UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | |

NVIDIA CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | |

| ý | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| Date and time: | Thursday, June 22, 2023 at 11:00 a.m. Pacific Daylight Time |

| |

| Location: | Virtually at www.virtualshareholdermeeting.com/NVDA2023 |

| |

| Items of business: | •Election of thirteen directors nominated by the Board of Directors •Advisory approval of our executive compensation •Advisory approval of the frequency of holding a vote on our executive compensation •Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024 •Transaction of other business properly brought before the meeting |

| |

| Record date: | You can attend and vote at the annual meeting if you were a stockholder of record at the close of business on April 24, 2023. |

| |

| Stockholder list: | A list of stockholders entitled to vote at the close of business on the record date will be available during the annual meeting at www.virtualshareholdermeeting.com/NVDA2023 and at our headquarters, 2788 San Tomas Expressway, Santa Clara, California, for 10 days prior to the annual meeting to registered stockholders for any legally valid purpose related to the annual meeting. To schedule an appointment to view the stockholder list during the 10 days prior to the annual meeting, please contact us at shareholdermeeting@nvidia.com. |

| |

| Virtual meeting admission: | We will be holding our annual meeting virtually at www.virtualshareholdermeeting.com/NVDA2023. To participate in the annual meeting, you will need the control number included on your notice of proxy materials or printed proxy card. |

| |

| Pre-meeting forum: | To communicate with our stockholders in connection with the annual meeting, we have established a pre-meeting forum located at www.proxyvote.com where you can submit advance questions. |

Your vote is very important. Whether or not you plan to attend the virtual annual meeting, PLEASE VOTE YOUR SHARES. As an alternative to voting during the virtual annual meeting, you may vote in advance online, by telephone or, if you have elected to receive a paper proxy card in the mail, by mailing the completed proxy card.

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on June 22, 2023. This Notice, our Proxy Statement, our Annual Report on Form 10-K, and our Annual Review are available at www.nvidia.com/proxy.

By Order of the Board of Directors

Timothy S. Teter

Secretary

2788 San Tomas Expressway, Santa Clara, California 95051

May 8, 2023

TABLE OF CONTENTS

This Proxy Statement contains forward-looking statements. All statements other than statements of historical or current facts, including statements regarding our environmental, social and corporate governance plans and goals, made in this document are forward-looking. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “goal,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential” and similar expressions intended to identify forward-looking statements. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our Annual Report on Form 10-K for the fiscal year ended January 29, 2023.

DEFINITIONS

| | | | | |

| 2007 Plan | NVIDIA Corporation Amended and Restated 2007 Equity Incentive Plan |

| AI | Artificial intelligence |

| AC | Audit Committee of the Board |

| ASC 718 | FASB Accounting Standards Codification Topic 718: Compensation - Stock Compensation |

| Base Operating Plan | Performance goal necessary to earn the target award under the Variable Cash Plan and for the target number of SY PSUs to become eligible to vest |

| Board | The Company’s Board of Directors |

| CAP | “Compensation actually paid,” as defined under Item 402(v) of Regulation S-K |

| CC | Compensation Committee of the Board |

| CD&A | Compensation Discussion and Analysis |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| Charter | The Company’s Restated Certificate of Incorporation |

| Control Number | Identification number for each stockholder included in Notice or proxy card |

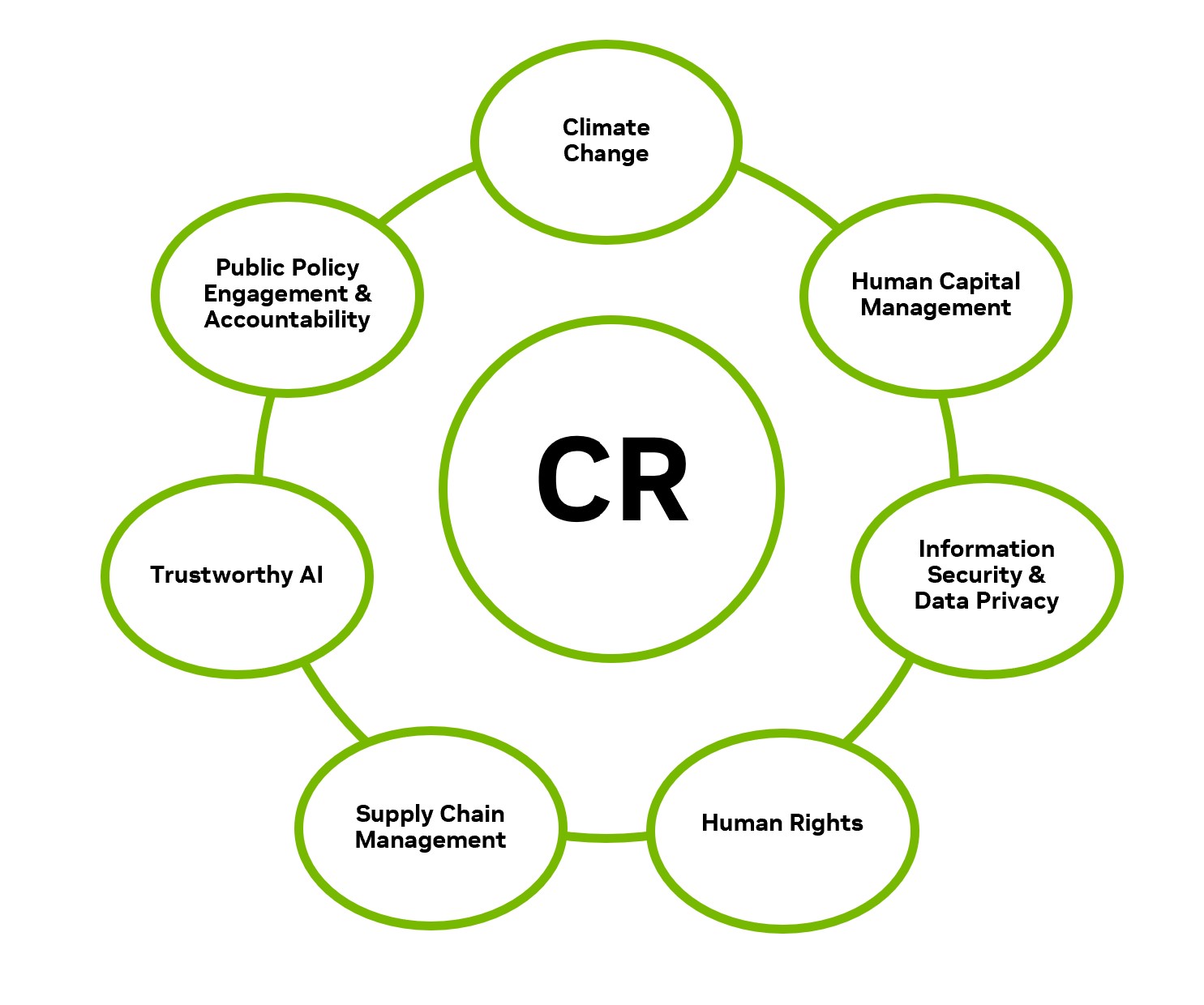

| CR | Corporate responsibility |

| ERM | Enterprise risk management |

| ESPP | NVIDIA Corporation Amended and Restated 2012 Employee Stock Purchase Plan |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| Fiscal 20__ | The Company’s fiscal year ended on the last Sunday in January of the stated year |

| Form 10-K | The Company’s Annual Report on Form 10-K for Fiscal 2023 filed with the SEC on February 24, 2023 |

| GAAP | Generally accepted accounting principles in the United States |

| Internal Revenue Code | U.S. Internal Revenue Code of 1986, as amended |

| Lead Director | Lead independent director |

| Meeting | Annual Meeting of Stockholders |

| MY PSUs | Multi-year PSUs with a three-year performance metric, vesting after three years |

| Nasdaq | The Nasdaq Stock Market LLC |

| NCGC | Nominating and Corporate Governance Committee of the Board |

| NEOs | Named Executive Officers consisting of our CEO, our CFO, and our other three most highly compensated executive officers as of the end of Fiscal 2023 |

| Non-GAAP Operating Income | GAAP operating income, as the Company reports in its SEC filings, excluding stock-based compensation expense, acquisition termination cost, acquisition-related costs, restructuring costs, IP-related costs, legal settlement costs, contributions and other costs. Please see Reconciliation of Non-GAAP Financial Measures in our CD&A for a reconciliation between the non-GAAP financial measures and GAAP results |

| Notice | Notice of Internet Availability of Proxy Materials |

| NVIDIA, Company, we, us, our | NVIDIA Corporation, a Delaware corporation |

| NYSE | New York Stock Exchange |

| PACs | Political action committees |

| PSU | Performance stock unit |

| PwC | PricewaterhouseCoopers LLP |

| RBA | Responsible Business Alliance |

| RSU | Restricted stock unit |

| S&P 500 | Standard & Poor’s 500 Composite Index |

| SEC | U.S. Securities and Exchange Commission |

| Section 162(m) | Section 162(m) of the Internal Revenue Code |

| Securities Act | Securities Act of 1933, as amended |

| Stretch | Performance goal necessary for the maximum number of MY PSUs to become eligible to vest |

| Stretch Operating Plan | Performance goal necessary to earn the maximum award under the Variable Cash Plan and for the maximum number of SY PSUs to become eligible to vest |

| SY PSUs | PSUs with a single-year performance metric, vesting over four years |

| Target | Performance goal necessary for the target number of MY PSUs to become eligible to vest |

| Threshold | Minimum performance goal necessary to earn an award under the Variable Cash Plan and for SY PSUs and MY PSUs to become eligible to vest |

| TSR | Total shareholder return |

| Variable Cash Plan | The Company’s variable cash compensation plan |

BUSINESS OVERVIEW

NVIDIA pioneered accelerated computing to help solve the most challenging computational problems. We specialize in markets in which our computing platforms can provide tremendous acceleration for applications.

| | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 Results |

| | | | | | |

| Revenue | | Gross Margin | | Operating Income | | Diluted EPS |

| $27.0 billion | | 56.9% | | $4.2 billion | | $1.74 |

flat year on year | | down 8.0 points year on year | | down 58% year on year | | down 55% year on year |

| | | | | | | | | | | | | | |

| Fiscal 2023 Reportable Segments |

Our two reportable segments are “Compute & Networking” and “Graphics”:

| | | | | | | | | | | | | | |

| Compute & Networking | Graphics | All Other* | Consolidated |

| | | | |

| Revenue | $15.1 billion | $11.9 billion | — | $27.0 billion |

up 36% year on year | down 25% year on year | flat year on year |

| | | | |

| | | | |

| Operating Income (Loss) | $5.1 billion | $4.6 billion | $(5.5) billion | $4.2 billion |

up 11% year on year | down 46% year on year | down 58% year on year |

| | | | |

* Includes expenses that our chief operating decision maker does not assign to either Compute & Networking or Graphics for purposes of making operating decisions or assessing financial performance.

| | | | | | | | | | | | | | |

| Fiscal 2023 Market Platforms |

Our platforms address four large markets where our expertise is critical:

| | | | | | | | | | | |

| | | |

| Data Center | Gaming | Professional Visualization | Automotive |

$15.0 billion revenue

up 41% year on year | $9.1 billion revenue

down 27% year on year | $1.5 billion revenue

down 27% year on year | $0.9 billion revenue

up 60% year on year |

Recent business highlights include:

•The NVIDIA Hopper GPU architecture and ramp of the first products based on the architecture, including the NVIDIA H100 Tensor Core GPU

•NVIDIA cloud services, including:

◦NVIDIA DGX Cloud, an AI supercomputing service that gives enterprises immediate access to the infrastructure and software needed to train advanced models for generative AI and other groundbreaking applications. NVIDIA has partnered with leading cloud service providers to host these services in their data centers

◦NVIDIA AI Foundations, a set of cloud services that advance enterprise-level generative AI and enable customization across use cases in areas such as text, visual content, and biology

◦NVIDIA Omniverse Cloud, a platform-as-a-service giving instant access to a full-stack environment to design, develop, deploy and manage industrial metaverse applications

•New inference platforms for generative AI inflection

•The new Ada Lovelace GPU architecture, and introduction of the first products based on Ada. We also introduced NVIDIA DLSS 3 for over 50 games and applications and brought GeForce RTX 4080-class performance to the GeForce NOW Ultimate membership tier

•Production of the NVIDIA DRIVE Orin autonomous vehicle system-on-a-chip and introduction of next-generation NVIDIA DRIVE Thor

| | | | | | | | |

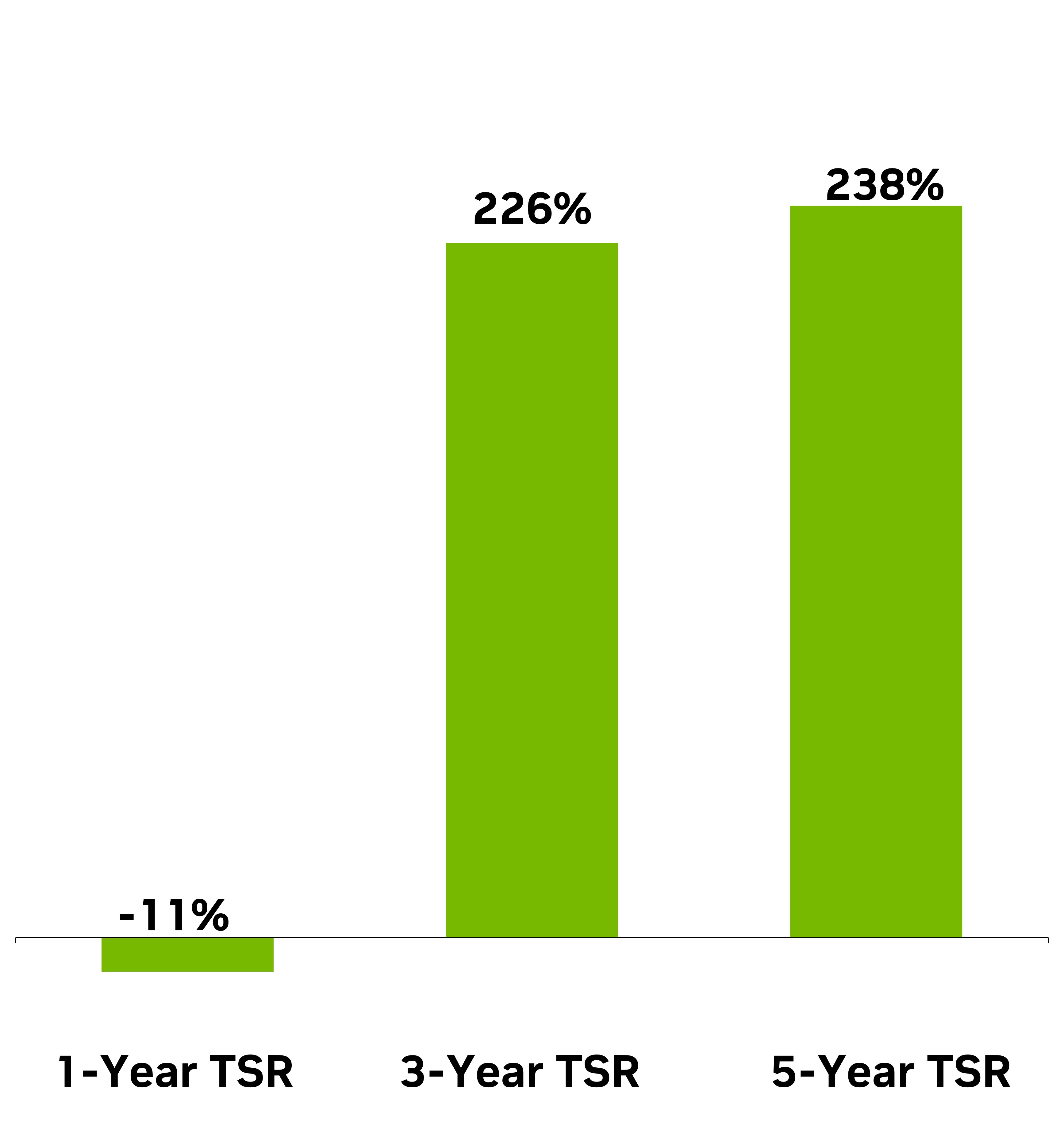

| Fiscal 2023 Returns to Shareholders |

| | |

| Total Shareholder Return* | | Total Capital Returned to Shareholders |

| | |

| *Represents cumulative stock price appreciation with dividends reinvested and is measured for the applicable fiscal year periods based on our closing stock price of $203.65 on the last trading day of Fiscal 2023. | | |

Please see our Form 10-K for more financial information for Fiscal 2023.

PROXY SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all the information that you should consider, and you should read the entire proxy statement carefully before voting.

2023 Annual Meeting of Stockholders

| | | | | |

| Date and time: | Thursday, June 22, 2023 at 11:00 a.m. Pacific Daylight Time |

| Location: | Virtually at www.virtualshareholdermeeting.com/NVDA2023 |

| Record date: | Stockholders as of April 24, 2023 are entitled to vote |

| Admission to meeting: | You will need your Control Number to attend the 2023 Meeting |

Voting Matters and Board Recommendations

A summary of the 2023 Meeting proposals is below. Every stockholder’s vote is important. Our Board urges you to vote your shares FOR Proposals 1, 2 and 4 and 1 YEAR for Proposal 3.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Matter | | Page | | Board Recommends | | Vote Required

for Approval | | Effect of Abstentions | | Effect of Broker Non-Votes |

| Management Proposals: | | | | | | | | | | |

| 1 | Election of thirteen directors | | | | FOR each director nominee | | More FOR than AGAINST votes | | None | | None |

| 2 | Advisory approval of our executive compensation | | | | FOR | | Majority of shares present, in person or represented by proxy, and entitled to vote on this matter | | Against | | None |

| 3 | Advisory approval of the frequency of holding an advisory vote on our executive compensation | | | | 1 YEAR | | Majority of shares present, in person or represented by proxy, and entitled to vote on this matter (1) | | Against | | None |

| 4 | Ratification of the selection of PwC as our independent registered public accounting firm for Fiscal 2024 | | | | FOR | | Majority of shares present, in person or represented by proxy, and entitled to vote on this matter | | Against | | N/A (2) |

(1) If none of the four choices for this proposal receive an affirmative vote from holders of a majority of the shares present, in person or represented by proxy, and entitled to vote on this matter, the Board will consider the choice that receives the highest number of votes as the choice supported by our stockholders

(2) Because this is a routine proposal, there are no broker non-votes

Election of Directors (Proposal 1)

The following table provides summary information about each director nominee:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Independent | | Financial Expert (1) | | Committee Membership | | Other Public Company Boards |

| Robert K. Burgess | | 65 | | 2011 | | | ü | | ü | | CC | | | |

| Tench Coxe | | 65 | | 1993 | | | ü | | | | CC | | 1 | |

| John O. Dabiri | | 43 | | 2020 | | | ü | | | | CC | | | |

| Persis S. Drell | | 67 | | 2015 | | | ü | | | | NCGC | | | |

| Jen-Hsun Huang | | 60 | | 1993 | | | | | | | | | | |

| Dawn Hudson | | 65 | | 2013 | | | ü | | ü | | CC Chairperson | | 2 | (2) |

| Harvey C. Jones | | 70 | | 1993 | | | ü | | ü | | CC, NCGC Chairperson (3) | | | |

| Michael G. McCaffery | | 69 | | 2015 | | | ü | | ü | | AC Chairperson (4) | | 1 | |

Stephen C. Neal Lead Director (5) | | 74 | | 2019 | | | ü | | | | NCGC Chairperson (3) | | | |

Mark L. Perry Lead Director (5) | | 67 | | 2005 | | | ü | | ü | | AC, NCGC | | | |

| A. Brooke Seawell | | 75 | | 1997 | | | ü | | ü | | AC Chairperson (4) | | 1 | |

| Aarti Shah | | 58 | | 2020 | | | ü | | | | AC | | | |

| Mark A. Stevens | | 63 | | 2008 | (6) | | ü | | | | AC, NCGC | | | |

(1) For purposes of qualifying as an AC financial expert

(2) Ms. Hudson is not seeking re-election to Modern Times Group MTG AB’s board of directors effective as of MTG’s 2023 annual general meeting

(3) Mr. Jones will serve as NCGC Chairperson until our 2023 Meeting, at which time Mr. Neal will take over as NCGC Chairperson

(4) Mr. McCaffery will serve as AC Chairperson until our 2023 Meeting, at which time Mr. Seawell will take over as AC Chairperson

(5) Mr. Perry will serve as Lead Director until our 2023 Meeting, at which time Mr. Neal will take over as Lead Director

(6) Previously served as a member of our Board from 1993 until 2006

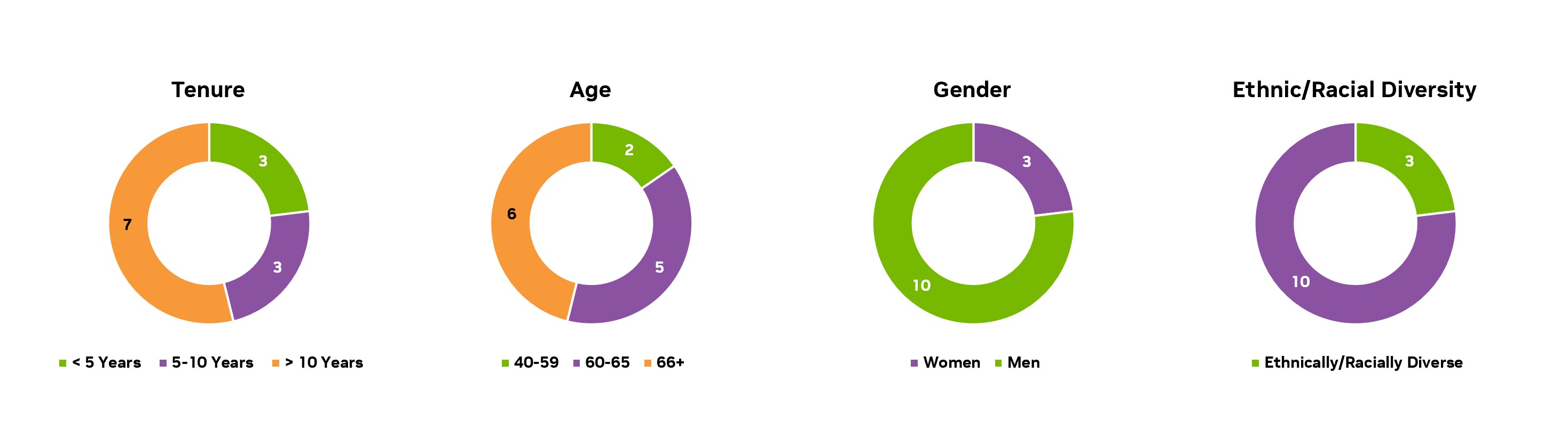

Recent Refreshment, Board Demographics and Nominee Qualifications

Our director nominees exhibit a variety of competencies, professional experience, and backgrounds, and contribute diverse viewpoints and perspectives to our Board. While the Board benefits from the experience and institutional knowledge that our longer-serving directors bring, it has also brought in new perspectives and ideas through the appointment of two new directors since 2020. The Board also regularly rotates committee membership and chairpersons to promote a diversity of viewpoints on the Board committees.

