UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | |

☒ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED February 29, 2024

OR

| | |

☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO__________

Commission File Number: 1-15829

FedEx Corporation

(Exact name of registrant as specified in its charter)

| |

Delaware | 62-1721435 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

942 South Shady Grove Road, Memphis, Tennessee | 38120 |

(Address of principal executive offices) | (ZIP Code) |

Registrant’s telephone number, including area code: (901) 818-7500

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, par value $0.10 per share | | FDX | | New York Stock Exchange |

0.450% Notes due 2025 | | FDX 25A | | New York Stock Exchange |

1.625% Notes due 2027 | | FDX 27 | | New York Stock Exchange |

0.450% Notes due 2029 | | FDX 29A | | New York Stock Exchange |

1.300% Notes due 2031 | | FDX 31 | | New York Stock Exchange |

0.950% Notes due 2033 | | FDX 33 | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer ☑ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | |

Common Stock | | Outstanding Shares at March 19, 2024 |

Common Stock, par value $0.10 per share | | 246,080,750 |

FEDEX CORPORATION

INDEX

| | |

| | PAGE |

| | |

PART I. FINANCIAL INFORMATION | | |

| | |

ITEM 1. Financial Statements | | |

Condensed Consolidated Balance Sheets

February 29, 2024 and May 31, 2023 | | 3 |

Condensed Consolidated Statements of Income

Three and Nine Months Ended February 29, 2024 and February 28, 2023 | | 5 |

Condensed Consolidated Statements of Comprehensive Income

Three and Nine Months Ended February 29, 2024 and February 28, 2023 | | 6 |

Condensed Consolidated Statements of Cash Flows

Nine Months Ended February 29, 2024 and February 28, 2023 | | 7 |

Condensed Consolidated Statements of Changes In Common Stockholders’ Investment

Three and Nine Months Ended February 29, 2024 and February 28, 2023 | | 8 |

Notes to Condensed Consolidated Financial Statements | | 9 |

Report of Independent Registered Public Accounting Firm | | 21 |

ITEM 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition | | 22 |

ITEM 3. Quantitative and Qualitative Disclosures About Market Risk | | 44 |

ITEM 4. Controls and Procedures | | 44 |

| | |

PART II. OTHER INFORMATION | | |

| | |

ITEM 1. Legal Proceedings | | 45 |

ITEM 1A. Risk Factors | | 45 |

ITEM 2. Unregistered Sales of Equity Securities and Use of Proceeds | | 45 |

ITEM 5. Other Information | | 45 |

ITEM 6. Exhibits | | 48 |

Signature | | 49 |

| | |

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS)

| | | | | | | | |

| | February 29, 2024

(Unaudited) | | | May 31,

2023 | |

ASSETS | | | | | | |

CURRENT ASSETS | | | | | | |

Cash and cash equivalents | | $ | 5,644 | | | $ | 6,856 | |

Receivables, less allowances of $775 and $800 | | | 9,904 | | | | 10,188 | |

Spare parts, supplies, and fuel, less allowances of $291 and $276 | | | 640 | | | | 604 | |

Prepaid expenses and other | | | 1,236 | | | | 962 | |

Total current assets | | | 17,424 | | | | 18,610 | |

PROPERTY AND EQUIPMENT, AT COST | | | 84,145 | | | | 80,624 | |

Less accumulated depreciation and amortization | | | 42,616 | | | | 39,926 | |

Net property and equipment | | | 41,529 | | | | 40,698 | |

OTHER LONG-TERM ASSETS | | | | | | |

Operating lease right-of-use assets, net | | | 16,935 | | | | 17,347 | |

Goodwill | | | 6,425 | | | | 6,435 | |

Other assets | | | 3,801 | | | | 4,053 | |

Total other long-term assets | | | 27,161 | | | | 27,835 | |

| | $ | 86,114 | | | $ | 87,143 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS, EXCEPT SHARE DATA)

| | | | | | | | |

| | February 29, 2024

(Unaudited) | | | May 31,

2023 | |

LIABILITIES AND COMMON STOCKHOLDERS’ INVESTMENT | | | | | | |

CURRENT LIABILITIES | | | | | | |

Current portion of long-term debt | | $ | 67 | | | $ | 126 | |

Accrued salaries and employee benefits | | | 2,541 | | | | 2,475 | |

Accounts payable | | | 3,780 | | | | 3,848 | |

Operating lease liabilities | | | 2,447 | | | | 2,390 | |

Accrued expenses | | | 4,473 | | | | 4,747 | |

Total current liabilities | | | 13,308 | | | | 13,586 | |

LONG-TERM DEBT, LESS CURRENT PORTION | | | 20,122 | | | | 20,453 | |

OTHER LONG-TERM LIABILITIES | | | | | | |

Deferred income taxes | | | 4,378 | | | | 4,489 | |

Pension, postretirement healthcare, and other benefit obligations | | | 2,527 | | | | 3,130 | |

Self-insurance accruals | | | 3,836 | | | | 3,339 | |

Operating lease liabilities | | | 14,878 | | | | 15,363 | |

Other liabilities | | | 690 | | | | 695 | |

Total other long-term liabilities | | | 26,309 | | | | 27,016 | |

COMMITMENTS AND CONTINGENCIES | | | | | | |

COMMON STOCKHOLDERS’ INVESTMENT | | | | | | |

Common stock, $0.10 par value; 800 million shares authorized; 318 million shares

issued as of February 29, 2024 and May 31, 2023 | | | 32 | | | | 32 | |

Additional paid-in capital | | | 3,898 | | | | 3,769 | |

Retained earnings | | | 37,174 | | | | 35,259 | |

Accumulated other comprehensive loss | | | (1,335 | ) | | | (1,327 | ) |

Treasury stock, at cost | | | (13,394 | ) | | | (11,645 | ) |

Total common stockholders’ investment | | | 26,375 | | | | 26,088 | |

| | $ | 86,114 | | | $ | 87,143 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | February 29, 2024 | | | February 28, 2023 | | | February 29, 2024 | | | February 28, 2023 | |

| | | | | | | | | | | | |

REVENUE | | $ | 21,738 | | | $ | 22,169 | | | $ | 65,584 | | | $ | 68,225 | |

OPERATING EXPENSES: | | | | | | | | | | | | |

Salaries and employee benefits | | | 7,693 | | | | 7,817 | | | | 23,311 | | | | 23,468 | |

Purchased transportation | | | 5,345 | | | | 5,402 | | | | 15,776 | | | | 16,834 | |

Rentals and landing fees | | | 1,145 | | | | 1,205 | | | | 3,434 | | | | 3,559 | |

Depreciation and amortization | | | 1,072 | | | | 1,031 | | | | 3,183 | | | | 3,101 | |

Fuel | | | 1,140 | | | | 1,350 | | | | 3,569 | | | | 4,765 | |

Maintenance and repairs | | | 804 | | | | 789 | | | | 2,482 | | | | 2,575 | |

Business optimization and realignment costs | | | 114 | | | | 123 | | | | 364 | | | | 197 | |

Other | | | 3,182 | | | | 3,410 | | | | 9,461 | | | | 10,317 | |

| | | 20,495 | | | | 21,127 | | | | 61,580 | | | | 64,816 | |

OPERATING INCOME | | | 1,243 | | | | 1,042 | | | | 4,004 | | | | 3,409 | |

OTHER (EXPENSE) INCOME: | | | | | | | | | | | | |

Interest, net | | | (91 | ) | | | (122 | ) | | | (279 | ) | | | (391 | ) |

Other retirement plans, net | | | 40 | | | | 102 | | | | 120 | | | | 304 | |

Other, net | | | (9 | ) | | | — | | | | (37 | ) | | | (87 | ) |

| | | (60 | ) | | | (20 | ) | | | (196 | ) | | | (174 | ) |

INCOME BEFORE INCOME TAXES | | | 1,183 | | | | 1,022 | | | | 3,808 | | | | 3,235 | |

PROVISION FOR INCOME TAXES | | | 304 | | | | 251 | | | | 951 | | | | 801 | |

NET INCOME | | $ | 879 | | | $ | 771 | | | $ | 2,857 | | | $ | 2,434 | |

EARNINGS PER COMMON SHARE: | | | | | | | | | | | | |

Basic | | $ | 3.55 | | | $ | 3.07 | | | $ | 11.43 | | | $ | 9.52 | |

Diluted | | $ | 3.51 | | | $ | 3.05 | | | $ | 11.31 | | | $ | 9.46 | |

DIVIDENDS DECLARED PER COMMON SHARE | | $ | 1.26 | | | $ | 1.15 | | | $ | 3.78 | | | $ | 4.60 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

