Exhibit 99.1

Vermilion Energy Inc. Announces Strategic Deep Basin Acquisition

CALGARY, AB, Dec. 23, 2024 /CNW/ - Vermilion Energy Inc. ("Vermilion", or the "Company") (TSX: VET) (NYSE: VET) is pleased to announce it has entered into an arrangement agreement (the "Arrangement Agreement") to acquire Westbrick Energy Ltd. ("Westbrick"), a privately held oil and gas company operating in the Deep Basin, for total consideration of $1.075 billion by way of a plan of arrangement under the Business Corporations Act (Alberta) (the "Acquisition"), expected to close in Q1 2025(1).

"The strategic acquisition of Westbrick represents a significant step forward in Vermilion's North American high-grading initiative to increase operational scale and enhance full-cycle margins in the liquids-rich Deep Basin," commented Dion Hatcher, President and CEO of Vermilion. "The Deep Basin is an area Vermilion has been operating in for nearly three decades and is currently the largest producing asset in the Company. The Acquisition adds 50,000 boe/d of stable production and approximately 1.1 million (770,000 net) acres of land from which Vermilion has identified over 700 drilling locations, providing a robust inventory to keep production flat for over 15 years while generating significant free cash flow to enhance the Company's long-term return of capital framework."

The Acquisition enhances depth and quality of Vermilion's Deep Basin inventory and complements the Company's high-growth, liquids-rich Montney asset. Vermilion's Canadian liquids-rich gas assets, combined with over 100 mmcf/d of high-netback, low-decline European natural gas production provides the Company with a premium realized natural gas price. Vermilion is committed to strategically growing its international assets both organically, as demonstrated by recent successes in Germany and Croatia, and via acquisitions. In the near term, the Company will focus on operational execution, debt reduction, return of capital, and further high-grading of assets within its portfolio, including non-core asset sales, to enhance long-term shareholder value.

Acquisition Highlights

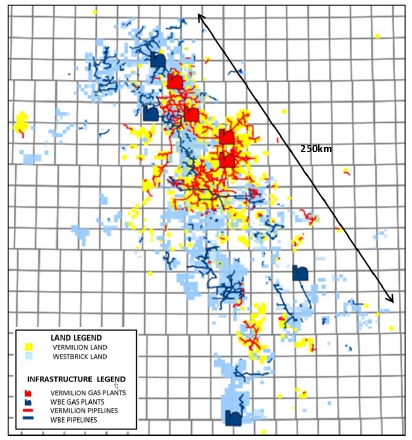

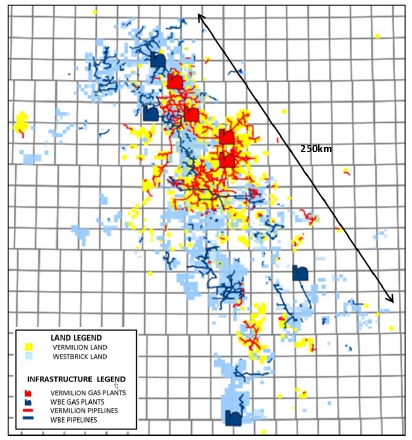

| • | Approximately 1.1 million (770,000 net) acres of land and four operated gas plants with total capacity of 102 mmcf/d in the southeast portion of the Deep Basin trend in Alberta. This footprint is contiguous and complementary to Vermilion's legacy Deep Basin assets providing significant operational and financial synergies, including: capital efficiency improvements, infrastructure optimization, gas marketing opportunities, and other corporate synergies. These synergies have not been factored into the economic evaluation but are expected to be realized over time. The Acquisition excludes undeveloped Duvernay rights on approximately 300,000 (290,000 net) acres of land which will be retained by the shareholders of Westbrick. |

| • | Stable annual production of 50,000 boe/d (75% gas and 25% liquids) expected in 2025(2), based on Vermilion's development plans. This production level represents 5% year-over-year growth and is forecast to generate more than $110 million of annual free cash flow ("FCF")(2,4) based on forward commodity prices(5). Revenue from the acquired assets will be derived approximately 50% from liquids and 50% from gas. In conjunction with the Acquisition, Vermilion plans to actively and opportunistically hedge gas production to mitigate financial risk. |

