UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21296

BARON SELECT FUNDS

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Select Funds

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Reports to Stockholders.

Baron Partners Fund

Baron Focused Growth Fund

Baron International Growth Fund

Baron Real Estate Fund

Baron Emerging Markets Fund

Baron Global Advantage Fund

Baron Real Estate Income Fund

Baron Health Care Fund

Baron FinTech Fund

Baron New Asia Fund

Baron Technology Fund

Baron Funds®

Baron Select Funds

Semi-Annual Financial Report

DEAR BARON SELECT FUNDS SHAREHOLDER:

In this report, you will find unaudited financial statements for Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron New Asia Fund, and Baron Technology Fund (the Funds) for the six months ended June 30, 2023. The U.S. Securities and Exchange Commission (the SEC) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer August 28, 2023 | | Linda S. Martinson Chairman, President and Chief Operating Officer August 28, 2023 | | Peggy Wong Chief Financial Officer August 28, 2023 |

This Semi-Annual Financial Report is for the Baron Select Funds, which currently has 12 series: Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron WealthBuilder Fund, Baron New Asia Fund, and Baron Technology Fund. Baron WealthBuilder Fund is included in a separate Financial Report. If you are interested in Baron WealthBuilder Fund or Baron Investment Funds Trust, which contains the Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund, and Baron Durable Advantage Fund, please visit the Funds’ website at baronfunds.com or contact us at 1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at baronfunds.com, by clicking on the “Regulatory Documents” link at the bottom left corner of the homepage or by calling 1-800-99BARON and on the SEC’s website at sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete Portfolios of Investments with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at sec.gov. Portfolios of Investments current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan”, and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (BAMCO or the Adviser) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to baronfunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Partners Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON PARTNERS FUND (RETAIL SHARES)

IN RELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(January 31,

1992) | |

Baron Partners Fund — Retail Shares1,2,3 | | | 42.40% | | | | 25.23% | | | | 31.16% | | | | 26.89% | | | | 21.15% | | | | 15.27% | |

Baron Partners Fund — Institutional Shares1,2,3,4 | | | 42.59% | | | | 25.56% | | | | 31.50% | | | | 27.23% | | | | 21.46% | | | | 15.40% | |

Baron Partners Fund — R6 Shares1,2,3,4 | | | 42.58% | | | | 25.55% | | | | 31.50% | | | | 27.22% | | | | 21.46% | | | | 15.40% | |

Russell Midcap Growth Index1 | | | 15.94% | | | | 23.13% | | | | 7.63% | | | | 9.71% | | | | 11.53% | | | | 9.79% | |

S&P 500 Index1 | | | 16.89% | | | | 19.59% | | | | 14.60% | | | | 12.31% | | | | 12.86% | | | | 10.06% | |

| 1 | The Russell Midcap® Growth Index measures the performance of medium-sized U.S. companies that are classified as growth. The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell Midcap® Growth Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 20% performance fee after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was April 30, 2003. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| June 30, 2023 (Unaudited) | | Baron Partners Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of Total

Investments* | |

Tesla, Inc. | | | 40.5% | |

CoStar Group, Inc. | | | 8.3% | |

Space Exploration Technologies Corp. | | | 8.3% | |

Arch Capital Group Ltd. | | | 6.2% | |

IDEXX Laboratories, Inc. | | | 5.1% | |

Hyatt Hotels Corporation | | | 4.9% | |

The Charles Schwab Corp. | | | 3.8% | |

FactSet Research Systems Inc. | | | 3.7% | |

Vail Resorts, Inc. | | | 3.5% | |

Iridium Communications Inc. | | | 3.2% | |

| |

| | | | 87.5% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Partners Fund1 increased 42.40%, outperforming the Russell Midcap Growth Index, which returned 15.94%.

Baron Partners Fund invests primarily in U.S. companies of any size with, in our view, significant long-term growth potential. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. The Fund is non-diversified, so its top 10 holdings are expected to comprise a significant percentage of the portfolio, and the Fund uses leverage, both of which increase risk. In addition, the Fund may be

subject to risks associated with potentially being concentrated in the securities of a single issuer or a small number of issuers, including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

As of June 30, 2023, 46.0% of the Fund’s net assets were invested in Tesla, Inc. stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected. Before investing in the Fund, investors should carefully consider publicly available information about Tesla. There can be no assurances that the Fund will maintain its investment in Tesla, as the Adviser maintains discretion to actively manage the Fund’s portfolio, including by decreasing or liquidating the Fund’s investment in Tesla at any time. However, for so long as the Fund maintains a substantial investment in Tesla, the Fund’s performance will be significantly affected by the performance of Tesla stock and any decline in the price of Tesla stock would materially and adversely affect your investment in the Fund.

U.S. equities rallied during the period, supported by easing inflation, a first-time pause in the Federal Reserve’s prolonged interest rate hike campaign, Congress’ successful avoidance of the debt ceiling cliff, earnings optimism, and economic releases bolstering the “soft landing” narrative. One notable aspect of the recovery was narrow market leadership. Seven mega-cap technology companies accounted for much of the recent gains in the major market indexes, driven by excitement surrounding their potential ability to gain from widespread adoption of artificial intelligence (AI).

Consumer Discretionary, Industrials, and Health Care were the top contributors. Financials and Real Estate detracted slightly.

The top contributor was electric vehicle (EV) company Tesla. We believe investors were encouraged by the recent stability in Tesla’s vehicle pricing following price reductions along with reports suggesting potential record vehicle deliveries. The company also announced that Model 3 and Y were eligible for U.S. tax credits, while China extended its EV tax benefits. The adoption of Tesla’s charging solutions by several competitors opened additional revenue opportunities. Finally, Tesla’s AI investments should benefit from recent advancements in the space.

