UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION WASHINGTON, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10571

BLUE CHIP INVESTOR FUNDS

(Exact name of registrant as specified in charter)

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Address of principal executive offices) (Zip code)

Ross C. Provence

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Name and address of agent for service)

Registrant’s telephone number, including area code: (619) 588-9700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Report to Stockholders.

BLUE CHIP INVESTOR FUND

ANNUAL REPORT

December 31, 2021

Blue Chip Investor Fund

Annual Report

December 31, 2021

(Unaudited) |

Dear Shareholders,

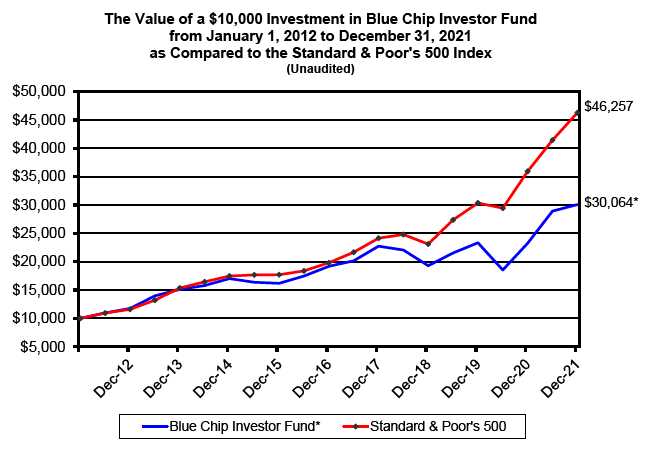

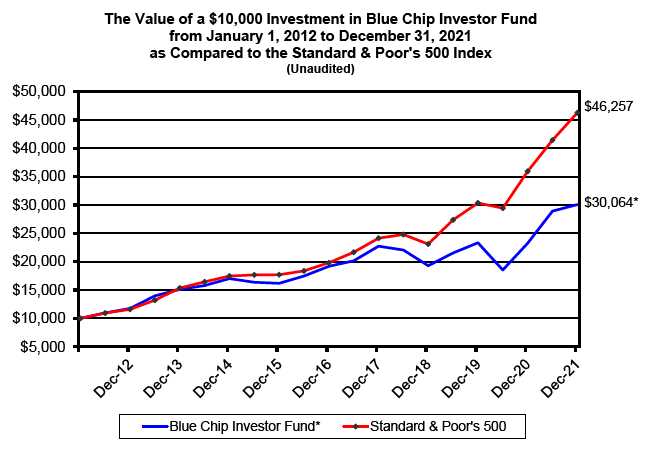

Blue Chip Investor Fund (“the Fund”) advanced 29.3% in 2021, versus an increase of 28.7% for the S&P 500. Our trailing five-year and ten-year annualized returns are 9.4% and 11.6%, respectively. These results compare to 18.5% and 16.6% for the S&P 500.

2021’s return was the Fund’s best in its 20-year history. We’re also pleased to note that long-term results are in line with our goal of compounding capital at 10% per annum. Relative to the S&P 500, we still have a gap to close and believe that will happen.

Over the long run, we believe the S&P 500 is capable of growing at approximately 6% to 8% annually (including dividends), so if we continue to deliver on our stated objective, the Fund has a reasonably good chance of future outperformance. Reinforcing our view is the fact that the S&P 500’s performance edge in recent years has been driven by multiple expansion1, whereas the majority of the Fund’s gains have been the result of actual earnings (or book value) growth.

Consider: The S&P 500 gained 16.6% annually over the last decade but its earnings grew at only 7.6% . The rest of the gains were due to the P/E expanding from approximately 13 to 23. In contrast, during this same period the shares of our largest holding—Berkshire Hathaway (32.5% of assets)—increased 14.6% annually. This closely matched its 12.9% annual gain in per-share book value, a proxy for the firm’s intrinsic value. Thus, its intrinsic value growth greatly exceeded that of the S&P 500, even though Berkshire’s share price underperformed.

Obviously, returns that are driven by multiple expansion rather than earnings growth aren’t sustainable. And, as Herbert Stein once said, “If something can’t go on forever, it will stop.” In the short run, speculation can cause stock prices to materially outperform or underperform actual business results. However, over the long run, earnings (intrinsic value) drive share prices, so that’s where we focus our attention, and that’s what excites us about the ongoing potential of the portfolio.

INVESTMENT STRATEGY

For the benefit of new shareholders, we dedicate a portion of this letter to summarizing our investment strategy. Longtime investors can skip to the next section.

The Fund employs a value-oriented, long-term investment approach. We buy and sell stocks with a business-owner mentality, essentially viewing each purchase as if we were buying the entire business and retaining management.

When making investment decisions, we ignore political and macroeconomic forecasts. There are no attempts to “time the market”, i.e., we don’t try to predict near-term stock price movements (a fool’s errand). Instead, we focus on identifying exceptional, hard-to-replicate businesses—run by shrewd, shareholder-friendly management teams—capable of delivering consistent, long-term growth. Even when such companies are identified, their stocks are only purchased when selling at a discount to our estimates of their intrinsic value.

Given that there are relatively few truly exceptional companies, with even fewer that we can fully understand and value, the Fund is quite concentrated. At year end, we held 18 stocks, with the top 10 accounting for 83% of the total portfolio’s dollar value.

PORTFOLIO ACTIVITY

We maintain that there’s substantial value in buying great companies and then sitting tight. Not only can a great company compound earnings—and, therefore, shareholder value—at above-average rates for decades, but our research suggests that this type of business is often less than fully valued in the public markets. Accordingly, we’ve been increasingly willing to hold some of our highly appreciated but genuinely excellent stocks for longer periods and at higher valuations so as to better capture their full upside potential.

1 When using the term “multiple expansion”, we’re referring to

the increase in price relative to earnings, i.e., the price-to-

earnings ratio, also known as the “P/E”. |

2021 Annual Report 1

Indeed, the Fund was actively passive throughout much of the year, reflected by portfolio turnover2 of only 13% (implying an average stock holding time of eight years). Nevertheless, we did make several moves that we feel significantly increased the overall quality and strength of the portfolio.

