- SBAC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SBA Communications (SBAC) DEF 14ADefinitive proxy

Filed: 12 Apr 23, 4:32pm

| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under§240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| SBA Communications Corporation 8051 Congress Avenue Boca Raton, Florida 33487 |

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

April 12, 2023

Dear Shareholder:

It is my pleasure to invite you to attend SBA Communications Corporation’s 2023 Annual Meeting of Shareholders. The meeting will be held on Thursday, May 25, 2023, at 10:00 a.m. local time at our corporate office, located at 8051 Congress Avenue, Boca Raton, Florida 33487. At the meeting, you will be asked to:

| 1. | Elect three directors, Steven E. Bernstein, Laurie Bowen and Amy E. Wilson, each for a three-year term expiring at the 2026 Annual Meeting of Shareholders. |

| 2. | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2023 fiscal year. |

| 3. | Approve, on an advisory basis, the compensation of our named executive officers. |

| 4. | Approve, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers. |

| 5. | Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

You are receiving this proxy statement because you own shares of our Class A common stock that entitle you to vote at the 2023 Annual Meeting of Shareholders. Our Board of Directors is soliciting proxies from shareholders who wish to vote at the Annual Meeting. Only shareholders of record as of the close of business on March 24, 2023 may vote at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting, regardless of the number you may hold. Whether or not you plan to attend, please vote using the Internet, by telephone or by mail, in each case by following the instructions in our proxy statement. This will not prevent you from voting your shares in person if you are present.

I look forward to seeing you on May 25, 2023.

Sincerely,

Steven E. Bernstein

Chairman of the Board

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report on or about April 12, 2023.

SBA’s proxy statement and annual report are available online at www.edocumentview.com/SBAC.

TABLE OF CONTENTS

SBA Communications Corporation | 2023 Proxy Statement i

PROXY SUMMARY

This proxy summary highlights information contained elsewhere in this proxy statement and does not contain all information that you should review and consider. Please read the entire proxy statement with care before voting.

2023 Annual Meeting of Shareholders

| Date and Time: | Thursday, May 25, 2023, at 10:00 a.m. local time | |

| Place: | 8051 Congress Avenue, Boca Raton, Florida 33487 | |

| Record Date: | March 24, 2023 | |

| Voting: | Each share of SBA Class A common stock outstanding at the close of business on the record date has one vote on each matter that is properly submitted for a vote at the annual meeting. |

Proposals and Board Recommendations

| Proposal | Board Recommendations | |

Proposal 1: Election of Directors (page 8) | FOR each director nominee | |

Proposal 2: Ratification of EY as Auditors (page 75) | FOR | |

Proposal 3: Advisory Vote on Executive Compensation (page 79) | FOR | |

Proposal 4: Advisory Vote on Frequency of Future Votes on Executive Compensation (page 80) | 1 YEAR | |

2022 FINANCIAL AND OPERATIONAL HIGHLIGHTS

In 2022, SBA continued to deliver strong financial and operational results. We deployed over $2 billion of capital through (i) portfolio expansion, with the addition of over 5,000 towers, (ii) meaningful dividend growth and (iii) opportunistic share repurchases. In addition, we improved our balance sheet and liquidity position and posted industry leading tower cash flow and Adjusted EBITDA margins. Highlights include:

(dollars in millions) | 2020 | 2021 | 2022 | |||||||||

Total revenue | $ | 2,083 | $ | 2,309 | $ | 2,633 | ||||||

Net Income | $ | 24 | $ | 238 | $ | 460 | ||||||

AFFO(1) | $ | 1,070 | $ | 1,193 | $ | 1,340 | ||||||

Tower Count | 32,923 | 34,177 | 39,311 | |||||||||

Adjusted EBITDA(1) (in millions)

| AFFO Per Share(1) (in dollars)

| Tower Cash Flow(1) (in millions)

|

| (1) | See the reconciliations of these Non-GAAP financial measures in Appendix A to this proxy statement. |

SBA Communications Corporation | 2023 Proxy Statement 1

PROXY SUMMARY

In 2022, we returned approximately $738.4 million in capital to our shareholders through the payment of $306.8 million in aggregate dividends during 2022 and the repurchase of approximately 1.3 million shares of our Class A common stock.

This performance has contributed to our ability to create significant shareholder value as we delivered 76% Total Shareholder Return (“TSR”) for the five years ended December 31, 2022. As the chart below demonstrates, our TSR over that period materially surpassed the TSR of our large public tower company peer group (approximately 56%) and significantly exceeded the TSR of the S&P 500 Index (approximately 57%) and the FTSE NAREIT All Equity REITs Index (approximately 24%).

Total Shareholder Returns

For more information relating to SBA’s financial performance, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2023.

2 SBA Communications Corporation | 2023 Proxy Statement

PROXY SUMMARY

Proposal 1 – Election of Directors (page 8)

Board Composition

The director nominees and the continuing directors of our Board of Directors (the “Board”) are balanced with a mix of skills, experience, diversity and perspectives. See page 8 for more information.

Governance Highlights

Effective Board Leadership and Independent Oversight |

> All directors other than our CEO are independent. (Page 22)

> Independent Chair and Lead Independent Director ensure independent oversight. (Page 17)

> Balanced Board with diversity of skills and experience. (Page 8)

> Board refreshment has resulted in three independent directors elected since 2015 and two new independent nominees in 2023. (Page 22)

> Board risk oversight and assessment. (Page 24)

> Board conducts annual self-evaluation of the Board, its Committees and each director to determine effective functioning. (Page 22)

> Independent directors regularly meet in executive session with the Lead Independent Director presiding. (Page 22)

> Succession planning process for Board members and executives. (Page 23)

|

SBA Communications Corporation | 2023 Proxy Statement 3

PROXY SUMMARY

Strong Governance Policies |

> Directors and officers are subject to robust stock ownership guidelines. (Page 53)

> Majority voting standard and director resignation policy in uncontested elections. (Page 11)

> Executives prohibited from pledging shares that are subject to the stock ownership requirements. (Page 16)

> Directors and officers are strictly prohibited from hedging any shares beneficially owned. (Page 16)

| |

Commitment to Shareholders and Other Stakeholders |

> Meaningful proxy access right for shareholders. (Page 21)

> Proactive shareholder engagement program. (Page 4)

> Strong commitment to corporate social responsibility and sustainability initiatives, including sustainable business practices. (Page 5)

|

Shareholder Engagement

We believe that shareholder engagement remains a key driver of our continued success. We engage with our shareholders on a regular basis through our active engagement program led by management and our Board. Through our engagement, we solicit shareholder views on matters including business strategy, corporate governance, executive compensation, environmental and social initiatives and other important topics. We use this feedback to assist SBA and the Board with matters requiring a broader shareholder perspective. We also listen to the feedback our shareholders provide through the annual say on pay advisory votes on our executive compensation. We have established a variety of communication channels to best accommodate our shareholders, facilitating effective discussions and feedback.

