UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-08549

Oak Associates Funds

(Exact name of registrant as specified in charter)

3875 Embassy Parkway, Suite 250

Akron, Ohio 44333

(Address of principal executive offices) (Zip code)

Charles A. Kiraly

3875 Embassy Parkway, Suite 250

Akron, Ohio 44333

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-462-5386

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

OAK ASSOCIATES FUNDS

This Page Intentionally Left Blank

At Oak, we believe the sustainable long-term growth for investors is best achieved through a concentrated focus on companies and sectors. Our high-conviction stock selection process centers on identifying multiple drivers of growth and engaging in fundamental research to uncover the right businesses within the right sectors. We then take meaningful positions - targeting unrealized value and seeing long-term capital appreciation independent of typical index results.

Dual-Concentrated Investment Approach

Long-term fundamental and multi-cycle analysis to uncover the highest

conviction sectors and holdings fueled by multiple drivers of growth.

SECTOR GROWTH DRIVERS

COMPANY GROWTH DRIVERS

Quantitative Screens ▲

Management Strength & Track Report ▲

MOAT+ Competitive Advantage ▲

Business Sustainability & Pricing Power ▲

Market Position & Leadership ▲

Long-term Earnings Growth ▲

Our Top-Down approach identifies Favorable Sectors in which to invest,

while our Bottom-Up approach finds Attractive Stocks within those Favorable Sectors.

|

| TABLE of CONTENTS |

|

| Shareholder Letter | 1 |

| | |

| Performance Update | |

| | |

| White Oak Select Growth Fund | 4 |

| | |

| Pin Oak Equity Fund | 6 |

| | |

| Rock Oak Core Growth Fund | 8 |

| | |

| River Oak Discovery Fund | 10 |

| | |

| Red Oak Technology Select Fund | 12 |

| | |

| Black Oak Emerging Technology Fund | 14 |

| | |

| Live Oak Health Sciences Fund | 16 |

| | |

| Important Disclosures | 18 |

| | |

| Disclosure of Fund Expenses | 21 |

| | |

| Financial Statements | |

| | |

| Schedules of Investments | 23 |

| | |

| Statements of Assets & Liabilities | 44 |

| | |

| Statements of Operations | 46 |

| | |

| Statements of Changes in Net Assets | 48 |

| | |

| Financial Highlights | 54 |

| | |

| Notes to Financial Statements | 58 |

| | |

| Report of Independent Registered Public Accounting Firm | 70 |

| | |

| Additional Information | 71 |

November 23, 2022

Dear Fellow Shareholders,

During the past fiscal year, the world progressed to live with the Coronavirus. Two years into the pandemic and with immunity levels creeping higher, through inoculations or infection, a return to normalcy was well underway. The realities of the post-pandemic economy, however, have had significant implications for the domestic US stock market. Steps to contain inflation, repair supply chains, replenish the labor force, and access affordable energy have presented challenges for global policymakers. Changes in interest rates and to other monetary constraints have pressured equity market valuations and increased risk aversion.

In the United States, after opting for a more tolerant perspective on rising prices throughout 2021, the Federal Reserve finally acted to curtail inflation in March 2022. It has since embarked on a broad plan to raise interest rates, constrain the money supply, deleverage its balance sheet and ultimately to cool the economy. The aggressive tightening cycle has pressured stocks and increased the risks of a deeper economic recession.

The US government’s policy response to the economic uncertainties of a global pandemic were understandable. Politicians’ actions to support employment through the Paycheck Protection Program and to provide direct stimulus to consumers, via the CARES Act, certainly helped stabilize the economy. However, once disrupted supply chains collided with consumers eager to move beyond the pandemic, inflation developed. Economists had expected rising prices to abate once production activity normalized and the labor force recovered. Inflation was thus characterized as being transitory rather than persistent. This assessment changed once Russia invaded Ukraine in February 2022 and global energy and food prices soared. Energy prices have an insidious way of affecting various industries, from fuel cost, feedstock for manufacturing, fertilizer for food, and utilities power generation. The Federal Reserve finally admitted it could no longer remain passive.

In March 2022, the US Central Bank launched into a series of interest rate increases to suppress inflation and slow economic activity. While its actions were foreseen and telegraphed, US equities struggled in the face of rising recession risk, the War in Ukraine and any potential contagion, and the severity of the rate hikes. Regardless of whether the tighter cycle produces a recession, a mid-cycle slowdown, or a soft landing, stocks do not like a contracting economy. Higher interest rates lower valuation multiples, while also creating a problem for earnings growth. A string of four consecutive 75-basis point increases were unprecedented and the Fed Funds rate rocketed from 0.25% to 4% in just 10 months. In turn, mortgage rates also surged, topping 7% by October 2022. This has had a sharp effect on home sales, affordability, and mortgage applications.

Exacerbating the inflation predicament was a contraction in the labor force during the pandemic. For a variety of reasons, from health concerns, immigration policies, pay structures, self-employment trends and demographics, the size of the US labor force fell sharply and has not fully returned to pre-Covid levels. Competition for workers has added wage pressure to the inflationary cycle. While a low unemployment rate typically reflects a healthy economy, it has also permitted the Federal Reserve to pursue a more aggressive tightening strategy. Since the Federal Reserve’s dual mandate is to promote full employment AND stable prices, the tight labor market has enabled it to attack inflation with less fear of driving serious unemployment. Policy makers hope that since

| 1-888-462-5386 | www.oakfunds.com | 1 |

businesses had been struggling to hire and retain employees, they may be reluctant to execute layoffs as in previous recessions. Thus far, unemployment claims suggest they may be correct.

A meaningful shift in the monetary backdrop has also had significant implications for investors. With the arrival of inflation, the program of Quantitative Easing (QE), or the purchasing of assets to provide liquidity and sustain artificially low interest rates, has been retired. The new de facto tightening should reduce the velocity of money and contract the money supply, helping remove the fuel for inflation. For the past two decades, however, QE has also provided inadvertent support for asset prices and facilitated risk. With the end of easy money and cheap financing, investors’ tolerance for stocks with long paths to profitability has faltered. This caused high beta, unprofitable, and highly-leveraged businesses to underperform during the fiscal year. Our investment philosophy tends to avoid unprofitable companies and those with high leverage, but the shift in risk aversion caused a contagion of equity market weakness.

The sharp increase in interest rates and new monetary environment has been painful for asset prices. Apart from equity market weakness, bond investors have also experienced one of their worst years on record. The iShares 20-Year Treasury Bond Fund, which tracks US Treasuries with maturity beyond 20 years, has dropped 33% during the fiscal year. Real estate investors are feeling the pain of higher lending rates and a series of consecutive monthly drops in home prices. Commercial real estate vacancy rates are also high due to enduring work-from-home trends. Thus far, the labor market remains tight, although the weakness in housing has damped consumer confidence. Unemployment at 3.57% is near 50-year lows and the number of jobs available per unemployed individual is still elevated. Meanwhile, the JOLTS Index, which measures job openings and turnover, has dropped slightly, but has yet to confirm new slack in the labor market. We continue to watch these data series closely to gauge the Federal Reserve’s success and whether the slowdown will accelerate into a severe recession.

