Unlocking Financial Technology To The World Exhibit 99.1

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company Opening Remarks 1 FIS Investor Day 2024 George Mihalos SVP, Head of Investor Relations

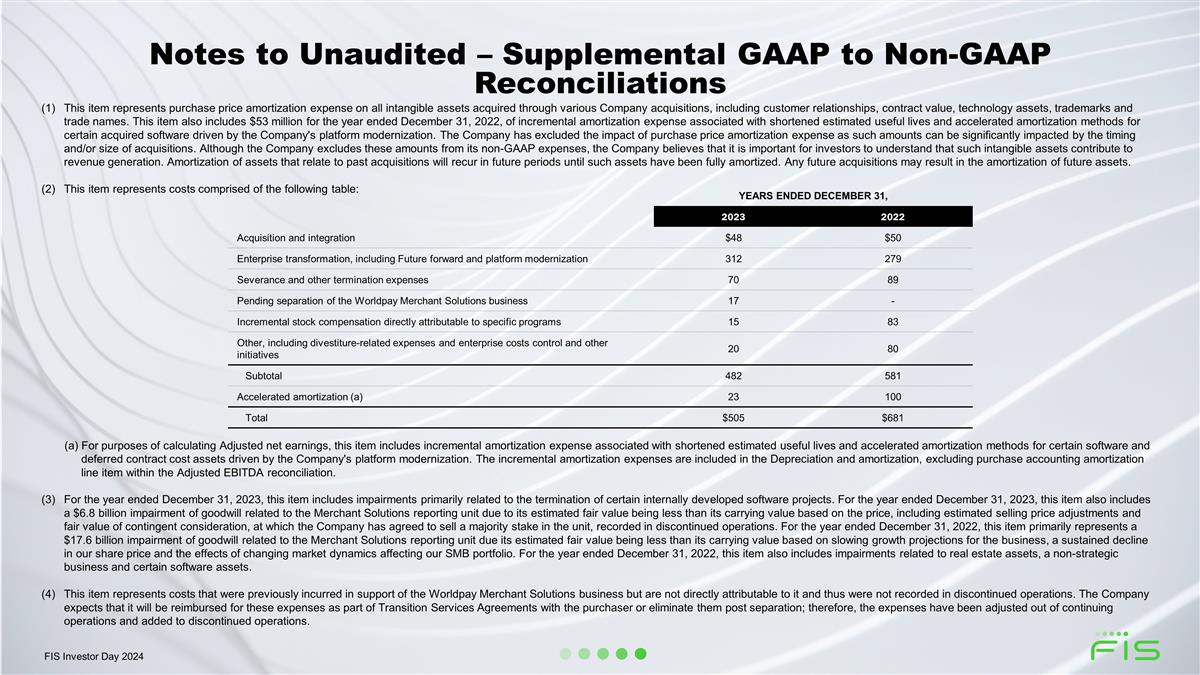

Disclosures Forward-looking Statements Our discussions today, including this presentation and any comments made by management, contain “forward-looking statements” within the meaning of the U.S. federal securities laws. Any statements that refer to future events or circumstances, including our future strategies or results, or that are not historical facts, are forward-looking statements. Actual results could differ materially from those projected in forward-looking statements due to a variety of factors, including the risks and uncertainties set forth in our earnings press release dated May 6, 2024, our annual report on Form 10-K for 2023 and our other filings with the SEC. We undertake no obligation to update or revise any forward-looking statements. Please see the Appendix for additional details on forward-looking statements. Non-GAAP Measures This presentation will reference certain non-GAAP financial information. For a description and reconciliation of non-GAAP measures presented in this document, please see the Appendix attached to this presentation or visit the Investor Relations section of the FIS website at www.fisglobal.com. FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 Strategic Vision 2 Stephanie Ferris CEO and President

Agenda Segment Strategy: Banking John Durrant Opening Remarks George Mihalos Strategic Vision Stephanie Ferris Technology Firdaus Bhathena Segment Strategy: Capital Markets Nasser Khodri Product & Innovation Tarun Bhatnagar Financial Overview James Kehoe Executive Q&A Stephanie Ferris & James Kehoe 1 2 3 4 5 6 7 8 FIS Investor Day 2024

$9.8B Revenues 14K+ Clients $16T Financial Assets on Platforms 95% of the World’s Leading Banks FIS: Leadership At Scale With Marquee Set Of Clients 2023 Metrics FIS Investor Day 2024

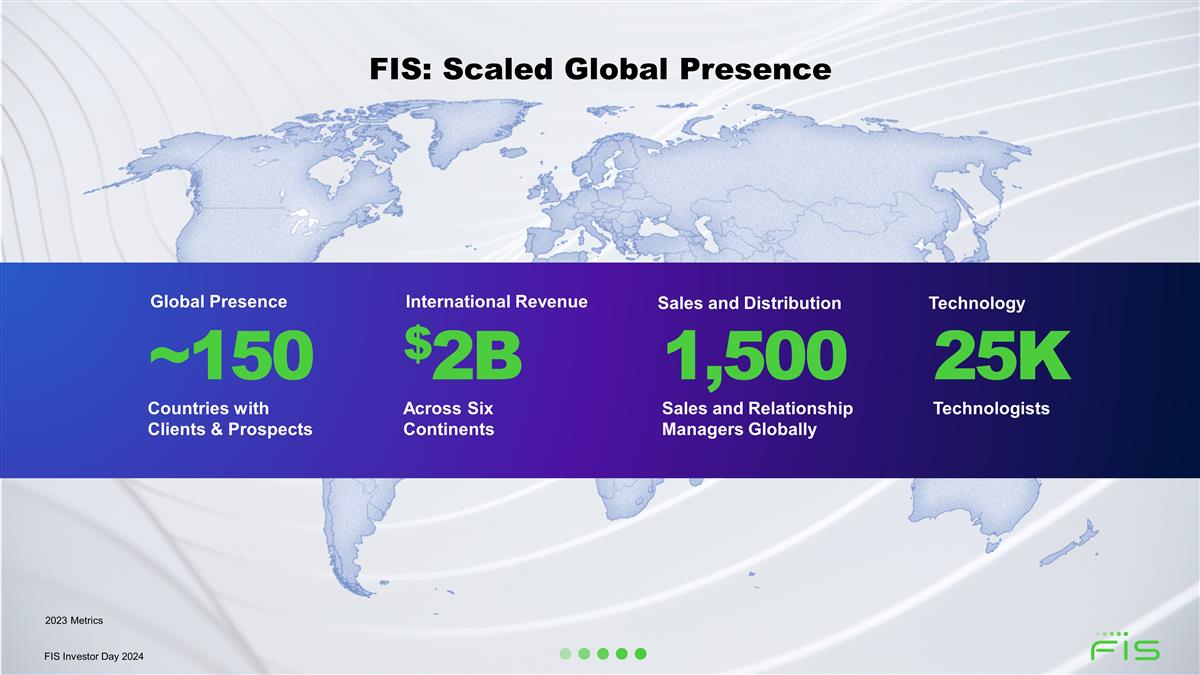

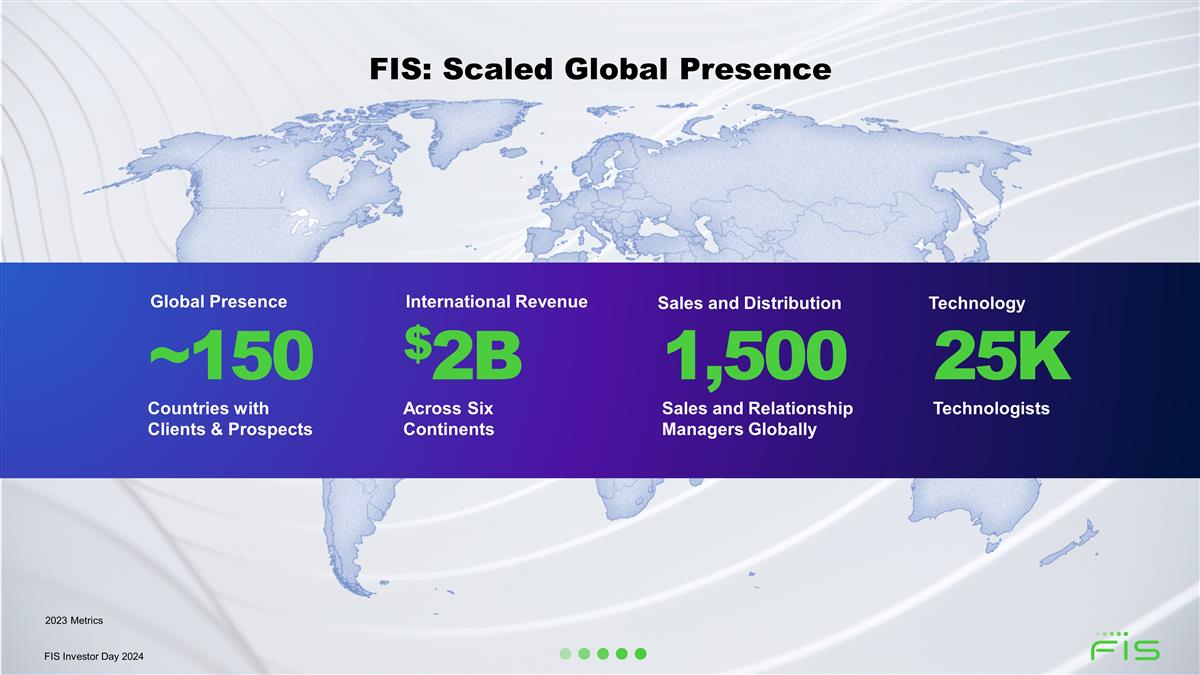

FIS: Scaled Global Presence 1,500Sales and Relationship Managers Globally Sales and Distribution ~150 Countries with Clients & Prospects Global Presence 25K Technologists Technology $2B Across Six Continents International Revenue 2023 Metrics FIS Investor Day 2024

Challenges Lost Focus on Banking Increasing Mix of Lower Margin, Slower Growing Solutions Financial Constraints Our response Commercial Excellence Focused on higher-growth higher-margin opportunities Improved sales productivity Client-centric Delivery Re-energized technology, innovation and implementation Simplification and Talent Separated Worldpay Introduced new leadership talent Drove efficiency across the organization Disciplined Capital Allocation Reallocated capital for long-term value creation Decisive Actions To Overcome Challenges And Improve Outcomes FIS Investor Day 2024

Outcomes >$550M Run-rate Cash Savings(2) +100bps Recurring Revenue Growth 2023 vs CAGR 2017 - 2022 +10ppts Growth Products’ Share of Technology Capital Spend(1) $1.7B+ Capital Return(2) Challenges Lost Focus on Banking Increasing Mix of Lower Margin, Slower Growing Solutions Financial Constraints Our response Commercial Excellence Focused on higher-growth higher-margin opportunities Improved sales productivity Client-centric Delivery Re-energized technology, innovation and implementation Simplification and Talent Separated Worldpay Introduced new leadership talent Drove efficiency across the organization Disciplined Capital Allocation Reallocated capital for long-term value creation Decisive Actions To Overcome Challenges And Improve Outcomes 95% Free Cash Flow Conversion(3) +110bps Increase in Sales Margin 2022 - 2023 2022 - 2024 projection 2023 Normalized Free Cash Flow conversion (excluding Worldpay Adj. EMI) excludes 2 ppts benefit from delayed tax payment related to hurricane relief in 2023 FIS Investor Day 2024

Increasing Target Cash Savings And Capital Return To Shareholders Financial Outlook Cash Savings Capital Return Broad based outperformance of quarterly financial commitments Increasing 2024 Adj. EPS outlook Raising OpEx savings target to $790M through 2026 Decreasing capital intensity of the business Raising 2024 share repurchase target to $4B Targeting capital return in excess of $4.8B in 2024 FIS Investor Day 2024

Our Vision Unlocking financial technology to the world. Best-of-breed financial solutions for FIs, corporates, fintechs and developers Flexible, consumable products that cut across verticals and geographies Always resilient, always secure, always on FIS Investor Day 2024

Outcomes of Future Forward Strategy: Shareholder Value Creation Unlocking Financial Technology To The World: A Multi-year Strategy Executing To Deliver Profitable Growth Allocating Capital With Discipline Unlocking enterprise-wide capabilities to serve a broader market Innovating on modern infrastructure with unmatched domain insight Maximizing the value of industry leading cores Building on momentum in Capital Markets with leading SaaS solutions Shifting organization focus to high- margin software Expanding into new verticals – corporates / fintechs / developers Capitalizing on cross-sell / up-sell opportunities Accelerating growth in Payments and Digital Improving cost base and prioritizing highest conviction opportunities Investing to enhance our strategy and extend our lead Driving strong returns from CapEx and M&A in a data-driven approach Committing to compelling shareholder returns Leveraging Our Strong Foundation FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. The blurring of boundaries in financial services fuels our growth. Our focused strategy and execution deliver strong results to shareholders. Today’s Key Messages FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. The blurring of boundaries in financial services fuels our growth. Our focused strategy and execution deliver strong results to shareholders. Today’s Key Messages FIS Investor Day 2024

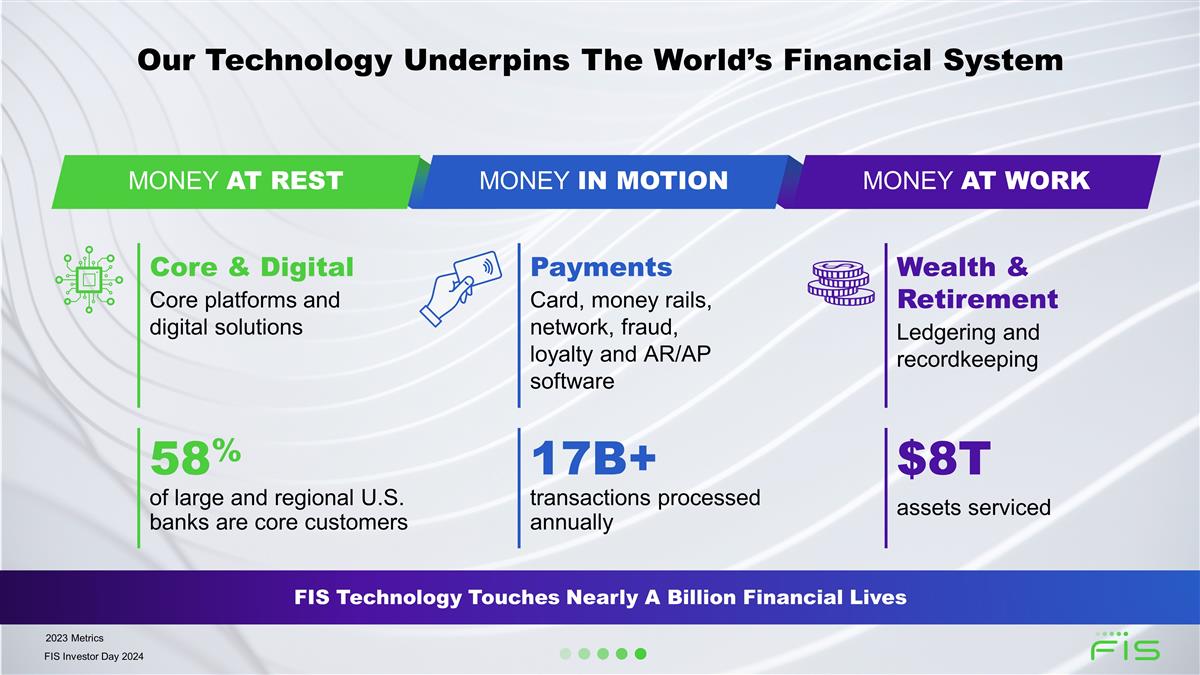

Unlocking Financial Technology To The World Across The Money Lifecycle Core Banking Digital Banking Payments Treasury & Risk Wealth & Retirement Trading & Asset Services Commercial Lending MONEY AT REST MONEY IN MOTION MONEY AT WORK FIS Investor Day 2024

2023 Adj. EBITDA Margin 40.4% Recurring Revenue 80% 2023 Revenue $9.8B Note: Revenue, Recurring Revenue, Adj. EBITDA Margin and TAM represent 2023 figures; Adj. Revenue Growth 2021 - 2023 CAGR TAM sourced Ernst & Young Revenue Mix TAM $15B $83B $95B 29% 44% 27% Revenue $2.8B $4.3B $2.7B Adj. Revenue CAGR 2021 - 2023 4% We Are A Global Leader In Large And Growing Markets MONEY AT REST MONEY IN MOTION MONEY AT WORK $193B $9.8B 100% FIS Investor Day 2024

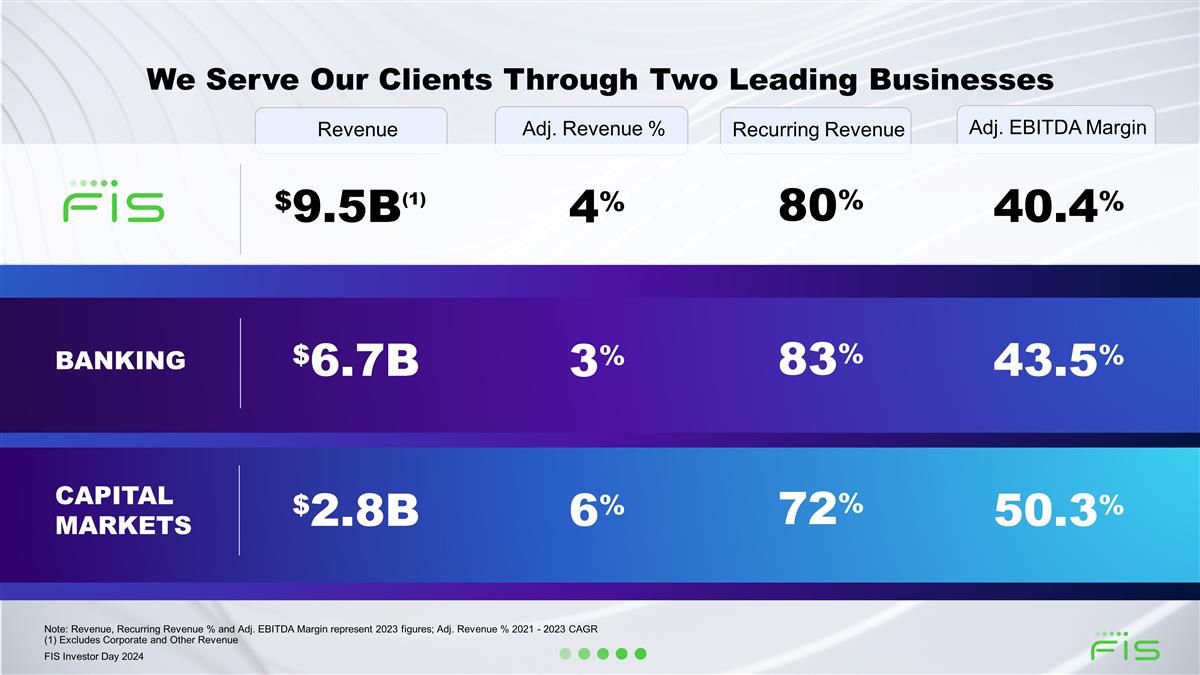

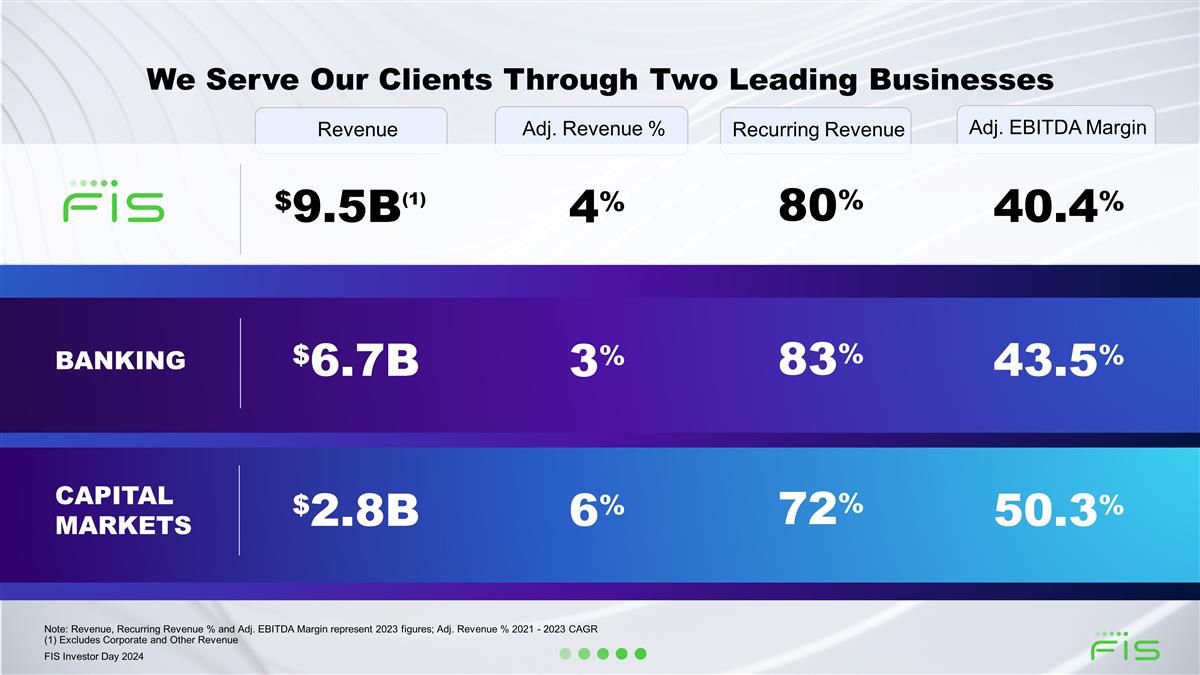

Note: Revenue, Recurring Revenue % and Adj. EBITDA Margin represent 2023 figures; Adj. Revenue % 2021 - 2023 CAGR (1) Excludes Corporate and Other Revenue We Serve Our Clients Through Two Leading Businesses Banking $6.7B 3% 43.5% Capital Markets 50.3% $2.8B 6% 83% 72% Revenue Adj. Revenue % Recurring Revenue Adj. EBITDA Margin $9.5B(1) 4% 40.4% 80% FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. The blurring of boundaries in financial services fuels our growth. Our focused strategy and execution deliver strong results to shareholders. Today’s Key Messages FIS Investor Day 2024

Industry trends FIs expanding across their money lifecycle Corporates entering the money lifecycle Banking industry consolidation Digitization of finance Rising regulatory complexity, security threats Changing interest rate environment Full suite of best-of-breed solutions across money lifecycle with: Flexible as-a-service consumption models Modern end-to-end digital experiences Mission-critical security and availability Seamless regulatory compliance Client Needs Traditional Boundaries Are Blurring Across The Money Lifecycle “Giant investment companies are pushing into new business areas blurring the lines…that define who does what on Wall Street…evolving into financial supermarkets” - Wall Street Journal(1) (1) Wall Street Journal – April 22, 2024 FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company Banking Capital Markets We Are Uniquely Positioned To Serve Our Clients FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company Banking Capital Markets We Are Uniquely Positioned To Serve Our Clients $400M Cross-sell Opportunity Globally Scaled Technology Global Distribution with a Marquee Set of Clients Best-of-breed Solution Suite >70% Large U.S. bank clients served by both Banking and Capital Markets FIS Investor Day 2024

LFI Regional & Community Banks Lending Technology Bank/Card Acquiring Treasury and Risk Trading and Asset Services Wealth and Retirement (1) Through strategic alliance with Worldpay MONEY AT REST MONEY IN MOTION MONEY AT WORK Core and Digital Banking Large Financial Institutions Regional and Community Banks Payments Card Issuing – Debit, Credit, Prepaid Acquiring(1) Money Rails Network Treasury and Risk Commercial Lending Trading and Asset Services Wealth and Retirement Our Scale And Capabilities Allow Us To Fully Meet Our Clients’ Needs FIS Investor Day 2024

Our Integrated Solutions Help A Global Bank Grow And Expand MONEY AT REST MONEY IN MOTION MONEY AT WORK Core Banking and Digital Debit Processing Wealth Management Decision Solutions NYCE Network Securities Processing SWIFT Services Fixed Income Services B2B Payments Securities Finance Outsourced Services Lockbox Processing Alternatives Modern Banking Platform Transaction Switching Custody Management 2000 2010 2020 2023 Key products & Solutions Capital Markets Banking Multinational retail, commercial and investment bank with >$250B assets Client since: 1988 Total FIS services: >100 Commercial Lending Tax and Compliance FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. The blurring of boundaries in financial services fuels our growth. Our focused strategy and execution deliver strong results to shareholders. Today’s Key Messages FIS Investor Day 2024

Accelerating Innovation On A Strong Foundation Scaled Technology Provider Best-of-breed on Cloud Foundation Platform for Innovation WHERE we’re GOING: WHERE WE ARE: Where we’VE BEEN: FIS Investor Day 2024

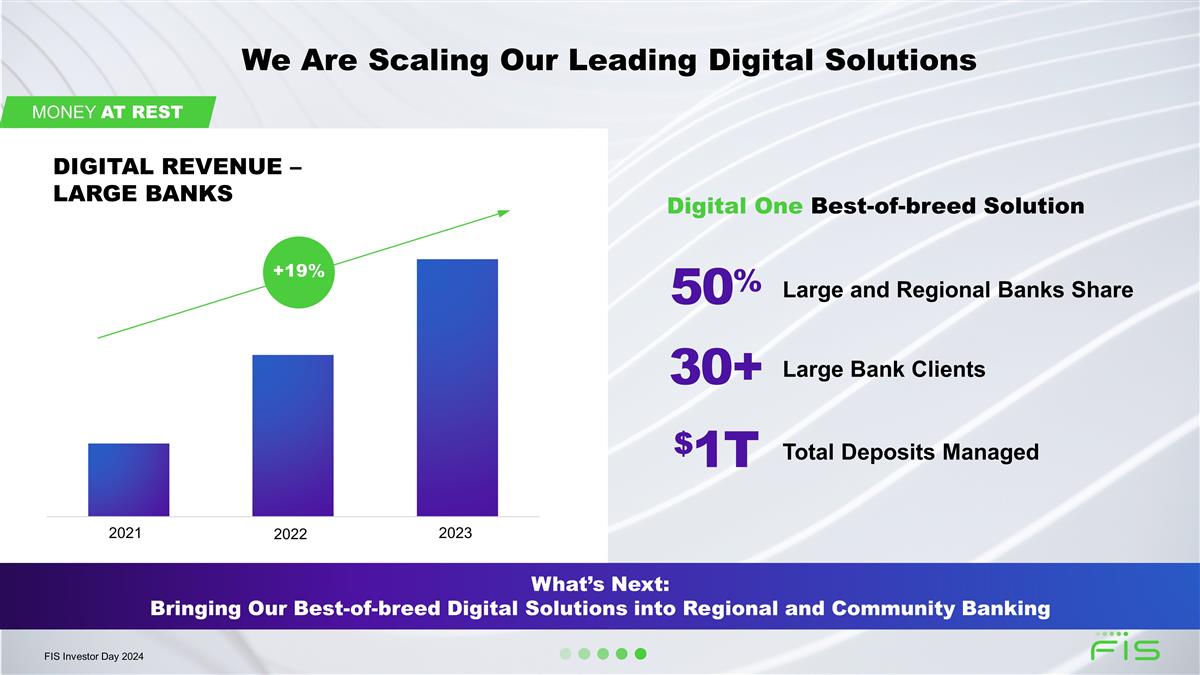

Building blocks of our strategy Outcomes achieved Capital MarketS Solutions Banking Solutions Drive operational excellence Modernize our industry-leading cores Scale our best-in-class digital suite Accelerate growth in payments Leverage global distribution to expand into fast-growing verticals Innovate with componentized SaaS-enabled solutions Increase exposure to new client verticals Driving growth through cross-sell +19% Increase In Digital Revenue In LFI(1) Focused Strategy And Execution Have Already Shifted Performance 83% Recurring Revenue 72% Recurring Revenue 50% New products with advanced tech +110bps Increase In Sales Margin(2) 50% Total revenue from payments 58% US LFI/Regional use FIS Core 30% Revenue from adjacent verticals 30% Clients Take Multiple Solutions >10% Growth In New Verticals(3) Note: Recurring Revenue, Total revenue from payments, US LFI/Regional use FIS Core, Clients take multiple solutions, Revenue from adjacent verticals and New products with advanced tech represent 2023 figures 2021 - 2023 CAGR 2022 - 2023 2025 / 2026 projection FIS Investor Day 2024

Disciplined Capital Allocation Focused On Long-term Value Creation Focusing on higher-growth, higher-margin solutions Modernizing technology to increase the pace of innovation Organic Investments Dividends targeting 35% payout of adjusted net income excluding Worldpay EMI Targeting return of capital exceeding $8B 2024 through 2026 Return of Capital Tuck-in acquisitions complementing organic investments Leveraging global distribution and scaled platform to drive synergies Generating attractive IRR M&A FIS Investor Day 2024

We are: Scaled Technology Leader We have: Global Distribution & Marquee Set Of Clients We deliver: Broad Suite Of Best-of-breed Solutions 1 2 3 Allowing Us To drive Double-Digit Total Return We Are Uniquely Positioned To Capitalize On Growth Opportunities FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 Technology 3 Firdaus Bhathena Chief Technology Officer

We deliver highly secure and resilient infrastructure. We build industry-leading solutions and experiences. We are investing in next-gen technology and platforms. Today’s Key Messages Clients trust us to run their business. Clients depend on us to compete and grow. Clients expect us to lead them into the future. FIS Investor Day 2024

MONEY AT WORK MONEY AT REST MONEY IN MOTION Industry-leading technology… …operating at global scale 60B+ transactions processed annually on our technology 250K virtual CPUs >200PB data stored and analyzed 25K technologists 1.5B API calls per month 90%+ workloads on cloud Our Technology Powers Global Finance Across The Money Lifecycle 2023 Metrics FIS Modern Banking Platform FIS #1 FIS Investor Day 2024

Accelerating Innovation On A Strong Foundation Scaled Technology Provider Best-of-breed on Cloud Foundation Platform for Innovation First to cloud, highly secure, resilient, scalable infrastructure Componentized products and seamless experiences to enable best-of-breed solutions, on cloud foundation Unified access to FIS and third-party capabilities across money at rest, money in motion and money at work WHERE we’re GOING: WHERE WE ARE: Where we’VE BEEN: FIS Investor Day 2024

CLOUD-ENABLED SECURE AND RESILIENT INFRASTRUCTURE Multi-cloud DATA AND RESPONSIBLE AI Componentized Products with Intuitive UX Core Banking Digital Banking Lending Tech Payments Wealth & Retirement Trading and Asset Svcs Treasury and Risk Third- parties Modern Technology Architecture Delivers Speed, Agility and Innovation Banks Corporates Fintechs ISVs Unified API-enabled Access …to enable easy integration with best-of-breed solutions …to enable plug-and-play solution bundles and seamless journeys …to improve time-to-market, scalability, geo-expansion and innovation …to deliver transformative insights FIS Investor Day 2024

We Continue To Strengthen Our Secure And Resilient Infrastructure Average remediation time Vulnerabilities proactively remediated 2022 2023 90% reduction in outages over last 5 years Zero recurrence in major outages across Infra and Platform Ops in 2021, 2022 and 2023 1,000 unique self-healing bots deployed mitigating 25K potential incidents in 2023 9,000+ AI-prevented impacts from product and infrastructure changes in 2023 Deploying next-gen capabilities to advance our industry-leading resiliency Advancing our state-of-the-art cybersecurity posture in a rapidly evolving environment Increased investment in cyber resilience AI-enabled threat mitigation Secure Cloud Edge Automation x9 82% 20B+ malicious requests blocked through automation(1) (1) 2022 - 2023 FIS Investor Day 2024

We Remain Ahead Of The Curve In Adopting Cloud Self-service experience Secure and resilient foundations Multi-cloud + hybrid-cloud interoperability Multi-cloud-native architecture Accelerated pathway to public cloud …and accelerating disciplined public cloud adoption Migrated 90%+ of workloads to cloud… 100% 100% Modernize with “pathway to cloud” Prioritize and assess for cloud readiness Govern, operate and optimize on cloud FIS Investor Day 2024

Select Examples Unlocking Significant Value With Cloud Trade compliance (Compliance Suite) ML Machine learning capabilities unlocked 3x Faster compute-heavy batch processes Enabling SaaS Accelerating innovation new markets Risk Management (Insurance Risk Suite) ~275% Revenue growth(1) ~325% Recurring revenue growth(1) Next-gen banking (Modern Banking Platform) $3.6B APAC TAM opportunity $$ Significantly lower cost to serve new markets (1) 2016 - 2023 FIS Investor Day 2024

Building Componentized Composable Products With Intuitive UX Modernize Cores In-Place Build Modern Products and Experiences Extend Client-centric Product Design and Delivery Excellence Enable best-of-breed solution bundles Increase cross-sell Enable new vertical expansion Enable seamless user journeys FIS Investor Day 2024

Technology Capital Allocation, % of total capital Efficient Capital Deployment To Accelerate High-growth Products high-growth products Remaining portfolio +10ppts increase in growth products’ share of technology capital $1,050M $800M FIS Investor Day 2024

Driving Growth With Modern Products And Experiences Unified API-enabled Access Layer Real-Time Analytics and Reporting MBP Core Deposits and Lending FIS and Public Cloud FIS Cloud Multicloud Retail Deposits Core Retail Lending Core Commercial Deposits Core Distributed Event Streaming Platform Quantum Modern, Digital Treasury Software Digital One Sleek and Intuitive Digital Banking Modern Banking Platform Next-Gen Core API-enabled API-enabled API-enabled Componentized Modern and highly customizable UI/UX Componentized “Secure by design” Componentized Real-time insights Cloud-native Cloud-native Cloud-native FIS Investor Day 2024

Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing traditional core processing capabilities Modernize-in-place: Componentizing Cores Enables Best-of-breed Solutions Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk FIS AND THIRD-PARTY PRODUCTS CORE PROCESSING Third-party products FIS products FIS core Core Deposits Compliance Core Lending Product Mgmt Unified API-enabled Access Layer Digital Channels Card Mgmt. Networks Customer Information Payments Document Mgmt. Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Reusing modern FIS and third-party products to accelerate core modernization Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Regulatory Reporting Collections Customer Information Product pricing Collateral Enabling flexible consumption through APIs to assemble best-of-breed solutions Lending for a fintech Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing core processing capabilities Core Deposits Compliance Core Lending Product Mgmt Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Rewriting componentized products on a modern tech stack Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Loyalty Enabling flexible consumption through APIs to assemble best-of-breed solutions Core Deposits Compliance Core Lending Product Mgmt Reconciliation Product & Organization General Ledger Unified API-enabled Access Layer Payments Card Mgmt. Fraud & Risk Real-time payments for insurance companies Core Deposits Compliance Core Lending Product Mgmt Product Pricing Digital Channels Unified API-enabled Access Layer Card Mgmt Regulatory Reporting Document Mgmt Fraud & Risk Enabling flexible consumption through APIs to assemble best-of-breed solutions Digital Bank-in-a-Box to accelerate deposit growth Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Card Mgmt Customer Information Payments Loyalty Flexible consumption through APIs to assemble best-of-breed solutions Incremental release of new components Proven, seamless transition ILLUSTRATIVE FIS Investor Day 2024

Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing traditional core processing capabilities Modernize-in-place: Componentizing Cores Enables Best-of-breed Solutions Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk FIS AND THIRD-PARTY PRODUCTS CORE PROCESSING Core Deposits Compliance Core Lending Product Mgmt Unified API-enabled Access Layer Digital Channels Card Mgmt Networks Customer Information Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Reusing modern FIS and third-party products to accelerate core modernization Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Regulatory Reporting Collections Customer Information Product pricing Collateral Lending for a fintech Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing core processing capabilities Core Deposits Compliance Core Lending Product Mgmt Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Rewriting componentized products on a modern tech stack Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Loyalty Enabling flexible consumption through APIs to assemble best-of-breed solutions Core Deposits Compliance Core Lending Product Mgmt Reconciliation Product & Organization General Ledger Unified API-enabled Access Layer Payments Card Mgmt. Fraud & Risk Real-time payments for insurance companies Core Deposits Compliance Core Lending Product Mgmt Product Pricing Digital Channels Unified API-enabled Access Layer Card Mgmt Regulatory Reporting Document Mgmt Fraud & Risk Enabling flexible consumption through APIs to assemble best-of-breed solutions Digital Bank-in-a-Box to accelerate deposit growth Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Card Mgmt Customer Information Payments Loyalty Flexible consumption through APIs to assemble best-of-breed solutions Incremental release of new components Proven, seamless transition ILLUSTRATIVE Third-party products FIS products FIS core Enabling flexible consumption through APIs to assemble best-of-breed solutions FIS Investor Day 2024

Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing traditional core processing capabilities Modernize-in-place: Componentizing Cores Enables Best-of-breed Solutions Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk FIS AND THIRD-PARTY PRODUCTS CORE PROCESSING Core Deposits Compliance Core Lending Product Mgmt Unified API-enabled Access Layer Digital Channels Card Mgmt Networks Customer Information Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Reusing modern FIS and third-party products to accelerate core modernization Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Regulatory Reporting Collections Customer Information Product pricing Collateral Enabling flexible consumption through APIs to assemble best-of-breed solutions Lending for a fintech Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing core processing capabilities Core Deposits Compliance Core Lending Product Mgmt Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Rewriting componentized products on a modern tech stack Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Loyalty Core Deposits Compliance Core Lending Product Mgmt Reconciliation Product & Organization General Ledger Unified API-enabled Access Layer Payments Card Mgmt. Fraud & Risk Real-time payments for insurance companies Core Deposits Compliance Core Lending Product Mgmt Product Pricing Digital Channels Unified API-enabled Access Layer Card Mgmt Regulatory Reporting Document Mgmt Fraud & Risk Enabling flexible consumption through APIs to assemble best-of-breed solutions Digital Bank-in-a-Box to accelerate deposit growth Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Card Mgmt Customer Information Payments Loyalty Flexible consumption through APIs to assemble best-of-breed solutions Incremental release of new components Proven, seamless transition ILLUSTRATIVE Third-party products FIS products FIS core Enabling flexible consumption through APIs to assemble best-of-breed solutions FIS Investor Day 2024

Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing traditional core processing capabilities Modernize-in-place: Componentizing Cores Enables Best-of-breed Solutions Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk FIS AND THIRD-PARTY PRODUCTS CORE PROCESSING Core Deposits Compliance Core Lending Product Mgmt Unified API-enabled Access Layer Digital Channels Card Mgmt Networks Customer Information Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Reusing modern FIS and third-party products to accelerate core modernization Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Regulatory Reporting Collections Customer Information Product pricing Collateral Enabling flexible consumption through APIs to assemble best-of-breed solutions Lending for a fintech Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing core processing capabilities Core Deposits Compliance Core Lending Product Mgmt Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Rewriting componentized products on a modern tech stack Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Loyalty Enabling flexible consumption through APIs to assemble best-of-breed solutions Core Deposits Compliance Core Lending Product Mgmt Reconciliation Product & Organization General Ledger Unified API-enabled Access Layer Payments Card Mgmt. Fraud & Risk Real-time payments for insurance companies Core Deposits Compliance Core Lending Product Mgmt Product Pricing Digital Channels Unified API-enabled Access Layer Card Mgmt. Regulatory Reporting Document Mgmt. Fraud & Risk Digital Bank-in-a-Box to accelerate deposit growth Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Card Mgmt Customer Information Payments Loyalty Flexible consumption through APIs to assemble best-of-breed solutions Incremental release of new components Proven, seamless transition ILLUSTRATIVE Third-party products FIS products FIS core Enabling flexible consumption through APIs to assemble best-of-breed solutions FIS Investor Day 2024

Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing traditional core processing capabilities Modernize-in-place: Componentizing Cores Enables Best-of-breed Solutions Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk FIS AND THIRD-PARTY PRODUCTS CORE PROCESSING Core Deposits Compliance Core Lending Product Mgmt Unified API-enabled Access Layer Digital Channels Card Mgmt Networks Customer Information Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Reusing modern FIS and third-party products to accelerate core modernization Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Regulatory Reporting Collections Customer Information Product pricing Collateral Enabling flexible consumption through APIs to assemble best-of-breed solutions Lending for a fintech Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Core Deposits Compliance Core Lending Product Mgmt Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Componentizing core processing capabilities Core Deposits Compliance Core Lending Product Mgmt Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Document Mgmt Enterprise Alerts Rate Mgmt Loyalty Fraud & Risk Item Processing Fraud & Risk Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Collateral Analytics & Insights Collections Product & Organization General Ledger Reconciliation Product Pricing Regulatory Reporting Rewriting componentized products on a modern tech stack Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Code Connect/ Banking Platform Services Digital Channels Card Mgmt Networks Enterprise Customer Payments Loyalty Enabling flexible consumption through APIs to assemble best-of-breed solutions Core Deposits Compliance Core Lending Product Mgmt Reconciliation Product & Organization General Ledger Unified API-enabled Access Layer Payments Card Mgmt. Fraud & Risk Real-time payments for insurance companies Core Deposits Compliance Core Lending Product Mgmt Product Pricing Digital Channels Unified API-enabled Access Layer Card Mgmt Regulatory Reporting Document Mgmt Fraud & Risk Enabling flexible consumption through APIs to assemble best-of-breed solutions Digital Bank-in-a-Box to accelerate deposit growth Core Deposits Compliance Core Lending Product Mgmt Analytics & Insights General Ledger Unified API-enabled Access Layer Digital Channels Card Mgmt. Customer Information Payments Loyalty Flexible consumption through APIs to assemble best-of-breed solutions Incremental release of new components Proven, seamless transition ILLUSTRATIVE Third-party products FIS products FIS core FIS Investor Day 2024

Streamline Client Implementations Configurable “product-in-a-box” deployments enabled by AI and automation Accelerate end-to-end product delivery Business + engineering + CX teams aligned to common OKRs Agile, DevSecOps, SRE Invest in Next-Gen skills and developer experience Accelerated hiring and upskilling for next-gen skills World-class tooling We Are Accelerating The Product Flywheel Through Client-Centric Product Design And Delivery Excellence Accelerate end-to-end integrated product delivery Streamline and automate Client Implementations Invest in nextgen skills and developer experience Business + engineering + CX/PS teams aligned to common OKRs Enterprise-wide adoption of Agile, DevSecOps, SRE Standardized and configurable “product-in-a-box” deployments “First-time-right” implementations enabled by AI and automation Revamped hiring and upskilling for nextgen skills, e.g., AI Enabling developers with tooling, e.g., GenAI-based coding and backlog grooming accelerants FIS Investor Day 2024

Our Results: Transforming Delivery Of High-Growth Products Note: Results from rollout to 15+ products and 50+ teams Higher client satisfaction Client NPS scores Improved quality Defects proactively detected and prevented +25 ppts +20-40% 70% Faster delivery Velocity: features delivered per “sprint” +15% Better predictability Features delivered vs committed per “sprint” FIS Investor Day 2024

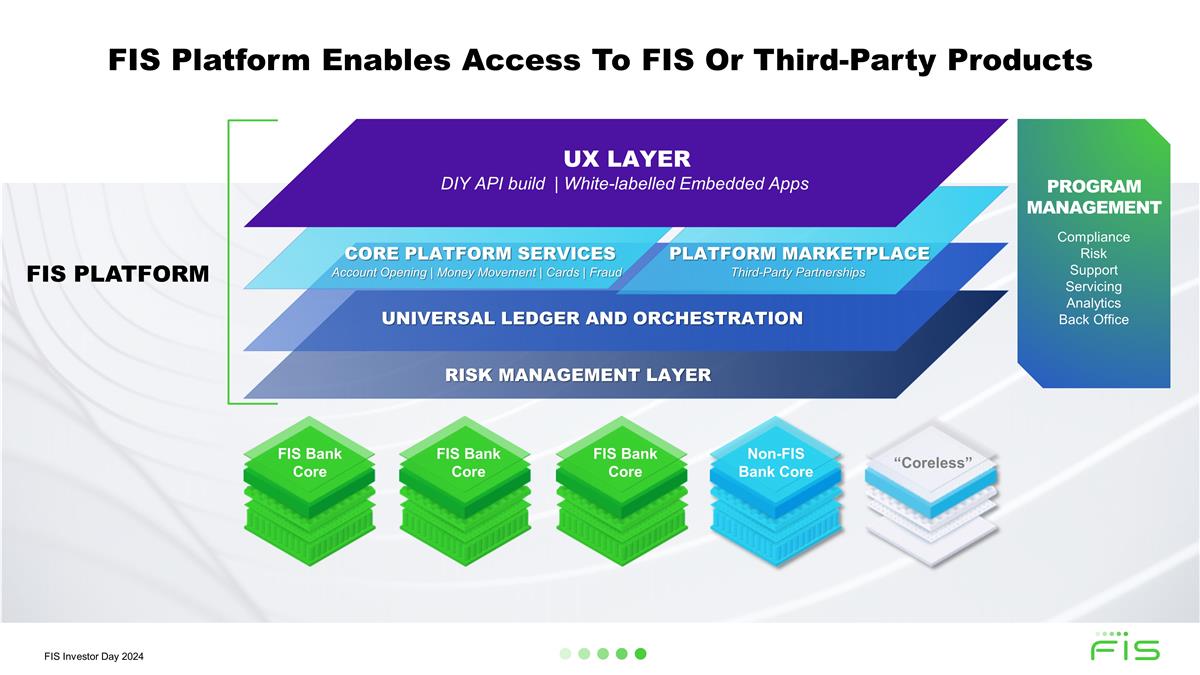

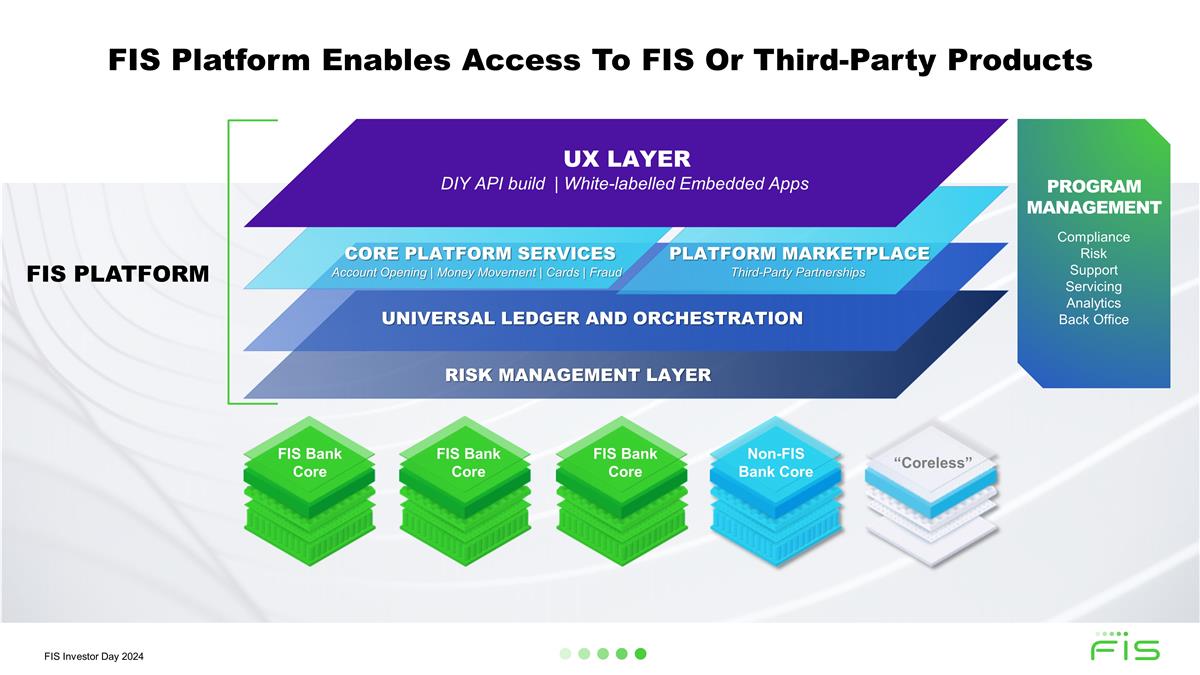

Speaker notes: I am incredibly excited about our new Embedded Finance API marketplace This is what makes our Money at Rest-Motion-Work ecosystem a true platform for innovation And offers a powerful array of capabilities to every financial services institution, corporate, fintech, and developer Our Embedded Finance platform is designed to be agnostic to sponsor banks, bank cores, and technology partners. We are enabling easy integration with best-of-breed FIS and third party solutions This is supported by our Banking Platform Services layer, enabling any bank to offer financial services through our unified APIs We believe Embedded Finance has the potential to unlock significant value across the financial ecosystem For FIS, Embedded Finance will help us not only grow share in our existing client base, but also expand to new clients such as corporates and fintechs FIS Platform Enables Access To FIS Or Third-Party Products Risk management layer PROGRAM MANAGEMENT Compliance Risk Support Servicing Analytics Back Office UNIVERSAL LEDGER AND ORCHESTRATION CORE PLATFORM SERVICES Account Opening | Money Movement | Cards | Fraud PLATFORM MARKETPLACE Third-Party Partnerships UX LAYER DIY API build | White-labelled Embedded Apps FIS Bank Core FIS Bank Core Non-FIS Bank Core “Coreless” FIS PLATFORM FIS Bank Core FIS Investor Day 2024

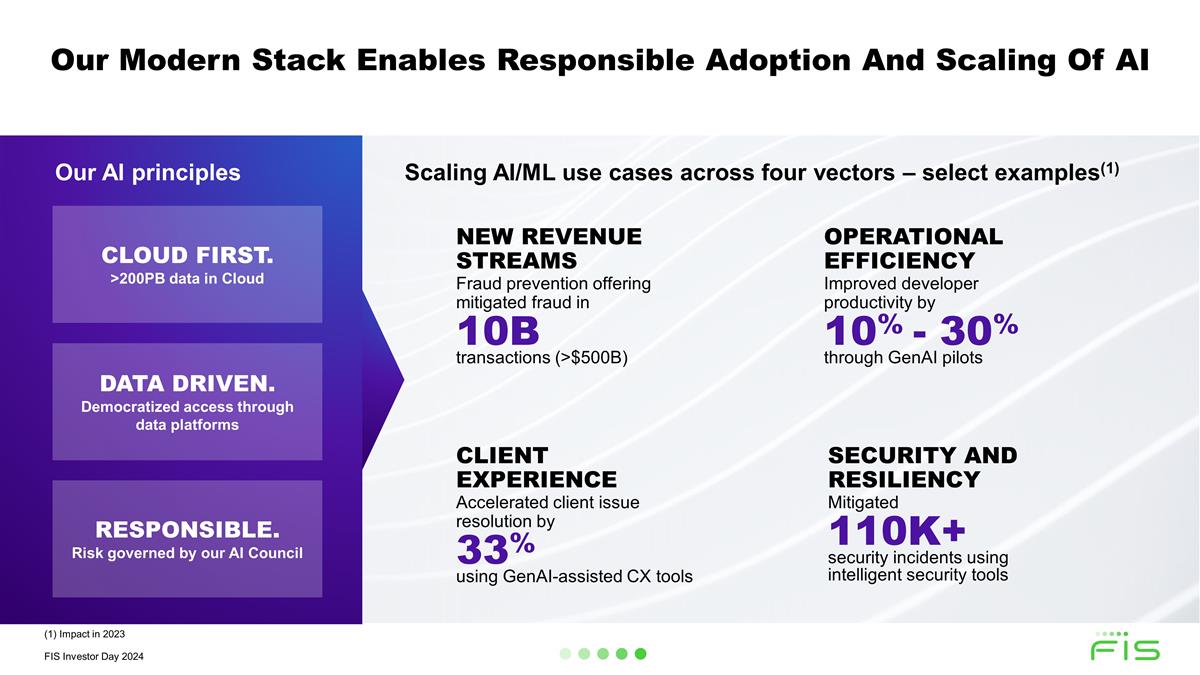

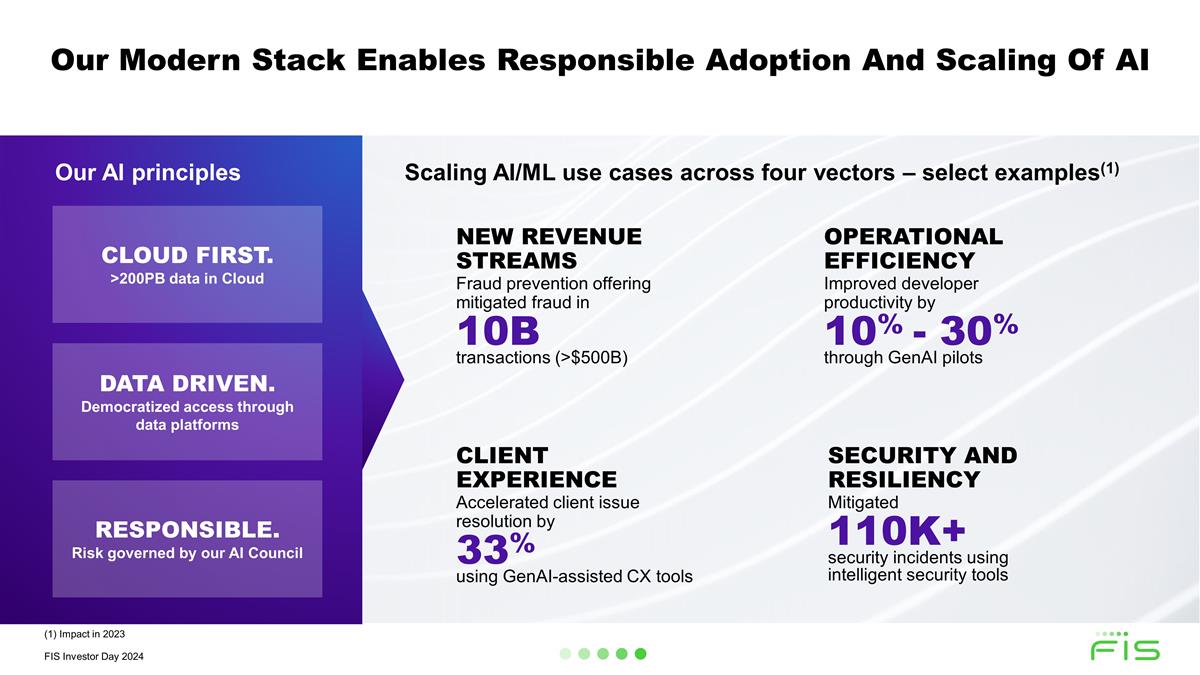

Security and Resiliency Mitigated 110K+ security incidents using intelligent security tools Client Experience Accelerated client issue resolution by 33% using GenAI-assisted CX tools Operational Efficiency Improved developer productivity by 10% - 30% through GenAI pilots New Revenue Streams Fraud prevention offering mitigated fraud in 10B transactions (>$500B) Scaling AI/ML use cases across four vectors – select examples(1) Our AI principles Cloud first. >200PB data in Cloud Data DRIVEN. Democratized access through data platforms Responsible. Risk governed by our AI Council Our Modern Stack Enables Responsible Adoption And Scaling Of AI (1) Impact in 2023 FIS Investor Day 2024

Highly secure and resilient cloud infrastructure at scale Clients depend on us to grow and lead them into the future Industry-leading products across the money lifecycle PROVEN RESULTS FROM ONGOING TECH TRANSFORMATION 1 2 3 Scaled Technology Leader Global Distribution & Marquee Set Of Clients Broad Suite Of Best-of-breed Solutions We Are Uniquely Positioned To Capitalize On Growth Opportunities FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company Segment Strategy: Banking Solutions FIS Investor Day 2024 4 John Durrant President, Banking Solutions

We are a leading provider of financial technology. Our growth strategy focuses on operational excellence, core and digital innovation, and payments. Clear path to deliver sustainable high-quality growth Today’s Key Messages FIS Investor Day 2024

We are a leading provider of financial technology. Our growth strategy focuses on operational excellence, core and digital innovation, and payments. Clear path to deliver sustainable high-quality growth Today’s Key Messages FIS Investor Day 2024

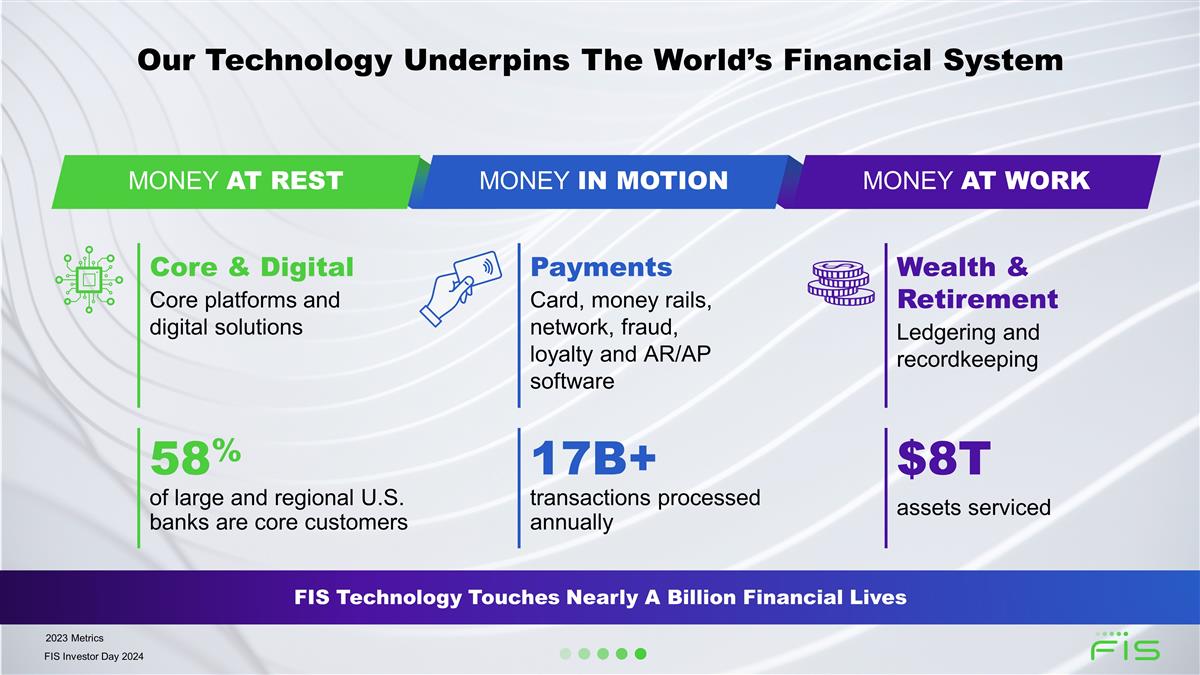

MONEY AT REST MONEY IN MOTION MONEY AT WORK Wealth & Retirement Payments Core & Digital Card, money rails, network, fraud, loyalty and AR/AP software Ledgering and recordkeeping Core platforms and digital solutions 17B+ $8T 58% of large and regional U.S. banks are core customers transactions processed annually assets serviced FIS Technology Touches Nearly A Billion Financial Lives Our Technology Underpins The World’s Financial System 2023 Metrics FIS Investor Day 2024

BANKING SOLUTIONS BANKING SOLUTIONS Revenue Mix MARKET US TAM Our Business Operates At Scale In Growing Markets Adj. Rev. % 2021 - 2023 US TAM Growth 2024 - 2026 MONEY AT REST MONEY IN MOTION MONEY AT WORK 40% 50% 10% $15B $53B $6B Wealth & Retirement Payments Core & Digital 2% 4% 7% 3% 5% 3% 100% 3% $74B 4% BANKING SOLUTIONS TOTAL 43.5% 83% $6.7B 3% 2023 Adj. EBITDA Margin Recurring Revenue 2023 Revenue Adj. Revenue CAGR 2021 - 2023 Note: Revenue, Recurring Revenue, Adj. EBITDA Margin and TAM represent 2023 figures; Adj. Revenue Growth 2021 - 2023 CAGR; TAM growth 2024 - 2026 CAGR TAM sourced Ernst & Young FIS Investor Day 2024

BANKS FINANCIAL SERVICES INSTITUTIONS We Provide Mission-Critical Technology To Our Clients CORPORATES & OTHER +3,000 +4,900 +1,800 Financial Services Companies and Credit Unions Large, Regional and Community Banks Fintechs, Retailers, Governments, Healthcare etc. 2023 Metrics FIS Investor Day 2024

Products Cores Digital Debit Processing Credit Processing Network (NYCE) Money Rails (ACH, Wires, etc.) AP/AR Fraud Loyalty Wealth Retirement Wealth & Retirement Payments Core & Digital Large Banks Corporates Core Clients Have An Average Of 20+ Products Financial Services Institutions Credit Unions Regional and Community Banks We Serve Clients Across All Their Financial Technology Needs FIS Investor Day 2024

2022 Banking Solutions Revenue ($B) Adjusted Revenue Growth GROWTH RATES Core Accounts(1) 3% 3% Card Transactions(2) 5% 5% Adj. EBITDA Margin 44% 42/45% H1 H2 5.8% 4.1% Adjusted Recurring Revenue Growth We Are On Track to Return to High-Quality Growth (1) Core deposit accounts hosted by FIS core platforms (2) Debit and credit transactions processed by FIS 2023 2024E $6.6 $6.7 ~$6.9 TARGET 4.9% 1.6% ~3.3% FIS Investor Day 2024

We are a leading provider of financial technology. Our growth strategy focuses on operational excellence, core and digital innovation, and payments. Clear path to deliver sustainable high-quality growth Today’s Key Messages FIS Investor Day 2024

Unlocking Financial Technology To The World: Our Banking Growth Strategy Core & Digital Operational Excellence Payments Continuing focus on client experience and sales excellence Build on our proven strengths with next-gen cores and digital solutions Increase payments growth by improving sales execution and capitalizing on market trends FIS Investor Day 2024

Continuing To Focus On Client Experience Increased dedicated client coverage(1) +54% Q1-2023 Q1-2024 Product implementations completed(2) +26% 2021 2023 Launched new self-service tools Dedicated support for core clients Investing in people, process and technology to accelerate implementations (1) # Assigned relationship managers by client entity / # of clients (2) Includes solution conversions, migrations, configurations and functionality updates completed in the year FIS Investor Day 2024

Sales Will Be Bolstered By Continued Improvement In The Sales Model And Expanded Distribution Increased Salesforce productivity(1) +15% 2022 2023 Increased focus on sales margin(2) +110 bps 2022 2023 Broadening distribution through: Partnership with Expanded reach through developers and ISVs $300M opportunity from continuing to deepen Capital Markets client relationships with Banking Solutions products (1) $ sales (excluding resellers) / quota carrying headcount (excluding resellers and enterprise account managers) (2) Segment contribution $ of products sold x product margin / total sales $ FIS Investor Day 2024

Horizon End-to-end integrated technology and services for community banks IBS Best-in-class commercial banking capabilities for regional banks 58% share(1) MBP First cloud native, core designed for largest banks Production Implementation We Are Building On Our Industry-Leading Core Banking Technology MONEY AT REST Consistent wins in banking consolidations 5 of top 20 U.S. banks 2 of top 4 Canadian banks >350 community bank clients on Horizon (1) Includes other FIS cores serving US banks with $10B+ in assets FIS Investor Day 2024

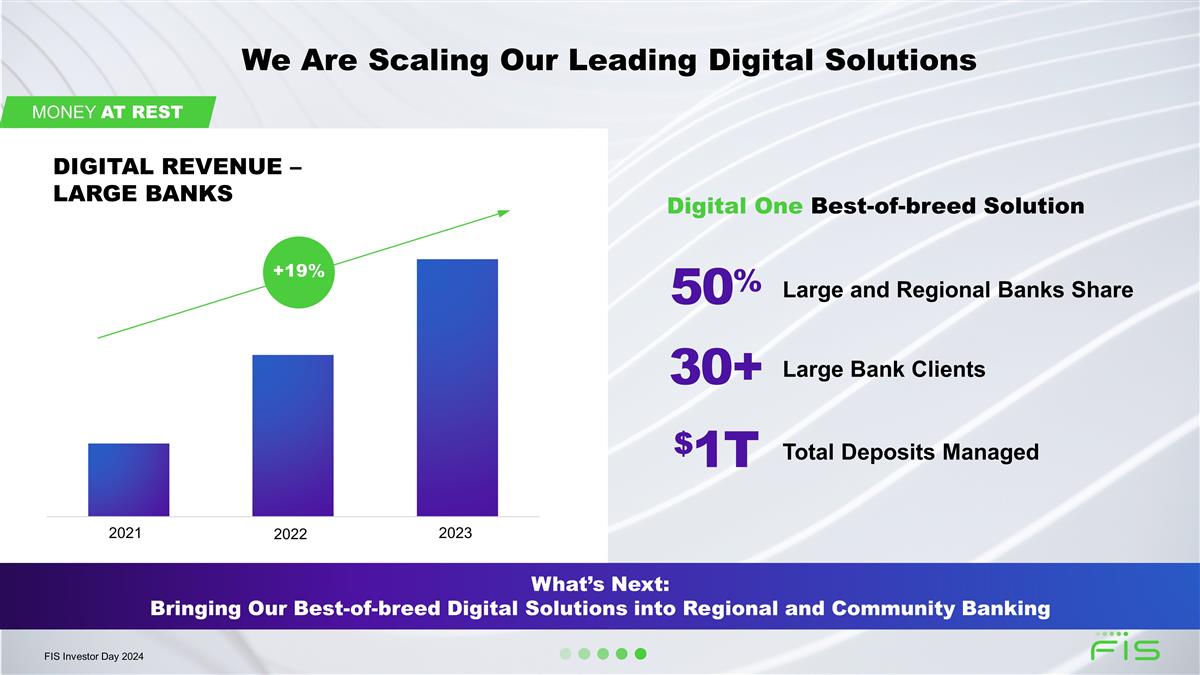

We Are Scaling Our Leading Digital Solutions Digital revenue – large banks +19% 2021 2022 2023 $1T 50% 30+ Digital One Best-of-breed Solution What’s Next: Bringing Our Best-of-breed Digital Solutions into Regional and Community Banking Total Deposits Managed Large and Regional Banks Share Large Bank Clients MONEY AT REST FIS Investor Day 2024

MONEY RAILS Value Added Services NETWORK ISSUER PROCESSING We Have A Scaled Payments Business That Will Fuel Further Growth We Are Refocusing Our Commercial Engine To Capitalize On Our Proven Products In High Growth Areas MONEY IN MOTION Credit Processing NYCE ACH, Wires, RTP, Zelle, Bill Pay, etc. AR / AP Fraud Loyalty Value Added Services Debit Processing Scaled credit and debit issuer processing that wins in our core and beyond, processing $900B Nationally available credit and debit network benefitting from market dynamics processing $100B annually Award winning corporate-facing software in a large, fast-growing markets processing $2T in Accounts Receivable(1) Scaled pay-by-points national network at point-of-sale with 70K locations Tools to protect money in motion for all payment methods Industry-leading payments services processing 3.5B items annually Full suite of configurable and customizable money rails for banks and non-bank verticals (1) 2022 FIS Investor Day 2024

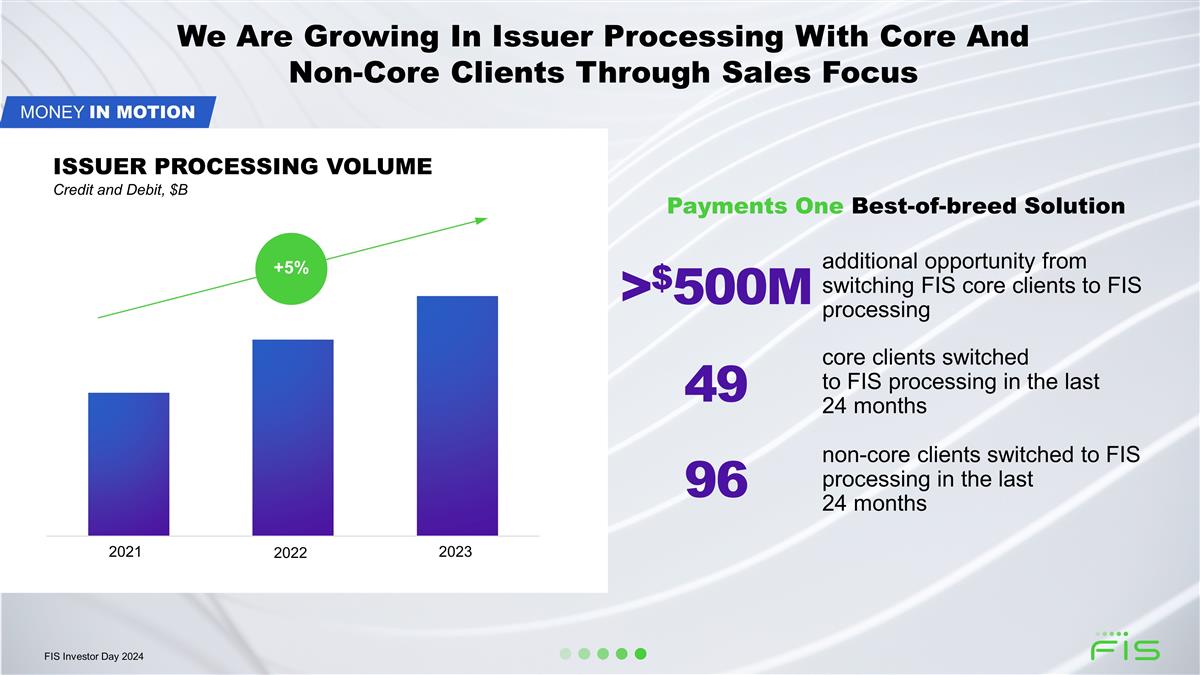

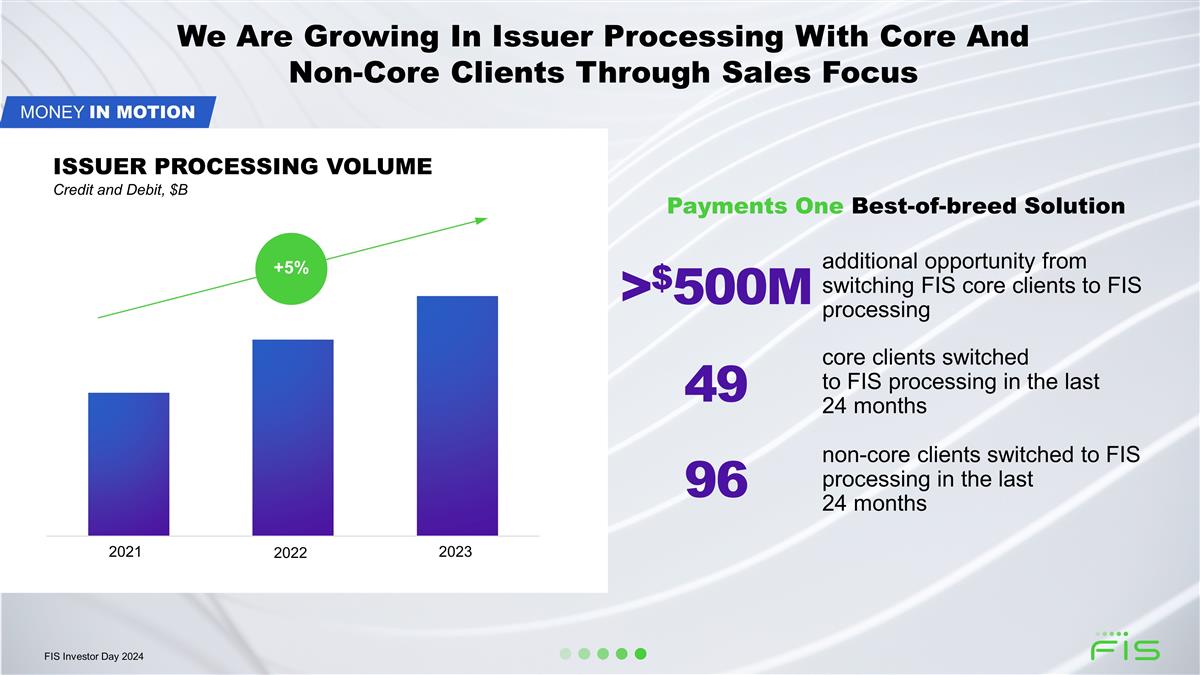

We Are Growing In Issuer Processing With Core And Non-Core Clients Through Sales Focus Issuer processing volume Credit and Debit, $B MONEY IN MOTION +5% 2021 2022 2023 >$500M 49 Payments One Best-of-breed Solution 96 additional opportunity from switching FIS core clients to FIS processing non-core clients switched to FIS processing in the last 24 months core clients switched to FIS processing in the last 24 months FIS Investor Day 2024

55M cardholders eligible for Premium Payback 36% Y-o-Y revenue growth We Will Continue To Grow Our Premium Payback Network Through Our Partnership With Worldpay Points Redeemed (B) 2021 2022 2023 17 21 24 MONEY IN MOTION Retailers Grocery Stores Pharmacies Gas Stations Premier Financial Institution Partners PREMIUM PAYBACK Leading Merchant Partners FIS Investor Day 2024

Market Dynamics Driving Increased Demand For NYCE 2020 2021 2022 2023 NYCE TRANSACTION VOLUME Number of transactions +8% MONEY IN MOTION NYCE Best-of-breed Solution >40 18 >$100M issuing banks and credit unions added to NYCE in the last 12 months additional opportunity from adding NYCE to FIS clients issuing banks in late-stage discussions to adopt NYCE FIS Investor Day 2024

We are a leading provider of financial technology. Our growth strategy focuses on operational excellence, core and digital innovation, and payments. Clear path to deliver sustainable high-quality growth Today’s Key Messages FIS Investor Day 2024

3.0% (1.0)% We Will Deliver Predictable And Sustainable Revenue Growth Of 3.5 - 4.5% By 2025 / 2026 Increased sales focus on payments solutions Capitalize on partnership with Worldpay Capture market trends in network and AR/AP Tuck-in M&A in payments Re-focusing on higher-quality revenue Setting lower growth targets for non-recurring Stable, recurring revenue Account and transaction linked revenue Continue our focus on operational excellence Industry-leading cores Modernized ahead of the competition Deliver digital product to regional and community banking Tuck-in M&A in digital Underlying Growth Core AND Digital Payments Non-Recurring 3.5% - 4.5% +1.5% - 2.5% FIS Investor Day 2024

Ahead of competitors in modernizing tech, providing faster and more flexible innovation Leveraging leadership in core to expand wallet share and enter new verticals Focusing on faster growing digital and payments HIGH-QUALITY RECURRING REVENUE GROWTH Scaled Technology Leader Global Distribution & Marquee Set Of Clients Broad Suite Of Best-of-breed Solutions 1 2 3 We Are Uniquely Positioned To Capitalize On Growth Opportunities FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 Segment Strategy: Capital Markets Solutions 5 Nasser Khodri President, Capital Markets Solutions

We are uniquely positioned to lead in fast-growing markets. Our innovative solutions drive growth in traditional and adjacent verticals. Our focused strategy and execution delivers strong results. Today’s Key Messages FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. Our innovative solutions drive growth in traditional and adjacent verticals. Our focused strategy and execution delivers strong results. Today’s Key Messages FIS Investor Day 2024

We Operate Across The Money Lifecycle Through Three Solution Ecosystems CAPITAL MARKETS 5% 7% 12% $66B $23B $30B 57% 32% 11% MONEY IN MOTION MONEY AT WORK Trading & Asset Services Treasury & Risk Commercial Lending 50.3% 72% $2.8B 6% 2023 Adj. EBITDA Margin Recurring Revenue 2023 Revenue Adj. Revenue CAGR 2021 - 2023 CAPITAL MARKETS TOTAL 6% $119B 100% Revenue Mix TAM TAM Growth Note: Revenue, Recurring Revenue, Adj. EBITDA Margin and TAM represent 2023 figures; Adj. Revenue Growth 2021 - 2023 CAGR; TAM growth 2024 - 2026 CAGR TAM sourced Ernst & Young FIS Investor Day 2024

We Have An Industry-Leading Position With A Global Client Base 6,000+ clients served across ~150 countries MONEY IN MOTION MONEY AT WORK 70% Top 100 Insurance Firms 1,500+ Risk Clients 1,250+ Treasury Clients $50T AUM of Traditional Asset Managers $4T AUM of Private Equity Institutions 17 of 25 Top Loan Syndication Agents Served FIS Investor Day 2024

FIS Treasury And Risk Ecosystem Enabling Strategic Growth, Protecting Client Assets And Mitigating Risk With RegTech Insurers and Corporates Key Trends Risk and RegTech: Protecting against risk and complying with regulations allowing our clients to focus on growth Outsourcing: Outsourcing of Treasury functions to cloud-based technology service providers Emerging Risks: New areas of risk continue to develop (i.e. capital adequacy, interest rate risk, IFRS and SEC ESG mandates) Treasury Banking Book and Liquidity Risk Credit Risk Market Risk Insurance Risk Climate Risk SaaS Treasury Enterprise Treasury MONEY IN MOTION Banks, Corporates and FIs Risk FIS Investor Day 2024

FIS Commercial Lending Ecosystem Innovating And Digitization Lending And Leasing Capabilities For Corporates And OEMs Digitization: Digitization of lending and credit data Outsourcing: Outsourcing of lending and credit technologies to cloud-based providers ESG: Shift of assets for leasing (electric vehicles) Shift of Capital: Shift of capital from public to private credit Auto & Equipment Finance Commercial Lending Technology Key Trends Loan Syndication Loan and Credit Servicing Auto Finance Asset Finance Loan Origination Loan and Credit Trading MONEY AT WORK Banks, Auto and Equipment Lenders (Captives) Banks, Corporates and FIs FIS Investor Day 2024

FIS Trading And Asset Services Ecosystem Innovating And Automating Transaction And Data Flows Across The Capital Markets Industry Buyside Evolution: Buyside companies taking on traditional sell side functions (e.g., self clearing) Shift of Capital: Shift of capital from public to private credit Big Data: Need for data availability to drive automation and efficiencies throughout the buyside and sell side ecosystems Buy Side Sell Side Outsourcing: Continued movement towards outsourcing mission critical technology to cloud-based solutions Asset Management Securities and Trading Compliance and Tax Key Trends Cross Asset Trading Electronic Trading Securities Processing Securities Finance and Collateral Cleared Derivatives Trade / Market Abuse Monitoring Tax Information Reporting Traditional Asset Management Alternatives and Credit Transfer Agency MONEY AT WORK FIS Investor Day 2024

Monoline Treasury Mgmt. provider Monoline Loan Origination provider Lending and Treasury focused Fintech Risk and Lending Buyside provider Exchange and Data provider Global Footprint Breadth of Solutions Why are we ahead: Integrated platforms with plug-and-play solutions Scale that drives market-leading efficiency Fit-for-purpose for the widest range of geographies Our Ability To Serve Global Clients Is Unparalleled Sell side provider FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. Our innovative solutions drive growth in traditional and adjacent verticals. Our focused strategy and execution delivers strong results. Today’s Key Messages FIS Investor Day 2024

Clients Across Verticals Value Our Ability To Serve Their Needs Across The Money Lifecycle Asset Mgrs. Asset Svcrs. Banks & Lenders Broker / Dealers Insur. Firms Auto & EqUip. Corps. Solution Ecosystem Asset Svcrs. Banks & Lenders Broker / Dealers Insur. Firms Auto & Equip. Asset Mgrs. Corps. Traditional verticals Adjacent verticals Commercial Lending Treasury and Risk Trading and Asset Services Risk Management Treasury MONEY AT WORK MONEY IN MOTION MONEY AT WORK Commercial Lending Auto & Equipment Finance Asset Management Trading, Derivatives and Securities Compliance and Tax FIS Investor Day 2024

We Have Expanded Substantially Beyond Our Traditional Verticals Adjacent verticals (Corporates, Insurance, Automotive, etc.) Traditional verticals (Asset Managers, Asset Servicers, Banks / Lenders, Broker / Dealers) Share of revenue per vertical category, ~% of total revenue Consuming solutions such as: Climate Risk Modeler Insurance Risk Management Treasury and Payments Management Asset Finance FIS Investor Day 2024

We Are Driving Growth Through Cross-Sell Asset Mgrs. Asset Svcrs. Banks & Lenders Broker / Dealers Insur. Firms Auto & EqUip. Corps. ~30% of our clients take multiple FIS solutions ~6% growth in revenue per client Best-of-breed Products Comprehensive Set of Solutions Innovation That Drives Growth Global Scale and Service Regulatory and Compliance Expertise Integrated Platforms and Ecosystems Client Needs FIS CAPITAL MARKETS IS UNMATCHED IN ABILITY TO DELIVER Note: Growth in revenue per client represents 2017 - 2023 $100m opportunity from continuing to deepen BANKING SOLUTIONS client relationships with CAPITAL MARKETS products FIS Investor Day 2024

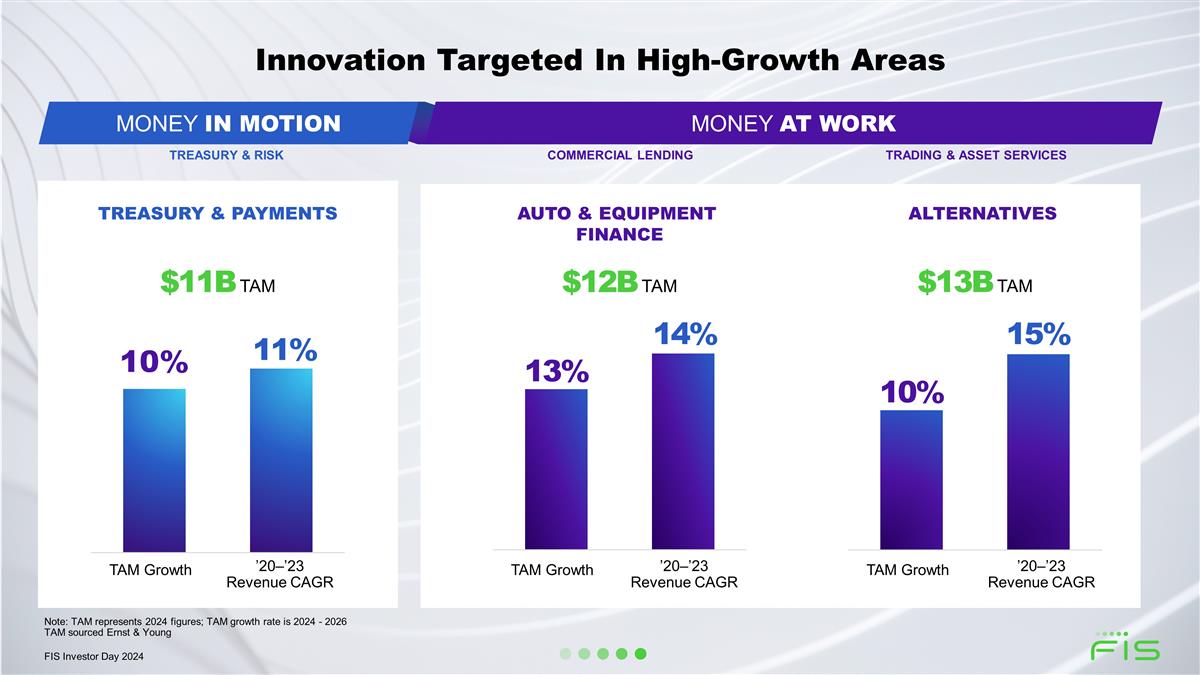

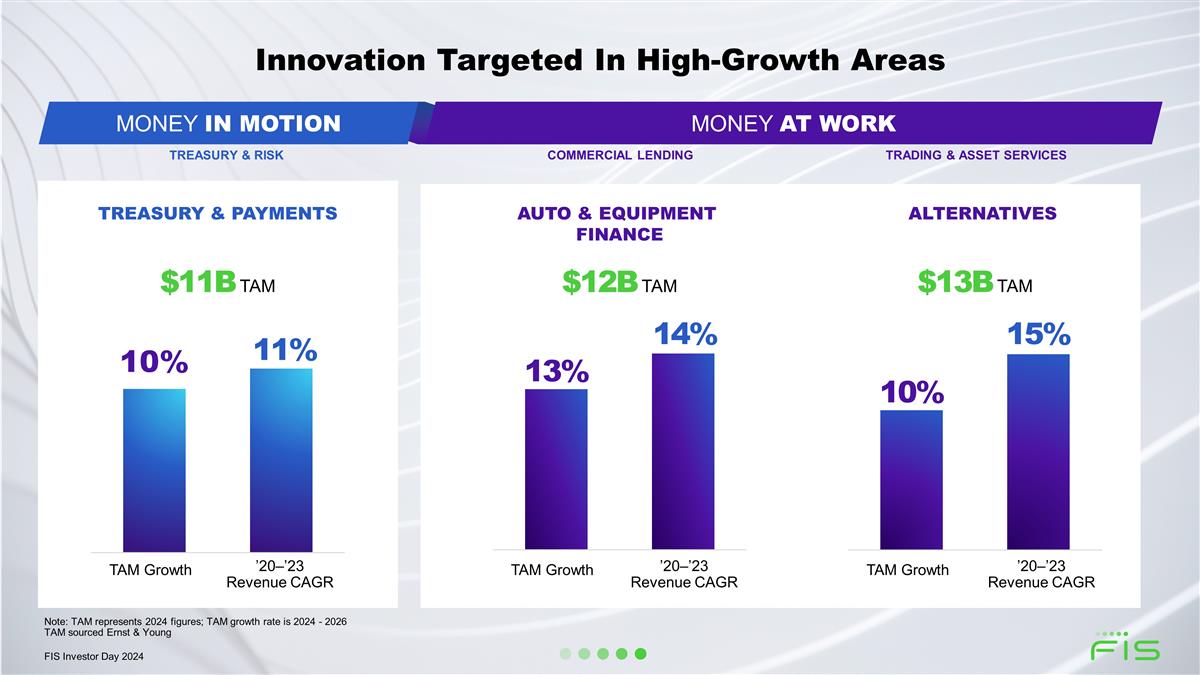

MONEY IN MOTION MONEY AT WORK Trading & Asset Services Treasury & Risk Commercial Lending $12B TAM Auto & Equipment Finance $11B TAM $13B TAM TAM Growth ’20–’23 Revenue CAGR 14% 11% 15% Treasury & payments Alternatives Innovation Targeted In High-Growth Areas TAM Growth ’20–’23 Revenue CAGR TAM Growth ’20–’23 Revenue CAGR Note: TAM represents 2024 figures; TAM growth rate is 2024 - 2026 TAM sourced Ernst & Young FIS Investor Day 2024

We are uniquely positioned to lead in fast-growing markets. Our innovative solutions drive growth in traditional and adjacent verticals. Our focused strategy and execution delivers strong results. Today’s Key Messages FIS Investor Day 2024

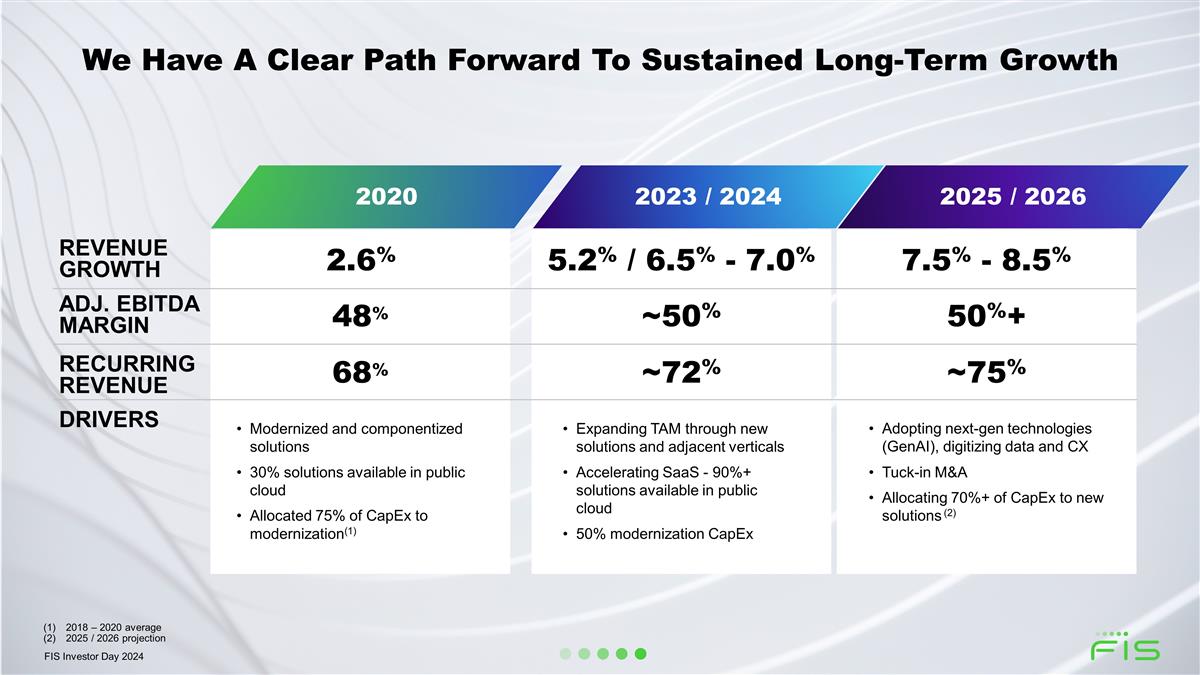

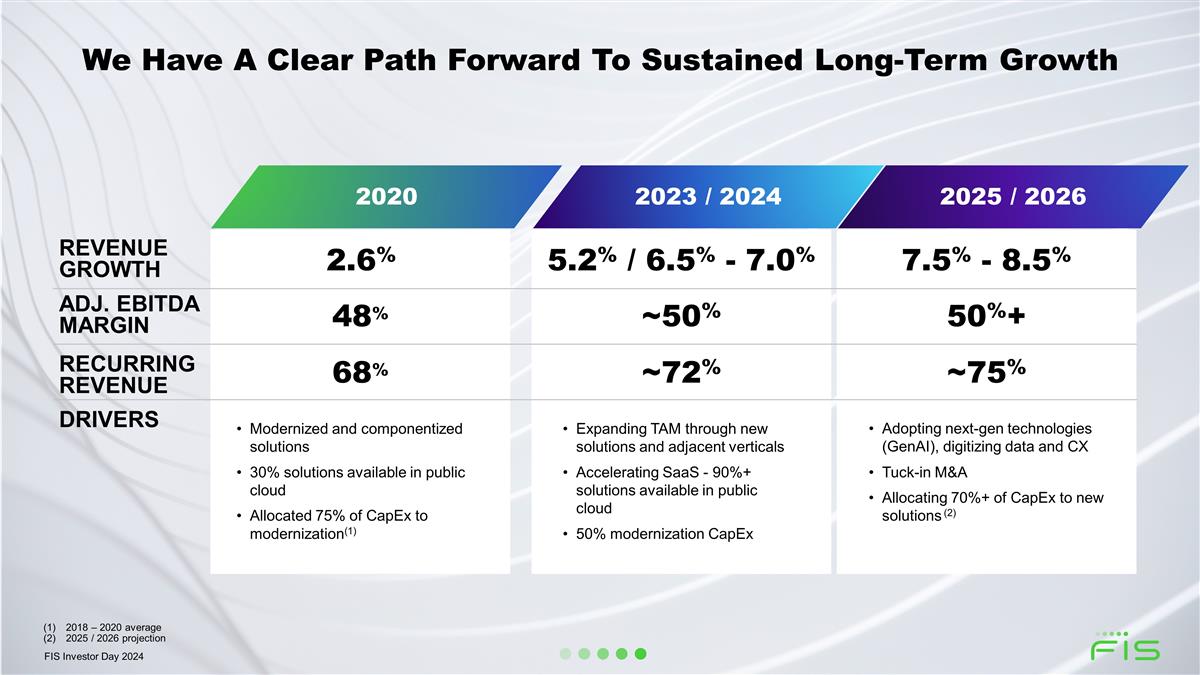

2020 2023 / 2024 2025 / 2026 Drivers REVENUE Growth 5.2% / 6.5% - 7.0% 7.5% - 8.5% ADJ. EBITDA Margin 48% ~50% 50%+ Recurring Revenue 68% ~72% ~75% We Have A Clear Path Forward To Sustained Long-Term Growth Adopting next-gen technologies (GenAI), digitizing data and CX Tuck-in M&A Allocating 70%+ of CapEx to new solutions (2) Modernized and componentized solutions 30% solutions available in public cloud Allocated 75% of CapEx to modernization(1) Expanding TAM through new solutions and adjacent verticals Accelerating SaaS - 90%+ solutions available in public cloud 50% modernization CapEx 2.6% 2018 – 2020 average 2025 / 2026 projection FIS Investor Day 2024

Predictable and Sustainable Growth of 7.5% - 8.5% by 2025 / 2026 Our Growth Objectives Corporates Automotive Insurance TRADITIONAL VERTICALS Expanding across tiers ADJACENT VERTICALS Expanding into adjacent verticals TUCK-IN ACQUISITIONS Enhancing growth Align to our M&A playbook Innovative capabilities Modern, cloud-based SaaS platforms Easy to integrate Accelerate in high-growth areas Alternatives Commercial lending technology Treasury Regulatory technology Comprehensive modernized solution set Global distribution Leading customer service Increasing penetration of solution ecosystems New Solutions Innovating to anticipate client needs Private Equity Next Generation Treasury Public Cloud Commercial Lending Technology Platform New Solutions Innovating to anticipate client needs Climate Risk Modeler Alternatives Investor Accounting Asset Finance Platforms ~5% Up to 3.5% FIS Investor Day 2024

Platform with market-leading componentized, cloud-native solutions Well-positioned to capture industry trends in large, growing, global markets Innovative solutions drive growth in traditional and adjacent verticals We Are Uniquely Positioned To Capitalize On Growth Opportunities Clear path to sustained High-Single Digit growth 1 2 3 Scaled Technology Leader Global Distribution & Marquee Set Of Clients Broad Suite Of Best-of-breed Solutions FIS Investor Day 2024

Unlocking Financial Technology To The World

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 Product & Innovation 6 Tarun Bhatnagar President, Platform and Enterprise Products

FIS Investor Day 2024

Helping banks grow and evolve Unleashing new value from data Unlocking financial technology to the world FIS Investor Day 2024

Helping banks grow and evolve Unleashing new value from data Unlocking financial technology to the world FIS Investor Day 2024

FIS Investor Day 2024

Helping banks grow and evolve Unleashing new value from data Unlocking financial technology to the world FIS Investor Day 2024

FIS Investor Day 2024

FIS Investor Day 2024

Helping banks grow and evolve Unleashing new value from data Unlocking financial technology to the world FIS Investor Day 2024

[at-el-io] For creators, by creators FIS Investor Day 2024

One of the nation’s largest bank-based financial services companies. Headquartered in Cleveland, Ohio. 40,000+ ATMS KeyBank and Allpoint ATMs nationwide $188.3 billion assets (as of 12/31/23) $6.4 billion Revenue (FY 2023) ~17,000 Full-time equivalent (FTE) employees FIS Investor Day 2024

Unlocking financial technology to the world Grow and evolve Unleashing new value FIS Investor Day 2024

FIS Investor Day 2024

Founded in 2014 and based in Wilmington, Delaware Second largest private student loan provider in the US. Applications decisions are instant. Offers education loans in all 50 states. FIS Investor Day 2024

Unlocking financial technology to the world Grow and evolve Unleashing new value FIS Investor Day 2024

FIS Investor Day 2024

Integrated solutions optimizing engagement across patient, provider, operational and financial workflows Premier provider of software and services within the healthcare industry Headquartered in White Plains, NY FIS Investor Day 2024

Unlocking financial technology to the world Grow and evolve Unleashing new value FIS Investor Day 2024

FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 7 James Kehoe Chief Financial Officer Financial Overview

2023: Setting a New Course Outperformed Financial Commitments Worldpay Transaction Resumed Share Repurchase 2024: Building Momentum Accelerating Revenue Growth Expanding Margin Increasing Return of Capital 2024+: Compelling Investment Thesis Accelerating Revenue and EPS Growth Disciplined Capital Return Double-digit Total Return Relentless Pursuit and Commitment to MAXIMIZE Shareholder value. Today’s Key Messages FIS Investor Day 2024

2023: Setting a New Course Outperformed Financial Commitments Worldpay Transaction Resumed Share Repurchase 2024: Building Momentum Accelerating Revenue Growth Expanding Margin Increasing Return of Capital 2024+: Compelling Investment Thesis Accelerating Revenue and EPS Growth Disciplined Capital Return Double-digit Total Return Relentless Pursuit and Commitment to MAXIMIZE Shareholder value. Today’s Key Messages FIS Investor Day 2024

Took Significant Action In 2023 Sustained high-quality recurring revenue growth Allocated resources to highest conviction growth opportunities Innovated to deliver high-impact solutions Drove efficiency throughout the organization with Future Forward Re-energized technology, innovation and implementation Aligned go-to-market initiatives with high-margin solutions Worldpay transaction improves focus / strengthens balance sheet Resumed share repurchase program and increased 2024 target Strategic tuck-in M&A and active portfolio management PRIORITIZED HIGH-QUALITY GROWTH OPTIMIZED OPERATIONAL EXECUTION REBALANCED CAPITAL ALLOCATION +100bps Recurring Revenue Growth 2023 vs CAGR 2017 - 2022 >$550M 2023 Future Forward Cash Savings $1.7B+ 2023 Capital Returned to Shareholders ESTABLISHED FOUNDATION FOR LONG-TERM VALUE CREATION. FIS Investor Day 2024

Delivered On Our 2023 Commitments Track Record of Exceeding Expectations METRICS ($ millions) Q1 2023 Q2 2023 Q3 2023 Q4 2023 Revenue Outlook $3,510 $3,375 - $3,425 $3,746 $3,675 - $3,725 $3,690 $3,640 - $3,690 $3,733 $3,654 - $3,704 Adjusted EBITDA Outlook $1,359 $1,285 - $1,325 $1,551 $1,510 - $1,540 $1,632 $1,580 - $1,625 $1,613 $1,558 - $1,608 Adjusted EBITDA Margin Outlook 38.7% 38.1% - 38.7% 41.4% 41.1% - 41.3% 44.2% 43.4% - 44.0% 43.2% 42.6% - 43.4% Adjusted EPS Outlook $1.29 $1.17 - $1.23 $1.55 $1.45 - $1.50 -- -- FOUR STRAIGHT QUARTERS OF OUTPERFORMING OUTLOOK. FIS Investor Day 2024

Track Record of Exceeding Expectations METRICS ($ millions) FY 2023 OUTLOOK (Original) FY 2023 RESULTS Q1 2024 OUTLOOK Q1 2024 RESULTS Revenue $14,200 - $14,450 $14,680 $2,430 - $2,455 $2,467 Adj. Revenue Growth (1)% - 1% 2% 2.5% - 3.5% 3.3% Adjusted EBITDA $5,900 - $6,100 $6,154 $955 - $970 $975 Adj. EBITDA % 41.5% - 42.2% 41.9% 39.3% - 39.5% 39.5% Adjusted EPS $5.70 - $6.00 $6.17 $0.94 - $0.97 $1.10 Delivered Commitments – Now 5 Straight Quarters FIVE STRAIGHT QUARTERS OF OUTPERFORMING OUTLOOK. FIS Investor Day 2024

2023: Setting a New Course Outperformed Financial Commitments Worldpay Transaction Resumed Share Repurchase 2024: Building Momentum Accelerating Revenue Growth Expanding Margin Increasing Return of Capital 2024+: Compelling Investment Thesis Accelerating Revenue and EPS Growth Disciplined Capital Return Double-digit Total Return Relentless Pursuit and Commitment to MAXIMIZE Shareholder value. Today’s Key Messages FIS Investor Day 2024

METRICS ($ millions, except per share data) FY 2024 Revenue $10,100 - $10,150 Adjusted Revenue Growth 4.0% - 4.5% Banking Solutions Capital Markets Solutions 3.0% - 3.5% 6.5% - 7.0% Adjusted EBITDA $4,100 - $4,140 Adjusted EBITDA Margin Margin Expansion 40.6% - 40.8% +20 - 40 bps Adjusted EPS $4.88 - $4.98 Adjusted EPS Growth Normalized EPS Growth (includes HSD negative impact from dis-synergies) +45% - 48% +10% - 12% FY 2024 GROWTH DRIVERS Banking Acceleration in new sales Focus on high-growth areas Capital Markets Expansion into new verticals Innovative solution suites Margin Expansion Underpinned by OpEx savings Normalized EPS Growth of 10% - 12% Includes HSD negative impact from dis-synergies $0.22 higher than original outlook Accelerating Growth And Expanding EBITDA Margin FIS Investor Day 2024

2023 2024 Total Capital to Shareholders $1.7B $4.8B Share Repurchases $510M $4.0B Leverage Ratio(1) 3.0x 2.8x Investment Grade Rating BBB/Baa2 BBB/Baa2 Increasing 2024 Share Repurchases From $3.5B To $4.0B (1) Leverage ratio calculated as total debt / Adjusted EBITDA unburdened by stock compensation INCREASING TOTAL CAPITAL RETURN FROM $1.7B IN 2023 TO $4.8B IN 2024. FIS Investor Day 2024

2023: Setting a New Course Outperformed Financial Commitments Worldpay Transaction Resumed Share Repurchase 2024: Building Momentum Accelerating Revenue Growth Expanding Margin Increasing Return of Capital 2024+: Compelling Investment Thesis Accelerating Revenue and EPS Growth Disciplined Capital Return Double-digit Total Return Relentless Pursuit and Commitment to MAXIMIZE Shareholder value. Today’s Key Messages FIS Investor Day 2024

Non-Recurring Revenue, driving ~1% decline in adjusted revenue growth High-Growth Products, digital and payments driving incremental revenue growth Underlying Growth, from existing clients Account Growth(1): 2.7% Transaction Growth(2): 5.4% KEY GROWTH DRIVERS Tuck-In Acquisitions, contributing 0.5% - 1.0% annually DRIVERS OF BANKING ADJ. REVENUE GROWTH (1) 2021 - 2023 core deposit account CAGR hosted by FIS core platforms (2) 2021 - 2023 debit and credit transactions CAGR processed by FIS Banking Growth Led By Organic Account / Transaction Growth FIS Investor Day 2024

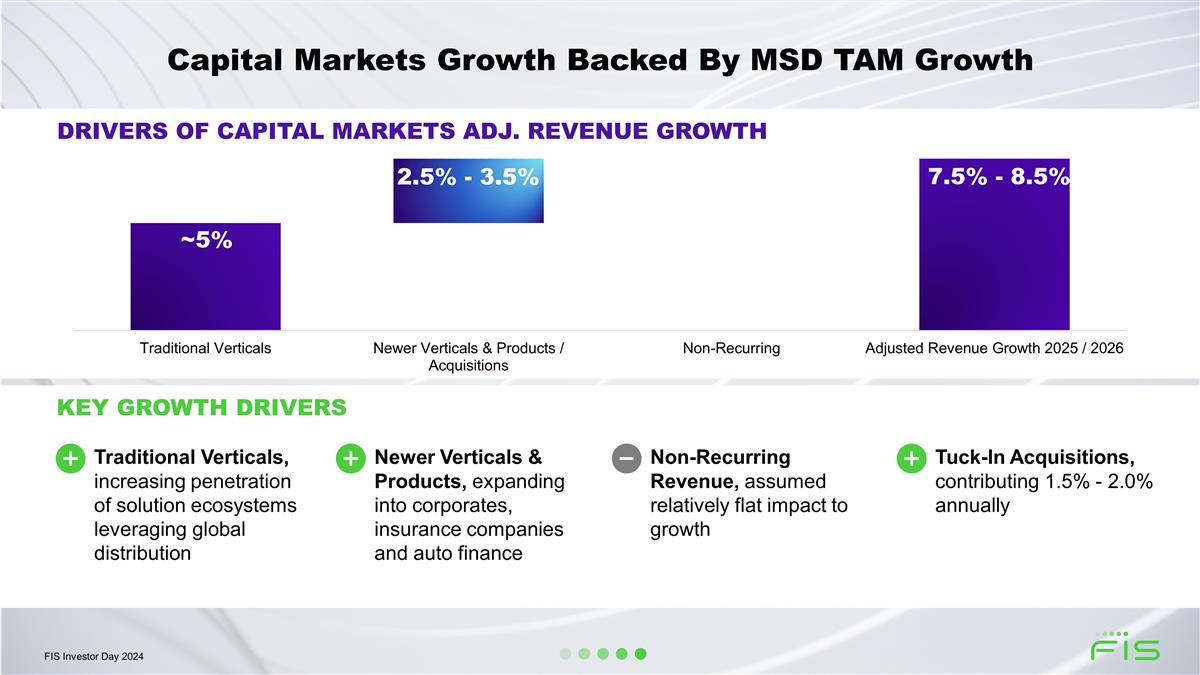

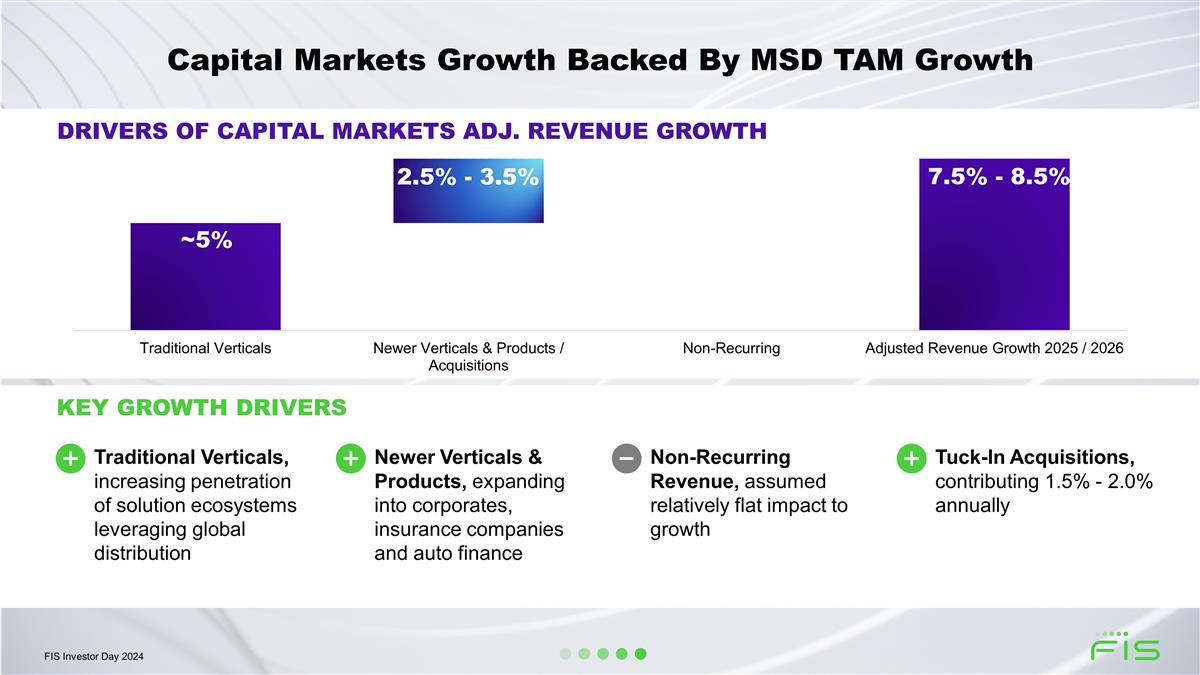

Capital Markets Growth Backed By MSD TAM Growth Non-Recurring Revenue, assumed relatively flat impact to growth Newer Verticals & Products, expanding into corporates, insurance companies and auto finance Traditional Verticals, increasing penetration of solution ecosystems leveraging global distribution Tuck-In Acquisitions, contributing 1.5% - 2.0% annually KEY GROWTH DRIVERS DRIVERS OF CAPITAL MARKETS ADJ. REVENUE GROWTH FIS Investor Day 2024

TAM / Underlying & Traditional Growth Strong Foundation of Transaction, Account and Traditional Vertical Growth Tuck-In Acquisitions 0.8% - 1.3% Annually Commercial Execution Sales Execution, Accelerated Cross-Sales Across Marquee Clients (1) TAM CAGR 2024 - 2026 (2) Corporate & Other revenue expected to decline ~20% annually TAM sourced Ernst & Young Recurring Growth Above Total Adj. Revenue Growth New / Higher Growth Verticals & Products / Innovation ADJ. REVENUE GROWTH TARGETS Revenue Growth Underpinned By Attractive TAM Growth KEY GROWTH DRIVERS 2024 2025 / 2026 TAM Growth(1) BANKING 3% - 3.5% 3.5% - 4.5% 4% CAPITAL MARKETS 6.5% - 7% 7.5% - 8.5% 6% FIS(2) 4% - 4.5% 4.5% - 5.5% 4.5% FIS Investor Day 2024

Segment Mix OpEx Savings Back Office Reinvention Technology Optimization Leveraging Gen AI / ML / BPO Dis-Synergy (TSAs) Cost Increases: Merit / Growth Investments Operating Leverage Sustainable Margin Expansion Of 40 - 60 bps Annually MARGIN LEVERS FIS Investor Day 2024

OPERATIONAL EXPENSE SAVINGS (Cumulative Impact $M) $435M $625M $790M Y-o-Y Benefit Raising Target For OpEx Cost Savings STRONG PIPELINE OF ADDITIONAL OPERATING EXPENSE SAVINGS EXITING 2024. FIS Investor Day 2024

Reiterating Our Disciplined Capital Allocation Priorities ROBUST CAPITAL GENERATION BALANCED CAPITAL ALLOCATION 35% Dividend Payout(1) STRONG COMMITMENT TO SHAREHOLDER RETURNS. 90%+ Adj. FCF Conversion 2.8x Gross Leverage $1B (1) Dividend payout based off FIS Adjusted Net Earnings, excluding Worldpay EMI 7% - 8% $0.8B - $1.2B Annual Buyback CapEx % of Revenue Annual M&A Allocation ROIC and Growth Decision Criteria Highly Synergistic, DCF Based, High IRR Plus Excess Capital Not Used for M&A FIS Investor Day 2024

KEY ASSUMPTIONS Below-The-Line Considerations Interest Expense Refinancing at higher rates; WAIR ~3.9% 2026 ~2% headwind to Adj. EPS growth Effective Tax Rate Rate optimization underway Expect gradual reduction over time Worldpay EMI growing 7.5% - 9.5% annually Adj. EBITDA Growth / Debt Paydown / Lower Tax Rate Non-GAAP Cash Expenses 15% decline annually (1) Normalized EMI contribution of approximately $408M or approximately $445M for 11 and 12 months of 2024, respectively ($ millions, except per share data) 2023 2024 2025 / 2026 D&A (Excl. Purchase Price Amort.) $1,023 ~$1,068 3% - 4% annually Net Interest Expense WAIR n/a ~2.9% 3.5% - 3.9% Effective Tax Rate 14% ~14.5% 12% - 13% Worldpay Adj. EMI (Incl. Lower Tax Rate) ~$390M ~$445M(1) 7.5% - 9.5% annually Non-GAAP Cash Expenses ~$490M ~$450M ~(15)% annually FIS Investor Day 2024

High quality recurring revenue growth profile that is durable Sustainable margin expansion via scale leverage / opex cost savings; >60 bps post 2026 Disciplined capital allocation that advances our strategy and enhances shareholder returns (1) 2025 / 2026 reflects 9% - 12% growth off of a FY 2024 pro forma Adj. EPS (12 months EMI) mid-point outlook of $5.00; FY 2024 continuing operations Adj. EPS (11 months EMI) mid-point outlook is $4.93 Durable Value Creation Drives Double-digit Total Return KEY DRIVERS Metrics 2024 2025 / 2026 Adj. Revenue Growth 4% - 4.5% 4.5% - 5.5% Adj. EBITDA Margin Expansion 20 - 40 bps 40 - 60 bps Adj. EPS Growth(1) 10% - 12% 9% - 12% Dividend Yield ~2% ~2% COMPELLING TOTAL RETURN 12% - 14% 11% - 14% TARGETING AT LEAST $6.00 OF ADJUSTED EPS IN 2026. FIS Investor Day 2024

Double-digit Total Return Durable Recurring Revenue Model Balance Sheet Strength and Flexibility Sustainable Operating Leverage Strong FCF Generation ~80% Recurring 40 - 60 bps Expansion Annually 2.8x Gross Leverage 90%+ Adj. FCF Conversion KEY TAKEAWAY: COMPELLING INVESTMENT THESIS STRONG FUNDAMENTAL BUSINESS MODEL FOR SUSTAINABLE VALUE CREATION. Durable Recurring Revenue Model Strong Free Cash Flow Generation 11% - 14% FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company FIS Investor Day 2024 Executive Q&A 8 Stephanie Ferris James Kehoe George Mihalos

Unlocking Financial Technology To The World

Unlocking Financial Technology To The World

We are: Scaled Technology Leader We have: Global Distribution & Marquee Set Of Clients We deliver: Broad Suite Of Best-Of-Breed Solutions 1 2 3 Allowing Us To drive Double-Digit Total Return We Are Uniquely Positioned To Capitalize On Growth Opportunities FIS Investor Day 2024

Citigroup Inc. The Toronto-Dominion Bank Capital One Financial Corporation The Goldman Sachs Group, Inc. JPMorgan Chase & Co. Truist Financial Corporation Bank of America Corporation U.S. Bancorp The PNC Financial Services Group, Inc. Wells Fargo & Company Appendix FIS Investor Day 2024

Normalized 2023 Adj. EPS Results FY 2023 Normalized Adj. EPS FY 2023 Adj. EPS (Con. Ops.) $3.37 Assuming transaction occurred 1/1/2023: EMI Contribution (Worldpay) $0.67 Capital Deployment $0.60 Normalized Tax Rate (WP Impact) $(0.14) Normalized FY 2023 Adj. EPS(1) $4.50 Estimated One Month Worldpay EMI $(0.06) Normalized Adj. EPS with 11 Months of WP(1) $4.44 (1) Normalization adjustments include a reduction in interest expense net of tax, increase in effective tax rate, share count reduction, EMI contribution, and excludes anticipated dis-synergies. FIS Investor Day 2024