The Board and the NCGC has identified and continue to seek highly qualified women and individuals from underrepresented groups to include in the initial pool of potential director nominees, as discussed below under Director Qualifications and Nomination of Directors. The Board’s commitment to achieving a diverse and inclusive membership is demonstrated by our director nominees. Three of our directors are women and three are ethnically and/or racially diverse. Our two newest members enhance the Board’s gender, ethnic and/or racial diversity. We expect Board diversity to increase before our 2024 Meeting.

Nominee Demographics

Nominee Skills, Competencies and Attributes

Below are the skills, competencies and attributes that our NCGC and Board consider important for our directors to have considering our current business and future market opportunities, and the director nominees who possess them:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Leadership & Operations Experience | Industry & Technical | Financial /Financial Community | Governance & Public Company Board | Emerging Technologies & Business Models | Marketing, Communications & Brand Management | Regulatory, Legal & Risk Management | Human Capital Management Experience | Diversity

|

| Burgess | ü | | ü | ü | ü | | | ü | |

| Coxe | | | ü | ü | ü | | | ü | |

| Dabiri | | ü | | | ü | | | | ü |

| Drell | ü | ü | | ü | ü | | | ü | ü |

| Huang | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Hudson | ü | | ü | ü | | ü | | ü | ü |

| Jones | ü | ü | ü | ü | ü | ü | | ü | |

| McCaffery | ü | | ü | ü | | | | ü | |

| Neal | ü | | | ü | | ü | ü | ü | |

| Perry | ü | | ü | ü | | | ü | ü | |

| Seawell | ü | | ü | ü | ü | | | ü | |

| Shah | ü | ü | | ü | ü | ü | ü | ü | ü |

| Stevens | | ü | ü | ü | ü | | | | |

Corporate Governance Highlights

Our Board is committed to strong corporate governance to promote the long-term interests of the Company and our stockholders. We seek a collaborative approach to stockholder issues that affect our business and to ensure that our stockholders see our governance and executive pay practices as well-structured. In the Fall of 2022, we contacted our top institutional stockholders, representing an aggregate ownership of 32%, to gain insights into their views on corporate governance, environmental and social practices, and diversity and inclusion.

Highlights of our corporate governance practices include:

| | | | | |

ü All Board members independent, except for our CEO ü Independent Lead Director ü Proxy access ü Declassified Board ü Majority voting for directors ü Active Board oversight of enterprise risk and risk management | ü 75% or greater attendance by each Board member at meetings of the Board and applicable committees ü Independent directors frequently meet in executive sessions ü At least annual Board and committee self assessments ü Annual stockholder outreach, including Lead Director participation ü Stock ownership guidelines for our directors and NEOs |

Advisory Approval of Executive Compensation for Fiscal 2023 (Proposal 2)

We are asking our stockholders to cast a non-binding vote, also known as “say-on-pay,” to approve our NEOs’ compensation. The Board believes that our compensation policies and practices are effective in achieving our goals of paying for performance; providing competitive pay so that we may attract and retain a high-caliber executive team; aligning our executives’ interests with those of our stockholders to create long-term value; and achieving simplicity and transparency with our compensation program. The Board and our stockholders have approved holding our “say-on-pay” votes annually.

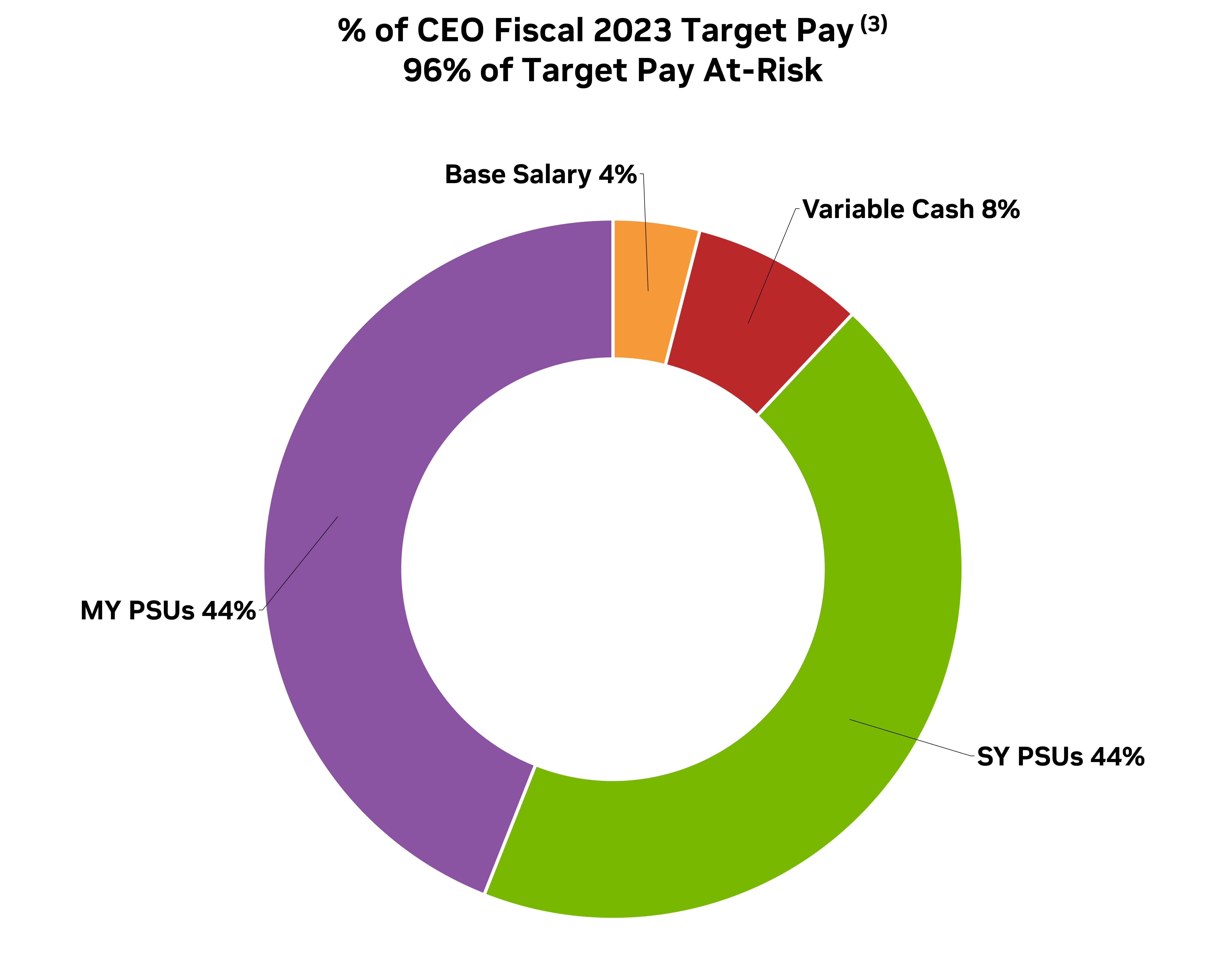

Executive Compensation Highlights

Our executive compensation program is designed to pay for performance. We utilize compensation elements that align our NEOs’ interests with those of our stockholders to create long-term value. Our NEO pay is heavily weighted toward performance-based, “at-risk” variable cash and long-term equity awards that are only earned if the Company achieves pre-established corporate financial metrics, but capped at a maximum of 200% of target (or 150% of target for our CEO’s PSUs). For the last several years, over 90% of our CEO’s, and over 50% of our other NEOs’, target pay has been performance-based and at-risk, and 100% of our CEO’s equity awards have been in the form of PSUs only.

At our 2022 Meeting, approximately 93% of the votes cast approved the compensation paid to our NEOs for Fiscal 2022. After considering this advisory vote and the feedback from our annual stockholder outreach, our CC concluded that our program effectively aligned executive pay with stockholder interests. Therefore, the CC maintained the same elements and metrics for Fiscal 2023 executive compensation, but (i) increased the proportion of “at-risk” target pay, and (ii) set the Threshold performance goals for revenue and Non-GAAP Operating Income above record-level Fiscal 2022 results, both of which further aligned corporate performance and executive pay.

Financial Performance and Link to Executive Pay

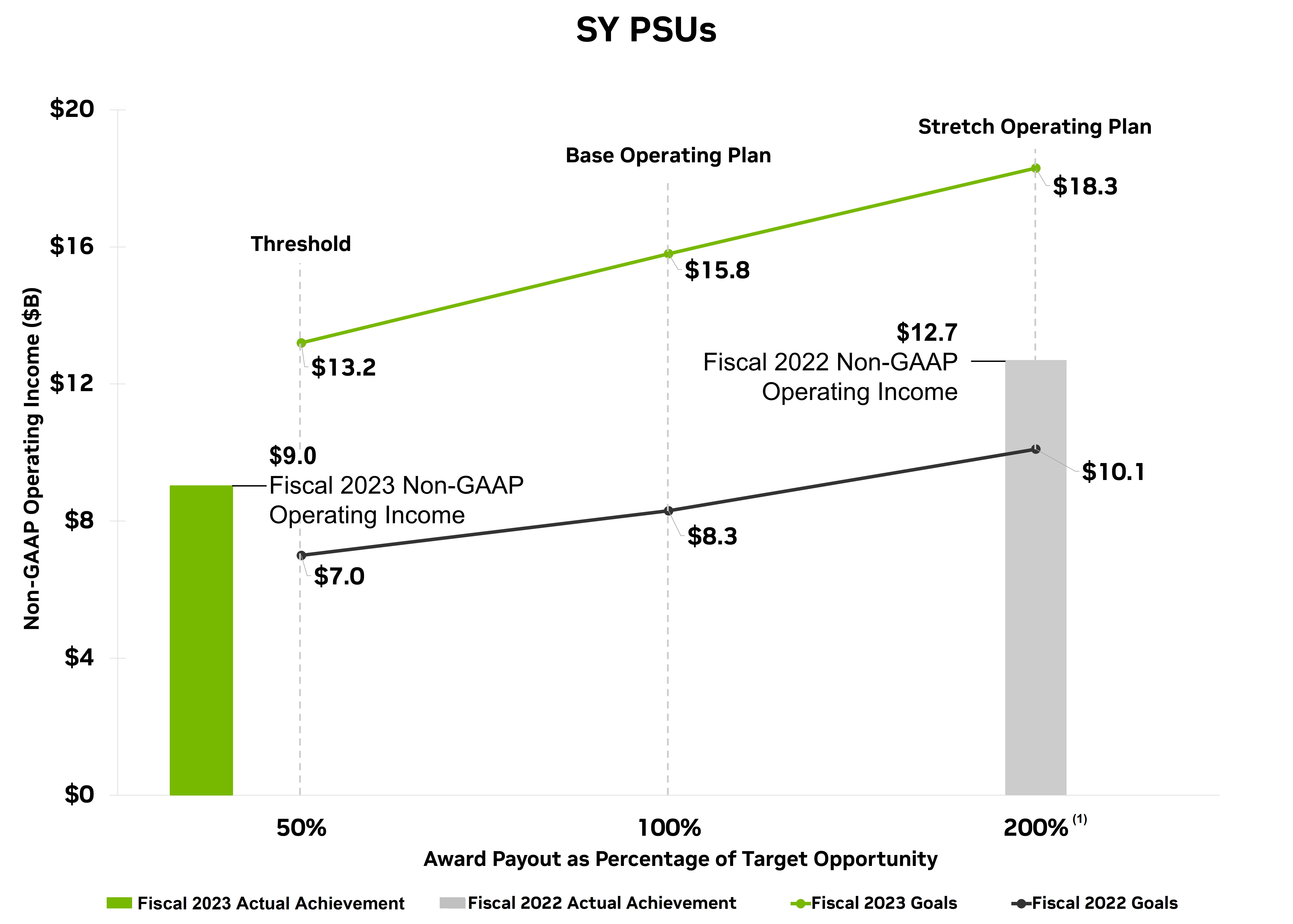

As described further in our CD&A, a significant portion of our executive pay opportunities are tied to the achievement of financial measures that drive business value and contribute to our long-term success. The table below shows our goals for the applicable periods that were completed at the end of Fiscal 2023 and their respective impact on our executive pay.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PERFORMANCE GOALS |

| | Variable Cash Plan | | SY PSUs | | MY PSUs |

| | Fiscal 2023 Revenue | | Payout as a % of Target Opportunity | | Fiscal 2023 Non-GAAP Operating Income (1) | | Shares Eligible to Vest as a % of Target Opportunity | | Fiscal 2021 to 2023

Relative TSR | | Shares Eligible to Vest as a % of Target Opportunity |

| Threshold | | $29.6 billion | | 50% | | $13.2 billion | | 50% | | 25th percentile | | 25% |

| Base Operating Plan (Target for MY PSUs) | | $33.5 billion | | 100% | | $15.8 billion | | 100% | | 50th percentile | | 100% |

| Stretch Operating Plan (Stretch for MY PSUs) | | $38.0 billion | | 200% | | $18.3 billion | | CEO 150%; Other NEOs 200% | | 75th percentile | | CEO 150%; Other NEOs 200% |

| | | | | | | | | | | | |

| PERFORMANCE ACHIEVEMENT AND PAYOUTS |

| | Variable Cash Plan | | SY PSUs | | MY PSUs |

| Performance Achievement for Period Ended Fiscal 2023 | |

$27.0 billion revenue (2) | | $9.0 billion Non-GAAP Operating Income (1) (2) | |

99th percentile 3-year TSR relative to S&P 500 (2) |

| Payout as % of Target Opportunity | | 0% | | 0% | | CEO 150%; Other NEOs 200% |

(1) See Reconciliation of Non-GAAP Financial Measures in our CD&A for a reconciliation between the non-GAAP financial measures and GAAP results.

(2) See Performance Metrics and Goals for Executive Compensation in our CD&A for a description and further discussion of revenue, Non-GAAP Operating Income and 3-year relative TSR.

Advisory Approval of the Frequency of Holding a Vote on Executive Compensation (Proposal 3)

We are asking our stockholders to cast a non-binding vote, also known as “say-on-frequency,” to indicate their preference regarding how frequently we should solicit a non-binding advisory vote on the compensation of our NEOs. Accordingly, we are asking stockholders to indicate whether they would prefer an advisory vote every one, two or three years. The Board recommends holding our “say-on-frequency” votes annually.

Ratification of Selection of PwC as our Independent Registered Public Accounting Firm for Fiscal 2024 (Proposal 4)

Although not required, we are asking our stockholders to ratify the AC’s selection of PwC as our independent registered public accounting firm for Fiscal 2024 because we believe it is a matter of good corporate practice. If our stockholders do not ratify the selection, the AC will reconsider the appointment, but may nevertheless retain PwC. Even if the selection is ratified, the AC may select a different independent registered public accounting firm at any time if it determines that such a change would be in the best interests of NVIDIA and our stockholders.

Corporate Responsibility

NVIDIA invents computing technologies that enable scientists, engineers, designers, researchers, and developers to improve lives and address global challenges. Our goal is to integrate sound CR principles and practices into every aspect of the Company. This proxy statement covers the following CR topics:

NVIDIA CORPORATION

2788 SAN TOMAS EXPRESSWAY

SANTA CLARA, CALIFORNIA 95051

(408) 486-2000

____________________________________________________

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS - JUNE 22, 2023

____________________________________________________

Information About the 2023 Meeting

Your proxy is being solicited for use at the 2023 Meeting on behalf of the Board. Our 2023 Meeting will take place virtually on Thursday, June 22, 2023 at 11:00 a.m. Pacific Daylight Time.

Virtual Meeting Philosophy and Benefits

The Board believes that holding the 2023 Meeting in a virtual format invites stockholder participation, while reducing the costs to stockholders and the Company associated with an in-person meeting. This balance allows the 2023 Meeting to remain focused on matters directly relevant to the interests of stockholders in an efficient way. We have designed the virtual format to protect stockholder rights, including by offering multiple opportunities to ask questions, publishing answers to questions received before or during the 2023 Meeting on our Investor Relations website, and providing an archived copy of the webcast after the 2023 Meeting.

Meeting Attendance

If you were an NVIDIA stockholder as of the close of business on the April 24, 2023 record date, or if you hold a valid proxy, you can attend, ask questions during, and vote at our 2023 Meeting at www.virtualshareholdermeeting.com/NVDA2023. Our 2023 Meeting will be held virtually; use the Control Number included on your Notice or printed proxy card to enter. Anyone can also listen to the 2023 Meeting live at www.virtualshareholdermeeting.com/NVDA2023.

If you encounter any difficulties accessing the virtual 2023 Meeting during the check-in or the course of the 2023 Meeting, please call the technical support number available on www.virtualshareholdermeeting.com/NVDA2023.

An archived copy of the webcast will be available at www.nvidia.com/proxy through June 21, 2024. Even if you plan to attend the 2023 Meeting virtually, we recommend that you also vote by proxy as described below so that your vote will be counted if you later decide not to attend.

Asking Questions

We encourage stockholders to submit questions through our pre-meeting forum located at www.proxyvote.com (using the Control Number included on your Notice or printed proxy card) as well as during the 2023 Meeting at www.virtualshareholdermeeting.com/NVDA2023. During the 2023 Meeting, we will answer as many stockholder-submitted questions related to the business of the 2023 Meeting as time permits. As soon as practicable following the 2023 Meeting, we will publish and answer questions received on our Investor Relations website. We intend to group questions and answers by topic and substantially similar questions will be answered only once. To promote fairness to all stockholders and efficient use of the Company’s resources, we will respond to one question per stockholder. We reserve the right to exclude questions regarding topics that are not pertinent to company business or are not otherwise suitable for the conduct of the 2023 Meeting.

Quorum and Voting

To hold our 2023 Meeting, we need a majority of the outstanding shares entitled to vote at the close of business on the April 24, 2023 record date, or a quorum, represented at the 2023 Meeting either by attendance virtually or by proxy. On April 24, 2023, there were 2,473,129,295 shares of common stock outstanding and entitled to vote, meaning that 1,236,564,648 shares must be represented at the 2023 Meeting or by proxy to have a quorum. A list of stockholders entitled to vote at the close of business on the record date will be available during the 2023 Meeting at

www.virtualshareholdermeeting.com/NVDA2023 and at our headquarters, 2788 San Tomas Expressway, Santa Clara, California, for 10 days prior to the 2023 Meeting to registered stockholders for any legally valid purpose related to the 2023 Meeting. To schedule an appointment to view the stockholder list during the 10 days prior to the 2023 Meeting, please contact us at shareholdermeeting@nvidia.com.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the 2023 Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is not a quorum, a majority of the votes present may adjourn the 2023 Meeting to another date.

For Proposal 1, you may vote FOR or AGAINST any nominee to the Board, or you may ABSTAIN from voting. For Proposal 3, you may vote for 1 YEAR, 2 YEARS or 3 YEARS as the preferred frequency of the advisory vote on executive compensation or you may ABSTAIN from voting. For each other matter to be voted on, you may vote FOR or AGAINST or ABSTAIN from voting.

Stockholder of Record

You are a stockholder of record if your shares were registered directly in your name with our transfer agent, Computershare, on April 24, 2023. You can vote shares, change your vote or revoke your proxy before the final vote at the 2023 Meeting in any of the following ways:

| | | | | | | | | | | | | | | | | |

| Vote | | Change Your Vote | | Revoke Your Proxy |

| Virtually attend and vote at the 2023 Meeting | ü | | ü | | |

| Via mail, by signing and mailing your proxy card to us before the 2023 Meeting | ü | | | | |

| By telephone or online, by following the instructions provided in the Notice or your proxy materials | ü | | ü | | |

| Submit another properly completed proxy card with a later date | | | ü | | |

| Send a written notice that you are revoking your proxy to NVIDIA Corporation, 2788 San Tomas Expressway, Santa Clara, California 95051, Attention: Timothy S. Teter, Secretary or via email to shareholdermeeting@nvidia.com | | | | | ü |

If you do not vote using any of the ways described above, your shares will not be voted.

Street Name Holder

If your shares were held through a nominee, such as a bank or broker, as of April 24, 2023, then you were the beneficial owner of shares held in “street name,” and you have the right to direct the nominee how to vote those shares for the 2023 Meeting. The nominee should provide you a separate Notice or voting instructions, and you should follow those instructions to tell the nominee how to vote. To vote by attending the 2023 Meeting virtually, you must obtain a valid proxy from your nominee.

