UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07923

City National Rochdale Funds

(Exact name of registrant as specified in charter)

400 North Roxbury Drive

Beverly Hills, CA 90210

(Address of principal executive offices) (Zip code)

Rochelle Levy

400 North Roxbury Drive

Beverly Hills, CA 90210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-889-0799

Date of fiscal year end: September 30, 2022

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act or 1940, as amended (the “Act”) (17 CFR § 270.30e-1) is attached hereto.

TABLE OF CONTENTS

| | City National Rochdale Funds Annual Report |

| | |

2 | Letter to Our Shareholders |

4 | Fixed Income Funds Investment Adviser’s Report |

6 | Fixed Income Funds Overview |

12 | Equity Funds Investment Adviser’s Report |

13 | Equity Funds Overview |

15 | Schedule of Investments/Consolidated Schedule of Investments |

141 | Statements of Assets and Liabilities/Consolidated Statement of Assets and Liabilities |

144 | Statements of Operations/Consolidated Statement of Operations |

148 | Statements of Changes in Net Assets/Consolidated Statements of Changes in Net Assets |

152 | Consolidated Statement of Cash Flows |

154 | Financial Highlights/Consolidated Financial Highlights |

157 | Notes to Financial Statements/Consolidated Notes to Financial Statements |

172 | Report of Independent Registered Public Accounting Firm |

174 | Trustees and Officers |

177 | Notice to Shareholders |

178 | Disclosure of Fund Expenses |

180 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT, and for reporting periods ended prior to March 31, 2019, on Form N-Q. The Funds’ Form N-PORT and Form N-Q filings are available on the Commission’s website at http://www.sec.gov. The most current Form N-PORT filing is also available on the Funds’ website at www.citynationalrochdalefunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.citynationalrochdalefunds.com, and (3) on the Commission’s website at www.sec.gov.

CITY NATIONAL ROCHDALE FUNDS | PAGE 1

letter to our shareholders (Unaudited) |

September 30, 2022 |

Dear Shareholders,

This annual report covers the one-year period ended September 30, 2022.

Investors have had little place to hide in 2022, as both equity and fixed income markets simultaneously recorded three consecutive negative quarters for the first time in over four decades. Unfortunately, volatility looks set to continue in the near term, with the persistence and breadth of inflation providing an unwelcome reminder to markets that interest rates may stay higher for longer than anticipated. Until a pattern of lower inflation readings is established, equities are likely going to have a hard time mounting a sustainable rebound, and bonds could remain under pressure.

The Federal Reserve (the “Fed”) and the U.S. government took extraordinary monetary and fiscal actions at the start of the COVID-19 outbreak that materially lessened the pandemic’s harmful effects on individuals and businesses. There was strong justification for these initial actions. However, as the pandemic progressed and it became increasingly likely that the economic threat was abating, more fiscal responsibility by the government would have been justified. The Fed also could have preempted the stimulative effects of excessive policy easing that were clearly driving prices higher across major sectors of the economy, including the stock market, housing market, commodities markets, labor market, and cryptocurrency markets.

The economy is now experiencing the inflationary effects of too much money stimulating prices combined with another consequence of the COVID-19 pandemic, a severe labor shortage that has caused wages to increase at rates not experienced in decades. This will require the Fed to raise interest rates until labor demand decreases to a point in which wage gains are at a level compatible with the Fed’s 2% inflation target.

The negative impact of the Fed’s belated response to inflation has been felt across financial markets in 2022. Two years of stock market appreciation have been erased, and bond values have experienced some of the most significant declines in our lifetime. What lies ahead? For some time now, CNR has maintained above-consensus views on recession probability, the upward path of interest rates, and geopolitical risks. It is now clear that central banks around the world will raise interest rates even further than our above-consensus forecasts had implied, making the current tightening cycle the most aggressive in three decades. Given this, we now see the global economy entering a recession next year and the probability of a recession in the United States rising to 60%.

The prospect for continued tight monetary policy leads us to be more concerned than consensus views regarding economic and corporate profit growth. Until consensus expectations better align with potential risks, we believe further declines in the financial markets are possible. Over the last two quarters, CNR has taken proactive actions across our investment strategies to attempt to mitigate our concerns. Such actions include reducing exposure to economically sensitive U.S. equities, eliminating exposure to European and Asian equities, and increasing allocations to investment grade and high yield municipal bonds. In the near term, we expect markets to remain volatile as investors gain greater clarity on the path of interest rate hikes and inflation, and weigh the implications for the economy and corporate profits. Nonetheless, our focus on holding high quality U.S. stocks and bonds through this period continues to give us confidence over the long term.

With that said, markets have rebounded strongly to start the fourth quarter but remain volatile as investors continue to grapple with a host of uncertainties, including midterm elections results, declining earnings expectations, signs of slowing inflation, and signals that the Fed will keep interest rates higher for longer. It is important to remember that rallies and swings in sentiment are a common feature of bear markets. Although October’s better-than-expected Consumer Price Index report is encouraging, a pattern of lower inflation readings likely still needs to be established for equities to mount a sustainable rebound.

CITY NATIONAL ROCHDALE FUNDS | PAGE 2

As always, we thank you for your trust and confidence in our abilities to continue to serve you well through your investment in the City National Rochdale Funds.

Sincerely,

Garrett R. D’Alessandro, CFA, CPWA®, CAIA, AIF®

President and Chief Executive Officer

City National Rochdale Funds

Past performance is no guarantee of future results. Certain shareholders may be subject to the Alternative Minimum Tax (AMT). Federal income tax rules apply to any capital gain distributions.

This information must be preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing.

City National Rochdale Funds do not generally accept investments by non-U.S. persons and may not be available in all states.

Bloomberg U.S. 1-5 Year Government Bond Index is an index of all investment grade bonds with maturities of more than one year and less than five years. The index is a market value weighted performance benchmark.

Bloomberg 1-5 Year U.S. Corporate A3 or Higher, 2% Issuer Constrained Index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between one and five years.

S&P Municipal Yield Index is an unmanaged index which measures the performance of high-yield and investment-grade municipal bonds with weights determined by credit rating.

The S&P 500 Index is a market capitalization value weighted composite index of 500 large capitalization U.S. companies and reflects the reinvestment of dividends.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market.

Bloomberg Intermediate U.S. Government/Credit Index consists of publicly issued, U.S. dollar-denominated U.S. Government, agency, or investment grade corporate fixed income securities with maturities from one to ten years. The comparative market index is not directly investable and is not adjusted to reflect expenses that the Commission requires to be reflected in the fund’s performance.

Bloomberg Intermediate-Short California Municipal Bond Index measures the performance of California municipal bonds.

Intercontinental Exchange Bank of America Merrill Lynch 0-1 Year Emerging Markets Corporate Plus Index tracks the performance of emerging markets non-sovereign debt publicly issued.

Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers.

CITY NATIONAL ROCHDALE FUNDS | PAGE 3

investment adviser’s report (Unaudited) |

September 30, 2022 |

Government Bond Fund – CNBIX

The Servicing Class shares of the Fund, for the fiscal year ended September 30, 2022, underperformed the Bloomberg U.S. 1-5 Year Government Bond Index (-7.23% for the Fund versus -7.03% for the benchmark). Calendar year to date, as of September 30, 2022, the Fund returned -6.44% versus the benchmark return of -6.33%. The Fund posted a return of -2.36% in Q3 2022, which underperformed the benchmarks -2.24% return. As of September 30, 2022, the Fund’s duration positioning was slightly short versus the benchmark. Government agency positions continue to augment portfolio yield. Additionally, tactical positioning along steeper positions in the yield curve may meaningfully contribute to total return through the end of the year.

CORPORATE BOND FUND – CNCIX

The Servicing Class shares of the Fund, for the fiscal year ended September 30, 2022, underperformed the Bloomberg 1-5 Year U.S. Corporate A3 or Higher, 2% Issuer Constrained Index (-7.90% for the Fund versus -7.71% for the benchmark). Calendar year to date, as of September 30, 2022, the Fund returned -7.21% versus the benchmark return of -7.09%. The Fund posted a return of -2.00% in Q3 2022, which outperformed the benchmark’s -2.13% return. Attributing to the Fund’s performance, as of September 30, 2022, the portfolio’s credit quality was stable with corporate allocations outperforming benchmark allocations via strong security selection. The portfolio was positioned slightly short to neutral to the benchmark duration. Looking forward, management will look to tactically adjust duration around U.S. Treasury rate and credit spread volatility.