During the 2022-2023 shareholder engagement season, we continued to focus our shareholder engagement on understanding the views of our shareholders on a variety of environmental, social and governance (ESG) issues as well as executive compensation matters. During this period, we reached out to shareholders representing approximately 65% of the common stock held by our top 20 shareholders at the time of such request. As a result, we exchanged correspondence and held meetings with our top 10 shareholders representing approximately 40% of our outstanding common stock. Our Lead Independent Director and/or our Chair of our Nominating and Corporate Governance Committee (the “NCG Committee”) participated in substantially all of these meetings. Our shareholder engagement included discussions of a variety of ESG issues, including:

| What We Heard | How We Responded | |

Shareholders supported science-based targets (SBTs) in developing climate-related initiatives. | We committed to setting near-term SBTs in connection with our SBT initiatives to reduce our Scope 1, Scope 2 and Scope 3 emissions. | |

4 SBA Communications Corporation | 2023 Proxy Statement

PROXY SUMMARY

| What We Heard | How We Responded | |

Shareholders supported renewable energy procurement initiatives and resource efficiency initiatives. | Over the past three years, we have invested more than $18 million on energy efficiency programs alone, including LED office and tower lighting retrofits—and have seen material energy savings. We have also capitalized on the increasing availability of hybrid and electric commercial vehicles, new technologies to reduce the fuel consumption of our vehicle fleet and have leveraged on-tower site renewable energy storage to further reduce the environmental impact of our portfolio. | |

Shareholders supported board oversight over ESG-related issues, such as Diversity, Equity and Inclusion (DEI) matters and Board composition. | Our NCG Governance Committee has oversight over our ESG initiatives, including progress on DEI strategies and receives regular reports from management on our sustainability program and initiatives. | |

Our engagement with a number of leading sustainability rating agencies and data aggregators reflects our sustained efforts to evolve with best practices and implement feedback from our shareholders. We also recognize the increasing importance of assessing and disclosing material climate-related risks and opportunities. Our Task Force on Climate-related Financial Disclosures (TCFD) report and publication of our third corporate sustainability report demonstrate our continued commitment to meeting our shareholders’ sustainability expectations.

Corporate Social Responsibility and Sustainability

As a leader in wireless communications infrastructure and related solutions, we believe our duties extend beyond the cell site. We are firmly committed to sustainable leadership, benefiting our customers, shareholders, suppliers, employees and the communities in which we operate. We build resilient shared infrastructure for telecommunications networks in both developed and emerging markets, thereby enabling increased access to digital technologies with minimal environmental footprint.

Our sustainability strategy focuses on enacting business practices that are both responsible and drive long-term shareholder value. We believe this is best achieved by upholding the highest ethical standards while considering our impact on the planet, local communities and the economy. Our sustainability strategy and the various improvement programs are governed by the Executive Sustainability Committee, comprised of our President and Chief Executive Officer and members of our executive leadership team, and the Sustainability Steering Group, comprised of senior leaders across our business units. Together with our corporate values, the following core environmental, social and corporate governance pillars help guide and prioritize our corporate social responsibility and sustainability strategy and resources:

SBA Communications Corporation | 2023 Proxy Statement 5

PROXY SUMMARY

In December 2022, we published our third corporate sustainability report illustrating our commitment to continued engagement and communication of our sustainable and responsible business practices to our stakeholders. We invite you to review our sustainability report on our website at www.sbasite.com under “Company/Corporate-Responsibility/Sustainability”.

Our NCG Committee has oversight over our Environmental, Social and Corporate Governance (ESG) initiatives, including our corporate sustainability report. Our NCG Committee has received reports from management on our sustainability program and initiatives at every regularly scheduled meeting of the NCG Committee since it was assigned the oversight responsibility.

| The Board of Directors recommends a vote “FOR” each of the director nominees. |

Proposal 2 – Ratification of EY as Auditors (page 75)

The Audit Committee of the Board has appointed Ernst & Young LLP to continue to serve as our independent registered public accounting firm for the 2023 fiscal year.

Ernst & Young has served as our independent registered public accounting firm since 2002.

Each year, the Audit Committee evaluates the qualifications, performance and independence of SBA’s independent registered public accounting firm to determine whether to re-engage the same independent registered public accounting firm or whether it should be rotated.

Based on this evaluation, the Audit Committee believes that the continued retention of Ernst & Young is in the best interests of SBA and its shareholders.

| The Board of Directors recommends a vote “FOR” ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2023 fiscal year. |

Proposal 3 – Advisory Vote on Executive Compensation (page 79)

Overview of Executive Compensation Practices

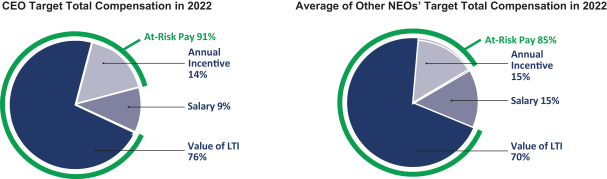

We pay for performance. The core of our executive compensation philosophy is that our executives’ pay should be linked to the performance of SBA. Accordingly, our executives’ compensation is heavily weighted toward compensation that is performance-based or equity-based. The compensation of our named executive officers, or NEOs, for 2022 reflects this commitment. Our executives’ compensation for 2022 consisted of a base salary, an annual incentive bonus and long-term equity awards that vest over or at the end of a three-year period. For 2022, 91% of our CEO’s target total compensation and an average of 85% of our other NEOs’ target total compensation was performance-based or equity-based. As a result, our executives only recognize value approaching their target compensation when our shareholders have enjoyed value creation.

6 SBA Communications Corporation | 2023 Proxy Statement

PROXY SUMMARY

Our long-term incentive award program is responsive to our shareholders. Our long-term incentive awards for our senior executives, which we structured following extensive engagement with our shareholders regarding our executive compensation plan design, are performance-based and we do not award stock options as part of our executive compensation program. Our long-term equity incentive awards are (1) two-thirds in the form of three-year performance-based restricted stock units which are earned equally based on our AFFO growth and our relative TSR performance and (2) one-third in the form of time-based restricted stock units.

Our executive compensation policies align our executives’ interests with those of our shareholders.

| What We Do | What We Do Not Do | |||||

| Robust stock ownership guidelines |  | Limited perquisites | |||

| Robust “no-fault” clawback policy that exceeds Dodd-Frank |

| No acceleration of vesting of equity awards in connection with terminations, absent a change in control | |||

| “Double trigger” change in control provisions in employment agreements |

| No pledging of shares subject to stock ownership requirements | |||

| All equity awards include a “double trigger” in a change in control for acceleration |

| No hedging of shares | |||

| Reduced severance multiple, or limited severance if retirement eligible, for termination without cause not associated with change in control |

| No tax gross-ups on perquisites or change in control benefits | |||

| Annual incentive bonus tied to performance metrics designed to deliver long-term growth and drive shareholder value |

| No pension or supplemental retirement plan benefits | |||

| 2/3rds of equity awards are performance-based and vest over or at the end of a three-year period; all equity awards have multi-year vesting |

| No repricing or buy-outs of stock options without shareholder approval | |||

| Compensation Committee composed entirely of independent directors |

| No stock options granted below fair market value | |||

| Independent compensation consultants, report directly to Compensation Committee and provide no other services to Company |

| Equity plan does not permit liberal share recycling | |||

| Comprehensive annual assessment of compensation risks |

| No liberal change in control definition in equity plan or employment agreements | |||

| The Board of Directors recommends a vote “FOR” adoption of the resolution approving the compensation of our NEOs, as described in the Compensation Discussion & Analysis section. |

SBA Communications Corporation | 2023 Proxy Statement 7

PROXY SUMMARY

Proposal 4 – Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation (page 80)

We are required to hold a vote on the frequency of Say on Pay proposals every six years. At our 2017 annual meeting, our shareholders voted to hold an advisory vote on our executive compensation program every year. Accordingly, we have submitted Say on Pay proposals on the compensation of our named executive officers at every subsequent annual meeting. After careful consideration, our Board recommends that we continue to conduct an advisory vote on executive compensation annually. Our Board believes that a frequency of every year for the Say on Pay vote on executive compensation is the best approach for SBA and our shareholders. An annual advisory vote provides more frequent shareholder feedback to our Board and the Compensation Committee regarding our executive compensation programs and policies.

| The Board of Directors recommends a vote for a frequency of “1 YEAR” for future non-binding shareholder votes on compensation of our named executive officers. |

8 SBA Communications Corporation | 2023 Proxy Statement

|

PROPOSAL 1 – ELECTION OF DIRECTORS

Balanced Board with Unique Perspectives

SBA has delivered TSR of 76% over the past five years, significantly surpassing the TSR of 57% delivered by the S&P 500 over that same period, and we believe that the sound stewardship of our Board has played an integral role in our ability to achieve this success. We are committed to ensuring that our Board is made up of directors who bring to the Board a wealth of leadership experience, diverse viewpoints, knowledge, skills and business experience in the substantive areas that impact our business and align with our strategy.

