Filed by ONEOK, Inc. pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: EnLink Midstream, LLC

Commission File No. 001-36336

Date: December 9, 2024

The following presentation was published on ONEOK, Inc.'s website on December 9, 2024.

Investor Presentation December 2024

Cautionary Statement 2 Forward - Looking Statements This presentation contains “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that ONEOK or EnLink expects, believes or anticipates will or may occur in the future are forward - looking statements . Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “opportunity,” “create,” “intend,” “could,” “would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,” “target,” “future,” “build,” “focus,” “continue,” “strive,” “allow” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward - looking statements . However, the absence of these words does not mean that the statements are not forward - looking . These forward - looking statements include, but are not limited to, statements regarding the proposed transaction, the expected closing of the proposed transaction and the timing thereof, and descriptions of ONEOK, EnLink and their combined operations after giving effect to the proposed transaction . There are a number of risks and uncertainties that could cause actual results to differ materially from the forward - looking statements included in this presentation . These include the risk that ONEOK will not be able to successfully integrate EnLink’s business ; the risk that cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected ; the risk that the credit ratings following the proposed transaction may be different from what ONEOK expects ; the risk that a condition to closing of the proposed transaction may not be satisfied, that a party may terminate the merger agreement relating to the proposed transaction or that the closing of the proposed transaction might be delayed or not occur at all ; the possibility that EnLink unitholders may not approve the proposed transaction ; the risk of potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction ; risks related to the occurrence of any other event, change or circumstance that could give rise to the termination of the merger agreement related to the proposed transaction ; the risk that changes in ONEOK’s capital structure could have adverse effects on the market value of its securities ; risks related to the ability of the parties to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on each of the companies’ operating results and business generally ; the risk that the proposed transaction could distract ONEOK’s and EnLink’s respective management teams from ongoing business operations or cause either of the companies to incur substantial costs ; risks related to the impact of any economic downturn and any substantial decline in commodity prices ; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters ; and other important factors that could cause actual results to differ materially from those projected . All such factors are difficult to predict and are beyond ONEOK’s or EnLink’s control, including those detailed in ONEOK’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K that are available on ONEOK’s website at www . oneok . com and on the website of the Securities and Exchange Commission (the “SEC”) at www . sec . gov, and those detailed in EnLink’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K that are available on EnLink’s website at http : //www . enlink . com and on the website of the SEC at www . sec . gov . All forward - looking statements are based on assumptions that ONEOK and EnLink believe to be reasonable but that may not prove to be accurate . Any forward - looking statement speaks only as of the date on which such statement is made, neither ONEOK nor EnLink undertakes any obligation to correct or update any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law . Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof . All references in this presentation to financial guidance are based on the news releases issued on Feb . 26 , 2024 , April 30 , 2024 , Aug . 5 , 2024 , and Oct . 29 , 2024 , and are not being updated or affirmed by this presentation . Non - GAAP Financial Measures This presentation contains references to certain non - GAAP financial measures . The non - GAAP financial measures presented may not provide information that is directly comparable to that provided by other companies, as other companies may calculate such financial results differently . ONEOK's, EnLink's or Medallion's non - GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to amounts presented in accordance with GAAP . ONEOK, EnLink or Medallion views these non - GAAP financial measures as supplemental and they are not intended to be a substitute for, or superior to, the information provided by GAAP financial results . Furthermore, this presentation includes or references certain forward - looking, non - GAAP financial measures . Because ONEOK, EnLink or Medallion provides these measures on a forward - looking basis, it cannot reliably or reasonably predict certain of the necessary components of the most directly comparable forward - looking GAAP financial measures, such as future depreciation, JV EBITDA, other noncash items, impairments and changes in working capital . Accordingly, ONEOK, EnLink or Medallion is unable to present a quantitative reconciliation of such forward - looking, non - GAAP financial measures to the respective most directly comparable forward - looking GAAP financial measure. ONEOK, EnLink or Medallion believes that these forward - looking, non - GAAP measures may be a useful tool for the investment community in comparing ONEOK's, EnLink’s or Medallion's forecasted financial performance to the forecasted financial performance of other companies in the industry.

Cautionary Statement 3 NO OFFER OR SOLICITATION This presentation is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Additional Information And Where to Find It In connection with the proposed transaction, ONEOK has filed with the SEC a registration statement on Form S - 4 (the “Registration Statement”) to register the shares of ONEOK’s common stock to be issued pursuant to the proposed transaction, which includes a preliminary prospectus of ONEOK and a preliminary proxy statement of EnLink (the “proxy statement/prospectus”) . Each of ONEOK and EnLink may also file other documents with the SEC regarding the proposed transaction . This document is not a substitute for the Registration Statement, proxy statement/prospectus or any other document which ONEOK or EnLink may file with the SEC in connection with the proposed transaction . BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO, AND RELATED MATTERS . After the Registration Statement has been declared effective, the definitive proxy statement/prospectus (if and when available) will be mailed to EnLink unitholders . Investors and security holders will be able to obtain free copies of the Registration Statement and proxy statement/prospectus, as each may be amended or supplemented from time to time, and other relevant documents filed by ONEOK and EnLink with the SEC (if and when available) through the website maintained by the SEC at www . sec . gov . Copies of documents filed with the SEC by ONEOK, including the definitive proxy statement/prospectus (when available) will be available free of charge from ONEOK’s website at www . oneok . com under the “Investors” tab . Copies of documents filed with the SEC by EnLink, including the definitive proxy statement/prospectus (when available) will be available free of charge from EnLink’s website at www . enlink . com under the “Investors” tab . Participants in the Solicitation ONEOK, EnLink and certain of their (or EnLink’s managing member’s) respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction . Information about ONEOK’s directors and executive officers is available in ONEOK’s Annual Report on Form 10 - K for the 2023 fiscal year filed with the SEC on February 27 , 2024 , and its revised definitive proxy statement for the 2024 annual meeting of shareholders filed with the SEC on May 1 , 2024 , and in the proxy statement/prospectus (when available) . Information about the directors and executive officers of EnLink’s managing member is available in its Annual Report on Form 10 - K for the 2023 fiscal year filed with the SEC on February 21 , 2024 , and in the proxy statement/prospectus (when available) . Other information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the Registration Statement, the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available . Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions . Copies of the documents filed with the SEC by ONEOK and EnLink will be available free of charge through the website maintained by the SEC at www . sec . gov . Additionally, copies of documents filed with the SEC by ONEOK, including the definitive proxy statement/prospectus (when available) will be available free of charge from ONEOK’s website at www . oneok . com and copies of documents filed with the SEC by EnLink, including the definitive proxy statement/prospectus (when available) will be available free of charge from EnLink’s website at www . enlink . com .

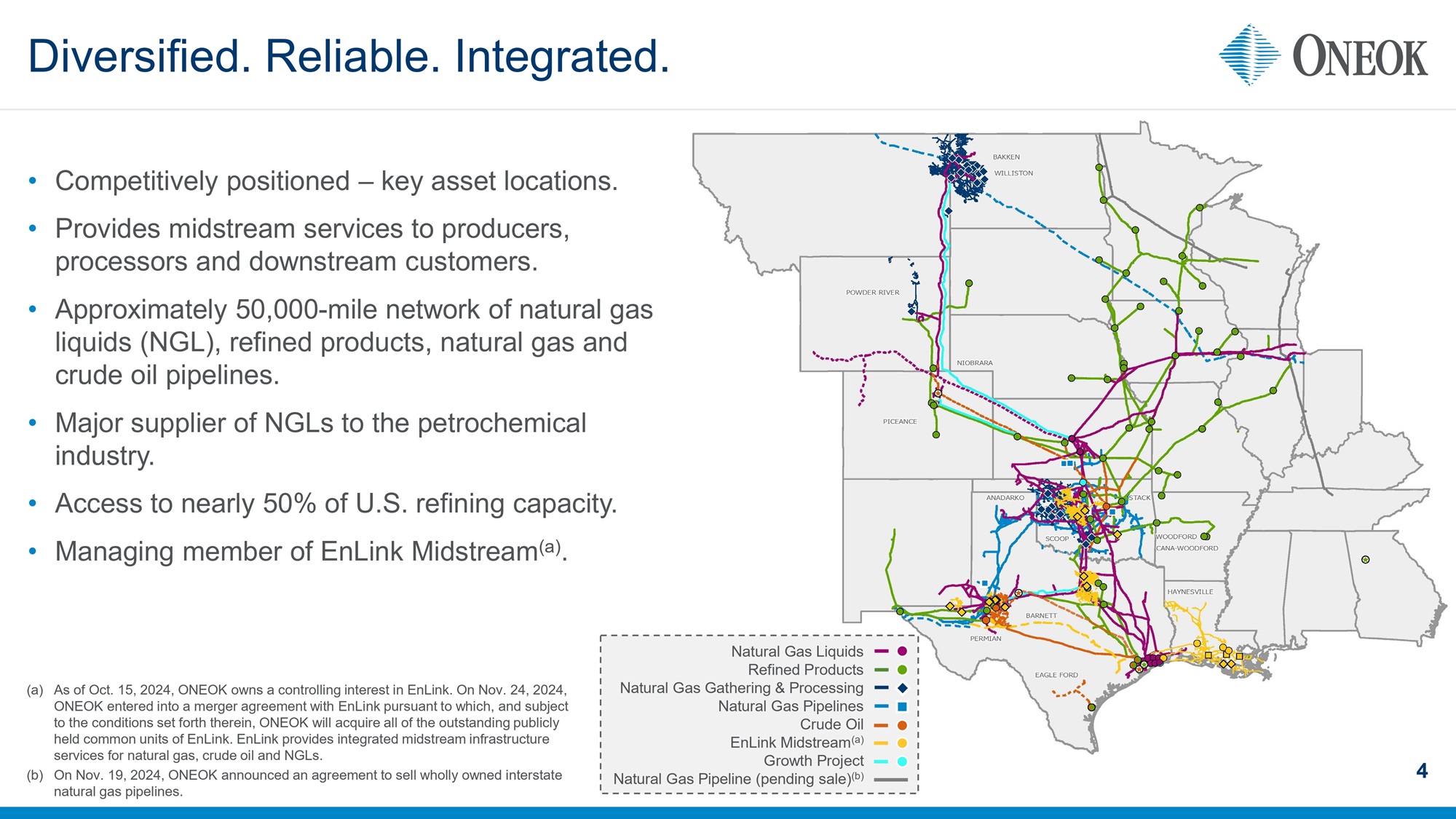

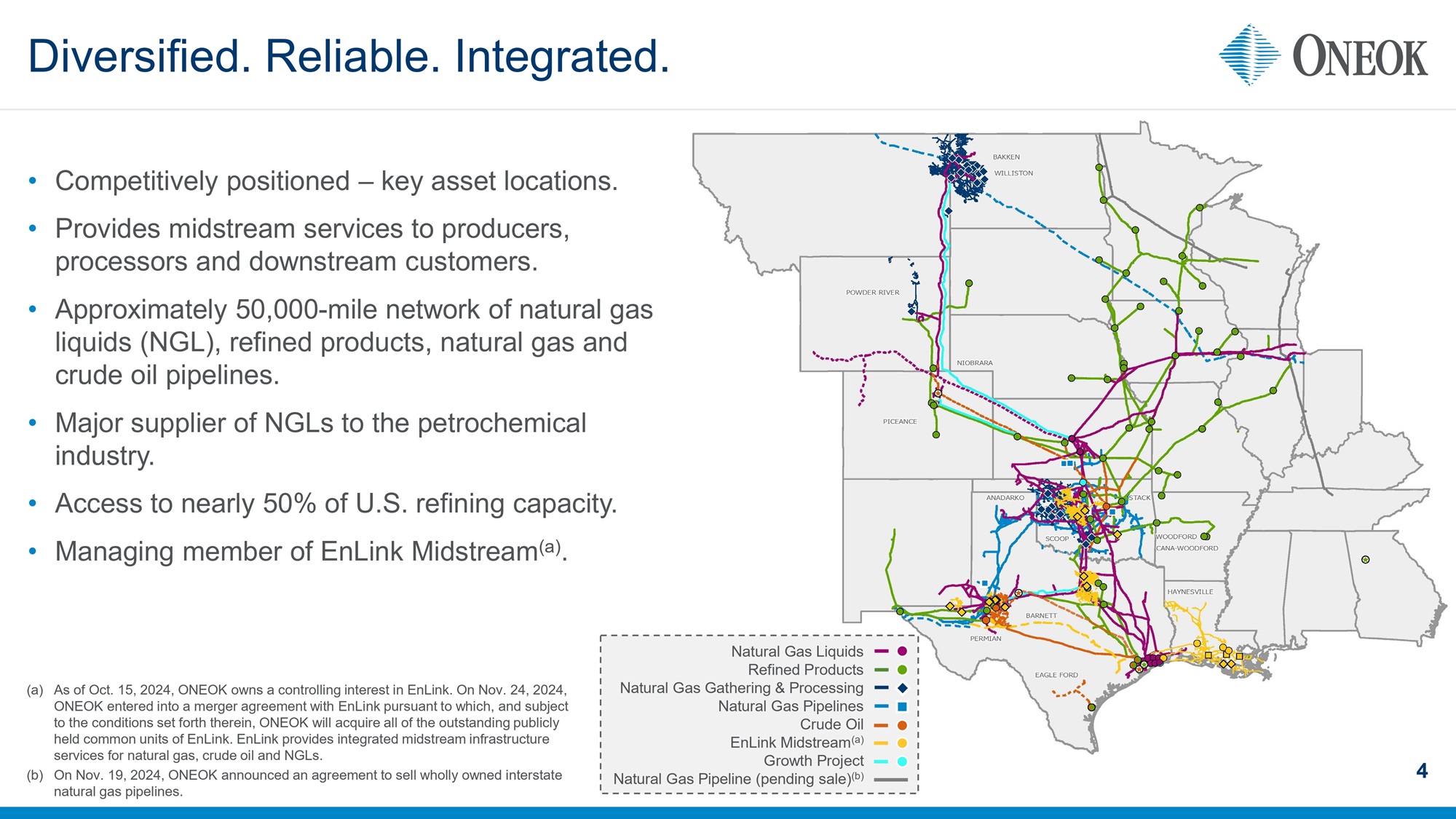

(a) As of Oct. 15, 2024, ONEOK owns a controlling interest in EnLink. On Nov. 24, 2024, ONEOK entered into a merger agreement with EnLink pursuant to which, and subject to the conditions set forth therein, ONEOK will acquire all of the outstanding publicly held common units of EnLink. EnLink provides integrated midstream infrastructure services for natural gas, crude oil and NGLs. (b) On Nov. 19, 2024, ONEOK announced an agreement to sell wholly owned interstate natural gas pipelines. • Competitively positioned – key asset locations. • Provides midstream services to producers, processors and downstream customers. • Approximately 50,000 - mile network of natural gas liquids (NGL), refined products, natural gas and crude oil pipelines. • Major supplier of NGLs to the petrochemical industry. • Access to nearly 50% of U.S. refining capacity. • Managing member of EnLink Midstream (a) . Diversified. Reliable. Integrated. 4 Natural Gas Liquids Refined Products Natural Gas Gathering & Processing Natural Gas Pipelines Crude Oil EnLink Midstream (a) Growth Project Natural Gas Pipeline (pending sale) (b)

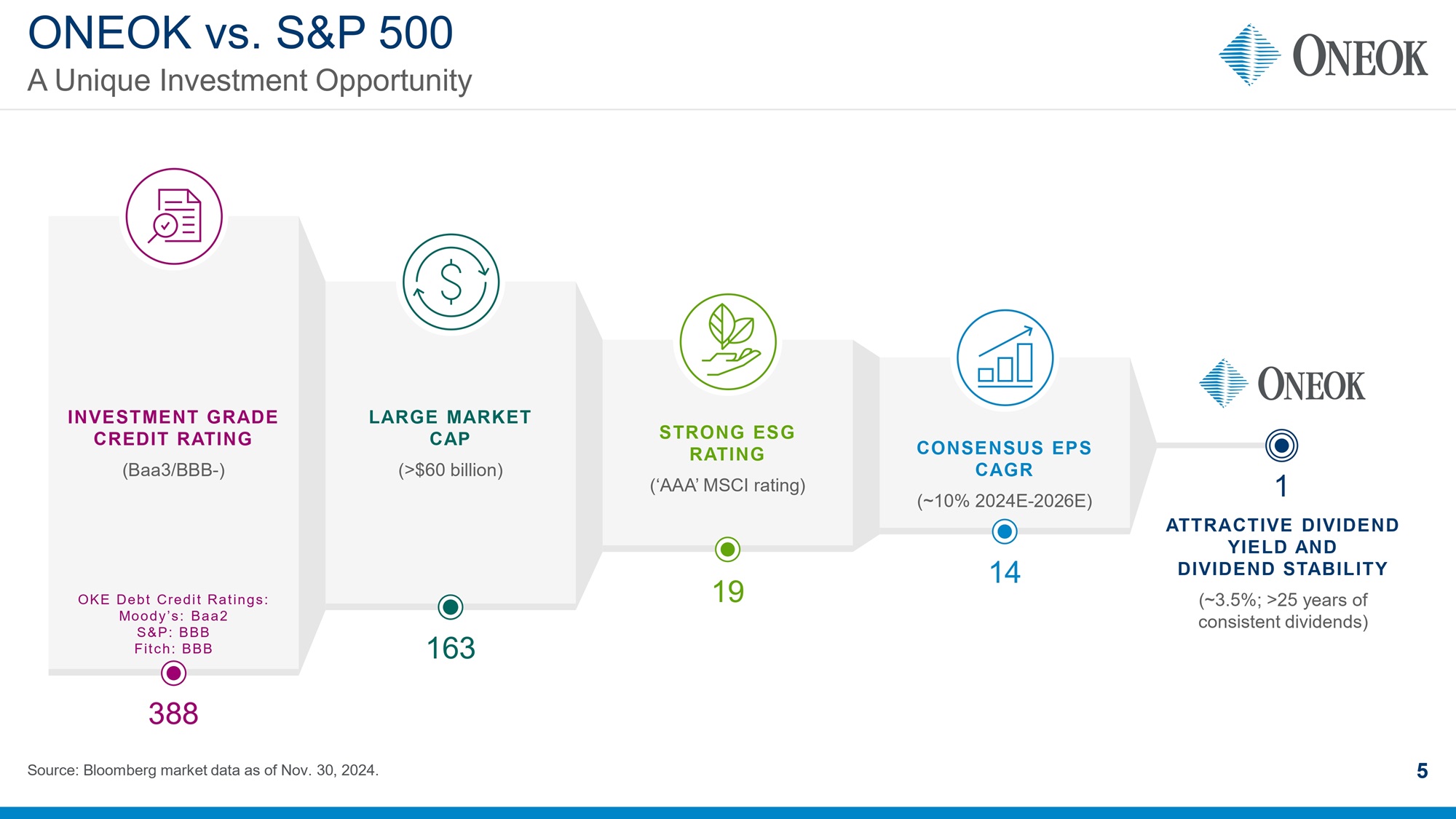

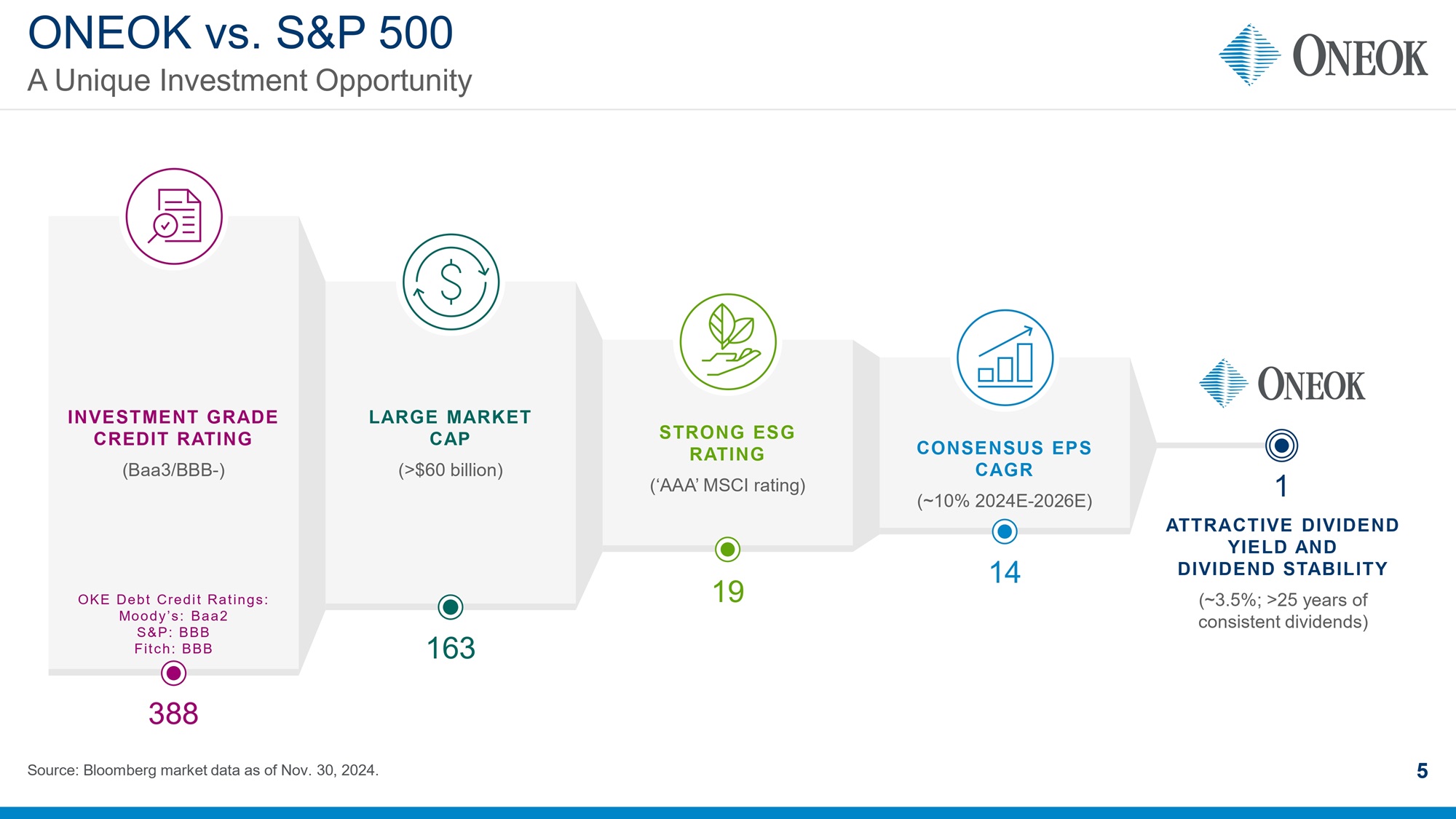

CONSENSUS EPS CAGR (~10% 2024E - 2026E) STRONG ESG RATING (‘AAA’ MSCI rating) LARGE MARKET CAP (>$60 billion) ONEOK vs. S&P 500 5 Source: Bloomberg market data as of Nov. 30 , 2024. INVESTMENT GRADE CREDIT RATING (Baa3/BBB - ) A Unique Investment Opportunity 388 163 19 1 ATTRACTIVE DIVIDEND YIELD AND DIVIDEND STABILITY (~3.5%; >25 years of consistent dividends) OKE Debt Credit Ratings: Moody’s: Baa2 S&P: BBB Fitch: BBB 14

6 Natural Gas Liquids (NGLs) Healthcare Products Food packaging critical in reducing food waste NGLs provide developing nations access to safer, cleaner energy Industrial/Manufacturing & Energy Infrastructure A lower - emission hydrocarbon - based fuel, producing reliable and cleaner energy, compared with other fossil fuels. Natural Gas Electricity Generation Transportation Fuel Heating & Cooking Industrial/ Manufacturing Crude oil can be processed into many different refined products such as gasoline, diesel fuel and aviation fuel. Refined Products and Crude Oil ONEOK delivers energy products that help meet domestic and international energy demand, contribute to energy security and provide safe, reliable and responsible energy solutions needed today and into the future. These essential energy products have many end - uses. Delivering the Energy That Improves Our Lives NGLs – ethane, propane, butane, isobutane and natural gasoline – are frequently produced along with natural gas and crude oil. Transportation Fuel Agriculture Aviation Industrial/ Manufacturing

7 Key Investment Considerations 1 Invest in high - return organic projects Adjacent to existing asset footprint 2 Sustain and increase dividend Target 3% - 4% annual growth and dividend payout ratio of ~85% or lower 3 Invest in high - return organic projects Adjacent to existing asset footprint Maintain strong balance sheet Investment - grade credit ratings and target 3.5x debt - to - EBITDA ratio 1 Share repurchases 4 S&P 500 index member and o ne of the largest energy infrastructure companies in North America. Scale. Capital Allocation Strategy Diversified services, product mix and free cash flow generation with strategically located and market connected assets. Scope. Flexibility to grow at the pace customers need through highly attractive organic opportunities. Growth. Strong balance sheet and i nvestment - grade credit ratings supported by a primarily fee - based business model. Resiliency. $2 billion share repurchase authorization