| • | 2025E annual net operating income of $275 million based on forward prices(5) translates into an NOI multiple of approximately 3.9x. The multiple compresses to 3.3x in 2026 as net operating income is forecast to increase to $330 million based on forward pricing(5). |

| • | Significant, high-quality drilling inventory adds over 700 locations in the Ellerslie, Notikewin, Rock Creek, Falher, Cardium, Wilrich and Niton formations, with half-cycle IRRs ranging from 40% to over 100% based on estimates provided by McDaniel & Associates Consultants Ltd ("McDaniel")(6) and using three consultant average October 1, 2024 pricing assumptions(6). |

| • | Proved developed producing ("PDP") and proved plus probable ("2P") reserves estimated at 92 million boe (75% gas) and 256 million boe (74% gas), respectively, based on McDaniel estimates(6). The acquisition price per boe of PDP reserves is $11.70, which translates to an implied recycle ratio of 1.3 times based on 2025 forecasted operating netbacks and 1.5 times based on 2026 forecasted operating netbacks, as noted above. Approximately 30% of the over 700 identified drilling locations have been included in the reserves estimates. |

| • | Before-tax PDP reserve net present value at a 10% discount rate is estimated at $1.0 billion based on McDaniel estimates(6) and using three consultant average October 1, 2024 pricing assumptions(6). This value represents over 90% of the purchase price, implying significant upside value associated with probable reserves and unbooked locations. |

| • | Vermilion's significant debt reduction efforts over the past five years, totaling over $1 billion since 2020, created the balance sheet capacity to execute this long-duration, strategic acquisition, yielding a 15% increase in excess free cash flow ("EFCF")(4) per share in 2025. The Company will continue its disciplined efforts on balance sheet management and capital allocation to ensure debt targets are reached in a timely fashion. |

Contiguous Land Position

Contiguous Land Position (CNW Group/Vermilion Energy Inc.)

Transaction Details

Pursuant to the Acquisition, Vermilion will acquire all of the issued and outstanding shares of Westbrick (the "Westbrick Shares"), including any securities convertible into Westbrick Shares that are exercised prior to or in conjunction with the closing of the Acquisition (the "Closing"). Holders of Westbrick Shares, including any securities convertible into Westbrick Shares that are exercised prior to or in conjunction with Closing, will be provided with the option to elect prior to Closing to receive up to a maximum of 1.7 million Vermilion common shares not to exceed $25 million in value based on Vermilion's five-day volume weighted average trading price on the Toronto Stock Exchange, immediately prior to execution of the Arrangement Agreement. Certain shareholders of Westbrick (the "Supporting Shareholders"), representing in excess of 90% of the Westbrick shares outstanding, have already executed a written resolution approving the arrangement. The Supporting Shareholders have also entered into voting support agreements agreeing not to change their approval of the arrangement as shareholders.

The Acquisition will be funded through Vermilion's undrawn $1.35 billion revolving credit facility. In connection with the Acquisition, Vermilion has also entered into a new fully underwritten $250 million term loan maturing May 2028 through a debt commitment letter with TD Securities Inc. (acting as underwriter) and a new fully underwritten US$300 million bridge facility through a debt commitment letter with Royal Bank of Canada and TD Securities Inc. Upon Closing, Vermilion is expected to have net debt(7) of $2.0 billion with a pro forma year-end 2025 net debt to fund flows from operations ("FFO") ratio(8) of 1.5 times and liquidity of approximately $500 million. In addition to allocating a portion of FCF to debt reduction, Vermilion will also initiate a process to identify and execute non-core asset divestments in order to accelerate debt reduction and further high-grade the portfolio, with the objective of reducing the net debt to FFO ratio to the targeted range of 1.0 times or less.

Pro Forma Outlook - A Global Gas Producer

Upon Closing, Vermilion will be an approximately 135,000 boe/d entity with greater than 80% of its production derived from its global gas franchise, consisting of liquids-rich gas in Alberta and BC and gas-weighted production in Ireland, Germany, Netherlands and Croatia. Assuming the Acquisition closes mid-Q1 2025, Vermilion anticipates corporate 2025 production to be in the range of 126,000 to 133,000 boe/d with capital expenditures expected to be in the range of $725 to 775 million. Inclusive of the incremental capital being allocated to the newly acquired Deep Basin assets, the aggregate capital investment into Vermilion's global gas portfolio will represent over 70% of total capital for 2025.