Our Nominating and Corporate Governance Committee, or NCG Committee, regularly reviews the characteristics, skills, background and expertise of the Board as a whole and its individual members to assess those traits against the developing needs of the Board and SBA. SBA is committed to seeking diversity and balance among directors of race, gender, geography, thought, viewpoints, backgrounds, skills, experience, and expertise. As the fundamentals of the wireless network ecosystem continue to evolve, SBA has continued to pursue ways to adapt and prosper from the ever-changing landscape and our NCG Committee has sought to expand the perspectives of our Board to provide us guidance and insight on this evolution.

As part of our ongoing board refreshment efforts, we have elected three new directors since 2015 and are nominating in this proxy statement two new independent director nominees. In conducting each of these director searches, our NCG Committee considered the leadership, technical skills and operational experience that we believed would address the Board’s then current needs. For each of these searches, we utilized the services of a professional recruiter who was instructed to conduct an extensive search to (1) identify candidates with the leadership, skills and experience targeted by the NCG Committee from, among other areas, the traditional corporate environment (including different stakeholders in the telecommunications and/or wireless industry), government, academia, private enterprise, non-profit organizations, and professions such as accounting, finance, marketing, human resources, and legal services and (2) ensure that the pool of candidates included diverse candidates with a particular focus on race and gender diversity. We believe that this board refreshment process has successfully allowed us to identify candidates who bring valuable viewpoints, backgrounds, skills, experience, and expertise, while also expanding the racial and gender diversity of our Board. Our three most recent nominations for the Board – Mr. Johnson in 2022, and Ms. Bowen and Ms. Wilson in 2023 – are illustrative of that effort. Mr. Johnson, brought to our Board his extensive experience in serving in senior finance roles at multiple REITs, including currently as Chief Financial Officer of Lamar Advertising Company, a leading outdoor advertising company REIT. Ms. Bowen brings to our Board her leadership experience in the development and execution of growth strategies across global portfolios of several multinational telecommunications companies. Finally, Ms. Wilson brings to our Board extensive corporate governance expertise as a corporate executive of a large publicly-traded company with a wealth of experience in global transactions.

The matrix below sets forth the collective skills and experience that we have identified as being essential for our Board to provide sound stewardship and the relevance of such skill or experience to our long-term value creation. Our NCG Committee seeks to have a Board with unique and balanced perspectives; consequently, we do not expect nor seek for each director to have each skill or experience set forth in the matrix. The skills, experience and background of each of our continuing directors and director nominees, and the characteristics that our NCG Committee and our Board identified in connection with his or her nomination is set forth in the director’s or director nominee’s biography which starts on page 12 of this proxy statement.

SBA Communications Corporation | 2023 Proxy Statement 9

PROPOSAL 1 – ELECTION OF DIRECTORS > BOARD QUALIFICATIONS AND SKILLS

The table below sets forth, for our director nominees and our continuing directors as a group, the diverse skills, experience and perspective that they bring to our Board and why our NCG Committee believes that the specific skill, experience or perspective is important to an effective SBA Board.

| SKILLS/EXPERIENCE/PERSPECTIVE | RELEVANCE TO SBA | DIRECTORS | ||||||

| GLOBAL PERSPECTIVE | Given that we operate in 16 countries across four continents, international experience helps our Board understand and anticipate the opportunities and challenges of our business and contributes to a diversity of perspectives in Board decision-making. | 89% | |||||

| WIRELESS/TECHNOLOGY | Directors with technical knowledge, experience in our industry and experience implementing technology strategies provide the Board operational insight and strengthen the Board’s expertise in evaluating and managing evolving technologies such as mobile edge computing. | 56% | |||||

| SENIOR LEADERSHIP | Significant leadership experience, including serving as a C-Suite or division executive, within a complex organization enhances the Board’s ability to manage risk and oversee operations. | 100% | |||||

| FINANCIAL/ACCOUNTING | Directors with strong financial and accounting backgrounds allow effective oversight and understanding of financial reporting, financing transactions, complex acquisitions and internal controls. | 67% | |||||

| INVESTMENT/CAPITAL ALLOCATION | Directors with experience with debt/capital market transactions and corporate finance experience assist in evaluating our financial vision and capital allocation strategy. | 78% | |||||

| PUBLIC COMPANY BOARD/ CORPORATE GOVERNANCE | Prior public company board and corporate governance experience supports our goals of strong Board and management accountability, transparency, effective oversight and good governance. | 100% | |||||

| RISK MANAGEMENT/ COMPLIANCE | Skills and experience in assessment and management of business and financial risk factors allow the Board to effectively oversee risk management and assist SBA in managing the risks that it encounters. | 67% | |||||

| MERGERS AND ACQUISITIONS/ STRATEGIC INVESTMENTS | As portfolio growth is a vital element in SBA’s long-term growth strategy, experience in evaluating and implementing M&A and strategic investments furthers the Board’s management and oversight of these transactions. | 100% | |||||

| OPERATIONAL/ HUMAN RESOURCES | Directors with operational and human capital experience provide the Board insight into effective recruitment, retention and succession planning. | 89% | |||||

10 SBA Communications Corporation | 2023 Proxy Statement

PROPOSAL 1 – ELECTION OF DIRECTORS > BOARD QUALIFICATIONS AND SKILLS

We seek to have a Board of independent directors that bring to us a wide range of viewpoints and experiences. As discussed later in this proxy statement, we annually evaluate the independence of each of our directors utilizing the definition of “independent director” in the listing rules of the Nasdaq Stock Market.

Our Board consists of independent, unaffiliated directors with a diversity of age, gender and ethnicity and a range of tenure, with our longer-serving directors providing important institutional knowledge and experience and our newer directors bringing fresh perspectives to deliberations. As shown in the Average Tenure chart below, our director nominees and continuing directors, excluding Mr. Bernstein, who founded SBA, and Mr. Stoops, our CEO, have a range of experience and tenure on our Board with an average tenure of 7 years.

Assuming the election of our director nominees, the composition of the Board will be as follows:

As of April 12, 2023, the composition of our Board was as follows:

| Board Diversity Matrix (As of April 12, 2023) | ||||||||

Total Number of Directors | 9 | |||||||

| Female | Male | |||||||

Gender Identity | ||||||||

Directors | 2 | 7 | ||||||

Demographic Background | ||||||||

African American or Black | — | 1 | ||||||

Asian | 1 | — | ||||||

White

|

| 1

|

|

| 6

|

| ||

SBA Communications Corporation | 2023 Proxy Statement 11

PROPOSAL 1 – ELECTION OF DIRECTORS > DIRECTORS AND DIRECTOR NOMINEES

Our Directors and Directors Nominees

Our Board, upon recommendation of our NCG Committee, has nominated Steven E. Bernstein, a current Class III Director, as well as Laurie Bowen and Amy E. Wilson, to be elected to serve as Class III directors of the Board for a three-year term expiring at the 2026 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified. Each of Mr. Bernstein, Ms. Bowen and Ms. Wilson has consented to serve if elected. Two of our directors, Ms. Russo who has served since 2020, and Mr. Cocroft, one of our longest-serving directors having served on our Board since 2004, advised us that they would not be standing for re-election at this year’s annual meeting. We are extremely grateful for the years of service and insight Ms. Russo and Mr. Cocroft have provided the Board and SBA during their respective tenures.

