- ORCL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Oracle (ORCL) DEF 14ADefinitive proxy

Filed: 25 Sep 24, 5:00pm

☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Section 240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

September 25, 2024

To our Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Oracle Corporation. Our Annual Meeting will be held on Thursday, November 14, 2024, at 9:00 a.m., Central Time. The 2024 Annual Meeting of Stockholders will be a virtual meeting. At our virtual Annual Meeting, stockholders will be able to attend, vote and submit questions via the Internet.

We describe in detail the actions we expect to take at the Annual Meeting in the following Notice of 2024 Annual Meeting of Stockholders and proxy statement. We have also made available a copy of our Annual Report on Form 10-K for fiscal 2024. We encourage you to read the Form 10-K, which includes information on our operations, products and services, as well as our audited financial statements.

This year, we will again be using the “Notice and Access” method of providing proxy materials to stockholders via the Internet. We believe that this process provides stockholders with a convenient and quick way to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. We will mail to most of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and the Form 10-K and vote electronically via the Internet. This notice will also contain instructions on how to receive a paper copy of the proxy materials. All stockholders who are not sent a notice, or who otherwise request, will be sent a paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email. See “Questions and Answers about the Annual Meeting” beginning on page 81 for more information.

Please use this opportunity to take part in our corporate affairs by voting your shares on the business to come before this meeting. Whether or not you plan to attend the meeting, please vote electronically via the Internet or by telephone, or, if you requested paper copies of the proxy materials, please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope. See “How Do I Vote?” on pages 7 and 8 of the proxy statement for more details. Voting electronically, by telephone or by returning your proxy card does NOT deprive you of your right to attend the virtual meeting and to vote your shares during the meeting for the matters acted upon at the meeting. If you cannot attend the virtual meeting, we invite you to listen to a recording following the Annual Meeting through November 21, 2024 by going to www.virtualshareholdermeeting.com/ORCL2024 or our website at www.oracle.com/investor.

Sincerely,

Lawrence J. Ellison

Chairman and Chief Technology Officer

2300 Oracle Way

Austin, Texas 78741

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE | 9:00 a.m., Central Time, on Thursday, November 14, 2024 | |

LOCATION | The meeting will be held in a virtual format only. Please visit www.virtualshareholdermeeting.com/ORCL2024. | |

REPLAY | A recording of the meeting will be available at www.virtualshareholdermeeting.com/ORCL2024 and on our website at www.oracle.com/investor following the Annual Meeting through November 21, 2024. | |

ITEMS OF BUSINESS | (1) To elect 13 director nominees to serve on the Board of Directors until our 2025 Annual Meeting of Stockholders.

(2) To hold an advisory vote to approve the compensation of our named executive officers.

(3) To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2025.

(4) To consider and act on one stockholder proposal, if properly presented at the Annual Meeting.

(5) To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. | |

RECORD DATE | September 16, 2024 | |

PROXY VOTING | It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares electronically via the Internet, by telephone or by completing and returning the proxy card or voting instruction card if you requested paper proxy materials. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you requested printed materials, the instructions are printed on your proxy card and included in the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement. | |

MEETING ADMISSION | You are entitled to attend the Annual Meeting online, vote and submit one question during the meeting by visiting www.virtualshareholdermeeting.com/ORCL2024 and entering the 16-digit control number included on the Notice of Internet Availability of Proxy Materials, on your proxy card (if you requested printed materials) or on the instructions that accompanied your proxy materials. You will only be entitled to vote and submit a question at the Annual Meeting if you are a stockholder as of the close of business on September 16, 2024, the record date. More details on how to participate in this year’s virtual meeting can be found on pages 7 and 8 and in the “Questions and Answers about the Annual Meeting” beginning on page 81. In the event of a technical malfunction or other situation that at the discretion of the Chairman of the Board of Directors may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held, the Chairman or Corporate Secretary of Oracle will convene the meeting at 4:00 p.m., Central Time on the same date and at the location specified above solely for the purpose of holding the adjourned meeting at this later time. Under the foregoing circumstances, we will post information regarding the announcement on the Investors page of Oracle’s website at www.oracle.com/investor. | |

| ||

Brian S. Higgins Senior Vice President and Corporate Secretary September 25, 2024 | ||

TABLE OF CONTENTS

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 9 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

Stock Ownership Guidelines for Directors and Senior Officers | 28 | |||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 34 | |||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 42 | ||||

| 43 | ||||

Determination of Executive Compensation Amounts for Fiscal 2024 | 43 | |||

| 46 | ||||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 66 | ||||

| 69 | ||||

| 71 | ||||

PROPOSAL NO. 2: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 72 | |||

PROPOSAL NO. 3: RATIFICATION OF THE SELECTION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 75 | |||

REPORT OF THE FINANCE AND AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 76 | |||

| 77 | ||||

2024 Annual Meeting of Stockholders  |

2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. For more complete information about these topics, please review our Annual Report on Form 10-K for fiscal 2024 and the contents of this proxy statement. Fiscal 2024 began on June 1, 2023 and ended on May 31, 2024. Fiscal 2025 began on June 1, 2024 and ends on May 31, 2025.

The Notice of Internet Availability of Proxy Materials, this proxy statement and the accompanying proxy card or voting instruction card, including an Internet link to our Annual Report on Form 10-K for fiscal 2024, were first made available to stockholders on or about September 25, 2024.

2024 Annual Meeting of Stockholders

Date and Time

Thursday, November 14, 2024 9:00 a.m., Central Time

Location

Online via live audio webcast at www.virtualshareholdermeeting.com/ORCL2024

Record Date

You will only be entitled to vote and submit a question for the Annual Meeting if you are a stockholder as of the close of business on September 16, 2024, the record date.

Replay

A recording of the meeting will be available on our website at www.oracle.com/investor and at www.virtualshareholdermeeting.com/ORCL2024 following the Annual Meeting through November 21, 2024. |

| Voting and Attendance

You may vote on the Internet, by telephone, by mail or during the Annual Meeting if you are a stockholder as of the close of business on the record date. You are entitled to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/ORCL2024 and entering the 16-digit control number included on the Notice of Internet Availability of Proxy Materials, on your proxy card (if you requested printed materials), or on the instructions that accompanied your proxy materials.

Submitting a Question

You may submit one question either in advance of or during the Annual Meeting if you are a stockholder as of the close of business on the record date. You may submit a question in advance of the meeting at www.proxyvote.com by logging in with your 16-digit control number. During the Q&A session at the Annual Meeting, we will endeavor to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. | ||||||

Voting Roadmap

Agenda Item |

Board Recommendation | Page

| ||

• Election of 13 directors | FOR Each Nominee | 71 | ||

• Advisory vote to approve the compensation of our named executive officers (NEOs) | FOR | 72 | ||

• Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2025 | FOR | 75 | ||

• Stockholder proposal | AGAINST | 77 | ||

2024 Annual Meeting of Stockholders  1 1 |

Director Nominees

In Proposal No. 1, we are asking you to vote FOR each of the 13 director nominees listed below. Each director attended at least 75% of all Board meetings and applicable committee meetings during fiscal 2024.