Towards the end of the fiscal year, the stubbornly-high consumer price index (CPI) for Goods, excluding energy, did show some moderation, although the Service series remains high and both are well above the 2-3% target levels. The initial drop in CPI Goods has fueled optimism that the Federal Reserve is closer to pausing its restricting actions, or even pivoting to being accommodative in order to avoid a recession. This prognostication may prove premature until further data confirming sustained progress against rising prices emerges. Until then the final determination of whether the Federal Reserve’s economic tightening will produce a recession remains outstanding.

Looking into 2023, the outlook for equities depends on a tapering of the Federal Reserve’s aggressive rate increase strategy. The restrictive fiscal and monetary conditions are difficult; however, the market’s fiscal year decline reflects the discounting of the new environment. Valuations have been lowered and expectations reset. The US economy has always been driven by the consumer. Success against inflation and a continued strong labor market would be positive for consumer confidence and spending. A decline in mortgage rates would also recharge the housing and construction sector. Given the severity of tightening measures already in the economic pipeline, we do believe that it is probable CPI and inflation have likely peaked and should continue to trend lower in 2023, albeit not always in a straight line. To endure the uncertainty, our approach has been to focus on companies with strong market positions and profitability. We naturally

| 2 | Annual Report | October 31, 2022 |

tend to avoid companies with high levels of leverage, or interest expense burdens, as we feel these are incremental constraints to diminish profits or create refinancing risk. We continue to favor those sectors with secular trends and shareholder-friendly practices.

Thank you for your investment in the Oak Associates Funds.

With regards,

Robert Stimpson, CFA

Co-Chief Investment Officer & Portfolio Manager

Oak Associates Funds

| 1-888-462-5386 | www.oakfunds.com | 3 |

| White Oak Select Growth Fund |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

White Oak Select Growth Fund (the “Fund”) fell 23.43% for the fiscal year ended October 31, 2022, while the S&P 500 Index dropped 14.61% and the Morningstar Large Blend Category declined 14.48%. Over the last ten years, the Fund has risen an average of 11.22% per year compared to 11.44% in its Large-Blend peer group.

The US stock market fell sharply during the fiscal year as the Federal Reserve (the “Fed”) launched a series of historic interest rate increases to tackle persistent inflation which developed as the global Coronavirus pandemic receded. The Fed has increased the overnight lending rate from 0.25% to 4.00% in just eight months, including four consecutive three-quarter point rate increases. It has also ended its practice of buying treasuries, or quantitative easing, to sustain a low interest rate environment. The efforts to constrain economic activity have weighed on US stocks and fueled fears of both an economic recession and policy mistake.

Within the US equity markets, a high exposure to energy stocks was necessary to outperform the S&P 500. The Russian invasion of Ukraine in February 2022 sent oil and natural gas prices soaring, adding to inflationary pressures and boosting profits for Energy companies. The S&P 500 Energy sector rose 65% during the fiscal year. Due to secular concerns over oil prices and geopolitical factors that may seek to strategically suppress oil prices, the portfolio has been underweight on energy, which hurt performance this year.

During the fiscal year, Amazon.com was the largest contributor to the Fund’s fiscal year decline due to its position as the largest holding. The online retailer was hurt by fears of a recession and overall consumer spending as regulators sought to slow the economy. The Fund’s worst performer was Meta Platforms, formerly known as Facebook. Sectors seen as pandemic beneficiaries, such as social media, were disproportionally hurt this past year as this thematic trade reversed. Despite strong profitability and valuation support, Meta was also penalized for its heavy investment into its Reality Lab, the division researching virtual reality products and development of the metaverse. These opportunities may take years before reaching profitability and investors have expressed their disappointment in CEO Mark Zuckerberg’s fiscal discipline given the economic uncertainty.

Amgen was the Fund’s best performing company during the fiscal year. The biotechnology giant benefited from stable growth and an attractive valuation. A return to “business-as-usual” has been slower for health care companies, but the sector’s defensive characteristics have helped it to outperform. Insurance company Chubb was also a strong performer. The company has benefited from pricing trends due to the strong labor market and rising inflation.

Looking to 2023, we believe the Fed will continue to constrain the economy in an effort to push inflation back to target levels and hopes to do so without driving unemployment. Given the difficulties businesses have had retaining and hiring employees, this economic contraction may avoid the increase in unemployment rate which usually develops. Since workers are consumers, this would be good for the economy. Only time will tell if the Fed’s actions successfully contain inflation or if they inadvertently trigger a deeper recession. Given these headwinds, we believe that high-quality growth stocks are an attractive market segment to weather both the inflation threat and economic uncertainty.

Thank you for your investment with the Oak Associates Funds.

| 4 | Annual Report | October 31, 2022 |

| White Oak Select Growth Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | WOGSX | | 1 | Alphabet, Inc. | 14.5% |

| Share Price | $105.61 | | 2 | Amazon.com, Inc. | 10.0% |

| Total Net Assets | $321.4M | | 3 | Charles Schwab Corp. (The) | 9.3% |

| Portfolio Turnover | 10% | | 4 | Amgen, Inc. | 6.9% |

| | | | 5 | Cisco Systems, Inc. | 6.9% |

| Sector Allocation^ | | | 6 | Chubb Ltd. | 6.1% |

| Health Care | 25.7% | | 7 | KLA Corp. | 5.8% |

| Technology | 22.2% | | 8 | Lowe’s Companies, Inc. | 5.5% |

| Financials | 21.7% | | 9 | JPMorgan Chase & Co. | 5.4% |

| Consumer Discretionary | 15.5% | | 10 | QUALCOMM, Inc. | 4.5% |

| Communications | 12.9% | | | | |

| Cash & Other Assets | 2.0% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| White Oak Select Growth Fund | -23.43% | 5.84% | 7.51% | 11.22% |

| S&P 500® Total Return Index1 | -14.61% | 10.22% | 10.44% | 12.79% |

| Morningstar Large Blend Category Average2 | -14.48% | 8.98% | 9.03% | 11.44% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.89%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 0.91%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 5 |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

Pin Oak Equity Fund (the “Fund”) declined 24.95% for the fiscal year ended October 31, 2022, while the broad Morningstar US Market Total Return Index fell 16.78% and the Morningstar Large Blend Category lost 14.48%. Over the last ten years, the Fund has added an average of 10.45% per year.

In March 2022, the Federal Reserve (the “Fed”) began a series of interest rate increases in an effort to slow the economy and combat stubbornly rising prices. Inflation developed after the accommodative fiscal and monetary policies enacted during the pandemic to support the economy, crashed into compromised supply chains and tight labor markets. In addition to instituting restrictive interest rates, the Fed tapered its quantitative easing program, incrementally constraining the money supply to dampen inflationary pressures.

US equities struggled under the series of historic interest rate hikes and the prospects of a restrictive environment. With national unemployment rates at low levels, the Fed estimates there is sufficient room to slow economic activity without compromising its dual mandate to promote employment. The strategy however, has increased concerns of a policy mistake that could drive the economy into a deep recession. The combination of a slowing economy, rising recession risk, and soaring mortgage rates have weighed on stocks and investor sentiment.

Social media company, Meta Platforms, formerly known as Facebook, was the Fund’s worst performer. Its stock fell after advertising policy changes at Apple might affect how companies share information on various operating system platforms. Investors have also expressed disappointment in the company’s aggressive spending on virtual reality projects at its Reality Labs division. While Meta’s core business can reportedly support such R&D investment, there is a long trajectory to profitability and investors are generally less tolerant of excessive spending due to the economic slowdown. Online betting company DraftKings, was the second worst performer. The investment thesis for DraftKings is dependent upon the expansion of online gaming. While some states have approved online sports betting, the economic pressures that tend to accelerate the expansion of gaming initiatives did not occur during the pandemic as expected. As a result, DraftKings customer acquisition costs remain high and national availability has yet to arrive. The stock was sold during the fiscal year due to the protracted development of the opportunity.

The Fund’s best performing holding was McKesson Corp. The pharmaceutical distribution company benefited from its stable business model and a “return to normal” within the healthcare industry. Additionally, agreements to settle litigation stemming from the opioid epidemic helped to remove a large legal uncertainty and provided clarity for investors. Amgen was the Fund’s second-best performer, due to a strong combination of attractive valuation and the company’s diversified approach to the growth in biotechnology and biological treatments.

Despite our expectations for continued volatility, the health of the US consumer and labor market could counter the economic constraints imposed by the Fed’s change to monetary policy. Progress towards thwarting inflation, while also avoiding an increase in unemployment, could both shorten and soften the economic contraction. Yet, the Fed’s actions and the economy’s ability to endure the tightening efforts remains indeterminate. We continue to focus on companies we believe are best situated to weather the uncertainty and those able to capitalize on the investment environment.

Thank you for your investment with the Oak Associates Funds.

| 6 | Annual Report | October 31, 2022 |

| Pin Oak Equity Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | POGSX | | 1 | Alphabet, Inc. – Class C | 11.7% |

| Share Price | $65.24 | | 2 | McKesson Corp. | 9.0% |

| Total Net Assets | $125.3M | | 3 | Amazon.com, Inc. | 8.4% |

| Portfolio Turnover | 15% | | 4 | Charles Schwab Corp. (The) | 7.6% |

| | | | 5 | Amdocs Ltd. | 5.6% |

| Sector Allocation^ | | | 6 | Gentex Corp. | 5.3% |

| Health Care | 24.7% | | 7 | Visa, Inc. – Class A | 5.2% |

| Technology | 24.0% | | 8 | KLA Corp. | 4.7% |

| Consumer Discretionary | 16.9% | | 9 | Assurant, Inc. | 4.2% |

| Financials | 15.2% | | 10 | Paychex, Inc. | 4.1% |

| Communications | 13.3% | | | | |

| Industrials | 2.0% | | | | |

| Energy | 1.2% | | | | |

| Cash & Other Assets | 2.7% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

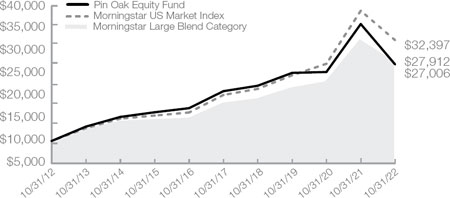

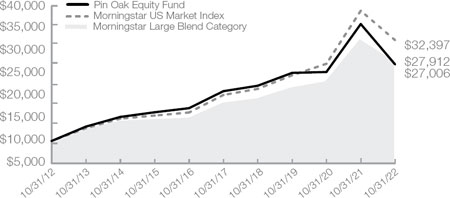

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| Pin Oak Equity Fund | -24.95% | 2.43% | 5.10% | 10.45% |

| Morningstar US Market Index1 | -16.78% | 9.63% | 9.88% | 12.47% |

| Morningstar Large Blend Category Average1 | -14.48% | 8.98% | 9.03% | 11.44% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.91%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 0.95%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 7 |

| Rock Oak Core Growth Fund |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

Rock Oak Core Growth Fund (the “Fund”) declined 16.52% for the fiscal year ended October 31, 2022, while the Morningstar U.S. Mid Cap Index fell 16.02%, and the Morningstar Mid Blend Category dropped 12.33%. Over the last ten years, the Fund has averaged an annual return of 8.98%.

Over the past fiscal year, the Federal Reserve (the “Fed”) has increased interest rates in an effort to combat the rise in inflation, which has proliferated globally. The Fed has essentially reversed the easy monetary and fiscal policies the markets enjoyed for most of the past decade. US equities are being negatively affected by this and other macroeconomic factors, including the amplified strength of the dollar, the ongoing war in Ukraine, and China’s enduring Covid lockdowns. The Fed’s aggressive interest rates increases have raised fears of a recession and policy mistake.

The Fund’s largest declines came from DraftKings and Enovis. DraftKings is an online sports entertainment and betting company. While DraftKings benefits from being a leader of online sports betting, it has been negatively impacted as investors shifted away from early-stage growth companies to more defensive segments of the market. Medical technology company, Enovis, was pressured by the Coronavirus Delta-variant surge late last year and into 2022 as supply chain issues weighed on results.

The Fund’s best performing stock in the fiscal year was Cardinal Health. The global integrated healthcare distribution company rallied on the normalization in consumer behavior regarding healthcare services as the pandemic dissipated. Another strong performer was Murphy USA, a retail gas station chain operator. Murphy has benefited from the increase in demand for fuel as consumers sought to travel more post the pandemic.

Looking to 2023, we expect inflation to slow as the accumulated impact of higher interest rates and deleveraging of the Fed’s balance sheet are felt across the economy. High inflation and climbing rates are having the Fed’s desired effect on consumers purchasing behavior. However, we expect market volatility to continue until evidence that sustained progress is reflected in the inflation data.

Higher interest rates also mean a higher cost of capital for those companies who borrow to fund new projects. As a result, it is increasingly vital to focus on companies that we feel demonstrate strong management teams, that trade at reasonable valuations and exemplify a commitment to shareholder value creation. The Fund continues to focus on these characteristics as a key tenant of its overall investment philosophy.

Thank you for your investment with the Oak Associates Funds.

| 8 | Annual Report | October 31, 2022 |

| Rock Oak Core Growth Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | RCKSX | | 1 | Hartford Financial Services Group, Inc (The) | 6.5% |

| Share Price | $14.95 | | 2 | Jazz Pharmaceuticals PLC | 5.2% |

| Total Net Assets | $10.1M | | 3 | Cardinal Health, Inc. | 4.3% |

| Portfolio Turnover | 21% | | 4 | Carlisle Companies, Inc. | 4.3% |

| | | | 5 | Quest Diagnostics, Inc. | 4.3% |

| Sector Allocation^ | | | 6 | Gentex Corp. | 4.1% |

| Health Care | 23.8% | | 7 | Republic Services, Inc. | 4.1% |

| Technology | 21.1% | | 8 | Nordson Corp. | 4.1% |

| Industrials | 18.2% | | 9 | F5, Inc. | 4.0% |

| Consumer Discretionary | 10.0% | | 10 | NetApp, Inc. | 4.0% |

| Financials | 8.9% | | | | |

| Energy | 8.8% | | | | |

| Materials | 7.3% | | | | |

| Cash & Other Assets | 1.9% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

| | This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| Rock Oak Core Growth Fund | -16.52% | 3.97% | 4.46% | 8.98% |

| Morningstar US Mid Cap Index1 | -16.02% | 8.80% | 8.90% | 12.12% |

| Morningstar Mid Blend Category Average1 | -12.33% | 8.05% | 7.07% | 10.21% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.40%/1.25%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 1.50%/1.25%

The Adviser has contractually agreed for a period of one year from February 28, 2022, the date of the Fund’s Prospectus, to waive all or a portion of its fee for the Fund (and to reimburse expenses to the extent necessary) in order to limit total annual Fund operating expenses after fee waivers and/or expense reimbursements, if any, to an annual rate of not more than 1.25% of average daily net assets. This contractual fee waiver may only be terminated subject to approval by the Board of Trustees of the Trust.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 9 |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

River Oak Discovery Fund (the “Fund”) declined 14.59% for the fiscal year ended October 31, 2022, while the Morningstar US Small Cap Total Return Index dropped 17.47% and the Morningstar Small Blend Category dropped 13.55%. Over the last ten years, the Fund has returned an average of 10.55% per year.