Our Bylaws permit the Board of Directors to set the size of the Board. At the beginning of 2022, our Board of Directors had eight directors. Following the appointment and election of Mr. Johnson as a Class I director in March 2022, the Board size was expanded and returned to its historical level of nine directors, eight of whom are independent. For the size and scope of our business and operations, we believe a board of approximately this size is appropriate as it is small enough to allow for effective communication among the members but large enough so that we get a diverse set of perspectives and experiences in our board room.

Our Board of Directors is currently divided into three classes. We believe that the classified Board is the most effective way for the Board to be organized because it ensures a greater level of certainty of continuity from year-to-year which provides stability in organization and experience. This continuity and stability is particularly important given the long-term nature of the agreements under which we produce revenue. As a result of the three classes, at each Annual Meeting, directors are elected for a three-year term.

Our Board, current directors and classifications are as follows:

| Class I | Class II | Class III | ||

| Mary S. Chan | Kevin L. Beebe | Steven E. Bernstein | ||

| George R. Krouse, Jr. | Jack Langer | Duncan H. Cocroft* | ||

| Jay L. Johnson | Jeffrey A. Stoops | Fidelma Russo* | ||

* Laurie Bowen and Amy E. Wilson have been nominated for election at the Annual Meeting and, if elected, will each serve as a Class III director, with a term expiring at the 2026 Annual Meeting.

Our Bylaws provide that, in uncontested elections, directors will be elected by a majority of the votes cast, and in contested elections, directors will be elected by a plurality of the votes cast. Our Bylaws further provide that a director who is not elected by a majority of the votes cast in an uncontested election must tender his or her resignation to the Board of Directors. The Board of Directors, taking into consideration the recommendation of the NCG Committee, will then decide whether to accept or reject the resignation, or whether other action should be taken.

As discussed above, we believe that each of our continuing directors and director nominees possesses the experience, skills and qualities to fully perform his or her duties as a director and contribute to SBA’s success. Our directors and director nominees were nominated because each is of high ethical character, highly accomplished in his or her field with superior credentials and recognition, has a reputation, both personal and professional, that is consistent with SBA’s image and reputation, has the ability to exercise sound business judgment, and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Each continuing director’s and director nominee’s principal occupation and other pertinent information about particular experience, qualifications, attributes and skills that led the Board to conclude that such person should serve as a director, appears on the following pages.

12 SBA Communications Corporation | 2023 Proxy Statement

PROPOSAL 1 – ELECTION OF DIRECTORS > NOMINEES FOR DIRECTOR

Nominees for Director

Class III Director Nominees

For Terms Expiring at the 2026 Annual Meeting

Steven E. Bernstein Director since: 1989 Independent Age: 62 Chair | Mr. Bernstein, our founder, has served as our Chair since our inception in 1989 and was our Chief Executive Officer from 1989 to 2001. Mr. Bernstein is also involved in a number of personal commercial real estate and other types of investments. Mr. Bernstein also serves on the Board of Directors of SpringBig Holdings, Inc., a digital marketing software company. Mr. Bernstein has a Bachelor of Science in Business Administration with a major in Real Estate from the University of Florida. Mr. Bernstein was previously a visiting professor at Lynn University, and serves on the boards of various local charities. | |

Qualifications. The Board nominated Mr. Bernstein to serve as a director of the Board because of his extensive senior management and operational experience in the wireless communications industry, including as the founder and first President and Chief Executive Officer of SBA.

Laurie Bowen Independent Age: 61 | Ms. Bowen is an experienced executive with over thirty years of leadership experience at large multinational telecommunications and technology companies. From 2016 through 2018, Ms. Bowen served as Chief Executive of Telecom Italia Sparkle in the Americas, a subsidiary of the international wholesale arm of Telecom Italia. From 2013 through 2015, she served as CEO, Business Solutions for Cable & Wireless Communications plc. She previously held senior positions at Tata Communications, BT Group plc and IBM. Since July 2015, Ms. Bowen has served as a non-executive director, and since 2020 Chair of the Nomination Committee, for Ricardo, PLC, a global engineering, environmental and strategic consultancy company. Since 2019, Ms. Bowen has served as a non-executive director and Chair of the Compensation committee for Chemring Group PLC, a global company which provides technology products and services to the aerospace, defense and security markets. Chemring Group PLC and Ricardo PLC are listed on the London Stock Exchange. Ms. Bowen previously served as a non-executive director at customer experience technology provider, Transcom Worldwide AB, listed on the Nasdaq Stockholm Exchange. | |

Qualifications. The Board nominated Ms. Bowen to serve as a director of the Board because of her extensive senior management experience with global telecommunications companies and implementation of growth strategies across international telecommunications portfolios.

| ||

SBA Communications Corporation | 2023 Proxy Statement 13

PROPOSAL 1 – ELECTION OF DIRECTORS > NOMINEES FOR DIRECTOR

Amy E. Wilson Independent Age: 52 | Amy E. Wilson is an experienced executive and attorney with over twenty years of corporate leadership and counsel experience within several areas of a worldwide Fortune 100 public company. Since October 2018, Ms. Wilson has served as General Counsel and Corporate Secretary for Dow Inc., a publicly-traded materials science company. From 2015 to 2018, Ms. Wilson served as the Corporate Secretary and Associate General Counsel for Dow. Ms. Wilson joined Dow’s Legal Department in 2000 and held various positions, including serving as Assistant Corporate Secretary and Assistant General Counsel from 2013 to 2015, and Senior Counsel and Assistant Corporate Secretary from 2008 to 2013. Prior to joining Dow, Ms. Wilson was an attorney with Currie Kendall, PLC, where she practiced in the areas of corporate and transactional law. Ms. Wilson currently serves on the Board of Directors for the U. S. Chamber of Commerce and MyMichigan Health and the Board of Trustees for the Charles J. Strosacker Foundation. | |

Qualifications. The Board nominated Ms. Wilson to serve as a director of the Board because of the breadth of her corporate governance and global transactional experience. The Board also considered her senior management and public company experience.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” each of the director nominees.

14 SBA Communications Corporation | 2023 Proxy Statement

PROPOSAL 1 – ELECTION OF DIRECTORS > DIRECTORS CONTINUING IN OFFICE

Directors Continuing in Office

Class I Directors

Terms Expire at the 2024 Annual Meeting

Mary S. Chan Director since: 2015 Independent Age: 60 Committees: • Compensation • Nominating and Corporate Governance | Ms. Chan is a telecommunications executive and has over 25 years of extensive global management experience in the telecommunications and wireless technology industries. Ms. Chan co-founded and since February 2016 has served as Managing Partner of VectoIQ, LLC, a consulting firm focused on Smart transportation product and services. From January 2021 to December 2022, Ms. Chan served as President and Chief Operating Officer of VectoIQ Acquisition Corp. II, a special purpose acquisition company. From May 2012 to April 2015, Ms. Chan served as President, Global Connected Consumer & OnStar Service, at General Motors Corporation, where she led the development and execution of General Motors’ strategic global infotainment plans, including the launch of 4G LTE connectivity across its global portfolio of vehicle brands. From September 2009 to March 2012, Ms. Chan served as Senior Vice President and General Manager, Enterprise Mobility Solutions & Services, at Dell Inc., where she helped expand Dell’s mobility product and service offerings. From December 2000 to August 2009, Ms. Chan held various senior vice president positions at Alcatel-Lucent and Lucent Technologies, including the positions of Executive Vice President, President of 4G/LTE Wireless Networks and Executive Vice President, President of Global Wireless Networks. Prior to Alcatel-Lucent/Lucent Technologies, Ms. Chan worked at AT&T Network Systems focusing on product and platform development of 2G and 3G wireless systems. Ms. Chan also serves on the Boards of Directors of CommScope Holding Company, Inc., a global network infrastructure provider, and Magna International Inc., a global automotive parts supplier. | |

Qualifications. The Board nominated Ms. Chan to serve as a director of the Board because of her extensive experience in the telecommunications and wireless technology industries, including her leadership experience in the development and execution of General Motors’ launch of 4G LTE connectivity across its global portfolio of vehicle brands. The Board also recognized her management experience gained through various senior management positions at large multinational companies.