We completely exited several holdings, including Hanesbrands (HBI), Ingredion (INGR) and Oshkosh (OSK), and we trimmed Advance Auto Parts (AAP). We also sold all the shares of Brookfield Asset Management Reinsurance (BAMR) that we received as a spinoff from Brookfield Asset Management.

With the proceeds of these sales we purchased two new stocks, AerCap (AER) and Wayfair (W), which we discuss below, and added to our positions in Markel (MKL) as well as Suncor (SU). Shareholders will notice we continue to own shares of Loyalty Ventures (LYLT), a leading loyalty rewards company, which were spun off from Alliance Data Systems.

AerCap (AER) – 5.1% of Assets

On March 10, 2021, AerCap announced an agreement to acquire GE Capital Aviation Services (GECAS) for approximately $6.1B (plus $25B of debt). The announcement immediately piqued our interest. We had monitored AerCap since 2015 and were attracted to the firm’s long-term track record, the economics of the business and the first-class management team led by CEO Gus Kelly. After examining the details of the deal, we liked what we read and started buying AerCap stock at an average price of $60.12 per share.

We believe AerCap bought GECAS at a very attractive price, a 50% discount to book value, immediately and significantly increasing AerCap’s intrinsic value. The acquisition mirrors the lucrative deal AerCap finalized in 2013: buying AIG’s aircraft leasing business, International Lease Finance Company (ILFC), which was also purchased at a discount and created enormous value for AerCap. The year following the agreement, AerCap’s per-share earnings and book value increased 79% and 72%, respectively, helping to more than double the share price.

These opportunistic transactions were possible because AerCap was essentially negotiating with a “forced seller” that appeared more interested in completing a deal than extracting the highest price. At the time, AIG and GE were struggling: heavily indebted conglomerates desperate to fix their balance sheets and repair core operations. Furthermore, the size of the transactions were not material to the sellers (based on the equity value versus market capitalization) but nearly doubled the size of AerCap. As the saying goes, “The rabbit runs faster than the fox, because the rabbit is running for his life while the fox is only running for his dinner3.”

AerCap is now the world’s largest aircraft-leasing company, with over 2,000 owned and managed aircraft, 900 engines and more than 300 helicopters. The business is straightforward. Like banks or other financial institutions, AerCap makes money based on a spread between interest income (i.e., lease revenue) and interest expenses.

Despite the cyclical nature of the airline industry, AerCap’s business is remarkably resilient. Since going public in 2006, the firm’s per-share book value has decreased just one time—reflecting the unprecedented challenges of 2020—and even then it fell less than 4%. In some ways, this episode has de-risked the business, proving that during a once-in-a-century pandemic, AerCap’s assets were surprisingly stable and the business remained profitable.

While there will be bumps along the way, expansion of global air travel is a massive secular trend where demand shows no sign of slowing in the long run. Airlines preferring to lease rather than own their fleets is another trend that’s likely to persist, given the clear advantages of greater flexibility and lower capital requirements. We think these tailwinds (pun intended), together with astute management, will continue to propel AerCap forward in the decades to come.

Wayfair (W) – 3.6% of Assets

Wayfair is an online retailer focused exclusively on the home-goods market (furniture, décor, bedding, appliances, kitchenware, lighting, flooring and much more). The firm’s unique asset-light business model has enabled it to grow rapidly even as it scales in size. Wayfair generates $14B (and growing) in annual sales yet carries no inventory. Instead, Wayfair acts as a digital platform that sends the orders of its 30 million active customers to its 16,000 suppliers, who “drop ship” the merchandise directly to the customers (though Wayfair often provides delivery/ logistics services).

2 Portfolio turnover is calculated by dividing the lesser of pur-

chases and sales by average monthly net assets.

3 Richard Dawkins, The Selfish Gene (1976). |

2021 Annual Report 2

The home-goods market is rapidly shifting from offline to online, especially as millennials (age 26 to 41—over 70 million people) become a larger segment of consumers. This cohort, and those that follow, are much more comfortable buying things on the internet, including product categories once thought impossible to sell online, such as jewelry and motor vehicles. As a result, the online home-goods market is projected to grow approximately 15% annually for the foreseeable future. Better still, given Wayfair’s dominant competitive position, it captures more than one-third of each dollar spent on household items online and is therefore growing at an even faster clip than the industry.

Why is Wayfair winning this category? Simple: It provides customers with noticeably superior selection, price, convenience and service. Suppliers want to be on the Wayfair platform for access to its tens of millions of shoppers, while those shoppers rely on Wayfair to provide more than 20 million household products. Equally important, Wayfair invests heavily to regularly improve its platform, ensuring it remains the best destination for both suppliers and shoppers.

To wit, Wayfair has spent billions to build out its own end-to-end proprietary logistics network that enables faster delivery speed, reduced merchandise damage and lower shipping cost. The firm maintains a customer service team of over 4,000 people who receive bonuses based on providing the best possible shopping experience. Wayfair is one of the world’s most sophisticated digital marketers, leveraging its capabilities to drive high-return new and repeat orders. It invests hundreds of millions of dollars each year on technological innovations, which include advanced virtual-reality/augmented-reality tools that let shoppers “see” before they buy.

Now that “Wayfair’s flywheel is spinning”—i.e., a superior customer experience leads to more shoppers, leading to more revenues, leading to more investments in the platform, leading to an even better customer experience, and so on—the upward momentum is hard to stop. Not only does this phenomenon drive fast growth but it continually strengthens the firm’s competitive position. The power of Wayfair’s business model is reflected in its financial performance. Since going public in 2014, Wayfair has grown revenues at an annualized rate of more than 45%.

As for profits, the true earning power of the company is masked by antiquated accounting rules. Growth investments made by traditional retailers are mostly tangible and capitalized, whereas investments made by digital retailers are generally nontangible and expensed. This difference affects reported income but has no impact on cashflow available to fund growth. To illustrate, when Walmart was growing rapidly in the 1970s and 80s, it reported substantial profits but negative free cashflow, since it was aggressively reinvesting in new store openings. These investments made sense because the returns were high. We believe Wayfair today evokes Walmart several decades ago.

Wayfair is large and expanding fast. Yet it still accounts for less than 2% of its total addressable market. The opportunity is massive, and Wayfair is aggressively reinvesting (at high rates of return) to become the winner in this category. By 2030, the market for home goods in North America and Europe is expected to reach $1.2T, while online penetration rates are projected to be roughly 25%. If this proves accurate and Wayfair maintains its current marketshare, the firm will produce annual revenues of approximately $110B, with pre-tax earnings of more than $10B. Under this scenario, a future stock price of $2,000 would be justifiable.

Despite Wayfair’s favorable long-term economics and growth runway, investors and analysts seem afraid of its stock in the near term. They don’t want to own a “growth company” that won’t grow during the next several quarters, as the firm undergoes challenging year-over-year comparisons. (In 2020, Wayfair’s revenues grew 55%, as it benefited from pandemic-related shelter-in-place orders which turned out to be a boon for home-goods sales and e-commerce as a whole.) Inflation and supply-chain constraints present headwinds too. Nonetheless, the Fund takes the long view and we’re undeterred by transitory issues. If our investment thesis is correct, near-term volatility notwithstanding, shareholders will inevitably prosper.

The company is led by founders Niraj Shah and Steve Conine, who collectively own 30% of the stock (and control the voting shares). They’re our type of managers, focused on building the greatest and most valuable company possible over the long haul.

We acquired our shares at an average price of $278.48.

OUTLOOK

With inflation at the highest levels in 40 years, it’s rightfully a topic on most investors’ minds. However, predicting what will happen next with inflation is quite difficult. Making profitable investments based on those forecasts is harder still. So, we take a different approach.

2021 Annual Report 3

In our view, the best way to withstand inflation, deflation or even stagflation is to own well-run companies that possess durable competitive positions, enjoy pricing power and maintain strong balance sheets. It helps, too, if you can buy these companies for less than their fair value. The ability to ride out periods of volatility, which is mandatory for successful stock investing, is paramount as well.

We remain absolutely focused on our goal to protect and prudently grow your capital over the long term. We consider it both a serious responsibility and a great privilege. Thank you for your continued trust and support.

Sincerely,

Steven G. Check

Co-Portfolio Manager | Ryan Kinney

Co-Portfolio Manager |

2021 Annual Report 4

Blue Chip Investor Fund

PERFORMANCE INFORMATION (Unaudited)

12/31/2021 NAV $206.84

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED DECEMBER 31, 2021

| | 1 Year(A) | | 5 Year(A) | | 10 Year(A) | |

| Blue Chip Investor Fund | 29.25% | | 9.40% | | 11.64% | |

| S&P 500(B) | 28.71% | | 18.47% | | 16.55% | |

The Fund’s total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, as stated in the fee table of the Prospectus dated May 1, 2021, was 1.44% (net of fee waivers or expense reimbursements it was 1.00%) . The Total Annual Fund Operating Expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds, and (b) the gross expense ratio may fluctuate due to changes in net assets and actual expenses incurred during the reported period.

(A) The 1 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions.

(B) The S&P 500 is a broad market-weighted average dominated by blue-chip stocks and is an unmanaged group of stocks whose composition is different from the Fund.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-877-59-FUNDS.

2021 Annual Report 5

| | Blue Chip Investor Fund �� |

BLUE CHIP INVESTOR FUND

by Sectors (Unaudited)

(as a percentage of Common Stocks) |

Proxy Voting Guidelines

(Unaudited) |

Check Capital Management, Inc., the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.bluechipinvestorfund.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling our toll free number(1-877-59-FUNDS). This information is also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Availability of Quarterly Schedule of Investments

The Fund publicly files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s web site at http://www.sec.gov.

2021 Annual Report 6

Disclosure of Expenses

(Unaudited) |

Shareholders of this Fund incur ongoing costs, including investment advisory fees and other Fund expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund’s transfer agent. IRA accounts will be charged an $8.00 annual maintenance fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on July 1, 2021, and held through December 31, 2021.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as the annual maintenance fee charged to IRA accounts or exchange fees or the expenses of underlying funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During the Period* |

| | | Account Value | | Account Value | | July 1, 2021 to |

| | | July 1, 2021 | | December 31, 2021 | | December 31, 2021 |

| |

| Actual | | $1,000.00 | | $1,039.65 | | $5.14 |

| |

| Hypothetical | | $1,000.00 | | $1,020.16 | | $5.09 |

| (5% annual return | | | | | | |

| before expenses) | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| |

2021 Annual Report 7

| Blue Chip Investor Fund |

| |

| | | | Schedule of Investments |

| | | | December 31, 2021 |

| Shares | | | Fair Value | | | % of Net Assets |

| |

| COMMON STOCKS | | | | | | |

| Air Courier Services | | | | | | |

| 7,000 | FedEx Corporation | $ | 1,810,480 | | | 3.85 | % |

| Asset Manager | | | | | | |

| 70,500 | Brookfield Asset Management Inc. Class A (Canada) | | 4,256,790 | | | 9.05 | % |

| Commercial Printing | | | | | | |

| 19,700 | Cimpress PLC (Netherlands) * | | 1,410,717 | | | 3.00 | % |

| Consumer Finance | | | | | | |

| 11,000 | Alliance Data Systems Corporation | | 732,270 | | | 1.56 | % |

| Diversified Bank | | | | | | |

| 30,000 | Wells Fargo & Co. | | 1,439,400 | | | 3.06 | % |

| Diversified Companies | | | | | | |

| 34 | Berkshire Hathaway Inc. Class A * (a) | | 15,322,508 | | | 32.58 | % |

| Fire, Marine & Casualty Insurance | | | | | | |

| 1,750 | Markel Corporation * | | 2,159,500 | | | 4.59 | % |

| Integrated Oil & Gas | | | | | | |

| 70,000 | Suncor Energy Inc. (Canada) | | 1,752,100 | | | 3.73 | % |

| Internet Content & Information | | | | | | |

| 1,100 | Alphabet Inc. - Class C * | | 3,182,949 | | | 6.77 | % |

| Retail - Auto Dealers & Gasoline Stations | | | | | | |

| 20,000 | CarMax, Inc. * | | 2,604,600 | | | 5.54 | % |

| Retail - Auto & Home Supply Stores | | | | | | |

| 4,600 | Advance Auto Parts, Inc. | | 1,103,448 | | | 2.35 | % |

| Retail - Catalog & Mail-Order Houses | | | | | | |

| 8,800 | Wayfair Inc. - Class A * | | 1,671,736 | | | 3.55 | % |

| Retail - Eating Places | | | | | | |

| 23,800 | Restaurant Brands International Inc. (Canada) | | 1,444,184 | | | 3.07 | % |

| Services - Business Services, NEC | | | | | | |

| 4,400 | Loyalty Ventures Inc. * | | 132,308 | | | 0.28 | % |

| Services - Equipment Rental & Leasing, NEC | | | | | | |

| 36,800 | AerCap Holdings N.V. (Ireland) * | | 2,407,456 | | | 5.12 | % |

| Services - Medical Laboratories | | | | | | |

| 7,500 | Quest Diagnostics Incorporated | | 1,297,575 | | | 2.76 | % |

| Wholesale - Motor Vehicles & Motor Vehicle Parts & Supplies | | | | | | |

| 62,000 | LKQ Corporation | | 3,721,860 | | | 7.91 | % |

| Total for Common Stocks (Cost $26,787,113) | | 46,449,881 | | | 98.77 | % |

| Money Market Funds | | | | | | |

| 593,583 | Fidelity Investments Money Market Funds Government | | | | | | |

| | Portfolio Class I 0.01% ** | | 593,583 | | | 1.26 | % |

| | (Cost - $593,583) | | | | | | |

| | Total Investments | | 47,043,464 | | | 100.03 | % |

| | (Cost - $27,380,696) | | | | | | |

| | Liabilities in Excess of Other Assets | | (15,594 | ) | | -0.03 | % |

| | Net Assets | $ | 47,027,870 | | | 100.00 | % |

* Non-Income Producing Securities.

** The yield rate shown represents the 7-day yield at December 31, 2021.

(a) The company’s 2020 annual report is available at www.berkshirehathaway.com/reports.html,

or sec.gov. |

The accompanying notes are an integral part of these

financial statements. |

2021 Annual Report 8

| Blue Chip Investor Fund |

| | |

| Statement of Assets and Liabilities | | | | |

| December 31, 2021 | | | | |

| Assets: | | | | |

| Investments at Fair Value | $ | 47,043,464 | | |

| (Cost - $27,380,696) | | | | |

| Dividends Receivable | | 26,383 | | |

| Prepaid Expenses | | 6,211 | | |

| Total Assets | | 47,076,058 | | |

| Liabilities: | | | | |

| Investment Advisory Fee Payable | | 20,800 | | |

| Administration Fee Payable | | 2,700 | | |

| Other Accrued Expenses | | 22,558 | | |

| Payable for Shareholder Redemptions | | 2,130 | | |

| Total Liabilities | | 48,188 | | |

| Net Assets | $ | 47,027,870 | | |

| Net Assets Consist of: | | | | |

| Paid In Capital | $ | 27,365,102 | | |

| Total Distributable Earnings | | 19,662,768 | | |

| Net Assets, for 227,367 Shares Outstanding | $ | 47,027,870 | | |

| (Unlimited shares authorized, without par value) | | | | |

| Net Asset Value, Offering Price and Redemption Price | | | | |

| Per Share ($47,027,870/227,367 shares) | $ | 206.84 | | |

| | |

| Statement of Operations | | | | |

| For the fiscal year ended December 31, 2021 | | | | |

| | |

| Investment Income: | | | | |

| Dividends (Net of foreign withholding tax of $21,879) | $ | 250,491 | | |

| Non-Cash Dividends | | 25,133 | | |

| Total Investment Income | | 275,624 | | |

| Expenses: | | | | |

| Investment Advisory Fees | | 441,090 | | |

| Transfer Agent & Accounting Fees | | 42,746 | | |

| Administration Fees | | 30,948 | | |

| Registration Fees | | 18,650 | | |

| Audit & Tax Fees | | 18,500 | | |

| Legal Fees | | 18,000 | | |

| Other Fees | | 9,113 | | |

| Custody Fees | | 7,806 | | |

| Trustee Fees | | 4,000 | | |

| Insurance Expense | | 1,168 | | |

| Printing and Postage Expense | | 661 | | |

| Total Expenses | | 592,682 | | |

| Less: Advisory Fee Waiver | | (151,592 | ) | |

| Net Expenses | | 441,090 | | |

| Net Investment Loss | | (165,466 | ) | |

| Net Realized and Unrealized Gain on Investments: | | | | |

| Net Realized Gain on Investments | | 602,497 | | |

| Net Change in Unrealized Appreciation on Investments | | 10,184,833 | | |

| Net Realized and Unrealized Gain on Investments | | 10,787,330 | | |

| Net Increase in Net Assets from Operations | $ | 10,621,864 | | |

The accompanying notes are an integral part of these

financial statements. |

2021 Annual Report 9

| Blue Chip Investor Fund |

| | |

| Statements of Changes in Net Assets | | | | | | | | |

| | | 1/1/2021 | | | | 1/1/2020 | | |

| | | to | | | | to | | |

| | | 12/31/2021 | | | | 12/31/2020 | | |

| From Operations: | | | | | | | | |

| Net Investment Loss | $ | (165,466 | ) | | $ | (30,823 | ) | |

| Net Realized Gain on Investments | | 602,497 | | | | 2,125,508 | | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | 10,184,833 | | | | (2,679,031 | ) | |

| Net Increase (Decrease) in Net Assets from Operations | | 10,621,864 | | | | (584,346 | ) | |

| From Distributions to Shareholders: | | (597,261 | ) | | | (2,144,863 | ) | |

| From Capital Share Transactions: | | | | | | | | |

| Proceeds From Sale of Shares | | 3,523,011 | | | | 2,864,959 | | |

| Shares Issued on Reinvestment of Dividends | | 597,261 | | | | 2,144,863 | | |

| Cost of Shares Redeemed | | (3,351,323 | ) | | | (4,628,973 | ) | |

| Net Increase from Shareholder Activity | | 768,949 | | | | 380,849 | | |

| Net Increase (Decrease) in Net Assets | | 10,793,552 | | | | (2,348,360 | ) | |

| Net Assets at Beginning of Period | | 36,234,318 | | | | 38,582,678 | | |

| Net Assets at End of Period | $ | 47,027,870 | | | $ | 36,234,318 | | |

| | |

| Share Transactions: | | | | | | | | |

| Issued | | 17,930 | | | | 17,857 | | |

| Reinvested | | 2,889 | | | | 13,276 | | |

| Redeemed | | (16,991 | ) | | | (30,885 | ) | |

| Net Increase in Shares | | 3,828 | | | | 248 | | |

| Shares Outstanding Beginning of Year | | 223,539 | | | | 223,291 | | |

| Shares Outstanding End of Year | | 227,367 | | | | 223,539 | | |

| Financial Highlights | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding | | 1/1/2021 | | | | 1/1/2020 | | | | 1/1/2019 | | | | 1/1/2018 | | | | 1/1/2017 | | |

| throughout the period: | | to | | | | to | | | | to | | | | to | | | | to | | |

| | | 12/31/2021 | | | | 12/31/2020 | | | | 12/31/2019 | | | | 12/31/2018 | | | | 12/31/2017 | | |

| Net Asset Value - | | | | | | | | | | | | | | | | | | | | |

| Beginning of Period | $ | 162.09 | | | $ | 172.79 | | | $ | 144.68 | | | $ | 180.09 | | | $ | 160.82 | | |

| Net Investment Income (Loss) (a) | | (0.74 | ) | | | (0.14 | ) | | | 1.83 | | | | (0.11 | ) | | | (0.17 | ) | |

| Net Gains or (Losses) on Investments | | | | | | | | | | | | | | | | | | | | |

| (realized and unrealized) (b) | | 48.15 | | | | (0.34 | ) | | | 28.41 | | | | (27.23 | ) | | | 29.97 | | |

| Total from Investment Operations | | 47.41 | | | | (0.48 | ) | | | 30.24 | | | | (27.34 | ) | | | 29.80 | | |

| | |

| Distributions (From Net Investment Income) | | - | | | | (0.09 | ) | | | (1.91 | ) | | | 0.00 | | | | (0.08 | ) | |

| Distributions (From Capital Gains) | | (2.66 | ) | | | (10.13 | ) | | | (0.22 | ) | | | (8.07 | ) | | | (10.45 | ) | |

| Total Distributions | | (2.66 | ) | | | (10.22 | ) | | | (2.13 | ) | | | (8.07 | ) | | | (10.53 | ) | |

| Net Asset Value - | | | | | | | | | | | | | | | | | | | | |

| End of Period | $ | 206.84 | | | $ | 162.09 | | | $ | 172.79 | | | $ | 144.68 | | | $ | 180.09 | | |

| Total Return (c) | | 29.25 | % | | | (0.26 | )% | | | 20.91 | % | | | (15.15 | )% | | | 18.50 | % | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets - End of Year (Thousands) | $ | 47,028 | | | $ | 36,234 | | | $ | 38,583 | | | $ | 33,711 | | | $ | 40,076 | | |

| Before Reimbursement | | | | | | | | | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | | 1.34 | % | | | 1.44 | % | | | 1.40 | % | | | 1.54 | % | | | 1.35 | % | |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | -0.72 | % | | | -0.53 | % | | | 0.73 | % | | | -0.45 | % | | | -0.45 | % | |

| After Reimbursement | | | | | | | | | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | | 1.00 | % | (d) | | 1.00 | % | (d) | | 1.00 | % | (d) | | 1.16 | % | (d) | | 1.00 | % | |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | -0.38 | % | (d) | | -0.09 | % | (d) | | 1.14 | % | (d) | | -0.06 | % | (d) | | -0.10 | % | |

| Portfolio Turnover Rate | | 13.33 | % | | | 21.80 | % | | | 14.89 | % | | | 26.80 | % | | | 24.16 | % | |

(a) Per share amounts calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in

net asset value for the period and may not reconcile with the aggregate gains and losses in the Statement of Operations due to

share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment

of all dividends and distributions.

(d) The ratio of expenses to average net assets includes interest expenses. The after reimbursement ratio of expense excluding

interest expense was 1.00%, 1.00%, 1.00% and 1.00% for 2018, 2019, 2020 and 2021, respectively. The after reimbursement ratio

of net investment income (loss) excluding interest expense is 0.10%, 1.14%, -0.09% and -0.38% for 2018, 2019, 2020 and 2021,

respectively. |

The accompanying notes are an integral part of these

financial statements. |

2021 Annual Report 10

NOTES TO FINANCIAL STATEMENTS

BLUE CHIP INVESTOR FUND

December 31, 2021

1.) ORGANIZATION

Blue Chip Investor Fund (the “Fund”) is a non-diversified series of the Blue Chip Investor Funds (the “Trust”), formerly Premier Funds. The Trust is an open-end investment company. The Trust was organized in Ohio as a business trust on November 1, 2001, and may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Fund commenced operations on January 1, 2002. At present, the Fund is the only series authorized by the Trust. The Fund’s investment objective is to seek long-term growth of capital. The Advisor to the Fund is Check Capital Management, Inc. (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the significant accounting policies described in this section.

SECURITY VALUATION

All investments in securities are recorded at their estimated fair value, as described in Note 3.

FEDERAL INCOME TAXES

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Fund identifies its major tax jurisdictions as U.S. Federal tax authorities; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended December 31, 2021, the Fund did not incur any interest or penalties.

SHARE VALUATION

The net asset value (the “NAV”) is generally calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share are equal to the net asset value per share.

DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expenses or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund.

USE OF ESTIMATES

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2021 Annual Report 11

Notes to Financial Statements - continued

OTHER

The Fund records security transactions based on trade date. Dividend income is recognized on the ex-dividend date. Interest income and interest expense, if any, are recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

3.) SECURITIES VALUATIONS

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets measured at fair value on a recurring basis follows.

Equity securities (common stocks). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security, and if an equity security is valued by the pricing service at its last bid, it is generally categorized as a level 2 security. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, subject to review of the Board of Trustees (the “Trustees” or the “Board”) and are categorized in level 2 or level 3, when appropriate.

Money market funds. Money market funds are valued at net asset value provided by the underlying fund and are classified in level 1 of the fair value hierarchy.

In accordance with the Trust’s good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single standard for determining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods.

2021 Annual Report 12

Notes to Financial Statements - continued

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of December 31, 2021:

| Valuation Inputs of Assets | | Level 1 | | Level 2 | | Level 3 | | Total |

| Common Stocks | | $46,449,881 | | $0 | | $0 | | $46,449,881 |

| Money Market Funds | | 593,583 | | 0 | | 0 | | 593,583 |

| Total | | $47,043,464 | | $0 | | $0 | | $47,043,464 |

The Fund did not hold any level 3 assets during the fiscal year ended December 31, 2021.

The Fund did not invest in any derivative instruments during the fiscal year ended December 31, 2021.

4.) INVESTMENT ADVISORY AGREEMENT

The Fund has entered into an investment advisory agreement (the “Management Agreement”) with the Advisor, Check Capital Management, Inc. Under the terms of the Management Agreement, the Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Trustees. Under the Management Agreement, the Advisor, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Advisor also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Trust. For its services, the Advisor receives an annual investment management fee from the Fund of 1.00% of the average daily net assets of the Fund which is payable monthly. As a result of the above calculation, for the fiscal year ended December 31, 2021, the Advisor earned management fees totaling $441,090, before the waiver of fees and/or reimbursement of expenses described below. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees, commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in acquired funds) at 1.00% of its average daily net assets through April 30, 2022. There are no provisions for recoupment for any of the contractual waivers entered into by the Advisor. The Advisor waived and/or reimbursed expenses of $151,592 for the fiscal year ended December 31, 2021. At December 31, 2021, the Fund owed the Advisor $20,800.

5.) RELATED PARTY TRANSACTIONS

The Fund has entered into an administration servicing agreement with Premier Fund Solutions, Inc. (the “Administrator”). The Fund pays 0.07% on the first $200 million of assets, 0.05% on the next $500 million of assets and 0.03% on assets above $500 million subject to a minimum monthly fee of $2,000. The Fund also pays all out-of-pocket expenses directly attributable to the Fund. Jeffrey R. Provence of the Administrator is also an Officer and Trustee of the Fund. For the fiscal year ended December 31, 2021, the Administrator earned $30,948. At December 31, 2021, the Fund owed the Administrator $2,700.

6.) PURCHASES AND SALES OF SECURITIES

For the fiscal year ended December 31, 2021, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $5,986,276 and $5,688,346, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

7.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of December 31, 2021, Charles Schwab & Co. Inc., located at 101 Montgomery Street, San Francisco, California, held for the benefit of others, in aggregate, 62.99% of the Fund, and thus may be deemed to control the Fund. Also, National Financial Services, LLC, located at 200 Liberty Street, New York, New York, held for the benefit of others, in aggregate, 35.79% of the Fund, and thus may be deemed to control the Fund.

8.) TAX MATTERS

For Federal income tax purposes, the cost of investments owned at December 31, 2021, was $27,380,696. At December 31, 2021, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows:

| | Appreciation | | (Depreciation) | | | Net Appreciation |

| | $22,684,805 | | ($3,022,037) | | | $19,662,768 |

As of December 31, 2021, there were no differences between book basis and tax basis.

2021 Annual Report 13

Notes to Financial Statements - continued

The tax character of distributions paid during fiscal years 2021 and 2020 was as follows:

| | | 2021 | | 2020 |

| Ordinary Income | | $ – | | $ 19,355 |

| Long-term Capital Gains | | 597,261 | | 2,125,508 |

| | | $ 597,261 | | $2,144,863 |

As of December 31, 2021, the components of distributable earnings on a tax basis were as follows:

| Unrealized Appreciation | | $ 19,662,768 |

| Total Distributable Earnings | | $ 19,662,768 |

As of December 31, 2021, total distributable earnings was increased by $160,230 and paid in capital was decreased by $160,230. The adjustment was primarily related to the reclassification of net operating loss.

9.) LOAN AGREEMENT

A loan agreement, subject to certain covenants and restrictions, is in place between the Fund and its custodian, U.S. Bank, N.A. The Fund may seek to obtain loans for the purpose of funding redemptions or purchasing securities up to the lesser of $8,500,000 or the maximum amount that the Fund is permitted to borrow under the Investment Company Act of 1940 using the securities in its portfolio as collateral and allowing U.S. Bank, N.A. the right to setoff to those securities. The maximum interest rate of such loans is set at a rate per annum equal to U.S. Bank’s prime–lending rate (which was 3.25% as of December 31, 2021) less 0.50% . During the fiscal year ended December 31, 2021, the Fund had an average loan balance of $0 and incurred no interest. Additionally, the maximum borrowing during the period was $0. As of December 31, 2021, there was no outstanding loan balance. No compensating balances are required. The loan matured on February 6, 2022. The loan was renewed through February 5, 2023.

10.) CONCENTRATION OF SECTOR RISK

If a Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments may negatively impact all companies in a particular sector and therefore the value of a Fund’s portfolio will be adversely affected. As of December 31, 2021, the Fund had 32.99% of the value of its net assets invested in stocks within the Diversified Companies sector.

11.) COVID-19 RISKS

Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues; and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen. An outbreak of infectious respiratory illness known as COVID-19, which is caused by a novel coronavirus (SARS-CoV-2), was first detected in China in December 2019 and subsequently spread globally. This coronavirus has resulted in, among other things, travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, significant disruptions to business operations, market closures, cancellations and restrictions, supply chain disruptions, lower consumer demand, and significant volatility and declines in global financial markets, as well as general concern and uncertainty. The impact of COVID-19 has adversely affected, and other infectious illness outbreaks that may arise in the future could adversely affect, the economies of many nations and the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

12.) SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring adjustment to or disclosure in the financial statements, except as disclosed in Note 9.

2021 Annual Report 14

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Blue Chip Investor Funds

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Blue Chip Investor Funds comprising Blue Chip Investor Fund (the “Fund”) as of December 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2004.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

February 22, 2022

2021 Annual Report 15

ADDITIONAL INFORMATION

December 31, 2021

(UNAUDITED)

|

1.) APPROVAL OF INVESTMENT ADVISORY AGREEMENT

On December 7, 2021, the Board of Trustees (the “Board” or the “Trustees”) considered the renewal of the Management Agreement (the “Agreement”) between the Advisor and the Trust, on behalf of the Fund. The Board reviewed the memorandum provided by legal counsel, noting that, in consideration of the continuance of the management agreement, the Board should review as much information as is reasonably necessary to evaluate the terms of the contract and determine whether it is fair to the Fund and its shareholders. The Board also reviewed the information provided by the Advisor to the Trustees for evaluation of continuance of the Agreement.

In renewing the Management Agreement, the Board of Trustees received material from the Advisor (the “Report”) addressing the following factors: (i) the investment performance of the Fund and the Advisor; (ii) the nature, extent and quality of the services provided by the investment Advisor to the Fund; (iii) the cost of the services to be provided and the profits to be realized by the Advisor and its affiliates from the relationship with the Fund; (iv) the extent to which economies of scale will be realized as the fund grows; and (v) whether the fee levels reflect these economies of scale to the benefit of shareholders.

As to the performance of the Fund, the Report included information regarding the performance of the Fund compared to a group of funds of similar size, style and objective (the “Peer Group”) as well as the Morningstar category average for the Fund. The Report also included comparative performance information for other accounts managed by the Advisor and the Fund’s benchmark index, the S&P 500® Index (the “Index”), and the Peer Group for the period ended September 30, 2021. The data showed that the Fund lagged similar accounts for the one-year and five-year periods and outperformed for the ten-year period. The data showed that the Fund lagged the Index for the three, five and ten year periods and outperformed the index for the one-year period. The data also showed that the Fund’s performance was above the category average for the one-year period and below the category average for the three, five and ten year periods. The data also showed the Fund outperformed the Peer Group for the one-year period and ten year periods, and underperformed the Peer Group for the three and five year periods. The data showed the Fund was within the range of the category and Peer Group during the periods of underperformance. The Trustees reviewed the information and concluded that the Fund’s performance was acceptable when viewed from a long-term perspective.

As for the nature, extent and quality of the services provided by the Advisor, the Trustees discussed the Advisor’s experience and capabilities. The representatives of the Advisor reviewed and discussed with the Board the Advisor’s Form ADV and the 17j-1 certifications. They summarized the information provided in the Report regarding matters such as the Advisor’s financial condition and investment personnel. The Trustees noted that while the Advisor employs a line of credit, it did not represent excessive leverage. They also discussed each portfolio manager’s background and investment management experience. Furthermore, they reviewed the Advisor’s financial information and discussed the firm’s ability to meet its obligations under the Agreement. The Board concluded that the nature and extent of the services provided by the Advisor were consistent with their expectations, that they were satisfied with the quality of services provided by the Advisor, and that the Advisor has the resources to meet its obligations under the Agreement. They noted that both the portfolio management and the Chief Compliance Officer services were acceptable.

As to the fee charged and costs of the services provided, the Board reviewed the fees under the Agreement compared to the Peer Group, the Fund’s category average and fees charged to other clients of the Advisor. The Board noted that the current net expense ratio was in line with the Peer Group and the category average. The Board noted that the advisory fee was similar to that charged to other clients of the Advisor, although not directly comparable because of the greater regulatory demands of the Fund on the Advisor. The Board concluded that the advisory fee, which was within the range of fees charged for the Peer Group and category, was reasonable, particularly in light of the Fund’s size and the net management fees received after waivers. The Board also reviewed a profit and loss analysis prepared by the Advisor that analyzed the expenses incurred by the Advisor in managing the Fund and the total revenue derived by the Advisor from the Fund. The Trustees noted that the Advisor did not utilize an affiliated broker and received no soft dollar benefits. The Trustees concluded that the Advisor was not overly profitable.

2021 Annual Report 16

Additional Information (Unaudited) - continued

As to the economies of scale, it was noted that the Advisor capped the Fund’s expenses during the period, excluding certain expenses, and will cap the Fund’s expenses for an additional one year period. The Trustees also noted they will revisit the issue of economies of scale as Fund assets grow. Next, the Independent Trustees met in executive session to discuss the continuation of the Agreement. The Officers of the Trust were excused during this discussion.

Upon reconvening the meeting, it was the consensus of the Trustees, including the disinterested Trustees, that renewal of the Management Agreement would be in the best interests of the Fund and the shareholders.

2.) LIQUIDITY RISK MANAGEMENT PROGRAM

During the fiscal year ended December 31, 2021, the Board reviewed the Fund’s liquidity risk management program, adopted pursuant to Rule 22e-4 under the Investment Company Act. The program is overseen by the Adviser, who has delegated certain responsibilities for managing the program to a liquidity program administrator (the “LPA”). The LPA reported that it had assessed, managed and reviewed the program for the Fund taking into consideration several factors including the liquidity of the Fund’s portfolio investments and the market, trading or investment specific considerations that may reasonably affect a security’s classification as a liquid investment. The LPA certified that the program was adequate, effectively implemented and needed no changes at that time.

2021 Annual Report 17

TRUSTEES AND OFFICERS

(Unaudited) |

The Board of Trustees supervises the business activities of the Trust. The names of the Trustees and executive officers of the Trust are shown below. Each Trustee who is an “interested person” of the Trust, as defined in the Investment Company Act of 1940, is indicated by an asterisk. Each Trustee serves until the Trustee sooner dies, resigns, retires or is removed. Officers hold office for one year and until their respective successors are chosen and qualified.

The Trustees and Officers of the Trust and their principal business activities during the past five years are:

Interested Trustees and Officers

| | | | | | Other |

| | | | Principal | Number of | Directorships |

| Name, | Position | Length of | Occupation(s) | Portfolios | Held By |

| Address, | with the | Time Served | During | Overseen | Trustee During |

| and Year of Birth | Trust | | Past 5 Years | By Trustee | the |

| | | | | | Past 5 Years |

| |

| Ross C. Provence*, (1938) | President, | Since 2001 | General Partner and Portfolio | 1 | PFS Funds |

| 1939 Friendship Drive, | Trustee and | | Manager for Value Trend Capital | | |

| Suite C, El Cajon, | Chairman | | Management, LP (1995 to current). | | |

| California 92020 | | | Estate planning attorney (1963 to | | |

| current). |

| |

| Jeffrey R. Provence*, | Secretary, | Since 2001 | CEO, Premier Fund Solutions, Inc. | 1 | PFS Funds, |

| (1969) | Treasurer | | (2001-Present). General Partner and | | Meeder Funds |

| 1939 Friendship Drive, | and Trustee | | Portfolio Manager for Value Trend | | |

| Suite C, El Cajon, | | | Capital Management, LP (1995 to | | |

| California 92020 | | | current). | | |

| |

| Jock Meeks, (1956) | Chief | Since 2004 | Client Services Director for Check | N/A | N/A |

| 575 Anton Blvd., Ste. 500 | Compliance | | Capital Management (2004 to cur- | | |

| Costa Mesa, CA 92626 | Officer | | rent). | | |

| | * Ross C. Provence and Jeffrey R. Provence are considered “interested persons” as defined in Section 2(a)(19) of the Investment

Company Act of 1940 due to their positions as officers of the Trust. Ross C. Provence is the father of Jeffrey R. Provence. |

Independent Trustees

| | | | | | Other |

| | | | Principal | | Directorships |

| Name, | Position | Length of | Occupation(s) | Number of | Held By |

| Address, | with the | Time Served | During | Portfolios | Trustee During |

| and Year of Birth | Trust | | Past 5 Years | Overseen | the |

| | | | | By Trustee | Past 5 Years |

| |

| Allen C. Brown, (1943) | Independent | Since 2001 | Law Office of Allen C. Brown, | 1 | PFS Funds |

| 222 West Madison Ave., | Trustee | | Estate planning and business | | |

| El Cajon, California 92020 | | | attorney (1970 to current). | | |

| |

| George Cossolias**, | Independent | Since 2001 | Partner of CWDL, CPAs (February | 1 | PFS Funds, |

| CPA, (1935) | Trustee | | 1, 2014 to current). Owner of | | Neiman Funds |

| 5151 Murphy Canyon | | | George Cossolias & Company, | | |

| Road, Suite 135, | | | CPAs (1972 to January 31, 2014). | | |

| San Diego, CA 92123 | | | President of Lubrication Specialists, | | |

| | | | Inc. (1996 to current). | | |

| |

| |

| ** Trustee Cossolias passed away after the date of this Annual Report. | | |

The Statement of Additional Information contains additional and more detailed information about the Trustees and is available without charge by calling the transfer agent at 1-877-59-FUNDS.

2021 Annual Report 18

Investment Advisor

Check Capital Management Inc.

575 Anton Boulevard, Suite 500

Costa Mesa, CA 92626-7169

Counsel

Thompson Hine LLP

312 Walnut Street, 14th Floor

Cincinnati, OH 45202

Custodian

U.S. Bank, N.A.

425 Walnut Street

Cincinnati, OH 45201

Dividend Paying Agent,

Shareholders' Servicing Agent,

Transfer Agent

Mutual Shareholder Services

8000 Town Centre Dr., Suite 400

Broadview Heights, OH 44147

Fund Administrator

Premier Fund Solutions, Inc.

1939 Friendship Drive, Suite C

El Cajon, CA 92020

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

342 N. Water Street

Suite 830

Milwaukee, WI 53202 |

This report is provided for the general information of the shareholders of the Blue Chip

Investor Fund. This report is not intended for distribution to prospective investors in the

Fund, unless preceded or accompanied by an effective prospectus. |

BLUE CHIP INVESTOR FUND

575 Anton Boulevard, Suite 500

Costa Mesa, California 92626 |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and the principal financial officer. The registrant has not made any amendments to its code of ethics during the covered period. The registrant has not granted any waivers from any provisions of the code of ethics during the covered period. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

In this regard, the registrant’s Board of Trustees had determined that George Cossolias was an audit committee finical expert and was independent for purposes of this Item 3. Prior to the filing of this Report Mr. Cossolias passed away. No member of the audit committee has currently identified as having all of the required technical attributes identified in instruction 2 (b) to item 3 of Form N-CSR to qualify as an “audit committee financial expert,” whether through the type of specialized education or experience required by that instruction. At this time, the Board believes the experience provided by each member of the audit committee collectively offers the fund adequate oversight by its audit committee given the fund’s level of financial complexity. The Board will from time to time reexamine such belief.

Item 4. Principal Accountant Fees and Services.

(a-d) The following table details the aggregate fees billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant to the registrant. The principal accountant has provided no services to the adviser or any entity controlled by, or under common control with the adviser that provides ongoing services to the registrant.

| | | FYE 12/31/2021 | | FYE 12/31/2020 |

| Audit Fees | | $14,750 | | $14,750 |

| Audit-Related Fees | | $0 | | $0 |

| Tax Fees | | $3,000 | | $3,000 |

| All Other Fees | | $750 | | $750 |

Nature of Tax Fees: preparation of Excise Tax Statement and 1120 RIC.

All Other Fees: Semi-Annual Report Review

(e) (1) The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

(e) (2) None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the aggregate non-audit fees billed by the registrant’s principal accountant for services to the registrant , the registrant’s investment adviser (not sub-adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, for the last two years.

| Non-Audit Fees | | FYE 12/31/2021 | | FYE 12/31/2020 |

| Registrant | | $3,750 | | $3,750 |

| Registrant’s Investment Adviser | | $0 | | $0 |

(h) The principal accountant provided no services to the investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Investments.

(a) Not applicable. Schedule filed with Item 1.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not applicable.

Item 8. Portfolio Managers of Closed End Management Investment Companies. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The Registrant’s president and chief financial officer concluded that the disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a -3(c))) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a -3(b)) and Rules 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR 240.13a -15(b) or 240.15d -15(b)).

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a -3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) Code of Ethics. Filed herewith.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(a)(3) Not applicable.

(a)(4) Not applicable.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Filed herewith.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | By: /s/Ross C. Provence

Ross C. Provence

President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By: /s/Ross C. Provence

Ross C. Provence

President |

| | By: /s/Jeffrey R. Provence

Jeffrey R. Provence

Chief Financial Officer |