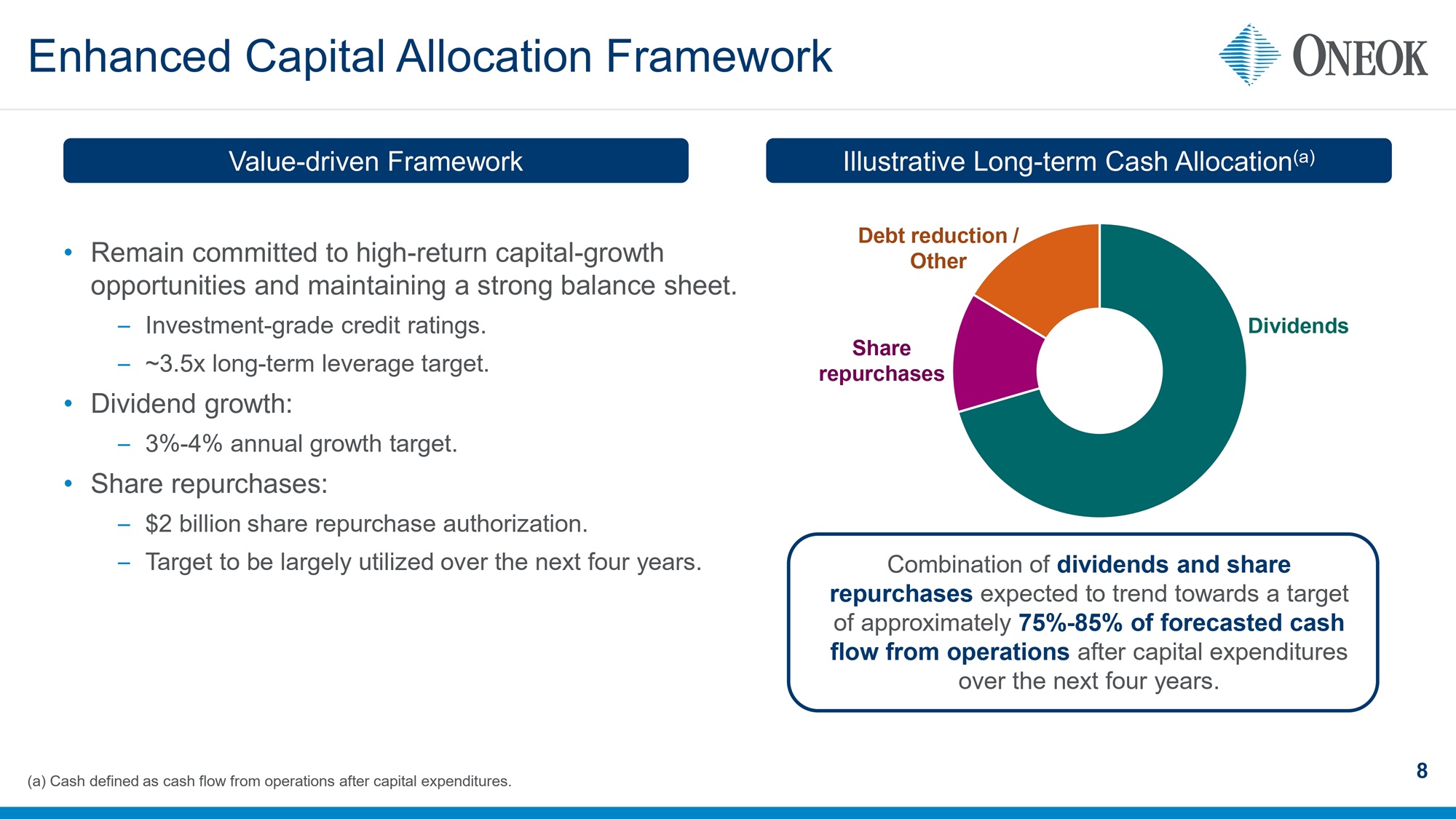

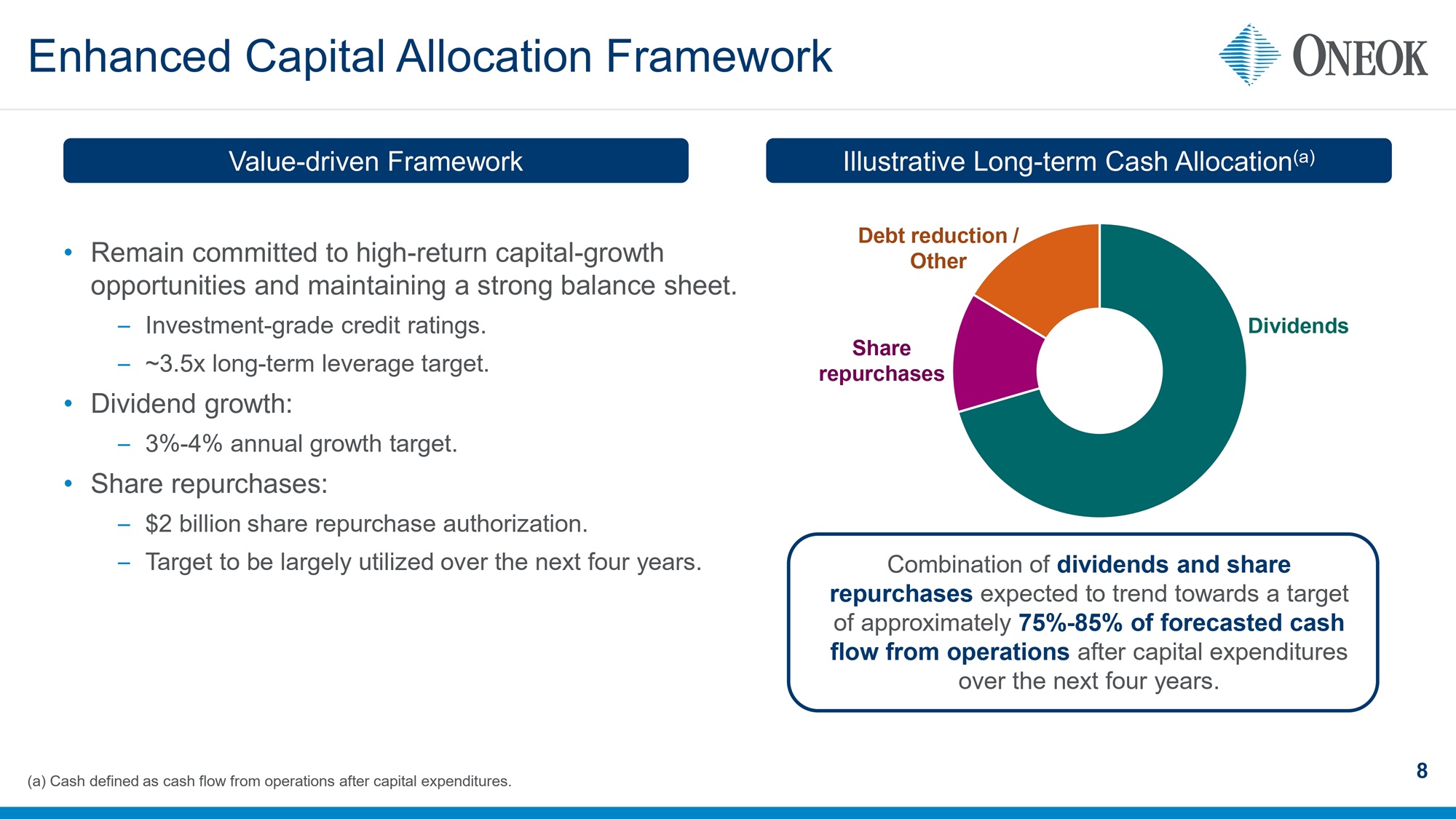

Enhanced Capital Allocation Framework • Remain committed to high - return capital - growth opportunities and maintaining a strong balance sheet. – Investment - grade credit ratings. – ~3.5x long - term leverage target. • Dividend growth: – 3% - 4% annual growth target. • Share repurchases: – $2 billion share repurchase authorization. – Target to be largely utilized over the next four years. Value - driven Framework Illustrative Long - term Cash Allocation (a) Dividends Share repurchases Debt reduction / Other Combination of dividends and share repurchases expected to trend towards a target of approximately 75% - 85% of forecasted cash flow from operations after capital expenditures over the next four years. (a) Cash defined as cash flow from operations after capital expenditures. 8

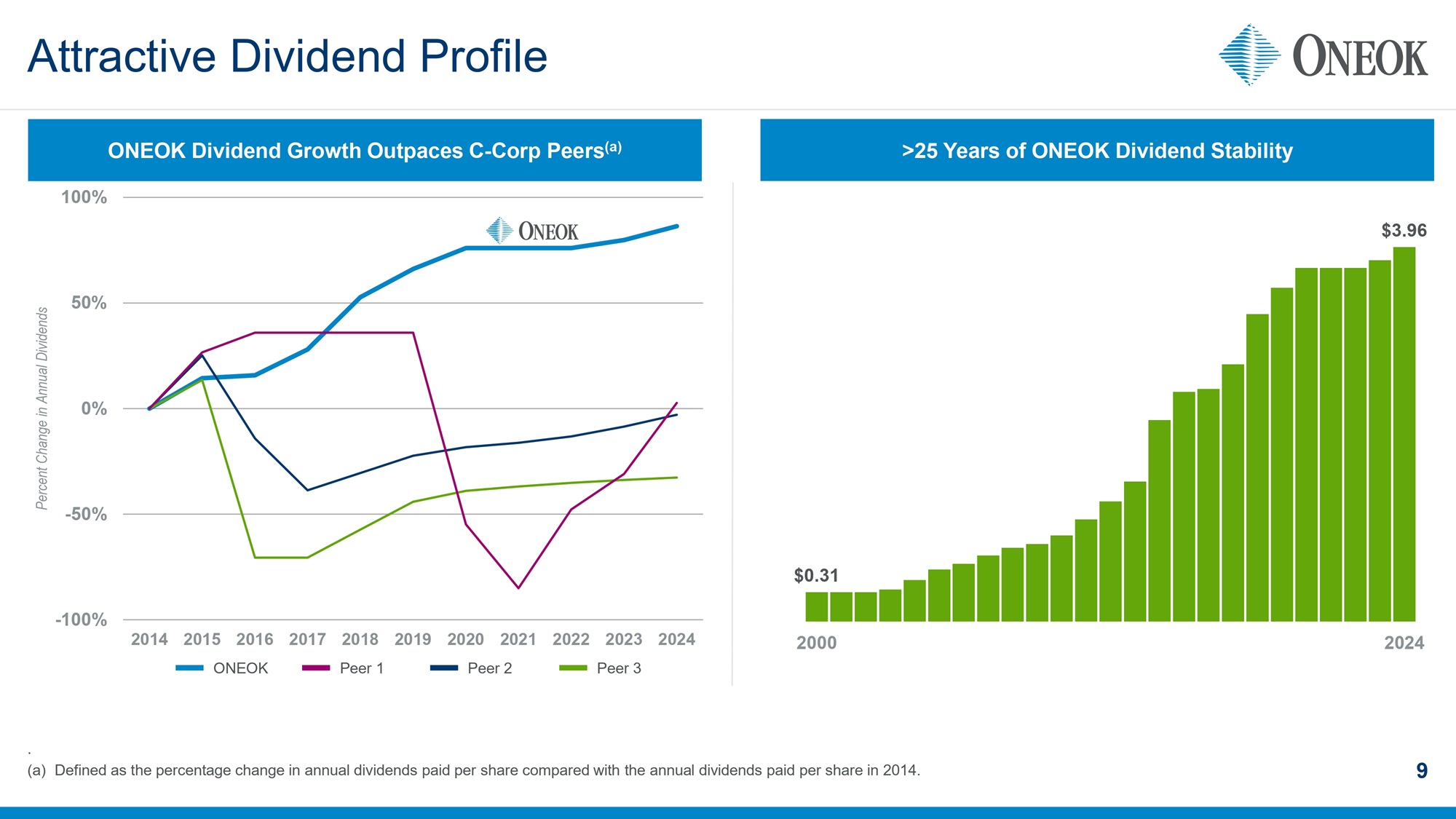

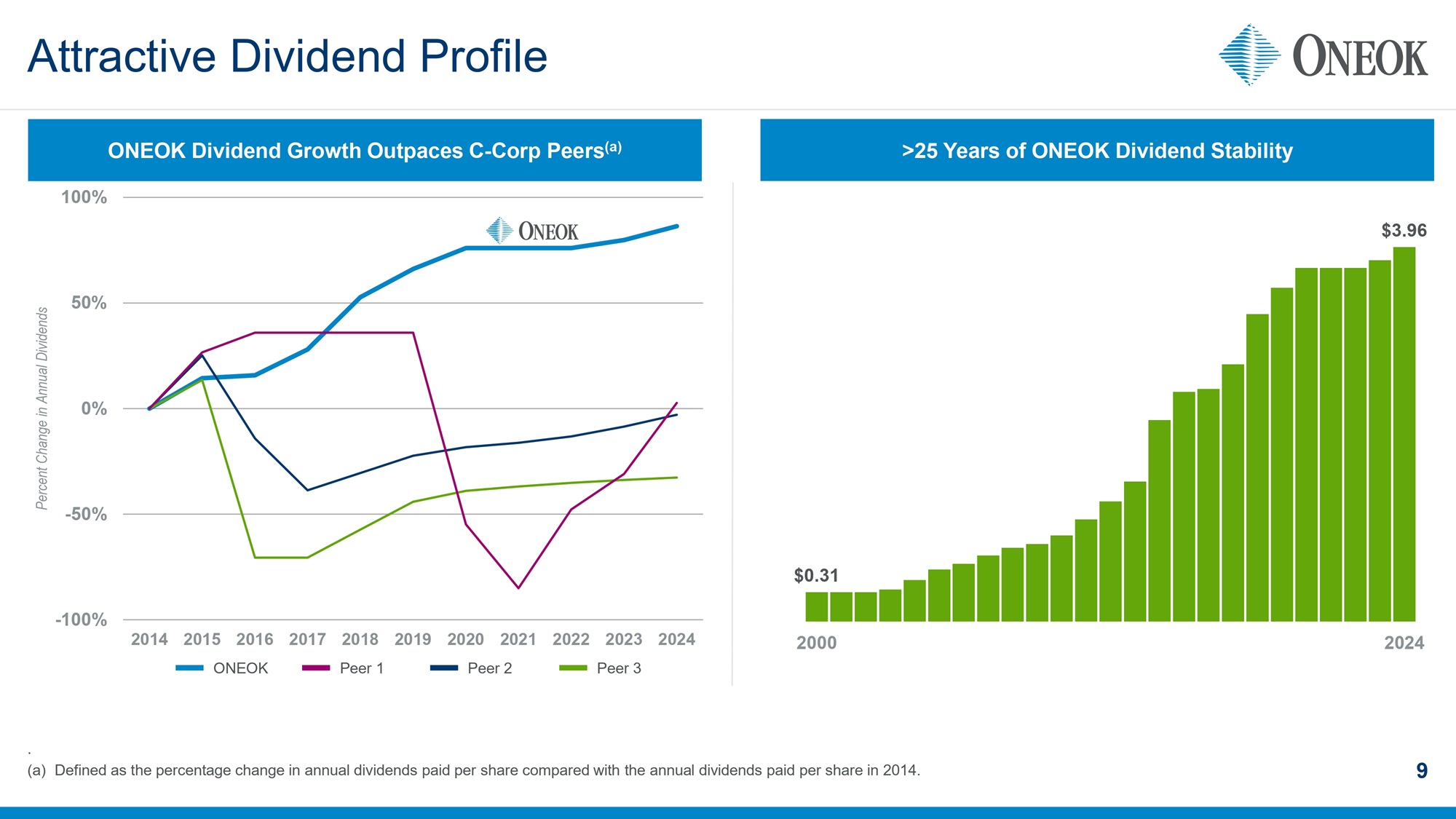

$0.31 $3.96 2000 2024 9 ONEOK Dividend Growth Outpaces C - Corp Peers (a) ONEOK Peer 1 Peer 2 Peer 3 >25 Years of ONEOK Dividend Stability . (a) Defined as the percentage change in annual dividends paid per share compared with the annual dividends paid per share in 2014 . Attractive Dividend Profile -100% -50% 0% 50% 100% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Percent Change in Annual Dividends

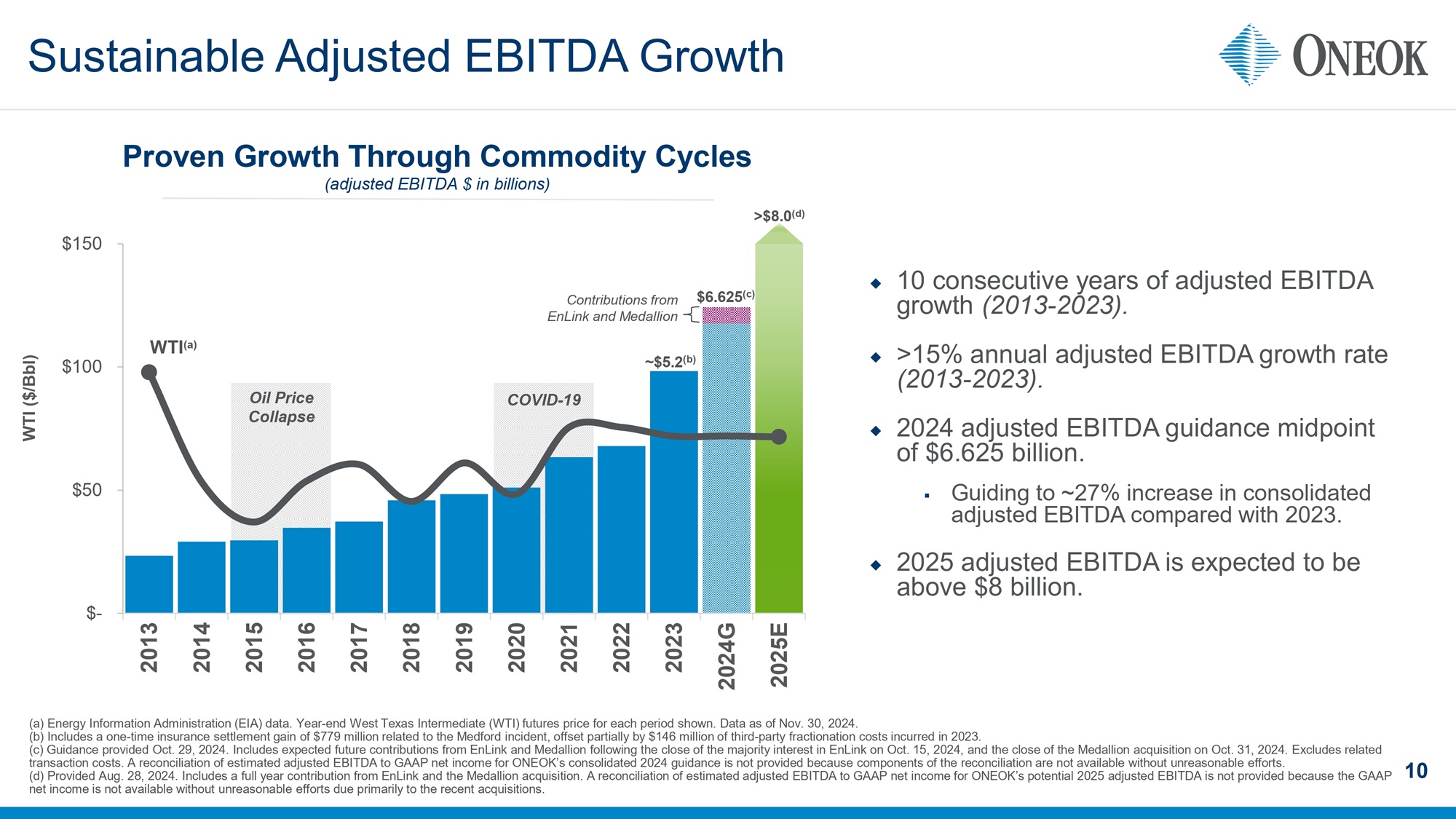

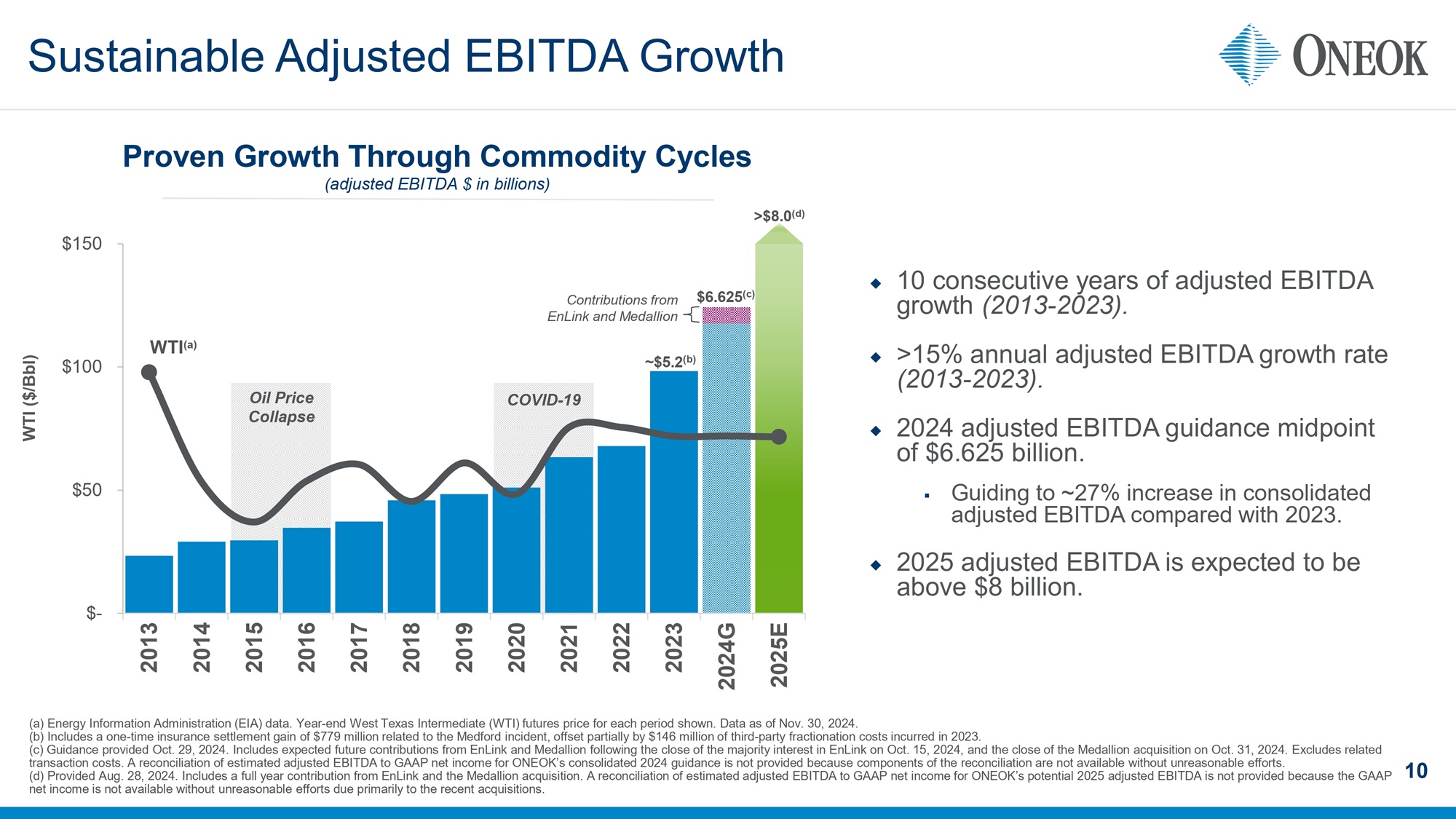

Sustainable Adjusted EBITDA Growth 10 Proven Growth Through Commodity Cycles (adjusted EBITDA $ in billions) WTI ($/ Bbl ) ◆ 10 consecutive years of adjusted EBITDA growth (2013 - 2023). ◆ >15% annual adjusted EBITDA growth rate (2013 - 2023). ◆ 2024 adjusted EBITDA guidance midpoint of $ 6 . 625 billion . ▪ Guiding to ~27% increase in consolidated adjusted EBITDA compared with 2023. ◆ 2025 adjusted EBITDA is expected to be above $8 billion. (a) Energy Information Administration (EIA) data. Year - end West Texas Intermediate (WTI) futures price for each period shown. Data as of Nov. 30, 202 4 . (b) Includes a one - time insurance settlement gain of $779 million related to the Medford incident, offset partially by $146 mill ion of third - party fractionation costs incurred in 2023 . (c) Guidance provided Oct. 29, 2024. I ncludes expected future contributions from EnLink and Medallion following the close of the majority interest in EnLink on Oct. 15, 20 24 , and the close of the Medallion acquisition on Oct. 31, 2024. Excludes related transaction costs. A reconciliation of estimated adjusted EBITDA to GAAP net income for ONEOK’s consolidated 2024 guidance is no t provided because components of the reconciliation are not available without unreasonable efforts. (d) Provided Aug. 28, 2024. I ncludes a full year contribution from EnLink and the Medallion acquisition. A reconciliation of estimated adjusted EBITDA to GAAP net i ncome for ONEOK’s potential 2025 adjusted EBITDA is not provided because the GAAP net income is not available without unreasonable efforts due primarily to the recent acquisitions. WTI (a) COVID - 19 Oil Price Collapse Contributions from EnLink and Medallion >$8.0 (d) ~$5.2 (b) $6.625 (c) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $- $50 $100 $150 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024G 2025E

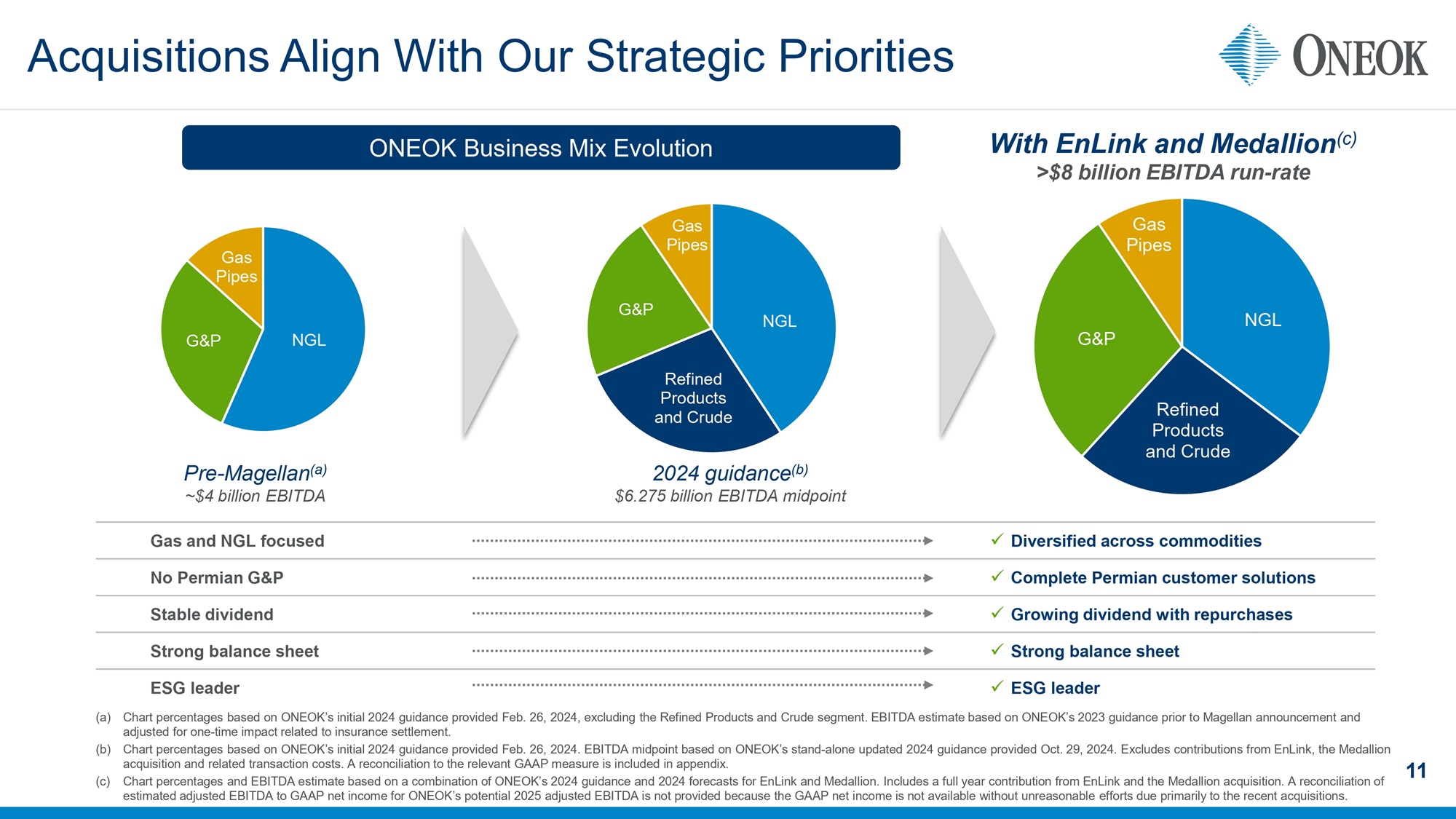

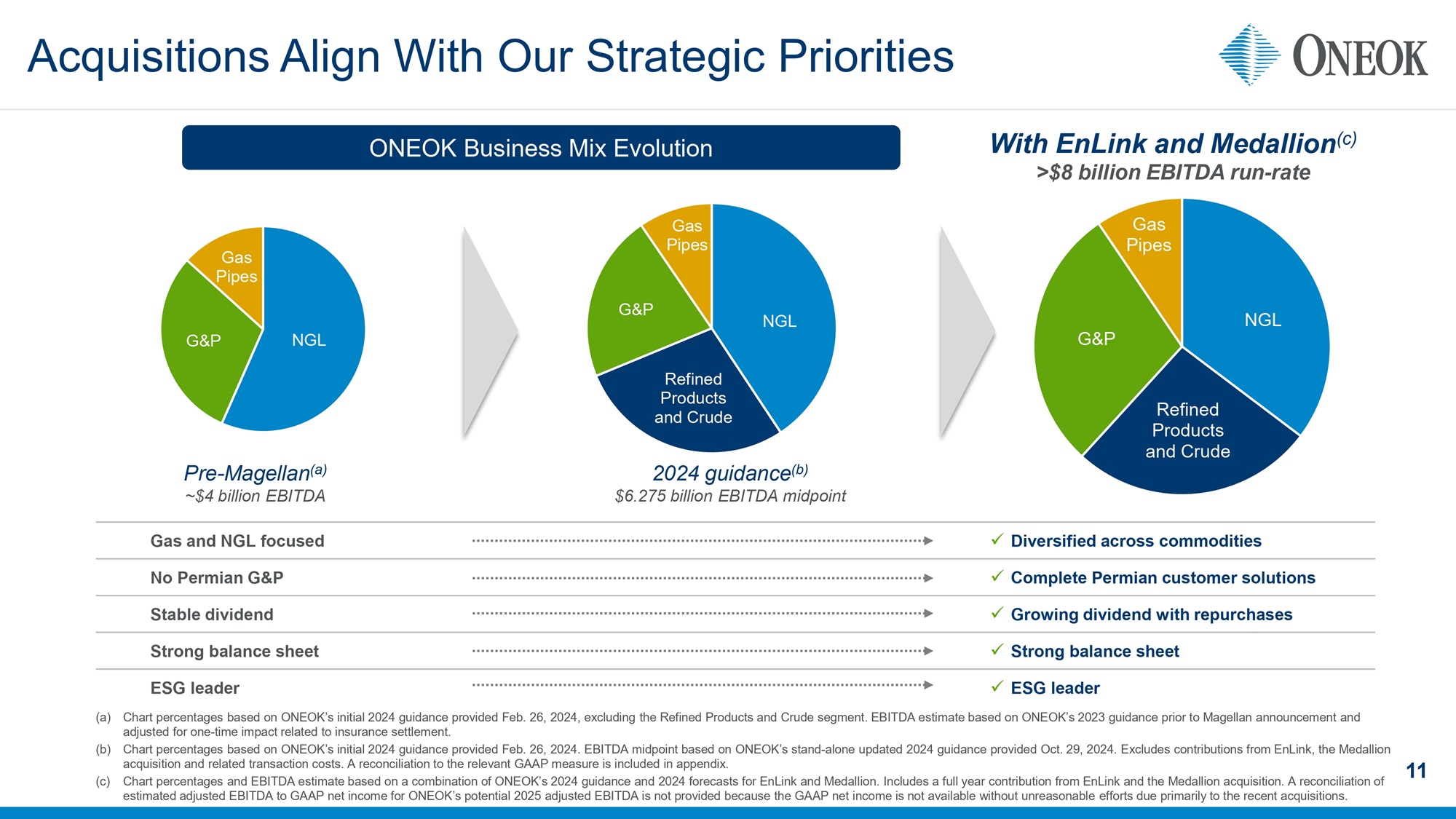

x Diversified across commodities Gas and NGL focused x Complete Permian customer solutions No Permian G&P x Growing dividend with repurchases Stable dividend x Strong balance sheet Strong balance sheet x ESG leader ESG leader Acquisitions Align With Our Strategic Priorities 11 (a) Chart percentages based on ONEOK’s initial 2024 guidance provided Feb. 26, 2024, excluding the Refined Products and Crude seg men t. EBITDA estimate based on ONEOK’s 2023 guidance prior to Magellan announcement and adjusted for one - time impact related to insurance settlement. (b) Chart percentages based on ONEOK’s initial 2024 guidance provided Feb. 26, 2024. EBITDA midpoint based on ONEOK’s stand - alone up dated 2024 guidance provided Oct. 29, 2024. Excludes contributions from EnLink, the Medallion acquisition and related transaction costs. A reconciliation to the relevant GAAP measure is included in appendix. (c) Chart percentages and EBITDA estimate based on a combination of ONEOK’s 2024 guidance and 2024 forecasts for EnLink and Medal lio n. I ncludes a full year contribution from EnLink and the Medallion acquisition. A reconciliation of estimated adjusted EBITDA to GAAP net income for ONEOK’s potential 2025 adjusted EBITDA is not provided because the GAAP net inc ome is not available without unreasonable efforts due primarily to the recent acquisitions. NGL G&P Gas Pipes NGL Refined Products and Crude G&P Gas Pipes NGL Refined Products and Crude G&P Gas Pipes Pre - Magellan (a) ~$4 billion EBITDA 2024 guidance (b) $6.275 billion EBITDA midpoint With EnLink and Medallion (c) >$8 billion EBITDA run - rate ONEOK Business Mix Evolution