(IN MILLIONS)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | February 29, 2024 | | | February 28, 2023 | | | February 29, 2024 | | | February 28, 2023 | |

NET INCOME | | $ | 879 | | | $ | 771 | | | $ | 2,857 | | | $ | 2,434 | |

OTHER COMPREHENSIVE (LOSS) INCOME: | | | | | | | | | | | | |

Foreign currency translation adjustments, net of tax benefit (expense) of $2 and $3 in 2024 and $(5) and $22 in 2023 | | | (39 | ) | | | 80 | | | | (39 | ) | | | (199 | ) |

Prior service credit arising during period, net of tax (expense) of $0 and ($11) in 2024 and $0 and $0 in 2023 | | | — | | | | — | | | | 36 | | | | — | |

Amortization of prior service credit, net of tax benefit of $0 and $0 in 2024 and $0 and $1 in 2023 | | | (2 | ) | | | (3 | ) | | | (5 | ) | | | (6 | ) |

| | | (41 | ) | | | 77 | | | | (8 | ) | | | (205 | ) |

COMPREHENSIVE INCOME | | $ | 838 | | | $ | 848 | | | $ | 2,849 | | | $ | 2,229 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(IN MILLIONS)

| | | | | | | | |

| | Nine Months Ended | |

| | February 29, 2024 | | | February 28, 2023 | |

Operating Activities: | | | | | | |

Net income | | $ | 2,857 | | | $ | 2,434 | |

Adjustments to reconcile net income to cash provided by operating activities: | | | | | | |

Depreciation and amortization | | | 3,183 | | | | 3,101 | |

Provision for uncollectible accounts | | | 323 | | | | 536 | |

Stock-based compensation | | | 130 | | | | 142 | |

Other noncash items including leases and deferred income taxes | | | 2,141 | | | | 2,425 | |

Business optimization and realignment costs, net of payments | | | (50 | ) | | | 20 | |

Changes in assets and liabilities: | | | | | | |

Receivables | | | (110 | ) | | | 373 | |

Other assets | | | (119 | ) | | | (110 | ) |

Accounts payable and other liabilities | | | (2,711 | ) | | | (3,534 | ) |

Other, net | | | (30 | ) | | | 14 | |

Cash provided by operating activities | | | 5,614 | | | | 5,401 | |

Investing Activities: | | | | | | |

Capital expenditures | | | (3,974 | ) | | | (4,420 | ) |

Purchase of investments | | | (110 | ) | | | (82 | ) |

Proceeds from sale of investments | | | 24 | | | | — | |

Proceeds from asset dispositions and other | | | 94 | | | | 72 | |

Cash used in investing activities | | | (3,966 | ) | | | (4,430 | ) |

Financing Activities: | | | | | | |

Principal payments on debt | | | (143 | ) | | | (123 | ) |

Proceeds from stock issuances | | | 265 | | | | 114 | |

Dividends paid | | | (949 | ) | | | (888 | ) |

Purchase of treasury stock | | | (2,000 | ) | | | (1,500 | ) |

Other, net | | | (7 | ) | | | 1 | |

Cash used in financing activities | | | (2,834 | ) | | | (2,396 | ) |

Effect of exchange rate changes on cash | | | (26 | ) | | | (99 | ) |

Net decrease in cash and cash equivalents | | | (1,212 | ) | | | (1,524 | ) |

Cash and cash equivalents at beginning of period | | | 6,856 | | | | 6,897 | |

Cash and cash equivalents at end of period | | $ | 5,644 | | | $ | 5,373 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN COMMON STOCKHOLDERS’ INVESTMENT

(UNAUDITED)

(IN MILLIONS, EXCEPT SHARE DATA)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | February 29, 2024 | | | February 28, 2023 | | | February 29, 2024 | | | February 28, 2023 | |

Common Stock | | | | | | | | | | | | |

Beginning Balance | | $ | 32 | | | $ | 32 | | | $ | 32 | | | $ | 32 | |

Ending Balance | | | 32 | | | | 32 | | | | 32 | | | | 32 | |

Additional Paid-in Capital | | | | | | | | | | | | |

Beginning Balance | | | 3,849 | | | | 3,487 | | | | 3,769 | | | | 3,712 | |

Purchase of treasury stock | | | 4 | | | | 218 | | | | (30 | ) | | | (82 | ) |

Employee incentive plans and other | | | 45 | | | | 30 | | | | 159 | | | | 105 | |

Ending Balance | | | 3,898 | | | | 3,735 | | | | 3,898 | | | | 3,735 | |

Retained Earnings | | | | | | | | | | | | |

Beginning Balance | | | 36,605 | | | | 33,557 | | | | 35,259 | | | | 32,782 | |

Net Income | | | 879 | | | | 771 | | | | 2,857 | | | | 2,434 | |

Cash dividends declared ($1.26, $1.15, $3.78, and $4.60 per share) | | | (310 | ) | | | (288 | ) | | | (942 | ) | | | (1,176 | ) |

Ending Balance | | | 37,174 | | | | 34,040 | | | | 37,174 | | | | 34,040 | |

Accumulated Other Comprehensive Loss | | | | | | | | | | | | |

Beginning Balance | | | (1,294 | ) | | | (1,385 | ) | | | (1,327 | ) | | | (1,103 | ) |

Other comprehensive (loss) income, net of tax benefit (expense) of $2, ($5), ($8), and $23 | | | (41 | ) | | | 77 | | | | (8 | ) | | | (205 | ) |

Ending Balance | | | (1,335 | ) | | | (1,308 | ) | | | (1,335 | ) | | | (1,308 | ) |

Treasury Stock | | | | | | | | | | | | |

Beginning Balance | | | (12,426 | ) | | | (11,576 | ) | | | (11,645 | ) | | | (10,484 | ) |

Purchase of treasury stock (4.1, 1.3, 8.0, and 9.2 million shares) | | | (1,011 | ) | | | (218 | ) | | | (1,985 | ) | | | (1,418 | ) |

Employee incentive plans and other (0.3, 0.2, 1.8, and 1.0 million shares) | | | 43 | | | | 28 | | | | 236 | | | | 136 | |

Ending Balance | | | (13,394 | ) | | | (11,766 | ) | | | (13,394 | ) | | | (11,766 | ) |

Total Common Stockholders’ Investment Balance | | $ | 26,375 | | | $ | 24,733 | | | $ | 26,375 | | | $ | 24,733 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(1) General

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES. These interim financial statements of FedEx Corporation (“FedEx”) have been prepared in accordance with accounting principles generally accepted in the United States and Securities and Exchange Commission (“SEC”) instructions for interim financial information, and should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended May 31, 2023 (“Annual Report”). Significant accounting policies and other disclosures normally provided have been omitted since such items are disclosed in our Annual Report.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (including normal recurring adjustments) necessary to present fairly our financial position as of February 29, 2024, and the results of our operations for the three- and nine-month periods ended February 29, 2024 and February 28, 2023, cash flows for the nine-month periods ended February 29, 2024 and February 28, 2023, and changes in common stockholders’ investment for the three- and nine-month periods ended February 29, 2024 and February 28, 2023. Operating results for the three- and nine-month periods ended February 29, 2024 are not necessarily indicative of the results that may be expected for the year ending May 31, 2024.

Except as otherwise specified, references to years indicate our fiscal year ending May 31, 2024 or ended May 31 of the year referenced and comparisons are to the corresponding period of the prior year.

REVENUE RECOGNITION.

Contract Assets and Liabilities

Contract assets include billed and unbilled amounts resulting from in-transit shipments, as we have an unconditional right to payment only once all performance obligations have been completed (e.g., packages have been delivered). Contract assets are generally classified as current, and the full balance is converted each quarter based on the short-term nature of the transactions. Our contract liabilities consist of advance payments and billings in excess of revenue. The full balance of deferred revenue is converted each quarter based on the short-term nature of the transactions.

Gross contract assets related to in-transit shipments totaled $663 million and $686 million at February 29, 2024 and May 31, 2023, respectively. Contract assets net of deferred unearned revenue were $455 million and $484 million at February 29, 2024 and May 31, 2023, respectively. Contract assets are included within current assets in the accompanying unaudited condensed consolidated balance sheets. Contract liabilities related to advance payments from customers were $23 million and $19 million at February 29, 2024 and May 31, 2023, respectively. Contract liabilities are included within current liabilities in the accompanying unaudited condensed consolidated balance sheets.

Disaggregation of Revenue

The following table provides revenue by service type (in millions) for the periods ended February 29, 2024 and February 28, 2023. This presentation is consistent with how we organize our segments internally for making operating decisions and measuring performance.

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

REVENUE BY SERVICE TYPE | | | | | | | | | | | | |

FedEx Express segment: | | | | | | | | | | | | |

Package: | | | | | | | | | | | | |

U.S. overnight box | | $ | 2,145 | | | $ | 2,165 | | | $ | 6,491 | | | $ | 6,718 | |

U.S. overnight envelope | | | 450 | | | | 478 | | | | 1,382 | | | | 1,477 | |

U.S. deferred | | | 1,317 | | | | 1,346 | | | | 3,712 | | | | 3,886 | |

Total U.S. domestic package revenue | | | 3,912 | | | | 3,989 | | | | 11,585 | | | | 12,081 | |

International priority | | | 2,318 | | | | 2,566 | | | | 7,035 | | | | 8,286 | |

International economy | | | 1,014 | | | | 698 | | | | 3,123 | | | | 2,116 | |

Total international export package revenue | | | 3,332 | | | | 3,264 | | | | 10,158 | | | | 10,402 | |

International domestic(1) | | | 1,016 | | | | 1,003 | | | | 3,126 | | | | 3,013 | |

Total package revenue | | | 8,260 | | | | 8,256 | | | | 24,869 | | | | 25,496 | |

Freight: | | | | | | | | | | | | |

U.S. | | | 648 | | | | 719 | | | | 1,814 | | | | 2,299 | |

International priority | | | 520 | | | | 687 | | | | 1,642 | | | | 2,387 | |

International economy | | | 389 | | | | 358 | | | | 1,236 | | | | 1,123 | |

International airfreight | | | 31 | | | | 47 | | | | 92 | | | | 126 | |

Total freight revenue | | | 1,588 | | | | 1,811 | | | | 4,784 | | | | 5,935 | |

Other | | | 253 | | | | 278 | | | | 787 | | | | 905 | |

Total FedEx Express segment | | | 10,101 | | | | 10,345 | | | | 30,440 | | | | 32,336 | |

FedEx Ground segment | | | 8,703 | | | | 8,658 | | | | 25,762 | | | | 25,211 | |

FedEx Freight segment | | | 2,125 | | | | 2,186 | | | | 6,776 | | | | 7,363 | |

FedEx Services segment | | | 64 | | | | 87 | | | | 201 | | | | 225 | |

Other and eliminations(2) | | | 745 | | | | 893 | | | | 2,405 | | | | 3,090 | |

| | $ | 21,738 | | | $ | 22,169 | | | $ | 65,584 | | | $ | 68,225 | |

(1)International domestic revenue relates to our international intra-country operations.

(2)Includes the FedEx Office and Print Services, Inc. (“FedEx Office”), FedEx Logistics, Inc. (“FedEx Logistics”), and FedEx Dataworks, Inc. (“FedEx Dataworks”) operating segments.

EMPLOYEES UNDER COLLECTIVE BARGAINING ARRANGEMENTS. The pilots of Federal Express Corporation (“FedEx Express”), who are a small number of its total employees, are represented by the Air Line Pilots Association, International (“ALPA”) and are employed under a collective bargaining agreement that took effect on November 2, 2015. The agreement became amendable in November 2021. Bargaining for a successor agreement began in May 2021, and in November 2022 the National Mediation Board (“NMB”), which is the U.S. governmental agency that oversees labor agreements for entities covered by the Railway Labor Act of 1926, as amended, began actively mediating the negotiations. In July 2023, FedEx Express’s pilots failed to ratify the tentative successor agreement that was approved by ALPA’s FedEx Express Master Executive Council the prior month. Bargaining for a successor agreement continues. In March 2024, ALPA requested that the NMB release it from mediation. The conduct of mediated negotiations has no effect on our operations. A small number of our other employees are members of unions.

STOCK-BASED COMPENSATION. We have three types of equity-based compensation: stock options, restricted stock, and, for outside directors, restricted stock units. The key terms of the stock option and restricted stock awards granted under our outstanding incentive stock plans and financial disclosures about these programs are set forth in our Annual Report. The key terms of the restricted stock units granted to our outside directors are set forth in our Current Report on Form 8-K dated September 21, 2023 and filed with the SEC on September 22, 2023.

Our stock-based compensation expense was $34 million for the three-month period ended February 29, 2024 and $130 million for the nine-month period ended February 29, 2024. Our stock-based compensation expense was $34 million for the three-month period ended February 28, 2023 and $142 million for the nine-month period ended February 28, 2023. Due to its immateriality, additional disclosures related to stock-based compensation have been excluded from this quarterly report.

BUSINESS OPTIMIZATION AND REALIGNMENT COSTS. In the second quarter of 2023, FedEx announced DRIVE, a comprehensive program to improve the company’s long-term profitability. This program includes a business optimization plan to drive efficiency among our transportation segments, lower our overhead and support costs, and transform our digital capabilities. We plan to consolidate our sortation facilities and equipment, reduce pickup-and-delivery routes, and optimize our enterprise linehaul network by moving beyond discrete collaboration to an end-to-end optimized network through Network 2.0, the multi-year effort to improve the efficiency with which FedEx picks up, transports, and delivers packages in the U.S. and Canada.

In the fourth quarter of 2023, we announced one FedEx, a consolidation plan to bring FedEx Express, FedEx Ground Package System, Inc. (“FedEx Ground”), and FedEx Corporate Services, Inc. (“FedEx Services”) into Federal Express Corporation, becoming a single company operating a unified, fully integrated air-ground express network under the respected FedEx brand. FedEx Freight, Inc., a wholly owned subsidiary of FedEx Freight Corporation (“FedEx Freight”), will continue to provide less-than-truckload (“LTL”) freight transportation services as a stand-alone and separate company under Federal Express Corporation. The organizational redesign will be implemented in phases with the new legal structure complete by June 2024. One FedEx will help facilitate our DRIVE transformation program to improve long-term profitability, including Network 2.0.

FedEx is making progress with Network 2.0, as the company has implemented Network 2.0 optimization in more than 50 locations in the U.S. In some markets, contracted service providers will handle the pickup and delivery of FedEx Ground and FedEx Express packages. In others, pickup and delivery will be handled exclusively by employee couriers.

We incurred costs associated with our business optimization activities of $114 million ($87 million, net of tax, or $0.35 per diluted share) in the three-month period ended February 29, 2024 and $364 million ($278 million, net of tax, or $1.10 per diluted share) in the nine-month period ended February 29, 2024. These costs were primarily related to professional services and severance. We recognized $120 million ($92 million, net of tax, or $0.36 per diluted share) of costs under this program in the three-month period ended February 28, 2023 and $180 million ($138 million, net of tax, or $0.53 per diluted share) in the nine-month period ended February 28, 2023. These costs were primarily related to consulting services, severance and related costs associated with organizational changes announced in the third quarter of 2023, and idling our operations in Russia. Business optimization costs are included in Corporate, other, and eliminations, FedEx Ground, and FedEx Express.

In 2021, FedEx Express announced a workforce reduction plan in Europe related to the network integration of TNT Express. The plan affected approximately 5,000 employees in Europe across operational teams and back-office functions and was completed in 2023.

We incurred costs associated with our business realignment activities of $3 million ($2 million, net of tax, or $0.01 per diluted share) in the three-month period ended February 28, 2023 and $17 million ($13 million, net of tax, or $0.05 per diluted share) in the nine-month period ended February 28, 2023. These costs were related to certain employee severance arrangements. The pre-tax cost of our business realignment activities through 2023 was approximately $430 million.

DERIVATIVE FINANCIAL INSTRUMENTS. Our risk management strategy includes the select use of derivative instruments to reduce the effects of volatility in foreign currency exchange exposure on operating results and cash flows. In accordance with our risk management policies, we do not hold or issue derivative instruments for trading or speculative purposes. All derivative instruments are recognized in the financial statements at fair value, regardless of the purpose or intent for holding them.

