UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant □

Check the appropriate box: | | | | | |

| □ | Preliminary Proxy Statement |

| □ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| □ | Definitive Additional Materials |

| □ | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | | | | |

| IDACORP, INC. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| þ | No fee required. |

| | |

| □ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| | |

| | |

| □ | Fee paid previously with preliminary materials. |

| | |

| □ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

April 6, 2021

Dear Fellow Shareholders:

You are cordially invited to attend the 2021 Annual Meeting of Shareholders of IDACORP, Inc. The Annual Meeting will be held on Thursday, May 20, 2021, at 10:00 a.m. (Mountain Time). As part of our precautions related to the pandemic, we have adopted again for this year a virtual format for our Annual Meeting to provide a safe, consistent, and convenient experience to all shareholders regardless of location. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/IDA, where you will be able to vote electronically and submit questions. In order to attend, you must register in advance at www.proxydocs.com/IDA prior to the deadline of May 19, 2021 at 3:00 p.m. (Mountain Time). Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and voting authorization form and subsequent instructions that will be delivered to you via email.

The matters to be acted upon at the meeting are described in our proxy materials, which are being furnished to our shareholders over the Internet, other than to those shareholders who requested a paper copy. In addition, at the Annual Meeting we will discuss the company’s 2020 financial results, operational matters, and several of the company’s strategic initiatives.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by telephone, or by mail, in accordance with the instructions included in the proxy statement.

We appreciate your continued interest in and support of our company.

Sincerely,

| | | | | | | | | | | | | | | | | |

Richard J. Dahl

Chair of the Board of Directors | | Lisa A. Grow

President and CEO | | | |

IDACORP, Inc.

1221 W. Idaho Street

Boise, Idaho 83702

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

VIRTUAL MEETING ONLY - NO PHYSICAL LOCATION

| | | | | |

| Date and Time: | Thursday, May 20, 2021 at 10:00 a.m. Mountain Time |

| |

| Place: | To register for and participate in the live online Annual Meeting, please visit www.proxydocs.com/IDA. Please note that you will need the control number included on your proxy card and Notice of Internet Availability in order to register for and to access the Annual Meeting. Registration to participate is due by Wednesday, May 19, 2021 at 3:00 p.m. Mountain Time. |

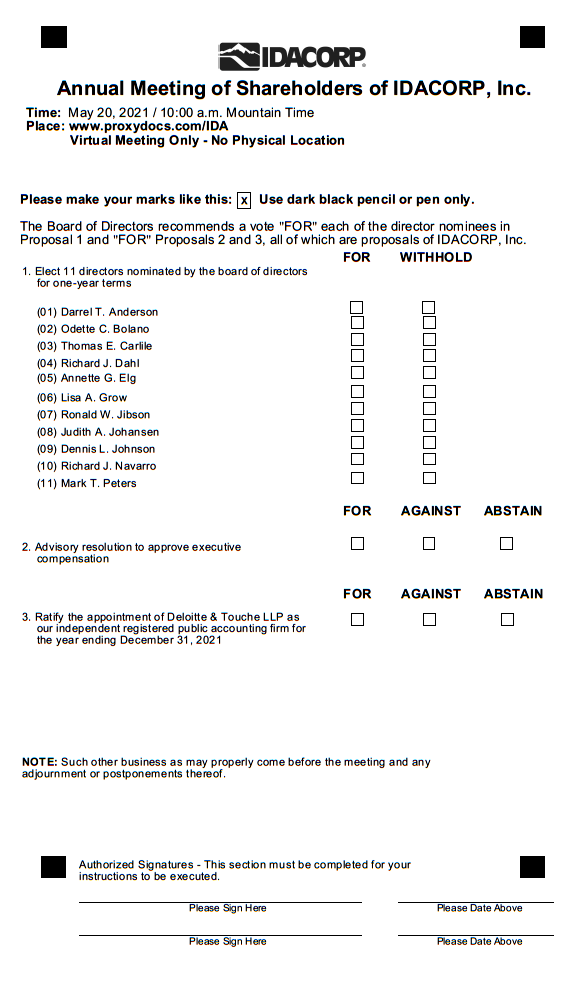

| Items of Business: | • To elect 11 directors nominated by the board of directors for one-year terms; • To vote on an advisory resolution to approve executive compensation; • To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021; and • To transact such other business that may properly come before the meeting and any adjournments or postponements of the meeting. |

| As of the date of this notice, the company has received no notice of any matters, other than those listed above, that may properly be presented at the annual meeting. If any other matters are properly presented for consideration at the meeting, the persons named as proxies on the proxy card that accompanies this proxy statement, or their duly constituted substitutes, will be deemed authorized to vote the shares represented by proxy or otherwise act on those matters in accordance with their judgment. |

| Record Date: | Holders of record of IDACORP common stock at the close of business on March 31, 2021, are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| How to Vote: | Please vote your shares at your earliest convenience. Registered holders may vote (a) by Internet prior to the Annual Meeting at www.proxypush.com/ida; (b) by Internet during the Annual Meeting at www.proxydocs.com/ida; (c) by toll-free telephone by calling (866) 702-2221; or (d) by mail (if you received a paper copy of the proxy materials by mail) by marking, signing, dating, and promptly mailing the enclosed proxy card in the postage-paid envelope. If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from them to vote your shares. |

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Shareholders: Our 2021 proxy statement and our annual report for the year ended December 31, 2020, are available free of charge at www.proxypush.com/ida.

By Order of the Board of Directors

Patrick A. Harrington

Corporate Secretary

April 6, 2021

CONTENTS

| | | | | | | | |

| | Page |

| PROXY STATEMENT HIGHLIGHTS | | i |

| | |

| PART 1 – INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING | | 1 |

| General Information | | 1 |

| Questions and Answers About the Annual Meeting, this Proxy Statement, and Voting | | 2 |

| | |

| PART 2 – CORPORATE GOVERNANCE AT IDACORP | | 6 |

| | |

| PART 3 – BOARD OF DIRECTORS | | 20 |

| PROPOSAL NO. 1: Election of Directors | | 20 |

| Committees of the Board of Directors | | 26 |

| Director Compensation | | 28 |

| | |

| PART 4 – EXECUTIVE COMPENSATION | | 31 |

| Compensation Discussion and Analysis | | 31 |

| Compensation Committee Report | | 51 |

| Our Compensation Policies and Practices as They Relate to Risk Management | | 52 |

| Compensation Tables | | 53 |

| 2020 Summary Compensation Table | | 53 |

| Grants of Plan-Based Awards in 2020 | | 55 |

| Outstanding Equity Awards at Fiscal Year-End 2020 | | 57 |

| Option Exercises and Stock Vested During 2020 | | 59 |

| Pension Benefits for 2020 | | 59 |

| Nonqualified Deferred Compensation for 2020 | | 64 |

| Potential Payments Upon Termination or Change in Control | | 66 |

| PROPOSAL NO. 2: Advisory Resolution to Approve Executive Compensation |

| 75 |

| CEO Pay Ratio | | 76 |

| | | |

| PART 5 – AUDIT COMMITTEE MATTERS | | 77 |

| PROPOSAL NO.3: Ratification of Appointment of Independent Registered Public Accounting Firm | | 77 |

| Independent Accountant Billings | | 77 |

| Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services | | 78 |

| Report of the Audit Committee | | 79 |

| | |

| PART 6 – OTHER MATTERS | | 80 |

| Other Business | | 80 |

| Shared-Address Shareholders | | 80 |

| 2022 Annual Meeting of Shareholders | | 80 |

| Annual Report and Financial Statements | | 81 |

APPENDICES | | A-1 |

| APPENDIX A – Compensation Survey Data Companies | | A-1 |

PROXY STATEMENT HIGHLIGHTS

2021 Annual Meeting Information:

In the Proxy Statement Highlights, we have included highlights of some of the matters discussed in more detail later in the proxy statement. As it is only a summary, please refer to the complete proxy statement and the 2020 Annual Report on Form 10-K for more information before you vote.

•Date and Time: May 20, 2021 at 10:00 a.m. Mountain Time

•Meeting Place and Registration Link: www.proxydocs.com/IDA. Virtual Meeting Only - No Physical Location.

◦You must register by May 19, 2021 at 3:00 p.m. Mountain Time.

•Eligibility: You are eligible to vote if you were a shareholder of record at the close of business on March 31, 2021.

•Your Vote: You may cast your vote in any of the following ways:

| | | | | | | | |

| | |

| Internet | Telephone | Mail |

For registered holders, visit www.proxypush.com/ida to vote. If your shares are held in street name, follow the instructions delivered to you by your bank or broker. You will need the control number included in your proxy card, voter instruction form, or Notice of Internet Availability. | For registered holders, call

1-866-702-2221. If your shares are held in street name, call the number on your voter instruction form. You will need the control number included in your proxy card, voter instruction form, or Notice of Internet Availability. | Send your completed and signed proxy card or voter instruction form to the address on your proxy card or voter instruction form. |

Agenda and Voting Matters:

| | | | | |

| Summary Description of Voting Matters | Board Voting Recommendation |

| 1. Election of eleven director nominees for a one-year term | ü FOR each director nominee |

