- GME Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

GameStop (GME) DEF 14ADefinitive proxy

Filed: 2 May 23, 5:14pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to (§)240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2023 Proxy Statement

Notice of 2023 Annual Meeting of Stockholders

to Be Held on June 15, 2023

Letter from our Chief Executive Officer

May 2, 2023

Fellow Stockholder,

Thank you for your ongoing investment in GameStop. We are fortunate to have such a passionate and supportive community of stockholders invested in us. We never take you – or your passion and support – for granted.

The past two years have been transformative for GameStop, resulting in us becoming a stronger and more efficient business. With that said, I want to shed some light on where we’ve been, where we are, and where we’re looking to go.

Where We’ve Been

At the start of fiscal 2021, GameStop had burdensome debt, dwindling cash, outdated systems and technology, and no meaningful stockholders in the boardroom. The Company was in distress and had an uncertain future. Recognizing this, we spent fiscal 2021 refreshing our board, rebuilding our teams, recapitalizing the balance sheet and paying down debt. We also established accretive partnerships, fortified our infrastructure and explored growth opportunities – some of which materialized and some of which did not. This was an important period of foundation-building and investment.

In fiscal 2022, GameStop’s operating environment dramatically changed due to the onset of inflation, rising interest rates and macro headwinds. Rather than stand still, we pivoted to cutting costs, optimizing inventory and enhancing the customer experience. We also found efficient ways to improve shipping times, integrate online and in-store shopping experiences, and establish a culture of increased incentivization among store leaders and tenured associates.

Where We Are

GameStop produced net income of $48.2 million in the fourth quarter of fiscal 2022, compared to a loss of $147.5 million in the fourth quarter of fiscal 2021. In addition, the Company ended the year with a healthy inventory position, negligible debt and significant cash on hand. This was the upshot of us doubling down on efficiency. We now have a foundation for pursuing consistent profitability, pragmatic growth and long-term value creation.

Where We’re Going

Looking ahead, GameStop is aggressively focused on achieving profitability while still pursuing pragmatic long-term growth. We intend to execute on these goals and improve our efficiency by focusing on multiple opportunities, including:

| • | Continuing to cut excess costs, including in Europe, where we have already initiated exits and partial wind-downs in certain countries, such as Ireland. |

| • | Leveraging our strengthened financial position to continue obtaining improved terms from suppliers and vendors. |

| • | Getting full console allocations to help us meet customer demand during this extended cycle. |

| • | Assessing partnerships with gaming and retail companies that can enable us to capture cost-effective top-line growth. |

| • | Leveraging our unique refurbishment capabilities to drive growth in pre-owned. |

| • | Building a stronger presence in higher-margin categories like collectibles and toys, where we have already seen pockets of growth. |

Although there is a lot of hard work and necessary execution in front of us, GameStop is a much healthier business today than it was at the start of our transformation. We plan to build on our momentum while prioritizing value creation and stockholders’ interests.

Thank you again for your investment.

Sincerely,

Matt Furlong

Chief Executive Officer and Director

Notice of Annual Meeting of Stockholders

Dear Stockholder:

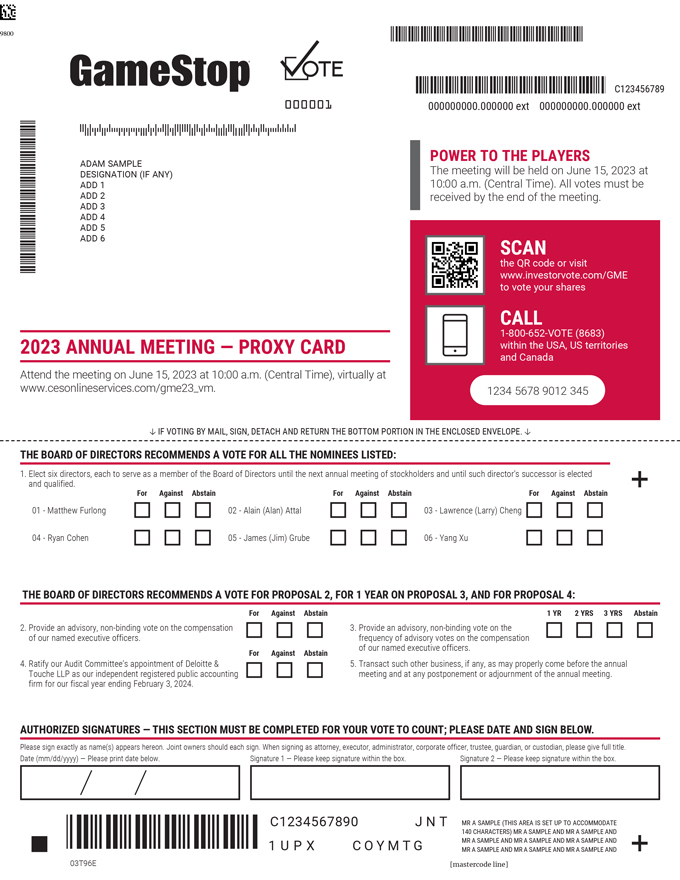

We invite you to attend our Annual Meeting of Stockholders on Thursday, June 15, 2023 at 10:00 a.m., Central Daylight Time (“CDT”), at www.cesonlineservices.com/gme23_vm, which will be held in virtual only format. You will not be able to attend the annual meeting in person. At the annual meeting, you will be asked to:

| (1) | Elect six directors, each to serve as a member of the Board of Directors until the next annual meeting of stockholders and until such director’s successor is elected and qualified; |

| (2) | Provide an advisory, non-binding vote on the compensation of our named executive officers; |

| (3) | Provide an advisory, non-binding vote on the frequency of advisory votes on the compensation of our named executive officers; |

| (4) | Ratify our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending February 3, 2024; and |

| (5) | Transact such other business, if any, as may properly come before the annual meeting and at any postponement or adjournment of the annual meeting. |

Only stockholders of record as of the close of business on April 21, 2023 (the “record date”) are entitled to vote at the annual meeting and any postponement or adjournment thereof. Please see pages 1 – 4 for additional information regarding attendance at the meeting and how to vote your shares. This Proxy Statement provides information that you should consider when you vote your shares.

Your vote is important. Even if you plan to attend the annual meeting virtually, we request that you vote your shares as soon as possible by following the voting instructions contained in this Proxy Statement. We have designed the format of the annual meeting to ensure that stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure stockholder access and participation.

By order of the Board of Directors.

Sincerely,

Mark H. Robinson | ||

General Counsel and Secretary | ||

May 2, 2023 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 15, 2023

This Notice of Annual Meeting, Proxy Statement, form of proxy and our 2022 Annual Report to Stockholders are available at http://investor.gamestop.com.

|

| IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS |

This Proxy Statement, form of proxy and 2022 Annual Report are available at http://investor.gamestop.com. Except as otherwise stated, information on our website is not a part of this Proxy Statement.

|

We will send a full set of proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) on or about May 2, 2023, and provide access to our proxy materials over the Internet, beginning on May 2, 2023, for the holders of record and beneficial owners of our shares of common stock as of the close of business on the record date. The Notice of Internet Availability instructs you on how to access and review the Proxy Statement and our 2022 annual report to stockholders. The Notice of Internet Availability also instructs you on how you may authorize a proxy to vote your shares over the Internet and provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual meeting materials via email, the email contains voting instructions and links to our annual report and proxy statement on the Internet. |

Certain statements in this Proxy Statement contain or may suggest “forward-looking” information (as defined in the Private Securities Litigation Reform Act of 1995) that involves risks and uncertainties that could cause results to be materially different from expectations. The words “will,” “may,” “designed to,” “outlook,” “believes,” “should,” “targets,” “anticipates,” “assumptions,” “plans,” “expects” or “expectations,” “intends,” “estimates,” “forecasts,” “guidance” and similar expressions identify certain of these forward-looking statements. We also may provide forward-looking statements in oral statements or other written materials released to the public. All statements contained or incorporated in this Proxy Statement or in any other public statements that address such future events or expectations are forward-looking statements. Important factors that could cause actual results to differ materially from these forward-looking statements are detailed in our 2022 annual report to stockholders. These forward-looking statements are not guarantees of future performance and speak only as of the date made, and, except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect subsequent events, new information or future circumstances.