When we become a party to a derivative instrument and intend to apply hedge accounting, we formally document the hedge relationship and the risk management objective for undertaking the hedge, which includes designating the instrument for financial reporting purposes as a fair value hedge, a cash flow hedge, or a net investment hedge.

If a derivative is designated as a cash flow hedge, the entire change in the fair value of the hedging instrument included in the assessment of hedge effectiveness is recorded in other comprehensive income. For net investment hedges, the entire change in the fair value is recorded in other comprehensive income. Any portion of a change in the fair value of a derivative that is considered to be ineffective, along with the change in fair value of any derivatives not designated in a hedging relationship, is immediately recognized in the income statement. We do not have any derivatives designated as a cash flow hedge for any period presented. As of February 29, 2024, we had €153 million of debt designated as a net investment hedge to reduce the volatility of the U.S. dollar value of a portion of our net investment in a euro-denominated consolidated subsidiary. As of February 29, 2024, the hedge remains effective.

SUPPLIER FINANCE PROGRAM. We offer a voluntary Supply Chain Finance (“SCF”) program through one of our financial institutions to certain of our suppliers. We agree to commercial terms with our suppliers, including prices, quantities, and payment terms, and they issue invoices to us based on the agreed-upon contractual terms. If our suppliers choose to participate in the SCF program, they determine which invoices, if any, to sell to the financial institution to receive an early discounted payment, while we settle the net payment amount with our financial institution on the payment due dates. We guarantee these payments with the financial institution.

Amounts due to our suppliers that participate in the SCF program are included in accounts payable in our consolidated balance sheets. We have been informed by the participating financial institutions that as of February 29, 2024 and May 31, 2023, suppliers have been approved to sell to them $64 million and $76 million, respectively, of our outstanding payment obligations.

RECENT ACCOUNTING GUIDANCE. New accounting rules and disclosure requirements can significantly affect our reported results and the comparability of our financial statements. We believe the following new accounting guidance is relevant to the readers of our financial statements.

Recently Adopted Accounting Standards

In September 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2022-04, Liabilities-Supplier Finance Programs (Topic 405-50): Disclosure of Supplier Finance Program Obligations, which requires a buyer in a supplier finance program (e.g., reverse factoring) to disclose sufficient information about the program to allow a user of financial statements to understand the program’s nature, activity during the period, changes from period to period, and potential magnitude. The amendments do not affect the recognition, measurement, or financial statement presentation of obligations covered by supplier finance programs. We adopted this standard effective June 1, 2023. The adoption of this standard did not have a material effect on our consolidated financial statements and related disclosures.

Accounting Standards Not Yet Adopted

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848), and in December 2022 subsequently issued ASU 2022-06, to temporarily ease the potential burden in accounting for reference rate reform. The standards provide optional expedients and exceptions for applying accounting principles generally accepted in the United States to existing contracts, hedging relationships, and other transactions affected by reference rate reform. The standards apply only to contracts and hedging relationships that reference the London Interbank Offered Rate (“LIBOR”) or another reference rate to be discontinued because of reference rate reform. The standards were effective upon issuance and can generally be applied through December 31, 2024. While there has been no material effect to our financial condition, results of operations, or cash flows from reference rate reform as of February 29, 2024, we continue to monitor our contracts and transactions for potential application of these ASUs.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which expands disclosures about a public entity’s reportable segments and requires more enhanced information about a reportable segment’s expenses, interim segment profit or loss, and how a public entity’s chief operating decision maker uses reported segment profit or loss information in assessing segment performance and allocating resources. The update will be effective for annual periods beginning after December 15, 2023 (fiscal 2025). We are assessing the effect of this update on our consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which expands disclosures in an entity’s income tax rate reconciliation table and regarding cash taxes paid both in the U.S. and foreign jurisdictions. The update will be effective for annual periods beginning after December 15, 2024 (fiscal 2026). We are assessing the effect of this update on our consolidated financial statements and related disclosures.

In March 2024, the SEC adopted final rules requiring public entities to provide certain climate-related information in their registration statements and annual reports. As part of the disclosures, entities will be required to quantify certain effects of severe weather events and other natural conditions in a note to their audited financial statements. The rules will be effective for annual periods beginning in calendar 2025 (fiscal 2026). We are assessing the effect of the new rules on our consolidated financial statements and related disclosures.

EQUITY AND OTHER INVESTMENTS. Equity investments in private companies for which we do not have the ability to exercise significant influence are accounted for at cost, with adjustments for observable changes in prices or impairments, and are classified as “Other assets” on our consolidated balance sheets with adjustments recognized in “Other (expense) income, net” on our consolidated statements of income. Each reporting period, we perform a qualitative assessment to evaluate whether the investment is impaired. Our assessment includes a review of available recent operating results and trends, recent sales/acquisitions of the investee securities, and other publicly available data. If the investment is impaired, we write it down to its estimated fair value.

Equity investments that have readily determinable fair values, including investments for which we have elected the fair value option, are included in “Other assets” on our consolidated balance sheets and measured at fair value with changes recognized in “Other (expense) income, net” on our consolidated statements of income.

During the nine-month period ended February 29, 2024, we purchased $100 million of debt securities with effective maturities ranging from less than one year to approximately three years. We did not purchase any debt securities during the three-month period ended February 29, 2024. These investments have been recognized in “Cash and cash equivalents” and “Prepaid expenses and other” on our consolidated balance sheets.

As of February 29, 2024, these investments are not material to our financial position or results of operations.

TREASURY SHARES. In December 2021, our Board of Directors authorized a stock repurchase program of up to $5 billion of FedEx common stock. As part of the 2021 program, we completed an accelerated share repurchase (“ASR”) agreement with a bank during the third quarter of 2024 to repurchase an aggregate of $1 billion of our common stock.

During the three-month period ended February 29, 2024, 4.1 million shares were repurchased under the ASR agreement at an average price of $245.80 per share for a total of $1 billion. The final number of shares delivered upon settlement of the ASR agreement was determined based on a discount to the volume-weighted average price of our stock during the term of the transaction. The repurchased shares were accounted for as a reduction to common stockholders’ investment in the accompanying consolidated balance sheet and resulted in a reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted earnings per share.

During the nine-month period ended February 29, 2024, we repurchased 8.0 million shares of FedEx common stock under ASR agreements under the 2021 program at an average price of $250.95 per share for a total of $2.0 billion. During the nine-month period ended February 28, 2023, we repurchased 9.2 million shares of FedEx common stock under ASR agreements under the 2021 program at an average price of $163.39 per share for a total of $1.5 billion. As of February 29, 2024, $564 million remained available to use for repurchases under the 2021 stock repurchase authorization. In March 2024, our Board of Directors authorized a new stock repurchase program for additional repurchases of up to $5 billion.

Shares under the 2021 and 2024 repurchase programs may be repurchased from time to time in the open market or in privately negotiated transactions. The timing and volume of repurchases are at the discretion of management, based on the capital needs of the business, the market price of FedEx common stock, and general market conditions. No time limits were set for the completion of the programs, and the programs may be suspended or discontinued at any time.

DIVIDENDS DECLARED PER COMMON SHARE. On February 16, 2024, our Board of Directors declared a quarterly dividend of $1.26 per share of common stock. The dividend will be paid on April 1, 2024 to stockholders of record as of the close of business on March 11, 2024. Each quarterly dividend payment is subject to review and approval by our Board of Directors, and we evaluate our dividend payment amount on an annual basis. There are no material restrictions on our ability to declare dividends, nor are there any material restrictions on the ability of our subsidiaries to transfer funds to us in the form of cash dividends, loans, or advances.

(2) Credit Losses

We are exposed to credit losses primarily through our trade receivables. We assess ability to pay for certain customers by conducting a credit review, which considers the customer’s established credit rating and our assessment of creditworthiness. We determine the allowance for credit losses on accounts receivable using a combination of specific reserves for accounts that are deemed to exhibit credit loss indicators and general reserves that are determined using loss rates based on historical write-offs by geography and recent forecast information, including underlying economic expectations. We update our estimate of credit loss reserves quarterly, considering recent write-offs, collections information, and underlying economic expectations.

Credit losses were $106 million for the three-month period ended February 29, 2024 and $323 million for the nine-month period ended February 29, 2024. Credit losses were $111 million for the three-month period ended February 28, 2023 and $536 million for the nine-month period ended February 28, 2023. Our allowance for credit losses was $441 million at February 29, 2024 and $472 million at May 31, 2023.