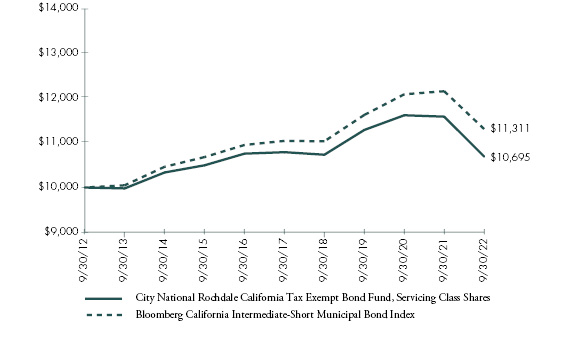

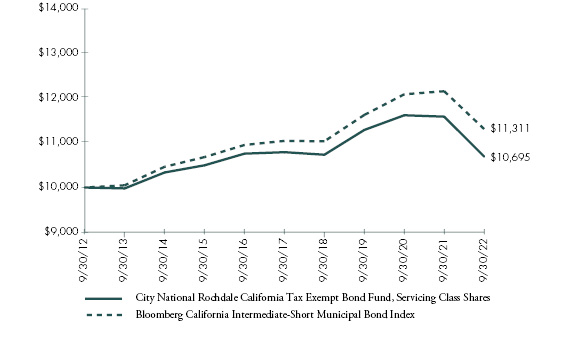

CALIFORNIA TAX EXEMPT BOND FUND – CNTIX

The Servicing Class shares of the Fund, for the fiscal year ended September 30, 2022, underperformed the Bloomberg Intermediate-Short California Municipal Bond Index (-7.71% for the Fund versus -6.96% for the benchmark). Calendar year to date, as of September 30, 2022, the Fund returned -7.81% versus the benchmark return of -7.10%. The Fund posted a return of -1.92% in Q3 2022, which outperformed the benchmark’s -2.18% return. Attributing to the Fund’s performance, as of September 30, 2022, the Fund has been decreasing duration and adding floating rate exposure, which benefitted the portfolio as short-term rates continue to adjust higher. Looking forward, credit quality remains strong and the Fund is looking for opportunities to enhance yield while remaining slightly short duration versus the benchmark.

MUNICIPAL HIGH INCOME BOND FUND – CNRMX

The Servicing Class shares of the Fund posted a return of -4.79% for Q3 2022, which underperformed the S&P Municipal Yield Index’s return of -4.61%. Calendar year to date, as of September 30, 2022, the Fund returned -17.09% versus the benchmark return of -16.17%. For the fiscal year ended September 30, 2022, the Fund returned -16.24%, which underperformed its benchmark return of -15.11%. The Fund’s performance reflected a duration slightly longer than its benchmark, and a relative overweight to the benchmark in tobacco MSA-backed bonds. The Fund will maintain a duration at or near the benchmark’s duration. The Fund will continue to take advantage of higher absolute interest rates to boost tax-exempt interest income. Although default rates have risen in certain sectors, such as senior living, municipal credit remains attractive overall. Security and sector selection remain a key focus in order to reduce credit risk in the portfolio. The Fund continues to look for securities and sectors that have become good values due to the selling pressure caused by retail investor redemptions in the tax-exempt municipal asset class.

INTERMEDIATE FIXED INCOME FUND – RIMCX

The Institutional Class shares of the Fund posted a return of -3.21% for Q3 2022, which underperformed the Bloomberg Intermediate U.S. Government Credit Index return of -3.06%. Calendar year to date, as of September 30, 2022, the Fund returned -10.25% versus the benchmark return of -9.62%. For the fiscal year ended September 30, 2022, the Fund returned -10.45%, which underperformed the benchmark’s return of -10.14%. The Fund has transitioned from being materially overweight corporate credit and underweight U.S. Treasury securities, with a barbell duration posture, to one that is neutral to the benchmark across most factors. Looking ahead, the Fund will continue to maintain a neutral

CITY NATIONAL ROCHDALE FUNDS | PAGE 4

corporate credit and government securities positioning relative to the benchmark, and will look to tactically trade around interest rate and/or credit spread volatility.

FIXED INCOME OPPORTUNITIES FUND – RIMOX

The Fund posted a return of -1.48% for Q3 2022, which outperformed the Bloomberg Global Credit Corporate Total Return Index return of -3.78%. Calendar year to date, as of September 30, 2022, the Fund returned -14.35% versus the Bloomberg Barclays Global Credit Corporate Total Return Index return of -16.42%. For the fiscal year ended September 30, 2022, the Fund returned -15.23%, which outperformed the Bloomberg Barclays Global Credit Corporate Total Return Index return of -16.39%. Nearly all segments of fixed income have been challenged this year, with the Bloomberg U.S. High Yield Index returning -14.74% and the Bloomberg U.S. Aggregate Bond Index returning -14.61% year to date through Q3 2022. In terms of portfolio contribution in Q3, the Fund’s collateralized loan obligation (“CLO”) debt sleeve was the largest underperformer and now has a -12.6% return for the year. This was due to a bounce back from negative returns and widening credit spreads, with some market participants looking for greater than expected liquidity. Fears of increased defaults have also contributed to some of the Fund’s negative returns. Despite this, we feel confident in CLO debt and see this as a mark-to-market situation. Emerging market high yield debt continues to be the biggest challenge for the Fund on an absolute return level, with strategy returns ranging from -15% (with the T. Rowe Price sleeve) to -27% (with the Ashmore sleeve) year to date. Both European and U.S. bank loans have been the best absolute performers for the Fund, and our portfolio managers have been on the right side of the benchmark in terms of performance. Our U.S. high yield debt exposure has performed in line with the market. In terms of outlook, continued uncertainty in the emerging markets and less liquid securities space could lead to outsized returns over the long-term.

This material represents the investment adviser’s assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

Performance data quoted represents past performance and does not guarantee similar future results. The investment performance and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-888-889-0799.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Mutual fund investing involves risk, including loss of principal. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments.

The California Tax Exempt Bond Fund invests primarily in California securities and may be more volatile and susceptible to a single adverse economic or regulatory occurrence affecting those obligations than a fund investing in obligations of a number of states.

The credit quality breakdown depicts the credit quality ratings of the Fund’s portfolio securities that are rated by one or both of two major nationally recognized statistical rating organizations (“NRSROs”). The two NRSROs currently utilized for this purpose are Standard & Poor’s (S&P) and Moody’s. When a bond is rated by S&P that rating is utilized. If it is not rated by S&P, the Moody’s rating is utilized. When a security is rated by neither, it is classified as “Not Rated.” For bonds, these credit quality ratings are shown without regard to gradations within a given rating category. For example, securities rated “AA-” or “AA+” have been included in the “AA” rated category. Long term ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Duration is a measure of a bond’s sensitivity to interest rate changes. The higher the bond’s duration, the greater its sensitivity to the change.

CITY NATIONAL ROCHDALE FUNDS | PAGE 5

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Government Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing primarily in U.S. Government securities.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Government Bond Fund, Servicing Class Shares, versus the Bloomberg U.S. 1-5 Year Government Bond Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-year

Return | 3-Year

Return | 5-year

Return | 10-year

Return |

Servicing Class*^ | CNBIX | -7.23% | -1.47% | -0.25% | -0.03% |

Class N* | CGBAX | -7.45% | -1.72% | -0.47% | -0.28% |

Bloomberg U.S. 1-5 Year Government Bond Index | n/a | -7.03% | -1.04% | 0.36% | 0.59% |

* | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank and certain retirement plan platforms. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

U.S. Treasury Notes, 1.875%, 8/31/2024 | | | 12.4 | % |

U.S. Treasury Notes, 2.625%, 5/31/2027 | | | 7.6 | % |

FNMA, 2.500%, 2/5/2024 | | | 6.5 | % |

FNMA, 2.625%, 9/6/2024 | | | 6.3 | % |

FNMA, 1.625%, 1/7/2025 | | | 5.6 | % |

FFCB, 0.200%, 10/2/2023 | | | 5.6 | % |

U.S. Treasury Notes, 2.750%, 8/31/2023 | | | 4.8 | % |

Tennessee Valley Authority, 2.875%, 9/15/2024 | | | 4.5 | % |

U.S. Treasury Notes, 2.625%, 12/31/2025 | | | 4.4 | % |

U.S. Treasury Notes, 0.625%, 10/15/2024 | | | 4.3 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 6

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Corporate Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing in a diversified portfolio of fixed income securities.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Corporate Bond Fund, Servicing Class Shares, versus the Bloomberg 1-5 Year U.S. Corporate A3 or Higher, 2% Issuer Constrained Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-year

Return | 3-Year

Return | 5-year

Return | 10-year

Return |

Servicing Class*^ | CNCIX | -7.90% | -1.17% | 0.35% | 0.83% |

Class N* | CCBAX | -8.21% | -1.42% | 0.08% | 0.57% |

Bloomberg 1-5 Year U.S. Corporate A3 or Higher, 2% Issuer Constrained Index | n/a | -7.71% | -0.69% | 0.82% | 1.31% |

* | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank and certain retirement plan platforms. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

Apple, 3.450%, 5/6/2024 | | | 3.2 | % |

Toyota Motor Credit, 2.250%, 10/18/2023 | | | 2.8 | % |

City National Rochdale Fixed Income Opportunities Fund | | | 2.8 | % |

U.S. Treasury Bill, 3.860%, 9/7/2023 | | | 2.7 | % |

UnitedHealth Group, 3.850%, 6/15/2028 | | | 2.7 | % |

JPMorgan Chase, 3.300%, 4/1/2026 | | | 2.7 | % |

Morgan Stanley, 3.130%, 7/27/2026 | | | 2.6 | % |

Citigroup, 1.460%, 6/9/2027 | | | 2.4 | % |

Applied Materials, 3.900%, 10/1/2025 | | | 2.4 | % |

General Motors Financial, 5.250%, 3/1/2026 | | | 2.4 | % |

* | Excludes Cash Equivalents |

Bond Credit Quality |

CREDIT RATINGS(1) | | % OF NET

ASSETS | |

U.S. Government Obligations | | | 6.7 | % |

AA | | | 7.6 | % |

A | | | 32.7 | % |

BBB | | | 48.7 | % |

Registered Investment Company | | | 2.8 | % |

Short-Term Investments and | | | | |

Other Net Assets | | | 0.7 | % |

(1) | Credit quality is based on ratings from Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”). Where S&P ratings are not available, credit quality is based on ratings from Moody’s Investor Services, Inc. (“Moody’s”). S&P and Moody’s ratings have been selected for several reasons, including the access to information and materials provided by S&P and Moody’s, as well as the Fund’s consideration of industry practice. The Not Rated category, if applicable, consists of securities that have not been rated by S&P or Moody’s. |

CITY NATIONAL ROCHDALE FUNDS | PAGE 7

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale California Tax Exempt Bond Fund |

The Fund seeks to provide current income exempt from federal and California state income tax (as the primary component of a total return strategy) by investing primarily in California municipal bonds.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale California Tax Exempt Bond Fund, Servicing Class Shares, versus the Bloomberg California Intermediate-Short Municipal Bond Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-year

Return | 3-Year

Return | 5-year

Return | 10-year

Return |

Servicing Class*^ | CNTIX | -7.71% | -1.79% | -0.18% | 0.67% |

Class N* | CCTEX | -8.00% | -2.03% | -0.43% | 0.42% |

Bloomberg California Intermediate- Short Municipal Index | n/a | -6.96% | -0.91% | 0.48% | 1.24% |

* | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank and certain retirement plan platforms. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

Barclays, 2.950%, 10/3/2022 | | | 6.3 | % |

California State, Public Works Board, 5.000%, 9/1/2025 | | | 3.3 | % |

California State, Infrastructure & Economic Development Bank, 5.000%, 7/1/2023 | | | 2.4 | % |

Santa Clara County, Financing Authority, 5.000%, 5/1/2029 | | | 2.4 | % |

California State, 5.000%, 10/1/2030 | | | 2.4 | % |

Westlands, Water District, 5.000%, 9/1/2027 | | | 2.3 | % |

San Francisco City & County, Public Utilities Commission, Water Revenue, 5.000%, 10/1/2027 | | | 2.3 | % |

San Mateo County, Joint Powers Financing Authority, 5.000%, 6/15/2026 | | | 2.3 | % |

Long Beach, Unified School District, 5.000%, 8/1/2026 | | | 2.2 | % |

California State, 5.000%, 8/1/2026 | | | 2.2 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 8

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Municipal High Income Fund |

The Fund seeks to provide a high level of current income that is not subject to federal income tax.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Municipal High Income Fund, Servicing Class Shares, versus the Bloomberg 60%LB Tax-Exempt HY/40%LB Municipal IG TR Unhedged USD Index(1) and the S&P Municipal Yield Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Effective January 31, 2016, the Adviser discontinued the voluntary fee waivers for the Fund. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-Year

Return | 3-Year

Return | 5-Year

Return | Inception

to Date |

Servicing Class(1)^ | CNRMX | -16.24% | -3.19% | -0.08% | 2.56% |

Class N(1)* | CNRNX | -16.47% | -3.47% | -0.33% | 2.30% |

Bloomberg 60%LB Tax-Exempt HY/40%LB Municipal IG TR Unhedged USD Index | n/a | -13.64% | -1.56% | 1.64% | 3.48% |

S&P Municipal Yield Index | n/a | -15.11% | -1.60% | 1.97% | 4.10% |

* | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

(1) | Commenced operations on December 30, 2013. |

^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank and certain retirement plan platforms. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

Puerto Rico, Sales Tax Financing, Sales Tax Revenue, 4.784%, 7/1/2058 | | | 1.3 | % |

Puerto Rico, Sales Tax Financing, Sales Tax Revenue, 4.500%, 7/1/2034 | | | 1.3 | % |

Buckeye Tobacco Settlement, Financing Authority, 5.000%, 6/1/2055 | | | 1.2 | % |

California State, Community Choice Financing Authority, 4.000%, 2/1/2052 | | | 0.8 | % |

Puerto Rico, Electric Power Authority, 5.250%, 7/1/2040 | | | 0.8 | % |

Ohio State, Air Quality Development Authority, 5.000%, 7/1/2049 | | | 0.7 | % |

Barclays, 2.950%, 10/3/2022 | | | 0.7 | % |

Jefferson County, Sewer Revenue, 6.000%, 10/1/2042 | | | 0.7 | % |

Chicago, 6.000%, 1/1/2038 | | | 0.7 | % |

Metropolitan Washington, Transportation Authority, 4.750%, 11/15/2045 | | | 0.6 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 9

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Intermediate Fixed Income Fund |

The Fund seeks current income and, to the extent consistent with this goal, capital appreciation.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Intermediate Fixed Income Fund, Class N Shares, versus the Bloomberg Intermediate U.S. Government/Credit Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Effective January 31, 2016, the Adviser discontinued the voluntary fee waivers for the Fund. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-Year

Return | 3-Year

Return | 5-Year

Return | 10-Year

Return |

Institutional Class(2)^ | RIMCX | -10.45% | -1.50% | 0.43% | 1.31% |

Class N*(1) | CNRIX | -10.88% | -1.98% | -0.06% | 0.87% |

Bloomberg Intermediate U.S. Government/Credit Index | n/a | -10.14% | -1.64% | 0.38% | 1.00% |

* | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

(1) | The predecessor to the City National Rochdale Intermediate Fixed Income Fund (the “Predecessor Fund”) commenced operations on December 31, 1999. On March 29, 2013, the Predecessor Fund was reorganized into the Fund. The performance results for the Class N Shares of the Fund for the period October 1, 2011, to March 29, 2013, reflect the performance of the Predecessor Fund’s Shares. |

(2) | Commenced operations on December 20, 2013. The performance results for Institutional Class Shares of the Fund for the period of October 1, 2012, to March 29, 2013, reflect the performance of the Predecessor Fund’s shares. The performance results for the Institutional Class Shares of the Fund for the period March 29, 2013, to December 19, 2013, reflect the performance of the Class N Shares. |

^ | The Fund’s Institutional Class shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the minimum initial investment requirement of $1,000,000 and certain tax deferred retirement plans (including 401(k) plans, employer sponsored 403(b) plans, 457 plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) held in plan level or omnibus accounts. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

U.S. Treasury Notes, 0.125%, 12/15/2023 | | | 8.4 | % |

U.S. Treasury Notes, 2.625%, 1/31/2026 | | | 7.8 | % |

U.S. Treasury Notes, 0.125%, 1/15/2024 | | | 7.2 | % |

U.S. Treasury Notes, 1.875%, 7/31/2026 | | | 6.3 | % |

U.S. Treasury Notes, 1.625%, 8/15/2029 | | | 5.0 | % |

U.S. Treasury Notes, 0.875%, 11/15/2030 | | | 4.8 | % |

City National Rochdale Fixed Income Opportunities Fund | | | 3.6 | % |

General Motors Financial, 4.350%, 1/17/2027 | | | 3.5 | % |

Credit Suisse Group Funding Guernsey, 4.550%, 46129 | | | 3.5 | % |

John Deere Capital, 2.800%, 9/8/2027 | | | 3.5 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 10

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Fixed Income Opportunities Fund |

The Fund seeks a high level of current income.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Fixed Income Opportunities Fund, Class N Shares, versus the the Bloomberg U.S. Aggregate Bond Index and the Bloomberg Global Credit Corporate Total Return Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-Year

