UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-K

__________________________

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35551

__________________________

Meta Platforms, Inc.

(Exact name of registrant as specified in its charter)

__________________________ | | | | | |

| Delaware | 20-1665019 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1601 Willow Road, Menlo Park, California 94025

(Address of principal executive offices and Zip Code)

(650) 543-4800

(Registrant's telephone number, including area code)

__________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.000006 par value | META | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of June 30, 2022, the last business day of the registrant's most recently completed second fiscal quarter, was $378 billion based upon the closing price reported for such date on the Nasdaq Global Select Market. On January 27, 2023, the registrant had 2,225,763,078 shares of Class A common stock and 366,876,470 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2023 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2022.

Meta Platforms, Inc.

Form 10-K

TABLE OF CONTENTS

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Unless expressly indicated or the context requires otherwise, the terms "Meta," "company," "we," "us," and "our" in this document refer to Meta Platforms, Inc., a Delaware corporation, and, where appropriate, its subsidiaries. The term "Family" refers to our Facebook, Instagram, Messenger, and WhatsApp products. For references to accessing Meta's products on the "web" or via a "website," such terms refer to accessing such products on personal computers. For references to accessing Meta's products on "mobile," such term refers to accessing such products via a mobile application or via a mobile-optimized version of our websites such as m.facebook.com, whether on a mobile phone or tablet.

LIMITATIONS OF KEY METRICS AND OTHER DATA

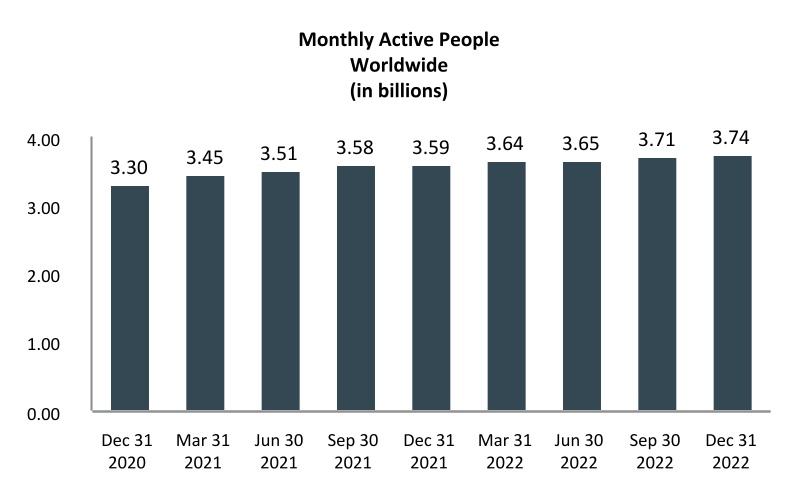

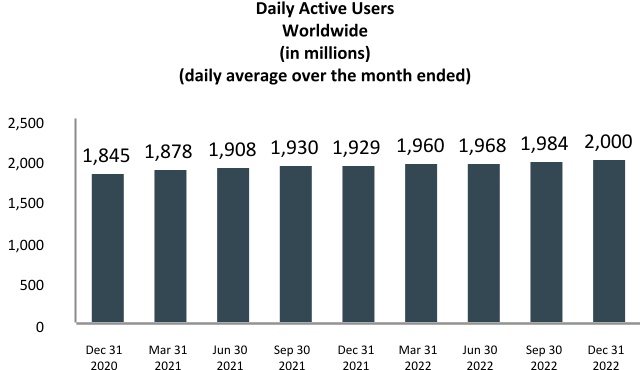

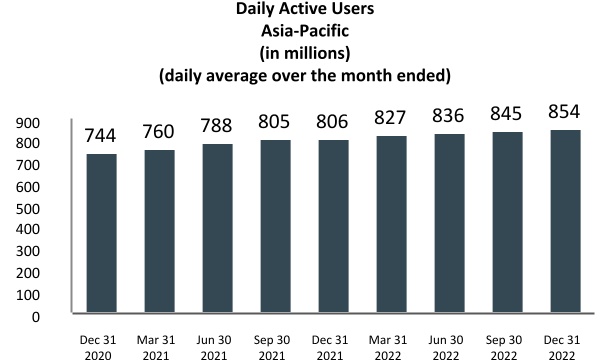

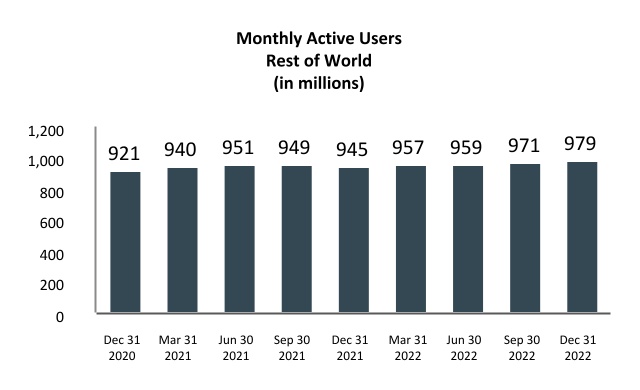

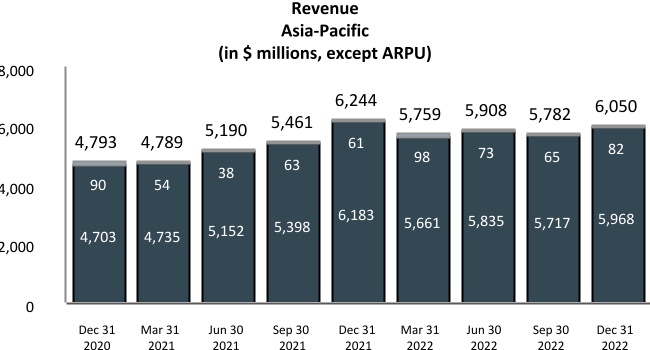

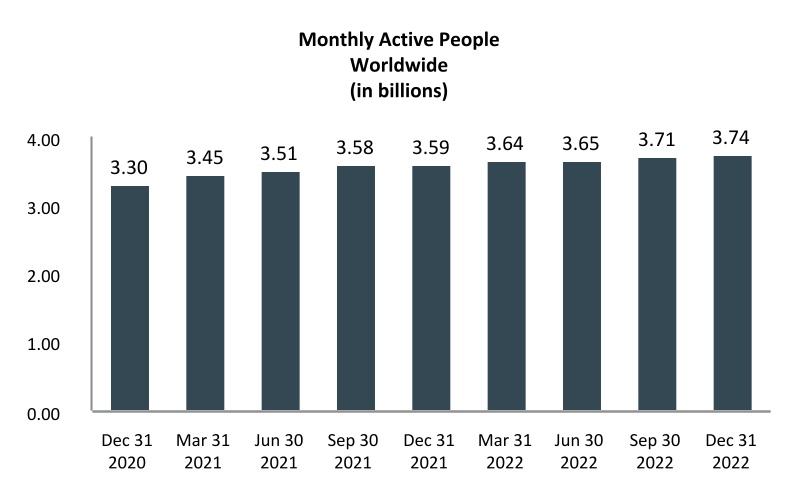

The numbers for our key metrics are calculated using internal company data based on the activity of user accounts. We report our estimates of the numbers of our daily active people (DAP), monthly active people (MAP), and average revenue per person (ARPP) (collectively, our "Family metrics") based on the activity of users who visited at least one of Facebook, Instagram, Messenger, and WhatsApp (collectively, our "Family" of products) during the applicable period of measurement. We have historically reported the numbers of our daily active users (DAUs), monthly active users (MAUs), and average revenue per user (ARPU) (collectively, our "Facebook metrics") based on user activity only on Facebook and Messenger and not on our other products. We believe our Family metrics better reflect the size of our community and the fact that many people are using more than one of our products. As a result, over time we intend to report our Family metrics as key metrics in place of DAUs, MAUs, and ARPU in our periodic reports filed with the Securities and Exchange Commission.

While these numbers are based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring usage of our products across large online and mobile populations around the world. The methodologies used to measure these metrics require significant judgment and are also susceptible to algorithm or other technical errors. In addition, we are continually seeking to improve our estimates of our user base, and such estimates may change due to improvements or changes in our methodology. We regularly review our processes for calculating these metrics, and from time to time we discover inaccuracies in our metrics or make adjustments to improve their accuracy, which can result in adjustments to our historical metrics. Our ability to recalculate our historical metrics may be impacted by data limitations or other factors that require us to apply different methodologies for such adjustments. We generally do not intend to update previously disclosed Family metrics for any such inaccuracies or adjustments that are within the error margins disclosed below.

In addition, our Family metrics and Facebook metrics estimates will differ from estimates published by third parties due to differences in methodology.

Family Metrics

Many people in our community have user accounts on more than one of our products, and some people have multiple user accounts within an individual product. Accordingly, for our Family metrics, we do not seek to count the total number of user accounts across our products because we believe that would not reflect the actual size of our community. Rather, our Family metrics represent our estimates of the number of unique people using at least one of Facebook, Instagram, Messenger, and WhatsApp. We do not require people to use a common identifier or link their accounts to use multiple products in our Family, and therefore must seek to attribute multiple user accounts within and across products to individual people. To calculate these metrics, we rely upon complex techniques, algorithms and machine learning models that seek to count the individual people behind user accounts, including by matching multiple user accounts within an individual product and across multiple products when we believe they are attributable to a single person, and counting such group of accounts as one person. These techniques and models require significant judgment, are subject to data and other limitations discussed below, and inherently are subject to statistical variances and uncertainties. We estimate the potential error in our Family metrics primarily based on user survey data, which itself is subject to error as well. While we expect the error margin for our Family metrics to vary from period to period, we estimate that such margin generally will be approximately 3% of our worldwide MAP. At our scale, it is very difficult to attribute multiple user accounts within and across products to individual people, and it is possible that the actual numbers of unique people using our products may vary significantly from our estimates, potentially beyond our estimated error margins. As a result, it is also possible that our Family metrics may indicate changes or trends in user numbers that do not match actual changes or trends.

To calculate our estimates of Family DAP and MAP, we currently use a series of machine learning models that are developed based on internal reviews of limited samples of user accounts and calibrated against user survey data. We apply significant judgment in designing these models and calculating these estimates. For example, to match user accounts within individual products and across multiple products, we use data signals such as similar device information, IP addresses, and user names. We also calibrate our models against data from periodic user surveys of varying sizes and frequency across our products, which are inherently subject to error. The timing and results of such user surveys have in the past contributed, and may in the future contribute, to changes in our reported Family metrics from period to period. In addition, our data limitations may affect our understanding of certain details of our business and increase the risk of error for our Family metrics estimates. Our techniques and models rely on a variety of data signals from different products, and we rely on more limited data signals for some products compared to others. For example, as a result of limited visibility into encrypted products, we have fewer

data signals from WhatsApp user accounts and primarily rely on phone numbers and device information to match WhatsApp user accounts with accounts on our other products. Similarly, although Messenger Kids users are included in our Family metrics, we do not seek to match their accounts with accounts on our other applications for purposes of calculating DAP and MAP. Any loss of access to data signals we use in our process for calculating Family metrics, whether as a result of our own product decisions, actions by third-party browser or mobile platforms, regulatory or legislative requirements, or other factors, also may impact the stability or accuracy of our reported Family metrics, as well as our ability to report these metrics at all. Our estimates of Family metrics also may change as our methodologies evolve, including through the application of new data signals or technologies, product changes, or other improvements in our user surveys, algorithms, or machine learning that may improve our ability to match accounts within and across our products or otherwise evaluate the broad population of our users. In addition, such evolution may allow us to identify previously undetected violating accounts (as defined below).

We regularly evaluate our Family metrics to estimate the percentage of our MAP consisting solely of "violating" accounts. We define "violating" accounts as accounts which we believe are intended to be used for purposes that violate our terms of service, including bots and spam. In the fourth quarter of 2022, we estimated that approximately 3% of our worldwide MAP consisted solely of violating accounts. Such estimation is based on an internal review of a limited sample of accounts, and we apply significant judgment in making this determination. For example, we look for account information and behaviors associated with Facebook and Instagram accounts that appear to be inauthentic to the reviewers, but we have limited visibility into WhatsApp user activity due to encryption. In addition, if we believe an individual person has one or more violating accounts, we do not include such person in our violating accounts estimation as long as we believe they have one account that does not constitute a violating account. From time to time, we disable certain user accounts, make product changes, or take other actions to reduce the number of violating accounts among our users, which may also reduce our DAP and MAP estimates in a particular period. We intend to disclose our estimates of the percentage of our MAP consisting solely of violating accounts on an annual basis. Violating accounts are very difficult to measure at our scale, and it is possible that the actual number of violating accounts may vary significantly from our estimates.

The numbers of Family DAP and MAP discussed in this Annual Report on Form 10-K, as well as ARPP, do not include users on our other products, unless they would otherwise qualify as DAP or MAP, respectively, based on their other activities on our Family products.

Facebook Metrics

We regularly evaluate our Facebook metrics to estimate the number of "duplicate" and "false" accounts among our MAUs. A duplicate account is one that a user maintains in addition to his or her principal account. We divide "false" accounts into two categories: (1) user-misclassified accounts, where users have created personal profiles for a business, organization, or non-human entity such as a pet (such entities are permitted on Facebook using a Page rather than a personal profile under our terms of service); and (2) violating accounts, which represent user profiles that we believe are intended to be used for purposes that violate our terms of service, such as bots and spam. The estimates of duplicate and false accounts are based on an internal review of a limited sample of accounts, and we apply significant judgment in making this determination. For example, to identify duplicate accounts we use data signals such as identical IP addresses and similar user names, and to identify false accounts we look for names that appear to be fake or other behavior that appears inauthentic to the reviewers. Any loss of access to data signals we use in this process, whether as a result of our own product decisions, actions by third-party browser or mobile platforms, regulatory or legislative requirements, or other factors, also may impact the stability or accuracy of our estimates of duplicate and false accounts. Our estimates also may change as our methodologies evolve, including through the application of new data signals or technologies or product changes that may allow us to identify previously undetected duplicate or false accounts and may improve our ability to evaluate a broader population of our users. Duplicate and false accounts are very difficult to measure at our scale, and it is possible that the actual number of duplicate and false accounts may vary significantly from our estimates.

In the fourth quarter of 2022, we estimated that duplicate accounts may have represented approximately 11% of our worldwide MAUs. We believe the percentage of duplicate accounts is meaningfully higher in developing markets such as the Philippines and Vietnam, as compared to more developed markets. In the fourth quarter of 2022, we estimated that false accounts may have represented approximately 4-5% of our worldwide MAUs. Our estimation of false accounts can vary as a result of episodic spikes in the creation of such accounts, which we have seen originate more frequently in specific countries such as Indonesia, Nigeria, and Vietnam. From time to time, we disable certain user accounts, make product changes, or take other actions to reduce the number of duplicate or false accounts among our users, which may also reduce our DAU and

MAU estimates in a particular period. We intend to disclose our estimates of the number of duplicate and false accounts among our MAUs on an annual basis.

The numbers of DAUs and MAUs discussed in this Annual Report on Form 10-K, as well as ARPU, do not include users on Instagram, WhatsApp, or our other products, unless they would otherwise qualify as DAUs or MAUs, respectively, based on their other activities on Facebook.

User Geography

Our data regarding the geographic location of our users is estimated based on a number of factors, such as the user's IP address and self-disclosed location. These factors may not always accurately reflect the user's actual location. For example, a user may appear to be accessing Facebook from the location of the proxy server that the user connects to rather than from the user's actual location. The methodologies used to measure our metrics are also susceptible to algorithm or other technical errors, and our estimates for revenue by user location and revenue by user device are also affected by these factors.

PART I

Item 1.Business

Overview

Our mission is to give people the power to build community and bring the world closer together.

All of our products, including our apps, share the vision of helping to bring the metaverse to life. We build technology that helps people connect and share, find communities, and grow businesses. Our useful and engaging products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables. We also help people discover and learn about what is going on in the world around them, enable people to share their experiences, ideas, photos and videos, and other activities with audiences ranging from their closest family members and friends to the public at large, and stay connected everywhere by accessing our products. Meta is moving our offerings beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the metaverse, which we believe is the next evolution in social technology. Our vision for the metaverse does not center on any single product, but rather an entire ecosystem of experiences, devices, and new technologies. While the metaverse is in the very early stages of its development, we believe it will become the next computing platform and the future of social interaction.

We report financial results for two segments: Family of Apps (FoA) and Reality Labs (RL). Currently, we generate substantially all of our revenue from selling advertising placements on our family of apps to marketers, which is reflected in FoA. Ads on our platforms enable marketers to reach people across a range of marketing objectives, such as generating leads or driving awareness. Marketers purchase ads that can appear in multiple places including on Facebook, Instagram, Messenger, and third-party applications and websites. RL reflects our efforts to develop the metaverse and generates revenue from sales of consumer hardware products, software and content.

We invest in our business based on our company priorities, and the majority of our investments are directed toward developing our family of apps. In 2022, 82% of our total costs and expenses were recognized in FoA and 18% were recognized in RL. Our FoA investments were $71.79 billion in 2022 and include expenses relating to headcount, data centers and technical infrastructure as part of our efforts to develop our apps and our advertising services. We are also making significant investments in our metaverse efforts, including developing virtual and augmented reality devices, software for social platforms, neural interfaces, and other foundational technologies for the metaverse. Our total RL investments were $15.88 billion in 2022 and include expenses relating to headcount and technology development across these efforts. As these are fundamentally new technologies that we expect will evolve as the metaverse ecosystem develops, many products for the metaverse may only be fully realized in the next decade. Although it is inherently difficult to predict when and how the metaverse ecosystem will develop, we expect our RL segment to continue to operate at a loss for the foreseeable future, and our ability to support our metaverse efforts is dependent on generating sufficient profits from other areas of our business. We expect this will be a complex, evolving, and long-term initiative. We are investing now because we believe this is the next chapter of the internet and will unlock monetization opportunities for businesses, developers, and creators, including around advertising, hardware, and digital goods.

Family of Apps Products

•Facebook. Facebook helps give people the power to build community and bring the world closer together. It's a place for people to share life's moments and discuss what's happening, nurture and build relationships, discover and connect to interests, and create economic opportunity. They can do this through Feed, Reels, Stories, Groups, and more.

•Instagram. Instagram brings people closer to the people and things they love. Instagram Feed, Stories, Reels, Video, Live, Shops, and messaging are places where people and creators can connect and express themselves through photos, video, and private messaging, and discover and shop from their favorite businesses.

•Messenger. Messenger is a simple yet powerful messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio and video calls.

•WhatsApp. WhatsApp is a simple, reliable, and secure messaging application that is used by people and businesses around the world to communicate and transact in a private way.

Reality Labs Products

Many of our metaverse investments are directed toward long-term, cutting edge research and development for products that are not on the market today and may only be fully realized in the next decade. This includes exploring new technologies such as neural interfaces using electromyography, which lets people control their devices using neuromuscular signals, as well as innovations in artificial intelligence (AI) and hardware to help build next-generation interfaces. In the near term, we are continuing to develop early metaverse experiences through Reality Labs' augmented and virtual reality products that help people feel connected, anytime, anywhere. Our current product offerings include Meta Quest virtual reality devices, as well as software and content available through the Meta Quest Store, which enable a range of social experiences that allow people to defy physical distance, including gaming, fitness, entertainment, and more. For example, we have launched Horizon Worlds, a social platform where people can interact with friends, meet new people, play games, and attend virtual events, and Horizon Workrooms, a virtual reality space for teams to connect and collaborate at work. As part of our virtual reality initiatives, we have also introduced mixed reality capabilities through our Meta Reality system on Meta Quest Pro, which allows users to experience the immersion and presence of virtual reality while still being grounded in the physical world. As part of our augmented reality initiatives, we have introduced Ray-Ban Stories smart glasses, which let people stay more present through hands-free interaction, and Meta Spark, a platform that allows creators and businesses to build augmented reality experiences that bring the digital and physical worlds together in our apps. In general, while all of these investments are part of our long-term initiative to help build the metaverse, our virtual reality and social platform efforts also include notable shorter-term projects developing specific products and services to go to market, whereas our augmented reality efforts are primarily directed toward longer-term research and development projects. For example, in 2023, we expect to spend approximately 50% of our Reality Labs operating expenses on our augmented reality initiatives, approximately 40% on our virtual reality initiatives, and approximately 10% on social platforms and other initiatives. We apply significant judgment in estimating this expense breakdown as there are certain shared costs across product lines, and our expectations are subject to change, including as the metaverse ecosystem and our business strategies evolve. In particular, we regularly evaluate our product roadmaps and make significant changes as our understanding of the technological challenges and market landscape and our product ideas and designs evolve.

Competition

Our business is characterized by innovation, rapid change, and disruptive technologies. We compete with companies providing connection, sharing, discovery, and communication products and services to users online, as well as companies that sell advertising to businesses looking to reach consumers and/or develop tools and systems for managing and optimizing advertising campaigns. We face significant competition in every aspect of our business, including, but not limited to, companies that facilitate the ability of users to create, share, communicate, and discover content and information online or enable marketers to reach their existing or prospective audiences. We compete to attract, engage, and retain people who use our products, to attract and retain businesses that use our free or paid business and advertising services, and to attract and retain developers who build compelling applications that integrate with our products. We also compete with companies that develop and deliver consumer hardware and virtual and augmented reality products and services. As we introduce or acquire new products, as our existing products evolve, or as other companies introduce new products and services, including as part of efforts to develop the metaverse or innovate through the application of new technologies such as AI, we may become subject to additional competition.

Technology

Our product development philosophy centers on continuous innovation in creating and improving products that are social by design, which means that our products are designed to place people and their social interactions at the core of the product experience. As our user base grows, as engagement with products like video and virtual reality increases, and as we deepen our investment in new technologies, our computing needs continue to expand. We make significant investments in technology both to improve our existing products and services and to develop new ones, as well as for our marketers and developers. We are also investing in protecting the security, privacy, and integrity of our platform by investing in both people and technology to strengthen our systems against abuse. Across all of these efforts, we are making significant investments in AI and machine learning, including to recommend relevant unconnected content across our products through our AI-powered discovery engine, to enhance our advertising tools and improve our ad delivery, targeting, and measurement capabilities, and

to develop new product features using generative AI.

Sales and Operations

The majority of our marketers use our self-service ad platform to launch and manage their advertising campaigns. We also have a global sales force that is focused on attracting and retaining advertisers and providing support to them throughout the stages of the marketing cycle from pre-purchase decision-making to real-time optimizations to post-campaign analytics. We work directly with these advertisers, as well as through advertising agencies and resellers. We operate offices in more than 90 cities around the globe, the majority of which have a sales presence. We also invest in and rely on self-service tools to provide direct customer support to our users and partners.

Marketing

Historically, our communities have generally grown organically with people inviting their friends to connect with them, supported by internal efforts to stimulate awareness and interest. In addition, we have invested and will continue to invest in marketing our products and services to grow our brand and help build community around the world.

Intellectual Property

To establish and protect our proprietary rights, we rely on a combination of patents, trademarks, copyrights, trade secrets, including know-how, license agreements, confidentiality procedures, non-disclosure agreements with third parties, employee disclosure and invention assignment agreements, and other contractual rights. In addition, to further protect our proprietary rights, from time to time we have purchased patents and patent applications from third parties. We do not believe that our proprietary technology is dependent on any single patent or copyright or groups of related patents or copyrights. We believe the duration of our patents is adequate relative to the expected lives of our products.

Government Regulation

We are subject to a variety of laws and regulations in the United States and abroad that involve matters central to our business, many of which are still evolving and being tested in courts, and could be interpreted in ways that could harm our business. These laws and regulations involve matters including privacy, data use, data protection and personal information, biometrics, encryption, rights of publicity, content, integrity, intellectual property, advertising, marketing, distribution, data security, data retention and deletion, data localization and storage, data disclosure, artificial intelligence and machine learning, electronic contracts and other communications, competition, protection of minors, consumer protection, civil rights, accessibility, telecommunications, product liability, e-commerce, taxation, economic or other trade controls including sanctions, anti-corruption and political law compliance, securities law compliance, and online payment services. Foreign data protection, privacy, content, competition, consumer protection, and other laws and regulations can impose different obligations, or penalties or fines for non-compliance, or be more restrictive than those in the United States.

These U.S. federal, state, and foreign laws and regulations, which in some cases can be enforced by private parties in addition to government entities, are constantly evolving and can be subject to significant change. As a result, the application, interpretation, and enforcement of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate, and may be interpreted and applied inconsistently from jurisdiction to jurisdiction and inconsistently with our current policies and practices. For example, regulatory or legislative actions or litigation affecting the manner in which we display content to our users, moderate content, or obtain consent to various practices, or otherwise relating to content that is made available on our products, could adversely affect our financial results. In the United States, the U.S. Supreme Court recently agreed to review a matter in which the scope of the protections available to online platforms under Section 230 of the Communications Decency Act (Section 230) is at issue. In addition, there have been, and continue to be, various efforts to remove or restrict the scope of the protections available to online platforms under Section 230, and any such changes may increase our costs or require significant changes to our products, business practices, or operations, which could adversely affect our business and financial results.

We are also subject to evolving laws and regulations that dictate whether, how, and under what circumstances we can transfer, process and/or receive certain data that is critical to our operations, including data shared between countries or regions in which we operate and data shared among our products and services. If we are unable to transfer data between and among countries and regions in which we operate, or if we are restricted from sharing data among our products and services,

it could affect our ability to provide our services, the manner in which we provide our services or our ability to target ads, which could adversely affect our financial results. For example, the Privacy Shield, a transfer framework we relied upon for data transferred from the European Union to the United States, was invalidated in July 2020 by the Court of Justice of the European Union (CJEU). In addition, the other bases upon which Meta relies to transfer such data, such as Standard Contractual Clauses (SCCs), have been subjected to regulatory and judicial scrutiny. On July 6, 2022, we received a draft decision from the Irish Data Protection Commission (IDPC) that preliminarily concluded that Meta Platforms Ireland's reliance on SCCs in respect of European Union/European Economic Area Facebook user data does not achieve compliance with the General Data Protection Regulation (GDPR) and preliminarily proposed that such transfers of user data from the European Union to the United States should therefore be suspended. Separately, on March 25, 2022, the European Union and United States announced that they had reached an agreement in principle on a new EU-U.S. Data Privacy Framework (EU-U.S. DPF). On October 7, 2022, President Biden signed the Executive Order on Enhancing Safeguards for United States Signals Intelligence Activities (E.O.), and on December 13, 2022, the European Commission published its draft adequacy decision on the proposed new EU-U.S. DPF. We believe a final decision in this inquiry may issue as early as the first quarter of 2023. Although the E.O. is a significant and positive step, if no adequacy decision is adopted by the European Commission and we are unable to continue to rely on SCCs or rely upon other alternative means of data transfers from the European Union to the United States, we will likely be unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe, which would materially and adversely affect our business, financial condition, and results of operations.

We have been subject to other significant legislative and regulatory developments in the past, and proposed or new legislation and regulations could significantly affect our business in the future. For example, we have implemented a number of product changes and controls as a result of requirements under the GDPR, and may implement additional changes in the future. The GDPR also requires submission of personal data breach notifications to our lead European Union privacy regulator, the IDPC, and includes significant penalties for non-compliance with the notification obligation as well as other requirements of the regulation. The interpretation of the GDPR is still evolving and draft decisions in investigations by the IDPC are subject to review by other European privacy regulators as part of the GDPR's consistency mechanism, which may lead to significant changes in the final outcome of such investigations. As a result, the interpretation and enforcement of the GDPR, as well as the imposition and amount of penalties for non-compliance, are subject to significant uncertainty. In addition, Brazil, the United Kingdom, and other countries have enacted similar data protection regulations imposing data privacy-related requirements on products and services offered to users in their respective jurisdictions. The California Consumer Privacy Act, as amended by the California Privacy Rights Act, and similar laws recently enacted by other states also establish certain transparency rules and create certain data privacy rights for users. In addition, the European Union's ePrivacy Directive and national implementation laws impose additional limitations on the use of data across messaging products and include significant penalties for non-compliance. Changes to our products or business practices as a result of these or similar developments have in the past adversely affected, and may in the future adversely affect, our advertising business. Similarly, there are a number of legislative proposals or recently enacted laws in the European Union, the United States, at both the federal and state level, as well as other jurisdictions that could impose new obligations or limitations in areas affecting our business. For example, the Digital Markets Act (DMA) in the European Union imposes new restrictions and requirements on companies like ours, including in areas such as the combination of data across services, mergers and acquisitions, and product design. The DMA also includes significant penalties for non-compliance, and its key requirements will be enforceable against designated gatekeeper companies in early 2024. We expect the DMA will cause us to incur significant compliance costs and make additional changes to our products or business practices. The requirements under the DMA will likely be subject to further interpretation and regulatory engagement. Pending or future proposals to modify competition laws in the United States and other jurisdictions could have similar effects. Further, the Digital Services Act (DSA) in the European Union, which will apply to our business as early as June 2023, will impose new restrictions and requirements for our products and services and may significantly increase our compliance costs. The DSA also includes significant penalties for non-compliance. In addition, some countries, such as India and Turkey, are considering or have passed legislation implementing data protection requirements or requiring local storage and processing of data or similar requirements that could increase the cost and complexity of delivering our services, cause us to cease the offering of our products and services in certain countries, or result in fines or other penalties. New legislation or regulatory decisions that restrict our ability to collect and use information about minors may also result in limitations on our advertising services or our ability to offer products and services to minors in certain jurisdictions.

We are, and expect to continue to be, the subject of investigations, inquiries, data requests, requests for information, actions, and audits by government authorities and regulators in the United States, Europe, and around the world, particularly in the areas of privacy and data protection, including with respect to minors, law enforcement, consumer protection, civil

rights, content moderation, and competition. We are also currently, and may in the future be, subject to regulatory orders or consent decrees, including the modified consent order we entered into with the U.S. Federal Trade Commission (FTC), which took effect in April 2020 and, among other matters, requires us to maintain a comprehensive privacy program. Orders issued by, or inquiries or enforcement actions initiated by, government or regulatory authorities could cause us to incur substantial costs, expose us to civil and criminal liability (including liability for our personnel) or penalties (including substantial monetary remedies), interrupt or require us to change our business practices in a manner materially adverse to our business (including changes to our products or user data practices), result in negative publicity and reputational harm, divert resources and the time and attention of management from our business, or subject us to other structural or behavioral remedies that adversely affect our business.

For additional information about government regulation applicable to our business, see Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

Human Capital

At Meta, our mission is to give people the power to build community and bring the world closer together. People are at the heart of every connection we empower, and we are proud of our unique company culture. We strive to build diverse teams across engineering, product design, marketing, and other areas to further our mission.

As we look forward, we expect the lasting effects of the global COVID-19 pandemic will change how we work and who we reach. We are proud of our response to the COVID-19 pandemic both internally and externally. Employee benefits were robust and established quickly: we implemented 15 days of subsidized backup care for child, adult, or eldercare; we paid emergency leave to help address short-term or transitional needs; and we established a temporary stipend to help employees work from home, to name just a few of the benefits.

We are committed to fostering an enriching environment for our global workforce, and we are focused on supporting our people in doing the best work of their careers, no matter where they are located. For example:

•Location is flexible but presence is essential. As of September 30, 2022, 83% of managers at Meta had direct reports in a different location, and 24% of our employees were fully remote.

•Remote work has helped us reach new talent in a competitive tech landscape and broaden our representation. We have seen that candidates who accepted remote job offers were more often underrepresented people.

•Beginning March 2023, we are permitting employees in eligible roles to transfer to any Meta office within their country of employment. We expect distributed teams to establish strong norms that support efficiency, including more predictable and coordinated in-person working time.

At the start of the COVID-19 pandemic, the world rapidly moved online and the surge of online commerce led to accelerated revenue growth. Many people predicted this would be a permanent acceleration that would continue even after the pandemic ended. Instead, not only did online commerce return to prior trends, but the more challenging macroeconomic environment and limitations on our ad targeting and measurement tools, among other factors, contributed to a decline in our revenue.

To address this new environment, we took a number of steps to become a more capital efficient company and, in November 2022, made one of the most difficult changes in Meta's history and announced a layoff of approximately 11,000 employees. The cost reduction efforts that we announced, including our plans to scale back budgets, reduce company perks, shrink our real estate footprint, and restructure teams to increase efficiency alone would not bring our expenses in line with our revenue growth and we had to implement the layoff. We made it a priority to treat outgoing employees with respect and announced a package for U.S. employees that included:

•Severance: 16 weeks of base pay plus two additional weeks for every year of service.

•Paid time off: payment for all remaining paid time off.

•Restricted stock unit vesting: receipt of November 2022 vesting for outstanding employee restricted stock unit awards.

•Health insurance: coverage of the cost of healthcare for employees and their families for six months.

•Career services: three months of career support with an external vendor, including early access to unpublished job leads.

•Immigration support: dedicated immigration specialists to help guide employees based on their needs.

We offered similar support for outgoing employees outside of the United States, taking into account local employment laws.

Employee Learning and Development

We value our investment in growing and keeping a highly skilled and efficient workforce. In addition to permitting employees to seek education reimbursement, we offer career development opportunities and work experience programs that extend beyond the physical and virtual classroom. To do this, we utilize various learning modalities, such as live virtual and in-person learning experiences, on-demand e-learning, self-service resources, learning communities, and coaching engagements.

The Pulse of Our Workforce

Each year, we conduct company-wide employee surveys to help understand how employees feel about working at Meta and what we can do to improve their experience. Our surveys help us measure company, manager, and personal experience over time. Further, our more frequent surveys, such as those that have been administered daily to an ongoing random sample of employees, allows us to measure real-time sentiment around emerging events and company changes. These surveys are designed to invite feedback and actionable suggestions, inform decisions, and drive change across the company.

Health and Well-being

Meta's health and well-being programs are designed to give employees a choice of flexible benefits to help them reach their personal well-being goals. Our programs are tailored to help boost employee physical and mental health, create financial peace of mind, provide support for families, and help employees build a strong community. Programs are designed and funded to support needs like autism care, cancer care, transgender services, holistic well-being, and mental health programs, which represent a few of the ways we support our employees and their dependents.

Diversity, Equity and Inclusion

We work to build a diverse and inclusive workplace where we can leverage our collective cognitive diversity to build the best products and make the best decisions for the global community we serve.

We offer full-time fully remote positions, including in locations where we do not have offices, which has deepened the diversity of our candidate pool. As published in our Diversity Report in July 2022, we saw that providing remote optionality increased the diversity of the overall composition of our workforce: U.S candidates who accepted remote job offers were substantially more likely to be Black, Hispanic, Native American, Alaskan Native, Pacific Islander, veterans and/or people with disabilities, and globally, candidates who accepted remote job offers were more likely to be women.

As part of our 2022 Diversity Report, we published our global gender diversity and U.S. ethnic diversity workforce data. As of June 30, 2022, our global employee base was comprised of 37.1% females and 62.9% males, and our U.S. employee base was comprised of the following ethnicities: 46.5% Asian, 37.6% White, 6.7% Hispanic, 4.9% Black, 4.0% two or more ethnicities, and 0.3% additional groups (including American Indian or Alaska Native and Native Hawaiian or Other Pacific Islander).

We want our products to work for the world and we need to grow and keep the best talent in order to do that. To aid in this effort, we have taken steps to reduce bias from our hiring processes and performance management systems.

We have also invested in learning opportunities to identify and reduce inherent bias through Diversity, Equity and Inclusion trainings for our employees and enhanced learning and development courses. In addition, we offer career development programs to employees, including opportunities for women leaders at Meta to connect, support and grow together and programs to help ensure that we develop leaders of color, build a more diverse leadership pipeline and foster a culture of sponsorship through leader advocacy.

Compensation and Benefits

We offer competitive compensation to attract and retain the best people, and we help care for our people so they can focus on our mission. Our employees' total compensation package includes market-competitive salary, bonuses or sales incentives, and equity. We generally offer full-time employees equity at the time of hire and through annual equity grants because we want them to be owners of the company and committed to our long-term success. We have conducted pay equity analyses for many years, and continue to be committed to pay equity. In 2022, we announced that our analyses indicate that we continue to have pay equity across genders globally and race in the United States for people in similar jobs, accounting for factors such as location, role, and level.

Through Life@ Meta, our holistic approach to benefits, we provide our employees and their dependents with resources to help them thrive. We offer a wide range of benefits across areas such as health, family, finance, community, and time away, including healthcare and wellness benefits, family building benefits, family care resources, retirement savings plans, access to tax and legal services, and Meta Resource Groups to build community at Meta.

Corporate Information

We were incorporated in Delaware in July 2004. We completed our initial public offering in May 2012 and our Class A common stock is currently listed on the Nasdaq Global Select Market under the symbol "META." Our principal executive offices are located at 1601 Willow Road, Menlo Park, California 94025, and our telephone number is (650) 543-4800.

Meta, the Meta logo, Facebook, FB, Instagram, Oculus, WhatsApp, and our other registered or common law trademarks, service marks, or trade names appearing in this Annual Report on Form 10-K are the property of Meta Platforms, Inc. or its affiliates. Other trademarks, service marks, or trade names appearing in this Annual Report on Form 10‑K are the property of their respective owners.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), are filed with the U.S. Securities and Exchange Commission (SEC). We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements, and other information with the SEC. Such reports and other information filed by us with the SEC are available free of charge on our website at investor.fb.com when such reports are available on the SEC's website. We use our investor.fb.com and about.fb.com/news/ websites as well as Mark Zuckerberg's Facebook Page (www.facebook.com/zuck) and Instagram account (www.instagram.com/zuck) as means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

The contents of the websites referred to above are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

Item 1A.Risk Factors

Certain factors may have a material adverse effect on our business, financial condition, and results of operations. You should consider carefully the risks and uncertainties described below, in addition to other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and related notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business. If any of the following risks actually occurs, our business, financial condition, results of operations, and future prospects could be materially and adversely affected. In that event, the trading price of our Class A common stock could decline, and you could lose part or all of your investment.

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks Related to Our Product Offerings

•our ability to add and retain users and maintain levels of user engagement with our products;

•the loss of, or reduction in spending by, our marketers;

•reduced availability of data signals used by our ad targeting and measurement tools;

•ineffective operation with mobile operating systems or changes in our relationships with mobile operating system partners;

•failure of our new products, or changes to our existing products, to attract or retain users or generate revenue;

Risks Related to Our Business Operations and Financial Results

•our ability to compete effectively;

•fluctuations in our financial results;

•unfavorable media coverage and other risks affecting our ability to maintain and enhance our brands;

•the COVID-19 pandemic, including its impact on our advertising business;

•acquisitions and our ability to successfully integrate our acquisitions;

•our ability to build, maintain, and scale our technical infrastructure, and risks associated with disruptions in our service;

•operating our business in multiple countries around the world;

•litigation, including class action lawsuits;

Risks Related to Government Regulation and Enforcement

•government restrictions on access to Facebook or our other products, or other actions that impair our ability to sell advertising, in their countries;

•complex and evolving U.S. and foreign privacy, data use and data protection, content, competition, consumer protection, and other laws and regulations;

•the impact of government investigations, enforcement actions, and settlements, including litigation and investigations by privacy and competition authorities;

•our ability to comply with regulatory and legislative privacy requirements, including our consent order with the Federal Trade Commission (FTC);

Risks Related to Data, Security, and Intellectual Property

•the occurrence of security breaches, improper access to or disclosure of our data or user data, and other cyber incidents or undesirable activity on our platform;

•our ability to obtain, maintain, protect, and enforce our intellectual property rights; and

Risks Related to Ownership of Our Class A Common Stock

•limitations on the ability of holders of our Class A Common Stock to influence corporate matters due to the dual class structure of our common stock and the control of a majority of the voting power of our outstanding capital stock by our founder, Chairman, and CEO.

Risks Related to Our Product Offerings

If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly harmed.

The size of our user base and our users' level of engagement across our products are critical to our success. Our financial performance has been and will continue to be significantly determined by our success in adding, retaining, and engaging active users of our products that deliver ad impressions, particularly for Facebook and Instagram. We have experienced, and expect to continue to experience, fluctuations and declines in the size of our active user base in one or more markets from time to time, particularly in markets where we have achieved higher penetration rates. User growth and engagement are also impacted by a number of other factors, including competitive products and services, such as TikTok, that have reduced some users' engagement with our products and services, as well as global and regional business, macroeconomic, and geopolitical conditions. For example, the COVID-19 pandemic has led to increases and decreases in the size and engagement of our active user base from period to period at different points during the pandemic, and may continue to have a varied impact on the size and engagement of our active user base in the future. In addition, in connection with the war in Ukraine, access to Facebook and Instagram was restricted in Russia and these services were then prohibited by the Russian government, which contributed to slight declines on a quarter-over-quarter basis in the number of DAUs and MAUs on Facebook in Europe in the first quarter and the second quarter of 2022, as well as a slight decline on a quarter-over-quarter basis in the total number of MAUs on Facebook in the second quarter of 2022. Any future declines in the size of our active user base may adversely impact our ability to deliver ad impressions and, in turn, our financial performance.

If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other social networking companies that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels. Our user engagement patterns have changed over time, and user engagement can be difficult to measure, particularly as we introduce new and different products and services. Any number of factors can negatively affect user retention, growth, and engagement, including if:

•users increasingly engage with other competitive products or services;

•we fail to introduce new features, products, or services that users find engaging or if we introduce new products or services, or make changes to existing products and services, that are not favorably received;

•users feel that their experience is diminished as a result of the decisions we make with respect to the frequency, prominence, format, size, and quality of ads that we display;

•users have difficulty installing, updating, or otherwise accessing our products on mobile devices as a result of actions by us or third parties that we rely on to distribute our products and deliver our services;

•user behavior on any of our products changes, including decreases in the quality and frequency of content shared on our products and services;

•we are unable to continue to develop products for mobile devices that users find engaging, that work with a variety of mobile operating systems and networks, and that achieve a high level of market acceptance;

•there are decreases in user sentiment due to questions about the quality or usefulness of our products or our user data practices, concerns about the nature of content made available on our products, or concerns related to privacy, safety, security, well-being, or other factors;

•we are unable to manage and prioritize information to ensure users are presented with content that is appropriate, interesting, useful, and relevant to them;

•we are unable to obtain or attract engaging third-party content;

•we are unable to successfully maintain or grow usage of and engagement with applications that integrate with our products;

•users adopt new technologies where our products may be displaced in favor of other products or services, or may not be featured or otherwise available;

•there are changes mandated by legislation, government and regulatory authorities, or litigation that adversely affect our products or users;

•we are unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe, or are otherwise limited in our business operations, as a result of European regulators, courts, or legislative bodies determining that our reliance on Standard Contractual Clauses (SCCs) or other legal bases we rely upon to transfer user data from the European Union to the United States is invalid;

•there is decreased engagement with our products, or failure to accept our terms of service, as part of privacy-focused changes that we have implemented or may implement in the future, whether voluntarily, in connection with the General Data Protection Regulation (GDPR), the European Union's ePrivacy Directive, the California Privacy Rights Act (CPRA), or other laws, regulations, or regulatory actions, or otherwise;

•technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the user experience, such as security breaches or failure to prevent or limit spam or similar content, or users feel their experience is diminished as a result of our efforts to protect the security and integrity of our platform;

•we adopt terms, policies, or procedures related to areas such as sharing, content, user data, or advertising, or we take, or fail to take, actions to enforce our policies, that are perceived negatively by our users or the general public, including as a result of decisions or recommendations from the independent Oversight Board regarding content on our platform;

•we elect to focus our product decisions on longer-term initiatives that do not prioritize near-term user growth and engagement (for example, we have announced plans to focus product decisions on optimizing the young adult experience in the long term);

•we make changes in our user account login or registration processes or changes in how we promote different products and services across our family of products;

•initiatives designed to attract and retain users and engagement, including the use of new technologies such as artificial intelligence, are unsuccessful or discontinued, whether as a result of actions by us, our competitors, or other third parties, or otherwise;

•third-party initiatives that may enable greater use of our products, including low-cost or discounted data plans, are scaled back or discontinued, or the pricing of data plans otherwise increases;

•there is decreased engagement with our products as a result of taxes imposed on the use of social media or other mobile applications in certain countries, internet shutdowns, or other actions by governments that affect the accessibility of our products in their countries (for example, beginning in the first quarter of 2022, our user growth and engagement were adversely affected by the war in Ukraine and service restrictions imposed by the Russian government);

•we fail to provide adequate customer service to users, marketers, developers, or other partners;

•we, developers whose products are integrated with our products, or other partners and companies in our industry are the subject of adverse media reports or other negative publicity, including as a result of our or their user data practices; or

•our current or future products, such as our development tools and application programming interfaces that enable developers to build, grow, and monetize applications, reduce user activity on our products by making it easier for our users to interact and share on third-party applications.

From time to time, certain of these factors have negatively affected user retention, growth, and engagement to varying degrees. If we are unable to maintain or increase our user base and user engagement, particularly for our significant revenue-generating products like Facebook and Instagram, our revenue and financial results may be adversely affected. Any significant decrease in user retention, growth, or engagement could render our products less attractive to users, marketers, and developers, which is likely to have a material and adverse impact on our ability to deliver ad impressions and, accordingly, our revenue, business, financial condition, and results of operations. As the size of our active user base fluctuates in one or more markets from time to time, we will become increasingly dependent on our ability to maintain or increase levels of user engagement and monetization in order to grow revenue.

We generate substantially all of our revenue from advertising. The loss of marketers, or reduction in spending by marketers, could seriously harm our business.

Substantially all of our revenue is currently generated from marketers advertising on Facebook and Instagram. As is common in the industry, our marketers do not have long-term advertising commitments with us. Many of our marketers spend only a relatively small portion of their overall advertising budget with us. Marketers will not continue to do business with us, or they will reduce the budgets they are willing to commit to us, if we do not deliver ads in an effective manner, if they do not believe that their investment in advertising with us will generate a competitive return relative to other alternatives, or if they are not satisfied for any other reason. We have implemented, and we will continue to implement, changes to our user data practices. Some of these changes reduce our ability to effectively target ads, which has to some extent adversely affected, and will continue to adversely affect, our advertising business. If we are unable to provide marketers with a suitable return on investment, the demand for our ads may not increase, or may decline, in which case our revenue and financial results may be harmed.

Our advertising revenue can also be adversely affected by a number of other factors, including:

•decreases in user engagement, including time spent on our products;

•our inability to continue to increase user access to and engagement with our products;

•product changes or inventory management decisions we may make that change the size, format, frequency, or relative prominence of ads displayed on our products or of other unpaid content shared by marketers on our products;

•our inability to maintain or increase marketer demand, the pricing of our ads, or both;

•our inability to maintain or increase the quantity or quality of ads shown to users;

•changes to the content or application of third-party policies that limit our ability to deliver, target, or measure the effectiveness of advertising, including changes by mobile operating system and browser providers such as Apple and Google;

•adverse litigation, government actions, or legislative, regulatory, or other legal developments relating to advertising, including developments that may impact our ability to deliver, target, or measure the effectiveness of advertising;

•user behavior or product changes that may reduce traffic to features or products that we successfully monetize, such as our feed and Stories products, including as a result of increased usage of our Reels or other video or messaging products;

•reductions of advertising by marketers due to our efforts to implement or enforce advertising policies that protect the security and integrity of our platform;

•the availability, accuracy, utility, and security of analytics and measurement solutions offered by us or third parties that demonstrate the value of our ads to marketers, or our ability to further improve such tools;

•loss of advertising market share to our competitors, including if prices to purchase our ads increase or if competitors offer lower priced, more integrated, or otherwise more effective products;

•limitations on our ability to offer a number of our most significant products and services, including Facebook and Instagram, in Europe as a result of European regulators, courts, or legislative bodies determining that our reliance on SCCs or other legal bases we rely upon to transfer user data from the European Union to the United States is invalid;

•changes in our marketing and sales or other operations that we are required to or elect to make as a result of risks related to complying with foreign laws or regulatory requirements or other government actions;

•decisions by marketers to reduce their advertising as a result of announcements by us or adverse media reports or other negative publicity involving us, our user data practices, our advertising metrics or tools, content on our products, our interpretation, implementation, or enforcement of policies relating to content on our products (including as a result of decisions or recommendations from the independent Oversight Board), developers with applications that are integrated with our products, or other companies in our industry;

•reductions of advertising by marketers due to objectionable content made available on our products by third parties, questions about our user data practices or the security of our platform, concerns about brand safety or potential legal liability, or uncertainty regarding their own legal and compliance obligations;

•the effectiveness of our ad targeting or degree to which users opt in or out of the use of data for ads, including as a result of product changes and controls that we have implemented or may implement in the future in connection with the GDPR, ePrivacy Directive, California Privacy Rights Act (CPRA), the Digital Markets Act (DMA), other laws, regulations, regulatory actions, or litigation, or otherwise, that impact our ability to use data for advertising purposes;

•the degree to which users cease or reduce the number of times they engage with our ads;

•changes in the way advertising on mobile devices or on personal computers is measured or priced;

•the success of technologies designed to block the display of ads or ad measurement tools;

•changes in the composition of our marketer base or our inability to maintain or grow our marketer base; and

•the impact of macroeconomic and geopolitical conditions, whether in the advertising industry in general, or among specific types of marketers or within particular geographies (for example, the war in Ukraine and service restrictions imposed by the Russian government have adversely affected our advertising business in Europe and other regions).

From time to time, certain of these factors have adversely affected our advertising revenue to varying degrees. The occurrence of any of these or other factors in the future could result in a reduction in demand for our ads, which may reduce the prices we receive for our ads, or cause marketers to stop advertising with us altogether, either of which would negatively affect our revenue and financial results.

Our ad targeting and measurement tools incorporate data signals from user activity on websites and services that we do not control, as well as signals generated within our products, and changes to the regulatory environment, third-party mobile operating systems and browsers, and our own products have impacted, and we expect will continue to impact, the availability of such signals, which will adversely affect our advertising revenue.

Our ad targeting and measurement tools rely on data signals from user activity on websites and services that we do not control, as well as signals generated within our products, in order to deliver relevant and effective ads to our users, and any changes in our ability to use such signals will adversely affect our business. For example, legislative and regulatory developments, such as the GDPR, ePrivacy Directive, and California Consumer Privacy Act (CCPA), as amended by the CPRA, have impacted, and we expect will continue to impact, our ability to use such signals in our ad products. In particular, we have seen increases in the number of users opting to control certain types of ad targeting in Europe following product changes implemented in connection with our GDPR and ePrivacy Directive compliance, and we have introduced product changes that limit data signal use for certain users in California following adoption of the CCPA. Regulatory guidance, decisions, or new legislation in these or other jurisdictions, such as the DMA, may require us to make additional changes to our products in the future that further reduce our ability to use these signals, which has occurred in the past. For example, we expect to implement additional changes in response to the December 2022 decision by the IDPC regarding the legal basis for our delivery of behavioral advertising in Europe.

In addition, mobile operating system and browser providers, such as Apple and Google, have implemented product changes and/or announced future plans to limit the ability of websites and application developers to collect and use these signals to target and measure advertising. For example, in 2021, Apple made certain changes to its products and data use policies in connection with changes to its iOS operating system that reduce our and other iOS developers' ability to target and measure advertising, which has negatively impacted, and we expect will continue to negatively impact, the size of the budgets marketers are willing to commit to us and other advertising platforms. In addition, we have implemented, and may continue to implement, product changes that give users the ability to limit our use of such data signals to improve ads and other experiences on our products and services, including changes implemented in connection with the GDPR and other regulatory frameworks.

These developments have limited our ability to target and measure the effectiveness of ads on our platform and negatively impacted our advertising revenue. For example, our advertising revenue has been negatively impacted by marketer reaction to targeting and measurement challenges associated with iOS changes beginning in 2021. If we are unable to mitigate these developments as they take further effect in the future, our targeting and measurement capabilities will be materially and adversely affected, which would in turn significantly impact our advertising revenue.

Our user growth, engagement, and monetization on mobile devices depend upon effective operation with mobile operating systems, networks, technologies, products, and standards that we do not control.

The substantial majority of our revenue is generated from advertising on mobile devices. There is no guarantee that popular mobile devices will continue to feature our products, or that mobile device users will continue to use our products rather than competing products. We are dependent on the interoperability of our products with popular mobile operating systems, networks, technologies, products, and standards that we do not control, such as the Android and iOS operating systems and mobile browsers. Changes, bugs, or technical issues in such systems, or changes in our relationships with mobile operating system partners, handset manufacturers, browser developers, or mobile carriers, or in the content or application of their terms of service or policies (which they have made in the past and continue to seek to implement) that degrade our products' functionality, reduce or eliminate our ability to update or distribute our products, give preferential treatment to competitive products, limit our ability to deliver, target, or measure the effectiveness of ads, or charge fees related to the distribution of our products or our delivery of ads have in the past adversely affected, and could in the future adversely affect,