| 2. Advisory resolution to approve our executive compensation | ü FOR |

| 3. Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 | ü FOR |

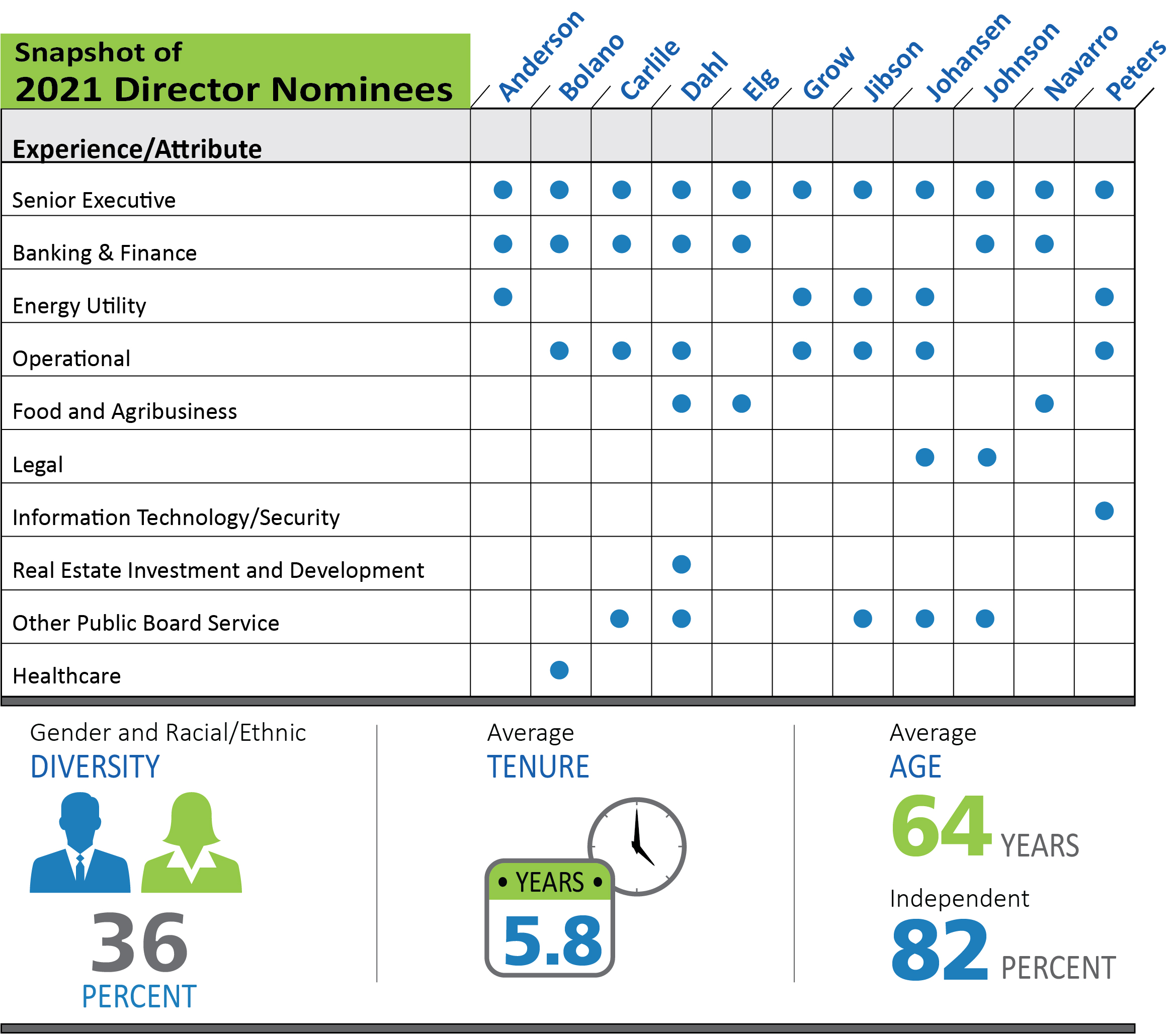

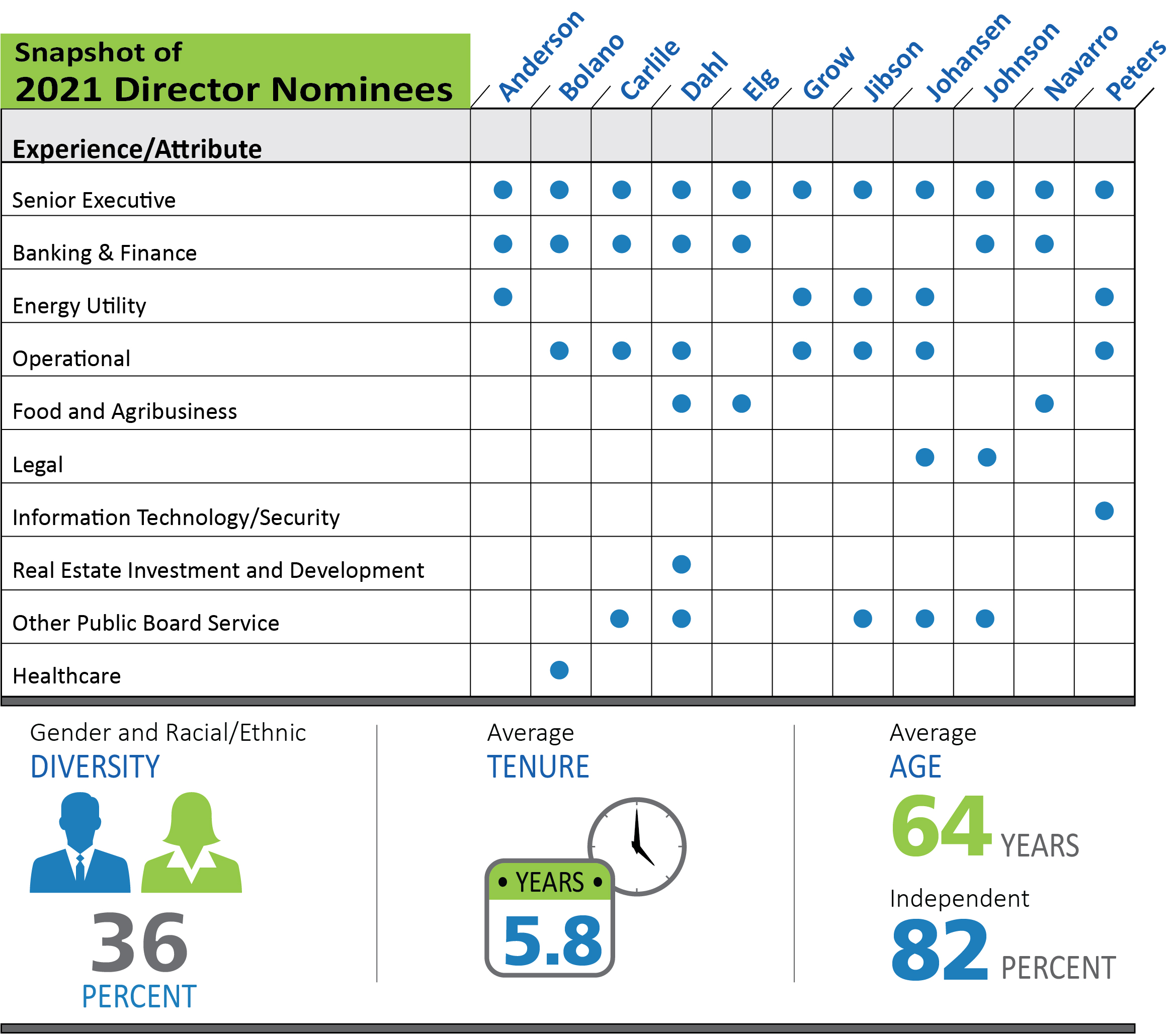

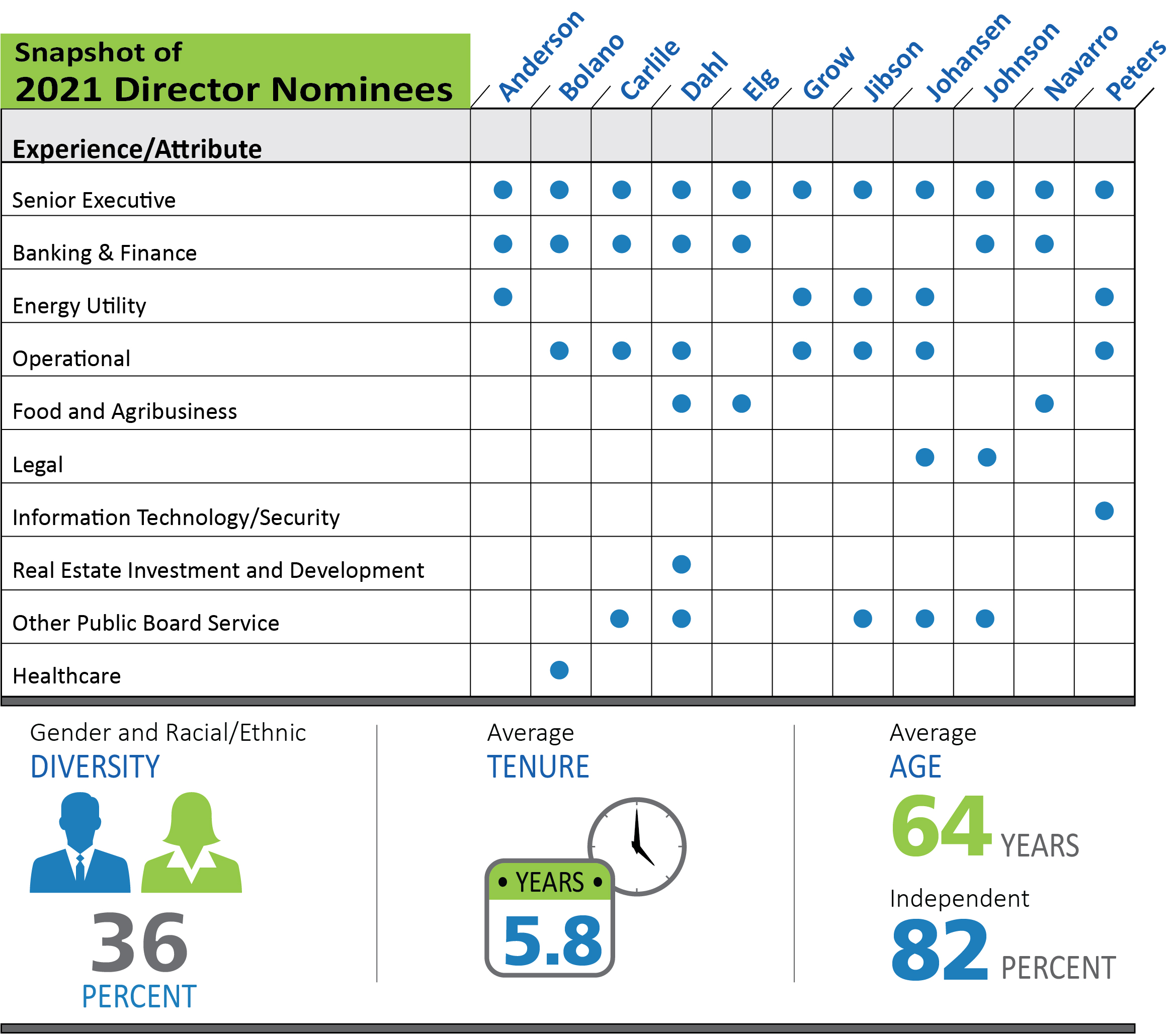

Information on Our Director Nominees:

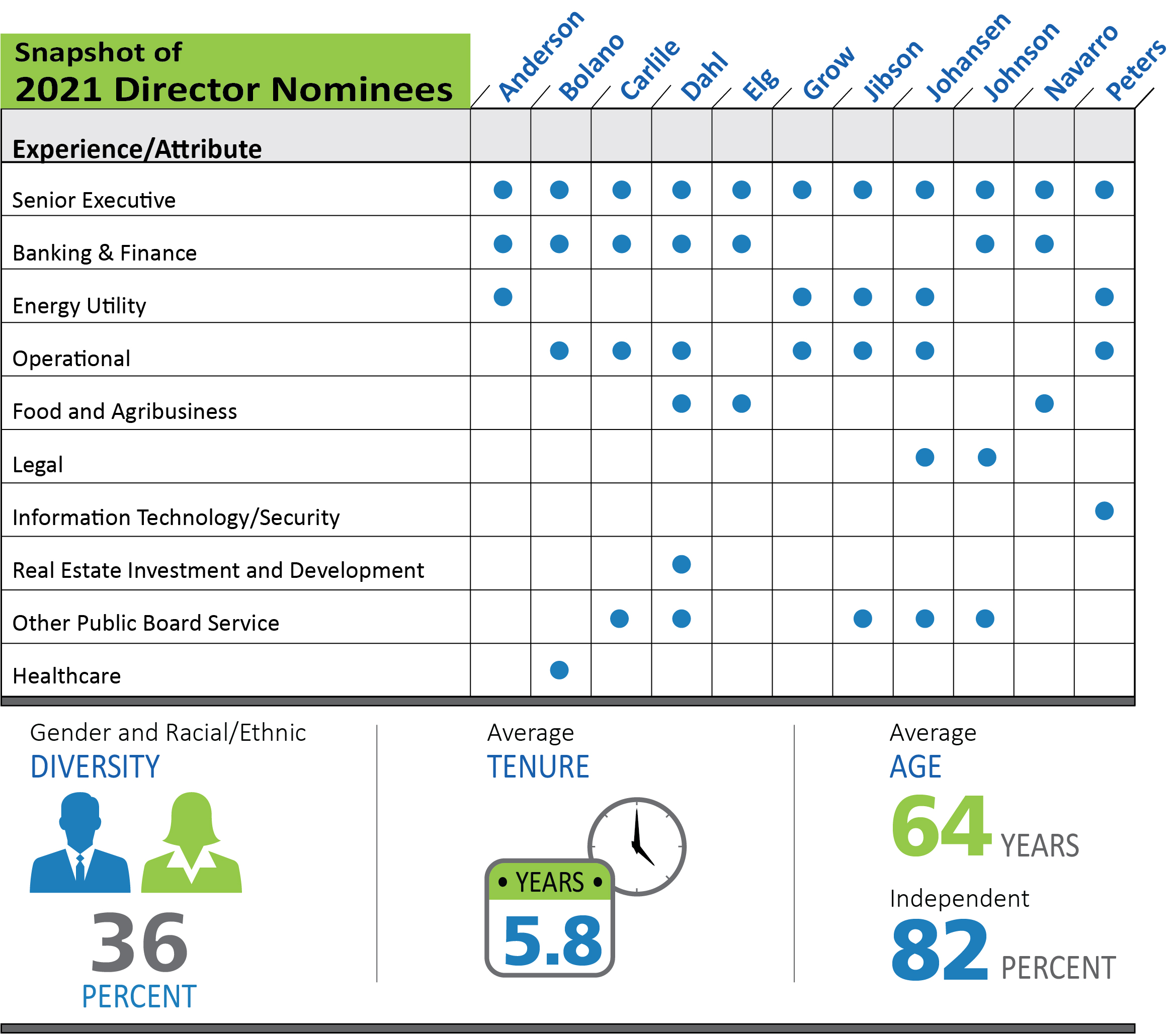

Our board of directors has nominated 11 directors for election at the 2021 Annual Meeting. You are being asked to vote on the election of each of the 11 nominees. Please see Part 3 – “Board of Directors” in this proxy statement for more information about each nominee. Below are the director nominee committee memberships and information as of the date of this proxy statement.

IDACORP, Inc. 2021 PROXY STATEMENT i

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Committee Memberships |

| Director Nominee | Director Since | Age | Independent1 | Audit | Compensation2 | Corp. Gov. & Nomin. | Executive2 |

| Darrel T. Anderson | 2013 | 63 | | | | | |

| Odette C. Bolano | 2020 | 61 | ü | ü | | | |

| Thomas E. Carlile | 2014 | 69 | ü | | | ü | |

Richard J. DahlBC | 2008 | 69 | ü | | | © | ü |

| Annette G. Elg | 2017 | 64 | ü | ü | | | |

| Lisa A. Grow | 2020 | 55 | | | | | © |

| Ronald W. Jibson | 2013 | 68 | ü | | ü | | |

| Judith A. Johansen | 2007 | 62 | ü | | ü | ü | |

| Dennis L. Johnson | 2013 | 66 | ü | ü | | ü | |

| Richard J. Navarro | 2015 | 68 | ü | © | | | ü |

Mark T. Peters3 | 2021 | 56 | ü | | | | |

© -- Committee Chair BC - Chair of the Board of Directors

1 Independent according to New York Stock Exchange listing standards and our Corporate Governance Guidelines

2 Current director Christine King, who is not a nominee for director at the Annual Meeting due to our mandatory retirement policy, is the Chair of the compensation committee and a member of the executive committee. Another director will be appointed to the compensation committee prior to Ms. King's retirement.

3 Dr. Peters has been appointed to the audit committee effective May 1, 2021.

]

]

IDACORP, Inc. 2021 PROXY STATEMENT ii

Governance Highlights and Investor Engagement:

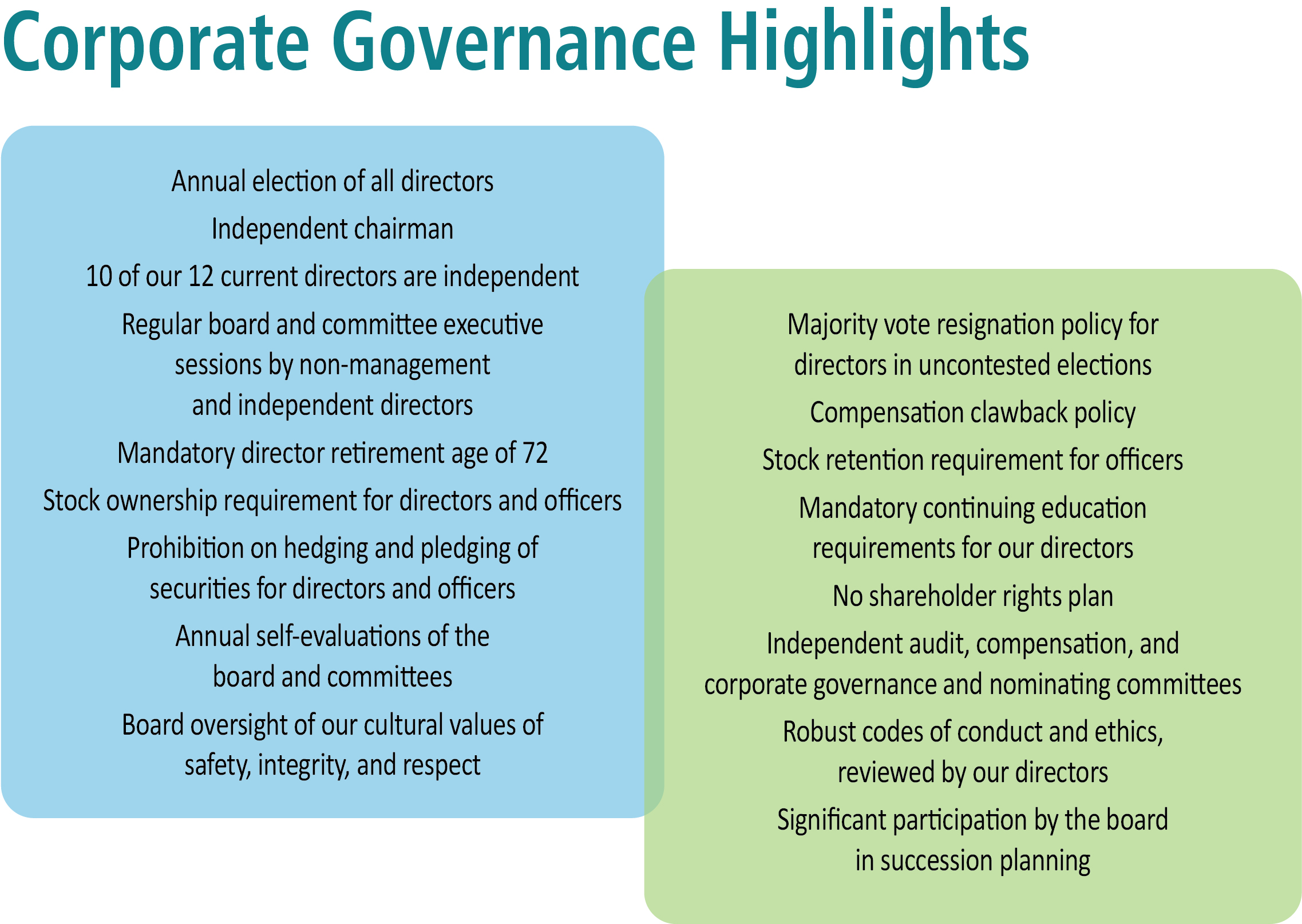

We seek to adopt and implement corporate governance practices that we believe are in the interests of our shareholders and that reflect best practices. Some of our governance practices include the following:

Our relationship with our shareholders and the investment community is of great importance to our company. To that end, shareholder engagement is a consideration in the performance evaluation of members of our executive team. Aside from our normal corporate communications, we engage with shareholders, the investment community, and interest groups through our participation in various utility and investment conferences, mini road shows, and one-on-one meetings and telephone discussions with investors. During those meetings, we solicit input on topics such as corporate governance, executive leadership, dividends, disclosure and corporate communications, transparency, and sustainability.

IDACORP, Inc. 2021 PROXY STATEMENT iii

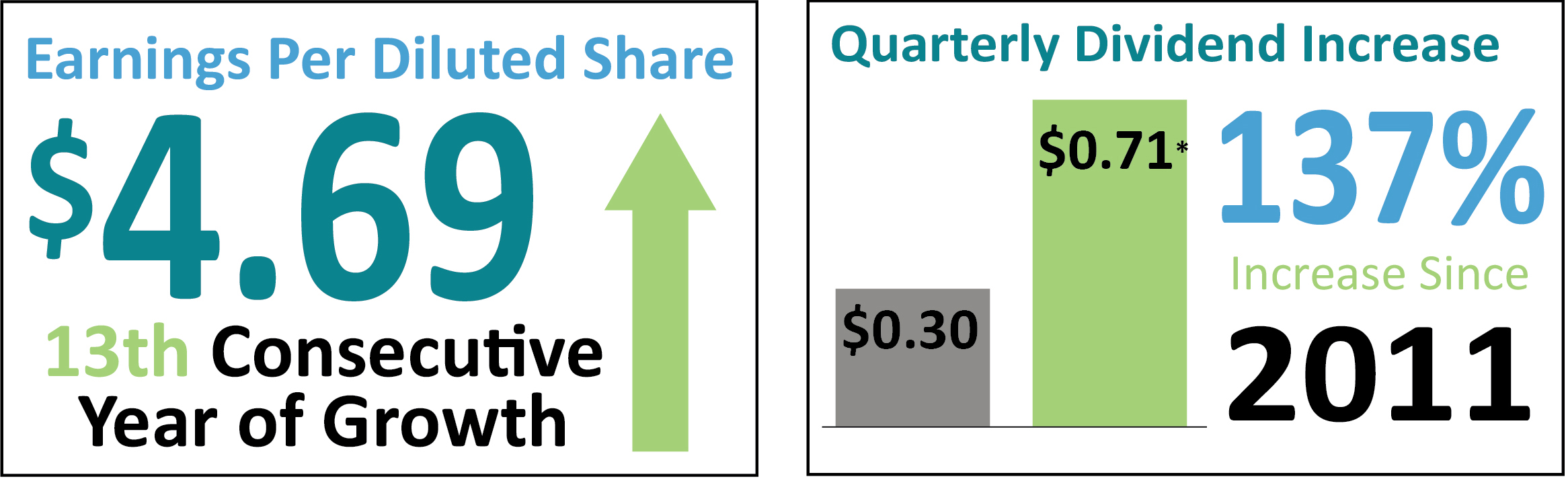

Our 2020 Performance Highlights

*Dividends per share as of February 2021

We had a successful year during 2020 in a number of respects:

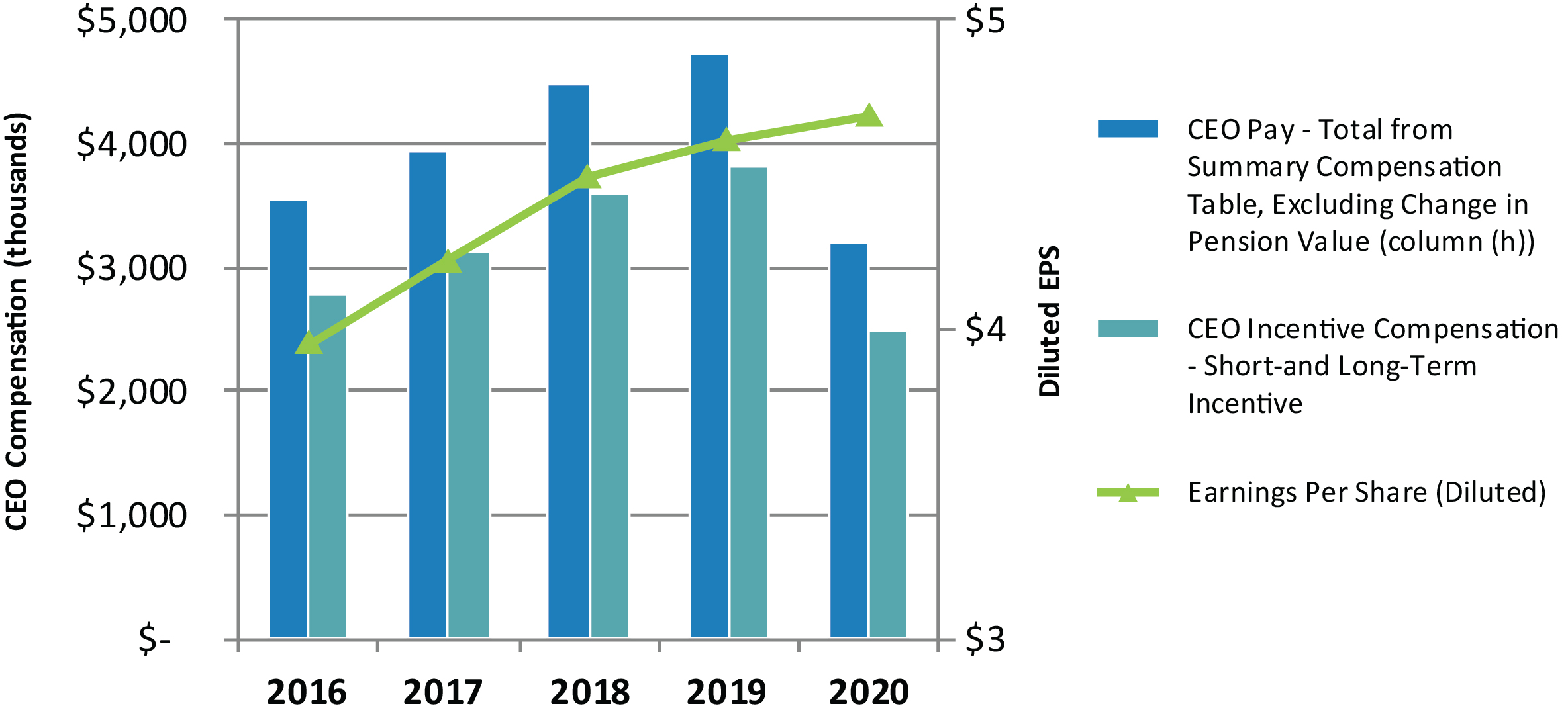

•We achieved our thirteenth consecutive year of earnings growth.

•Our board of directors increased the quarterly dividend from $0.67 per share to $0.71 per share, as part of a 137 percent increase in quarterly dividends approved over the last nine years, which for 2020 moved us into our target payout ratio of between 60 and 70 percent of sustainable IDACORP earnings on an annualized basis.

•Idaho Power's customer count grew 2.7 percent.

•Idaho Power received some of its highest customer satisfaction ratings in company history.

•Idaho Power continued its strong safety performance in 2020, achieving the second lowest number of Occupational Safety and Health Administration (OSHA) recordable incidents in Idaho Power's history, only behind 2019's record safety results.

•In October 2020, Idaho Power and the co-owner of the Boardman coal-fired power plant ceased coal-fired operations at the plant, consistent with Idaho Power's continued path away from coal generation.

•We beat our carbon dioxide (CO2) emissions intensity goal, with an average reduction of 29 percent since 2010, and set a new goal in May 2020 to reduce emissions by 35 percent by 2025 compared with the baseline year of 2005.

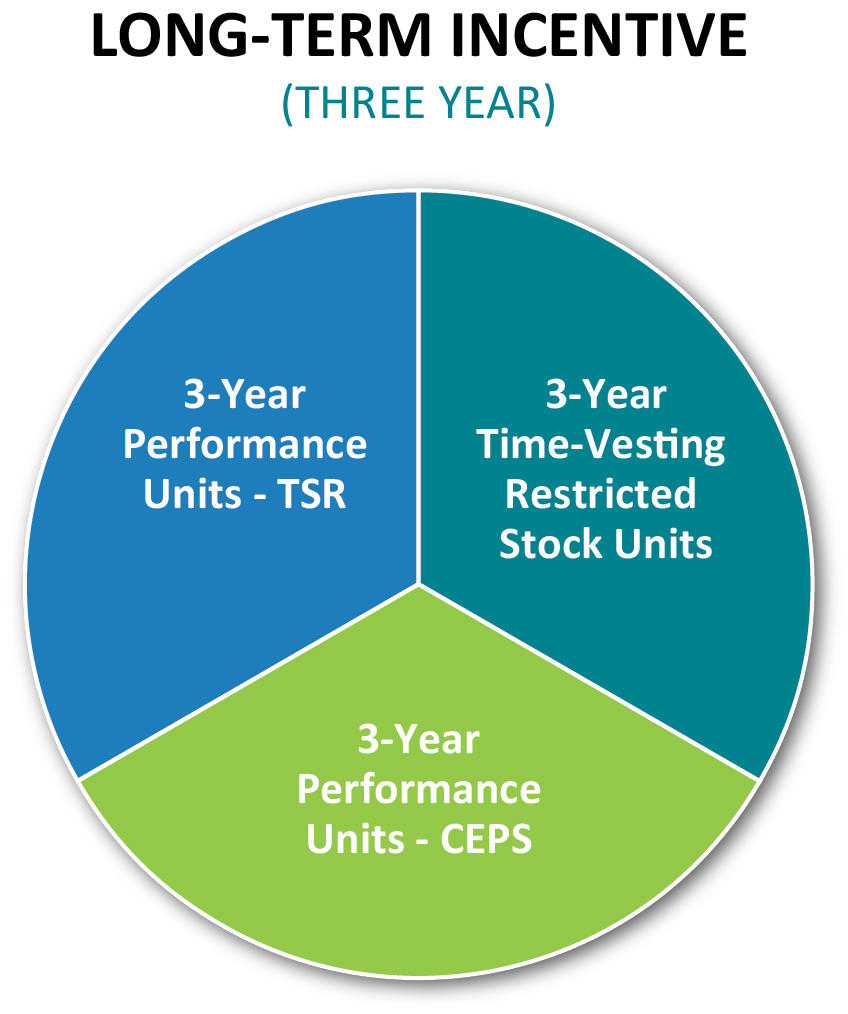

Executive Compensation Program Design Highlights:

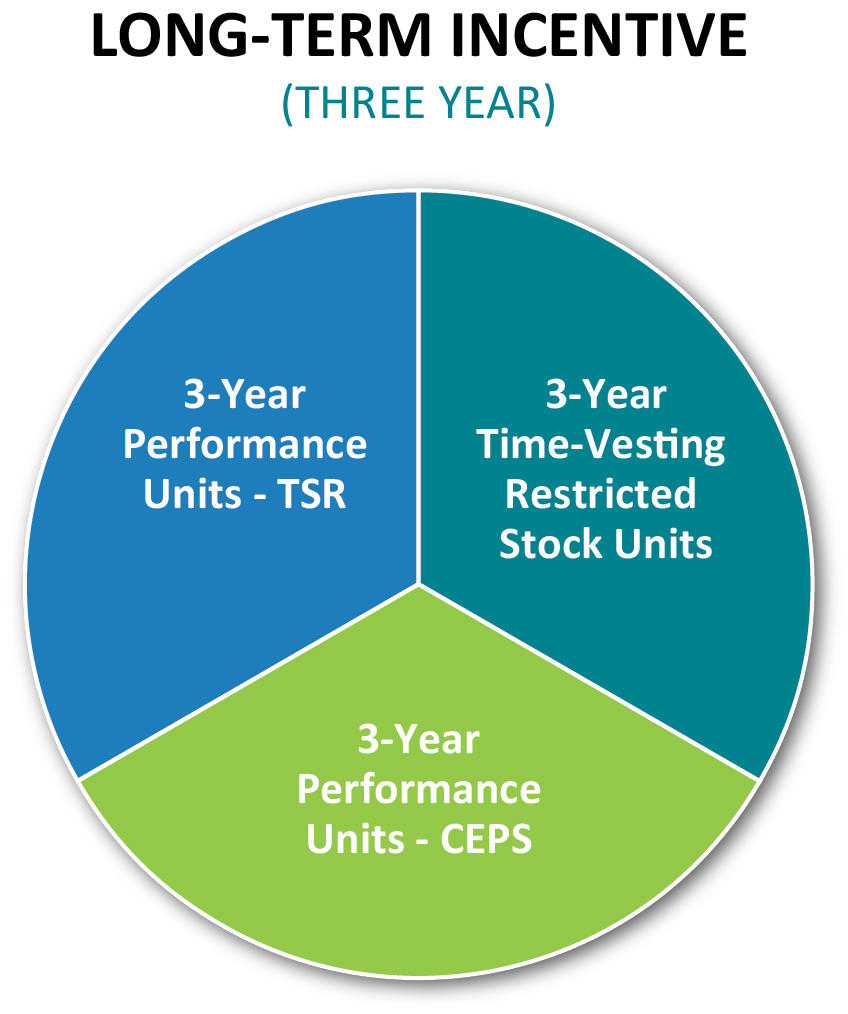

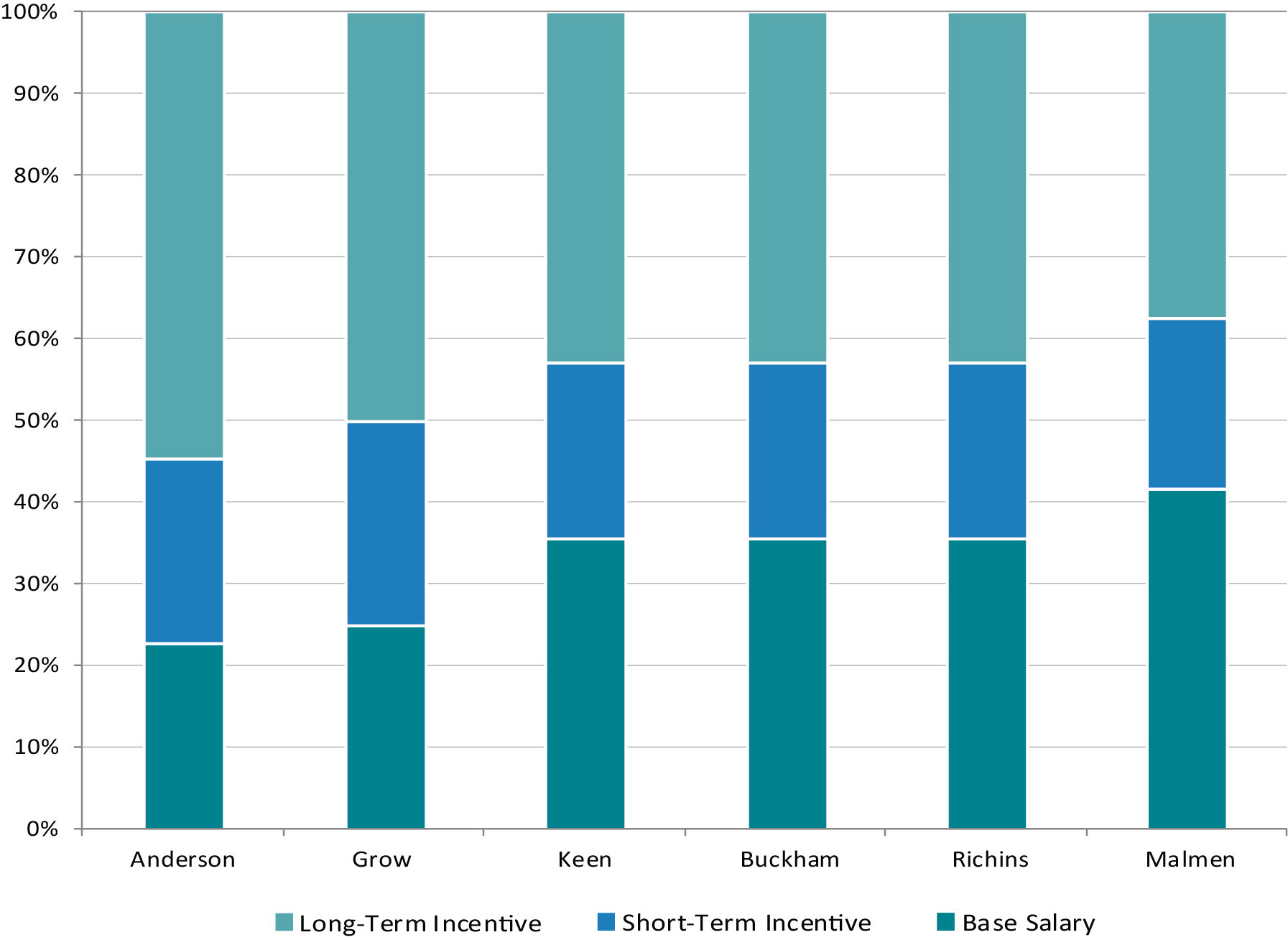

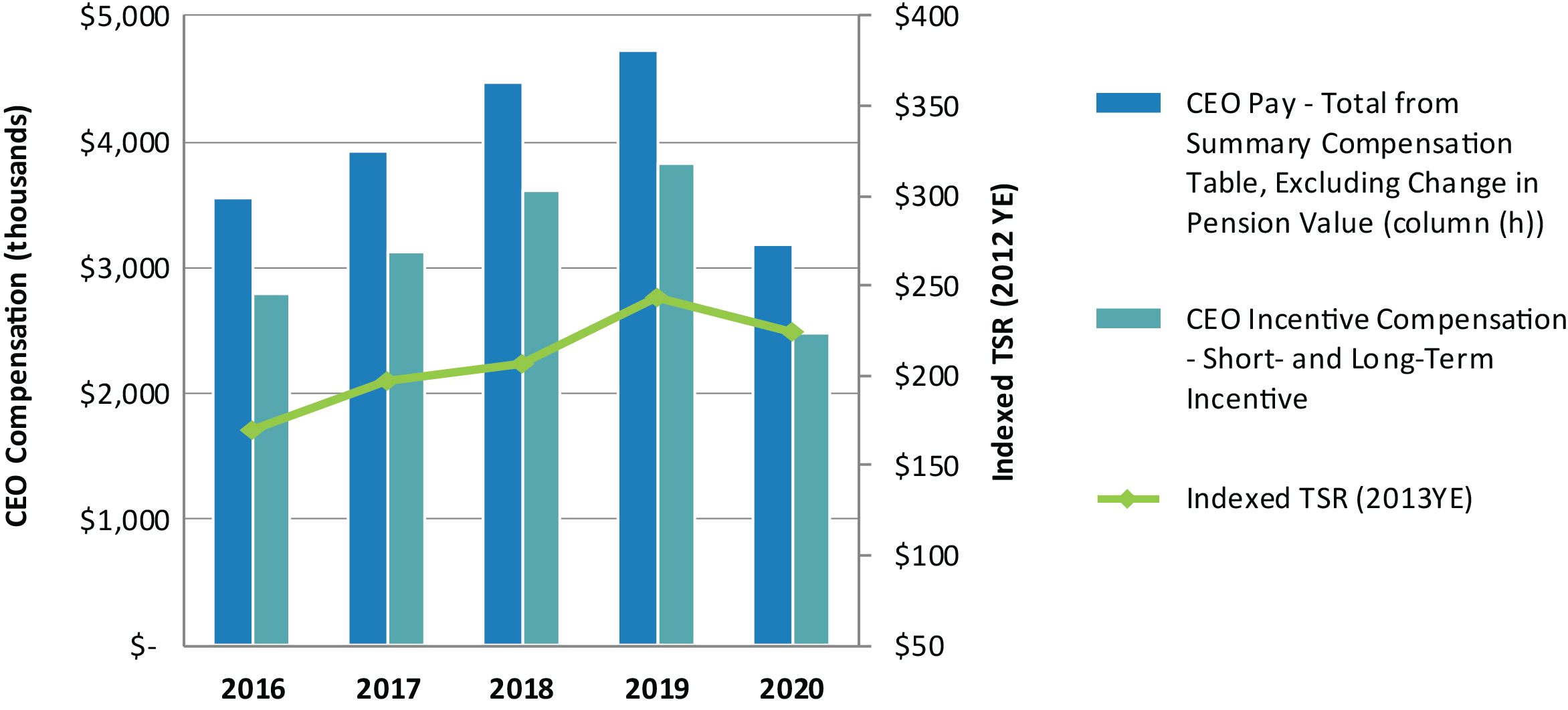

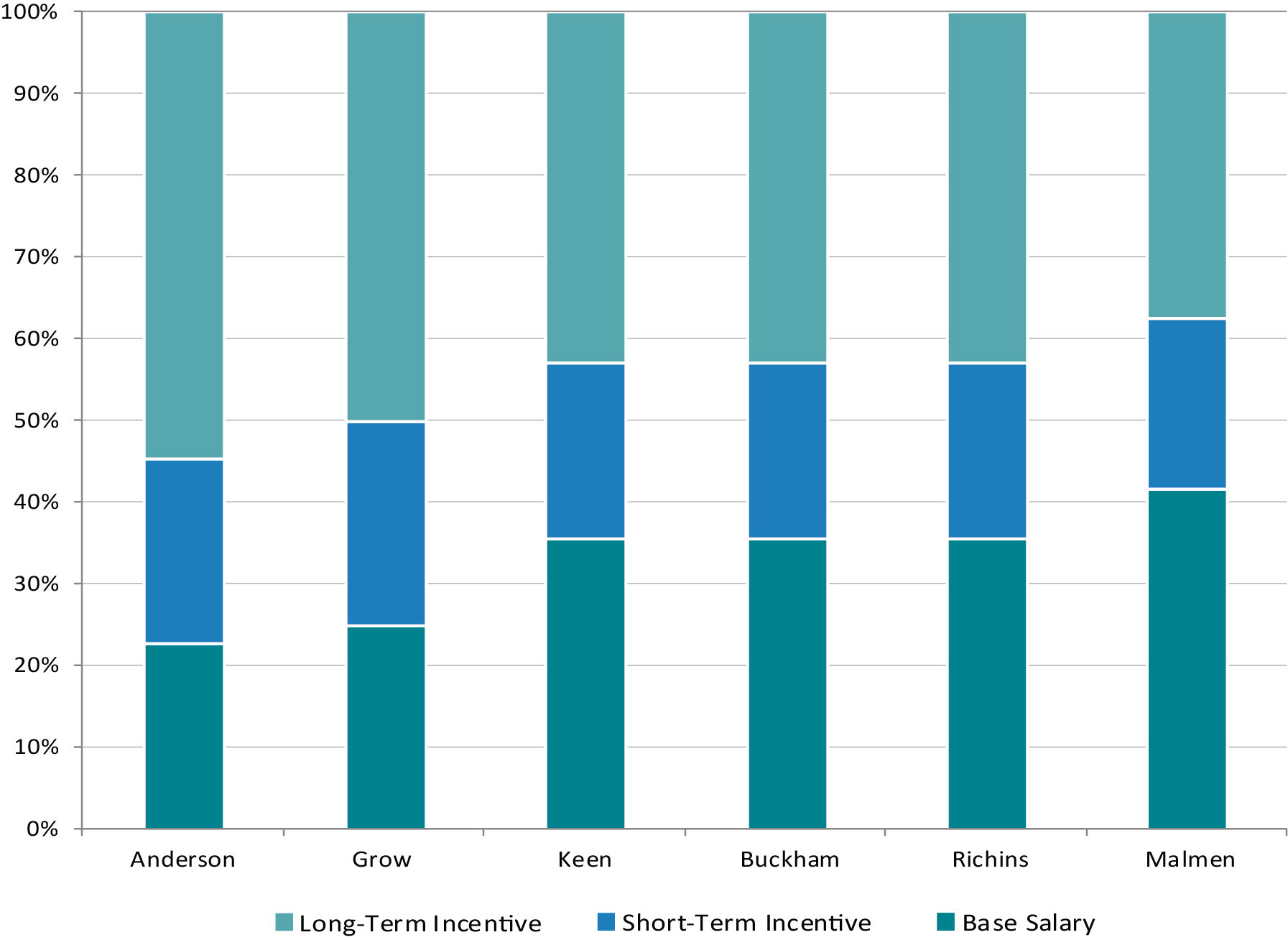

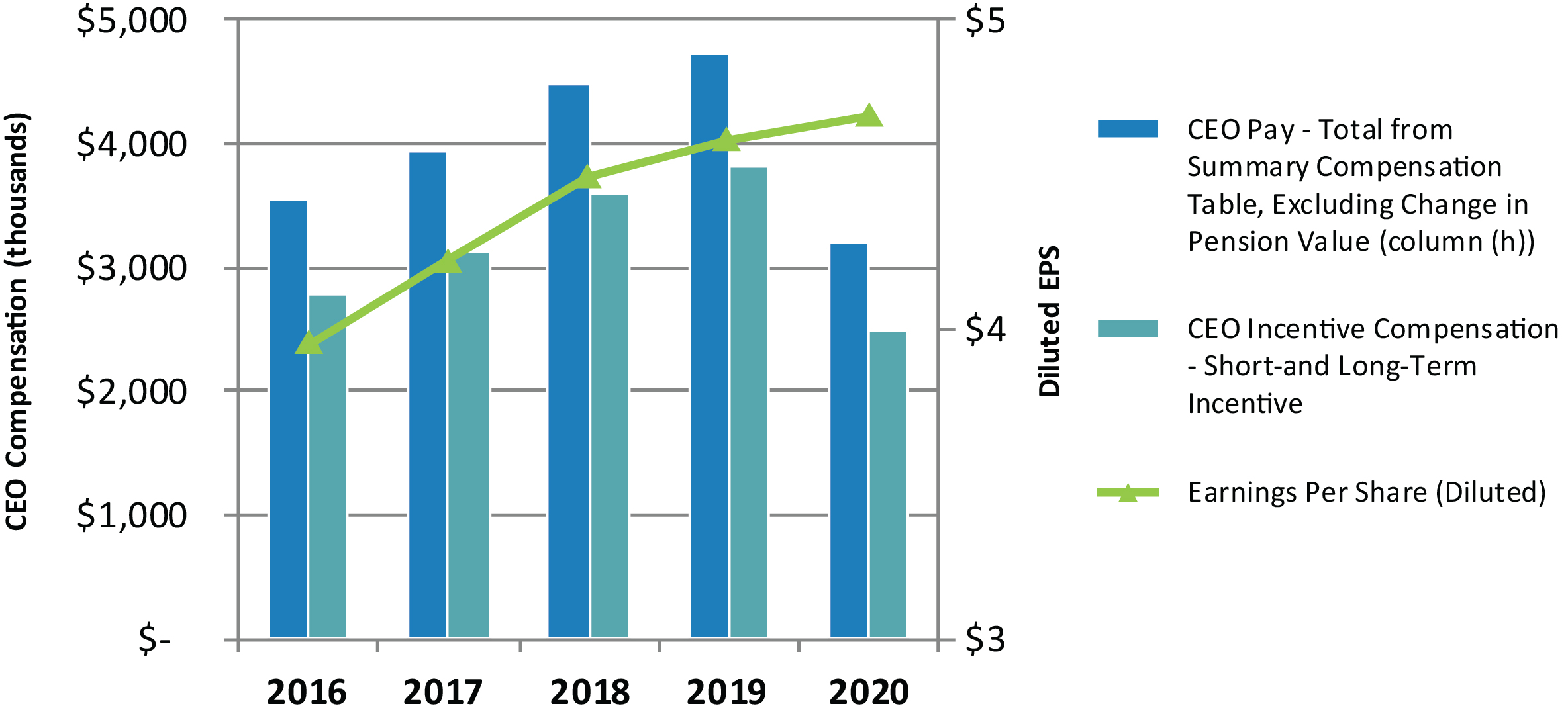

We believe strong performance by our executive officers is essential to achieving long-term growth in shareholder value and to delivering superior service to our utility customers. We seek to accomplish this by making the majority of our executive officers’ pay “at-risk,” meaning we tie much of our executive officers’ target compensation to our financial and operational performance. In order to be earned, a substantial portion of our executives’ compensation requires that we achieve successful results over one- and three-year performance periods. As an executive’s level of responsibility increases, so does the percentage of total compensation at-risk, which we believe aligns the interests of our executives who have the highest level of decision-making authority with the interests of our shareholders. Our executive compensation policy provides that between 35 percent and 75 percent of our executive officers’ total target compensation should be at-risk incentive compensation under the short-term and long-term incentive plans.