Nominee | Age | Director Since | Independent | Current Committees | ||||

Awo Ablo Executive Vice President, Strategy and Partnerships, Tony Blair Institute for Global Change | 52 | 2022 |  | • Governance | ||||

Jeffrey S. Berg Chairman, Northside Services, LLC; Former Chairman and CEO, International Creative Management, Inc. | 77 | 1997 |  | • Independence (Chair) • Finance and Audit | ||||

Michael J. Boskin Tully M. Friedman Professor of Economics and Wohlford Family Hoover Institution Senior Fellow, Stanford University | 78 | 1994 |  | • Finance and Audit (Chair) | ||||

Safra A. Catz CEO, Oracle Corporation | 62 | 2001 |

|

| ||||

Bruce R. Chizen Senior Adviser, Permira Advisers LLP; Strategic Advisor, Voyager Capital; Former CEO, Adobe Systems Incorporated | 69 | 2008 |  | • Governance (Chair) • Finance and Audit | ||||

George H. Conrades* Executive Advisor and Former Chairman and CEO, Akamai Technologies, Inc.; Managing Partner, Longfellow Venture Partners | 85 | 2008 |  | • Compensation (Chair) • Independence | ||||

Lawrence J. Ellison Chairman, Chief Technology Officer (CTO) and Founder, Oracle Corporation | 80 | 1977 |

|

| ||||

Rona A. Fairhead Former Minister of State, U.K. Department for International Trade; Former Chair, BBC Trust; Former Chair and CEO, Financial Times Group Limited | 63 | 2019 |  | • Finance and Audit | ||||

Jeffrey O. Henley Vice Chairman of the Board, Oracle Corporation | 79 | 1995 |

|

| ||||

Charles W. Moorman Senior Advisor and Former CEO, Amtrak; Former CEO, Norfolk Southern Corporation | 72 | 2018 |  | • Compensation • Independence | ||||

Leon E. Panetta Co-founder and Chairman, Panetta Institute for Public Policy; Former U.S. Secretary of Defense; Former Director of the Central Intelligence Agency | 86 | 2015 |  | • Compensation • Governance | ||||

William G. Parrett Former CEO, Deloitte Touche Tohmatsu | 79 | 2018 |  | • Governance | ||||

Naomi O. Seligman Senior Partner, Ostriker von Simson, Inc. | 86 | 2005 |  | • Compensation (Vice Chair) | ||||

| * | Current lead independent director. See “Corporate Governance—Board Leadership Structure” on page 28 for more information. |

2  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

Corporate Governance Highlights

Board of Directors | Stockholder Rights and Engagement | Good Governance Practices | ||

* Board of Directors as of September 16, 2024, the record date of the Annual Meeting. |

|

| ||

Stockholder Engagement and Board Responsiveness

We have a long tradition of engaging with our stockholders to solicit their views on a wide variety of issues, including corporate governance, environmental and social matters, executive compensation and other issues. Our directors and members of our Legal and Investor Relations teams engage with stockholders throughout the year. The feedback received from our stockholder engagement efforts is communicated to and considered by the Board of Directors (the Board), and, when appropriate, the Board implements changes in response to stockholder feedback.

| Ø | Independent Director Engagement. On a regular basis, representatives of our independent directors hold meetings with our stockholders covering a wide range of topics, which have recently included executive compensation, Board refreshment and leadership structure, culture and inclusion and other corporate governance matters. The meetings tend to be between our largest institutional stockholders and all of the members of our Compensation Committee. Neither our Chairman nor our CEO participates in these meetings. We provide an open forum to our stockholders to discuss and comment on any aspects of our executive compensation program and any governance matters. The Board believes these meetings are important because they foster a relationship of accountability between the Board and our stockholders and help us better understand and respond to our stockholders’ priorities and perspectives. |

2024 Annual Meeting of Stockholders  3 3 |

In fiscal 2024, all members of our Compensation Committee held meetings with eight large institutional stockholders. Thus far in fiscal 2025, we have reached out to eight large institutional stockholders to set up meetings with members of the Compensation Committee and the full Compensation Committee has already held video conference meetings with four large institutional stockholders.

| Ø | Executive Director Engagement. As part of our regular Investor Relations engagement program, our executive directors hold meetings with a number of our institutional stockholders throughout the year. We also hold an annual financial analyst meeting at Oracle CloudWorld in Las Vegas where analysts are invited to ask questions and hear presentations from key members of our management team, including our executive directors. |

| Ø | Legal and Investor Relations Engagement. Members of our Legal and Investor Relations teams also engage with stockholders throughout the year. Stockholder proposals are presented to the Nomination and Governance Committee (the Governance Committee) and the committee provides recommendations to the Board regarding such proposals. Typically, members of our Legal team then engage with stockholder proponents before the proxy statement is filed. After our proxy statement is filed, members of our Legal and Investor Relations teams offer to re-engage with stockholders to discuss matters on the annual stockholder meeting agenda and solicit feedback. When appropriate, independent directors join these discussions. |

| Ø | Say-on-Pay Vote Outcome and Board Responsiveness. Stockholders approved our advisory say-on-pay proposal at our 2023 Annual Meeting with 73% of the votes cast voting in favor of the compensation of our NEOs. This result represents an improvement compared to 2022 and our Board remains committed to understanding stockholder views and looks forward to continuing to increase levels of support in the future. As described above, all members of the Compensation Committee have met with and continue to engage with stockholders to actively understand what actions the Compensation Committee may take to address stockholder concerns. |

4  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

Below is a summary of the Board’s response to the most significant feedback received from stockholders.

What We Heard

| The Board’s Response

| |||

| The current compensation program for Mr. Ellison and Ms. Catz expires at the end of fiscal year 2025; please explain what changes the Compensation Committee is considering for the fiscal 2026 performance-based equity awards and whether the awards will be less complicated structurally than the current PSOs

| The Compensation Committee intends for the new program to align Mr. Ellison’s and Ms. Catz’s compensation with the interests of stockholders and Oracle’s business goals. While the Compensation Committee has not determined the exact structure of the next performance-based equity program that will be put in place for Mr. Ellison and Ms. Catz for fiscal 2026, the directors intend to take the diverse range of stockholder feedback into account when designing the new program.

| ||

Please provide additional disclosure regarding how the Compensation Committee determines the amounts of performance-based cash bonuses, if any, paid to NEOs | See page 46 for information regarding the process the Compensation Committee follows and the factors it considers when awarding performance-based cash bonuses and the decision to select year-over-year growth in our non-GAAP operating income as the financial performance metric for determining our NEOs’ bonuses for fiscal 2024 (other than for Mr. Levey, whose bonus arrangement is described on page 47).

| |||

What We Heard

| The Board’s Response

| |||

| Mr. Ellison’s pledging of Oracle common stock may pose a risk to stockholders | The Governance Committee reviews Mr. Ellison’s pledging arrangements and carefully assesses any associated risks on a quarterly basis and reports on such arrangements and risks to the Finance and Audit Committee (F&A Committee) and the Board. The Governance Committee periodically seeks outside advice and counsel in connection with its oversight of Mr. Ellison’s pledging arrangements to allow for an independent third-party to assess and provide feedback to the Board on the pledging arrangements.