SBA Communications Corporation | 2023 Proxy Statement 15

PROPOSAL 1 – ELECTION OF DIRECTORS > DIRECTORS CONTINUING IN OFFICE

Jay L. Johnson Director since: 2022 Independent Age: 46 Committees: • Audit • Nominating and Corporate Governance | Mr. Johnson has served as the Chief Financial Officer, Executive Vice President and Treasurer of Lamar Advertising Company, a leading outdoor advertising company, since October 2019. Prior to joining Lamar Advertising Company, Mr. Johnson served as Executive Vice President and Chief Financial Officer of DiamondRock Hospitality Company, a self-advised real estate investment trust with a portfolio of hotels and resorts, from April 2018 until August 2019, and as Senior Vice President and Treasurer of Host Hotels & Resorts, Inc. (“Host”), a major lodging real estate investment trust and owner of luxury hotels, from April 2015 to March 2018. Prior to his role as Senior Vice President and Treasurer of Host, Mr. Johnson served from 2010 through 2015 in various roles within Host’s corporate finance and treasury group. Prior to joining Host, Mr. Johnson served in various positions at KeyBank Real Estate Capital and at Bank of America. Prior to those roles in banking, he worked with the management consulting practice of Deloitte & Touche LLP and in the investment banking group at Prudential Securities and the industrial markets trading division of Enron Corporation. Mr. Johnson also serves as a member of the board of directors at Newell Brands, Inc., a global consumer goods company. | |

Qualifications. The Board nominated Mr. Johnson to serve as a director of the Board because of his executive and management experience, financial expertise, and his extensive experience in real estate, REITs and financial services.

George R. Krouse, Jr. Director since: 2009 Independent Age: 77 Committees: • Audit • Nominating and Corporate Governance (Chair) | Mr. Krouse, an attorney, retired in December 2007 after spending 37 years at the law firm of Simpson Thacher & Bartlett LLP, where he practiced in the corporate, capital markets and merger and acquisition areas. While at Simpson Thacher & Bartlett LLP, Mr. Krouse served as Head of the Corporate Department, managing partner and was a member of the Executive Committee of the firm. Mr. Krouse also serves on the Board of Visitors at Duke University School of Law and is a 2002 recipient of the Law School’s Distinguished Alumni Award. In 2006, he was appointed a Senior Lecturing Fellow at Duke University School of Law. | |

Qualifications. The Board nominated Mr. Krouse to serve as a director of the Board because of his years and depth of experience as a securities and M&A partner at a major law firm, where he counseled large companies on matters of corporate governance, risk oversight, capital markets, general business matters and acquisition transactions, as well as his senior financial and business management experience at this same firm.

16 SBA Communications Corporation | 2023 Proxy Statement

PROPOSAL 1 – ELECTION OF DIRECTORS > DIRECTORS CONTINUING IN OFFICE

Class II Directors

Terms Expire at the 2025 Annual Meeting

Kevin L. Beebe Director since: 2009 Independent Age: 64 Committees: • Audit • Compensation | Since November 2007, Mr. Beebe has been President and Chief Executive Officer of 2BPartners, LLC, a partnership that provides strategic, financial and operational advice to investors and management. Previously he was Group President of Operations at ALLTEL Corporation, a telecommunications services company, from 1998 to 2007. From 1996 to 1998, Mr. Beebe served as Executive Vice President of Operations for 360° Communications Co., a wireless communications company. Mr. Beebe also serves on the Boards of Directors of Skyworks Solutions, Inc., a semiconductor company, and Frontier Communications Corporation, a communications company. In addition, Mr. Beebe is a founding partner in Astra Capital, a private equity firm. | |

Qualifications. The Board nominated Mr. Beebe to serve as a director of the Board because of his executive and management experience, and in particular his extensive experience in telecommunications and technology.

Jack Langer Director since: 2004 Independent Age: 74 Committees: • Compensation (Chair) • Nominating and Corporate Governance Lead Independent Director | Mr. Langer is a private investor. From April 1997 to December 2002, Mr. Langer served as Managing Director and the Global Co-Head of the Media Group at Lehman Brothers Inc. From 1995 to 1997, Mr. Langer served as the Managing Director and Head of Media Group at Bankers Trust & Company. From 1990 to 1994, Mr. Langer served as Managing Director and Head of Media Group at Kidder Peabody & Company, Inc. Mr. Langer previously served on the Board of Directors of CKX, Inc., a publicly traded company engaged in the ownership, development and commercial utilization of entertainment content. | |

Qualifications. The Board nominated Mr. Langer to serve as a director of the Board because of his management and advisory experience with national and global companies as well as his vast experience in investment banking, including his experience in raising capital for companies and mergers and acquisitions.

Jeffrey A. Stoops Director since: 1999 President, Chief Executive Officer and Director Age: 64 | Mr. Stoops joined SBA in April 1997 and has served as a director of SBA since August 1999. Mr. Stoops was appointed Chief Executive Officer effective as of January 2002, President in April 2000, and previously served as our Chief Financial Officer. Mr. Stoops served on the Board of Directors of Custom Truck One Source, Inc., a specialty equipment company, from July 2019 to April 2021. | |

Qualifications. The Board nominated Mr. Stoops to serve as a director of the Board because of his current and prior senior executive and financial management experience at SBA, his operational knowledge and experience at SBA and his business and competitive knowledge of the wireless infrastructure industry.

SBA Communications Corporation | 2023 Proxy Statement 17

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors has voluntarily adopted Corporate Governance Guidelines. Our Corporate Governance Guidelines describe our corporate governance practices and policies and provide a framework for our Board governance. The topics addressed in our Corporate Governance Guidelines include director independence, director qualifications, committee membership and structure, shareholder communications with the Board, director compensation and the annual performance evaluation of the Board. Our Corporate Governance Guidelines provide, among other things, that:

| > | In the event the Chair is not an independent director, the independent directors of the Board will, upon recommendation of the NCG Committee, appoint a Lead Independent Director; |

| > | A majority of directors of the Board must be independent as defined by the Nasdaq Listing Standards; |

| > | No director may serve on more than two public company boards in addition to SBA’s Board without prior consultation with the Chair of the NCG Committee; |

| > | The Board will have, at all times, an Audit Committee, Compensation Committee and NCG Committee (the “Committees”), and each of their members will be independent as defined by the Nasdaq Listing Standards and applicable SEC rules; |

| > | The Board will appoint all members of the Committees; |

| > | The Board will conduct an annual self-evaluation to determine whether it and its Committees are functioning effectively; |

| > | Each director nominee must agree to tender his or her resignation for consideration by the Board if such director fails to receive a majority of votes cast in any uncontested re-election; |

| > | No executive officer or director may pledge any shares of SBA’s Class A common stock that count toward satisfying such executive officer’s or director’s ownership requirement as set forth in the Stock Ownership Guidelines; and |

| > | No executive officer or director may enter into hedging arrangements with respect to any shares of SBA’s Class A common stock. |

The NCG Committee reviews our Corporate Governance Guidelines not less than annually, and, if necessary, will recommend changes to the Board. Our Corporate Governance Guidelines are available to view at our website, www.sbasite.com, under the Investor Relations – Corporate Governance section.

