- AMZN Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Amazon.com (AMZN) DEFA14AAdditional proxy soliciting materials

Filed: 2 May 23, 6:47pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

AMAZON.COM, INC.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check all boxes that apply):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2023 Annual Meeting of Shareholders Investor Outreach May 2023

Table of Contents » Item 1: Our Director Nominees (slides 3 - 6) » Item 3: Advisory vote to approve executive compensation (slides 7 - 10) » Other management proposals – Items 2, 4, and 5 (slide 11) » Items 6 - 23: Shareholder proposals (slides 12 - 17) » Worker Safety, Worker Choice, Labor Relations, and ESG Data (slides 18 – 21) » Appendix

Strong, diverse, and engaged board 3 » Diverse and engaged directors with the appropriate mix of skills, qualifications, backgrounds, and tenures to support and help drive our long - term performance » Our board engages with shareholders through meetings, briefings, and correspondence: » Since the beginning of 2022, our lead independent director, the Chair of the Nominating and Corporate Governance Committee (NCGC), or the Chair of the Leadership Development and Compensation Committee (LDCC) participated in meetings with shareholders owning more than 29% of our stock (not counting the approximately 12% voted by our founder and Executive Chair), including one - on - one or small group meetings with most of our 20 largest shareholders » Our shareholder engagement team’s full - time, year - round responsibilities include engaging with our investors and communicating directly with our Board members to inform them on topics discussed and feedback received; since the beginning of 2022, this team has met with 70 of our 100 largest unaffiliated shareholders and many shareholders with smaller holdings

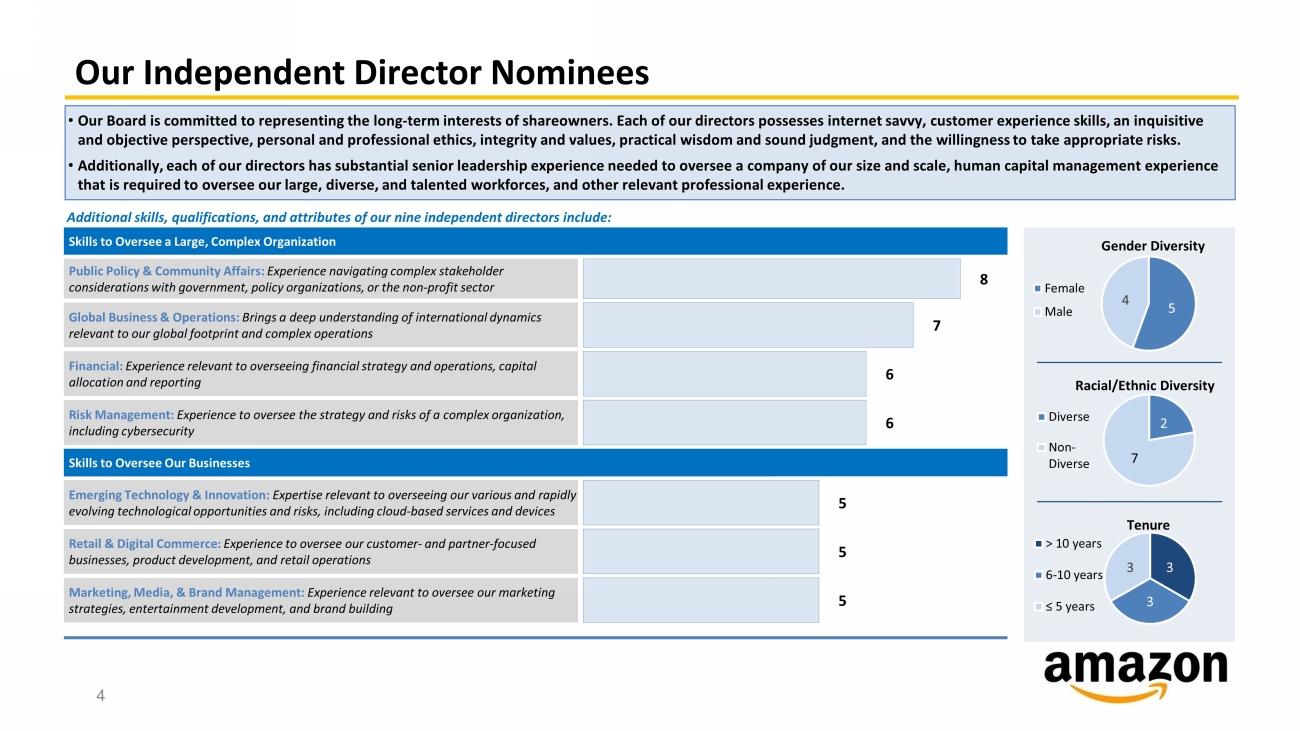

4 Our Independent Director Nominees Additional skills, qualifications, and attributes of our nine independent directors include: Skills to Oversee a Large, Complex Organization Public Policy & Community Affairs: Experience navigating complex stakeholder considerations with government, policy organizations, or the non - profit sector 8 Global Business & Operations: Brings a deep understanding of international dynamics relevant to our global footprint and complex operations 7 Financial: Experience relevant to overseeing financial strategy and operations, capital allocation and reporting 6 Risk Management: Experience to oversee the strategy and risks of a complex organization, including cybersecurity 6 Skills to Oversee Our Businesses Emerging Technology & Innovation: Expertise relevant to overseeing our various and rapidly evolving technological opportunities and risks, including cloud - based services and devices 5 Retail & Digital Commerce: Experience to oversee our customer - and partner - focused businesses, product development, and retail operations 5 Marketing, Media, & Brand Management: Experience relevant to oversee our marketing strategies, entertainment development, and brand building 5 • Our Board is committed to representing the long - term interests of shareowners. Each of our directors possesses internet savvy, c ustomer experience skills, an inquisitive and objective perspective, personal and professional ethics, integrity and values, practical wisdom and sound judgment, and t he willingness to take appropriate risks. • Additionally, each of our directors has substantial senior leadership experience needed to oversee a company of our size and sca le, human capital management experience that is required to oversee our large, diverse, and talented workforces, and other relevant professional experience. 5 4 Gender Diversity Female Male 2 7 Racial/Ethnic Diversity Diverse Non- Diverse 3 3 3 Tenure > 10 years 6-10 years ≤ 5 years

5 Select Human Capital Management Experience Independent Director Human Capital Management Experience Edith W. Cooper Director Since: 2021 Co - Founder of Medley Living, Inc. and Former EVP of Goldman Sachs » Ms. Cooper served as EVP, Global Head of Human Capital Management of Goldman Sachs from March 2008 to December 2017. During her long tenure as a senior executive, she gained expertise in talent development, recruiting, retention, and workplace cultu re. General (Ret.) Keith B. Alexander Director Since: 2020 CEO, President, and Chair of IronNet , Inc. » Gen. Alexander served as the Commander of U.S. Cyber Command from May 2010 to March 2014 and was Director of the National Security Agency and Chief of the Central Security Service from August 2005 to March 2014. Through his military and defense experience, he gained experience managing large, diverse, and talented workforces. Indra K. Nooyi Director Since: 2019 Former Chair and CEO of PepsiCo, Inc. » Ms. Nooyi was the Chair and CEO of Pepsi, which employed approximately 263,000 people worldwide, including approximately 113,000 people within the United States. Approximately 100,000 of these jobs were created while Ms. Nooyi served as CEO. Peps i a nd its subsidiaries are party to numerous collective bargaining agreements. Daniel P. Huttenlocher Director Since: 2016 Dean of MIT Schwarzman College of Computing » Dr. Huttenlocher’s background brings a unique understanding of the intersection between human capital and technology/computing/robotic advancements that directly relate to the Company’s current and future workforce, informing such areas as key investments in safety, ergonomics, and use of robotics. Wendell P. Weeks Director Since: 2016 Chairman and CEO of Corning Incorporated » Mr. Weeks is Chair and CEO of Corning, which has 57,500 full - and part - time employees in 44 countries. The number of Corning employees has more than doubled during his tenure as CEO. Approximately 65% of all Corning employees are in production and maintenance roles and an estimated 58% of those employees are represented by a union or works council. Judith A. McGrath Director Since: 2014 Former Chair and CEO of MTV Networks » Ms. McGrath was the Chair and CEO of MTV Networks, where she was responsible for the compensation strategy for over 12,000 employees and diversity and inclusion initiatives for the employee population. She was known for her strong support for emplo yee s and the performers on the company’s networks, as well as creative, culturally relevant programming ideas. Jamie S. Gorelick Director Since: 2012 Partner with Wilmer Cutler Pickering Hale and Dorr LLP » Ms. Gorelick has experience addressing diversity, equity, and inclusion, both on a policy level and in practice in the workpl ace , through her work advising companies and institutions on anti - harassment, non - discrimination, and gender and race issues. Jonathan J. Rubinstein Director Since: 2010 Former co - CEO of Bridgewater Associates, LP » Mr. Rubinstein has experience addressing human capital management issues, including oversight of workplace environment and culture, as well as in - depth knowledge of diversity, equity, and inclusion matters and sustainability issues, through his roles as a senior executive and director at numerous technology and finance companies. Patricia Q. Stonesifer Director Since: 1997 Former President and CEO of Martha’s Table » Ms. Stonesifer has human capital management experience as a former executive at Microsoft, CEO of the Gates Foundation, and President and CEO of Martha’s Table. As a global employer of over 1.4 million people, human capital management experience has been an important aspect of our ongo ing Board refreshment strategy that we will continue to prioritize as we evaluate talented, multi - faceted candidates who can contribute broadly to the Board