The Governance Committee believes that Mr. Ellison’s pledging arrangements do not pose a material risk to stockholders or to Oracle for several reasons, including Mr. Ellison’s financial capacity to repay his personal term loans without resorting to the sale or transfer of pledged shares, none of his shares being pledged as collateral for margin accounts, and the pledged shares not being used to shift or hedge any economic risk in owning Oracle common stock. See pages 25 and 26 for details on our Pledging Policy and the Governance Committee’s review of Mr. Ellison’s pledging arrangements.

| ||

Several members of the Board are long-tenured and there is concern that they may not be as engaged or effectively challenge management | The Board believes it is desirable to maintain a mix of longer-tenured, experienced directors who have developed deep institutional knowledge of and valuable insight into the company and its operations along with newer directors who can offer fresh perspectives. Longer-serving directors with experience and institutional knowledge bring critical skills, have a better understanding of the challenges Oracle is facing and may be at times more comfortable challenging management, including our CEO and CTO, given the long-standing relationship. The Board has worked diligently to identify and interview qualified new director candidates. The Board elected five new directors in the last seven fiscal years. In addition, the Board refreshment process includes several continuing education opportunities for directors to engage with key executives throughout the company while gaining a deeper understanding of Oracle’s products and services.

|

2024 Annual Meeting of Stockholders  5 5 |

Fiscal 2024 Named Executive Officers (NEOs)

Lawrence J. Ellison Chairman and CTO* |

Safra A. Catz CEO** |

Jeffrey O. Henley Vice Chairman |

Stuart Levey Executive Vice President, Chief Legal Officer |

Edward Screven Executive Vice President, Chief Corporate Architect

|

*Although Mr. Ellison is not an NEO for fiscal 2024, we have included his compensation in the presentation of the compensation tables as voluntary disclosure ** Ms. Catz also serves as our principal financial officer |

Human Capital and Compensation Best Practices

Best Practices We Employ

|

|

Practices We Avoid

× No severance benefit arrangements for executives except as required by law or provided under our equity incentive plan to employees generally

× No “single-trigger” change in control vesting of equity awards

× No change in control acceleration of performance-based cash bonuses

× No minimum guaranteed vesting for performance-based equity awards granted to our NEOs

× No “golden parachute” tax reimbursements or gross-ups for our NEOs

× No payout or settlement of dividends or dividend equivalents on unvested equity awards

× No supplemental executive retirement plans, executive pensions or excessive retirement benefits

× No repricing, cash-out or exchange of “underwater” stock options without stockholder approval |

6  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

PROXY STATEMENT

We are providing these proxy materials in connection with Oracle Corporation’s 2024 Annual Meeting of Stockholders (the Annual Meeting). The Notice of Internet Availability of Proxy Materials (the Notice), this proxy statement and the accompanying proxy card or voting instruction card, including an Internet link to our most recently filed Annual Report on Form 10-K, were first made available to stockholders on or about September 25, 2024. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

HOW DO I VOTE?

Your vote is important. You may vote on the Internet, by telephone, by mail or during the Annual Meeting, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card.

Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on November 13, 2024.

| Ø | Vote on the Internet |

If you are a stockholder of record, you may submit your proxy by going to www.proxyvote.com and following the instructions provided in the Notice. If you requested printed proxy materials, you may follow the instructions provided with your proxy materials and on your proxy card. If your shares are held with a broker, you will need to go to the website provided on your Notice or voting instruction card. Have your Notice, proxy card or voting instruction card in hand when you access the voting website. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy materials.

| Ø | Vote by Telephone |

If you are a stockholder of record, you can also vote by telephone by dialing 1-800-690-6903. If your shares are held with a broker, you can vote by telephone by dialing the number specified on your voting instruction card. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded. Have your proxy card or voting instruction card in hand when you call.

| Ø | Vote by Mail |

If you have requested printed proxy materials, you may choose to vote by mail, by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. If the envelope is missing and you are a stockholder of record, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If the envelope is missing and your shares are held with a broker, please mail your completed voting instruction card to the address specified therein. Please allow sufficient time for mailing if you decide to vote by mail.

Please note that if you received a Notice, you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by Internet and how to request paper copies of the proxy materials.

| Ø | Voting at the Annual Meeting |

The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote on the virtual meeting platform. The shares voted electronically, telephonically, or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

2024 Annual Meeting of Stockholders  7 7 |

| Ø | Attending the Annual Meeting |

This year’s Annual Meeting will be held in a virtual format only. The accompanying proxy materials and the meeting’s website, www.virtualshareholdermeeting.com/ORCL2024, include instructions on how to participate in the meeting and how you may vote your shares of Oracle stock. To be admitted to the Annual Meeting online, vote and submit a question during the meeting, you must enter the 16-digit control number included on the Notice of Internet Availability of Proxy Materials, on your proxy card (if you requested printed materials), or on the instructions that accompanied your proxy materials.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Participants should also give themselves enough time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

We encourage you to access the Annual Meeting before it begins. Online check-in will start 15 minutes before the meeting on November 14, 2024. If you have difficulty accessing the meeting, please call the technical support number that will be posted on the meeting log-in page.

Q&A at the Annual Meeting

During the question and answer session, we will address questions submitted in advance of, and questions submitted live during, the Annual Meeting that comply with our meeting rules of conduct. You may submit one question either in advance of or during the meeting. You may submit a question in advance of the meeting at www.proxyvote.com after logging in with the 16-digit control number included on the Notice of Internet Availability of Proxy Materials, on your proxy card (if you requested printed materials), or on the instructions that accompanied your proxy materials. Alternatively, you may submit a question during the Annual Meeting through www.virtualshareholdermeeting.com/ORCL2024.

Please identify yourself when submitting a question. We will endeavor to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. The meeting rules of conduct will be available during the Annual Meeting at www.virtualshareholdermeeting.com/ORCL2024. We reserve the right to edit any inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or Oracle’s business. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition in the interest of time and fairness to all stockholders.

The question and answer session will be accessible following the meeting as part of the recording of the meeting that will be available at www.virtualshareholdermeeting.com/ORCL2024 and on our website at www.oracle.com/investor following the Annual Meeting through November 21, 2024.

|

8  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

BOARD OF DIRECTORS

Nominees for Directors

There are 13 director nominees, all of whom stood for election at our last annual meeting of stockholders. Two of our current non-independent directors, Renée J. James and Vishal Sikka, will not be standing for re-election at the Annual Meeting. We thank them for their service to Oracle. Following the Annual Meeting, the Board size will be reduced from 15 to 13 directors.

| Ø | Director Qualifications |

Our Corporate Governance Guidelines (described in “Corporate Governance—Corporate Governance Guidelines” on page 23) contain Board membership qualifications that apply to Board nominees recommended by the Governance Committee. The Governance Committee strives for a mix of skills, experience and perspectives that will help create an outstanding, diverse, dynamic and effective Board. In selecting nominees, the Governance Committee assesses the character and acumen of candidates and endeavors to collectively establish areas of core competency of the Board, including, among others, industry and technical knowledge and experience; management, accounting and finance expertise; and demonstrated business judgment, leadership and strategic vision. The Governance Committee values a diversity of backgrounds, experience, perspectives and leadership in different fields when identifying director nominees. As noted in our Corporate Governance Guidelines, the Governance Committee is committed to actively seeking directors who are diverse with respect to gender, race and ethnicity for the pool from which director candidates are chosen.

The Governance Committee also takes director tenure into consideration when making director nomination decisions and believes that it is desirable to maintain a mix of longer-tenured, experienced directors that have developed increased institutional knowledge of and valuable insight into our company and its operations and newer directors with fresh perspectives. The Governance Committee and the Board also believe that longer-tenured, experienced directors are a significant strength of the Board, given the large size of our company, the breadth of our product offerings and the international scope of our organization. See “Corporate Governance—Director Tenure, Board Refreshment and Diversity” on page 31 for more information.