Board Leadership Structure

As stated in our Corporate Governance Guidelines, the Board has not adopted a formal policy regarding the need to separate or combine the offices of Chair of the Board and Chief Executive Officer and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for SBA. Currently, SBA separates the positions of CEO and Chair in recognition of the differences between the two roles. The CEO is responsible for the strategic direction of SBA and the day-to-day leadership and performance of SBA, while the Chair provides guidance to the CEO, sets the agenda for the Board meetings and presides over

18 SBA Communications Corporation | 2023 Proxy Statement

CORPORATE GOVERNANCE

meetings of the Board. In addition, SBA believes that the current separation provides a more effective monitoring and objective evaluation of the CEO’s performance. The separation also allows the Chair to strengthen the Board’s objective oversight of SBA’s performance and governance standards.

Lead Independent Director

In order to facilitate and strengthen the Board’s independent oversight of SBA’s performance, strategy and succession planning and to uphold effective governance standards, the Board has established the role of a Lead Independent Director. Our Corporate Governance Guidelines only require the appointment of a Lead Independent Director in the event that our Chair is not independent. Although our current Chair, Mr. Bernstein, is “independent” under the Nasdaq Listing Standards, the Board decided to continue to maintain a Lead Independent Director for 2023 as it believes that the Lead Independent Director provides additional perspective and expanded communication among directors. Mr. Langer currently serves as SBA’s Lead Independent Director.

The Lead Independent Director’s duties, which are listed in our Corporate Governance Guidelines, include:

| > | presiding at all executive sessions of the independent directors and Board meetings at which the Chair is not present; |

| > | serving as liaison between the Chair and the independent directors; |

| > | approving the Board meeting agendas and schedules and the subject matter of the information to be sent to the Board; |

| > | the authority to call meetings of the independent directors; |

| > | ensuring he or she is available for consultation and direct communication if requested by major shareholders; and |

| > | performing such other duties as the Board deems appropriate. |

Board Meetings

During 2022, the Board of Directors held a total of six meetings. Each incumbent director attended at least 75% of the aggregate of (1) the total number of meetings of the Board during the period in which he or she was a director and (2) the total number of meetings of all Board committees (“Committees”) on which he or she served during the period in which he or she was a director. It is the policy of the Board of Directors to encourage its members to attend SBA’s Annual Meeting of Shareholders. All members of the Board of Directors in 2022 were present at SBA’s 2022 Annual Meeting of Shareholders.

Board Committees

The Board has three standing Committees: the Audit Committee, the Compensation Committee and the NCG Committee. Copies of the Committee charters of each of the Audit Committee, the Compensation Committee and the NCG Committee setting forth the respective responsibilities of the Committees can be found under the Investor Relations – Corporate Governance section of our website at www.sbasite.com, and such information is also available in print to any shareholder who requests it through our Investor Relations department. Each of the Committees reviews, and revises (if necessary), its respective charter not less than annually.

Each Committee Chair reports on the Committee actions and recommendations at Board of Director meetings.

SBA Communications Corporation | 2023 Proxy Statement 19

CORPORATE GOVERNANCE

AUDIT COMMITTEE

Members

Duncan H. Cocroft (Chair) Kevin L. Beebe Jay L. Johnson George R. Krouse Jr. Fidelma Russo

Number of Meetings in 2022

6 | Responsibilities

> Oversees our accounting and financial reporting processes and the audits of our financial statements.

> Establishes our audit policies, evaluates the independence of and selects our independent auditors, and oversees the engagement of our independent auditors. The Audit Committee maintains free and open means of communication between our directors, management and the independent auditors.

> Oversees the performance of our internal audit function, develops controls to ensure the integrity of our financial statements and the quality of disclosure, and monitors our compliance with legal and regulatory requirements.

> Responsible for monitoring the effectiveness of our information system, cybersecurity and data privacy controls. In connection with such responsibilities, the Audit Committee receives quarterly reports from our Senior Vice President and Chief Information Officer.

> Establishes procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters.

> Preparation of Report of the Audit Committee (page 71).

Independence and Financial Expertise

The Board of Directors has determined that each member of the Audit Committee meets the independence requirements under the Nasdaq Listing Standards and the enhanced independence standards for audit committee members required by the SEC.

The Board of Directors has determined that each of Messrs. Beebe, Cocroft and Johnson meets the requirements of an audit committee financial expert under SEC rules. For information regarding the business experience of the members of the Audit Committee, see “Proposal 1 – Election of Directors.”

|

20 SBA Communications Corporation | 2023 Proxy Statement

CORPORATE GOVERNANCE

COMPENSATION COMMITTEE

Members

Jack Langer (Chair) Kevin L. Beebe Mary S. Chan Duncan H. Cocroft

Number of Meetings in 2022

5 | Responsibilities

> Establishes salaries, incentives and other forms of compensation for our Chief Executive Officer, each of our executive officers (our Executive Vice Presidents) and our Chief Accounting Officer (collectively, the “Officer Group”) and terms of any related employment agreements.

> Periodic review and recommendations for director compensation.

> Administers our equity-based compensation plans, including awards under such plans, and our Stock Ownership Guidelines.

> Oversees and administers our Executive Compensation Recoupment Policy.

> Reviews the results of any advisory shareholder votes on executive compensation and considers whether to recommend adjustments to our executive compensation policies and practices as a result of such votes.

> Periodic review of talent development programs, human capital management and succession planning.

> Preparation of Compensation Committee Report (page 55).

> The Compensation Committee Chair reports on Compensation Committee actions and recommendations at Board of Director meetings.

Independence

The Board reviewed the background, experience and independence of the Compensation Committee members based primarily on the directors’ responses to questions relating to their relationships, background and experience. Based on this review, the Board determined that each member of the Compensation Committee meets the independence requirements of the Nasdaq Listing Standards, including the heightened independence requirements specific to compensation committee members.

|

Role of Compensation Consultants and Advisors. The Compensation Committee has the authority, pursuant to its charter, to engage the services of outside legal or other experts and advisors as it in its sole discretion deems necessary and appropriate to assist the Compensation Committee in fulfilling its duties and responsibilities. For 2022, the Compensation Committee selected and retained F.W. Cook & Co., Inc. (“FW Cook”), an independent compensation consulting firm, and instructed FW Cook to provide the Compensation Committee with a review of competitive market data for each member of the Officer Group, and to work directly with the Compensation Committee to prepare proposals for 2022 executive compensation and director compensation. FW Cook also assisted with structuring our performance-based equity award program. FW Cook did not perform any services for us other than its services to the Compensation Committee. We believe that the use of independent consultants provides additional assurance that our programs are reasonable and consistent with our objectives. The Compensation Committee reviewed the independence of FW Cook in light of the SEC rules and the Nasdaq Listing Standards regarding compensation consultants and has concluded that FW Cook’s work for the Compensation Committee during 2022 did not raise any conflict of interest and that FW Cook is independent.

SBA Communications Corporation | 2023 Proxy Statement 21

CORPORATE GOVERNANCE

Role of Management and Delegation of Authority. As more fully discussed under “Compensation Discussion and Analysis – Evaluating Compensation Program Design and Relative Competitive Position,” our CEO provides the Compensation Committee with (1) evaluations of each named executive officer, including himself, and (2) recommendations regarding base salary levels for the upcoming year for each named executive officer (other than himself), an evaluation of the extent to which the named executive officer met his annual incentive plan bonus target, and the aggregate total long-term incentive value that each named executive officer (other than himself) should receive. Our CEO typically attends all regularly-scheduled Compensation Committee meetings to assist the Compensation Committee in its discussion and analysis of the various agenda items, and is generally excused from the meetings as appropriate, including for discussions regarding his own compensation. The Compensation Committee may delegate to SBA’s management the authority to administer incentive compensation and benefit plans provided for employees, as it deems appropriate and to the extent permitted by applicable laws, rules, regulations and Nasdaq Listing Standards.

Compensation Committee Interlocks and Insider Participation. During 2022, Ms. Chan and Messrs. Beebe, Cocroft and Langer served as members of the Compensation Committee, and none of these directors is or has been an officer or employee of SBA. During 2022, none of our executive officers served as a director of another entity, one of whose executive officers served on the Compensation Committee, and none of our executive officers served as a member of the compensation committee of another entity, whose executive officers served as a member of our Board.

There were no transactions during the 2022 fiscal year between SBA and any of the directors who served as members of the Compensation Committee for any part of the 2022 fiscal year that would require disclosure by SBA under the SEC’s rules requiring disclosure of certain relationships and related party transactions.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Members

George R. Krouse, Jr. (Chair) Jay L. Johnson Jack Langer Fidelma Russo

Number of Meetings in 2022

5 | Responsibilities

> Solicits, considers, recommends and nominates candidates to serve on the Board under criteria adopted by it from time to time.

> Nominates the Lead Independent Director in the event the Chair is not an independent director.

> Recommends to the Board whether to accept or reject the resignation tendered by a director who failed to receive a majority of votes cast in any uncontested re-election.

> Advises the Board with respect to Board composition and procedures and Committee composition, function, structure, procedures and charters.

> Oversees periodic evaluations of the Board, the Committees and directors, including establishing criteria to be used in connection with such evaluations.

> Reviews and reports to the Board on a periodic basis with regard to matters of corporate governance.

> Develops and reviews succession planning for Board members and executive officers.

> Oversees our ESG initiatives and reporting, including our corporate sustainability report.

> Considers and recommends to the Board the approval of any waivers to SBA’s Code of Conduct (as defined below) for a director or executive officer.

|

22 SBA Communications Corporation | 2023 Proxy Statement

CORPORATE GOVERNANCE

Consideration of Director Nominees. The NCG Committee considers possible candidates for nominees for directors from many sources, including management and shareholders. The NCG Committee evaluates the suitability of potential candidates nominated by shareholders in the same manner as other candidates recommended to the NCG Committee, in accordance with the Criteria for Nomination to the Board of Directors, which is attached as Annex A to the NCG Committee charter. The NCG Committee Charter requires, and the Criteria for Nomination provides, that, when considering nominees for the Board, the NCG Committee should seek to provide a diversity and balance among directors of race, gender, geography, thought, viewpoints, background, skills, experience and expertise. The Criteria for Nomination to the Board of Directors contains the following requirements, among others, for suitability:

| > | high ethical character and a reputation that is consistent with SBA’s reputation; |

| > | superior credentials; |

| > | current or prior experience as a CEO, President or CFO of a public company or leading a complex organization; |

| > | relevant expertise and experience; |

| > | the number of other boards (and their committees) on which a candidate serves; |

| > | the ability to exercise sound business judgment; and |

| > | the lack of material relationships with competitors or other third parties that could present realistic possibilities of conflict of interest or legal issues. |

The NCG Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to SBA’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the NCG Committee or the Board decides not to re-nominate a member for re-election, the NCG Committee identifies the desired skills and experience of a new nominee in light of the Criteria for Nomination. Current members of the NCG Committee and Board are polled for suggestions as to individuals meeting the Criteria for Nomination of the NCG Committee.

From time to time, the NCG Committee has engaged, and may in the future engage, the services of executive search firms to assist the NCG Committee and the Board of Directors in identifying and evaluating potential director candidates. The NCG Committee Charter requires that any search firm retained to assist the NCG Committee in seeking candidates for the Board be instructed to seek to include diverse candidates in terms of the Criteria for Nomination from, among other areas, the traditional corporate environment, government, academia, private enterprise, non-profit organizations, and professions such as accounting, finance, marketing, human resources, and legal services.

Shareholder Nominations of Director Candidates. Our Bylaws permit an eligible shareholder or group of eligible shareholders of any size to nominate up to 25% of our board of directors for inclusion in our proxy statement if they have continuously owned at least 3% of our Class A common stock for at least three years. However, candidates who were previously nominated by shareholders for any of the two most recent annual meetings and who received less than 20% of the total votes cast at any of those annual meetings are not eligible to be nominated utilizing the proxy access provisions. Shareholders who wish to nominate directors for inclusion in our proxy statement or directly at an annual meeting in accordance with the procedures in our Bylaws should follow the instructions under “Shareholder Proposals and Director Nominations” in this proxy statement.

SBA Communications Corporation | 2023 Proxy Statement 23

CORPORATE GOVERNANCE

Board Independence

Pursuant to our Corporate Governance Guidelines, we require that a majority of our Board of Directors and all members of our three standing Committees be comprised of directors who are “independent,” as such term is defined in the listing standards of the Nasdaq Stock Market (the “Nasdaq Listing Standards”). Each year, the Board undertakes a review of the independence of directors and director nominees, which includes a review of responses to questionnaires asking about any relationships with us. This review is designed to identify and evaluate any transactions or relationships between a director or director nominee, or any member of his or her immediate family and us, or members of our senior management or other members of our Board of Directors, and all relevant facts and circumstances regarding any such transactions or relationships. Consistent with these considerations, our Board has affirmatively determined that each of Mses. Bowen, Chan, Russo and Wilson and each of Messrs. Beebe, Bernstein, Cocroft, Johnson, Krouse and Langer are independent.

Executive Sessions. The independent members of the Board of Directors generally meet in executive session at each regularly scheduled meeting of the Board.

Board and Committee Self-Evaluation and Refreshment

Our Board conducts annual self-evaluations to assess the effectiveness of the Board and its Committees. These annual self-evaluations are overseen by the NCG Committee and are designed to enhance the overall effectiveness of the Board and each Committee and identify areas of potential improvement. They include written questionnaires that solicit feedback from the Board and Committee members on a range of topics, including the Committees’ roles, structure and composition; the extent to which the mix of skills, experience and other attributes of the individual directors is appropriate for the Board and each Committee; the scope of duties delegated to the Committees, including the allocation of risk assessment between the Board and its Committees; interaction with management; information and resources; the adequacy of open lines of communication between directors and members of management; the Board and Committee meeting process and dynamics; and follow-through on recommendations developed during the evaluation process.

Our Board has also implemented annual individual director self-evaluations that require each director to assess his or her performance as a director and the performance of the Board as a whole. This process involves directors providing direct feedback to the Chair of the Board, the Lead Independent Director and the Chair of the NCG Committee who, in turn, review the self-evaluations for any actions that should be taken to enhance the effectiveness of the Board.

Following the annual self-evaluations, the NCG Committee discusses areas for potential improvement with the Board and/or relevant Committees and, if necessary, identifies steps required to implement these improvements. Director suggestions for improvements to the evaluation questionnaires and process are considered for incorporation for the following year. As part of the NCG Committee’s discussion and evaluation of areas for improvement, board refreshment, including the commitment to have a balanced Board with diversity of skills and experience, is a topic that is considered.

