- DLB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Dolby Laboratories (DLB) DEF 14ADefinitive proxy

Filed: 20 Dec 24, 8:46am

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

Dolby Laboratories, Inc.

1275 Market Street

San Francisco, California 94103

(415) 558-0200

December 20, 2024

Dear Stockholder:

We cordially invite you to attend the Annual Meeting of Stockholders of Dolby Laboratories, Inc. The Annual Meeting will be held virtually via live webcast on Tuesday, February 4, 2025, at 10:30 a.m. Pacific Standard Time. Stockholders will not be able to attend the Annual Meeting in person. The Annual Meeting will be accessible at meetnow.global/M66FQT7. Please see “Additional Meeting Matters—Attending the Virtual Annual Meeting” in the Proxy Statement accompanying this letter for information on how to attend, submit questions and vote at the Annual Meeting.

We are making available to you the accompanying Notice of Annual Meeting, Proxy Statement and form of proxy card or voting instruction form on or about December 20, 2024.

We are pleased to furnish proxy materials to stockholders primarily over the internet. We believe that this process expedites stockholders’ receipt of proxy materials, lowers the costs of our Annual Meeting, and conserves natural resources. On or about December 20, 2024, we mailed to our stockholders a notice that includes instructions on how to access our Proxy Statement and 2024 Annual Report and how to vote online. The notice also includes instructions on how you can receive a paper copy of your Annual Meeting materials, including the Notice of Annual Meeting, Proxy Statement and proxy card or voting instruction form. If you elected to receive your Annual Meeting materials by mail, the Notice of Annual Meeting, Proxy Statement and proxy card or voting instruction form were enclosed. If you elected to receive your Annual Meeting materials via e-mail, the e-mail contains voting instructions and links to the 2024 Annual Report and the Proxy Statement, both of which are available at https://investor.dolby.com/financials/annual-reports/default.aspx.

Additional details regarding admission to and the business to be conducted at the Annual Meeting are described in the accompanying Notice of Annual Meeting and Proxy Statement. A copy of our 2024 Annual Report is included with the Proxy Statement for those stockholders who are receiving paper copies of the proxy materials.

Your vote is important. Regardless of whether you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote over the internet, by telephone or by mailing a proxy card or voting instruction form. Please review the instructions on the proxy card or voting instruction form regarding each of these voting options. Voting will ensure your representation at the Annual Meeting regardless of whether you attend the Annual Meeting.

Thank you for your ongoing support of Dolby Laboratories, Inc.

Sincerely yours,

Kevin Yeaman

President, Chief Executive Officer, and Director

Dolby Laboratories, Inc.

Notice of Annual Meeting of Stockholders

to be held on February 4, 2025

To the Stockholders of Dolby Laboratories, Inc.:

The Annual Meeting of Stockholders of Dolby Laboratories, Inc., a Delaware corporation, will be held virtually via live webcast on Tuesday, February 4, 2025, at 10:30 a.m. Pacific Standard Time, for the following purposes:

| 1. | To elect eight directors to serve until the 2026 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| 2. | To hold an advisory vote to approve Named Executive Officer compensation; |

| 3. | To hold an advisory vote on the frequency of future advisory votes to approve Named Executive Officer compensation; |

| 4. | To approve an amendment of our Amended and Restated Certificate of Incorporation to provide for officer exculpation as permitted by Delaware law; |

| 5. | To ratify the appointment of KPMG LLP as Dolby’s independent registered public accounting firm for the fiscal year ending September 26, 2025; and |

| 6. | To transact such other business as may properly come before the Annual Meeting and any postponement, adjournment or continuation of the Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. We are not aware of any other business to come before the Annual Meeting.

Only stockholders of record as of the close of business on December 6, 2024 and their proxies are entitled to notice of and to vote at the Annual Meeting and any postponement, adjournment or continuation thereof.

All stockholders are invited to attend the Annual Meeting virtually and no stockholder will be able to attend the Annual Meeting in person. The Annual Meeting will be accessible at meetnow.global/M66FQT7. Please see “Additional Meeting Matters—Attending the Virtual Annual Meeting” in the Proxy Statement accompanying this letter for information on how to attend, submit questions and vote at the Annual Meeting.

Stockholders may also vote over the internet, by telephone, or by mail in advance of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy, or voting your shares at the Annual Meeting. See “Additional Meeting Matters—How to Vote” in the Proxy Statement accompanying this Notice for more information.

| By Order of the Board of Directors, |

|

| Andy Sherman |

| Corporate Secretary |

December 20, 2024

Whether or not you expect to attend the Annual Meeting, we encourage you to read the Proxy Statement accompanying this Notice and submit your proxy or voting instructions as promptly as possible in order to ensure your representation at the Annual Meeting. You may submit your proxy or voting instructions for the Annual Meeting by completing, signing, dating and returning your proxy card or voting instruction form in the pre-addressed envelope provided (if applicable), or, in most cases, by using the telephone or the internet. Even if you have given your proxy, you may still vote at the meeting if you attend the Annual Meeting. For specific instructions on how to vote your shares, please refer to “Additional Meeting Matters—How to Vote” in the Proxy Statement accompanying this Notice and the instructions on the proxy card or voting instruction form.

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights certain information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement carefully before voting as this summary does not contain all the information that you should consider.

2025 Annual Meeting of Stockholders

The Annual Meeting will be held virtually via live webcast. Stockholders will not be able to attend the Annual Meeting in person.

Date and Time: | Tuesday, February 4, 2025 at 10:30 a.m. Pacific Standard Time | |

Place: | Live webcast accessible at meetnow.global/M66FQT7. Please see “Attending the Virtual Annual Meeting” beginning on page 76 for information on how to attend, submit questions and vote at the Annual Meeting. | |

Record Date: | December 6, 2024 | |

Proposals to Be Voted on at 2025 Annual Meeting

Proposal | Board Recommendation | Page Number for Additional Information | ||

1. Election of Directors | FOR | 7 | ||

2. Advisory Vote to Approve Named Executive Officer Compensation | FOR | 68 | ||

3. Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation | ONE YEAR | 69 | ||

4. Amendment of Amended and Restated Certificate of Incorporation to Provide for Officer Exculpation as Permitted by Delaware Law | FOR | 70 | ||

5. Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | 73 |

Director Nominees

The nominees for election to our Board at the 2025 Annual Meeting are listed below, along with their current committee assignments and certain biographical information about them as of December 6, 2024, the record date for the Annual Meeting.

| Committee Memberships | ||||||||||||||||||||||

Name | Age | Director Since | Principal Occupation | Indep. | AC | CC | NGC | SPC | TSC | |||||||||||||

Kevin Yeaman | 58 | 2009 | President and CEO | No |  | |||||||||||||||||

Peter Gotcher | 65 | 2003 | Chair of the Board | Yes |  | |||||||||||||||||

David Dolby | 47 | 2011 | CEO, Dolby Family Ventures | No |  | |||||||||||||||||

Tony Prophet | 65 | 2021 | Director | Yes |  |  | ||||||||||||||||

Emily Rollins | 54 | 2021 | Director | Yes |  | |||||||||||||||||

Simon Segars | 57 | 2015 | Director | Yes |  |  |  | |||||||||||||||

Anjali Sud | 41 | 2019 | CEO, Tubi, Inc. | Yes |  | |||||||||||||||||

Avadis Tevanian, Jr. | 63 | 2009 | Managing Director, NextEquity Partners | Yes |  |  |  |  | ||||||||||||||

AC = Audit Committee, CC = Compensation Committee, NGC = Nominating and Governance Committee, SPC = Stock Plan Committee, TSC = Technology Strategy Committee

= Chair = Chair |  = Member = Member |

1

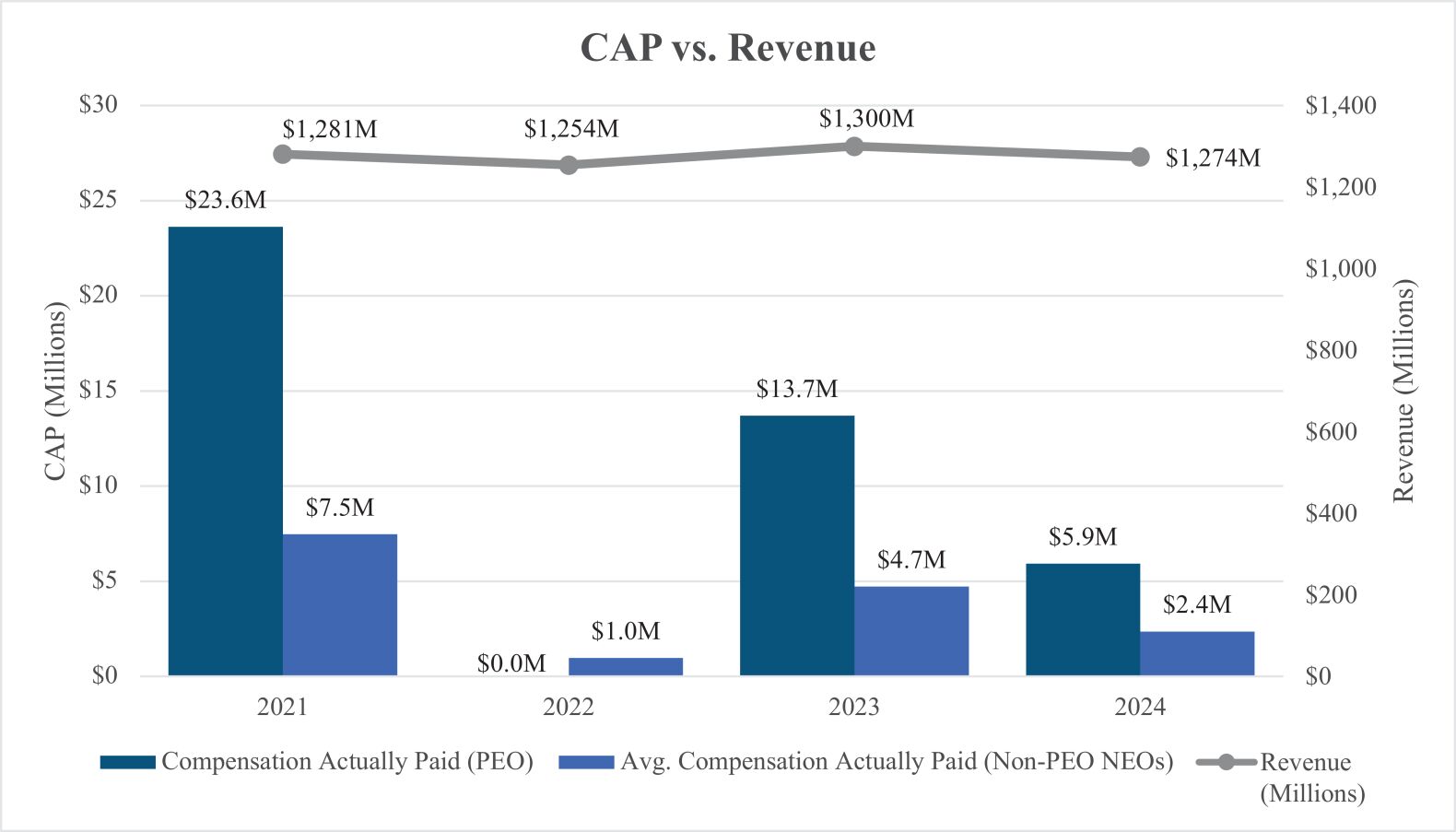

Fiscal 2024 Financial Highlights

Our key financial highlights for fiscal 2024 and a comparison to fiscal 2023 are shown below. For information about our business strategy and our business highlights for fiscal 2024, please see the sections entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2024 Annual Report on Form 10-K.

| Fiscal 2024 | Fiscal 2023 | Percentage Change | ||||||

Total Revenue | $1.27 billion | $1.30 billion | (2.3 | %) | ||||

Net Income | $261.8 million | $200.7 million | 30.4 | % | ||||

Diluted Earnings Per Share | $2.69 | $2.05 | 31.2 | % | ||||

Non-GAAP Net Income(1) | $369.0 million | $348.0 million | 6.0 | % | ||||

Non-GAAP Diluted Earnings Per Share(1) | $3.79 | $3.56 | 6.5 | % | ||||

Stock Price Per Share (High and Low) | $90.06 / $66.35 | $91.02 / $61.55 | — | |||||

Stock Price Per Share as of Fiscal Year-End | $75.61 | $79.26 | (4.6 | %) | ||||

| (1) | A reconciliation of our non-GAAP to GAAP financial results is set forth in Appendix A to this Proxy Statement. |

Return of Capital to Stockholders

In addition, shortly after the end of fiscal 2024, in November 2024, we announced a 10% increase in our dividend, from $0.30 to $0.33 per share.

Named Executive Officers

Our named executive officers (our “NEOs”) for fiscal 2024 were:

| • | Kevin Yeaman, our President and Chief Executive Officer; |

| • | Robert Park, our Senior Vice President and Chief Financial Officer; |

| • | Andy Sherman, our Executive Vice President, General Counsel, and Corporate Secretary; |

| • | John Couling, our Senior Vice President, Entertainment; and |

| • | Shriram Revankar, our Senior Vice President, Advanced Technology Group. |

2

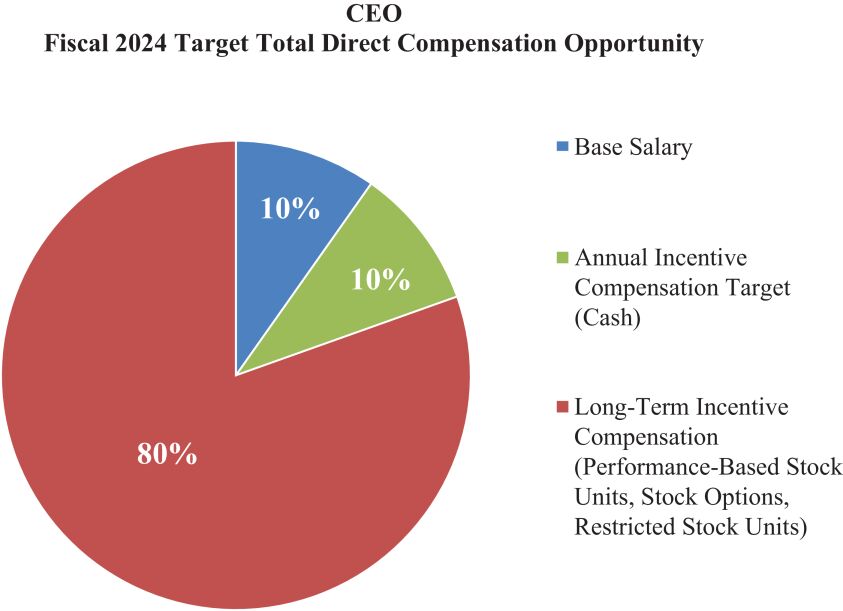

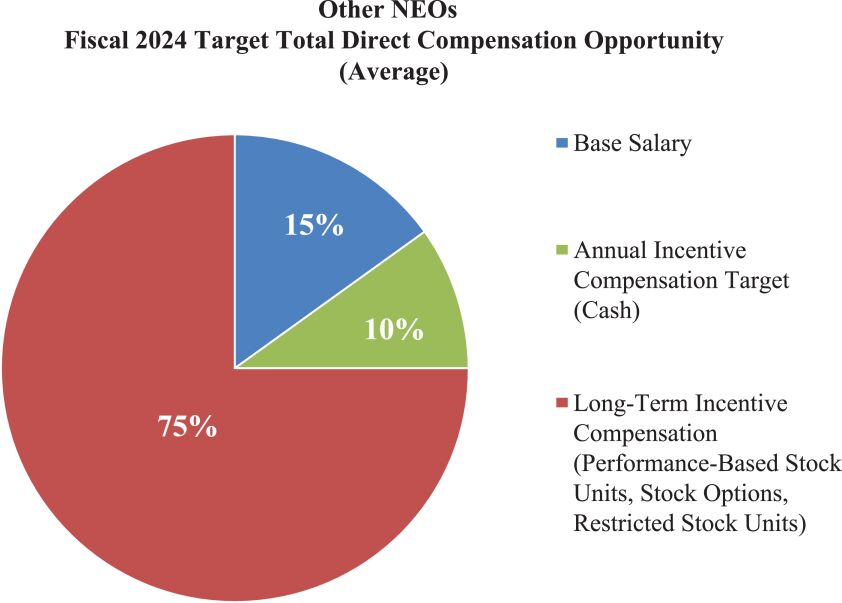

Principal Elements of Executive Compensation and Fiscal 2024 Executive Compensation Highlights

|  |

| Element of Compensation | Fiscal 2024 Highlights | |

| Base Salary | • For calendar 2024, the Compensation Committee of our Board increased the base salary for our CEO by 1.6% and for each of our other NEOs by 3%, consistent with the merit-based increases for our general U.S. workforce, which were based on competitive market data for technology companies. | |

| Annual Incentive Compensation (Cash) | • NEO annual incentive compensation targets—stated as a percentage of base salary for calendar 2024—were maintained at fiscal 2023 levels (100% for our CEO and 65% for each of our other NEOs).