Our Board Committees Are Active and Engaged 6 Our full Board and individual Committees provide in - depth oversight of key risks facing the Company and tactics and strategies f or addressing them Nominating and Corporate Governance Committee Leadership Development and Compensation Committee Audit Committee » Chair: Jamie S. Gorelick » Committee Meetings in 2022 : 5 » Responsibilities : Oversees our environmental, social, and corporate governance policies and initiatives, including The Climate Pledge, Amazon’s goal to be net zero carbon by 2040 » Recent Focus Areas: » Board composition, diversity, and skills » Identifying and evaluating new director candidates to join the Board » Board’s self - evaluation processes » Amazon’s policies and initiatives regarding the environment and sustainability, corporate social responsibility, and corporate governance » Review of recent public policy and public relations initiatives » Feedback from shareholder engagement on the foregoing matters » Chair: Judith A. McGrath » Committee Meetings in 2022 : 7 » Responsibilities : Reviews and establishes compensation of the Company’s executive officers, evaluates our programs and practices relating to talent and leadership development, and oversees the Company’s strategies and policies related to human capital management » Recent Focus Areas: » Shareholder engagement and feedback on the design, amounts, and effectiveness of our senior executives’ compensation » Programs supporting our ambition to create safe, healthy, and inclusive work environments, including an independent racial equity audit for our U.S. hourly employees » Our work to improve safety as reflected in our safety report, “Delivered with Care,” which details a 69% and 53% decrease in our lost time incident rate in the United States and worldwide since 2019 » Talent management and development, including our highly competitive compensation (with an average wage for employees in customer fulfillment and transportation of $19 per hour) and comprehensive benefits (401k, 20 weeks paid parental leave, and health insurance); diversity, equity, and inclusion goals; and the expansion of our upskilling programs » Chair: Indra K. Nooyi » Committee Meetings in 2022 : 7 » Responsibilities : Oversees our financial statements and financial reporting process, business continuity, operational risks, legal and regulatory matters, and our compliance policies and procedures » Recent Focus Areas: » Amazon’s risk assessment and compliance functions » Data privacy » Policies, procedures, and reports on political contributions and lobbying expenses » Tax matters » Comprised of independent directors Gen. Alexander and Messrs. Huttenlocher and Rubinstein » Responsibilities: Oversees data protection and cybersecurity matters Ad Hoc Committee

Item 3 — Advisory Vote to Approve Executive Compensation 7 Overview of Our Named Executive Officer Compensation » Since late 2002, we have granted RSUs on an every - other - year basis (as well as upon promotions or as new hire awards) as our primary form of compensation » We grant RSUs with long - term vesting schedules (generally 5 years or more) instead of a few discrete performance vesting goals in order to promote long - term value creation and constant innovation and reinvention » We do not provide severance benefits or accelerate vesting upon termination » Our approach to executive compensation works well for Amazon » We recognize that our executive compensation program differs from the approach used by many companies » We have carefully considered those alternatives and, based on how we run our business and what we have achieved, we see more risks than potential benefits from changing an approach that has been so successful for our shareholders over the past 26 years, simply to conform to a mold followed by other companies

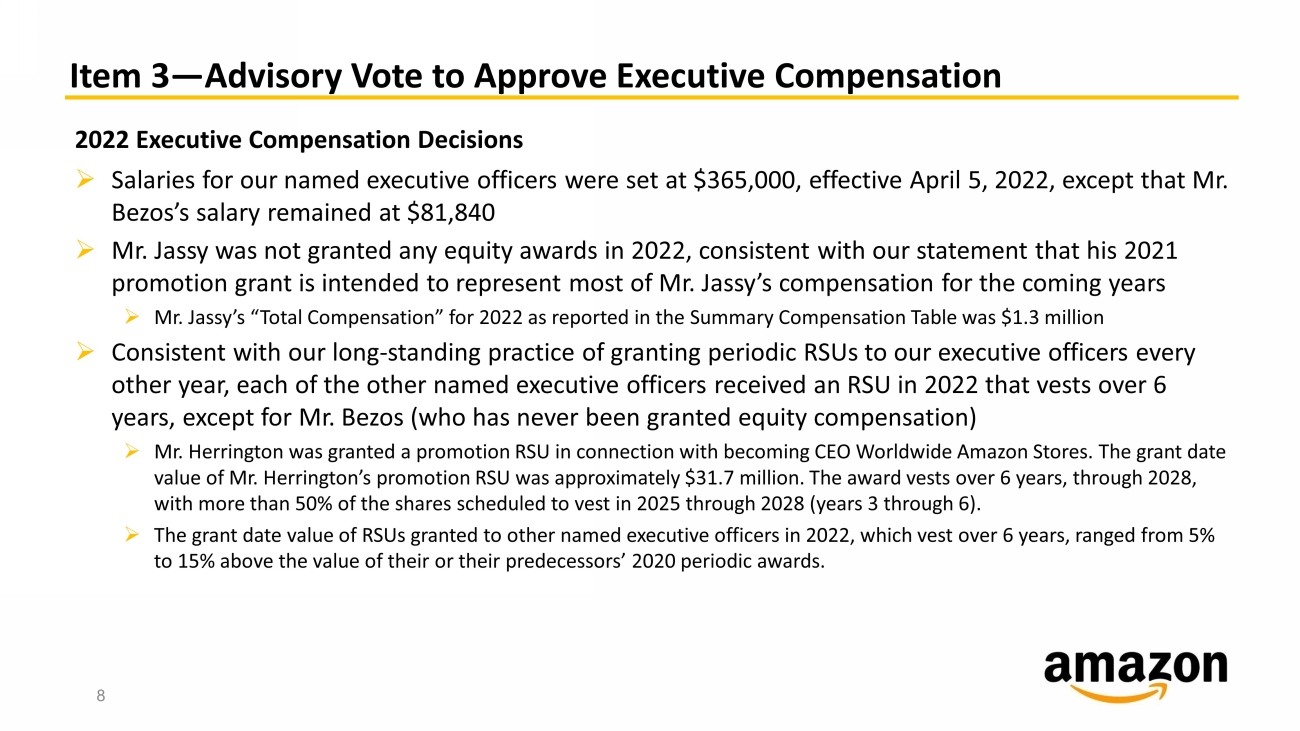

Item 3 — Advisory Vote to Approve Executive Compensation 8 2022 Executive Compensation Decisions » Salaries for our named executive officers were set at $365,000, effective April 5, 2022, except that Mr. Bezos’s salary remained at $81,840 » Mr. Jassy was not granted any equity awards in 2022, consistent with our statement that his 2021 promotion grant is intended to represent most of Mr. Jassy’s compensation for the coming years » Mr. Jassy’s “Total Compensation” for 2022 as reported in the Summary Compensation Table was $1.3 million » Consistent with our long - standing practice of granting periodic RSUs to our executive officers every other year, each of the other named executive officers received an RSU in 2022 that vests over 6 years, except for Mr. Bezos (who has never been granted equity compensation) » Mr. Herrington was granted a promotion RSU in connection with becoming CEO Worldwide Amazon Stores. The grant date value of Mr. Herrington’s promotion RSU was approximately $31.7 million. The award vests over 6 years, through 2028, with more than 50% of the shares scheduled to vest in 2025 through 2028 (years 3 through 6). » The grant date value of RSUs granted to other named executive officers in 2022, which vest over 6 years, ranged from 5% to 15% above the value of their or their predecessors’ 2020 periodic awards.

Item 3 — Advisory Vote to Approve Executive Compensation 9 » Mr. Jassy was granted RSUs in 2021 in connection with his promotion to President and CEO of Amazon » The 2021 RSUs are intended to represent most of Mr. Jassy’s compensation for the coming years » The terms of his promotion grant are designed to establish a long - term owner’s perspective and encourage bold, long - term initiatives » Mr. Jassy’s 2021 RSUs do not begin to vest until 2023, and more than 80% of the shares are scheduled to vest in 2026 through 2031 (years 5 through 10) » Mr. Jassy’s compensation is strongly aligned with our long - term stock price performance » Compensation Actually Paid (as defined by the SEC) to Mr. Jassy in 2022 was negative $148 million, largely attributable to the 2022 decline in value of restricted stock units scheduled to vest over the next 8 years Vesting Schedule and Potential Realizable Value of Mr. Jassy’s RSUs Mr. Jassy’s 2022 realized compensation (salary plus all other compensation plus value of stock vested during the year) declined by 25% from 2021 (values based on 12/30/22 closing price of $84.00 per share and actual vest date value of RSUs vested in 2022) Mr. Jassy’s 2021 Promotion Grant of 61,000 RSUs 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Pre-2021 RSUs 2021 RSU Shares Vesting by Year 248,080 195,340 141,000 106,000 30,000 70,000 95,000 175,000 24,680 200,000 200,000 200,000 200,000 50,000 $31.9M $18.9M $17.7M $16.9M $16.8M $16.8M $16.8M $16.8M $16.8M $4.2M

Item 3 — Advisory Vote to Approve Executive Compensation 10 Shareholder Engagement Since Our 2022 Say - on - Pay Vote » In the course of our extensive shareholder outreach following our 2022 Annual Meeting: » We contacted 40 of our 50 largest shareholders owning approximately 34% of our stock (not counting the approximately 12% voted by our founder and Executive Chair) offering to discuss executive compensation » We heard back from and engaged with shareholders owning over 33% of our stock » Ms. McGrath, the Chair of the Leadership Development and Compensation Committee, participated in meetings with shareholders owning more than 29% of our stock, including one - on - one or small group meetings with most of our 20 largest shareholders » Our engagement also occurred in meetings that included investors beyond our 50 largest shareholders, and we received comments from some shareholders in writing » In response to shareholders’ votes, comments, and feedback, the Leadership Development and Compensation Committee: » Did not grant RSUs to Mr. Jassy in 2022, consistent with our previous statement that Mr. Jassy’s 2021 award is intended to represent most of his compensation for the coming years » Confirmed that it does not intend to grant periodic awards in 2023 to any of the 2022 named executive officers » Affirmed that it will continue to grant RSUs with long - term vesting (such as the RSUs granted in 2022 that vest over six years)

Items 2, 4, and 5 — Other Management Proposals 11 Item Topic Why We Recommend You Support This Proposal 2 Ratification of the Appointment of E&Y as Independent Auditors » Audit Committee undertakes a robust evaluation process each year to confirm that the retention of Ernst & Young as our independent auditor continues to be in our shareholders’ best interests » E&Y has served as our independent auditor since 1996, which provides the firm with a deep understanding, and the ability to handle the breadth and complexity, of our business » E&Y provides only limited services to Amazon other than audit and audit - related services 4 Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation » Conducting an annual advisory vote provides shareholders a meaningful opportunity to provide regular and timely feedback » After consideration of our shareholders’ vote in favor of conducting an annual advisory vote to approve our executive compensation in 2017, the Company has held an annual advisory vote on executive compensation since then 5 Reapproval of the Company’s 1997 Stock Incentive Plan, as Amended and Restated, for Purposes of French Tax Law » We are not proposing to make any changes to the 1997 Plan itself and are not requesting approval of an increase in the number of authorized shares reserved for grant » Approval of this proposal would allow our French employees and subsidiaries to benefit from more favorable income and social tax treatment as permitted by law with respect to tax - qualified restricted stock units