(3) Accumulated Other Comprehensive Loss

The following table provides changes in accumulated other comprehensive income (“AOCI”), net of tax, reported in our unaudited condensed consolidated financial statements for the periods ended February 29, 2024 and February 28, 2023 (in millions; amounts in parentheses indicate debits to AOCI):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Foreign currency translation loss: | | | | | | | | | | | | |

Balance at beginning of period | | $ | (1,362 | ) | | $ | (1,427 | ) | | $ | (1,362 | ) | | $ | (1,148 | ) |

Translation adjustments | | | (39 | ) | | | 80 | | | | (39 | ) | | | (199 | ) |

Balance at end of period | | | (1,401 | ) | | | (1,347 | ) | | | (1,401 | ) | | | (1,347 | ) |

Retirement plans adjustments: | | | | | | | | | | | | |

Balance at beginning of period | | | 68 | | | | 42 | | | | 35 | | | | 45 | |

Prior service credit arising during period | | | — | | | | — | | | | 36 | | | | — | |

Reclassifications from AOCI | | | (2 | ) | | | (3 | ) | | | (5 | ) | | | (6 | ) |

Balance at end of period | | | 66 | | | | 39 | | | | 66 | | | | 39 | |

Accumulated other comprehensive (loss) at end of period | | $ | (1,335 | ) | | $ | (1,308 | ) | | $ | (1,335 | ) | | $ | (1,308 | ) |

The following table presents details of the reclassifications from AOCI for the periods ended February 29, 2024 and February 28, 2023 (in millions; amounts in parentheses indicate debits to earnings):

| | | | | | | | | | | | | | | | | | |

| | Amount Reclassified from

AOCI | | | Affected Line Item in the

Income Statement |

| | Three Months Ended | | | Nine Months Ended | | | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | | | |

Amortization of retirement plans

prior service credits, before tax | | $ | 2 | | | $ | 3 | | | $ | 5 | | | $ | 7 | | | Other retirement plans, net |

Income tax benefit | | | — | | | | — | | | | — | | | | (1 | ) | | Provision for income taxes |

AOCI reclassifications, net of tax | | $ | 2 | | | $ | 3 | | | $ | 5 | | | $ | 6 | | | Net income |

(4) Financing Arrangements

We have a shelf registration statement filed with the SEC that allows us to sell, in one or more future offerings, any combination of our unsecured debt securities and common stock and allows pass-through trusts formed by FedEx Express to sell, in one or more future offerings, pass-through certificates.

FedEx Express has issued $970 million of Pass-Through Certificates, Series 2020-1AA (the “Certificates”) with a fixed interest rate of 1.875% due in February 2034 utilizing pass-through trusts. The Certificates are secured by 19 Boeing aircraft with a net book value of $1.7 billion at February 29, 2024. The payment obligations of FedEx Express in respect of the Certificates are fully and unconditionally guaranteed by FedEx.

During the third quarter of 2024, we had in place a $2.0 billion five-year credit agreement (the “Old Five-Year Credit Agreement”) and a $1.5 billion three-year credit agreement (the “Old Three-Year Credit Agreement” and together with the Old Five-Year Credit Agreement, the “Old Credit Agreements”). The Old Five-Year Credit Agreement included a $250 million letter of credit sublimit. As of February 29, 2024, no amounts were outstanding under the Old Credit Agreements, no commercial paper was outstanding, and $250 million of the letter of credit sublimit was unused under the Old Five-Year Credit Agreement.

The Old Credit Agreements contained a financial covenant requiring us to maintain a ratio of debt to consolidated earnings (excluding noncash retirement plans mark-to-market adjustments, noncash pension service costs, and noncash asset impairment charges) before interest, taxes, depreciation, and amortization (“adjusted EBITDA”) of not more than 3.5 to 1.0, calculated as of the last day of each fiscal quarter on a rolling four-quarters basis. The ratio of our debt to adjusted EBITDA was 1.9 to 1.0 at February 29, 2024. We were in compliance with all other covenants in the Old Credit Agreements during the third quarter of fiscal 2024.

On March 15, 2024, we replaced the Old Credit Agreements with a $1.75 billion three-year credit agreement (the “New Three-Year Credit Agreement”) and a $1.75 billion five-year credit agreement (the “New Five-Year Credit Agreement” and together with the New Three-Year Credit Agreement, the “New Credit Agreements”). The New Three-Year Credit Agreement and the New Five-Year Credit Agreement expire in March 2027 and March 2029, respectively. Each of the New Credit Agreements has a $125 million letter of credit sublimit. The New Credit Agreements are available to finance our operations and other cash flow needs.

The New Credit Agreements amended the financial covenant included in the Old Credit Agreements to (i) net unrestricted cash and cash equivalents up to $500 million from the definition of debt and (ii) add back business optimization and restructuring expenses and pro forma cost savings and synergies associated with an acquisition to adjusted EBITDA. The aggregate amount of adjustments for business optimization and restructuring expenses and pro forma cost savings and synergies associated with an acquisition may not exceed 10% of adjusted EBITDA (calculated after giving effect to any such addback and such cap and all other permitted addbacks and adjustments) in any period. Additionally, following the consummation of an acquisition for which the aggregate cash consideration is at least $250 million, FedEx may elect to increase the ratio to 4.0 to 1.0 with respect to the last day of the fiscal quarter during which such acquisition is consummated and the last day of each of the immediately following three consecutive fiscal quarters, provided that there must be at least two consecutive fiscal quarters between such elections during which the ratio is 3.5 to 1.0.

The financial covenant discussed above is the only significant restrictive covenant in the New Credit Agreements. The New Credit Agreements contain other customary covenants that do not, individually or in the aggregate, materially restrict the conduct of our business. We do not expect the covenants contained in the New Credit Agreements to affect our operations, including our liquidity or expected funding needs. If we failed to comply with the financial covenant or any other covenants in the New Credit Agreements, our access to financing could become limited. Our commercial paper program is backed by unused commitments under the New Credit Agreements, and borrowings under the program reduce the amount available under the New Credit Agreements.

Long-term debt, including current maturities and exclusive of finance leases, had carrying values of $19.8 billion at February 29, 2024 and $19.8 billion at May 31, 2023, compared with estimated fair values of $17.7 billion at February 29, 2024 and $17.5 billion at May 31, 2023. The annualized weighted-average interest rate on long-term debt was 3.5% at February 29, 2024. The estimated fair values were determined based on quoted market prices and the current rates offered for debt with similar terms and maturities. The fair value of our long-term debt is classified as Level 2 within the fair value hierarchy. This classification is defined as a fair value determined using market-based inputs other than quoted prices that are observable for the liability, either directly or indirectly.

(5) Computation of Earnings Per Share

The calculation of basic and diluted earnings per common share for the periods ended February 29, 2024 and February 28, 2023 was as follows (in millions, except per share amounts):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Basic earnings per common share: | | | | | | | | | | | | |

Net earnings allocable to common shares(1) | | $ | 878 | | | $ | 770 | | | $ | 2,853 | | | $ | 2,430 | |

Weighted-average common shares | | | 247 | | | | 251 | | | | 249 | | | | 255 | |

Basic earnings per common share | | $ | 3.55 | | | $ | 3.07 | | | $ | 11.43 | | | $ | 9.52 | |

Diluted earnings per common share: | | | | | | | | | | | | |

Net earnings allocable to common shares(1) | | $ | 878 | | | $ | 770 | | | $ | 2,853 | | | $ | 2,430 | |

Weighted-average common shares | | | 247 | | | | 251 | | | | 249 | | | | 255 | |

Dilutive effect of share-based awards | | | 3 | | | | 2 | | | | 3 | | | | 2 | |

Weighted-average diluted shares | | | 250 | | | | 253 | | | | 252 | | | | 257 | |

Diluted earnings per common share | | $ | 3.51 | | | $ | 3.05 | | | $ | 11.31 | | | $ | 9.46 | |

Anti-dilutive options excluded from diluted earnings per

common share | | | 6.3 | | | | 7.8 | | | | 6.3 | | | | 7.7 | |

(1) Net earnings available to participating securities were immaterial in all periods presented.

(6) Retirement Plans

We sponsor programs that provide retirement benefits to most of our employees. These programs include defined benefit pension plans, defined contribution plans, and postretirement healthcare plans. Key terms of our retirement plans are provided in our Annual Report.