• Annual incentive compensation payments for our NEOs under our fiscal 2024 Executive Bonus Plan were based on a multiplier keyed to our revenue achievement, assuming we exceeded a non-GAAP operating income “gate” (below which there would be no funding). For purposes of the 2024 Executive Bonus Plan, we achieved non-GAAP operating income of $400.1 million against a gate of $318.8 million and adjusted revenue of $1,264.9 million against a threshold requirement of $1,170.0 million and a target of $1,300.0 million, resulting in a multiplier of 86.5%. The $1,264.9 million revenue number was lower than our reported GAAP revenue for fiscal 2024 because the Compensation Committee excluded the revenue attributable to two acquisitions that closed in fiscal 2024 for purposes of the 2024 Executive Bonus Plan, which resulted in lower achievement under the plan than had this exclusion not been made. Based on these results, our NEOs received annual incentive compensation payments equal to 86.5% of their annual incentive compensation targets.

• For information about our use of non-GAAP financial measures for purposes of the 2024 Executive Bonus Plan and a reconciliation of our non-GAAP to GAAP financial measures, see “Multiplier — Revenue and Non-GAAP Operating Income Goals” on page 42 of, and Appendix A to, this Proxy Statement. | |

3

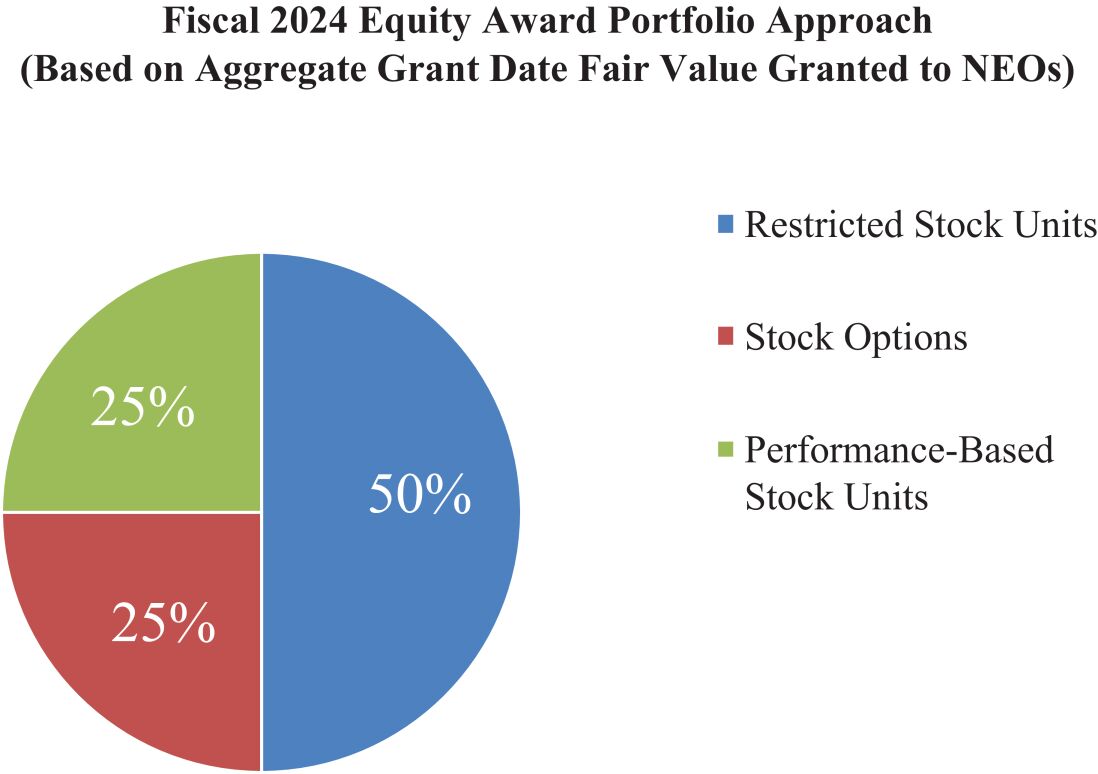

| Element of Compensation | Fiscal 2024 Highlights | |

| Long-Term Incentive Compensation (Performance Stock Unit Awards, Stock Options and Restricted Stock Unit Awards) | • The equity mix for the long-term incentive compensation granted to our NEOs in fiscal 2024 was as follows:

| |

• The realization of the long-term incentive compensation granted to our NEOs is conditioned upon the satisfaction of multi-year vesting requirements and, in the case of performance stock unit awards, the achievement of pre-established performance conditions. | ||

Performance Stock Unit Awards

A portion of the long-term incentive compensation granted to our NEOs for fiscal 2024 was in the form of performance stock unit awards. The shares of our Class A Common Stock subject to performance stock unit awards may be earned contingent on our achievement of annualized relative total stockholder return levels for Dolby over a three-year performance period, measured against a comparator index, the S&P Midcap 400 Index (^MID). From 0% to 200% of the target number of shares subject to the performance stock unit awards may be earned, depending on our level of achievement of these performance conditions. The Compensation Committee believes that granting a portion of long-term incentive compensation in the form of equity that is earned only upon the achievement of pre-established performance conditions further aligns the interests of our NEOs with those of our stockholders.

Executive Stock Ownership Guidelines

Based on our belief that stock ownership further aligns the interests of senior management with those of our stockholders, our executive officers, including our NEOs, are subject to our executive stock ownership guidelines, which provide that:

| • | Our CEO is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the value of five times his annual base salary; and |

| • | Each other NEO is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the value of two times his or her annual base salary. |

As of the end of fiscal 2024, all of our NEOs were in compliance with our executive stock ownership guidelines.

4

Policy on Recoupment of Incentive Compensation (“Clawback”)

Our policy on the recoupment of incentive compensation requires us to recover certain cash or equity-based incentive compensation payments or awards made or granted to an executive officer in the event we are required to prepare an Accounting Restatement (as defined in “Compensation Discussion and Analysis—Policy on Recoupment of Incentive Compensation (“Clawback”)” below).

Advisory Vote on the Compensation of our NEOs

We are asking our stockholders to approve, on an advisory (non-binding) basis, the compensation of our NEOs as described in this Proxy Statement. At our 2024 Annual Meeting of Stockholders, approximately 99% of the voting power of the shares present and entitled to vote voted in favor of the compensation of our NEOs. For fiscal 2024, there were no material changes to our executive compensation program. The Compensation Committee believes that our executive compensation policies and practices continue to support an executive compensation program that is closely aligned with stockholder interests and that benefits us in the long term.

Advisory Vote on the Frequency of Future Advisory Votes to Approve NEO Compensation

We are asking our stockholders to approve, on an advisory (non-binding) basis, the frequency of future advisory votes to approve the compensation of our NEOs. Securities and Exchange Commission rules require us to present this vote to stockholders every six years, and at our 2019 Annual Meeting of Stockholders, our stockholders approved conducting an advisory vote to approve the compensation of our NEOs every year, consistent with our Board’s recommendation on the matter at the time. Our Board continues to recommend that stockholders approve holding an advisory vote to approve the compensation of our NEOs on an annual basis.

Amendment of our Amended and Restated Certificate of Incorporation to Provide for Officer Exculpation as Permitted by Delaware Law

Stockholders are being asked to approve an amendment of Section 1 of Article VII of our Amended and Restated Certificate of Incorporation. The proposed amendment to our Amended and Restated Certificate of Incorporation would provide for the exculpation of certain of our officers from liability to the extent permitted by Delaware law, as it may be amended from time to time. Our Board has determined that this amendment to our Amended and Restated Certificate of Incorporation is appropriate and in the best interests of the company and our stockholders, has approved and adopted the proposed amendment subject to receipt of the requisite approval by the company’s stockholders, and has recommended the proposed amendment to the company’s stockholders for approval and adoption.

Ratification of Independent Registered Accounting Firm

Our Audit Committee has appointed the firm of KPMG LLP as our independent registered public accounting firm for fiscal 2025. Stockholders are being asked to ratify the selection of KPMG LLP as our independent registered public accounting firm.

5

Dolby Laboratories, Inc.

1275 Market Street

San Francisco, California 94103

(415) 558-0200

PROXY STATEMENT

The Board of Directors (our “Board”) of Dolby Laboratories, Inc., a Delaware corporation, is soliciting proxies to be used at the Annual Meeting of Stockholders to be held virtually via live webcast on Tuesday, February 4, 2025, at 10:30 a.m. Pacific Standard Time and any postponement, adjournment or continuation thereof (the “Annual Meeting”). Stockholders will not be able to attend the Annual Meeting in person. The Annual Meeting will be accessible at meetnow.global/M66FQT7. Please see “Attending the Virtual Annual Meeting” beginning on page 76 for information on how to attend, submit questions and vote at the Annual Meeting.