TABLE OF CONTENTS

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 16 | |||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

Offer Letters and Potential Payments upon Termination or Change in Control | 28 | |||

| 30 | ||||

| 31 | ||||

| 33 | ||||

PROPOSAL 4: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 34 | |||

Annual Evaluation and Selection of Independent Registered Public Accounting Firm | 34 | |||

| 35 | ||||

Audit Committee Matters - Primary Responsibilities and Fiscal 2022 Actions | 36 | |||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be considered and voted upon at our 2023 annual meeting of stockholders (“annual meeting”) we have summarized information contained elsewhere in this Proxy Statement or in our Annual Report on Form 10-K for the fiscal year ended January 28, 2023 (“Annual Report”). Please note that our fiscal year is composed of the 52 or 53 weeks ending on the Saturday closest to the last day of January. Fiscal year 2022 consisted of the 52 weeks ended on January 28, 2023 (“fiscal 2022”). Fiscal year 2021 consisted of the 52 weeks ended on January 29, 2022 (“fiscal 2021”) and fiscal year 2020 consisted of the 52 weeks ended on January 30, 2021 (“fiscal 2020”). This summary does not contain all of the information you should consider about the proposals being submitted to stockholders at the annual meeting. We encourage you to read the entire Proxy Statement and Annual Report carefully before voting.

ANNUAL MEETING OF STOCKHOLDERS

Date and Time:

June 15, 2023

10:00 a.m., CDT

Website:

www.cesonlineservices.com/gme23_vm

Record Date:

April 21, 2023

AGENDA

| Voting Matter | Page | |

| 5 | |

2 Advisory Vote on Executive Compensation

| 18 | |

| 33 | ||

4 Ratification of Appointment of Independent Registered Accounting Firm

| 34 | |

How to Cast Your Vote:

| Vote by Internet |  | By Mail:

|  | By Phone:

| |||||

| Shares Held of Record: | Shares Held of Record: | Shares Held of Record: | ||||||||

| www.cesonlineservices.com/gme23_vm | See Proxy Card | 1-866-641-4276 | ||||||||

| Shares Held in Street Name: | Shares Held in Street Name: | Shares Held in Street Name: | ||||||||

| See Notice of Internet Availability or Voting Instruction Form | See Voting Instruction Form | See Voting Instruction Form | ||||||||

Information About The Annual Meeting and Voting

1. What am I Voting on? |

The Board of Directors (“Board”) of GameStop Corp. (“GameStop,” the “Company,” “we,” “us,” or “our”) is soliciting your vote for the following:

Business Items

| Board Voting Recommendation | Page Reference | ||

1. To elect the six nominees identified in this Proxy Statement to serve as directors

| FOR ALL Nominees | 5 | ||

2. To approve, on an advisory, non-binding basis, our executive compensation

| FOR | 18 | ||

3. To select the frequency of every one, two or three years for an advisory, non-binding vote on our executive compensation | FOR every one year | 33 | ||

4. To ratify our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending February 3, 2024 | FOR | 34 | ||

2. Who Is Entitled to Vote? |

Holders of record of shares of common stock as of the close of business on April 21, 2023 are entitled to notice of and to vote at the annual meeting. Shares of common stock can be voted only if the stockholder is present or is represented by proxy at the annual meeting. As of the record date, 304,717,030 shares of common stock were issued, outstanding and entitled to vote.

3. How Do I Vote? |

Stockholders of Record. If you are a stockholder of record, there are several ways for you to vote your shares of common stock at the annual meeting:

| • | Virtual Attendance. You may vote your shares electronically at the annual meeting by following the instructions on the virtual annual meeting website at www.cesonlineservices.com/gme23_vm. If you choose to vote by proxy, you may do so using the Internet, telephone or, if you received a printed copy of your proxy materials, mail. Even if you plan to attend the annual meeting virtually, we recommend that you submit your proxy card by mail or voting instructions via the Internet or by telephone by the applicable deadline so that your vote will be counted if you later decide not to attend the annual meeting. |

| • | Voting by Internet. Before the annual meeting you may vote your shares through the Internet by following the directions on the proxy card. Internet voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on the proxy card. The procedures allow you to appoint a proxy to vote your shares and to confirm that your instructions have been properly recorded. |

| • | Voting by Telephone. You may vote your shares by telephone by following the directions on the proxy card. Telephone voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on the proxy card. The procedures allow you to appoint a proxy to vote your shares and to confirm that your instructions have been properly recorded. |

| • | Voting by Mail. If you choose to vote by mail, simply complete the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. If you sign your proxy card and return it without marking any voting instructions, your shares will be voted: (1) FOR ALL of the director nominees identified in this Proxy Statement; (2) FOR the approval of the compensation of our Named Executive Officers (“NEOs”); (3) FOR an annual advisory vote on the compensation of our NEOs; and (4) FOR the ratification of our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending February 3, 2024. |

Beneficial Owners. If you are a stockholder whose shares are held in “street name” (i.e., in the name of a broker or other custodian) you may vote the shares electronically at the annual meeting only if you obtain a legal proxy from the broker or other custodian giving you the right to vote the shares. At the time of the meeting, go to www.cesonlineservices.com/gme23_vm and follow the

| 2023 Proxy Statement | 1 |

instructions to upload and submit your legal proxy. Alternatively, you may have your shares voted at the annual meeting by following the voting instructions provided to you by your broker or custodian. Although most brokers offer voting via the Internet, by telephone, and mail, availability and specific procedures will depend on their voting arrangements.

4. How May You Revoke or Change Your Vote? |

You may revoke your proxy at any time before it is voted at the annual meeting by any of the following methods:

| • | Submitting a later-dated proxy via the Internet, over the telephone or by mail. |

| • | Sending a written notice, including by fax at 817.424.2002, to our Secretary. You must send any written notice of a revocation of a proxy so as to be delivered before the taking of the vote at the annual meeting to: |

GameStop Corp.

625 Westport Parkway

Grapevine, Texas 76051

Attention: Secretary

| • | Attending the annual meeting virtually and voting. Your attendance at the annual meeting will not in and of itself revoke your proxy. |

5. How can I attend the annual meeting? |

The annual meeting will be held virtually on Thursday, June 15, 2023 at 10:00 a.m., CDT. You are entitled to attend the annual meeting if you were a stockholder as of the record date, or if you hold a valid proxy for the annual meeting, by accessing www.cesonlineservices.com/gme23_vm. Participation in the meeting is limited due to the capacity of the host platform and access to the meeting will be accepted on a first-come, first-served basis once electronic entry begins. Electronic entry to the meeting will begin at 9:30 a.m. CDT and the meeting will begin promptly at 10:00 a.m., CDT.

In order to ensure that your shares are represented at the meeting, we strongly encourage you to vote your shares by proxy prior to the annual meeting and further encourage you to submit your proxies electronically—by telephone or by Internet—by following the easy instructions on the enclosed proxy card. Your vote is important and voting electronically should facilitate the timely receipt of your proxy.

6. What Constitutes a Quorum? |

A quorum of common stockholders is required to hold a valid annual meeting of stockholders. Unless a quorum is present at the annual meeting, no action may be taken at the annual meeting except the adjournment thereof to a later time. The holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting must be present or by proxy to constitute a quorum. All valid proxies returned will be included in the determination of whether a quorum is present at the annual meeting. The shares of a stockholder whose ballot on any or all proposals is marked as “abstain” will be treated as present for quorum purposes. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those uninstructed shares, constituting “broker non-votes,” will be considered as present for determining a quorum, but will not be voted with respect to that matter.

7. What Is a Broker Non-Vote? |

A “broker non-vote” occurs when a nominee (such as a custodian or bank) holding shares for a beneficial owner returns a signed proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. For routine matters, the New York Stock Exchange (the “NYSE”) gives brokers the discretion to vote, even if they have not received voting instructions from the beneficial owners. Each broker has its own policies that control whether or not it casts votes for routine matters. In this Proxy Statement, the ratification of our independent registered public accounting firm is expected to be considered routine by the NYSE.

8. What Vote Is Required to Approve Each Proposal? |

Voting Rights Generally. Each share of common stock is entitled to one vote on each matter to be voted on at the annual meeting. Stockholders have no cumulative voting rights. Although the advisory vote on Proposals 2 and 3 are non-binding, as provided by law, the Compensation Committee of the Board and the Board will review the results of the vote and, consistent with our record of stockholder engagement, will consider the results of the vote when making future compensation decisions and determinations regarding the frequency of advisory votes on our executive compensation.

2 | 2023 Proxy Statement |

|

Election of Directors. Our Bylaws provide that, in an uncontested election, a nominee for director is elected only if such nominee receives the affirmative vote of a majority of the total votes cast for such nominee. The majority voting standard does not apply in contested elections, and directors are elected by a plurality of the votes cast in a contested election.

The majority voting standard will apply to the election of directors at the annual meeting. Accordingly, a nominee for election to the Board will be elected if the number of votes cast “for” such nominee exceeds the number of votes cast “against” that nominee. Abstentions and broker non-votes will not be treated as votes cast in the election of a director and will therefore have no effect on the result of such vote.

Advisory Vote on Executive Compensation. Approval on an advisory, non-binding basis of the compensation of our NEOs requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the annual meeting on this proposal. Abstentions (if any) will have the same effect as a vote “against” this proposal. Broker non-votes (if any) will have no effect on this proposal because they are not entitled to vote on this proposal. As an advisory vote, the proposal to approve the compensation of our NEOs is not binding upon us. However, our Compensation Committee, which is responsible for designing and administering our executive compensation programs, and the Board, value the opinions expressed by our stockholders and will consider the results of the vote when making future compensation decisions.

Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation. The frequency of the advisory vote on our executive compensation receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by our stockholders. Abstentions and broker non-votes will therefore have no effect on the result of such vote.

Ratification of Appointment of Independent Registered Public Accounting Firm. Ratification of our Audit Committee’s appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for our fiscal year ending February 3, 2024 requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the annual meeting on this proposal. Abstentions (if any) will have the same effect as a vote “against” this proposal. The approval of this proposal is a routine matter on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from this proposal. Broker non-votes (if any) will have no effect on the outcome of this proposal because they are not entitled to vote on this proposal. If the stockholders should not ratify the appointment of Deloitte, the Audit Committee will reconsider the appointment.

9. Who Counts the Votes? |

We have engaged Computershare, our transfer agent, to act as our independent tabulator to receive and tabulate votes. We have engaged Morrow Sodali, LLC (“Morrow Sodali”), our proxy solicitor, to act as our inspector of election. Morrow Sodali will certify the results and determine the existence of a quorum and the validity of proxies and ballots.

10.Who Pays the Cost of Solicitation of Proxies? |

We will pay for the cost of preparing, assembling, printing, mailing and distributing these proxy materials. Our directors, officers and employees may solicit proxies or votes in person, by telephone, or by electronic communication. Such individuals will not receive any additional compensation for these solicitation activities. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our stock. We have engaged Morrow Sodali to act as our proxy solicitor in connection with the proposals to be acted upon at our annual meeting. For those services we will pay Morrow Sodali approximately $35,000 plus expenses.

11.What Does it Mean if I Receive More Than One Proxy Card? |

Some of your shares may be registered differently or held in more than one account. You should vote each of your accounts via the Internet, by telephone or mail. If you mail your proxy cards, please sign, date and return each proxy card to assure that all of your shares are voted.

12.How Do I Submit a Stockholder Proposal for Next Year’s Annual Meeting? |

Stockholder proposals may be submitted for inclusion in the Proxy Statement for our 2024 annual meeting of stockholders in accordance with Rule 14a-8 of the Securities and Exchange Commission (“SEC”). See “Other Matters—Proposals Pursuant to Rule 14a-8” later in this Proxy Statement. In addition, eligible stockholders are entitled to nominate and include in our Proxy Statement for our 2024 annual meeting Director nominees, subject to limitations and requirements in our Bylaws. See “Other Matters—Proxy Access Director Nominees” later in this Proxy Statement. Any stockholder who wishes to propose any business at the 2024 annual meeting other than for inclusion in our Proxy Statement pursuant to Rule 14a-8 or pursuant to the proxy access provisions in our Bylaws must provide timely notice and satisfy the other requirements for stockholders proposals in our Bylaws. See “Other Matters—

| 2023 Proxy Statement | 3 |

Other Proposals and Nominees” later in this Proxy Statement. Proposals should be sent via registered, certified, or express mail to: Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051.

13.What is Included in the Proxy Materials? |

We have furnished our Annual Report with this Proxy Statement. The Annual Report includes our audited financial statements for fiscal 2022, along with other financial information about us. Our Annual Report is not part of the proxy solicitation materials.

You can obtain, free of charge, a copy of our Annual Report, which includes our audited financial statements, by:

| • | accessing our website at http://investor.gamestop.com; |

| • | writing to our Secretary, at 625 Westport Parkway, Grapevine, Texas 76051; or |

| • | calling (817) 424-2000. |

You can also obtain a copy of our Annual Report and other periodic filings that we make with the SEC from the SEC’s EDGAR database at www.sec.gov.

14.How Can I Access the Proxy Materials Electronically? |

Your proxy card will contain instructions on how to:

| • | view our proxy materials for the annual meeting on the Internet; and |

| • | instruct us to send our future proxy materials to you electronically by e-mail. |

Our proxy materials are also available on our website at http://investor.gamestop.com.

15.How Are the Proxy Materials Being Distributed? |

On or about May 2, 2023, we will begin mailing the proxy materials to stockholders of record as of April 21, 2023, and we will post our proxy materials at http://investor.gamestop.com. In addition, the website provides information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

16.Can Stockholders and Other Interested Parties Communicate Directly with The Board? |

Yes. We invite stockholders and other interested parties to communicate directly and confidentially with the full Board, the Chair of the Board or the non-management directors as a group by writing to the Board, the Chair or the Non-Management Directors, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051, Attn: Secretary. The Secretary will forward such communications to the intended recipient or recipients and will retain copies for our corporate records.

17.Can I Participate and Ask Questions During the Virtual Annual Meeting? |

Yes. Beginning 30 minutes prior to, and during the Annual Meeting, you will be able to access the Rules of Conduct applicable to the annual meeting, and if you are attending the meeting as a registered stockholder of record or registered beneficial owner, you can submit questions by accessing the meeting site at www.cesonlineservices.com/gme23_vm and following the directions. We will hold a Q&A session during the annual meeting, during which we intend to answer questions that are pertinent to the items being brought before the stockholder vote at the annual meeting, as time permits and in accordance with our Rules of Conduct for the annual meeting.

18. What if I have technical or other “IT” problems logging into or participating in the virtual 2023 Annual Meeting? |

We encourage you to access the meeting site in advance of the annual meeting start time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support line number that will be posted on the virtual meeting site.

4 | 2023 Proxy Statement |

|

PROPOSAL 1: ELECTION OF DIRECTORS

General

The Board has nominated each of the six individuals identified below under “The Nominees” to stand for election at the annual meeting.

Each director elected at the annual meeting will hold office for a term expiring at the 2024 annual meeting of stockholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal. Each of the nominees identified in this Proxy Statement has consented to being named as a nominee in our proxy materials and has accepted the nomination and agreed to serve as a director if elected by the stockholders. We have no reason to believe that any of the nominees will be unable to serve as a director. However, should any nominee be unable to serve if elected, the Board may reduce the number of directors or recommend a substitute nominee. The shares represented by all valid proxies may be voted for the election of a substitute if one is nominated by the Board.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR ALL OF THE BOARD’S SIX NOMINEES. PROXIES SOLICITED BY THIS PROXY STATEMENT WILL BE VOTED FOR ALL SIX NOMINEES UNLESS A VOTE AGAINST A NOMINEE OR ABSTENTION IS SPECIFICALLY INDICATED.

The Nominees

The following table sets forth the names and ages of the individuals nominated by the Board for election at the annual meeting, the years they first became a director, the positions, if any, they hold with the Company, and the standing committees of the Board, if any, on which they serve as of April 21, 2023:

| Name | Age | Director Since | Position with the Company | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Strategic Planning and Capital Allocation Committee | |||||||

Matthew (Matt) Furlong | 44 | 2021 | Chief Executive Officer(1) |

|

|

|

| |||||||

Alain (Alan) Attal | 53 | 2021 | Director | X | X(2) | X(2) | X | |||||||

Lawrence (Larry) Cheng | 47 | 2021 | Director |

| X | X |

| |||||||

Ryan Cohen(3) | 37 | 2021 | Director |

|

|

| X(2) | |||||||

James (Jim) Grube | 52 | 2021 | Director | X(2) | X |

| X | |||||||

Yang Xu | 44 | 2021 | Director | X |

| X |

| |||||||

| (1) | Sole employee-director |

| (2) | Committee Chair |

| (3) | Chair of the Board of Directors |

| 2023 Proxy Statement | 5 |

Director Qualifications and Experience

Our business is managed under the direction of the Board and we strive to maintain a board with a mix of skills and experiences that, taken together, provide us with the variety and depth of knowledge necessary for effective oversight, direction and vision. The following matrix presents qualifications and experiences the Board considered in recommending each director nominee for election:

Qualifications and Experience | Matt Furlong | Alan Attal | Larry Cheng | Ryan Cohen | Jim Grube | Yang Xu | ||||||

Business experience in a senior leadership position provides the perspective and practical understanding of leading a business organization | ● | ● | ● | ● | ● | ● | ||||||

Finance and capital allocation experience gained from experience as a chief executive officer, finance or accounting executive, or audit committee member is important because effective capital allocation, accurate financial reporting and effective internal controls are critical to our success | ● | ● | ● | ● | ● | ● | ||||||

Marketing or brand management experience is valuable because of the strategic importance of consumer positioning and brand management in the specialty retail business | ● | ● |

| ● |

|

| ||||||

Retail experience provides an understanding of strategic and operational issues facing specialty retail companies | ● | ● | ● | ● | ● |

| ||||||

Ecommerce experience helps guide our strategic emphasis on online and mobile channels and building a superior customer experience | ● | ● | ● | ● | ● |

| ||||||

Technology experience provides the insight and perspective needed to make the technology investment decisions required to meet our strategic imperatives | ● | ● | ● | ● | ● |

| ||||||

6 | 2023 Proxy Statement |

|

Biographies of Director Nominees

The biographies describe each director nominee’s qualifications and relevant experience. The biographies include key qualifications, skills and attributes most relevant to the decision to nominate candidates to serve on the Board.

| MATTHEW (MATT) FURLONG - Chief Executive Officer, GameStop Corp. | ||

Director Since: 2021 | Age: 44 | |

Other Public Company Directorships: | • None | |

| GameStop Committees: | • None | |

Prior to joining the Company, Mr. Furlong served as Country Leader, Australia for Amazon (NASDAQ: AMZN) since September 2019 and in various other roles at Amazon since October 2012, including as Director and Technical Advisor, Amazon North America. Prior to joining Amazon, Mr. Furlong served in various roles at The Procter & Gamble Company focused on brand, marketing and sales growth strategies.

Director Qualifications: Mr. Furlong brings to the Board more than two decades of experience in the technology, retail and consumer marketing verticals, having served in senior management positions overseeing merchandising, marketing, supply chain, store operations, ecommerce and business development. | ||

ALAIN (ALAN) ATTAL - Former Chief Marketing Officer, Chewy Inc. | ||

Director Since: 2021 | Age: 53 | |

Other Public Company Directorships: | • None | |

GameStop Committees: | • Audit Committee | |

• Compensation Committee, Chair | ||

• Nominating and Corporate Governance Committee, Chair | ||

• Strategic Planning and Capital Allocation Committee | ||

Mr. Attal is an ecommerce executive and entrepreneur with more than two decades of experience building and managing businesses. From 2017 through 2018, Mr. Attal served as the Chief Marketing Officer of Chewy Inc. (NYSE: CHWY) and oversaw an annual acquisition budget of more than $300 million, which was allocated to broadcast, direct mail and digital advertising and engagement initiatives. From 2011 through early 2017, he served as Chewy’s Chief Operating Officer and oversaw its expansion from three people to more than 10,000 employees and $3 billion in revenues.

Director Qualifications: Mr. Attal brings to the Board more than two decades of experience building and managing businesses, having served in senior management positions overseeing marketing and operations. | ||

| LAWRENCE (LARRY) CHENG - Co-Founder and Managing Partner, Volition Capital | ||

Director Since: 2021 | Age: 47 | |

Other Public Company Directorships: | • None | |

GameStop Committees: | • Compensation Committee | |

• Nominating and Corporate Governance Committee | ||

Larry Cheng is Co-Founder and Managing Partner of Volition Capital, a leading growth equity investment firm based in Boston, Massachusetts and the first investor in Chewy Inc. (NYSE: CHWY) He has more than two decades of venture capital and growth equity investing experience based on time at Volition Capital, Fidelity Ventures, Battery Ventures, and Bessemer Venture Partners. He presently leads the Internet and Consumer team at Volition Capital, focusing on disruptive companies in ecommerce, internet services, consumer brands, and digital media and gaming. He received his bachelor’s degree from Harvard College where he concentrated in Psychology.

Director Qualifications: Mr. Cheng brings to the Board significant experience in capital allocation, finance, ecommerce, internet services, consumer brands, digital media and gaming. | ||

| 2023 Proxy Statement | 7 |

| RYAN COHEN - Founder and Former Chief Executive Officer, Chewy, Inc. | ||

Director Since: 2021 | Age: 37 | |

Other Public Company Directorships: | • None | |

GameStop Committees: | • Strategic Planning and Capital Allocation Committee, Chair | |

Ryan Cohen joined GameStop’s Board of Directors in January 2021 and has served as our Chairman since June 9, 2021. He is the manager of RC Ventures, the largest stockholder of the Company. Mr. Cohen previously founded and served as the Chief Executive Officer of Chewy Inc. (NYSE: CHWY), where he oversaw the company’s growth and ascension to market leadership in the pet industry. Mr. Cohen led the company through its successful sale to PetSmart Inc. prior to stepping down in March 2018.

Director Qualifications: In addition to his ownership perspective, Mr. Cohen brings to the Board his demonstrated leadership experience as a successful entrepreneur and his valuable expertise in retail strategy, ecommerce and online marketing. | ||

| JAMES (JIM) GRUBE - Former Chief Financial Officer, Rad Power Bikes | ||

Director Since: 2021 | Age: 52 | |

Other Public Company Directorships: | • None | |

GameStop Committees: | • Audit Committee, Chair | |

• Compensation Committee | ||

• Strategic Planning and Capital Allocation Committee | ||

Mr. Grube is a business and finance executive with more than two decades of corporate experience. He was most recently the Chief Financial Officer of Rad Power Bikes, a global e-bike mobility company. He previously served as the Chief Financial Officer of Vacasa (NASDAQ: VCSA) from 2019 through 2020, a North American vacation rental management company, and as Chief Financial Officer of Chewy, Inc (NYSE: CHWY) from 2015 through 2018. He was formerly Senior Vice President of Finance at Hilton (NYSE: HLT) from 2009 through 2015 and a Director of Finance at Amazon (NASDAQ: AMZN) from 2007 through 2009. He has a bachelor’s degree in Industrial Engineering from Purdue University and received his master’s degree from the Massachusetts Institute of Technology.

Director Qualifications: Mr. Grube brings to the Board more than two decades of corporate experience, having served in senior management positions overseeing finance, accounting, treasury, tax, and procurement. | ||

| YANG XU - SVP of Corporate Development and Global Treasurer, The Kraft Heinz Company | ||

Director Since: 2021 | Age: 44 | |

Other Public Company Directorships: | • None | |

GameStop Committees: | • Audit Committee | |

• Nominating and Corporate Governance Committee | ||

Yang Xu is Senior Vice President of Corporate Development and Global Treasurer at The Kraft Heinz Company, and serves as a member of its Executive Committee. She has more than two decades of broad experience across the capital markets, finance, strategic planning, transactions and business operations in the United States, Asia and Europe. Prior to The Kraft Heinz Company, she held roles with Whirlpool Corporation and General Electric Healthcare. She has a bachelor’s degree in Finance from Wuhan University, a master’s degree in management from the HEC School of Management and a master’s degree in Business Administration from the London Business School.

Director Qualifications: Ms. Xu brings to the Board more than two decades of broad experience, including in capital markets, finance, strategic planning, transactions and business operations. | ||

Board Oversight of Strategy

The Board is deeply engaged and involved in overseeing our long-range strategy, including evaluating key market opportunities, consumer trends and competitive developments. The Board’s oversight of risk is another integral component of the Board’s oversight and engagement on strategic matters. Strategy-related matters are regularly discussed at Board meetings and, as relevant, at Board

8 | 2023 Proxy Statement |

|

committee meetings. Matters of strategy also inform committee-level discussions of many issues, including business risk. Engagement of the Board on these issues and other matters of strategic importance continues in between Board meetings, including through updates to the Board on significant items and discussions between our Chief Executive Officer and the independent Chair of the Board on a periodic basis. Each director is expected to and does bring to bear his or her own talents, insights and experiences on these strategy discussions.

Meetings and Committees of the Board

The Board met six times during fiscal 2022. Each incumbent director who served on the Board at any time during fiscal 2022 attended 75% or more of the aggregate of the total number of meetings of the Board and the total number of meetings of all committees thereof on which they served (held during the period in fiscal 2022 that he or she served).

The Board has four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, and a Strategic Planning and Capital Allocation Committee.

Audit Committee

The Audit Committee assists the Board in fulfilling its oversight responsibility and reviews:

| • | The adequacy and integrity of our financial statements, financial reporting process and disclosure controls and procedures and internal controls over financial reporting; |

| • | The appointment, termination, compensation, retention and oversight of the independent registered public accountants; |

| • | The scope of the audit performed by the independent registered public accounting firm of our books and records; |

| • | The internal audit function and plan; |

| • | Our compliance with legal and regulatory requirements; and |

| • | With management and the independent auditor, any related party transactions and approves such transactions, if any. |

In addition, the Audit Committee has established procedures for the receipt, retention and treatment of confidential and anonymous complaints regarding our accounting, internal accounting controls and auditing matters. The Board has adopted a written charter setting out the functions of the Audit Committee (the “Audit Committee Charter”), a copy of which is available on our website at http://investor.gamestop.com/corporate-governance and is available in print to any stockholder who requests it in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. As required by the Audit Committee Charter, the Audit Committee will continue to review and reassess the adequacy of the Audit Committee Charter annually and recommend any changes to the Board for approval.

The current members of the Audit Committee are Jim Grube (Chair), Alan Attal and Yang Xu, each of whom is an “independent” director under the listing standards of the NYSE. The Board has determined that Mr. Grube has the requisite attributes of an “audit committee financial expert” as defined by regulations promulgated by the SEC and that such attributes were acquired through relevant education and/or experience. In addition to meeting the independence standards of the NYSE, each member of the Audit Committee is financially literate and meets the independence standards established by the SEC. The Audit Committee met five times during fiscal 2022.

Compensation Committee

The Compensation Committee is primarily responsible for:

| • | Establishing and reviewing the compensation of the Chief Executive Officer and all other executive officers; |

| • | Establishing and approving the terms of employment for new executive officers and the terms associated with any executive officer’s termination; |

| • | Making recommendations to the Board with respect to incentive-compensation and equity-based plans, which are subject to Board approval; |

| • | Administering and exercising all authority granted to it under any incentive compensation plans covering primarily executive officers or involving the compensatory issuance of Company securities, whether currently existing or hereafter adopted by the Board; and |

| • | Annually report on executive compensation for inclusion in our annual Proxy Statement. |

The Compensation Committee has the authority to engage executive compensation advisers, if desired, to assist the Compensation Committee in conducting its duties.

| 2023 Proxy Statement | 9 |

The current members of the Compensation Committee are Alan Attal (Chair), Larry Cheng and Jim Grube, each of whom meets the independence standards of the NYSE and the SEC. The Board has adopted a written charter setting out the functions of the Compensation Committee, a copy of which is available on our website at http://investor.gamestop.com/corporate-governance and is available in print to any stockholder who requests it in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. The Compensation Committee met four times during fiscal 2022.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is primarily responsible for:

| • | Reviewing and recommending to the Board candidates for service on the Board and its committees, including the nomination of existing directors; |

| • | Establishing, maintaining and periodically assessing a process for the receipt and consideration of written recommendations for Board candidates in accordance with applicable rules of the NYSE and any other applicable laws, rules and regulations; |

| • | Periodically reviewing and making recommendations to the Board regarding the size and composition of the Board and its committees; |

| • | Annually reviewing the independence of the directors; |

| • | Overseeing our orientation process for newly elected directors and regularly assessing the adequacy of and need for additional director continuing education programs; |

| • | Overseeing the annual performance evaluation of the Board and its committees and management; and |

| • | Periodically reviewing and recommending changes to our Corporate Governance Guidelines. |

The current members of the Nominating and Corporate Governance Committee are Alan Attal (Chair), Larry Cheng and Yang Xu, each of whom meets the independence standards of the NYSE. The Board has adopted a written charter setting out the functions of the Nominating and Corporate Governance Committee, a copy of which can be found on our website at http://investor.gamestop.com/corporate-governance and is available in print to any stockholder who requests it in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. The Nominating and Corporate Governance Committee met three times during fiscal 2022.

Strategic Planning and Capital Allocation Committee

The Strategic Planning and Capital Allocation Committee was formed in January 2021 and is primarily responsible for evaluating and making recommendations to the Board with respect to:

| • | Our operational objectives, expense structure and corporate strategy; |

| • | Our capital structure and capital allocation priorities, including with respect to investments, capital market activities, share repurchases, leverage and liquidity levels and dividends; |

| • | Our performance with respect to strategies, investments and initiatives versus original projections; |

| • | The parameters of, and assumptions underlying, our annual operating and capital plans and budgets; |

| • | The employment status of our executive officers and, to the extent appropriate, recommending any successors to such persons; |

| • | Strategic acquisitions, divestitures, partnerships and business combinations; and |

| • | In conjunction with the Compensation Committee, the performance of management and the metrics through which we align executive compensation with individual, departmental and corporate performance. |

The current members of the Strategic Planning and Capital Allocation Committee are Ryan Cohen (Chair), Alan Attal and Jim Grube, each of whom meets the independence standards of the NYSE. The Board has adopted a written charter setting out the functions of the Strategic Planning and Capital Allocation Committee, a copy of which can be found on our website at http://investor.gamestop.com/corporate-governance and is available in print to any stockholder who requests it in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051.

Minimum Qualifications

The Nominating and Corporate Governance Committee ensures that the Board possesses the right mix of skills and experiences to provide effective guidance and oversight to management as it executes our short and long-term strategy. The Nominating and

10 | 2023 Proxy Statement |

|

Corporate Governance Committee does not set specific minimum qualifications for directors except to the extent required to meet applicable legal, regulatory and stock exchange requirements, including, but not limited to, the independence requirements of the NYSE and the SEC, as applicable. Nominees for director will be selected on the basis of outstanding achievement in their personal careers, board experience, wisdom, integrity, ability to make independent and analytical inquiries, understanding of the business environment and willingness to devote adequate time to Board duties. The Board believes that each director should have a basic understanding of (i) the principal operational and financial objectives and plans and strategies of the Company, (ii) the results of operations and financial condition of the Company and of any significant subsidiaries or business segments and (iii) the relative standing of the Company and its business segments in relation to its competitors. The Board has established a director retirement age of 75, unless the Chair of the Board grants a waiver as permitted under the retirement policy. Currently, none of our directors is of retirement age.

Nominating Process

The Nominating and Corporate Governance Committee will consider recommendations for director candidates from a variety of sources (including incumbent directors, stockholders (in accordance with the procedures described below), our management and third-party search firms). When nominating an incumbent director for re-election at an annual meeting, the Nominating and Corporate Governance Committee considers the director’s performance on the Board and its committees and the director’s qualifications in light of the Nominating and Corporate Governance Committee’s assessment of the Board’s needs. The Nominating and Corporate Governance Committee has not adopted any criteria for evaluating a candidate for nomination to the Board that differ depending on whether the candidate is nominated by a stockholder, an incumbent director, our management, third-party search firm or other source.

Consideration of Stockholder-Nominated Directors

In addition to proposing a candidate for possible nomination by the Nominating and Corporate Governance Committee, any stockholder is entitled to directly nominate one or more candidates for election to the Board in accordance with our Bylaws. See “Other Matters—Other Proposals and Nominees” later in this Proxy Statement. Also, in March 2017, the Board amended the Bylaws to include a proxy access provision. The proxy access bylaw allows a stockholder, or a group of up to 25 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years, to nominate and include in our proxy materials director nominees constituting up to two individuals or 25% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in Article III of the Bylaws. The complete text of our Bylaws, as amended, is available on our website at http://investor.gamestop.com/corporate-governance and is available in print to any stockholder who requests it in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. See “Other Matters—Proxy Access Director Nominees” elsewhere in this Proxy Statement.

Annual Board Evaluation Process

The Board recognizes that a robust and constructive evaluation process is an essential part of good corporate governance and board effectiveness. The evaluation processes utilized by the Board are designed and implemented under the direction of the Nominating and Corporate Governance Committee and aim to assess Board and committee effectiveness as well as individual Director performance and contribution levels. The Nominating and Corporate Governance Committee and full Board consider the results of these evaluations in connection with their review of Director nominees to ensure the Board continues to operate effectively.

Our directors regularly complete governance questionnaires and self-assessments. These questionnaires and assessments, and feedback from discussions between members of the Nominating and Corporate Governance Committee and individual directors, facilitate a candid assessment of: (i) the Board’s performance in areas such as business strategy, risk oversight, talent development and succession planning and corporate governance; (ii) the Board’s structure, composition and culture; and (iii) the mix of skills, qualifications and experiences of our directors.

Corporate Governance

Director Independence; Independence Determination

The Board has adopted the definition of independence in the listing standards of the NYSE. In its assessment of director independence, the Board considers all commercial, charitable and other relationships and transactions that any director or member of his or her immediate family may have with us, with any of our affiliates or with any of our consultants or advisers.

The Board has affirmatively determined that each of Alan Attal, Larry Cheng, Ryan Cohen, Jim Grube and Yang Xu is independent under the NYSE standards as well as under standards set forth in SEC regulations, and that the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are composed exclusively of independent directors under the

| 2023 Proxy Statement | 11 |

foregoing standards. The Board has affirmatively determined that each of its former non-management directors serving on the Board and the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee during fiscal 2022 were independent under the NYSE standards as well as under standards set forth in SEC regulations. The Board did not determine Mr. Furlong to be independent because of his current executive position.

Our independent and non-management directors hold regularly scheduled executive sessions without management present.

Board Leadership Structure

The Board’s leadership structure is currently composed of an independent Chair of the Board, our Chief Executive Officer and four other independent directors. Effective immediately upon his election at the 2021 annual meeting, Ryan Cohen became the Chair of the Board. In this role, Mr. Cohen presides over regularly scheduled meetings with the other non-management directors to discuss and evaluate our business without members of management present and provides guidance and oversight to management. Mr. Furlong, our Chief Executive Officer also serves as a director. The Board believes that Mr. Furlong’s service as a director further enhances the Board’s oversight of our day-to-day operations and provides additional management expertise with respect to the complexities of our business units. All directors play an active role in overseeing our business both at the Board and committee level. This structure, together with our other corporate governance practices, provides strong independent oversight of management while ensuring clear strategic direction for us. The Board believes that at this time our stockholders are best served by this structure.

Majority Voting in the Election of Directors

Directors must be elected by a majority of the votes cast in elections for which the number of nominees for election does not exceed the number of directors to be elected. A plurality vote standard applies to contested elections where the number of nominees exceeds the number of directors to be elected. Our Bylaws provide that any incumbent director who does not receive a majority of the votes cast in an uncontested election is required to tender his or her resignation for consideration by our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The director who tenders his or her resignation will not participate in the Nominating and Corporate Governance Committee’s or the Board’s decision. In determining its recommendation to the Board, the Nominating and Corporate Governance Committee will consider all factors that it deems relevant. Following such determination, we will promptly publicly disclose the Board’s decision, including, if applicable, the reasons for rejecting the tendered resignation.

Human Capital Management Oversight

The Board, as a whole and through its standing committees, has made human capital management a priority. The Board believes that the diverse talents of our global team of associates is a key contributor to our success as a global brand. We are committed to the ongoing talent development of all our associates and offer rewarding learning opportunities through our training programs and high-potential talent development programs as well as educational assistance programs. For additional information on our human capital management, see our Annual Report on Form 10-K for fiscal 2022.

Codes of Ethics

We have adopted a Code of Ethics for Senior Financial and Executive Officers that is applicable to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, any Executive Vice President, any Senior Vice President or Vice President employed in a finance or accounting role and any managing director or finance director of all our foreign subsidiaries. We have also adopted a Code of Standards, Ethics and Conduct applicable to all of our associates and non-employee directors. The Code of Ethics for Senior Financial and Executive Officers and the Code of Standards, Ethics and Conduct are available on our website at http://investor.gamestop.com/corporate-governance and are available in print to any stockholder who requests them in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. In accordance with SEC rules, we intend to disclose any amendment (other than any technical, administrative or other non-substantive amendment) to either of the above Codes, or any waiver of any provision thereof with respect to certain specified officers listed above, on our website at http://investor.gamestop.com/corporate-governance within four business days following such amendment or waiver.

Clawback Policy

We have adopted a clawback policy which requires the Board, when permitted by law, to require reimbursement of annual incentive payments or long-term incentive payments from a current or former executive officer where the payment was predicated upon achieving certain financial results or other operating metrics, and either (1) the Board determines in its good faith judgment that such financial results or other operating metrics were achieved in whole or part as a result of fraud or other misconduct on the part of such executive, or fraud or other misconduct of other employees of which such executive had knowledge, whether or not such conduct results in any restatement of our financial statements filed with the SEC, or (2) such financial results or other operating metrics were

12 | 2023 Proxy Statement |

|

the subject of a restatement of our financial statements filed with the SEC, and a lower payment would have been made to the executive officer based upon the restated financial results. We will, to the fullest extent possible under applicable law, seek to recover from the individual executive officer, in the case of (1), the full amount of the individual executive officer’s incentive payments for the relevant period (including, at a minimum, for the three-year period prior to such financial results), and in the case of (2), the amount by which the individual executive officer’s incentive payments for the relevant period (including, at a minimum, for the three-year period prior to the restatement of financial results) exceeded the lower payment that would have been made based on the restated financial results.

Equity Ownership Policy

The Board believes that it is important for each executive officer and non-employee director to have a financial stake in us to help align the executive officer’s and non-employee director’s interests with those of our stockholders. To that end, we have an equity ownership policy requiring that each executive officer and non-employee director maintain ownership of common stock with a value of at least the following:

Executive Officer or Non-employee Director | Fiscal 2022 Stock Ownership Guidelines | |

Chief Executive Officer | 5 times base salary | |

Chief Operating Officer or Executive Vice President | 3 times base salary | |

Non-employee Director | $275,000 | |

New executive officers or non-employee directors are given a period of five (5) years to attain full compliance with these requirements. These requirements will be reduced by 50% for executive officers after the executive officer reaches the age of 62 in order to facilitate appropriate financial planning.

For purposes of these determinations, (i) stock ownership includes shares of common stock which are directly owned or owned by family members residing with the executive officer or non-employee director, or by family trusts, as well as vested options and vested restricted stock, and unvested restricted stock or equivalents, unless they are subject to achievement of performance targets, and common stock or stock equivalents credited to such executive officer or non-employee director under any deferred compensation plan, and (ii) common stock shall be valued per share using the 200-day trailing average NYSE per share closing price. As of January 28, 2023, each of our executive officers and non-employee directors was in compliance with our equity ownership policy (either because they owned adequate shares or are within the applicable grace period to obtain adequate shares).

Anti-Hedging Policy

Given that the aim of ownership of common stock is to ensure that employees and directors have a direct personal financial stake in our performance, hedging transactions on the part of employees and directors could be contrary to that purpose. Therefore, we have adopted an anti-hedging policy which states that the implementation by an employee or director of hedging strategies or transactions using short sales, puts, calls or other types of financial instruments (including, but not limited to, prepaid variable forward contracts, equity swaps, collars, and exchange funds) based upon the value of our common stock and applied to equity securities granted to such employee or director, or held, directly or indirectly, by such employee or director, is strictly prohibited.

Corporate Governance Guidelines; Certifications

The Board has adopted Corporate Governance Guidelines. The Corporate Governance Guidelines are available on our website at http://investor.gamestop.com/corporate-governance and are available in print to any stockholder who requests them in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051.

On an annual basis, our Chief Executive Officer submits to the NYSE the annual certification required by Section 303A.12(a) of the NYSE Listed Company Manual. In addition, we have filed with the SEC as exhibits to our Annual Report on Form 10-K for fiscal 2022 the certifications of our Chief Executive Officer and Chief Financial Officer required pursuant to Section 302 of the Sarbanes-Oxley Act relating to the quality of our public disclosure.

Communications Between Stockholders and Interested Parties and the Board

Stockholders and other interested persons seeking to communicate with the Board should submit any communications in writing to our Secretary, GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. Any such communication must state the number of shares beneficially owned by the stockholder making the communication. Our Secretary will forward such communication to the full Board or to any individual director or directors (including the presiding director of the executive sessions of the non-management directors or the non-management directors as a group) to whom the communication is directed.

| 2023 Proxy Statement | 13 |

Attendance at Annual Meetings

All members of the Board are expected to attend the annual meeting and be available to address questions or concerns raised by stockholders. At our 2022 annual meeting of stockholders, all of our then incumbent directors who stood for re-election at the 2022 annual meeting attended the meeting virtually.

Succession Planning

The Board is responsible for succession planning and succession planning issues are discussed as a matter of course at regular Board meetings. In addition, the Nominating and Corporate Governance Committee and the Strategic Planning and Capital Allocation Committee periodically review the talent development and succession plans for our senior executive officer positions, including the Chief Executive Officer.

Risk Oversight

Responsibility for risk oversight resides with the full Board. Committees have been established to help the Board carry out this responsibility by focusing on key areas of risk inherent in the business. The Audit Committee oversees risk associated with financial and accounting matters, including compliance with legal and regulatory requirements, related-party transactions and our financial reporting and internal control systems. The Audit Committee also oversees our internal audit function and regularly meets separately with representatives of our internal audit team, the Chief Financial Officer, external auditors and other financial and executive management. The Compensation Committee oversees risks associated with compensation policies and the retention and development of executive talent, including the development of policies that do not encourage excessive risk-taking by our executives. These policies include various factors to help mitigate risk, including vesting periods, equity ownership policies, and clawback provisions. The Compensation Committee and management also regularly review our compensation policies to determine effectiveness and to assess the risk they present to us. Based on this review, we have concluded that our compensation policies and procedures are not reasonably likely to have a material adverse effect on us. In addition, at least annually, the Board conducts a formal business review including a risk assessment related to our existing business and new initiatives. Because overseeing risk is an ongoing process and inherent in strategic decisions, the Board also discusses risk throughout the year at other meetings in relation to specific topics or actions, including cybersecurity.

Stock Split

On July 6, 2022, our Board of Directors declared a four-for-one stock split of our common stock in the form of a stock dividend (the “Stock Split”). This dividend was distributed on July 21, 2022 to stockholders of record at the close of business on July 18, 2022 and a similar adjustment was made for holders of restricted stock units. All references made to restricted shares and restricted stock units in the tables set forth below and applicable disclosures have been retroactively adjusted to reflect the effects of the Stock Split.

Director Compensation

Each non-employee director (other than Mr. Cohen) elected at the annual meeting receives a restricted stock unit (“RSU”) award with respect to a number of shares determined by dividing $200,000 by the average closing price of our common stock for the 30 trading days immediately preceding the annual meeting. Such RSUs will vest upon the earlier of the next regularly scheduled annual meeting following the award date or the grantee’s death. One share of common stock will be distributed in respect of each vested RSU within 60 days following the relevant vesting date or event. Under this structure, no cash compensation will be paid to our non-employee directors.

Mr. Cohen has declined to receive any compensation for his service as a non-employee director.

The following table provides information regarding compensation of our non-employee directors for fiscal 2022.

Name | Fees Earned or Paid in Cash | Stock Awards(1)(2) | Total | |||||||||

Current Non-Employee Directors: |

|

|

|

|

|

|

|

|

| |||

Alain (Alan) Attal(2) | $ | — | $ | 200,060 | $ | 200,060 | ||||||

Ryan Cohen(2) | — | — | — | |||||||||

James (Jim) Grube(2) | — | 200,060 | 200,060 | |||||||||

Lawrence (Larry) Cheng(2) | — | 200,060 | 200,060 | |||||||||

Yang Xu(2) | — | 200,060 | 200,060 | |||||||||

14 | 2023 Proxy Statement |

|

| (1) | Reflects the grant date fair values in accordance with FASB ASC Topic 718. The grant date fair value of these awards may differ from the award values described in the narrative above, because grant date fair value is determined with reference to the closing price of our common stock on the grant date, whereas these awards were sized with reference to an average closing price of our common stock for a multi-day period preceding the applicable grant date. The Board decided to use this trailing average approach to determine award sizes to reduce the impact of short-term stock price volatility. These RSUs vest on the date of the next regularly scheduled annual meeting of stockholders, subject to continued service to the Company. |

| (2) | As of January 28, 2023, each of the non-employee directors set forth in the above table held the following number of unvested restricted stock units: Alan Attal—7,000; Ryan Cohen—0; James (Jim) Grube—7,000; Lawrence (Larry) Cheng—7,000; Yang Xu—7,000. |

We have reimbursed and will continue to reimburse our directors for reasonable expenses incurred in connection with their attendance at Board and committee meetings. Because the Board believes that it is important for each director to have a financial stake in us to help align the director’s interests with those of our stockholders, we require our directors maintain a certain level of ownership of common stock. For a description of the equity ownership policy, see “Corporate Governance-Equity Ownership Policy” above.

Directors who are also executive officers (presently, Mr. Furlong) do not receive additional compensation for their services as directors, and none of the directors receive additional compensation for their services as committee chairpersons or as our Chair of the Board. Please see the portions of this Proxy Statement regarding executive compensation for a description of Mr. Furlong’s compensation.

Executive Officers

The following table sets forth the names and ages of our current and former executive officers and the positions they hold or held, as applicable:

Name | Age | Title | ||||

Current Executive Officers: | ||||||

Matthew (Matt) Furlong | 44 | Chief Executive Officer | ||||

Diana Saadeh-Jajeh(1) | 53 | Chief Financial Officer | ||||

Nir Patel(2) | 41 | Chief Operating Officer | ||||

Former Executive Officers: | ||||||

Michael Recupero(1) | 49 | Former Chief Financial Officer | ||||

| (1) | Effective as of July 7, 2022, Mr. Recupero departed from service as our Chief Financial Officer, at which time Ms. Saadeh-Jajeh was named Chief Financial Officer. |

| (2) | Effective as of May 31, 2022, Mr. Patel was appointed as Chief Operating Officer. |

Assuming his re-election to the Board at the annual meeting, Ryan Cohen will continue in his role as the Chair of the Board. As an independent chair, Mr. Cohen has the responsibility for presiding over regularly scheduled meetings with the other non-management directors to discuss and evaluate our business without members of management present and provides guidance and oversight to management. Our Chief Executive Officer has responsibility for the development and execution of our strategic plans and for leadership and oversight of all of our day-to-day operations and performance.

Business Experience of Executive Officers

Matthew (Matt) Furlong serves as our President and Chief Executive Officer (in addition to his role as a director), a role he has held since June 2021. Prior to joining the Company, Mr. Furlong served as Country Leader, Australia for Amazon (NASDAQ: AMZN) since September 2019 and in various other roles at Amazon since October 2012, including as Director, Technical Advisor, Amazon North America. Prior to joining Amazon, Mr. Furlong served in various roles at The Procter & Gamble Company focused on brand, marketing and sales strategies.

Diana Saadeh-Jajeh serves as our Chief Financial Officer, a role she has held since July 2022. Prior to being appointed Chief Financial Officer, Ms. Saadeh-Jajeh was the Company’s Chief Accounting Officer from her start date in June 2020. In addition, to her Chief Accounting Officer responsibilities, Ms Saadeh-Jajeh also served as an interim CFO from March 2021 to July 2021. Prior to joining the Company, Ms. Saadeh-Jajeh served as Vice President, Global Finance Operations & Transformation of JUUL Labs, Inc. and held senior financial leadership roles for Equinix, Inc., e.l.f. Beauty, Inc. and Visa Inc. Ms. Saadeh-Jajeh is a Certified Public Accountant.

| 2023 Proxy Statement | 15 |

Nir Patel serves as our Chief Operating Officer, a role he has had since May 2022. Mr. Patel has approximately two decades of experience in operations, merchandising, supply chain, and retail and store operations. Most recently, he was Chief Executive Officer at Belk, a privately owned national retailer with more than 300 stores across 16 states. He previously held senior roles at Kohl’s and Lands’ End after beginning his career at Target and Gap.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth the number of shares of our common stock (including common stock that may be purchased pursuant to the exercise of options, warrants or otherwise within 60 days of April 21, 2023) beneficially owned on April 21, 2023 by each director, each of the NEOs, each holder of 5% or more of our common stock and all of our directors and executive officers as a group. Except as otherwise noted, the individual director or executive officer (including former executive officers who are NEOs) or his or her immediate family members had sole voting and investment power with respect to the identified securities. Except as otherwise noted, the address of each person listed below is c/o GameStop Corp., 625 Westport Parkway, Grapevine, Texas 76051. The total number of shares of our common stock outstanding as of April 21, 2023 was 304,717,030.

| Name | Shares Beneficially Owned | |||||||||||||||

| Number (1) | % | |||||||||||||||

5% Stockholders: | ||||||||||||||||

RC Ventures LLC | 36,404,000 | (2) | 11.9% | |||||||||||||

P.O. Box 25250, PMB 30427 | ||||||||||||||||

Miami, FL 33102 | ||||||||||||||||

BlackRock, Inc. | 21,977,404 | (3) | 7.2% | |||||||||||||

55 East 52nd Street | ||||||||||||||||

New York, NY 10055 | ||||||||||||||||

The Vanguard Group | 24,664,433 | (4) | 8.1% | |||||||||||||

100 Vanguard Blvd. | ||||||||||||||||

Malvern, PA 19355 | ||||||||||||||||

Directors and Executive Officers: | ||||||||||||||||

Ryan Cohen | 36,404,000 | (2) | 11.9% | |||||||||||||

Alain (Alan) Attal | 528,692 | (5) | * | |||||||||||||

Matthew (Matt) Furlong | 284,376 | (6) | * | |||||||||||||

Michael Recupero | 222,384 | (7) | * | |||||||||||||

Diana Saadeh-Jajeh | 103,922 | (8) | * | |||||||||||||

Nir Vinay Patel | 1,126,768 | (9) | * | |||||||||||||

Lawrence (Larry) Cheng | 44,088 | (10) | * | |||||||||||||

James (Jim) Grube | 15,092 | (11) | * | |||||||||||||

Yang Xu | 11,088 | (12) | * | |||||||||||||

|

| |||||||||||||||

All Directors and Officers as a Group (8 persons) | 38,518,026 | (13) | * | |||||||||||||

|

| |||||||||||||||

| * | Less than 1.0%. |