Our retirement plans costs for the periods ended February 29, 2024 and February 28, 2023 were as follows (in millions):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Defined benefit pension plans, net | | $ | 92 | | | $ | 59 | | | $ | 274 | | | $ | 176 | |

Defined contribution plans | | | 240 | | | | 242 | | | | 722 | | | | 714 | |

Postretirement healthcare plans | | | 20 | | | | 24 | | | | 64 | | | | 70 | |

| | $ | 352 | | | $ | 325 | | | $ | 1,060 | | | $ | 960 | |

Net periodic benefit cost of the pension and postretirement healthcare plans for the periods ended February 29, 2024 and February 28, 2023 included the following components (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | U.S. Pension Plans | | | International Pension Plans | | | Postretirement Healthcare Plans | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Service cost | | $ | 136 | | | $ | 162 | | | $ | 9 | | | $ | 13 | | | $ | 7 | | | $ | 10 | |

Other retirement plans expense (income): | | | | | | | | | | | | | | | | | | |

Interest cost | | | 341 | | | | 304 | | | | 10 | | | | 8 | | | | 15 | | | | 14 | |

Expected return on plan assets | | | (400 | ) | | | (422 | ) | | | (2 | ) | | | (3 | ) | | | — | | | | — | |

Amortization of prior service credit and other | | | (2 | ) | | | (1 | ) | | | — | | | | (2 | ) | | | (2 | ) | | | — | |

| | | (61 | ) | | | (119 | ) | | | 8 | | | | 3 | | | | 13 | | | | 14 | |

| | $ | 75 | | | $ | 43 | | | $ | 17 | | | $ | 16 | | | $ | 20 | | | $ | 24 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended | |

| | U.S. Pension Plans | | | International Pension Plans | | | Postretirement Healthcare Plans | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Service cost | | $ | 408 | | | $ | 488 | | | $ | 29 | | | $ | 34 | | | $ | 21 | | | $ | 28 | |

Other retirement plans expense (income): | | | | | | | | | | | | | | | | | | |

Interest cost | | | 1,022 | | | | 913 | | | | 32 | | | | 25 | | | | 45 | | | | 42 | |

Expected return on plan assets | | | (1,199 | ) | | | (1,266 | ) | | | (13 | ) | | | (11 | ) | | | — | | | | — | |

Amortization of prior service credit and other | | | (5 | ) | | | (5 | ) | | | — | | | | (2 | ) | | | (2 | ) | | | — | |

| | | (182 | ) | | | (358 | ) | | | 19 | | | | 12 | | | | 43 | | | | 42 | |

| | $ | 226 | | | $ | 130 | | | $ | 48 | | | $ | 46 | | | $ | 64 | | | $ | 70 | |

For 2024, no pension contributions are required for our tax-qualified U.S. domestic pension plan (“U.S. Pension Plan”) as it is fully funded under the Employee Retirement Income Security Act. We made voluntary contributions of $800 million to our U.S. Pension Plan during the nine-month period ended February 29, 2024.

(7) Business Segment Information

We provide a broad portfolio of transportation, e-commerce, and business services through companies competing collectively, operating collaboratively, and innovating digitally as one FedEx. Our primary operating companies are FedEx Express, the world’s largest express transportation company; FedEx Ground, a leading North American provider of small-package ground delivery services; and FedEx Freight, a leading North American provider of LTL freight transportation services. These companies represent our major service lines and, along with FedEx Services, constitute our reportable segments.

Our reportable segments include the following businesses:

| |

FedEx Express Segment | FedEx Express (express transportation, small-package ground delivery, and freight transportation) |

| FedEx Custom Critical, Inc. (time-critical transportation) |

FedEx Ground Segment | FedEx Ground (small-package ground delivery) |

| |

FedEx Freight Segment | FedEx Freight (LTL freight transportation) |

| |

FedEx Services Segment | FedEx Services (sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and back-office functions) |

In the fourth quarter of 2023, FedEx announced one FedEx, a consolidation plan to bring FedEx Express, FedEx Ground, and FedEx Services into Federal Express Corporation, becoming a single company operating a unified, fully integrated air-ground express network under the respected FedEx brand. The organizational redesign will be implemented in phases with the new legal structure complete by June 2024. During the implementation process in 2024, each of our current reportable segments will continue to have discrete financial information that will be regularly reviewed when evaluating performance and making resource allocation decisions, and aligns with our management reporting structure and our internal financial reporting. In the first quarter of 2025 when the consolidation plan has been completed, we expect to begin reporting a new segment structure that will align with an updated management reporting structure and how management will evaluate performance and make resource allocation decisions under one FedEx.

References to our transportation segments include, collectively, the FedEx Express segment, the FedEx Ground segment, and the FedEx Freight segment.

FedEx Services Segment

The FedEx Services segment operates combined sales, marketing, administrative, and information-technology functions in shared services operations for U.S. customers of our major business units and certain back-office support to our operating segments which allows us to obtain synergies from the combination of these functions. For the international regions of FedEx Express, some of these functions are performed on a regional basis and reported by FedEx Express in their natural expense line items.

The FedEx Services segment provides direct and indirect support to our operating segments, and we allocate all of the net operating costs of the FedEx Services segment to reflect the full cost of operating our businesses in the results of those segments. We review and evaluate the performance of our transportation segments based on operating income (inclusive of FedEx Services segment allocations). For the FedEx Services segment, performance is evaluated based on the effect of its total allocated net operating costs on our operating segments.

Operating expenses for each of our transportation segments include the allocations from the FedEx Services segment to the respective transportation segments. These allocations also include charges and credits for administrative services provided between operating companies. The allocations of net operating costs are based on metrics such as relative revenue or estimated services provided. We believe these allocations approximate the net cost of providing these functions. Our allocation methodologies are refined periodically, as necessary, to reflect changes in our businesses.

Corporate, Other, and Eliminations

Corporate and other includes corporate headquarters costs for executive officers and certain legal and finance functions, certain other costs and credits not attributed to our core business, and certain costs associated with developing our “innovate digitally” strategic pillar through our FedEx Dataworks operating segment. FedEx Dataworks is focused on creating solutions to transform the digital and physical experiences of our customers and team members.

Also included in Corporate and other is the FedEx Office operating segment, which provides an array of document and business services and retail access to our customers for our package transportation businesses, and the FedEx Logistics operating segment, which provides integrated supply chain management solutions, specialty transportation, customs brokerage, and global ocean and air freight forwarding.

The results of Corporate, other, and eliminations are not allocated to the other business segments.

Certain FedEx operating companies provide transportation and related services for other FedEx companies outside their reportable segment in order to optimize our resources. Billings for such services are based on negotiated rates, which we believe approximate fair value, and are reflected as revenue of the billing segment. These rates are adjusted from time to time based on market conditions. Such intersegment revenue and expenses are eliminated in our consolidated results and are not separately identified in the following segment information because the amounts are not material.

The following table provides a reconciliation of reportable segment revenue and operating income (loss) to our unaudited condensed consolidated financial statement totals for the periods ended February 29, 2024 and February 28, 2023 (in millions):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Revenue: | | | | | | | | | | | | |

FedEx Express segment | | $ | 10,101 | | | $ | 10,345 | | | $ | 30,440 | | | $ | 32,336 | |

FedEx Ground segment | | | 8,703 | | | | 8,658 | | | | 25,762 | | | | 25,211 | |

FedEx Freight segment | | | 2,125 | | | | 2,186 | | | | 6,776 | | | | 7,363 | |

FedEx Services segment | | | 64 | | | | 87 | | | | 201 | | | | 225 | |

Other and eliminations | | | 745 | | | | 893 | | | | 2,405 | | | | 3,090 | |

| | $ | 21,738 | | | $ | 22,169 | | | $ | 65,584 | | | $ | 68,225 | |

Operating income (loss): | | | | | | | | | | | | |

FedEx Express segment | | $ | 233 | | | $ | 119 | | | $ | 575 | | | $ | 634 | |

FedEx Ground segment | | | 942 | | | | 844 | | | | 2,945 | | | | 2,136 | |

FedEx Freight segment | | | 340 | | | | 386 | | | | 1,308 | | | | 1,477 | |

Corporate, other, and eliminations | | | (272 | ) | | | (307 | ) | | | (824 | ) | | | (838 | ) |

| | $ | 1,243 | | | $ | 1,042 | | | $ | 4,004 | | | $ | 3,409 | |

(8) Commitments

As of February 29, 2024, our purchase commitments under various contracts for the remainder of 2024 and annually thereafter were as follows (in millions):

| | | | | | | | | | | | |

| | Aircraft and Aircraft Related | | | Other(1) | | | Total | |

2024 (remainder) | | $ | 92 | | | $ | 158 | | | $ | 250 | |

2025 | | | 1,596 | | | | 654 | | | | 2,250 | |

2026 | | | 540 | | | | 464 | | | | 1,004 | |

2027 | | | 269 | | | | 234 | | | | 503 | |

2028 | | | 341 | | | | 147 | | | | 488 | |

Thereafter | | | 1,654 | | | | 92 | | | | 1,746 | |

Total | | $ | 4,492 | | | $ | 1,749 | | | $ | 6,241 | |

(1)Primarily information technology and advertising.