This Proxy Statement and the accompanying notice and form of proxy are first being made available to stockholders on or about December 20, 2024.

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to our stockholders primarily via the internet. On or about December 20, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and our 2024 Annual Report. The Notice of Internet Availability of Proxy Materials also provides information on how to access your voting instructions to be able to vote through the internet or by telephone. Other stockholders, in accordance with their prior requests, have received e-mail notification of how to access our proxy materials and vote via the internet, or have been mailed paper copies of our proxy materials and a proxy card or voting instruction form.

Internet distribution of our proxy materials helps to expedite receipt by stockholders, lowers the cost of the Annual Meeting and conserves natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees

Our Board currently consists of eight members. Our Bylaws permit our Board to establish by resolution the authorized number of directors, and eight directors are currently authorized.

Our Board proposes the election of eight directors, each to serve until the next Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. All incumbent directors are nominees for re-election to our Board. All of the nominees have been recommended for nomination by the Nominating and Governance Committee, and all of them are currently serving as directors. All nominees were elected by the stockholders at last year’s annual meeting. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. If any nominee is unable or declines to serve as director at the time of the Annual Meeting, an event that we do not currently anticipate, proxies will be voted for any nominee designated by our Board to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the nominees named below.

Information Regarding the Director Nominees and our Director Emeritus

Director Nominees

Names of the nominees, along with their current committee assignments, and certain biographical information about them as of December 6, 2024, the record date for the Annual Meeting, are set forth below:

Name | Age | Position with the Company | Director Since | |||||||

Kevin Yeaman(1) | 58 | President, Chief Executive Officer and Director | 2009 | |||||||

Peter Gotcher(2*) | 65 | Chair of the Board of Directors | 2003 | |||||||

David Dolby(3) | 47 | Director | 2011 | |||||||

Tony Prophet(4)(5) | 65 | Director | 2021 | |||||||

Emily Rollins(5*) | 54 | Director | 2021 | |||||||

Simon Segars(2)(3*)(5) | 57 | Director | 2015 | |||||||

Anjali Sud(4) | 41 | Director | 2019 | |||||||

Avadis Tevanian, Jr.(1)(2)(3)(4*) | 63 | Director | 2009 | |||||||

| (1) | Member of the Stock Plan Committee |

| (2) | Member of the Nominating and Governance Committee |

| (3) | Member of the Technology Strategy Committee |

| (4) | Member of the Compensation Committee |

| (5) | Member of the Audit Committee |

| * | Serves as Chair of referenced committee |

7

Kevin Yeaman became our President and CEO in March 2009 and has been a member of our Board since he assumed the role of CEO. He joined Dolby as Chief Financial Officer and Vice President in October 2005, was appointed Senior Vice President in November 2006 and Executive Vice President in July 2007. As Chief Financial Officer, Mr. Yeaman led the company’s global finance organization and, among other things, developed infrastructure to support growth and expansion. Prior to joining Dolby, he worked for seven years at Epiphany, Inc., a publicly traded enterprise software company, most recently as Chief Financial Officer from August 1999 to October 2005. Previously, Mr. Yeaman also served as Worldwide Vice President of Field Finance Operations for Informix Software, Inc., a provider of relational database software, from February 1998 to August 1998. From September 1988 to February 1998, Mr. Yeaman served in Silicon Valley and London in various positions at KPMG LLP, an accounting firm. Mr. Yeaman was inducted as a member of the Academy of Motion Picture Arts and Sciences in 2014. He also sits on the Board of Trustees of the Academy Museum Foundation and an education board. He holds a B.S. degree in commerce from Santa Clara University.

As Dolby’s Chief Executive Officer and former Chief Financial Officer, Mr. Yeaman has extensive experience in Dolby’s markets and brings to our Board a deep understanding of Dolby, its strategy, finances, and operations.

Peter Gotcher has served as a director since June 2003 and as Chair of the Board of Directors since March 2011. Mr. Gotcher served as Executive Chair of the Board of Directors from March 2009 to March 2011. Mr. Gotcher is an independent investor. Mr. Gotcher was a venture partner with Redpoint Ventures, a private investment firm, from September 1999 to January 2003. Prior to joining Redpoint Ventures, Mr. Gotcher was a venture partner with Institutional Venture Partners, a private investment firm, from 1997 to September 1999. Prior to joining Institutional Venture Partners, Mr. Gotcher founded and served as the President, Chief Executive Officer and Chair of the Board of Digidesign from 1984 to 1995. Digidesign was acquired by Avid Technology, a media software company, in 1995 and Mr. Gotcher served as the General Manager of Digidesign and Executive Vice President of Avid Technology from January 1995 to May 1996. Mr. Gotcher has served on the board of directors of GoPro, Inc. since June 2014, and served on the board of directors of Pandora Media, Inc. from September 2005 to May 2017. Mr. Gotcher also serves on the boards of directors of several private companies. Mr. Gotcher holds a B.A. degree in English literature from the University of California at Berkeley.

As the founder, former Chief Executive Officer and Chair of Digidesign and a former venture capitalist, Mr. Gotcher has a broad understanding of the operational, financial and strategic issues facing public companies. In addition, his service on other boards and committees, including as a member of the Audit Committee and Compensation and Leadership Committee of GoPro, Inc., as a former member of the Compensation Committee and member and chair of the Nominating and Corporate Governance Committee of Pandora Media, Inc., and his extensive experience in Dolby’s markets, provide valuable perspective for our Board and give him significant operating experience, as well as financial, accounting and corporate governance experience.

David Dolby has served as a director since February 2011. Mr. Dolby is founder and Chief Executive Officer of Dolby Family Ventures, an early-stage venture firm unrelated to Dolby Laboratories that launched in June 2014 to invest in companies and technologies with the potential for significant social impact. Previously, Mr. Dolby served as a consultant to our Board on technology strategy matters from February 2011 to February 2015. Mr. Dolby also served as Manager, Strategic Partnerships of Dolby Laboratories from May 2008 to February 2011. In this role, Mr. Dolby was responsible for managing the company’s strategic partnerships and technology standards for internet media encoding, delivery and playback. He represented the company in technical and business working groups at a variety of international standards groups, including Universal Serial Bus, Digital Living Network Alliance, Digital Entertainment Content

8

Ecosystem Ultraviolet, and Blu-ray Disc Association. Mr. Dolby has attended industry events with the company for a significant number of years, including Audio Engineering Society, National Association of Broadcasters, International Consumer Electronics Show, ShoWest, Cine Expo International, IFA, and Custom Electronic Design and Installation Association. From 2006 to 2008, Mr. Dolby was a self-employed entrepreneur and investor. Mr. Dolby attended Stanford Business School between 2004 and 2006. During that time, he served as product manager at Kaleidescape, Inc., a Silicon Valley technology firm focused on high-performance music and movie server systems. From 2003 to 2006, he owned and operated Charter Flight LLC, a private aircraft leasing business. In addition, during 2004, Mr. Dolby was an investment banking analyst focused on technology at Perseus Group (subsequently known as GCA Savvian Corporation and then GCA Corporation until its acquisition by Houlihan Lokey in October 2021). From 2000 to 2002, Mr. Dolby was an employee of NetVMG, a company developing route control software for optimizing multi-homed IP network routing. Before joining NetVMG, Mr. Dolby worked for engineering firms Bechtel and Poe & Associates. From November 2013 to January 2023, Mr. Dolby served on the board of directors of Cogstate Limited, a cognitive assessment and training company focused on the development and commercialization of computerized tests of cognition. Mr. Dolby served on Cogstate’s Remuneration and Nomination Committee. Mr. Dolby currently serves on the governing boards of various not-for-profit entities, including the Boards of Trustees of the Salk Institute for Biological Sciences and the Academy Museum of Motion Pictures. He is also a member of the Academy of Motion Picture Arts and Sciences. Mr. Dolby received a B.S.E. in Civil Engineering from Duke University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Dolby brings experience to our Board in home theater system technology and software technology productization, and offers a long-term perspective on the growth of the company and its commitment to excellence in audio and video.

Tony Prophet has served as a director since December 2021. Mr. Prophet was formerly the Chief Equality and Recruiting Officer at salesforce.com, inc. (“Salesforce”), which he joined in September 2016 until July 2021. Before Salesforce, Mr. Prophet served as Corporate Vice President, Education Marketing, of Microsoft Corporation, from June 2015 to September 2016, as Corporate Vice President, Windows and Search Marketing, from February 2015 to June 2015, and as Corporate Vice President, Windows Marketing, from May 2014 to February 2015. Prior to Microsoft, Mr. Prophet held leadership roles at HP Inc. from 2006 to 2014, including leading worldwide PC and printing operations. Before that, Mr. Prophet served in positions of increasing responsibility at multiple organizations, including leading worldwide operations for the Carrier Business unit of United Technologies and rising to Partner at Booz Allen Hamilton. In addition to his operating roles, Mr. Prophet served on the board of directors of Gannett Co., Inc., a subscription-led and digitally focused media and marketing solutions company, from 2013 to May 2019. Mr. Prophet is also a Board Advisor to Aviso AI, a provider of a predictive revenue intelligence platform, since September 2021. He holds a BS in industrial engineering from General Motors Institute (now Kettering University) and an MBA from the Stanford Graduate School of Business.

As a long-time, accomplished technology business executive, Mr. Prophet brings to our Board substantial leadership experience in industrial, consumer electronic, hardware, and software spaces.

Emily Rollins has served as a director since February 2021. She served in various positions at Deloitte & Touche LLP from 1992 to 2020, including as an Audit and Assurance Partner from 2006 until her retirement in September 2020. At Deloitte, Ms. Rollins served technology and media companies and guided hundreds of clients through complex audit and reporting processes. Ms. Rollins also served in positions of increasing responsibility, including leadership roles in Deloitte’s US Technology, Media, and Telecommunications industry group, Audit Innovation and Transformation, and Diversity and Inclusion. She led firmwide initiatives to recruit, develop, and retain women and diverse professionals as well as transform and modernize Deloitte’s audit platform. Ms. Rollins has served on the board of directors of

9

Xometry, Inc., an AI-enabled marketplace for on-demand manufacturing enabling buyers to efficiently source on-demand manufactured parts and assemblies, since March 2021 and serves as chair of Xometry’s Audit Committee and member of the Environmental and Social Governance Committee. She also has served on the board of directors of Science 37 Holdings, Inc., a research company that specializes in decentralized clinical trials to enable universal access to clinical research, since October 2021 and is chair of Science 37’s Audit Committee. Ms. Rollins also serves on the boards of three private technology companies and several non-profit entities and associations. Ms. Rollins is a Certified Public Accountant and holds a B.A. degree in Accounting and International Relations from Claremont McKenna College.

After nearly 30 years in public accounting, Ms. Rollins brings to our Board considerable experience as an advisor to boards and executive teams and extensive financial and public accounting expertise as an audit expert in the technology and media spaces.

Simon Segars has served as a director since February 2015. From 1991 to 2022, Mr. Segars worked for Arm Ltd (known as Arm Holdings Plc prior to 2017), a designer and provider of microprocessors, software development tools and related technologies that was publicly held until its acquisition by SoftBank Group Corp. in September 2016. Mr. Segars served as Arm’s Chief Executive Officer from July 2013, and as a member of its board of directors from 2005, to February 2022, respectively. Mr. Segars also served as a member of SoftBank Group Corp.’s board of directors from June 2017 to June 2021. He served as President of Arm in 2013 before being promoted to Chief Executive Officer. Mr. Segars held the position of Executive Vice President and General Manager, Physical IP Division, from 2007 to 2012. Prior senior roles at Arm include Executive Vice President, Engineering; Executive Vice President, Worldwide Sales; and Executive Vice President, Business Development. Mr. Segars worked on many of the early Arm CPU products and led the development of the ARM7 and ARM9 Thumb® families. He holds a number of patents in the field of embedded CPU architectures. Mr. Segars received his Bachelors in Electronic Engineering from the University of Sussex, and obtained a Masters of Computer Science from the University of Manchester. In recognition of his extraordinary lifetime accomplishments and his impact on the global technology industry, Mr. Segars was conferred an Honorary Doctor of Science from the University of Sussex in 2019. In July 2024, Mr. Segars was elected as a Fellow of the Royal Society. Mr. Segars has served on the board of directors of Vodafone Group Plc, a multinational telecommunications company, since July 2022, where he serves as a member of the ESG Committee, and has served as chair of the Technology Committee since July 2023. Mr. Segars also serves on the boards of directors of Edge Impulse, a development platform for machine learning on edge devices, Silicon Quantum Computing Pty Ltd, a developer of quantum computing systems where he is board Chair, and TechWorks, a UK industry association.

As chair of Vodafone’s Technology Committee and a trained and former engineer, Mr. Segars has extensive experience in technology strategy and the technological elements of Dolby’s business operations. In addition, with his significant experience as an executive officer of Arm, and his service on the boards of both public and private companies, Mr. Segars brings to our Board a valuable understanding of the operational and strategic issues facing companies. Further, as a member of Vodafone’s ESG Committee, Mr. Segars enhances our Board’s capabilities in sustainability and sustainable business practices.

Anjali Sud has served as a director since May 2019. Ms. Sud has served as the Chief Executive Officer of Tubi, Inc., a subsidiary of the Fox Corporation that provides free ad-supported TV streaming service in the United States, since September 2023. Before Tubi, from July 2017 to August 2023, Ms. Sud served as the Chief Executive Officer of Vimeo, Inc., a provider of cloud-based software tools that enable creative professionals, marketers and enterprises to stream, host, distribute and monetize videos online and across devices. She also served on Vimeo’s board of directors from May 2021 to August 2023. Prior to that, Ms. Sud held various positions at Vimeo since July 2014, before being promoted to CEO in July 2017. Before Vimeo, Ms. Sud served in various positions at Amazon.com, Inc. from 2010 to 2014, most recently as Director of Marketing. Ms. Sud holds a B.S. degree from the Wharton School at the University of Pennsylvania and an M.B.A. from Harvard Business School.

10

As the Chief Executive Officer of Tubi and having served in executive positions in other technology and media companies, Ms. Sud brings extensive knowledge of the technology industry and operational experience to the boardroom, including an understanding of the operational, financial and strategic issues facing audio-visual content creators and streaming service providers. In addition, through her prior role as Director of Marketing at Amazon, Ms. Sud brings valuable business and marketing insight and experience to our Board.

Avadis Tevanian, Jr. has served as a director since February 2009. Dr. Tevanian serves as a Managing Director of NextEquity Partners, a firm he co-founded in July 2015, making venture capital investments. Previously, Dr. Tevanian served as the Software Chief Technology Officer of Apple Inc. from 2003 to 2006. As Software CTO, Dr. Tevanian focused on setting the company-wide software technology direction for Apple. Prior to his tenure as Software CTO, Dr. Tevanian was Senior Vice President of Software at Apple, a role he took on when Apple acquired NeXT, Inc. in 1997. As Senior Vice President of Software, Dr. Tevanian led the software engineering team responsible for the creation of macOS and worked as part of Apple’s executive team. Before joining Apple, he was Vice President of Engineering at NeXT, Inc. and was responsible for managing NeXT’s engineering department. Dr. Tevanian started his professional career at Carnegie Mellon University, where he was a principal designer and engineer of the Mach operating system upon which Nextstep, and now macOS and iOS, are based. Dr. Tevanian previously served on the board of directors of Tellme Networks, Inc., an internet telecom company, from May 2006 until the company was acquired by Microsoft in March 2007. He holds a B.A. degree in mathematics from the University of Rochester and M.S. and Ph.D. degrees in computer science from Carnegie Mellon University.

With more than 30 years of operational and software expertise, including as Apple’s Chief Software Technology Officer, Dr. Tevanian brings to our Board extensive experience in consumer technology businesses and a deep understanding of the operational and strategic issues facing companies.

There are no family relationships among any of our directors and executive officers.

See “Corporate Governance Matters” and “Compensation of Directors” for additional information regarding our Board.

Our Board of Directors recommends a vote “FOR” the election of each of the nominees set forth above.

Director Emeritus

N. William Jasper, Jr. served as a director from June 2003 until his retirement from our Board in February 2021, at which time he received the honorary title of Director Emeritus, in an uncompensated, non-voting capacity. Mr. Jasper joined Dolby in February 1979 as Chief Financial Officer and retired as President and Chief Executive Officer in March 2009. He served in a variety of positions prior to becoming President in May 1983, including as our Vice President, Finance and Administration and as our Executive Vice President. Mr. Jasper is an at-large member of the Academy of Motion Picture Arts and Sciences. He holds a B.S. degree in industrial engineering from Stanford University and an M.B.A. from the University of California at Berkeley.

