Q4 and FY 2023 Update Exhibit 99.1

Highlights 03�Financial Summary 04�Operational Summary 07�Vehicle Capacity 09�Core Technology 10�Other Highlights 11�Outlook 12�Photos & Charts 13�Key Metrics 22�Financial Statements 24�Additional Information 31

S U M M A R Y H I G H L I G H T S (1) Excludes SBC (stock-based compensation) and release of valuation allowance on deferred tax assets; (2) Free cash flow = operating cash flow less capex; (3) Includes cash, cash equivalents and investments; (4) Tesla estimate based on preliminary data; (5) Calculated by dividing Cost of Automotive Sales Revenue by respective quarter’s new deliveries (ex-operating leases); (6)Active driver supervision required; does not make the vehicle autonomous. Profitability $8.9B GAAP operating income in 2023; $2.1B in Q4 $15.0B GAAP net income in 2023; $7.9B in Q4 $10.9B non-GAAP net income1 in 2023; $2.5B in Q4 One-time non-cash tax benefit of $5.9B recorded in Q4 for the release of valuation allowance on certain deferred tax assets In 2023, we delivered over 1.2 million Model Ys, making it the best-selling vehicle, of any kind, globally. For a long time, many doubted the viability of EVs. Today, the best-selling vehicle on the planet is an EV. Free cash flow remained strong in 2023 at $4.4B, even as we focused on future growth projects with our highest capital expenditures and R&D expenses in company history. Energy storage deployments reached 14.7 GWh in 2023, more than double compared to the previous year, while Energy Generation and Storage business profits nearly quadrupled in 2023. Gross profit of our Services & Other business increased from a ~$500M loss in 2019 to a ~$500M profit in 2023. Cost of goods sold per vehicle5 declined sequentially in Q4. Our team remains focused on growing our output, investing in our future growth and finding additional cost efficiencies in 2024. In late December, we started rolling out V12 of FSD Beta6. Trained on data from a fleet of over a million vehicles, this system uses AI to influence vehicle controls (steering wheel, pedals, indicators, etc.) instead of hard-coding every driving behavior. V12 marks a new era in the path to full autonomy. We are focused on bringing the next generation platform to market as quickly as we can, with the plan to start production at Gigafactory Texas. This platform will revolutionize how vehicles are manufactured. Cash Operating cash flow of $13.3B; free cash flow2 of $4.4B in 2023 Operating cash flow of $4.4B; free cash flow of $2.1B in Q4 $3.0B increase in our cash and investments3 in Q4 to $29.1B Operations Model Y became the best-selling vehicle in the world4 Energy storage deployment of 14.7 GWh in 2023, 125% growth

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 YoY Total automotive revenues 21,307 19,963 21,268 19,625 21,563 1% Energy generation and storage revenue 1,310 1,529 1,509 1,559 1,438 10% Services and other revenue 1,701 1,837 2,150 2,166 2,166 27% Total revenues 24,318 23,329 24,927 23,350 25,167 3% Total gross profit 5,777 4,511 4,533 4,178 4,438 -23% Total GAAP gross margin 23.8% 19.3% 18.2% 17.9% 17.6% -612 bp Operating expenses 1,876 1,847 2,134 2,414 2,374 27% Income from operations 3,901 2,664 2,399 1,764 2,064 -47% Operating margin 16.0% 11.4% 9.6% 7.6% 8.2% -784 bp Adjusted EBITDA 5,404 4,267 4,653 3,758 3,953 -27% Adjusted EBITDA margin 22.2% 18.3% 18.7% 16.1% 15.7% -652 bp Net income attributable to common stockholders (GAAP) 3,687 2,513 2,703 1,853 7,928 115% Net income attributable to common stockholders (non-GAAP) 4,106 2,931 3,148 2,318 2,485 -39% EPS attributable to common stockholders, diluted (GAAP) 1.07 0.73 0.78 0.53 2.27 112% EPS attributable to common stockholders, diluted (non-GAAP) 1.19 0.85 0.91 0.66 0.71 -40% Net cash provided by operating activities 3,278 2,513 3,065 3,308 4,370 33% Capital expenditures (1,858) (2,072) (2,060) (2,460) (2,306) 24% Free cash flow 1,420 441 1,005 848 2,064 45% Cash, cash equivalents and investments 22,185 22,402 23,075 26,077 29,094 31%

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) 2019 2020 2021 2022 2023 YoY Total automotive revenues 20,821 27,236 47,232 71,462 82,419 15% Energy generation and storage revenue 1,531 1,994 2,789 3,909 6,035 54% Services and other revenue 2,226 2,306 3,802 6,091 8,319 37% Total revenues 24,578 31,536 53,823 81,462 96,773 19% Total gross profit 4,069 6,630 13,606 20,853 17,660 -15% Total GAAP gross margin 16.6% 21.0% 25.3% 25.6% 18.2% -735 bp Operating expenses 4,138 4,636 7,083 7,197 8,769 22% (Loss) income from operations (69) 1,994 6,523 13,656 8,891 -35% Operating margin -0.3% 6.3% 12.1% 16.8% 9.2% -758 bp Adjusted EBITDA 2,985 5,817 11,621 19,186 16,631 -13% Adjusted EBITDA margin 12.1% 18.4% 21.6% 23.6% 17.2% -637 bp Net (loss) income attributable to common stockholders (GAAP) (862) 721 5,519 12,556 14,997 19% Net income attributable to common stockholders (non-GAAP) 36 2,455 7,640 14,116 10,882 -23% EPS attributable to common stockholders, diluted (GAAP) (0.33) 0.21 1.63 3.62 4.30 19% EPS attributable to common stockholders, diluted (non-GAAP) 0.01 0.75 2.26 4.07 3.12 -23% Net cash provided by operating activities 2,405 5,943 11,497 14,724 13,256 -10% Capital expenditures (1,327) (3,157) (6,482) (7,158) (8,898) 24% Free cash flow 1,078 2,786 5,015 7,566 4,358 -42% Cash, cash equivalents and investments 6,268 19,384 17,707 22,185 29,094 31%

F I N A N C I A L S U M M A R Y Revenue Total revenue grew 3% YoY in Q4 to $25.2B. YoY, revenue was impacted by the following items: + growth in vehicle deliveries + growth in other parts of the business + positive FX impact of $0.1B1 - reduced vehicle average selling price (ASP) YoY (excl. FX impact), including unfavorable impact of mix - lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4`22 Profitability Our operating income decreased YoY to $2.1B in Q4, resulting in an 8.2% operating margin. YoY, operating income was primarily impacted by the following items: - reduced vehicle ASP due to pricing and mix - increase in operating expenses partly driven by AI and other R&D projects - lower FSD revenue recognition YoY due to FSD Beta wide release in North America in Q4`22 - cost of Cybertruck production ramp + lower cost per vehicle, including lower raw material costs, logistics costs and IRA credit benefit + growth in vehicle deliveries + gross profit growth in Energy Generation and Storage While it did not impact Operating Income, we did record a one-time non-cash tax benefit of $5.9B in Q4 for the release of valuation allowance on certain deferred tax assets. Cash Quarter-end cash, cash equivalents and investments increased sequentially by $3.0B to $29.1B in Q4, driven by free cash flow of $2.1B and financing activities of $0.9B. (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q4’22.

Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 YoY Model 3/Y production 419,088 421,371 460,211 416,800 476,777 14% Other models production 20,613 19,437 19,489 13,688 18,212 -12% Total production 439,701 440,808 479,700 430,488 494,989 13% Model 3/Y deliveries 388,131 412,180 446,915 419,074 461,538 19% Other models deliveries 17,147 10,695 19,225 15,985 22,969 34% Total deliveries 405,278 422,875 466,140 435,059 484,507 20% of which subject to operating lease accounting 15,184 22,357 21,883 17,423 10,563 -30% Total end of quarter operating lease vehicle count 140,667 153,988 168,058 176,231 176,564 26% Global vehicle inventory (days of supply)(1) 13 15 16 16 15 15% Solar deployed (MW) 100 67 66 49 41 -59% Storage deployed (MWh) 2,462 3,889 3,653 3,980 3,202 30% Tesla locations 963 1,000 1,068 1,129 1,208 25% Mobile service fleet 1,584 1,692 1,769 1,846 1,909 21% Supercharger stations 4,678 4,947 5,265 5,595 5,952 27% Supercharger connectors 42,419 45,169 48,082 51,105 54,892 29% (1)Days of supply is calculated by dividing new vehicle ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). O P E R A T I O N A L S U M M A R Y (Unaudited)

2019 2020 2021 2022 2023 YoY Model 3/Y production 302,301 454,932 906,032 1,298,434 1,775,159 37% Other models production 62,931 54,805 24,390 71,177 70,826 0% Total production 365,232 509,737 930,422 1,369,611 1,845,985 35% Model 3/Y deliveries 300,885 442,562 911,242 1,247,146 1,739,707 39% Other models deliveries 66,771 57,085 24,980 66,705 68,874 3% Total deliveries 367,656 499,647 936,222 1,313,851 1,808,581 38% of which subject to operating lease accounting 25,439 34,470 60,912 47,582 72,226 52% Total end of year operating lease vehicle count 49,901 72,089 120,342 140,667 176,564 26% Global vehicle inventory (days of supply)(1) 13 15 6 16 16 0% Solar deployed (MW) 173 205 345 348 223 -36% Storage deployed (MWh) 1,651 3,022 3,992 6,541 14,724 125% Tesla locations(2) 433 523 644 963 1,208 25% Mobile service fleet 758 894 1,281 1,584 1,909 21% Supercharger stations 1,821 2,564 3,476 4,678 5,952 27% Supercharger connectors 16,104 23,277 31,498 42,419 54,892 29% (1)Days of supply is calculated by dividing new vehicle ending inventory by the relevant year’s deliveries and using 300 trading days (aligned with Automotive News definition). (2)We revised our methodology for reporting Tesla’s physical footprint to include all sales, service, delivery and body shop locations globally for 2022 onwards. O P E R A T I O N A L S U M M A R Y (Unaudited)

V E H I C L E C A P A C I T Y Current Installed Annual Vehicle Capacity Current Status Region Model Capacity Status California Model S / Model X 100,000 Production Model 3 / Model Y 550,000 Production Shanghai Model 3 / Model Y >950,000 Production Berlin Model Y 375,000 Production Texas Model Y >250,000 Production Cybertruck >125,000 Production Nevada Tesla Semi - Pilot production Various Next Gen Platform - In development TBD Roadster - In development Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM – light-duty vehicles only; TTM = Trailing twelve months After our scheduled global factory shutdown in Q3, our global production reached a record annualized run rate of nearly 2.0 million vehicles in Q4. The refreshed Model 3 - with a significantly quieter cabin, ventilated seats, a screen for rear seats, longer range and many other improvements - is now available globally. US: California, Nevada and Texas Before Tesla purchased the Fremont factory, the record output of the previous owner was nearly 430,000 vehicles made in a single year. In 2023, the Tesla Fremont factory produced nearly 560,000 vehicles thanks to our ~20,000 Fremont-based employees. At Gigafactory Texas, we began production of the Cybertruck and delivered the first units to customers. We expect the ramp of Cybertruck to be longer than other models given its manufacturing complexity. China: Shanghai Shanghai resumed normal rate production in Q4, rebounding from the scheduled downtime in Q3. Production of the updated Model 3 ramped to full speed in less than two months. Europe: Berlin-Brandenburg Model Y production in Berlin continued to grow in Q4, achieving both a record weekly production rate and a sequential increase in total production volume for the seventh consecutive quarter.

Cost of goods sold per vehicle C O R E T E C H N O L O G Y Cumulative miles driven with FSD Beta (millions) Artificial Intelligence Software and Hardware In Q4, we released our latest FSD Beta software (V12) to select Tesla employees, and more recently, to customers. V12 utilizes end-to-end training, enhancing the driving experience. We also introduced the 2nd generation of the Optimus robot, which uses Tesla-designed actuators and sensors and improved AI capabilities. Both FSD Beta and Optimus are trained with similar technology pillars: real-world data, neural net training and cutting-edge hardware and software. Vehicle and Other Software We delivered the Cybertruck with an all-new user interface and new communication bus, Etherloop, that efficiently moves data while significantly reducing wiring. As part of our holiday update, when parking, Tesla vehicles without ultrasonic sensors display a high-fidelity 3D rendering of the vehicle's surroundings, including nearby barriers, vehicles and painted markings. Wireless Bluetooth headphones can also now be paired with the rear screen when watching shows or playing games. FleetAPI now enables third-party solutions that enhance integration and management of Tesla devices. Battery, Powertrain & Manufacturing Cost of goods sold per vehicle declined sequentially to slightly above $36,000. Even as we approach the natural limit of cost down of our existing vehicle lineup, our team continues to focus on further cost reductions across all points of production, from raw materials to final delivery.

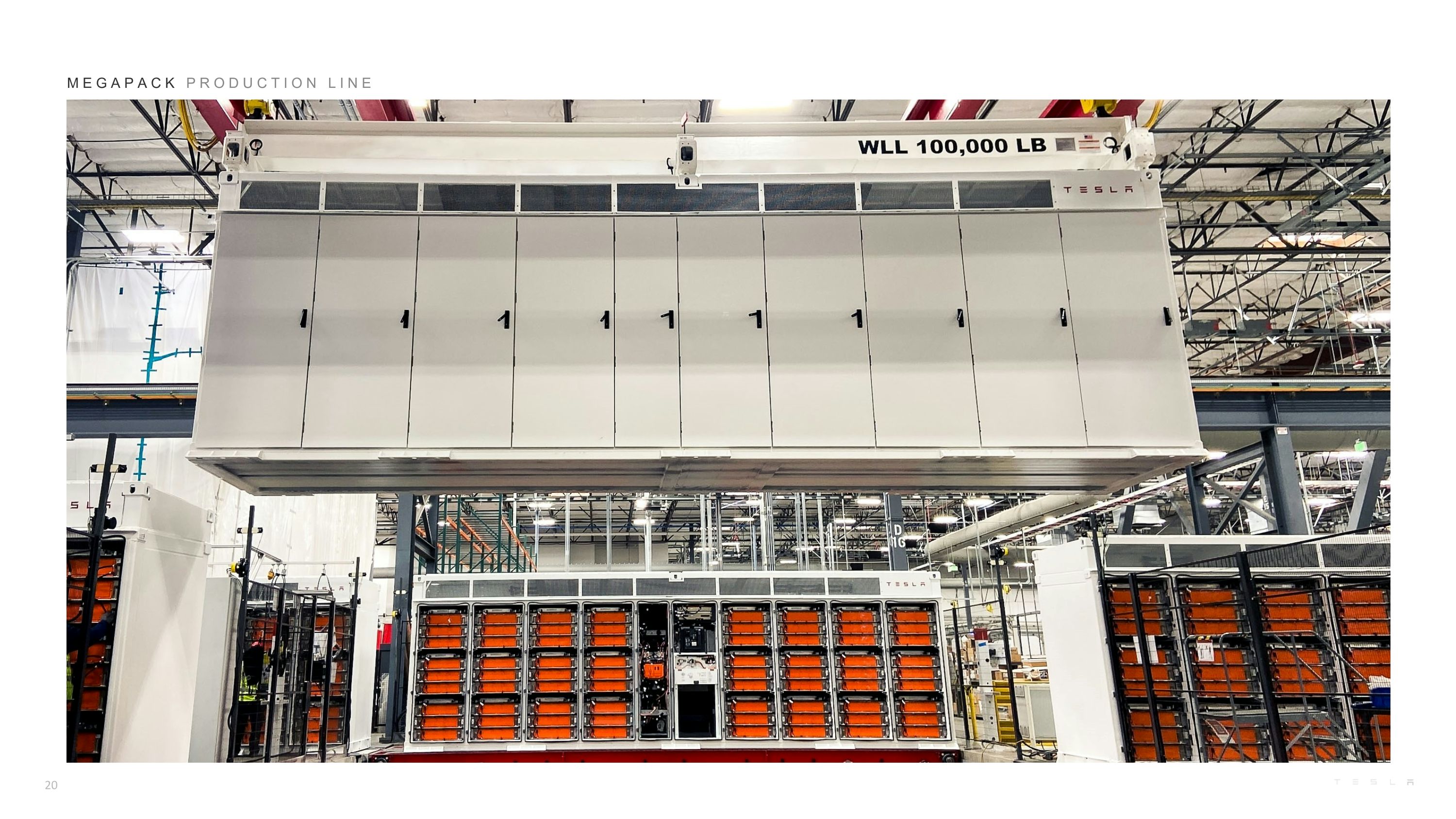

O T H E R H I G H L I G H T S Services & Other gross profit ($M) Energy Storage Energy storage deployments decreased sequentially in Q4 to 3.2 GWh, for a total deployment of 14.7 GWh in 2023, a 125% increase compared to 2022. While we expect deployments will continue to be volatile on a sequential basis, impacted by logistics and the global distribution of projects at any given time, we expect continued growth on a trailing twelve-month basis going forward. We continue to ramp our 40 GWh Megafactory in Lathrop, CA toward full capacity. Solar Solar deployments declined on a sequential and YoY basis to 41 MW. Downward pressure on solar demand continued into Q4 as interest rates have remained high. Profitability in the quarter was negatively impacted by lower deployments and seasonal weakness in solar energy generation. Services and Other business The Services and Other business continued to grow alongside our fleet in 2023, achieving record revenue and gross profit generation. The biggest drivers of profit generation in 2023 were part sales, used vehicle sales, merchandise sales and pay-per-use supercharging. As our fleet continues to expand in the coming years, there is an opportunity for fleet-related services to become a more meaningful driver of profit generation. Energy Storage deployments (GWh)

O U T L O O K Volume Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and the next one we believe will be initiated by the global expansion of the next-generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next-generation vehicle at Gigafactory Texas. In 2024, the growth rate of deployments and revenue in our Energy Storage business should outpace the Automotive business. Cash We have sufficient liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period. Profit While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits. Product Cybertruck production and deliveries will ramp throughout this year. In addition, we continue to make progress on our next generation platform.

P H O T O S & C H A R T S

M O D E L Y - B E S T - S E L L I N G V E H I C L E G L O B A L L Y I N 2 0 2 3

U P D A T E D M O D E L 3 - A V A I L A B L E G L O B A L L Y

F R E M O N T F A C T O R Y P R O D U C E D N E A R L Y 5 6 0 , 0 0 0 V E H I C L E S I N 2 0 2 3 , A N A L L – T I M E R E C O R D

C Y B E R T R U C K D E L I V E R Y E V E N T

C Y B E R T R U C K

C Y B E R T R U C K P R O D U C T I O N L I N E

M E G A P A C K P R O D U C T I O N L I N E

T E S L A W R A P S

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B)

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) Vehicle Deliveries (millions of units)

F I N A N C I A L S T A T E M E N T S

In millions of USD or shares as applicable, except per share data Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 REVENUES Automotive sales 20,241 18,878 20,419 18,582 20,630 Automotive regulatory credits 467 521 282 554 433 Automotive leasing 599 564 567 489 500 Total automotive revenues 21,307 19,963 21,268 19,625 21,563 Energy generation and storage 1,310 1,529 1,509 1,559 1,438 Services and other 1,701 1,837 2,150 2,166 2,166 Total revenues 24,318 23,329 24,927 23,350 25,167 COST OF REVENUES Automotive sales 15,433 15,422 16,841 15,656 17,202 Automotive leasing 352 333 338 301 296 Total automotive cost of revenues 15,785 15,755 17,179 15,957 17,498 Energy generation and storage 1,151 1,361 1,231 1,178 1,124 Services and other 1,605 1,702 1,984 2,037 2,107 Total cost of revenues 18,541 18,818 20,394 19,172 20,729 Gross profit 5,777 4,511 4,533 4,178 4,438 OPERATING EXPENSES Research and development 810 771 943 1,161 1,094 Selling, general and administrative 1,032 1,076 1,191 1,253 1,280 Restructuring and other 34 — — — — Total operating expenses 1,876 1,847 2,134 2,414 2,374 INCOME FROM OPERATIONS 3,901 2,664 2,399 1,764 2,064 Interest income 157 213 238 282 333 Interest expense (33) (29) (28) (38) (61) Other (expense) income, net (42) (48) 328 37 (145) INCOME BEFORE INCOME TAXES 3,983 2,800 2,937 2,045 2,191 Provision for (benefit from) income taxes 276 261 323 167 (5,752) NET INCOME 3,707 2,539 2,614 1,878 7,943 Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries 20 26 (89) 25 15 NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS 3,687 2,513 2,703 1,853 7,928 Net income per share of common stock attributable to common stockholders Basic $ 1.18 $ 0.80 $ 0.85 $ 0.58 $ 2.49 Diluted $ 1.07 $ 0.73 $ 0.78 $ 0.53 $ 2.27 Weighted average shares used in computing net income per share of common stock Basic 3,160 3,166 3,171 3,176 3,181 Diluted 3,471 3,468 3,478 3,493 3,492 S T A T E M E N T O F O P E R A T I O N S (Unaudited)

B A L A N C E S H E E T (Unaudited) In millions of USD 31-Dec-22 31-Mar-23 30-Jun-23 30-Sep-23 31-Dec-23 ASSETS Current assets Cash, cash equivalents and investments 22,185 22,402 23,075 26,077 29,094 Accounts receivable, net 2,952 2,993 3,447 2,520 3,508 Inventory 12,839 14,375 14,356 13,721 13,626 Prepaid expenses and other current assets 2,941 3,227 2,997 2,708 3,388 Total current assets 40,917 42,997 43,875 45,026 49,616 Operating lease vehicles, net 5,035 5,473 5,935 6,119 5,989 Solar energy systems, net 5,489 5,427 5,365 5,293 5,229 Property, plant and equipment, net 23,548 24,969 26,389 27,744 29,725 Operating lease right-of-use assets 2,563 2,800 3,352 3,637 4,180 Digital assets, net 184 184 184 184 184 Goodwill and intangible assets, net 409 399 465 441 431 Deferred tax assets 328 399 537 648 6,733 Other non-current assets 3,865 4,185 4,489 4,849 4,531 Total assets 82,338 86,833 90,591 93,941 106,618 LIABILITIES AND EQUITY Current liabilities Accounts payable 15,255 15,904 15,273 13,937 14,431 Accrued liabilities and other 8,205 8,378 8,684 8,530 9,080 Deferred revenue 1,747 1,750 2,176 2,206 2,864 Current portion of debt and finance leases (1) 1,502 1,404 1,459 1,967 2,373 Total current liabilities 26,709 27,436 27,592 26,640 28,748 Debt and finance leases, net of current portion (1) 1,597 1,272 872 2,426 2,857 Deferred revenue, net of current portion 2,804 2,911 3,021 3,059 3,251 Other long-term liabilities 5,330 5,979 6,924 7,321 8,153 Total liabilities 36,440 37,598 38,409 39,446 43,009 Redeemable noncontrolling interests in subsidiaries 409 407 288 277 242 Total stockholders' equity 44,704 48,054 51,130 53,466 62,634 Noncontrolling interests in subsidiaries 785 774 764 752 733 Total liabilities and equity 82,338 86,833 90,591 93,941 106,618 (1) Breakdown of our debt is as follows: Vehicle and energy product financing (non-recourse) 2,001 1,708 1,475 3,660 4,613 Recourse debt 44 44 44 44 44 Total debt excluding vehicle and energy product financing 44 44 44 44 44 Days sales outstanding 10 11 12 12 11 Days payable outstanding 72 75 70 70 63

In millions of USD Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 CASH FLOWS FROM OPERATING ACTIVITIES Net income 3,707 2,539 2,614 1,878 7,943 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment 989 1,046 1,154 1,235 1,232 Stock-based compensation 419 418 445 465 484 Deferred income taxes (81) (55) (148) (113) (6,033) Other 354 40 (47) 145 262 Changes in operating assets and liabilities (2,110) (1,475) (953) (302) 482 Net cash provided by operating activities 3,278 2,513 3,065 3,308 4,370 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (1,858) (2,072) (2,060) (2,460) (2,306) Purchases of solar energy systems, net of sales (0) (1) (0) 1 (1) Purchases of investments (4,368) (2,015) (5,075) (6,131) (5,891) Proceeds from maturities of investments 19 1,604 3,539 3,816 3,394 Proceeds from sales of investments — — 138 — — Receipt of government grants 76 — — — — Business combinations, net of cash acquired — — (76) 12 — Net cash used in investing activities (6,131) (2,484) (3,534) (4,762) (4,804) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from other debt activities (162) (127) (124) (140) (141) Net (repayments) borrowings under vehicle and energy product financing (335) (294) (233) 2,194 952 Net cash flows from noncontrolling interests – Solar (65) (43) (34) (45) (76) Other 67 231 63 254 152 Net cash (used in) provided by financing activities (495) (233) (328) 2,263 887 Effect of exchange rate changes on cash and cash equivalents and restricted cash 123 50 (94) (98) 146 Net (decrease) increase in cash and cash equivalents and restricted cash (3,225) (154) (891) 711 599 Cash and cash equivalents and restricted cash at beginning of period 20,149 16,924 16,770 15,879 16,590 Cash and cash equivalents and restricted cash at end of period 16,924 16,770 15,879 16,590 17,189 S T A T E M E N T O F C A S H F L O W S (Unaudited)

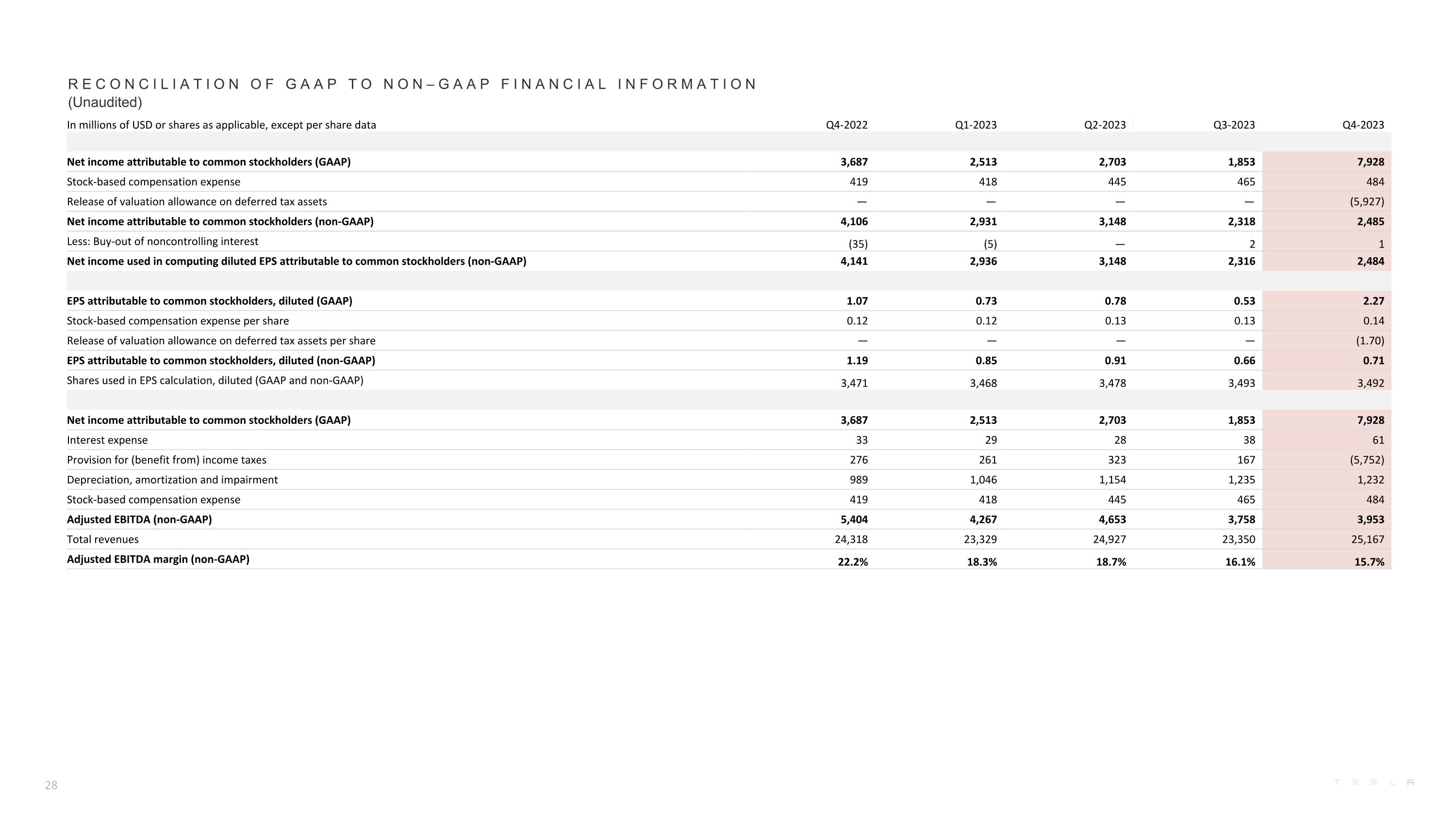

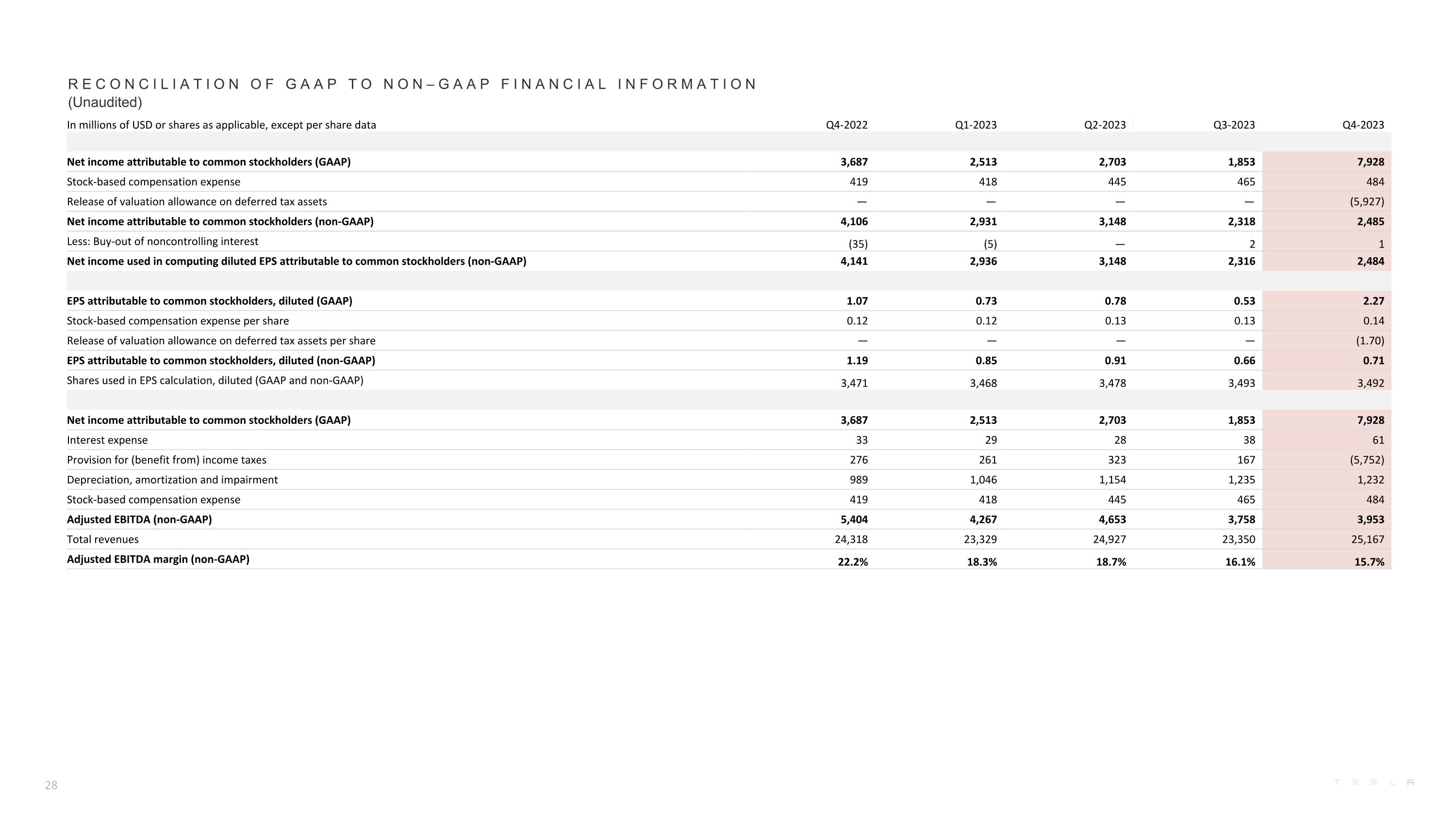

In millions of USD or shares as applicable, except per share data Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 Net income attributable to common stockholders (GAAP) 3,687 2,513 2,703 1,853 7,928 Stock-based compensation expense 419 418 445 465 484 Release of valuation allowance on deferred tax assets — — — — (5,927) Net income attributable to common stockholders (non-GAAP) 4,106 2,931 3,148 2,318 2,485 Less: Buy-out of noncontrolling interest (35) (5) — 2 1 Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 4,141 2,936 3,148 2,316 2,484 EPS attributable to common stockholders, diluted (GAAP) 1.07 0.73 0.78 0.53 2.27 Stock-based compensation expense per share 0.12 0.12 0.13 0.13 0.14 Release of valuation allowance on deferred tax assets per share — — — — (1.70) EPS attributable to common stockholders, diluted (non-GAAP) 1.19 0.85 0.91 0.66 0.71 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,471 3,468 3,478 3,493 3,492 Net income attributable to common stockholders (GAAP) 3,687 2,513 2,703 1,853 7,928 Interest expense 33 29 28 38 61 Provision for (benefit from) income taxes 276 261 323 167 (5,752) Depreciation, amortization and impairment 989 1,046 1,154 1,235 1,232 Stock-based compensation expense 419 418 445 465 484 Adjusted EBITDA (non-GAAP) 5,404 4,267 4,653 3,758 3,953 Total revenues 24,318 23,329 24,927 23,350 25,167 Adjusted EBITDA margin (non-GAAP) 22.2% 18.3% 18.7% 16.1% 15.7% R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited)

In millions of USD or shares as applicable, except per share data 2019 2020 2021 2022 2023 Net (loss) income attributable to common stockholders (GAAP) (862) 721 5,519 12,556 14,997 Stock-based compensation expense 898 1,734 2,121 1,560 1,812 Release of valuation allowance on deferred tax assets — — — — (5,927) Net income attributable to common stockholders (non-GAAP) 36 2,455 7,640 14,116 10,882 Less: Buy-out of noncontrolling interest 8 31 (5) (27) (2) Less: Dilutive convertible debt — — (9) (1) — Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 28 2,424 7,654 14,143 10,884 EPS attributable to common stockholders, diluted (GAAP) (0.33) 0.21 1.63 3.62 4.30 Stock-based compensation expense per share 0.34 0.54 0.63 0.45 0.52 Release of valuation allowance on deferred tax assets per share — — — — (1.70) EPS attributable to common stockholders, diluted (non-GAAP) 0.01 0.75 2.26 4.07 3.12 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 2,661 3,249 3,386 3,475 3,485 Net (loss) income attributable to common stockholders (GAAP) (862) 721 5,519 12,556 14,997 Interest expense 685 748 371 191 156 Provision for (benefit from) income taxes 110 292 699 1,132 (5,001) Depreciation, amortization and impairment 2,154 2,322 2,911 3,747 4,667 Stock-based compensation expense 898 1,734 2,121 1,560 1,812 Adjusted EBITDA (non-GAAP) 2,985 5,817 11,621 19,186 16,631 Total revenues 24,578 31,536 53,823 81,462 96,773 Adjusted EBITDA margin (non-GAAP) 12.1% 18.4% 21.6% 23.6% 17.2% R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited)

R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) In millions of USD 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 Net cash provided by operating activities – TTM (GAAP) 8,024 9,184 9,931 11,497 13,851 14,078 16,031 14,724 13,242 13,956 12,164 13,256 Capital expenditures – TTM (4,050) (5,009) (5,823) (6,482) (6,901) (7,126) (7,110) (7,158) (7,463) (7,793) (8,450) (8,898) Free cash flow – TTM (non-GAAP) 3,974 4,175 4,108 5,015 6,950 6,952 8,921 7,566 5,779 6,163 3,714 4,358 In millions of USD 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 Net income attributable to common stockholders – TTM (GAAP) 1,143 2,181 3,468 5,519 8,399 9,516 11,190 12,556 11,751 12,195 10,756 14,997 Interest expense – TTM 678 583 546 371 333 302 229 191 159 143 128 156 Provision for (benefit from) income taxes – TTM 359 453 490 699 976 1,066 1,148 1,132 1,047 1,165 1,027 (5,001) Depreciation, amortization and impairment – TTM 2,390 2,504 2,681 2,911 3,170 3,411 3,606 3,747 3,913 4,145 4,424 4,667 Stock-based compensation expense – TTM 2,137 2,264 2,196 2,121 1,925 1,812 1,699 1,560 1,560 1,644 1,747 1,812 Adjusted EBITDA – TTM (non-GAAP) 6,707 7,985 9,381 11,621 14,803 16,107 17,872 19,186 18,430 19,292 18,082 16,631 TTM = Trailing twelve months In millions of USD 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 Net cash provided by operating activities (GAAP) 964 2,400 3,019 1,641 2,124 3,147 4,585 3,995 2,351 5,100 3,278 2,513 3,065 3,308 4,370 Capital expenditures (546) (1,005) (1,151) (1,348) (1,505) (1,819) (1,810) (1,767) (1,730) (1,803) (1,858) (2,072) (2,060) (2,460) (2,306) Free cash flow (non-GAAP) 418 1,395 1,868 293 619 1,328 2,775 2,228 621 3,297 1,420 441 1,005 848 2,064 In millions of USD 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 Net income attributable to common stockholders (GAAP) 104 331 270 438 1,142 1,618 2,321 3,318 2,259 3,292 3,687 2,513 2,703 1,853 7,928 Interest expense 170 163 246 99 75 126 71 61 44 53 33 29 28 38 61 Provision for (benefit from) income taxes 21 186 83 69 115 223 292 346 205 305 276 261 323 167 (5,752) Depreciation, amortization and impairment 567 584 618 621 681 761 848 880 922 956 989 1,046 1,154 1,235 1,232 Stock-based compensation expense 347 543 633 614 474 475 558 418 361 362 419 418 445 465 484 Adjusted EBITDA (non-GAAP) 1,209 1,807 1,850 1,841 2,487 3,203 4,090 5,023 3,791 4,968 5,404 4,267 4,653 3,758 3,953

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its fourth quarter 2023 financial results conference call beginning at 4:30 p.m. CT on January 24, 2024 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units installed and equipment sales; we report installations at time of commissioning for storage projects or inspection for solar projects, and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding operating leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the future development, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in launching and manufacturing our products and features cost-effectively; our ability to grow our sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for electric vehicles generally and our vehicles specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive and energy product markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 31, 2023. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise.