- FDX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

FedEx (FDX) PRE 14APreliminary proxy

Filed: 26 Jul 24, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☑ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

FedEx Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

FEDEX. MAKING SUPPLY CHAINS SMARTER FOR EVERYONE.

FedEx was founded to connect people to possibilities. For over 50 years, our ecosystem of networks and team members across over 220 countries and territories has kept our customers, global trade, and society moving.

General representation current as of February 2024.

Flexibility, efficiency, and intelligence: these three values are the core of the FedEx global network and our mission to create smarter supply chains as we connect the world. The positive contributions of what we deliver every day extend well beyond shipper and recipient. Directly and indirectly, these contributions—known as the FedEx Effect—support millions of jobs, generate billions of dollars in economic activity and GDP, and strengthen both the local communities and global marketplace we serve.

More than fifty years of incessant innovation and strategic leadership give us the ability—and responsibility—to shape a more prosperous and sustainable world, with greater opportunity for all. As we strive to make supply chains smarter for everyone, we put our values of flexibility, efficiency, and intelligence into action—from the in-kind shipping of disaster relief supplies where and when they’re needed most, to increasing the amount of renewable energy powering our facilities, to supporting our team members with upskilling and tuition reimbursement. We remain committed to delivering transparent and timely updates on our management of environmental, social, and governance (ESG) matters that are aligned with our company’s strategic focus.

| The 2024 ESG Report discusses our ESG strategies, programs, and progress toward our goals. Explore our goals and progress at fedex.com/en-us/sustainability/reports.html. *The information on the 2024 ESG Report webpage, the ESG Report, or any other information on the FedEx website that we may refer to herein is not incorporated by reference into, and does not form any part of, this proxy statement. Any targets or goals discussed in our ESG Report and in this proxy statement may be aspirational, and as such, no guarantees or promises are made that these goals will be met. Furthermore, certain statistics and metrics disclosed in this proxy statement and in the ESG Report are estimates and may be based on assumptions that turn out to be incorrect. FedEx does not undertake or assume any obligation to update or revise such information, whether as a result of new information, future events, or otherwise. |

A MESSAGE FROM OUR EXECUTIVE CHAIRMAN AND LEAD INDEPENDENT DIRECTOR

To our stockholders,

In connection with our 2024 Annual Meeting of Stockholders to be held on 23 September 2024, we are sharing how FedEx continues to transform our business while delivering the highest standards of ethics, integrity, and reliability through our robust governance practices.

On 1 June 2024, we became one FedEx — a historic move that positions us to leverage the strengths of our networks, people, and assets in more efficient ways. One FedEx represents an important milestone in our history as we enhance the company’s ability to meet the evolving needs of customers and market shifts while building a stronger, more profitable enterprise.

Our comprehensive program to improve efficiency, known as DRIVE, is continuing to optimize FedEx networks, improve service, reduce costs, and strengthen our performance culture. DRIVE is focused on outcomes, quick decision-making, and strong execution.

FedEx remains committed to exemplary corporate governance standards and practices. In December, we welcomed Silvia Davila to the Board of Directors. Ms. Davila serves as the regional president of Latin America for Danone S.A., where she is responsible for leading operations in Mexico and for all categories in the Latin America region. She brings vast experience in leading financial and digital transformations. Her leadership skills and extensive expertise will provide great value to FedEx as we continue to execute our global transformation.

FY25 will be another period of extraordinary achievement as we continue this transformative journey to create smarter, more resilient supply chains for everyone. We are confident that our future will provide significant value to our customers, team members, stockholders, and communities.

Sincerely,

|  |

| Frederick W. Smith Founder and Executive Chairman FedEx Corporation | David P. Steiner Lead Independent Director FedEx Corporation |

| 2024 Proxy Statement | 3 |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION, DATED JULY 26, 2024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Items of Business

| Voting Proposal | Board Recommendation | ||||

| 1 | Elect the fourteen nominees named in the proxy statement as FedEx directors for a one-year term | ✓ | FOR each director nominee | ||

| 2 | Advisory vote to approve named executive officer compensation | ✓ | FOR | ||

| 3 | Ratification of the appointment of Ernst & Young LLP as FedEx’s independent registered public accounting firm for fiscal year 2025 | ✓ | FOR | ||

| 4 | Approval of an amendment to the Third Amended and Restated Certificate of Incorporation of FedEx Corporation to limit liability of certain officers as permitted by law | ✓ | FOR | ||

| 5 | Approval of an amendment to the Third Restated Certificate of Incorporation of Federal Express Corporation to remove the “pass-through voting” provision | ✓ | FOR | ||

| 6-8 | Act upon three stockholder proposals, if properly presented at the meeting | ✕ | AGAINST | ||

Stockholders also will consider any other matters that may properly come before the meeting.

How to Attend the Virtual Annual Meeting

FedEx’s 2024 annual meeting of stockholders will be a virtual meeting, conducted exclusively via live audio webcast at www.virtualshareholdermeeting.com/FDX2024. There will not be a physical location for the annual meeting, and you will not be able to attend the meeting in person.

To attend the annual meeting of stockholders at www.virtualshareholdermeeting.com/ FDX2024, you must enter the control number on your proxy card, voting instruction form, or Notice of Internet Availability. Whether or not you plan to attend the virtual annual meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described to the right. During the meeting, you may ask questions and vote.To vote at the meeting, visit www.virtualshareholdermeeting.com/FDX2024. For more information, please see page 117.

Please Vote Your Shares

Your vote is very important. Please vote your shares whether or not you plan to attend the meeting.

By order of the Board of Directors,

MARK R. ALLEN

Executive Vice President,

General Counsel and Secretary

August [•], 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON SEPTEMBER 23, 2024:

The following materials are available at www.proxyvote.com:

| The Notice of Annual Meeting of Stockholders to be held September 23, 2024; |

| The FedEx 2024 Proxy Statement; and |

| The FedEx Annual Report to Stockholders for the fiscal year ended May 31, 2024. |

A Notice Regarding the Internet Availability of Proxy Materials or the proxy statement, form of proxy, and accompanying materials are first being sent to stockholders on or about August [•], 2024.

| LOGISTICS | |

| Date and Time Monday, September 23, 2024, at 8:00 a.m. Central Time |

| Location Online via webcast at www. virtualshareholdermeeting.com/ FDX2024 |

| Who Can Vote Stockholders of record at the close of business on July 29, 2024, may vote at the meeting or any postponements or adjournments of the meeting. |

| HOW TO CAST YOUR VOTE If you are a registered stockholder, you can vote by any of the following methods: | |

| Online www.proxyvote.com up until 11:59 p.m. Eastern Time on 9/22/2024. For shares held in any FedEx or subsidiary employee stock purchase plan or benefit plan, vote by 11:59 p.m. Eastern Time on 9/19/2024. |

| By phone 1-800-690-6903; Dial toll-free 24/7 up until 11:59 p.m. Eastern Time on 9/22/2024. For shares held in any FedEx or subsidiary employee stock purchase plan or benefit plan, vote by 11:59 p.m. Eastern Time on 9/19/2024. |

| Proxy card Completing, signing, and returning your proxy card |

| At the meeting You also may vote online during the annual meeting by following the instructions provided on the meeting website during the annual meeting. To vote at the meeting, visit www.virtualshareholdermeeting. com/FDX2024. |

| If you are a beneficial owner and received a voting instruction form, please follow the instructions provided by your bank, broker, or other nominee to vote your shares. | |

| 4 |  |

TABLE OF CONTENTS

| 2024 Proxy Statement | 5 |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find additional information in this proxy statement.

| Proposal 1 Election of Directors |

| NOMINEE AND POSITION | AGE | DIRECTOR SINCE | COMMITTEES | OTHER PUBLIC DIRECTORSHIPS | ||||

| AFC | CHRC | CyTOC | GSPPC | |||||

| SILVIA DAVILA  Regional President, Latin America of Danone S.A. | 53 | 2023 |  |  | Betterware de México, S.A.P.I. de C.V. | ||

| MARVIN R. ELLISON  Chairman of the Board, President, and Chief Executive Officer of Lowe’s Companies, Inc. | 59 | 2014 |  |  | Lowe’s Companies, Inc. | ||

| STEPHEN E. GORMAN  Former Chief Executive Officer of Air Methods Corporation | 69 | 2022 |  |  | Peabody Energy Corporation | ||

| SUSAN PATRICIA GRIFFITH  President and Chief Executive Officer of The Progressive Corporation | 59 | 2018 |  |  | The Progressive Corporation | ||

| AMY B. LANE  Former Managing Director and Group Leader, Global Retailing Investment Banking Group, Merrill Lynch & Co., Inc. | 71 | 2022 |  |  | NextEra Energy, Inc. and TJX Companies Inc. | ||

| R. BRAD MARTIN  Vice Chairman Vice ChairmanChairman of RBM Venture Company | 72 | 2011 |  | Westrock Coffee Company | |||

| NANCY A. NORTON  Retired Vice Admiral, U.S. Navy | 59 | 2022 |  | Leidos Holdings, Inc. | |||

| FREDERICK P. PERPALL  Chief Executive Officer of The Beck Group | 49 | 2021 |  |  | Starwood Property Trust, Inc. | ||

| JOSHUA COOPER RAMO  Chairman and Chief Executive Officer, Sornay, LLC | 55 | 2011 |  |  | |||

| SUSAN C. SCHWAB  Professor Emerita at the University of Maryland School of Public Policy | 69 | 2009 |  |  | Caterpillar Inc. and Marriott International, Inc. | ||

| FREDERICK W. SMITH Executive Chairman and Chairman of the Board of FedEx Corporation | 80 | 1971 | |||||

| DAVID P. STEINER  Lead Independent Director Lead Independent DirectorFormer Chief Executive Officer of Waste Management, Inc. | 64 | 2009 |  | Vulcan Materials Company | |||

| RAJESH SUBRAMANIAM President and Chief Executive Officer of FedEx Corporation | 58 | 2020 | The Procter & Gamble Company | ||||

| PAUL S. WALSH  Executive Chairman of the Board of McLaren Group Limited | 69 | 1996 |  | McDonald’s Corporation and Vintage Wine Estates, Inc. | |||

| AFC – Audit and Finance Committee | CyTOC – Cyber and Technology Oversight Committee |  | Member |  | Independent |

| CHRC – Compensation and Human Resources Committee | GSPPC – Governance, Safety, and Public Policy Committee |  | Chair |

| Your Board of Directors recommends that you vote “FOR” the election of each of the fourteen nominees. | See page 12 |

| 6 |  |

Proxy Statement Summary – Director Nominee Highlights

Director Nominee Highlights*

Diversity of Tenure, Age, Gender, and Background

| Independent Director Nominee Tenure** | Age** |

|  |

| Board Refreshment | Diversity |

|  |

| * | Statistics assume all director nominees are elected at the annual meeting. |

| ** | As of August [•], 2024 |

Director Nominee Experience, Qualifications, Attributes, and Skills

The Board believes that it is desirable that the following experience, qualifications, attributes, and skills be possessed by one or more of FedEx’s Board members because of their particular relevance to the company’s business and structure, and these were all considered by the Board in connection with this year’s director nomination process:

| Transportation/ Logistics/Supply Chain | International | Financial | Marketing | Retail/ E-commerce |

|  |  |  |  |

| 6 Nominees | 8 Nominees | 6 Nominees | 7 Nominees | 7 Nominees |

| Technological/Digital/ Cybersecurity | Energy | Human Resource Management | Government | Risk Management |

|  |  |  |  |

| 4 Nominees | 5 Nominees | 2 Nominees | 4 Nominees | 7 Nominees |

| Leadership | ||||

| ||||

| 14 Nominees |

| 2024 Proxy Statement | 7 |

Proxy Statement Summary – Corporate Governance Highlights

Corporate Governance Highlights

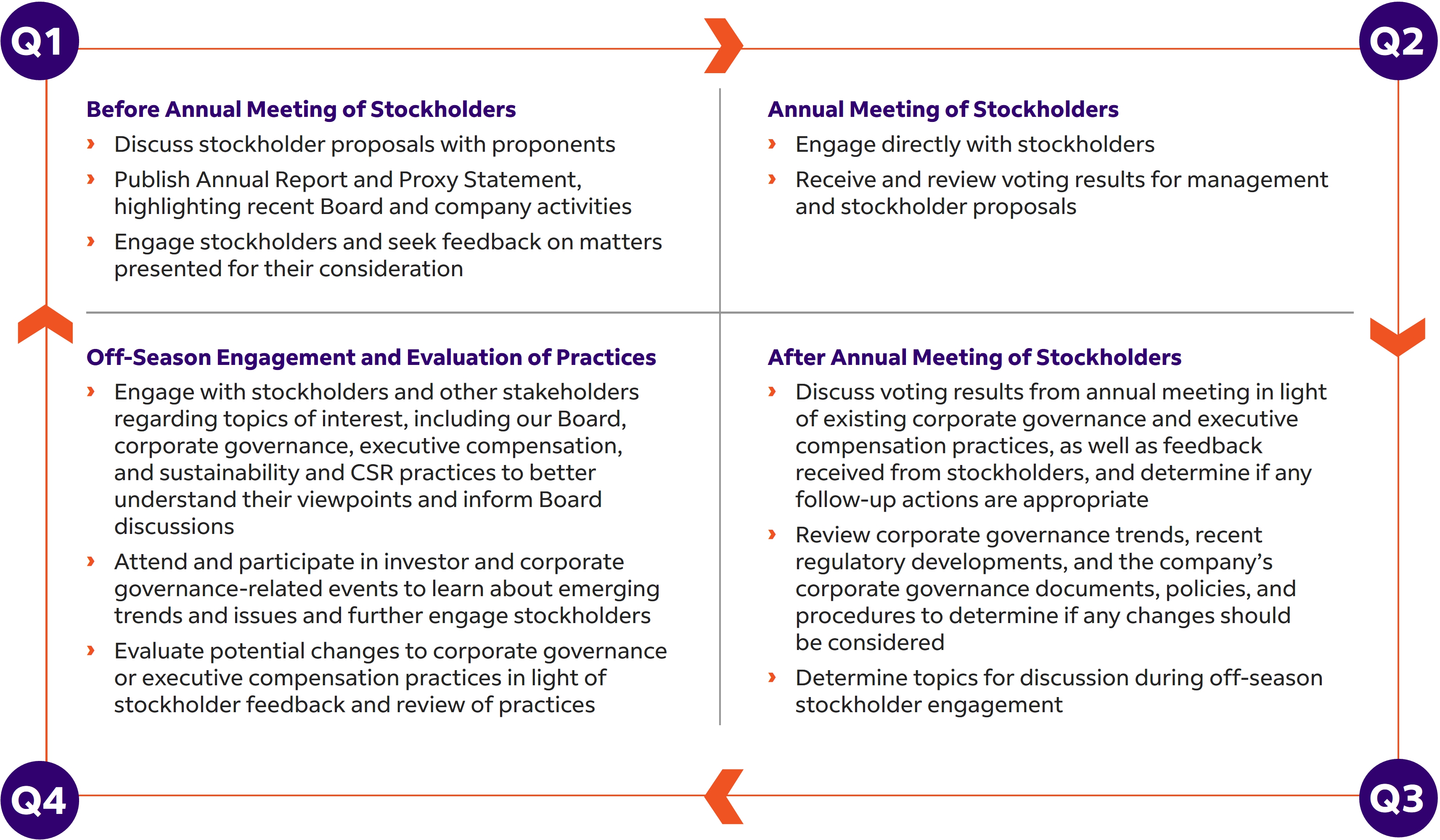

You can find detailed information about our corporate governance policies and practices in the Corporate Governance Matters section of this proxy statement. You can also access our corporate governance documents under the ESG heading on the Investor Relations page of our website at investors.fedex.com. Information contained on our website is not deemed to be incorporated by reference as part of this proxy statement.

Corporate Governance Facts

✓Proxy Access ✓Majority Voting for Directors and Resignation Requirement for Directors Who Fail to Receive Majority Vote ✓Annual Election of All Directors ✓Gender and Racially/Ethnically Diverse Board ✓Annual Board and Committee Self-Evaluations ✓No Supermajority Voting Provisions in Company’s Charter or Bylaws ✓Stockholder Right to Call a Special Meeting ✓Separate Chairman of the Board & CEO ✓Independent Vice Chairman ✓Lead Independent Director ✓Independent Directors Meet Regularly Without Management Present ✓Annual Independent Director Evaluations of Executive Chairman of the Board and the CEO | ✓Limit on Number of Other Directorships and Commitments ✓No Director Serves on More Than Two Other Public Company Boards ✓No Directors Who are Public Company Executive Officers Serve on More Than One Other Public Company Board ✓Code of Conduct Applicable to All Directors ✓Lead Independent Director’s Mandatory Service as Chair of Governance, Safety, and Public Policy Committee ✓Stock Ownership Goal for Directors and Executive Officers ✓Policies on Recoupment of Incentive Compensation ✓Policy on Limitation of Severance Benefits ✓No Poison Pill |

| 8 |  |

Proxy Statement Summary – Proposal 2

| Proposal 2 Advisory Vote to Approve Named Executive Officer Compensation |

Our executive compensation program is designed not only to retain and attract highly qualified and effective executives, but also to motivate them to substantially contribute to FedEx’s future success for the long-term benefit of stockholders and reward them for doing so. We believe there should be a strong relationship between pay and corporate performance, and our executive compensation program reflects this belief.

At our 2023 annual meeting of stockholders, our “say-on-pay” proposal received support from 89.7% of the votes cast.

For additional information, please see “Executive Compensation — Compensation Discussion and Analysis.”

Elements of Compensation

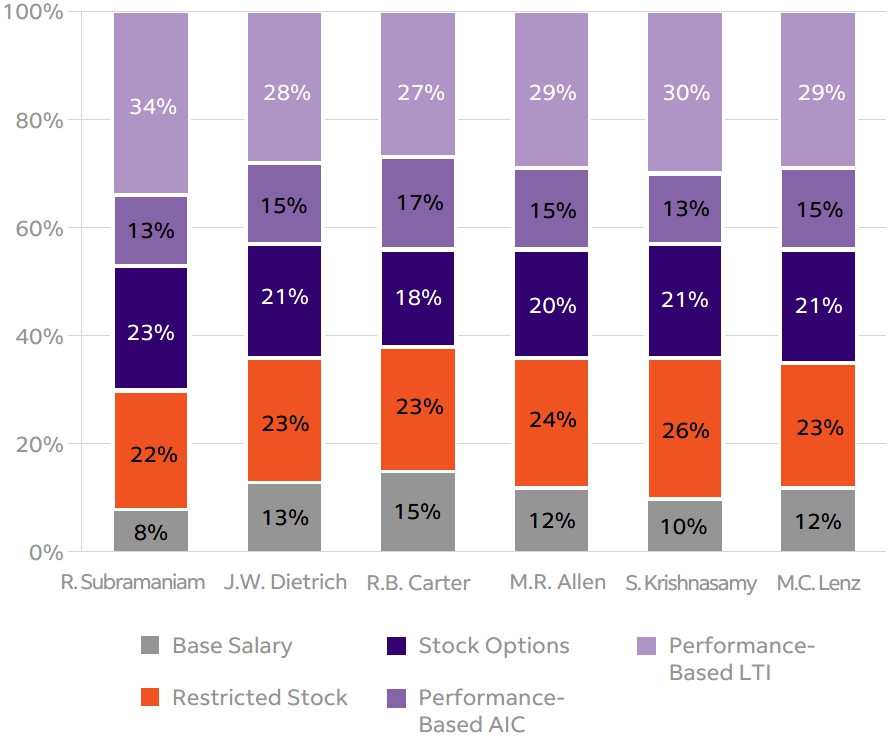

The elements of target total direct compensation for fiscal 2024 are presented below.

| ELEMENT AND FISCAL 2024 AVERAGE NEO TARGET PAY MIX(1) | DESCRIPTION AND METRICS | |||

| Base Salary |  | Fixed cash income to retain and attract highly marketable executives in a competitive market for executive talent. | |

| Performance-Based AIC |  | Annual cash incentive program designed to motivate our executives to achieve annual financial goals and other business objectives and reward them accordingly. Total amount paid was based on: Achievement of adjusted consolidated operating income objectives and individual performance goals Achievement of adjusted consolidated operating income objectives and individual performance goals | ||

| Performance-Based LTI |  | Long-term cash incentive program designed to motivate management to build long-term stockholder value and reward them accordingly. For the FY22–FY24 long-term incentive (“LTI”) plan, total payout opportunity was based on: Achievement of aggregate adjusted earnings-per-share (“EPS”) goals for the three-fiscal-year period (weighted at 75% of the total payout opportunity); and Achievement of aggregate adjusted earnings-per-share (“EPS”) goals for the three-fiscal-year period (weighted at 75% of the total payout opportunity); and Achievement of goals for total capital expenditures as a percentage of total revenue (“CapEx/Revenue”) for the three-fiscal-year period (weighted at 25% of the total payout opportunity). Achievement of goals for total capital expenditures as a percentage of total revenue (“CapEx/Revenue”) for the three-fiscal-year period (weighted at 25% of the total payout opportunity). | |

| Restricted Stock |  | Annual equity incentive awards designed to further align the interests of our executives with those of our stockholders by facilitating significant ownership of FedEx stock. The number of options and shares of restricted stock awarded is primarily based on an officer’s position and level of responsibility. | ||

| Stock Options |  | |||

| (1) | See page 48 for individual fiscal 2024 target total direct compensation components. |

| Your Board of Directors recommends that you vote “FOR” this proposal. | See page 42 |

| 2024 Proxy Statement | 9 |

Proxy Statement Summary – Proposal 3

Compensation Highlights  Under the fiscal 2024 annual incentive compensation (“AIC”) plan, annual bonus payments were tied to achieving specified levels of fiscal 2024 adjusted consolidated operating income. Consistent with our pay-for-performance philosophy, achievement below the target objective for adjusted consolidated operating income for fiscal 2024 resulted in below-target payouts under the fiscal 2024 AIC plan. Under the fiscal 2024 annual incentive compensation (“AIC”) plan, annual bonus payments were tied to achieving specified levels of fiscal 2024 adjusted consolidated operating income. Consistent with our pay-for-performance philosophy, achievement below the target objective for adjusted consolidated operating income for fiscal 2024 resulted in below-target payouts under the fiscal 2024 AIC plan. LTI payouts for fiscal 2024 were tied to meeting pre-established aggregate adjusted EPS goals (75%) and CapEx/ Revenue goals (25%) over a three-fiscal-year period. A significant year-over-year adjusted EPS decline in fiscal 2023 resulted in below-threshold attainment under the EPS component of the FY22–FY24 LTI plan, while CapEx/ Revenue below the maximum objective over the three-fiscal-year period resulted in maximum attainment under this component, all resulting in below-target total payouts under the FY22–FY24 LTI plan. LTI payouts for fiscal 2024 were tied to meeting pre-established aggregate adjusted EPS goals (75%) and CapEx/ Revenue goals (25%) over a three-fiscal-year period. A significant year-over-year adjusted EPS decline in fiscal 2023 resulted in below-threshold attainment under the EPS component of the FY22–FY24 LTI plan, while CapEx/ Revenue below the maximum objective over the three-fiscal-year period resulted in maximum attainment under this component, all resulting in below-target total payouts under the FY22–FY24 LTI plan. In response to investor feedback on the metrics used in our LTI plans, the Compensation & HR Committee and the Board of Directors incorporated a new metric — return on invested capital (“ROIC”) — into the FY24–FY26 LTI plan in lieu of the CapEx/Revenue metric used in the FY22–FY24 and FY23–FY25 LTI plans. In response to investor feedback on the metrics used in our LTI plans, the Compensation & HR Committee and the Board of Directors incorporated a new metric — return on invested capital (“ROIC”) — into the FY24–FY26 LTI plan in lieu of the CapEx/Revenue metric used in the FY22–FY24 and FY23–FY25 LTI plans. Officers realize value from the stock options included in the total direct compensation calculation only if the stock price appreciates after the grant date. The exercise price for the fiscal 2024 annual stock option grant to executive officers was $229.595. The closing price of FedEx common stock on July 29, 2024 was $[•]. Officers realize value from the stock options included in the total direct compensation calculation only if the stock price appreciates after the grant date. The exercise price for the fiscal 2024 annual stock option grant to executive officers was $229.595. The closing price of FedEx common stock on July 29, 2024 was $[•]. |

| Proposal 3 Ratification of the Appointment of Ernst & Young LLP as FedEx’s Independent Registered Public Accounting Firm | ||

The Audit and Finance Committee is directly responsible for the appointment, compensation, retention, and oversight of our independent registered public accounting firm and has specific policies in place to ensure its independence. The Audit and Finance Committee has appointed Ernst & Young LLP (“Ernst & Young”) to serve as FedEx’s independent registered public accounting firm for fiscal 2025. Ernst & Young has been our independent registered public accounting firm since 2002. Fees paid to Ernst & Young for fiscal 2024 and 2023 are detailed on page 96. Representatives of Ernst & Young will attend the meeting, will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions. | |||

Your Board of Directors recommends that you vote “FOR” this proposal. | See page 93 |

| Proposal 4 Approval of an Amendment to the Third Amended and Restated Certificate of Incorporation of FedEx Corporation to Limit Liability of Certain Officers as Permitted by Law | ||

Delaware recently amended Section 102(b)(7) of the Delaware General Corporation Law (“DGCL”) to allow a Delaware corporation to include a provision in its certificate of incorporation eliminating the personal liability of certain officers for monetary damages for breach of fiduciary duty as an officer in certain circumstances. The Board of Directors seeks approval from FedEx’s stockholders of an amendment to the Third Amended and Restated Certificate of Incorporation of FedEx to provide for such officer exculpation as permitted by the DGCL. Additional information, including the full text of the proposed amendment, is detailed on page 97. | |||

Your Board of Directors recommends that you vote “FOR” this proposal. | See page 97 |

| 10 |  |

Proxy Statement Summary – Proposals 5-8

| Proposal 5 Approval of an Amendment to the Third Restated Certificate of Incorporation of Federal Express Corporation to Remove the “Pass-Through Voting” Provision | ||

The Board of Directors seeks approval from FedEx’s stockholders of an amendment to the Third Restated Certificate of Incorporation of Federal Express Corporation (“Federal Express”), a wholly owned subsidiary of FedEx, to remove a provision that requires the vote of stockholders of FedEx, in addition to the vote of FedEx as sole stockholder of Federal Express, in order for Federal Express to take certain actions. Accordingly, the provision gives FedEx’s stockholders direct voting rights with respect to matters affecting Federal Express, FedEx’s wholly owned subsidiary, rather than only requiring the approval of FedEx as sole stockholder. No such approval has ever been sought from the FedEx stockholders with respect to Federal Express under this provision. The amendment will provide FedEx with the flexibility to manage its organization under the holding company structure more efficiently and effectively. Additional information, including the full text of the proposed amendment, is detailed on page 99. | |||

Your Board of Directors recommends that you vote “FOR” this proposal. | See page 99 |

| Proposals 6-8 Three Stockholder Proposals, if properly presented | ||

Your Board of Directors recommends that you vote “AGAINST” each of these proposals. | See pages 103-111 |

Forward-Looking Statements

Certain statements in this proxy statement may be considered “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to FedEx’s financial condition, results of operations, cash flows, plans, objectives, future performance, and business. Forward-looking statements include those preceded by, followed by, or that include the words “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “forecasts,” “anticipates,” “plans,” “estimates,” “targets,” “projects,” “intends”, or similar expressions. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from historical experience or from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, the factors that can be found in FedEx’s and its subsidiaries’ press releases and FedEx’s filings with the SEC, including its Annual Report on Form 10-K for fiscal 2024. Any forward-looking statement speaks only as of the date on which it is made. FedEx does not undertake or assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

| 2024 Proxy Statement | 11 |

CORPORATE GOVERNANCE MATTERS

| Proposal 1 Election of Directors | ||

All of FedEx’s directors are elected at each annual meeting of stockholders and hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. The Board of Directors currently consists of fourteen members. The Board proposes that each of the current directors be reelected to the Board. Each of the nominees elected at this annual meeting will hold office until the annual meeting of stockholders to be held in 2025 and until his or her successor is duly elected and qualified or until his or her earlier disqualification, death, resignation, or removal. Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders may vote your shares for the substitute nominee. Vote Required for Approval Under FedEx’s majority-voting standard, each of the fourteen director nominees must receive more votes cast “for” than “against” his or her election in order to be elected to the Board. For more information, please see “— Process for Selecting Directors — Nomination Process — Majority-Voting Standard for Director Elections.” | |||

Your Board of Directors recommends that you vote “FOR” the election of each of the fourteen nominees. | |||

Process for Selecting Directors

The Board is responsible for recommending director candidates for election by the stockholders and for electing directors to fill vacancies or newly created directorships. The Board has delegated the screening and evaluation process for director candidates to the Governance, Safety, and Public Policy Committee (“GSPP Committee”), which identifies, evaluates, and recruits highly qualified director candidates and recommends them to the Board.

Experience, Qualifications, Attributes, and Skills

The GSPP Committee seeks director nominees with the skills and experience needed to properly oversee the interests, risks, and businesses of the company. The Committee carefully evaluates each candidate to ensure that he or she possesses the experience, qualifications, attributes, and skills that the Committee has found are necessary for an effective Board member. These crucial qualities include, among others:

The highest level of personal and professional ethics, integrity, and values; The highest level of personal and professional ethics, integrity, and values; Practical wisdom and mature judgment; Practical wisdom and mature judgment; An inquiring and independent mind; An inquiring and independent mind; Expertise that is useful to FedEx and complementary to the background and experience of other Board members; and Expertise that is useful to FedEx and complementary to the background and experience of other Board members; and Willingness to represent the best interests of all stockholders and objectively appraise management performance. Willingness to represent the best interests of all stockholders and objectively appraise management performance. |

In addition to the qualifications that each director nominee must have, the Board believes that one or more of FedEx’s Board members should possess the experience and expertise listed below because of their particular relevance to the company’s business, strategy, and structure. These were all considered by the Board in connection with this year’s director nomination process.

| 12 |  |

Corporate Governance Matters – Process for Selecting Directors

| TRANSPORTATION/LOGISTICS/SUPPLY CHAIN MANAGEMENT EXPERIENCE |  | ENERGY EXPERTISE | Diversity: The Board is committed to having a membership that reflects a diversity of gender, race, ethnicity, age, and background. This commitment is demonstrated by the fact that the Board currently includes five female directors and four directors who are racially or ethnically diverse. | ||

| INTERNATIONAL EXPERIENCE |  | HUMAN RESOURCE MANAGEMENT EXPERTISE | |||

| FINANCIAL EXPERTISE |  | GOVERNMENT EXPERIENCE | |||

| MARKETING EXPERTISE |  | RISK MANAGEMENT EXPERTISE | |||

| RETAIL/E-COMMERCE EXPERTISE |  | LEADERSHIP EXPERIENCE | |||

| TECHNOLOGICAL/ DIGITAL/CYBERSECURITY EXPERTISE |

Nomination Process

Nomination of Director Candidates

The GSPP Committee identifies, evaluates, and recruits director candidates, considers the advisability of adding new directors to the current composition of the Board, and evaluates and recommends existing director nominees to the Board as follows:

|  |  |  |  |  |  | |||||||||||

| The GSPP Committee considers potential new candidates that may be proposed by current directors, management, professional search firms, stockholders, or other persons. The Committee may engage a third-party executive search firm to assist in identifying potential director candidates. The Committee considers and evaluates a director candidate recommended by a stockholder in the same manner as a nominee recommended by a Board member, management, search firm, or other sources. | The GSPP Committee evaluates a potential new director candidate thoroughly in considering whether the candidate meets the criteria that the Board seeks in all of its directors and how that candidate’s skills and experience would positively contribute to the Board. The process may include reviewing the candidate’s qualifications, interviewing the candidate, engaging an outside firm to gather additional information about the candidate, and making inquiries of persons with knowledge of the candidate. | In its evaluation of all director candidates, including the members of the Board eligible for reelection, the GSPP Committee considers the appropriate size, composition, skills, and contributions of current members and the needs of the Board and each of its committees. | AS A RESULT OF THIS PROCESS, FIVE NEW, INDEPENDENT, HIGHLY QUALIFIED DIRECTORS HAVE JOINED (AND REMAIN ON) THE FEDEX BOARD IN THE PAST FIVE YEARS. | ||||||||||||||

Stockholder Recommendations

The GSPP Committee will consider director nominees recommended by stockholders. To recommend a prospective director candidate for the GSPP Committee’s consideration, stockholders may submit the candidate’s name, qualifications, including whether the candidate satisfies the requirements set forth in our Corporate Governance Guidelines and discussed in “— Process for Selecting Directors — Experience, Qualifications, Attributes, and Skills,” and other relevant biographical information in writing to: FedEx Corporation Governance, Safety, and Public Policy Committee, c/o Corporate Secretary, 942 South Shady Grove

| 2024 Proxy Statement | 13 |

Corporate Governance Matters – Process for Training and Evaluating Directors

Road, Memphis, Tennessee 38120. FedEx’s Bylaws require stockholders to give advance notice of stockholder proposals and nominations of director candidates. For more information, please see “Stockholder Proposals and Director Nominations for 2025 Annual Meeting.”

Majority-Voting Standard for Director Elections

FedEx’s Bylaws require that we use a majority-voting standard in uncontested director elections and a resignation requirement for directors who fail to receive the required majority vote. The Bylaws also prohibit the Board from reverting to a plurality-voting standard without the affirmative vote of the holders of at least a majority of the voting power of all the shares of FedEx stock entitled to vote generally in the election of directors, voting together as a single class. Under the majority-voting standard, a director nominee must receive more votes cast “for” than “against” his or her election in order to be elected to the Board. In accordance with the majority-voting standard and resignation requirement, each director who is standing for reelection at the annual meeting has tendered an irrevocable resignation from the Board of Directors that will take effect if (i) the director does not receive more votes cast “for” than “against” his or her election at the annual meeting, and (ii) the Board accepts the resignation. FedEx’s Bylaws require the Board of Directors, within 90 days after certification of the election results, to accept the director’s resignation unless there is a compelling reason for the director to remain on the Board and to promptly disclose its decision (including, if applicable, the reasons for rejecting the resignation) in a filing with the SEC.

Process for Training and Evaluating Directors

New Director Orientation

FedEx has a New Director Orientation Program that enables new members of the Board to quickly become active and effective Board members. The program includes, among other things, an overview of fiduciary duties and responsibilities of directors, individual meetings with key members of the Board and senior management, facility tours, and invitations to attend committee meetings regardless of whether the new director is a member of those committees, in order to gain a better understanding of committee functions. The process is tailored to take into account the individual needs of each new director.

The GSPP Committee is responsible for overseeing the New Director Orientation Program and the Executive Vice President, General Counsel and Secretary is responsible for administering the program and reporting to the GSPP Committee the status of the orientation process with respect to each new director. The orientation process is designed to provide new directors with comprehensive information about the company’s business, strategy, capital structure, financial performance, risk oversight, evaluation of management, and executive compensation practices, as well as the policies, procedures, and responsibilities of the Board and its committees.

Continuing Director Education

FedEx provides continuing director education through individual speakers at Board meetings, generally four times per year. The company receives feedback from the directors on potential topics that would be useful for these discussions. In addition to facilitating these customized in-house programs, FedEx monitors pertinent developments in director education and recommends valuable outside programs for Board committee chairpersons to attend. The GSPP Committee reviews the company’s director education process on an annual basis to ensure the continuing education provided serves to further directors’ knowledge in their oversight responsibilities.

Board and Committee Evaluations

The GSPP Committee oversees an annual performance evaluation of each committee of the Board and the Board as a whole. Each Board member also completes an individual self-assessment, and those responses are provided to the Chairman of the Board and the chairperson of the GSPP Committee, who is also our Lead Independent Director. The responses to the performance evaluations and individual self-assessments are compiled annually by a third party who distributes the results to the applicable recipients.

The GSPP Committee reviews and discusses the evaluation results for each committee and the Board as a whole. Each committee discusses its annual evaluation results and identifies any opportunities for improvement. The chairperson of the GSPP Committee reports the results to the Board of Directors, including any action plans. The chairperson also reports to the Board the results of the full Board assessment. The Chairman of the Board and chairperson of the GSPP Committee discuss any notable results from the individual director self-assessments with the relevant directors.

As part of the evaluation, our directors consider the Board’s processes to ensure, among other things, that its leadership structure remains effective, that Board and committee meetings are conducted in a manner that promotes candid and constructive dialogue, sufficient time has been allocated for such meetings, agenda items reflect key matters of importance to the company, and that the materials provided to the Board and the reports received from management are useful, comprehensive, and timely.

| 14 |  |

Corporate Governance Matters – Nominees for Election to the Board

Nominees for Election to the Board

Below you will find each nominee’s biography along with other pertinent information, including a selection of each Board nominee’s skills and qualifications. Following the biographies, we have included a chart that exhibits the collective experience, qualifications, attributes, and skills of our Board nominees.

| SILVIA DAVILA INDEPENDENT | |||

Age: 53 Director Since: 2023 Committees: Compensation and Human Resources Cyber and Technology Oversight Other Public Company Directorships: Betterware de México, S.A.P.I de C.V. | Ms. Davila currently serves as Regional President, Latin America of Danone S.A., a multinational food product company, a position she has held since 2021. She previously served as Senior Vice President, Essential Dairy and Plant Based Latin America of Danone from 2017 to 2021. Ms. Davila served as Vice President and Global Food Chief Marketing Officer of Mars, Inc. from 2014 to 2017. She served in a variety of marketing and brand roles at Mars, Inc., Procter & Gamble Company, and McDonald's Corporation from 1989 to 2014. Ms. Davila previously served as a director of Fibra Monterrey, a real estate company, from October 2021 to June 2024. Ms. Davila was first appointed to the Board in December 2023 and was recommended for consideration as a director by a search firm engaged to assist in identifying potential director nominees. SKILLS AND QUALIFICATIONS | ||

| International Experience Responsible for leading operations in Mexico for all categories in the Latin American region for Danone. Held a variety of roles in Latin America and Europe at Danone, Mars, Procter & Gamble, and McDonalds. Serves as Global Vice President of the International Women’s Forum. | ||

| Marketing Extensive marketing and brand experience in the retail and e-commerce sectors gained from roles at leading consumer companies. Previously served as professor of Strategic Marketing Planning at the Monterrey Institute of Technology. | ||

| Technology/Digital/Cybersecurity Significant experience in digital transformation in current and prior roles. | ||

| 2024 Proxy Statement | 15 |

Corporate Governance Matters – Nominees for Election to the Board

| MARVIN R. ELLISON INDEPENDENT | |||

Age: 59 Director Since: 2014 Committees: Audit and Finance Governance, Safety, and Public Policy Other Public Company Directorships: Lowe’s Companies, Inc. | Mr. Ellison serves as Chairman of the Board, President, and Chief Executive Officer of Lowe’s Companies, Inc., a home improvement retailer, serving as Chairman since June 2021 and President and Chief Executive Officer since July 2018. Mr. Ellison served as Chairman of J. C. Penney Company, Inc., an apparel and home furnishings retailer, from August 2016 until May 2018, and Chief Executive Officer from August 2015 through May 2018 (J. C. Penney filed for reorganization in federal bankruptcy court on May 15, 2020). He served as President and CEO-Designee of J. C. Penney from November 2014 through July 2015. From August 2008 through October 2014, Mr. Ellison served as Executive Vice President – U.S. Stores of The Home Depot, Inc., a home improvement specialty retailer. From June 2002 to August 2008, he served in a variety of operational roles at The Home Depot, including as President – Northern Division and as Senior Vice President – Global Logistics. Prior to joining The Home Depot, Mr. Ellison spent 15 years at Target Corporation in a variety of operational roles. He is a former director of J. C. Penney Company, Inc. and H&R Block, Inc. SKILLS AND QUALIFICATIONS | ||

| Marketing; Retail/E-Commerce Marketing expert with significant retail and e-commerce expertise through his executive experience at Lowe’s, The Home Depot, and J. C. Penney. | ||

| Leadership Significant executive leadership experience gained from executive positions held at Lowe’s, J. C. Penney, and The Home Depot. | ||

| Transportation/Logistics/Supply Chain Management Served in a variety of logistics roles during his career, including as Senior Vice President – Global Logistics at The Home Depot. | ||

| 16 |  |

Corporate Governance Matters – Nominees for Election to the Board

| STEPHEN E. GORMAN INDEPENDENT | |||

Age: 69 Director Since: 2022 Committees: Cyber and Technology Oversight Governance, Safety, and Public Policy Other Public Company Directorships: Peabody Energy Corporation | Mr. Gorman is the former Chief Executive Officer of Air Methods Corporation, a leading domestic provider in the air medical market, a position he held from August 2018 until his retirement in January 2020. Prior to that, he served as the President and Chief Executive Officer of Borden Dairy Company, a fresh milk and value-added dairy processor and distributor, from 2014 until July 2017. Prior to joining Borden Dairy, he served as Executive Vice President and Chief Operating Officer of Delta Air Lines, Inc. from 2008 to 2014 and Executive Vice President – Operations of Delta Airlines from 2007 to 2008. Prior to that, Mr. Gorman served as the President and Chief Executive Officer of Greyhound Lines, Inc. from 2003 to 2007; the Executive Vice President, Operations Support and President, North America for Krispy Kreme Doughnuts, Inc. from 2001 to 2003; and Executive Vice President – Flight Operations & Technical Operations for Northwest Airlines Corp. in 2001. He previously served as a director of Greyhound Lines, Inc., Rohn Industries, Inc., Timco Aviation Services, Inc., Pinnacle Airlines Corporation, and ArcBest Corporation. SKILLS AND QUALIFICATIONS | ||

| Transportation/Logistics/Supply Chain Management Extensive experience in the transportation industry as CEO and COO of public companies in the aviation and transportation industries. | ||

| Financial As a public company CEO, had oversight of financial statements and strategic financial decisions, and led mergers and acquisitions and strategic restructuring activities. | ||

| Risk Management Extensive risk management expertise as CEO and COO of public companies in the aviation and transportation industries. | ||

| International Has extensive experience as an executive officer of large companies with global operations. | ||

| Leadership Extensive leadership in CEO and other executive officer leadership positions for several large public and private corporations and experience as a public company director, including service as Lead Independent Director (ArcBest Corporation). | ||

| 2024 Proxy Statement | 17 |

Corporate Governance Matters – Nominees for Election to the Board

| SUSAN PATRICIA GRIFFITH INDEPENDENT | |||

Age: 59 Director Since: 2018 Committees: Compensation and Human Resources Governance, Safety, and Public Policy Other Public Company Directorships: The Progressive Corporation | Ms. Griffith currently serves as President and Chief Executive Officer of The Progressive Corporation, a leading property and casualty insurance company, positions she has held since July 2016. Prior to being named President and Chief Executive Officer, Ms. Griffith served as Progressive’s Personal Lines Chief Operating Officer from April 2015 through June 2016 and Vice President from May 2015 through June 2016. She joined Progressive as a claims representative in 1988 and has served in many key leadership positions during her tenure. Ms. Griffith held several managerial positions in the Claims division before being named Chief Human Resources Officer in 2002. In 2008, she returned to the Claims division as the group president, and prior to being named Personal Lines Chief Operating Officer, she was President of Customer Operations from April 2014 to March 2015. Ms. Griffith was named one of FORTUNE magazine’s “Most Powerful Women in Business” in 2016 and 2017. She is a former director of The Children’s Place, Inc. SKILLS AND QUALIFICATIONS | ||

| Marketing; Retail/E-Commerce Extensive executive and managerial experience in an industry that emphasizes distinctive advertising and marketing campaigns. | ||

| Leadership Has held a series of executive leadership positions at The Progressive Corporation, including her role as President and CEO. | ||

| Technological/Digital/Cybersecurity Executive and managerial experience at a company that relies heavily on its ability to adapt to change, innovate, develop, and implement new applications and other technologies. | ||

| Risk Management; Human Resource Management Extensive risk management expertise as President and CEO at The Progressive Corporation; has held several other managerial positions, including Chief Human Resources Officer, at The Progressive Corporation. | ||

| AMY B. LANE INDEPENDENT | |||

Age: 71 Director Since: 2022 Committees: Audit and Finance Compensation and Human Resources Other Public Company Directorships: NextEra Energy, Inc. and TJX Companies Inc. | Ms. Lane is the former Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., an investment banking firm, a position she held from 1997 until her retirement in 2002. Ms. Lane previously served as Managing Director at Salomon Brothers, Inc., an investment banking firm, where she founded and led the retail industry investment banking unit, having joined Salomon Brothers in 1989. Ms. Lane also previously served as a director of GNC Holdings, Inc. and as a member of the Board of Trustees of Urban Edge Properties. SKILLS AND QUALIFICATIONS | ||

| Financial Earned an MBA in Finance from The Wharton School, University of Pennsylvania. Has numerous years of experience in financial services, capital markets, finance, and accounting, and public company audit and finance committee experience, including as a chair. | ||

| Retail/E-Commerce Founded and led the retail industry investment banking units at Salomon Brothers and Merrill Lynch and is a member of the Board of TJX Companies Inc., a leading global off-price retailer. | ||

| Energy Member of the Board of NextEra Energy, Inc., a leading clean energy company. | ||

| Leadership Significant executive leadership, management, and strategy expertise as the former leader of two investment banking practices covering the global retailing industry and service as a director on numerous public company boards. | ||

| 18 |  |

Corporate Governance Matters – Nominees for Election to the Board

| R. BRAD MARTIN INDEPENDENT — VICE CHAIRMAN | |||

Age: 72 Director Since: 2011 Committees: Audit and Finance (Chair) Other Public Company Directorships: Westrock Coffee Company | Mr. Martin is Chairman of RBM Venture Company, a private investment company, a position he has held since 2007. He previously served as Chairman and Chief Executive Officer of Riverview Acquisition Corp., an investment company, from April 2021 until its merger with Westrock Coffee Company in August 2022. Mr. Martin was formerly the Chairman of the Board of Chesapeake Energy Corporation, a producer of oil, natural gas, and natural gas liquids, a position he held from October 2015 to February 2021. He was Chairman and Chief Executive Officer of Saks Incorporated from 1989 to 2006 and remained Chairman until his retirement in 2007. He is the former Interim President of the University of Memphis, a position he held from July 2013 until May 2014. He was previously a director of Chesapeake Energy Corporation, First Horizon National Corporation, Caesars Entertainment Corporation, Dillard’s, Inc., Gaylord Entertainment Company, lululemon athletica inc., Ruby Tuesday, Inc., and Riverview Acquisition Corp. SKILLS AND QUALIFICATIONS | ||

| Financial; Risk Management Earned an MBA from Vanderbilt University. As a former CEO of a public company, he actively supervised the CFO, and has significant public company audit committee experience, including as a chair. An audit committee financial expert, as determined by the Board. Former chair of the First Horizon National Corporation Executive and Risk Committee. | ||

| Marketing; Retail/E-Commerce Gained valuable retail marketing experience and successfully applied his marketing expertise as the former CEO of Saks, a leading department store retailer. | ||

| Energy; Transportation/Logistics/Supply Chain Management Former member of the board of Pilot Travel Centers LLC and former Chairman of the Board of Chesapeake Energy Corporation. | ||

| Government Former Tennessee state representative. | ||

| NANCY A. NORTON INDEPENDENT | |||

Age: 59 Director Since: 2022 Committees: Cyber and Technology Oversight (Chair) Other Public Company Directorships: Leidos Holdings, Inc. | Vice Admiral Norton is the retired Director of the Defense Information Systems Agency (DISA), a U.S. Department of Defense combat support agency, and commander, Joint Force Headquarters Department of Defense Information Network, positions she held from February 2018 through February 2021 after serving as Vice Director of DISA from August 2017 through February 2018. Vice Admiral Norton served over 34 years of active duty service as an officer in the U.S. Navy. She served as the director, Command, Control, Communications and Cyber Directorate, U.S. Pacific Command; director of Warfare Integration for Information Warfare; and held commands and posts in multiple international locations. She is the recipient of numerous personal and campaign awards, including the National Security Agency’s Frank B. Rowlett Award for individual achievement in information security. SKILLS AND QUALIFICATIONS | ||

| Technological/Digital/Cybersecurity Served as Director of DISA, where her focus was providing information and cyber security tools and support for the U.S. Department of Defense; held numerous other communications and information security senior leadership positions while serving in the U.S. Navy. | ||

| Human Resource Management Led global teams as a Vice Admiral in the U.S. Navy and Director of DISA. | ||

| International Has extensive experience conducting technology and cyberspace operations as a U.S. Naval officer, including numerous international leadership positions. | ||

| Government; Leadership Served for 34 years as an officer in the U.S. Navy; provided leadership and oversight of global team at DISA. | ||

| 2024 Proxy Statement | 19 |

Corporate Governance Matters – Nominees for Election to the Board

| FREDERICK P. PERPALL INDEPENDENT | |||

Age: 49 Director Since: 2021 Committees: Audit and Finance Governance, Safety, and Public Policy Other Public Company Directorships: Starwood Property Trust, Inc. | Mr. Perpall currently serves as Chief Executive Officer of The Beck Group, one of the world’s largest integrated design-build firms, a position he has held since 2013. Mr. Perpall leads the firm’s domestic and international design, planning, and construction business. He also serves on the Board of Councilors for The Carter Center and is President of the United States Golf Association Executive Committee. Mr. Perpall has a bachelor’s and master’s degree from the University of Texas at Arlington and is a member of the American Institute of Architects College of Fellows, an alumnus of Harvard Business School’s Advanced Management Program, and a former Americas Fellow at The Baker Institute at Rice University. He previously served as a director of Triumph Bancorp, Inc. SKILLS AND QUALIFICATIONS | ||

| Risk Management Has extensive experience in an industry where oversight and management of risks related to safety and compliance are mission-critical functions. | ||

| Financial Alumnus of Harvard Business School’s Advanced Management Program; public company audit and investment committee member. | ||

| Leadership Eleven years of service as Chief Executive Officer of The Beck Group. | ||

| JOSHUA COOPER RAMO INDEPENDENT | |||

Age: 55 Director Since: 2011 Committees: Audit and Finance Cyber and Technology Oversight Other Public Company Directorships: None | Mr. Ramo is Chairman and Chief Executive Officer of Sornay, LLC, a strategic advisory firm, a position he has held since January 2021. He previously served as Vice Chairman, Co-Chief Executive Officer, of Kissinger Associates, Inc., a strategic advisory firm, from 2011 through 2020 (he was Vice Chairman since 2011 and Co-Chief Executive Officer since 2015). He served as Managing Director of Kissinger Associates from 2006 to 2011. Prior to joining Kissinger Associates, he was Managing Partner of JL Thornton & Co., LLC, a consulting firm. Before that, he worked as a journalist and served as Senior Editor, Foreign Editor, and then Assistant Managing Editor of TIME Magazine from 1995 to 2003. He is a former director of Starbucks Corporation. SKILLS AND QUALIFICATIONS | ||

| International Has been a term member of the Council on Foreign Relations, Asia 21 Leaders Program, World Economic Forum’s Young Global Leaders, and Global Leaders of Tomorrow. He co-founded the U.S.-China Young Leaders Forum in conjunction with the National Committee on U.S.-China Relations. | ||

| Leadership Chairman and Chief Executive Officer, Sornay, LLC; former Vice Chairman, Co-Chief Executive Officer, of Kissinger Associates. | ||

| 20 |  |

Corporate Governance Matters – Nominees for Election to the Board

| SUSAN C. SCHWAB INDEPENDENT | |||

Age: 69 Director Since: 2009 Committees: Compensation and Human Resources Cyber and Technology Oversight Other Public Company Directorships: Caterpillar Inc. and Marriott International, Inc. | Ambassador Schwab is currently Professor Emerita at the University of Maryland School of Public Policy, a position she has held since June 2020. Prior to being named Professor Emerita, Ambassador Schwab was a Professor from January 2009 to May 2020. She has also served as a strategic advisor to Mayer Brown LLP, a law firm, since March 2010. She served as U.S. Trade Representative from 2006 to January 2009 and as Deputy U.S. Trade Representative from 2005 to 2006. She was Vice Chancellor of the University System of Maryland and President and Chief Executive Officer of the University System of Maryland Foundation from 2004 to 2005. Ambassador Schwab was Dean of the University of Maryland School of Public Policy from 1995 to 2003. She was Director of Corporate Business Development of Motorola, Inc., an electronics manufacturer, from 1993 to 1995. She was Assistant Secretary of Commerce for the U.S. and Foreign Commercial Service from 1989 to 1993. Ambassador Schwab also serves as Board Chair of the National Foreign Trade Council. She is a former director of The Boeing Company. SKILLS AND QUALIFICATIONS | ||

| International; Government Former U.S. Trade Representative and former Director–General of the U.S. and Foreign Commercial Service (Assistant Secretary of Commerce), the export promotion arm of the U.S. government. | ||

| Leadership Former U.S. Trade Representative, former Director–General of the U.S. and Foreign Commercial Service (Assistant Secretary of Commerce), former President and Chief Executive Officer of the University System of Maryland Foundation, and former Dean of the University of Maryland School of Public Policy. | ||

| FREDERICK W. SMITH | |||

Age: 80 Director Since: 1971 Committees: None Other Public Company Directorships: None | Mr. Smith is the company’s founder and has been Executive Chairman of FedEx since June 1, 2022, and Chairman of the Board since 1998. Mr. Smith was Chief Executive Officer of FedEx from 1998 through May 2022 and President of FedEx from 1998 through January 2017. He was Chairman, President, and Chief Executive Officer of Federal Express from 1983 to 1998, Chief Executive Officer of Federal Express from 1977 to 1998, President of Federal Express from 1971 to 1975, and Chairman of Federal Express from 1975 to May 2022. SKILLS AND QUALIFICATIONS | ||

| Transportation/Logistics/Supply Chain Management; Leadership Founder and former CEO of our company and the pioneer of the express transportation industry. | ||

| Energy Chairman Emeritus of the Energy Security Leadership Council. | ||

| International Founder and former CEO of our multinational company and has served on the board of the Council on Foreign Relations and as chairman of the U.S.-China Business Council and the French-American Business Council. | ||

| 2024 Proxy Statement | 21 |

Corporate Governance Matters – Nominees for Election to the Board

| DAVID P. STEINER INDEPENDENT — LEAD INDEPENDENT DIRECTOR | |||

Age: 64 Director Since: 2009 Committees: Governance, Safety, and Public Policy (Chair) Other Public Company Directorships: Vulcan Materials Company | Mr. Steiner is the former Chief Executive Officer of Waste Management, Inc., a provider of integrated waste management services, serving as Chief Executive Officer from 2004 through October 2016. He was President of Waste Management, Inc. from 2010 through July 2016, Executive Vice President and Chief Financial Officer from 2003 to 2004, Senior Vice President, General Counsel and Corporate Secretary from 2001 to 2003, and Vice President and Deputy General Counsel from 2000 to 2001. He was a partner at Phelps Dunbar L.L.P., a law firm, from 1990 to 2000. Mr. Steiner was previously a director of TE Connectivity Ltd. and Waste Management, Inc. SKILLS AND QUALIFICATIONS | ||

| Transportation/Logistics/Supply Chain Management Former CEO of Waste Management, which transports waste materials. | ||

| Financial Has an accounting degree from Louisiana State University and was CFO of Waste Management before becoming its CEO. | ||

| Energy Former CEO of Waste Management, which has taken an industry leadership role in converting waste to renewable energy. | ||

| RAJESH SUBRAMANIAM | |||

Age: 58 Director Since: 2020 Committees: None Other Public Company Directorships: The Procter & Gamble Company | Mr. Subramaniam serves as President and Chief Executive Officer of FedEx Corporation, a position he has held since June 2022. During his more than 30-year tenure with FedEx, Mr. Subramaniam has served in a multitude of leadership roles, including President and Chief Executive Officer-Elect of FedEx Corporation from March 2022 to May 2022, President and Chief Operating Officer of FedEx Corporation from March 2019 to March 2022, President and Chief Executive Officer of Federal Express, the world’s largest express transportation company, from January 2019 to March 2019, and Executive Vice President and Chief Marketing and Communications Officer of FedEx Corporation from January 2017 to December 2018. He served as Executive Vice President of Marketing and Communications at FedEx Services from 2013 to January 2017. He is a former director of First Horizon National Corporation. SKILLS AND QUALIFICATIONS | ||

| Transportation/Logistics/Supply Chain Management Over 30 years of experience across the FedEx enterprise. Serves on The President’s Export Council. | ||

| International; Leadership Has held leadership roles at FedEx in the Asia-Pacific region and Canada. Serves on the U.S.-India Strategic Partnership Forum, U.S.-India CEO Forum, and the U.S.-China Business Council. | ||

| Marketing; Retail/E-Commerce Oversaw all aspects of FedEx’s global marketing and communications, including advertising, brand and reputation, product and business development, e-commerce, revenue and forecasting planning, retail marketing, and digital access. | ||

| Technological/Digital/Cybersecurity Responsible for several landmark developments at FedEx, including the continuing digital transformation of the company, and has had an instrumental role in recent technology upgrades to address the continued growth of e-commerce. | ||

| 22 |  |

Corporate Governance Matters – Nominees for Election to the Board

| PAUL S. WALSH INDEPENDENT | |||

Age: 69 Director Since: 1996 Committees: Compensation and Human Resources (Chair) Other Public Company Directorships: McDonald’s Corporation and Vintage Wine Estates, Inc. | Mr. Walsh is Executive Chairman of the Board of McLaren Group Limited, a luxury automotive, motorsport, and technology company, a position he has held since January 2020. He also currently serves as an advisor for L.E.K. Consulting, a global strategy consulting firm, and TPG Capital LLP, a private investment firm. Mr. Walsh formerly served as Operating Partner at Bespoke Capital Partners LLC, an investment company, and Executive Chairman of Bespoke Capital Acquisition Corp., in each case from August 2016 until June 2021, and he served as Chairman of the Board of Compass Group PLC, a food service and support services company, from February 2014 to December 2020. Mr. Walsh served as Chief Executive Officer of Diageo plc, a beverage company, from 2000 to June 2013 and then served as an advisor to the company from July 2013 through 2014. Mr. Walsh also is an advisor of Chime Communications Limited, and director of UPL Corporation Ltd., Cayman. Mr. Walsh was Chairman, President, and Chief Executive Officer of The Pillsbury Company, a wholly owned subsidiary of Diageo plc, from 1996 to 2000, and Chief Executive Officer of The Pillsbury Company from 1992 to 1996. He was previously a director of Avanti Communications Group PLC, Centrica plc, Compass Group PLC, Diageo plc, HSBC Holdings plc, Ontex Group NV, Pace Holdings Corp., RM2 International S.A., TPG Pace Holdings Corp., Unilever PLC, and Bespoke Capital Acquisition Corp. SKILLS AND QUALIFICATIONS | ||

| International Former CEO of a U.K.–based, large multinational corporation. | ||

| Financial Has held executive finance positions, including CFO of a major division, at a U.K.–based public company. | ||

| Marketing; Retail/E-Commerce Led a company that owes much of its growth and success to highly effective marketing of its brands. His consumer-centric experience brings a vital and unique perspective to the Board. | ||

| Government Has held executive positions at companies where government interface is crucial. | ||

| 2024 Proxy Statement | 23 |

Corporate Governance Matters – Nominees for Election to the Board

Summary of Director Nominee Experience, Qualifications, Attributes, and Skills

|  |  |  |  |  |  |  |  |  |  |  |  |  | |||

| Transportation/Logistics/Supply Chain Management Experience is a positive attribute as it greatly increases a director’s understanding of our business operations and its management. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| International Experience is beneficial given our operations in over 220 countries and territories. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Financial Expertise is important given our use of financial targets as measures of success and the importance of accurate financial reporting and robust internal auditing. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Marketing Expertise is valuable because we emphasize promoting and protecting the FedEx brand, one of our most important assets. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Retail/E-Commerce Expertise is significant because we are strategically focused on the opportunity presented by this massive and fast-growing market. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Technological/Digital/Cybersecurity Expertise is beneficial because attracting and retaining customers and competing effectively depend in part upon the sophistication, security, and reliability of our technology. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Energy Expertise is important as we are committed to protecting the environment and have initiatives under way to reduce our energy use and minimize our environmental impact. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Human Resource Management Expertise is important because our success depends on the talent, dedication, and well-being of our people — our greatest asset. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Government Experience is useful in our highly regulated industry as we work constructively with governments around the world. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Risk Management Expertise is important as we work to identify and manage risks to our business and operations in a complex global environment. |  |  |  |  |  |  |  |  |  |  |  |  |  |  | |

| Leadership Experience is critical because we want directors with the experience and confidence to capably advise our senior management team on a wide range of issues. |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Audit Committee Financial Expert

The Board of Directors has determined that R. Brad Martin is an audit committee financial expert as that term is defined in SEC rules.

| 24 |  |

Corporate Governance Matters – Nominees for Election to the Board

Director Independence

The Board of Directors has determined that each member of the Audit and Finance, Compensation and Human Resources, and GSPP Committees is independent. With the exception of Frederick W. Smith and Rajesh Subramaniam, each of the Board’s current members and director nominees (Silvia Davila, Marvin R. Ellison, Stephen E. Gorman, Susan Patricia Griffith, Amy B. Lane, R. Brad Martin, Nancy A. Norton, Frederick P. Perpall, Joshua Cooper Ramo, Susan C. Schwab, David P. Steiner, and Paul S. Walsh) is independent and meets the applicable independence requirements of the New York Stock Exchange (including the additional New York Stock Exchange and SEC requirements for Audit and Finance Committee and Compensation and Human Resources Committee members, as applicable, with respect to current committee members) and the Board’s more stringent standards for determining director independence. Mr. Smith is FedEx’s Executive Chairman, and Mr. Subramaniam is FedEx’s President and Chief Executive Officer. Kimberly A. Jabal and V. James Vena each served as a director for a portion of fiscal 2024 prior to the 2023 annual meeting. Ms. Jabal and Mr. Vena were independent during the time they served.

Under the Board’s standards of director independence, which are included in FedEx’s Corporate Governance Guidelines, available under the ESG heading on the Investor Relations page of our website at investors.fedex.com, a director will be considered independent only if the Board affirmatively determines that the director has no direct or indirect material relationship with FedEx, other than as a director. The standards set forth certain categories or types of transactions, relationships, or arrangements with FedEx, as follows, each of which (i) is deemed not to be a material relationship with FedEx, and thus (ii) will not, by itself, prevent a director from being considered independent:

| Prior Employment of Director. The director was employed by FedEx or was personally working on FedEx’s audit as an employee or partner of FedEx’s independent auditor, and over five years have passed since such employment, partner, or auditing relationship ended. |

| Prior Employment of Immediate Family Member. An immediate family member was an officer of FedEx or was personally working on FedEx’s audit as an employee or partner of FedEx’s independent auditor, and over five years have passed since such employment, partner, or auditing relationship ended. |

| Current Employment of Immediate Family Member. An immediate family member is employed by FedEx in a non-officer position, or by FedEx’s independent auditor not as a partner and not personally working on FedEx’s audit. |

| Interlocking Directorships. An executive officer of FedEx served on the board of directors of a company that employed the director or employed an immediate family member as an executive officer, and over five years have passed since either such relationship ended. |

| Transactions and Business Relationships. The director or an immediate family member is a partner, greater than 10% shareholder, director, or officer of a company that makes or has made payments to, or receives or has received payments (other than contributions, if the company is a tax-exempt organization) from, FedEx for property or services, and the amount of such payments has not within any of such other company’s three most recently completed fiscal years exceeded one percent (or $1 million, whichever is greater) of such other company’s consolidated gross revenue for such year. |

| Indebtedness. The director or an immediate family member is a partner, greater than 10% shareholder, director, or officer of a company that is indebted to FedEx or to which FedEx is indebted, and the aggregate amount of such debt is less than one percent (or $1 million, whichever is greater) of the total consolidated assets of the indebted company. |

| Charitable Contributions. The director is a trustee, fiduciary, director, or officer of a tax-exempt organization to which FedEx contributes, and the contributions to such organization by FedEx have not within any of such organization’s three most recently completed fiscal years exceeded one percent (or $250,000, whichever is greater) of such organization’s consolidated gross revenue for such year. |

In determining each director’s independence, the Board broadly considered all relevant facts and circumstances, including the following immaterial transactions, relationships, and arrangements:

| Mr. Ellison and Robert B. Carter (who served as FedEx’s Executive Vice President, FedEx Information Services, and Chief Information Officer until June 30, 2024) serve on the Board of Trustees of the University of Memphis, a non-profit entity to which FedEx makes payments and charitable contributions. The payments and charitable contributions made by FedEx to the University of Memphis in its fiscal 2024 represented 1.9% of the University’s consolidated gross revenue for the year. The payments and charitable contributions made by FedEx to the University of Memphis in its fiscal 2023 represented 2.8% of the University’s consolidated gross revenue for the year, and payments and charitable contributions made by FedEx to the University of Memphis in its fiscal 2022 represented less than one percent of the University’s consolidated gross revenue for the year. The Board determined that Mr. Ellison is an independent director under the Board’s independence standards as he does not have a direct or indirect material relationship with either FedEx or the University of Memphis, other than as a director or trustee, and does not derive any financial or other personal benefit from these transactions. |

| FedEx has an ordinary course business relationship with Lowe’s Companies, Inc., an entity for which Mr. Ellison has served as Chairman of the Board since June 2021 and President and Chief Executive Officer and as a director since July 2018. The amount of the payments made by FedEx to Lowe’s (and vice versa) within any of its three most recently completed fiscal years has not exceeded one percent (or $1 million, whichever is greater) of its consolidated gross revenue for such year. |

| 2024 Proxy Statement | 25 |

Corporate Governance Matters – Nominees for Election to the Board

| FedEx has an ordinary course business relationship with The Progressive Corporation, an entity for which Ms. Griffith serves as President and Chief Executive Officer and as a director since July 2016. The amount of the payments made by FedEx to Progressive (and vice versa) within any of its three most recently completed fiscal years has not exceeded one percent (or $1 million, whichever is greater) of its consolidated gross revenue for such year. |

| FedEx has an ordinary course business relationship with McLaren Group Limited, an entity for which Mr. Walsh serves as Chief Executive Officer. The amount of the payments made by McLaren to FedEx within any of its three most recently completed fiscal years has not exceeded one percent (or $1 million, whichever is greater) of its consolidated gross revenue for such year. |

Related Person Transactions

In accordance with the company’s Policy on Review and Preapproval of Related Person Transactions, which is described in more detail below in “— Board Processes and Policies — Policy on Review and Preapproval of Related Person Transactions,” the GSPP Committee has reviewed the following existing related person transactions and determined that they remain in the best interests of FedEx and our stockholders:

| FedEx’s policy on personal use of corporate aircraft requires officers to pay FedEx two times the cost of fuel, plus applicable passenger ticket taxes and fees, for personal trips. Pursuant to this requirement, Mr. Smith paid FedEx $1,137,913 during fiscal 2024 in connection with certain personal use of corporate aircraft. |

| Effective June 1, 2024, Mr. Smith’s oldest son is employed by Federal Express Corporation as its Chief Operating Officer —International and Chief Executive Officer — Airline and was formerly its President and Chief Executive Officer — Airline and International. The compensation of Mr. Smith’s oldest son for fiscal 2024 (including any incentive compensation amounts and the Black-Scholes value of any stock option award) was $4,337,039. |

| Mr. Smith’s daughter is employed by FedEx Corporation as a staff director of global public policy; Mr. Subramaniam’s brother is employed by Federal Express as a manager of information technology; the son-in-law of Mark R. Allen, FedEx’s Executive Vice President, General Counsel and Secretary, is employed by FedEx as a managing director in the legal department; and the wife of Sriram Krishnasamy, FedEx’s Executive Vice President, Chief Digital and Information Officer and Chief Transformation Officer, is employed by Federal Express as a manager of information technology. The total annual compensation of each of Mr. Smith’s daughter, Mr. Subramaniam’s brother, Mr. Allen’s son-in-law, and Mr. Krishnasamy’s wife for fiscal 2024 (including any incentive compensation and the Black-Scholes value of any stock option award) did not, individually, exceed $428,000. |