If you are a beneficial holder and do not provide voting instructions to your nominee, the nominee will not be authorized to vote your shares on “non-routine” matters, including elections of directors (even if not contested), and executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of holding such votes). This is called a “broker non-vote.” However, the nominee can still register your shares as being present at the 2023 Meeting for determining quorum, and the nominee will have discretion to vote for matters considered by the NYSE to be “routine,” including Proposal 4 regarding the ratification of the selection of our independent registered public accounting firm. If you are a beneficial owner and want to ensure that all of the shares you beneficially own are voted in favor or against Proposal 4, you must give your broker or nominee specific instructions to do so or the broker will have discretion to vote on that proposal. In addition, you MUST give your nominee instructions in order for your vote to be counted on Proposals 1, 2 and 3, as these are “non-discretionary” items. We strongly encourage you to vote.

Any NVIDIA stockholder whose shares are held in street name by a member brokerage firm may revoke a proxy and vote his or her shares at the 2023 Meeting only in accordance with applicable rules and procedures of the national stock exchanges, as employed by the street name holder’s brokerage firm.

Vote Count

On each matter to be voted upon, stockholders have one vote for each share of NVIDIA common stock owned as of April 24, 2023. Votes will be counted by the inspector of election as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal Number | | Proposal Description | | Vote Required for Approval | | Effect of Abstentions | | Effect of Broker

Non-Votes |

| 1 | | Election of thirteen directors | | Directors are elected if they receive more FOR votes than AGAINST votes | | None | | None |

| 2 | | Advisory approval of our executive compensation | | FOR votes from the holders of a majority of shares present, in person or represented by proxy, and entitled to vote on this matter | | Against | | None |

| 3 | | Advisory approval of the frequency of holding a vote on our executive compensation | | The frequency receiving votes from the holders of a majority of shares present, in person or represented by proxy, and entitled to vote on this matter (1) | | Against | | None |

| 4 | | Ratification of the selection of PwC as our independent registered public accounting firm for Fiscal 2024 | | FOR votes from the holders of a majority of shares present, in person or represented by proxy, and entitled to vote on this matter | | Against | | N/A (2) |

(1) If none of the four choices for this proposal receive an affirmative vote from holders of a majority of the shares present, in person or represented by proxy, and entitled to vote on this matter, the Board will consider the choice that receives the highest number of votes as the choice supported by our stockholders.

(2) Because this is a routine proposal, there are no broker non-votes.

If you are a stockholder of record and you return a signed proxy card without marking any selections, your shares will be voted FOR each of the nominees listed in Proposal 1, for 1 YEAR for Proposal 3, and FOR the other proposals. If any other matter is properly presented at the 2023 Meeting, Jen-Hsun Huang or Timothy S. Teter as your proxyholder will vote your shares using his best judgment.

Vote Results

Preliminary voting results will be announced at the 2023 Meeting. Final voting results will be published in a current report on Form 8-K, which will be filed with the SEC by June 28, 2023.

Proxy Materials

As permitted by SEC rules, we are making our proxy materials available to stockholders online at www.nvidia.com/proxy. On or about May 8, 2023, we sent stockholders who owned our common stock at the close of business on April 24, 2023 (other than those who previously requested electronic or paper delivery) a Notice containing instructions on how to access our proxy materials, vote online or by telephone, and elect to receive future proxy materials electronically or in printed form by mail.

If you choose to receive future proxy materials electronically (via www.proxyvote.com for stockholders of record and www.icsdelivery.com/nvda for street name holders), you will receive an email next year with links to the proxy materials and proxy voting site.

SEC rules also permit companies and intermediaries, such as brokers, to satisfy Notice and proxy material delivery requirements for multiple stockholders with the same address by delivering a single Notice or set of proxy materials addressed to those stockholders. We follow this practice, known as “householding,” unless we have received contrary instructions from any stockholder at that address.

If you received more than one Notice or full set of proxy materials, then your shares are either registered in more than one name or are held in different accounts. Please vote the shares covered by each Notice or proxy card. To modify your instructions so that you receive one Notice or proxy card for each account or name, please contact your broker. Your “householding” election will continue until you are notified otherwise or until you revoke your consent.

To make a change regarding the form in which you receive proxy materials (electronically or in print), or to request receipt of a separate set of documents to a household, contact our Investor Relations Department (through our website at www.nvidia.com, by email to shareholdermeeting@nvidia.com, by phone at (408) 486-2000 or by mail at 2788 San Tomas Expressway, Santa Clara, California 95051).

We will pay the entire cost of soliciting proxies. Our directors and employees may also solicit proxies in person, by telephone, by mail, via the Internet or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies. We have also retained MacKenzie Partners on an advisory basis for an approximate fee of $15,000 and they may help us solicit proxies from brokers, bank nominees and other institutional

owners. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

2024 Meeting Deadlines for Submission of Stockholder Proposals, Nomination of Directors and Other Business of Stockholders

Proposals to be Considered for Inclusion in Our Proxy Materials Pursuant to Rule 14a-8

Stockholders who wish to present proposals pursuant to Rule 14a-8 promulgated under the Exchange Act for inclusion in the proxy materials to be distributed by us in connection with our 2024 Meeting must submit their proposals in writing to NVIDIA Corporation, 2788 San Tomas Expressway, Santa Clara, California 95051, Attention: Timothy S. Teter, Secretary or by email to shareholdermeeting@nvidia.com, on or before January 9, 2024.

Director Nominations Under Our Proxy Access Bylaw

A stockholder (or a group of up to 20 stockholders) who has owned at least 3% of the voting power of our outstanding capital stock for at least three continuous years and has complied with the other requirements in our Bylaws may nominate and include in our proxy materials director nominees constituting up to the greater of (a) up to two director candidates or (b) up to 20% of the number of directors in office on the last day that a submission may be delivered. Notice of a proxy access nomination for consideration at our 2024 Meeting must be received following the above instructions not later than the close of business on March 24, 2024, and not earlier than February 23, 2024. In the event that we hold the 2024 Meeting more than 30 days prior to, or delayed by more than 30 days after, the first anniversary of the 2023 Meeting, for written notice by the stockholder to be timely, such notice must be delivered following the above instructions not earlier than the close of business on the 120th day prior to the 2024 Meeting and not later than the close of business on the 90th day prior to the 2024 Meeting or the 10th day following the day on which public announcement of the date of the 2024 Meeting is first made by us, whichever is later.

Other Director Nominations and Proposals

Apart from Rule 14a-8 and the proxy access provision of our Bylaws, under our Bylaws certain procedures must be followed for a stockholder to nominate a director or to introduce an item of business at an annual meeting of stockholders. If you wish to nominate a director or introduce an item of business at the 2024 Meeting that is not included in the proxy materials to be distributed by us in connection with our 2024 Meeting, you must do so in writing following the above instructions not later than the close of business on March 24, 2024, and not earlier than February 23, 2024. In the event that we hold the 2024 Meeting more than 30 days prior to, or delayed by more than 70 days after, the first anniversary of the 2023 Meeting, for written notice by the stockholder to be timely, such notice must be delivered following the above instructions not earlier than the close of business on the 120th day prior to the 2024 Meeting and not later than the close of business on the 90th day prior to the 2024 Meeting or the 10th day following the day on which public announcement of the date of the 2024 Meeting is first made by us, whichever is later.

Additional Requirements and Information

We also advise you to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals, director nominations, and proxy access nominations. We recognize the importance of the ability of our stockholders to nominate directors to our Board. Accordingly, our Board will take into account feedback we receive from our stockholder engagement process regarding the process and disclosure requirements of our Bylaws for nominating directors and other proposals. Our Board will engage with stockholders of various holdings size regarding any proposed amendments to our Bylaws that would require a nominating stockholder to disclose to us (i) such stockholder’s plans to nominate candidates to the board of directors of other public companies, or disclose prior director nominations or proposals that such stockholder privately submitted to other public companies or (ii) information about such stockholder’s limited partners or business associates beyond the existing requirements of our Bylaws.

Proposal 1—Election of Directors

| | |

What am I voting on? Electing the 13 director nominees identified below to hold office until the 2024 Meeting and until his or her successor is elected or appointed. Vote required for approval: Directors are elected if they receive more FOR votes than AGAINST votes. Effect of abstentions: None. Effect of broker non-votes: None. |

Our Board has 13 members. All of our directors have one-year terms and stand for election annually. Our nominees include 12 independent directors, as defined by the rules and regulations of Nasdaq, and one NVIDIA officer: Mr. Huang, who serves as our President and CEO. Each of the nominees is currently a director of NVIDIA previously elected by our stockholders.

The Board expects the nominees will be available for election. If a nominee declines or is unable to act as a director, your proxy may be voted for any substitute nominee proposed by the Board or the size of the Board may be reduced.

Recommendation of the Board

The Board recommends that you vote FOR the election of each of the following nominees:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Occupation | | Independent | | Financial Expert (1) | | Committee Membership | | Other Public Company Boards |

| Robert K. Burgess | | 65 | | 2011 | | | Independent Consultant | | ü | | ü | | CC | | | |

| Tench Coxe | | 65 | | 1993 | | | Former Managing Director, Sutter Hill Ventures | | ü | | | | CC | | 1 | |

| John O. Dabiri | | 43 | | 2020 | | | Centennial Professor of Aeronautics and Mechanical Engineering, California Institute of Technology | | ü | | | | CC | | | |

| Persis S. Drell | | 67 | | 2015 | | | Provost, Stanford University | | ü | | | | NCGC | | | |

| Jen-Hsun Huang | | 60 | | 1993 | | | President & CEO, NVIDIA Corporation | | | | | | | | | |

| Dawn Hudson | | 65 | | 2013 | | | Former Chief Marketing Officer, National Football League | | ü | | ü | | CC Chairperson | | 2 | (2) |

| Harvey C. Jones | | 70 | | 1993 | | | Managing Partner, Square Wave Ventures | | ü | | ü | | CC, NCGC Chairperson (3) | | | |

| Michael G. McCaffery | | 69 | | 2015 | | | Chairman of the Board of Directors, Makena Capital Management | | ü | | ü | | AC Chairperson (4) | | 1 | |

Stephen C. Neal Lead Director (5) | | 74 | | 2019 | | | Chairman Emeritus & Senior Counsel, Cooley LLP | | ü | | | | NCGC Chairperson (3) | | | |

Mark L. Perry Lead Director (5) | | 67 | | 2005 | | | Independent Consultant and Director | | ü | | ü | | AC, NCGC | | 1 | |

| A. Brooke Seawell | | 75 | | 1997 | | | Venture Partner, New Enterprise Associates | | ü | | ü | | AC Chairperson (4) | | 1 | |

| Aarti Shah | | 58 | | 2020 | | | Former Senior Vice President & Chief Information and Digital Officer, Eli Lilly and Company | | ü | | | | AC | | | |

| Mark A. Stevens | | 63 | | 2008 | (6) | | Managing Partner, S-Cubed Capital | | ü | | | | AC, NCGC | | | |

(1) For purposes of qualifying as an AC financial expert

(2) Ms. Hudson is not seeking re-election to Modern Times Group MTG AB’s board of directors effective as of MTG’s 2023 annual general meeting

(3) Mr. Jones will serve as NCGC Chairperson until our 2023 Meeting, at which time Mr. Neal will take over as NCGC Chairperson

(4) Mr. McCaffery will serve as AC Chairperson until our 2023 Meeting, at which time Mr. Seawell will take over as AC Chairperson

(5) Mr. Perry will serve as Lead Director until our 2023 Meeting, at which time Mr. Neal will take over as Lead Director

(6) Previously served as a member of our Board from 1993 until 2006

Director Qualifications and Nomination of Directors

The NCGC identifies, reviews and assesses the qualifications of existing and potential directors and selects nominees for recommendation to the Board for approval. In accordance with our Corporate Governance Policies and the NCGC Charter, the NCGC is committed to Board diversity and shall consider a nominee’s background and experience to ensure that a broad range of perspectives is represented on the Board. The NCGC may conduct appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates and may engage a professional search firm to identify and assist the committee in identifying, evaluating, and conducting due diligence on potential director nominees. The NCGC has not established specific age, gender, education, experience, or skill requirements for potential members, and instead considers numerous factors regarding the nominee taking into account our current and future business models, including the following:

| | | | | |

•Integrity and candor •Independence •Senior leadership and operational experience •Professional, technical and industry knowledge •Financial expertise •Financial community experience (including as an investor in other companies) •Marketing, communications and brand management background •Governance and public company board experience •Experience with emerging technologies and new business models •Regulatory, legal and risk management expertise, including in cybersecurity matters | •Diversity, including race, ethnicity, sexuality, gender or membership in another underrepresented community •Human capital management experience •Experience in academia •Willingness and ability to devote substantial time and effort to Board responsibilities and Company oversight •Ability to represent the interests of the stockholders as a whole rather than special interest groups or constituencies •All relationships between the proposed nominee and any of our stockholders, competitors, customers, suppliers or other persons with a relationship to NVIDIA •For nominees for re-election, overall service to NVIDIA, including past attendance, participation and contributions to the activities of the Board and its committees |

The NCGC and the Board understand the importance of Board refreshment, and strive to maintain an appropriate balance of tenure, diversity, professional experience and backgrounds, skills, and education on the Board. While the Board benefits from the experience and institutional knowledge that our longer-serving directors bring, it has also brought in new perspectives and ideas through the appointment of two new directors since 2020. The Board also regularly rotates membership on and who is appointed as chairperson of its committees to help promote a diversity of viewpoints on the Board committees. Our longer-tenured directors are familiar with our operations and business areas and have the perspective of overseeing our activities from a variety of economic and competitive environments. Our newer directors have brought expertise in brand development and cybersecurity and familiarity with technology developments at leading academic institutions that are important to supporting NVIDIA as it enters new markets. Each year, the NCGC and Board review each director’s individual performance, including the director’s past contributions, outside experiences and activities, and committee participation, and determine how his or her experience and skills continue to add value to NVIDIA and the Board.

The Board and the NCGC have identified and continue to seek highly qualified women and individuals from underrepresented groups to include in the initial pool of potential director nominees. The Board’s commitment to achieving a diverse and inclusive membership is demonstrated by our director nominees. Three of our directors are women and three are ethnically and/or racially diverse. Our two newest members enhance the Board’s gender, ethnic and/or racial diversity. We expect Board diversity to increase before our 2024 Meeting.

Below are the skills, competencies and attributes that our Board considers important for our directors to have considering our current business and future market opportunities:

| | | | | | | | | | | | | | |

| | Senior Leadership & Operations Experience | | Directors with senior leadership and operations experience provide experienced oversight of our business, and unique experiences and perspectives. They are uniquely positioned to contribute practical insight into business strategy and operations, driving growth, building and strengthening corporate culture and supporting the achievement of strategic priorities and objectives. |

| | Industry & Technical | | Directors with industry experience and technical backgrounds facilitate within the Board a deeper understanding of innovations and a technical assessment of our products and services. |

| | Financial/Financial Community | | Experience in financial matters and the financial community assists our Board with review of our operations and finances, including overseeing our financial statements, capital structure and internal controls. Those with a venture capital background also offer valuable stockholder perspectives. |

| | Governance & Public Company Board | | Directors with experience in corporate governance, such as service on boards and board committees, or as executives of other large, public companies, are familiar with the dynamics and operation of a board of directors and the impact that governance policies have on a company. This experience supports our goals of strong Board and management accountability, transparency, and protection of stockholder interests. Public company board experience also helps our directors identify challenges and risks we face as a public company, including oversight of strategic, operational, compliance-related matters and stockholder relations. |

| | Emerging Technologies & Business Models | | Experience in emerging technologies and business models is integral to our growth strategies given our unique business model and provides important insights as our business expands into new areas. |

| | Marketing, Communications & Brand Management | | Directors with experience in marketing, communications and brand management offer guidance on our products directly marketed to consumers, important perspectives on expanding our market share and communicating with our customers and other stakeholders. |

| | Regulatory, Legal & Risk Management | | Our business requires compliance with a variety of regulatory requirements in different jurisdictions. We face new regulatory matters and regulations as our business grows. We are also subject to multiple lawsuits. Directors with experience in governmental, public policy, legal and risk management areas, including cybersecurity, help provide valuable insights and oversight for our Company. |

| | Human Capital Management Experience | | Our people are critical to our success. Directors with experience in organizational management, talent development, and developing values and culture in a large global workforce provide key insights. Human capital management experience also assists our Board in overseeing executive and employee compensation, development, and engagement. |

| | Diversity | | Directors with diverse backgrounds, experiences, and perspectives improves the dialogue and decision-making in the board room and contributes to overall Board effectiveness. In the director biographies below, this icon indicates gender or ethnic diversity. |

Our Board believes that having a diverse mix of directors with complementary qualifications, expertise and attributes is essential to meeting its oversight responsibility. The table below reflects certain diversity information based on self-identification by each director.

Board Diversity Matrix (as of May 8, 2023)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gender Identity | | Demographic Background |

| Male | | Female | | Non-Binary | | Did not disclose | | African American or Black | | Hispanic or Latinx | | Asian | | Native American or Alaskan Native | | Native Hawaiian or Other Pacific Islander | | White | | Two or more races or ethnicities | | LGBTQ+ | | Did not disclose |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Burgess | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Coxe | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Dabiri | ü | | | | | | | | ü | | | | | | | | | | | | | | | | |

| Drell | | | ü | | | | | | | | | | | | | | | | ü | | | | | | |

| Huang | ü | | | | | | | | | | | | ü | | | | | | | | | | | | |

| Hudson | | | ü | | | | | | | | | | | | | | | | ü | | | | | | |

| Jones | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| McCaffery | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Neal | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Perry | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Seawell | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

| Shah | | | ü | | | | | | | | | | ü | | | | | | | | | | | | |

| Stevens | ü | | | | | | | | | | | | | | | | | | ü | | | | | | |

The NCGC evaluates candidates proposed by stockholders using the same criteria as it uses for other candidates. Stockholders seeking to recommend a prospective nominee should follow the instructions under Stockholder Communications with the Board of Directors below. Stockholder submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Proxy Access

In addition, our Board voluntarily adopted proxy access. As a result, we will include in our proxy statement information regarding the greater of (a) up to two director candidates or (b) up to 20% of the number of directors in office on the last day that a submission may be delivered, if nominated by a stockholder (or group of up to 20 stockholders) owning at least 3% of the voting power of our outstanding capital stock for at least three continuous years. The stockholder(s) must provide timely written notice of such nomination and the stockholder(s) and nominee must satisfy the other requirements specified in our Bylaws. This summary of our proxy access rules is not intended to be complete and is subject to limitations set forth in our Bylaws and Corporate Governance Policies, both of which are available on the Investor Relations section of our website at www.nvidia.com. Stockholders are advised to review these documents, which contain the requirements for director nominations. The NCGC did not receive any stockholder nominations during Fiscal 2023.

Our Director Nominees

The biographies below include information, as of the date of this proxy statement, regarding the particular experience, qualifications, attributes or skills of each director, relative to the skills matrix above, that led the NCGC and Board to believe that he or she should continue to serve on the Board.

| | | | | | | | | | | |

| | ROBERT K. BURGESS | Robert K. Burgess has served as an independent investor and board member to technology companies since 2005. He was chief executive officer from 1996 to 2005 of Macromedia, Inc., a provider of internet and multimedia software, which was acquired by Adobe Systems Incorporated; he also served from 1996 to 2005 on its board of directors, as chairman of its board of directors from 1998 to 2005 and as executive chairman for his final year. Previously, he held key executive positions from 1984 to 1991 at Silicon Graphics, Inc. (SGI), a graphics and computing company; from 1991 to 1995, served as chief executive officer and a board member of Alias Research, Inc., a publicly traded 3D software company, until its acquisition by SGI; and resumed executive positions at SGI during 1996. Mr. Burgess was a director of IMRIS Inc., a provider of image guided therapy solutions, from 2010 to 2013, of Adobe from 2005 to 2019, and of Rogers Communications Inc., a communications and media company, from 2016 to 2019. He holds a BCom degree from McMaster University. Mr. Burgess brings to the Board senior management and operating experience and expertise in the areas of financial and risk management. He has been in the computer graphics industry since 1984. He has a broad understanding of the roles and responsibilities of a corporate board and provides valuable insight on a range of issues in the technology industry. |

| Independent Consultant |

| Age: 65 |

| Director Since: 2011 |

| Committees: CC |

| Independent Director |

| Financial Expert |

| Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Emerging Technologies & Business Models |

| | Human Capital Management Experience |

| | | | | | | | | | | |

| | TENCH COXE | Tench Coxe was a managing director of Sutter Hill Ventures, a venture capital investment firm, from 1989 to 2020, where he focused on investments in the IT sector. Prior to joining Sutter Hill Ventures in 1987, he was director of marketing and MIS at Digital Communication Associates. He serves on the board of directors of Artisan Partners Asset Management Inc., an institutional money management firm. He was a director of Mattersight Corp., a customer loyalty software firm, from 2000 to 2018. Mr. Coxe holds a BA degree in Economics from Dartmouth College and an MBA degree from Harvard Business School. Mr. Coxe brings to the Board expertise in financial and transactional analysis and provides valuable perspectives on corporate strategy and emerging technology trends. His significant financial community experience gives the Board an understanding of the methods by which companies can increase value for their stockholders.

|

| Former Managing Director, Sutter Hill Ventures |

| Age: 65 |

| Director Since: 1993 |

Committees: CC |

| Independent Director |

Other Current Public Company Boards: •Artisan Partners Asset Management Inc. (since 1995) |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Emerging Technologies & Business Models |

| | Human Capital Management Experience |

| | | | | | | | | | | |

| | JOHN O. DABIRI | John O. Dabiri is the Centennial Professor of Aeronautics and Mechanical Engineering at the California Institute of Technology. He is the recipient of a MacArthur Foundation "Genius Grant," the National Science Foundation Alan T. Waterman Award, and the Presidential Early Career Award for Scientists and Engineers. He heads the Dabiri Lab, which conducts research at the intersections of fluid mechanics, energy and environment, and biology. From 2015 to 2019, he served as a Professor of Civil and Environmental Engineering and of Mechanical Engineering at Stanford University, where he was recognized with the Eugene L. Grant Award for Excellence in Teaching. From 2005 to 2015, he was a Professor of Aeronautics and Bioengineering at the California Institute of Technology, during which time he also served as Director of the Center for Bioinspired Wind Energy, Chair of the Faculty, and Dean of Students. Dr. Dabiri is a Fellow of the American Physical Society, where he previously served as Chair of the Division of Fluid Dynamics. He serves on President Biden's Council of Advisors on Science and Technology (PCAST) and Energy Secretary Granholm's Energy Advisory Board (SEAB). He also serves on the Board of Trustees of the Gordon and Betty Moore Foundation and previously served as a member of the National Academies’ Committee on Science, Technology, and Law. Dr. Dabiri holds a PhD degree in Bioengineering and an MS degree in Aeronautics from the California Institute of Technology, and a BSE degree summa cum laude in Mechanical and Aerospace Engineering from Princeton University. Dr. Dabiri brings to the Board a versatile research background and cutting-edge expertise in various engineering fields, along with a proven record of successful innovation. |

| Centennial Professor of Aeronautics and

Mechanical Engineering, California Institute of Technology |

| Age: 43 |

| Director Since: 2020 |

| Committees: CC |

| Independent Director |

| Other Current Public Company Boards: None |

| | Industry & Technical |

| | Emerging Technologies & Business Models |

| | Diversity |

| | |

| | | | | | | | | | | |

| | PERSIS S. DRELL | Persis S. Drell has been the Provost of Stanford University since 2017. A Professor of Materials Science and Engineering and Professor of Physics, Dr. Drell has been on the faculty at Stanford since 2002, and was the Dean of the Stanford School of Engineering from 2014 to 2017. She also served as the Director of SLAC from 2007 to 2012. Dr. Drell is a member of the National Academy of Sciences and the American Academy of Arts and Sciences, and is a fellow of the American Physical Society and a fellow of the American Association for the Advancement of Science. She has been the recipient of a Guggenheim Fellowship and a National Science Foundation Presidential Young Investigator Award. Dr. Drell holds a PhD from the University of California, Berkeley and an AB degree in Mathematics and Physics from Wellesley College. An accomplished researcher and educator, Dr. Drell brings to the Board expert leadership in guiding innovation in science and technology.

|

| Provost, Stanford University |

| Age: 67 |

| Director Since: 2015 |

| Committees: NCGC |

| Independent Director |

| Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Industry & Technical |

| | Governance & Public Company Board |

| | Emerging Technologies & Business Models |

| | Human Capital Management Experience |

| | Diversity |

| | | | | | | | | | | |

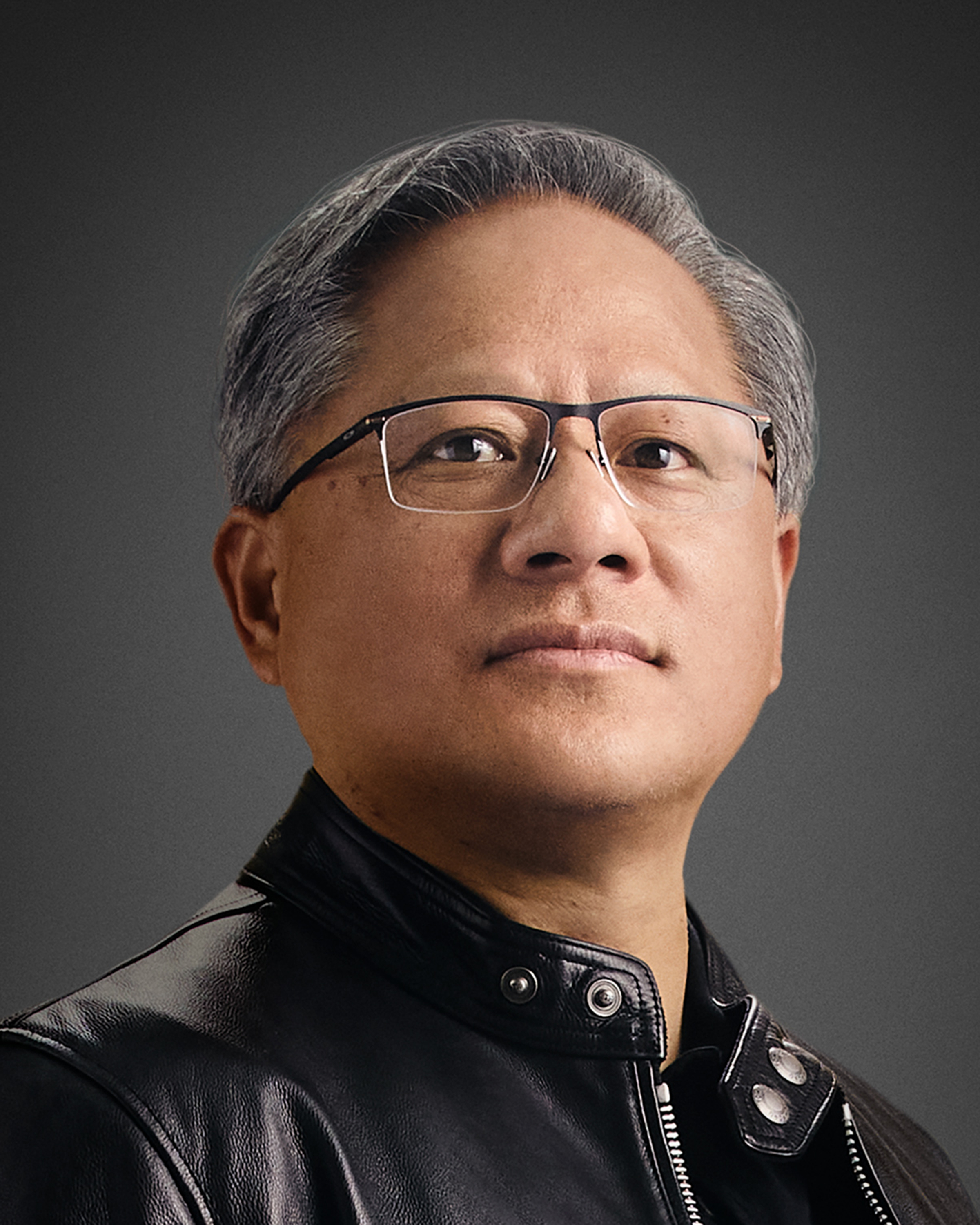

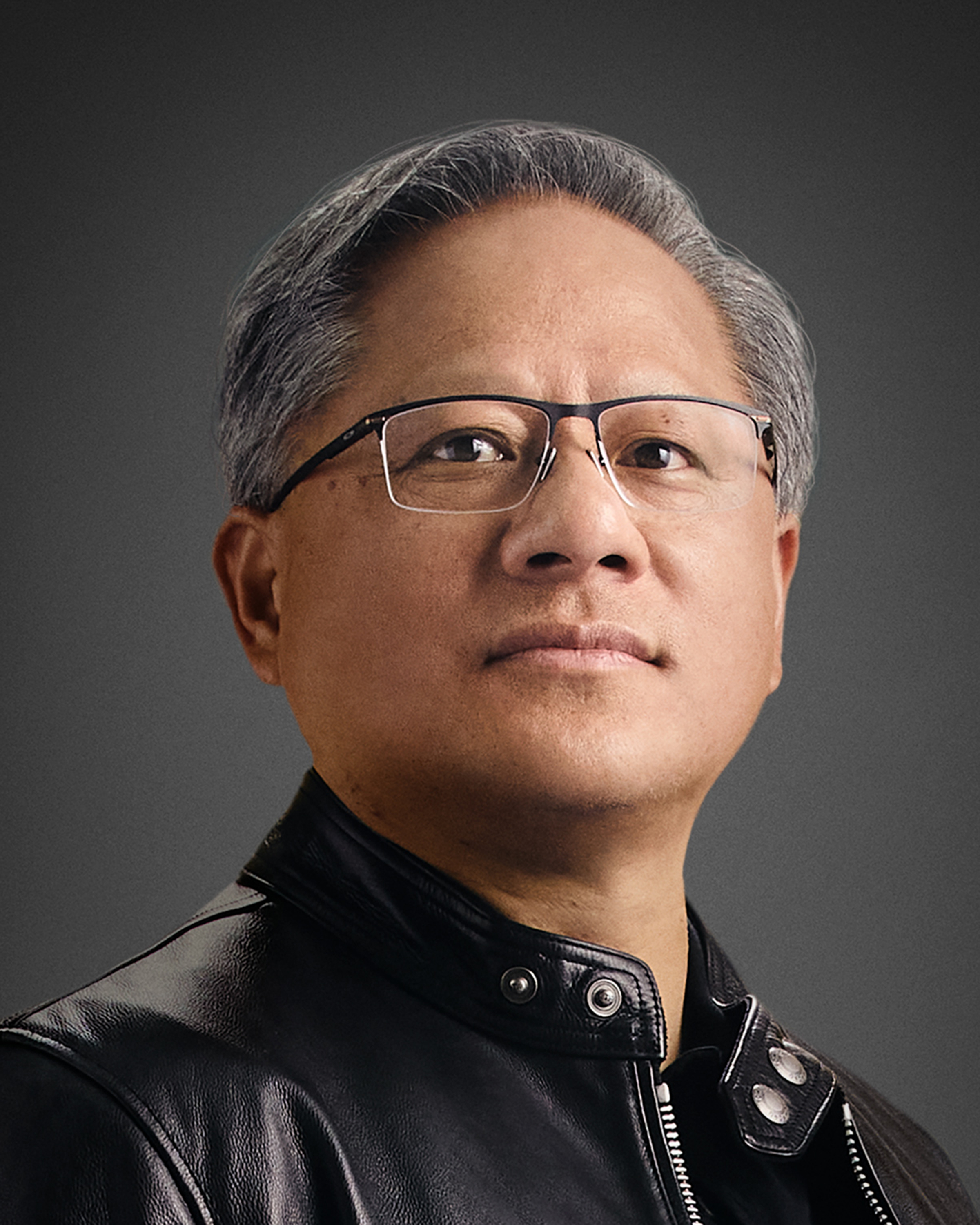

| | JEN-HSUN HUANG | Jen-Hsun Huang founded NVIDIA in 1993 and has served since its inception as president, chief executive officer, and a member of the board of directors. Mr. Huang is a recipient of the Semiconductor Industry Association’s highest honor, the Robert N. Noyce Award; IEEE Founder’s Medal; the Dr. Morris Chang Exemplary Leadership Award; and honorary doctorate degrees from Taiwan’s National Chiao Tung University, National Taiwan University, and Oregon State University. He was included in TIME magazine’s 2021 list of the world’s 100 most influential people. In 2019, Harvard Business Review ranked him No. 1 on its list of the world’s 100 best-performing CEOs over the lifetime of their tenure. In 2017, he was named Fortune’s Businessperson of the Year. Prior to founding NVIDIA, Huang worked at LSI Logic and Advanced Micro Devices. Mr. Huang holds a BSEE degree from Oregon State University and an MSEE degree from Stanford University. Mr. Huang is one of the technology industry’s most respected executives, having taken NVIDIA from a startup to a world leader in accelerated computing. Under his guidance, NVIDIA has compiled a record of consistent innovation and sharp execution, marked by products that have gained strong market share. |

