UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21296

BARON SELECT FUNDS

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Select Funds

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

Baron Partners Fund

Baron Focused Growth Fund

Baron International Growth Fund

Baron Real Estate Fund

Baron Emerging Markets Fund

Baron Global Advantage Fund

Baron Real Estate Income Fund

Baron Health Care Fund

Baron FinTech Fund

Baron New Asia Fund

Baron Technology Fund

Baron Funds®

Baron Select Funds

Annual Financial Report

DEAR BARON SELECT FUNDS SHAREHOLDER:

In this report, you will find audited financial statements for Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron New Asia Fund, and Baron Technology Fund (the “Funds”) for the year ended December 31, 2022. The U.S. Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer February 27, 2023 | | Linda S. Martinson Chairman, President and Chief Operating Officer February 27, 2023 | | Peggy Wong Treasurer and Chief Financial Officer February 27, 2023 |

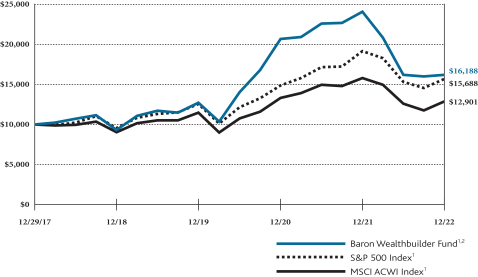

This Annual Financial Report is for the Baron Select Funds, which currently has 12 series: Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron WealthBuilder Fund, Baron New Asia Fund, and Baron Technology Fund. Baron WealthBuilder Fund is included in a separate Financial Report. If you are interested in Baron WealthBuilder Fund or Baron Investment Funds Trust, which contains the Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund, and Baron Durable Advantage Fund, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at www.BaronFunds.com, by clicking on the “Regulatory Documents” link at the bottom left corner of the homepage or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan”, and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to www.BaronFunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Partners Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON PARTNERS FUND (RETAIL SHARES)

IN RELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(January 31,

1992) | |

Baron Partners Fund — Retail Shares1,2,3 | | | (42.56)% | | | | 23.33% | | | | 21.66% | | | | 19.17% | | | | 14.22% | |

Baron Partners Fund — Institutional Shares1,2,3,4 | | | (42.41)% | | | | 23.65% | | | | 21.98% | | | | 19.49% | | | | 14.35% | |

Baron Partners Fund — R6 Shares1,2,3,4 | | | (42.41)% | | | | 23.64% | | | | 21.97% | | | | 19.48% | | | | 14.35% | |

Russell Midcap Growth Index1 | | | (26.72)% | | | | 3.85% | | | | 7.64% | | | | 11.41% | | | | 9.43% | |

S&P 500 Index1 | | | (18.11)% | | | | 7.66% | | | | 9.42% | | | | 12.56% | | | | 9.67% | |

| 1 | The Russell Midcap® Growth Index measures the performance of medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The indexes and Baron Partners Fund are with dividends, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 20% performance fee after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was April 30, 2003. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| December 31, 2022 (Unaudited) | | Baron Partners Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of Total

Investments* | |

Tesla, Inc. | | | 25.8% | |

Space Exploration Technologies Corp. | | | 10.2% | |

CoStar Group, Inc. | | | 9.8% | |

Arch Capital Group Ltd. | | | 7.1% | |

The Charles Schwab Corp. | | | 5.9% | |

IDEXX Laboratories, Inc. | | | 5.6% | |

Hyatt Hotels Corp. | | | 5.2% | |

FactSet Research Systems, Inc. | | | 5.0% | |

Vail Resorts, Inc. | | | 4.3% | |

Gartner, Inc. | | | 4.1% | |

| |

| | | | 82.9% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Partners Fund1 declined 42.56%, underperforming the Russell Midcap Growth Index, which retreated 26.72%.

Baron Partners Fund invests primarily in U.S. companies of any size with, in our view, significant long-term growth potential. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. The Fund is non-diversified, so its top 10 holdings are expected to comprise a significant percentage of the portfolio, and the Fund uses leverage, both of which increase risk. In addition, the Fund may be subject to risks associated with potentially being concentrated in the

securities of a single issuer or a small number of issuers, including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

As of December 31, 2022, 31.0% of the Fund’s net assets are invested in Tesla, Inc. stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected. Before investing in the Fund, investors should carefully consider publicly available information about Tesla. There can be no assurances that the Fund will maintain its investment in Tesla, as the Adviser maintains discretion to actively manage the Fund’s portfolio, including by decreasing or liquidating the Fund’s investment in Tesla at any time. However, for so long as the Fund maintains a substantial investment in Tesla, the Fund’s performance will be significantly affected by the performance of Tesla stock and any decline in the price of Tesla stock would materially and adversely affect your investment in the Fund.

2022 was an exceptionally challenging time for U.S. equities. Stubbornly high inflation, a much more hawkish U.S. Federal Reserve, global supply-chain disruptions, Russia’s invasion of Ukraine, and China’s COVID-related shutdown combined to spur a precipitous sell-off. Growth stocks underperformed value stocks in the risk-off environment. However, toward year end, the markets rallied on raised expectations that the Fed would ease up on its aggressive tightening program given signs of a slowdown in inflation.

Industrials and Financials were material contributors. Consumer Discretionary, Information Technology, and Health Care were the top detractors.

Space Exploration Technologies Corp. (SpaceX) was the top contributor. SpaceX is a high-profile private company founded by Elon Musk that designs, manufactures, and launches rockets, satellites, and spacecrafts. Its long-term goal is to enable human beings to inhabit Mars. We believe SpaceX is creating substantial value through the expansion of its Starlink broadband service. It also reliably provides reusable launch capabilities, including crewed space flights, and is making progress on its largest rocket, Starship. We value SpaceX using prices of recent financing transactions and a proprietary valuation model.

Tesla was the top detractor. Shares of this manufacturer of electric vehicles, related software and components, and solar and energy storage products fell on investor concerns regarding volume and pricing dynamics, as demand appeared to be negatively impacted by a potential recession and higher interest rates. In addition, following Twitter, Inc.’s acquisition, CEO Elon Musk dedicated a material portion of his time to that company and sold Tesla shares to fund the transaction, driving investor concerns regarding his dedication to Tesla. We remain confident in Tesla’s fundamentals and management team.

We invest for the long term in businesses that we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic that this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

| Baron Focused Growth Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FOCUSED GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2500 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(May 31,

1996) | |

Baron Focused Growth Fund — Retail Shares1,2,3 | | | (28.30)% | | | | 23.71% | | | | 20.63% | | | | 15.10% | | | | 12.70% | |

Baron Focused Growth Fund — Institutional Shares1,2,3,4 | | | (28.11)% | | | | 24.02% | | | | 20.94% | | | | 15.39% | | | | 12.84% | |

Baron Focused Growth Fund — R6 Shares1,2,3,4 | | | (28.11)% | | | | 24.03% | | | | 20.94% | | | | 15.40% | | | | 12.84% | |

Russell 2500 Growth Index1 | | | (26.21)% | | | | 2.88% | | | | 5.97% | | | | 10.62% | | | | 7.65% | |

S&P 500 Index1 | | | (18.11)% | | | | 7.66% | | | | 9.42% | | | | 12.56% | | | | 8.80% | |

| 1 | The Russell 2500™ Growth Index measures the performance of small- to medium-sized U.S. companies that are classified as growth and the S&P 500 Index of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The indexes and Baron Focused Growth Fund are with dividends, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 15% performance fee through 2003 after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, the returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was June 30, 2008. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| December 31, 2022 (Unaudited) | | Baron Focused Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Space Exploration Technologies Corp. | | | 11.9% | |

Tesla, Inc. | | | 10.4% | |

Arch Capital Group Ltd. | | | 7.8% | |

Hyatt Hotels Corp. | | | 6.2% | |

CoStar Group, Inc. | | | 6.2% | |

Vail Resorts, Inc. | | | 5.2% | |

FactSet Research Systems, Inc. | | | 5.0% | |

MSCI, Inc. | | | 4.8% | |

Iridium Communications Inc. | | | 4.5% | |

Figs Inc. | | | 3.5% | |

| |

| | | | 65.4% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Focused Growth Fund1 declined 28.30%, underperforming the Russell 2500 Growth Index, which retreated 26.21%.

Baron Focused Growth Fund invests in a non-diversified portfolio of companies that we believe are well capitalized and have exceptional management, significant growth potential, and durable barriers to competition. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. In addition, the Fund may be subject to risks associated with potentially being concentrated in the

securities of a single issuer or a small number of issuers, including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

As of December 31, 2022, 10.4% of the Fund’s net assets are invested in Tesla, Inc. stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected. Before investing in the Fund, investors should carefully consider publicly available information about Tesla. There can be no assurances that the Fund will maintain its investment in Tesla, as the Adviser maintains discretion to actively manage the Fund’s portfolio, including by decreasing or liquidating the Fund’s investment in Tesla at any time. However, for so long as the Fund maintains a substantial investment in Tesla, the Fund’s performance will be significantly affected by the performance of Tesla stock and any decline in the price of Tesla stock would materially and adversely affect your investment in the Fund.

2022 was an exceptionally challenging time for U.S. equities. Stubbornly high inflation, a much more hawkish U.S. Federal Reserve, global supply-chain disruptions, Russia’s invasion of Ukraine, and China’s COVID-related shutdown combined to spur a precipitous sell-off. Growth stocks underperformed value stocks in the risk-off environment. However, toward year end, the markets rallied on raised expectations that the Fed would ease up on its aggressive tightening program given signs of a slowdown in inflation.

Industrials and Financials contributed. Consumer Discretionary, Information Technology, and Communication Services were the top detractors.

SpaceX was the top contributor. SpaceX is a high-profile private company founded by Elon Musk that designs, manufactures, and launches rockets, satellites, and spacecrafts. Its long-term goal is to enable human beings to inhabit Mars. We believe SpaceX is creating substantial value through the expansion of its Starlink broadband service. It also reliably provides reusable launch capabilities, including crewed space flights, and is making progress on its largest rocket, Starship. We value SpaceX using prices of recent financing transactions and a proprietary valuation model.

Tesla was the top detractor. Shares of this manufacturer of electric vehicles, related software and components, and solar and energy storage products fell on investor concerns regarding volume and pricing dynamics, as demand appeared to be negatively impacted by a potential recession and higher interest rates. In addition, following Twitter, Inc.’s acquisition, CEO Elon Musk dedicated a material portion of his time to that company and sold Tesla shares to fund the transaction, driving investor concerns regarding his dedication to Tesla. We remain confident in Tesla’s fundamentals and management team.

We invest for the long term in businesses that we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic that this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

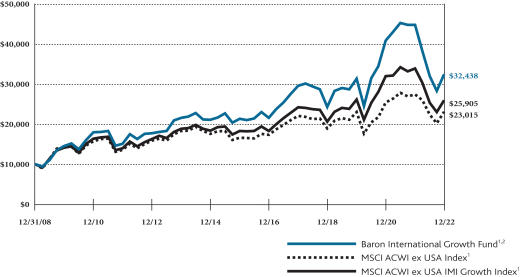

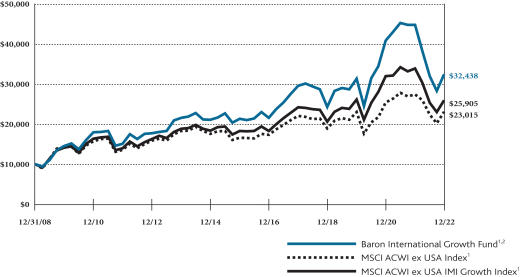

| Baron International Growth Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON INTERNATIONAL GROWTH FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWIEX USA INDEXANDTHE MSCI ACWIEX USA IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2008)^ | |

Baron International Growth Fund — Retail Shares1,2 | | | (27.47)% | | | | 1.25% | | | | 1.92% | | | | 6.24% | | | | 8.77% | |

Baron International Growth Fund — Institutional Shares1,2,3 | | | (27.29)% | | | | 1.49% | | | | 2.17% | | | | 6.50% | | | | 9.04% | |

Baron International Growth Fund — R6 Shares1,2,3 | | | (27.28)% | | | | 1.48% | | | | 2.16% | | | | 6.50% | | | | 9.03% | |

MSCI ACWI ex USA Index1 | | | (16.00)% | | | | 0.07% | | | | 0.88% | | | | 3.80% | | | | 6.13% | |

MSCI ACWI ex USA IMI Growth Index1 | | | (23.49)% | | | | (0.26)% | | | | 1.39% | | | | 4.77% | | | | 7.04% | |

| † | The Fund’s 3- and 5-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 2, 2009. |

| 1 | The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of large- and mid-cap securities across developed and emerging markets, excluding the United States. The MSCI ACWI ex USA IMI Growth Index is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large-, mid-, and small-cap growth securities across developed and emerging markets, excluding the United States. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and Baron International Growth Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| December 31, 2022 (Unaudited) | | Baron International Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Arch Capital Group Ltd. | | | 2.9% | |

AstraZeneca PLC | | | 2.8% | |

argenx SE | | | 2.5% | |

Linde plc | | | 2.4% | |

Meyer Burger Technology AG | | | 2.2% | |

Keyence Corporation | | | 1.8% | |

BNP Paribas S.A. | | | 1.7% | |

Pernod Ricard SA | | | 1.7% | |

Constellation Software, Inc. | | | 1.7% | |

Industria de Diseno Textil, S.A. | | | 1.7% | |

| |

| | | | 21.5% | |

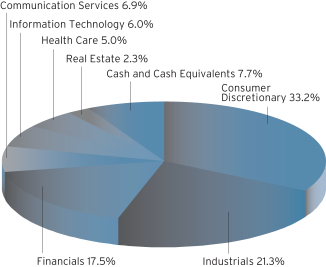

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron International Growth Fund1 declined 27.47%, underperforming the MSCI ACWI ex USA Index, which declined 16.00%.

Baron International Growth Fund is a diversified fund that invests for the long term primarily in securities of non-U.S. growth companies. The Fund expects to diversify among developed and developing countries throughout the world, although total exposure to developing countries will not exceed 35%. The Fund may purchase securities of companies of any size. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was an exceptionally challenging year for global equities, and international markets were no exception. Russia’s invasion of Ukraine, tighter financial conditions to combat higher inflation, a strong U.S. dollar, and China’s economic growth decline due to its zero-COVID policy pressured international equities throughout much of the year. Toward year end, however, signs of a slowdown in inflation, falling gas prices amid unusually mild weather in Europe, the end of the U.K.’s bond crisis, and China’s abrupt reopening and unveiling of aggressive easing and stimulus measures helped stage a rally that continued into the start of 2023.

The U.S., Denmark, and Poland contributed the most. The top detractors were the U.K., China, and Japan.

No sector contributed. The top detractors were Communication Services, Industrials, and Consumer Discretionary.

The top contributor was Arch Capital Group Ltd. Shares of this specialty insurance company rose on favorable pricing trends in the property and casualty (P&C) insurance market, leading to faster premium growth and improved underwriting margins. P&C insurance stocks broadly outperformed as relative safe havens in the midst of market volatility. The stock also benefited from inclusion in the S&P 500 Index, which prompted buying from passive funds.

Shares of top detractor Future plc, a special-interest publisher of digital content, magazines, and events, were down on U.K. macro weakness and news that the company’s long-time CEO plans to step down. Fundamentally, Future demonstrated strength in the weakened digital advertising space, with organic growth outpacing peers. Longer term, we believe Future can continue to grow organically and through M&A, and we await updates on leadership.

With international equities trading near a 30-year valuation low relative to the U.S. and an improving relative economic and earnings outlook for the region, we think international equities may be poised for outperformance. Longer term, we believe international earnings will benefit from the investment cycle needed to fund deglobalization, supply-chain diversification, sustainability, and energy, commodity, and agricultural security, as well as China’s pivot to value-added economic activity. Further, we believe the 14-year U.S. dollar bull market is close to an end. As always, we are confident we have invested in well-positioned and well-managed companies with substantial long-term return potential.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

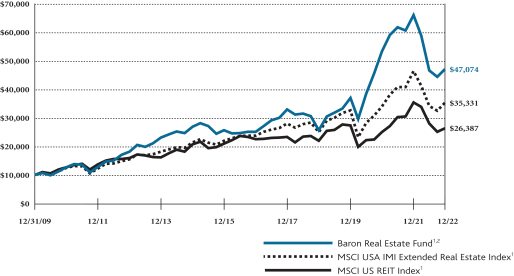

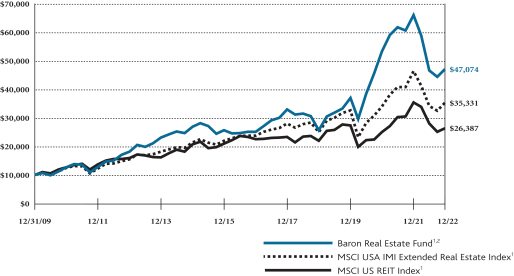

| Baron Real Estate Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI USA IMI EXTENDED REAL ESTATE INDEXAND MSCI US REIT INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2009)^ | |

Baron Real Estate Fund — Retail Shares1,2 | | | (28.61)% | | | | 8.40% | | | | 7.38% | | | | 9.99% | | | | 12.66% | |

Baron Real Estate Fund — Institutional Shares1,2 | | | (28.44)% | | | | 8.69% | | | | 7.65% | | | | 10.28% | | | | 12.94% | |

Baron Real Estate Fund — R6 Shares1,2,3 | | | (28.44)% | | | | 8.68% | | | | 7.66% | | | | 10.28% | | | | 12.94% | |

MSCI USA IMI Extended Real Estate Index1 | | | (23.84)% | | | | 2.72% | | | | 4.73% | | | | 8.59% | | | | 10.20% | |

MSCI US REIT Index1 | | | (25.37)% | | | | (1.16)% | | | | 2.48% | | | | 5.20% | | | | 7.75% | |

| ^ | Commencement of investment operations was January 4, 2010. |

| 1 | The MSCI USA IMI Extended Real Estate Index is a custom index calculated by MSCI for, and as requested by, BAMCO, Inc. The index includes real estate and real estate-related GICS classification securities. MSCI makes no express or implied warranties or representation and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The MSCI US REIT Index is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the U.S. equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and Baron Real Estate Fund are with dividends, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

8

| | |

| December 31, 2022 (Unaudited) | | Baron Real Estate Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

CoStar Group, Inc. | | | 5.3% | |

Prologis, Inc. | | | 5.2% | |

Toll Brothers, Inc. | | | 4.9% | |

Brookfield Corporation | | | 4.6% | |

American Tower Corp. | | | 4.3% | |

Equinix, Inc. | | | 3.9% | |

CBRE Group, Inc. | | | 3.8% | |

Lennar Corporation | | | 3.7% | |

D.R. Horton, Inc. | | | 3.1% | |

SiteOne Landscape Supply, Inc. | | | 3.1% | |

| |

| | | | 41.9% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Real Estate Fund1 declined 28.61%, underperforming the MSCI USA IMI Extended Real Estate Index, which declined 23.84%.

Baron Real Estate Fund is a diversified fund that under normal circumstances, invests 80% of its net assets in real estate and real estate-related companies of all sizes, and in companies which, in

the opinion of the Adviser, own significant real estate assets at the time of investment. The Fund seeks to invest in well-managed companies that we believe have significant long-term growth opportunities. The Fund’s investment universe extends beyond real estate investment trusts (“REITs”) to include hotels, senior housing operators, casino and gaming operators, tower operators, infrastructure-related companies and master limited partnerships, data centers, building products companies, real estate service companies, and real estate operating companies. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was challenging to navigate. Stubbornly high inflation, a much more hawkish U.S. Federal Reserve program resulting in a spike in interest rates, global supply-chain disruptions, Russia’s invasion of Ukraine, and China’s COVID-related shutdown combined to spur a precipitous sell-off. Toward year end, however, the markets rallied on raised expectations that the Fed would ease up on its aggressive tightening program given signs of a slowdown in inflation.

No real estate category contributed. REITs, building products/services, and real estate operating companies were the top detractors.

CoStar Group, Inc. was the top contributor. Shares of this leading provider of information and marketing services to the commercial real estate industry rose as the company continued to benefit from the migration of real estate market spend to online channels. CoStar is investing aggressively to build out its residential marketing platform, which offers dramatic upside potential, in our view. It has over $4.7 billion in cash, which we expect it to begin to deploy for opportunistic M&A.

The top detractor was Brookfield Corporation. Shares of this global investor in real estate, infrastructure, renewable power, private equity, and credit assets fell alongside other alternative asset managers due to an evolving outlook for long-term interest rates and the path of Federal Reserve hikes. Higher rates impact the ability to realize investment gains, deploy capital at attractive internal rates of return, and raise funds. Longer term, we like the company’s strong asset management platform with high earnings visibility and ability to deploy capital globally.

We remain cautious near term given unprecedented and aggressive central bank tightening into a slowing global economy and heightened geopolitical risks. However, we believe the shares of many real estate-related companies may benefit from asymmetrical returns in the next two to three years. Valuations are attractive, business fundamentals remain strong, corporate and consumer balance sheets are healthy, unemployment is low, inflation is moderating, and much of the move to higher rates may have already occurred.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

| Baron Emerging Markets Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON EMERGING MARKETS FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI EM INDEXANDTHE MSCI EM IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2010)^ | |

Baron Emerging Markets Fund — Retail Shares1,2 | | | (25.99)% | | | | (3.68)% | | | | (2.95)% | | | | 2.83% | | | | 2.51% | |

Baron Emerging Markets Fund — Institutional Shares1,2 | | | (25.82)% | | | | (3.44)% | | | | (2.70)% | | | | 3.10% | | | | 2.77% | |

Baron Emerging Markets Fund — R6 Shares1,2,3 | | | (25.81)% | | | | (3.42)% | | | | (2.69)% | | | | 3.10% | | | | 2.77% | |

MSCI EM Index1 | | | (20.09)% | | | | (2.69)% | | | | (1.40)% | | | | 1.44% | | | | 0.89% | |

MSCI EM IMI Growth Index1 | | | (23.88)% | | | | (2.02)% | | | | (1.06)% | | | | 2.65% | | | | 1.90% | |

| † | The Fund’s 10-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 3, 2011. |

| 1 | The MSCI EM (Emerging Markets) Index and the MSCI EM (Emerging Markets) IMI Growth Index are free float-adjusted market capitalization weighted indexes. The MSCI EM (Emerging Markets) Index Net USD and the MSCI EM (Emerging Markets) IMI Growth Index Net USD are designed to measure the equity market performance of large-, mid-, and small-cap securities in the emerging markets. The MSCI EM (Emerging Markets) IMI Growth Index Net USD screens for growth-style securities. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and Baron Emerging Markets Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033 unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

10

| | |

| December 31, 2022 (Unaudited) | | Baron Emerging Markets Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing Company Limited | | | 4.9% | |

Samsung Electronics Co., Ltd. | | | 3.6% | |

Alibaba Group Holding Limited | | | 3.1% | |

Tencent Holdings Limited | | | 2.7% | |

Reliance Industries Limited | | | 2.7% | |

Bajaj Finance Limited | | | 2.6% | |

Suzano S.A. | | | 2.0% | |

Bharti Airtel Limited | | | 1.8% | |

Korea Shipbuilding & Offshore Engineering Co., Ltd. | | | 1.7% | |

PT Bank Rakyat Indonesia (Persero) Tbk | | | 1.6% | |

| |

| | | | 26.6% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Emerging Markets Fund1 declined 25.99%, underperforming the MSCI EM Index, which retreated 20.09%.

Baron Emerging Markets Fund is a diversified fund that invests for the long term primarily in companies of any size with their principal business activities or trading markets in developing countries. The Fund may invest up to 20% of its net assets in developed and frontier countries. The Fund seeks to invest in companies with significant long-term growth prospects and purchase them at prices we believe to be favorable. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was an exceptionally challenging year for global equities, and emerging markets (EM) were no exception. Russia’s invasion of Ukraine, tighter financial conditions to combat higher inflation, a strong U.S. dollar, and China’s economic growth decline due to its zero-COVID policy pressured EM equities throughout much of the year. Toward year end, however, signs of a slowdown in inflation coupled with China’s abrupt reopening and unveiling of aggressive easing and stimulus measures helped stage a rally that continued into the start of 2023.

On a country basis, the U.K. and Italy were slight contributors. China, Russia, and India detracted the most.

No sector contributed. Information Technology, Industrials, and Financials detracted the most.

Glencore PLC was the top contributor. Shares of this diversified natural resources company, including copper and cobalt for batteries, increased in 2022 due to a rise in key commodities prices as well as improvements in its trading divisions. We expect a multi-year supply deficit for copper driven by a structural demand increase from electrification. Electric vehicles and wind/solar power plants require four to five times more copper than their conventional counterparts.

Semiconductor giant Taiwan Semiconductor Manufacturing Company Ltd. was the top detractor. Shares fell due to macroeconomic and geopolitical uncertainties and softening demand for consumer electronics. We retain conviction that Taiwan Semi’s technological leadership, pricing power, and exposure to secular growth markets, including high-performance computing, automotive, and IoT, will allow the company to deliver strong earnings growth over the next several years.

With EM equities trading near a 30-year valuation low relative to the U.S. and an improving relative economic and earnings outlook for the region, we think EM equities may be poised for outperformance. Longer term, we believe EM earnings will benefit from the investment cycle needed to fund deglobalization, supply-chain diversification, sustainability, and energy, commodity, and agricultural security; India’s productivity initiatives reaching escape velocity and driving a virtuous investment cycle; and China’s pivot to value-added economic activity. Further, we believe the 14-year U.S. dollar bull market is close to an end. As always, we are confident we have invested in well-positioned and well-managed companies with substantial long-term return potential.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

| Baron Global Advantage Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GLOBAL ADVANTAGE FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWI INDEXANDTHE MSCI ACWI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2012) | |

Baron Global Advantage Fund — Retail Shares1,2 | | | (51.69)% | | | | (4.52)% | | | | 3.95% | | | | 9.18% | | | | 8.99% | |

Baron Global Advantage Fund — Institutional Shares1,2 | | | (51.57)% | | | | (4.28)% | | | | 4.21% | | | | 9.43% | | | | 9.23% | |

Baron Global Advantage Fund — R6 Shares1,2,3 | | | (51.58)% | | | | (4.27)% | | | | 4.21% | | | | 9.44% | | | | 9.24% | |

MSCI ACWI Index1 | | | (18.36)% | | | | 4.00% | | | | 5.23% | | | | 7.98% | | | | 7.95% | |

MSCI ACWI Growth Index1 | | | (28.61)% | | | | 3.75% | | | | 6.37% | | | | 9.20% | | | | 8.95% | |

| † | The Fund’s, 3-, 5-, and 10-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The MSCI ACWI Index and the MSCI ACWI Growth Index are free float-adjusted market capitalization weighted indexes. The MSCI ACWI Index and the MSCI ACWI Growth Index are designed to measure the equity market performance of large- and mid-cap securities across developed and emerging markets, including the United States. The MSCI ACWI Growth Index screens for growth-style securities. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and Baron Global Advantage Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

| December 31, 2022 (Unaudited) | | Baron Global Advantage Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Total Investments* | |

Endava plc | | | 6.6% | |

Think & Learn Private Limited | | | 5.7% | |

MercadoLibre, Inc. | | | 5.6% | |

Bajaj Finance Limited | | | 4.9% | |

argenx SE | | | 4.6% | |

Snowflake Inc. | | | 4.5% | |

CrowdStrike Holdings, Inc. | | | 3.8% | |

Datadog, Inc. | | | 3.4% | |

Coupang, Inc. | | | 3.4% | |

Shopify Inc. | | | 3.3% | |

| |

| | | | 45.7% | |

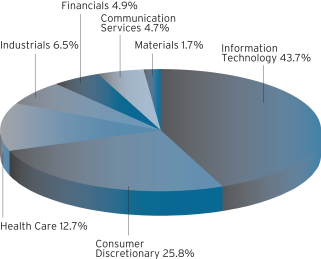

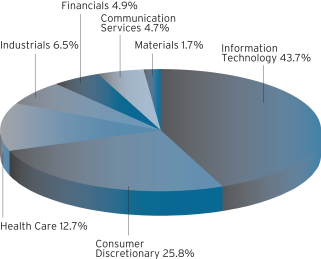

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Global Advantage Fund1 declined 51.69%, underperforming the MSCI ACWI Index, which declined 18.36%.

The Fund is a diversified fund that, under normal circumstances, invests primarily in equity securities of companies throughout the world, with capitalizations within the range of companies included in the MSCI ACWI Index. At all times, the Fund will have

investments in equity securities of companies in at least three countries outside the U.S. Under normal conditions, at least 40% of net assets will be invested in stocks of companies outside the U.S. (at least 30% if foreign market conditions are not favorable). The Adviser seeks to invest in businesses it believes have significant opportunities for growth, durable competitive advantages, exceptional management, and an attractive valuation. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was an exceptionally challenging time for global equities. Stubbornly high inflation, a much more hawkish U.S. Federal Reserve, global supply-chain disruptions, Russia’s invasion of Ukraine, and China’s COVID-related shutdown combined to spur a precipitous sell-off. Toward year end, the markets rallied on raised expectations that the Fed and other central banks would ease up on their aggressive tightening programs given signs of a slowdown in inflation.

Poland and Brazil contributed slightly. The U.S., Israel, and Canada detracted the most.

Industrials contributed to performance. Information Technology, Consumer Discretionary, and Health Care detracted the most.

The top contributor was argenx SE, a biotechnology company focused on autoimmune disorders. Shares increased alongside stellar commercial execution and the launch of Vyvgart for myasthenia gravis, first in the U.S. followed by Japan. Every quarter indicated above-consensus demand that translated into beats and raises. Long term, we believe that Vyvgart is a scarce asset and has the potential to re-write the treatment of autoimmune diseases. It is truly a “pipeline in a product.”

The top detractor was electric vehicle company Rivian Automotive, Inc. Liquidity risk remained elevated, with outsized cash outflow during its early production phase, while confidence in unit economics and execution remained challenged with macro pressure on the industry. We remain investors. Despite supply-chain complexities, Rivian achieved a seven-fold growth in its monthly production rate since late 2021. Positive product reviews, an integrated technology approach, and unique partnerships generate a core for an attractive long-term opportunity.

Every day we live and invest in an uncertain world. The constant challenges we face are real and serious, with clearly uncertain outcomes. History would suggest that most will prove passing or manageable. The business of capital allocation (or investing) is the business of taking risk, managing the uncertainty, and taking advantage of the long-term opportunities that those risks and uncertainties create. We are confident our process is the right one, and we believe it will enable us to make good investment decisions over time.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

| Baron Real Estate Income Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE INCOME FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI US REIT INDEX

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Five Years

and Since

Inception

December 29,

2017)^ | |

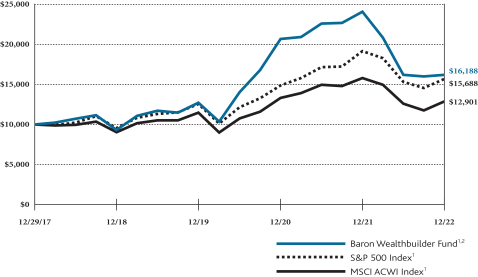

Baron Real Estate Income Fund — Retail Shares1,2 | | | (27.61)% | | | | 4.50% | | | | 6.70% | |

Baron Real Estate Income Fund — Institutional Shares1,2 | | | (27.43)% | | | | 4.75% | | | | 6.91% | |

Baron Real Estate Income Fund — R6 Shares1,2 | | | (27.41)% | | | | 4.76% | | | | 6.89% | |

MSCI US REIT Index1 | | | (25.37)% | | | | (1.16)% | | | | 2.48% | |

| ^ | Commencement of investment operations was January 2, 2018. |

| 1 | The MSCI US REIT Index is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The index and Baron Real Estate Income Fund include reinvestment of interest, capital gains and dividends, which positively impact the performance results. The index is unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

14

| | |

| December 31, 2022 (Unaudited) | | Baron Real Estate Income Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Prologis, Inc. | | | 13.8% | |

American Tower Corp. | | | 10.4% | |

Equinix, Inc. | | | 7.3% | |

Public Storage Incorporated | | | 6.0% | |

SBA Communications Corp. | | | 5.3% | |

Simon Property Group, Inc. | | | 4.9% | |

Sun Communities, Inc. | | | 4.9% | |

EastGroup Properties, Inc. | | | 4.1% | |

Extra Space Storage Inc. | | | 3.3% | |

Rexford Industrial Realty, Inc. | | | 3.3% | |

| |

| | | | 63.4% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Real Estate Income Fund1 declined 27.61%, underperforming the MSCI US REIT Index, which declined 25.37%.

Baron Real Estate Income Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in real estate income-producing securities and other real estate securities of any market capitalization, including common stocks

and equity securities, debt and preferred securities, non-U.S. real estate income-producing securities, and any other real estate-related yield securities. The Fund is likely to maintain a significant portion of its assets in real estate investment trusts (“REITs”). REITs pool money to invest in properties (“equity REITs”) or mortgages (“mortgage REITs”), and their revenue primarily consists of rent derived from owned, income producing real estate properties, and capital gains from the sale of such properties. The Fund generally invests in equity REITs. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was challenging to navigate. Stubbornly high inflation, a much more hawkish U.S. Federal Reserve program resulting in a spike in interest rates, global supply-chain disruptions, Russia’s invasion of Ukraine, and China’s COVID-related shutdown combined to spur a precipitous sell-off. Raised investor expectations that the Fed would ease up on its aggressive tightening program given signs of a slowdown in inflation spurred a late-year rally. While Real Estate participated in the rally, it underperformed most other sectors.

Triple-net REITs and student housing REITs were slight contributors in 2022. Industrial REITs, non-REIT real estate companies, and multi-family REITs were the top detractors.

Gaming and Leisure Properties, Inc. was the top contributor. Shares of this owner and leaser of real estate to casinos rose on its status as a safe haven in an uncertain macro environment. The company pays out a well-covered 5.5% dividend and is growing organic EBITDA at a low single-digit rate. Its tenants are well positioned to make rent payments even in a downturn, and its balance sheet is strong enough to fund new acquisitions should something come available.

Prologis, Inc. was the top detractor. Shares of this industrial warehouse REIT fell on investor concerns that tenant demand would slow given Amazon’s decision to curtail expansion plans coupled with broader economic uncertainty. We maintain conviction. Industrial real estate has attractive fundamentals, with organic growth among the highest across all real estate asset types. Prologis’ assets, markets, management, and balance sheet positions it to benefit from this favorable fundamental backdrop.

We remain cautious near term given unprecedented and aggressive central bank tightening into a slowing global economy and heightened geopolitical risks. However, we believe the shares of many real estate-related companies may benefit from asymmetrical returns in the next two to three years. Valuations are attractive, business fundamentals remain strong, corporate and consumer balance sheets are healthy, unemployment is low, inflation is moderating, and much of the move to higher rates may have already occurred.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects the results of Retail Shares. |

15

| | |

| Baron Health Care Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON HEALTH CARE FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 HEALTH CARE INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three

Years | | | Since

Inception

April 30,

2018) | |

Baron Health Care Fund — Retail Shares1,2 | | | (17.10)% | | | | 12.15% | | | | 13.61% | |

Baron Health Care Fund — Institutional Shares1,2 | | | (16.85)% | | | | 12.41% | | | | 13.90% | |

Baron Health Care Fund — R6 Shares1,2 | | | (16.90)% | | | | 12.44% | | | | 13.90% | |

Russell 3000 Health Care Index1 | | | (6.10)% | | | | 9.95% | | | | 12.06% | |

S&P 500 Index1 | | | (18.11)% | | | | 7.66% | | | | 10.22% | |

| † | The Fund’s 3-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell 3000 Health Care Index is a free float-adjusted market capitalization index that measures the performance of all equity in the US equity market. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The indexes and Baron Health Care Fund are with dividends, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

16

| | |

| December 31, 2022 (Unaudited) | | Baron Health Care Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

UnitedHealth Group Incorporated | | | 9.5% | |

Eli Lilly and Company | | | 6.0% | |

Thermo Fisher Scientific Inc. | | | 4.2% | |

Humana Inc. | | | 4.0% | |

AstraZeneca PLC | | | 3.9% | |

Merck & Co., Inc. | | | 3.7% | �� |

argenx SE | | | 3.6% | |

McKesson Corporation | | | 3.5% | |

Intuitive Surgical, Inc. | | | 3.4% | |

Vertex Pharmaceuticals Incorporated | | | 3.2% | |

| |

| | | | 45.1% | |

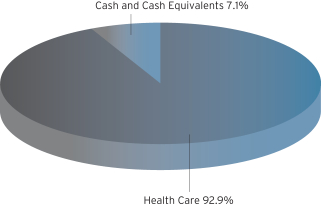

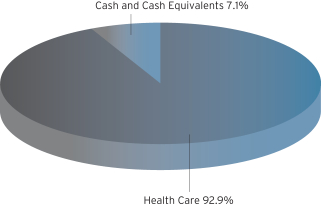

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron Health Care Fund1 declined 17.10%, underperforming the Russell 3000 Health Care Index, which fell 6.10%.

Baron Health Care Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in equity securities of companies engaged in the research, development, production, sale, delivery, or distribution of products and services

related to the health care industry. The Fund’s allocation among the different subsectors of the health care industry will vary depending upon the relative potential the Fund sees within each area. The Adviser seeks to invest in businesses it believes have significant growth opportunities, durable competitive advantages, exceptional management, and attractive valuations. The Fund may purchase securities of companies of any market capitalization and may invest in foreign stocks. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

Health Care, while down for the year, was a relative outperformer in a challenging time for equities. Sub-industries within the sector were impacted differently by macroeconomic conditions. For instance, while still-subdued medical procedural volumes were a headwind for medical device companies, they were a tailwind for managed care companies. The valuation of many biotechnology stocks — a high-growth, high-risk group — plummeted. Life sciences tools companies were pressured by concerns around peaking COVID-related revenues and a weak funding environment for biotechnology.

The managed health care and health care distributors sub-industries contributed the most. Life sciences tools & services and health care equipment detracted the most.

Eli Lilly and Company was the top contributor. Shares of this global pharmaceutical company rose on investor optimism about its new product pipeline, including Mounjaro for diabetes and obesity and Donanemab for Alzheimer’s disease. Lilly has a healthy base business with limited near-term patent expirations, a strong pipeline, and potential for significant margin expansion, which should translate to strong revenue and earnings growth over at least the next five years.

Dechra Pharmaceuticals PLC, a veterinary pharmaceutical company, was the top detractor. Shares fell alongside other high-multiple stocks that outperformed in 2021. Investor concerns that post-COVID demand for veterinary services would soften also pressured shares. We remain shareholders. Animal health is an expanding industry, and we believe Dechra will continue its above-market growth, given its focus on geographic expansion and niche markets underserved by large pharmaceutical companies as well as its successful M&A strategy.

The Health Care sector has many favorable long-term attributes. Valuations are attractive, balance sheets are generally in good shape, and we are in a transformational period with major advances in science, medicine, and technology. We focus on identifying high-quality, competitively advantaged companies with great management teams that we believe will benefit from the secular trends we have identified.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

17

| | |

| Baron FinTech Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FINTECH FUND† (RETAIL SHARES)

INRELATIONTOTHE S&P 500 INDEXANDTHE FACTSET GLOBAL FINTECH INDEX

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Three Years

and Since

Inception

December 31,

2019^ | |

Baron FinTech Fund — Retail Shares1,2 | | | (33.46)% | | | | 3.99% | |

Baron FinTech Fund — Institutional Shares1,2 | | | (33.30)% | | | | 4.24% | |

Baron FinTech Fund — R6 Shares1,2 | | | (33.30)% | | | | 4.24% | |

S&P 500 Index1 | | | (18.11)% | | | | 7.66% | |

FactSet Global FinTech Index 1 | | | (33.66)% | | | | (4.87)% | |

| † | The Fund’s 3-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 2, 2020. |

| 1 | The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. The FactSet Global FinTech Index is an unmanaged and equal-weighted index that measures the equity market performance of companies engaged in Financial Technologies, primarily in the areas of software and consulting, data and analytics, digital payment processing, money transfer, and payment transaction-related hardware, across 30 developed and emerging markets. The indexes and Baron FinTech Fund are with dividends, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. As of 2/3/2023, the Fund has changed its primary benchmark to the FactSet Global FinTech Index from the S&P 500 Index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

18

| | |

| December 31, 2022 (Unaudited) | | Baron FinTech Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Visa, Inc. | | | 5.9% | |

Mastercard Incorporated | | | 5.6% | |

S&P Global Inc. | | | 4.7% | |

Intuit Inc. | | | 4.7% | |

The Charles Schwab Corp. | | | 4.1% | |

LPL Financial Holdings Inc. | | | 4.1% | |

Accenture plc | | | 3.9% | |

MSCI, Inc. | | | 3.6% | |

Endava plc | | | 3.4% | |

Fair Isaac Corporation | | | 3.1% | |

| |

| | | | 43.0% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron FinTech Fund1 declined 33.46%, underperforming the S&P 500 Index, which declined 18.11%.2

Baron FinTech Fund is a non-diversified fund that invests in companies of any market capitalization that develop or use innovative technologies related in a significant way to financial

services. The Fund invests principally in U.S. securities but may invest up to 25% in non-U.S. securities. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was exceptionally challenging for the markets, and fintech stocks were hit especially hard, with the FactSet Global FinTech Index underperforming the S&P 500 Index by 15.55%. Investors grappled with persistently high inflation, a much more hawkish Federal Reserve, global supply-chain issues, the Russia-Ukraine war, and COVID-related lockdowns in China. However, toward year end, the markets rallied on raised expectations that the Fed would ease up on its aggressive tightening program given signs of a slowdown in inflation.

No sector contributed. Information Technology, Financials, and Industrials detracted the most.

LPL Financial Holdings Inc., the largest independent broker-dealer in the U.S., was the top contributor. Shares rose in 2022 as rising interest rates led to increases in earnings estimates. LPL is a beneficiary of rising rates because it earns a yield on the uninvested cash balances held in client accounts. We retain conviction, as LPL benefits from secular growth in the demand for financial advice and a shift among advisors toward independent models.

The top detractor was Endava plc, which provides outsourced software development for business customers. Shares fell despite strong business momentum, with 41% revenue growth over the last 12 months. The share price decline was likely due to growth moderating from elevated rates during the prior year as well as concern about macroeconomic uncertainty potentially weighing on client demand. We continue to own the stock because we believe Endava will continue gaining share in a large global market for IT services.

Despite the recent pullback, we feel positive about the growth prospects for our holdings. We believe FinTech investors are becoming more discerning about the durability of business models, expected profitability, the duration of growth, and the cost of capital. We believe greater investor discipline is healthy and should be a boon for the Fund and the types of businesses we favor. Longer term, we expect FinTech companies to benefit from secular growth trends such as the shift to electronic payments, the rise of e-commerce, the need for data and analytics to inform decision-making, the electronification of the capital markets, and the need for more modern technology and digital transformation in all areas of commerce.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

| 2 | As of 2/3/2023, the Fund has changed its primary benchmark to the FactSet Global FinTech Index. As of 12/31/2022, the Fund’s primary benchmark was the S&P 500 Index. |

19

| | |

| Baron New Asia Fund (Unaudited) | | December 31, 2022 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON NEW ASIA FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI AC ASIAEX JAPAN INDEXAND MSCI AC ASIAEX JAPAN IMI GROWTH INDEX

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2022 | |

| | | One

Year | | | Since

Inception

July 30,

2021 | |

Baron New Asia Fund — Retail Shares1,2 | | | (27.24)% | | | | (19.15)% | |

Baron New Asia Fund — Institutional Shares1,2 | | | (26.94)% | | | | (18.92)% | |

Baron New Asia Fund — R6 Shares1,2 | | | (26.84)% | | | | (18.92)% | |

MSCI AC Asia ex Japan Index1 | | | (19.67)% | | | | (16.27)% | |

MSCI AC Asia ex Japan IMI Growth Index1 | | | (24.26)% | | | | (19.95)% | |

| 1 | The MSCI AC Asia ex Japan Index measures the performance of large and mid cap equity securities representation across 2 of 3 developed markets countries (excluding Japan) and 8 emerging markets countries in Asia. The MSCI AC Asia ex Japan IMI Growth Index measures the performance of large, mid, and small cap securities exhibiting overall growth style characteristics across 2 of 3 developed markets countries (excluding Japan) and 8 emerging market countries in Asia. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and Baron New Asia Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The indexes are unmanaged. The index performance is not fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

20

| | |

| December 31, 2022 (Unaudited) | | Baron New Asia Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2022

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing

Company Limited | | | 5.3% | |

Samsung Electronics Co., Ltd. | | | 3.7% | |

Tencent Holdings Limited | | | 3.4% | |

Alibaba Group Holding Limited | | | 3.0% | |

Reliance Industries Limited | | | 3.0% | |

Bajaj Finance Limited | | | 2.8% | |

ICICI Bank Limited | | | 2.7% | |

HDFC Bank Limited | | | 2.4% | |

Bharti Airtel Limited | | | 2.2% | |

Yum China Holdings Inc. | | | 2.1% | |

| |

| | | | 30.7% | |

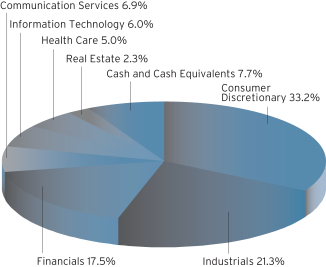

SECTOR BREAKDOWNASOF DECEMBER 31, 2022†*

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2022, Baron New Asia Fund1 declined 27.24%, underperforming the MSCI AC Asia ex Japan Index, which fell 19.67%.

Baron New Asia Fund is a diversified fund that invests primarily in companies of all sizes with significant growth potential located in Asia. The Fund emphasizes securities in developing Asian markets, including frontier markets. Under normal circumstances, the Fund invests 80% of its net assets in companies located in Asia. The Fund seeks to invest in companies with significant long-term growth prospects and purchase them at prices we believe to be favorable. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2022 was an exceptionally challenging year for global equities, and Asia emerging markets (EM) were no exception. Russia’s invasion of Ukraine, tighter financial conditions to combat higher inflation, a strong U.S. dollar, and China’s economic growth decline due to its zero-COVID policy pressured Asia EM equities throughout much of the year. Toward year end, however, signs of a slowdown in inflation coupled with China’s abrupt reopening and unveiling of aggressive easing and stimulus measures helped stage a rally that continued into the start of 2023.

No country contributed meaningfully to performance. China, India, and Taiwan were the top detractors.

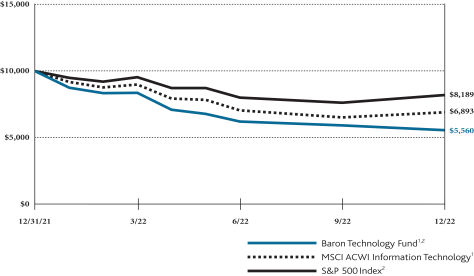

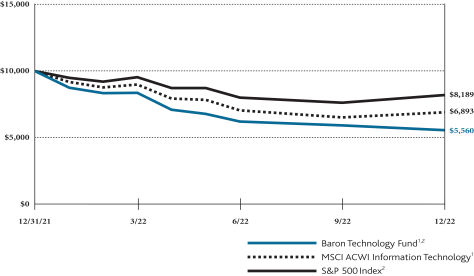

There were no meaningful sector contributors to performance. Information Technology, Industrials, and Consumer Discretionary detracted the most.