The top detractor was online brokerage firm The Charles Schwab Corp. Shares fell sharply following the March bankruptcy of Silicon Valley Bank (SVB) and the resulting weakness in regional banks. Despite running a much different business than SVB, Schwab faced deposit pressure through cash sorting in the wake of the collapse. We retain long-term conviction. Shares have since partially recovered. We are encouraged by Schwab’s exceptional client loyalty, robust organic growth, and industry-leading operating expense per client assets.

We invest for the long term in businesses we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

| Baron Focused Growth Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FOCUSED GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2500 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(May 31,

1996) | |

Baron Focused Growth Fund — Retail Shares1,2,3 | | | 22.75% | | | | 19.65% | | | | 25.71% | | | | 22.49% | | | | 16.51% | | | | 13.30% | |

Baron Focused Growth Fund — Institutional Shares1,2,3,4 | | | 22.90% | | | | 19.95% | | | | 26.04% | | | | 22.80% | | | | 16.81% | | | | 13.45% | |

Baron Focused Growth Fund — R6 Shares1,2,3,4 | | | 22.92% | | | | 19.97% | | | | 26.05% | | | | 22.81% | | | | 16.82% | | | | 13.45% | |

Russell 2500 Growth Index1 | | | 13.38% | | | | 18.58% | | | | 6.56% | | | | 7.00% | | | | 10.38% | | | | 8.00% | |

S&P 500 Index1 | | | 16.89% | | | | 19.59% | | | | 14.60% | | | | 12.31% | | | | 12.86% | | | | 9.26% | |

| 1 | The Russell 2500™ Growth Index measures the performance of small to medium-sized companies that are classified as growth. The S&P 500 Index measures the performance of 500 widely the performance of small to medium-sized U.S. companies that held large cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell 2500™ Growth Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 15% performance fee through 2003 after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, the returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was June 30, 2008. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| June 30, 2023 (Unaudited) | | Baron Focused Growth Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Tesla, Inc. | | | 14.8% | |

Space Exploration Technologies Corp. | | | 8.7% | |

Arch Capital Group Ltd. | | | 6.2% | |

Hyatt Hotels Corporation | | | 5.3% | |

CoStar Group, Inc. | | | 4.7% | |

Vail Resorts, Inc. | | | 4.4% | |

FactSet Research Systems Inc. | | | 4.2% | |

MSCI Inc. | | | 3.7% | |

Iridium Communications Inc. | | | 3.6% | |

Guidewire Software, Inc. | | | 3.5% | |

| |

| | | | 59.2% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Focused Growth Fund1 increased 22.75%, outperforming the Russell 2500 Growth Index, which increased 13.38%.

Baron Focused Growth Fund invests in a non-diversified portfolio of companies that we believe are well capitalized and have exceptional management, significant growth potential, and durable barriers to competition. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. In addition, the Fund may be subject

to risks associated with potentially being concentrated in the securities of a single issuer or a small number of issuers, including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

As of June 30, 2023, 14.8% of the Fund’s net assets were invested in Tesla, Inc. stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected. Before investing in the Fund, investors should carefully consider publicly available information about Tesla. There can be no assurances that the Fund will maintain its investment in Tesla, as the Adviser maintains discretion to actively manage the Fund’s portfolio, including by decreasing or liquidating the Fund’s investment in Tesla at any time. However, for so long as the Fund maintains a substantial investment in Tesla, the Fund’s performance will be significantly affected by the performance of Tesla stock and any decline in the price of Tesla stock would materially and adversely affect your investment in the Fund.

U.S. equities rallied during the period, supported by easing inflation, a first-time pause in the Federal Reserve’s prolonged interest rate hike campaign, Congress’ successful avoidance of the debt ceiling cliff, earnings optimism, and economic releases bolstering the “soft landing” narrative. One notable aspect of the recovery was the narrow market leadership. Seven mega-cap technology companies accounted for much of the recent gains in the major market indexes, driven by excitement surrounding their potential ability to benefit from widespread adoption of artificial intelligence (AI).

Consumer Discretionary, Industrials, and Information Technology were the top contributors. Real Estate detracted.

The top contributor was electric vehicle (EV) company Tesla. We believe investors were encouraged by the recent stability in Tesla’s vehicle pricing following price reductions along with reports suggesting potential record vehicle deliveries. The company also announced that Model 3 and Y were eligible for U.S. tax credits, while China extended its EV tax benefits. The adoption of Tesla’s charging solutions by several competitors opened additional revenue opportunities. Finally, Tesla’s AI investments should benefit from recent advancements in the space.

Life sciences REIT Alexandria Real Estate Equities, Inc. was the top detractor due to investor concerns that rent growth may slow in Alexandria’s markets on declining demand combined with an increase in new buildings with vacancies coming online. We expect Alexandria’s portfolio to outperform the broader life sciences market given its differentiated cluster model and captive tenant base. We remain excited about Alexandria’s long-term prospects and view the current valuation as attractive.

We invest for the long term in businesses that we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic that this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

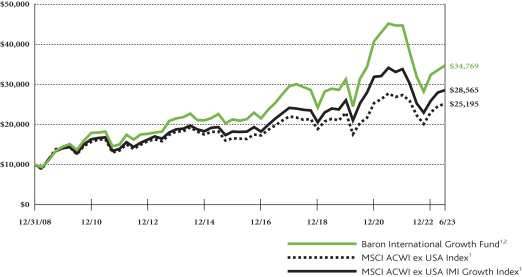

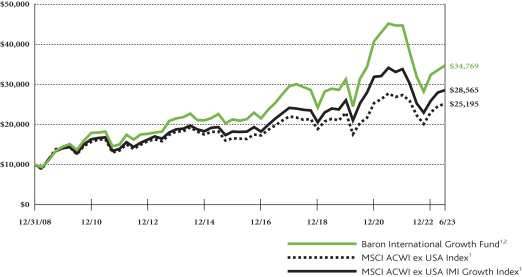

| Baron International Growth Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON INTERNATIONAL GROWTH FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWIEX USA INDEXANDTHE MSCI ACWIEX USA IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2008)^ | |