Return | 3-Year

Return | 5-Year

Return | 10-Year

Return |

Class N(1) | RIMOX | -15.23% | -2.57% | -0.59% | 2.34% |

Bloomberg U.S. Aggregate Bond Index | n/a | -14.60% | -3.26% | -0.27% | 0.89% |

Bloomberg Global Credit Corporate Total Return Index | n/a | -16.39% | -3.00% | 0.35% | 2.37% |

40/35/25 hybrid of the following three indices: | n/a | -13.23% | -2.28% | 0.04% | 2.20% |

Bloomberg Multiverse Total Return Index Value Hedged USD | n/a | -12.21% | -3.01% | 0.34% | 1.79% |

S&P Global Leveraged Loan Index | n/a | -2.62% | 2.12% | 3.00% | 3.70% |

Bloomberg Emerging Markets High Yield Index | n/a | -22.72% | -6.10% | -3.13% | 1.64% |

(1) | The predecessor to the City National Rochdale Fixed Income Opportunities Fund (the “Predecessor Fund”) commenced operations on July 1, 2009. On March 29, 2013, the Predecessor Fund was reorganized into the Fund. The performance results for the Class N Shares of the Fund for the period October 1, 2012, to March 29, 2013, reflect the performance of the Predecessor Fund’s Shares. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

Golub Capital BDC 3 | | | 2.2 | % |

ShaMaran Petroleum, 12.000%, 7/30/2025 | | | 0.6 | % |

Teva Pharmaceutical Finance Netherlands III BV, 6.750%, 3/1/2028 | | | 0.6 | % |

Latina Offshore, 8.875%, 10/15/2022 | | | 0.5 | % |

Cartesian LP | | | 0.4 | % |

Primary Wave Music IP Fund LP | | | 0.4 | % |

Golub Capital BDC 4 | | | 0.4 | % |

SCC Power, 8.000%, 12/31/2028 | | | 0.4 | % |

Andrade Gutierrez International, 9.500%, 12/30/2024 | | | 0.4 | % |

YPF, 9.000%, 2/12/2026 | | | 0.4 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 11

investment adviser’s report (Unaudited) |

September 30, 2022 |

Equity Funds |

EQUITY INCOME FUND – RIMHX

The Fund (N-share class) posted a return of -7.96% in Q3 2022, which underperformed the Dow Jones U.S. Select Dividend Index’s return of -7.70%. Year to date, the Fund’s return is -12.26% versus -10.07% for its benchmark. For the fiscal year ended September 30, 2022, the Fund returned -4.41%, which underperformed its benchmark return of -3.10%. The Fund’s 2023 outlook has grown more cautious amidst “higher for longer” inflation and correspondingly higher near-term interest rate hikes by the Fed, raising the risk that the expected economic slowdown turns into a recession. Q3 saw interest rates break out to higher levels, not seen in recent years which created near-term challenges for dividend stocks. Given the market volatility and higher odds of a recession, we have further dialed down risk in the Fund’s portfolio. We decreased the Fund’s exposure to REITs and the consumer discretionary sector during the quarter, and added exposure to the utilities sector. We maintain a bias for dividend growth over yield. The Fund was ranked in the first quintile of its Lipper category for the year to date and trailing one-year periods. Over time, we expect improvement in the Fund’s longer-term performance periods.

U.S. CORE EQUITY FUND – CNRVX

The Servicing Class shares of the Fund posted a return of -4.94% for Q3 2022, which underperformed the S&P 500 Index return of -4.88%. Calendar year to date, as of September 30, 2022, the Fund returned -26.72%, which underperformed its benchmark return of -23.87%. For the fiscal year ended September 30, 2022, the Fund returned -18.42%, which underperformed its benchmark return of -15.47%. Our thesis remains “Risks Are Rising.” We have decreased our economic forecast for S&P EPS in 2023 due to rising inflation, higher interest rates, wage pressures, a decline in consumer confidence, and persistent supply chain bottlenecks. While global activity is slowing with increased recession risk, the United States is best positioned. The Fund received a 5 rating overall from Lipper for tax efficiency, a 4 rating for capital preservation, and a 2 rating for total return and expenses.

This material represents the investment adviser’s assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

Performance data quoted represents past performance and does not guarantee similar future results. The investment performance and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-888-889-0799.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

CITY NATIONAL ROCHDALE FUNDS | PAGE 12

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale Equity Income Fund |

The Fund seeks to provide significant income and long-term capital appreciation.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale Equity Income Fund, Class N Shares, versus the S&P 500 Index and the 60/25/15 Hybrid of the following 3 Indexes: Dow Jones U.S. Select Dividend Index, BofA ML Core Fixed Rate Preferred Securities Index and MSCI U.S. REIT Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Effective January 31, 2016, the Adviser discontinued the voluntary fee waivers for the Fund. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-year

Return | 3-Year

Return | 5-year

Return | 10-year

Return |

Class N(1) | RIMHX | -4.41% | 0.45% | 3.05% | 6.31% |

S&P 500 Index | n/a | -15.47% | 8.16% | 9.24% | 11.70% |

60/25/15 Hybrid of the following 3 Indexes: | n/a | -8.35% | 2.78% | 4.95% | 8.27% |

Dow Jones U.S. Select Dividend Index | n/a | -3.10% | 5.88% | 6.89% | 10.53% |

BofA ML Core Fixed Rate Preferred Securities Index | n/a | -16.41% | -2.90% | 0.41% | 3.36% |

MSCI U.S. REIT Index | n/a | -16.56% | -2.00% | 2.93% | 6.20% |

(1) | The predecessor to the City National Rochdale Equity Income Fund (the “Predecessor Fund”) commenced operations on June 1, 1999. On March 29, 2013, the Predecessor Fund was reorganized into the Fund. The performance results for the Class N Shares of the Fund for the period October 1, 2010, to March 29, 2013, reflect the performance of the Predecessor Fund’s Shares. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

First Horizon | | | 3.8 | % |

Marathon Petroleum | | | 3.7 | % |

Chevron | | | 3.2 | % |

Duke Energy | | | 3.1 | % |

American Electric Power | | | 3.0 | % |

Dominion Energy | | | 2.9 | % |

MetLife | | | 2.9 | % |

Williams | | | 2.8 | % |

Entergy | | | 2.6 | % |

Merck | | | 2.6 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 13

fund overview (Unaudited) |

September 30, 2022 |

City National Rochdale U.S. Core Equity Fund |

The Fund seeks to provide long-term capital appreciation.

Comparison of Change in the Value of a $10,000 Investment in the City National Rochdale U.S. Core Equity Fund, Servicing Class Shares, versus the S&P 500 Index(1)

(1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Effective January 31, 2016, the Adviser discontinued the voluntary fee waivers for the Fund. |

| Past performance is no indication of future performance. |

| The Fund’s comparative benchmark does not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index. |

AVERAGE ANNUAL TOTAL RETURNS |

Shares | Ticker

Symbol | 1-year

Return | 3-Year

Return | 5-year

Return | Inception

to Date |

Servicing Class*(1)^ | CNRVX | -18.42% | 5.09% | 8.77% | 11.46% |

Institutional Class*(1)^^ | CNRUX | -18.18% | 5.18% | 8.94% | 11.77% |

Class N*(1) | CNRWX | -18.61% | 4.83% | 8.51% | 11.18% |

S&P 500 Index | n/a | -15.47% | 8.16% | 9.24% | 12.12% |

* | The graph is based on only Servicing Class Shares; performance for Institutional Class and Class N Shares would be different due to differences in fee structures. |

(1) | Commenced operations on December 3, 2012. |

^ | The Fund’s Servicing Class shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank and certain retirement plan platforms. |

^^ | The Fund’s Institutional Class shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the minimum initial investment requirements, and certain tax-deferred retirement plans (including 401(k) plans, employer-sponsored 403(b) plans, 457 plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) held in plan level or omnibus accounts. |

TOP TEN HOLDINGS* |

% OF PORTFOLIO |

Apple | | | 6.2 | % |

Microsoft | | | 6.2 | % |

Consumer Discretionary Select Sector SPDR Fund | | | 5.5 | % |

UnitedHealth Group | | | 4.6 | % |

Visa | | | 3.4 | % |

Home Depot | | | 3.4 | % |

Cintas | | | 3.2 | % |

Costco Wholesale | | | 3.0 | % |

Mastercard | | | 2.9 | % |

Thermo Fisher Scientific | | | 2.6 | % |

* | Excludes Cash Equivalents |

CITY NATIONAL ROCHDALE FUNDS | PAGE 14

schedule of investments |

September 30, 2022 |

City National Rochdale Government Money Market Fund |

Description | | Face Amount (000) | | | Value (000) | |

U.S. Government Agency Obligations [58.5%] |

FFCB | | | | | | | | |

3.110%, US Federal Funds Effective Rate + 0.030%, 03/09/23(A) | | $ | 50,000 | | | $ | 50,000 | |