IDACORP, Inc. 2021 PROXY STATEMENT iv

We seek to establish performance metrics for incentive compensation that reward our executive officers for achieving objectives that align with our shareholders’ interests, and we use both operational and financial metrics for our incentive compensation. Our long-term incentive metrics are measures of the creation of shareholder value, rewarding appreciation in stock price and total shareholder return. Short-term incentive is paid in cash and long-term incentive is paid in IDACORP restricted stock units. Because of the diversity of our performance metrics, our executive officers’ annual compensation can vary considerably depending on our actual performance in any period. For 2020, we used the following metrics:

*Please see Part 4 – “Executive Compensation” in this proxy statement for more information on the calculation of this measure.

We have a number of compensation policies and practices that we use to help align the interests of management with our shareholders, including the following:

ü We use a number of financial and operational performance metrics for executive compensation and have a policy that a significant percentage of our executives’ target compensation be at-risk

ü We have solely independent directors on our compensation committee

ü Our compensation committee retains an independent consultant

ü We impose minimum stock ownership and retention obligations

ü We have adopted a clawback policy

ü We impose a maximum cap on incentive compensation

ü We do not provide employment agreements

ü We do not permit hedging or pledging of our stock by executive officers

ü We provide only limited perquisites

ü We do not provide stock options

ü We have a low burn rate on equity for incentive awards

ü We analyze peer groups and market data

ü We set our target goal for TSR performance at the 55th percentile of our peer group for long-term incentive

In 2020, we received 92 percent of votes cast in favor of our executive compensation programs. Please see Part 4 – “Executive Compensation” in this proxy statement for a more detailed discussion of our compensation programs, including plan metrics and payouts, and shareholder engagement efforts.

IDACORP, Inc. 2021 PROXY STATEMENT v

| | |

PROXY STATEMENT

IDACORP, Inc. – 1221 W. Idaho Street – Boise, Idaho 83702-5627

PART 1 – INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING |

General Information

This proxy statement contains information about the 2021 Annual Meeting of Shareholders (“Annual Meeting”) of IDACORP, Inc. (“IDACORP”). The Annual Meeting will be held on Thursday, May 20, 2021, at 10:00 a.m. (Mountain Time). As part of our precautions related to the pandemic, we have adopted a virtual-only format for our Annual Meeting to provide a consistent and convenient experience to all shareholders regardless of location. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/IDA, where you will be able to vote electronically and submit questions. In order to attend, you must register in advance at www.proxydocs.com/IDA prior to the deadline of May 19, 2021 at 3:00 p.m. (Mountain Time). Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and voting authorization form and subsequent instructions that will be delivered to you via email.

References in this proxy statement to the “company,” “we,” “us,” or “our” refer to IDACORP. We also refer to Idaho Power Company (“Idaho Power”) in this proxy statement. Idaho Power is an electric utility engaged in the generation, transmission, distribution, sale, and purchase of electric energy and is our principal operating subsidiary.

This proxy statement is being furnished to you by our board of directors to solicit your proxy to vote your shares at the Annual Meeting and any adjournment of the Annual Meeting. All returned proxies that are not revoked will be voted in accordance with your instructions.

You are entitled to participate in the Annual Meeting only if you are an IDACORP shareholder as of the close of business on March 31, 2021, the record date, or hold a valid proxy for the meeting. In order to be admitted to the online Annual Meeting, you must have the control number included on your proxy card and Notice of Internet Availability.

We make our proxy materials and our annual report to shareholders available on the Internet as our primary distribution method. Most shareholders will only be mailed a Notice of Internet Availability. The scheduled mailing date of the Notice of Internet Availability is on or about April 6, 2021. The Notice of Internet Availability specifies how to access proxy materials on the Internet, how to submit your proxy vote, and how to request a hard copy of the proxy materials. On or about April 6, 2021, we also began mailing printed copies of our proxy materials to our shareholders who had previously requested paper copies of our proxy materials.

Note About Forward-Looking Statements: Statements in this proxy statement that relate to future plans, objectives, expectations, performance, events, and the like, including statements regarding future financial and operational performance (whether associated with compensation arrangements or otherwise), may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Forward-looking statements may be identified by words including, but not limited to, “anticipates,” “believes,” “intends,” “estimates,” “expects,” “targets” “should,” and similar expressions. Shareholders are cautioned that any such forward-looking statements are subject to risks and uncertainties. Actual results may differ materially from those projected in the forward-looking statements. We assume no obligation to update any such forward-looking statement, except as required by applicable law. Shareholders should review the risks and uncertainties listed in our most recent Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission (“SEC”), including the risks described therein, which contain factors that may cause results to differ materially from those contained in any forward-looking statement.

IDACORP, Inc. 2021 PROXY STATEMENT 1

Questions and Answers About the Annual Meeting, this Proxy Statement, and Voting

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending the Notice of Internet Availability to most of our shareholders. All shareholders will have the ability to access the proxy materials on a website referred to in the Notice of Internet Availability or may request a printed set of the proxy materials at no charge. Shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis by following the instructions provided in the Notice of Internet Availability.

How can I participate in the Annual Meeting?

The Annual Meeting will be held exclusively online via live webcast. To participate, you will need the control number included on your proxy card and Notice of Internet Availability. In order to attend, you must register in advance at www.proxydocs.com/IDA prior to the deadline of May 19, 2021 at 3:00 p.m. (Mountain Time). Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and voting authorization form and subsequent instructions that will be delivered to you via email.

Who is entitled to vote at the Annual Meeting?

You are entitled to notice of, and to vote at, the Annual Meeting if you owned shares of our common stock at the close of business on March 31, 2021. This is referred to as the “record date.” As of the record date, we had 50,515,478 outstanding shares of common stock entitled to one vote per share on all matters.

What if I have difficulties locating the control number prior to the day of the Annual Meeting?

Prior to the day of the Annual Meeting, if you need assistance with your control number and you hold your shares in your own name, please call toll-free (800) 635-5406 in the United States. If you hold your shares in the name of a bank or brokerage firm, you will need to contact your bank or brokerage firm for assistance with your control number.

What if I have technical difficulties accessing the online Annual Meeting?

If you encounter difficulties accessing the online Annual Meeting during the check-in or the Annual Meeting itself, including any difficulties with your control number, please call the number provided on the site for assistance.

What matters are before the Annual Meeting, and how does the IDACORP Board of Directors recommend I vote?

At the Annual Meeting, our shareholders will consider and vote on the matters listed below. In determining how to vote, please consider the detailed information regarding each proposal as discussed in this proxy statement.

| | | | | | | | | | | |

| Proposal Number | Description of Proposal | Board Recommendation | Page Reference |

| 1 | Elect to the board of directors the eleven nominees who are named in this proxy statement to serve until the 2022 annual meeting of shareholders, or until their successors are elected and qualified | FOR each director nominee | 20 |

| 2 | Advisory resolution to approve our executive compensation | FOR | 75 |

| 3 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021 | FOR | 77 |

IDACORP, Inc. 2021 PROXY STATEMENT 2

Will any other business be conducted at the Annual Meeting or will other matters be voted on?

As of the date of this proxy statement, we are unaware of any matters, other than those listed in the Notice of 2021 Annual Meeting of Shareholders, that may properly be presented at the Annual Meeting. If any other matters are properly presented for consideration at the meeting, including, among other things, consideration of a motion to adjourn the meeting to another time or place, the persons named as proxies, or their duly constituted substitutes, will be deemed authorized to vote those shares for which proxies have been given or otherwise act on such matters in accordance with their judgment.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered the “shareholder of record” with respect to those shares. If your shares are held by a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of the shares, and those shares are referred to as being held in “street name.” As the beneficial owner of those shares, you have the right to direct your broker, bank, or nominee how to vote your shares, and you should receive separate instructions from your broker, bank, or other holder of record describing how to vote your shares. You also are invited to attend the Annual Meeting in person. However, because a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

How can I vote my shares before the Annual Meeting?

If you hold shares in your own name as a shareholder of record, you may vote by Internet or telephone before the Annual Meeting by following the instructions contained in the Notice of Internet Availability. Under Idaho law, proxies granted according to those instructions will be valid. If you request printed copies of the proxy materials by mail, you may also cast your vote by completing, signing, and dating the proxy card provided to you and returning it in the postage-paid envelope provided to you. Your vote by Internet or telephone or through your mailed proxy card will authorize the individuals named on the proxy card to serve as your proxy to vote your shares at the Annual Meeting in the manner you indicate.

If you are a beneficial owner of shares held in street name, your broker, bank, or other nominee should provide you with materials and instructions for voting your shares. Please check with your broker or bank and follow the voting procedures your broker or bank provides to vote your shares.

Submitting a proxy or voting through the telephone or the Internet will not affect your right to participate in the Annual Meeting.

If I am the beneficial owner of shares held in street name by my bank or broker, how will my shares be voted?

If you complete and return the voting instruction form provided to you by your bank or broker, we expect that your shares will be voted in accordance with your instructions. If you do not provide voting instructions, brokerage firms only have authority under applicable New York Stock Exchange rules to vote shares on discretionary matters. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 is the only matter included in the proxy statement that is considered a discretionary matter. When a proposal is not discretionary and the brokerage firm has not received voting instructions from its customers, the brokerage firm cannot vote the shares on that proposal. Those shares are considered “broker non-votes.” Please promptly follow the instructions you receive from your bank or broker so your vote can be counted.

If I am a shareholder of record, how will my shares be voted?

All proxies will be voted in accordance with the instructions you submitted via the Internet, by toll-free telephone, or, if you requested printed proxy materials, by completing, signing, and returning the proxy card provided to you. If you completed and submitted your proxy (and do not revoke it) prior to the Annual Meeting, but do not specify how your shares should be voted for one or more of the voting proposals, the shares of IDACORP common stock represented by the proxy will be voted in accordance with the recommendation of our board of directors, for those proposals for which you did not vote.

IDACORP, Inc. 2021 PROXY STATEMENT 3

Can I vote at the online Annual Meeting?

Yes, if you participate in the online Annual Meeting by visiting www.proxydocs.com/IDA, you will be able to vote your shares and submit questions during the meeting.

May I change or revoke my proxy?

You may change or revoke your proxy before it is voted at the Annual Meeting by (1) granting a subsequent proxy through the Internet or by telephone, or (2) delivering to us a signed proxy card with a date later than your previously delivered proxy. If you participate in the virtual meeting and wish to vote online during the meeting, you may revoke your proxy at that time. You may also revoke your proxy by mailing your written revocation to IDACORP’s corporate secretary at 1221 West Idaho Street, Boise, Idaho 83702-5627. We must receive your mailed written revocation before the Annual Meeting for it to be effective.

What is the “quorum” for the Annual Meeting and what happens if a quorum is not present?

The presence at the Annual Meeting, online or by proxy, of a majority of the shares issued and outstanding and entitled to vote as of March 31, 2021, is required to constitute a “quorum.” The existence of a quorum is necessary in order to take action on the matters scheduled for a vote at the Annual Meeting. If you vote by Internet or telephone, or submit a properly executed proxy card, your shares will be included for purposes of determining the existence of a quorum. Proxies marked “abstain” and “broker non-votes” also will be counted in determining the presence of a quorum. If the shares present online or represented by proxy at the Annual Meeting are not sufficient to constitute a quorum, the chair of the meeting or the shareholders may, by a vote of the holders of a majority of votes present in person or represented by proxy, without further notice to any shareholder (unless a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

What is an “abstention”?

An “abstention” occurs when a shareholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. An abstention with respect to a matter submitted to a vote will not be counted for or against the matter. Consequently, an abstention with respect to any of the proposals to be presented at the Annual Meeting will not affect the outcome of the vote.

What is a “broker non-vote”?

A broker non-vote occurs when a broker or other nominee who holds shares for another person does not vote on a particular proposal because that holder does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner of the shares. If no voting instructions have been provided by the beneficial owner, brokers will have discretionary voting power to vote shares with respect to the ratification of the appointment of the independent registered public accounting firm, but not with respect to any of the other proposals. A broker non-vote will have the same effect as an abstention and, therefore, will not affect the outcome of the vote.

What vote is required to approve each proposal?

The following votes are required for approval of each proposal at the Annual Meeting:

| | | | | | | | |

| Proposal Number | Vote Requirement | Effect of Withholding, Abstentions and Broker Non-Votes |

| 1 | Our directors are elected by a plurality of the votes cast by the shares entitled to vote in the election of directors. | No effect, though a “withhold” vote is relevant under our director resignation policy |

| 2 | The advisory resolution on executive compensation is approved if the votes cast in favor exceed the votes cast against the resolution. | No effect |

| 3 | The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 is approved if the votes cast in favor exceed the votes cast against ratification. | Abstentions will have no effect; uninstructed shares are subject to a discretionary vote by a broker or other nominee |

IDACORP, Inc. 2021 PROXY STATEMENT 4

What happens if, under Proposal No. 1, a director receives a greater number of votes “withheld” than votes “for” such director?

As noted above, a plurality of votes cast by shareholders present, in person or by proxy, at the Annual Meeting is required for the election of our directors. “Plurality” means that the nominees receiving the largest number of votes cast for his or her election are elected for the number of director positions that are to be filled at the meeting. However, under our director resignation policy, if a director nominee in an uncontested election receives a greater number of votes “withheld” from his or her election than votes “for” such election, the director must promptly tender a resignation to the board of directors. The board of directors will then decide whether to accept the resignation within 90 days following certification of the shareholder vote (based on the recommendation of the corporate governance and nominating committee, which is comprised exclusively of independent directors). We will publicly disclose the board of directors’ decision and its reasoning with regard to the offered resignation.

Who will count the votes?

An independent tabulator will tabulate the votes cast by mail, Internet, or telephone. Our corporate secretary will tabulate any votes cast at the Annual Meeting and will act as inspector of election to certify the results.

Where can I find the voting results?

We expect to report the voting results on a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

Are the votes of specific shareholders confidential?

It is our policy that all proxies for the Annual Meeting that identify shareholders, including employees, are to be kept confidential from the public. Proxies will be forwarded to the independent tabulator who receives, inspects, and tabulates the proxies. We do not intend to disclose the voting decisions of any shareholder to any third party except (a) as required by law or order or directive of a court or governmental agency, (b) to allow the inspector of election inspectors to review and certify the results of the shareholder vote, (c) in the event of a dispute as to the vote or voting results, or (d) in the event of a matter of significance where there is a proxy solicitation in opposition to the board of directors, based on an opposition proxy statement filed with the SEC.

Who will pay the cost of this solicitation and how will these proxies be solicited?

We will pay the cost of soliciting your proxy. Our officers and employees may solicit proxies, personally or by telephone, fax, mail, or other electronic means, without extra compensation. In addition, D.F. King & Co., Inc. will solicit proxies from brokers, banks, nominees, and institutional investors or other shareholders at a cost of approximately $6,500 plus out-of-pocket expenses. We will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for their expenses in providing our proxy materials to beneficial owners.

What if I have further questions not addressed in this proxy statement?

If you have any questions about voting your shares or participating in the Annual Meeting, please call our Shareowner Services Department at (800) 635-5406.

IDACORP, Inc. 2021 PROXY STATEMENT 5

| | |

PART 2 – CORPORATE GOVERNANCE AT IDACORP |

Overview of Our Corporate Governance Practices

The goals of our corporate governance principles and practices are to promote the long-term interests of our shareholders, as well as to maintain appropriate checks and balances and compliance systems, to strengthen management accountability, engender public trust, and facilitate prudent decision making. We evaluate our corporate governance principles and practices and modify existing, or develop new, policies and standards when appropriate. Some of our notable corporate governance practices include the following:

| | | | | | | | | | | |

| ü | Annual election of all directors

| ü | Majority vote resignation policy for directors in uncontested elections |

| ü | Independent chairperson | ü | Compensation clawback policy |

| ü | 10 of our 12 current directors, and 9 of our 11 director nominees, are independent | ü | Stock retention requirement for officers |

| ü | Regular board and committee executive sessions by non-management and independent directors | ü | Mandatory continuing education requirements for our directors |

| ü | Mandatory director retirement age of 72 | ü | No shareholder rights plan |

| ü | Stock ownership requirement for directors and officers | ü | Independent audit, compensation, and corporate governance and nominating committees |

| ü | Prohibition on hedging and pledging of securities for directors and officers | ü | Robust codes of conduct and ethics, reviewed by our board |

| ü | Annual self-evaluations of the board and committees | ü | Significant participation by the board in succession planning |

| ü | Board oversight of our cultural values of safety, integrity, and respect | ü | Consideration of diversity in our board member selection |

IDACORP, Inc. 2021 PROXY STATEMENT 6

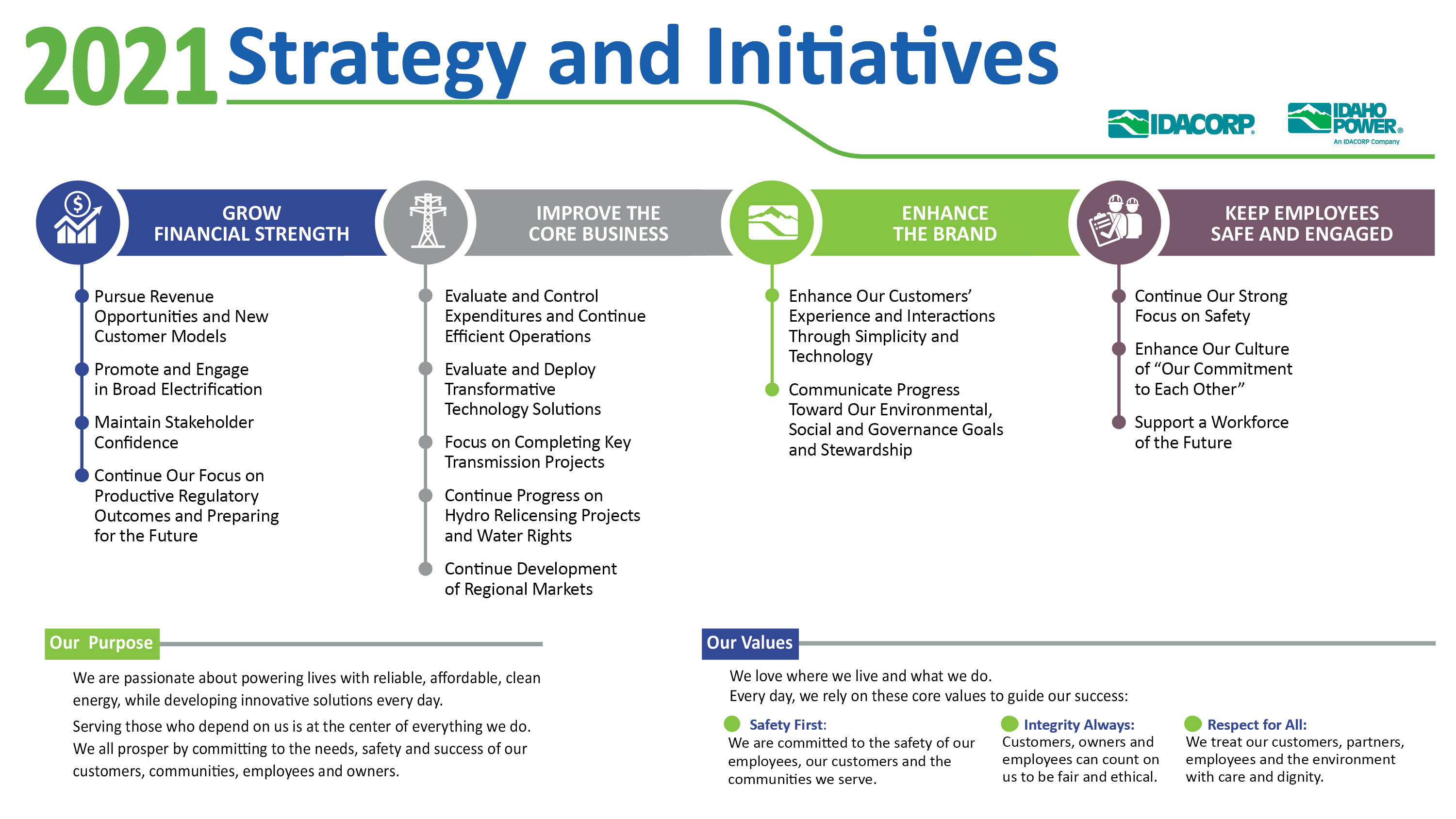

Our Strategic and Environmental, Social, and Governance (“ESG”) Initiatives

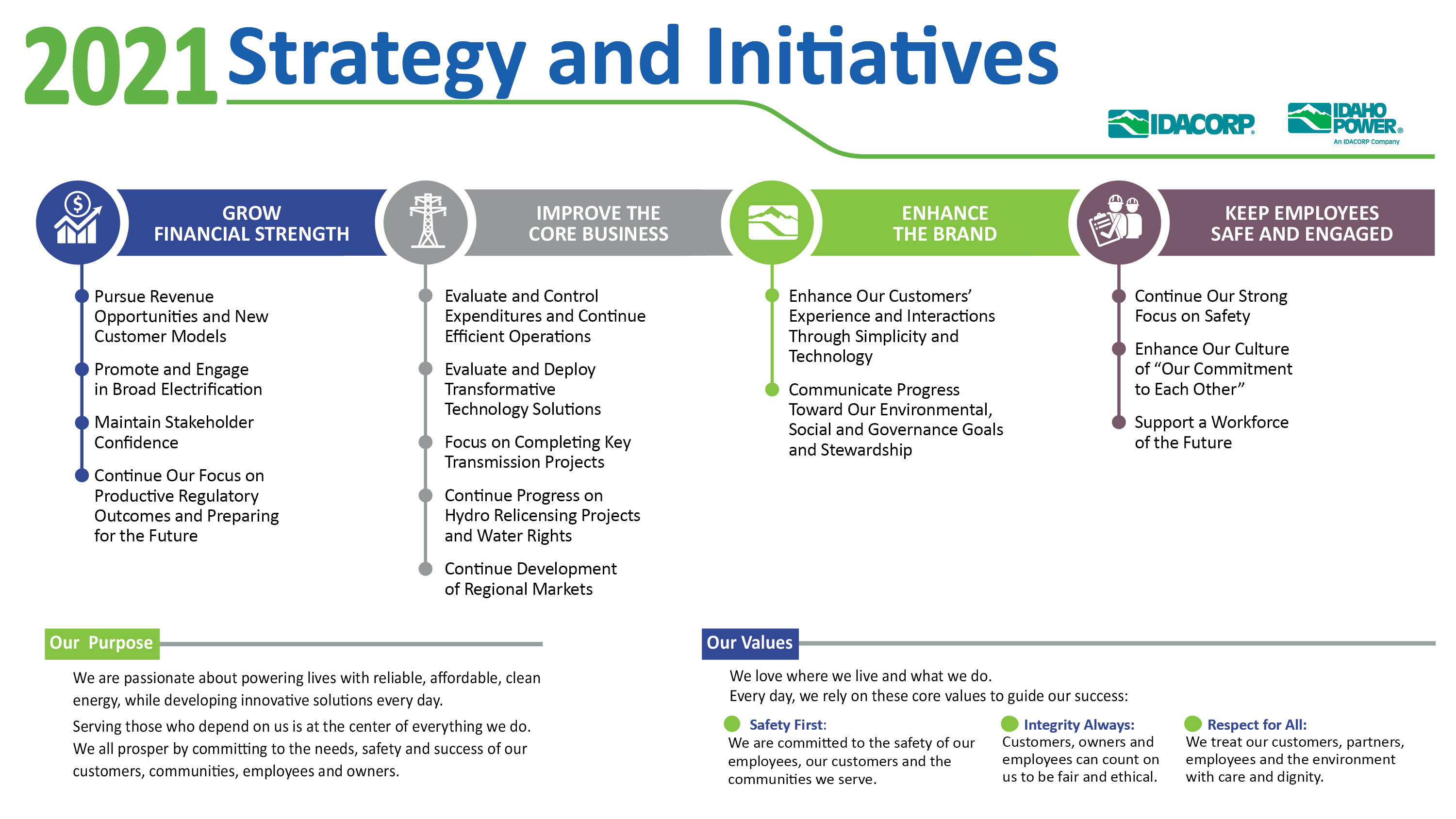

We are committed to our focus on competitive total returns and generating long-term value for shareholders. Our business strategy emphasizes Idaho Power as our core business, as Idaho Power's regulated utility operations are the primary driver of our operating results. Our board of directors regularly reviews our long-term strategy, which as of the date of this proxy statement is focused on the following areas and initiatives:

In executing the focus areas above, we seek to balance the interests of shareholders, Idaho Power customers, employees, and other stakeholders. Idaho Power is working to continue to provide safe, affordable, reliable service to its customers from diversified generation resources, with a continued commitment to strong, sustainable financial results and strong credit ratings.

ESG Initiatives

Our board of directors, with considerable focus from the corporate governance and nominating committee, is responsible for the oversight of our ESG initiatives that are determined by management to be material to the company's business and is informed at least quarterly by members of the company's ESG steering committee comprised of officers and business area experts of the goals, measures, and results of our ESG and sustainability programs. We publicly release annual ESG reports and the most current ESG report is located on Idaho Power’s website, together with other information on ESG issues relevant to Idaho Power. The ESG reports and related website content are not incorporated by reference into this proxy statement.

Our ESG initiatives include:

•establishing responsible management goals and long-term strategies related to our impact on the environment, such as

◦Idaho Power's "Clean Today, Cleaner Tomorrow.®" goal to provide Idaho Power's customers with 100-percent clean energy by 2045,

IDACORP, Inc. 2021 PROXY STATEMENT 7

◦the sustainability benefits from the Boardman-to-Hemingway transmission project, which includes integrating renewable energy generation and deferring or eliminating the need for development of additional fossil-fueled resources,

◦continuing various environmental stewardship programs along the Snake River, including fish habitat preservation, water temperature reduction, and fish and plant restoration,

◦wildfire mitigation planning and actions, and

◦wildlife habitat, archaeological and cultural resource, and raptor protection stewardship programs.

•operational excellence in providing reliable, affordable, and clean energy,

•engaging and empowering Idaho Power’s workforce (including succession planning at all levels, employee development, leadership education, retirement planning education, and providing competitive compensation and benefits, including post-retirement benefits),

•promoting a culture of safety, diversity, equity, and inclusiveness for all employees, and

•building strong community partnerships for healthy, sustainable economic development in Idaho Power’s service area.

Carbon Emission Reduction

Carbon emissions intensity is a measure of the pounds of carbon dioxide ("CO2") emitted per MWh of energy generated. Idaho Power tracks carbon emissions intensity to measure the impact of its efforts to reduce carbon emissions relative to growing power demand in its service area. We have actively engaged in voluntary carbon emissions intensity reduction over the past decade with an original goal to reduce emissions 10-15 percent from the baseline year of 2005 levels. We have achieved and furthered the reduction goal several times. We increased the goal to reduce carbon emission intensity by at least 15-20 percent for the period from 2010 to 2020, and exceeded this goal with an estimated average reduction of 29 percent over that period compared with 2005. In May 2020, our board of directors approved an increased goal to reduce carbon emission intensity by 35 percent for the period from 2021-2025 compared with 2005.

