UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

Tier 1 offering

Offering Statement UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

LifeQuest World Corp.

(Exact name of registrant as specified in its charter)

Date: February __, 2024

| Minnesota | 4950 | 88-0407679 |

(State or Other Jurisdiction of Incorporation) | (Primary Standard Classification Code) | (IRS Employer Identification No.) |

100 Challenger Road, 8th Floor

Ridgefield Park, NJ 07660

Phone: 646-201-5242

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

CT Corporation System Inc.

100 S 5th Str #1075

Minneapolis, MN 55402

Phone: 562-986-8043

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in conjunction with the attached XML Document for Items 1-6

PART I - END

Please send copies of all correspondence to:

The Doney Law Firm

4955 S. Durango Rd. Ste. 165

Las Vegas, NV 89113

(702) 982-5686

PRELIMINARY OFFERING CIRCULAR DATED FEBRUARY ____, 2024

An offering statement pursuant to Regulation A relating to these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

LifeQuest World Corp.

13,000,000 SHARES OF COMMON STOCK

$0.001 PAR VALUE PER SHARE

In this public offering of 13,000,000 shares of our common stock, we are offering 10,000,000 shares of our common stock and the selling shareholders are offering 3,000,000 shares of our common stock underlying warrants. We will not receive any of the proceeds from the sale of shares by the selling shareholders unless the warrants are exercised. This offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold.

Our Common Stock trades in the OTCMarket Pink Open Market under the symbol LQWC. There is currently no active trading market for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, shareholders may be unable to resell their securities in our company.

All of the shares being registered for sale by us will be sold at a fixed price, which will be within a range of $0.05 to $0.10 per share, established at qualification for the duration of the offering. There is no minimum amount we are required to raise from the shares being offered by the Company. There is no minimum amount we are required to raise from the shares being offered by the Company. There are no arrangements to place the funds received in an escrow, trust, or similar arrangement and the funds will be available to us following deposit into the Company’s bank account. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this offering will successfully raise enough funds to institute our company’s business plan.

Resale shares may be sold to or through underwriters or dealers, directly to purchasers or through agents designated from time to time by the selling shareholders. For additional information regarding the methods of sale, you should refer to the section entitled “Plan of Distribution” in this offering. There is no minimum number of shares required to be purchased by each investor.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days. We may, however, at any time and for any reason terminate the offering.

| SHARES OFFERED BY COMPANY | | PRICE TO PUBLIC(1) | | SELLING AGENT COMMISSIONS | | PROCEEDS TO THE COMPANY(2) |

| Per Share | | $ | 0.10 | | | $ | Not applicable | | $ | 0.10 |

| Minimum Purchase | | | None | | | | Not applicable | | | Not applicable |

| Total (10,000,000 shares) | | $ | 1,000,000 | | | $ | Not applicable | | $ | 1,000,000 |

| | (1) | Price range of offering being estimated pursuant to Rule 253(b). Estimate includes a maximum offering price of $0.10 and a maximum number of shares offered in this offering of 10,000,000 shares for an estimated maximum aggregate offering of $1,000,000. |

| | (2) | Does not include expenses of the offering, estimated to be $65,000 including legal, accounting and other costs of registration. |

| SHARES OFFERED SELLING SHAREHOLDERS | | PRICE TO PUBLIC(1) | | SELLING AGENT COMMISSIONS | | PROCEEDS TO THE SELLING SHAREHOLDERS |

| Per Share | | $ | 0.10 | | Not applicable | | $ | 0.10 |

| Minimum Purchase | | None | | Not applicable | | Not applicable |

| Total (3,000,000 shares) | | $ | 300,000 | | Not applicable | | $ | 300,000 |

| | (1) | Price range of offering being estimated pursuant to Rule 253(b). Estimate includes a maximum offering price of $0.10 and a maximum number of shares offered in this offering of 3,000,000 shares for an estimated maximum aggregate offering of $300,000. |

We expect to commence the offer and sale of the shares of common stock being offered pursuant to this offering circular within two calendar days of the qualification date, but only after filing a supplement to include the offering price per share within the range presented.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 14.

The date of this offering circular is February ____, 2024

The following table of contents has been designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

TABLE OF CONTENTS

PART II – OFFERING CIRCULAR

You should rely only on the information contained in this offering circular or contained in any free writing offering circular filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this offering circular filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

PART - II

offering circular SUMMARY

This summary highlights information contained elsewhere in this Offering Circular and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire Offering Circular, including our consolidated financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this Offering Circular. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations refer to LifeQuest World Corp and its wholly owned subsidiary, BioPipe Global Corp.

This offering circular, and any supplement to this offering circular include “forward-looking statements.” To the extent that the information presented in this offering circular discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this offering circular.

This summary only highlights selected information contained in greater detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning on Page 14, and the financial statements, before making an investment decision.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

The Company

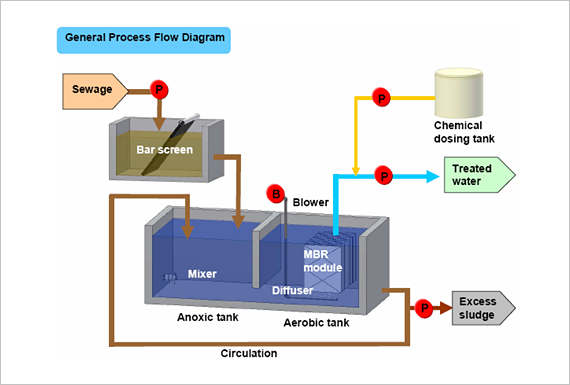

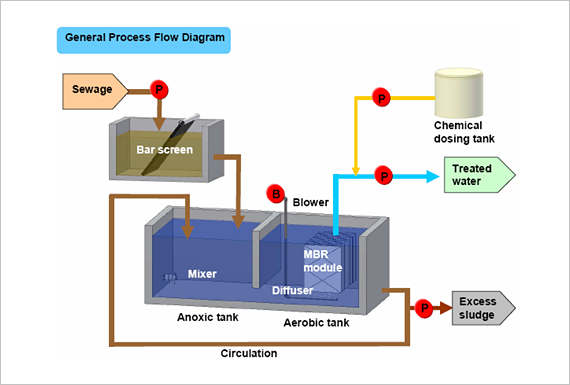

LifeQuest World Corp., through its our wholly owned subsidiary, BioPipe Global Corp., is a wastewater treatment company that treats domestic sewage (wastewater from toilets, kitchens, showers, laundry, etc.) into clean water ready for secondary purposes like flushing of toilets or irrigation, without producing sludge.

