- CNXN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PC Connection (CNXN) DEF 14ADefinitive proxy

Filed: 29 Mar 24, 12:37pm

| |||

UNITED STATES | |||

SECURITIES AND EXCHANGE COMMISSION | |||

Washington, D.C. 20549 | |||

| |||

SCHEDULE 14A | |||

(Rule 14a-101) | |||

| |||

INFORMATION REQUIRED IN PROXY STATEMENT | |||

| |||

SCHEDULE 14A INFORMATION | |||

| |||

Proxy Statement Pursuant to Section 14(a) of the Securities | |||

| |||

Filed by the Registrant ⌧ | |||

Filed by a Party other than the Registrant ◻ | |||

Check the appropriate box: | |||

| |||

◻ | Preliminary Proxy Statement | ||

◻ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

⌧ | Definitive Proxy Statement | ||

◻ | Definitive Additional Materials | ||

◻ | Soliciting Material under §240.14a-12 | ||

| |||

PC CONNECTION, INC. | |||

(Name of Registrant as Specified in its Charter) | |||

| |||

| |||

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |||

| |||

Payment of Filing Fee (Check all boxes that apply): | |||

| |||

⌧ | No fee required | ||

◻ | Fee paid previously with preliminary materials | ||

◻ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||

| | ||

| | | |

PC CONNECTION, INC.

730 Milford Road

Merrimack, New Hampshire 03054

(603) 683-2000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Wednesday, May 15, 2024 10:00 a.m. EDT

The 2024 Annual Meeting of Stockholders of PC Connection, Inc., a Delaware corporation, which we refer to as the Company, will be held at our corporate headquarters, 730 Milford Road, Merrimack, NH 03054 on Wednesday, May 15, 2024 at 10:00 a.m. (EDT) to consider and act upon the following matters:

1. To elect six directors to serve until the 2025 Annual Meeting of Stockholders;

2. To ratify the selection by the Audit Committee of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on March 18, 2024 are entitled to notice of and to vote at the meeting or any adjournments thereof. All stockholders are cordially invited to attend the meeting. As a way to conserve natural resources and reduce annual meeting costs, we are electronically distributing proxy materials as permitted under rules of the Securities and Exchange Commission. Many of you will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials via the Internet. You can also request mailed paper copies if you prefer.

Audio webcast capabilities will be available at https://edge.media-server.com/mmc/p/soemh2jp. Teleconference capabilities will also be available at https://register.vevent.com/register/BI35c90cf4a1bc439294dba3f8707d19a2.

Although audio webcast and teleconference capabilities will be available in order to enable stockholders who wish to listen to the Annual Meeting to do so without attending the Annual Meeting, stockholders will not be able to vote or revoke a proxy via the audio webcast or teleconference. Therefore, to ensure that your vote is counted at the Annual Meeting, the Company encourages its stockholders to complete and return the proxy card included with the Notice Regarding the Availability of Proxy Materials, or through your broker, bank or other nominee’s voting instruction form.

| | |

|

| By Order of the Board of Directors, |

| | |

| | Patricia Gallup |

| | Chair of the Board |

| | |

Merrimack, New Hampshire | | |

March 29, 2024 | | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 15, 2024: The Notice of the 2024 Annual Meeting, Proxy Statement and the Annual Report for the year ended December 31, 2023, and the form of proxy card are available as of today’s date March 29, 2024 at http://ir.connection.com/financials/annual-reports-and-proxy.

IT IS IMPORTANT YOU VOTE YOUR SHARES SO THEY ARE COUNTED AT THE ANNUAL MEETING. YOU CAN VOTE YOUR SHARES: OVER THE INTERNET AT THE WEB ADDRESS INCLUDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS AND INCLUDED IN THE PROXY CARD OR VOTING INSTRUCTION FORM (IF YOU RECEIVED A PROXY CARD OR VOTING INSTRUCTION FORM); BY TELEPHONE THROUGH THE NUMBER INCLUDED IN THE PROXY CARD OR VOTING INSTRUCTION FORM (IF YOU RECEIVED A PROXY CARD OR VOTING INSTRUCTION FORM); OR BY SIGNING AND DATING YOUR PROXY CARD (IF YOU RECEIVED A PROXY CARD) AND MAILING IT IN THE PREPAID AND ADDRESSED ENVELOPE.

PC CONNECTION, INC.

730 Milford Road

Merrimack, New Hampshire 03054

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Wednesday, May 15, 2024 10:00 a.m. EDT

This Proxy Statement is furnished in connection with the solicitation of proxies by PC Connection, Inc., a Delaware corporation, which we refer to as the Company, we, us, or our, by our Board of Directors, or the Board, for our 2024 Annual Meeting of Stockholders, or the “Annual Meeting”, to be held on Wednesday, May 15, 2024 at 10:00 a.m. (EDT) at our corporate headquarters, 730 Milford Road, Merrimack, NH 03054 or any adjournment or adjournments of the Annual Meeting. You may obtain directions to the location of the Annual Meeting by contacting Investor Relations at 603-683-2505.

All proxies will be voted in accordance with the stockholders’ instructions. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise at the Annual Meeting by delivery of a written revocation to our secretary, or a subsequently dated proxy may be provided electronically or telephonically through the procedures set forth in the enclosed proxy card (if you received a proxy card) or voting instruction form (if you received the proxy materials by mail from a broker or bank), or by voting in person during the Annual Meeting.

Voting Securities and Votes Required

On March 18, 2024, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 26,362,938 shares of our Common Stock, $0.01 par value per share, or the Common Stock. Stockholders are entitled to one vote per share of Common Stock. Our stock record books will be available for inspection by stockholders of record at our offices at the above address and at the time and place of the Annual Meeting.

The presence, in person or by proxy, of the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting shall be necessary to constitute a quorum for the transaction of business. If a quorum is not present, the meeting will be adjourned until a quorum is obtained. Abstentions will be considered as present for purposes of determining whether a quorum is present. Proxies reflecting broker non-votes (where a broker or nominee does not have discretionary authority to vote on a proposal) will be considered as present for purposes of determining whether a quorum is present provided that the shares cast a vote on at least one matter presented for a vote.

If a quorum is present at the Annual Meeting, the vote required to adopt each of the scheduled proposals will be as follows:

Election of Directors. Any election of directors by stockholders shall be determined by a plurality of the votes cast on the election (candidates who receive the highest number of “for” votes are elected). Stockholders may vote “for” or “withhold” authority to vote with respect to one or more director nominees; however, where candidates are unopposed, “withhold” votes will have no effect on the election of such nominees. In addition, shares held of record by stockholders that fail to provide voting instructions and broker non-votes, as described below, will have no effect on the election of such nominees.

1

Other Matters. The affirmative vote of the holders of a majority of the votes cast (meaning the number of shares voted “for” a proposal must exceed the number of shares voted “against” such proposal) will be required to: ratify the selection of our independent registered public accounting firm (Proposal 2). Stockholders may vote “for,” “against,” or “abstain” from voting on Proposal 2. Abstentions are not considered votes cast for the foregoing purpose and will have no effect on the vote for Proposal 2 or the shares voting on such matter. If you are a stockholder of record and do not cast your vote, no votes will be cast on your behalf on any of the matters of business at the Annual Meeting. The failure to vote by a stockholder of record will have no effect on the vote for Proposal 2 or the shares voting on such matter.

Broker Non-Votes. Persons who hold shares on the record date through a broker, bank, or other intermediary (referred to hereafter as “brokers” for ease of reference) are considered beneficial owners and the shares are referred to as held in “street name”. Brokers holding shares in “street name” must vote according to specific instructions they receive from the beneficial owners of those shares. If brokers do not receive specific instructions, brokers may in some cases vote the shares in their discretion. However, brokers holding shares in “street name” for their beneficial owners are prohibited from voting on behalf of the clients on certain matters unless the brokers have received specific voting instructions from those clients. Accordingly, we expect that a broker will be unable to vote shares held on behalf of a beneficial owner on Proposal 1 regarding the election of directors unless such broker has received specific voting instructions from the beneficial owner. However, we expect that a broker will have discretion to vote shares held on behalf of a beneficial owner on Proposal 2, the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024, even if such broker has not received specific voting instructions from the beneficial owner. Shares held in “street name” by brokers who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor or against such matter and will also not be counted as votes cast on such matter.

Votes cast by proxy by mail will be tabulated by the inspector of election appointed for the Annual Meeting, who will also determine whether a quorum is present.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Officers and Directors

Unless otherwise provided below, the following table sets forth, as of March 18, 2024, the beneficial ownership of our Common Stock by: (i) each of our current and nominated directors; (ii) each of our named executive officers in the Summary Compensation Table under the heading “Executive Compensation” below; and (iii) all our current directors and executive officers as a group. Unless otherwise indicated, each person has sole investment and voting power, or shares such power with his or her spouse, with respect to the shares set forth in the following table. The inclusion in this table of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

Except as otherwise set forth below, the street address of each beneficial owner is c/o PC Connection, Inc., 730 Milford Road, Merrimack, New Hampshire 03054.

| | | | | |

| | Shares of | | Percentage of | |

| | Common Stock | | Common | |

| | Beneficially | | Stock | |

Name |

| Owned(1) |

| Outstanding(2) | |

Patricia Gallup |

| 14,397,090 | (3) | 54.6 | % |

Timothy McGrath |

| 296,748 | (4) | 1.1 | % |

David Beffa-Negrini |

| 76,250 | | * | |

Jack Ferguson |

| 74,680 | | * | |

Thomas Baker | | 29,383 | | * | |

Barbara Duckett |

| 14,877 | | * | |

Gary Kinyon | | 2,500 | | * | |

Jay Bothwick | | 1,250 | | * | |

All current directors and executive officers as a group (8 individuals) |

| 14,892,778 | | 56.5 | % |

* | Less than 1% of the total number of our outstanding shares of Common Stock on March 18, 2024. |

| (1) | The number of shares beneficially owned by each director or executive officer is determined under rules promulgated by the Securities and Exchange Commission, or the “SEC”, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power, and also any shares which the individual has the right to acquire as of March 18, 2024 or will have the right to acquire within 60 days thereof through the exercise of any stock option, vesting of restricted stock units, or other right to acquire Common Stock. |

| (2) | The number of shares of Common Stock deemed outstanding for purposes of determining such percentages includes 26,362,938 shares outstanding as of March 18, 2024, and any shares subject to issuance upon exercise of options, vesting of restricted stock units, or other rights held by the person in question that were exercisable on or vest within 60 days after March 18, 2024. |

| (3) | Includes (i) 2,460,052 shares of Common Stock held by a grantor retained annuity trust of which Patricia Gallup is the sole trustee, or the Comack Trust, (ii) 6,879,962 shares of Common Stock held by an irrevocable trust of which Ms. Gallup is the sole trustee, or the David Hall Trust 2003, (iii) 162,093 shares of Common Stock held by The Estate of David McLellan Hall, for which Ms. Gallup serves as executor, (iv) 275,000 shares of Common Stock held by an irrevocable trust formed under the laws of the state of New Hampshire of which Ms. Gallup is the sole trustee and as to which Ms. Gallup disclaims beneficial ownership, or the North Branch Trust and (v) 15,133 shares of Common Stock held by Ms. Gallup’s spouse, as to which Ms. Gallup disclaims beneficial ownership. Ms. Gallup has the sole power to vote or direct the vote of 4,604,850 shares of Common Stock, shared power to vote or direct vote of 9,792,240 shares of Common Stock; sole power to dispose or direct the disposition of 4,604,850 shares of Common Stock and the shared power to dispose or direct the disposition of 9,792,240 shares of Common Stock. |

| (4) | Includes 10,000 RSUs scheduled to vest on April 1, 2024. Each RSU represents the right to receive one share of Common Stock upon vesting. |

3

Stock Ownership of Certain Beneficial Owners

To our knowledge, as of March 18, 2024, the following entities beneficially owned more than 5% of our Common Stock.

| | | | | | | |

| | | | | | | |

| | | | Shares Of | | Percentage of | |

| | Title | | Common Stock | | Common Stock | |

Name and Address | | of Class | | Beneficially Owned | | Outstanding(1) | |

David Hall Trust 2003 | | | | | | | |

PO Box 256 | | Common Stock | | 6,879,962 | (2) | 26.1 | % |

Keene, NH 03431 | | | | | | | |

| | | | | | | |

BlackRock, Inc. | | | | | | | |

50 Hudson Yards | | Common Stock | | 2,477,290 | (3) | 9.4 | % |

New York, NY 10001 | | | | | | | |

| | | | | | | |

Comack Trust | | | | | | | |

PO Box 256 | | Common Stock | | 2,460,052 | (4) | 9.3 | % |

Keene, NH 03431 | | | | | | | |

| | | | | | | |

Dimensional Fund Advisors, Inc. | | | | | | | |

6300 Bee Cave Road, Building One | | Common Stock | | 1,905,196 | (5) | 7.2 | % |

Austin, Texas, 78746 | | | | | | | |

| (1) | The number of shares of Common Stock deemed outstanding for purposes of determining such percentages is 26,362,938 as of March 18, 2024. |

| (2) | As the sole trustee of the David Hall Trust 2003, Patricia Gallup may be deemed to beneficially own the shares held by the David Hall Trust 2003. The David Hall Trust 2003 has the sole power to vote or direct the vote of 0 shares of Common Stock, the shared power to vote or direct the vote of 6,879,962 shares of Common Stock, the sole power to dispose or direct the disposition of 0 shares of Common Stock, and the shared power to dispose or direct the disposition of 6,879,962 shares of Common Stock. |

| (3) | The information presented herein is as reported in, and based solely upon, a Schedule 13G/A filed with the SEC on January 24, 2024 by BlackRock, Inc., which we refer to as BlackRock. BlackRock possesses the sole power to vote or direct the vote of 2,364,914 shares of Common Stock, the shared power to vote or direct the vote of 0 shares of Common Stock, the sole power to dispose or direct the disposition of 2,477,290 shares of Common Stock and shared power to dispose or direct the disposition of 0 shares of Common Stock. |

| (4) | As the sole trustee of the Comack Trust, Patricia Gallup may be deemed to beneficially own the shares held by the Comack Trust. The Comack Trust has the sole power to vote or direct the vote of 0 shares of Common Stock, the shared power to vote or direct the vote of 2,460,052 shares of Common Stock, the sole power to dispose or direct the disposition of 0 shares of Common Stock and the shared power to dispose or direct the disposition of 2,460,052 shares of Common Stock. |

| (5) | The information presented herein is as reported in, and based solely upon, a Schedule 13G/A filed with the SEC on February 9, 2024 by Dimensional Fund Advisors LP, which we refer to as Dimensional, an investment advisor registered under Section 203 of the Investment Advisors Act of 1940. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). All shares of Common Stock listed as owned by Dimensional are owned by the Funds. In its role as investment advisor or manager, Dimensional possesses the sole power to vote or direct the vote of 1,876,275 shares of Common Stock, the shared power to vote or direct the vote of 0 shares of Common Stock, the sole power to dispose or direct the disposition of 1,905,196 shares of Common Stock and the shared power to dispose or direct the disposition of 0 shares of Common Stock. |

4

PROPOSAL ONE

ELECTION OF DIRECTORS

Directors are to be elected at the Annual Meeting. The size of our Board of Directors is currently fixed at six members. Our Bylaws provide that our directors will be elected at each annual meeting of our stockholders to serve until the next annual meeting of stockholders or until their successors are duly elected and qualified.

The person named in the enclosed proxy (Patricia Gallup) will vote to elect the six nominees named below as our directors unless authority to vote for the election of any or all of the nominees is withheld by marking the proxy to that effect. Each nominee is presently serving as a director, and each nominee has consented to being named in this Proxy Statement and to serve, if elected. If for any reason any nominee should be unable to serve, the person acting under the proxy may vote the proxy for the election of any substitute nominee designated by our Board of Directors. It is not presently expected that any of the nominees will be unavailable to serve.

Our Board of Directors recommends a vote “FOR” the election of the nominees described below.

Set forth below is certain biographical information about each nominee to our Board of Directors, including the positions and offices they hold, their principal occupations and their business experience. Information with respect to the number of shares of Common Stock directly and indirectly beneficially owned by each nominee as of March 18, 2024, appears under “Security Ownership of Certain Beneficial Owners and Management”.

Nominees for Election to our Board of Directors

Patricia Gallup, age 70, has been the Chair of our Board of Directors since September 1994 and Chief Administrative Officer since August 2011. She served as Chief Executive Officer from September 2002 until August 2012 and from 1990 to 2001. Ms. Gallup is a co-founder of our Company, has been on our Board of Directors since its inception and has served as an executive officer since 1982.

David Beffa-Negrini, age 70, has served on our Board of Directors since September 1994, and serves as a member of the Audit Committee. He had held a variety of senior management roles with the Company and was the Co-President of our former subsidiary, Merrimack Services, from September 2005 to February 2007. He served as our Vice President of Corporate Communications from June 2000 to February 2007. Mr. Beffa-Negrini retired from the Company in 2008.

Jay Bothwick, age 67, has served on our Board of Directors since March 2022 and as Vice Chair and Secretary since August 2022. Mr. Bothwick also serves as the Chair of the Corporate Development Committee, or the CDC. Mr. Bothwick has been a Managing Director of CrossHarbor Capital Partners LLC, an investment and asset management firm focused on commercial real estate, since August 2021. Prior to joining CrossHarbor Capital Partners LLC, Mr. Bothwick spent almost 40 years practicing in the corporate group at WilmerHale, a national law firm.

Barbara Duckett, age 79, has served on our Board of Directors since June 2009, and serves as the Chair of the Compensation Committee and as a member of the Audit and Corporate Development Committees. From 2000 to 2013, Ms. Duckett was the President, Chief Executive Officer, and a member of the board of directors of Home Healthcare, Hospice and Community Services. Since 2021, Ms. Duckett has served as a member of the board of directors and as Chair of the Professional Affairs Committee of Cheshire Medical Center. Prior to joining the board of directors at Cheshire Medical Center, Ms. Duckett served as a member of the board of directors of Monadnock Community Hospital, as well as other non-profit and privately held healthcare organizations, at the local, state, and national level.

Jack Ferguson, age 85, has been on our Board of Directors since May 2016, and serves as the Chair of the Audit Committee and as a member of the Compensation and Corporate Development Committees. Mr. Ferguson served as our Executive Vice President from May 2007 to March 2012, Chief Financial Officer from December 2005 to March 2012, and Treasurer from November 1997 to March 2012. From December 1992 to May 2007, he served in various executive financial roles at the Company. Prior to joining the Company, Mr. Ferguson was with Deloitte & Touche, an

5

international accounting firm, where he served as a partner for over 15 years on both domestic and international client assignments. He retired from the Company in March 2012.

Gary Kinyon, age 69, has been on our Board of Directors since May 2021. Mr. Kinyon has been a partner at Bradley & Faulkner, P.C. since 1983. He has served as a Corporator and Director of the Savings Bank of Walpole since 2010, and as a Corporator and Trustee of New Hampshire Mutual Bancorp since 2018.

We believe that each of our nominees is qualified to serve as a director of the Company as a result of his or her level of business experience described in the individual biographies above. The nominees have served in a broad range of senior management roles, and have served on boards of directors or in leadership roles for a variety of nonprofit and community organizations. The Board has concluded that the depth of experience and the combination of the different backgrounds of each of our nominees facilitate the Company’s goal of having a diversity of viewpoints and backgrounds on the Board, and gives the Company a broad range of experience on which to draw. Accordingly, the Board has concluded that each of these individuals should serve as a director of the Company, in light of its business and structure, at the time of filing this proxy. In particular:

| ● | Ms. Gallup is a co-founder of the Company and has served as an executive, director, or corporate officer of the Company for over 40 years and, as a result, has in-depth knowledge of the information technology (IT) industry and our business. She also has experience serving as a board member of both public and private companies in the banking and manufacturing industries, respectively. |

| ● | Mr. Beffa-Negrini served the Company in a variety of leadership roles and senior management positions, and has more than 35 years of experience in the IT industry. Following his retirement from the Company in 2008, Mr. Beffa-Negrini pursued other business and investment opportunities outside and within the IT industry. His experience and qualifications provide the Board with insights into the organizational development of the Company, along with a broad knowledge base of the industry. |

| ● | Mr. Bothwick has over 30 years of experience advising senior management and boards of directors of public and private entities on a wide range of legal matters including governance, structuring, mergers and acquisitions, and SEC disclosure compliance. Mr. Bothwick served as outside legal counsel for the Company for over 20 years. Accordingly, Mr. Bothwick brings to the Board strong knowledge of our business, corporate development, as well as disclosure and reporting obligations applicable to the Company as a publicly traded entity. |

| ● | Ms. Duckett has significant executive management and board-level experience with numerous organizations in the healthcare industry. Accordingly, Ms. Duckett brings to the Board strong business knowledge as well as insight into the growing healthcare industry, which is a sector the Company serves. |

| ● | Mr. Ferguson served the Company in a variety of executive financial positions for almost 20 years and, as a result, has in-depth knowledge of the Company’s business as well as the IT industry. Accordingly, Mr. Ferguson’s experience and strong financial background provides the Board with insights into the Company’s business development and financials. |

| ● | Mr. Kinyon has been a partner in a general practice law firm specializing in business formation, reorganization, banking, business transactions, commercial/residential financing, contracts and real estate since 1983 thereby possessing the knowledge to assist with the business of the Company and its customers, employees and other stakeholders. |

No family relationship exists between any of our executive officers, directors, or director nominees.

6

| | |

Board Diversity Matrix (As of March 29, 2024) | ||

Total Number of Directors | 6 | |

| Female | Male |

Part I: Gender Identity | ||

Directors | 2 | 4 |

Part II: Demographic Background | ||

White | 2 | 4 |

INFORMATION CONCERNING DIRECTORS, NOMINEES, AND EXECUTIVE OFFICERS

Board Meetings and Attendance

Our Board of Directors met six times during the year ended December 31, 2023, either in person or by teleconference. During 2023, each director attended at least 75% of the aggregate number of Board meetings and the number of meetings held by all committees on which he or she served. Our Board of Directors does not currently have a policy with regard to the attendance of Board members at our annual meeting of stockholders, though all of our current directors virtually attended our 2023 Annual Meeting.

Board Committees

Our Board of Directors has established three standing committees–Audit, Compensation, and Corporate Development. The Audit and Compensation Committees each operate under written charters that have been approved by our Board of Directors. Each charter can be viewed on our website at http://ir.connection.com. We include our website address in this Proxy Statement only as an inactive textual reference and do not intend it to be an active link to our website. The information on our website and the information contained or linked therein or otherwise connected thereto is not a part of or incorporated by reference into this Proxy Statement, regardless of any reference to such website in this Proxy Statement.

Our Board of Directors has determined that all of the members of our three standing committees are independent as defined under the rules of the Nasdaq Stock Market including, in the case of all members of the Audit Committee, the independence requirements set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and, in the case of all members of the Compensation Committee, the independence requirements set forth in Rule 10C-1 under the Exchange Act. Our Board of Directors has also determined that each member of the Compensation Committee qualifies as a non-employee director under Exchange Act Rule 16b-3.

Audit Committee

The Audit Committee’s responsibilities include:

| ● | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| ● | overseeing the work of our independent registered public accounting firm, including resolution of disagreements between Company management and the independent auditor regarding financial reporting and through the receipt and consideration of certain reports and other communications required to be made by the independent registered public accounting firm; |

| ● | preapproving all audit services to be provided to us, whether provided by our principal auditor or other firms, and all other services (review, attest, and non-audit) to be provided to us by the independent auditor; |

| ● | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

7

| ● | monitoring our internal control over financial reporting, disclosure controls and procedures, and code of business conduct and ethics; |

| ● | discussing our risk assessment and risk management policies; |

| ● | establishing policies regarding hiring employees from the independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns; |

| ● | meeting independently with our internal auditing staff, independent registered public accounting firm, and management; |

| ● | reviewing policies and procedures for reviewing and approving or ratifying related person transactions; |

| ● | reviewing and approving or ratifying any related person transactions; and |

| ● | preparing the audit committee report required by SEC rules. |

The Chair of our Audit Committee is Mr. Ferguson and the members are Ms. Duckett and Mr. Beffa-Negrini. Our Board of Directors has determined that Ms. Duckett and Mr. Ferguson each qualify as an “audit committee financial expert” as defined by applicable SEC rules. The Audit Committee met five times in 2023.

Compensation Committee

The Compensation Committee’s responsibilities include:

| ● | annually reviewing and approving corporate goals and objectives relevant to our CEO and our other executive officers compensation; |

| ● | reviewing and approving, or recommending for approval by the Board of Directors, our CEO’s compensation and the compensation of our other executive officers; |

| ● | overseeing evaluations of our senior executives; |

| ● | overseeing and administering our cash and equity incentive plans; |

| ● | overseeing and administering our clawback policy; |

| ● | reviewing and making recommendations to our Board of Directors with respect to incentive-compensation and equity-based plans; |

| ● | reviewing and making recommendations to our Board of Directors with respect to director compensation; |

| ● | reviewing and making recommendations to our Board relating to management succession planning, including policies and principles for CEO selection and performance review, as well as policies regarding succession in the event of an emergency or the retirement of the CEO; |

| ● | reviewing and discussing annually with management our “Compensation Discussion and Analysis;” |

| ● | overseeing any compensation consultants, legal counsel or other advisors that it, in its sole discretion, retains or obtains advice from; and |

| ● | preparing the Compensation Committee report required by SEC rules. |

8

The processes and procedures followed by our Compensation Committee in considering and determining executive and director compensation are described below under the heading “Executive and Director Compensation Processes.” The Compensation Committee may form and delegate authority to one or more subcommittees as it deems appropriate from time to time under the circumstances. See Executive and Director Compensation Process for a discussion of certain authority the Compensation Committee has delegated to a committee of the Board of Directors comprised of Ms. Gallup, to issue certain awards under the 2020 Stock Incentive Plan.

The Chair of the Compensation Committee is Ms. Duckett and the other member is Mr. Ferguson. The Compensation Committee met two times in 2023.

Corporate Development Committee

The CDC is responsible for evaluating and providing recommendations with respect to strategic transactions by the Company including, but not limited to, potential acquisitions, mergers and other significant business strategies or initiatives. The Chair of the CDC is Mr. Bothwick and the members are Ms. Duckett and Mr. Ferguson. The CDC did not meet in 2023.

Controlled Company Status

We are a “Controlled Company” as defined in Nasdaq Stock Market Rule 5615(c). Our Board of Directors has based this determination on the fact that approximately 54.6% of our voting stock is beneficially owned by Ms. Gallup.

We do not have a standing nominating committee, and the functions of evaluating and selecting directors have been performed by our Board of Directors as a whole. Our Board of Directors will from time to time evaluate biographical information and background material relating to and for the purpose of identifying potential candidates and interview selected candidates. Our Board of Directors does not currently have a charter or written policy with regard to the nomination process.

Board Leadership Structure

Ms. Gallup is the Chair of our Board of Directors and Chief Administrative Officer of our Company. While the roles of Chief Executive Officer and Chair are separate, our leadership structure does not include a lead independent director. In light of our controlled company status discussed above, we believe that the creation of a lead independent director position is not necessary at this time. Our Board of Directors has determined that having Ms. Gallup act as Chair and as Chief Administrative Officer of our Company is in the best interests of the Company and our stockholders and is consistent with good corporate governance for the following reasons:

| ● | our Chair and Chief Administrative Officer is more familiar with our business and strategy than an independent, non-employee Chair would be, and is thus better positioned to focus our Board’s agenda on the key issues facing our Company; |

| ● | our structure provides strong and consistent leadership for our Company, without risking overlap or conflict of roles; and |

| ● | oversight of our Company is the responsibility of our Board as a whole, and this responsibility can be properly discharged without an independent Chair. |

9

Our Board decided to separate the roles of Chair and Chief Executive Officer because it believes that this leadership structure offers the following benefits:

| ● | enhancing our Board’s objective evaluation of our Chief Executive Officer; |

| ● | freeing the Chief Executive Officer to focus on company operations instead of Board administration; and |

| ● | providing the Chief Executive Officer with an experienced sounding board. |

Mr. Bothwick has served as Vice Chair of the Board of Directors since 2022.

Director Independence

Under applicable Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors considered whether any of Messrs. Ferguson, Beffa-Negrini, Kinyon or Bothwick, or Ms. Duckett has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and determined that none of these directors has such a relationship. In making such determinations, the Board of Directors considered the relationships that each such director has with the Company and other facts and circumstances the Board of Directors deemed relevant in determining independence, including any commercial relationship between the director and the Company and the director’s equity ownership of the Company. Our Board of Directors has determined that each of Messrs. Ferguson, Beffa-Negrini, Kinyon and Bothwick, and Ms. Duckett is an “independent director” as defined under Nasdaq Stock Market Inc. Marketplace Rule 5605(a)(2).

Executive and Director Compensation Processes

Our Compensation Committee generally reviews employee performance and compensation on an annual basis. Our Compensation Committee also compares the salaries of our executive officers to salaries of individuals who hold comparable positions in our immediate peer group as appropriate. The Compensation Committee makes salary recommendations based on a number of factors, including the level and breadth of each executive officer’s responsibilities and experience. Salary recommendations are also made with a view to retaining our executive talent. The Compensation Committee may, in its discretion, invite the Chief Executive Officer to be present during the approval of, or deliberations with respect to, other executive officer compensation, and our Chief Executive Officer may make recommendations relating to the salaries of our other executive officers. However, our Compensation Committee does not permit our Chief Executive Officer to be present during deliberations regarding his compensation or any votes related thereto. After the foregoing evaluation the Compensation Committee will then recommend the compensation payable to such executive officers for approval by the full Board of Directors. Our Board of Directors, after an evaluation of the recommendation of the Compensation Committee, will then approve the compensation packages for each of our executive officers.

In 2023, our Compensation Committee recommended, and our Board approved, cash performance awards issued pursuant the 2020 Stock Incentive Plan, or the 2023 Cash Performance Awards. The amounts payable under the 2023 Cash Performance Awards were subject to the achievement of certain company-wide financial performance goals with target payments determined based on a percentage of the executive officer's base salary.

Our Compensation Committee administers the 2020 Stock Incentive Plan, and our Amended and Restated 1997 Employee Stock Purchase Plan, as amended. To the extent permitted by applicable law, our Board of Directors or the Compensation Committee may delegate its authority to grant options and other awards that constitute rights under Delaware law to employees and non-executive officers under the 2020 Stock Incentive Plan, to either a committee of our Board or to our Chief Executive Officer, provided that it will fix the terms of such awards to be granted (including the exercise price of such awards, which may include a formula by which the exercise price will be determined) and the maximum number of shares subject to awards that may be granted.

10

The Compensation Committee has the authority to retain compensation consultants and other outside advisors to assist in the evaluation of executive officer compensation.

Oversight of Risk

Our Board of Directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our Board of Directors and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our Board of Directors oversees risk management activities relating to business strategy, capital allocation, organizational structure, and certain operational risks, including those arising from cybersecurity threats; our Audit Committee oversees risk management activities related to financial controls and legal and compliance risks, and our Compensation Committee oversees risk management activities relating to the Company’s compensation policies and practices. Each committee reports to the full Board on a regular basis, including with respect to the committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

Director Candidates

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition. Minimum qualifications include high-level leadership experience in business activities, breadth of knowledge about issues affecting the Company, experience on other boards of directors, preferably public company boards, and time available for meetings and consultation on Company matters. While we do not have a formal policy with regard to the consideration of diversity in identifying director nominees, our Board of Directors desires a group of candidates who represent a diversity of viewpoints, backgrounds, skills, and expertise that enable them to make a significant contribution to our Board of Directors, our Company, and stockholders. In the event of a need for a new or additional director, our Board of Directors would evaluate potential nominees by reviewing their qualifications, results of personal and reference interviews, and such other information as the Board may deem relevant.

We do not currently employ an executive search firm, or pay a fee to any other third party, to locate qualified candidates for director positions.

Our Board of Directors has generally nominated the current directors for re-election at each annual meeting of stockholders. Our Board of Directors has therefore not established special procedures for evaluating stockholder recommendations. If we were to receive recommendations of candidates from our stockholders, the Board of Directors would consider such recommendations in the same manner as all other candidates. Stockholders who wish to suggest qualified candidates should send relevant information to the attention of the Corporate Secretary, PC Connection, Inc., 730 Milford Road, Merrimack, New Hampshire 03054 (603-683-2164).

Communicating with the Board of Directors

We have not implemented a process for our stockholders to send communications to our Board of Directors, other than as set out elsewhere in this proxy. We have not done so primarily due to our status as a controlled company, as discussed above.

Code of Business Conduct and Ethics

We have adopted a written Code of Business Conduct and Ethics, which we refer to as the Policy, which applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer, controller, and persons performing similar functions. We have posted our Policy on our website at http://ir.connection.com. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq Stock Market listing standards concerning any amendments to, or waivers from, any provision of the Policy that occur in the future.

11

Employee, Officer and Director Hedging

Our insider trading policy prohibits our employees, officers or directors from engaging in any of the following types of transactions with respect to our securities: short sales, including short sales “against the box”; purchases or sales of puts, calls or other derivative securities; or purchases of financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) or other transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities.

Director Compensation

Each director is entitled to receive an annual retainer of $75,000, payable quarterly, for service on the Board. Each independent director also receives an annual retainer of $20,000, payable quarterly. In addition, Board members who act in a Chair capacity receive annual fees as follows: Board Chair, $35,000; Board Vice-Chair, $45,000; Audit Committee Chair, $10,000; Compensation Committee Chair, $5,000; and sub-committee Chair, $5,000. The Chair and members of the CDC receive fees of $50,000 and $10,000, respectively, for each quarter in which the committee is actively engaged in the process of developing and evaluating strategic alternatives, including the holding of multiple meetings in the quarter.

As more fully described below, the following table describes compensation paid to each director for the year ended December 31, 2023, except for compensation paid to Ms. Gallup, which is reflected below in the Summary Compensation Table for Fiscal Years Ended December 31, 2023, 2022, and 2021.

Director Compensation for Fiscal Year Ended December 31, 2023

| | | |

| | Fees Earned or | |

Name(1) | | Paid in Cash(2) | |

Jay Bothwick | | $ | 140,000 |

Jack Ferguson | | $ | 105,000 |

Barbara Duckett | | $ | 100,000 |

David Beffa-Negrini | | $ | 95,000 |

Gary Kinyon | | $ | 95,000 |

| (1) | As of December 31, 2023, the aggregate number of outstanding stock awards held by each non-employee director were as follows: |

| | |

|

| Aggregate Number of |

Name | | Outstanding Stock Awards |

Jay Bothwick |

| 3,750 |

Jack Ferguson |

| 4,500 |

Barbara Duckett | | 4,500 |

David Beffa-Negrini |

| 4,500 |

Gary Kinyon |

| 2,500 |

| (2) | The fees listed include an annual retainer, an independent director retainer, and varying fees based on participation in Board committees. Board members also are entitled to receive reimbursement for all reasonable expenses incurred in attending Board and committee meetings. |

12

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee of our Board of Directors oversees the design and implementation of our executive compensation program. In this role, the Compensation Committee, which is comprised of two independent directors, evaluates the performance of, and reviews annually all compensation decisions relating to our Chief Executive Officer. Our Chief Executive Officer annually reviews the performance of our other named executive officers and makes recommendations regarding their compensation. Our Compensation Committee may adopt or revise such recommendations in making compensation recommendations for our other named executive officers. Our Board of Directors, after evaluating the recommendations made, will then approve compensation for our executive officers.

At the 2022 Annual Meeting of Stockholders, a majority of stockholder votes were cast to approve on an advisory basis the compensation of our named executive officers as disclosed in our 2022 Proxy Statement. The Compensation Committee noted the affirmative vote on the Company’s executive compensation program as it determined executive officer compensation for 2024.

Our executive officers consist of our Chief Executive Officer, Chief Financial Officer, and Chief Administrative Officer. For 2023, our named executive officers were:

| | ||

Name | Title | ||

Timothy McGrath | President and Chief Executive Officer | ||

Thomas Baker | Senior Vice President, Chief Financial Officer and Treasurer | ||

Patricia Gallup | Chair and Chief Administrative Officer | ||

Compensation Objectives

Our Compensation Committee’s primary objectives with respect to executive compensation are to attract, retain, and motivate our executives and to create long-term stockholder value. Additionally, the Committee seeks to ensure that executive compensation is aligned with our corporate strategies and business objectives, and that it promotes the achievement of key strategic and financial performance measures by linking short- and long-term cash and equity incentives to the achievement of measurable company performance goals.

To achieve these objectives, the Compensation Committee evaluates our executive compensation program with the goal of setting compensation at levels the Compensation Committee believes are competitive with those of other companies in our industry and our region that compete with us for executive talent. In addition, our executive compensation program ties a substantial portion of each executive’s overall compensation to managing their respective areas of responsibility and meeting key strategic, financial, and operational goals. These goals include success in (a) demonstrated leadership ability, (b) management development, (c) compliance with our policies, and (d) anticipation of, and response to, changing market and economic conditions that enhance our ability to operate profitably. From time to time, we also provide a portion of our executive compensation in the form of stock options, RSUs, and other stock-based awards that vest over time, which we believe helps to attract new management talent, as well as retain our existing executives. We believe such grants align our executives’ interests with those of our stockholders by allowing them to participate in the longer-term success of our Company as reflected in stock price appreciation.

We compete with many other companies for executive personnel. Accordingly, the Compensation Committee generally targets overall base salary and cash performance award compensation for executives at or near the midpoint of compensation paid to similarly situated executives of companies analyzed in our survey data, described more fully below. We may adjust this general target in certain situations when necessary, due to the experience level of the individual or other market factors.

13

Components of our Executive Compensation Program

The primary elements of our executive compensation program are:

| ● | base salary; |

| ● | cash performance awards; |

| ● | equity awards; |

| ● | benefits and other compensation; and |

| ● | severance benefits. |

Allocations between long-term and short-term compensation, cash and non-cash compensation, or the different forms of non-cash compensation vary, depending on our current initiatives and stated goals. Our goals for 2023 were focused on continuing the growth trend in consolidated net sales and net income that we established in prior years and, additionally, achieving a better leveraging of our expense structure by attaining our targeted selling, general and administrative, or SG&A, expenses as a percentage of billings. Accordingly, the performance targets for the 2023 Cash Performance Awards were designed to help achieve these two objectives. A total of 60% of the amount payable pursuant to the 2023 Cash Performance Awards was allocated to the achievement of a net income target of $90.2 million, and 40% was allocated to achievement of an SG&A expense target of 10.44% of billings. A multiplier was then applied to each component based on the degree to which the respective target was met or exceeded, ranging from 0.5 to 1.7 for each target. No payment would have been made under the 2023 Cash Performance Awards if net income was less than $81.2 million and SG&A expenses were in excess of 11.48% of billings.

Peer Group

Pearl Meyer & Partners, in its capacity as independent compensation consultant to the Compensation Committee, conducted a competitive assessment of our executive compensation and general compensation programs in 2018. As part of its assessments, Pearl Meyer & Partners provided comparative market data on compensation practices and programs based on an in-depth analysis of peer companies deemed comparable in terms of product and service offerings and/or revenue levels. Also considered in the analysis was broader market survey data reflecting industry- and size-appropriate comparators. Individual compensation ranges for each executive position were provided that compared the compensation ranges to actual salary levels.

The following companies, whose executive positions’ responsibilities were most similar to ours, were included in the peer group:

| ● | Anixter International, Inc. |

| ● | Benchmark Electronics, Inc. |

| ● | CACI International Inc. |

| ● | CDW Corporation |

| ● | ConvergeOne Holdings, Inc. |

| ● | ePlus, Inc. |

| ● | Insight Enterprises, Inc. |

| ● | ManTech Int’l Corporation |

| ● | NETGEAR, Inc. |

| ● | Presidio, Inc. |

| ● | ScanSource, Inc. |

| ● | Unisys Corporation |

The Compensation Committee used the survey data provided by Pearl Meyer & Partners in 2018 to assist it in the review and comparison of each element of executive compensation, including base salary, cash performance award compensation, and other long-term incentive vehicles for our executives. With this information, the Compensation Committee analyzed compensation for each executive. The Compensation Committee targeted different compensation levels for each element of compensation as described below.

14

In 2023, our Compensation Committee engaged Pearl Meyer & Partners to serve as its independent compensation consultant and to conduct an updated competitive assessment of our executive compensation program. The results of this updated assessment were delivered to our Compensation Committee in November 2023 and included market data on the compensation practices and programs of companies deemed comparable in terms of product and service offerings and/or revenue levels. The companies included in the assessment were as follows:

| ● | Alteryx, Inc. |

| ● | Applied Industrial Technologies, Inc. |

| ● | Benchmark Electronics, Inc. |

| ● | CACI International Inc. |

| ● | CDW Corporation |

| ● | CommScope Holding Company, Inc. |

| ● | Diebold Nixdorf, Incorporated |

| ● | Envestnet, Inc. |

| ● | ePlus, Inc. |

| ● | Global Industrial Company |

| ● | Insight Enterprises, Inc. |

| ● | RingCentral, Inc. |

| ● | ScanSource, Inc. |

| ● | Thoughtworks Holding, Inc. |

| ● | Xerox Holdings Corporation |

We expect that our Compensation Committee will use the information provided by Pearl Meyer & to inform its compensation decisions and recommendations in 2024. Our Compensation Committee has assessed the independence of Pearl Meyer & Partners consistent with SEC rules and Nasdaq listing standards and has concluded that the engagement of Pearl Meyer & Partners did not raise any conflicts of interest that would prevent these consultants from independently advising our Compensation Committee.

Base Salary

Base salaries are reviewed at least annually by the Compensation Committee, and in the case of named executive officers other than our Chief Executive Officer, are based on recommendations of the Chief Executive Officer. These salaries are adjusted from time to time to realign salaries with current market levels after taking into account individual responsibilities, performance, experience, and the peer group data.

The Compensation Committee reviews the base salaries of our executives initially by reference to the median base salary level of the Pearl Meyer & Partners survey data. The Compensation Committee then makes adjustments to these reference levels for each executive’s base salary based on comparisons to the survey data and evaluation of the executive’s level of responsibility and experience, as well as company-wide performance. The Compensation Committee also considers the executive’s success in achieving business results and demonstrating leadership in determining actual base salary levels.

In 2023, there were no changes in the base salaries of our three executive officers.

The compensation levels of our executives are established to recognize the relative level of responsibility of each executive. Our Chief Executive Officer’s compensation is higher than the levels of our other executives in order to reflect the generally broader and more significant level of responsibility of our Chief Executive Officer. We found that the 2018 compensation survey results generally reflected this pattern for most companies.

The Compensation Committee believes that periodically benchmarking and aligning base salaries based on the results of these benchmarks is critical to a competitive compensation program. Other elements of compensation are affected by changes in base salary. Annual incentives are targeted and paid out as a percentage of base salary, and the target levels of long-term incentives are also determined as a percentage of base salary.

15

Executive Cash Performance Awards

In 2023, our Board, upon the recommendation of the Compensation Committee, approved the 2023 Cash Performance Awards issued pursuant to the 2020 Stock Incentive Plan. Annual cash performance awards are intended to compensate our executives for the achievement of certain financial performance goals. In 2023, our Board, upon the recommendation of the Compensation Committee, selected company-wide net income and expense leverage goals as the financial performance goals for 2023 with target payments determined based on a percentage of the executive officer's base salary. The Compensation Committee and our Board believe that our success is dependent on the ability of our management group to integrate and work together to meet common company-wide goals. Accordingly, the financial performance goals for 2023 were based on company-wide financial results and not individual goals.

The target payout amounts under the 2023 Cash Performance Awards were equal to 100% of base salary for our Chief Executive Officer and Chief Financial Officer and 75% of base salary for our Chief Administrative Officer. The 2023 Cash Performance Awards also provided incentives for our executives to reach beyond their target corporate goals. If performance exceeded the financial performance goals, the 2023 Cash Performance Awards provided that the executive officers could receive cash payments of up to 170% of their base salary. Proportionally lower payments could be made under the 2023 Cash Performance Awards for achievement levels between 90% and 100% of the financial performance goals, and no amounts would have been paid where less than 90% of the financial performance goal was achieved. In February 2023, our Board, upon the recommendation of our Compensation Committee, approved the following financial performance goals for the 2023 Cash Performance Awards: (i) a consolidated net income goal of $90.2 million for 2023, reflecting our growth target for the year and (ii) an expense leverage goal to limit 2023 consolidated SG&A expenses as a percentage of billings at 10.44%.

In 2023, our net income was $83.3 million and SG&A expense as a percentage of billings was 11.03%. This resulted in 92.3% achievement of the net income goal, resulting in a payout of 50% of target level for that performance factor, and 94.3% achievement of the SG&A expense as a percentage of billings goal, resulting in a payout of 50% of target level for that performance factor. Accordingly, we paid our named executive officers an aggregate of $1.0 million pursuant to their 2023 Cash Performance Awards.

The table below details the payments made to each of our named executive officers pursuant to their respective 2023 Cash Performance Awards:

| | | | | | |

|

| 2023 Cash Performance |

| | ||

Name of Executive | | Award Payouts | | Percentage of Base Salary | ||

Timothy McGrath | | $ | 632,500 |

| 50 | % |

Thomas Baker | | $ | 206,250 | | 50 | % |

Patricia Gallup | | $ | 122,625 |

| 38 | % |

Equity Awards

Our equity award program is a vehicle for offering long-term incentives to our executives. We believe that equity grants help attract management talent and provide a strong link to our long-term performance and help to align the interests of our executives and our stockholders. In addition, the vesting feature of our equity grants furthers our goal of executive retention by providing an incentive to our executives to remain as our employees during the vesting period. In determining the size of equity grants to our executives, the Compensation Committee and the Chief Executive Officer consider comparative share ownership of executives in our compensation peer group, our company-wide performance, the applicable executive’s performance, the amount of equity previously awarded to the executive, the vesting of such awards, and the recommendation of management.

Our equity awards have typically taken the form of RSUs. The Compensation Committee and our Chief Executive Officer review all components of the executive’s compensation when determining equity awards to ensure that an executive’s total compensation conforms to our overall philosophy and objectives.

16

Stock options, when granted, have a ten-year life, and vesting and exercise rights cease shortly after termination of employment except in the case of death or disability. We do not have any equity ownership guidelines for our executives.

Benefits and Other Compensation

We maintain broad-based benefits that are provided to all employees, including health and dental insurance, life and disability insurance, and a 401(k) plan. Executives are eligible to participate in all of our employee benefit plans, in each case on the same basis as other employees. We provide a matching contribution equal to 50% of the employee’s deferral contributions to the 401(k) plan that does not exceed 6% of their qualified compensation.

No executive officer received perquisites with an aggregate value in excess of $10,000 in 2023.

Severance Benefits

Pursuant to the incentive and retention agreements we have entered into with Mr. McGrath and Mr. Baker, each is entitled to severance payments for twenty-four months if the Company terminates the executive’s employment other than for cause (as defined in the incentive and retention agreements), subject to a dollar-for-dollar reduction for cash compensation he may receive pursuant to any employment or consulting arrangement in such twenty-four months period. In addition, each is entitled to receive an amount in respect of his annual target payout under the 2020 Stock Incentive Plan (assuming achievement of 100% of target payout) prorated for the number of days he is employed for the year in which termination of employment occurs, such amount payable in a lump sum on the date the first installment of severance is paid. In the event of a change in control (as defined in the incentive and retention agreements), each is entitled to additional severance payments and certain other specified benefits, including the payment of COBRA continuation coverage costs otherwise payable by Mr. McGrath and Mr. Baker for a period of twenty-four months, in the event of termination of their employment under specified circumstances. We have provided more detailed information about these benefits, along with estimates of their value under various circumstances, under the caption “Potential Payments Upon Termination or Change in Control” below.

We believe providing these benefits helps us compete for executive talent. After reviewing the practices of companies represented in our peer group, we believe that our severance and change of control benefits are generally in line with severance packages offered to executives at such companies.

Tax and Accounting Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended, which we refer to as the Code, generally disallows a tax deduction to public companies for compensation in excess of $1 million paid in any one year to each of certain of the company’s current and former executive officers.

We account for equity compensation awarded to our employees per the methods prescribed by ASC 718, which require us to recognize compensation expense in our financial statements for all share-based payments based upon an estimate of their fair value over the service period of the award. We record cash compensation as an expense at the time the obligation is accrued. We believe that the accounting impact of the different forms of equity compensation awards generally reflects their economic impact. Accordingly, the underlying accounting treatment is not a material consideration in determining the specific nature or size of equity awards granted. The tax impact of the awards on the recipient and the effectiveness of the award in retaining executives are more relevant considerations.

17

Executive Compensation

The following table sets forth compensation information for our Chief Executive Officer, Chief Financial Officer, and our other most highly compensated executive officer who served as an executive officer during 2023, who were collectively our named executive officers for 2023.

Summary Compensation Table for Fiscal Years Ended December 31, 2023, 2022 and 2021

| | | | | | | | | | | | | |

| | | | | | | | Non-Equity | | |

| | |

| | | | | | | | Incentive | | | | | |

| | | | | | Stock | | Plan | | All Other | | | |

| | | | Salary | | Awards(1) | | Compensation(2) | | Compensation(3) | | Total | |

Name and Principal Position | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | |

Timothy McGrath |

| 2023 | | 1,265,000 | | — | | 632,500 | | 18,364 | (5) | 1,915,864 | |

President and Chief Executive Officer |

| 2022 | | 1,176,539 | (4) | 2,165,200 | | 1,437,040 | | 9,150 | (6) | 4,787,929 | |

|

| 2021 | | 1,150,000 | | 887,200 | | 1,163,800 | | 8,550 | (7) | 3,209,550 | |

| | | | | | | | | | | | | |

Thomas Baker |

| 2023 | | 412,500 | | — | | 206,250 | | 18,364 | (5) | 637,114 | |

Senior Vice President, Chief Financial |

| 2022 | | 383,654 | (8) | 1,082,600 | | 468,600 | | 17,026 | (6) | 1,951,880 | |

Officer and Treasurer |

| 2021 | | 375,000 | | 1,926,600 | | 379,500 | | 8,700 | (7) | 2,689,800 | |

| | | | | | | | | | | | | |

Patricia Gallup |

| 2023 | | 327,000 | | — | | 122,625 | | 119,900 | (5) | 569,525 | |

Chief Administrative Officer and |

| 2022 | | 327,000 | | — | | 278,604 | | 119,150 | (6) | 724,754 | |

Chairman of the Board |

| 2021 | | 327,000 | | 221,800 | | 248,193 | | 118,550 | (7) | 915,543 | |

| (1) | Valuation represents the aggregate grant date fair value of the stock awards granted each year computed in accordance with ASC 718. Please see Note 10, “Stockholders’ Equity and Share-Based Compensation” of our Notes to Consolidated Financial Statements of our Annual Report on Form 10-K for the year ended December 31, 2023, for further information regarding share-based compensation. |

Each RSU represents the right to receive one share of Common Stock upon vesting.

| (2) | Non-equity incentive compensation for our executive officers was awarded pursuant to the 2020 Stock Incentive Plan, upon the achievement of company-wide net income and expense leverage goals. |

| (3) | We have omitted perquisites and other personal benefits in those instances where the aggregate amount of such perquisites and other personal benefits for a named executive officer totaled less than $10,000. |

| (4) | Effective October 1, 2022, Mr. McGrath’s annual salary was increased from $1,150,000 to $1,265,000, and the salary presented above includes the pro-rated increase. |

| (5) | Consists of: (a) our contributions for Messrs. McGrath and Baker and Ms. Gallup under our 401(k) Plan each in the amount of $9,900; (b) other compensation for Messrs. McGrath and Baker each in the amount of $8,464; and (c) $110,000 in Director fees for Ms. Gallup. |

| (6) | Consists of: (a) our contributions for Messrs. McGrath and Baker and Ms. Gallup under our 401(k) Plan in the amounts of $9,150, $8,700, and $9,150, respectively; (b) $8,326 in other compensation for Mr. Baker; and (c) $110,000 in Director fees for Ms. Gallup. |

| (7) | Consists of: (a) our contributions for Messrs. McGrath and Baker and Ms. Gallup under our 401(k) Plan in the amounts of $8,550, $8,700, and $8,550, respectively; and (b) $110,000 in Director fees for Ms. Gallup. |

| (8) | Effective October 1, 2022, Mr. Baker’s annual salary was increased from $375,000 to $412,500, and the salary presented above includes the pro-rated increase. |

18

Grants of Plan-Based Awards

The following table sets forth certain information regarding grants of plan-based awards made to our named executive officers during 2023.

Grants of Plan-Based Awards for Fiscal Year Ended December 31, 2023

| | | | | | | | | | | | |

| | | | Estimated Future Payouts Under |

| |||||||

|

| Grant |

| Non‑Equity Incentive Plan Awards(1) |

| |||||||

Name | | Date | | Threshold |

| Target |

| Maximum | | |||

Timothy McGrath |

| 2/9/2023 | | $ | 632,500 | | $ | 1,265,000 | | $ | 2,150,500 | |

Thomas Baker |

| 2/9/2023 | | $ | 206,250 | | $ | 412,500 | | $ | 701,250 | |

Patricia Gallup | | 2/9/2023 | | $ | 163,500 | | $ | 327,000 | | $ | 555,900 | |

| (1) | Threshold, target, and maximum amounts are based on the achievement of certain financial milestones, which are described above. All non-equity incentive plan awards listed were made under the 2020 Stock Incentive Plan. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information regarding outstanding equity awards held by our named executive officers as of December 31, 2023.

Outstanding Equity Awards at Fiscal Year Ended December 31, 2023

| | | | | | |

| | Stock Awards |

| |||

|

| |

| Market |

| |

| | Number of | | Value of |

| |

| | Shares or | | Shares or |

| |

| | Units of | | Units of |

| |

| | Stock That | | Stock That |

| |

| | Have Not | | Have Not |

| |

Name | | Vested | | Vested(1) |

| |

Timothy McGrath |

| 16,000 | (2) | $ | 1,075,360 | |

|

| 34,000 | (3) | $ | 2,285,140 | |

| | 40,000 | (4) | $ | 2,688,400 | |

| | 15,000 | (5) | $ | 1,008,150 | |

| | 10,000 | (6) | $ | 672,100 | |

| | 30,000 | (7) | $ | 2,016,300 | |

| | | | | | |

Thomas Baker | | 10,000 | (8) | $ | 672,100 | |

| | 10,000 | (9) | $ | 672,100 | |

| | 15,000 | (10) | $ | 1,008,150 | |

| | | | | | |

Patricia Gallup |

| 2,000 | (11) | $ | 134,420 | |

| | 2,500 | (12) | $ | 168,025 | |

| (1) | The fair value of RSUs was based on the closing price of our Common Stock on December 31, 2023 of $67.21 per share. |

| (2) | The RSUs granted to Mr. McGrath in October 2014 vest according to the following schedule: 8,000 units will vest on each of September 1, 2024 and September 1, 2025. |

| (3) | The RSUs granted to Mr. McGrath in March 2016 vest according to the following schedule: 12,000 units will vest on September 1, 2024; 7,000 units will vest on September 1, 2025; 10,000 units will vest on September 1, 2026; and 5,000 units will vest on September 1, 2027. |

| (4) | The RSUs granted to Mr. McGrath in February 2018 vest over six years in equal annual installments of 10,000 units, the first installment of which vested on April 1, 2022. |

19

| (5) | The RSUs granted to Mr. McGrath in October 2019 vest over seven years in equal annual installments of 5,000 units, the first installment of which vested on October 29, 2020. |

| (6) | The RSUs granted to Mr. McGrath in December 2021 vest over four years in equal annual installments of 5,000 units, the first installment of which vested on December 17, 2022. |

| (7) | The RSUs granted to Mr. McGrath in November 2022 vest over four years in equal annual installments of 10,000 units, the first installment of which vested on November 21, 2023. |

| (8) | The RSUs granted to Mr. Baker in February 2021 vest over four years in equal annual installments of 5,000, the first installment of which vested on February 23, 2022. |

| (9) | The RSUs granted to Mr. Baker in December 2021 vest over four years in equal annual installments of 5,000, the first installment of which vested on December 17, 2022. |

| (10) | The RSUs granted to Mr. Baker in November 2022 vest over four years in equal annual installments of 5,000, the first installment of which vested on November 21, 2023. |

| (11) | The RSUs granted to Ms. Gallup in February 2018 for her service on the Board of Directors vest annually in six equal installments of 500 units, the first installment of which vested on September 1, 2022. |

| (12) | The RSUs granted to Ms. Gallup in December 2021 for her service on the Board of Directors vest annually in four equal installments of 1,250 units, the first installment of which vested on December 17, 2022. |

Options Exercised and Stock Vested

No options were exercised during 2023. The following table sets forth certain information regarding RSUs held by our named executive officers that vested during 2023.

| | | | | | |

| | Stock Awards | | |||

| | Number of Shares | | Value Realized | | |

Name | | Acquired on Vesting | | on Vesting(1) | | |

Timothy McGrath |

| 55,000 | | $ | 3,075,850 | |

Thomas Baker | | 23,750 | | $ | 1,269,575 | |

Patricia Gallup(2) | | 1,750 | | $ | 111,213 | |

| (1) | The value realized on vesting equals the number of shares acquired multiplied by the closing price of our Common Stock on the applicable vesting date. |

| (2) | The RSUs were awarded to Ms. Gallup for her service on the Board of Directors. |

CEO Pay Ratio Disclosure

Following is a reasonable estimate, prepared under applicable SEC rules, of the ratio of the annual total compensation of our Chief Executive Officer to the median of the annual total compensation of our other employees. We determined our 2023 median employee for this Proxy Statement based on base pay/cash compensation/W-2 wages actually paid during 2023 (annualized in the case of full- and part-time employees who joined the Company during 2023) to each of our 2,702 employees (excluding the Chief Executive Officer) as of December 31, 2023. The annual total compensation of our 2023 median employee (other than the Chief Executive Officer) for 2023 was $75,159. As disclosed in the Summary Compensation Table appearing on page 18, our Chief Executive Officer’s annual total compensation for 2023 was $1,915,864. Based on the foregoing, our estimate of the ratio of the annual total compensation of our CEO to the median of the annual total compensation of all other employees was approximately 25 to 1 for 2023. Given the different methodologies that various public companies will use to determine an estimate of their pay ratio, the estimated ratio reported above should not be used as a basis for comparison between companies.

20

Pay Versus Performance

Pay Versus Performance Table

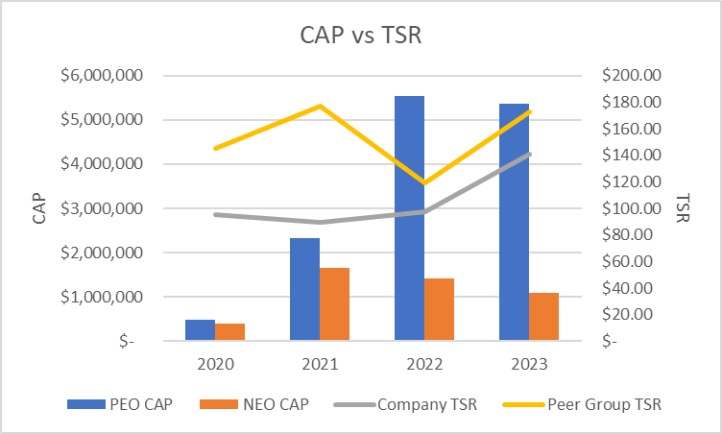

The following tables and related disclosures provide information about (i) the total compensation of our principal executive officer, or PEO, and our other named executive officers, or NEOs, as presented in the Summary Compensation Table on page 18, or the SCT Amounts, (ii) the compensation actually paid to our PEO and NEOs, as calculated pursuant to the SEC’s pay-versus-performance rules, or the CAP Amounts, (iii) certain financial performance measures, and (iv) the relationship of the CAP Amounts to those financial performance measures.

This disclosure has been prepared in accordance with Item 402(v) of Regulation S-K under the Exchange Act and does not necessarily reflect value actually realized by the executives or how our Compensation Committee evaluates compensation decisions in light of company or individual performance. For discussion of how our Compensation Committee seeks to align pay with performance when making compensation decisions, please review Compensation Discussion and Analysis beginning on page 13.

| | | | | | | | | | | | | | | | | |

| | | | | | Average | | | | | | | | | | | |

| | | | | | Summary | | Average | | | | | | | | | |

| | | | | | Compensation | | Compensation | | Value of Initial Fixed $100 | | | | | | ||

| | Summary | | | | Table Total for | | Actually Paid to | | Investment Based on: | | | | | | ||

| | Compensation | | Compensation | | Non-PEO Named | | Non-PEO Named | | Total | | Peer Group Total | | | | SG&A | |

| | Table Total | | Actually Paid | | Executive | | Executive | | Shareholder | | Shareholder | | Net | | Percentage of | |

Year | | for PEO(1) ($) | | to PEO(2) ($) | | Officers(1) ($) | | Officers(2) ($) | | Return (TSR) ($) | | Return(3) ($) | | Income ($) | | Billings(4) | |

2023 | | 1,915,864 | | 5,357,164 | | 603,320 | | 1,096,862 | | 140.87 | | 172.77 | | 83,271,000 | | 11.03 | % |

2022 | | 4,787,929 | | 5,547,279 | | 1,338,317 | | 1,416,376 | | 97.66 | | 119.45 | | 89,219,000 | | 10.46 | % |