The NCG Committee and the Board regularly review Board composition and succession planning, including succession planning for the Chair of the Board and/or Lead Independent Director. As part of such review the NCG Committee and the Board considers the additional director qualifications, skills, experience, attributes and diversity that would enhance overall Board effectiveness. The NCG Committee also considers the size and composition of the Board and its Committees, as well as the Board leadership structure to ensure strong independent oversight and a Board that best meets the evolving needs of SBA. As embodied in our Governance

24 SBA Communications Corporation | 2023 Proxy Statement

CORPORATE GOVERNANCE

Guidelines, SBA is committed to seeking diversity and balance on our Board with directors of race, gender, geography, thoughts, viewpoints, backgrounds, skills, experience and expertise. As part of our ongoing board refreshment efforts, we have elected three new directors since 2015 and are nominating in this proxy statement two new independent director nominees. In conducting each of these director searches, our NCG Committee considered the leadership, technical skills and operational experience that we believed would address the Board’s then current needs. For each of these searches, we utilized the services of a professional recruiter who was instructed to conduct an extensive search to (1) identify candidates with the leadership, skills and experience targeted by the NCG Committee from, among other areas, the traditional corporate environment (including different stakeholders in the telecommunications and/or wireless industry), government, academia, private enterprise, non-profit organizations, and professions such as accounting, finance, marketing, human resources, and legal services and (2) ensure that the pool of candidates included diverse candidates with a particular focus on race and gender diversity. We believe that this board refreshment process has successfully allowed us to identify candidates who bring valuable viewpoints, backgrounds, skills, experience, and expertise, while also expanding the racial and gender diversity of our Board. Our three most recent nominees to the Board—Mr. Johnson in 2022, and Ms. Bowen and Ms. Wilson in 2023—are illustrative of that effort. Mr. Johnson, brought to our Board his extensive experience in serving in senior finance roles at multiple REITs, including currently as Chief Financial Officer of Lamar Advertising Company, a leading outdoor advertising company REIT. Ms. Bowen brings to our Board her leadership experience in the development and execution of growth strategies across global portfolios of several multinational telecommunications companies. Finally, Ms. Wilson brings to our Board extensive corporate governance expertise as a corporate executive of a large publicly-traded company with a wealth of experience in global transactions.

Executive Succession Planning

Succession planning and execution is one of the Board’s most important responsibilities, and the success of our recent leadership transitions is a testament to the care and diligence that the Board has devoted to this key topic. For many years, the Board has focused attention on this area and has developed programs and procedures designed to address it. These plans became relevant and actionable when Kurt Bagwell, our Executive Vice President and President – International, and Thomas Hunt, our Executive Vice President, Chief Administrative Officer and General Counsel, each announced his intention to retire effective at the end of 2022. The resulting transition, which included Richard Cane being promoted to Executive Vice President and President – International and Joshua Koenig being promoted to Executive Vice President, Chief Administrative Officer and General Counsel, was carried out smoothly and orderly with the oversight of the NCG Committee and the Compensation Committee. More recently, Jeffrey Stoops announced that he would retire at the end of 2023 and the Board announced that our current Executive Vice President and Chief Financial Officer, Brendan Cavanagh, would assume the position of President and Chief Executive Officer upon Mr. Stoops’ retirement.

The Board’s succession planning activities are strategic, long-term and supported by the Board’s committees and external consultants. As a result of the Board’s thoughtful approach to executive succession planning, the Board was well-positioned to effectuate the recent leadership transitions. The Board was intensively involved in evaluating each of these executives prior to their promotions and had opportunities to observe each executive through presentations to the Board as well as through significant informal contact.

SBA Communications Corporation | 2023 Proxy Statement 25

CORPORATE GOVERNANCE

Risk Management

Board Role in Management of Risk

The Board is actively involved in the oversight and management of risks that could affect SBA. This oversight and management is conducted primarily through Committees, as disclosed below, but the full Board has retained responsibility for general oversight of risks. The NCG Committee is responsible for annually reviewing and delegating the risk oversight responsibilities of each Committee and ensuring that each Committee should be primarily responsible for that oversight.

| Committee | Areas of Risk Management Oversight | |

Audit Committee | Risk management process; management and effectiveness of accounting, auditing, external reporting, ethics, compliance and internal controls and cybersecurity | |

Compensation Committee | Executive compensation and benefits policies, practices and disclosures, leadership succession planning and talent management, work environment and culture | |

Nominating and Corporate Governance Committee | Director independence, Board refreshment and succession planning, overall Board effectiveness, potential conflicts of interest and other governance, sustainability and climate reporting and compliance matters | |

Although each Committee is responsible for overseeing the management of certain risks as delegated to such Committees by the full Board, the Committees report back to the full Board regarding the risks described above. This enables the Board and the Committees to coordinate risk oversight and the relationships among the various risks faced by us.

Oversight of Cybersecurity Risks

Our Board believes a strong cybersecurity strategy is vital to protect our business, customers and assets. The Audit Committee oversees SBA’s internal cybersecurity and other information technology and data privacy risks, controls, strategies and procedures. In addition, the Audit Committee periodically evaluates our cyber strategy to ensure its effectiveness and, if appropriate, includes a review from third-party experts. Our Senior Vice President and Chief Information Officer reports to the Audit Committee at every regularly scheduled meeting of the Audit Committee (or more frequently, as needed) regarding cybersecurity risk exposure and cybersecurity risk management strategy. Our Executive Leadership Team governs our cybersecurity strategy and programs through regularly scheduled meetings. In addition, our Board also may review and assess cybersecurity risks as part of its responsibilities for general risk oversight.

We are members of global industry organizations such as the Information Systems Audit and Control Association (ISACA), International Information System Security Certification Consortium (ISC) and International Association of Privacy Professionals (IAPP). Our information security management systems are comprehensive and leveraged to drive our cybersecurity program. Our cybersecurity policies, procedures, controls and risk assessments are based on the National Institute of Standards and Technology (NIST) Cybersecurity Framework. We leverage the core functions of the NIST Cybersecurity Framework – Identify, Protect, Detect, Respond and Recover, to identify opportunities for improvement and risk mitigation. We also leverage the principles of the ISO 27001 standard and have achieved ISO 27001:2013 certification for one of our data centers. Key elements of our information security management systems include, among others:

| > | Risk assessments |

26 SBA Communications Corporation | 2023 Proxy Statement

CORPORATE GOVERNANCE

| > | Organizational structure and responsibilities |

| > | Objectives and targets |

| > | Physical and technical safeguards |

| > | Information security incident management |

| > | Regular audits |

| > | Progress reports |

| > | Metrics |

| > | Continuous improvement of the information security management system |

We maintain a data incident response and a business continuity management plan to timely, consistently and compliantly address cyber threats that may occur despite our safeguards. The response plan covers the major phases of the incident response process, including (1) preparation, (2) detection and analysis, (3) containment and investigation, (4) notification, which may include timely notice to our Board if deemed material or appropriate, (5) eradication and recovery and (6) incident closure and post-incident analysis. Our response plan is reviewed annually, regularly tested and kept up to date. The scope of this plan is global and includes our business units, regions, subsidiaries and affiliates. Our business continuity management system includes targets and objectives, impact analyses and risk assessments, business continuity procedures, exercise and testing, monitoring and corrective action plans, training and awareness, documentation and data compilation and standards for data centers and servers. We work with third-party industry experts to conduct annual vulnerability assessments and penetration testing. In the past three years, we have not experienced a material information security breach. As such, we have not incurred any material expenses from cybersecurity breaches or any expenses from penalties or settlements related to a cybersecurity breach during that time.

We maintain a robust privacy compliance program. New hires are required to participate in cybersecurity onboarding training, and current employees are responsible for completing mandatory cybersecurity training annually and quarterly phishing awareness training. Our leadership team participates in advanced, targeted cybersecurity training and exercises to ensure additional security.

Compensation Risks