Based on a mid-Q1 2025 close and forward commodity prices(5), including the impact from the current hedge position which covers approximately 25% of 2025 production, Vermilion forecasts pro forma 2025 FFO of $1.2 billion (~$7.80 per share)(3) and FCF of approximately $450 million (~$2.90 per share)(4). Based on this forecast, the Company expects to exit 2025 with net debt(7) of approximately $1.8 billion representing a net debt to FFO ratio(8) of 1.5 times. On a pro forma basis, the Company will target a return of capital ("ROC") payout of 40% of EFCF until net debt reaches an appropriate level, at which time we will increase the payout back to 50%. The absolute amount of capital returned to shareholders at the pro forma target is expected to be equivalent to our base business with a 50% ROC payout. Over the long-term, the Acquisition is expected to increase the amount of capital available for shareholder returns. Vermilion plans to provide an updated 2025 budget and financial guidance upon Closing.

Pro Forma Highlights

| • | Dominant Deep Basin Position: Vermilion will have over 1.1 million net acres of land in the Deep Basin, where the Company has been operating for nearly three decades, with current production over 75,000 boe/d. Vermilion becomes the fifth largest Deep Basin producer, enhancing its operational scale to further reduce costs and improve capital efficiencies. |

| • | High-Graded Asset Base with Enhanced Inventory: Acquired assets will immediately attract capital and allow for near-term high-grading within Vermilion's pro forma development plans in the Deep Basin while providing an enhanced inventory capable of holding production flat for over 15 years. |

| • | Enhanced Long-term Return of Capital: Equivalent absolute return of capital in the near-term and materially positive to shareholder return of capital in the medium and long-term. |

| • | Accretive and Synergistic: Immediately improved FFO and EFCF per share, expect to supplement with achievable financial and operating synergies. |

| • | A Global Gas Producer: Upon closing of the Acquisition, Vermilion will be an approximately 135,000 boe/d entity with greater than 80% of its production derived from its global gas franchise, consisting of approximately 550 mmcfe/d of liquids-rich gas in Alberta and BC and over 100 mmcf/d of European gas with direct exposure to LNG pricing, resulting in premium realized gas prices. |

Advisors

TD Securities Inc. is acting as exclusive financial advisor to Vermilion with respect to the Acquisition. Dentons Canada LLP is acting as legal counsel to Vermilion with respect to the Acquisition. RBC Capital Markets and Scotiabank are acting as joint financial advisors to Westbrick with respect to the transaction. Osler, Hoskin & Harcourt LLP is acting as legal counsel to Westbrick with respect to the transaction.

Conference Call

Vermilion will host a conference call and webcast presentation on Monday, December 23, 2024, starting at 7:00 AM MST (9:00 AM EST) to discuss the Acquisition. To participate, call 1-888-510-2154 (Canada and US Toll Free) or 1-437-900-0527 (International and Toronto Area). A recording of the conference call will be available for replay by calling 1-888-660-6345 (Canada and US Toll Free) or 1-289-819-1450 (International and Toronto Area) and using conference replay entry code 04399# from December 23, 2024, at 10:00 AM MST to January 6, 2025, at 10:00 AM MST.

To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/4iOkvwk to receive an instant automated call back. You may also access the webcast at https://app.webinar.net/D6o37N5qYxL. The webcast links, along with conference call slides, will be available on Vermilion's website at https://www.vermilionenergy.com/invest-with-us/events-presentations/ under Upcoming Events prior to the conference call.

| 1. | The Arrangement Agreement contains customary representations, warranties, interim operational covenants of each party and customary closing conditions, including receipt of applicable shareholder, court and other regulatory approvals. |

| 2. | Anticipated 2025 production and financial results from acquired assets, based on company estimates and full year average reference prices as at November 21, 2024 (see below). Results reflect full year production and cash flow estimates and may not align with Company guidance following the close of the transaction, which will reflect post-close production and cash flow contributions. |

| 3. | Fund flows from operations (FFO) is a total of segments measure comparable to net earnings (loss) that is comprised of sales less royalties, transportation, operating, G&A, corporate income tax, PRRT, windfall taxes, interest expense, equity based compensation settled in cash, realized gain (loss) on derivatives, realized foreign exchange gain (loss), and realized other income (expense). The measure is used to assess the contribution of each business unit to Vermilion's ability to generate income necessary to pay dividends, repay debt, fund asset retirement obligations, and make capital investments. FFO does not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Per share amounts are supplementary financial measures and are not standardized financial measures under IFRS, and therefore may not be comparable to similar measures disclosed by other issuers. They are calculated using FFO (a total of segments measure) and weighted average basic shares outstanding. The measure is used to assess the contribution per share of each business unit. |

| 4. | Free cash flow (FCF) and excess free cash flow (EFCF) are non-GAAP financial measures comparable to cash flows from operating activities. FCF is comprised of FFO less drilling and development and exploration and evaluation expenditures and EFCF is FCF less payments on lease obligations and asset retirement obligations settled. FCF and EFCF per basic share are non-GAAP supplementary financial measures and are not standardized financial measures under IFRS and may not be comparable to similar measures disclosed by other issuers. They are calculated using FCF or EFCF and weighted average basic shares outstanding. |

| 5. | 2025 forward strip pricing as at November 21, 2024: Brent US$72.31/bbl; WTI US$68.49/bbl; LSB = WTI less US$4.96/bbl; TTF $19.90/mmbtu; NBP $20.04/mmbtu; AECO $2.34/mcf; CAD/USD 1.40; CAD/EUR 1.48 and CAD/AUD 0.91. 2026 forward strip pricing as at November 21, 2024: Brent US$70.26/bbl; WTI US$66.25/bbl; LSB = WTI less US$6.18/bbl; TTF $15.83/mmbtu; NBP $15.92/mmbtu; AECO $3.16/mcf; CAD/USD 1.39; CAD/EUR 1.50 and CAD/AUD 0.90. |

| 6. | Estimated gross proved, developed and producing, total proved, and total proved plus probable reserves as evaluated by McDaniel & Associates Consultants Ltd. ("McDaniel") in a report dated December 17, 2024, with an effective date of November 30, 2024 (the "McDaniel Reserves Report"). Net present value of discounted cash flows as provided in the McDaniel Reserves Report. Three consultant average October 1, 2024 pricing assumptions used in reserve estimates as follows: 2025 WTI US$72.00/bbl, AECO C$2.50/mmbtu, CAD/USD FX rate 0.747; 2026 WTI US$74.98/bbl, AECO C$3.36/mmbtu, CAD/USD FX rate 0.753; 2027 WTI US$76.65/bbl, AECO C$3.62/mmbtu, CAD/USD FX rate 0.753. |

| 7. | Net debt is a capital management measure most directly comparable to long-term debt and is comprised of long-term debt (excluding unrealized foreign exchange on swapped USD borrowings) plus adjusted working capital (defined as current assets less current liabilities, excluding current derivatives and current lease liabilities). |

| 8. | Net debt to four quarter trailing fund flows from operations is a supplementary financial measure and is not a standardized financial measure under IFRS. It may not be comparable to similar measures disclosed by other issuers and is calculated using net debt (capital management measure) and FFO (total of segment measure). The measure is used to assess the ability to repay debt. |

About Vermilion

Vermilion is an international energy producer that seeks to create value through the acquisition, exploration, development and optimization of producing assets in North America, Europe and Australia. The Company's business model emphasizes free cash flow generation and returning capital to investors when economically warranted, augmented by value-adding acquisitions. Vermilion's operations are focused on the exploitation of light oil and liquids-rich natural gas conventional and unconventional resource plays in North America and the exploration and development of conventional natural gas and oil opportunities in Europe and Australia.

Vermilion's priorities are health and safety, the environment, and profitability, in that order. Nothing is more important than the safety of the public and those who work with Vermilion, and the protection of the natural surroundings. Vermilion has been recognized by leading ESG rating agencies for its transparency on and management of key environmental, social and governance issues. In addition, the Company emphasizes strategic community investment in each of its operating areas.