11

COMPENSATION OF DIRECTORS

The following table provides information concerning the compensation paid by us to each of our non-employee directors for fiscal 2024. Our CEO did not receive additional compensation for his service as a director, and his compensation as an employee is presented in the Fiscal 2024 Summary Compensation Table.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

Micheline Chau(3) | 26,071 | — | — | — | 26,071 | |||||||||||||||

David Dolby | 55,000 | 231,142 | — | — | 286,142 | |||||||||||||||

Peter Gotcher | 140,000 | 231,142 | — | — | 371,142 | |||||||||||||||

Tony Prophet(4) | 70,893 | 231,142 | — | — | 302,035 | |||||||||||||||

Emily Rollins | 80,000 | 231,142 | — | — | 311,142 | |||||||||||||||

Simon Segars(5) | 76,456 | 231,142 | — | — | 307,598 | |||||||||||||||

Anjali Sud | 60,000 | 231,142 | — | — | 291,142 | |||||||||||||||

Avadis Tevanian, Jr.(6) | 88,786 | 231,142 | — | — | 319,928 | |||||||||||||||

| (1) | Consists of Board and committee annual retainers and, if applicable, Board chair retainer and committee chair retainers. |

| (2) | Stock Awards consist solely of restricted stock unit awards for shares of our Class A Common Stock. The amounts reported reflect the grant date fair value of each equity award computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“ASC Topic 718”), excluding estimated forfeitures. See Note 9 to our consolidated financial statements in our 2024 Annual Report on Form 10-K for more information. The amounts reported do not reflect the compensation actually realized by our non-employee directors. There can be no assurance that the restricted stock unit awards will vest (in which case no value will be realized by the individual) or that the value on vesting will approximate the compensation expense recognized by us. |

| (3) | Ms. Chau retired from our Board when her term expired on February 6, 2024, the date of the 2024 Annual Meeting. Her compensation reflects a partial year of service. |

| (4) | Mr. Prophet joined the Audit Committee and rotated off from the Nominating and Governance Committee in the second quarter of fiscal 2024, and his annual retainers for service on those committees reflect a partial year of service. |

| (5) | Mr. Segars joined the Technology Strategy Committee and assumed the role of Chair of that committee in the second quarter of fiscal 2024, and his annual retainer and committee chair retainer for service on that committee reflect a partial year of service. |

| (6) | Dr. Tevanian rotated off as the Chair of the Technology Strategy Committee in the second quarter of fiscal 2024, and his committee chair retainer for service on that committee reflects a partial year of service. |

In fiscal 2024, our non-employee directors received the following restricted stock unit awards (which are also reflected in the table above):

Name | Grant Date | Approval Date | Number of Securities Subject to Restricted Stock Unit Awards | Grant Date Fair Value ($) | ||||||||||||

Micheline Chau | — | — | — | — | ||||||||||||

David Dolby | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

Peter Gotcher | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

Tony Prophet | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

Emily Rollins. | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

Simon Segars | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

12

Name | Grant Date | Approval Date | Number of Securities Subject to Restricted Stock Unit Awards | Grant Date Fair Value ($) | ||||||||||||

Anjali Sud | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

Avadis Tevanian, Jr. | 2/6/2024 | 2/6/2024 | 2,952 | 231,142 | ||||||||||||

As of September 27, 2024, the aggregate number of shares of our Class A Common Stock subject to restricted stock unit awards held by each of our non-employee directors is listed in the table below. As of such date, no stock options to purchase shares of our Class A Common Stock were held by any of our non-employee directors.

Name | Aggregate Number of Shares of Class A Common Stock Subject to Outstanding Restricted Stock Unit Awards at Sep. 27, 2024 | |||

David Dolby | 2,952 | |||

Peter Gotcher | 2,952 | |||

Tony Prophet | 2,952 | |||

Emily Rollins | 2,952 | |||

Simon Segars | 2,952 | |||

Anjali Sud | 2,952 | |||

Avadis Tevanian, Jr. | 2,952 | |||

Standard Non-Employee Director Compensation Arrangements

We offer a combination of cash and equity compensation to our non-employee directors, with the goal of attracting and retaining highly-qualified non-employee directors and director candidates to serve on our Board. The Nominating and Governance Committee is responsible for conducting annual reviews of our non-employee director compensation and, if appropriate, recommending to our Board any changes in the type or amount of compensation so that our non-employee director compensation remains attractive and competitive. No changes have been made to cash compensation levels since fiscal 2020 and no changes have been made to the equity compensation terms since fiscal 2016.

Cash Compensation

During fiscal 2024, the annual cash retainers for serving as a non-employee director on our Board or committees of our Board were as follows:

Board/Committee | Member Annual Retainer | Chair Annual Retainer (in Addition to Member Annual Retainer) | ||||||

Board | $ | 50,000 | $ | 75,000 | ||||

Audit | $ | 13,000 | $ | 17,000 | ||||

Compensation | $ | 10,000 | $ | 15,000 | ||||

Nominating and Governance | $ | 7,000 | $ | 8,000 | ||||

Technology Strategy | $ | 5,000 | $ | 5,000 | ||||

13

Members of the Stock Plan Committee receive no annual cash retainer for serving on this committee.

Equity Compensation

The substantial majority of our outside director compensation is in the form of equity in order to align the interests of our non-employee directors with the interests of our stockholders. During fiscal 2024, a newly appointed non-employee director was eligible to receive an initial restricted stock unit award, and all incumbent/continuing non-employee directors were eligible to receive an annual ongoing restricted stock unit award, in each case covering that number of shares of our Class A Common Stock as determined by dividing $250,000 (pro-rated for complete months of service in the case of an initial restricted stock unit award for a newly-appointed director) by the average closing price of our Class A Common Stock for the 30 trading days ending on (and including) the trading day immediately preceding the grant date, rounded down to the nearest whole share. Both initial and ongoing restricted stock unit awards vest in full on the day preceding the date of the next Annual Meeting of Stockholders following the grant date of the award (or if earlier, the first anniversary of the award’s grant date), subject to continued service on our Board. All shares covered by initial or ongoing restricted stock unit awards will become fully vested immediately prior to a change in control of Dolby, so long as the director is then on our Board.

Director Compensation Review

The Nominating and Governance Committee reviews our non-employee director compensation on an annual basis, and if appropriate, recommends changes to our Board to further our goal of keeping non-employee director compensation attractive and competitive. For fiscal 2024, the Nominating and Governance Committee engaged Compensia, Inc. (“Compensia”), the Compensation Committee’s independent executive compensation consulting firm, for purposes of conducting a non-employee director compensation review. The Nominating and Governance Committee directed Compensia to evaluate our director compensation relative to director compensation at companies included in our compensation peer group that we used as a market check for our fiscal 2024 executive officer compensation, in light of our goal of attracting and retaining highly-qualified non-employee directors and director candidates. Following such review, Compensia concluded that our non-employee director compensation program remained aligned with peer practice, and the Nominating and Governance Committee concluded that no changes to director compensation were advisable for fiscal 2024.

In addition to assisting the Nominating and Governance Committee on its non-employee director compensation review, Compensia has advised the Compensation Committee on executive officer and equity compensation. The Compensation Committee took into account the provision of these services and the compensation to Compensia for such services in determining that its relationship with Compensia and the work of Compensia on behalf of the Compensation Committee has not raised any conflict of interest, as described in “Compensation Discussion and Analysis—Roles of the Compensation Committee, Management and Compensation Consultant—Role of Compensation Consultant.”

Other Arrangements

We reimburse our non-employee directors for reasonable travel, lodging, and related expenses in connection with attendance at our Board and committee meetings and company-related activities. In addition, consistent with our Corporate Governance Guidelines, we encourage and support the activities of our directors in attending corporate governance and other professional development, continuing education and training programs designed for board members of publicly-held companies, and we reimburse our directors for reasonable expenses incurred in connection with these activities. Further, eligible non-employee directors may elect to participate in our company-wide healthcare program (which is a program generally applicable to all employees and that does not discriminate in scope, terms or operation, in favor of executive officers or directors), provided that they pay the premiums associated with their (and their eligible dependents’) healthcare coverage. Lastly, non-employee directors are allowed to use our screening rooms for personal purposes up to four times per year, subject to availability and the payment by the non-employee director of any incremental expenses associated with such use.

14

Non-Employee Director Stock Ownership Guidelines

Our Board has approved stock ownership guidelines for our non-employee directors based on our belief that stock ownership further aligns the interests of our non-employee directors with those of our stockholders. These guidelines provide that each non-employee director is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the value of five times his or her annual retainer for service on our Board (subject to a “floor” to account for potential significant decreases in stock price, consisting of a fixed number of shares having a value equal to five times the annual Board retainer on September 22, 2015, representing the date of the most recent amendment of the stock ownership guidelines; or in the case of directors who joined our Board after such date, a value equal to five times the annual Board retainer in effect when he or she joined the Board). Compliance is measured as of the last day of each fiscal year. For purposes of our non-employee director stock ownership guidelines, a director’s “annual retainer” excludes any retainer for serving as a member or chair of any Board committees, or for serving as the Chair of the Board. New directors have a compliance period of five years from the date they first become a non-employee director to achieve the requisite level of ownership.

