APPENDIX 4C QUARTERLY ACTIVITY REPORT FOR QUARTER ENDED SEPTEMBER 30, 2024 Melbourne, Australia: October 31 and New York, USA: October 30, 2024: Mesoblast Limited (ASX:MSB; Nasdaq:MESO), global leader in allogeneic cellular medicines for inflammatory diseases, today provided highlights of its recent activities for the first quarter ended September 30, 2024. Mesoblast Chief Executive Silviu Itescu said: “We have had an extremely busy and productive quarter starting right from the outset with the filing of our Biologics License Application (BLA) with the United States Food and Drug Administration (FDA) for approval of Ryoncil® (remestemcel-L) in the treatment of children with steroid-refractory acute graft versus host disease (SR-aGvHD). We continue to be engaged in active and ongoing interactions with the agency as part of the review process. We are anticipating a decision prior to or on the FDA’s Prescription Drug User Fee Act (PDUFA) goal date of January 7, 2025.” “During the period we put in place a strategic financing to ensure that the Company is well capitalized for a commercial launch of RYONCIL. This has been structured as a convertible note subscription agreement with our largest shareholder for issue, at Mesoblast’s sole discretion, up to US$50.0 million convertible notes following approval of RYONCIL by FDA. At the same time, we have maintained a strong focus on our cost control with net operating spend for the period of US$10.5 million, down 26% on the prior corresponding quarter.” “I look forward to providing an update at our Annual General Meeting (AGM) on November 15th 12.00 noon AEDT (November 14th 8.00pm EST).” KEY HIGHLIGHTS Ryoncil® (Remestemcel-L) for Steroid-Refractory Acute Graft Versus Host Disease – Potential FDA Approval • There are no approved treatments for children under 12 with steroid-refractory acute GvHD, making approval of a safe and effective treatment for this vulnerable population the most urgent need. • Mesoblast resubmitted its BLA to FDA for approval of RYONCIL on July 8, 2024 and anticipates a decision prior to or on the FDA’s Prescription Drug User Fee Act (PDUFA) goal date of January 7, 2025. • FDA has already conducted the Pre-License Inspection (PLI) of the manufacturing process for RYONCIL in May 2023 and this did not result in the issuance of any Form 483. • Inventory has been manufactured and there is an established supply chain to ensure cryopreserved product is available for delivery to meet the needs of each site immediately post approval, with ability to scale up as necessary going forward. • We have been working diligently to lay the groundwork for a successful launch of RYONCIL, including hiring select senior positions to implement a targeted commercial strategy since 50% of pediatric transplants are performed at just 15 centers. • Post approval implementation will initially target those centers with greatest experience using the RYONCIL product and highest volume, with staged rollout beyond. Exhibit 99.1

Revascor® (Rexlemestrocel-L) for Pediatric Congenital Heart Disease - Hypoplastic Left Heart Syndrome • Earlier this year, FDA granted Mesoblast’s second generation allogeneic, STRO3-immunoselected, and industrially manufactured stromal cell product REVASCOR both Rare Pediatric Disease Designation (RPDD) and Orphan-Drug Designation (ODD) for treatment of children with hypoplastic left heart syndrome (HLHS), a potentially life-threatening congenital heart condition. • Results from a blinded, randomized, placebo-controlled prospective trial of REVASCOR conducted in the United States in children with HLHS were published in the December 2023 issue of the peer reviewed The Journal of Thoracic and Cardiovascular Surgery Open (JTCVS Open).1 • A single intramyocardial administration of REVASCOR at the time of staged surgery resulted in the desired outcome of significantly larger increases in left ventricular (LV) end-systolic and end- diastolic volumes over 12 months compared with controls as measured by 3D echocardiography (p=0.009 & p=0.020 respectively). • These changes are indicative of clinically important growth of the small left ventricle, facilitating the ability to have a successful surgical correction, known as full biventricular (BiV) conversion, which allows for a normal two ventricle circulation. • Without full BiV conversion the right heart chamber is under excessive strain with increased risk of heart failure, liver cirrhosis, and death. • RPDD demonstrates that the disease is serious or life-threatening and the manifestations primarily affect individuals aged from birth to 18 years, including age groups often called neonates, infants, children, and adolescents, and that the disease is a rare disease or condition. • On FDA approval of a BLA for REVASCOR for the treatment of HLHS, Mesoblast may be eligible to receive a Priority Review Voucher (PRV) that can be redeemed for any subsequent marketing application or may be sold or transferred to a third party. • Mesoblast plans to meet with FDA to discuss the clinical data to support regulatory approval for REVASCOR in children with this life-threatening condition. REVASCOR for Chronic Heart Failure with Reduced Ejection Fraction (HFrEF) and Persistent Inflammation • In March FDA informed Mesoblast that it supports an accelerated approval pathway for its second generation allogeneic, STRO3-immunoselected, and industrially manufactured stromal cell product REVASCOR, for patients with end-stage ischemic HFrEF kept alive with a left ventricular assist device (LVAD). • This followed presentation to FDA of the results of two complementary randomized controlled trials of REVASCOR, one in patients with end-stage HFrEF and LVADs and a second in advanced NYHA class II/III HFrEF patients. • Mesoblast has received RMAT designation for rexlemestrocel-L in the treatment of end-stage heart failure in LVAD patients and intends to meet with FDA, after the meeting on HLHS, to discuss data presentation, timing and FDA expectations for an accelerated approval filing in these patients. Rexlemestrocel-L for Chronic Low Back Pain associated with Degenerative Disc Disease – Phase 3 Program • The confirmatory Phase 3 trial of Mesoblast’s second generation allogeneic, STRO3-immunoselected, and industrially manufactured stromal cell product rexlemestrocel-L in patients with chronic low back pain (CLBP) due to inflammatory degenerative disc disease (DDD) of less than five years duration has commenced enrollment at multiple sites across the United States. • FDA has previously agreed on the design of this 300-patient randomized, placebo-controlled confirmatory Phase 3 trial, and the 12-month primary endpoint of pain reduction as an approvable indication. • This endpoint was successfully met in Mesoblast’s first Phase 3 trial. • Key secondary measures include improvement in quality of life and function. • A particular focus is on treatment of patients on opioids, since discogenic back pain accounts for approximately 50% of prescription opioid usage in the US. • Significant pain reduction and opioid cessation were observed in Mesoblast’s first Phase 3 trial.

• FDA has designated rexlemestrocel-L a Regenerative Medicine Advanced Therapy (RMAT) for the treatment of chronic low back pain. RMAT designation provides all the benefits of Breakthrough and Fast Track designations, including rolling review and eligibility for priority review on filing of a BLA. FINANCIAL REPORT We have continued our disciplined financial management strategy focused on ensuring that we are well- positioned to execute our clinical, manufacturing, and commercialization plans while maintaining conservative fiscal practices. The successful implementation of our cost containment plan over the past 12 months and the re-prioritization of projects has enabled us to reduce cash expenditure whilst still making significant strides forward on key programs as outlined above. To ensure that the Company is well capitalized for a commercial launch of RYONCIL, we recently entered into a convertible note subscription agreement with our largest shareholder for issue, at Mesoblast’s sole discretion, up to US$50.0 million convertible notes following approval of RYONCIL by FDA. First Quarter Results • Cash balance at September 30, 2024 is US$51.1 million, with additional US$60.0 million available from existing financing facilities on RYONCIL approval. • Net operating cash spend of US$10.5 million for the first quarter FY2025. • 26% (US$3.7 million) reduction in net operating cash spend for the first quarter FY2025 versus the prior comparative quarter in FY2024. Other Fees to Non-Executive Directors were nil, consulting payments to Non-Executive Director were US$40,000 and salary payments to full-time Executive Directors were US$231,552, detailed in Item 6 of the Appendix 4C cash flow report for the quarter.2 From 1 August 2024, Non-Executive directors have voluntarily deferred 50% cash payment of their director fees and agreed to receive the remaining 50% of their fees in equity-based incentives and Executive Directors (our Chief Executive and Chief Medical Officers) have voluntarily reduced their base salaries for FY25 by 30% in lieu of accepting equity-based incentives. A copy of the Appendix 4C – Quarterly Cash Flow Report for the first quarter FY2025 is attached. About Mesoblast Mesoblast (the Company) is a world leader in developing allogeneic (off-the-shelf) cellular medicines for the treatment of severe and life-threatening inflammatory conditions. The Company has leveraged its proprietary mesenchymal lineage cell therapy technology platform to establish a broad portfolio of late- stage product candidates which respond to severe inflammation by releasing anti-inflammatory factors that counter and modulate multiple effector arms of the immune system, resulting in significant reduction of the damaging inflammatory process. Mesoblast has a strong and extensive global intellectual property portfolio with protection extending through to at least 2041 in all major markets. The Company’s proprietary manufacturing processes yield industrial-scale, cryopreserved, off-the-shelf, cellular medicines. These cell therapies, with defined pharmaceutical release criteria, are planned to be readily available to patients worldwide. Mesoblast is developing product candidates for distinct indications based on its remestemcel-L and rexlemestrocel-L allogeneic stromal cell technology platforms. Remestemcel-L is being developed for inflammatory diseases in children and adults including steroid refractory acute graft versus host disease, and biologic-resistant inflammatory bowel disease. Rexlemestrocel-L is being developed for advanced chronic heart failure and chronic low back pain. Two products have been commercialized in Japan and Europe by Mesoblast’s licensees, and the Company has established commercial partnerships in Europe and China for certain Phase 3 assets. Mesoblast has locations in Australia, the United States and Singapore and is listed on the Australian Securities Exchange (MSB) and on the Nasdaq (MESO). For more information, please see www.mesoblast.com, LinkedIn: Mesoblast Limited and Twitter: @Mesoblast

References / Footnotes 1. Wittenberg RE et al. Prospective randomized controlled trial of the safety and feasibility of a novel mesenchymal precursor cell therapy in hypoplastic left heart syndrome, JTCVS Open Volume 16, Dec 2023. 2. As required by ASX listing rule 4.7 and reported in Item 6 of the Appendix 4C, reported are the aggregated total payments to related parties being Executive Directors and Non-Executive Directors. Forward-Looking Statements This press release includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements should not be read as a guarantee of future performance or results, and actual results may differ from the results anticipated in these forward-looking statements, and the differences may be material and adverse. Forward-looking statements include, but are not limited to, statements about: the initiation, timing, progress and results of Mesoblast’s preclinical and clinical studies, and Mesoblast’s research and development programs; Mesoblast’s ability to advance product candidates into, enroll and successfully complete, clinical studies, including multi-national clinical trials; Mesoblast’s ability to advance its manufacturing capabilities; the timing or likelihood of regulatory filings and approvals (including any future decision that the FDA may make on the BLA for remestemcel-L for pediatric patients with SR-aGVHD), manufacturing activities and product marketing activities, if any; the commercialization of Mesoblast’s product candidates, if approved; regulatory or public perceptions and market acceptance surrounding the use of stem-cell based therapies; the potential for Mesoblast’s product candidates, if any are approved, to be withdrawn from the market due to patient adverse events or deaths; the potential benefits of strategic collaboration agreements and Mesoblast’s ability to enter into and maintain established strategic collaborations; Mesoblast’s ability to establish and maintain intellectual property on its product candidates and Mesoblast’s ability to successfully defend these in cases of alleged infringement; the scope of protection Mesoblast is able to establish and maintain for intellectual property rights covering its product candidates and technology; estimates of Mesoblast’s expenses, future revenues, capital requirements and its needs for additional financing; Mesoblast’s financial performance; developments relating to Mesoblast’s competitors and industry; and the pricing and reimbursement of Mesoblast’s product candidates, if approved. You should read this press release together with our risk factors, in our most recently filed reports with the SEC or on our website. Uncertainties and risks that may cause Mesoblast’s actual results, performance or achievements to be materially different from those which may be expressed or implied by such statements, and accordingly, you should not place undue reliance on these forward-looking statements. We do not undertake any obligations to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Release authorized by the Chief Executive. For more information, please contact: Corporate Communications / Investors Media Paul Hughes BlueDot Media T: +61 3 9639 6036 Steve Dabkowski E: investors@mesoblast.com T: +61 419 880 486 E: steve@bluedot.net.au

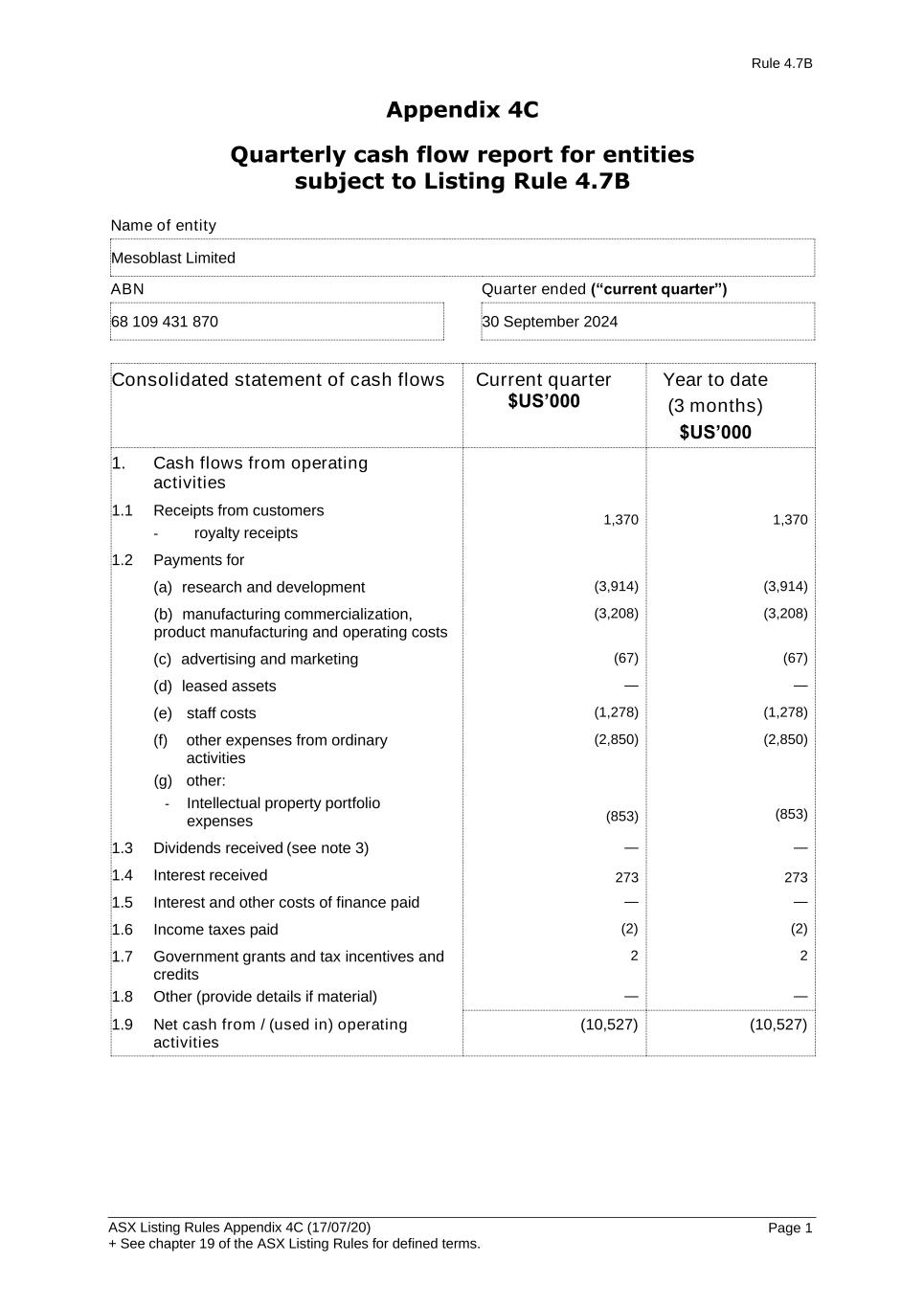

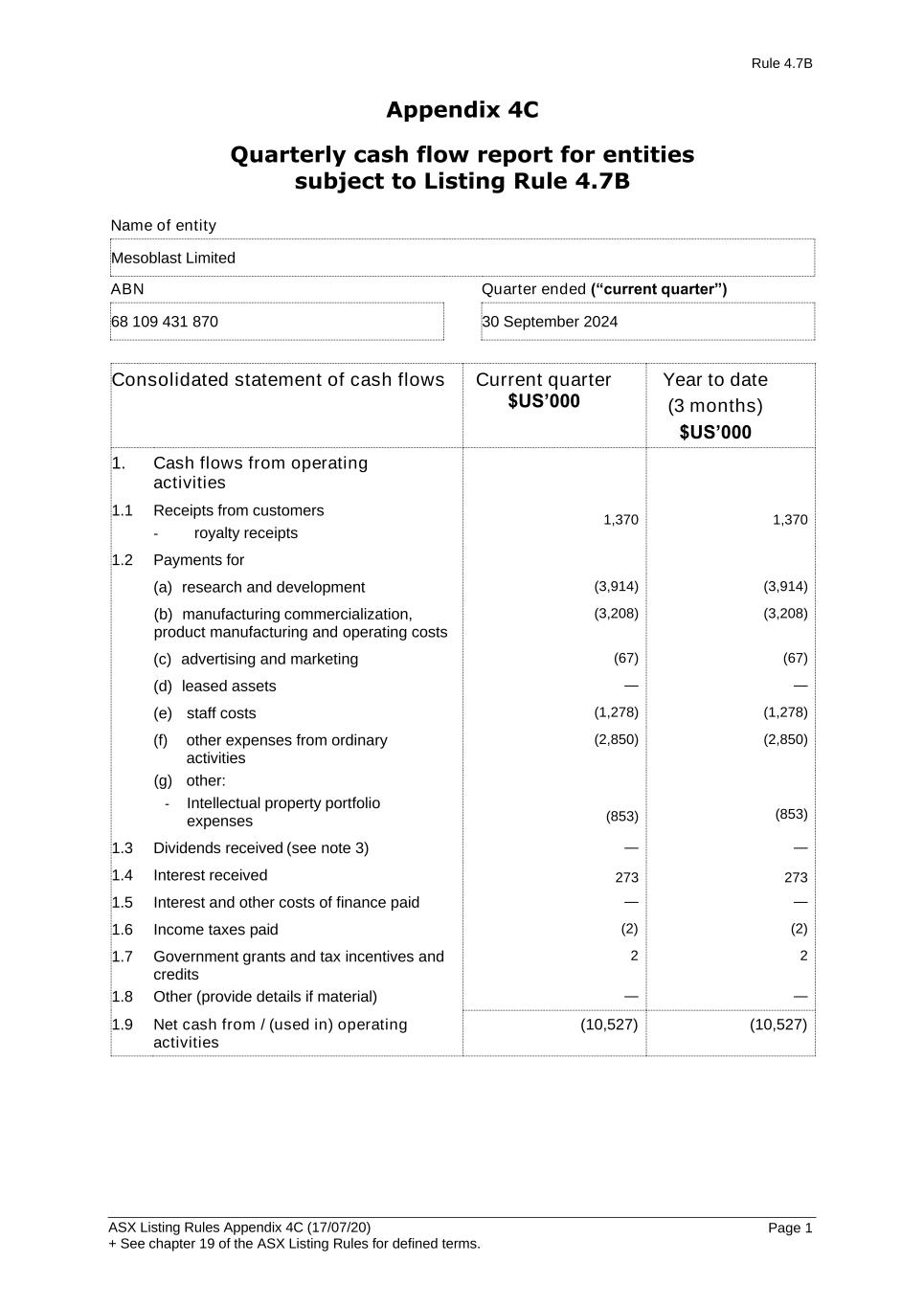

Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 1 Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B Name of entity Mesoblast Limited ABN Quarter ended (“current quarter”) 68 109 431 870 30 September 2024 Consolidated statement of cash flows Current quarter $US’000 Year to date (3 months) $US’000 1. Cash flows from operating activities 1.1 Receipts from customers - royalty receipts 1,370 1,370 1.2 Payments for (a) research and development (3,914) (3,914) (b) manufacturing commercialization, product manufacturing and operating costs (3,208) (3,208) (c) advertising and marketing (67) (67) (d) leased assets — — (e) staff costs (1,278) (1,278) (f) other expenses from ordinary activities (g) other: - Intellectual property portfolio expenses (2,850) (2,850) (853) (853) 1.3 Dividends received (see note 3) — — 1.4 Interest received 273 273 1.5 Interest and other costs of finance paid — — 1.6 Income taxes paid (2) (2) 1.7 Government grants and tax incentives and credits 2 2 1.8 Other (provide details if material) — — 1.9 Net cash from / (used in) operating activities (10,527) (10,527)

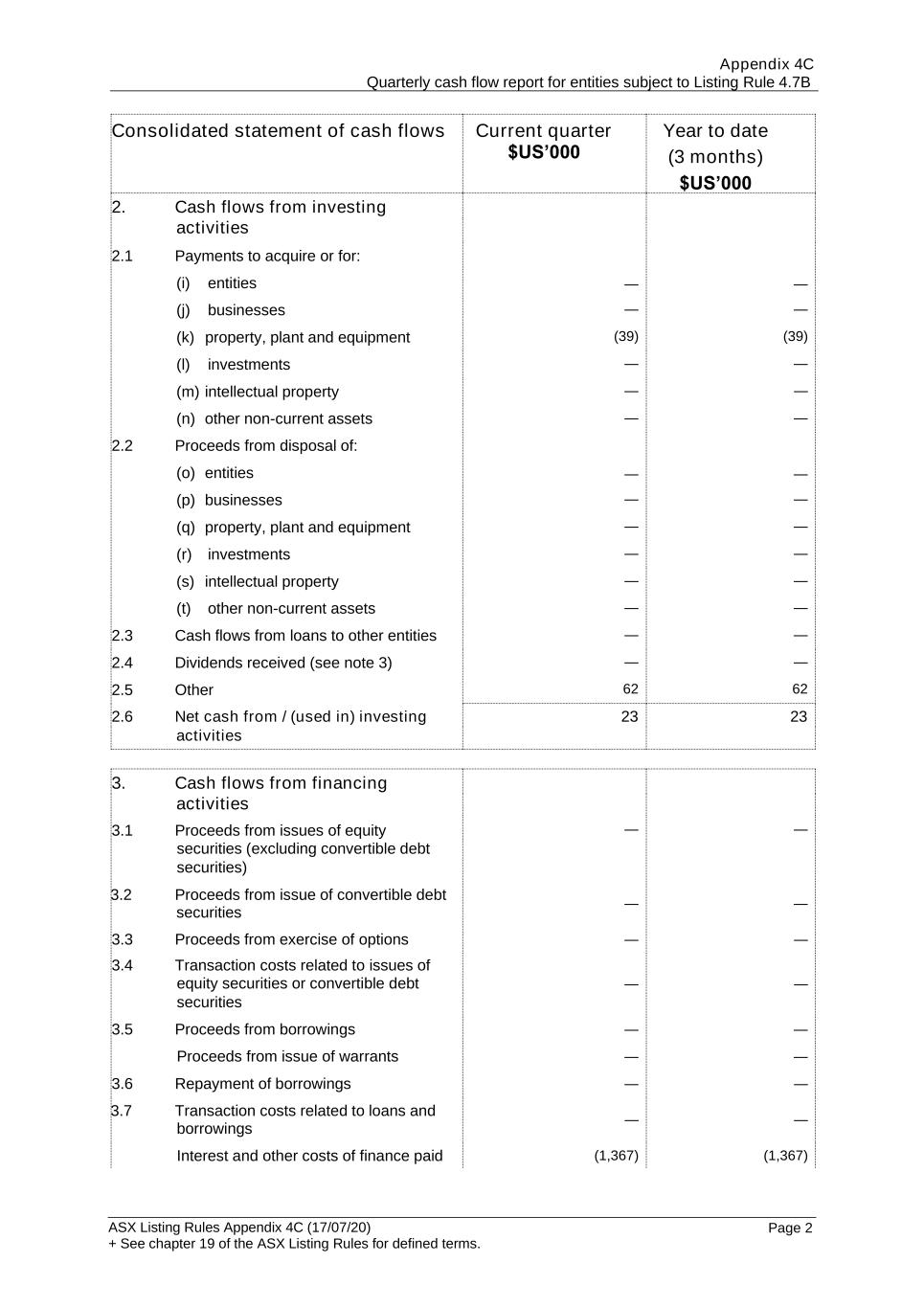

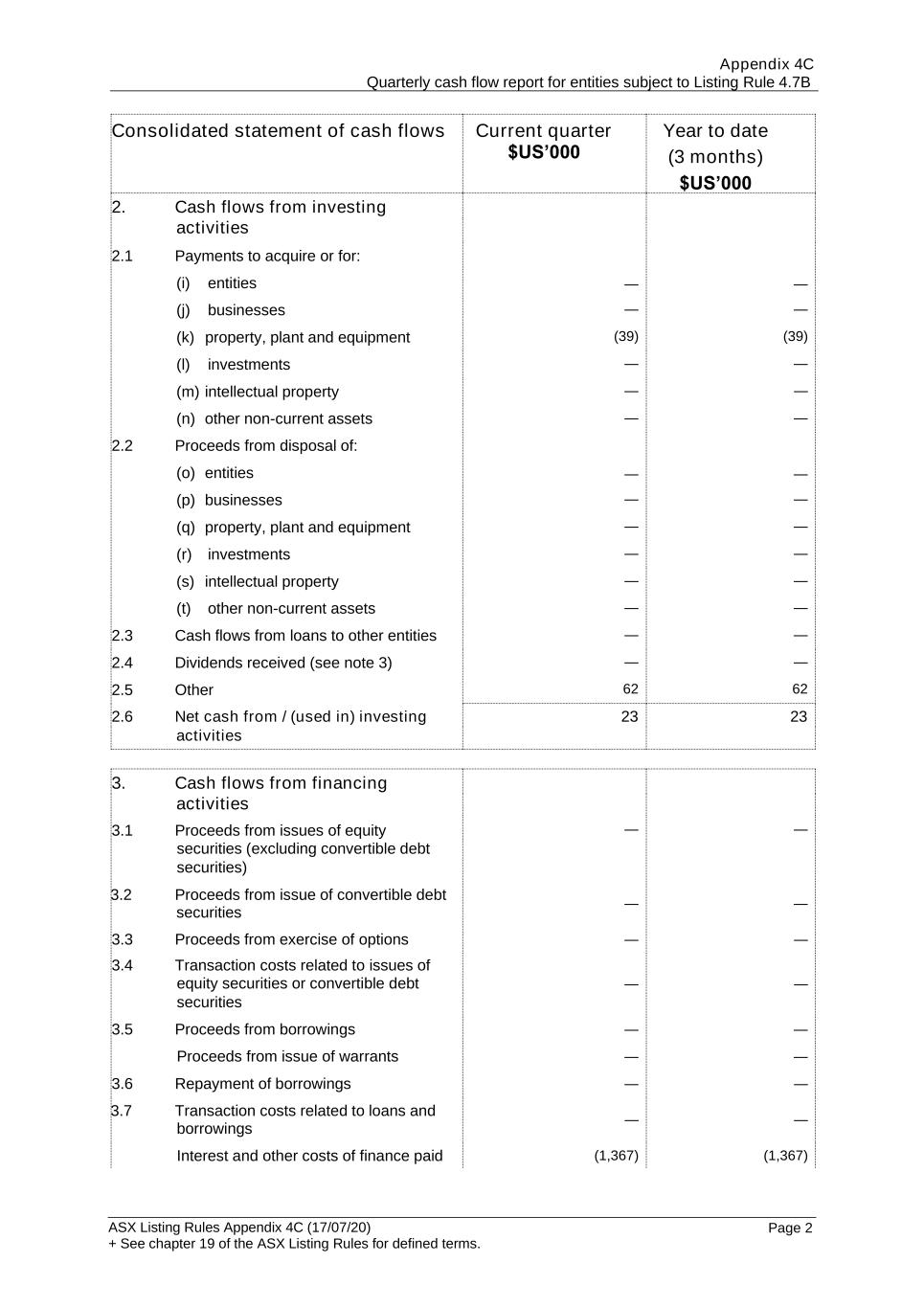

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 2 Consolidated statement of cash flows Current quarter $US’000 Year to date (3 months) $US’000 2. Cash flows from investing activities 2.1 Payments to acquire or for: (i) entities — — (j) businesses — — (k) property, plant and equipment (39) (39) (l) investments — — (m) intellectual property — — (n) other non-current assets — — 2.2 Proceeds from disposal of: (o) entities — — (p) businesses — — (q) property, plant and equipment — — (r) investments — — (s) intellectual property — — (t) other non-current assets — — 2.3 Cash flows from loans to other entities — — 2.4 Dividends received (see note 3) — — 2.5 Other 62 62 2.6 Net cash from / (used in) investing 23 23 activities 3. Cash flows from financing activities 3.1 Proceeds from issues of equity — — securities (excluding convertible debt securities) 3.2 Proceeds from issue of convertible debt securities — — 3.3 Proceeds from exercise of options — — 3.4 Transaction costs related to issues of equity securities or convertible debt — — securities 3.5 Proceeds from borrowings — — Proceeds from issue of warrants — — 3.6 Repayment of borrowings — — 3.7 Transaction costs related to loans and borrowings — — Interest and other costs of finance paid (1,367) (1,367)

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 3 Consolidated statement of cash flows Current quarter $US’000 Year to date (3 months) $US’000 3.8 Dividends paid — — 3.9 Other (payment of lease liability) (569) (569) 3.10 Net cash from / (used in) financing activities (1,936) (1,936) 4. Net increase / (decrease) in cash 62,960 (10,527) 23 (1,936) 599 62,960 (10,527) 23 (1,936) 599 and cash equivalents for the period 4.1 Cash and cash equivalents at beginning of quarter (July 1, 2024)/beginning of year (July 1, 2024) 4.2 Net cash from / (used in) operating activities (item 1.9 above) 4.3 Net cash from / (used in) investing activities (item 2.6 above) 4.4 Net cash from / (used in) financing activities (item 3.10 above) 4.5 Effect of movement in exchange rates on cash held 4.6 Cash and cash equivalents at end of 51,119 51,119 period 5. Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts Current quarter $US’000 Previous quarter $US’000 5.1 Bank balances 50,703 62,563 5.2 Call deposits — — 5.3 Bank overdrafts — — 5.4 Other (Term deposits) 416 397 5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above) 51,119 62,960 6. Payments to related parties of the entity and their associates Current quarter $US'000 6.1 Aggregate amount of payments to related parties and their associates included in item 1 272 6.2 Aggregate amount of payments to related parties and their associates included in item 2 — Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. Consulting payments to Non-Executive Director and salary payments to full-time Executive Directors (for the current quarter) = US$271,552

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 4 7. Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. Total facility amount at quarter end $US’000 Amount drawn at quarter end $US’000 7.1 Loan facilities 90,000* 80,000* 7.2 Credit standby arrangements — — 7.3 Other (please specify) 50,000* — 7.4 Total financing facilities 140,000* 80,000* 7.5 Unused financing facilities available at quarter end 60,000* 7.6 Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. *Convertible note facility Mesoblast entered into a convertible note subscription agreement with its largest shareholder, Gregory George (“Investor”) for issue, at its sole discretion, up to US$50 million convertible notes following approval by the United States Food and Drug Administration (“FDA”) of Mesoblast’s lead product candidate Ryoncil® (remestemcel-L) in the treatment of children with steroid refractory acute graft versus host disease (SR- aGvHD). The facility can be drawn down in US$10 million tranches following an FDA approval of RYONCIL for a 90-day period. The convertible notes have a coupon of 5% per annum on the face value of issued notes. The conversion price of the convertible notes will be US$9.06 per ADR (American Depository Receipt) equivalent to A$1.32 per ASX-listed share. The maturity date of the convertible notes will be 4 years after the first issuance of notes (unless redeemed or converted earlier). At any time up to the maturity date, the Investor may elect to convert convertible notes issued into fully paid ordinary shares or ADRs of Mesoblast, at the conversion price. The convertible notes will be unsecured and be subordinated to the Company’s two existing secured financing facilities. The conversion price is subject to adjustment mechanisms in the event of future share issues, capital reductions, share consolidations and other corporate actions in accordance with customary adjustment rules. *Loan facility with Oaktree Capital Management, Inc. Mesoblast refinanced its senior debt facility on November 19, 2021 with a secured five-year credit facility provided by funds managed by Oaktree Capital Management, L.P. (“Oaktree”).The balance of funds drawn down is currently US$50.0 million. The loan has an initial interest only period of three years, at a fixed rate of 9.75% per annum, after which time 40% of the principal is payable over two years and a final payment due no later than November 2026. The loan interest rate is fixed and as at June 30, 2024 the interest rate was 9.75%. For the first two years to November 19, 2023, 8% interest was paid in cash, while 1.75% interest was not paid in cash, instead it was paid in kind (PIK) and accrued onto the loan balance outstanding.

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 5 *Loan facility with NovaQuest Capital Management, L.L.C. On June 29, 2018, Mesoblast entered into a Loan and Security Agreement with NovaQuest Capital Management, L.L.C. (“NovaQuest”) for a non-dilutive US$40.0 million secured eight-year term loan. Mesoblast drew the first tranche of US$30.0 million of the loan on closing. An additional US$10.0 million from the loan will be drawn on marketing approval of remestemcel-L for the treatment in pediatric patients with SR-aGVHD by FDA. The loan term included an interest only period of approximately four years through until July 8, 2022. All interest and principal payments (i.e. the amortization period) are deferred until after the first commercial sale of remestemcel-L in the treatment of pediatric patients with SR-aGVHD. Principal is repayable in equal quarterly instalments over the amortization period of the loan based on a percentage of net sales and are limited by a payment cap. The loan has a fixed interest rate of 15% per annum. The financing is subordinated to the senior creditor, Oaktree. 8. Estimated cash available for future operating activities $US’000 8.1 Net cash from / (used in) operating activities (item 1.9) (10,527) 8.2 Cash and cash equivalents at quarter end (item 4.6) 51,119 8.3 Unused finance facilities available at quarter end (item 7.5) 60,000* 8.4 Total available funding (item 8.2 + item 8.3) 111,119 8.5 Estimated quarters of funding available (item 8.4 divided by item 8.1) 10.6 Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. * Under the NovaQuest loan facility, an additional US$10.0 million from the loan will be drawn on marketing approval of remestemcel-L for the treatment in pediatric patients with steroid-refractory acute graft versus host disease by the United States Food and Drug Administration. Under the Convertible Note facility, an additional up to US$50.0 million of convertible notes is available for issue at Mesoblast’s sole discretion following FDA approval of RYONCIL for a 90-day period. 8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions: 8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? Answer: Not applicable 8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? Answer: Not applicable 8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? Answer: Not applicable Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered.

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B ASX Listing Rules Appendix 4C (17/07/20) + See chapter 19 of the ASX Listing Rules for defined terms. Page 6 Compliance statement 1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. 2 This statement gives a true and fair view of the matters disclosed. Date: .......31 October 2024............................................................................. Authorised by: ......Chief Executive............................................................................. (Name of body or officer authorising release – see note 4) Notes 1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. 2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report. 3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. 4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. 5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.