The amounts reflected in the table above for purchase commitments represent noncancelable agreements to purchase goods or services. Open purchase orders that are cancelable are not considered unconditional purchase obligations for financial reporting purposes and are not included in the table above.

As of February 29, 2024, we had $648 million in deposits and progress payments on aircraft purchases and other planned aircraft-related transactions. These deposits are classified in the “Other assets” caption of our accompanying unaudited condensed consolidated balance sheets. Aircraft and related contracts are subject to price escalations. The following table is a summary of the key aircraft we are committed to purchase as of February 29, 2024 with the year of expected delivery:

| | | | | | | | | | | | | | | | | | | | |

| | Cessna SkyCourier 408 | | | ATR 72-600F | | | B767F | | | B777F | | | Total | |

2024 (remainder) | | | 5 | | | | 2 | | | | 3 | | | | — | | | | 10 | |

2025 | | | 13 | | | | 8 | | | | 10 | | | | 2 | | | | 33 | |

2026 | | | 14 | | | | 1 | | | | 2 | | | | — | | | | 17 | |

2027 | | | — | | | | — | | | | — | | | | — | | | | — | |

2028 | | | — | | | | — | | | | — | | | | — | | | | — | |

Thereafter | | | — | | | | — | | | | — | | | | — | | | | — | |

Total | | | 32 | | | | 11 | | | | 15 | | | | 2 | | | | 60 | |

A summary of future minimum lease payments under noncancelable operating and finance leases with an initial or remaining term in excess of one year as of February 29, 2024 is as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| | Aircraft

and Related

Equipment | | | Facilities

and Other | | | Total

Operating

Leases | | | Finance Leases | | | Total Leases | |

2024 (remainder) | | $ | 30 | | | $ | 579 | | | $ | 609 | | | $ | 5 | | | $ | 614 | |

2025 | | | 121 | | | | 2,995 | | | | 3,116 | | | | 34 | | | | 3,150 | |

2026 | | | 117 | | | | 2,666 | | | | 2,783 | | | | 30 | | | | 2,813 | |

2027 | | | 117 | | | | 2,363 | | | | 2,480 | | | | 22 | | | | 2,502 | |

2028 | | | 117 | | | | 2,036 | | | | 2,153 | | | | 21 | | | | 2,174 | |

Thereafter | | | 246 | | | | 9,031 | | | | 9,277 | | | | 648 | | | | 9,925 | |

Total lease payments | | | 748 | | | | 19,670 | | | | 20,418 | | | | 760 | | | | 21,178 | |

Less imputed interest | | | (92 | ) | | | (3,001 | ) | | | (3,093 | ) | | | (328 | ) | | | (3,421 | ) |

Present value of lease liability | | $ | 656 | | | $ | 16,669 | | | $ | 17,325 | | | $ | 432 | | | $ | 17,757 | |

While certain of our lease agreements contain covenants governing the use of the leased assets or require us to maintain certain levels of insurance, none of our lease agreements include material financial covenants or limitations.

As of February 29, 2024, FedEx has entered into additional leases which have not yet commenced and are therefore not part of the right-of-use asset and liability. These leases are generally for build-to-suit facilities and have undiscounted future payments of approximately $1.8 billion that will commence when FedEx gains beneficial access to the leased asset. Commencement dates are expected to be from 2024 to 2027.

(9) Contingencies

Service Provider Lawsuits. FedEx Ground is defending lawsuits in which it is alleged that FedEx Ground should be treated as a joint employer of drivers employed by service providers engaged by FedEx Ground. These cases are in varying stages of litigation, and we are not currently able to estimate an amount or range of potential loss in all of these matters. However, we do not expect to incur, individually or in the aggregate, a material loss in these matters. Nevertheless, adverse determinations in these matters could, among other things, entitle service providers’ drivers to certain payments, including wages and penalties, from the service providers and FedEx Ground and result in employment and withholding tax and benefit liability for FedEx Ground. We continue to believe that FedEx Ground is not an employer or joint employer of the drivers of these independent businesses.

FedEx Services Employment Lawsuit. In May 2021, FedEx Services was named as a defendant in a lawsuit filed in the U.S. District Court for the Southern District of Texas related to the termination of a former FedEx Services employee. The complaint alleged race discrimination and retaliation for complaints of discrimination under Section 1981 of the Civil Rights Act of 1866 and Title VII of the Civil Rights Act of 1964. After trial, in October 2022, the jury found in favor of FedEx Services on the race discrimination claims but awarded the plaintiff compensatory damages of approximately $1.0 million for emotional distress and punitive damages of $365 million for the retaliation claims. The court entered final judgment in the amount of approximately $366 million. FedEx Services appealed the verdict to the U.S. Court of Appeals for the Fifth Circuit. FedEx Services argued on appeal that FedEx Services is entitled to judgment as a matter of law on the retaliation claims, plaintiff’s claims were not timely filed, punitive damages are not available as a matter of law and, if allowed, must be reduced to no greater than a single-digit multiple of the award for compensatory damages based on the United States Supreme Court’s ruling in State Farm v. Campbell, and the compensatory damages award must be reduced to conform with the evidence and the Fifth Circuit’s maximum recovery rule. FedEx Services argued in the alternative that a new trial should be granted.

In February 2024, a three-judge panel of the U.S. Court of Appeals for the Fifth Circuit reduced the $366 million judgment to approximately $250,000. In March 2024, the U.S. Court of Appeals for the Fifth Circuit unanimously denied plaintiff’s petition for rehearing. An immaterial loss accrual has been recorded in FedEx’s consolidated financial statements.

FedEx Ground Negligence Lawsuit. In December 2022, FedEx Ground was named as a defendant in a lawsuit filed in Texas state court related to the alleged kidnapping and first-degree murder of a minor by a driver employed by a service provider engaged by FedEx Ground. The complaint alleges compensatory and punitive damages against FedEx Ground for negligent and gross negligent hiring and retention, as well as negligent entrustment. The service provider and driver are also named as defendants in the lawsuit. An immaterial loss accrual has been recorded in FedEx’s consolidated financial statements. It is reasonably possible that an additional material loss could be incurred. Given the early stage of the litigation, we cannot estimate the amount or range of such additional loss, if any.

Other Matters. FedEx and its subsidiaries are subject to other legal proceedings that arise in the ordinary course of business, including certain lawsuits containing various class-action allegations of wage-and-hour violations in which plaintiffs claim, among other things, that they were forced to work “off the clock,” were not paid overtime, or were not provided work breaks or other benefits, as well as other lawsuits containing allegations that FedEx and its subsidiaries are responsible for third-party losses related to vehicle accidents that could exceed our insurance coverage for such losses. In the opinion of management, the aggregate liability, if any, with respect to these other actions will not have a material adverse effect on our financial position, results of operations, or cash flows.

Environmental Matters. SEC regulations require us to disclose certain information about proceedings arising under federal, state, or local environmental provisions if we reasonably believe that such proceedings may result in monetary sanctions above a stated threshold. Pursuant to the SEC regulations, FedEx uses a threshold of $1 million or more for purposes of determining whether disclosure of any such proceedings is required. Applying this threshold, there are no environmental matters required to be disclosed for this period.