Baron International Growth Fund — Retail Shares1,2 | | | 7.18% | | | | 8.83% | | | | 3.39% | | | | 3.41% | | | | 6.68% | | | | 8.97% | |

Baron International Growth Fund — Institutional Shares1,2,3 | | | 7.33% | | | | 9.08% | | | | 3.65% | | | | 3.66% | | | | 6.95% | | | | 9.24% | |

Baron International Growth Fund — R6 Shares1,2,3 | | | 7.33% | | | | 9.08% | | | | 3.64% | | | | 3.65% | | | | 6.95% | | | | 9.24% | |

MSCI ACWI ex USA Index1 | | | 9.47% | | | | 12.72% | | | | 7.22% | | | | 3.52% | | | | 4.75% | | | | 6.58% | |

MSCI ACWI ex USA IMI Growth Index1 | | | 10.27% | | | | 12.90% | | | | 4.12% | | | | 3.83% | | | | 5.65% | | | | 7.51% | |

| † | The Fund’s 5-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 2, 2009. |

| 1 | The MSCI ACWI ex USA Index Net (USD) is designed to measure the equity market performance of large and mid cap securities across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. The MSCI ACWI ex USA IMI Growth Index Net (USD) is designed to measure the performance of large, mid and small cap growth securities exhibiting overall growth style characteristics across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| June 30, 2023 (Unaudited) | | Baron International Growth Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Linde plc | | | 2.5% | |

Meyer Burger Technology AG | | | 2.5% | |

argenx SE | | | 2.2% | |

AMG Critical Materials N.V. | | | 2.2% | |

AstraZeneca PLC | | | 2.2% | |

eDreams ODIGEO SA | | | 2.1% | |

Keyence Corporation | | | 2.1% | |

Arch Capital Group Ltd. | | | 2.1% | |

Industria de Diseno Textil, S.A. | | | 2.0% | |

Taiwan Semiconductor Manufacturing Company Limited | | | 2.0% | |

| |

| | | | 21.9% | |

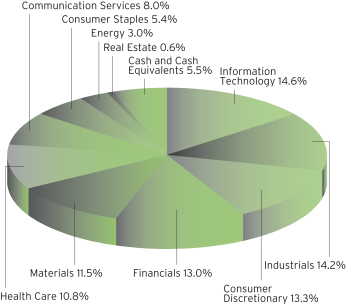

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron International Growth Fund1 increased 7.18%, underperforming the MSCI ACWI ex USA Index, which gained 9.47%.

Baron International Growth Fund is a diversified fund that invests for the long term primarily in securities of non-U.S. growth companies. The Fund expects to diversify among developed and developing countries throughout the world, although total exposure to developing countries will not exceed 35%. The Fund may purchase securities of companies of any size. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

International equities gained in the period. European equities advanced despite continued geopolitical challenges and a narrowly averted regional banking crisis. Japan emerged as a potential market leader as enhanced corporate governance and investor activism sparked improved returns on capital. China’s post-reopening recovery remained subdued, although we expect the recovery to accelerate as conditions normalize. Indian and Brazilian equities returned to leadership, a sign of rising market confidence that several central banks may be on the cusp of a rate cutting cycle — regardless of Federal Reserve action. We believe this unusual circumstance can be attributed to the scale of U.S. COVID-related stimulus and resulting inflation compared to a more constrained response elsewhere.

Spain, Japan, and Korea contributed the most. The top detractors were the U.K., China, and Germany.

Consumer Discretionary, Financials, and Information Technology contributed the most. Energy detracted slightly.

The top contributor was Japanese semiconductor company Renesas Electronics Corporation, driven by resilient revenue growth and margins despite an industry-wide cyclical slowdown. As a global leader in microcontrollers, analog, and power devices, we believe Renesas will be a major beneficiary of the secular growth of semiconductor content in automotive, industrial, data center, and IoT applications.

Software company WANdisco plc was the top detractor. On March 9, WANdisco unexpectedly disclosed “potentially fraudulent irregularities” in purchase orders, related revenue, and bookings allegedly involving a rogue senior sales employee and asked for shares to be suspended from trading. Pending further information and given that the company has temporarily suspended confidence in recently reported revenues and guidance, we marked down shares significantly.

With international equities trading near a 30-year valuation low relative to the U.S. and an improving relative economic and earnings outlook for the region, we think international equities may be poised for outperformance. Longer term, we believe international equities will benefit from the investment needed to fund deglobalization, supply-chain diversification, sustainability, and energy, commodity, and agricultural security. Further, we believe the 14-year U.S. dollar bull market is close to an end. As always, we are confident we have invested in well-positioned and well-managed companies with substantial long-term return potential.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

| Baron Real Estate Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI USA IMI EXTENDED REAL ESTATE INDEXAND MSCI US REIT INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2009)^ | |

Baron Real Estate Fund — Retail Shares1,2 | | | 14.86% | | | | 15.89% | | | | 12.06% | | | | 11.38% | | | | 10.53% | | | | 13.31% | |

Baron Real Estate Fund — Institutional Shares1,2 | | | 15.00% | | | | 16.21% | | | | 12.35% | | | | 11.67% | | | | 10.82% | | | | 13.60% | |

Baron Real Estate Fund — R6 Shares1,2,3 | | | 15.00% | | | | 16.21% | | | | 12.35% | | | | 11.67% | | | | 10.82% | | | | 13.61% | |

MSCI USA IMI Extended Real Estate Index1 | | | 12.11% | | | | 15.79% | | | | 11.90% | | | | 7.30% | | | | 8.86% | | | | 10.73% | |

MSCI US REIT Index1 | | | 4.78% | | | | (1.38)% | | | | 7.67% | | | | 3.34% | | | | 5.10% | | | | 7.82% | |

| ^ | Commencement of investment operations was January 4, 2010. |

| 1 | The MSCI USA IMI Extended Real Estate Index Net (USD) is an unmanaged custom index calculated by MSCI for, and as requested by, BAMCO, Inc. The index includes real estate and real estate-related GICS classified securities. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The MSCI US REIT Index Net (USD) is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

8

| | |

| June 30, 2023 (Unaudited) | | Baron Real Estate Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Toll Brothers, Inc. | | | 8.4% | |

Brookfield Corporation | | | 6.3% | |

Prologis, Inc. | | | 5.4% | |

CoStar Group, Inc. | | | 4.8% | |

Lennar Corporation | | | 4.6% | |

Equinix, Inc. | | | 4.4% | |

D.R. Horton, Inc. | | | 3.5% | |

Wynn Resorts, Limited | | | 3.4% | |

MGM Resorts International | | | 3.4% | |

Blackstone Inc. | | | 3.2% | |

| |

| | | | 47.3% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Real Estate Fund1 increased 14.86%, outperforming the MSCI USA IMI Extended Real Estate Index, which returned 12.11%.