Vermilion trades on the Toronto Stock Exchange and the New York Stock Exchange under the symbol VET.

Disclaimer

Certain statements included or incorporated by reference in this document may constitute forward-looking statements or information under applicable securities legislation. Such forward-looking statements or information typically contain statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", or similar words suggesting future outcomes or statements regarding an outlook. Forward looking statements or information in this document may include, but are not limited to: statements regarding the timing of the Acquisition and the expected impacts of completing the Acquisition; satisfaction or waiver of the closing conditions in the Arrangement Agreement (including receipt of applicable shareholder, court and other regulatory approvals); well production timing and expected production rates and financial returns, including half-cycle internal rate of return, therefrom, including related to the Acquisition; wells expected to be drilled in 2025, 2026 and beyond, including as a result of the Acquisition if it is completed; exploration and development plans and the timing thereof, including as a result of the Acquisition if it is completed; petroleum and natural gas sales, netbacks, and the expectation of generating strong free cash flow therefrom; the effect of changes in crude oil and natural gas prices, and changes in exchange and inflation rates; statements regarding Vermilion's hedging program, its plans to add to its hedging positions and the anticipated impact of Vermilion's hedging program on the economics of the Acquisition and other projects and free cash flows; capital expenditures including Vermilion's ability to fund such expenditures in 2025 and future periods; Vermilion's debt capacity, including the availability of funds under financing arrangements that Vermilion has negotiated in connection with the Acquisition and its ability to meet draw down conditions applicable to such financing, and Vermilion's ability to manage debt and leverage ratios and raise additional debt; future production levels and the timing thereof, including Vermilion's 2025 guidance, and rates of average annual production growth, including Vermilion's ability to maintain or grow production; future production weighting, including weighting for product type or geography; estimated volumes of reserves and resources, including with respect to those reserves and resources that may be acquired pursuant to the Acquisition; statements regarding the return of capital and Vermilion's normal course issuer bid; the flexibility of Vermilion's capital program and operations; business strategies and objectives; operational and financial performance, including the ability of Vermilion to realize synergies from the Acquisition; significant declines in production or sales volumes due to unforeseen circumstances; statements regarding the growth and size of Vermilion's future project inventory, including the number of future drilling locations expected to be available if the transaction contemplated by the Arrangement Agreement is completed; acquisition and disposition plans and the economics and timing thereof; operating and other expenses, including the payment and amount of future dividends; and the timing of regulatory proceedings and approvals.

Such forward-looking statements or information are based on a number of assumptions, all or any of which may prove to be incorrect. In addition to any other assumptions identified in this document, assumptions have been made regarding, among other things: the ability of Vermilion to obtain equipment, services and supplies in a timely manner to carry out its activities in Canada and internationally; the ability of Vermilion to market crude oil, natural gas liquids, and natural gas successfully to current and new customers; the timing and costs of pipeline and storage facility construction and expansion and the ability to secure adequate product transportation; the timely receipt of required regulatory approvals; the ability of Vermilion to obtain financing on acceptable terms; foreign currency exchange rates and interest rates; future crude oil, natural gas liquids, and natural gas prices; management's expectations relating to the timing and results of exploration and development activities; the impact of Vermilion's dividend policy on its future cash flows; credit ratings; the ability of Vermilion to effectively maintain its hedging program; expected earnings/(loss) and adjusted earnings/(loss); expected earnings/(loss) or adjusted earnings/(loss) per share; expected future cash flows and free cash flow and expected future cash flow and free cash flow per share; estimated future dividends; financial strength and flexibility; debt and equity market conditions; general economic and competitive conditions; ability of management to execute key priorities; and the effectiveness of various actions resulting from the Vermilion's strategic priorities.

Although Vermilion believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward looking statements because Vermilion can give no assurance that such expectations will prove to be correct. Financial outlooks are provided for the purpose of understanding Vermilion's financial position and business objectives, and the information may not be appropriate for other purposes. Forward looking statements or information are based on current expectations, estimates, and projections that involve a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by Vermilion and described in the forward-looking statements or information. These risks and uncertainties include, but are not limited to: the timely receipt of any required regulatory approvals and the satisfaction of all other conditions to the completion of the Acquisition; the ability of Vermilion to complete the Acquisition; the ability of management to execute its business plan; the risks of the oil and gas industry, both domestically and internationally, such as operational risks in exploring for, developing and producing crude oil, natural gas liquids, and natural gas; risks and uncertainties involving geology of crude oil, natural gas liquids, and natural gas deposits; risks inherent in Vermilion's marketing operations, including credit risk; the uncertainty of reserves estimates and reserves life and estimates of resources and associated expenditures; the uncertainty of estimates and projections relating to production and associated expenditures; potential delays or changes in plans with respect to exploration or development projects; constraints at processing facilities and/or on transportation; Vermilion's ability to enter into or renew leases on acceptable terms; fluctuations in crude oil, natural gas liquids, and natural gas prices, foreign currency exchange rates, interest rates and inflation; health, safety, and environmental risks and uncertainties related to environmental legislation, hydraulic fracturing regulations and climate change; uncertainties as to the availability and cost of financing; the ability of Vermilion to add production and reserves through exploration and development activities; the possibility that government policies or laws may change or governmental approvals may be delayed or withheld; weather conditions, political events and terrorist attacks; uncertainty in amounts and timing of royalty payments; risks associated with existing and potential future law suits and regulatory actions against or involving Vermilion; and other risks and uncertainties described elsewhere in this document or in Vermilion's other filings with Canadian securities regulatory authorities.

The forward-looking statements or information contained in this document are made as of the date hereof and Vermilion undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events, or otherwise, unless required by applicable securities laws.

This document contains metrics commonly used in the oil and gas industry. These oil and gas metrics do not have any standardized meaning or standard methods of calculation and therefore may not be comparable to similar measures presented by other companies where similar terminology is used and should therefore not be used to make comparisons. Natural gas volumes have been converted on the basis of six thousand cubic feet of natural gas to one barrel of oil equivalent. Barrels of oil equivalent (boe) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet to one barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Financial data contained within this document are reported in Canadian dollars, unless otherwise stated.

Estimates of Drilling Locations: Unbooked drilling locations, including those associated with the Acquisition, are the internal estimates of Vermilion based on Vermilion's prospective acreage and the acreage that may be acquired pursuant to the Acquisition and an assumption as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources (including contingent and prospective). Unbooked locations have been identified by Vermilion's management as an estimation of Vermilion's multiyear drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information including expected activities if the Acquisition is completed. There is no certainty that Vermilion will drill all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and natural gas reserves, resources or production. The drilling locations on which Vermilion will actually drill wells, including the number and timing thereof is ultimately dependent upon completion of the Acquisition, the availability of funding, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While a certain number of the unbooked drilling locations have been de-risked by Westbrick drilling existing wells in relative close proximity to such unbooked drilling locations, other unbooked drilling locations are farther away from existing wells where management of Vermilion has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Reserves Data: There are numerous uncertainties inherent in estimating quantities of crude oil, natural gas and NGL reserves, and the future cash flows attributed to such reserves. The reserve and associated cash flow information incorporated in this release, including those relating to the reserves to be acquired pursuant to the Acquisition, are estimates only. Generally, estimates of economically recoverable crude oil, NGL and natural gas reserves (including the breakdown of reserves by product type) and the future net cash flows from such estimated reserves are based upon a number of variable factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially from actual results. For those reasons, estimates of the economically recoverable crude oil, NGL and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary. Vermilion's actual production, revenues, taxes and development and operating expenditures with respect to its reserves will vary from estimates and such variations could be material.

View original content to download multimedia:https://www.prnewswire.com/news-releases/vermilion-energy-inc-announces-strategic-deep-basin-acquisition-302338290.html

SOURCE Vermilion Energy Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2024/23/c8828.html

%CIK: 0001293135

For further information: For further information please contact: Dion Hatcher, President & CEO; Lars Glemser, Vice President & CFO; and/or Kyle Preston, Vice President, Investor Relations, TEL (403) 269-4884 | IR TOLL FREE 1-866-895-8101 | investor_relations@vermilionenergy.com | www.vermilionenergy.com

CO: Vermilion Energy Inc.

CNW 07:00e 23-DEC-24