For the fiscal year ended October 31, 2022 economies around the globe have faced the highest inflation rates in decades. To combat this, the Federal Reserve (the “Fed”) and other Central Banks have raised interest rates intending to cool red hot demand trends that developed as the Coronavirus pandemic retreated. Inflation has remained stubbornly high due to supply chain disruptions and an imbalance between workers and available jobs. Extraneous complications regarding the war in Ukraine, and China’s ongoing Covid lockdowns have added economic friction. While performance has varied across sectors and the overall market has declined, small capitalization stocks weathered the uncertainty better than expected, given that they tend to be more cyclical and suffer under periods of risk aversion.

The Fund’s worst performer during the fiscal year was Cerence Inc. The company, which provides a variety of technology for vehicles, suffered from the continued supply constraints affecting global automakers. Global digital consulting company, Perficient, was also a performance detractor due to an uptick in project delays and cancellations due to increased macro challenges. Over the long-term, the company should continue to benefit as businesses look to increase productivity through digital transformation.

The top contributor to the Fund was Calix Inc, which is an enterprise software company that offers communications, networking, and cloud computing software and services for the telecommunication industry. The stock rose due to the increase in global broadband infrastructure investments. Mandiant and Meritor were also top contributors during the period. Both companies were acquisition targets of Alphabet Inc and Cummins Inc, respectively. Acquisitions of portfolio holdings are common given the Fund’s strategy of identifying leaders where we see a niche focus in attractive growth segments of the economy.

Going forward, high inflation and interest rates will put a strain on both consumers and companies. As the Fed begins to see inflation rollover, we expect them to slow or pause interest rate increases. This should provide an advantageous environment in the equity market. Relative to large-capitalization stocks, smaller companies currently offer a similar return profile, but are trading at lower valuation levels.

The Fund remains focused on seeking out niche companies with a strong commitment to shareholder value creation. This narrow focus can produce better execution, as these companies are generally able to thwart potential competitors and create acquisition targets. The Fund also intends to remain squarely focused on small-cap stocks as key growth sectors for the equity market.

Thank you for your investment with the Oak Associates Funds.

| 10 | Annual Report | October 31, 2022 |

| River Oak Discovery Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | RIVSX | | 1 | Calix, Inc | 4.7% |

| Share Price | $15.56 | | 2 | Cohu, Inc. | 4.1% |

| Total Net Assets | $21.9M | | 3 | Korn Ferry | 3.8% |

| Portfolio Turnover | 28% | | 4 | Barrett Business Services, Inc. | 3.8% |

| | | | 5 | Adtalem Global Education, Inc. | 3.8% |

| Sector Allocation^ | | | 6 | Kulicke & Soffa Industries, Inc. | 3.8% |

| Technology | 35.5% | | 7 | AllianceBernstein Holding LP | 3.7% |

| Industrials | 24.8% | | 8 | Selective Insurance Group, Inc. | 3.6% |

| Financials | 15.8% | | 9 | Nextgen Healthcare, Inc. | 3.6% |

| Health Care | 9.5% | | 10 | Cirrus Logic, Inc. | 3.5% |

| Consumer Discretionary | 6.9% | | | | |

| Consumer Staples | 5.1% | | | | |

| Communications | 0.5% | | | | |

| Cash & Other Assets | 1.9% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| River Oak Discovery Fund | -14.59% | 14.01% | 8.81% | 10.55% |

| Morningstar US Small Cap Index1 | -17.47% | 6.16% | 5.28% | 9.67% |

| Morningstar Small Blend Category Average1 | -13.55% | 7.86% | 5.76% | 9.75% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.18%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 1.21%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 11 |

| Red Oak Technology Select Fund |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

Red Oak Technology Select Fund (the “Fund”) dropped 27.15% for the fiscal year ended October 31, 2022, while the S&P 500 Equal Weight Information Technology Index declined 18.93% and the Morningstar Technology Sector Category fell by 36.94%. Over the last ten years, the Fund has increased by an average of 15.68% per year.

Inflationary pressures, both domestically and abroad, caused the US Market to fall during the most recent fiscal year. Consumers and investors alike have enjoyed easy money policies both monetarily and fiscally for much of the past decade largely without inflation rearing its head. However, the substantial accommodative measures employed to address the pandemic created abundant demand that overwhelmed depleted inventories and disrupted supply chains. Further compounding the global supply shock has been the war in Ukraine as well as continued lockdowns in China.

We remain constructive on the broader Technology industry as its secular trends continue to make it one of the most profitable and fastest growing sectors within the market. Valuations have contracted and investor sentiment, as a contrarian indicator, has fallen to depressed levels, creating a better foundation for a sustained recovery to build. Several segments appear particularly attractive on a relative valuation basis including Software, Semiconductors, and Semiconductor Capital Equipment for long-term investors.

The Fund’s worst performing stock was Meta Platforms. The social media leader was challenged during the period due to increased competition and weaker advertising pricing, a result of slowing macroeconomic conditions. Search giant Alphabet was also a significant detractor as its rapid pace of growth slowed due to global economic weakness, particularly in Europe. Both businesses remain market leaders and we have confidence in their prospects.

The Fund’s biggest contributor was Check Point Software Technologies. Despite a slowing economy, spending on security software and hardware remained solid particularly for cloud customers. Another top contributor during the period was Citrix Systems, a cloud computing company and beneficiary of the work-from-home trend, which announced it was being acquired by private investors.

Going forward, the Fund will continue to pursue blue-chip, technology companies with dominant market positions and favorable shareholder return metrics that are trading at attractive valuations. Higher interest rates and the resulting increased cost of capital should make these characteristics even more important for investors in the evolving investment landscape.

Thank you for your investment with the Oak Associates Funds.

| 12 | Annual Report | October 31, 2022 |

| Red Oak Technology Select Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | ROGSX | | 1 | Apple, Inc. | 7.7% |

| Share Price | $29.27 | | 2 | Alphabet, Inc. | 6.5% |

| Total Net Assets | $441.9M | | 3 | Amazon.com, Inc. | 6.3% |

| Portfolio Turnover | 13% | | 4 | Cisco Systems, Inc. | 5.9% |

| | | | 5 | Microsoft Corp. | 5.9% |

| Sector Allocation^ | | | 6 | Oracle Corp. | 5.6% |

| Technology | 72.7% | | 7 | KLA Corp. | 5.0% |

| Communications | 10.3% | | 8 | Synopsys, Inc. | 4.6% |

| Consumer Discretionary | 9.3% | | 9 | QUALCOMM, Inc. | 4.1% |

| Industrials | 6.1% | | 10 | NXP Semiconductors NV | 3.8% |

| Cash & Other Assets | 1.6% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

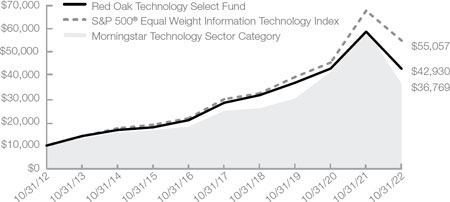

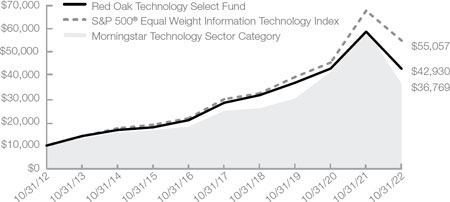

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| Red Oak Technology Select Fund | -27.15% | 5.08% | 8.64% | 15.68% |

| S&P 500® Equal Weight Information Technology Index1 | -18.93% | 11.75% | 12.97% | 18.60% |

| Morningstar Technology Sector Category Average2 | -36.94% | 7.23% | 9.00% | 15.05% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 0.90%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 0.92%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 13 |

| Black Oak Emerging Technology Fund |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

Black Oak Emerging Technology Fund (the “Fund”) declined 24.06% for the fiscal year ended October 31, 2022, while the S&P 500 Equal Weight Information Technology Index fell 18.93% and the Morningstar Technology Sector Category dropped 36.94%. Over the last ten years, the Fund has risen an average of 14.43% per year.

As inflation escalated last year and into 2022, it became clear that the Federal Reserve (the “Fed”) was behind the curve and that action was required. Fed Chairman Powell finally began raising interest rates in March and continued at a moderate pace which initially calmed investors. However, as inflation continued to rise above expectations, the Fed was forced to step up its pace. The fear has now shifted from feeling they were too far behind the curve to get inflation under control to the risk of oversteering and causing a bigger recession than intended or necessary.

Technology stocks underperformed during the period as investors turned to more defensive areas of the market amid the prospects of a slowing economy. In a slower growth environment resulting from a more restrictive monetary policy, we would expect investors to gravitate to those areas that can continue to expand despite these conditions. The Technology sector remains one of the most profitable and fastest growing sectors of the economy. Lowered expectations and valuation levels have created many attractive opportunities that we anticipate will reward those investors willing to look beyond near-term disruptions.

The Fund’s worst performing stock was Cognyte Software. Despite being in the attractive end market of security software, demand for Cognyte Software’s products fell as its government customers focused on budget cuts amid a slowing economy. After being a top contributor last year, semiconductor manufacturer Ambarella, was also a detractor this fiscal year as inventory levels rebalance over the near-term. Production capacity issues at global automakers have also hampered its results.

The Fund’s strongest performer during the fiscal year was CSG Systems International. CSG Systems provides customer management solutions to the communications market and is benefiting from the automation of services such as invoice production, billing and customer analysis. Another one of the Fund’s largest contributors, industrial solutions provider, Applied Industrial Technologies, helps customers overcome a difficult labor market through its offering of automation technologies.

Going forward, the Fund will continue to seek opportunities within the Technology sector exposed to emerging niches, with solid earnings prospects, and that are trading at favorable valuations.

Thank you for your investment with the Oak Associates Funds.

| 14 | Annual Report | October 31, 2022 |

| Black Oak Emerging Technology Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | BOGSX | | 1 | Apple, Inc. | 5.9% |

| Share Price | $6.44 | | 2 | KLA Corp. | 4.1% |

| Total Net Assets | $52.4M | | 3 | Kulicke & Soffa Industries, Inc. | 4.0% |

| Portfolio Turnover | 25% | | 4 | Cohu, Inc. | 3.7% |

| | | | 5 | Diodes, Inc. | 3.5% |

| Sector Allocation^ | | | 6 | Jack Henry & Associates, Inc. | 3.5% |

| Technology | 75.2% | | 7 | Nordson Corp. | 3.4% |

| Industrials | 11.4% | | 8 | Nextgen Healthcare, Inc. | 3.4% |

| Health Care | 5.0% | | 9 | SolarEdge Technologies, Inc. | 3.3% |

| Energy | 3.3% | | 10 | Applied Industrial Technologies, Inc. | 3.3% |

| Consumer Discretionary | 2.5% | | | | |

| Cash & Other Assets | 2.6% | | | | |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| Black Oak Emerging Technology Fund | -24.06% | 15.06% | 12.69% | 14.43% |

| S&P 500® Equal Weight Information Technology Index1 | -18.93% | 11.75% | 12.97% | 18.60% |

| Morningstar Technology Sector Category Average2 | -36.94% | 7.23% | 9.00% | 15.05% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.01%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 1.03%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 15 |

| Live Oak Health Sciences Fund |

|

| |

| James D. Oelschlager |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Robert D. Stimpson, CFA |

| Co-Chief Investment Officer |

| & Portfolio Manager |

| |

|

| |

| Jeffrey B. Travis, CFA |

| Portfolio Manager |

Live Oak Health Sciences Fund (the “Fund”) grew 3.95% for the fiscal year ended October 31, 2022, while the S&P 500® Health Care Index rose 0.81% and the Morningstar Health Sector Category dropped 17.14%. Over the last ten years, the Fund has increased by an average return of 11.77% per year.

The primary cause of equity market weakness in 2022 has been focused on concerns surrounding the rise in inflation caused by excess liquidity injected into the economy during the pandemic. After opting for patience throughout 2021, the Federal Reserve finally began an interest rate tightening cycle in March. In light of their broad efforts to restrict the economy, concerns have developed over whether its actions will cause a severe recession.

While US equity markets retreated during the period, the Healthcare sector benefited from investors shifting towards more defensive areas of the economy. Several sectors within healthcare offer stable revenue and benefit from secular demographic trends. Since medical costs have been rising consistently for more than a decade, healthcare companies are already familiar with operating in an inflationary environment.

The Fund’s biggest contributor to returns for the year was McKesson Corporation. McKesson distributes pharmaceuticals, data and analytic solutions, as well as medical-surgical supplies and has benefited from strong organic growth across each of its offerings. Improved operating efficiencies have also resulted in solid, free cash flow generation. Vertex Pharmaceuticals, a leader in developing treatments for cystic fibrosis, was also a top performer as its primary franchise continues to exceed expectations and its pipeline of new offerings shows increasing promise.

The Fund’s largest detractor was drug research tools and support services provider, Charles River Laboratories. After years of strong outperformance driven by increased research and development (R&D) spending resulting from the pandemic, growth slowed on a relative basis weighing on the shares. Slower R&D spending during the period also impacted the shares of Illumina, a leading provider of systems utilized by genomic research centers, academic institutions and pharmaceutical and biotechnology companies to sequence and analyze genes.

Looking ahead, favorable demographics, persistent innovation and technological advancements within the sector should continue to provide attractive opportunities for long-term investors. The Fund continues to favor what are in our opinion stable healthcare companies with healthy balance sheets, strong secular tailwinds and earnings prospects at attractive valuations.

Thank you for your investment with the Oak Associates Funds.

| 16 | Annual Report | October 31, 2022 |

| Live Oak Health Sciences Fund | Performance Update |

| | All data below is as of October 31, 2022 (Unaudited) |

| Fund Data | | | Top 10 Holdings^ | |

| Ticker | LOGSX | | 1 | UnitedHealth Group, Inc. | 6.3% |

| Share Price | $21.37 | | 2 | Cigna Corp. | 5.6% |

| Total Net Assets | $57.3M | | 3 | United Therapeutics Corp. | 5.5% |

| Portfolio Turnover | 47% | | 4 | McKesson Corp. | 5.3% |

| | | | 5 | Anthem, Inc. | 5.2% |

| Sector Allocation^ | | | 6 | Amgen, Inc. | 4.8% |

| Health Care | 98.3% | | 7 | Regeneron Pharmaceuticals, Inc. | 4.2% |

| Cash & Other Assets | 1.7% | | 8 | AmerisourceBergen Corp. | 4.0% |

| | | | 9 | Cardinal Health, Inc. | 3.8% |

| | | | 10 | Merck & Co., Inc. | 3.3% |

| ^ | Percentages are based on net assets. Holdings are subject to change. |

Growth of $10,000 Chart

This chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years. Past performance does not guarantee future results. This chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| | Return | Return | Return | Return |

| Live Oak Health Sciences Fund | 3.95% | 10.85% | 8.48% | 11.77% |

| S&P 500® Health Care Index1 | 0.81% | 14.08% | 12.41% | 14.77% |

| Morningstar Health Sector Category Average2 | -17.14% | 8.35% | 7.81% | 12.76% |

Gross/Net Expense Ratio (per the prospectus dated February 28, 2022): 1.00%

Gross/Net Expense Ratio (as of the fiscal year ended October 31, 2022): 1.02%

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, please visit www.oakfunds.com or call 1-888-462-5386.

| 1 | Standard & Poor’s is the source and owner of the S&P Index data. |

| 2 | Morningstar, Inc. is the source and owner of the Morningstar Classification data. See Pages 18 and 19 for additional disclosure. |

| 1-888-462-5386 | www.oakfunds.com | 17 |

All data below is as of October 31, 2022 (Unaudited)

Mutual fund investing involves risk, including the possible loss of principal. The value of a Fund’s investments will vary from day to day in response to the activities of individual companies and general market and economic conditions. Because a Fund may invest a significant portion of its assets in particular industry sectors which it believes hold the most potential for favorable returns, poor performance or adverse economic events affecting one or more of these over-weighted sectors could have a greater impact on a Fund than it would on another mutual fund with a broader range of investments.

Index Definitions and Disclosures

All indices are unmanaged and index performance figures include reinvestment of dividends but do not reflect any fees, expenses or taxes. Investors cannot invest directly in an index.

Oak Associates Funds (the “Funds”) are not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to individuals who invest in the Funds or any member of the public regarding the advisability of investing in equity securities generally or in the Funds in particular or the ability of the Funds to track the Morningstar Indices or general equity market performance. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE FUNDS OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. You cannot invest directly in an index.

Morningstar Health Care Category – Health portfolios focus on the medical and health-care industries. Most invest in a range of companies, buying everything from pharmaceutical and medical-device makers to HMOs, hospitals, and nursing homes. A few portfolios concentrate on just one industry segment, such as service providers or biotechnology firms.

Morningstar Large Blend Category – Large-blend portfolios are fairly representative of the overall US stock market in size, growth rates, and price. Stocks in the top 70% of the capitalization of the US equity market are defined as large-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios tend to invest across the spectrum of US industries, and owing to their broad exposure, the portfolios’ returns are often similar to those of the S&P 500 Index.

Morningstar Mid Blend Category – The typical mid-cap blend portfolio invests in US stocks of various sizes and styles, giving it a middle-of-the-road profile. Most shy away from high-priced growth stocks, but aren’t so price-conscious that they land in value territory. The US mid-cap range for market capitalization typically falls between $1billion-$8 billion and represents 20% of the total capitalization of the US equity market. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

Morningstar Small Blend Category – Small-blend portfolios favor US firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the US equity market are defined as small-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

| 18 | Annual Report | October 31, 2022 |

| Important Disclosures |

| All data below is as of October 31, 2022 (Unaudited) |

Morningstar Technology Category – Technology portfolios buy high-tech businesses in the US or outside of the US Most concentrate on computer, semiconductor, software, networking, and Internet stocks. A few also buy medical-device and biotechnology stocks and some concentrate on a single technology industry.

Morningstar US Market Index – Measures the performance of US securities and targets 97% market capitalization coverage of the investable universe. It is a diversified broad market index. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria.

Morningstar US Mid Cap Index – Tracks the performance of US mid-cap stocks that fall between 70th and 90th percentile in market capitalization of the investable universe. In aggregate the Mid-Cap Index represents 20 percent of the investable universe.

Morningstar US Small Cap Index – Measures the performance of US small-cap stocks. These stocks fall between the 90th and 97th percentile in market capitalization of the investable universe. In aggregate, the Small-Cap Index represents 7 percent of the investable universe. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria.

Standard & Poor’s – is the source and owner of the S&P Index data contained in this material and all trademarks and copyrights related thereto. Any further dissemination or redistribution is strictly prohibited. Standard & Poor’s is not responsible for the formatting or configuration of this material or for any inaccuracy in Oak Associates Funds’ presentation thereof.

S&P 500® Index – is a commonly-recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad US equity performance.

S&P 500® Equal Weight Information Technology Index – The S&P 500® Equal Weight Information Technology Index is an unmanaged equal weighted version of the S&P 500® Information Technology Index that consists of the common stocks of the following industries: internet equipment, computers and peripherals, electronic equipment, office electronics and instruments, semiconductor equipment and products, diversified telecommunication services, and wireless telecommunication services that comprise the Information Technology sector of the S&P 500® Index.

S&P 500® Health Care Index – The S&P 500® Health Care Index is a capitalization-weighted index that encompasses two main industry groups. The first includes companies who manufacture health care equipment and supplies or provide health care related services, including distributors of health care products, providers of basic health care services, and owners and operators of health care facilities and organizations. The second group consists of companies primarily involved in the research, development, production and marketing of pharmaceuticals and biotechnology products.

S&P 500® Total Return Index – The S&P 500® Total Return Index is a commonly recognized, market capitalization weighted index of 500 widely held equity securities, designed to measure broad US equity performance.

| 1-888-462-5386 | www.oakfunds.com | 19 |

| Important Disclosures |

| All data below is as of October 31, 2022 (Unaudited) |

Investment Definitions

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices. Smart beta emphasizes capturing investment factors of market inefficiencies in a rules-based and transparent way.

Correlation is a statistic that measures the degree to which two securities move in relation to each other.

The P/E is the ratio for valuing a company that measures its current share price relative to its per share earnings. The price-earnings ratio can be calculated as market value per share divided by earnings per share.

Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation. Book value is also the net asset value of a company, calculated as total assets minus intangible assets and liabilities.

Free cash flow yield is an overall return evaluation ratio of a stock, which standardizes the free cash flow per share a company is expected to earn against its market price per share. The ratio is calculated by taking the free cash flow per share divided by the share price.

| 20 | Annual Report | October 31, 2022 |

| Disclosure of Fund Expenses |

| As of October 31, 2022 (Unaudited) |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from May 1, 2022 through October 31, 2022.

Actual Expenses

The first line of the table for each Fund provides information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table for each class is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| 1-888-462-5386 | www.oakfunds.com | 21 |

| Disclosure of Fund Expenses |

| As of October 31, 2022 (Unaudited) |

| | Beginning | Ending | | |

| | Account Value | Account Value | Annualized | Expenses |

| | May 1, | October 31, | Expense | Paid During |

| | 2022 | 2022 | Ratio | Period(a) |

| White Oak Select Growth Fund | | | | |

| Actual Return | $1,000.00 | $ 915.20 | 0.93% | $4.49 |

| Hypothetical 5% Return | $1,000.00 | $1,020.51 | 0.93% | $4.74 |

| Pin Oak Equity Fund | | | | |

| Actual Return | $1,000.00 | $ 915.30 | 0.97% | $4.68 |

| Hypothetical 5% Return | $1,000.00 | $1,020.32 | 0.97% | $4.93 |

| Rock Oak Core Growth Fund | | | | |

| Actual Return | $1,000.00 | $ 936.70 | 1.25% | $6.10 |

| Hypothetical 5% Return | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| River Oak Discovery Fund | | | | |

| Actual Return | $1,000.00 | $1,021.00 | 1.24% | $6.31 |

| Hypothetical 5% Return | $1,000.00 | $1,018.96 | 1.24% | $6.30 |

| Red Oak Technology Select Fund | | | | |

| Actual Return | $1,000.00 | $ 858.10 | 0.94% | $4.40 |

| Hypothetical 5% Return | $1,000.00 | $1,020.47 | 0.94% | $4.78 |

| Black Oak Emerging Technology Fund | | | | |

| Actual Return | $1,000.00 | $ 934.70 | 1.06% | $5.17 |

| Hypothetical 5% Return | $1,000.00 | $1,019.86 | 1.06% | $5.40 |

| Live Oak Health Sciences Fund | | | | |

| Actual Return | $1,000.00 | $1,052.20 | 1.04% | $5.36 |

| Hypothetical 5% Return | $1,000.00 | $1,019.98 | 1.04% | $5.28 |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| 22 | Annual Report | October 31, 2022 |

| White Oak Select Growth Fund | Schedule of Investments |

| | As of October 31, 2022 |

| | | | | | Fair | |

| | | Shares | | | Value | |

| COMMON STOCKS — 97.99% | | | | | | | | |

| COMMUNICATIONS — 12.94% | | | | | | | | |

| Internet Media & Services — 12.94% | | | | | | | | |

| Alphabet, Inc. - Class A(a) | | | 152,000 | | | $ | 14,365,520 | |

| Alphabet, Inc. - Class C(a) | | | 248,000 | | | | 23,475,680 | |

| Meta Platforms, Inc. - Class A(a) | | | 40,015 | | | | 3,727,797 | |

| | | | | | | | 41,568,997 | |

| CONSUMER DISCRETIONARY — 15.47% | | | | | | | | |

| E-Commerce Discretionary — 10.01% | | | | | | | | |

| Amazon.com, Inc.(a)(b) | | | 314,100 | | | | 32,176,404 | |

| | | | | | | | | |

| Retail - Discretionary — 5.46% | | | | | | | | |

| Lowe’s Companies, Inc.(b) | | | 90,000 | | | | 17,545,500 | |

| | | | | | | | | |

| FINANCIALS — 21.67% | | | | | | | | |

| Asset Management — 9.27% | | | | | | | | |

| Charles Schwab Corp. (The) | | | 374,100 | | | | 29,804,547 | |

| | | | | | | | | |

| Banking — 5.45% | | | | | | | | |

| JPMorgan Chase & Co. | | | 139,065 | | | | 17,505,502 | |

| | | | | | | | | |

| Institutional Financial Services — 0.81% | | | | | | | | |

| State Street Corp. | | | 35,000 | | | | 2,590,000 | |

| | | | | | | | | |

| Insurance — 6.14% | | | | | | | | |

| Chubb Ltd. | | | 91,890 | | | | 19,746,242 | |

| | | | | | | | | |

| HEALTH CARE — 25.75% | | | | | | | | |

| Biotech & Pharma — 13.81% | | | | | | | | |

| Amgen, Inc. | | | 82,460 | | | | 22,293,061 | |

| Novartis AG - ADR | | | 114,060 | | | | 9,253,688 | |

| Pfizer, Inc. | | | 275,700 | | | | 12,833,835 | |

| | | | | | | | 44,380,584 | |

| Health Care Facilities & Services — 6.61% | | | | | | | | |

| Cigna Corp. | | | 32,952 | | | | 10,645,473 | |

| Laboratory Corporation of America Holdings(b) | | | 47,770 | | | | 10,598,252 | |

| | | | | | | | 21,243,725 | |

| 1-888-462-5386 | www.oakfunds.com | 23 |

| Schedule of Investments | White Oak Select Growth Fund |

| | As of October 31, 2022 |

| | | | | | Fair | |

| | | Shares | | | Value | |

| Medical Equipment & Devices — 5.33% | | | | | | | | |

| Alcon, Inc. | | | 138,000 | | | $ | 8,373,840 | |

| Zimmer Biomet Holdings, Inc. | | | 77,390 | | | | 8,772,157 | |

| | | | | | | | 17,145,997 | |

| TECHNOLOGY — 22.16% | | | | | | | | |

| Semiconductors — 13.29% | | | | | | | | |

| KLA Corp. | | | 58,835 | | | | 18,618,336 | |

| NXP Semiconductors NV | | | 66,513 | | | | 9,716,219 | |

| QUALCOMM, Inc. | | | 122,300 | | | | 14,389,818 | |

| | | | | | | | 42,724,373 | |

| Technology Hardware — 6.93% | | | | | | | | |

| Cisco Systems, Inc. | | | 490,000 | | | | 22,260,700 | |

| | | | | | | | | |

| Technology Services — 1.94% | | | | | | | | |

| Cognizant Technology Solutions Corp. - Class A | | | 100,000 | | | | 6,225,000 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $165,726,947) | | | | | | | 314,917,571 | |

| 24 | Annual Report | October 31, 2022 |

| White Oak Select Growth Fund | Schedule of Investments |

| | As of October 31, 2022 |

| | | Shares or | | | Fair | |

| | | Principal ($) | | | Value | |

| SHORT-TERM INVESTMENTS — 13.11% | | | | | | | | |

| REPURCHASE AGREEMENTS — 0.43% | | | | | | | | |

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 2.73%, dated 10/31/2022 and maturing 11/1/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.25% to 2.88% and maturity dates ranging from 5/15/2024 to 8/15/2031 with a par value of $1,621,471 and a collateral value of $1,423,567 | | | 1,395,653 | | | $ | 1,395,653 | |

| | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED — 12.68% | | | | | | | | |

| Mount Vernon Liquid Assets Portfolio, LLC, 3.21%(c) | | | 40,764,671 | | | | 40,764,671 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $42,160,324) | | | | | | | 42,160,324 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 111.10% | | | | | | | | |

| (Cost $207,887,271) | | | | | | | 357,077,895 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (11.10)% | | | | | | | (35,689,796 | ) |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 321,388,099 | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $39,419,770. |

| (c) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

ADR — American Depositary Receipt

The accompanying notes are an integral part of the financial statements.

| 1-888-462-5386 | www.oakfunds.com | 25 |

| Schedule of Investments | Pin Oak Equity Fund |

| | As of October 31, 2022 |

| | | | | | Fair | |

| | | Shares | | | Value | |

| COMMON STOCKS — 97.26% | | | | | | | | |

| COMMUNICATIONS — 13.25% | | | | | | | | |

| Entertainment Content — 0.91% | | | | | | | | |

| Activision Blizzard, Inc. | | | 15,632 | | | $ | 1,138,010 | |

| | | | | | | | | |

| Internet Media & Services — 12.34% | | | | | | | | |

| Alphabet, Inc. - Class A(a) | | | 35,000 | | | | 3,307,850 | |

| Alphabet, Inc. - Class C(a) | | | 120,000 | | | | 11,359,200 | |

| Meta Platforms, Inc. - Class A(a) | | | 8,569 | | | | 798,288 | |

| | | | | | | | 15,465,338 | |

| CONSUMER DISCRETIONARY — 16.89% | | | | | | | | |

| Automotive — 5.34% | | | | | | | | |

| Gentex Corp.(b) | | | 252,500 | | | | 6,688,725 | |

| | | | | | | | | |

| E-Commerce Discretionary — 11.55% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 102,400 | | | | 10,489,856 | |

| eBay, Inc.(b) | | | 100,000 | | | | 3,984,000 | |

| | | | | | | | 14,473,856 | |

| ENERGY — 1.24% | | | | | | | | |

| Oil & Gas Producers — 1.24% | | | | | | | | |

| Coterra Energy, Inc. | | | 50,000 | | | | 1,556,500 | |

| | | | | | | | | |

| FINANCIALS — 15.18% | | | | | | | | |

| Asset Management — 7.57% | | | | | | | | |

| Charles Schwab Corp. (The) | | | 119,101 | | | | 9,488,777 | |

| | | | | | | | | |

| Institutional Financial Services — 3.39% | | | | | | | | |

| Bank of New York Mellon Corp. (The) | | | 100,745 | | | | 4,242,372 | |

| | | | | | | | | |

| Insurance — 4.22% | | | | | | | | |

| Assurant, Inc.(b) | | | 38,900 | | | | 5,284,954 | |

| | | | | | | | | |

| HEALTH CARE — 24.74% | | | | | | | | |

| Biotech & Pharma — 10.52% | | | | | | | | |

| Amgen, Inc. | | | 18,500 | | | | 5,001,475 | |

| Gilead Sciences, Inc. | | | 48,145 | | | | 3,777,457 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 5,881 | | | | 4,403,399 | |

| | | | | | | | 13,182,331 | |

| 26 | Annual Report | October 31, 2022 |

| Pin Oak Equity Fund | Schedule of Investments |

| | As of October 31, 2022 |

| | | | | | Fair | |

| | | Shares | | | Value | |

| Health Care Facilities & Services — 14.22% | | | | | | | | |

| McKesson Corp. | | | 28,900 | | | $ | 11,252,793 | |

| Molina Healthcare, Inc.(a) | | | 12,291 | | | | 4,410,748 | |

| Quest Diagnostics, Inc. | | | 15,000 | | | | 2,154,750 | |

| | | | | | | | 17,818,291 | |

| INDUSTRIALS — 1.99% | | | | | | | | |

| Electrical Equipment — 1.99% | | | | | | | | |

| Amphenol Corp. - Class A | | | 32,860 | | | | 2,491,774 | |

| | | | | | | | | |

| TECHNOLOGY — 23.97% | | | | | | | | |

| Semiconductors — 4.67% | | | | | | | | |

| KLA Corp. | | | 18,498 | | | | 5,853,692 | |

| | | | | | | | | |

| Software — 3.20% | | | | | | | | |

| Akamai Technologies, Inc.(a) | | | 45,324 | | | | 4,003,469 | |

| | | | | | | | | |

| Technology Services — 16.10% | | | | | | | | |

| Amdocs Ltd. | | | 81,587 | | | | 7,041,774 | |

| Paychex, Inc. | | | 43,649 | | | | 5,164,113 | |

| PayPal Holdings, Inc.(a) | | | 18,000 | | | | 1,504,440 | |

| Visa, Inc. - Class A(b) | | | 31,220 | | | | 6,467,535 | |

| | | | | | | | 20,177,862 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $67,669,399) | | | | | | | 121,865,951 | |

| 1-888-462-5386 | www.oakfunds.com | 27 |

| Schedule of Investments | Pin Oak Equity Fund |

| | As of October 31, 2022 |

| | | Shares or | | | Fair | |

| | | Principal ($) | | | Value | |

| SHORT-TERM INVESTMENTS — 23.65% | | | | | | | | |

| REPURCHASE AGREEMENTS — 9.67% | | | | | | | | |

| Tri-Party Repurchase Agreement with South Street Securities LLC and Bank of New York Mellon, 2.73%, dated 10/31/2022 and maturing 11/1/2022, collateralized by U.S. Treasury Securities with rates ranging from 0.25% to 2.88% and maturity dates ranging from 5/15/2024 to 8/15/2031 with a par value of $14,084,457 and a collateral value of $12,365,409 | | | 12,122,950 | | | $ | 12,122,950 | |

| | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED — 13.98% | | | | | | | | |

| Mount Vernon Liquid Assets Portfolio, LLC, 3.21%(c) | | | 17,516,969 | | | | 17,516,969 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $29,639,919) | | | | | | | 29,639,919 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 120.91% | | | | | | | | |

| (Cost $97,309,318) | | | | | | | 151,505,870 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (20.91)% | | | | | | | (26,199,257 | ) |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 125,306,613 | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $17,107,801. |

| (c) | Rate disclosed is the seven day effective yield as of October 31, 2022. |

The accompanying notes are an integral part of the financial statements.

| 28 | Annual Report | October 31, 2022 |

| Rock Oak Core Growth Fund | Schedule of Investments |

| | As of October 31, 2022 |

| | | | | | Fair | |

| | | Shares | | | Value | |

| COMMON STOCKS — 98.06% | | | | | | | | |

| CONSUMER DISCRETIONARY — 10.02% | | | | | | | | |

| Automotive — 4.12% | | | | | | | | |

| Gentex Corp. | | | 15,785 | | | $ | 418,145 | |

| | | | | | | | | |

| Leisure Products — 2.81% | | | | | | | | |

| Thor Industries, Inc.(a) | | | 3,490 | | | | 284,330 | |

| | | | | | | | | |

| Wholesale - Discretionary — 3.09% | | | | | | | | |

| Pool Corp.(a) | | | 1,030 | | | | 313,357 | |

| | | | | | | | | |

| ENERGY — 8.76% | | | | | | | | |

| Oil & Gas Producers — 6.22% | | | | | | | | |

| Coterra Energy, Inc.(a) | | | 11,541 | | | | 359,271 | |

| Murphy USA, Inc.(a) | | | 864 | | | | 271,737 | |

| | | | | | | | 631,008 | |

| Renewable Energy — 2.54% | | | | | | | | |

| SolarEdge Technologies, Inc.(b) | | | 1,120 | | | | 257,634 | |

| | | | | | | | | |

| FINANCIALS — 8.93% | | | | | | | | |

| Insurance — 8.93% | | | | | | | | |

| Assurant, Inc.(a) | | | 1,830 | | | | 248,624 | |

| Hartford Financial Services Group, Inc. (The) | | | 9,065 | | | | 656,397 | |

| | | | | | | | 905,021 | |

| HEALTH CARE — 23.80% | | | | | | | | |

| Biotech & Pharma — 9.96% | | | | | | | | |

| Exelixis, Inc.(a)(b) | | | 18,149 | | | | 300,910 | |