3.080%, U.S. SOFR + 0.040%, 08/17/23(A) | | | 50,000 | | | | 50,000 | |

3.140%, U.S. SOFR + 0.100%, 08/08/24(A) | | | 25,000 | | | | 25,000 | |

3.130%, U.S. SOFR + 0.090%, 08/26/24(A) | | | 120,000 | | | | 120,000 | |

FHLB | | | | | | | | |

3.100%, U.S. SOFR + 0.060%, 12/15/22(A) | | | 50,000 | | | | 50,000 | |

FHLB DN | | | | | | | | |

2.460%, 10/05/10(B)(C) | | | 175,000 | | | | 174,952 | |

2.655%, 10/12/10(B)(C) | | | 300,000 | | | | 299,757 | |

2.525%, 10/07/22(B)(C) | | | 400,000 | | | | 399,888 | |

2.650%, 10/14/22(B)(C) | | | 150,000 | | | | 149,857 | |

2.702%, 10/19/22(B)(C) | | | 500,000 | | | | 499,327 | |

2.646%, 10/21/22(B)(C) | | | 75,000 | | | | 74,890 | |

2.858%, 10/26/22(B)(C) | | | 300,000 | | | | 299,406 | |

2.777%, 11/02/22(B)(C) | | | 75,000 | | | | 74,816 | |

2.782%, 11/04/22(B)(C) | | | 250,000 | | | | 249,346 | |

3.165%, 11/14/22(B)(C) | | | 50,000 | | | | 49,807 | |

3.216%, 11/23/22(B)(C) | | | 100,000 | | | | 99,529 | |

| | | | | | | | | | | | | |

Total U.S. Government Agency Obligations |

(Cost $2,666,575) | | | 2,666,575 | |

| | | | | | | | | | | | | |

U.S. Treasury Obligations [27.4%] |

U.S. Treasury Bills | | | | | | | | |

2.444%, 10/04/22(B)(C) | | | 300,000 | | | | 299,939 | |

2.377%, 10/11/22(B)(C) | | | 500,000 | | | | 499,671 | |

2.722%, 11/01/22(B)(C) | | | 100,000 | | | | 99,766 | |

2.693%, 11/08/22(B)(C) | | | 150,000 | | | | 149,576 | |

U.S. Treasury Notes | | | | | | | | |

3.417%, US Treasury 3 Month Bill Money Market Yield + 0.049%, 01/31/23(A) | | | 150,000 | | | | 150,012 | |

3.402%, US Treasury 3 Month Bill Money Market Yield + 0.034%, 04/30/23(A) | | $ | 50,000 | | | $ | 50,001 | |

| | | | | | | | | | | | | |

Total U.S. Treasury Obligations |

(Cost $1,248,965) | | | 1,248,965 | |

| | | | | | | | | | | | | |

Short-Term Investment [4.2%] |

Morgan Stanley Institutional Liquidity Funds - Government Portfolio, 2.750%** | | | 190,289,845 | | | | 190,290 | |

| | | | | | | | | | | | | |

Total Short-Term Investment |

(Cost $190,290) | | | 190,290 | |

| | | | | | | | | | | | | |

Repurchase Agreements [10.1%] |

Barclays MBS (D) | | | | | | | | |

2.950%, dated 09/30/22, repurchased on 10/03/22, repurchase price $12,002,968 (collateralized by a U.S. Treasury Note, par value $14,325,500, 1.250%, 09/30/2028; with a total market value of $12,240,051) | | | 12,000 | | | | 12,000 | |

Barclays (D) | | | | | | | | |

3.050%, dated 09/30/22, repurchased on 10/03/22, repurchase price $100,025,570 (collateralized by various U.S. Treasury obligations, par values ranging from $3,000-$52,988,317, 0.000%-2.500%, 07/15/2023-09/20/2051; with a total market value of $102,000,000) | | | 100,000 | | | | 100,000 | |

Daiwa MBS (D) | | | | | | | | |

3.020%, dated 09/30/22, repurchased on 10/03/22, repurchase price $200,051,046 (collateralized by various U.S. Treasury obligations, par values ranging from $400-$61,431,249, 0.125%-6.000%, 11/30/2022-08/01/2052; with a total market value of $205,650,139) | | | 200,000 | | | | 200,000 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 15

schedule of investments |

September 30, 2022 |

City National Rochdale Government Money Market Fund (concluded) |

Description | | Face Amount (000) | | | Value (000) | |

Goldman Sachs (D) | | | | | | | | |

2.960%, dated 09/30/22, repurchased on 10/03/22, repurchase price $150,037,223 (collateralized by various U.S. Treasury obligations, par values ranging from $17,680,400-$100,000,000, 0.000%-2.875%, 05/31/2025-11/15/2048; with a total market value of $153,000,000) | | $ | 150,000 | | | $ | 150,000 | |

| | | | | | | | | | | | | |

Total Repurchase Agreements |

(Cost $462,000) | | | 462,000 | |

| | | | | | | | | | | | | |

Total Investments [100.2%] |

(Cost $4,567,830) | | $ | 4,567,830 | |

| | | | | | | | | | | | | |

Percentages are based on net assets of $4,560,203 (000).

** | The rate reported is the 7-day effective yield as of September 30, 2022. |

(A) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates for certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

(C) | Interest rate represents the security’s effective yield at the time of purchase. |

(D) | Tri-party Repurchase Agreement. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

SOFR — Secured Overnight Financing Rate

The following is a summary of the inputs used as of September 30, 2022, in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Government Agency Obligations | | $ | — | | | $ | 2,666,575 | | | $ | — | | | $ | 2,666,575 | |

U.S. Treasury Obligations | | | — | | | | 1,248,965 | | | | — | | | | 1,248,965 | |

Short-Term Investment | | | 190,290 | | | | — | | | | — | | | | 190,290 | |

Repurchase Agreements | | | — | | | | 462,000 | | | | — | | | | 462,000 | |

Total Investments in Securities | | $ | 190,290 | | | $ | 4,377,540 | | | $ | — | | | $ | 4,567,830 | |

Amounts designated as “—” are either $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 16

schedule of investments |

September 30, 2022 |

City National Rochdale Government Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

U.S. Treasury Obligations [53.3%] |

U.S. Treasury Notes | | | | | | | | |

3.125%, 08/15/25 | | $ | 500 | | | $ | 485 | |

2.875%, 09/30/23 | | | 350 | | | | 345 | |

2.750%, 08/31/23 | | | 1,055 | | | | 1,041 | |

2.750%, 08/31/25 | | | 600 | | | | 575 | |

2.625%, 12/31/25 | | | 1,000 | | | | 952 | |

2.625%, 05/31/27 | | | 1,750 | | | | 1,644 | |

2.375%, 04/30/26 | | | 330 | | | | 310 | |

1.875%, 08/31/24 | | | 2,805 | | | | 2,683 | |

1.750%, 07/31/24 | | | 800 | | | | 765 | |

1.125%, 10/31/26 | | | 1,000 | | | | 887 | |

0.625%, 10/15/24 | | | 1,000 | | | | 930 | |

0.625%, 07/31/26 | | | 1,000 | | | | 875 | |

| | | | | | | | | | | | | |

Total U.S. Treasury Obligations |

(Cost $12,249) | | | 11,492 | |

| | | | | | | | | | | | | |

U.S. Government Agency Obligations [32.6%] |

FFCB | | | | | | | | |

0.200%, 10/02/23 | | | 1,250 | | | | 1,201 | |

FNMA | | | | | | | | |

2.625%, 09/06/24 | | | 1,400 | | | | 1,360 | |

2.500%, 02/05/24 | | | 1,445 | | | | 1,410 | |

2.125%, 04/24/26 | | | 955 | | | | 889 | |

1.625%, 01/07/25 | | | 1,280 | | | | 1,208 | |

Tennessee Valley Authority | | | | | | | | |

2.875%, 09/15/24 | | | 1,000 | | | | 972 | |

| | | | | | | | | | | | | |

Total U.S. Government Agency Obligations |

(Cost $7,442) | | | 7,040 | |

| | | | | | | | | | | | | |

U.S. Government Mortgage-Backed Obligations [6.5%] |

FHLMC, Ser 2016-4635, Cl EG, Pool FHR 4635 EG | | | | | | | | |

2.500%, 12/15/46 | | | 909 | | | | 848 | |

FNMA, Pool AS4877 | | | | | | | | |

3.000%, 04/01/30 | | | 511 | | | | 484 | |

FNMA ARM, Pool 766620 | | | | | | | | |

2.547%, ICE LIBOR USD 12 Month + 1.677%, 03/01/34(A) | | | 26 | | | | 26 | |

GNMA, Pool 497411 | | | | | | | | |

6.000%, 01/15/29 | | $ | 2 | | | $ | 2 | |

GNMA ARM, Pool G2 81318 | | | | | | | | |

2.875%, US Treas Yield Curve Rate T Note Const Mat 1 Yr + 1.500%, 04/20/35(A) | | | 36 | | | | 36 | |