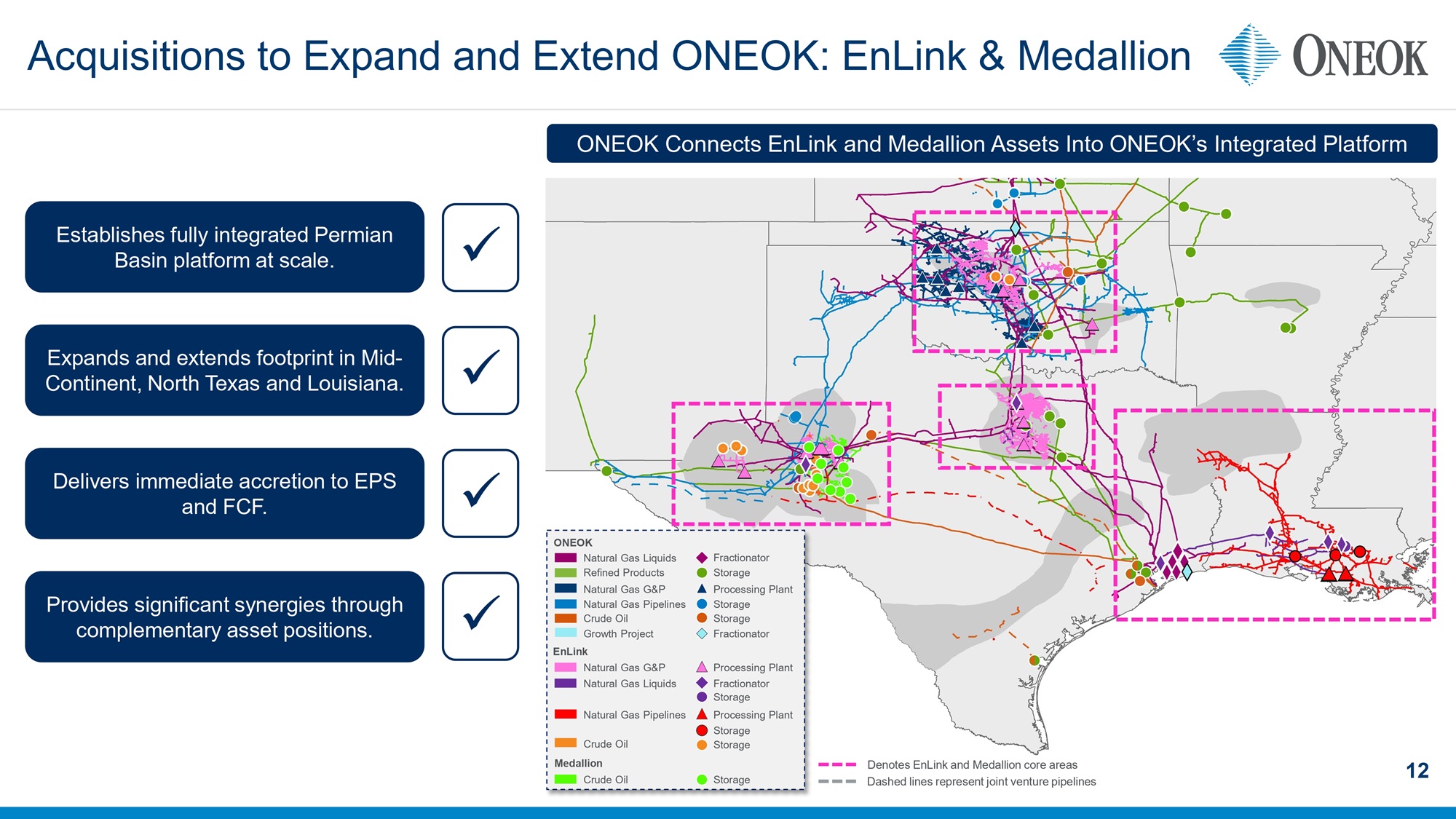

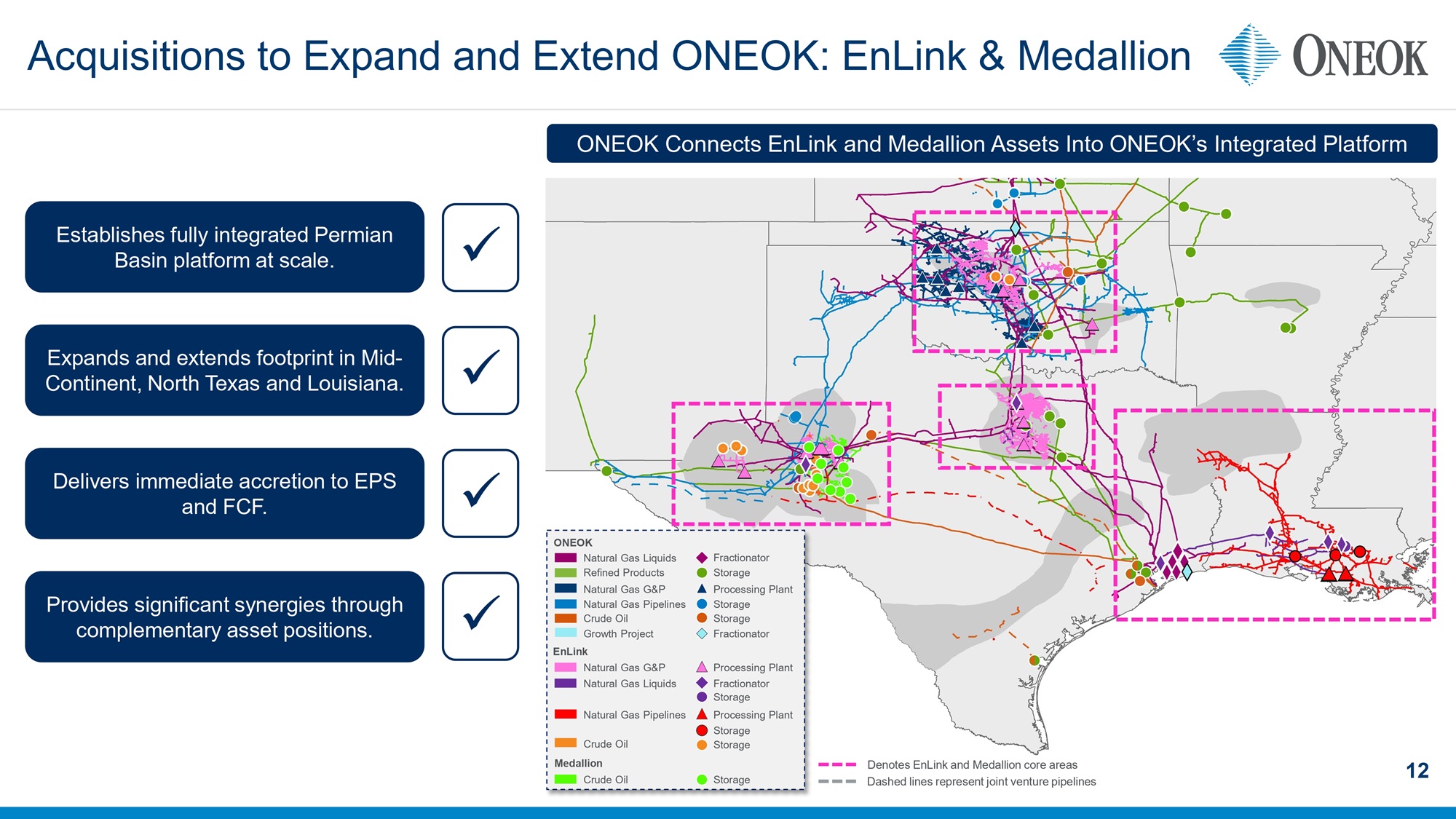

12 Acquisitions to Expand and Extend ONEOK: EnLink & Medallion Dashed lines represent joint venture pipelines Denotes EnLink and Medallion core areas ONEOK Connects EnLink and Medallion Assets Into ONEOK’s Integrated Platform EnLink Natural Gas G&P Refined Products ONEOK Natural Gas G&P Natural Gas Liquids Natural Gas Pipelines Natural Gas Liquids Storage Fractionator Processing Plant Medallion Fractionator Storage Crude Oil Storage Storage Processing Plant Crude Oil Storage Natural Gas Pipelines Processing Plant Growth Project Fractionator Crude Oil Storage Storage Expands and extends footprint in Mid - Continent, North Texas and Louisiana. Delivers immediate accretion to EPS and FCF. x x Establishes fully integrated Permian Basin platform at scale. x Provides significant synergies through complementary asset positions. x

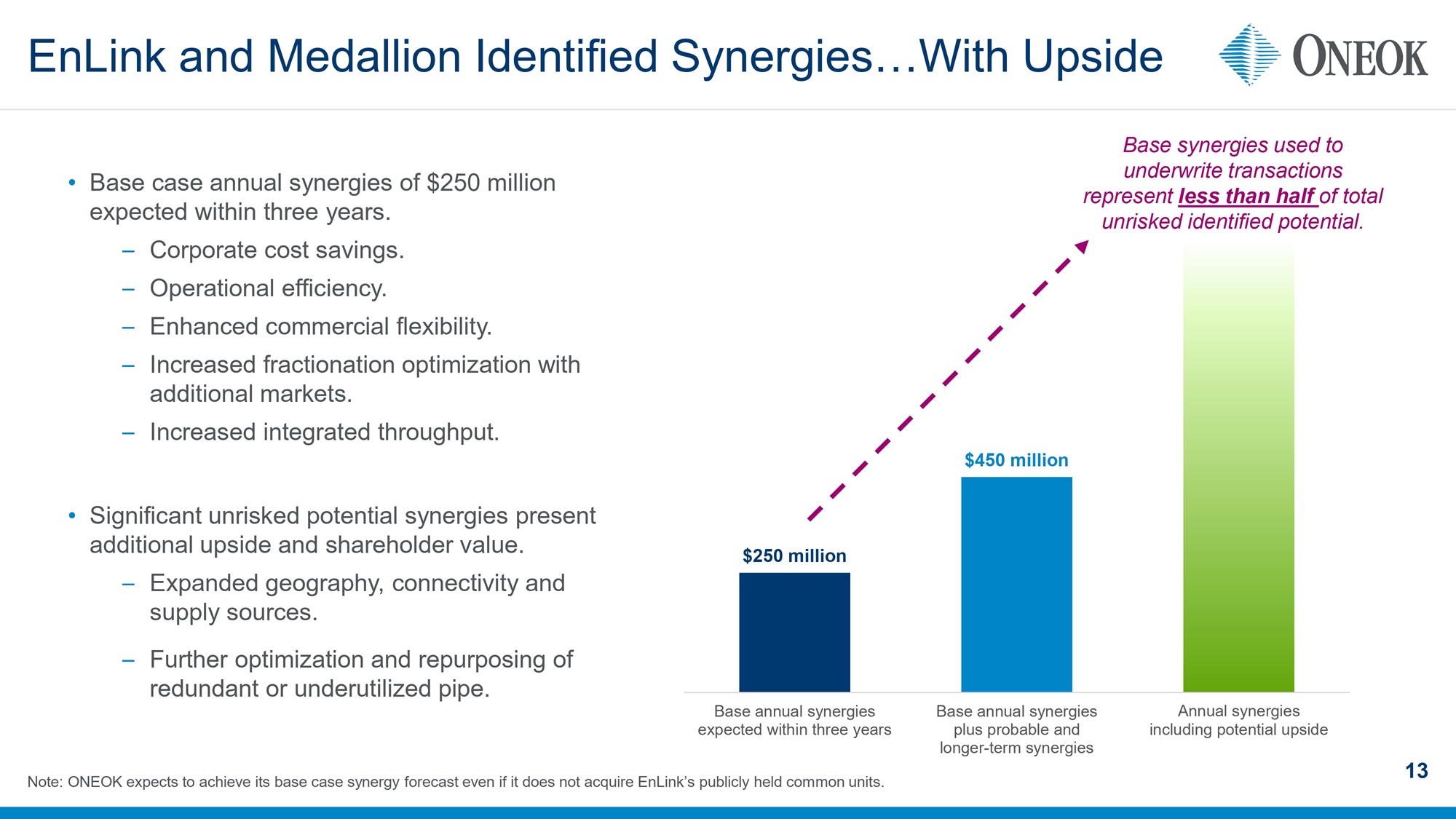

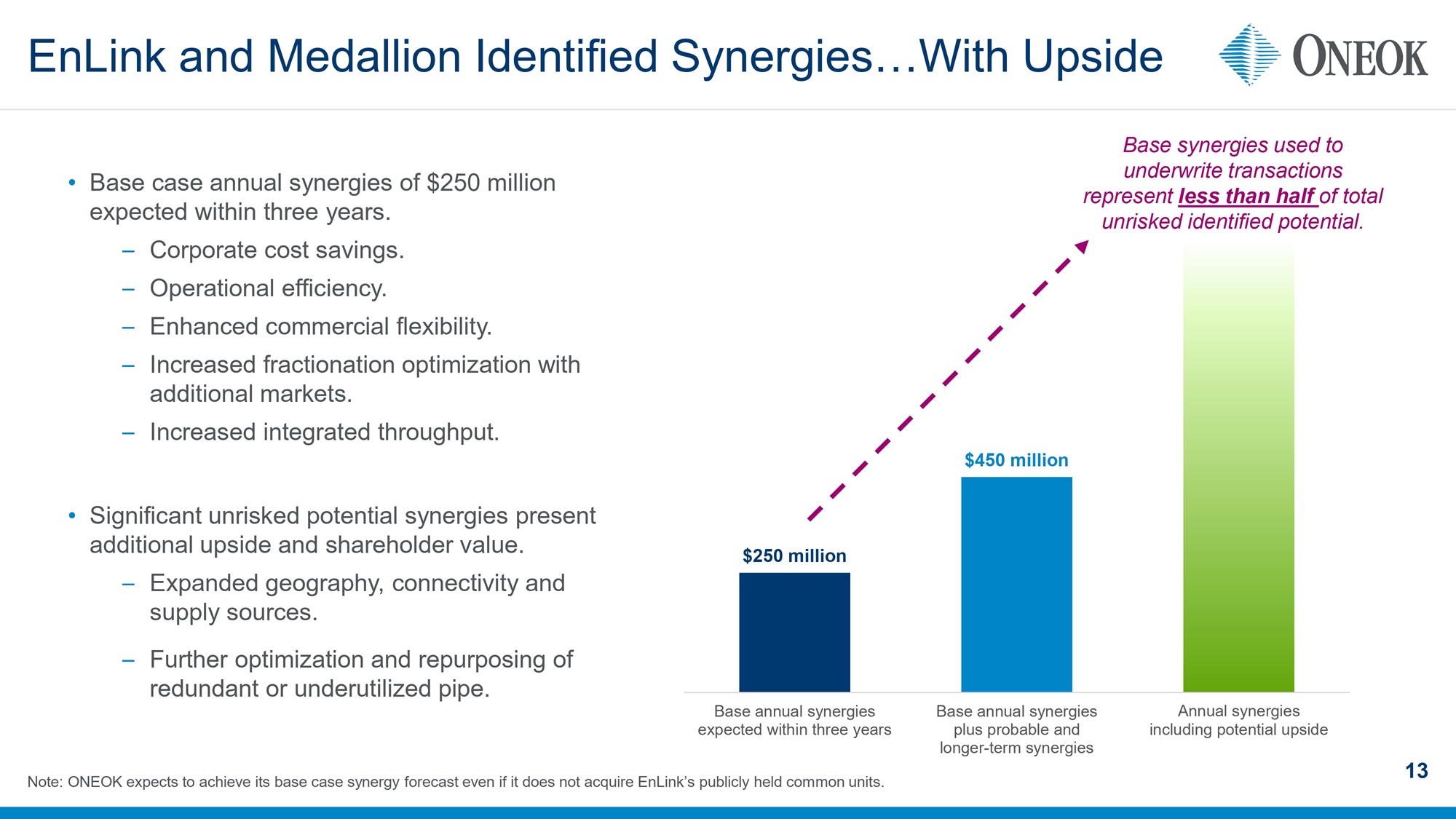

$250 million $450 million Base annual synergies expected within three years Base annual synergies plus probable and longer-term synergies Annual synergies including potential upside 13 • Base case annual synergies of $250 million expected within three years. – Corporate cost savings. – Operational efficiency. – Enhanced commercial flexibility. – Increased fractionation optimization with additional markets. – Increased integrated throughput. • Significant unrisked potential synergies present additional upside and shareholder value. – Expanded geography, connectivity and supply sources. – Further optimization and repurposing of redundant or underutilized pipe. Base synergies used to underwrite transactions represent less than half of total unrisked identified potential. Note: ONEOK expects to achieve its base case synergy forecast even if it does not acquire EnLink’s publicly held common units. EnLink and Medallion Identified Synergies…With Upside

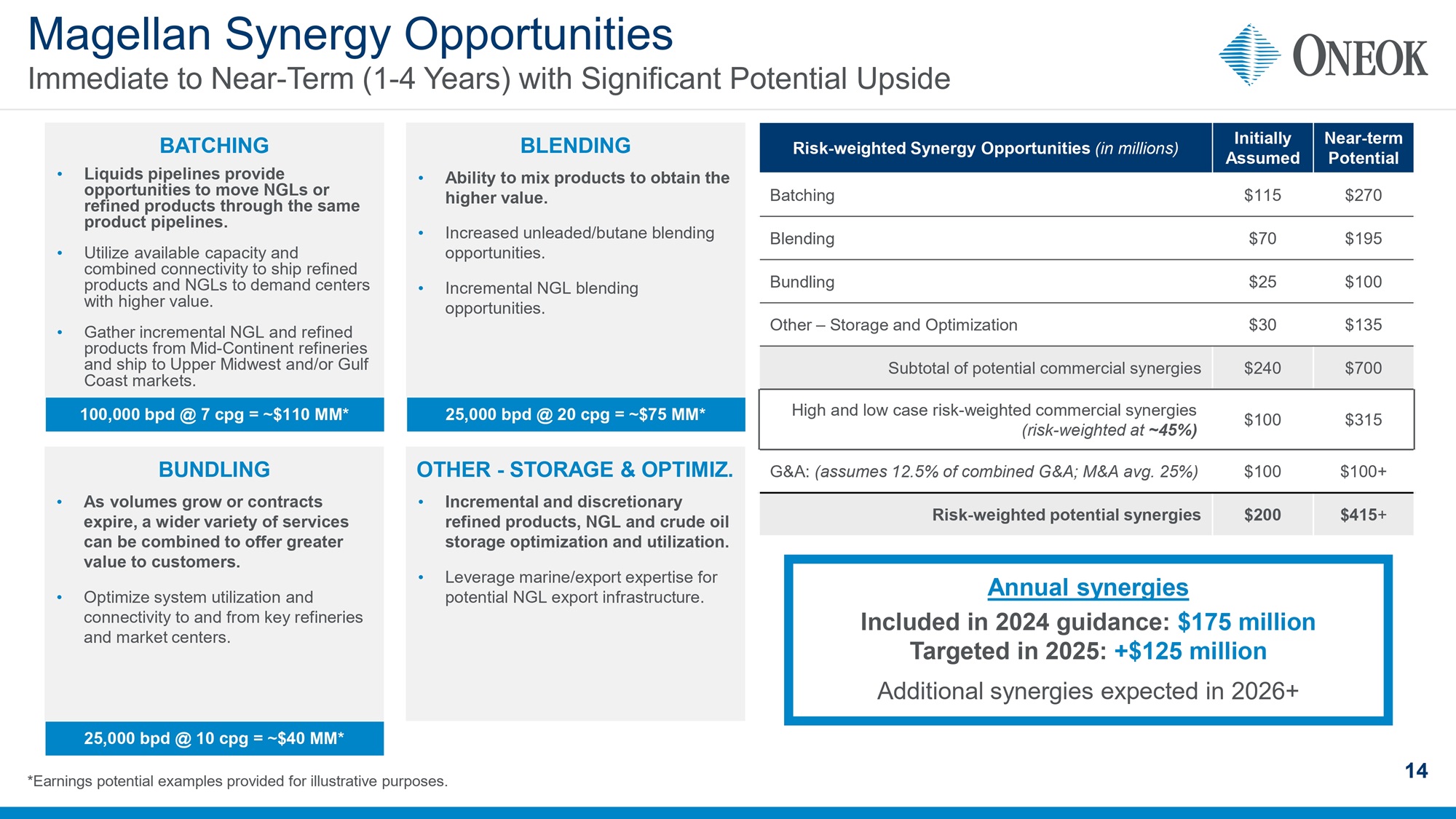

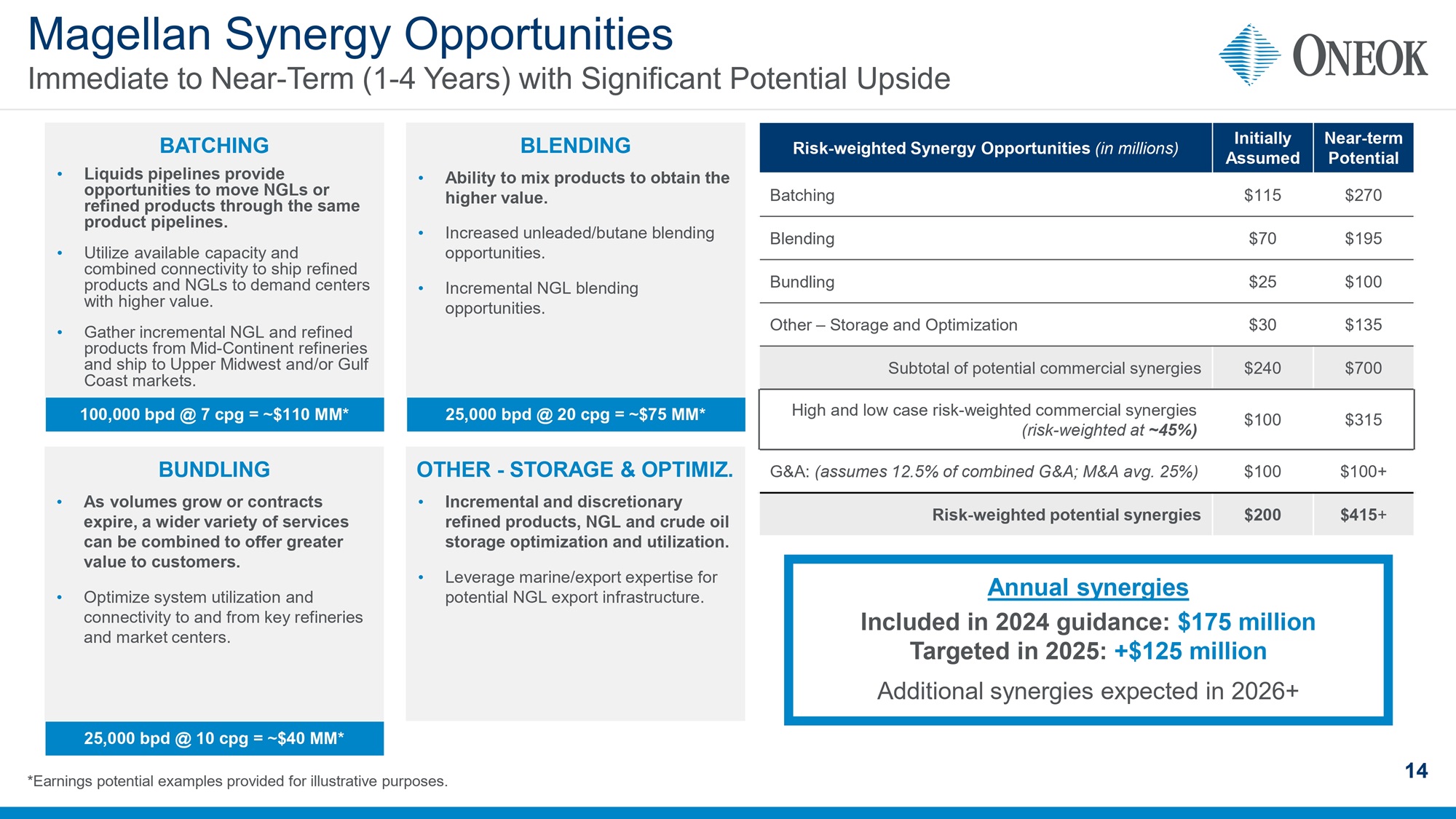

Magellan Synergy Opportunities Immediate to Near - Term (1 - 4 Years) with Significant Potential Upside BATCHING Near - term Potential Initially Assumed Risk - weighted Synergy Opportunities (in millions) $270 $115 Batching $195 $70 Blending $100 $25 Bundling $135 $30 Other – Storage and Optimization $700 $240 Subtotal of potential commercial synergies $315 $100 High and low case risk - weighted commercial synergies (risk - weighted at ~45%) $100+ $100 G&A: (assumes 12.5% of combined G&A; M&A avg. 25%) $415 + $200 Risk - weighted potential synergies • Liquids pipelines provide opportunities to move NGLs or refined products through the same product pipelines. • Utilize available capacity and combined connectivity to ship refined products and NGLs to demand centers with higher value. • Gather incremental NGL and refined products from Mid - Continent refineries and ship to Upper Midwest and/or Gulf Coast markets. 100,000 bpd @ 7 cpg = ~$ 110 MM* BLENDING • Ability to mix products to obtain the higher value. • Increased unleaded/butane blending opportunities. • Incremental NGL blending opportunities. 25,000 bpd @ 20 cpg = ~$ 75 MM* BUNDLING • As volumes grow or contracts expire, a wider variety of services can be combined to offer greater value to customers. • Optimize system utilization and connectivity to and from key refineries and market centers. 25,000 bpd @ 10 cpg = ~$ 40 MM* OTHER - STORAGE & OPTIMIZ . • Incremental and discretionary refined products, NGL and crude oil storage optimization and utilization. • Leverage marine/export expertise for potential NGL export infrastructure. *Earnings potential examples provided for illustrative purposes. 14 Annual synergies Included in 2024 g uidance : $175 million Targeted in 2025: +$125 million Additional synergies expected in 2026+