(10) Supplemental Cash Flow Information

Cash paid for interest expense and income taxes for the nine-month periods ended February 29, 2024 and February 28, 2023 was as follows (in millions):

| | | | | | | | |

| | 2024 | | | 2023 | |

Cash payments for: | | | | | | |

Interest (net of capitalized interest) | | $ | 538 | | | $ | 497 | |

Income taxes | | $ | 1,265 | | | $ | 823 | |

Income tax refunds received | | | (97 | ) | | | (50 | ) |

Cash tax (refunds)/payments, net | | $ | 1,168 | | | $ | 773 | |

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of

FedEx Corporation

Results of Review of Interim Financial Statements

We have reviewed the accompanying condensed consolidated balance sheet of FedEx Corporation (the Company) as of February 29, 2024, the related condensed consolidated statements of income, comprehensive income, and changes in common stockholders’ investment for the three- and nine-month periods ended February 29, 2024 and February 28, 2023, the condensed consolidated statements of cash flows for the nine-month periods ended February 29, 2024 and February 28, 2023, and the related notes (collectively referred to as the “condensed consolidated interim financial statements”). Based on our reviews, we are not aware of any material modifications that should be made to the condensed consolidated interim financial statements for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheet of the Company as of May 31, 2023, the related consolidated statements of income, comprehensive income, cash flows, and changes in common stockholders’ investment for the year then ended, and the related notes (not presented herein); and in our report dated July 17, 2023, we expressed an unqualified audit opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of May 31, 2023, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

Basis for Review Results

These financial statements are the responsibility of the Company’s management. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the SEC and the PCAOB. We conducted our review in accordance with the standards of the PCAOB. A review of interim financial statements consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Memphis, Tennessee

March 21, 2024

Item 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition

GENERAL

The following Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) describes the principal factors affecting the results of operations, liquidity, capital resources, and critical accounting estimates of FedEx Corporation (“FedEx”). This discussion should be read in conjunction with the accompanying quarterly unaudited condensed consolidated financial statements and our Annual Report on Form 10-K for the year ended May 31, 2023 (“Annual Report”). Our Annual Report includes additional information about our significant accounting policies, practices, and the transactions that underlie our financial results, as well as a detailed discussion of the most significant risks and uncertainties associated with our financial condition and operating results.

We provide a broad portfolio of transportation, e-commerce, and business services, offering integrated business solutions through operating companies competing collectively, operating collaboratively, and innovating digitally as one FedEx. Our primary operating companies are Federal Express Corporation (“FedEx Express”), the world’s largest express transportation company; FedEx Ground Package System, Inc. (“FedEx Ground”), a leading North American provider of small-package ground delivery services; and FedEx Freight Corporation (“FedEx Freight”), a leading North American provider of less-than-truckload (“LTL”) freight transportation services. These companies represent our major service lines and, along with FedEx Corporate Services, Inc. (“FedEx Services”), constitute our reportable segments.

Our FedEx Services segment provides sales, marketing, information technology, communications, customer service, technical support, billing and collection services, and certain back-office functions that support our operating segments. For the international regions of FedEx Express, some of these functions are performed on a regional basis and reported by FedEx Express in their natural expense line items. See “Reportable Segments” for further discussion. Additional information on our businesses can be found in our Annual Report.

Except as otherwise specified, references to years indicate our fiscal year ending May 31, 2024 or ended May 31 of the year referenced, and comparisons are to the corresponding period of the prior year. References to our transportation segments include, collectively, the FedEx Express segment, the FedEx Ground segment, and the FedEx Freight segment.

The key indicators necessary to understand our operating results include:

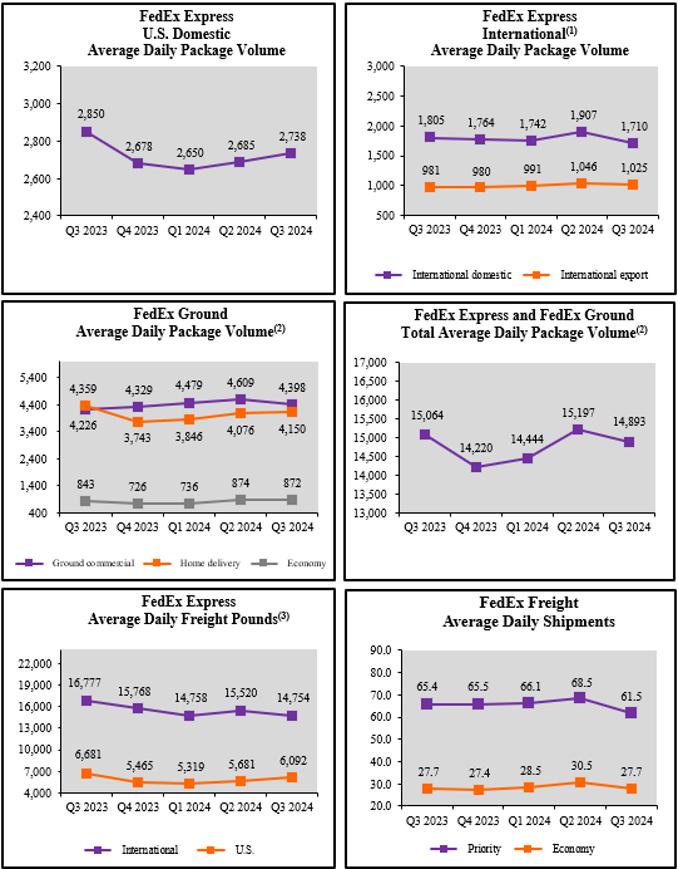

•the overall customer demand for our various services based on macroeconomic factors and the global economy;

•the volumes of transportation services provided through our networks, primarily measured by our average daily volume and shipment weight and size;

•the mix of services purchased by our customers;

•the prices we obtain for our services, primarily measured by yield (revenue per package or pound or revenue per shipment or hundredweight for LTL freight shipments);

•our ability to manage our cost structure (capital expenditures and operating expenses) to match shifting volume levels; and

•the timing and amount of fluctuations in fuel prices and our ability to recover incremental fuel costs through our fuel surcharges.

Trends Affecting Our Business

The following trends significantly affect the indicators discussed above, as well as our business and operating results. See the risk factors identified under Part I, Item 1A. “Risk Factors” in our Annual Report, as updated by our quarterly reports on Form 10-Q, for more information. Additionally, see “Results of Operations – Consolidated Results – Business Optimization and Realignment Costs and – Outlook” and “Financial Condition – Liquidity Outlook” below for additional information on efforts we are taking to mitigate adverse trends.

Macroeconomic Conditions

While macroeconomic risks apply to most companies, we are particularly vulnerable. The transportation industry is highly cyclical and especially susceptible to trends in economic activity. Our primary business is to transport goods, so our business levels are directly tied to the purchase and production of goods and the rate of global trade growth. The decline in U.S. imports of consumer goods that started in late 2022, along with slowed global industrial production, has contributed to weakened economic conditions for the transportation industry. Consequently, this environment has led to lower package and freight volumes at FedEx Express and FedEx Freight, negatively affecting our results in the third quarter and nine months of 2024.

Inflation and Interest Rates

During the third quarter and nine months of 2024, global inflation decelerated year over year but continues to be above historical levels. Additionally, global interest rates remained elevated in an effort to curb inflation. We are experiencing a decline in demand for our transportation services as elevated inflation and interest rates are negatively affecting consumer and business spending. We expect inflation and high interest rates to continue to negatively affect our results of operations for the remainder of 2024.

Fuel

We must purchase large quantities of fuel to operate our aircraft and vehicles, and the price and availability of fuel is beyond our control and can be highly volatile. The timing and amount of fluctuations in fuel prices and our ability to recover incremental fuel costs through our fuel surcharges can significantly affect our operating results either positively or negatively in the short term. Lower fuel prices negatively affected yields through lower fuel surcharges and drove a decrease in fuel expense during the third quarter and nine months of 2024 at all of our transportation segments.

Geopolitical Conflicts

Given the nature of our global operations, geopolitical conflicts may adversely affect our business and results of operations. While we do not expect ongoing geopolitical conflicts to have a direct material effect on our business or results of operations, the broader consequences are adversely affecting the global economy and may also have the effect of heightening other risks disclosed in our Annual Report.

RESULTS OF OPERATIONS

Many of our operating expenses are directly affected by revenue and volume levels, and we expect these operating expenses to fluctuate on a year-over-year basis consistent with changes in revenue and volumes. Therefore, the discussion of operating expense captions focuses on the key drivers and trends affecting expenses other than those factors strictly related to changes in revenue and volumes. The line item “Other operating expense” includes costs associated with outside service contracts (such as information technology services, temporary labor, facilities services, and security), insurance, professional fees, and operational supplies.

CONSOLIDATED RESULTS

The following tables compare summary operating results and changes in revenue and operating results (dollars in millions, except per share amounts) for the periods ended February 29, 2024 and February 28, 2023: