UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Tesla, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On June 11, 2024, Elon Musk posted the following on X.

Brad Gerstner: You know, a couple of weeks ago, the state of Delaware, the Chancery Court, you know, this judge, Kathleen McCormick…

Bill Gurley: Yeah.

Brad Gerstner: …she you know, pretty shockingly struck down Elon's 2018 pay package. […] Remember, the company was on the verge of bankruptcy. They basically cut a pay package with him where he took nothing if the company didn't improve, but if the company hit certain targets, he would get paid out, you know, 1% tranches of options, I think over 12 tranches, which because the company, right […], had this extraordinary turnaround […] you know, he achieved his goals. So, now she's kind of Monday morning quarterbacking, she’s looking back, and she says his pay package is unfathomable and she said that the board never asked the $55 billion question, Bill, was it even necessary to pay him this to retain him and to achieve the company's goals? […] So, of course, this can be […] appealed to the Delaware Supreme Court and it will be. But…

Bill Gurley: Yeah.

Brad Gerstner: …you know, in response to this, Elon and I think many others, just said, hold on a second here. What the hell just happened? You know, the state of Delaware has had this historical advantage in corporate law because of its predictability and its predictability wasn't because of the code, but it was because the judiciary, right, there was a lot of precedent in the state of Delaware and this seemed to turn that totally on its head. He said he was gonna move, you know, incorporation to the state of Texas. You know, we're starting to see, you know, other companies follow suit and other people talking about this.

So, what was your reaction, you know […] you know, seeing, you know, something that was, I think most of us thought was highly unlikely and, and pretty shocking?

Bill Gurley: Yeah I, well, first of all, I think it's super important for everyone to pay attention to this. I don't, I don’t actually think it's just an outlier event. […] I think it’s so unprecedented in Delaware’s history that it really marks a moment for everyone to pay attention. […] And there's a couple of things I would pay attention to. One, one data point you, you left out, which came up recently, is the […] lawyers that, that pursued this case are asking for five or six billion dollars in payment. And it turns out when you bring a derivative suit […] in Delaware […] there have been cases where people ask for a percent and the judge gets to kind of decide that. And, you know…

Brad Gerstner: Incredible.

Bill Gurley: If you step back and look, the, the this is a victimless crime, and I think that’s the thing that makes Delaware look like a kangaroo court here. The, everyone knows the lawyer grabbed someone that only […] had nine shares and those nine shares went way up. But, it's kind of silly […] because it's so small anyway. So how could how could […] a client with nine shares lead to a multibillion dollar award to a lawyer? And that's only true […] if you’ve created a […] bounty hunter system, you know, a bureaucratic bounty hunter system. There's something in California called PAGA that's kind of evolved this way and, and if that’s the new norm in Delaware, that’s […] really, really concerning.

The other thing that's […] different here is the stock went way, way up. So, I think we've all become accustomed to, when stock prices going down, these, these litigators, you know, grab a handful of shareholders and bring a shareholder lawsuit. And we're like, oh, yeah […], unfortunately, that’s become a way of life. But, but to attack companies that go way up, you know, I [...] would two things: one, I would offer this pay package, I looked at it in detail to, any CEO I work with, and I think they would all turn it down because there was no, there’s no cash, no guarantee, and the first tranche was a 2x of the stock. So like, that’s fantastic.

I […] think the biggest problem with compensation packages, and you may, may tackle that some other day, is a misalignment with shareholders…

Brad Gerstner: Totally.

Bill Gurley: […] where people are getting paid when the stock doesn’t move that’s what RSUs do […]. And here…

Brad Gerstner: And by the way, that’s the standard in corporate America. We have this grift where people make a ton of money and the stock doesn’t do anything. Look at the pay package…

Bill Gurley: Right, so…

Bill Gurley: …for Mary Barra at GM.

Bill Gurley: So, the first tranche here was if the stock doubled and I would offer that to anyone. I would also say if any other CEO took a package like this, I would, in a public company, I would be very encouraged to consider buying a lot of it.

Brad Gerstner: Totally […]

Bill Gurley: And so, […] it may be like one of the most […] you know, shareholder aligned incentive packages ever, which is, is exactly what you would think Delaware courts would be looking after. […] And ISS as well, which is a […] whole nother subject. But […] so, I think it’s just really bad. […] And it […] does show a new side of Delaware, […] you know, one that they haven’t shown before and, and so I think everyone has to pay attention.

Brad Gerstner: Right no, I mean, it’s […] shocking. And if you, you know […], I was a corporate lawyer in my, my first life, as you know. If you actually go and look […] at the […] actual corporate law code in the state of Delaware, right. It’s almost word for word, the same as Texas, the same as California and, and so on. […] The point here is it’s not that Delaware has code, you know, a legal code around, around corporations that’s so much different than every other state. What has set it apart is it has way more legal precedent, way more trials that have occurred and judges who have interpreted that in a way that is very shareholder aligned, shareholder friendly. So, the big, I think…

Bill Gurley: […] And they’re known for letter of the law. So the constructionist argument.

Brad Gerstner: Correct. And so and so here we have a moment. And the reason it’s so shocking is because it’s at odds with all of the precedent that people had come to expect. So, I think there are going to be…

Bill Gurley: Yeah, […] we left out they had 70% shareholder approval. I mean, […] and there was a low […], high low probability event that happened to happen and you can’t look at that after the fact and say, oh, it was obvious this was going to happen, you know. You can’t do that.

Brad Gerstner: Right. I think that […] I think that, you know, if this is, if this stands, so I imagine corporations right now are in holding patterns, right. Elon is moving, you know, reincorporating in Texas. I think a lot of other corporations will stay pending the Delaware Supreme Court appeals ruling, right. If they […] overturn […] this judge’s ruling, then I think you may be back to the status quo in the state of Delaware. But if they uphold the ruling, and deny, I mean, I think Elon said, despite all the goodness that's occurred, saving the company from bankruptcy, this means he effectively gets paid zero for the last five years. I mean, it's such an outlandish outcome. So, if it gets […] if it gets upheld, I expect you’re going to see significant flight from the state of Delaware […] by […] people reincorporating in these other states that, you know, frankly, that are pretty friendly as well.

Bill Gurley: Right, I just thought of something. So, if it's upheld and if these lawyers are paid anything as a percentage, anything other than maybe just their hourly fee, so if those two things happen, I would make the argument that every company in Delaware has to move to a different domicile because they could be sued in a future derivative lawsuit for the risk they've taken by staying in Delaware.

Brad Gerstner: Oh, my God. Oh, my God. You're so right. You are so right. Oh, mic drop on that. They […] you know. So now on the boards that I sit on, I have to warn them that if they stay in the state of Delaware, then they're knowingly and negligently taking on this incremental risk.

Bill Gurley: Absolutely.

Brad Gerstner: Oh, wow.

On June 11, 2024, Kimbal Musk posted the following on X.

On June 12, Tesla posted the following on X.

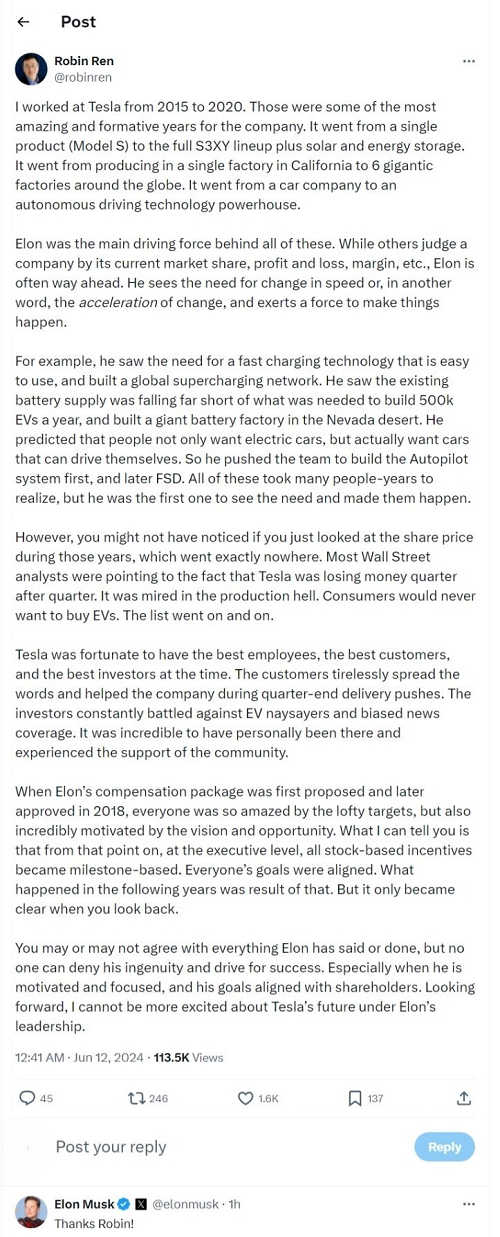

On June 12, Elon Musk posted the following on X.

Additional Information and Where to Find It

Tesla, Inc. (“Tesla”) has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A with respect to its solicitation of proxies for Tesla’s 2024 annual meeting (the “Definitive Proxy Statement”). The Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS OF TESLA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED ON AT THE 2024 ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by Tesla through the website maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents from Tesla by contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page on its website at ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting. Information regarding the interests of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 reflecting Tesla’s current expectations that involve risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning its goals, commitments, strategies and mission, its plans and expectations regarding the proposed redomestication of Tesla from Delaware to Texas (the “Texas Redomestication”) and the ratification of Tesla’s 2018 CEO pay package (the “Ratification”), expectations regarding the future of litigation in Texas, including the expectations and timing related to the Texas business court, expectations regarding the continued CEO innovation and incentivization under the Ratification, potential benefits, implications, risks or costs or tax effects, costs savings or other related implications associated with the Texas Redomestication or the Ratification, expectations about stockholder intentions, views and reactions, the avoidance of uncertainty regarding CEO compensation through the Ratification, the ability to avoid future judicial or other criticism through the Ratification, its future financial position, expected cost or charge reductions, its executive compensation program, expectations regarding demand and acceptance for its technologies, growth opportunities and trends in the markets in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,” “continues,” “could,” “design,” “drive,” “estimates,” “expects,” “future,” “goals,” “intends,” “likely,” “may,” “plans,” “potential,” “seek,” “sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and you should not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause Tesla’s actual results to differ materially from those in the forward-looking statements, including, without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item 1A, “Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise described or updated from time to time in Tesla’s other filings with the SEC. The discussion of such risks is not an indication that any such risks have occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained in this document.