Baron Real Estate Fund is a diversified fund that under normal circumstances, invests 80% of its net assets in real estate and real estate-related companies of all sizes, and in companies which, in the opinion of the Adviser, own significant real estate assets at the time of investment. The Fund seeks to invest in well-managed companies that we believe have significant long-term growth opportunities. The Fund’s investment universe extends beyond real estate investment trusts (REITs) to include hotels, senior housing operators, casino and gaming operators, tower operators, infrastructure-related companies and master limited partnerships, data centers, building products companies, real estate service companies, and real estate operating companies. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

U.S. equities rallied in the period, supported by easing inflation, a first-time pause in the Federal Reserve’s prolonged interest rate hike campaign, Congress’ successful avoidance of the debt ceiling cliff, earnings optimism, and economic releases bolstering the “soft landing” narrative. While the performance of REITs was more subdued given continued higher interest rates, the Fund’s benchmark was more in line with the overall market, as this index includes many non-REIT real estate-related companies.

Homebuilders & land developers, building products/services, and REITs were the top contributors. There were no significant category detractors.

Homebuilder Toll Brothers, Inc. was the top contributor on reports of improving business fundamentals, as demand for U.S. housing has remained robust and higher than consensus. New single-family home construction activity remains below the levels needed to meet demand following a decade of under-building. Toll Brothers is well positioned, in our view, to benefit from housing growth through its sizable land bank, healthy balance sheet, and market share gains against smaller players.

Jones Lang LaSalle Incorporated, a leading commercial real estate services provider, was the top detractor. Shares fell after the failures of several regional banks raised concerns that lending conditions would tighten and commercial real estate transaction activity would slow, both of which would negatively impact several of Jones Lang’s business lines. We take reassurance in Jones Lang’s healthy balance sheet and inexpensive valuation.

We think 2023 may emerge as a mirror image of 2022 in that many of last year’s headwinds reverse course and become tailwinds. Many real estate companies offer compelling return prospects that, in some cases, may include a trifecta combination of growth, dividends, and an improved valuation.

We believe we have assembled a portfolio of best-in-class competitively advantaged companies with compelling long-term growth and share price appreciation potential. We continue to believe the benefits of our broader and more flexible approach, which allows us to invest in both REITs and non-REIT real estate-related companies, will shine even brighter in the years ahead in part due to the new and evolving real estate landscape.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

| Baron Emerging Markets Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON EMERGING MARKETS FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI EM INDEXANDTHE MSCI EM IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2010)^ | |

Baron Emerging Markets Fund — Retail Shares1,2 | | | 6.40% | | | | 2.38% | | | | 0.11% | | | | 0.09% | | | | 3.42% | | | | 2.92% | |

Baron Emerging Markets Fund — Institutional Shares1,2 | | | 6.60% | | | | 2.66% | | | | 0.34% | | | | 0.34% | | | | 3.68% | | | | 3.18% | |

Baron Emerging Markets Fund — R6 Shares1,2,3 | | | 6.59% | | | | 2.66% | | | | 0.37% | | | | 0.34% | | | | 3.69% | | | | 3.19% | |

MSCI EM Index1 | | | 4.89% | | | | 1.75% | | | | 2.32% | | | | 0.93% | | | | 2.95% | | | | 1.24% | |

MSCI EM IMI Growth Index1 | | | 4.50% | | | | 1.24% | | | | 0.17% | | | | 1.07% | | | | 3.82% | | | | 2.18% | |

| † | The Fund’s 3- and 5-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 3, 2011. |

| 1 | The MSCI EM (Emerging Markets) Index Net (USD) is designed to measure equity market performance of large and mid-cap securities across 24 Emerging Markets countries. The MSCI EM (Emerging Markets) IMI Growth Index Net (USD) is a free float-adjusted market capitalization index designed to measure equity market performance of large, mid and small-cap securities exhibiting overall growth characteristics across 24 Emerging Markets countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2033 unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

10

| | |

| June 30, 2023 (Unaudited) | | Baron Emerging Markets Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing Company Limited | | | 6.0% | |

Samsung Electronics Co., Ltd. | | | 4.7% | |

Tencent Holdings Limited | | | 3.8% | |

Alibaba Group Holding Limited | | | 3.7% | |

HD Korea Shipbuilding & Offshore Engineering Co., Ltd. | | | 2.4% | |

Bajaj Finance Limited | | | 2.2% | |

HDFC Bank Limited | | | 2.2% | |

Suzano S.A. | | | 1.9% | |

Delta Electronics, Inc. | | | 1.9% | |

PT Bank Rakyat Indonesia (Persero) Tbk | | | 1.8% | |

| |

| | | | 30.7% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Emerging Markets Fund1 increased 6.40%, outperforming the MSCI EM Index, which increased 4.89%.

Baron Emerging Markets Fund is a diversified fund that invests for the long term primarily in companies of any size with their principal business activities or trading markets in developing countries. The Fund may invest up to 20% of its net assets in developed and frontier countries. The Fund seeks to invest in companies with significant long-term growth prospects and purchase them at prices we believe to be favorable. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

While emerging markets (EM) equities gained in the period, they lagged their developed market counterparts. China’s post-COVID reopening recovery remained subdued. We expect the recovery to accelerate as conditions normalize and President Xi’s new team pushes for an economic rebound. Indian equities returned to leadership, as the economic and earnings expansion in the country continued. Brazil also saw significant gains, and we view the recent strength in India and Brazil as a manifestation of rising confidence that several EM central banks are on the cusp of a rate cutting cycle — regardless of Federal Reserve action. We believe this unusual circumstance can be attributed to the scale of U.S. COVID-related stimulus and resulting inflation compared to a more constrained response elsewhere.

On a country basis, Taiwan, Korea, and India were the top contributors. China, Hong Kong, and Italy detracted the most.

Financials, Information Technology, and Industrials contributed the most. Consumer Discretionary, Health Care, and Energy detracted the most.

Taiwan Semiconductor Manufacturing Company Limited was the top contributor. Shares of this semiconductor company rose on easing geopolitical concerns and expectations for end-demand recovery. We believe Taiwan Semi’s technological leadership, pricing power, and exposure to secular growth markets, including high-performance computing, artificial intelligence (AI), automotive, 5G, and IoT, will allow the company to sustain strong earnings growth over the next several years.

Think & Learn Private Limited, the parent entity of “Byju’s — the Learning App,” was the top detractor as COVID-related tailwinds that benefited online/digital education slowed. In addition, Byju’s announced that Deloitte had resigned as its auditor along with three investor-appointed Directors. These material adverse events required us to adjust down our stake’s fair market value. While disappointed, we believe that, as India’s largest education technology player, the company will benefit from structural growth in online education services in the country.

With EM near a 30-year valuation low relative to the U.S. and an improving relative economic and earnings outlook, we think EM equities are poised for outperformance. Longer term, we believe EM will benefit from the investment needed to fund deglobalization, supply-chain diversification, sustainability, and energy, commodity, and agricultural security; India’s productivity initiatives; and China’s pivot to value-added economic activity. Further, we believe the 14-year U.S. dollar bull market is near an end. As always, we are confident we have invested in well-positioned and well-managed companies with substantial long-term return potential.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

| Baron Global Advantage Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GLOBAL ADVANTAGE FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWI INDEXANDTHE MSCI ACWI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2012) | |

Baron Global Advantage Fund — Retail Shares1,2 | | | 16.28% | | | | 7.63% | | | | (9.17)% | | | | 4.59% | | | | 10.58% | | | | 10.05% | |

Baron Global Advantage Fund — Institutional Shares1,2 | | | 16.43% | | | | 7.91% | | | | (8.94)% | | | | 4.86% | | | | 10.83% | | | | 10.30% | |

Baron Global Advantage Fund — R6 Shares1,2,3 | | | 16.46% | | | | 7.91% | | | | (8.94)% | | | | 4.87% | | | | 10.84% | | | | 10.30% | |

MSCI ACWI Index1 | | | 13.93% | | | | 16.53% | | | | 10.99% | | | | 8.10% | | | | 8.75% | | | | 8.85% | |

MSCI ACWI Growth Index1 | | | 24.25% | | | | 23.05% | | | | 9.57% | | | | 10.45% | | | | 11.00% | | | | 10.67% | |

| † | The Fund’s, 3-, 5-, and 10-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The MSCI ACWI Index Net is designed to measure the equity market performance of large and midcap securities across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. The MSCI ACWI Growth Index Net is designed to measure the equity market performance of large and mid cap securities exhibiting overall growth style characteristics across 23 Developed Markets (DM) countries and 24 Emerging Markets (EM) countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

| June 30, 2023 (Unaudited) | | Baron Global Advantage Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

NVIDIA Corporation | | | 7.8% | |

MercadoLibre, Inc. | | | 7.1% | |

Shopify Inc. | | | 5.9% | |

Snowflake Inc. | | | 5.3% | |

Bajaj Finance Limited | | | 4.6% | |

CrowdStrike Holdings, Inc. | | | 4.4% | |

Endava plc | | | 4.3% | |

Tesla, Inc. | | | 4.2% | |

Coupang, Inc. | | | 3.8% | |

Adyen N.V. | | | 3.5% | |

| |

| | | | 51.0% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Global Advantage Fund1 increased 16.28%, outperforming the MSCI ACWI Index, which increased 13.93%.

The Fund is a diversified fund that, under normal circumstances, invests primarily in equity securities of companies throughout the world, with capitalizations within the range of companies included in the MSCI ACWI Index. At all times, the Fund will have investments in equity securities of companies in at least three countries outside the U.S. Under normal conditions, at least 40% of net assets will be invested in stocks of companies outside the U.S. (at least 30% if non-U.S. market conditions are not favorable). The Adviser seeks to invest in businesses it believes have significant opportunities for growth, durable competitive advantages, exceptional management, and an attractive valuation. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

The U.S., Canada, and Argentina contributed the most. The U.K., India, and China detracted the most.

Information Technology, Consumer Discretionary, and Health Care contributed the most. Communication Services detracted.

Semiconductor company NVIDIA Corporation was the top contributor. Shares nearly tripled in the period after NVIDIA reported a meaningful acceleration in demand for its data center GPUs, which drove a material beat in guidance with revenues projected to increase from $7.2 billion to $11 billion sequentially. This unprecedented acceleration is driven by growing demand due to the rise in generative artificial intelligence (AI). We believe NVIDIA’s end-to-end AI platform and the ecosystem it has cultivated over the last 15 years will benefit the company for years to come.

Think & Learn Private Limited, the parent entity of “Byju’s — the Learning App,” was the top detractor as COVID-related tailwinds that benefited online/digital education slowed. In addition, Byju’s announced that Deloitte had resigned as its auditor along with three investor-appointed Directors. These material adverse events required us to adjust down our stake’s fair market value. While disappointed, we believe that, as India’s largest education technology player, the company will benefit from structural growth in online education services in the country.

Every day we live and invest in an uncertain world. The constant challenges we face are real and serious, with clearly uncertain outcomes. History would suggest that most will prove passing or manageable. The business of capital allocation (or investing) is the business of taking risk, managing the uncertainty, and taking advantage of the long-term opportunities that those risks and uncertainties create. We are optimistic about the long-term prospects of the companies in which we are invested and continue to search for new ideas and investment opportunities while remaining patient and investing only when we believe the target companies are trading at attractive prices relative to their intrinsic values.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

| Baron Real Estate Income Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE INCOME FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI US REIT INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception

December 29,

2017)^ | |

Baron Real Estate Income Fund — Retail Shares1,2 | | | 8.02% | | | | (1.19)% | | | | 7.73% | | | | 8.39% | | | | 7.55% | |

Baron Real Estate Income Fund — Institutional Shares1,2 | | | 8.19% | | | | (0.94)% | | | | 8.05% | | | | 8.63% | | | | 7.79% | |

Baron Real Estate Income Fund — R6 Shares1,2 | | | 8.12% | | | | (1.01)% | | | | 8.05% | | | | 8.60% | | | | 7.78% | |

MSCI US REIT Index1 | | | 4.78% | | | | (1.38)% | | | | 7.67% | | | | 3.34% | | | | 3.13% | |

| ^ | Commencement of investment operations was January 2, 2018. |

| 1 | The MSCI US REIT Index Net (USD) is an unmanaged free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The index and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The index is unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

14

| | |

| June 30, 2023 (Unaudited) | | Baron Real Estate Income Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Prologis, Inc. | | | 9.9% | |

Equinix, Inc. | | | 8.9% | |

Welltower Inc. | | | 6.5% | |

Digital Realty Trust, Inc. | | | 6.2% | |

Invitation Homes, Inc. | | | 5.5% | |

AvalonBay Communities, Inc. | | | 5.0% | |

American Homes 4 Rent | | | 4.5% | |

Rexford Industrial Realty, Inc. | | | 3.8% | |

Brookfield Corporation | | | 3.7% | |

Toll Brothers, Inc. | | | 3.5% | |

| |

| | | | 57.5% | |

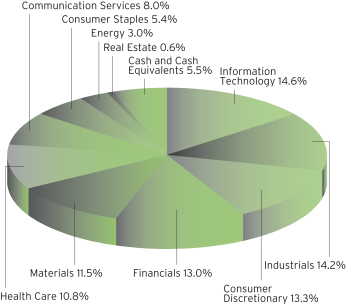

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Real Estate Income Fund1 increased 8.02%, outperforming the MSCI US REIT Index, which increased 4.78%.

Baron Real Estate Income Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in real estate income-producing securities and other real estate securities of any market capitalization, including common stocks

and equity securities, debt and preferred securities, non-U.S. real estate income-producing securities, and any other real estate-related yield securities. The Fund is likely to maintain a significant portion of its assets in real estate investment trusts (REITs). REITs pool money to invest in properties (equity REITs) or mortgages (mortgage REITs), and their revenue primarily consists of rent derived from owned, income-producing real estate properties, and capital gains from the sale of such properties. The Fund generally invests in equity REITs. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

U.S. equities rallied in the period, supported by easing inflation, a pause in the Federal Reserve’s interest rate hike campaign, Congress’ successful avoidance of the debt ceiling cliff, earnings optimism, and economic releases bolstering the “soft landing” narrative. REITs, however, lagged the overall market on continued higher interest rates, which raise the cost of the debt many REITs use to fund acquisitions and development projects while prompting income-oriented investors to rotate money from REITs into fixed income instruments.

Industrial REITs, non-REIT real estate companies, and data center REITs were the top contributors. Hotel REITs and other REITs detracted slightly.

Data center REIT Equinix, Inc. was the top contributor. Shares increased on results that beat consensus, including a robust multi-year growth outlook and strong demand and bookings as companies accelerate digital transformation. We retain conviction in Equinix due to a long demand runway behind cloud adoption and IT outsourcing, its unique ability to offer a global platform, and continued execution on strategic M&A transactions to enhance its moat.

Senior housing operator Ventas, Inc. was the top detractor. Shares fell on increasing concern over Ventas’ ability to take advantage of the external growth opportunity combined with a credit impairment and unfavorable resolution of a smaller mezzanine investment. We believe Ventas’ operations will continue to inflect positively in the years to come given the favorable supply/demand backdrop and increasing growth of the 80-year-old-plus population.

We think 2023 may emerge as a mirror image of 2022 in that many of last year’s headwinds reverse course and become tailwinds. Many real estate companies offer compelling return prospects that, in some cases, may include a trifecta combination of growth, dividends, and an improved valuation.

Further, we believe the benefits of our broader and more flexible approach that prioritizes a full array of REITs while also investing in non-REIT income-oriented real estate companies will shine even brighter in the new and evolving real estate landscape.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects the results of Retail Shares. |

15

| | |

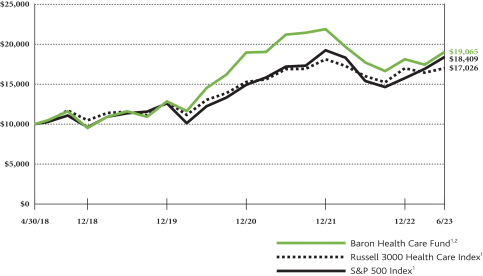

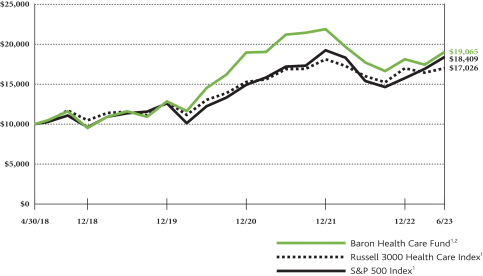

| Baron Health Care Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON HEALTH CARE FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 HEALTH CARE INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception

April 30,

2018) | |

Baron Health Care Fund — Retail Shares1,2 | | | 5.09% | | | | 7.58% | | | | 9.50% | | | | 12.71% | | | | 13.30% | |

Baron Health Care Fund — Institutional Shares1,2 | | | 5.14% | | | | 7.85% | | | | 9.76% | | | | 12.98% | | | | 13.58% | |

Baron Health Care Fund — R6 Shares1,2 | | | 5.20% | | | | 7.85% | | | | 9.76% | | | | 13.00% | | | | 13.58% | |

Russell 3000 Health Care Index1 | | | 0.06% | | | | 6.34% | | | | 9.31% | | | | 10.49% | | | | 10.85% | |

S&P 500 Index1 | | | 16.89% | | | | 19.59% | | | | 14.60% | | | | 12.31% | | | | 12.54% | |

| 1 | The Russell 3000® Health Care Index is an unmanaged index representative of companies involved in medical services or health care in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies as determined by total market capitalization. The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell 3000® Health Care Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

16

| | |

| June 30, 2023 (Unaudited) | | Baron Health Care Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

UnitedHealth Group Incorporated | | | 8.6% | |

Eli Lilly and Company | | | 7.7% | |

Intuitive Surgical, Inc. | | | 4.9% | |

Merck & Co., Inc. | | | 4.8% | |

Thermo Fisher Scientific Inc. | | | 4.4% | |

Vertex Pharmaceuticals Incorporated | | | 3.8% | |

DexCom, Inc. | | | 3.7% | |

Inspire Medical Systems, Inc. | | | 3.0% | |

The Cooper Companies, Inc. | | | 2.9% | |

HCA Healthcare, Inc. | | | 2.6% | |

| |

| | | | 46.4% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron Health Care Fund1 increased 5.09%, outperforming the Russell 3000 Health Care Index, which increased 0.06%.

Baron Health Care Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in equity securities of companies engaged in the research, development, production, sale, delivery, or distribution of products and services related to the health care industry. The Fund’s allocation among the

sub-industries of the Health Care sector will vary depending upon the relative potential the Fund sees within each area. The Adviser seeks to invest in businesses it believes have significant growth opportunities, durable competitive advantages, exceptional management, and attractive valuations. The Fund may purchase securities of companies of any market capitalization and may invest in non-U.S. stocks. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

Health Care was flat for the period. Relative underperformance was driven largely by rotation to higher growth sectors and stocks as Health Care is generally considered a defensive play. Meanwhile, health care demand has begun to normalize, driven by pent-up need for medical care as COVID has shifted from pandemic to endemic status and fewer constraints on labor and supply-related capacity. While this increase in demand is a headwind for managed care companies, it is a tailwind for health care providers and medical device companies. Biotechnology stocks lagged due to a more difficult funding environment.

The pharmaceuticals, health care equipment, and life sciences tools & services sub-industries contributed the most. Managed health care and health care services detracted.

Eli Lilly and Company was the top contributor. Shares of this global pharmaceutical company rose on optimism about its new product pipeline, including Mounjaro for diabetes and obesity and Donanemab for Alzheimer’s disease. Lilly has a healthy base business with limited near-term patent expirations, a strong pipeline, and potential for significant margin expansion, which should translate to strong revenue and earnings growth.

Leading health care franchise UnitedHealth Group Incorporated was the top detractor. Shares fell alongside other managed care companies. Despite solid results and 2023 guidance within its long-term earnings goal, shares were pressured by proposed changes to the Medicare audit program, preliminary 2024 Medicare Advantage (MA) rates, and the impact of Medicaid recertification. We believe UnitedHealth is the best-positioned managed care player, with a leading franchise in MA, the market’s fastest growing segment. We expect strong growth and profitability, driven by positive demographic trends, effective cost management, industry-leading technology investments, enhanced expertise in population health, and a growing portfolio of providers.

The Health Care sector has many favorable long-term attributes. Valuations are attractive, balance sheets are generally in good shape, and we are in a transformational period with major advances in science, medicine, and technology. We focus on identifying high-quality, competitively advantaged companies with great management teams that we believe will benefit from the secular trends we have identified.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

17

| | |

| Baron FinTech Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FINTECH FUND† (RETAIL SHARES)

INRELATIONTOTHE FACTSET GLOBAL FINTECH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Three

Years | | | Since

Inception

December 31,

2019^ | |

Baron FinTech Fund — Retail Shares1,2 | | | 10.28% | | | | 13.67% | | | | 2.43% | | | | 6.34% | |

Baron FinTech Fund — Institutional Shares1,2 | | | 10.38% | | | | 13.96% | | | | 2.67% | | | | 6.59% | |

Baron FinTech Fund — R6 Shares1,2 | | | 10.38% | | | | 13.86% | | | | 2.67% | | | | 6.59% | |

FactSet Global FinTech Index1 | | | 14.50% | | | | 12.82% | | | | (0.53)% | | | | (0.41)% | |

S&P 500 Index1 | | | 16.89% | | | | 19.59% | | | | 14.60% | | | | 11.39% | |

| † | The Fund’s 3-year historical performance was impacted by gains from IPOs and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 2, 2020. |

| 1 | The FactSet Global FinTech Index™ is an unmanaged and equal-weighted index that measures the equity market performance of companies engaged in Financial Technologies, primarily in the areas of software and consulting, data, and analytics, digital payment processing, money transfer, and payment transactional-related hardware across 30 developed and emerging markets. The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the FactSet Global Fintech Index™ and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. As of February 3, 2023, the Fund has changed its primary benchmark from the S&P 500 Index to the FactSet Global FinTech Index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

18

| | |

| June 30, 2023 (Unaudited) | | Baron FinTech Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Visa Inc. | | | 5.1% | |

Mastercard Incorporated | | | 5.0% | |

S&P Global Inc. | | | 5.0% | |

Intuit Inc. | | | 4.6% | |

Fair Isaac Corporation | | | 3.6% | |

Accenture plc | | | 3.5% | |

LPL Financial Holdings Inc. | | | 3.3% | |

Fiserv, Inc. | | | 3.2% | |

MercadoLibre, Inc. | | | 3.2% | |

The Progressive Corporation | | | 3.2% | |

| |

| | | | 39.8% | |

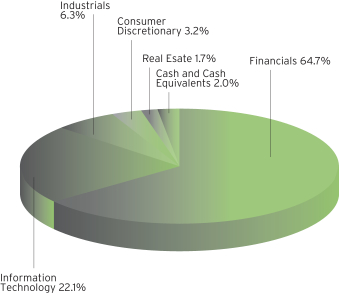

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the six months ended June 30, 2023, Baron FinTech Fund1 increased 10.28%, underperforming the FactSet Global FinTech Index, which increased 14.50%.2

Baron FinTech Fund is a non-diversified fund that invests in companies of any market capitalization that develop or use innovative technologies related in a significant way to financial services. The Fund invests principally in U.S. securities but may invest up to 25% in non-U.S. securities. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

U.S. equities rallied during the period, supported by easing inflation, a first-time pause in the Federal Reserve’s prolonged interest rate hike campaign, Congress’ successful avoidance of the debt ceiling cliff, earnings optimism, and economic releases bolstering the “soft landing” narrative. One notable aspect of the recovery was the narrow market leadership. Seven mega-cap technology companies accounted for much of the recent gains in the major market indexes, driven by excitement surrounding their potential ability to gain from widespread adoption of artificial intelligence.

Financials, Information Technology, and Industrials contributed the most. No sector detracted.

Fair Isaac Corporation, a data and analytics company focused on predicting consumer behavior, contributed the most on solid earnings results and raised guidance. CEO Will Lansing expressed confidence the business can hold up across various macro backdrops and sounded particularly excited about momentum in the software business. We believe Fair Isaac will be a steady earnings compounder, which should drive solid returns over a multi-year period.

The top detractor was online brokerage firm The Charles Schwab Corp. Shares fell sharply following the March bankruptcy of Silicon Valley Bank (SVB) and the resulting weakness in regional banks. Despite running a much different business than SVB, Schwab faced deposit pressure through cash sorting in the wake of the collapse. We retain long-term conviction. Shares have since partially recovered. We are encouraged by Schwab’s exceptional client loyalty, robust organic growth, and industry-leading operating expense per client assets.

We have curated a diversified portfolio of fintech businesses to reduce the exposure to any single economic outcome. The portfolio is balanced across seven themes, each of which is influenced by idiosyncratic factors. We include a mix of Leaders and Challengers, with the relative mix driven by top-down risk considerations and bottom-up opportunities. We believe fintech remains in the early innings of growth as incumbent financial institutions still have a long digitization journey ahead and younger consumers continue favoring digital solutions.

| * | Individual weights may not sum to displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. Individual weights may not sum to 100% due to rounding. |

| 1 | Performance information reflects results of the Retail Shares. |

| 2 | As of February 3, 2023, the Fund has changed its primary benchmark from the S&P 500 Index to the FactSet Global FinTech Index. |

19

| | |

| Baron New Asia Fund (Unaudited) | | June 30, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON NEW ASIA FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI AC ASIAEX JAPAN INDEXAND MSCI AC ASIAEX JAPAN IMI GROWTH INDEX

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED JUNE 30, 2023 | |

| | | Six

Months* | | | One

Year | | | Since

Inception

July 30,

2021 | |

Baron New Asia Fund — Retail Shares1,2 | | | 5.00% | | | | (1.89)% | | | | (12.33)% | |

Baron New Asia Fund — Institutional Shares1,2 | | | 4.98% | | | | (1.76)% | | | | (12.16)% | |

Baron New Asia Fund — R6 Shares1,2 | | | 4.97% | | | | (1.76)% | | | | (12.10)% | |

MSCI AC Asia ex Japan Index1 | | | 3.03% | | | | (1.15)% | | | | (10.92)% | |

MSCI AC Asia ex Japan IMI Growth Index1 | | | 2.83% | | | | (1.68)% | | | | (13.92)% | |

| 1 | The MSCI AC Asia ex Japan Index Net (USD) measures the performance of large and mid cap equity securities representation across 2 of 3 developed markets countries (excluding Japan) and 8 emerging markets countries in Asia. The MSCI AC Asia ex Japan IMI Growth Index Net (USD) measures the performance of large, mid, and small cap securities exhibiting overall growth style characteristics across 2 of 3 developed markets countries (excluding Japan) and 8 emerging market countries in Asia. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2033, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

20

| | |

| June 30, 2023 (Unaudited) | | Baron New Asia Fund |

TOP TEN HOLDINGSASOF JUNE 30, 2023

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing Company Limited | | | 6.8% | |

Samsung Electronics Co., Ltd. | | | 5.1% | |

Tencent Holdings Limited | | | 4.3% | |

Alibaba Group Holding Limited | | | 3.6% | |

Bajaj Finance Limited | | | 3.1% | |

HDFC Bank Limited | | | 2.9% | |

Reliance Industries Limited | | | 2.4% | |

HD Korea Shipbuilding & Offshore Engineering Co., Ltd. | | | 2.1% | |

Godrej Consumer Products Limited | | | 2.1% | |

Yum China Holdings Inc. | | | 2.0% | |

| |

| | | | 34.6% | |

SECTOR BREAKDOWNASOF JUNE 30, 2023†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

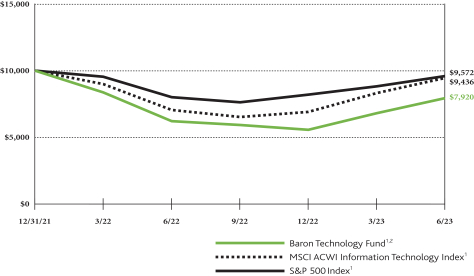

For the six months ended June 30, 2023, Baron New Asia Fund1 increased 5.00%, outperforming the MSCI AC Asia ex Japan Index, which increased 3.03%.