| President and Chief Executive Officer, NVIDIA Corporation |

| Age: 60 |

| Director Since: 1993 |

| Committees: None |

| Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Industry & Technical |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Emerging Technologies & Business Models |

| | Marketing, Communications & Brand Management |

| | Regulatory, Legal & Risk Management |

| | Human Capital Management Experience |

| | Diversity |

| | | | | | | | | | | |

| | DAWN HUDSON | Dawn Hudson serves on the boards of various companies. From 2014 to 2018, Ms. Hudson served as Chief Marketing Officer for the National Football League. Previously, she served from 2009 to 2014 as vice chairman of The Parthenon Group, an advisory firm focused on strategy consulting. She was president and chief executive officer of Pepsi-Cola North America, the beverage division of PepsiCo, Inc. for the U.S. and Canada, from 2005 to 2007 and president from 2002, and simultaneously served as chief executive officer of the foodservice division of PepsiCo, Inc. from 2005 to 2007. Previously, she spent 13 years in marketing, advertising and branding strategy, holding leadership positions at major agencies, such as D’Arcy Masius Benton & Bowles and Omnicom Group Inc. Ms. Hudson currently serves on the board of directors of The Interpublic Group of Companies, Inc., an advertising holding company; Modern Times Group MTG AB, a gaming company (1); and a private skincare company. She was a director of P.F. Chang’s China Bistro, Inc., a restaurant chain, from 2010 to 2012; of Allergan, Inc., a biopharmaceutical company, from 2008 to 2014; of Lowes Companies, Inc., a home improvement retailer, from 2001 to 2015; and of Amplify Snack Brands, Inc., a snack food company, from 2014 to 2018. She holds a BA degree in English from Dartmouth College. Ms. Hudson brings to the board experience in executive leadership. As a longtime marketing executive, she has valuable expertise and insights in leveraging brands, brand development and consumer behavior. She also has considerable corporate governance experience, gained from more than a decade of serving on the boards of public companies.

(1) Ms. Hudson is not seeking re-election to Modern Times Group MTG AB’s board of directors effective as of MTG’s 2023 annual general meeting |

| Former Chief Marketing Officer, National Football League |

| Age: 65 |

| Director Since: 2013 |

| Current Committees: CC |

| Independent Director |

| Financial Expert |

| Other Current Public Company Boards: •The Interpublic Group of Companies, Inc. (since 2011) •Modern Times Group MTG AB (since 2020) (1) |

| | Senior Leadership & Operations Experience |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Marketing, Communications & Brand Management |

| | Human Capital Management Experience |

| | Diversity |

| | | | | | | | | | | |

| | HARVEY C. JONES | Harvey C. Jones has been the managing partner of Square Wave Ventures, a private investment firm, since 2004. Mr. Jones has been an entrepreneur, high technology executive and active venture investor for over 30 years. In 1981, he co-founded Daisy Systems Corp., a computer-aided engineering company, ultimately serving as its president and chief executive officer until 1987. Between 1987 and 1998, he led Synopsys, Inc., a major electronic design automation company, serving as its chief executive officer for seven years and then as executive chairman. In 1997, Mr. Jones co-founded Tensilica Inc., a privately held technology IP company that developed and licensed high performance embedded processing cores. He served as chairman of the Tensilica board of directors from inception through its 2013 acquisition by Cadence Design Systems, Inc. He was a director of Tintri Inc., a company that built data storage solutions for virtual and cloud environments, from 2014 to 2018. Mr. Jones holds a BS degree in Mathematics and Computer Sciences from Georgetown University and an MS degree in Management from Massachusetts Institute of Technology. Mr. Jones brings to the board an executive management background, an understanding of semiconductor technologies and complex system design. He provides valuable insight into innovation strategies, research and development efforts, as well as management and development of our technical employees. His significant financial community experience gives the Board an understanding of the methods by which companies can increase value for their stockholders.

|

| Managing Partner, Square Wave Ventures |

| Age: 70 |

| Director Since: 1993 |

| Current Committees: CC, NCGC |

| Independent Director |

| Financial Expert |

| | Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Industry & Technical |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Emerging Technologies & Business Models |

| | Marketing, Communications & Brand Management |

| | Human Capital Management Experience |

| | | | | | | | | | | |

| | MICHAEL G. McCAFFERY | Michael G. McCaffery is the Chairman of the Board of Directors of Makena Capital Management, LLC, an investment management firm. From 2013 to 2023, he was the Managing Director of Makena Capital Management. From 2005 to 2013, he was the Chief Executive Officer of Makena Capital Management. From 2000 to 2006, he was the President and Chief Executive Officer of the Stanford Management Company, the university subsidiary charged with managing Stanford University’s financial and real estate investments. Prior to Stanford Management Company, Mr. McCaffery was President and Chief Executive Officer of Robertson Stephens and Company, a San Francisco-based investment bank and investment management firm, from 1993 to 1999, and also served as Chairman in 2000. Mr. McCaffery is currently a director of C3.ai, Inc., an AI software provider, and also serves on the boards of directors, or on the advisory boards, of several privately held companies and non-profits. He was a director of KB Home, a homebuilding company, from 2003 until 2015. He holds a BA degree from the Woodrow Wilson School of Public and International Affairs at Princeton University, a BA Honours degree and an MA degree in Politics, Philosophy and Economics from Merton College, Oxford University, Oxford, England, and an MBA degree from the Stanford Graduate School of Business. Mr. McCaffery brings to the Board a broad array of business, investment and real estate experience and recognized expertise in financial matters, as well as a demonstrated commitment to good corporate governance.

|

| Chairman of the Board of Directors, Makena Capital Management |

| Age: 69 |

| Director Since: 2015 |

| Committees: AC |

| Independent Director |

| Financial Expert |

| Other Current Public Company Boards: •C3.ai, Inc. (since 2009) |

| | Senior Leadership & Operations Experience |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Human Capital Management Experience |

| | | | | | | | | | | |

| | STEPHEN C. NEAL | Stephen C. Neal serves as Chairman Emeritus and Senior Counsel of the law firm Cooley LLP, where he was also Chief Executive Officer from 2001 until 2008. In addition to his extensive experience as a trial lawyer on a broad range of corporate issues, Mr. Neal has represented and advised numerous boards of directors, special committees of boards and individual directors on corporate governance and other legal matters. Prior to joining Cooley in 1995, Mr. Neal was a partner of the law firm Kirkland & Ellis LLP. Mr. Neal served on the board of directors of Levi Strauss & Co. from 2007 to 2021, and served as chairperson from 2011 to 2021. Mr. Neal holds an AB degree from Harvard University and a JD degree from Stanford Law School. Mr. Neal brings to the Board deep knowledge and broad experience in corporate governance as well as his perspectives drawn from advising many companies throughout his career. |

| Chairman Emeritus and Senior Counsel, Cooley LLP |

| Age: 74 |

| Director Since: 2019 |

| Committees: NCGC |

| Lead Director (As of 2023 Meeting) |

| Independent Director |

| Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Governance & Public Company Board |

| | Marketing, Communications & Brand Management |

| | Regulatory, Legal & Risk Management |

| | Human Capital Management Experience |

| | | | | | | | | | | |

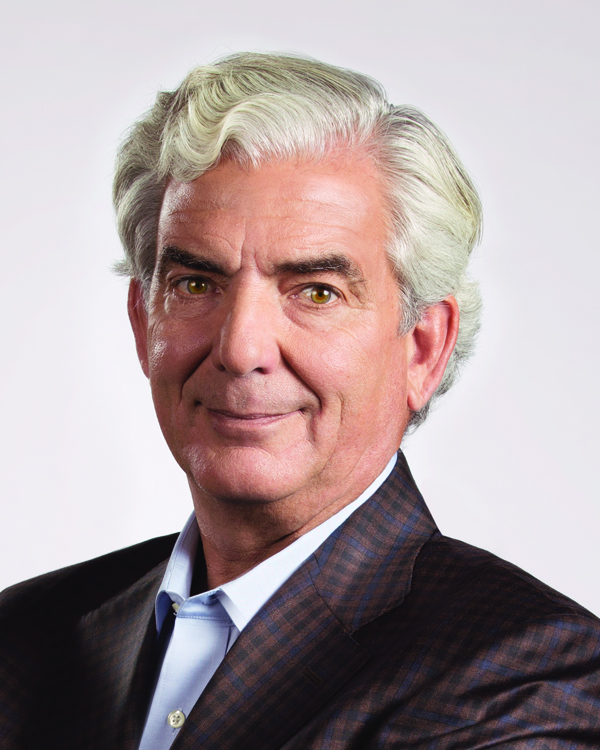

| | MARK L. PERRY | Mark L. Perry serves on the boards of, and consults for, various companies and non-profit organizations. From 2012 to 2015, Mr. Perry served as an Entrepreneur-in-Residence at Third Rock Ventures, a venture capital firm. He served from 2007 to 2011 as president and chief executive officer of Aerovance, Inc., a biopharmaceutical company. He was an executive officer from 1994 to 2004 at Gilead Sciences, Inc., a biopharmaceutical company, serving in a variety of capacities, including general counsel, chief financial officer, and executive vice president of operations, responsible for worldwide sales and marketing, legal, manufacturing and facilities; he was also its senior business advisor until 2007. From 1981 to 1994, Mr. Perry was with the law firm Cooley LLP, where he was a partner for seven years. He served on the board of MyoKardia, Inc. from 2012 to 2020 and on the board of Global Blood Therapeutics, Inc. from 2015 to 2022. Mr. Perry holds a BA degree in History from the University of California, Berkeley, and a JD degree from the University of California, Davis. Mr. Perry brings to the Board operating and finance experience gained in a large corporate setting. He has varied experience in legal affairs and corporate governance, and a deep understanding of the roles and responsibilities of a corporate board. |

| Independent Consultant and Director |

| Age: 67 |

| Director Since: 2005 |

| Committees: AC, NCGC |

| Lead Director (Until 2023 Meeting) |

| Financial Expert |

| Other Current Public Company Boards: None |

| | Senior Leadership & Operations Experience |

| | Financial/Financial Community |

| | Governance & Public Company Board |

| | Regulatory, Legal & Risk Management |

| | Human Capital Management Experience |

| | | | | | | | | | | |