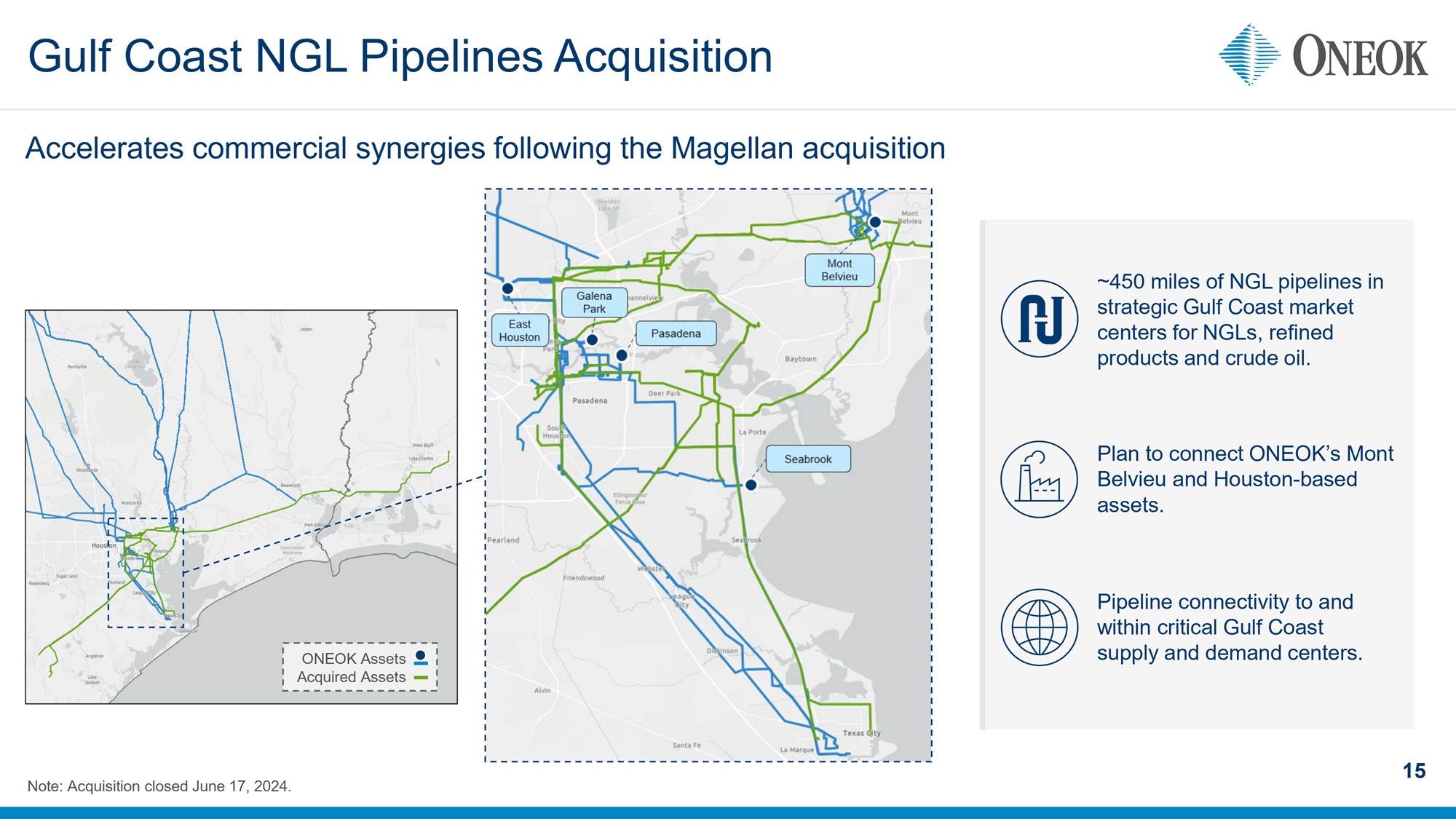

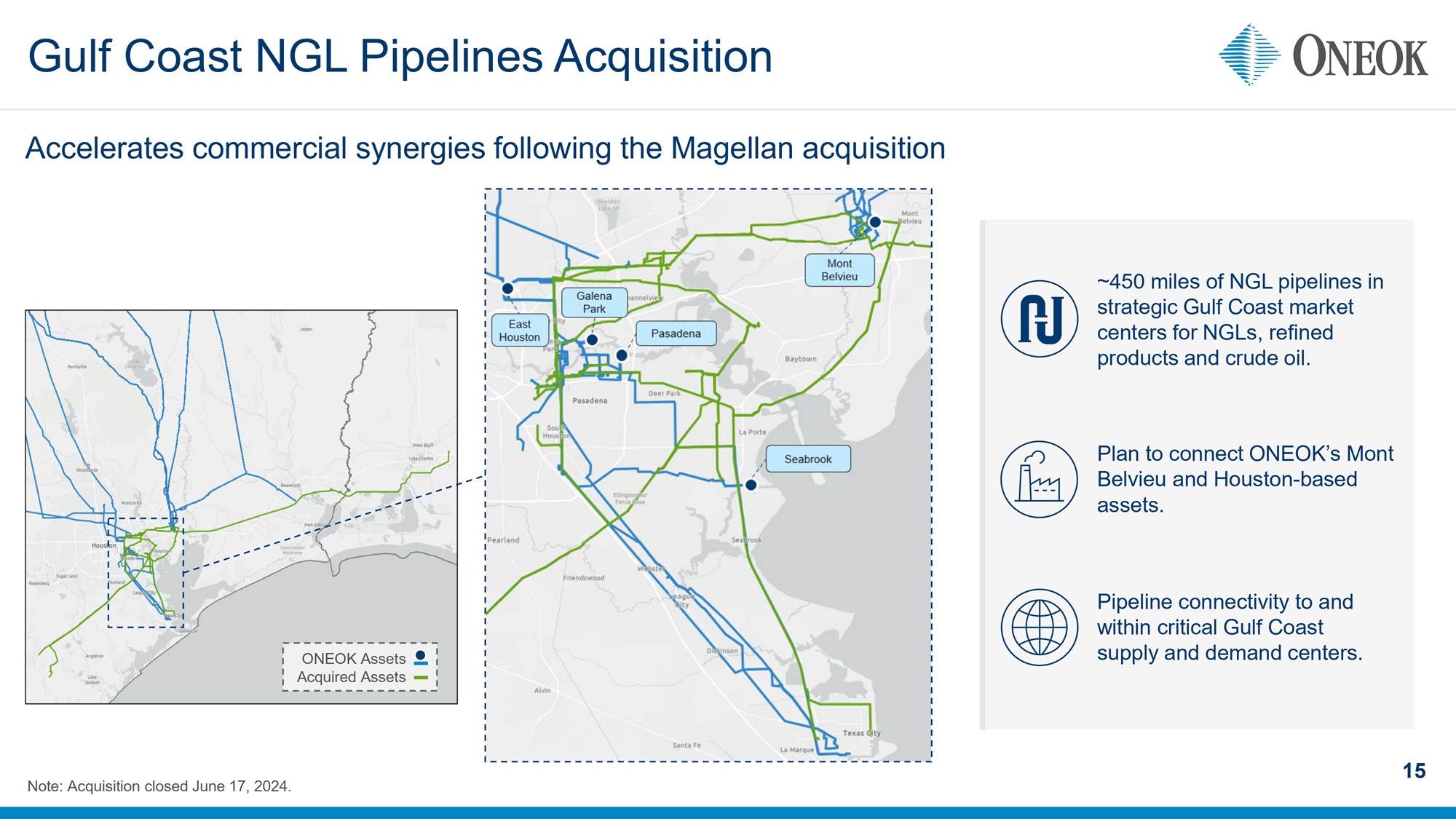

Gulf Coast NGL Pipelines Acquisition 15 Accelerates commercial synergies following the Magellan acquisition ~450 miles of NGL pipelines in strategic Gulf Coast market centers for NGLs, refined products and crude oil. Plan to connect ONEOK’s Mont Belvieu and Houston - based assets. Pipeline connectivity to and within critical Gulf Coast supply and demand centers. ONEOK Assets Acquired Assets Note: Acquisition closed June 17, 2024.

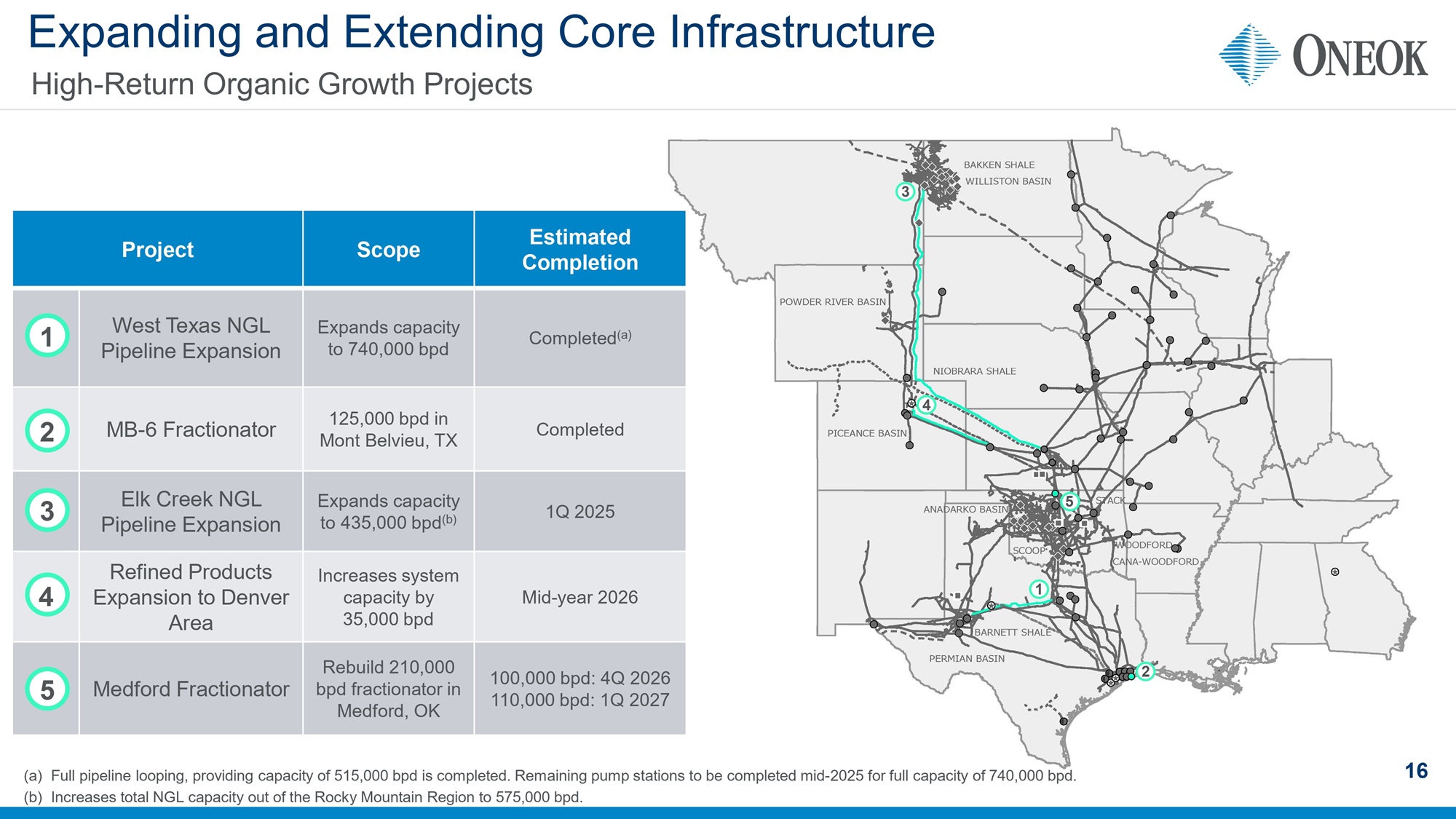

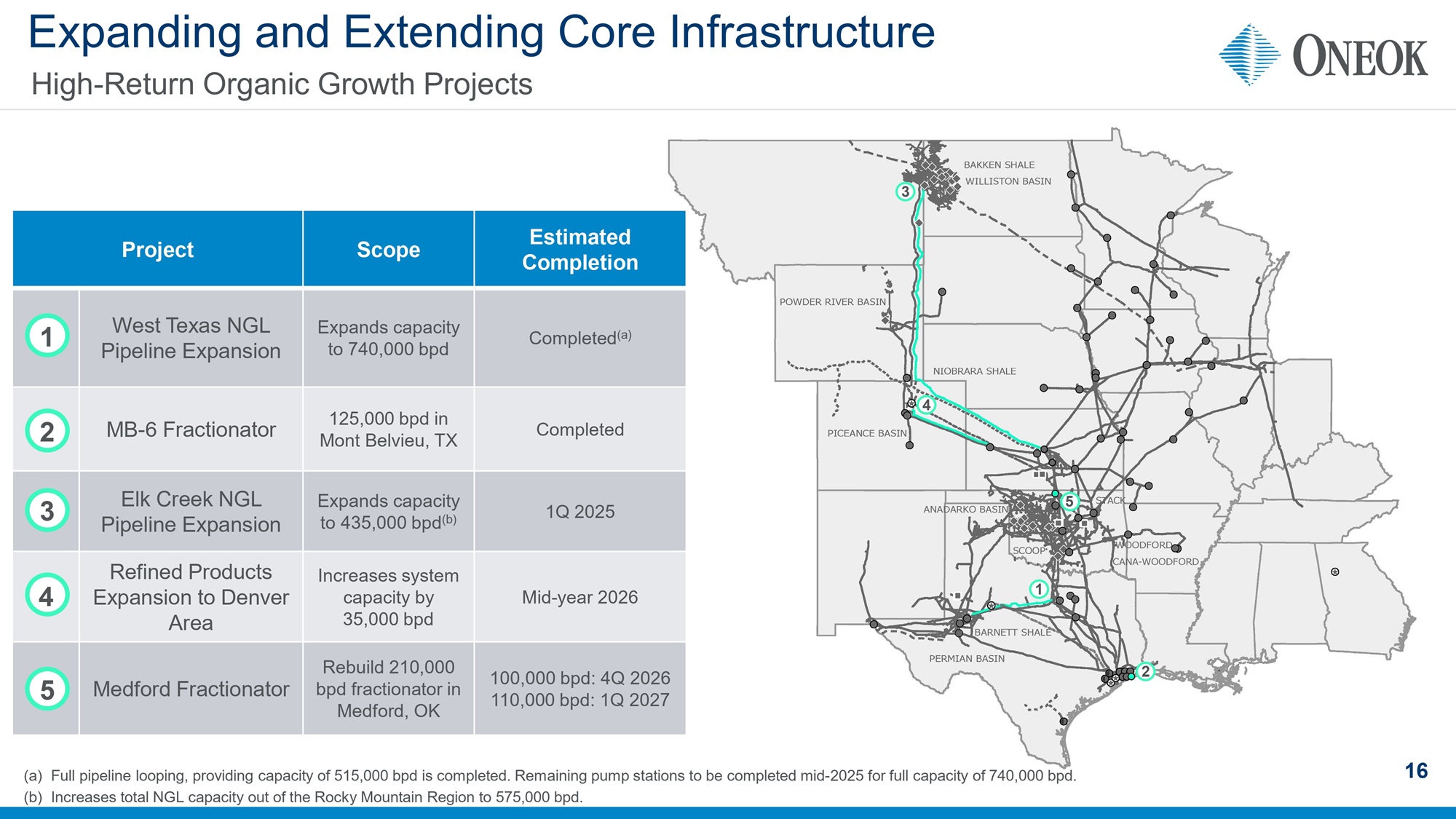

Expanding and Extending Core Infrastructure High - Return Organic Growth Projects Estimated Completion Scope Project Completed (a) Expands capacity to 740,000 bpd West Texas NGL Pipeline Expansion Completed 125,000 bpd in Mont Belvieu, TX MB - 6 Fractionator 1Q 2025 Expands capacity to 435,000 bpd (b) Elk Creek NGL Pipeline Expansion Mid - year 2026 Increases system capacity by 35,000 bpd Refined Products Expansion to Denver Area 100,000 bpd: 4Q 2026 110,000 bpd: 1Q 2027 Rebuild 210,000 bpd fractionator in Medford, OK Medford Fractionator 1 (a) Full pipeline looping, providing capacity of 515,000 bpd is completed. Remaining pump stations to be completed mid - 2025 for full capacity of 740,000 bpd. (b) Increases total NGL capacity out of the Rocky Mountain Region to 575,000 bpd. 2 3 4 5 16 3 4 5 1 2

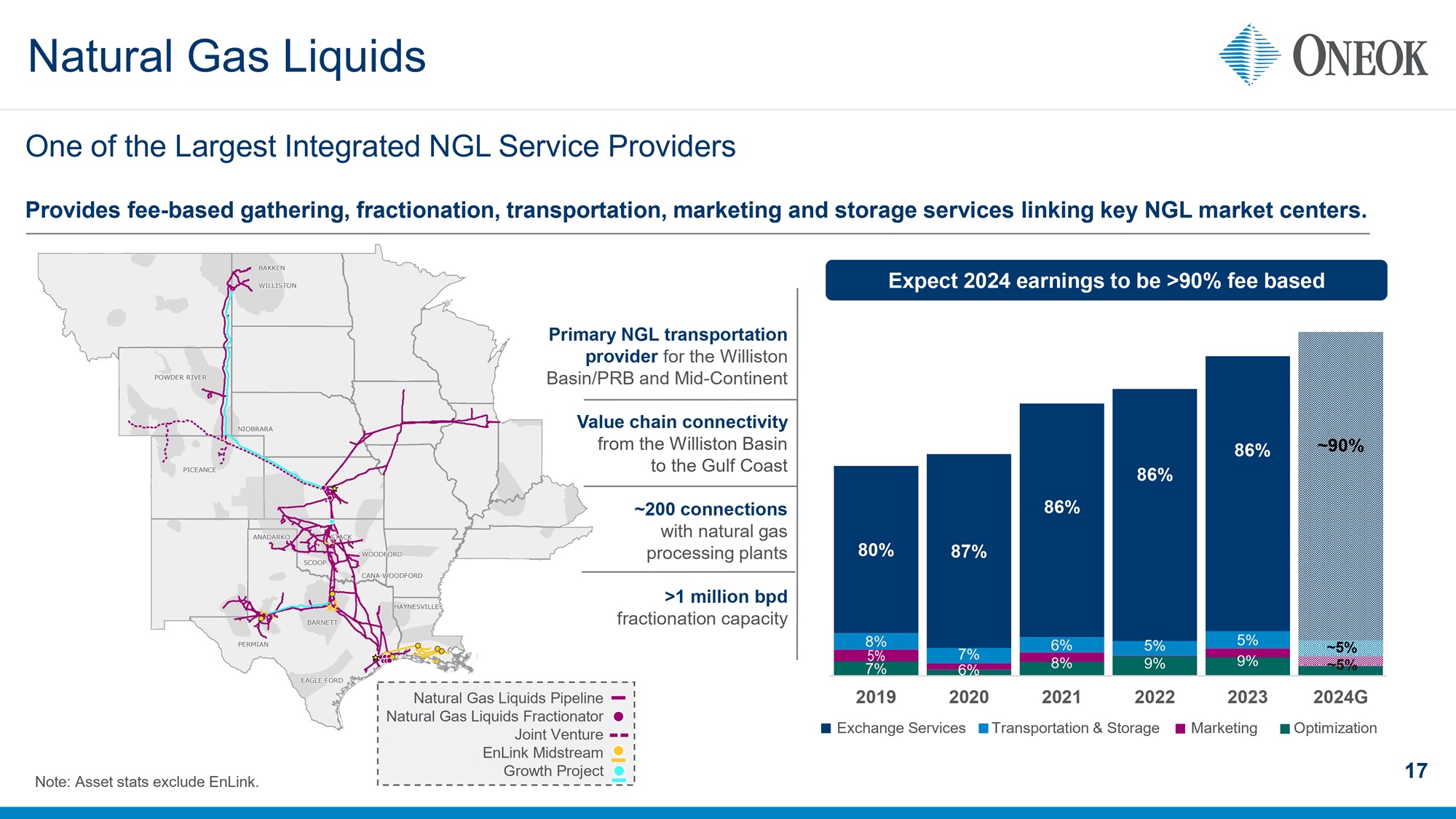

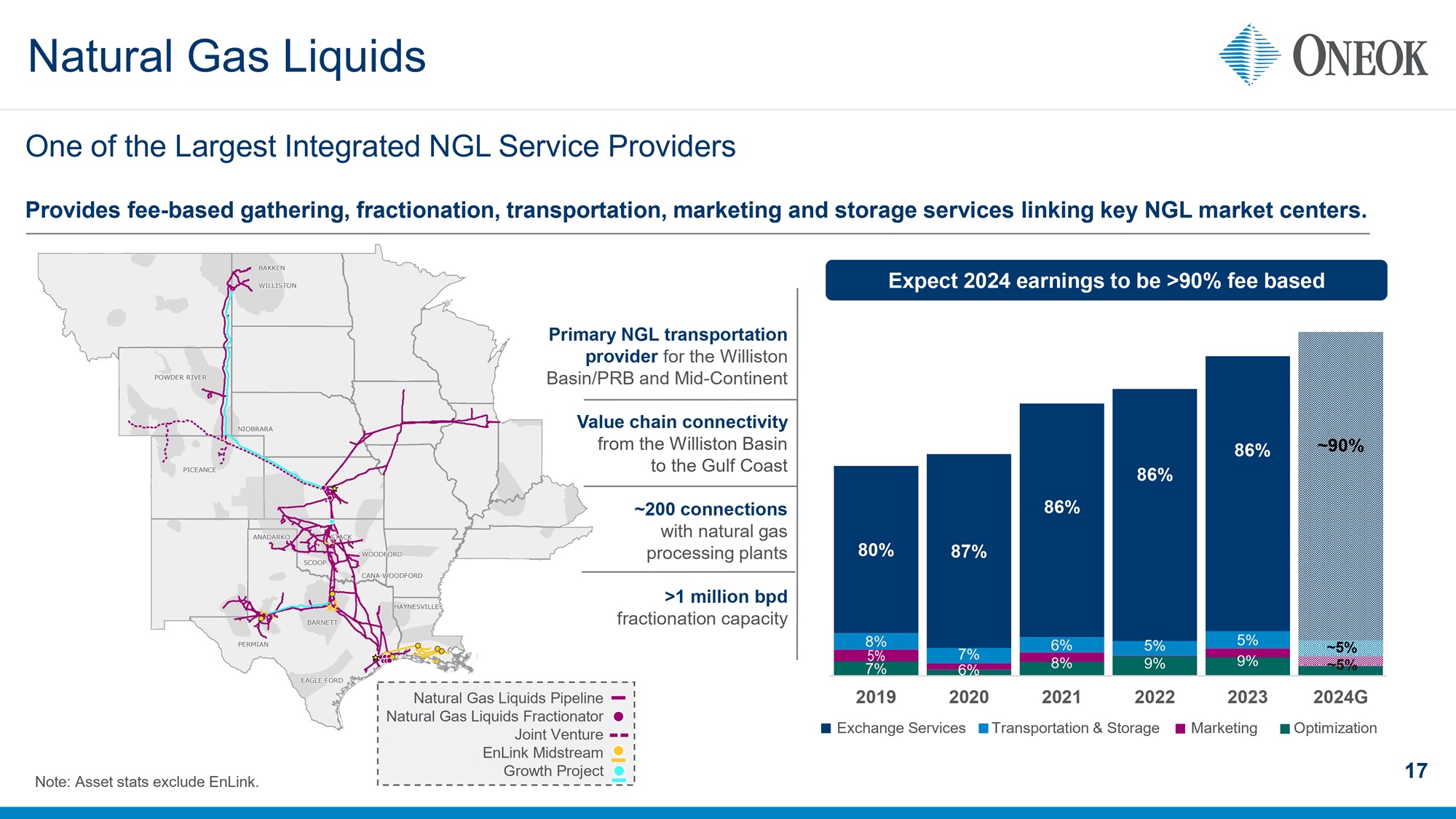

Natural Gas Liquids 17 One of the Largest Integrated NGL Service Providers Provides fee - based gathering, fractionation, transportation, marketing and storage services linking key NGL market centers. Primary NGL transportation provider for the Williston Basin/PRB and Mid - Continent Value chain connectivity from the Williston Basin to the Gulf Coast ~200 connections with natural gas processing plants >1 million bpd f ractionation capacity 7% 6% 8% 9% 9% 5% 8% 7% 6% 5% 5% ~5% 80% 87% 86% 86% 86% ~90% 2019 2020 2021 2022 2023 2024G Expect 2024 earnings to be >90% fee based Optimization Marketing Transportation & Storage Exchange Services Natural Gas Liquids Pipeline Natural Gas Liquids Fractionator Joint Venture EnLink Midstream Growth Project ~5% Note: Asset stats exclude EnLink.