GNMA ARM, Pool G2 81447 | | | | | | | | |

1.625%, US Treas Yield Curve Rate T Note Const Mat 1 Yr + 1.500%, 08/20/35(A) | | | 10 | | | | 9 | |

| | | | | | | | | | | | | |

Total U.S. Government Mortgage-Backed Obligations |

(Cost $1,511) | | | 1,405 | |

| | | | | | | | | | | | | |

Municipal Bonds [5.4%] |

Florida [3.4%] |

Florida State, Board of Administration Finance, Ser A, RB | | | | | | | | |

1.258%, 07/01/25 | | | 810 | | | | 733 | |

| | | | | | | | | | | | | |

Texas [2.0%] |

Harris County, Port Authority of Houston, Ser B, GO | | | | | | | | |

2.250%, 10/01/26 | | | 475 | | | | 436 | |

| | | | | | | | | | | | | |

Total Municipal Bonds |

(Cost $1,313) | | | 1,169 | |

| | | | | | | | | | | | | |

Short-Term Investment [2.0%] |

SEI Daily Income Trust Government Fund, Cl F, 2.569%** | | | 429,887 | | | | 430 | |

| | | | | | | | | | | | | |

Total Short-Term Investment |

(Cost $430) | | | 430 | |

| | | | | | | | | | | | | |

Total Investments [99.8%] |

(Cost $22,945) | | $ | 21,536 | |

| | | | | | | | | | | | | |

Percentages are based on net assets of $21,584 (000).

** | The rate reported is the 7-day effective yield as of September 30, 2022. |

(A) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates for certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

ARM — Adjustable Rate Mortgage

Cl — Class

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 17

schedule of investments |

September 30, 2022 |

City National Rochdale Government Bond Fund (concluded) |

FFCB — Federal Farm Credit Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

GO — General Obligation

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rates

RB — Revenue Bond

Ser — Series

USD — U.S. Dollar

The following is a list of the inputs used as of September 30, 2022 in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Treasury Obligations | | $ | — | | | $ | 11,492 | | | $ | — | | | $ | 11,492 | |

U.S. Government Agency Obligations | | | — | | | | 7,040 | | | | — | | | | 7,040 | |

U.S. Government Mortgage-Backed Obligations | | | — | | | | 1,405 | | | | — | | | | 1,405 | |

Municipal Bonds | | | — | | | | 1,169 | | | | — | | | | 1,169 | |

Short-Term Investment | | | 430 | | | | — | | | | — | | | | 430 | |

Total Investments in Securities | | $ | 430 | | | $ | 21,106 | | | $ | — | | | $ | 21,536 | |

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 -- Significant Accounting Policies in the Notes

to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 18

schedule of investments |

September 30, 2022 |

City National Rochdale Corporate Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

Corporate Bonds [88.9%] |

Automotive [5.2%] |

General Motors Financial | | | | | | | | |

5.250%, 03/01/26 | | $ | 2,600 | | | $ | 2,531 | |

Toyota Motor Credit, MTN | | | | | | | | |

2.250%, 10/18/23 | | | 3,000 | | | | 2,936 | |

| | | | | | | | | | | | | |

Total Automotive | | | 5,467 | |

| | | | | | | | | | | | | |

Banks [7.4%] |

BPCE | | | | | | | | |

4.000%, 04/15/24 | | | 1,800 | | | | 1,768 | |

Cooperatieve Rabobank UA | | | | | | | | |

4.375%, 08/04/25 | | | 1,500 | | | | 1,434 | |

Standard Chartered | | | | | | | | |

3.950%, 01/11/23(A) | | | 2,250 | | | | 2,241 | |

Wells Fargo, MTN | | | | | | | | |

3.300%, 09/09/24 | | | 2,500 | | | | 2,411 | |

| | | | | | | | | | | | | |

Total Banks | | | 7,854 | |

| | | | | | | | | | | | | |

Broadcasting & Cable [2.3%] |

Comcast | | | | | | | | |

3.700%, 04/15/24 | | | 2,500 | | | | 2,458 | |

| | | | | | | | | | | | | |

Chemicals [0.1%] |

Dow Chemical | | | | | | | | |

4.550%, 11/30/25 | | $ | 148 | | | $ | 146 | |

| | | | | | | | | | | | | |

Computer System Design & Services [3.2%] |

Apple | | | | | | | | |

3.450%, 05/06/24 | | | 3,450 | | | | 3,393 | |

| | | | | | | | | | | | | |

Drugs [2.3%] |

AbbVie | | | | | | | | |

2.600%, 11/21/24 | | | 2,500 | | | | 2,380 | |

| | | | | | | | | | | | | |

Electric Utilities [5.0%] |

Duke Energy | | | | | | | | |

3.150%, 08/15/27 | | | 1,575 | | | | 1,424 | |

Exelon | | | | | | | | |

2.750%, 03/15/27(A) | | | 2,000 | | | | 1,798 | |

Georgia Power | | | | | | | | |

3.250%, 04/01/26 | | | 2,200 | | | | 2,063 | |

| | | | | | | | | | | | | |

Total Electric Utilities | | | 5,285 | |

| | | | | | | | | | | | | |

Enterprise Software/Serv [2.0%] |

Oracle | | | | | | | | |

2.500%, 04/01/25 | | | 2,250 | | | | 2,097 | |

| | | | | | | | | | | | | |

Financial Services [2.3%] |

American Express | | | | | | | | |

4.200%, 11/06/25 | | | 2,500 | | | | 2,440 | |

| | | | | | | | | | | | | |

Food, Beverage & Tobacco [8.9%] |

Anheuser-Busch | | | | | | | | |

3.650%, 02/01/26 | | | 2,250 | | | | 2,162 | |

Coca-Cola | | | | | | | | |

1.750%, 09/06/24 | | | 2,500 | | | | 2,382 | |

General Mills | | | | | | | | |

3.200%, 02/10/27 | | | 2,500 | | | | 2,326 | |

PepsiCo | | | | | | | | |

2.250%, 03/19/25 | | | 2,600 | | | | 2,460 | |

| | | | | | | | | | | | | |

Total Food, Beverage & Tobacco | | | 9,330 | |

| | | | | | | | | | | | | |

Industrials [1.4%] |

Penske Truck Leasing LP | | | | | | | | |

3.450%, 07/01/24(A) | | | 1,500 | | | | 1,443 | |

| | | | | | | | | | | | | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 19

schedule of investments |

September 30, 2022 |

City National Rochdale Corporate Bond Fund (continued) |

Description | | Face Amount (000) | | | Value (000) | |

Investment Bank/Broker-Dealer [1.8%] |

Jefferies Group | | | | | | | | |

4.850%, 01/15/27 | | $ | 2,000 | | | $ | 1,913 | |

| | | | | | | | | | | | | |

Medical Products & Services [4.5%] |

Abbott Laboratories | | | | | | | | |

3.875%, 09/15/25 | | | 2,355 | | | | 2,305 | |

Gilead Sciences | | | | | | | | |

3.700%, 04/01/24 | | | 2,500 | | | | 2,461 | |

| | | | | | | | | | | | | |

Total Medical Products & Services | | | 4,766 | |

| | | | | | | | | | | | | |

Medical-HMO [2.7%] |

UnitedHealth Group | | | | | | | | |

3.850%, 06/15/28 | | | 3,000 | | | | 2,821 | |

| | | | | | | | | | | | | |

Petroleum & Fuel Products [8.6%] |

Energy Transfer | | | | | | | | |

4.050%, 03/15/25 | | | 2,000 | | | | 1,918 | |

EOG Resources | | | | | | | | |

2.625%, 03/15/23 | | | 2,520 | | | | 2,499 | |

Exxon Mobil | | | | | | | | |

2.275%, 08/16/26 | | | 2,500 | | | | 2,278 | |

Shell International Finance BV | | | | | | | | |

2.875%, 05/10/26 | | | 2,500 | | | | 2,330 | |

| | | | | | | | | | | | | |

Total Petroleum & Fuel Products | | | 9,025 | |

| | | | | | | | | | | | | |

Pharmacy Services [1.8%] |

CVS Health | | | | | | | | |

2.875%, 06/01/26 | | | 2,000 | | | | 1,852 | |

| | | | | | | | | | | | | |

Real Estate Investment Trusts [2.2%] |

Prologis | | | | | | | | |

3.250%, 10/01/26 | | | 2,500 | | | | 2,330 | |

| | | | | | | | | | | | | |

Retail [2.0%] |

AutoZone | | | | | | | | |

3.125%, 04/21/26 | | | 2,250 | | | | 2,115 | |

| | | | | | | | | | | | | |

Security Brokers & Dealers [20.6%] |

Banco Santander | | | | | | | | |

2.746%, 05/28/25 | | | 2,600 | | | | 2,378 | |

Bank of America, MTN | | | | | | | | |

4.250%, 10/22/26 | | | 2,500 | | | | 2,376 | |

Barclays, MTN | | | | | | | | |

4.338%, ICE LIBOR USD 3 Month + 1.356%, 05/16/24(B) | | $ | 2,250 | | | $ | 2,225 | |

Citigroup | | | | | | | | |

1.462%, U.S. SOFR + 0.770%, 06/09/27(B) | | | 3,000 | | | | 2,555 | |

Goldman Sachs Group, MTN | | | | | | | | |

3.850%, 07/08/24 | | | 2,500 | | | | 2,444 | |

JPMorgan Chase | | | | | | | | |

3.300%, 04/01/26 | | | 3,000 | | | | 2,811 | |

Morgan Stanley, MTN | | | | | | | | |

3.125%, 07/27/26 | | | 3,000 | | | | 2,763 | |

NatWest Group | | | | | | | | |

4.519%, ICE LIBOR USD 3 Month + 1.550%, 06/25/24(B) | | | 2,300 | | | | 2,273 | |

Sumitomo Mitsui Financial Group | | | | | | | | |

1.402%, 09/17/26 | | | 2,250 | | | | 1,920 | |

| | | | | | | | | | | | | |

Total Security Brokers & Dealers | | | 21,745 | |

| | | | | | | | | | | | | |

Semi-Conductors [2.4%] |

Applied Materials | | | | | | | | |

3.900%, 10/01/25 | | | 2,600 | | | | 2,546 | |

| | | | | | | | | | | | | |

Telephones & Telecommunications [2.2%] |

Verizon Communications | | | | | | | | |

2.625%, 08/15/26 | | | 2,500 | | | | 2,271 | |

| | | | | | | | | | | | | |

Total Corporate Bonds |

(Cost $101,939) | | | 93,677 | |

| | | | | | | | | | | | | |

U.S. Treasury Obligations [6.7%] |

U.S. Treasury Bill | | | | | | | | |

3.855%, 09/07/23(C) (D) | | | 3,000 | | | | 2,892 | |

U.S. Treasury Notes | | | | | | | | |

3.423%, US Treasury 3 Month Bill Money Market Yield + 0.055%, 10/31/22(B) | | | 2,250 | | | | 2,250 | |

3.000%, 07/31/24 | | | 2,000 | | | | 1,956 | |

| | | | | | | | | | | | | |

Total U.S. Treasury Obligations |

(Cost $7,133) | | | 7,098 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 20

schedule of investments |

September 30, 2022 |

City National Rochdale Corporate Bond Fund (concluded) |

Description | | Shares | | | Value (000) | |

Affiliated Registered Investment Company [2.8%] |

City National Rochdale Fixed Income Opportunities Fund, Cl N‡ | | | 157,077 | | | $ | 2,922 | |

| | | | | | | | | | | | | |

Total Affiliated Registered Investment Company |

(Cost $4,000) | | | 2,922 | |

| | | | | | | | | | | | | |

Closed-End Fund [0.0%] |

Stone Ridge Reinsurance Risk Premium Interval Fund* | | | 98 | | | | 4 | |

| | | | | | | | | | | | | |

Total Closed-End Fund |

(Cost $4) | | | 4 | |

| | | | | | | | | | | | | |

Short-Term Investment [0.7%] |

SEI Daily Income Trust Government Fund, Cl F, 2.569%** | | | 707,401 | | | | 707 | |

| | | | | | | | | | | | | |

Total Short-Term Investment |

(Cost $707) | | | 707 | |

| | | | | | | | | | | | | |

Total Investments [99.1%] |

(Cost $113,783) | | $ | 104,408 | |

| | | | | | | | | | | | | |

Percentages are based on net assets of $105,361 (000).

** | The rate reported is the 7-day effective yield as of September 30, 2022. |

* | Non-income producing security. |

‡ | Investment in Affiliate. |

(A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On September 30, 2022, the value of these securities amounted to $5,482 (000), representing 5.2% of the net assets of the Fund. |

(B) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates for certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

(D) | Interest rate represents the security’s effective yield at the time of purchase. |

Cl — Class

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

LP — Limited Partnership

MTN — Medium Term Note

Ser — Series

SOFR — Secured Overnight Financing Rate

USD — U.S. Dollar

The following is a list of the inputs used as of September 30, 2022 in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 93,677 | | | $ | — | | | $ | 93,677 | |

U.S. Treasury Obligations | | | — | | | | 7,098 | | | | — | | | | 7,098 | |

Affiliated Registered Investment Company | | | 2,922 | | | | — | | | | — | | | | 2,922 | |

Closed-End Fund | | | 4 | | | | — | | | | — | | | | 4 | |

Short-Term Investment | | | 707 | | | | — | | | | — | | | | 707 | |

Total Investments in Securities | | $ | 3,633 | | | $ | 100,775 | | | $ | — | | | $ | 104,408 | |

The following is a summary of the transactions with affiliates for the period ended

September 30, 2022 (000):

| | | City National

Rochdale

Fixed Income

Opportunities

Fund,

Class N | |

Beginning balance as of 09/30/21 | | $ | 3,660 | |

Purchases at Cost | | | — | |

Proceeds from Sales | | | — | |

Realized Gain (Loss) | | | — | |

Unrealized Gain (Loss) | | $ | (738 | ) |

Ending balance as of 9/30/22 | | $ | 2,922 | |

Dividend Income | | | 209 | |

| | | City National

Rochdale

Fixed Income

Opportunities

Fund, Class

N (Shares) | |

Beginning balance as of 09/30/21 | | | 157,077 | |

Purchases | | | — | |

Sales | | | — | |

Ending balance as of 9/30/22 | | | 157,077 | |

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 - Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 21

schedule of investments |

September 30, 2022 |

City National Rochdale California Tax Exempt Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

Municipal Bonds [92.3%] |

California [91.5%] |

Anaheim Housing & Public Improvements Authority, RB | | | | | | | | |

Callable 10/01/27 @ 100 | | | | | | | | |

5.000%, 10/01/29 | | $ | 245 | | | $ | 265 | |

Bay Area Toll Authority, Sub-Ser, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.000%, 10/01/24(A) | | | 140 | | | | 145 | |

Brea, Redevelopment Agency Successor, Redevelopment Project, TA | | | | | | | | |

Callable 08/01/23 @ 100 | | | | | | | | |

5.000%, 08/01/25 | | | 550 | | | | 558 | |

California County, Tobacco Securitization Agency, RB | | | | | | | | |

5.000%, 06/01/30 | | | 300 | | | | 314 | |

California State University, Ser A, RB | | | | | | | | |

Callable 11/01/25 @ 100 | | | | | | | | |

5.000%, 11/01/26 | | | 150 | | | | 158 | |

California State, Community Choice Financing Authority, Ser A-1, RB | | | | | | | | |

Callable 05/01/28 @ 100 | | | | | | | | |

4.000%, 05/01/53(B) | | | 500 | | | | 489 | |

California State, Community Choice Financing Authority, Ser S, RB | | | | | | | | |

Callable 09/01/27 @ 101 | | | | | | | | |

4.000%, 10/01/52(B) | | | 500 | | | | 495 | |

California State, Department of Water Resources, Ser AX, RB | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

5.000%, 12/01/29 | | | 510 | | | | 558 | |

California State, GO | | | | | | | | |

5.000%, 11/01/24 | | $ | 1,000 | | | $ | 1,038 | |

California State, GO | | | | | | | | |

5.000%, 08/01/26 | | | 1,000 | | | | 1,066 | |

California State, GO | | | | | | | | |

Callable 12/01/23 @ 100 | | | | | | | | |

5.000%, 12/01/26 | | | 1,000 | | | | 1,021 | |

California State, GO | | | | | | | | |

Callable 11/01/23 @ 100 | | | | | | | | |

5.000%, 11/01/27 | | | 500 | | | | 510 | |

California State, GO | | | | | | | | |

5.000%, 10/01/30 | | | 1,000 | | | | 1,119 | |

California State, GO | | | | | | | | |

5.000%, 09/01/31 | | | 500 | | | | 561 | |

California State, GO | | | | | | | | |

Callable 04/01/32 @ 100 | | | | | | | | |

5.000%, 04/01/33 | | | 500 | | | | 557 | |

California State, GO | | | | | | | | |

Callable 04/01/31 @ 100 | | | | | | | | |

4.000%, 10/01/33 | | | 500 | | | | 508 | |

California State, Health Facilities Financing Authority, RB | | | | | | | | |

5.000%, 11/01/27 | | | 220 | | | | 237 | |

California State, Health Facilities Financing Authority, RB | | | | | | | | |

5.000%, 10/01/39(B) | | | 565 | | | | 584 | |

California State, Health Facilities Financing Authority, RB | | | | | | | | |

4.000%, 03/01/25 | | | 100 | | | | 101 | |

California State, Health Facilities Financing Authority, Ser A, RB | | | | | | | | |

Callable 11/15/22 @ 100 | | | | | | | | |

5.000%, 11/15/25 | | | 665 | | | | 666 | |

California State, Health Facilities Financing Authority, RB | | | | | | | | |

5.000%, 11/01/27 | | | 650 | | | | 705 | |

California State, Infrastructure & Economic Development Bank, RB | | | | | | | | |

4.000%, 05/01/28 | | | 175 | | | | 179 | |

California State, Infrastructure & Economic Development Bank, Ser B, RB | | | | | | | | |

5.000%, 07/01/23 | | | 1,150 | | | | 1,164 | |

California State, Municipal Finance Authority, RB | | | | | | | | |

5.000%, 06/01/23 | | | 200 | | | | 202 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 22

schedule of investments |

September 30, 2022 |

City National Rochdale California Tax Exempt Bond Fund (continued) |

Description | | Face Amount (000) | | | Value (000) | |

California State, Municipal Finance Authority, RB, BAM | | | | | | | | |

5.000%, 05/15/29 | | $ | 300 | | | $ | 318 | |

California State, Public Works Board, Judicial Council, Ser B, RB | | | | | | | | |

5.000%, 10/01/23 | | | 475 | | | | 484 | |

California State, Public Works Board, RB | | | | | | | | |

5.000%, 09/01/25 | | | 1,510 | | | | 1,586 | |

California State, Public Works Board, Ser B, RB | | | | | | | | |

5.000%, 10/01/25 | | | 245 | | | | 258 | |

California State, Public Works Board, Ser C, RB | | | | | | | | |

Callable 03/01/27 @ 100 | | | | | | | | |

5.000%, 03/01/28 | | | 500 | | | | 534 | |

California State, Public Works Board, Ser S, RB | | | | | | | | |

Callable 04/01/27 @ 100 | | | | | | | | |

5.000%, 04/01/28 | | | 800 | | | | 856 | |

California State, Statewide Communities Development Authority, Cottage Health System, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.000%, 11/01/24(A) | | | 350 | | | | 362 | |

California State, Statewide Communities Development Authority, RB | | | | | | | | |

Callable 02/15/26 @ 100 | | | | | | | | |

5.000%, 08/15/30 | | | 550 | | | | 579 | |

California State, University Systemwide Revenue, Ser A, RB | | | | | | | | |

5.000%, 11/01/24 | | | 990 | | | | 1,027 | |

California State, University Systemwide Revenue, Ser A, RB | | | | | | | | |

Callable 05/01/26 @ 100 | | | | | | | | |

5.000%, 11/01/27 | | | 350 | | | | 372 | |

California State, University Systemwide Revenue, Ser B-1, RB | | | | | | | | |

Callable 05/01/26 @ 100 | | | | | | | | |

1.600%, 11/01/47(B) | | | 1,000 | | | | 880 | |

Chino Basin Regional Financing Authority, Sub-Ser, RB | | | | | | | | |

Callable 06/01/30 @ 100 | | | | | | | | |

5.000%, 06/01/31 | | | 250 | | | | 279 | |

East Bay, Municipal Utility District, Water System Revenue, Ser A, RB | | | | | | | | |

Callable 06/01/25 @ 100 | | | | | | | | |

5.000%, 06/01/29 | | $ | 850 | | | $ | 890 | |

El Dorado Irrigation District, Ser A, RB | | | | | | | | |

Callable 03/01/30 @ 100 | | | | | | | | |

5.000%, 03/01/32 | | | 235 | | | | 256 | |

Fremont, Public Financing Authority, RB | | | | | | | | |

5.000%, 10/01/25 | | | 1,000 | | | | 1,052 | |

Golden State Tobacco Securitization, Ser A-1, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.000%, 06/01/27(A) | | | 500 | | | | 540 | |

Irvine, Improvement Board, TA, BAM | | | | | | | | |

4.000%, 09/02/31 | | | 710 | | | | 707 | |

Long Beach, Harbor Revenue, Ser A, RB, AMT | | | | | | | | |

5.000%, 05/15/27 | | | 500 | | | | 526 | |

Long Beach, Unified School District, GO | | | | | | | | |

5.000%, 08/01/26 | | | 1,000 | | | | 1,068 | |

Los Angeles County, Metropolitan Transportation Authority, RB | | | | | | | | |

5.000%, 06/01/26 | | | 250 | | | | 266 | |

Los Angeles County, Public Works Financing Authority, Ser E-2, RB | | | | | | | | |

4.000%, 12/01/28 | | | 500 | | | | 520 | |

Los Angeles, Department of Airports, Ser C, RB | | | | | | | | |

5.000%, 05/15/25 | | | 660 | | | | 690 | |

Los Angeles, Department of Airports, Sub-Ser, RB | | | | | | | | |

Callable 05/15/32 @ 100 | | | | | | | | |

5.000%, 05/15/33 | | | 100 | | | | 110 | |

Los Angeles, Department of Airports, Sub-Ser, RB, AMT | | | | | | | | |

Callable 05/15/26 @ 100 | | | | | | | | |

5.000%, 05/15/29 | | | 400 | | | | 411 | |

Los Angeles, Department of Water & Power, Power System Project, Ser C, RB | | | | | | | | |

5.000%, 07/01/23 | | | 580 | | | | 589 | |

Los Angeles, Department of Water & Power, Ser A, RB | | | | | | | | |

5.000%, 07/01/27 | | | 510 | | | | 551 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 23

schedule of investments |

September 30, 2022 |

City National Rochdale California Tax Exempt Bond Fund (continued) |

Description | | Face Amount (000) | | | Value (000) | |

Los Angeles, Sanitation Districts Financing Authority, Ser A, RB | | | | | | | | |

Callable 10/01/25 @ 100 | | | | | | | | |

5.000%, 10/01/28 | | $ | 525 | | | $ | 554 | |

Los Angeles, Wastewater System Revenue, Sub-Ser A, RB | | | | | | | | |

Callable 06/01/27 @ 100 | | | | | | | | |

5.000%, 06/01/30 | | | 140 | | | | 151 | |

Marin Municipal Water District, Sub-Ser, RB | | | | | | | | |

5.000%, 06/15/32 | | | 430 | | | | 481 | |

Metropolitan Water District of Southern California, Ser A, RB | | | | | | | | |

5.000%, 10/01/31 | | | 250 | | | | 284 | |

Orange County, Redevelopment Agency Successor Agency, TA, AGM | | | | | | | | |

5.000%, 09/01/23 | | | 335 | | | | 340 | |

Redding, Electric System Revenue, RB | | | | | | | | |

5.000%, 06/01/24 | | | 655 | | | | 674 | |

Redding, Electric System Revenue, RB | | | | | | | | |

5.000%, 06/01/25 | | | 595 | | | | 621 | |

Riverside County, Infrastructure Financing Authority, Ser A, RB | | | | | | | | |

Callable 11/01/26 @ 100 | | | | | | | | |

4.000%, 11/01/29 | | | 520 | | | | 532 | |

Riverside Redevelopment Agency Successor Agency, Ser A, RB | | | | | | | | |

5.000%, 09/01/27 | | | 100 | | | | 107 | |

San Diego County, Ser A, RB | | | | | | | | |

Callable 10/15/24 @ 100 | | | | | | | | |

5.000%, 10/15/28 | | | 125 | | | | 129 | |

San Diego, Association of Governments South Bay Expressway Revenue, Ser A, RB | | | | | | | | |

Callable 07/01/27 @ 100 | | | | | | | | |

5.000%, 07/01/28 | | | 365 | | | | 389 | |

San Dieguito Unified High School District, Ser E-2, GO | | | | | | | | |

4.000%, 08/01/30 | | | 100 | | | | 105 | |

San Francisco Bay Area Rapid Transit District, GO | | | | | | | | |

Callable 08/01/29 @ 100 | | | | | | | | |

5.000%, 08/01/33 | | | 100 | | | | 110 | |