On April 17, 2019, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with BioPipe Acquisition, Inc., a New Jersey corporation (“Merger Sub”) and BioPipe Global Corp., a privately held New Jersey corporation (“BioPipe Global”). In connection with the closing of this merger transaction, Merger Sub merged with and into BioPipe Global (the “Merger”) on April 30, 2019, with the filing of Articles of Merger with the New Jersey Secretary of State.

In addition, pursuant to the terms and conditions of the Merger Agreement:

| | • | All of the outstanding shares of BioPipe Global was exchanged for the right to receive an aggregate of 75,000,000 share of the Company’s common stock, par value $0.001 per share, which was issued to certain shareholders in connection with an Intellectual Property Purchase Agreement set forth below; |

| | • | BioPipe Global provided customary representations and warranties and closing conditions, including approval of the Merger by a majority of its voting shareholders; and |

| | • | Bradford Brock, our prior officer and director, was required to cancel 55,000,000 shares of his Common Stock in the Company but permitted to retain 1,000,000 shares in the Company. |

From the date of the Merger Agreement, we have been engaged in eco-friendly decentralized wastewater treatment. The Company’s mission is to become a singular platform for highly efficient, scalable, low footprint onsite treatment technologies for treatment sewage wastewater and industrial wastewater. Our flagship product is Biopipe STP, (sewage wastewater treatment), which is a highly scalable and biological sewage wastewater system that treats domestic sewage into clean water ready for secondary purposes.

On May 7, 2019, under an Intellectual Property Purchase Agreement, BioPipe Global acquired all the assets of BioPipe Global AG, a Swiss company, and its wholly-owned Turkish subsidiary, BioPipe Cevre Teknolojileri A.S. We acquired all trade receivables, income, royalties, damages, rights to sue, rights to enforce and any and all payments unpaid and due now or hereafter due or payable with respect to the patented BioPipe System.

In the last five years, the BioPipe STP system has been installed in Bangladesh, India, Ethiopia, the Philippines, South Africa, Turkey, UAE, Qatar, Saudi Arabia, Oman, and Maldives. These BioPipe systems are running successfully at hospitals, resorts, hotels, commercial and government buildings, labor camps, ports and individual homes.

On September 26, 2019, the Company entered into a 50-50 joint venture and technology transfer agreement with South Africa based, Abrimix Pty Ltd. The purpose of the agreement was to introduce our Biopipe STP into southern Africa and eventually introduce Abrimix in the countries we operate in. Abrimix is a patented, low footprint, scalable industrial wastewater treatment technology with the ability to treat a wide variety of industrial wastewater. Due to disruptions related to Covid-19 and a lack of funding, the parties to the joint venture dissolved the venture and, on May 30, 2022 , a technology license agreement was put in place which includes royalty payment of 7.5% of Net Revenue.

Traditional centralized wastewater treatment systems are expensive to install and operate, energy-intensive and are dependent on chemicals. The world is seeking sustainable solutions through decentralized wastewater treatment which “get back to nature” while using 21st century technologies and management. Reuse of Biopipe treated water may include irrigation of gardens and agricultural fields or replenishing surface water and groundwater. Reused water may also be directed toward fulfilling certain needs in residences (e.g. toilet flushing), businesses and industry, and where necessary, treated to reach potable standards.

The circular water economy as a business model provides sustainable production and consumption of treated water and recovery of resources. Recycled water can meet some of this need, benefited by the nutrient content inherent in wastewater. Only mid-range treatment levels would be required, as irrigation can be accomplished while minimizing the potential for human contact with the recycled water. Reusing wastewater as part of sustainable water management allows water to remain as an alternative water source for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies.

Circular Economy of Water

Lifequest is seeking to build a platform of disruptive decentralized wastewater treatment systems (DEWATS) that are highly efficient, scalable, cost effective with small footprint. Our flagship biological treatment system, Biopipe STP, can be adapted to treat all types of wastewaters, but our current focus is on domestic wastewater. Our Abrimix process through our technology partnership is a versatile primary treatment for all types of industrial wastewater with a small footprint and is superior to the nearest Dissolve Air Floatation technology. The treated water from our Biopipe system can be reused for irrigation, exterior washing, irrigation and re-flushing of toilets. Both solutions offer a pathway to zero liquid discharge solutions.

Reclaiming water from waste for reuse applications (instead of using freshwater supplies) can be a water-saving measure. When treated waste water is eventually discharged back into natural water sources, it still has significant benefits to the ecosystem, such as improving streamflow, nourishing plant life and recharging aquifers, as part of the natural water cycle. With the number of water-stressed countries rising, treatment and reuse of wastewater is becoming increasingly necessary.

BioPipe is a revolutionary sewage wastewater treatment system. Biopipe is a highly scalable, eco-friendly and extremely cost-effective wastewater treatment with a broad installed base. It is the planet’s first biological wastewater treatment system where the process takes place entirely inside the pipe and:

| | ☐ | | | 100% biological system with NO chemicals used |

| | ☐ | | | There is absolutely no sludge produced and no odor |

| | ☐ | | | Lower energy consumption versus competing systems |

| | ☐ | | | Very low operation and maintenance cost |

| | ☐ | | | Virtually silent |

| | ☐ | | | Modular design |

| | ☐ | | | Low footprint |

| | ☐ | | | Meets or exceeds discharge standards globally |

Biopipe currently has around 44 plants installed around the globe, and we expect significant number of projects in India and Ethiopia and limited numbers in South Africa and the Philippines. Some of these plants were installed prior to the merger agreement. We have now set up joint ventures, licensing and distribution in five countries.

Abrimix is an industrial effluent treatment technology. It is an innovative technology that applies “shear” to increase the kinetics and completeness of reactions within aqueous solutions. The Abrimix Technology can be applied to various influents where certain reactions are desired to achieve the dissolution, oxidation, and/or precipitation of certain elements, the phase separation of ultra-fine suspended solids and the breaking of emulsions within a liquid. Abrimix (Pty) Ltd. has several plants running in South Africa and Biopipe’s subsidiary in India has done two plants in India to date under the joint venture.

The key component to the Abrimix Technology is the powerful static in-line mixer or “Reaction Enhancing Unit.” This patented unit improves the speed and thoroughness of liquid and gaseous chemical interactions within aqueous solutions. The unit, most commonly referred to as a High Shear Reactor (HSR), utilizes a specifically designed and researched hydrodynamic flow path that is derived from proven and sound fluid engineering mechanics.