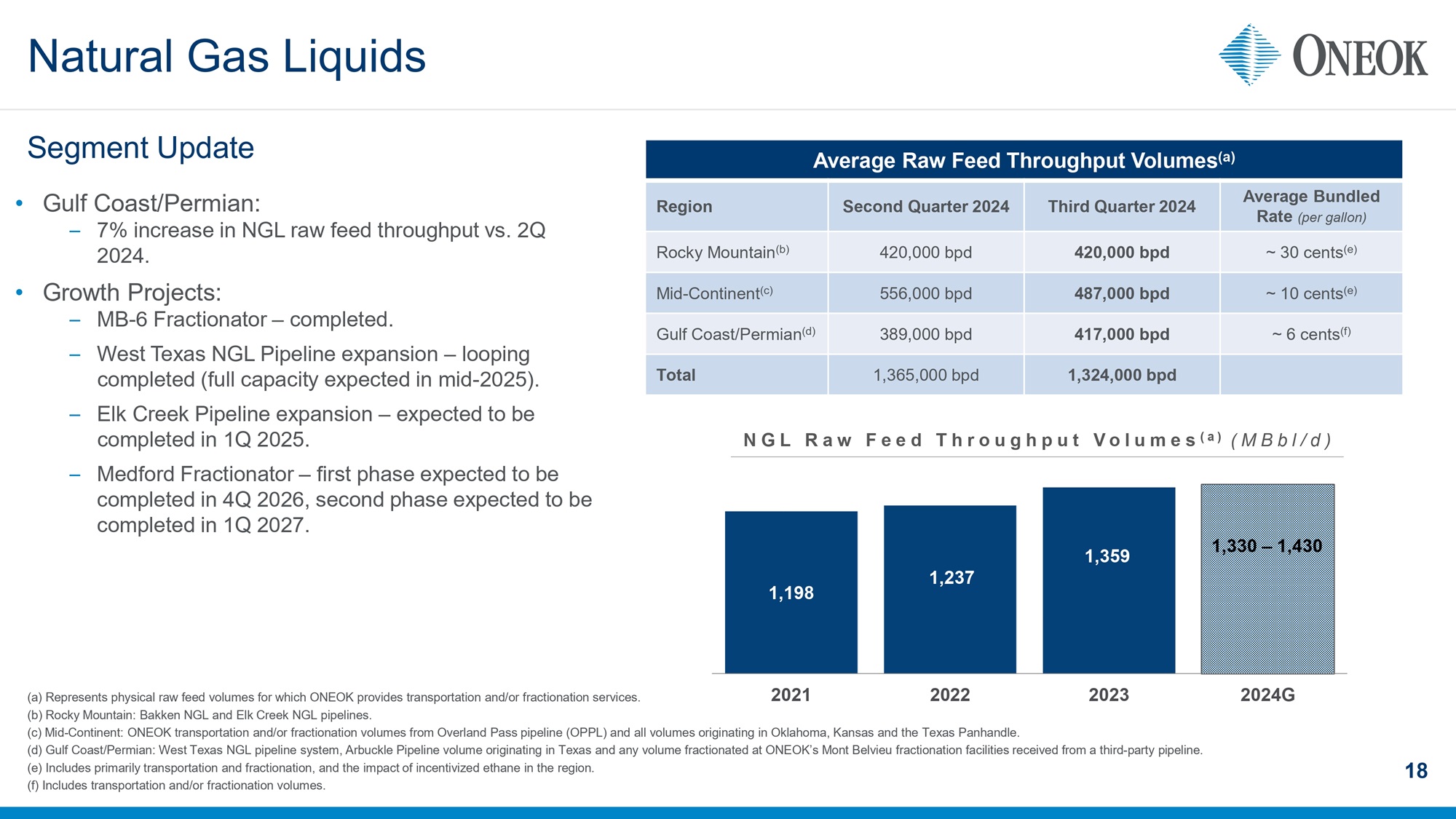

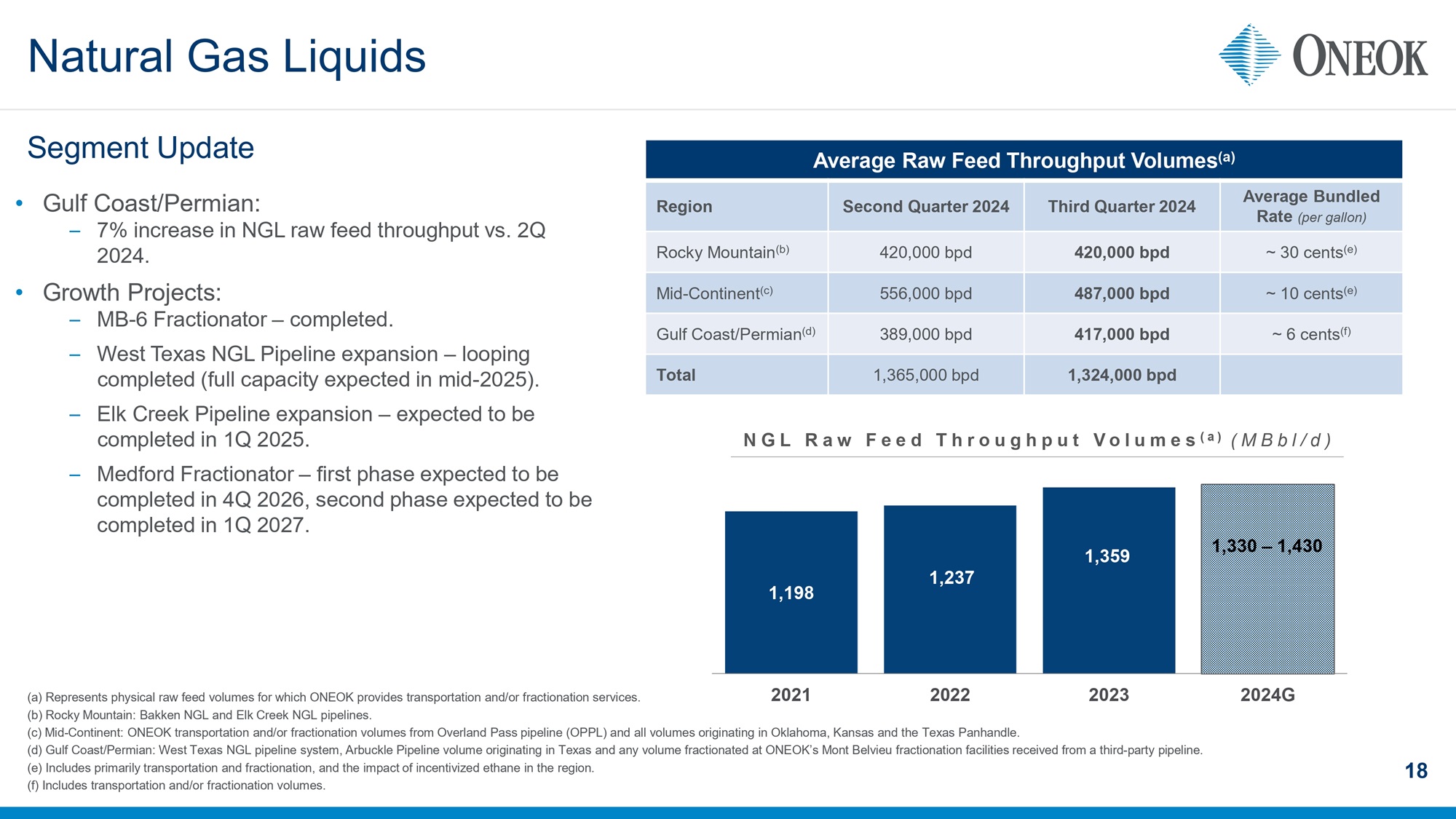

1,198 1,237 1,359 1,330 – 1,430 2021 2022 2023 2024G Natural Gas Liquids 18 Segment Update (a) Represents physical raw feed volumes for which ONEOK provides transportation and/or fractionation services. (b ) Rocky Mountain: Bakken NGL and Elk Creek NGL pipelines. (c) Mid - Continent: ONEOK transportation and/or fractionation volumes from Overland Pass pipeline (OPPL) and all volumes originat ing in Oklahoma, Kansas and the Texas Panhandle. (d) Gulf Coast/Permian: West Texas NGL pipeline system, Arbuckle Pipeline volume originating in Texas and any volume fraction ate d at ONEOK’s Mont Belvieu fractionation facilities received from a third - party pipeline. (e) Includes primarily transportation and fractionation, and the impact of incentivized ethane in the region. (f) Includes transportation and/or fractionation volumes. Average Raw Feed Throughput Volumes (a) Average Bundled Rate (per gallon) Third Quarter 2024 Second Quarter 2024 Region ~ 30 cents (e) 420,000 bpd 420,000 bpd Rocky Mountain (b) ~ 10 cents (e) 487,000 bpd 556,000 bpd Mid - Continent (c) ~ 6 cents (f) 417,000 bpd 389,000 bpd Gulf Coast/Permian (d) 1,324,000 bpd 1,365,000 bpd Total NGL Raw Feed Throughput Volumes (a) ( MBbl /d) • Gulf Coast/Permian: – 7% increase in NGL raw feed throughput vs. 2Q 2024. • Growth Projects: – MB - 6 Fractionator – completed. – West Texas NGL Pipeline expansion – looping completed (full capacity expected in mid - 2025). – Elk Creek Pipeline expansion – expected to be completed in 1Q 2025. – Medford Fractionator – first phase expected to be completed in 4Q 2026, second phase expected to be completed in 1Q 2027.

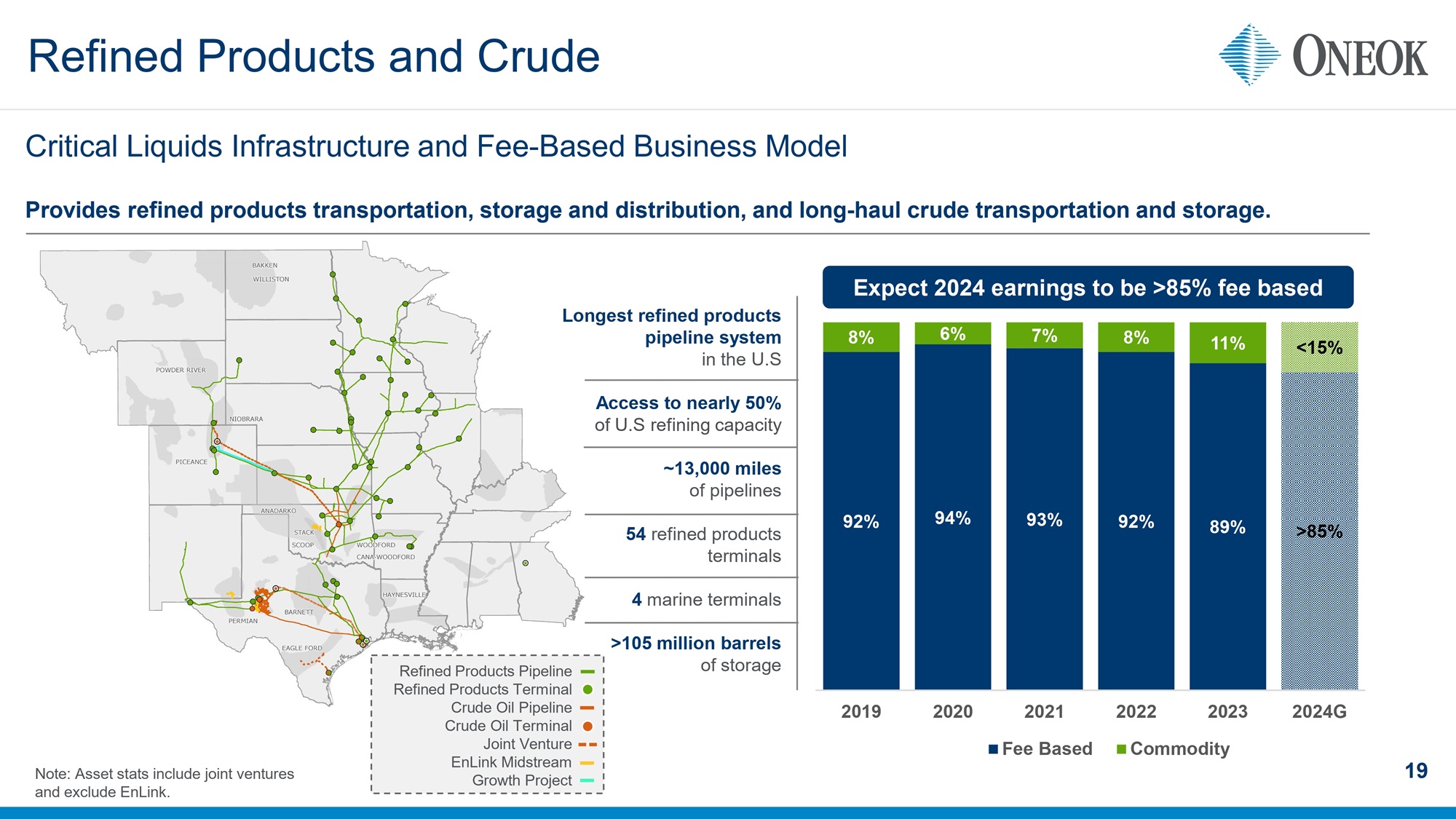

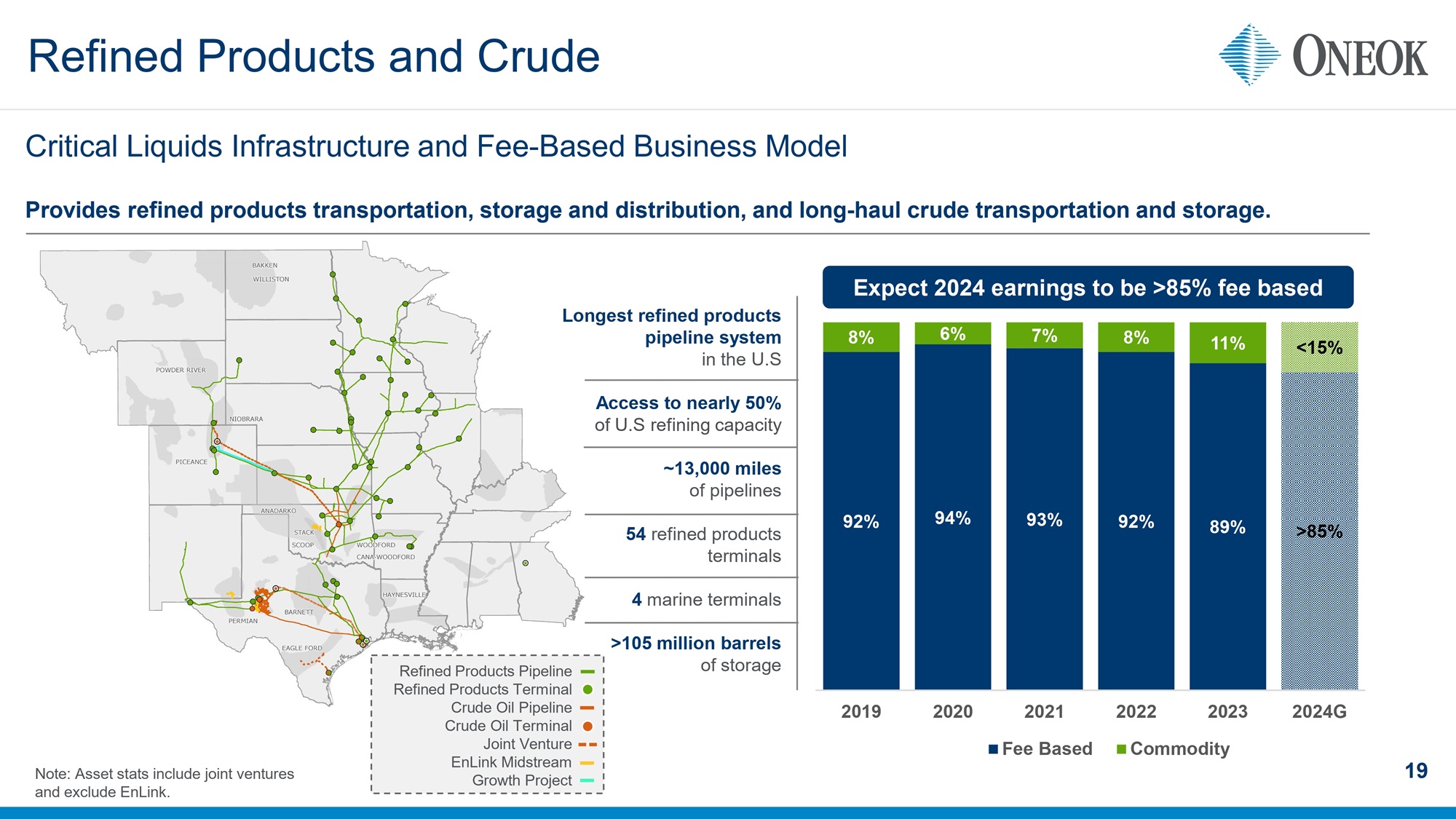

92% 94% 93% 92% 89% >85% 8% 6% 7% 8% 11% <15% 2019 2020 2021 2022 2023 2024G Fee Based Commodity Refined Products and Crude 19 Critical Liquids Infrastructure and Fee - Based Business Model Provides refined products transportation, storage and distribution, and long - haul crude transportation and storage. Expect 2024 earnings to be >85 % fee based Refined Products Pipeline Refined Products Terminal Crude Oil Pipeline Crude Oil Terminal Joint Venture EnLink Midstream Growth Project Longest refined products pipeline system in the U.S Access to nearly 50% of U.S refining capacity ~13,000 miles of pipelines 54 refined products terminals 4 marine terminals >105 million barrels of storage Note: Asset stats include joint ventures and exclude EnLink.

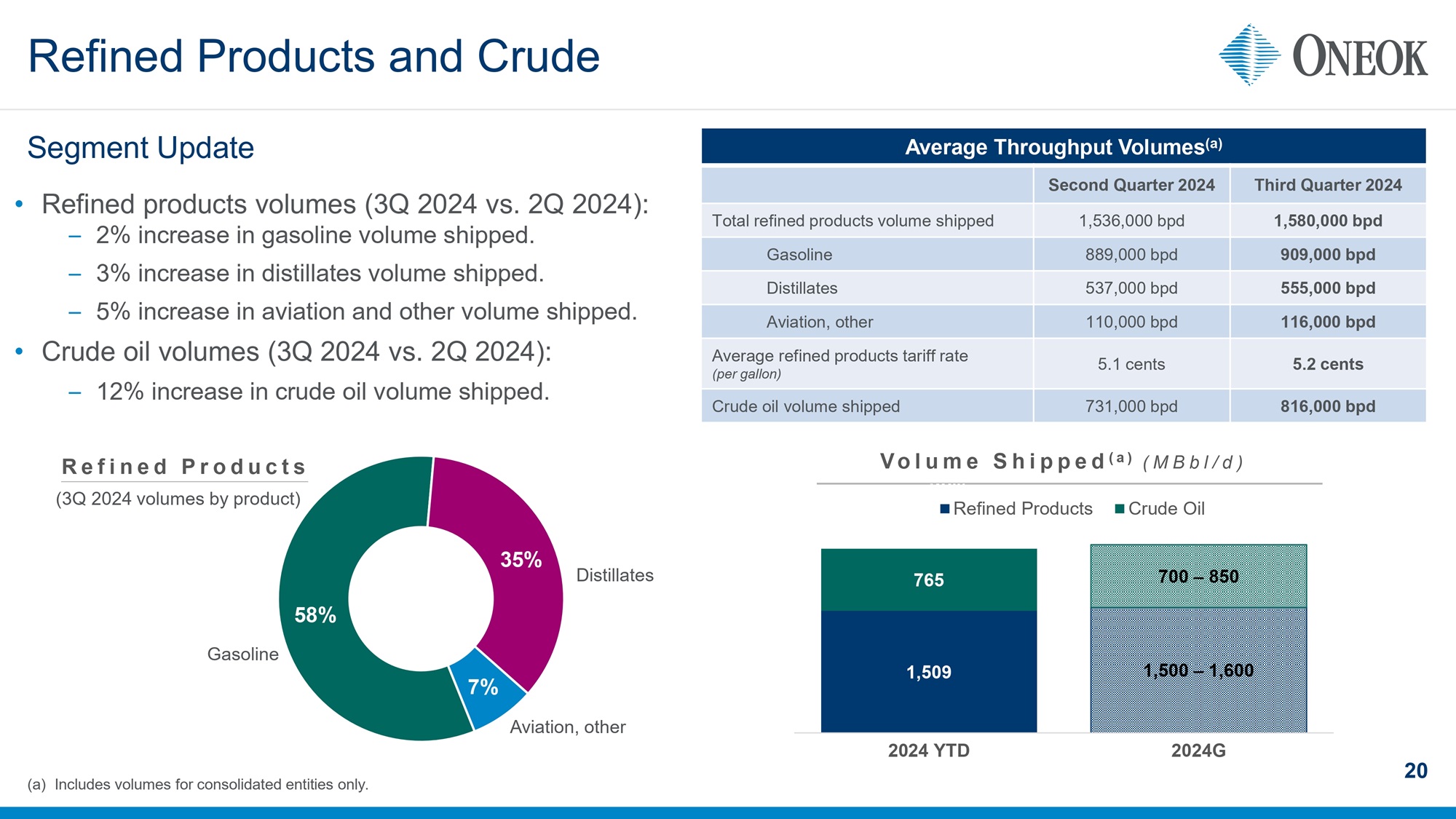

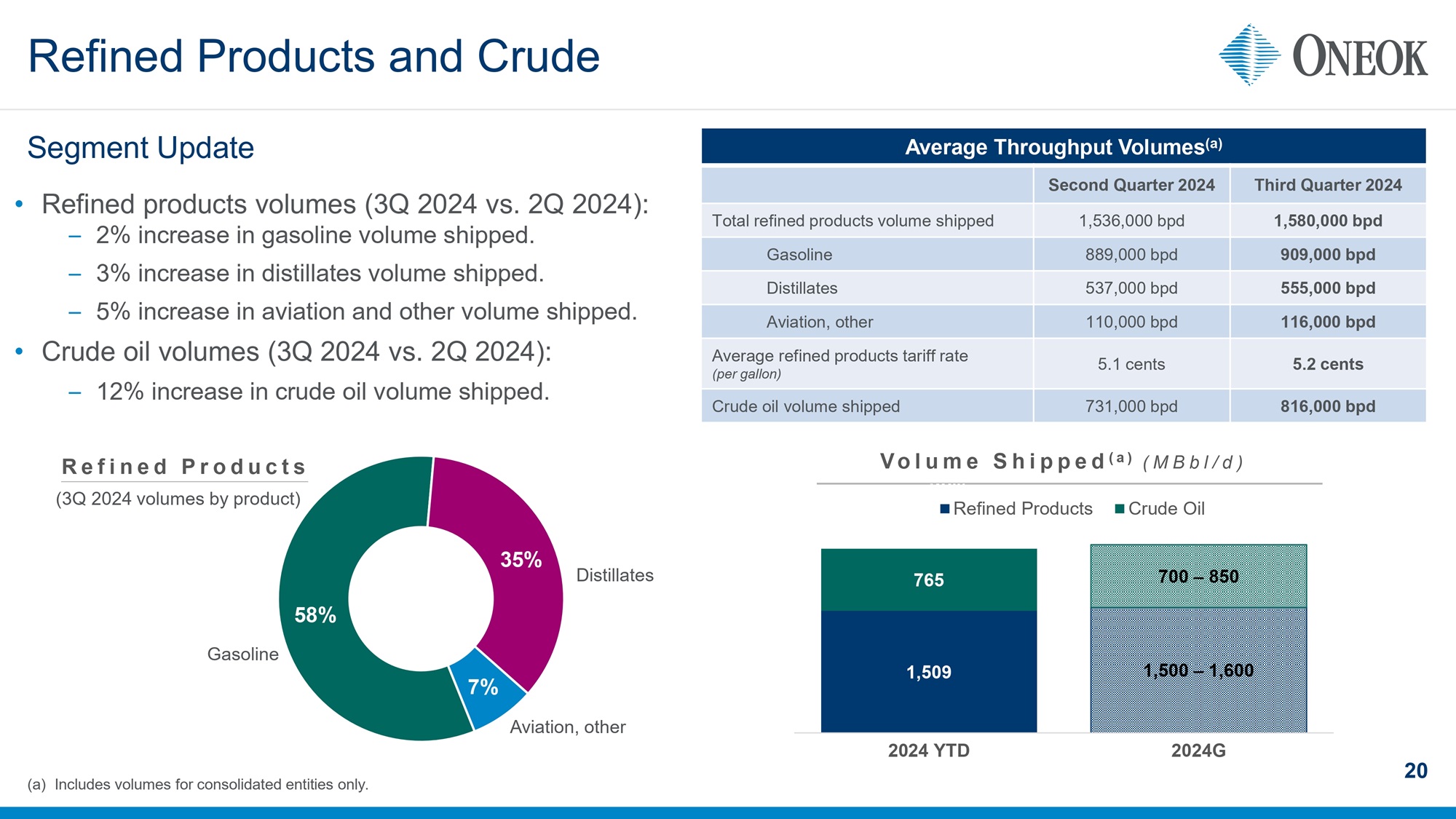

Refined Products and Crude 20 (a) Includes volumes for consolidated entities only. Average Throughput Volumes (a) Third Quarter 2024 Second Quarter 2024 1,580,000 bpd 1,536,000 bpd Total refined products volume shipped 909,000 bpd 889,000 bpd Gasoline 555,000 bpd 537,000 bpd Distillates 116,000 bpd 110,000 bpd Aviation, other 5.2 cents 5.1 cents Average refined products tariff rate (per gallon) 816,000 bpd 731,000 bpd Crude oil volume shipped 38% 56% Segment Update • Refined products volumes (3Q 2024 vs. 2Q 2024) : – 2 % increase in gasoline volume shipped. – 3 % increase in distillates volume shipped. – 5% increase in aviation and other volume shipped. • Crude oil volumes (3Q 2024 vs. 2Q 2024): – 12% increase in crude oil volume shipped. 1,509 1,500 – 1,600 765 700 – 850 2024 YTD 2024G Volume Shipped (a) ( MBbl /d) Refined Products Crude Oil Gasoline Refined Products Aviation, other Distillates (3Q 2024 volumes by product) 58% 35% 7%

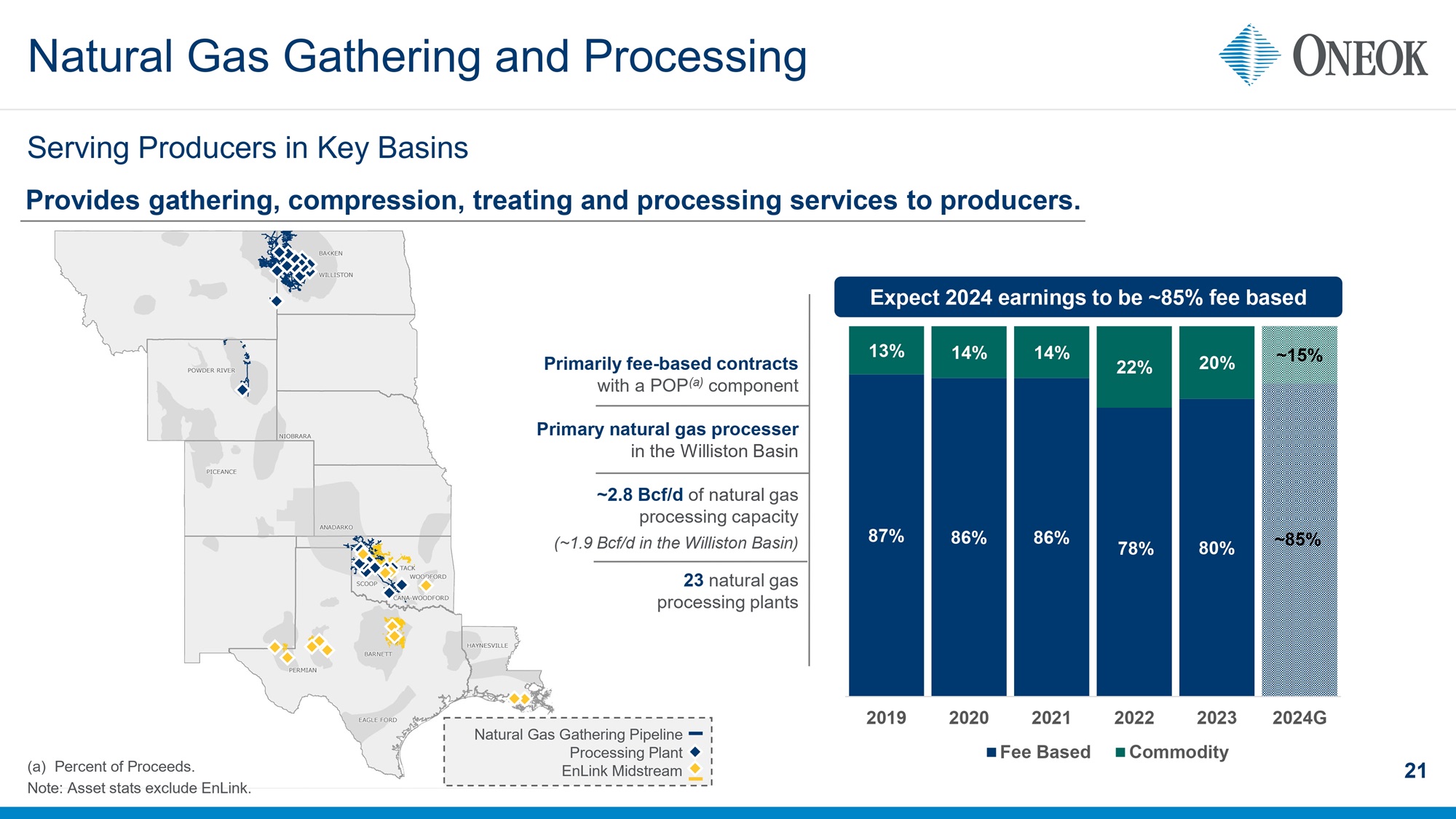

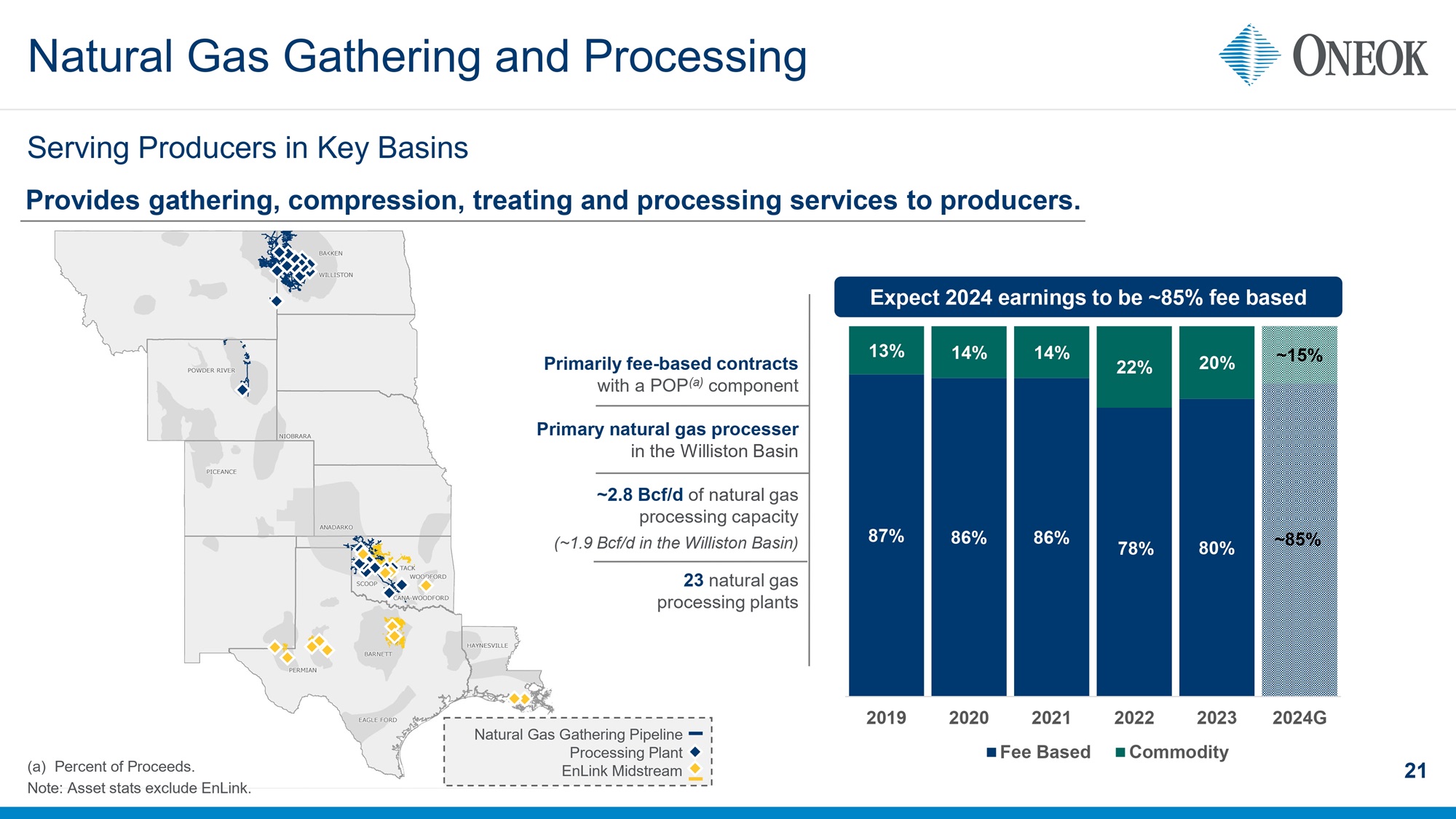

Natural Gas Gathering and Processing 21 Serving Producers in Key Basins Primarily fee - based contracts with a POP (a) component Primary natural gas processer in the Williston Basin ~2.8 Bcf/d of natural gas processing capacity (~ 1.9 Bcf /d in the Williston Basin) 23 natural gas processing plants Provides gathering, compression, treating and processing services to producers. 87% 86% 86% 78% 80% ~85% 13% 14% 14% 22% 20% ~15% 2019 2020 2021 2022 2023 2024G Fee Based Commodity Expect 2024 earnings to be ~85% fee based (a) Percent of Proceeds. Note: Asset stats exclude EnLink. Natural Gas Gathering Pipeline Processing Plant EnLink Midstream

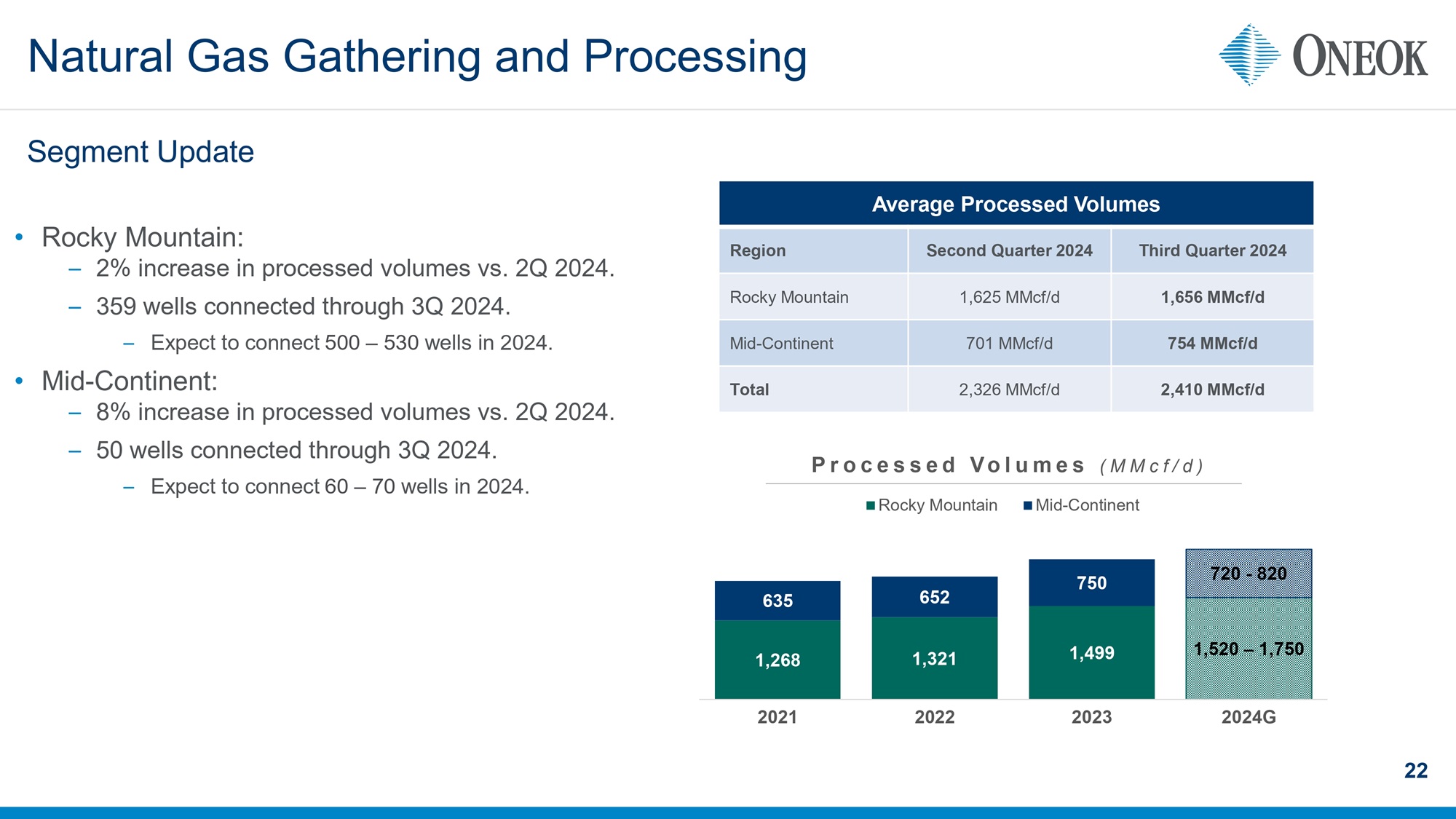

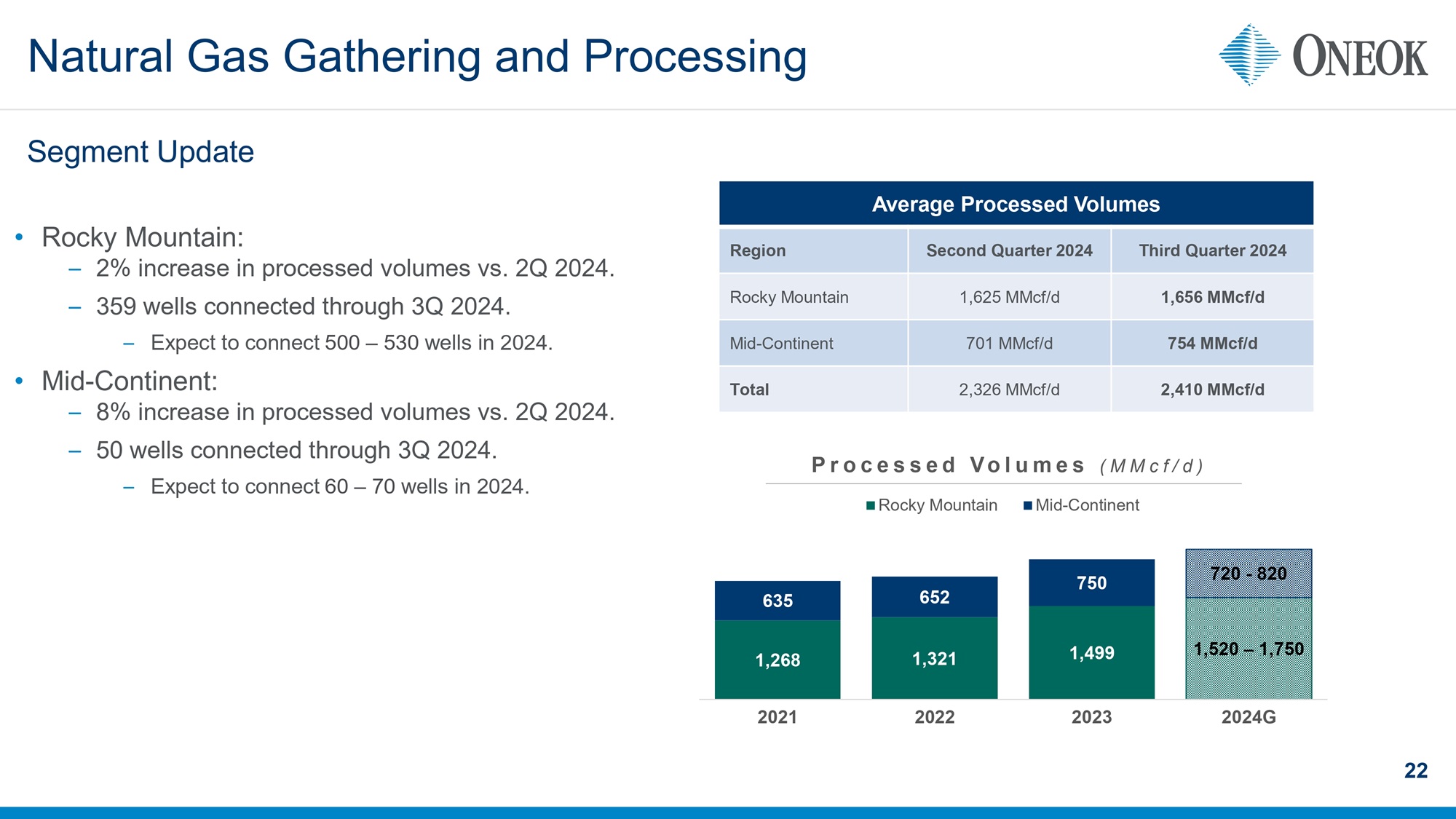

Natural Gas Gathering and Processing 22 Segment Update 1,268 1,321 1,499 1,520 – 1,750 635 652 750 720 - 820 2021 2022 2023 2024G Processed Volumes (MMcf/d) Rocky Mountain Mid-Continent Average Processed Volumes Third Quarter 2024 Second Quarter 2024 Region 1,656 MMcf /d 1,625 MMcf /d Rocky Mountain 754 MMcf /d 701 MMcf /d Mid - Continent 2,410 MMcf /d 2,326 MMcf /d Total • Rocky Mountain : – 2% increase in processed volumes vs. 2Q 2024. – 359 wells connected through 3Q 2024. – Expect to connect 500 – 530 wells in 2024. • Mid - Continent : – 8% increase in processed volumes vs. 2Q 2024. – 50 wells connected through 3Q 2024. – Expect to connect 60 – 70 wells in 2024.

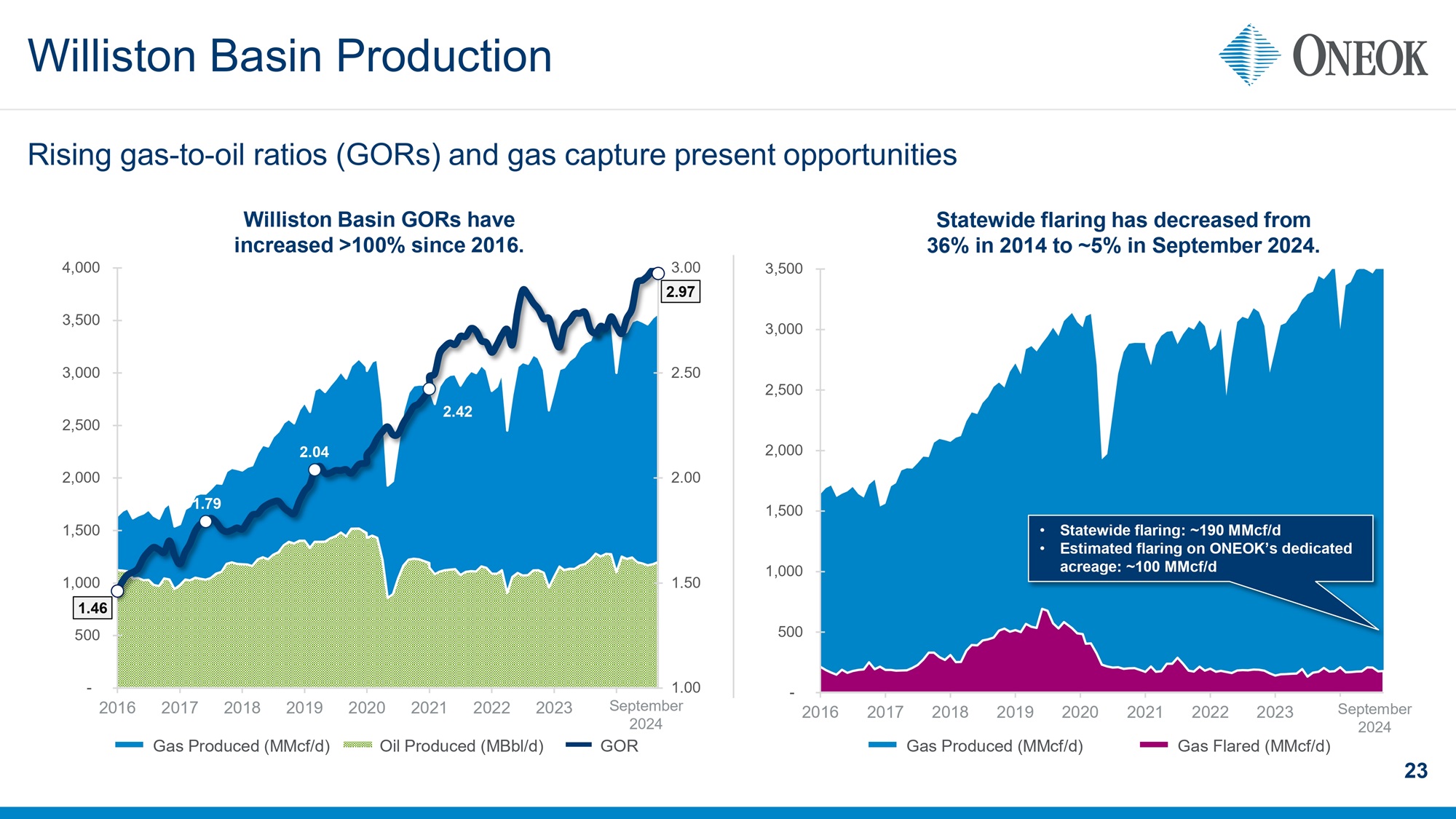

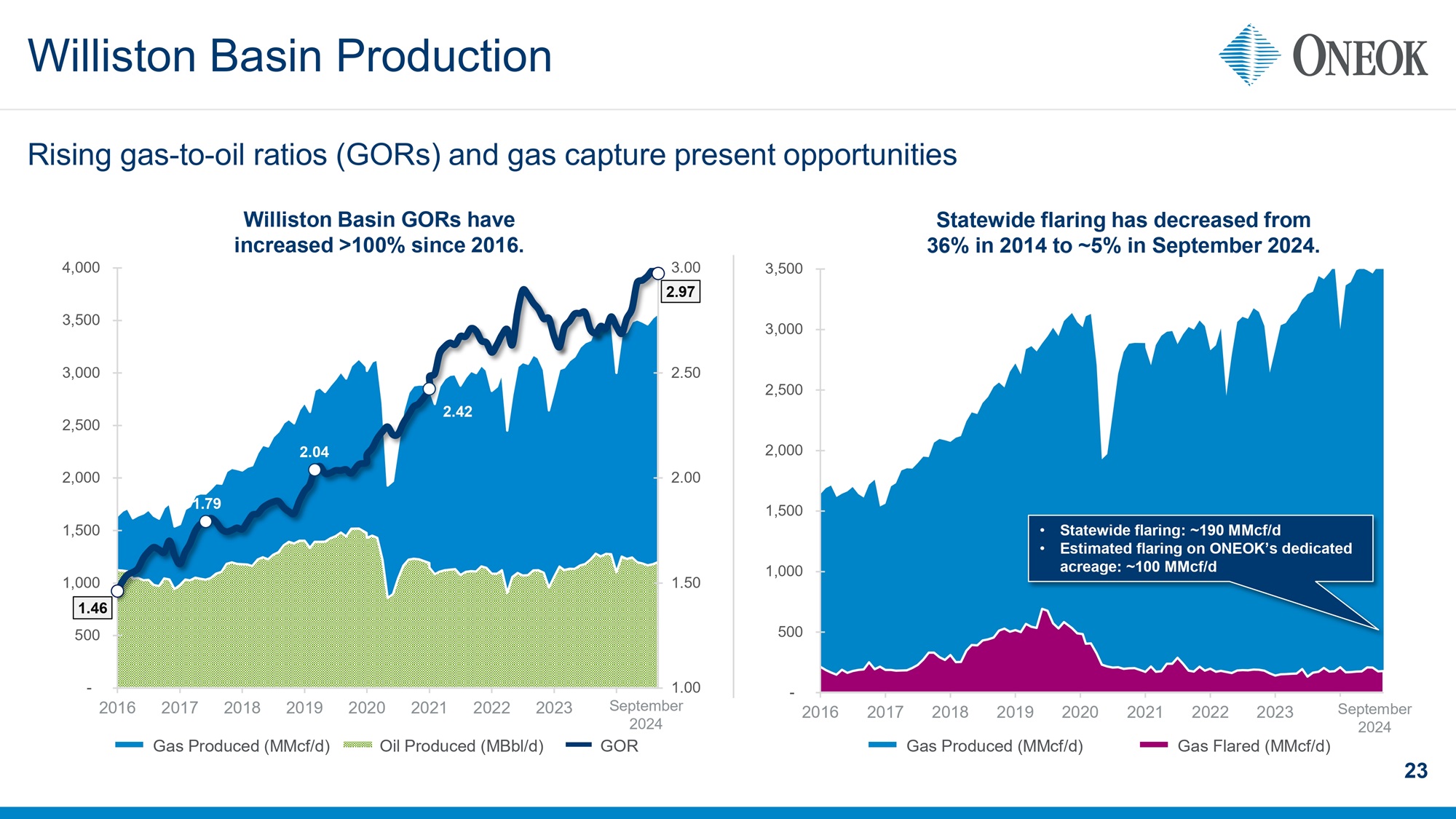

1.46 1.79 2.04 2.42 2.97 1.00 1.50 2.00 2.50 3.00 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 - 500 1,000 1,500 2,000 2,500 3,000 3,500 2016 2017 2018 2019 2020 2021 2022 2023 2024 23 Williston Basin Production Rising gas - to - oil ratios (GORs) and gas capture present opportunities Williston Basin GORs have increased >10 0 % since 2016. • Statewide flaring: ~190 MMcf/d • Estimated flaring on ONEOK’s dedicated acreage: ~100 MMcf /d Statewide flaring has decreased from 36% in 2014 to ~5% in September 2024. Gas Produced ( MMcf /d) Oil Produced ( MBbl /d) GOR Gas Produced ( MMcf /d) Gas Flared ( MMcf /d) September 2024 September 2024

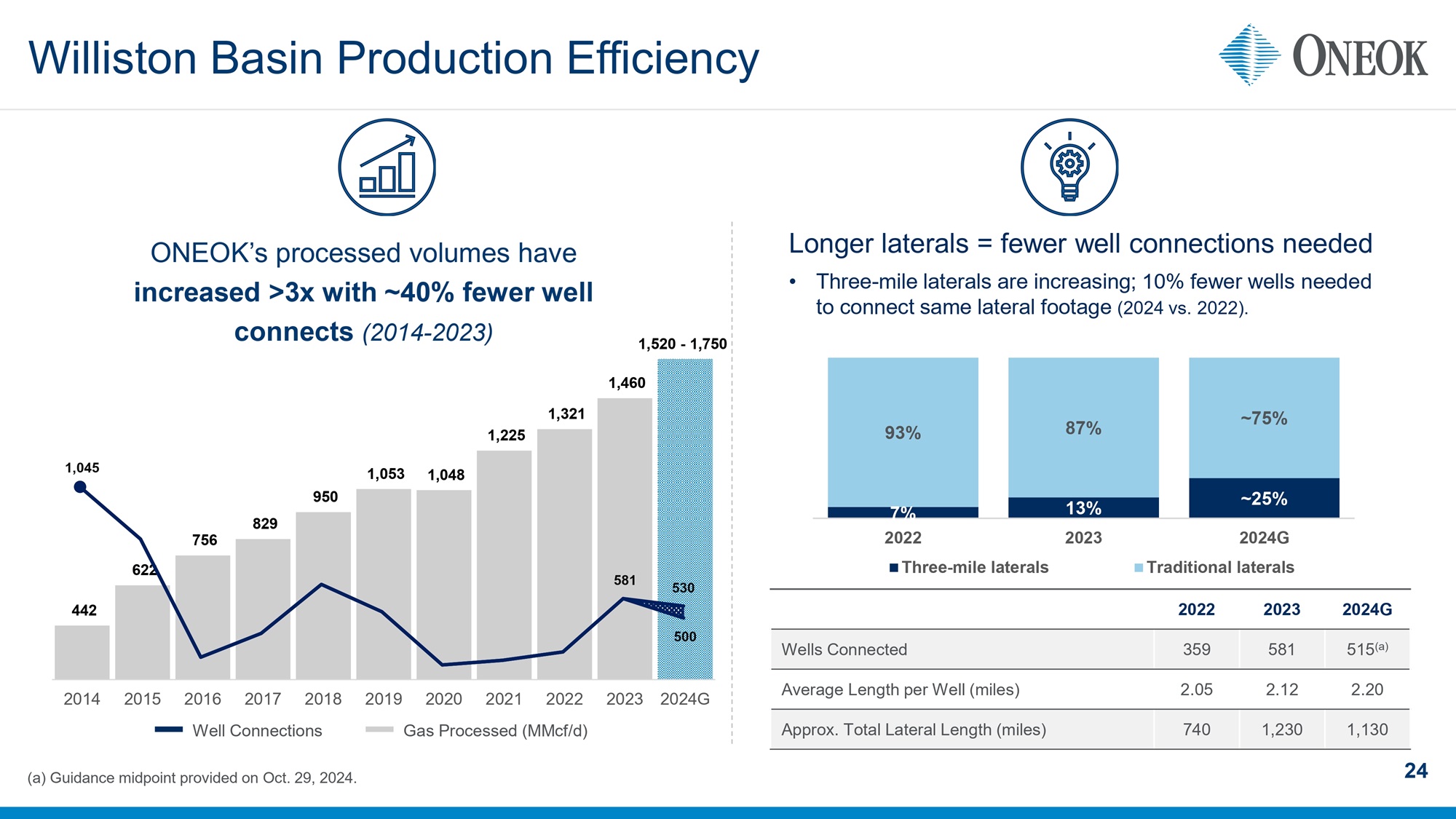

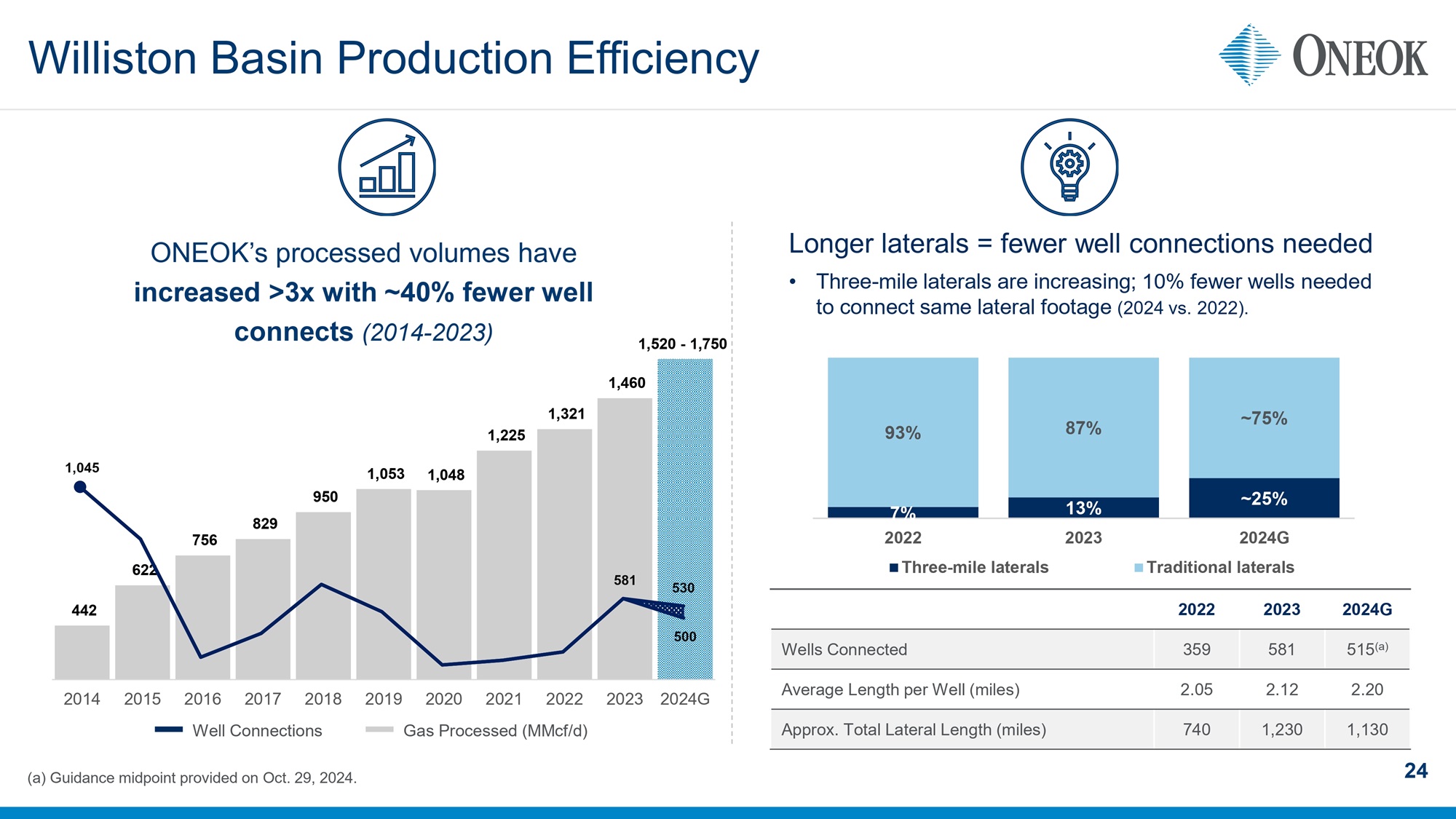

24 (a) Guidance midpoint provided on Oct. 29, 2024. Williston Basin Production Efficiency ONEOK’s processed volumes have increased >3x with ~40% fewer well connects (2014 - 2023) 2024G 2023 2022 515 (a) 581 359 Wells Connected 2.20 2.12 2.05 Average Length per Well (miles) 1,130 1,230 740 Approx. Total Lateral Length (miles) Longer laterals = fewer well connections needed • Three - mile laterals are increasing; 10% fewer wells needed to connect same lateral footage (2024 vs. 2022). Well Connections Gas Processed ( MMcf /d) 442 622 756 829 950 1,053 1,048 1,225 1,321 1,460 1,520 - 1,750 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024G 7% 13% ~25% 93% 87% ~75% 2022 2023 2024G Three-mile laterals Traditional laterals 500 1,045 581 530

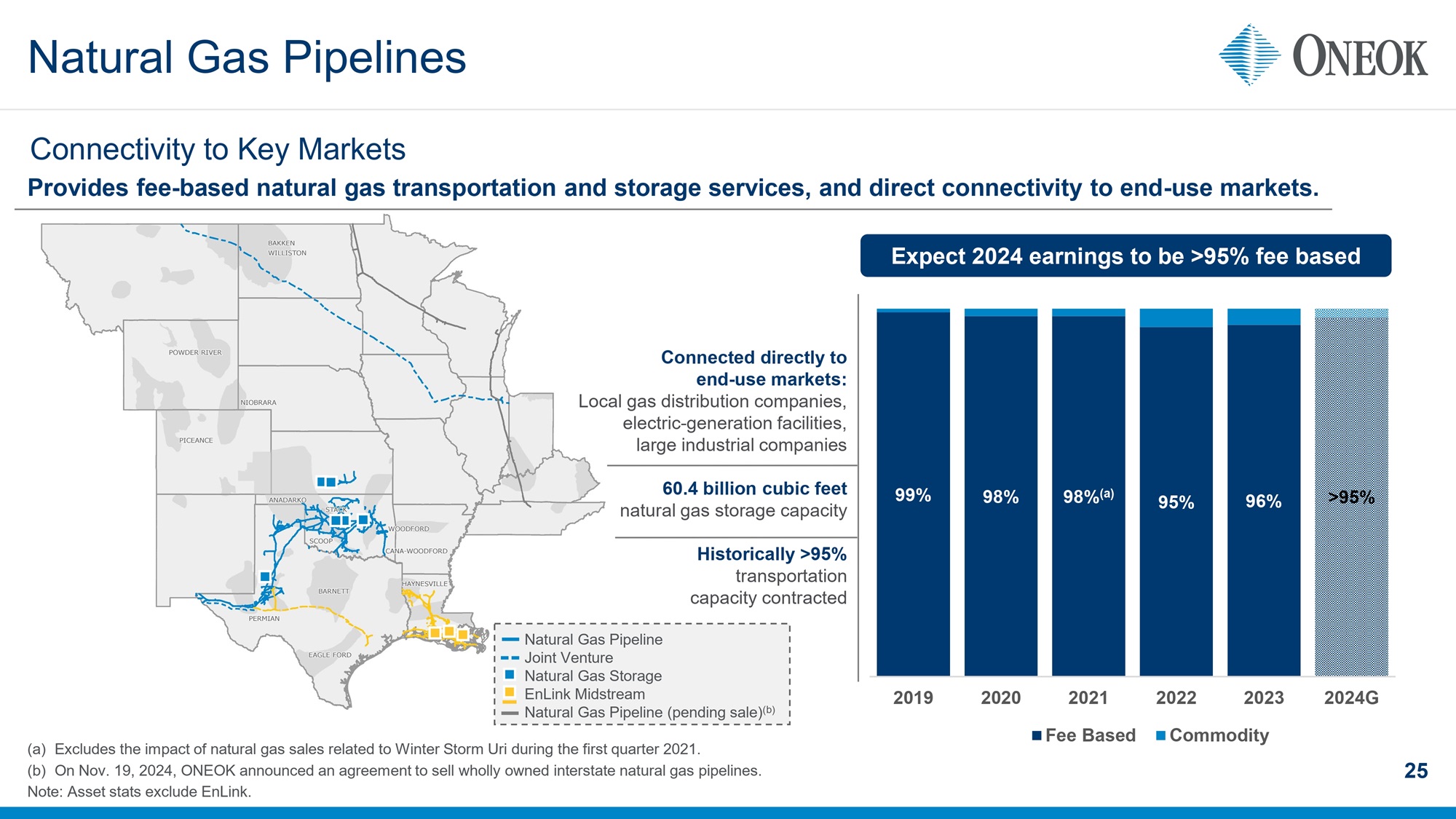

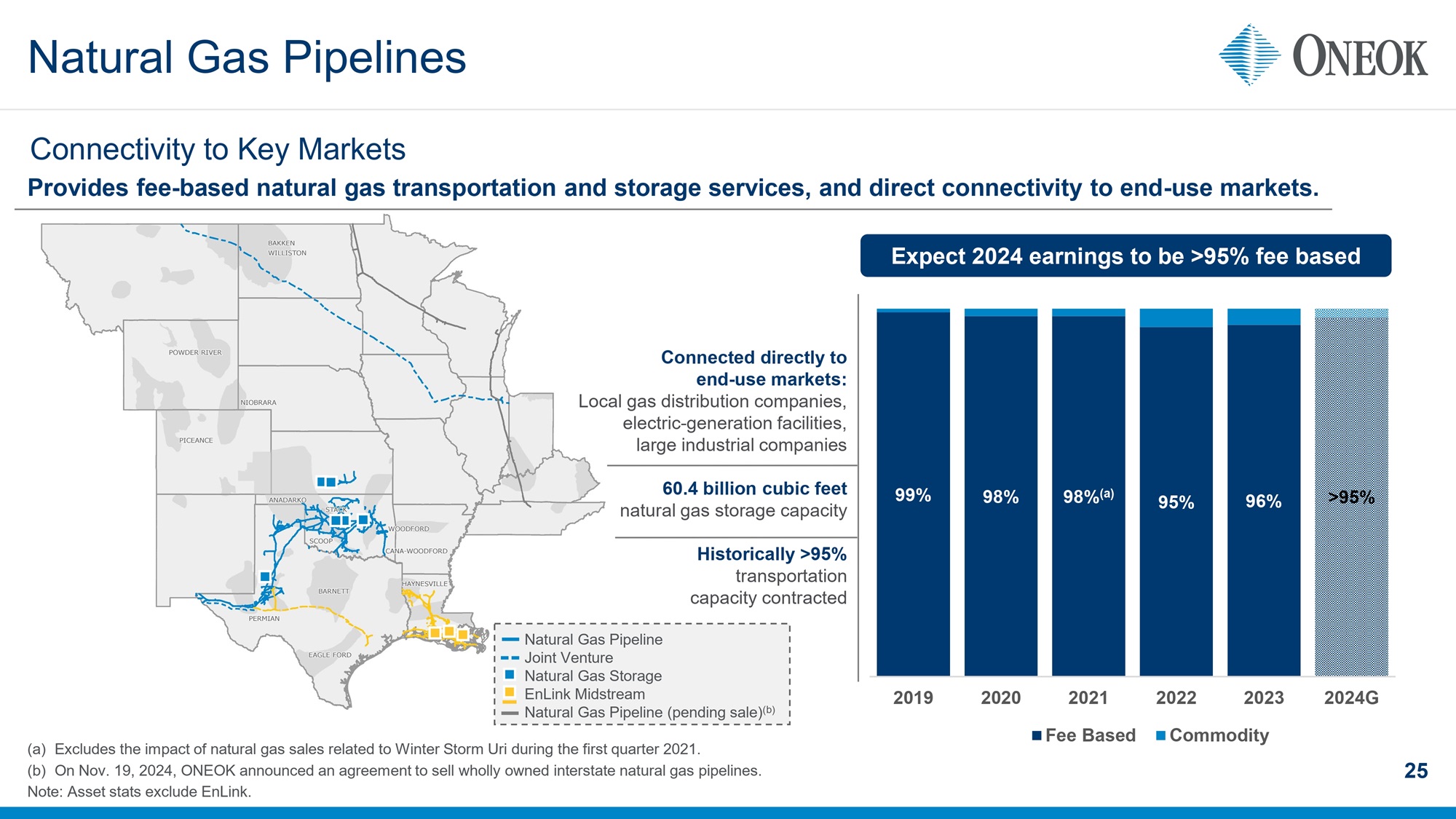

25 (a) Excludes the impact of natural gas sales related to Winter Storm Uri during the first quarter 2021. (b) On Nov. 19, 2024, ONEOK announced an agreement to sell wholly owned interstate natural gas pipelines. Note: Asset stats exclude EnLink. Natural Gas Pipelines Provides fee - based natural gas transportation and storage services, and direct connectivity to end - use markets. 99% 98% 98% (a) 95% 96% >95% 2019 2020 2021 2022 2023 2024G Fee Based Commodity Connected directly to end - use markets: Local gas distribution companies, electric - generation facilities, large industrial companies 60.4 billion cubic feet natural gas storage capacity Historically >95% transportation capacity contracted Expect 2024 earnings to be > 95 % fee based Connectivity to Key Markets Natural Gas Pipeline Joint Venture Natural Gas Storage EnLink Midstream Natural Gas Pipeline (pending sale) (b)

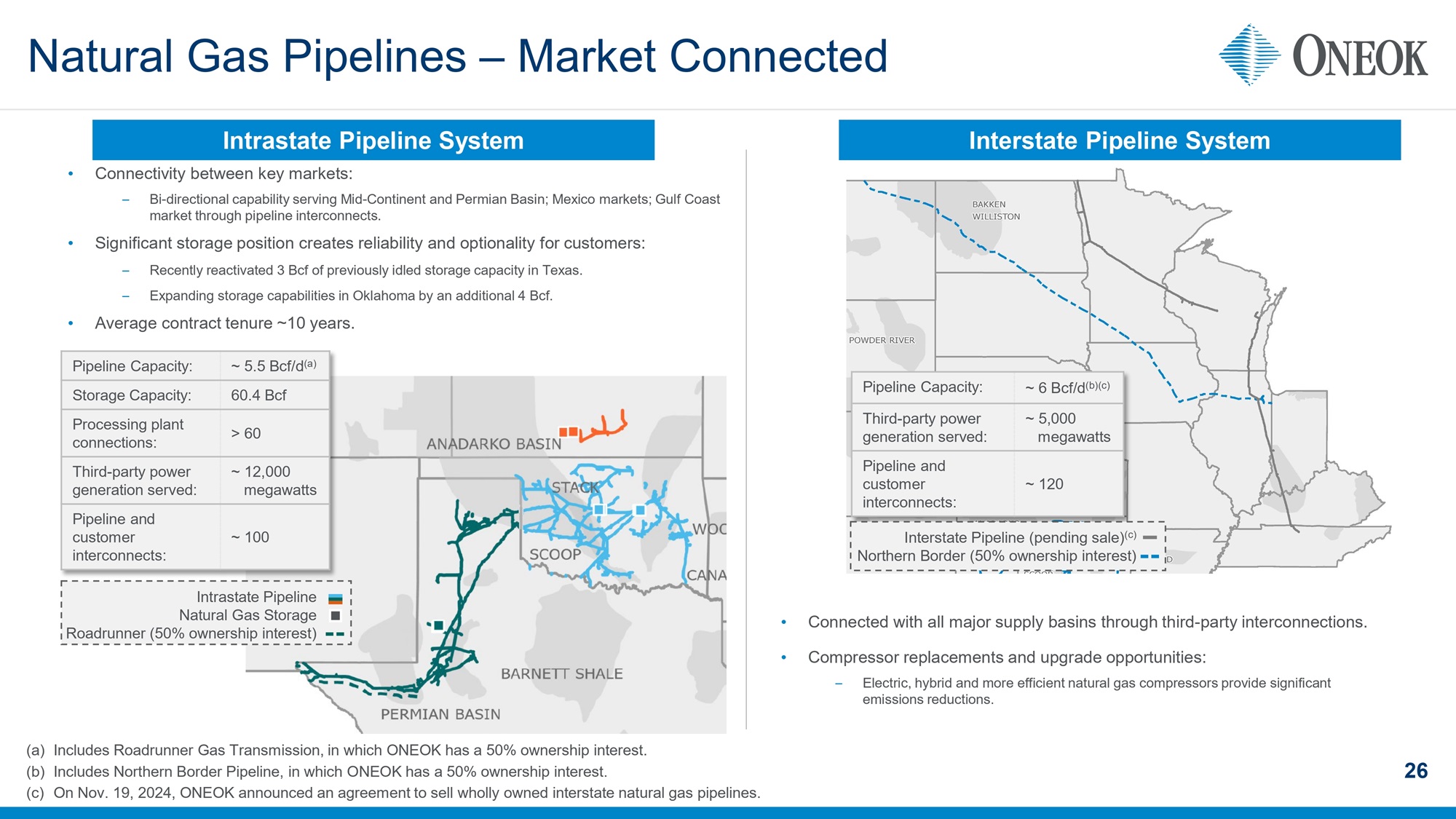

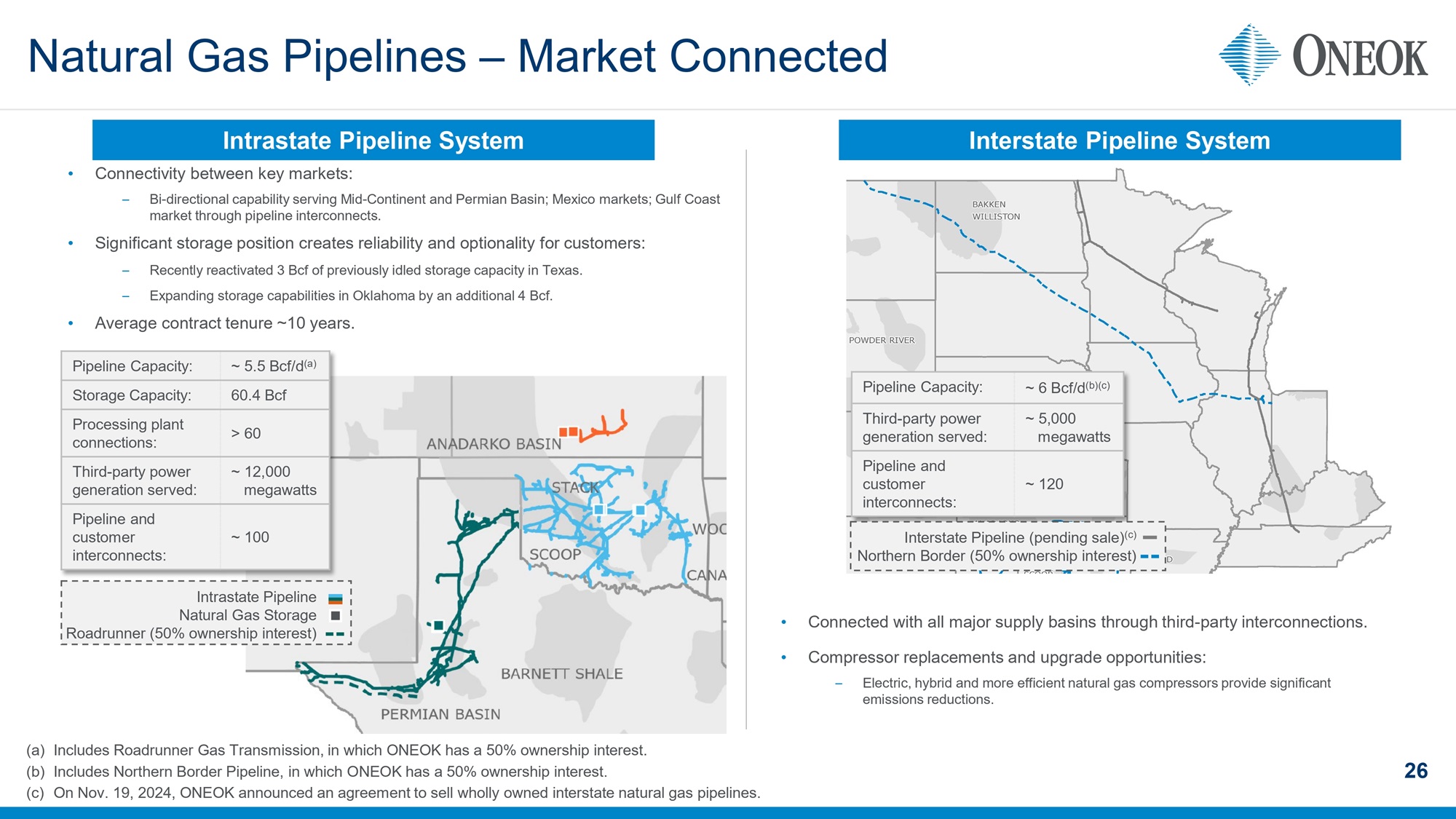

Natural Gas Pipelines – Market Connected 26 (a) Includes Roadrunner Gas Transmission, in which ONEOK has a 50% ownership interest. (b) Includes Northern Border Pipeline, in which ONEOK has a 50% ownership interest. (c) On Nov. 19, 2024, ONEOK announced an agreement to sell wholly owned interstate natural gas pipelines. Interstate Pipeline System Intrastate Pipeline System ~ 6 Bcf/d (b)(c) Pipeline Capacity: ~ 5,000 megawatts Third - party power generation served: ~ 120 Pipeline and customer interconnects: ~ 5.5 Bcf /d (a) Pipeline Capacity: 60.4 Bcf Storage Capacity: > 60 Processing plant connections: ~ 12,000 megawatts Third - party power generation served: ~ 100 Pipeline and customer interconnects: • Connectivity between key markets: – Bi - directional capability serving Mid - Continent and Permian Basin; Mexico markets; Gulf Coast market through pipeline interconnects. • Significant storage position creates reliability and optionality for customers: – Recently reactivated 3 Bcf of previously idled storage capacity in Texas. – Expanding storage capabilities in Oklahoma by an additional 4 Bcf. • Average contract tenure ~10 years. • Connected with all major supply basins through third - party interconnections. • Compressor replacements and upgrade opportunities: – Electric, hybrid and more efficient natural gas compressors provide significant emissions reductions. Intrastate Pipeline Natural Gas Storage Roadrunner (50% ownership interest) Interstate Pipeline (pending sale) ( c ) Northern Border (50% ownership interest)

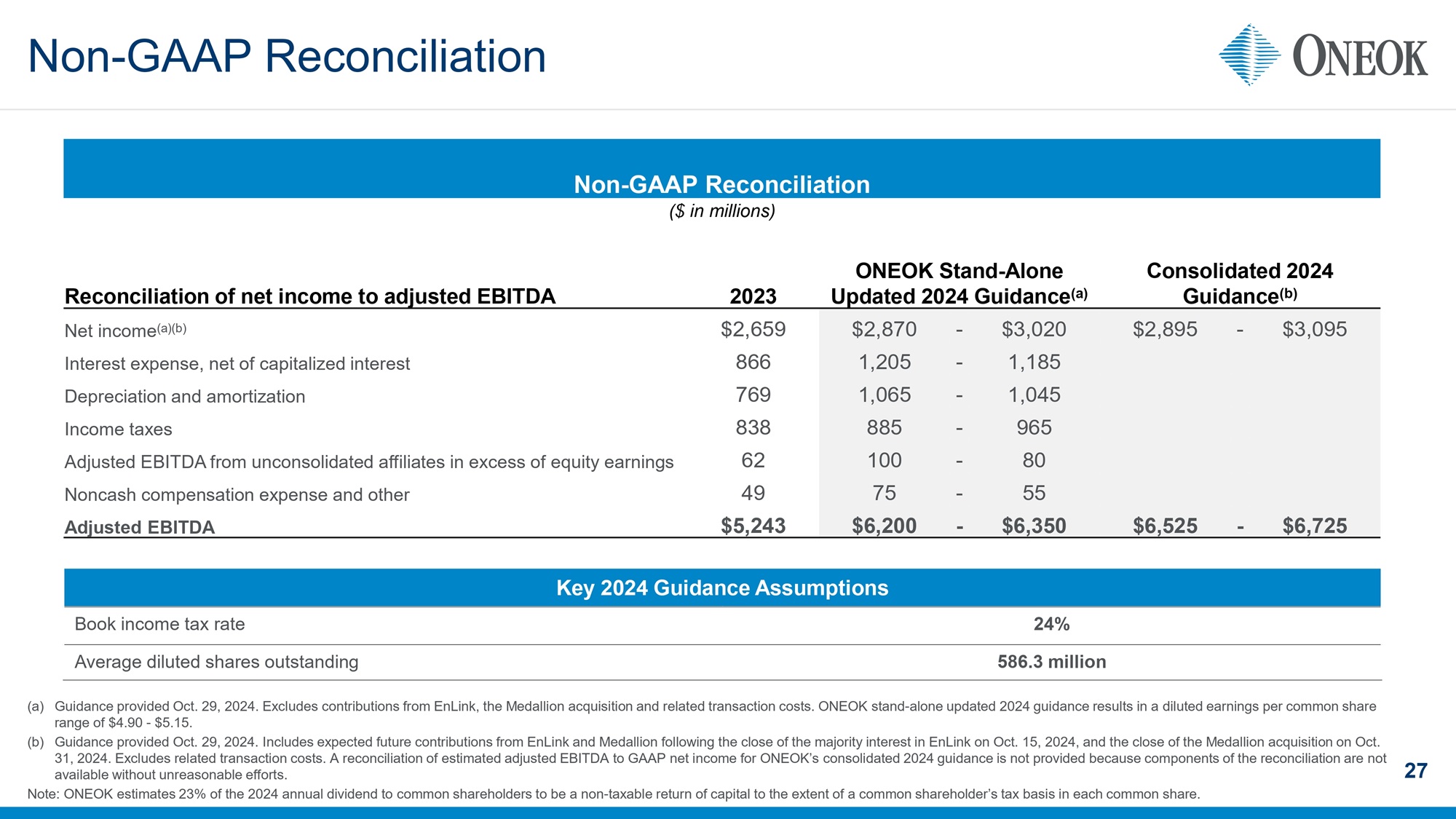

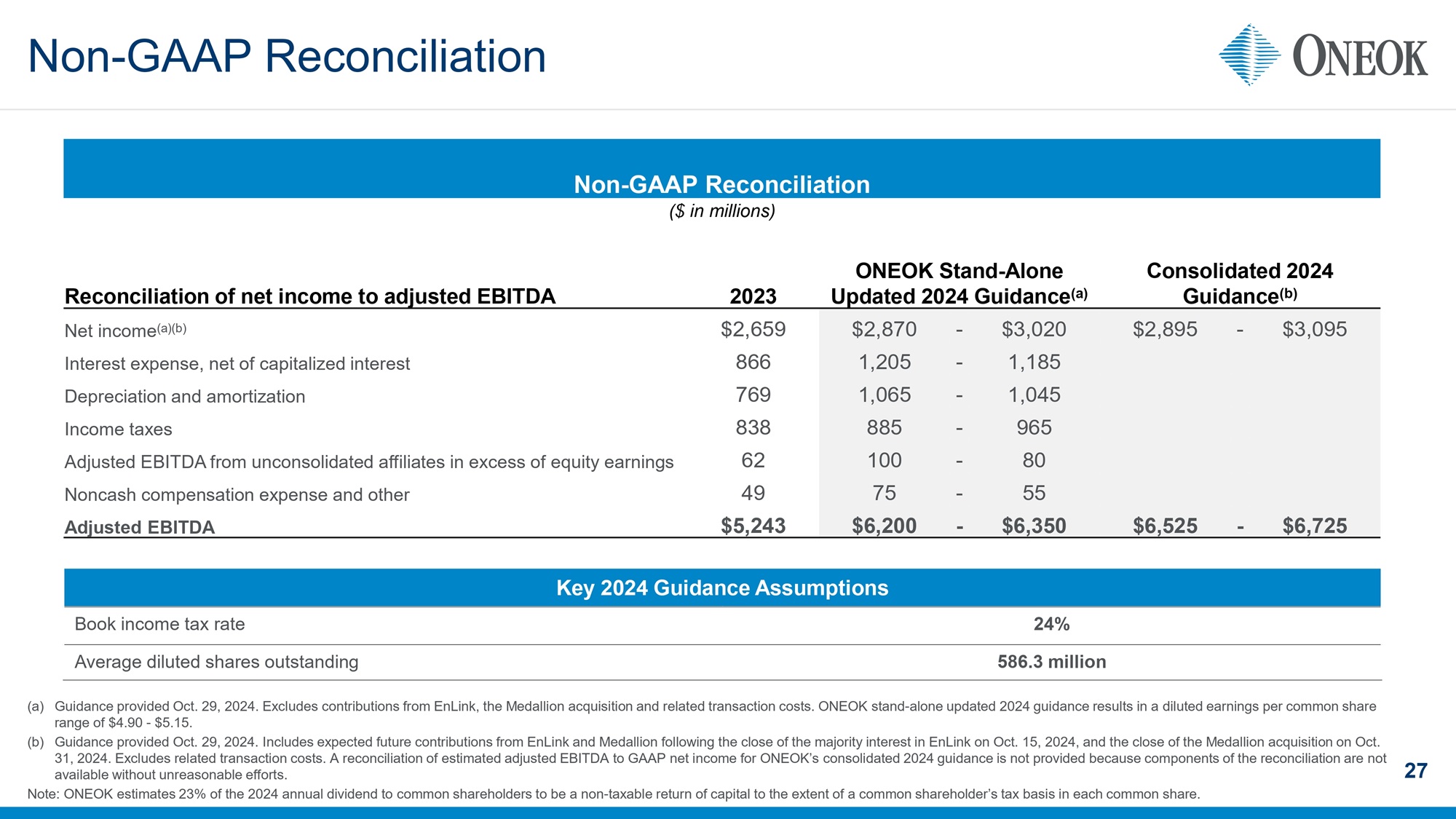

Non - GAAP Reconciliation 27 Key 2024 Guidance Assumptions 24% Book income tax rate 586.3 million Average diluted shares outstanding Non - GAAP Reconciliation ($ in millions) Consolidated 2024 Guidance (b) ONEOK Stand - Alone Updated 2024 Guidance (a) 2023 Reconciliation of net income to adjusted EBITDA $3,095 - $2,895 $3,020 - $2,870 $2,659 Net income (a)(b) 1,185 - 1,205 866 Interest expense, net of capitalized interest 1,045 - 1,065 769 Depreciation and amortization 965 - 885 838 Income taxes 80 - 100 62 Adjusted EBITDA from unconsolidated affiliates in excess of equity earnings 55 - 75 49 Noncash compensation expense and other $6,725 - $6,525 $6,350 - $6,200 $5,243 Adjusted EBITDA (a) Guidance provided Oct. 29, 2024. Excludes contributions from EnLink, the Medallion acquisition and related transaction costs. ON EOK stand - alone updated 2024 guidance results in a diluted earnings per common share range of $4.90 - $5.15. (b) Guidance provided Oct. 29, 2024. Includes expected future contributions from EnLink and Medallion following the close of the maj ority interest in EnLink on Oct. 15, 2024, and the close of the Medallion acquisition on Oct. 31, 2024. Excludes related transaction costs. A reconciliation of estimated adjusted EBITDA to GAAP net income for ONEOK’s co nso lidated 2024 guidance is not provided because components of the reconciliation are not available without unreasonable efforts. Note: ONEOK estimates 23% of the 2024 annual dividend to common shareholders to be a non - taxable return of capital to the extent of a common shareholder’s tax basis in each common share.

Environmental, Social and Governance (ESG) New New photo?

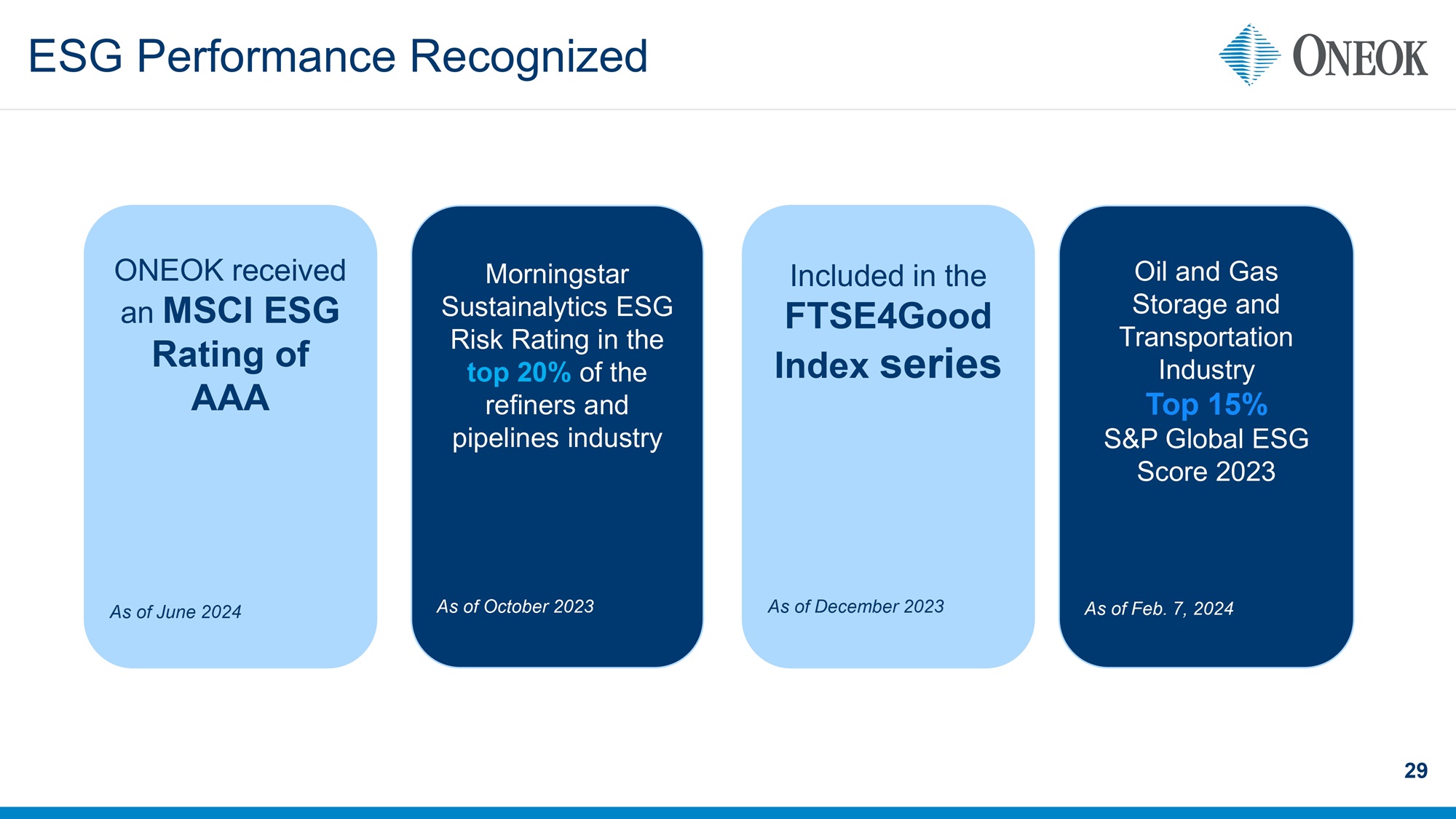

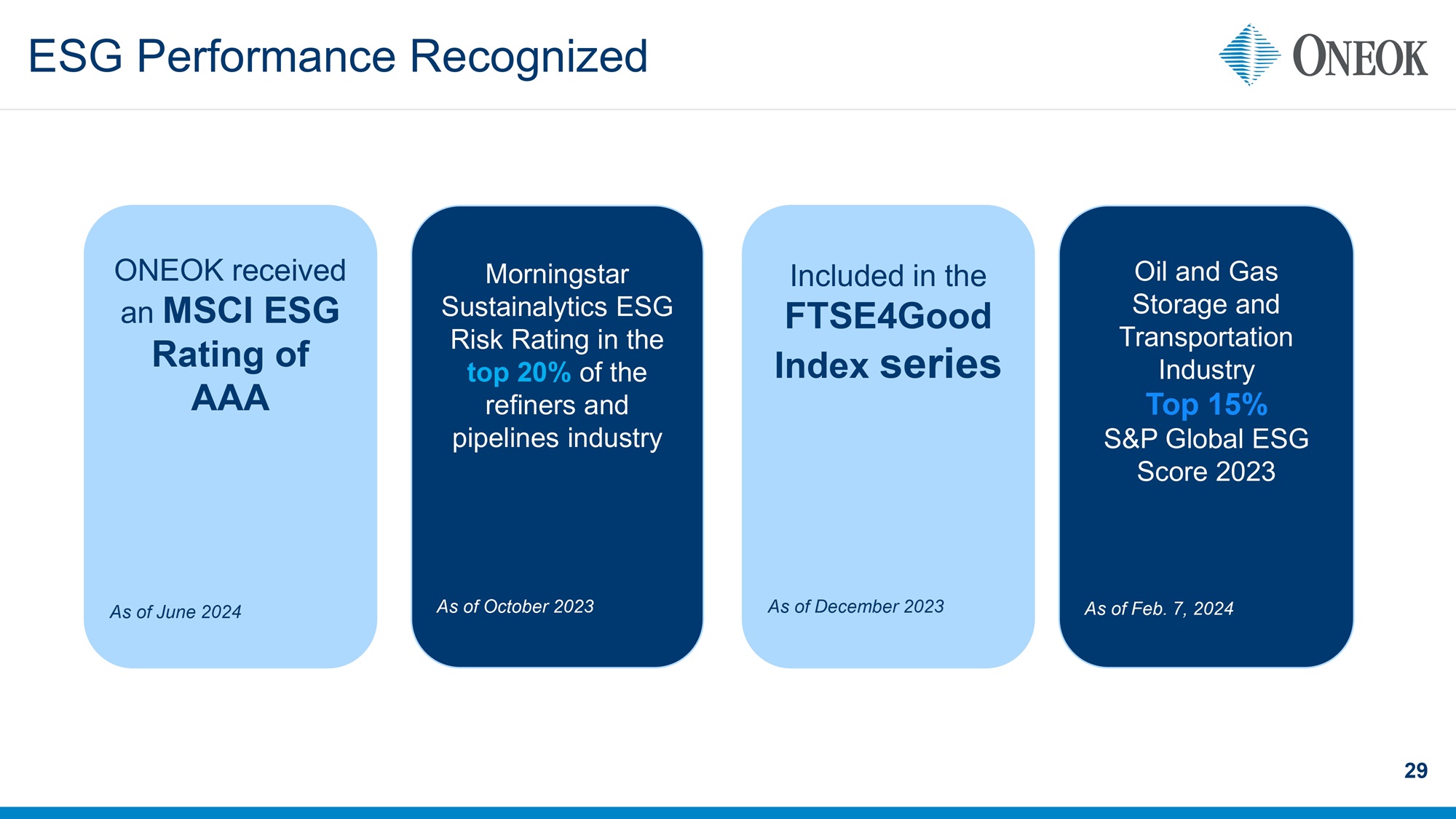

ESG Performance Recognized 29 Included in the FTSE4Good Index series As of June 2023 ONEOK received an MSCI ESG Rating of AAA As of June 2024 Morningstar Sustainalytics ESG Risk Rating in the t op 20% of the refiners and pipelines industry As of October 2023 Included in the FTSE4Good Index series As of December 2023 Oil and Gas Storage and Transportation Industry Top 15% S&P Global ESG Score 2023 As of Feb. 7, 2024

Achieved GHG reductions equating to approximately 20% of the 2030 target MSCI ESG Rating of AAA Formed Alternative Energy Solutions and ONEOK Ventures business groups 2022 Announced 2030 GHG Emissions Reduction Target Added reporting references to TCFD 2021 Renewables team established Joined ONE Future SASB reporting External assurance received on several E&S metrics 2020 Established ESG Council Included in DJSI North American Index 2019 Added environmental metric to incentive program Formed new Sustainability Group Conducted first GRI materiality assessment 1st ESG report published Added safety and health metric to incentive program ONEOK’s Sustainability Journey 30 Milestones on Our Path to Continuous Improvement 2009 2014 – 2018 Achieved GHG reductions equating to approximately 50% of the 2030 target (a) MSCI ESG Rating of AAA America’s Greatest Workplaces 2024, Newsweek 2023 – 2024 (a) As of Dec. 31, 2023.

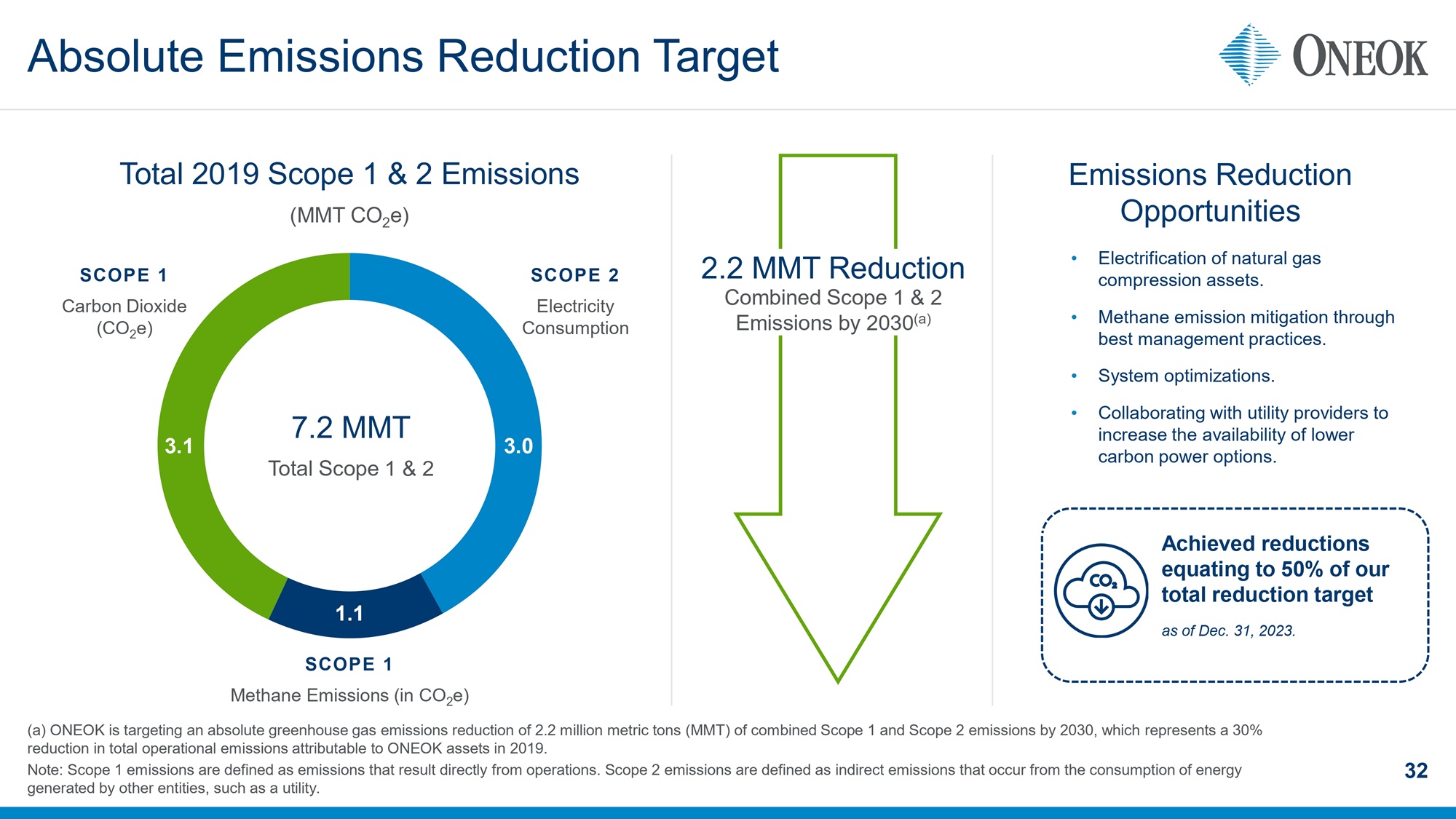

>$9.5 million contributed to local communities and >13,500 hours volunteered in 2023. >$3.5 million (>30% of total giving) contributed to D&I - related organizations in 2023. C ompany sponsored Business Resource Groups. Inclusive employee benefits: Including adoption assistance, fertility services, mental health benefits, domestic partnership benefits and more . Absolute emissions reduction target: 2.2 million metric ton reduction of combined Scope 1 and 2 GHG emissions by 2030 (a) . Member of ONE Future Initiative: Committed to a methane emissions intensity target. Sustainability and Alternative Energy Solutions groups: Promote sustainable business practices and evaluate energy transformation opportunities. Committed to safe operations and proactive community outreach: Including pipeline safety outreach and open house events for growth projects. Diverse board of directors: Members elected annually, including a nonexecutive independent board chair and independent committee chairs. 9 0 % independent; 30% female; 20 % racial or ethnic minority. Executive compensation: Aligned with business strategies. Environmental and safety performance metrics: Included in short - term incentive compensation for all employees. ESG Initiatives and Practices - Highlights 31 Committed to Safety and the Environment Our People and Communities Effective Governance and Oversight (a) ONEOK is targeting an absolute greenhouse gas emissions reduction of 2.2 million metric tons (MMT) of combined Scope 1 an d S cope 2 emissions by 2030, which represents a 30% reduction in total operational emissions attributable to ONEOK assets in 2019.

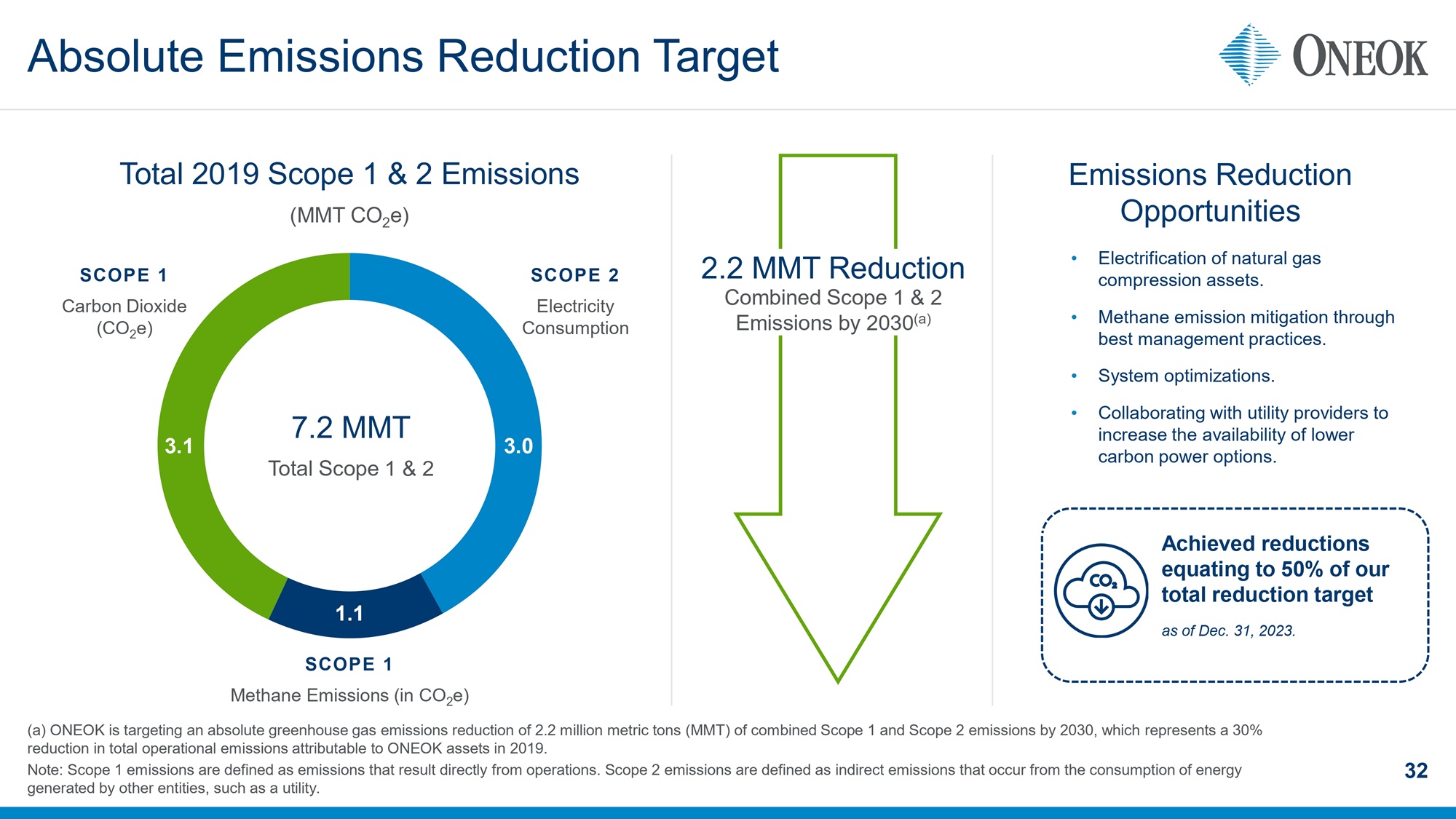

Absolute Emissions Reduction Target 32 (a) ONEOK is targeting an absolute greenhouse gas emissions reduction of 2.2 million metric tons (MMT) of combined Scope 1 an d S cope 2 emissions by 2030, which represents a 30% reduction in total operational emissions attributable to ONEOK assets in 2019. Note: Scope 1 emissions are defined as emissions that result directly from operations. Scope 2 emissions are defined as indir ect emissions that occur from the consumption of energy generated by other entities, such as a utility. (MMT CO 2 e) Total 2019 Scope 1 & 2 Emissions Combined Scope 1 & 2 Emissions by 2030 (a) 2.2 MMT Reduction Emissions Reduction Opportunities • Electrification of natural gas compression assets. • Methane emission mitigation through best management practices. • System optimizations. • Collaborating with utility providers to increase the availability of lower carbon power options. Total Scope 1 & 2 7.2 MMT 3.1 1.1 3.0 SCOPE 2 Electricity Consumption SCOPE 1 Methane Emissions (in CO 2 e) SCOPE 1 Carbon Dioxide (CO 2 e) Achieved reductions equating to 50% of our total reduction target as of Dec. 31, 2023.

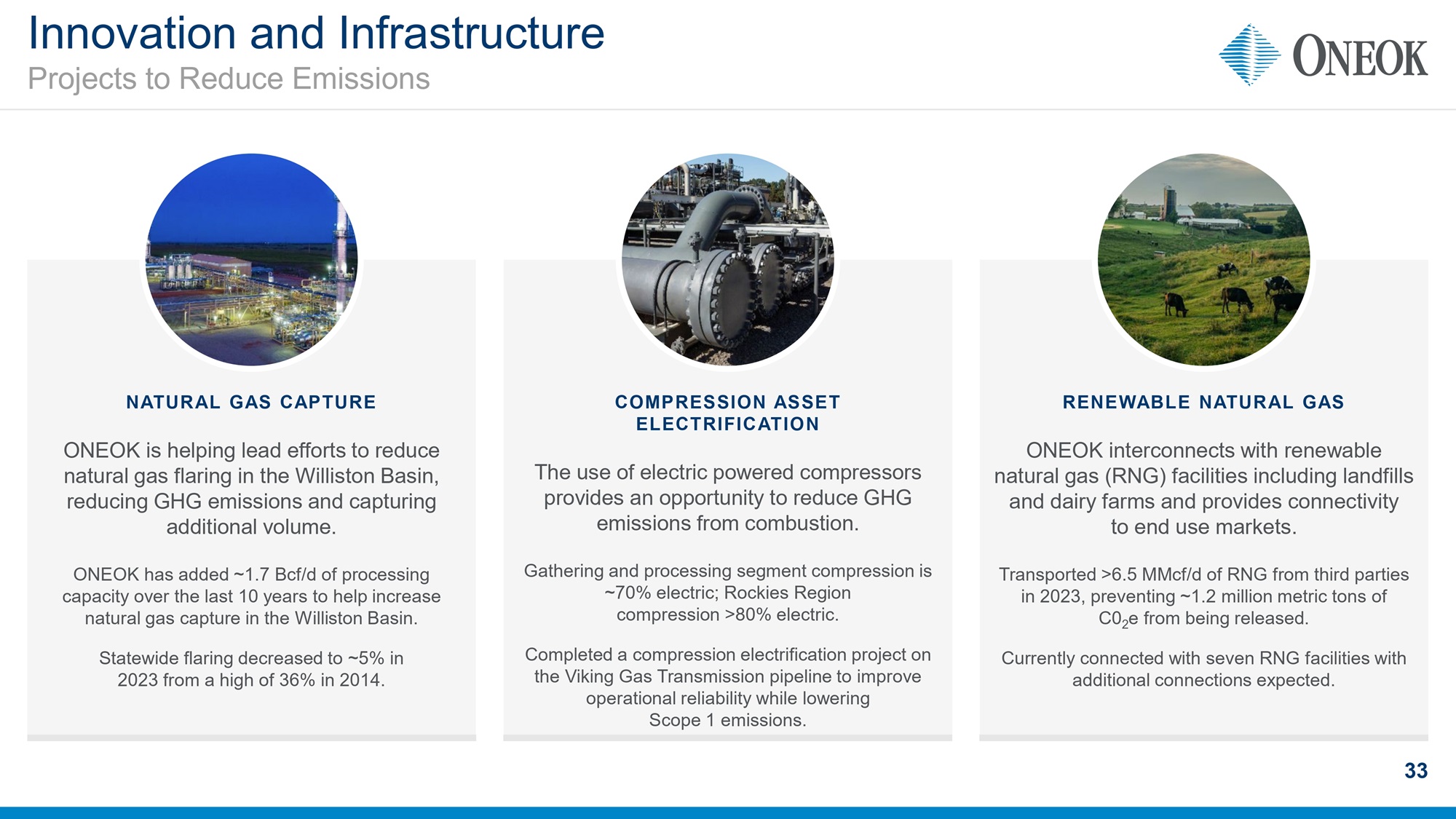

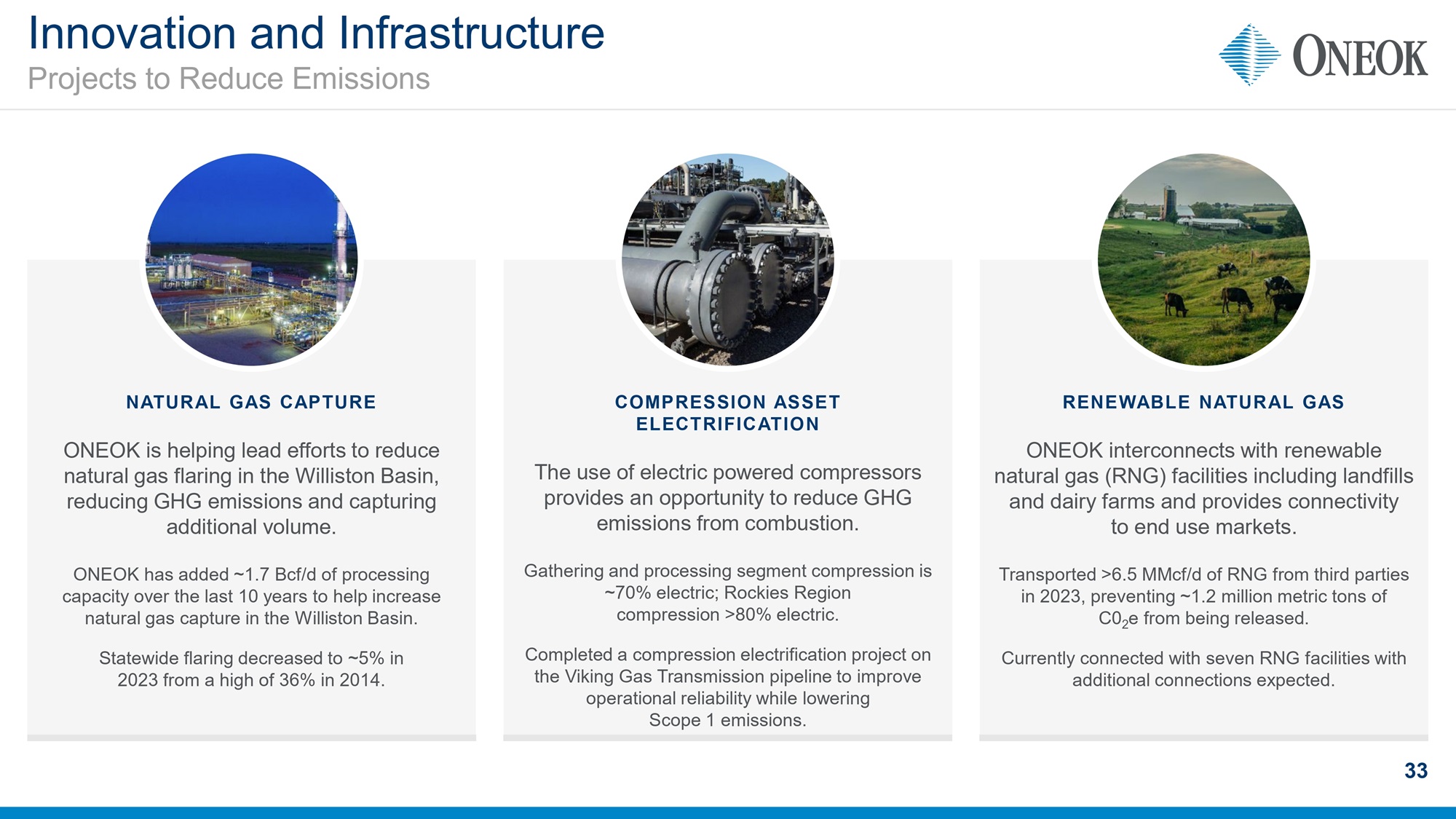

Innovation and Infrastructure 33 NATURAL GAS CAPTURE ONEOK is helping lead efforts to reduce natural gas flaring in the Williston Basin, reducing GHG emissions and capturing additional volume. ONEOK has added ~1.7 Bcf/d of processing capacity over the last 10 years to help increase natural gas capture in the Williston Basin. Statewide flaring decreased to ~5% in 2023 from a high of 36% in 2014. COMPRESSION ASSET ELECTRIFICATION The use of electric powered compressors provides an opportunity to reduce GHG emissions from combustion. Gathering and processing segment compression is ~70% electric; Rockies Region compression >80% electric. Completed a compression electrification project on the Viking Gas Transmission pipeline to improve operational reliability while lowering Scope 1 emissions. RENEWABLE NATURAL GAS ONEOK interconnects with renewable natural gas (RNG) facilities including landfills and dairy farms and provides connectivity to end use markets. Transported >6.5 MMcf/d of RNG from third parties in 2023, preventing ~1.2 million metric tons of C0 2 e from being released. Currently connected with seven RNG facilities with additional connections expected. Projects to Reduce Emissions

December 2024