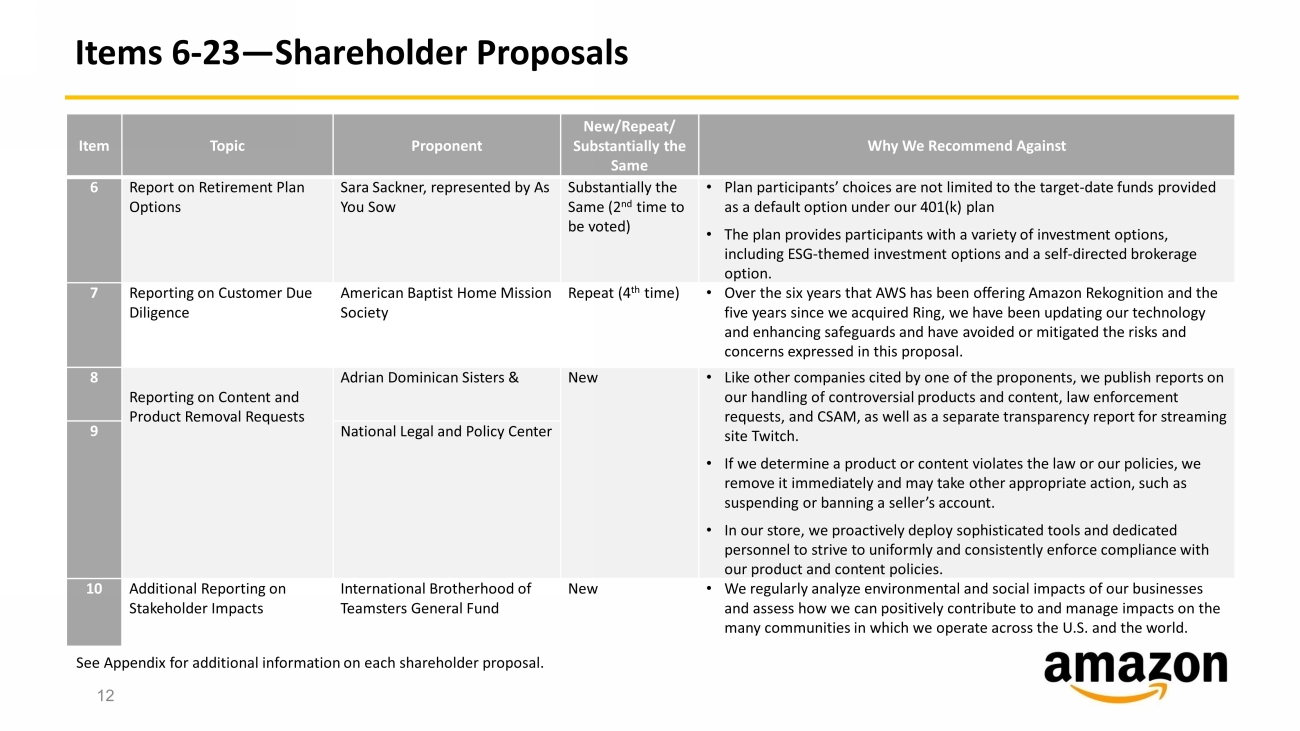

Items 6 - 23 — Shareholder Proposals 12 Item Topic Proponent New /Repeat/ Substantially the Same Why We Recommend Against 6 Report on Retirement Plan Options Sara Sackner, represented by As You Sow Substantially the Same (2 nd time to be voted) • Plan participants’ choices are not limited to the target - date funds provided as a default option under our 401(k) plan • The plan provides participants with a variety of investment options, including ESG - themed investment options and a self - directed brokerage option. 7 Reporting on Customer Due Diligence American Baptist Home Mission Society Repeat (4 th time) • Over the six years that AWS has been offering Amazon Rekognition and the five years since we acquired Ring, we have been updating our technology and enhancing safeguards and have avoided or mitigated the risks and concerns expressed in this proposal. 8 Reporting on Content and Product Removal Requests Adrian Dominican Sisters & New • Like other companies cited by one of the proponents, we publish reports on our handling of controversial products and content, law enforcement requests, and CSAM, as well as a separate transparency report for streaming site Twitch. • If we determine a product or content violates the law or our policies, we remove it immediately and may take other appropriate action, such as suspending or banning a seller’s account. • In our store, we proactively deploy sophisticated tools and dedicated personnel to strive to uniformly and consistently enforce compliance with our product and content policies. 9 National Legal and Policy Center 10 Additional Reporting on Stakeholder Impacts International Brotherhood of Teamsters General Fund New • We regularly analyze environmental and social impacts of our businesses and assess how we can positively contribute to and manage impacts on the many communities in which we operate across the U.S. and the world. See Appendix for additional information on each shareholder proposal.

Items 6 - 23 — Shareholder Proposals 13 Item Topic Proponent New/Repeat/ Substantially the Same Why We Recommend Against 11 Alternative Tax Reporting Missionary Oblates of Mary Immaculate – United States Province Repeat (2 nd time) • We report our total tax contributions in many of the countries in which we operate, and our Tax Principles provides transparency on our taxation approach. 12 Additional Reporting on Climate Lobbying Eric and Emily Johnson and Mercy Rome, represented by Newground Social Investment Substantially the Same (2 nd time) • The proponent filed substantially the same proposal last year and withdrew its proposal after we issued a report on lobbying alignment with the Paris Agreement which we believe addressed the proposal’s underlying concerns. • Our report details the processes we have in place to provide oversight of our public policy activities. 13 Additional Reporting on Gender/Racial Pay Anne Bartol Butterfield, represented by Arjuna Capital Repeat (5 th time) • In 2022, at Amazon, women globally and in the United States earned 99.6 cents and 99.5 cents, respectively, for every dollar that men earned performing the same jobs. In 2022, racial/ethnic minorities in the United States earned 99.5 cents for every dollar that white employees earned performing the same jobs. • We annually publish gender and race representation information on our website, which includes representation by job type, such as field and customer support employees, corporate employees, and senior leaders, and we publish our consolidated EEO - 1 reports. 14 Analysis of Costs Associated with Diversity, Equity, and Inclusion Programs National Center for Public Policy Research New • We have risk management processes to protect against risks to the Company, including our Board’s oversight of risks related to our diversity, equity, and inclusion policies and initiatives. See Appendix for additional information on each shareholder proposal.

Items 6 - 23 — Shareholder Proposals 14 Item Topic Proponent New/Repeat/ Substantially the Same Why We Recommend Against 15 Amendment to Our Bylaws to Require Shareholder Approval for Certain Future Amendments James McRitchie, represented by John Chevedden New • The proposed bylaw restrictions requested by this proposal would be highly unusual, inefficient, and impractical, given the broad wording of the proposal, and could require a shareholder vote for bylaw amendments that are minor or designed to enhance transparency for our shareholders. 16 Additional Reporting on Freedom of Association Catherine Donnelly Foundation, represented by the Shareholder Association for Research & Education New • In our conversations and in their responsive filing with the SEC, the proponents reveal the true intent behind this proposal – and it is not an independent assessment. It is promotion of “neutrality” agreements. It is our employees’ right to join, form, or not to join a labor organization of their own selection, without fear of reprisal, intimidation, or harassment. This right to choose or not choose union representation belongs exclusively to employees, not unions or employers. On the contrary, neutrality agreements are contracts between a union and employer — employees are not party to these agreements and they have not bargained for or agreed to them. • Unions met the minimum showing of support required for the National Labor Relations Board (NLRB) to schedule a representation vote at only four – a tiny fraction – of our U.S. locations. Amazon’s last representation vote was in October 2022. See Appendix for additional information on each shareholder proposal.

Items 6 - 23 — Shareholder Proposals 15 Item Topic Proponent New/Repeat/ Substantially the Same Why We Recommend Against 17 New Policy Regarding Our Executive Compensation Process AFL - CIO Reserve Fund New • Contrary to the proposal’s implication that our compensation practices differ between senior executives and other employees, our compensation program is generally consistent across the Company and provides for similar pay arrangements with employees at most levels. • The pay ratio of our CEO to median compensated employee is 38:1. 18 Additional Reporting on Animal Welfare Standards MacConnel Lowe Trust, represented by People for the Ethical Treatment of Animals New • Whole Foods Market was ranked first and received an A+ grade in the Humane Society’s Food Industry Scorecard and has received continued recognition for responsible sourcing and animal welfare from other trusted and reputable non - governmental organizations, including Mercy for Animals and Compassion in World Farming. • The claims made by the proponent’s representative against Sweet Stem Farms (which is not currently a Whole Foods Market supplier), Nellie’s Free Range Eggs, Diestel Turkey Ranch, and Petaluma Egg Farms that are cited in the proposal could not be verified after thorough investigations 19 Additional Board Committee Jing Zhao New • Our current Board and committee structure, which allocates oversight responsibilities among the full Board and each of its committees, already provides an appropriate level of oversight of the types of environmental, social, regulatory, and human capital matters raised in the proposal. See Appendix for additional information on each shareholder proposal.

Items 6 - 23 — Shareholder Proposals 16 Item Topic Proponent New/Repeat/ Substantially the Same Why We Recommend Against 20 Alternative Director Candidate Policy Oxfam America, Inc. Repeat (3 rd time) • Our current process to identify and nominate directors has successfully recruited diverse and qualified directors with extensive human capital management experience. 21 Report on Warehouse Working Conditions Thomas Dadashi Tazehozi, represented by Tulipshare Limited Repeat (2 nd time) • We have disclosed our recordable incident rate (RIR) and lost time incident rate (LTIR) data. Between 2019 and 2022, we saw our worldwide RIR improve by almost 24% and our LTIR improve by 53%. • From 2021 to 2022, we improved our worldwide recordable incident rate by 11% and our lost time incident rate by 14%. • Amazon is fully cooperating with the Occupational Safety and Health Administration’s (OSHA) investigations regarding worker safety, which are significantly more in depth than what a third - party assessment would entail. See Appendix for additional information on each shareholder proposal.

Items 6 - 23 — Shareholder Proposals 17 Item Topic Proponent New/Repeat/ Substantially the Same Why We Recommend Against 22 Report on Packaging Materials The George Gund Foundation, represented by As You Sow Repeat (3 rd time) • In 2022, we publicly reported on the amount of single - use plastic (97,222 metric tons) being used across our global operations network to ship orders to customers. • We’ve also reported that in 2021, we reduced average plastic packaging weight per shipment by over 7%. • In addition, more than 8% of Amazon shipments include no additional packaging. • We’ve also innovated and invested in technologies, processes, and materials over the last several years to help reduce the weight of the packaging per shipment by 38%, and we have eliminated the use of more than 1.5 million tons of packaging materials since 2015, despite the number of shipments having substantially increased as our business has grown. 23 Report on Customer Use of Certain Technologies John Harrington Repeat (5 th time) • Over the six years that AWS has been offering Amazon Rekognition, we have been updating our technology and enhancing safeguards and have avoided or mitigated the risks and concerns expressed in this proposal. For example, AWS has not received a single verified report of Amazon Rekognition being used in the harmful manner posited in the proposal. See Appendix for additional information on each shareholder proposal.

Worker Safety at Amazon 18 Our employees’ safety and well - being is a top priority, and our goal is to be the safest workplace in the industries in which we operate » We are transparent about our commitment to and efforts to improve workplace safety, discussing our initiatives in detail in o ur safety report titled “Delivered with Care: Safety, Health, and Well - Being at Amazon” and on our safety website at safety.aboutamazon.com » Our Lost Time Incident Rate — a measure of the number of injuries and illnesses that result in time away from work — was 1.9 worldwide and 1.6 in the United States in 2022, a 53% and 69% improvement from 2019, respectively » Our Recordable Incident Rate — which measures how often an injury or illness occurs at work — was 5.1 worldwide and 6.7 in the United States in 2022, a 24% and 23% improvement from 2019, respectively » These rates and trends compare favorably to those of large logistics companies, and are in stark contrast to the absence of a ny public reporting by some of the large “big box” retailers with which we compete » Amazon is fully cooperating with the Occupational Safety and Health Administration’s (OSHA) investigations regarding worker safety, which is significantly more in depth than what a third - party assessment would entail – and from the beginning, we have been open and transparent about our operations and programs and welcome the opportunity for OSHA’s feedback. » Amazon’s efforts to cooperate and provide the government documents and information involves significant time and expense, and we believe that we should remain focused on responding to the government’s investigations and continuing to advance our own programs – not divert resources and expense on a third - party assessment that duplicates what Amazon’s workplace health and safety team and government regulators are already doing

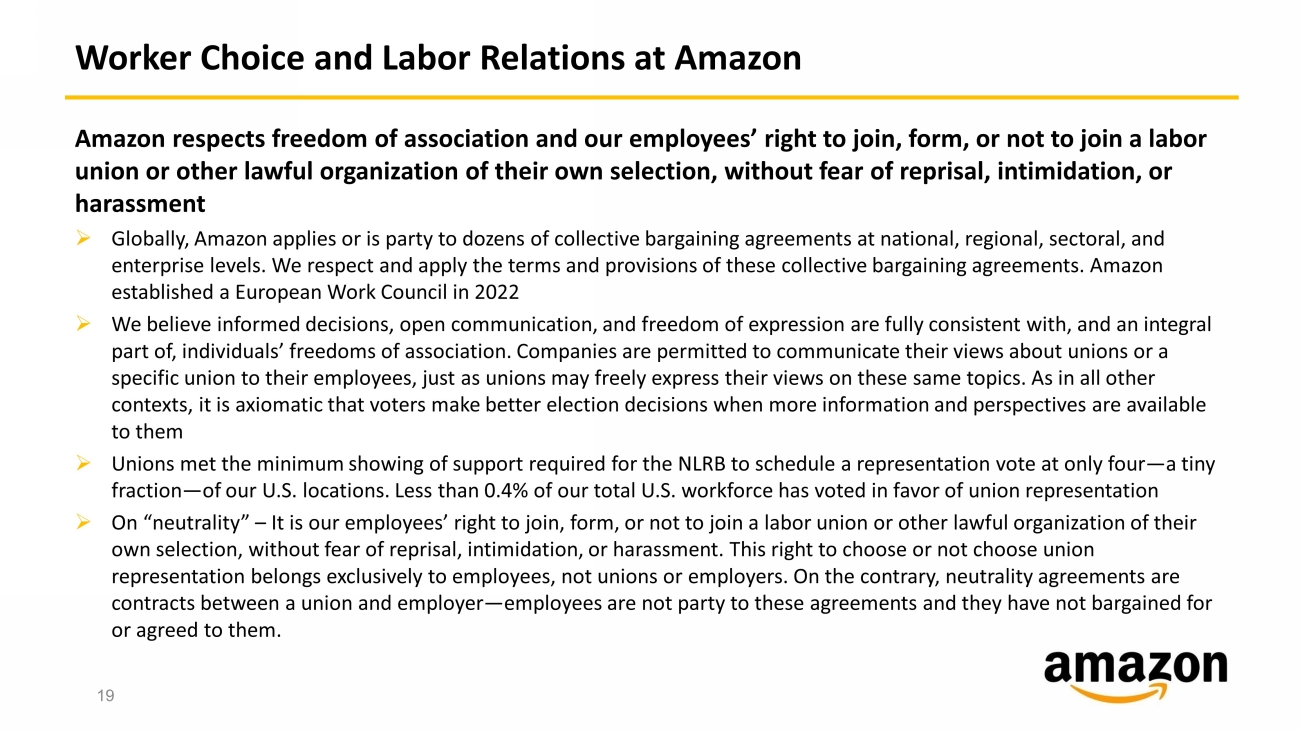

Worker Choice and Labor Relations at Amazon 19 Amazon respects freedom of association and our employees’ right to join, form, or not to join a labor union or other lawful organization of their own selection, without fear of reprisal, intimidation, or harassment » Globally, Amazon applies or is party to dozens of collective bargaining agreements at national, regional, sectoral, and enterprise levels. We respect and apply the terms and provisions of these collective bargaining agreements. Amazon established a European Work Council in 2022 » We believe informed decisions, open communication, and freedom of expression are fully consistent with, and an integral part of, individuals’ freedoms of association. Companies are permitted to communicate their views about unions or a specific union to their employees, just as unions may freely express their views on these same topics. As in all other contexts, it is axiomatic that voters make better election decisions when more information and perspectives are available to them » Unions met the minimum showing of support required for the NLRB to schedule a representation vote at only four — a tiny fraction — of our U.S. locations. Less than 0.4% of our total U.S. workforce has voted in favor of union representation » On “neutrality” – It is our employees’ right to join, form, or not to join a labor union or other lawful organization of their own selection, without fear of reprisal, intimidation, or harassment. This right to choose or not choose union representation belongs exclusively to employees, not unions or employers. On the contrary, neutrality agreements are contracts between a union and employer — employees are not party to these agreements and they have not bargained for or agreed to them.

Worker Choice and Labor Relations at Amazon 20 Amazon respects freedom of association and our employees’ right to join, form, or not to join a labor union or other lawful organization of their own selection, without fear of reprisal, intimidation, or harassment » Unfair Labor Practice (ULP) charges consist solely of allegations and can be filed by anyone — any private citizen, union, or company » The approximately 250 ULP charges filed against Amazon in 2021 - 2022 need to be viewed in context: » During the same period, there were more than twice as many ULP claims filed against a large unionized U.S. logistics company » More than half of the approximately 250 ULP charges against Amazon were filed by unions to gain support at the four facilities where unions sought representation votes » Moreover, approximately half of the ULP charges filed against Amazon in 2021 and 2022 have already been dismissed or withdrawn for lack of merit at the earliest agency investigatory stages. In their responsive filing with the SEC for Item 16, the proponent asserts that NLRB regional offices have determined half the ULP charges filed against Amazon have “merit” — this is unsupported and materially false. » As of April 30, 2023, none of those approximately 250 ULP filings resulted in a final NLRB order against Amazon. That rate of 0.0% is also far below the rate of 2.4% identified as typical by the proponents in their responsive SEC filing.

21 Other Environmental, Social, and Human Capital Initiatives The Climate Pledge and Renewable Energy » The Climate Pledge is our goal to reach net - zero carbon emissions across our operations by 2040. » In 2022, Amazon grew its renewable energy capacity by 8.3 gigawatts (GW) through 133 new projects in 11 countries. This brings Amazon’s total portfolio to more than 20 GW across 401 renewable energy projects in 22 countries. » The Climate Pledge Fund is investing in visionary companies across industries, including transportation and logistics, energy generation, storage and utilization, manufacturing and materials, circular economy, and food and agriculture » The Right Now Climate Fund works to restore and conserve forests, wetlands, and grasslands around the world. Investing in Our Communities » As of March 2023, the Amazon Housing Equity Fund has had a significant, positive impact on rental affordability in communities Amazon calls home, with more than $1.6 billion in loans and grants committed. » These commitments have preserved or created over 12,500 affordable units to house more than 18,000 people. Human Capital » From 2019 to 2022, we invested approximately $1 billion in safety initiatives unrelated to COVID - 19 and, in 2023, we are investing another approximately $550 million in safety initiatives. » In March 2023, we also published our second annual safety report highlighting our commitment to and innovations in worker safety and disclosing key safety metrics. Circular Economy and Avoiding and Managing Waste » Since 2015, we have eliminated more than 1.5 million tons of packaging material and reduced per - shipment packaging weight by 38%. » In 2021, more than 8% of shipments had no additional Amazon packaging and we reduced average plastic packaging weight per shipment by over 7%, resulting in 97,222 metric tons of single - use plastic being used across our global operations network to ship orders to customers. Human Rights » We have codified our commitment to human rights in our Amazon Global Human Rights Principles, informed by UN and ILO frameworks. » We focus our supply chain efforts on key commitment areas: Safe Workplaces, Freely Chosen Employment, Gender Equity, Fair Wages, Environmental Protection, and Grievance Mechanisms. » We use human rights impact assessments as a due diligence tool to identify and address adverse impacts business activities might have on individuals such as workers, local community members, or consumers. Diversity, Equity, and Inclusion » When evaluating 2022 compensation, our reported data demonstrates that women globally and in the United States earned 99.6 cents and 99.5 cents, respectively, for every dollar that men earned performing the same jobs, and racial/ethnic minorities in the United States earned 99.5 cents for every dollar that white employees earned performing the same jobs. » In 2022, we retained a respected law firm to conduct an independent racial equity audit to evaluate any disparate racial impacts on our U.S. hourly employees resulting from our policies, programs, and practices.

Additional Information on Shareholder Proposals 22 Appendix

Item 6 — Shareholder Proposal Requesting a Report on Retirement Plan Options 23 Proponent: Sara Sackner, represented by As You Sow Why We Recommend You Vote Against This Proposal » Plan participants’ choices are not limited to the default plan option. Our 401(k) plan provides participants with a variety of investment options, including ESG - themed investment options and thousands of investments (mutual funds, individual stocks, and ETFs) through a self - directed brokerage option » As is customary for large retirement plans like our 401(k) plan, a plan fiduciary (rather than our Board) is responsible for selecting 401(k) investment options, including the default investment option. These investment options take into account a variety of potential risks, reward opportunities, and goals, including, but not limited to, those related to climate change

Item 7 — Shareholder Proposal Requesting a Report on Customer Due Diligence 24 Proponent: American Baptist Home Mission Society Why We Recommend You Vote Against This Proposal » Amazon is committed to the responsible use of our artificial intelligence and machine learning (AI/ML) products and services and other AWS services. We have been consistent and proactive in our efforts to address concerns and mitigate the risk of misuse through policy and advocacy efforts, customer contractual requirements and training, consultation with third party experts, and other policies and practices » For example, Credo AI, a company that specializes in responsible AI, performed a third - party evaluation, which supports that Rekognition performs well across demographic attributes. In 2020, we implemented a global moratorium on police use of Amazon Rekognition’s facial comparison feature for criminal investigations. As part of an ongoing commitment to improving its products and services by soliciting feedback from community stakeholders and independent experts, Ring completed a civil rights and civil liberties audit with the Policing Project at New York University School of Law in 2021, during the course of which Ring implemented over one hundred changes to its products, policies, and legal processes. Ring continues to engage with community stakeholders and independent experts like the Center for Democracy and Technology » Customers (including any government or law enforcement customer) must agree to the AWS Acceptable Use Policy (AUP), which prohibits use of AWS’s services “for any illegal or fraudulent activity.” We also publish materials for our customers t o understand how to responsibly develop and use ML systems (for example, “The Responsible Use of ML Guide” https://d1.awsstatic.com/responsible - machine - learning/responsible - use - of - machine - learning - guide.pdf) » Over the six years that AWS has been offering Amazon Rekognition and the five years since we acquired Ring, we have been updating our technology and enhancing safeguards and have avoided or mitigated the risks and concerns expressed in this proposal. For example, AWS has not received a single verified report of Amazon Rekognition being used in the harmful manner posited in the proposal

Item 8 and Item 9 — Shareholder Proposals Regarding Content and Product Removal Requests Why We Recommend You Vote Against This Proposal » We strive to comply with local laws and regulations in the places where we do business. In addition, we maintain publicly - posted policies that describe products and content that we prohibit. For example, we prohibit products and content that promote the abu se or sexual exploitation of children; or violate copyright, trademark, or consumer safety laws and regulations » Regardless of whether a product or content is flagged through our own proactive compliance efforts or by a government or law enforcement official, a customer, or a third party, we follow the same process: we review the product or content against our pol icies and the law, where applicable. If we determine a product or content violates the law or our policies, we remove it immediatel y a nd may take other appropriate action, such as suspending or banning a seller’s account » In our store, we proactively deploy sophisticated tools and dedicated personnel to strive to uniformly and consistently enfor ce compliance with our product and content policies » As a store, we have chosen to offer a very broad range of viewpoints, including content or products that may conflict with ou r s tated positions » Item 8’s proponent incorrectly states that our e - commerce competitors such as eBay and Mercado Libre provide reporting that Amaz on does not. » eBay’s transparency report consists of information on counterfeit items – which is covered in our Brand Protection Report https://www.aboutamazon.com/news/company - news/amazon - brand - protection - report - 2022 ; and items blocked by filtering algorithms – which is covered in Amazon’s handling of controversial products and content https://www.aboutamazon.com/news/how - amazon - works/amazons - approach - to - controversial - products - and - content . They also note that peer companies offer disclosures made in compliance with government orders or local laws, which Amazon doe s in our CSAM report https://www.aboutamazon.com/news/policy - news - views/amazon - csam - transparency - report - 2022 , Twitch Transparency Reports https://safety.twitch.tv/s/article/Transparency - Reports?language=en_US&la , and Ring Law Enforcement Information Requests https://ring.com/law - enforcement - information - requests . We also report Amazon Law Enforcement Information Requests https://www.amazon.com/gp/help/customer/display.html?nodeId=GYSDRGWQ2C2CRYEF 25 Proponent for Item 8: Adrian Dominican Sisters Proponent for Item 9: National Legal and Policy Center

Item 10 — Shareholder Proposal Requesting Additional Reporting on Stakeholder Impacts Why We Recommend You Vote Against This Proposal » As we work toward reaching our climate goals, we are also committed to the people, workers, and communities that support our entire value chain so that they are treated with fundamental dignity and respect. For example, we are a founding member of Beyond the Megawatt, an initiative of the Clean Energy Buyers Institute focused on ensuring a just and equitable transition to renewable energy. We regularly analyze environmental and social impacts of our businesses and assess how we can positively contribute to and manage impacts on the many communities in which we operate across the United States and the world » We believe all employees should have the opportunity to learn new skills, grow, and build their careers as they develop their professional journeys and prepare for economies of the future. Therefore, we want to make it easy for people to have access to the skills they need to grow their careers by offering programs like Upskilling 2025 and Amazon Career Choice » Our commitment to sustainability includes supporting partners in our supply chain that respect human rights, provide safe and inclusive workplaces, and promote a sustainable future. We have codified our commitment to human rights in our Amazon Global Human Rights Principles and have published our Supply Chain Standards, which are grounded in principles of inclusivity, continuous improvement, and supply chain accountability 26 Proponent: International Brotherhood of Teamsters General Fund

Item 11 — Shareholder Proposal Requesting Alternative Tax Reporting Why We Recommend You Vote Against This Proposal » Under the oversight of the Audit Committee of our Board of Directors, we have adopted and published our Tax Principles, which provide transparency on Amazon’s approach to taxation » We report on our tax contributions and other economic contributions in the United States, United Kingdom, Germany, Italy, France, Spain, and Canada » The GRI Tax Standards are not commonly used among U.S. companies or our peer companies. While we do not formally utilize these guidelines, we believe our Tax Principles, underlying controls, and the Audit Committee’s oversight address many of the requirements found in GRI Tax Standards 207 - 1, - 2, and - 3 » While we expect to be required to report certain country - by - country tax information for European Union countries following the European Parliament’s recent vote to require such information, and for certain other countries (such as Australia), we believe the prescriptive granularity of reporting under GRI Tax Standard 207 - 4 would potentially force disclosure of competitively sensitive information about our operations and cost structures and would hamper our ability to make operational decisions 27 Proponent: Missionary Oblates of Mary Immaculate – United States Province

Item 12 — Shareholder Proposal Requesting Additional Reporting on Climate Lobbying Why We Recommend You Vote Against This Proposal » We have already issued a report on lobbying alignment with the Paris Agreement, which we believe addresses the proposal’s underlying concern. In fact, we received a similar proposal from this same proponent last year, which the proponent withdrew after we issued the report. We also report comprehensively and transparently on an annual basis our public policy expenditures, including direct and indirect lobbying expenditures such as our payments to U.S. - based trade associations, coalitions, charities, and social welfare organizations to which our Public Policy team contributed at least $10,000 » We have processes in place to provide oversight of our public policy activities, and we take a number of actions to mitigate the potential risk associated with misalignment between our views and the lobbying activities undertaken by organizations we support » When, as a result of our own review or as a result of media or stakeholder inquiries, we identify potential misalignment between positions we support and the positions that such an organization advocates, we will carefully weigh the risks and benefits to Amazon of our continued membership in or support of such organization. In those situations, we will communicate to the organization that we do not support positions it takes that are not aligned with our public policy positions. In other instances, we may terminate our membership and/or withdraw our financial support if the risks arising from a particular position the organization supports outweigh the overall benefits to Amazon of being a member 28 Proponent: Eric and Emily Johnson and Mercy Rome, represented by Newground Social Investment

Item 13 — Shareholder Proposal Requesting Additional Reporting on Gender/Racial Pay Why We Recommend You Vote Against This Proposal » Amazon currently provides extensive information on compensation by gender and by race/ethnicity. When evaluating 2022 compensation in the United States, including base compensation, cash bonuses, and stock, our reported data demonstrates that women globally and in the United States earned 99.6 cents and 99.5 cents, respectively, for every dollar that men earned performing the same jobs, and racial/ethnic minorities in the United States earned 99.5 cents for every dollar that white employees earned performing the same jobs » Amazon reports global gender and U.S. race and ethnicity data for our entire workforce, field & customer support employees, corporate employees, people managers, and senior leaders. We also disclose our EEO - 1 consolidated reports » We are strongly committed to promoting gender and racial diversity and inclusion in our workforce, including among our leadership ranks 29 Proponent: Anne Bartol Butterfield, represented by Arjuna Capital

Item 14 — Shareholder Proposal Requesting an Analysis of Costs Associated with Diversity, Equity, and Inclusion Programs Why We Recommend You Vote Against This Proposal » Diversity, equity, and inclusion are cornerstones of our continued success and critical components of our culture. We believe these values are not only good for business; they’re simply right » We have risk management processes to protect against risks to the Company, including our Board’s oversight of risks related to our diversity, equity, and inclusion policies and initiatives 30 Proponent: National Center for Public Policy Research

Item 15 — Shareholder Proposal Requesting an Amendment to Our Bylaws to Require Shareholder Approval for Certain Future Amendments Why We Recommend You Vote Against This Proposal » Under Delaware corporate law, our Board must act in our shareholders’ best interest when it exercises its authority under our Amended and Restated Certificate of Incorporation (the “Certificate”) to determine whether, when, and in what manner to amend our Bylaws. We believe that delegation of authority under our Certificate provides the Board with the appropriate ability to exercise its fiduciary duties when it considers potential updates, including to reflect changes in applicable law and evolving circumstances and corporate governance best practices » Our existing governance policies and practices promote board accountability and responsiveness to shareholders and we have a strong track record of proactively engaging with our shareholders on governance matters » The shareholder approval requirements requested by this proposal are inappropriate and out of line with typical public company governance provisions. We believe that the proposed requirements would be highly unusual, inefficient, and impractical, given the broad wording of the proposal that could require holding a shareholder vote for any amendment, even if minor or designed to enhance transparency for our shareholders 31 Proponent: James McRitchie, represented by John Chevedden

Item 16 — Shareholder Proposal Requesting Additional Reporting on Freedom of Association Why We Recommend You Vote Against This Proposal » We respect the rights of our employees to form, join, or not to join a labor union or other lawful organization of their own selection, without fear of reprisal, intimidation, or harassment, and our policies and practices protect these rights as disc uss ed in detail in the report we published in 2022. » A careful review of the facts regarding our workplace employee relations shows a different situation than suggested by this proposal and its supporting statement. For example, it is important to understand that unions met the minimum showing of support required for the National Labor Relations Board (“NLRB”) to schedule a representation vote at only four — a tiny fraction — of our U.S. locations. Less than 0.4% of our total U.S. workforce has voted in favor of union representation. Amazon has not had a representation vote in the U.S. since October 2022. » We believe that the independent assessment requested by SHARE and the Strategic Organizing Center would merely seek to duplicate the investigative and regulatory oversight that exists in the US and elsewhere while requiring significant time and expense. » In our conversations and in their responsive filing with the SEC, the proponents reveal the true intent behind this proposal – and it is not an independent assessment. It is promotion of “neutrality” agreements like those highlighted with International Union of Food, Agricultural, Hotel, Restaurant, Catering, Tobacco, and Allied Workers Associations (IUF) and Communication Workers of America (CWA). It is our employees’ right to join, form, or not to join a labor organization of their own selectio n, without fear of reprisal, intimidation, or harassment. This right to choose or not choose union representation belongs exclusively to employees, not unions or employers. On the contrary, neutrality agreements are contracts between a union and employer — employees are not party to these agreements and they have not bargained for or agreed to them. 32 Proponent: Catherine Donnelly Foundation, represented by the Shareholder Association for Research & Education

Item 17 — Shareholder Proposal Requesting a New Policy Regarding Our Executive Compensation Process Why We Recommend You Vote Against This Proposal » Our compensation programs are designed to be highly transparent and aligned with shareholder interests with a view towards maximizing long - term shareholder value. Our goal of providing competitive compensation arrangements to attract and retain the best talent applies throughout the Company, as evidenced by our competitive pay and benefits for employees. Contrary to the proposal’s implication that our compensation practices differ between senior executives and other employees, our compensation program is generally consistent across the Company and provides for similar pay arrangements with employees at most levels. In 2022, Amazon’s CEO Andy Jassy received $1,298,723 in compensation. » Our Leadership Development and Compensation Committee already takes a thoughtful and diligent approach when evaluating executive compensation, considering a wide array of factors such as shareholder engagement and feedback, the annual advisory vote on executive compensation, and analyses by proxy advisory firms. In addition, this executive compensation evaluation is already informed by the Committee’s other oversight responsibilities, which include compensation for all employees. Under its charter, the Committee monitors and assesses our programs and practices for attracting, developing, training, and retaining talented employees at all levels, from front - line employees through senior executives and the CEO, as well as employee compensation and benefits. Also, the Committee reviews the CEO pay ratio data that we report annually in our proxy statements. In 2022 the pay ratio of our CEO to median compensated employee was 38:1 » We value shareholder feedback to inform our executive compensation practices, and we continue to believe that shareholders support our executive compensation as evidenced by direct engagement with shareholders 33 Proponent: AFL - CIO Reserve Fund

Item 18 — Shareholder Proposal Requesting Additional Reporting on Animal Welfare Standards Why We Recommend You Vote Against This Proposal » We take a zero - tolerance approach to animal cruelty, abuse, and neglect » Whole Foods Market has a long history of setting industry - leading standards when it comes to responsible sourcing and animal welfare and continues to raise the bar and push the industry forward » Whole Foods Market was ranked first and received an A+ grade in the Humane Society’s Food Industry Scorecard and has received continued recognition for responsible sourcing and animal welfare from other trusted and reputable non - governmental organizations, including Mercy for Animals and Compassion in World Farming » Whole Foods Market takes seriously any allegations of animal cruelty or mistreatment and, if needed, takes appropriate, corrective action after an investigation into any such claims » The claims made by the proponent’s representative against Sweet Stem Farms (which is not currently a Whole Foods Market supplier), Nellie’s Free Range Eggs, Diestel Turkey Ranch, and Petaluma Egg Farms that are cited in the proposal could not be verified after thorough investigations 34 Proponent: MacConnel Lowe Trust, represented by People for the Ethical Treatment of Animals

Item 19 — Shareholder Proposal Requesting an Additional Board Committee Why We Recommend You Vote Against This Proposal » Our current Board and committee structure, which allocates oversight responsibilities among the full Board and each of its committees, already provides an appropriate level of oversight of the types of environmental, social, regulatory, and human capital matters raised in the proposal. For example, the Nominating and Corporate Governance Committee is responsible for overseeing and monitoring Amazon’s policies and initiatives relating to our environmental, sustainability, and corporate social responsibility practices, including risks related to human rights, ethical business practices, our operations and supply chain, and engagement with customers, suppliers, and communities » This oversight structure has supported and helped drive Amazon’s commitment to corporate social responsibility and many of the other matters raised in the proposal, as reflected by our current policies, practices, and initiatives, including for example our commitments regarding the environment, sustainability, diversity, equity and inclusion, and worker safety » Because our current structure already provides appropriate Board and committee oversight of, and has supported and helped drive, Amazon’s commitments to such environmental, social, regulatory, and human capital matters, we believe that adding a separate Board committee overseeing such matters would be redundant and counterproductive 35 Proponent: Jing Zhao

Item 20 — Shareholder Proposal Requesting an Alternative Director Candidate Policy Why We Recommend You Vote Against This Proposal » The Board recognizes that our employees are the foundation of our success and is intently focused on supporting their well - being and success » We have many processes in place to provide for effective and broad - based participation by our diverse employee base in our decision - making and governance through well - calibrated programs, practices, and forums that facilitate communication, participation, and action » Our current process to identify and nominate directors has successfully recruited diverse and qualified directors with extensive human capital management experience 36 Proponent: Oxfam America, Inc.

Item 21 — Shareholder Proposal Requesting a Report on Warehouse Working Conditions Why We Recommend You Vote Against This Proposal » From the beginning of 2019 to the end of 2022, even with the addition of nearly 900,000 new employees, we saw our worldwide r eco rdable incident rate improve by almost 24% (to 5.1) and our lost time incident rate improve by 53% (to 1.9). From 2021 to 2022, we i mpr oved our worldwide recordable incident rate by 11% and our lost time incident rate by 14%. These are substantial improvements and a so lid foundation from which to build, and we are committed to continuing this trend. » We are transparent about our commitment and efforts to improve workplace safety, discussing our initiatives in detail in our “De livered with Care” report and on our website. From 2019 to 2022, we invested approximately $1 billion in safety initiatives unrelated to C OVI D - 19 and, in 2023, we are investing another approximately $550 million in safety initiatives. » Our Board, including through the Leadership Development and Compensation Committee, which is composed solely of independent d ire ctors, has direct oversight of employee well - being and workplace safety and regularly reviews these matters » As reinforced in our 2022 safety, health, and well - being report, “Delivered with Care,” safety is integral to everything we do — e very day, in every country, and across our business — and we continually enhance and improve our safety processes, programs, and technology. Our tran sparency and candor contrasts with reports by third - parties which mischaracterize Occupational Safety and Health Administration’s (OSHA) “Days Away, Restricted, or Transferred” (DART) data by referring to it as a “serious injury rate” in order to support an exaggerated and mis leading narrative about our operations » Amazon is fully cooperating with OSHA investigations regarding worker safety, which are significantly more in depth than what a third - party assessment would entail – and from the beginning, we have been open and transparent about our operations and programs and welcom e the opportunity for OSHA’s feedback. Amazon’s efforts to cooperate and provide the government documents and information involves sig nificant time and expense, and we believe that we should remain focused on responding to the government’s investigation and continuing to advance our own programs – not divert resources and expense on a third - party assessment that duplicates what Amazon’s workplace health a nd safety team and government regulators are already doing 37 Proponent: Thomas Dadashi Tazehozi, represented by Tulipshare Limited

Item 22 — Shareholder Proposal Requesting a Report on Packaging Materials Why We Recommend You Vote Against This Proposal » We are committed to protecting the planet and recognize the importance of reducing plastic waste, which is why we publicly re por t on the amount of single - use plastic being used across our global operations network to ship orders to customers » In 2021, we reduced average plastic packaging weight per shipment by over 7%, resulting in 97,222 metric tons of single - use plas tic being used across our global operations network to ship orders to customers. While the proposal cites a recent report estimating our use of plastic packaging, for the third year in a row, the report’s calculations are seriously flawed, overestimating our use of plastic by mor e than 300% and relying on outdated assumptions regarding the sources of plastic waste entering our oceans » In contrast to consumer - packaged goods companies, Amazon’s greatest impact comes from helping other manufacturers reduce their u se of plastic in packaging and reducing our own use of plastic for products repackaged for delivery. In this regard, we have taken act ion to reduce reliance on the use of plastics in a number of areas, including products manufactured by other companies, packaging for shipm ent and delivery, our Amazon and other private label devices, and our physical stores. In 2021, more than 8% of shipments had no Amazon packagi ng » Over the last several years, we’ve innovated and invested in technologies, processes, and materials that have helped reduce t he weight of the packaging per shipment by 38% and eliminated the use of more than 1.5 million tons of packaging materials since 2015, despite th e number of shipments having substantially increased as our business has grown » Where plastic packaging is still currently in use, we are using less material and more recycled content. For example, increas ing the recycled content of our plastic film bags for outbound packaging in the United States from 25% to 50% contributed to Amazon avoiding o ver 30,000 tons of plastic use in 2021. We also replaced nearly 70% of our mixed (paper/plastic) mailers with a recyclable paper padded maile r i n 2021 and plan to completely phase out the mixed mailer. All paper bags, cardboard envelopes and cardboard boxes used by Amazon in Europe ar e 1 00% recyclable. We have also replaced plastic air pillows used to secure items inside the box with 100% recycled and recyclable p ack ing paper » We are engaged in efforts to support the development of recycling infrastructure across our industry and innovation in materi als to address plastic waste 38 Proponent: The George Gund Foundation, represented by As You Sow

Item 23 — Shareholder Proposal Requesting a Report on Customer Use of Certain Technologies Why We Recommend You Vote Against This Proposal » Amazon is committed to the responsible use of our artificial intelligence and machine learning (AI/ML) products and services. We have been consistent and proactive in our efforts to address concerns and mitigate the risk of misuse through policy and advocacy efforts, customer contractual requirements and training, consultation with third party experts, and other policies and practices » For example, Credo AI, a company that specializes in responsible AI, performed a third - party evaluation, which supports that Rekognition performs well across demographic attributes. In 2020, we implemented a global moratorium on police use of Amazon Rekognition’s facial comparison feature for criminal investigations » Over the six years that AWS has been offering Amazon Rekognition, we have been updating our technology and enhancing safeguards and have avoided or mitigated the risks and concerns expressed in this proposal. For example, AWS has not received a single verified report of Amazon Rekognition being used in the harmful manner posited in the proposal » We believe strongly in harnessing the capabilities of advanced technology such as the cloud and machine learning to promote ongoing safety and security of our fellow citizens, our communities, and the world. While we understand the concerns over potential misuse, we believe these are effectively addressed through the policies and procedures we have adopted and that we continue to advance with input from internal and third - party partners and stakeholders 39 Proponent: John Harrington

This document includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental, social, and other sustainability plans, initiatives, projections, goals, commitments, expectations, or prospects, are forward - looking. We use words such as anticipates, believes, commits, expects, future, goal, intends, plans, projects, seeks, and similar expressions to identify forward - looking statements. Forward - looking statements reflect management’s current expectations and are inherently uncertain. Actual results or outcomes could differ materially due to a variety of factors. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2022 Annual Report on Form 10 - K and our 2021 Amazon Sustainability Report. Any standards of measurement and performance made in reference to our environmental, social, and other sustainability plans and goals are developing and based on assumptions, and no assurance can be given that any such plan, initiative, projection, goal, commitment, expectation, or prospect can or will be achieved. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document. 40 Other Information