Glanris Media is a green hybrid media made from rice hull and is extremely effective in removing heavy metals, color/turbidity, chlorine and chloramine, suspended solids and colloids, gas and oil, solvents and low molecular weight organics, as well as odors. The media can be regenerated with a weak acid. Glanris media is produced by Glanris Corp and the Company is a distributor in India.

Our Strategy

Our initial focus is on countries that have high water stress and a large gap between production of sewage and industrial wastewater versus installed capacity or simply lag adequate wastewater treatment infrastructure.

Our core strategy is to introduce Biopipe and Abrimix through joint ventures, license agreements partners or distribution partners with strategic and well-established partners in the top 10 countries with sewage problems. The JV partner, license partner or distribution partner handles sales marketing, installation, operations, and maintenance. This includes India, Bangladesh, the Philippines, Ethiopia, and South Africa.

Our Market

Packaged Treatment

Our decentralized wastewater treatment falls into the category of packaged wastewater technology. According to Ken Research estimates, the Global Water and Wastewater Treatment Equipment Market is valued around ~US$ 50 billion by 2022 and it is further expected to reach a market size of ~US$ 75 billion opportunity by 2028. The key drivers are (a) rising population and rapid urbanization. According to The World Bank Group, the urban population has seen a rise from 55% of the world population in 2018 to 57% of the world population in 2021, as many people from rural area shift to the urban region for better employment opportunities.

Biological Treatment

According to a report published by Research Dive, the global biological wastewater treatment market is anticipated to reach $15 billion and rising at a CAGR of 5.2% through 2031. Our Biopipe biological treatment technology, currently being applied to domestic sewage wastewater, can be applied to many other types of wastewaters. Abrimix wastewater treatment technology has the ability to treat a wide variety of industrial wastewaters.

Countries We Operate In:

India

Biopipe Global has a 99% owned subsidiary in Biopipe India Private Ltd. for our operations in India.

India possesses 4% of the world’s water resources and is home to 17.7% of the world’s population and ranks 13th for overall water stress. India is also recognized as one of the world’s “very highly water-stressed countries” on the Aqueduct’s Water Risk Atlas, ranking 13th. (World Resources Institute, 2019).

Water stress has developed in most places due to the imbalance between local supplies and demand from people, agriculture, and industry—in 26 of India’s 32 major cities, 10%–60% of total water demand remains unmet. Two facts exacerbate the water scarcity: (i) most of India’s water sources are highly polluted; and (ii) very little wastewater is actually treated and reused, making water the other single-use resource wreaking havoc on the climate with its pollution.

It has also made it mandatory by certain state pollution control boards for apartments and commercial complexes to install STPs. India generates 72,368 million liters (MLD) of sewage every day, only 28% is treated and reused. A new report by the Council on Energy, Environment and Water (CEEW), states that 80% of wastewater generated by urban India has the potential to be treated and reused for non-potable purposes like irrigation, which can relieve the immense pressure on water bodies, lower pollution levels and provide water security in the face of climate crisis-induced weather events that can render water bodies unreliable. The Indian water and wastewater treatment market is on a dynamic trajectory, projected to rise from USD 1.31 billion in 2020 to an impressive USD 2.08 billion by 2025, showcasing a compelling CAGR of 9.7%.

Bangladesh

We currently have nine Biopipe STPs running in Bangladesh and we are in the process of introducing our Abrimix industrial wastewater solution under our license agreement.

Bangladesh is an important market for our solutions. According to Bangladesh Institute of Planners, capital Dhaka along dumps 1.16 million m3 of sewage per day into the local rivers. According to www.water.org, out of its population of 165 million people, 68 million people (41% of the population) lack access to a reliable, safely managed source of water, and 100 million people (61%) lack access to safely managed household sanitation facilities. https://bdnews24.com/environment/2019/05/25/dhaka-pumps-1.1-million-cubic-metres-of-sewage-into-rivers-daily-study-says

According to official records of the Bangladesh Inland Water Transport Authority (BIWTA), around 350,000 kilograms (350 metric tons) of toxic waste is dumped into rivers every day from about 7,000 industries and other residential areas in greater Dhaka and adjacent areas. Bangladesh annually discharges 1.03 billion tons of textile wastewater without treatment. The government has implemented a Zero Liquid Discharge (ZLD) policy to address industrial wastewater discharge. Under this policy, industries are required to treat and recycle their wastewater to ensure zero discharge into water bodies.

South Africa

We currently have one Biopipe sewage treatment plant in South Africa under the 50-50 joint venture. Abrimix Pty Ltd. has eleven of its own industrial wastewater treatment plants in South Africa. The Company teamed with Abrimix to introduce Biopipe in South Africa and Abrimix’s technology in the countries we currently operate in. The agreement is for 50-50 distribution of profits.

South Africa is another water stressed country with massive sewage problem. More than half of the sewage treatment installed capacity is not working and close to 50,000 liters of sewage is being dumped every second - https://mg.co.za/article/2017-07-21-south-africas-shit-has-hit-the-fan . The local governments are asking developers to have their own decentralized sewage wastewater systems before any development is approved. This creates what we believe is a highly scalable Build Own & Operate (BOO) or leasing opportunity whereby we will provide the system and charge the customers for the amount of water reused. BOO or Leasing is expected to produce a long term stable cashflow.

South Africa is heavily dependent on centralized wastewater treatment plants and most are not functioning well or not meeting the standards. A total of 334 (39%) of municipal wastewater systems were identified to be in a critical state in 2021, compared to 248 (29%) in 2013. A total of 102 (89%) out of the 115 DPW systems were identified in critical state, compared to 84% in 2013.

South Africa represents a huge opportunity for decentralized wastewater systems or packaged treatment plants like Biopipe. There was only one packaged treatment plant installed by the government sector. However, due to budget constraints, as well as Covid, we have not been able to penetrate the market in South Africa as we had planned. Also, we have experienced operated plant issues with Morgan Beef and we have to upgrade the plant to produce better quality effluent. For South Africa, we expect business activity to pick up in the second half of fiscal year 2024.

Source: Green Drop 2022

Capex Advantage

Biopipe has considerable advantages over other packaged or decentralized wastewater treatment technologies when it comes to operating cost. It currently costs circa $2,550,000 per 1000m3 for a centralized system which involves $1,481,000 per 1000m3 capex on reticulated sewerage, circa $162,000 per 1000m3 for main sewer lines and $891,890 per 1000m3 on conventional treatment plant. Biopipe offers considerably lower capex.