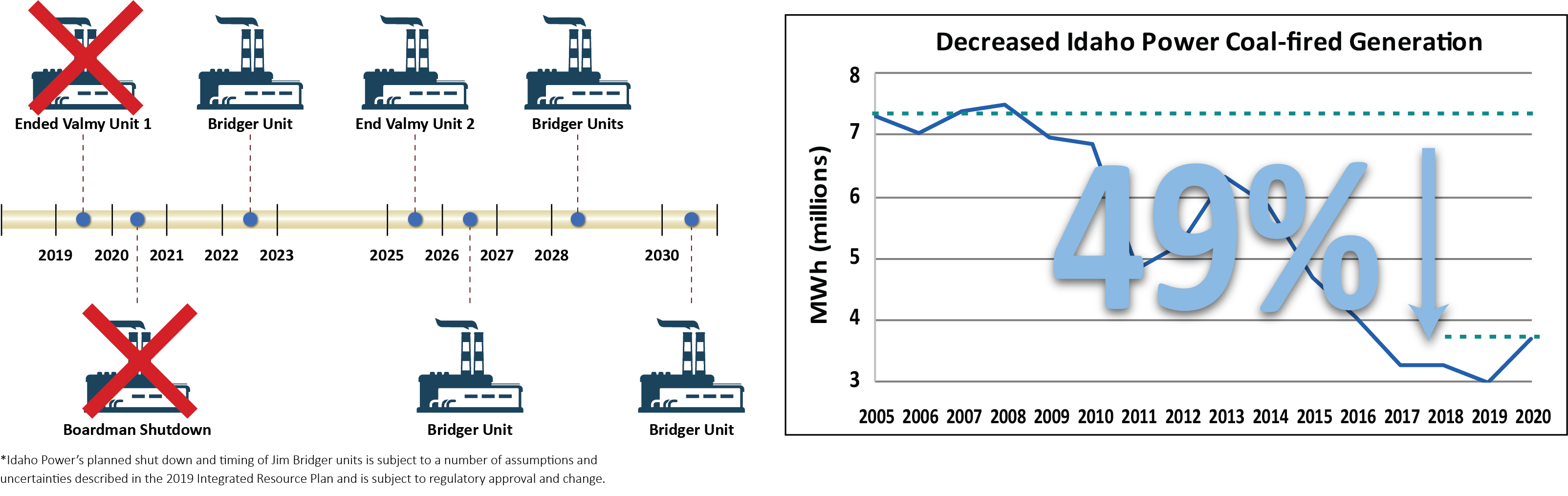

We monitor environmental requirements and assess whether environmental control measures are or remain economically appropriate. Our most recent Integrated Resource Plan in 2019 identified the following schedule to retire Idaho Power's participation in its remaining co-owned coal-fired plants.

IDACORP, Inc. 2021 PROXY STATEMENT 8

Board and Board Committee Oversight of Human Capital Management

Our board of directors provides oversight for the company's human capital management. Management updates the full board of directors and its committees regularly on safety metrics, total rewards for employees, benefit and pension programs, succession planning and training programs, and diversity, equity, and inclusion initiatives, among other things. Each committee of the board of directors is delegated and takes on specific roles in this oversight. The compensation committee is responsible for overseeing employee compensation and benefit plans and general labor issues. The audit committee is responsible for overseeing risk management, including compliance with the code of business conduct and physical security risks relating to employees. The corporate governance and nominating committee is responsible for overseeing risks associated with governance and social issues associated with employees as part of its ESG risk oversight function.

Safety

We are committed to the safety of our employees, customers, and the communities we serve. We believe that safe, engaged, and effective employees are critical to the company’s success and that the company’s record of safety helps keep its service reliable and affordable. Idaho Power consistently ranks in the top 30 percent of all United States utilities in safety performance. Reflective of our focus on safety, the company’s Occupational Health and Safety Administration recordable injury rate was below the industry average rate during four of the past five years, and its safety metrics in 2019 and 2020 were the strongest in the company’s history.

In response to the COVID-19 pandemic, we implemented significant changes that it determined were in the best interest of its employees, as well as the communities in which it operates, in addition to complying with government regulations. While the nature of our industry necessitated that much of our field-based workforce continue to operate in the field, we implemented numerous measures to help ensure the safety of those employees, and the public, amidst the pandemic. Most of our non-field employees worked remotely beginning in March 2020 and remain working remotely as of the date of this proxy statement.

Diversity, Equity, and Inclusion ("DEI") Initiative

One of our core values as a company is “respect for all.” Our Code of Business Conduct, available publicly on our website, states our position that employees deserve a workplace where they can be treated in a professional and respectful manner, and each of our employees has the responsibility to create and maintain such an environment. In furtherance of this core value, we post our "Our Commitment to Each Other" initiative on our website, which promotes an inclusive company environment as follows:

At Idaho Power, we are committed to an inclusive environment where we are all valued, respected and given equal consideration for our contributions. We believe that to be successful as a company we must be able to innovate and adapt, which only happens when we seek out and value diverse backgrounds, opinions and perspectives. Our collaborative environment thrives when we are engaged, feel we belong and are empowered to do our best work. We are a stronger company when we stand together and embrace our differences.

IDACORP, Inc. 2021 PROXY STATEMENT 9

Our talent acquisition and talent development teams within our Human Resources department partner closely with senior management to ensure alignment of the company's human capital management with our corporate values with respect to DEI. We strive to recruit and retain diverse talent from all backgrounds, instill an inclusive culture and strengthen programs that provide advancement opportunities for all. We have programs in place to encourage STEM participation, training to minimize bias and ensure a respectful and inclusive workplace, community outreach to underserved communities, and partnerships with multiple diversity-focused organizations. In 2020, we formed a DEI steering committee consisting of officers, senior managers, and other employees to help the company with its DEI initiative and efforts. We consider DEI to be an important component of our overall ESG program, and certain of our officers regularly provide information on those and other ESG efforts to our board of directors and board committees.

As of December 31, 2020, 36 percent of our senior management were women, 21 percent of our officers were women, 45 percent of our board of directors were women, and one member of our board of directors was racially or ethnically diverse.

Employee Satisfaction

Our human capital programs are designed to attract, retain, and develop the highest quality employees. We believe we maintain a good relationship with our employees due to a strong safety culture, respectful and inclusive environment, opportunities for development, and competitive compensation and benefits. We regularly conduct employee engagement surveys to seek feedback from our employees on a variety of topics, including safety reporting, support for development, understanding of the company’s initiatives, communication, and being treated with respect and feeling valued. We share the survey results with employees, and senior management incorporates the results of the surveys in their action plans in order to respond to the feedback and improve employee relations. We achieved an 82 percent participation rate in the 2020 employee engagement survey with an overall 82 percent positive employee satisfaction score.

Total Rewards

We provide our employees with competitive pay and benefits, based in large part on salary studies and market data. We use a structured compensation schedule and regularly conduct compensation analyses that helps mitigate the potential for gender, race, or ethnicity-based disparities in compensation. Beyond base salaries and incentive compensation, benefits for all full-time employees include an employee savings (401(k)) plan and company matching contributions, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, parental leave, employee assistance programs, and tuition assistance. Currently after five years of employment, a full-time employee vests in Idaho Power’s defined benefit pension plan. We also tie annual employee incentive compensation to metrics based on the categories of earnings, power system reliability, and customer satisfaction reflective of broad stakeholder interests and each employee's contribution.

We deliver a variety of training opportunities and provide rotational assignment and continuous learning and development opportunities to our employees. Our talent development programs, overseen by a talent development team in the Human Resources department, are designed to help employees achieve their career goals, build management skills, and lead their organizations.

We also encourage and enable our employees to support many charitable causes. This includes volunteer program engagement promoted by the company or employees. We also have an employee-led organization called the “Employee Community Funds,” which administers charitable contributions from employees; Idaho Power matches a portion of employee donations, which supplements the company’s separate charitable contributions.

Additional ESG Information

To learn more about our corporate responsibility and ESG efforts, see our most recent ESG Report on our website at www.idacorpinc.com/about-us/sustainability. The information in that report is not incorporated by reference into this proxy statement.

IDACORP, Inc. 2021 PROXY STATEMENT 10

Codes of Business Conduct

We have a Code of Business Conduct that applies to all of our officers and employees. We also have a separate Code of Business Conduct and Ethics for directors. These are posted on our website at www.idacorpinc.com/governance/governance-documents. We will also post on that website any amendments to, or waivers of, our Codes of Business Conduct, as required by SEC rules or New York Stock Exchange listing standards.

Board Leadership Structure

The board of directors separated the positions of chair of the board of directors and CEO in 1999. Our CEO is responsible for leadership, overall management of our business strategy, and day-to-day operations, while our chair presides over meetings of our board of directors and provides guidance to our CEO regarding policies and procedures approved by our board of directors. Separating these two positions allows our CEO to focus on our day-to-day business and operations, while allowing the chair of the board of directors to lead the board of directors in its fundamental role of providing advice to, and independent oversight of, management. The board of directors recognizes the time, effort, and energy that the CEO is required to devote to his position, as well as the increasing commitment required of the chair position, particularly as the board of directors’ oversight responsibilities continue to grow.

While our bylaws and Corporate Governance Guidelines do not mandate that our chair and CEO positions be separate, the board of directors believes for the reasons outlined above that having separate positions and having an independent director serve as chair is the appropriate leadership structure for the company at this time. The board of directors believes that this issue is part of the succession planning process and that it is in the best interests of the company for the board of directors to make a determination as to the advisability of continuing to have separate positions when it appoints a new CEO.

The Board of Directors’ Role in Risk Oversight and Succession Planning

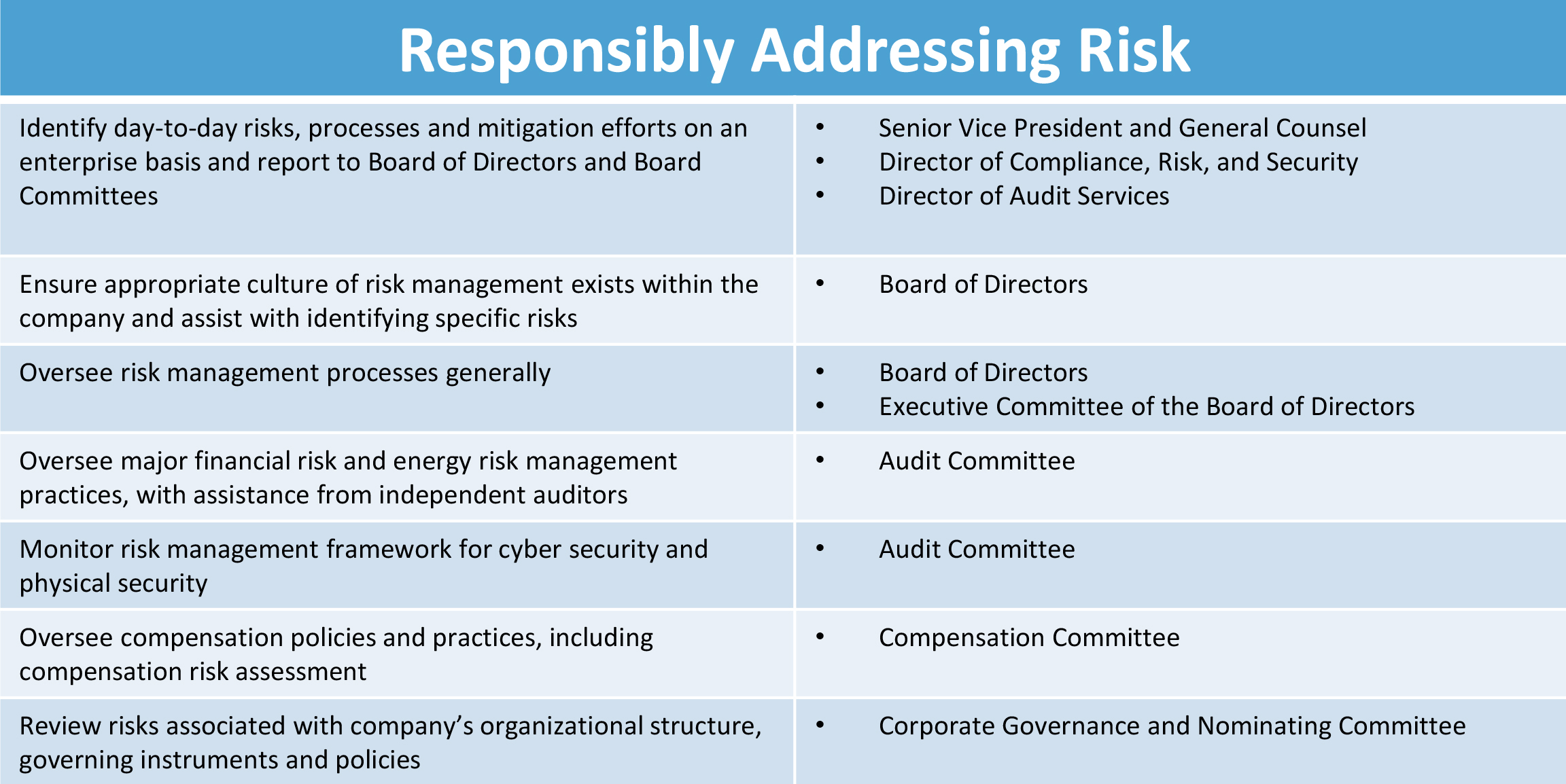

Our management team is responsible for the day-to-day management of risks the company faces. Our senior vice president and general counsel and our director of compliance, risk, and security, together with our director of audit services, are responsible for overseeing and coordinating risk assessment processes and mitigation efforts on an enterprise wide basis. These leaders administer processes intended to identify key business risks, assist in appropriately assessing and managing these risks within stated limits, enforce policies and procedures designed to mitigate risk, and report on these items to other members of senior management and the board of directors. These leaders report regularly to the board of directors and appropriate board committees regarding risks the company faces and how the company is managing those risks.

IDACORP, Inc. 2021 PROXY STATEMENT 11

While our senior vice president and general counsel, our director of compliance, risk and security, and our director of audit services, together with other members of our senior leadership team, are responsible for the day-to-day management of risk, our board of directors is responsible for ensuring that an appropriate culture of risk management exists within our company, for setting the right “tone at the top,” and assisting management in addressing specific risks that our company faces. The board of directors has the responsibility to oversee the risk management processes designed and implemented by management and confirm the processes are adequate and functioning as designed.

While the full board of directors is ultimately responsible for high-level risk oversight at our company, it is assisted by the executive committee, the audit committee, the compensation committee, and the corporate governance and nominating committee in fulfilling its oversight responsibilities in certain areas of risk. The executive committee assists the board of directors in fulfilling its oversight responsibilities with respect to the company’s risk management processes generally. The audit committee assists the board of directors in fulfilling its oversight responsibilities with respect to major financial risk exposures and our energy risk management practices (including hedging transactions and collateral requirements) and, in accordance with the listing standards of the New York Stock Exchange, discusses policies with respect to risk assessment and risk management. Representatives from our independent registered public accounting firm attend audit committee meetings, regularly make presentations to the audit committee, comment on management presentations, and engage in private sessions with the audit committee, without members of management present, to raise any concerns they may have with our risk management practices. The audit committee and the executive committee also assist the board of directors in monitoring management’s risk management framework for cyber security and physical security on a regular basis. The compensation committee assists the board of directors in fulfilling its oversight responsibilities with respect to risks arising from our compensation policies and practices. The corporate governance and nominating committee undertakes periodic reviews of processes for management of risks associated with our company’s organizational structure, governing instruments, and ESG issues. In fulfilling their respective responsibilities, the committees meet regularly with our officers and members of senior management, as well as our internal and external auditors. Each committee has full access to management, as well as the ability to engage and compensate its own independent advisors.

The board of directors receives regular reports from the executive committee, audit committee, compensation committee, and corporate governance and nominating committee relating to the oversight of risks in their areas of responsibility. Based on this and information provided by management, the board of directors evaluates our risk management processes and oversight and considers whether any changes should be made to those processes or the board of directors’ risk oversight function. We believe that this division of risk oversight ensures that oversight of each type of risk the company faces is allocated, at least initially, to the particular directors most qualified to oversee it. It also promotes board efficiency because the committees are able to select the most timely or important risk-related issues for the full board of directors to consider.

One of the risks our company faces is that a significant number of our long-term employees have retired and we expect will continue to retire in the coming years. As a result, our board of directors is actively involved in monitoring our succession planning. The board of directors reviews the succession plans developed by members of senior management at least annually, with a focus on ensuring a talent pipeline at the officer level and for specific critical roles. We seek to ensure that our directors are exposed to a variety of members of our leadership team, and not just the senior-most officers, on a regular basis, through formal presentations and informal events. Our board of directors is also informed of general workforce trends, expected retirement levels or turnover, and recruiting and development programs, which is of particular importance given Idaho Power’s specialized workforce and recent high rate of employee retirements.

Board Meetings and Director Attendance

The members of our board of directors are expected to attend board meetings and the meetings of board committees on which they serve, to spend the time needed and to meet as frequently as necessary to properly discharge their responsibilities. The board of directors held five meetings in 2020, with all of our directors attending 100 percent of those meetings. Each director also attended 100 percent of the meetings of the committees in 2020 on which he or she was a member in 2020, with the exception Mr. Johnson, who was absent from one audit committee meeting due to an illness in his family. Our Corporate Governance Guidelines provide that all directors are expected to attend our annual meeting of shareholders and be available, when requested by the chair of the board of directors, to answer any questions shareholders may have. All then-serving members of the board of directors attended our 2020 annual meeting of shareholders.

IDACORP, Inc. 2021 PROXY STATEMENT 12

Board Committee Charters

Our standing committees of the board of directors are the executive committee, the audit committee, the compensation committee, and the corporate governance and nominating committee. We have:

• charters for the audit committee, compensation committee, and corporate governance and nominating committee; and

• Corporate Governance Guidelines, which address issues including the responsibilities, qualifications, and compensation of the board of directors, as well as board leadership, board committees, director resignation, and self-evaluation.

Our committee charters and our Corporate Governance Guidelines may be accessed on our website at http://www.idacorpinc.com/governance/governance-documents. Information on our committees of the board of directors is included in Part 3 – “Board of Directors – Committees of the Board of Directors.”

Director Independence and Executive Sessions

Our board of directors has adopted a policy, contained in our Corporate Governance Guidelines (available at www.idacorpinc.com/governance/governance-documents), that the board of directors will be composed of a majority of independent directors. The board of directors reviews annually the relationships that each director has with the company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the company). Following the annual review, only those directors who the board of directors affirmatively determines have no material relationship with the company and can exercise independent judgment will be considered independent directors, subject to additional qualifications prescribed under the listing standards of the New York Stock Exchange and under applicable laws.

All members of our board of directors are non-employees, except Lisa A. Grow, who is our president and chief executive officer ("CEO"). The board of directors has determined that all members of our board of directors, other than Ms. Grow and Mr. Anderson (our previous chief executive officer who retired effective June 2020), are independent based on all relevant facts and circumstances and under the New York Stock Exchange listing standards and our Corporate Governance Guidelines.

Our non-employee directors meet in executive session at each regular meeting of the board of directors. Additionally, our independent directors meet separately in executive session periodically, and not less frequently than annually. The independent chair of the board of directors presides at board meetings and at regularly scheduled executive sessions of independent and non-management directors.

Board Membership Criteria and Consideration of Diversity

We believe that directors should possess the highest personal and professional ethics, integrity, and values and be committed to representing the long-term interests of our shareholders. Directors must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. We also consider a nexus to Idaho Power’s service area a desirable trait. We endeavor to have a diverse board with a variety of attributes and experience at policy-making levels in areas that are relevant to our business activities, in addition to diversity with respect to gender, race, and ethnicity. We believe our director nominees bring a strong diversity of attributes and experiences to the board of directors as leaders in business, finance, accounting, regulation, and the utility industry as shown in the chart below.

IDACORP, Inc. 2021 PROXY STATEMENT 13

Under the oversight of the corporate governance and nominating committee, the board of directors conducts an annual self-evaluation of its performance and utilizes the results to assess and determine the characteristics and critical skills required of directors. Each of our audit, compensation, and corporate governance and nominating committees also performs an annual self-assessment. The board of directors and committees self-assessment surveys are completed anonymously by each board member and committee member and provide for a full assessment of board of director and committee performance, including recommendations for improvement. The board of directors and committees review the compiled results from the respective self-assessment surveys and discuss responsive actions to the survey results. Each board member also completes a confidential questionnaire related to compliance with independence standards and director qualifications annually. The responses are provided to our general counsel and to our corporate secretary who compiles a report for the corporate governance and nominating committee. This report is also presented for review by the full board of directors. In addition, our Corporate Governance Guidelines and the corporate governance and nominating committee charter provide that the corporate governance and nominating committee will annually review board committee assignments and consider the rotation of the chair and members of the committees with a view toward balancing the benefits derived from continuity against the benefits derived from the diversity of experience and viewpoints of the various directors.

In addition, we require that:

•at least one member of our audit committee be an “audit committee financial expert”;

•our directors automatically retire immediately prior to the first annual meeting of shareholders after they reach age 72; and

•a majority of board members be independent under our Corporate Governance Guidelines and applicable New York Stock Exchange listing standards.

IDACORP, Inc. 2021 PROXY STATEMENT 14

Director Resignation Policy

We have a policy that provides that if any director nominee in an uncontested election receives a greater number of votes “withheld” from his or her election than votes “for” such election, the director nominee must tender his or her resignation to the board of directors promptly after the voting results are certified. The corporate governance and nominating committee, comprised entirely of independent directors and which will specifically exclude any director who is required to tender his or her own resignation, will consider the tendered resignation and make a recommendation to the board of directors, taking into account all factors deemed relevant. These factors include, without limitation, the underlying reasons why shareholders withheld votes from the director (if ascertainable) and whether the underlying reasons are curable, the length of service and qualifications of the director whose resignation has been tendered, the director's contributions to our company, whether by accepting the resignation we will no longer be in compliance with any applicable law, rule, regulation, or governing document, and whether or not accepting the resignation is in the best interests of our company and our shareholders. Our board of directors will act upon the corporate governance and nominating committee’s recommendation within 90 days following certification of the shareholder vote and will consider the factors considered by the corporate governance and nominating committee and any additional information and factors as the board of directors believes to be relevant. We will publicly disclose the board of directors’ decision and rationale with regard to any resignation offered under the director resignation policy.

Process for Determining Director Nominees

In determining the composition of our board of directors, we seek a balanced mix of local experience, which we believe is specifically relevant for a utility, and national or public company experience, among other factors of experience and diversity. As a utility company with operations predominantly in Idaho and Oregon, we believe it is important for our company and our local directors to be involved in and otherwise support local community and charitable organizations.

Our corporate governance and nominating committee is responsible for selecting and recommending to the board of directors candidates for election as directors. Our Corporate Governance Guidelines contain procedures for the committee to identify and evaluate new director nominees, including candidates our shareholders recommend in compliance with our Corporate Governance Guidelines. The corporate governance and nominating committee begins the process of identifying and evaluating potential nominees for director positions by taking into consideration the results of the annual director questionnaires and self-evaluation process described above while keeping the full board of directors informed of the nominating process. The corporate governance and nominating committee reviews candidates recommended by shareholders and may hire a search firm to identify other candidates.

The corporate governance and nominating committee gathers additional information on the candidates to determine if they qualify to be members of our board of directors. The corporate governance and nominating committee examines whether the candidates are independent, whether their election would violate any federal or state laws, rules, or regulations that apply to us, and whether they meet all requirements under our Corporate Governance Guidelines, committee charters, bylaws, codes of business conduct and ethics, and any other applicable corporate document or policy. The corporate governance and nominating committee also considers whether the nominees will have potential conflicts of interest, and whether they will represent a single or special interest, before finalizing a list of candidates for the full board of directors to consider for nomination.

Process for Shareholders to Recommend Candidates for Director

Our Corporate Governance Guidelines set forth the requirements that you must follow if you wish to recommend director candidates to our corporate governance and nominating committee. If you recommend a candidate for director, you must provide the following information:

• the candidate’s name, age, business address, residence address, telephone number, principal occupation, the class and number of shares of our voting stock the candidate owns beneficially and of record, a statement as to how long the candidate has held such stock, a description of the candidate’s qualifications to be a director, whether the candidate would be an independent director, and any other information you deem relevant with respect to the recommendation; and

• your name and address as they appear on our stock records, the class and number of shares of voting stock you own beneficially and of record, and a statement as to how long you have held the stock.

IDACORP, Inc. 2021 PROXY STATEMENT 15

Recommendations must be sent to our corporate secretary at the address provided below. Our corporate secretary will review all written recommendations and send those conforming to the requirements described above to the corporate governance and nominating committee for review and consideration. The corporate governance and nominating committee evaluates the qualifications of candidates properly submitted by shareholders in the same manner as it evaluates the qualifications of director candidates identified by the committee or the board of directors.

Shareholders who wish to nominate persons for election to the board of directors, rather than recommend candidates for consideration, must follow the procedures set forth in our bylaws. Copies of our bylaws may be obtained by writing to our corporate secretary at IDACORP, Inc., 1221 West Idaho Street, Boise, Idaho 83702-5627, or by calling our corporate secretary at (208) 388-2200. See also the section entitled 2022 Annual Meeting of Shareholders in Part 6 - “Other Matters” in this proxy statement.

Communications with the Board of Directors and Audit Committee

Shareholders and other interested parties may communicate with members of the board of directors by:

• calling (866) 384-4277 if they have a concern to bring to the attention of the board of directors, our chair of the board of directors, or our non-employee directors as a group; or

• logging on to http://secure.ethicspoint.com/domain/media/en/gui/62899/index.html and following the instructions to file a report if the concern is of an ethical nature.

Our general counsel receives all such communications. These communications are distributed to the board of directors, or to the chair or specific directors as appropriate, depending on the facts and circumstances of the communication. Communications may include the reporting of concerns related to governance, corporate conduct, business ethics, financial practices, legal issues, and accounting or audit matters. If a report concerns questionable accounting practices, internal accounting controls, or auditing matters, our general counsel will also forward your report to the chair of the audit committee. The acceptance and forwarding of communication to any director does not imply that the director owes or assumes any fiduciary duty to the person submitting the communication, all such duties being only as prescribed by applicable law.

Political Advocacy and Lobbying Activities

We routinely engage in federal, state, and local public policy discussions ranging from issues that specifically impact the generation, transmission, and distribution of electricity to more general topics related to regulation, taxation, business, and labor. Our political advocacy objectives focus on a variety of interests, including costs to customers and owners, safety, reliability of service and our responsibility to the environment, employees, stakeholders, and communities. To that end, we are also active in a number of state, regional, and national trade associations that may engage in political activity on these issues.

Our voluntary, non-partisan employee political action committee (IDA-PAC) participates in the political process through contributions to candidate campaigns, other political action committees, and ballot measure campaigns in compliance with applicable laws. Those contributions are made in furtherance of the company’s interests and without regard to the personal political preferences of our directors, executives, or employees. In 2015, the board of directors voluntarily adopted a policy in response to the 2010 U.S. Supreme Court decision in Citizens United v. Federal Election Commission, that we will not provide direct corporate funding for independent advertisements that support or oppose political candidates for election to public office.

Further, our Senior Vice President of Public Affairs who monitors and approves all such activities, is required to report lobbying expenditures; contributions to candidates, ballot measures and initiatives, trade and industry associations, and certain other organizations that may engage in activities involving legislative measures; and contributions to elections to the corporate governance and nominating committee for their review on a biennial, election-cycle basis. The corporate governance and nominating committee reviews our political contributions (including contributions to IDA-PAC) and our lobbying efforts and updates the full board of directors on such activities.

Corporate political contributions and lobbying activities are subject to regulation by the states in which we operate and the federal government, including requirements to provide disclosures of federal and state lobbying expenses, which are made publicly available by the various government authorities to which we report. For the 2020 election cycle, we contributed approximately $68,000 to political action committees at all levels of government. Of that

IDACORP, Inc. 2021 PROXY STATEMENT 16

amount, $32,000 was contributed by IDA-PAC to federal candidates. We also contributed $109,000 to candidates for Idaho and Oregon state elections. Contributions to candidates were made to both primary political parties. For 2020, we spent approximately $830,000 on lobbying expenditures, including compensation for our employees engaged in lobbying efforts and membership dues for trade associations. We made no contributions to 527 groups, 501(c)(4)s for political purposes, or to ballot measures in the 2020 election cycle.

Anti-Hedging and Anti-Pledging Policy

Our compensation policy and corporate governance guidelines prohibit executive officers (as well as directors) from hedging their ownership of company common stock. Under our policy, a director or executive officer may not enter into transactions that allow the director or officer to benefit from devaluation of our stock or be the technical legal owner of our stock without the full benefits and risks of such ownership. In addition, our corporate governance guidelines provide that our directors, officers, and senior managers of our company are prohibited from pledging (through a margin feature or otherwise) our securities as collateral in order to secure personal loans or other obligations. The guidelines and policy do not generally apply to all employees.

Certain Relationships and Related Transactions