As of the end of fiscal 2024, all of our non-employee directors were in compliance with, or within the new director compliance period specified in, our non-employee director stock ownership guidelines.

15

CORPORATE GOVERNANCE MATTERS

Board Meetings and Committees

Our Board held five meetings in fiscal 2024. Each of our directors attended at least 75% of the aggregate number of meetings held by our Board and the committees on which he or she served during fiscal 2024.

The standing committees of our Board consist of an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, and a Stock Plan Committee, each of which has the composition and responsibilities described below. Our Board also has convened an ad hoc Technology Strategy Committee, which has the composition and responsibilities described below. Our Board may in the future convene additional ad hoc committees of our Board as it deems necessary or advisable.

Each of the committees of our Board described below acts pursuant to a written charter approved by our Board, each of which is available on the Governance Overview page of the Investor Relations section of our website at https://investor.dolby.com/governance/Governance-Overview/default.aspx.

The non-employee members of our Board regularly meet in executive session without management present. In addition, the independent members of our Board also meet regularly in executive session. Peter Gotcher, the independent Chair of our Board, serves as the Presiding Director of these executive sessions.

Audit Committee

The current members of the Audit Committee are Tony Prophet, Emily Rollins, and Simon Segars, each of whom is a non-employee member of our Board. Micheline Chau served as a member of the Audit Committee during fiscal 2024, through the date of her retirement from our Board on February 6, 2024. Our Board appointed Mr. Prophet to the Audit Committee effective as of such date. No other members of our Board served on the Audit Committee during fiscal 2024. Ms. Rollins is the chair of the Audit Committee. The Audit Committee held seven meetings in fiscal 2024. Our Board has determined that each member of the Audit Committee meets the requirements for independence under the current requirements of the New York Stock Exchange (the “NYSE”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”). In addition, our Board also has determined that each member of the Audit Committee meets the requirements for financial literacy under the applicable rules and regulations of the NYSE and SEC, and that Ms. Rollins and Mr. Segars each is an “audit committee financial expert” as defined in SEC rules.

The Audit Committee has established a telephone and internet whistleblower hotline for the anonymous submission of suspected violations, including accounting, internal controls or auditing matters, harassment, fraud, and policy violations.

The Audit Committee is responsible for, among other things:

| • | Monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| • | Selecting and hiring our independent auditors, and approving the audit and permissible non-audit services to be performed by them; |

| • | Evaluating the qualifications, performance and independence of our independent auditors; |

| • | Evaluating the performance of our internal audit function; |

| • | Reviewing the adequacy and effectiveness of our control policies and procedures; |

| • | Acting as our Qualified Legal Compliance Committee to review any report made known to the committee by attorneys employed or retained by Dolby or its subsidiaries of a material violation of U.S. federal or state securities or similar laws; |

16

| • | Reviewing, approving or ratifying related person transactions; |

| • | Attending to risk management matters, including cybersecurity risk oversight; and |

| • | Preparing the Audit Committee report that the SEC requires in this Proxy Statement. |

Compensation Committee

The current members of the Compensation Committee are Tony Prophet, Anjali Sud, and Avadis Tevanian, Jr., each of whom is a non-employee member of our Board. Micheline Chau served as a member of the Compensation Committee during fiscal 2024, through the date of her retirement from our Board on February 6, 2024. No other members of our Board served on the Compensation Committee during fiscal 2024. Dr. Tevanian is the chair of the Compensation Committee. In fiscal 2024, the Compensation Committee held seven meetings and acted by unanimous written consent on one occasion. Our Board has determined that each member of the Compensation Committee meets the requirements for independence under current NYSE and SEC rules and regulations. The Compensation Committee is responsible for, among other things:

| • | Reviewing and approving corporate goals and objectives relevant to our CEO’s compensation and evaluating our CEO’s performance in light of those goals and objectives; |

| • | Reviewing and approving the following elements of compensation for our CEO and other executive officers: annual base salary; annual incentive compensation, including the specific performance goals and amounts; long-term incentive compensation; employment agreements; severance arrangements and change in control provisions; and any other significant benefits, compensation or arrangements that are not available to employees generally; |

| • | Administering Dolby’s broad-based equity incentive plans, including granting equity awards under such plans; |

| • | Evaluating and approving compensation plans, policies and programs for our CEO and other executive officers; |

| • | Reviewing and monitoring matters related to human capital management; |

| • | Attending to compensation-related risk management matters; |

| • | Overseeing our policy on the recoupment (“clawback”) of incentive compensation and our executive stock ownership guidelines; |

| • | Retaining and assessing the independence of any Compensation Committee advisors; and |

| • | Reviewing the Compensation Discussion and Analysis, and preparing the Compensation Committee report, that the SEC requires in our annual report on Form 10-K or in this Proxy Statement. |

Nominating and Governance Committee

The current members of the Nominating and Governance Committee are Peter Gotcher, Simon Segars, and Avadis Tevanian, Jr., each of whom is a non-employee member of our Board. Tony Prophet served as a member of the Nominating and Governance Committee during fiscal 2024, through February 6, 2024, at which point he was appointed to the Audit Committee following Micheline Chau’s retirement. No other members of our Board served on the Nominating and Governance Committee during fiscal 2024. Mr. Gotcher is the chair of the Nominating and Governance Committee. The Nominating and Governance Committee held four meetings in fiscal 2024. Our Board has determined that each member of the Nominating and Governance Committee meets the requirements for independence under current NYSE and SEC rules and regulations. The Nominating and Governance Committee is responsible for, among other things:

| • | Assisting our Board in identifying and recommending director nominees; |

| • | Developing and recommending corporate governance principles; |

17

| • | Overseeing the evaluation of our Board, Board committees and individual directors; |

| • | Recommending Board committee assignments; |

| • | Making an annual report to our Board on succession planning for the position of CEO; |

| • | Reviewing and monitoring environmental, social and governance matters of significance to us; |

| • | Attending to Board- and corporate governance-related risk management matters; and |

| • | Reviewing and making recommendations to our Board regarding director compensation. |

Stock Plan Committee

The current members of the Stock Plan Committee are Avadis Tevanian, Jr. and Kevin Yeaman. No other members of our Board served on the Stock Plan Committee during fiscal 2024. In fiscal 2024, the Stock Plan Committee held one meeting and granted equity awards by unanimous written consent on 13 occasions. The Stock Plan Committee has the authority to grant stock options, stock appreciation rights and restricted stock unit awards to newly hired employees and consultants who will not be executive officers or directors of Dolby on the date of grant, and to make performance, promotion or retention grants of equity awards to employees and consultants who are not executive officers or directors of Dolby on the date of grant. Equity awards granted by the Stock Plan Committee are subject to the terms and conditions of the Equity-Based Award Grant and Vesting Policy described in the Compensation Discussion and Analysis below.

Technology Strategy Committee

The current members of the Technology Strategy Committee are David Dolby, Simon Segars, and Avadis Tevanian, Jr. No other members of our Board served on the Technology Strategy Committee during fiscal 2024. Dr. Tevanian was the chair of the committee in fiscal 2024, through February 6, 2024. Mr. Segars joined the committee and has been serving as chair since such date. The Technology Strategy Committee held two meetings during fiscal 2024. The Technology Strategy Committee is responsible for exploring the opportunities and issues associated with Dolby’s technology strategies and intellectual property.

Board’s Role in Risk Oversight

Our Board is responsible for overseeing Dolby’s risk management structure. Management is responsible for establishing our business and operational strategies, identifying and assessing the related risks and implementing appropriate risk management practices on a day-to-day basis. Our Board reviews our business and operational strategies and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the company. Our Board meets with management at least quarterly to review, advise, and direct management with respect to strategic business risks, operational risks, legal risks and risks related to Dolby’s acquisition strategies, among others. In fiscal 2024, this also included review of risks relating to ongoing macroeconomic conditions and related uncertainty and geopolitical instability. Our Board also delegates oversight to Board committees to oversee selected elements of risk.

The Audit Committee oversees financial risk exposures, including monitoring our financial condition and investments, the integrity of our financial statements, accounting matters, internal control over financial reporting, the independence of Dolby’s independent registered public accounting firm, KPMG, plans regarding business continuity and cybersecurity, and guidelines and policies with respect to risk assessment and risk management. The Audit Committee receives periodic updates on internal controls and related assessments from Dolby’s finance department and an annual attestation report on internal control over financial reporting from KPMG. The Audit Committee oversees Dolby’s annual enterprise business risk assessment, which is conducted by our Internal Audit Department. The annual enterprise business risk assessment reviews the primary risks facing the company and Dolby’s associated risk mitigation measures. In addition, the Audit Committee discusses other risk assessment and risk management policies of the company periodically with management.

18

The Compensation Committee oversees the design of executive compensation structures that create incentives that encourage behaviors and decisions consistent with our business strategy, including a review of an annual risk assessment with respect to our compensation programs and policies generally.

The Nominating and Governance Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership, structure and compensation, succession planning for our directors and executive officers and corporate governance policies.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board does not have a policy regarding the separation of the offices of the Chair of the Board and CEO and that our Board is free to choose the Chair of the Board in any way that it deems best for the company at any given point in time. Our Board believes that these issues should be considered as part of our Board’s broader governance responsibilities.

Our Board has determined that having two different individuals serve in the roles of Chair of the Board and CEO is in the best interest of the company’s stockholders at this time. Mr. Yeaman currently serves as our CEO and Mr. Gotcher currently serves as the independent Chair of our Board. The CEO is responsible for the strategic direction, day-to-day leadership, and performance of the company, while the Chair of the Board provides overall leadership to our Board. The Chair of the Board also works with the CEO and General Counsel to prepare Board meeting agendas and chairs meetings of our Board. This leadership structure allows the CEO to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure provides an appropriate allocation of roles and responsibilities at this time.

Board Independence

Our Board has determined that Mses. Rollins and Sud, and Messrs. Gotcher, Prophet, Segars, and Dr. Tevanian do not have any material relationship with Dolby and are independent within the meaning of the standards established by the NYSE. In making this determination, our Board considered all relevant facts and circumstances known to us, including each director’s commercial, accounting, legal, banking, consulting, charitable and familial relationships.

Succession Planning

As reflected in our Corporate Governance Guidelines, a key responsibility of our Board is to work with the Nominating and Governance Committee on succession planning for our CEO. As part of this process, our Board works with the Nominating and Governance Committee to identify potential successors to our CEO and the committee makes an annual report to our Board. Our Board also has adopted an emergency succession plan in the event of the death, disability, incapacity or unanticipated departure or leave of our CEO.

Policy for Director Recommendations

It is the policy of the Nominating and Governance Committee to consider recommendations for candidates to our Board from stockholders holding at least 250,000 shares of our Common Stock continuously for at least 12 months prior to the date of the submission of the recommendation.

A stockholder that wishes to recommend a candidate for election to our Board should send the recommendation by letter to Dolby Laboratories, Inc., 1275 Market Street, San Francisco, California 94103, Attn: General Counsel. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and Dolby, and evidence of

19

the recommending stockholder’s ownership of Dolby Common Stock consistent with the ownership requirements set forth above. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, addressing issues of character, integrity, judgment, independence, areas of expertise, corporate experience, length of service, potential conflicts of interest, other commitments, personal references, diversity characteristics, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board.

For a recommendation to be considered by our Board, the recommending stockholder must promptly provide such other information as may reasonably be requested by the company or our Board to determine the eligibility of such recommended candidate to serve as an independent director of the company or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, or the qualifications of such recommended candidate, including but not limited to the information required to be provided in connection with a stockholder nomination of a director candidate set forth in Section 2.14 of our Bylaws.

The committee will use the following procedures to identify and evaluate any individual recommended or offered for nomination to our Board:

| • | The committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the committee from other sources; |

| • | In its evaluation of director candidates, including the members of our Board eligible for re-election, the committee will consider the following: (i) the current size and composition of our Board and the needs of our Board, and the respective committees of our Board; (ii) without assigning any particular weighting or priority to any of these factors, such factors as character, integrity, judgment, independence, areas of expertise, corporate experience, length of service, potential conflicts of interest, other commitments, and diversity (including with respect to experience, perspective, professional background, education, and geography), as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board; and (iii) other factors that the committee may consider appropriate; |

| • | The committee requires the following minimum qualifications, which are the desired qualifications and characteristics for Board membership, to be satisfied by any nominee for a position on our Board: (i) the highest personal and professional ethics and integrity; (ii) proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment; (iii) skills that are complementary to those of the existing Board; (iv) the ability to assist and support management and make significant contributions to Dolby’s success; and (v) an understanding of the fiduciary responsibilities that are required of a member of our Board and the commitment of time and energy necessary to diligently carry out those responsibilities; |

| • | If the committee determines that an additional or replacement director is required, the committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, our Board or management; and |

| • | The committee may propose to our Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to our Board. |

We do not maintain a separate policy regarding the diversity of our Board, but during the director nomination process, as described above, the Nominating and Governance Committee considers certain diversity characteristics and attributes in the evaluation of director candidates.

For stockholders who wish to nominate a candidate for election to our Board (as opposed to only recommending a candidate for consideration by the Nominating and Governance Committee as described above), see the procedures discussed in “Additional Meeting Matters” below.

20

Policies and Procedures for Communications to Non-Employee or Independent Directors

In cases where stockholders or interested parties wish to communicate directly with our non-employee or independent directors, messages may be sent to our General Counsel, at generalcounsel@dolby.com, or to Dolby Laboratories, Inc., 1275 Market Street, San Francisco, California 94103, Attn: General Counsel. The office of our General Counsel monitors these communications and our General Counsel will provide a summary of all received messages to our Board at each regularly scheduled meeting of our Board, or if appropriate, solely to the non-employee or independent directors at each regularly scheduled executive session of non-employee or independent directors. Where the nature of a communication warrants, our General Counsel may obtain the more immediate attention of the appropriate committee of our Board, of non-employee or independent directors, of independent advisors or of Dolby management, as our General Counsel considers appropriate. Our General Counsel may decide in the exercise of his judgment whether a response to any stockholder or interested party communication is necessary.

Attendance at Annual Meeting of Stockholders

We encourage our directors to attend our Annual Meetings of Stockholders, and all of the members of our Board attended the 2024 Annual Meeting.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics, which is applicable to all of our directors and our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions. The Code of Business Conduct and Ethics is available on the Governance Overview page of the Investor Relations section of our website at https://investor.dolby.com/governance/Governance-Overview/default.aspx. We will post any amendments or waivers to the Code of Business Conduct and Ethics that are required to be disclosed by the rules of the SEC or NYSE on this website.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that contain the general framework for the governance of the company. Among other things, our Corporate Governance Guidelines address:

| • | The role of our Board; |

| • | The size and composition of our Board and its committees; |

| • | New director orientation and continuing education; |

| • | Board and committee authority to retain independent advisors; |

| • | Board meetings and process; |

| • | Board self-evaluation; |

| • | Evaluation of our CEO and succession planning; |

| • | Corporate business principles and policies applicable to our Board; and |

| • | Communications by Board members with outside constituencies. |

The Nominating and Governance Committee will periodically review the guidelines and report any recommended changes to our Board. The Corporate Governance Guidelines are available on the Governance Overview page of the Investor Relations section of our website at https://investor.dolby.com/governance/Governance-Overview/default.aspx.

21

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Tony Prophet, Anjali Sud, and Avadis Tevanian, Jr. Micheline Chau also served as a member of the Compensation Committee during fiscal 2024, through the date of her retirement from our Board on February 6, 2024. None of the members of our Compensation Committee during the last fiscal year is or has been an officer or employee of our company or had any relationship requiring disclosure under Item 404 of Regulation S-K under the Securities Act of 1933. None of our executive officers has served as a member of the board of directors or compensation committee (or other committee serving an equivalent function) of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Rule 10b5-1 Trading Plans

Certain of our directors and executive officers have adopted, and in the future may adopt, written trading plans that meet the requirements of Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (“Rule 10b5-1”). Rule 10b5-1 allows persons who may be considered insiders of an issuer to adopt pre-arranged written plans for trading specified amounts of stock. Rule 10b5-1 trading plans establish predetermined trading parameters that, among other things, do not permit the person adopting the trading plan to exercise subsequent influence over how, when or whether to effect trades. Once a Rule 10b5-1 trading plan has been properly adopted, trades may be executed pursuant to the terms of the trading plan at times when the person would otherwise be restricted from trading (e.g., during a closed trading window). Rule 10b5-1 trading plans are designed to allow individuals to purchase or sell shares in an orderly fashion for asset diversification, liquidity, tax planning and other purposes when they might otherwise be restricted from doing so due to material, non-public information that they might possess at the time of the purchase or sale.