Below we identify the key experiences, qualifications and skills our director nominees bring to the Board and that the Board considers important in light of Oracle’s businesses and industry.

Industry Knowledge and Experience

|

We seek to have directors with experience as executives or directors or in other leadership positions in the particular technology industries in which we compete because our success depends on developing and investing in innovative products and technologies. We believe this experience is critical to the Board’s ability to understand our products and business, assess our competitive position within the technology industry and the strengths and weaknesses of our competitors, maintain awareness of technology trends and innovations, and evaluate potential acquisitions and our acquisition strategy.

|

Management, Oversight of Complex Organizations, Accounting and Finance Expertise

|

We believe that an understanding of management practices, oversight of complex organizations and accounting/finance expertise is important for our directors. We value management experience in our directors as it provides a practical understanding of organizations, processes, strategies, risk management and the methods to drive change and growth that permit the Board to, among other things, identify and recommend improvements to our business operations, sales and marketing approaches and product strategy. We also seek to have at least one independent director who qualifies as an audit committee financial expert, and we expect all of our directors to be financially knowledgeable.

|

2024 Annual Meeting of Stockholders  9 9 |

Business Judgment, Leadership and Strategic Vision

|

We believe that directors with experience in significant leadership positions are commonly required to demonstrate excellent business judgment, leadership skills and strategic vision. We seek directors with these characteristics as they bring important insights to Board deliberations and processes. We also believe that is important to have directors with experience leading other large, complex organizations who can collaborate with and provide counsel to our executive management team.

|

The Board evaluates its own composition in the context of the diverse experiences and perspectives that the directors collectively bring to the boardroom. Their backgrounds provide the Board with vital insights. The matrix below summarizes what our Board believes are desirable skills and experiences for director nominees in light of our current business strategy but does not encompass all skills and experiences of such director nominees. Each director nominee’s biography provides further details regarding each nominee’s specific qualifications.

Key Skills & Experience | Ellison | Catz | Henley | Ablo | Berg | Boskin | Chizen | Conrades | Fairhead | Moorman | Panetta | Parrett | Seligman | |||||||||||||

Technology Industry |  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||

Risk Management |  |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

Strategic Transformation |  |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

Global Organizations |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||

Long-term Growth Strategy |  |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

Healthcare Industry |  |  |  |  |  |  |  | |||||||||||||||||||

Governmental Affairs and Regulation |  |  |  |  |  |  |  |  |  | |||||||||||||||||

Finance and Accounting |  |  |  |  |  |  | ||||||||||||||||||||

International Tax and Monetary Policy |  |  |  |  |  |  |  | |||||||||||||||||||

Technological Innovation and IP |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||

Cybersecurity |  |  |  |  |  |  |  |  | ||||||||||||||||||

Executive Leadership and Talent Development |  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||

Former/current director at another public company |  |  |  |  |  |  |  |  |  | |||||||||||||||||

10  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

The experiences, qualifications and skills of each director that the Board considered in his or her nomination are included below the directors’ individual biographies on the following pages. The Board concluded that each nominee should serve as a director based on the specific experience and attributes listed below and the direct personal knowledge of each nominee’s previous service on the Board, including the insight and collegiality each nominee brings to the Board’s functions and deliberations. The age of each director is provided as of September 16, 2024, the record date for the Annual Meeting.

AWO ABLO | ||||||

Independent Director Director since 2022 Age: 52

|

|

Ms. Ablo has served as the Executive Vice President, Strategy and Partnerships at the Tony Blair Institute for Global Change (the Institute), a global non-profit organization, since November 2022 and as an advisor to iceaddis, an Ethiopian innovation hub and technology startup incubator, since 2022. She previously served as the Executive Director, External Relations at the Institute from October 2017 to November 2022 and as the Director, External Affairs at the Institute from March 2017 to October 2017. Previously, Ms. Ablo was Director of Development and External Relations for the Tony Blair Africa Governance Initiative from May 2016 to March 2017. She has also served on various advisory groups and committees, including the Chatham House Global Health Working Group.

Qualifications: Ms. Ablo brings to the Board extensive experience collaborating with senior international government officials, including through her experience at the Institute and through her previous role with the BBC World Service Trust. She also offers valuable perspective on healthcare matters resulting from her past role at the International HIV/AIDS Alliance and her service on the Chatham House Global Health Working Group and other advisory groups and committees. Our Board benefits from Ms. Ablo’s insight into the perspectives and needs of our government and healthcare customers throughout the world.

| ||||

Board Committees: Governance | ||||||

| ||||||

JEFFREY S. BERG | ||||||

Independent Director Director since 1997 Age: 77

|

|

Mr. Berg has been an agent, media executive and adviser in the entertainment industry for over 45 years. Mr. Berg has served as Chairman of Northside Services, LLC, a media and entertainment advisory firm, since May 2015. Mr. Berg was Chairman of Resolution, a talent and literary agency he founded, from January 2013 until April 2015. Between 1985 and 2012, he was the Chairman and CEO of International Creative Management, Inc. (ICM), a talent agency for the entertainment industry. He has served as Co-Chair of California’s Council on Information Technology and was President of the Executive Board of the College of Letters and Sciences at the University of California at Berkeley. He previously served on the Board of Trustees of the Anderson School of Management at the University of California at Los Angeles and the Court of Governors of the London School of Economics.

Qualifications: As the former CEO of ICM, Mr. Berg brings to the Board over 25 years of leadership experience running one of the world’s preeminent full service talent agencies in the entertainment industry. Mr. Berg’s prior experience as CEO and as a representative of some of the world’s most well-known performing artists, writers, directors and production companies offers the Board a valuable perspective with respect to managing a global brand in rapidly changing industries and in management, compensation and operational matters.

| ||||

Board Committees: Finance and Audit, Independence (Chair) | ||||||

| ||||||

MICHAEL J. BOSKIN | ||||||

Independent Director Director since 1994 Age: 78

|

|

Dr. Boskin is the Tully M. Friedman Professor of Economics and Wohlford Family Hoover Institution Senior Fellow at Stanford University, where he has been on the faculty since 1971. He is CEO and President of Boskin & Co., Inc., a consulting firm. He was Chairman of the President’s Council of Economic Advisers from February 1989 until January 1993. Dr. Boskin currently serves as director of Bloom Energy Corporation.

Qualifications: Dr. Boskin is recognized internationally for his research on world economic growth, tax and budget theory and policy, U.S. saving and consumption patterns and the implications of changing technology and demography on capital, labor and product markets. He brings to the Board significant economic and financial expertise and provides a valuable perspective on a number of challenges faced by Oracle due to its global operations, including, for example, questions regarding international tax and monetary policy, treasury functions, currency exposure and general economic and labor trends and risks. In addition, Dr. Boskin’s experience as CEO of his consultancy firm and as a former director of another large, complex global organization provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| ||||

Board Committees: Finance and Audit (Chair)

| ||||||

| ||||||

2024 Annual Meeting of Stockholders  11 11 |

SAFRA A. CATZ | ||||||

Chief Executive Officer Director since 2001 Age: 62 |

Ms. Catz has been our CEO since September 2014. She served as our President from January 2004 to September 2014 and as our Chief Financial Officer (CFO) most recently from April 2011 until September 2014. Ms. Catz was previously our CFO from November 2005 until September 2008 and our Interim CFO from April 2005 until July 2005. Prior to being named President, she held various other positions with us since joining Oracle in 1999. During the last five years, Ms. Catz previously served as a director of The Walt Disney Company.

Qualifications: In her current role at Oracle, Ms. Catz is responsible for all operations at Oracle other than product development and engineering. As our CEO and former CFO, our Board benefits from Ms. Catz’s many years with Oracle and her unique expertise regarding Oracle’s strategic vision, management and operations. Prior to joining Oracle, Ms. Catz developed deep technology industry experience as a managing director with the investment banking firm Donaldson, Lufkin & Jenrette from 1986 to 1999 covering the technology industry. With this experience, Ms. Catz brings valuable insight regarding the technology industry generally, and in particular in the execution of our acquisition strategy. In addition, Ms. Catz’s service as a director of other large, complex global organizations provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| |||||

BRUCE R. CHIZEN | ||||||

Independent Director Director since 2008 Age: 69

|

Mr. Chizen is currently an independent consultant and has served as Senior Adviser to Permira Advisers LLP (Permira), a private equity firm, since July 2008 and as a Strategic Advisor at Voyager Capital, a venture capital firm, since May 2023. Mr. Chizen previously served as a Venture Partner at Voyager Capital from July 2009 to May 2023. He has also served as an Operating Partner for Permira Growth Opportunities, a private equity fund, since June 2018. From 1994 to 2008, Mr. Chizen served in a number of positions at Adobe Systems Incorporated (Adobe), a provider of design, imaging and publishing software, including CEO (2000 to 2007), President (2000 to 2005), acting CFO (2006 to 2007) and strategic adviser (2007 to 2008). Mr. Chizen currently serves as Chair of both ChargePoint, Inc. and Informatica Inc. and as a director of Synopsys, Inc.

Qualifications: As the former CEO of Adobe, Mr. Chizen brings to the Board first-hand experience in successfully leading and managing a large, complex global organization in the technology industry. In particular, Mr. Chizen’s experience in heading the extension of Adobe’s product leadership provides the Board with perspectives applicable to challenges faced by Oracle. In addition, Mr. Chizen’s current roles at Permira and Voyager Capital require him to be very familiar with companies driven by information technology or intellectual property, which allows him to provide the Board with valuable insights in its deliberations regarding Oracle’s acquisition and product strategies. The Board also benefits from Mr. Chizen’s financial expertise and significant audit and financial reporting knowledge, including his experience as the former acting CFO of Adobe. Mr. Chizen’s service as a director of large, complex global organizations, as well as smaller private companies, provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| |||||

Board Committees: Finance and Audit, Governance (Chair) | ||||||

| ||||||

GEORGE H. CONRADES | ||||||

Lead Independent Director Director since 2008 Age: 85

|

Mr. Conrades has served as an Executive Advisor to Akamai Technologies, Inc. (Akamai), a content delivery network services provider for media and software delivery and cloud security solutions, since June 2018. He previously served as Akamai’s CEO from 1999 to 2005 and Chairman from 1999 to 2018. Mr. Conrades currently serves as Managing Partner at Longfellow Venture Partners, a private venture fund advising and investing in early stage healthcare and technology companies. He also served as a Venture Partner at Polaris Venture Partners, an early stage investment company, from 1998 to 2012 and is currently Partner Emeritus. During the last five years, Mr. Conrades previously served as a director of Cyclerion, Inc.

Qualifications: As the former CEO of Akamai, Mr. Conrades brings to the Board first-hand experience in successfully leading and managing a large, complex global organization in the technology industry. Mr. Conrades’ experience provides the Board with a perspective applicable to challenges faced by Oracle. In addition, Mr. Conrades’ current role at Longfellow Venture Partners requires him to be very familiar with growth companies, including those driven by information technology or intellectual property, which allows him to provide the Board with valuable insights in its deliberations regarding Oracle’s acquisition and product strategies. Mr. Conrades’ service as a director of large, complex global organizations, as well as smaller private companies, provides the Board with important perspectives in its evaluation of Oracle’s practices and processes as well as matters related to human capital management and compensation.

| |||||

Board Committees: Compensation (Chair), Independence

| ||||||

| ||||||

12  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

LAWRENCE J. ELLISON | ||||||

Chairman, Chief Technology Director since 1977 Age: 80 |

Mr. Ellison has been our Chairman of the Board and CTO since September 2014. Mr. Ellison served as our CEO from June 1977, when he founded Oracle, until September 2014. He previously served as our Chairman of the Board from May 1995 to January 2004. In the last five years, he previously served as a director of Tesla, Inc.

Qualifications: Mr. Ellison is Oracle’s Founder and served as our CEO since we commenced operations in June 1977 through September 2014. He is widely regarded as a technology visionary and one of the world’s most successful business executives. Mr. Ellison’s familiarity with and knowledge of our technologies and product offerings are unmatched. He continues to lead and oversee our product engineering, technology development and strategy. For over 45 years he has successfully steered Oracle in new strategic directions in order to adapt to and stay ahead of our competition and changing industry trends. Mr. Ellison is our largest stockholder, beneficially owning approximately 41.6% of the outstanding shares of our common stock (based on data available as of September 16, 2024), directly aligning his interests with those of our stockholders.

| |||||

RONA A. FAIRHEAD | ||||||

Independent Director Director since 2019 Age: 63

|

Mrs. Fairhead served as Minister of State for Trade and Export Promotion, Department for International Trade in the United Kingdom from September 2017 to May 2019. She previously served as Chair of the British Broadcasting Corporation (BBC) Trust from October 2014 to April 2017. From 2006 to 2013, Mrs. Fairhead was Chair and CEO of the Financial Times Group Limited, which was a division of Pearson plc, and, prior to that, she served as Pearson plc’s CFO. Before joining Pearson plc, Mrs. Fairhead held a variety of leadership positions at Bombardier Inc. and Imperial Chemical Industries plc. Mrs. Fairhead serves as Chair of the Board of RS Group plc (previously Electrocomponents plc) and as Senior Independent Director of CVC Capital Partners plc and is a member of the U.K. House of Lords.

Qualifications: Mrs. Fairhead brings to the Board extensive international experience in finance, risk management and global operations gained from her leadership roles at the BBC Trust, the Financial Times Group Limited, Pearson plc, RS Group plc and other multinational companies. She also contributes significant expertise in government affairs from her experience as the U.K. Minister of State for Trade and Export Promotion. Mrs. Fairhead brings her valuable perspectives on risk management resulting from her experiences serving as chair of the risk committee and financial system vulnerabilities committee of HSBC Holdings plc and as chair of the U.K. Government’s Cabinet Office Audit and Risk Committee. In addition, Mrs. Fairhead brings to the Board global marketplace insights and customer perspectives developed through her current and prior service on the boards of directors at multinational public companies across multiple industries.

| |||||

Board Committees: Finance and Audit

| ||||||

| ||||||

JEFFREY O. HENLEY | ||||||

Vice Chairman Director since 1995 Age: 79 |

Mr. Henley has served as our Vice Chairman of the Board since September 2014. Mr. Henley previously served as our Chairman of the Board from January 2004 to September 2014. He served as our Executive Vice President and CFO from March 1991 to July 2004.