Opex Advantage

The average cost to treat 1 m3 of wastewater is circa $1/m3 and median cost is $0.48/m3, with the latter giving a more representative estimate of treatment cost. Biopipe does not use energy hogging blowers for aeration, dosing of chemicals and minimal maintenance.

Source: Green Drop 2022

Ethiopia

On October 1, 2019, we entered into an Exclusive Distribution Agreement with Tesurcon Trading PLC . Under the agreement, we have been working in Ethiopia for the past 3 years to develop the market for our Biopipe system. The exercise started with a shipment of a demo plant in 2021 to the Ministry of Water & Irrigation. Due to political uncertainty and longer government approval process, we were able to finally install and commission the demo plant at the Ministry of Water & Irrigation facility in 2023. Since then, we have concluded one commercial sale and currently have a robust pipeline of projects.

Ethiopia is considered water-stressed because the rapid population growth over the last decade has put a strain on its abundant water sources. Despite estimations showing that 13.5 to 28 billion cubic meters of renewable annual groundwater is available per year, only 2.6 billion cubic meters is usable. According to the UNICEF/WHO Joint Monitoring Program, only half of the population in Ethiopia has access to basic water services, while less than 10 percent of the population can access basic sanitation services. Access to basic WASH services is substantially lower among rural populations than urban. As of 2020, only 40 percent of Ethiopia’s rural population could access basic water, compared with 84 percent in urban areas. Rural and urban access to at least basic sanitation reflects a similarly large gap with only five percent of the rural population having access compared to 21 percent of the urban. Since 78 percent (93.6 million people) of Ethiopia’s total population resides in rural areas, overcoming these access gaps is key to Ethiopia’s national development. On the other hand, rapid urban population growth is estimated to be nearly five percent per year. This puts pressure on the need to maintain and expand water and sanitation infrastructure in Ethiopia’s cities and small towns.

Sanitation and water deficit remains a problem. According to a 2021 Joint Monitoring Program, only 7 percent of the households in Ethiopia have an individual toilet where fecal waste ends up safely disposed of and treated in situ or offsite.

The Philippines

We have a joint venture with Bpipe Corporation on a 40-60 basis.

The Philippines has the two factors that cause us to operate there (a) water deficit and (b) sanitation deficit. According to UNICEF, around 50.3 million Filipinos (around 10 million families) do not have access to safely managed sanitation services and of these some 24 million use limited/unimproved toilets or none at all. The main sources of water pollution include:

| • | untreated domestic (also called ‘municipal’) wastewater discharges (33%); |

| • | industrial sources (27%); |

| | • | agriculture and livestock (29%); |

| | • | and non-point sources such as agricultural farms (11%). |

The pollution of Philippine waters comes for a significant part from untreated domestic and industrial wastewater. Only about five percent of households are connected to sewerage networks and treatment facilities. In Metro Manila alone, approximately 2,000 cubic meters of solvent wastes, 22,000 tons of heavy metals, infectious wastes, biological sludge, lubricants, and intractable wastes, as well as 25 million cubic meters of acid/alkaline liquid wastes are improperly disposed of annually.

Our principal place of business is located at 100 Challenger Road, 8th Floor Ridgefield Park, NJ 07660. General information about us can be found at http://biopipe.co/. The information contained on or connected to our website is not incorporated by reference into this Offering Circular on Form 1-A and should not be considered part of this or any other report filed with the SEC.

Risks Affecting Us

Our business will be subject to numerous risks and uncertainties, including those described in “Risk Factors” immediately following this offering circular summary and elsewhere in this offering circular. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include, but are not limited to, the following:

| | • | Company has failed to generate profits; |

| | • | Disruption due to Covid-19 disrupted our business development and resulted is loss of sales pipeline; |

| | • | Significant competition; |

| | • | The business risks of international operations, particularly in emerging markets; |

| | • | Geopolitical situation in countries we operate in; |

| | • | Risk of not getting paid by customers; |

| | • | Inability to finance fulfilment of orders; |

| | • | failure of manufacturers to deliver products or provide services in a cost effective and timely manner; |

| | • | Risk of exposure of our intellectual property and confidential information; |

| | • | Risk associated with water treatment industry; |

| | • | Failure of Build Own Operate plants; |

| | • | Risk of repatriation of profits from overseas operations; and |

| | • | we are not a 12g reporting company. |

The Offering

| Securities being offered by the Company | 10,000,000 shares of common stock, at a fixed price of $____ offered by us on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold, through our officers and directors. |

| | |

| Securities being offered by the Selling Stockholders | 3,000,000 shares of common stock underlying warrants, at a fixed price of $____ offered by selling stockholder in a resale offering. This fixed price applies at all times for the duration of the offering. |

| | |

| Offering price per share | We and the selling shareholder will sell the shares at a fixed price per share of $___ for the duration of this Offering. |

| | |

| Number of shares of common stock outstanding before the offering of common stock | 120,984,150 common shares are currently issued and outstanding. |

| | |

| Number of shares of common stock outstanding after the offering of common stock | 130,984,150 common shares will be issued and outstanding if we sell all of the shares we are offering herein. |

| | |

The minimum number of shares to be sold in this offering | None |

| | |

| Use of Proceeds | We intend to use the gross proceeds to us for working capital and for other corporate purposes. |

| | |

| Termination of the Offering | The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. |

| | |

| Subscriptions | All subscriptions once accepted by us are irrevocable. |

| | |

| Registration Costs | We estimate our total offering registration costs and selling expenses to be approximately $65,000. |

| | |

| Risk Factors | See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information contained in this offering circular. We have not authorized anyone to provide you with information different from that which is contained in this offering circular. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

MANAGEMENT’S DISCUSSION AND ANALYSIS

You should read the following discussion and analysis of our financial condition and results of our operations together with our financial statements and related notes appearing at the end of this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled "Risk Factors" and elsewhere in this Offering Circular.

Results of Operations for the Years Ended May 31, 2022 and 2023

Revenues

Our total revenue reported for the year ended May 31, 2023, was $149,806, compared with $349,297 for the year ended May 31, 2022.

Our revenues fiscal year ended 2023 revenue declined largely due to delays in a major government tender that was pushed out into fiscal year 2024, lack of sales activity in Bangladesh due to shortage of hard currency and delays in getting our demo plant commissioned on time. We could not generate any revenue from our South African operated plant due to issues with Morgan Beef and need for upgrading the plant to produce better quality effluent. The key issues involved generation of wastewater at twice the capacity of the designed plant, high variability in incoming wastewater, management turnover at Morgan Beef and suspension of its export license due to outbreak of foot and mouth disease. Additionally, the client would like the water to be treated to point where the treated water can be used for washing the inside of the abattoir. Unless we experience continued setbacks, such as those described above, we expect business activity to pick up in the second half of fiscal year 2024 after the plant upgrade is completed. We have selected an engineering procurement and construction (EPC) company to provide the secondary and tertiary treatments to meet the client’s quality and volume needs. Our Biopipe sewage treatment technology was selected as the technology of choice in a municipal tender involving twenty-one plants. We are in the middle of final negotiations of the terms with the general contractor who has won the tender. All plants have to delivered within the next twelve months. Additionally, we have entered into an agreement with a channel partner in India which has already secured one contract and upon successful commissioning of the 200 m3/day plant, expect additional orders of two 400 m3/day plants. We are also seeing strong activity in Ethiopia where Biopipe has been approved by the government. We shipped our first commercial plant after successfully demonstrating the efficiency of Biopipe system at Ministry of Water and Irrigation.

Cost of Revenues

Our total cost of revenues for the year ended May 31, 2023, was to $111,936 compared with $258,336 for the year ended May 31, 2022. Our gross margins were relatively stable year over year.

Operating Expenses

Operating expenses declined to $307,324 for the year ended May 31, 2023, from $378,564 for the year ended May 31, 2022. The decrease in operating expenses is largely the result of a decline in professional fees and wages.

We expect our operating expenses will increase in future quarters with the expenses for professional fees in connection with this offering, as well as increased operational activity.

Other Expenses/Other Income

We had other expenses of $41,959 for the year ended May 31, 2023, as compared with other expenses of $24,641 for the year ended 2022. We booked an expense on the Bangladesh joint venture, which was dissolved and our relationship with restructured into a licensing agreement. We also booked an expense based on fluctuations in foreign currency rates. Each foreign entity maintains the books in the foreign currency and then translates them to USD for the financial statements, which results in fluctuations throughout the year.

Net Loss

We finished the year ended May 31, 2023, with a loss of $379,714, as compared to a net loss of $217,338 during the year ended May 31, 2022.

Results of Operations for the Six Months Ended November 30, 2023 and 2022

Revenues

Our total revenue reported for the six months ended November 30, 2023, was $42,251, compared with $45,591 for the six months ended November 30, 2022. The decrease in revenues is the result of delays in delivery and commissioning of two new plants. Additionally, a tender in which our Biopipe STP was selected as the system of choice was delayed and was opened in April of 2023.

Cost of Revenues

Our total cost of revenues for the six months ended November 30, 2023, was to $23,464 compared with $6,441 for the six months ended November 30, 2022. The increase in cost of revenues is the result of purchases of high sheer reactors from Abrimix Pty Ltd.

Operating Expenses

Operating expenses declined to $100,730 for the six months ended November 30, 2023, from $150,374 for the six months ended November 30, 2022. The decrease in operating expenses is the result of decline in SG&A.

We expect our operating expenses will increase in future quarters with the expenses for professional fees in connection with this offering, as well as increased operational activity.

Other Expenses/Other Income

We had other income of $79 for the six months ended November 30, 2023, as compared with other expenses of $88,570 for the six months ended November 30, 2022. The other expenses in 2022 were the result of loss of $92,227 from dissolution of the joint venture in Bangladesh.

Net Loss

We finished the six months ended November 30, 2023, with a loss of $89,725, as compared to a net loss of $261,393 during the six months ended November 30, 2022.

Liquidity and Capital Resources

As of November 30, 2023, we had total current assets of $345,591 and current liabilities of $101,349, resulting in working capital of $244,242 as of November 20, 2023, as compared with working capital of $228,480 at May 31, 2023.

Our operating activities used $259,141 in cash for the year ended May 31, 2023, as compared with cash used of $242,929 from operating activities in the year ended May 31, 2022. Our negative operating cash flow for 2023 was mainly the result of changes in accounts receivable, net operating loss and net loss allocated to noncontrolling interest.

Our operating activities used $52,865 in cash for the six months ended November 30, 2023, as compared with cash used of $143,009 from operating activities in the six months ended November 30, 2022. Our negative operating cash flow for 2023 was mainly the result of our net loss for the period, offset by adjustments to operating activities.

Our investing activities provided $38,679 for the year ended May 31, 2023, as compared with net cash used of $397,847 for the year ended May 31, 2022. Our positive investing cash flow in 2023 is the result of changes to the basis of purchased fixed assets from foreign currency.

Our investing activities used $750 for the six months ended November 30, 2023, as compared with net cash provided of $38,849 for the six months ended November 30, 2022. Our negative investing cash flow in 2023 is the result of changes in the fixed asset basis from foreign currency.

Financing activities provided $11,500 in cash for the six months ended November 30, 2023, compared with $12,942 in cash provided in the six months ended November 30, 2022. Our positive financing cash flow was mainly the result of sale of common sure pursuant to Reg D.

Based upon our current financial condition, we have sufficient capital to operate our business for the next twelve months at the current levels, but we lack funds for our expansion efforts. We are seeking financing to upgrade our operating plant at Morgan Beef Pty Ltd. in South Africa, to finance government tenders and work orders received from Eagle Infrastructure Ltd. where we must supply 21 Biopipe sewage wastewater treatment plants in India and to ramp up the marketing of our products. We intend to fund these expansion efforts through this offering, or through increased sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the years ended May 31, 2023 and 2022 or for the six months ended November 30, 2023.

Critical Accounting Polices

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Our critical accounting policies are disclosed in Note 2 of our unaudited consolidated financial statements included in this Offering Circular with the Securities and Exchange Commission.

Off Balance Sheet Arrangements

As of November 30, 2023, there were no off-balance sheet arrangements.

Recent Accounting Pronouncements

The recent accounting pronouncements that are material to our financial statements are disclosed in Note 2 of our consolidated unaudited yearend financial statements included in this Offering Circular filed with the Securities and Exchange Commission and in Note 2 of our unaudited consolidated financial statements included herein.

RISK FACTORS

Please consider the following risk factors and other information in this offering circular relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this offering circular before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risk Factors Related to Our Financial Condition

We have limited cash on hand and there is substantial doubt as to our ability to continue as a going concern.

As at November 30, 2023, we had cash on hand of $303,531 and we had working capital of $244,242. While this is enough to operate at present levels for the next 12 months, our current capital resources will limit our ability to make capital investments in Build Own & Operate or Leased projects. We also expect to continue to incur significant operating and capital expenditures for the next twelve months as we ramp our marketing and funding of purchase orders, government tenders, upgrading of Morgan Beef Build Own & Operate plant, and other initiatives. We also expect to experience negative cash flow in the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and thereafter maintain profitability. As of November 30, 2023, we have an accumulated deficit of $1,401,511and we may not be able to generate sufficient revenues or achieve profitability in the future. Our failure to generate significant revenues, achieve or maintain profitability could negatively impact the value of our Common Stock.

Risk Factors Related to Our Business

We have a limited operating history upon which investors can evaluate our future prospects.

Our operating subsidiary, BioPipe Global Corp., was incorporated in the State of New Jersey on April 23, 2019. Therefore, we have limited operating history upon which an evaluation of our business plan or performance and prospects can be made. The business and prospects of the Company must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established business. To successfully introduce and market our products and services at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that the Company can successfully address these challenges. If it is unsuccessful, the Company and its business, financial condition and operating results could be materially and adversely affected.

Given the limited operating history, management has little basis on which to forecast future demand for our products and services from our existing customer base, much less new customers. We are depended on our in-country joint venture, license and distribution partners. It is difficult to accurately forecast future revenues because the business of the Company is new and its market has not been developed. If the forecasts for the Company prove incorrect, the business, operating results and financial condition of the Company will be materially and adversely affected. Moreover, the Company may be unable to adjust its spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction in revenues would immediately and adversely affect the business, financial condition and operating results of the Company.

We are dependent on our in-country Joint Venture partners, Licensors and Distributors

Our success depends on the ability of our joint venture, license and distribution partners to effectively market, install and support our wastewater treatment systems. Acquisitions, strategic investments, partnerships, or alliances could be difficult to identify, pose integration challenges, divert the attention of management, disrupt our business, dilute stockholder value, and adversely affect our business, financial condition, and results of operations.

We have in the past and may in the future seek to obtain joint venture, license, and distribution partners that we believe could complement or expand product offerings, enhance our technology, or otherwise offer growth opportunities.

Any such transaction may divert the attention of management and cause us to incur various expenses in identifying, investigating, and pursuing suitable opportunities, whether or not the transactions are completed, and may result in unforeseen operating difficulties and expenditures. Any such transactions that we are able to complete may not result in synergies or other benefits we expect to achieve, which could result in substantial impairment charges. These transactions could also result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our results of operations.

We may not be able to compete successfully with current and future competitors.

We have many potential competitors in the wastewater equipment and services industry. We will compete, in our current and proposed businesses, with other companies, most of which have far greater marketing and financial resources and experience than we do. We cannot guarantee that we will be able to penetrate our intended market and be able to compete profitably, if at all.

If we do not continually upgrade our technology, it may become obsolete and we may not be able to compete with other companies.

We cannot assure you that we will be able to keep pace with advances in technology for wastewater treatment or that our services will not become obsolete. We cannot assure you that competitors will not develop related or similar wastewater treatment systems.

Defects in our products or failures in quality control could impair our ability to sell our products or could result in product liability claims, litigation and other significant events involving substantial costs.

Detection of any significant defects in our products or failure in our quality control procedures may result in, among other things, delay in time-to-market, loss of sales and market acceptance of our products, diversion of development resources, and injury to our reputation. The costs we may incur in correcting any product defects may be substantial. Additionally, errors, defects or other performance problems could result in financial or other damages to our customers, which could result in litigation. Product liability litigation, even if we prevail, would be time consuming and costly to defend, and if we do not prevail, could result in the imposition of a damages award. Our offshore operating entities carry general liability insurance. The company uses off-the-shelf components which our covered by manufacturer warranties.

There can be no assurances of protection for proprietary rights or reliance on trade secrets.

The ownership and protection of the Company’s trademarks, patents, trade secrets and intellectual property rights are significant aspects of its future success. Unauthorized parties may attempt to replicate or otherwise obtain and use the Company’s products and technology. Policing the unauthorized use of current or future trademarks, patents, trade secrets or intellectual property rights could be difficult, expensive, time-consuming and unpredictable, as may be enforcing these rights against unauthorized use by others. Identifying unauthorized use of intellectual property rights is difficult as the Company may be unable to effectively monitor and evaluate the intellectual property used by its competitors, including parties such as unlicensed dispensaries, and the processes used to produce such products. In addition, in any infringement proceeding, some or all of the trademarks, patents or other intellectual property rights or other proprietary know-how, or arrangements or agreements seeking to protect the same may be found invalid, unenforceable, anti-competitive or not infringed. An adverse result in any litigation or defense proceedings could put one or more of the trademarks, patents or other intellectual property rights at risk of being invalidated or interpreted narrowly and could put existing intellectual property applications at risk of not being issued. Any or all of these events could materially and adversely affect the Company’s business, financial condition and results of operations.

In addition, other parties may claim that the Company’s products infringe on their proprietary and perhaps patent protected rights. Such claims, whether or not meritorious, may result in the expenditure of significant financial and managerial resources, legal fees, result in injunctions, temporary restraining orders and/or require the payment of damages.

We may not be able to manage our growth effectively.

We must continually implement and improve our products and/or services, operations, operating procedures and quality controls on a timely basis, as well as expand, train, motivate and manage our work force in order to accommodate anticipated growth and compete effectively in our market segment. Successful implementation of our strategy also requires that we establish and manage a competent, dedicated work force and employ additional key employees in corporate management, product development, client service and sales. We can give no assurance that our personnel, systems, procedures and controls will be adequate to support our existing and future operations. If we fail to implement and improve these operations, there could be a material, adverse effect on our business, operating results and financial condition.

Risks associated with operating abroad may negatively affect our ability to implement our business plan.

The Company’s expansion into jurisdictions outside of the United States is subject to risks. In addition, in jurisdictions outside of the United States, there can be no assurance that any market for the Company’s products or services will develop or be maintained. The Company may face new or unexpected risks or significantly increase its exposure to one or more existing risks, including economic instability, changes in laws and regulations, and the effects of competition. These factors may limit the Company’s ability to successfully expand its operations into such jurisdictions and may have a material adverse effect on the Company’s business, financial condition and results of operations.

There might be unanticipated obstacles to the execution of our business plan.

The Company’s business plans may change significantly. The Company’s Build Own & Operate (BOO), municipal projects requiring bank guarantees and purchase order financing are capital intensive. Management believes that the Company’s chosen activities and strategies are achievable in light of current water stress and wastewater problem around the world.

Failure to comply with local laws and regulations.

We may incur substantial costs on an ongoing basis to comply with all laws and regulations. New or stricter laws and/or regulations could increase our costs and make us less competitive.

Wastewater operations entail significant risks and may impose significant costs.

Wastewater treatment systems fail or do not operate properly, or if there is a spill, untreated or partially treated wastewater could discharge onto property or into nearby streams and rivers, causing various damages and injuries, including environmental damage. Liabilities resulting from such damages and injuries could harm our business, financial condition, and results of operations.

Significant or prolonged disruptions in the supply of important goods or services from third parties could harm our business, financial condition, and results of operations.

We are dependent on procuring all our components from third parties and any deterioration in quality or disruption or prolonged delays in obtaining important supplies such as water pipe, valves, pumps, control panels, or other materials, could harm our ability to deliver and commission plants on time.

Risks Related to Insiders and Control Persons

Insiders will continue to have substantial control over us and our policies after this offering and will be able to influence corporate matters.

Enes Kutluca, our COO and director, owns 20,802,342 shares of our common stock representing 20.93% of our outstanding shares. Mr. Kutluca also has an option to purchase 10% of our outstanding common stock. The option is exercisable at market price and subject to vesting. Max Khan, our CEO and director, has the same option as Mr. Kutluca. These options commence, as stated in their respective employment agreements, upon the company adopting a stock option plan, which has not yet occurred and the board of directors has stated that it does not expect to adopt a plan until second half of 2024. Fifty percent (50%) of the options shall vest on the date a stock option plan is adopted and the remaining fifty percent (50%) of the options shall vest and become exercisable on the first anniversary of the date a stock option plan is adopted by the company.

Once the stock option plan is adopted, these shareholders will have the right to acquire approximately 20% of our outstanding common stock. Even after the offering, these officers and shareholders, whose interests may differ from other stockholders, have the ability to exercise significant control over us. They are able to exercise significant influence over all matters requiring approval by our stockholders, including the election of directors, the approval of significant corporate transactions, and any change of control of our company. They could prevent transactions, which would be in the best interests of the other shareholders. Their interests may not necessarily be in the best interests of the shareholders in general.

We may engage in transactions that present conflicts of interest.

The Company’s officers and directors may enter into agreements with the Company from time to time which may not be equivalent to similar transactions entered into with an independent third party. A conflict of interest arises whenever a person has an interest on both sides of a transaction. While we believe that it will take prudent steps to ensure that all transactions between the Company and any officer or director are fair, reasonable, and no more than the amount it would otherwise pay to a third party in an “arms’-length” transaction, there can be no assurance that any transaction will meet these requirements in every instance.

We have agreed to indemnify our officers and directors against lawsuits to the fullest extent of the law.

The Company is a Minnesota corporation. Minnesota law permits the indemnification of officers and directors against expenses incurred in successfully defending against a claim. Minnesota law also authorizes corporations to indemnify their officers and directors against expenses and liabilities incurred because of their being or having been an officer or director. Our organizational documents provide for this indemnification to the fullest extent permitted by law.

We currently do not maintain any insurance coverage. In the event that we are found liable for damage or other losses, we would incur substantial and protracted losses in paying any such claims or judgments. Although we intend to acquire such coverage immediately upon resources becoming available, there is no guarantee that we can secure such coverage or that any insurance coverage would protect us from any damages or loss claims filed against us.

We depend significantly on the services of the members of our management team, and the departure of any of those persons could cause our operating results to suffer.

Our success depends significantly on the continued individual and collective contributions of our management team. The loss of the services of any member of our management team or the inability to hire and retain experienced management personnel could harm our business, financial condition, and results of operations.

Members of our Board and our executive officers may have other business interests and obligations to other entities.

Neither our directors nor our executive officers will be required to manage our company as their sole and exclusive function and they may have other business interests and may engage in other activities in addition to those relating to our company, provided that such activities do not compete with the business of our company. We are dependent on our directors and executive officers to successfully operate our company, and in particular Max Khan and Mehmet Enes Kutluca. Their other business interests and activities could divert time and attention from operating our business.

Risks Related to the Offering and the Market for our Stock

Because there is no minimum offering amount, funds raised may not be sufficient to complete the plans of the Company as set forth in “Use of Proceeds” in this Offering Circular.

There is no minimum offering amount. If we do not raise the maximum proceeds, funds raised may not be sufficient to complete all plans of the Company as set forth in “Use of Proceeds” in this Offering Circular, which could inhibit our ability to commence to generate revenue.

We have the right to issue shares of preferred stock. If we were to issue preferred stock, it is likely to have rights, preferences and privileges that may adversely affect the common stock.

We are authorized to issue 50,000,000 shares of “blank check” preferred stock, with such rights, preferences and privileges as may be determined from time-to-time by our board of directors. Our board of directors is empowered, without stockholder approval, to issue preferred stock in one or more series, and to fix for any series the dividend rights, dissolution or liquidation preferences, redemption prices, conversion rights, voting rights, and other rights, preferences and privileges for the preferred stock.

The issuance of shares of preferred stock, depending on the rights, preferences and privileges attributable to the preferred stock, could reduce the voting rights and powers of the common stock and the portion of our assets allocated for distribution to common stockholders in a liquidation event, and could also result in dilution in the book value per share of the common stock we are offering. The preferred stock could also be utilized, under certain circumstances, as a method for raising additional capital or discouraging, delaying or preventing a change in control of the Company, to the detriment of the investors in the common stock offered hereby.

New investors in our common stock will experience immediate and substantial dilution after this Offering.

If you purchase shares of common stock in this Offering, you will experience immediate dilution, because the price that you pay will be substantially greater than the adjusted pro forma net tangible book value per share that you acquire. This dilution is due in large part to our negative book value.

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Our common stock is quoted under the symbol “LQWC” on the OTCPink operated by OTC Markets Group, Inc., an electronic inter-dealer quotation medium for equity securities. We do not currently have an active trading market. There can be no assurance that an active and liquid trading market will develop or, if developed, that it will be sustained.

Our securities are very thinly traded. Accordingly, it may be difficult to sell shares of our common stock without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the stock.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control.

Our stock price is subject to a number of factors, including:

| | • | Technological innovations or new products and services by us or our competitors; |

| | • | Government regulation of our products and services; |

| | • | The establishment of partnerships with other environmental companies; |

| | • | Intellectual property disputes; |

| | • | Additions or departures of key personnel; |

| | • | Issuances of our common stock; |

| | • | Our ability to execute our business plan; |

| | • | Operating results below or exceeding expectations; |

| | • | Financial condition of our joint venture partners; |

| | • | Whether we achieve profits or not; |

| | • | Loss or addition of any strategic relationship; |

| | • | Economic and other external factors; and |

| | • | Period-to-period fluctuations in our financial results. |

Our stock price may fluctuate widely as a result of any of the above. In addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Because we are subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any listed, trading equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules which may increase the difficulty Purchasers may experience in attempting to liquidate such securities.

We do not expect to pay dividends in the foreseeable future. Any return on investment may be limited to the value of our common stock.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will occur only if our stock price appreciates.

We will have broad discretion in applying the net proceeds of this Offering and we may not use those proceeds in ways that will enhance our business operations.

We have significant flexibility in applying the net proceeds we will receive in this Offering. We will use the proceeds that we receive from the sale of shares in this Offering for legal fees, accounting expenses, research and development, capital investments and working capital. As part of your investment decision, you will not be able to assess or direct how we apply these net proceeds. If we do not apply these funds effectively, we may lose significant business opportunities.

The securities laws may restrict transferability of the securities sold in the Offering.

The shares in this Offering have not been registered under the Securities Act or registered or qualified under any state or foreign securities laws. Such securities are being issued based upon the Company’s reliance upon an exemption from registration under the Securities Act for an offer and sale of securities that does not involve a public offering. Unless such securities are so registered, they may not be offered or sold except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state or foreign securities laws.

You must make an independent investment analysis in connection with this Offering.

No independent legal, accounting or business advisors have been appointed to represent the interests of prospective Investors in connection with this Offering. Neither the Company nor any of its officers, directors, employees or agents makes any representation or expresses any opinion with respect to the merits of an investment in the shares offered hereby. Each prospective Investor is therefore encouraged to engage independent accountants, appraisers, attorneys and other advisors to (i) conduct due diligence review as the prospective investor may deem necessary and advisable, and (ii) provide advice with respect to the merits of an investment in the shares offered hereby and applicable risk factors as a prospective investor may deem necessary and advisable to rely upon. We will fully cooperate with any prospective Investor who desires to conduct an independent analysis, so long as it determines, in our sole discretion, that cooperation is not unduly burdensome. Each prospective Investor acknowledges that he, she or it has been informed and understands.

Because we lack certain internal controls over financial reporting in that we do not have an audit committee and our Board of Directors has no technical knowledge of U.S. GAAP and internal control of financial reporting and relies upon the Company's financial personnel to advise the Board on such matters, we are subject to increased risk related to financial statement disclosures.

We lack certain internal controls over financial reporting in that we do not yet have an audit committee and our Board of Directors has little technical knowledge of U.S. GAAP and internal control of financial reporting and relies upon the Company's financial personnel and accounting firm to advise the Board on such matters. Accordingly, we are subject to increased risk related to financial statement disclosures.

FORWARD LOOKING STATEMENTS

This offering circular contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this offering circular.

DESCRIPTION OF BUSINESS

Overview

LifeQuest World Corp., through its our wholly owned subsidiary, BioPipe Global Corp., is a wastewater treatment company with world’s only sludge free onsite wastewater system.

On April 17, 2019, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with BioPipe Acquisition, Inc., a New Jersey corporation (“Merger Sub”) and BioPipe Global Corp., a privately held New Jersey corporation (“BioPipe Global”). In connection with the closing of this merger transaction, Merger Sub merged with and into BioPipe Global (the “Merger”) on April 30, 2019, with the filing of Articles of Merger with the New Jersey Secretary of State.

As a result of the Merger Agreement, we are now engaged in eco-friendly decentralized wastewater treatment. The Company’s mission is to become a singular platform for highly efficient, scalable, low footprint onsite treatment technologies for treatment sewage wastewater and industrial wastewater. Our flagship product is Biopipe STP, (sewage wastewater treatment), which is a highly scalable and biological sewage wastewater system that treats domestic sewage into clean water ready for secondary purposes.

On May 7, 2019, under an Intellectual Property Purchase Agreement, BioPipe Global acquired all the assets of BioPipe Global AG, a Swiss company, and its wholly-owned Turkish subsidiary, BioPipe Cevre Teknolojileri A.S. We acquired all trade receivables, income, royalties, damages, rights to sue, rights to enforce and any and all payments unpaid and due now or hereafter due or payable with respect to the patented BioPipe System.

In the last five years, the BioPipe STP system has been installed in Bangladesh, India, Ethiopia, the Philippines, South Africa, Turkey, UAE, Qatar, Saudi Arabia, Oman, and Maldives. These BioPipe systems are running successfully at hospitals, resorts, hotels, commercial and government buildings, labor camps, ports and individual homes.

On September 26, 2019, the Company entered into a 50-50 joint venture and technology transfer agreement with South Africa based, Abrimix Pty Ltd. The purpose of the agreement was to introduce our Biopipe STP into southern Africa and eventually introduce Abrimix in the countries we operate in. Abrimix is a patented, low footprint, scalable industrial wastewater treatment technology with the ability to treat a wide variety of industrial wastewater. Due to disruptions related to Covid-19 and a lack of funding, the parties to the joint venture dissolved the venture and, on June 1, 2022, a technology license agreement was put in place. Under the licensing agreement, the prior joint venture partner, Biotech Innovations Ltd. is required to pay 7.5% of net revenues.

Traditional centralized wastewater treatment systems are expensive, energy-intensive and chemical-dependent. The world is seeking sustainable solutions through decentralized wastewater treatment which “get back to nature” while using 21st century technologies and management. Reuse may include irrigation of gardens and agricultural fields or replenishing surface water and groundwater. Reused water may also be directed toward fulfilling certain needs in residences (e.g. toilet flushing), businesses and industry, and where necessary, treated to reach drinking water standards.

The reuse of wastewater has long been established as critically important for irrigation, especially in arid countries. According to the World Bank, there will be a 40 percent global shortfall between supply and demand of water by 2030. And by 2025, approximately 1.8 billion people will be living in regions with “absolute water scarcity.” The World Bank also estimates that 70 percent of water use today is for agriculture. A projected global population of 9 billion by 2050 is expected to require a 60 percent increase in agricultural production and a 15 percent increase in water withdrawals. Recycled water can meet some of this need, benefited by the nutrient content inherent in wastewater. And only mid-range treatment levels would be required, as irrigation can be accomplished while minimizing the potential for human contact with the recycled water. Reusing wastewater as part of sustainable water management allows water to remain as an alternative water source for human activities. This can reduce scarcity and alleviate pressures on groundwater and other natural water bodies. At the nexus between unusable wastewater and clean water, lies BioPipe: