.55% | -0.23% | | 1.30% | — | |

| Performance Index | | | | | | |

| 60% S&P 500/40% Bloomberg U.S. Aggregate Bond | 26.44% | 9.13% | | 9.21% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $925,571,309 |

| Management Fees (dollars paid during the reporting period) | $7,915,947 |

| Portfolio Turnover Rate | 72 | % |

| Total Number of Portfolio Holdings | 615 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | | | | | | | | | | | | | |

| Common Stocks | 60.4% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Mortgage-Backed Securities | 12.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Bonds | 9.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury Securities | 8.7% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Mortgage Obligations | 2.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset-Backed Securities | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Collateralized Loan Obligations | 1.2% | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stocks | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial Mortgage-Backed Securities | 0.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Agency Securities | 0.5% | | | | | | | | | | | | | | | | | | | | | | | | |

| Municipal Securities | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.3% | | | | | | | | | | | | | | | | | | | | | | | | |

| Sovereign Governments and Agencies | 0.0% | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 1.8% | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.9)% | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H394

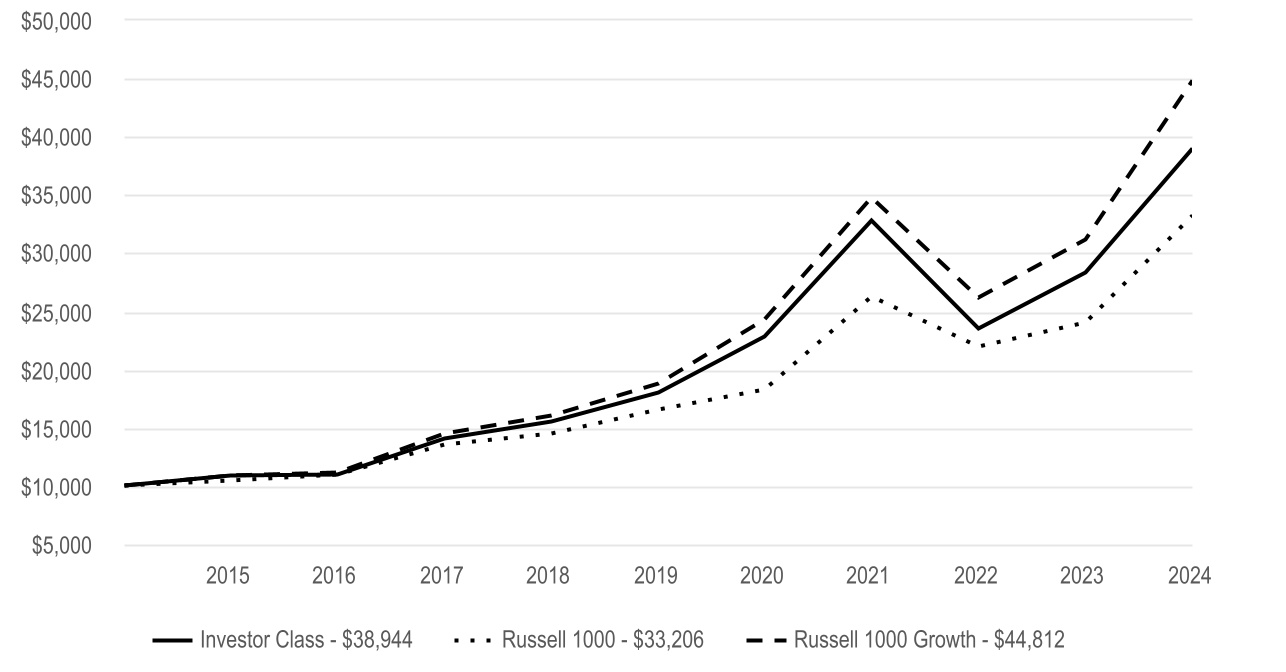

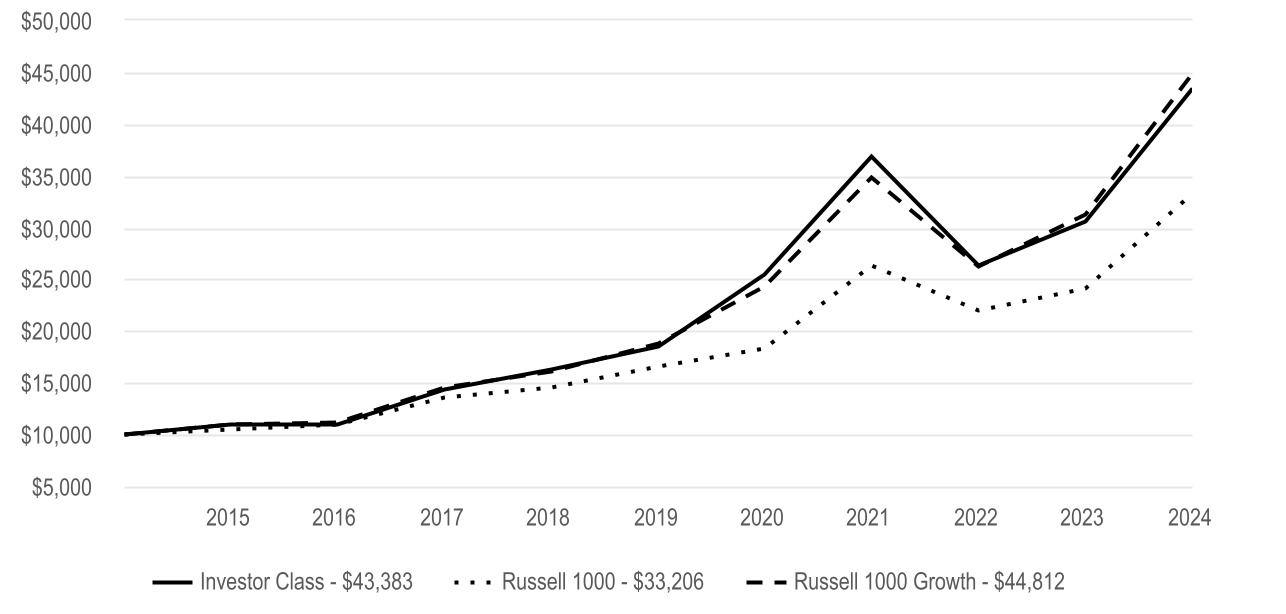

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| Investor Class (TWCGX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021. This report describes changes to the fund that occurred during the reporting period.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $108 | 0.91% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund Investor Class returned 37.43% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| Investor Class | 37.43% | 16.67% | 14.56% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Fund Changes |

|

|

| Beginning October 2024, the total eligible investments required to qualify for a waiver of the annual account maintenance fee changed from $10,000 to $25,000. Such fee will also be waived for any accounts for which the shareholder has elected to receive electronic delivery of all fund/account documents. |

|

|

|

|

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083106

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| I Class (TWGIX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| I Class | $84 | 0.71% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund I Class returned 37.71% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| I Class | 37.71% | 16.90% | 14.79% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083205

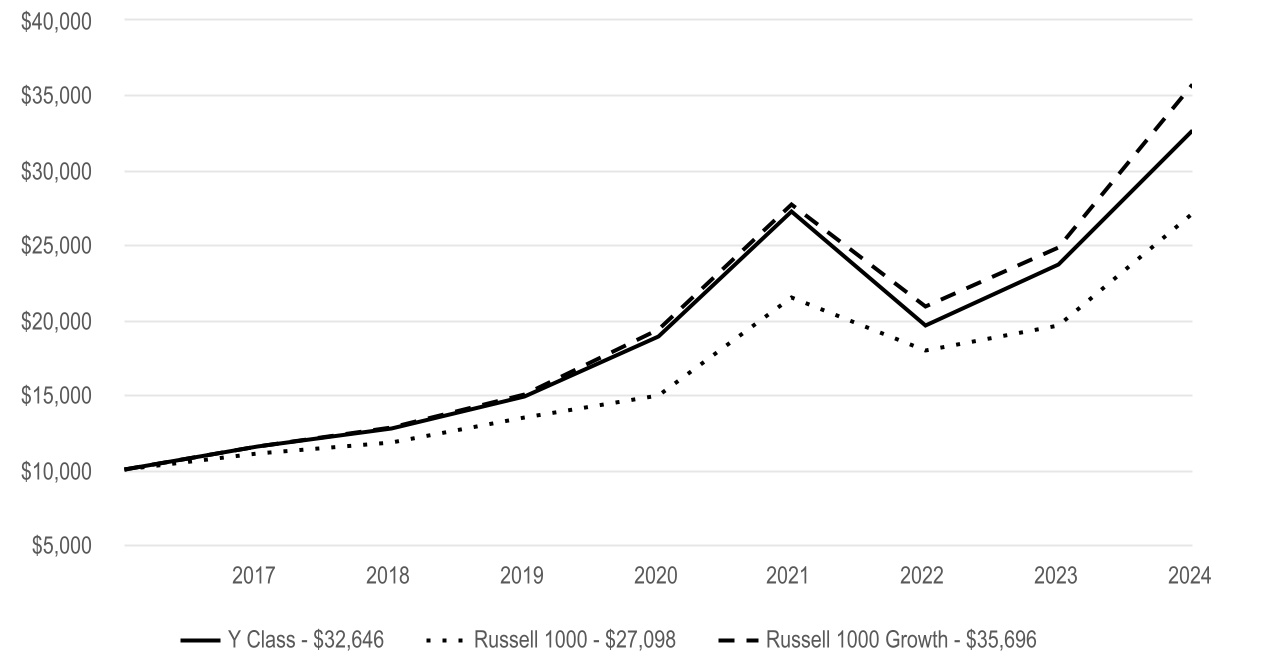

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| Y Class (AGYWX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Y Class | $67 | 0.56% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund Y Class returned 37.91% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

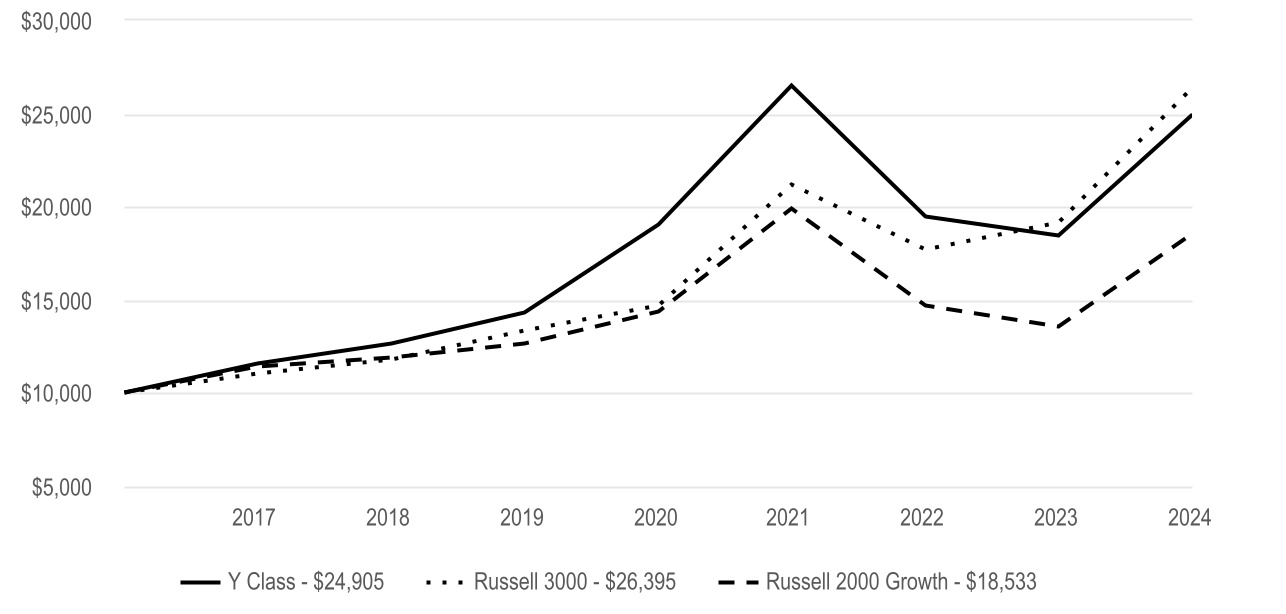

Cumulative Performance (based on an initial $10,000 investment) |

| April 10, 2017 through October 31, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| Y Class | 37.91% | 17.08% | | 16.93% | 4/10/17 | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | | 14.09% | — | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | | 18.32% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H378

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| A Class (TCRAX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| A Class | $138 | 1.16% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund A Class returned 37.10% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

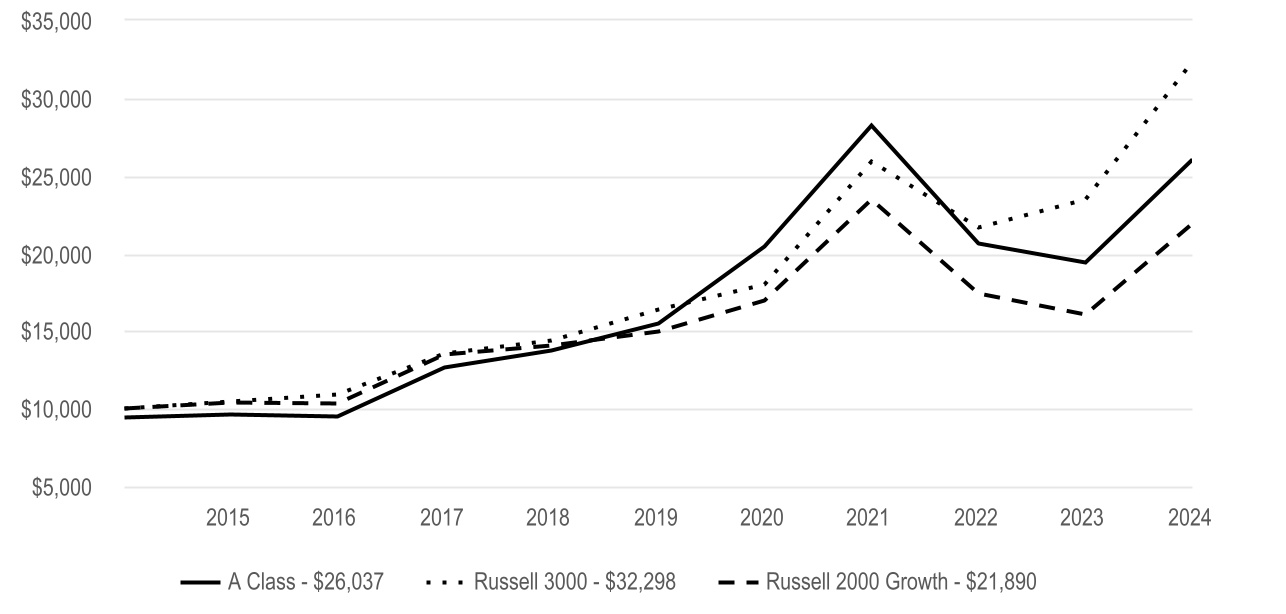

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

| The initial investment is adjusted to reflect the maximum initial sales charge. |

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| A Class | 37.10% | 16.38% | 14.28% | | | |

| A Class - with sales charge | 29.21% | 15.01% | 13.60% | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

| A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum contingent deferred sales charge of 1.00%. |

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083403

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| C Class (TWRCX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| C Class | $225 | 1.91% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund C Class returned 36.06% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

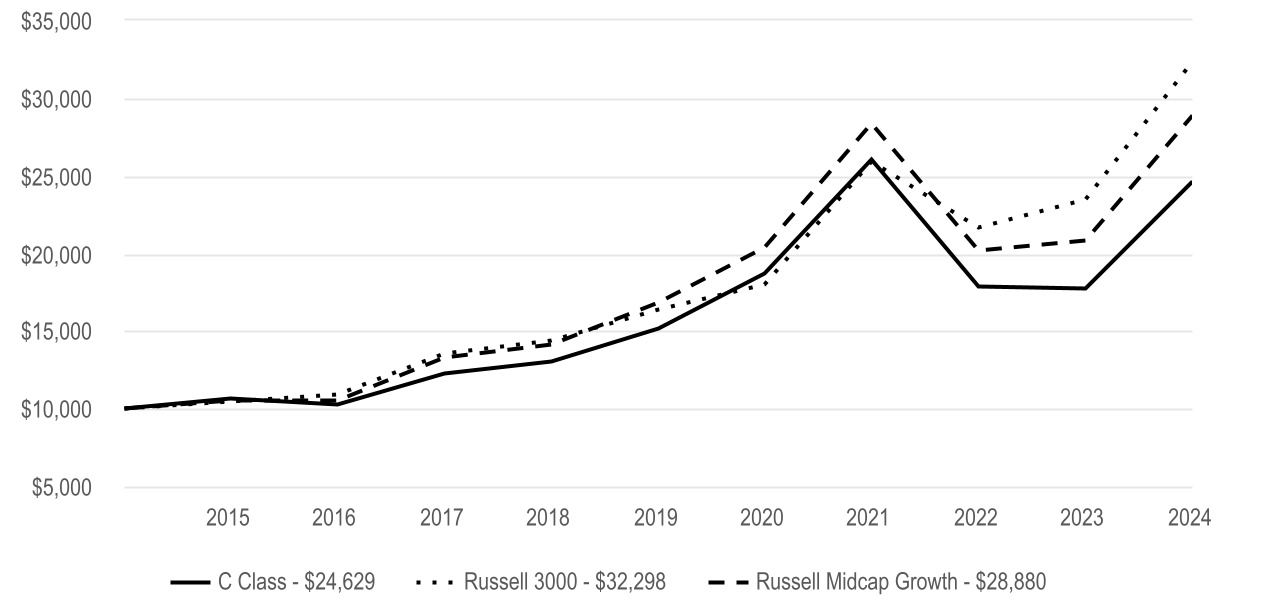

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| C Class | 36.06% | 15.51% | 13.42% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

| C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion. |

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H626

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| R Class (AGWRX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R Class | $167 | 1.41% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund R Class returned 36.76% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| R Class | 36.76% | 16.09% | 13.99% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-25083189

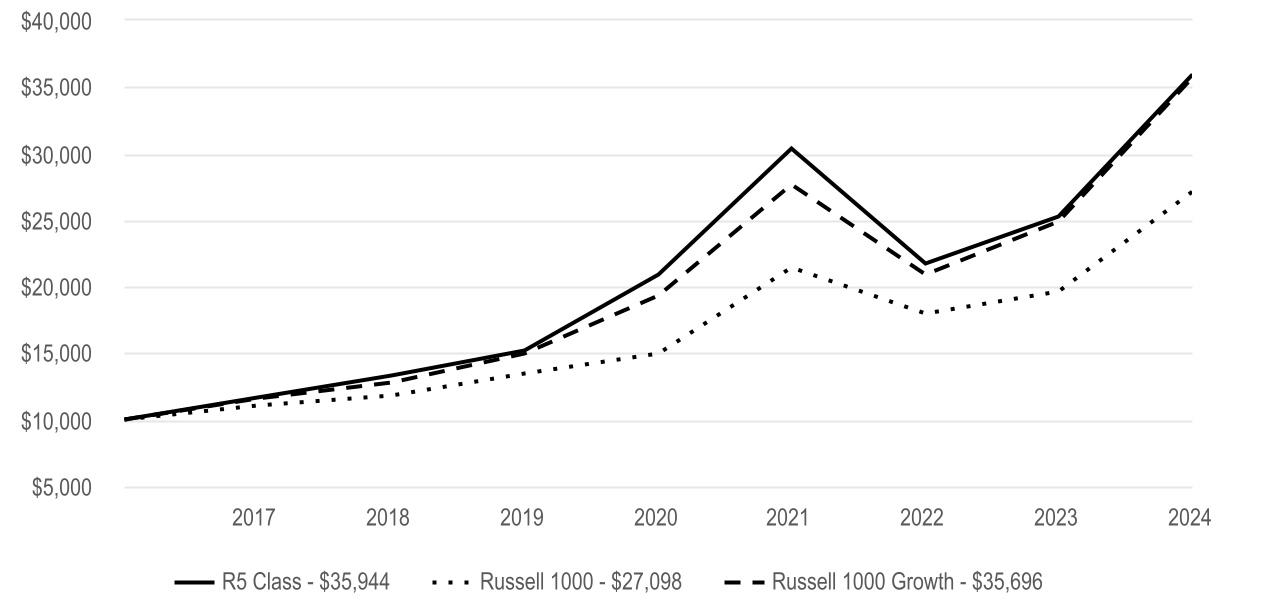

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| R5 Class (AGWUX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R5 Class | $84 | 0.71% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund R5 Class returned 37.72% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

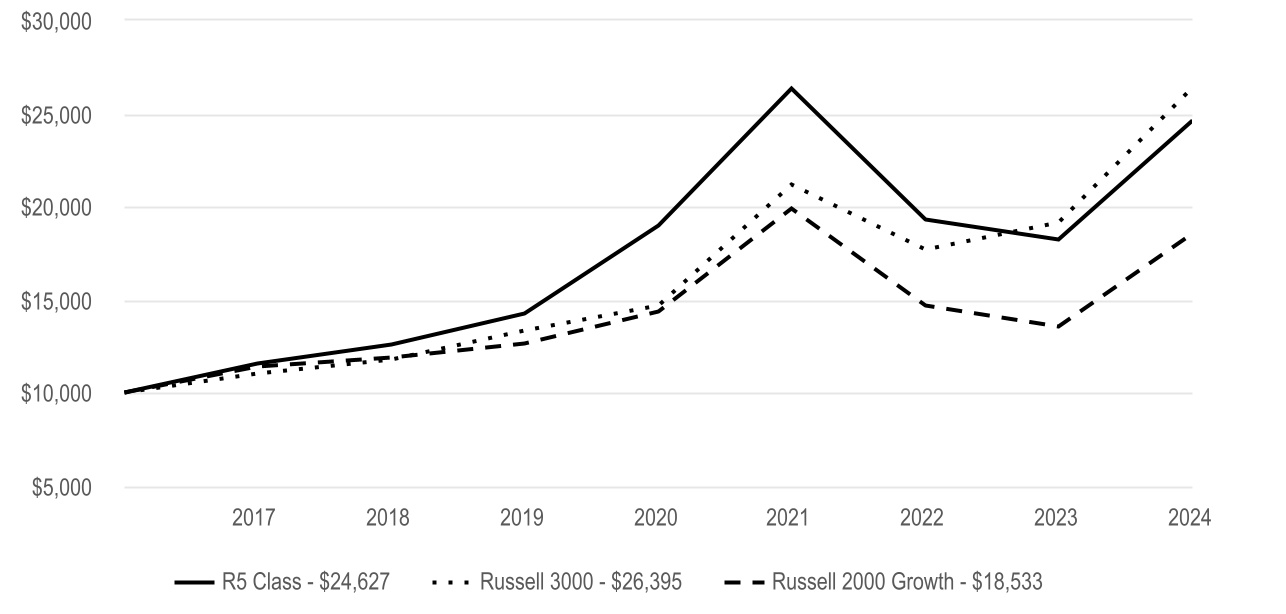

Cumulative Performance (based on an initial $10,000 investment) |

| April 10, 2017 through October 31, 2024 |

|

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | | Since Inception | Inception Date | |

| R5 Class | 37.72% | 16.90% | | 16.76% | 4/10/17 | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | | 14.09% | — | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | | 18.32% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H386

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

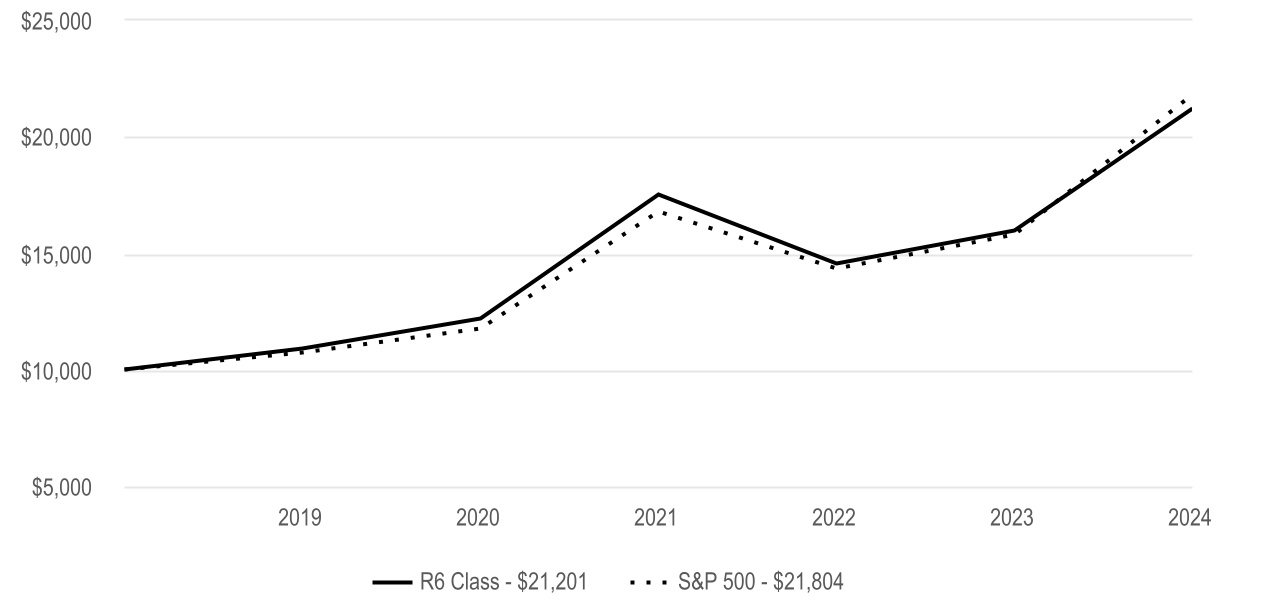

| R6 Class (AGRDX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| R6 Class | $67 | 0.56% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund R6 Class returned 37.91% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

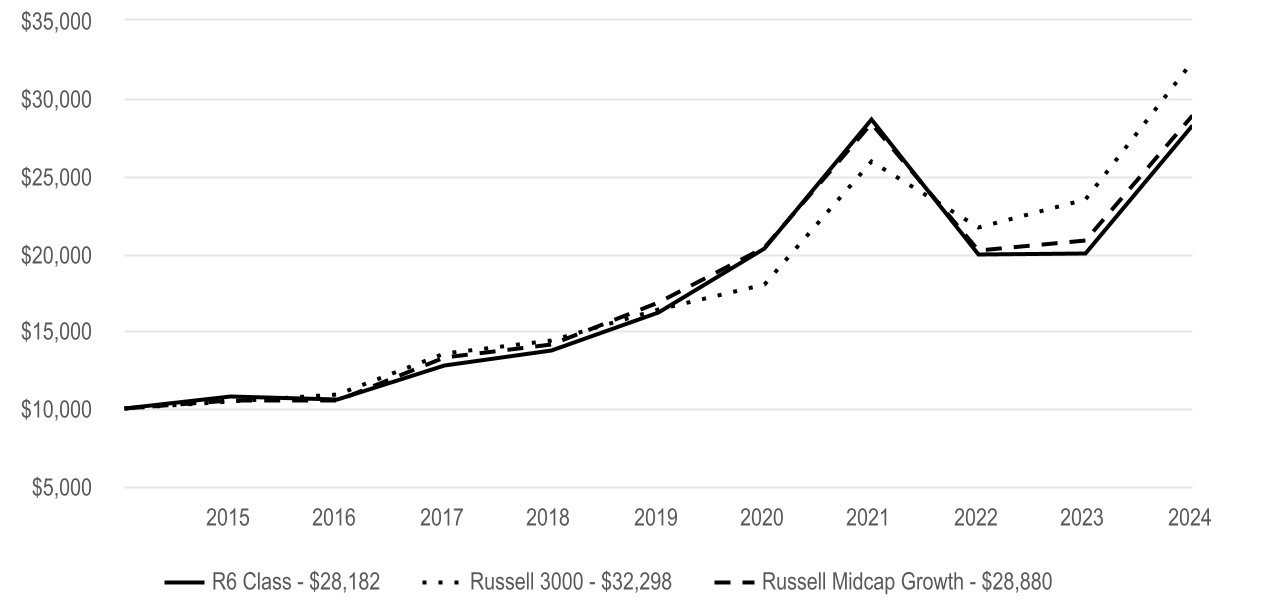

Cumulative Performance (based on an initial $10,000 investment) |

| October 31, 2014 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | 5 Year | 10 Year | | | |

| R6 Class | 37.91% | 17.08% | 14.97% | | | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | 15.00% | 12.75% | | | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | 19.00% | 16.18% | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H519

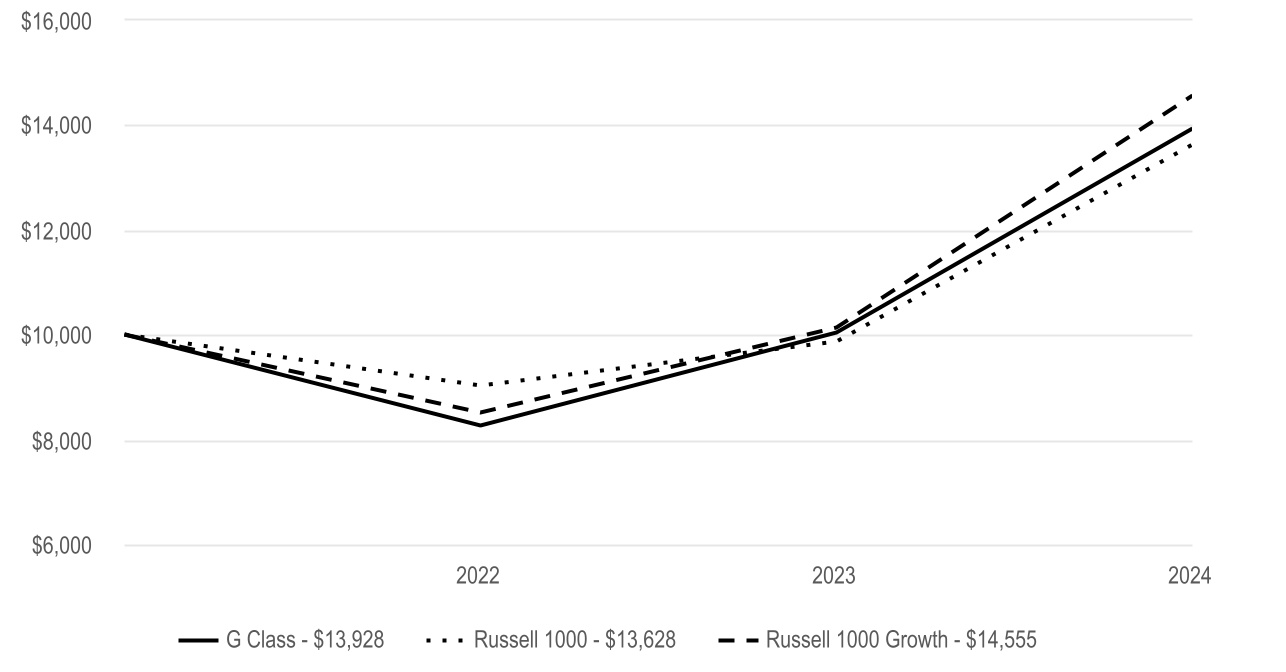

ANNUAL SHAREHOLDER REPORT

Growth Fund

| | | | | |

| G Class (ACIHX) | October 31, 2024 |

This annual shareholder report contains important information about Growth Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| G Class | $0 | 0.00% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Growth Fund G Class returned 38.69% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell 1000 Growth Index. |

| • | Stock choices made the information technology (IT) sector the leading detractor by far from relative performance. Positioning in the IT services and semiconductors and semiconductor equipment industries helped most. The sector was home to four of the top 10 individual detractors for the period. |

| • | In the consumer discretionary sector, positioning in the automobile components and hotels, restaurants and leisure industries detracted. Electronic payment processor Visa was a meaningful detractor in the financials sector. |

| • | In terms of contributors to performance, positioning in the industrials sector helped most. Electrical equipment stocks were the main sources of strength. These stocks have benefited from the ongoing rollout of artificial intelligence technology, which requires digital infrastructure products and services with an emphasis on energy efficiency. |

| • | Elsewhere, positioning in the life sciences tools and services, biotechnology and pharmaceuticals companies made the health care sector another source of strength. Investors tended to avoid companies with long-standing drugs subject to newly proposed government price controls and favor stocks of more innovative firms addressing large medical needs, such as diabetes and obesity. |

| | |

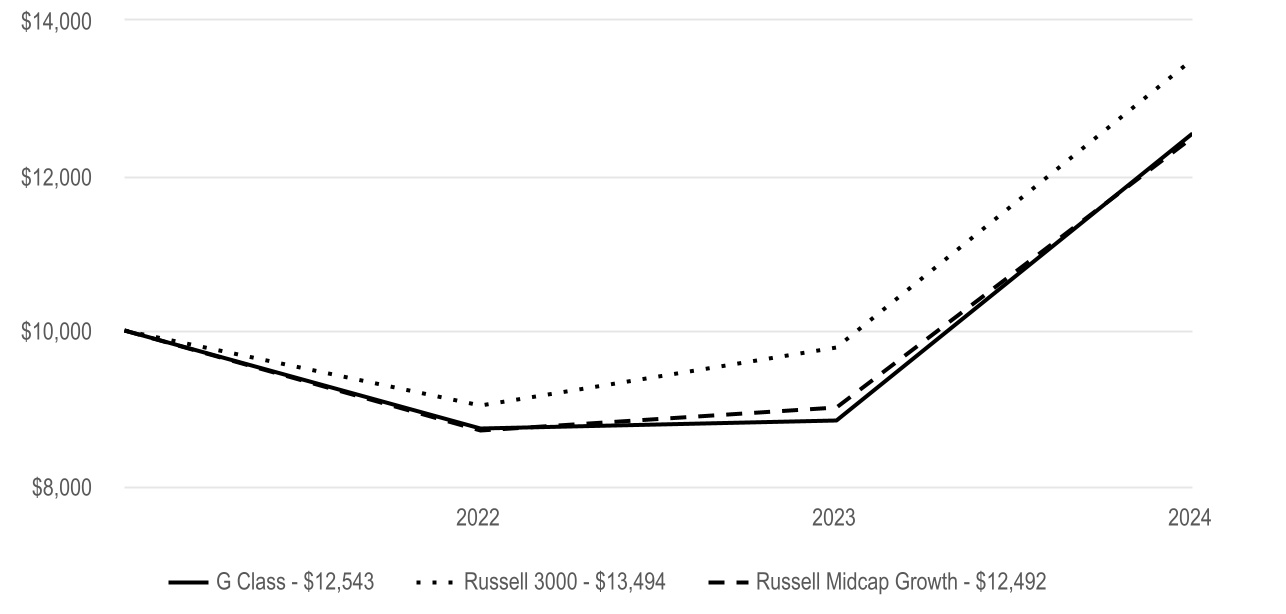

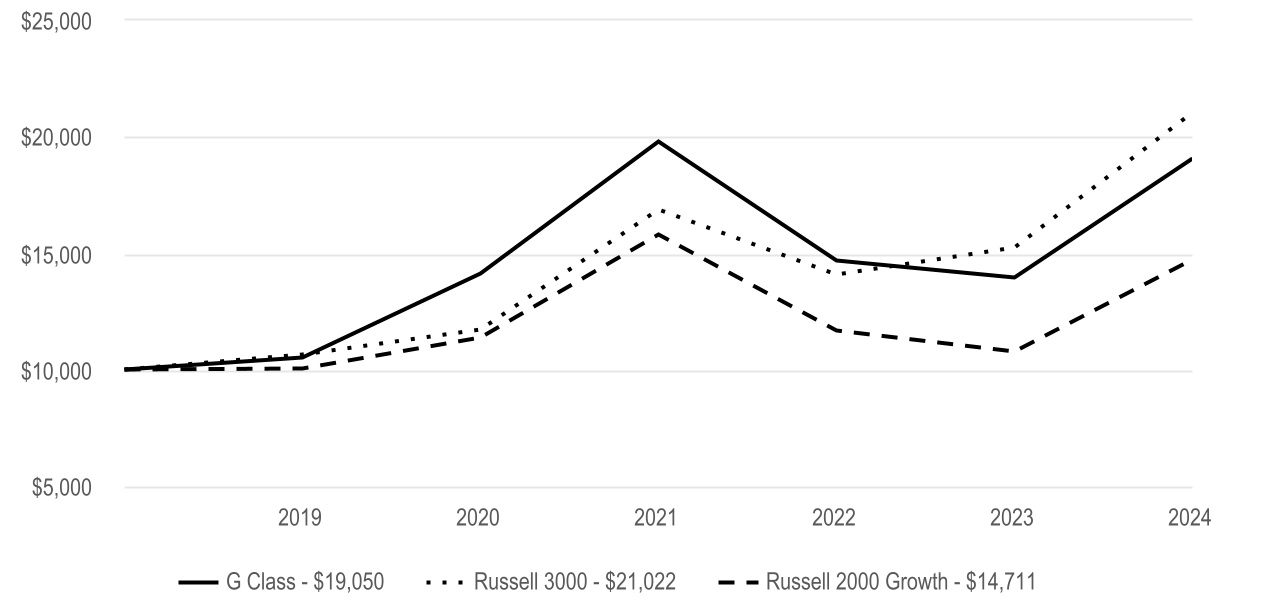

Cumulative Performance (based on an initial $10,000 investment) |

| March 1, 2022 through October 31, 2024 |

|

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

| 1 Year | | | Since Inception | Inception Date | |

| G Class | 38.69% | | | 13.21% | 3/1/22 | |

| | | | | | |

| Regulatory Index | | | | | | |

| Russell 1000 | 38.07% | | | 12.29% | — | |

| | | | | | |

| Performance Index | | | | | | |

| Russell 1000 Growth | 43.77% | | | 15.09% | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| The regulatory index is provided as a broad measure of market performance. The performance index is provided because the advisor believes it is more reflective of the fund’s investment strategy. |

|

|

|

|

|

|

|

|

|

|

| | |

|

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments fund. This information is for educational purposes only and is not intended as investment advice. Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value will fluctuate and redemption value may be more or less than original cost, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total returns for periods less than one year are not annualized. Visit americancentury.com for more recent performance information.

|

| | | | | |

Fund Statistics | |

| Net Assets | $15,311,460,619 |

| Management Fees (dollars paid during the reporting period) | $110,525,512 |

| Portfolio Turnover Rate | 21 | % |

| Total Number of Portfolio Holdings | 81 |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Types of Investments in Portfolio (as a % of net assets) | | | | Top Five Industries (as a % of net assets) | | | | | | | | | | | | |

| Common Stocks | 99.5% | | | | | Software | 18% | | | | | | | | | | | | | | | | | | |

| Exchange-Traded Funds | 0.4% | | | | | Semiconductors and Semiconductor Equipment | 17% | | | | | | | | | | | | | | | | | | |

| Short-Term Investments | 0.2% | | | | | Interactive Media and Services | 13% | | | | | | | | | | | | | | | | | | |

| Other Assets and Liabilities | (0.1)% | | | | | Technology Hardware, Storage and Peripherals | 10% | | | | | | | | | | | | | | | | | | |

| | | | | | | Broadline Retail | 6% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| For additional information about the fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy voting information, scan the QR code or visit americancentury.com/docs. |

| | |

|

| ©2024 American Century Proprietary Holdings, Inc. All rights reserved. |

A-2508H212

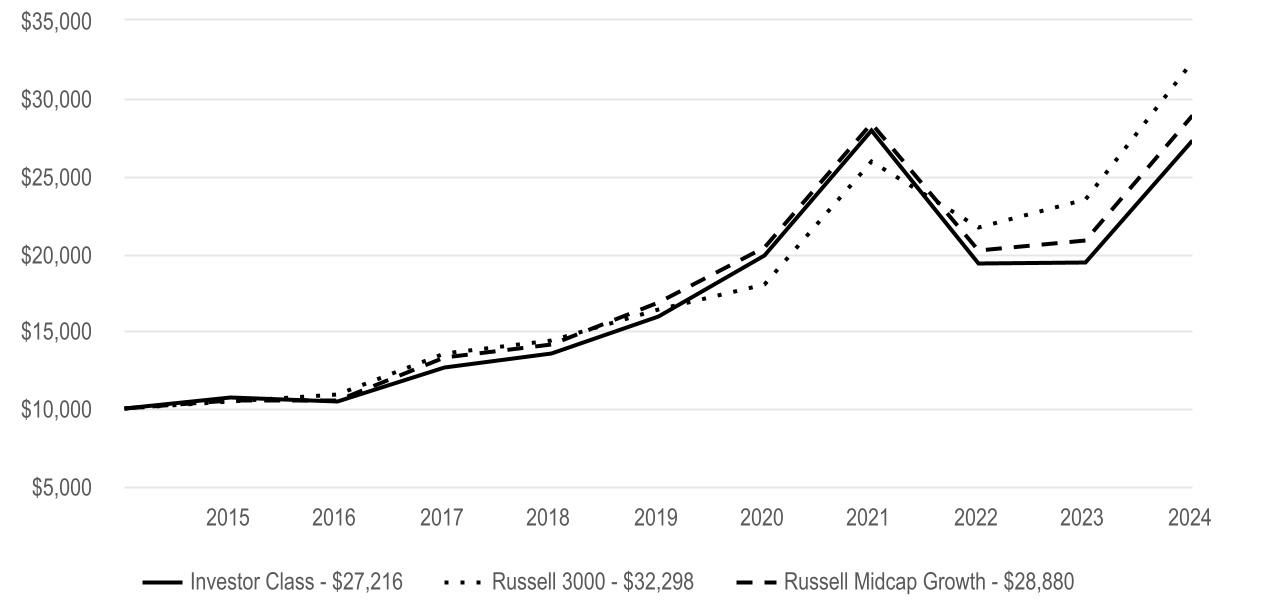

ANNUAL SHAREHOLDER REPORT

Heritage Fund

| | | | | |

| Investor Class (TWHIX) | October 31, 2024 |

This annual shareholder report contains important information about Heritage Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the fund at americancentury.com/docs. You can also request this information by contacting us at 1-800-345-2021. This report describes changes to the fund that occurred during the reporting period.

| | | | | | | | |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) |

|

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $120 | 1.00% |

|

| | | | | |

| What were the key factors that affected the fund’s performance? |

Heritage Fund Investor Class returned 40.52% for the reporting period ended October 31, 2024. |

| The fund seeks long-term capital growth. The commentary below refers to the fund's performance compared to the Russell Midcap Growth Index. |

| • | Holdings in the health care sector contributed the most to performance. Three of the top 10 contributors to relative results were in the biotechnology industry. Positioning in the health care providers and services and life sciences tools and services industries was another source of strength. |

| • | Stock choices among industrials and communication services stocks contributed to performance. In the industrials sector, electrical equipment and ground transportation were key contributors. Entertainment and media stocks drove outperformance in the communication services sector. |

| • | The main source of weakness was positioning in the financials sector, led by an underweight to financial services stocks. Holdings in the capital markets and banking industries were other notable detractors. |