Qualifications: Our Board benefits from Mr. Henley’s many years with Oracle and his deep expertise and knowledge regarding our strategic vision, management and operations. Mr. Henley meets regularly with significant Oracle customers and is instrumental in closing major commercial transactions worldwide. This role allows Mr. Henley to remain close to our customers and the technology industry generally. Mr. Henley also brings to the Board significant financial and accounting expertise from his service as our former CFO and in other finance positions prior to joining Oracle.

| |||||

2024 Annual Meeting of Stockholders  13 13 |

CHARLES W. MOORMAN | ||||||

Independent Director Director since 2018 Age: 72

|

Mr. Moorman is currently a Senior Advisor to Amtrak, a position he has held since 2018, and he previously served as President and CEO from August 2016 to January 2018. Mr. Moorman was previously CEO (from 2005 to 2015) and Chairman (from 2006 to 2015) of Norfolk Southern Corporation (Norfolk Southern), a transportation company. From 1975 to 2005, he held various positions in operations, information technology, and human resources at Norfolk Southern. Mr. Moorman serves as a director of Chevron Corporation and in the last five years he previously served as a director of Duke Energy Corporation.

Qualifications: As the former CEO of Norfolk Southern, Mr. Moorman brings to the Board extensive experience leading and managing the operations of a large, complex Fortune 500 company. Mr. Moorman’s forty-year career with Norfolk Southern included numerous senior management and executive positions requiring expertise in engineering, technology, finance and risk management. Mr. Moorman also brings to the Board significant regulatory expertise and familiarity with environmental affairs gained through his leadership roles at both Amtrak and Norfolk Southern. In addition, Mr. Moorman’s service as a director of other large public companies provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| |||||

Board Committees: Compensation, Independence

| ||||||

| ||||||

LEON E. PANETTA | ||||||

Independent Director Director since 2015 Age: 86

|

|

Secretary Panetta served as U.S. Secretary of Defense from 2011 to 2013 and as Director of the Central Intelligence Agency from 2009 to 2011. Prior to that time, Secretary Panetta was a member of the U.S. House of Representatives from 1977 to 1993, served as Director of the Office of Management and Budget from 1993 to 1994 and served as President Bill Clinton’s Chief of Staff from 1994 to 1997. He is the co-founder and Chairman of the Panetta Institute for Public Policy and currently serves as moderator of the Leon Panetta Lecture Series, a program he created. Secretary Panetta previously served as Distinguished Scholar to Chancellor Charles B. Reed of the California State University System and professor of public policy at Santa Clara University.

Qualifications: With a distinguished record of public service at the highest levels of government, Secretary Panetta brings to the Board robust, first-hand knowledge of government affairs and public policy issues. Secretary Panetta’s 16 years of experience in the U.S. House of Representatives and service in the administrations of two U.S. Presidents allow him to advise the Board on a wide range of issues related to Oracle’s interactions with governmental entities. In addition, Secretary Panetta’s service as a leader of large and complex government institutions, including the U.S. Department of Defense, the Central Intelligence Agency and the Office of Management and Budget, provides the Board with important perspectives on Oracle’s operational practices and processes, as well as risk management and oversight expertise.

| ||||

Board Committees: Compensation,

| ||||||

| ||||||

WILLIAM G. PARRETT | ||||||

Independent Director Director since 2018 Age: 79

|

|

Mr. Parrett served as the CEO of Deloitte Touche Tohmatsu (Deloitte), a multinational professional services network, from 2003 until 2007. He joined Deloitte in 1967 and served in a series of roles of increasing responsibility until his retirement in 2007. Mr. Parrett serves as a director of Blackstone Inc. and Thoughtworks, Inc. In the last five years, he previously served as a director of the Eastman Kodak Company, Conduent Inc., Thermo Fisher Scientific Inc. and UBS Group AG. Mr. Parrett is a Certified Public Accountant with an active license.

Qualifications: As the former CEO of Deloitte, Mr. Parrett brings to the Board significant experience leading and managing the operations of a large, complex global organization. Mr. Parrett is highly skilled in the fields of auditing, accounting and internal controls, and risk management, and he brings valuable financial expertise to the Board. In addition, Mr. Parrett’s service as a director of other public companies in the technology and financial services sectors provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| ||||

Board Committees: Governance

| ||||||

| ||||||

14  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

NAOMI O. SELIGMAN | ||||||

Independent Director Director since 2005 Age: 86

|

|

Ms. Seligman has served as a senior partner at Ostriker von Simson, Inc., a technology research firm which chairs the CIO Strategy Exchange, since June 1999. Since 1999, this forum has brought together senior executives in four vital quadrants of the IT sector. From 1977 until June 1999, Ms. Seligman served as a co-founder and senior partner of the Research Board, Inc., a private sector institution sponsored by 100 chief information officers from major global corporations. In the last five years, Ms. Seligman previously served as a director of Akamai Technologies, Inc.

Qualifications: As a senior partner at Ostriker von Simson, Inc., a co-partner of the CIO Strategy Exchange, and a co-founder and former senior partner of the Research Board, Inc., Ms. Seligman is recognized as a thought leader in the technology industry. Ms. Seligman also serves as an independent advisor to some of the largest multinational corporations where she helps oversee global strategy and operations, which allows her to provide our Board with important perspectives in its evaluation of Oracle’s practices and processes as well as matters related to human capital management and compensation. The Board also benefits from Ms. Seligman’s strong experience and customer-focused perspective and the valuable insights gained from the senior-level relationships she maintains throughout the technology industry.

| ||||

Board Committees: Compensation (Vice Chair)

| ||||||

| ||||||

2024 Annual Meeting of Stockholders  15 15 |

| Ø | Recommendations of Director Candidates |

The Governance Committee will consider all properly submitted candidates recommended by stockholders for Board membership. Our Corporate Governance Guidelines (available on our website at www.oracle.com/goto/corpgov) set forth the Governance Committee’s policy regarding the consideration of all properly submitted candidates recommended by stockholders as well as candidates recommended by current Board members and others.

Any stockholder wishing to recommend a candidate for consideration for nomination by the Governance Committee must provide written notice to the Corporate Secretary of Oracle by mail at Oracle Corporation, 2300 Oracle Way, Austin, Texas 78741 or by email (Corporate_Secretary@oracle.com) with a confirmation copy sent by mail to the address above. The written notice must include the candidate’s name, biographical data and qualifications and a written consent from the candidate agreeing to be named as a nominee and to serve as a director if nominated and elected. By following these procedures, a stockholder will have properly submitted a candidate for consideration. However, there is no guarantee that the candidate will be nominated.

Potential director candidates are generally suggested to the Governance Committee by current Board members and stockholders and are evaluated at meetings of the Governance Committee. In evaluating such candidates, every effort is made to complement and strengthen skills within the existing Board. The Governance Committee seeks Board approval of the final candidates recommended by the Governance Committee. The same evaluation procedures apply to all candidates for director, whether submitted by stockholders or otherwise.

Information regarding procedures for the stockholder submission of director nominations to be considered at our next annual meeting of stockholders may be found in “Corporate Governance—Proxy Access and Director Nominations” on page 24 and “Stockholder Proposals for the 2025 Annual Meeting” on page 80. Submissions must follow the requirements set forth in our Bylaws.

In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 (Exchange Act) no later than September 15, 2025. However, we note that this date does not supersede any of the requirements or timing set forth in our Bylaws.

Communications with the Board

Any person wishing to communicate with any of our directors, including our lead independent director and our other independent directors, regarding bona fide issues about Oracle may send an email to Corporate_Secretary@oracle.com or may write to the director(s), c/o the Corporate Secretary of Oracle at 2300 Oracle Way, Austin, Texas 78741. The Corporate Secretary will periodically forward relevant communications to the appropriate directors or committees of the Board. In addition, we present germane communications, as well as draft responses, at meetings of our Governance Committee. These communications and draft responses are also provided to the appropriate committee or group of directors based on the subject matter of the communication; for example, communications regarding executive compensation are provided to our Compensation Committee, in addition to our Governance Committee.

Board Meetings

Our business, property and affairs are managed under the direction of the Board. Members of the Board are kept informed of our business through discussions with our Chairman, Vice Chairman, CEO, Chief Legal Officer, Corporate Secretary and other officers and employees, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

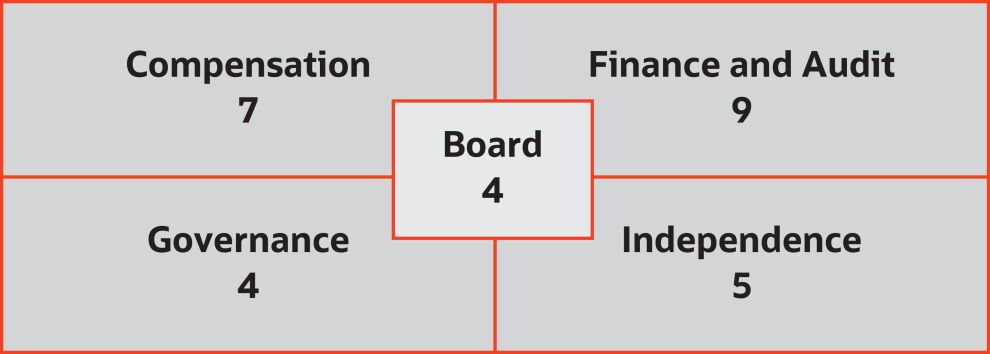

During fiscal 2024, the Board met four times. Each director attended at least 75% of all Board and applicable committee meetings in fiscal 2024. Board members are also expected to attend our annual meeting of stockholders. In November 2023, 14 directors attended our annual meeting of stockholders, with one absent due to illness.

Number of Board and Committee Meetings Fiscal 2024

16  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

Board members are also given the opportunity to attend director education sessions throughout the year. The sessions feature presentations by members of management on different areas of our business. Although these sessions are not mandatory, many of our directors choose to participate.

Committees, Membership and Meetings

The current standing committees of the Board are the F&A Committee, the Governance Committee, the Compensation Committee and the Committee on Independence Issues (the Independence Committee).

Each committee reviews its charter at least annually, or more frequently as legislative and regulatory developments and business circumstances warrant. Each of the committees may make additional recommendations to our Board for revision of its charter to reflect evolving best practices. The charters for the F&A, Governance, Compensation, and Independence Committees are posted on our website at www.oracle.com/goto/corpgov.

| Ø | Committee Membership |

The table below identifies committee membership as of September 16, 2024, the record date of the Annual Meeting.

Director | Finance and Audit | Compensation | Governance | Independence | ||||

Awo Ablo | ||||||||

Jeffrey S. Berg |  |  |  Chair Chair | |||||

Michael J. Boskin |  Chair Chair | |||||||

Safra A. Catz | ||||||||

Bruce R. Chizen |  |  Chair Chair | ||||||

George H. Conrades |  Chair Chair |  | ||||||

Lawrence J. Ellison | ||||||||

Rona A. Fairhead |  | |||||||

Jeffrey O. Henley | ||||||||

Renée J. James | ||||||||

Charles W. Moorman |  |  | ||||||

Leon E. Panetta |  |  | ||||||

William G. Parrett |  | |||||||

Naomi O. Seligman |  Vice Chair Vice Chair | |||||||

Vishal Sikka | ||||||||

The Board has determined that all directors who served during fiscal 2024 on the Compensation, F&A, Governance and Independence Committees were independent under the applicable New York Stock Exchange (NYSE) listing standards during the periods they served on those committees. The Board has also determined that all directors who served during fiscal 2024 on the Compensation and F&A Committees satisfied the applicable NYSE and U.S. Securities and Exchange Commission (SEC) heightened independence standards for members of compensation and audit committees during the periods they served on those committees. See “Corporate Governance—Board of Directors and Director Independence” on pages 30 and 31 for more information.

2024 Annual Meeting of Stockholders  17 17 |

The Finance and Audit Committee |

The F&A Committee oversees our accounting and financial reporting processes and the audit and integrity of our financial statements, assists the Board in fulfilling its oversight responsibilities regarding audit, finance, accounting, cybersecurity, tax and legal compliance and risk, and evaluates merger and acquisition transactions and investment transactions proposed by management. In particular, the F&A Committee is responsible for overseeing the engagement, independence, compensation, retention and services of our independent registered public accounting firm. The F&A Committee’s primary responsibilities and duties are to:

| • | act as an independent and objective party to monitor our financial reporting process and internal control over financial reporting; |

| • | review and appraise the audit efforts of our independent registered public accounting firm; |

| • | receive regular updates from our internal audit department regarding our internal audit plan and compliance with various policies and operational processes across all lines of business; |

| • | evaluate our quarterly financial performance at earnings review meetings; |

| • | consider and review acquisition and investment candidates and opportunities identified by management; |

| • | oversee management’s establishment and enforcement of financial policies and business practices; |

| • | oversee our compliance with laws and regulations and our Code of Ethics and Business Conduct; |

| • | provide an open avenue of communication between the Board and the independent registered public accounting firm, Chief Legal Officer, financial and senior management, Chief Compliance & Ethics Officer and internal audit department; |

| • | review and discuss with management privacy and data security risk exposures, including, among other things, the potential impacts of those exposures on our business, financial results, operations and reputation; and |

| • | produce the Report of the Finance and Audit Committee of the Board, included elsewhere in this proxy statement, as required by SEC rules. |

The F&A Committee held executive sessions with our independent registered public accounting firm on four occasions in fiscal 2024. The Board has determined that each of Dr. Boskin and Mrs. Fairhead qualifies as an “audit committee financial expert” as defined by SEC rules.

The Compensation Committee |

The Compensation Committee helps us attract, retain and incentivize talented executives. The Compensation Committee’s primary responsibilities and duties are to:

| • | review and approve all compensation arrangements of our CEO and our other executive officers, including, as applicable, base salaries, bonuses and equity awards; |

| • | review and approve non-employee director compensation, subject to ratification by the Board; |

| • | lead the Board in its evaluation of the performance of our CEO; |

| • | review and discuss the Compensation Discussion and Analysis (CD&A) portion of our proxy statement with management and determine whether to recommend to the Board that the CD&A be included in our proxy statement; |

| • | review the Compensation Committee Report for inclusion in our proxy statement, as required by SEC rules; |

| • | review and monitor matters related to human capital management, including talent acquisition and retention; |

| • | review, approve and administer our stock plans and approve equity awards to certain participants; |

| • | annually assess the risks associated with our compensation practices, policies and programs applicable to our employees to determine whether such risks are appropriate or reasonably likely to have a material adverse effect on Oracle; |

| • | oversee and review compliance with the stock ownership guidelines for our directors and senior officers; and |

| • | oversee our 401(k) Plan Committee and amend the Oracle Corporation 401(k) Savings and Investment Plan (the 401(k) Plan) when appropriate. |

18  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

In determining any component of executive or director compensation, the Compensation Committee considers the aggregate amounts and mix of all components in its decisions. Our legal department, human resources department and the Compensation Committee’s independent compensation consultant support the Compensation Committee in its work. For additional details regarding the Compensation Committee’s role in determining executive compensation, including its engagement of an independent compensation consultant, refer to “Executive Compensation—Compensation Discussion and Analysis” beginning on page 36. See “Executive Compensation—Compensation Discussion and Analysis—Elements of Our Executive Compensation Program—Long-Term Incentive Compensation—Equity Awards and Grant Administration” on page 49 for a discussion of the Compensation Committee’s role as the administrator of our stock plans and for a discussion of our policies and practices regarding the grant of our equity awards.

Risk Assessment of Compensation Policies and Practices

The Compensation Committee, in consultation with management and Compensia, Inc., the committee’s independent compensation consultant, has assessed the compensation policies and practices applicable to our executive officers and other employees and concluded that they do not create risks that are reasonably likely to have a material adverse effect on Oracle. The Compensation Committee conducts this assessment annually.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has ever been an officer or employee of Oracle or of any of our subsidiaries or affiliates or has had any relationship with Oracle requiring disclosure under Item 404 of Regulation S-K under the Exchange Act. During the last fiscal year:

| • | none of our executive officers served on the board of directors of any other entity, any officers of which served on our Compensation Committee; and |

| • | none of our executive officers served on the compensation committee of any other entity, any officers of which served either on our Board or on our Compensation Committee. |

The Nomination and Governance Committee |

The Governance Committee’s primary responsibilities and duties are to:

| • | review and evaluate the size, composition, function and duties of the Board consistent with its needs; |

| • | identify, consider, recommend and assist in recruiting qualified candidates for election to the Board; |

| • | review and reassess the adequacy of our corporate governance policies and procedures, including our Corporate Governance Guidelines; |

| • | review the performance of the Board and its committees (including reviewing the performance of individual directors); |

| • | review and assess the adequacy of our policies, plans and procedures regarding succession planning; |

| • | oversee compliance with our Policy on Pledging Oracle Securities (see pages 25 and 26 for details) and risks related to pledging arrangements; and |

| • | oversee and periodically review our environmental, social and governance (ESG) programs, including environmental sustainability. |

The Committee on Independence Issues |

The Independence Committee is comprised solely of independent directors and is charged with reviewing and approving individual transactions, or a series of related transactions, involving amounts in excess of $120,000 between us (or any of our subsidiaries) and any of our affiliates, such as an executive officer, director or owner of 5% or more of our common stock. The Independence Committee’s efforts are intended to ensure that each proposed related person transaction is on terms that, when taken as a whole, are fair to us. If any member of the Independence Committee would derive a direct or indirect benefit from a proposed transaction, he or she is excused from the review and approval process with regard to that transaction. The role of the Independence Committee also encompasses monitoring of related person relationships as well as reviewing proposed transactions and other matters for potential conflicts of interest and possible corporate opportunities in accordance with our Global Conflict of Interest Policy. In addition, the Independence Committee evaluates and makes recommendations to the Board regarding the independence of each non-employee director under the applicable NYSE listing standards.

2024 Annual Meeting of Stockholders  19 19 |

Director Compensation

| Ø | Highlights |

| Initial and annual equity awards capped at a maximum dollar value |  | Emphasis on equity to align director compensation with our stockholders’ long-term interests | |||

| No committee chair equity awards |  | No per-meeting fees | |||

| Stockholder-approved limits on equity awards |  | No performance-based equity awards | |||

| Robust stock ownership guidelines (see page 28 for details) |  | No retirement benefits or perquisites | |||

| Ø | Overview |

Our directors play a critical role in guiding our strategic direction and overseeing the management of Oracle. Ongoing developments in corporate governance, executive compensation and financial reporting have resulted in increased demand for highly qualified and productive public company directors. In addition, Oracle’s acquisition program and expansion into new lines of business can demand substantial time commitments from our directors.

The compensation paid to our non-employee directors is designed to be commensurate with the considerable time commitments, requisite skill set and the many responsibilities and risks of being a director of a public company of Oracle’s size, complexity and profile. Our non-employee directors are compensated based on their respective levels of Board participation and responsibilities, including service on Board committees. Our non-employee directors display a high level of commitment and flexibility in their service to Oracle. Several of our directors serve on more than one committee. Our non-employee directors regularly engage with our senior management and meet with our stockholders throughout the year to better understand their perspectives. Annual cash retainers and equity awards granted to our non-employee directors are intended to correlate with their respective qualifications, responsibilities and time commitments.

Our employee directors, Mr. Ellison, Ms. Catz and Mr. Henley, do not receive separate compensation for serving as directors of Oracle.

| Ø | Annual Equity Grant for Directors |

Non-employee directors participate in our Amended and Restated 1993 Directors’ Stock Plan (the Directors’ Stock Plan), which sets forth stockholder-approved stock option limits on annual equity awards for service on the Board and as a committee chair or vice chair. The Directors’ Stock Plan provides that in lieu of all or some of the stock option limits set forth in the plan, non-employee directors may receive grants of restricted stock units (RSUs) of an equivalent value, as determined by the Board. The Board has determined that a ratio of four stock options to one RSU should be used, consistent with its historic approach for equity awards granted to Oracle employees, and that all non-employee director equity awards will be delivered in the form of RSUs that are granted on May 31 of each year and fully vest on the first anniversary of the date of grant, subject to the director’s continued service.

For a number of years, the Board has provided that each equity award will be limited to the lesser of the stockholder-approved equity award limits set forth in the Directors’ Stock Plan or a specified grant value and has granted equity awards with a value significantly below such stockholder-approved equity award limits. The Board approved further changes to our non-employee director compensation program in fiscal 2020, including reductions in the size of equity awards and the elimination of committee chair equity awards.

Below is a summary of the stockholder-approved equity award limit for annual equity awards compared to the Board-approved grant value limit for such awards and the number of RSUs actually granted to non-employee directors on May 31, 2024. As noted above, no additional equity awards were granted to committee chairs or vice chairs.

Grant Type | Stockholder-Approved Equity Award Limit | Board-Approved Grant Value Limit | Equity Actually Granted on May 31, 2024 (1) | % Reduction from Stockholder-Approved Limits (2) | ||||

Board Annual Grant | 45,000 options (or 11,250 RSUs) | $350,000 | 2,986 RSUs |  73% 73% | ||||

20  2024 Annual Meeting of Stockholders 2024 Annual Meeting of Stockholders |

| (1) | Calculated by dividing the grant value limit of $350,000 by the closing price of Oracle common stock on the date of grant ($117.19 per share), rounding down to the nearest whole share. |

| (2) | Approximate percentage reduction in the number of RSUs actually granted on May 31, 2024 compared to stockholder-approved equity award limits. |

| Ø | Initial Equity Grant for New Directors |

The Directors’ Stock Plan also provides for an initial equity award of not more than 45,000 stock options (or 11,250 RSUs) for new non-employee directors, prorated based upon the number of full calendar months remaining in the fiscal year of the director’s appointment. In accordance with the reductions to our non-employee director compensation described above, any new non-employee director will receive an initial equity award equal to the lesser of 11,250 RSUs or RSUs with a total value of $350,000 (calculated by dividing the grant value by the closing price of Oracle common stock on the date of grant, rounding down to the nearest whole share), prorated based upon the number of full calendar months remaining in the fiscal year of the director’s appointment. Initial equity awards fully vest on the first anniversary of the date of grant, subject to the director’s continued service.

| Ø | Cash Retainer Fees for Directors |