________________________________________ (1) Refer to the selected financial information accompanying this press release for a reconciliation of GAAP to Non-GAAP numbers. October 10, 2024 FOR IMMEDIATE RELEASE Contact: Aircastle Advisor LLC Jim Connelly, SVP ESG & Corporate Communications Tel: +1-203-504-1871 jconnelly@aircastle.com Aircastle Announces Second Quarter 2024 Results Highlights for the Three Months Ended August 31, 2024 • Total revenues of $217 million and net income of $29 million • Adjusted EBITDA(1) of $199 million • Lease rental revenue and direct financing and sales-type lease revenue increased 8% • Sold 10 aircraft and other flight equipment for proceeds of $304 million and gains on sale of $35 million; extended leases on 22 aircraft • Acquired 4 aircraft for $120 million • Fleet utilization over 99% Liquidity • Issued $500 million 5.75% unsecured senior notes due 2031 • Net debt-to-equity of 1.9 times at August 31, 2024 • Total liquidity as of October 1, 2024 of $3.1 billion includes $2.1 billion of undrawn facilities, $0.5 billion of projected adjusted operating cash flows and sales through October 1, 2025, and $0.5 billion of unrestricted cash • 214 unencumbered aircraft and other flight equipment with a net book value of $6.0 billion

2 Mike Inglese, Aircastle’s CEO, stated, "Global demand for passenger air travel is at an all-time high, with load factors close to operational limits. However, Boeing and Airbus forecast only minimal delivery improvements in the near term. These conditions have led to robust lease rates and steady demand for placements and extensions of the narrow-body aircraft that comprise most of our fleet. In the second fiscal quarter, we capitalized on this momentum by extending 22 leases, selling 10 aircraft, and achieving a net income of $29 million." Mr. Inglese concluded, “In the second half of our fiscal year, we look forward to expanding our fleet with a focus on new-technology aircraft. Despite the strong competition we're seeing among aircraft investors, we believe Aircastle has a competitive edge due to our outstanding team, ample liquidity, strong balance sheet as well as the outstanding support of our shareholders, Marubeni Corporation and Mizuho Leasing.” Aviation Assets As of August 31, 2024, Aircastle owned 244 aircraft and other flight equipment having a net book value of $7.1 billion. We also manage 9 aircraft with a net book value of $265 million on behalf of our joint venture with Mizuho Leasing. Owned Aircraft As of August 31, 2024 As of August 31, 2023 Net Book Value of Flight Equipment $ 7,077 $ 6,751 Net Book Value of Unencumbered Flight Equipment $ 6,043 $ 5,208 Number of Aircraft 244 239 Number of Unencumbered Aircraft 214 201 Number of Lessees 77 73 Number of Countries 46 43 Weighted Average Fleet Age (Years)(1) 9.7 9.7 Weighted Average Remaining Lease Term (Years)(1) 5.3 5.2 Weighted Average Fleet Utilization during the three months ended August 31, 2024 and 2023(2) 99.2 % 98.3 % Managed Aircraft on behalf of Joint Ventures Net Book Value of Flight Equipment $ 265 $ 278 Number of Aircraft 9 9 _______________ 1. Weighted by Net Book Value. 2. Aircraft on-lease days as a percentage of total days in period weighted by Net Book Value. Conference Call In connection with this press release, management will host a conference call on Thursday, October 10, 2024, at 9:00 A.M. Eastern Time. All interested parties are welcome to participate on the live call. The conference call can be accessed by dialing 1 (800) 836-8184 (from within the U.S. and Canada) or +1 (646) 357-8785 (outside the U.S. and Canada) ten minutes prior to the scheduled start. Please reference our company name “Aircastle” when prompted by the operator. A simultaneous webcast of the conference call will be available to the public on a listen-only basis at www.aircastle.com. Please allow extra time prior to the call to visit the site and download the necessary software required to listen to the internet broadcast. For those who are not available to listen to the live call, a replay will be available on Aircastle's website shortly after the live call.

3 About Aircastle Limited Aircastle Limited acquires, leases and sells commercial jet aircraft to airlines throughout the world. As of August 31, 2024, Aircastle owned and managed on behalf of its joint ventures 253 aircraft leased to 78 airline customers located in 46 countries. Safe Harbor All statements in this press release, other than characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not necessarily limited to, statements relating to our proposed public offering of notes and our ability to acquire, sell, lease or finance aircraft, raise capital, pay dividends, and increase revenues, earnings, EBITDA and Adjusted EBITDA and the global aviation industry and aircraft leasing sector. Words such as "anticipates," "expects," "intends," "plans," "projects," "believes," "may," "will," "would," "could," "should," "seeks," "estimates" and variations on these words and similar expressions are intended to identify such forward-looking statements. These statements are based on our historical performance and that of our subsidiaries and on our current plans, estimates and expectations and are subject to a number of factors that could lead to actual results materially different from those described in the forward-looking statements; Aircastle can give no assurance that its expectations will be attained. Accordingly, you should not place undue reliance on any such forward-looking statements which are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of this press release. These risks or uncertainties include, but are not limited to, those described from time to time in Aircastle's filings with the SEC and previously disclosed under "Risk Factors" in Item 1A of Aircastle's most recent Form 10-K and any subsequent filings with the SEC. In addition, new risks and uncertainties emerge from time to time, and it is not possible for Aircastle to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Such forward-looking statements speak only as of the date of this press release. Aircastle expressly disclaims any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances.

4 Aircastle Limited and Subsidiaries Consolidated Balance Sheets (Dollars in thousands, except share data) August 31, 2024 February 29, 2024 (Unaudited) ASSETS Cash and cash equivalents $ 432,564 $ 129,977 Accounts receivable 12,778 12,518 Flight equipment held for lease, net 6,798,327 6,940,502 Net investment in leases, net 278,270 282,439 Unconsolidated equity method investment 43,709 42,710 Other assets 267,907 271,807 Total assets $ 7,833,555 $ 7,679,953 LIABILITIES AND SHAREHOLDERS’ EQUITY LIABILITIES Borrowings from secured financings, net $ 636,410 $ 875,397 Borrowings from unsecured financings, net 3,823,665 3,823,099 Accounts payable, accrued expenses and other liabilities 212,315 219,588 Lease rentals received in advance 62,894 52,654 Security deposits 71,689 69,544 Maintenance payments 558,568 505,897 Total liabilities 5,365,541 5,546,179 Commitments and Contingencies SHAREHOLDERS’ EQUITY Preference shares, $0.01 par value, 50,000,000 shares authorized, 400 (aggregate liquidation preference of $400,000) shares issued and outstanding at August 31, 2024 and February 29, 2024 — — Common shares, $0.01 par value, 250,000,000 shares authorized, 17,840 and 15,564 shares issued and outstanding at August 31, 2024 and February 29, 2024, respectively — — Additional paid-in capital 2,378,774 2,078,774 Retained earnings 89,240 55,000 Total shareholders’ equity 2,468,014 2,133,774 Total liabilities and shareholders’ equity $ 7,833,555 $ 7,679,953

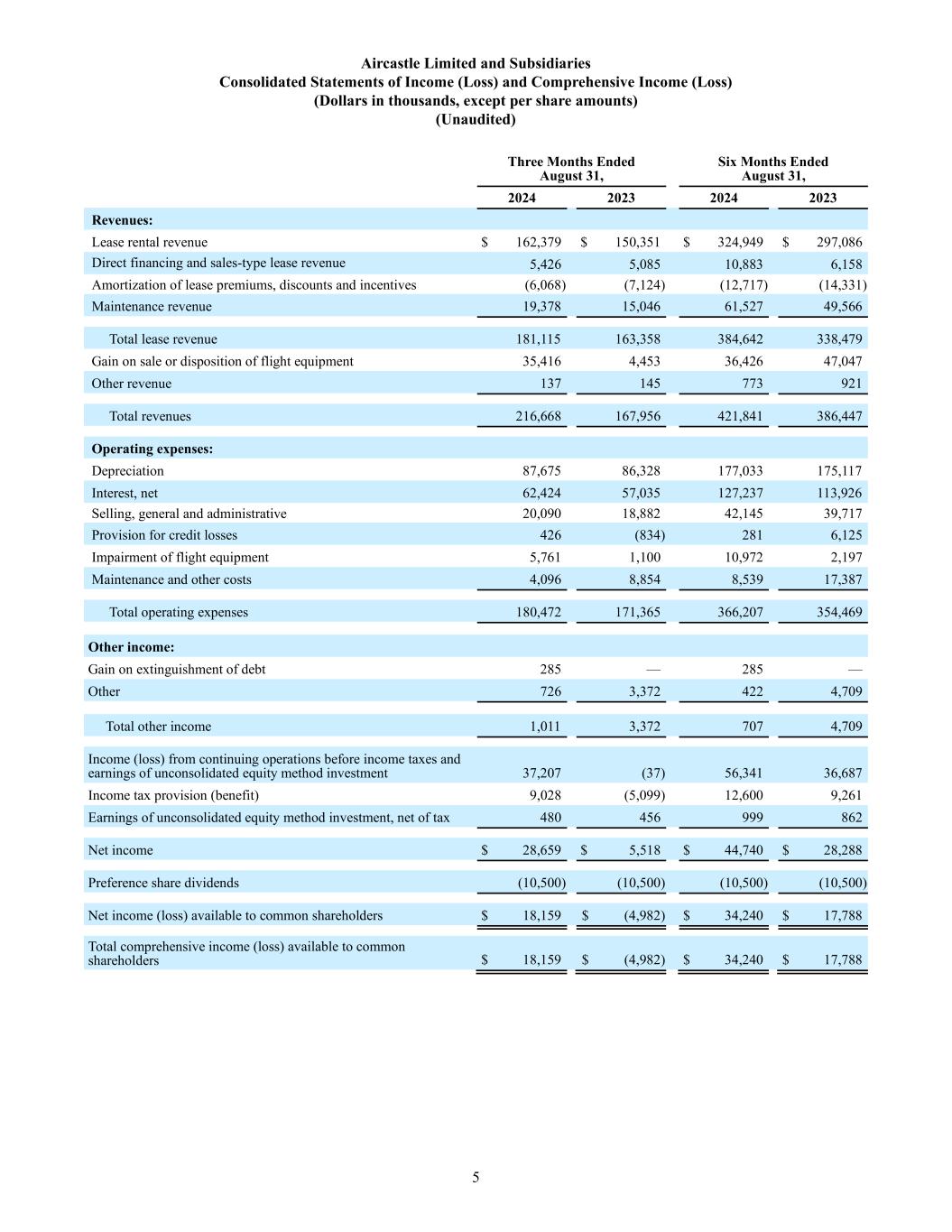

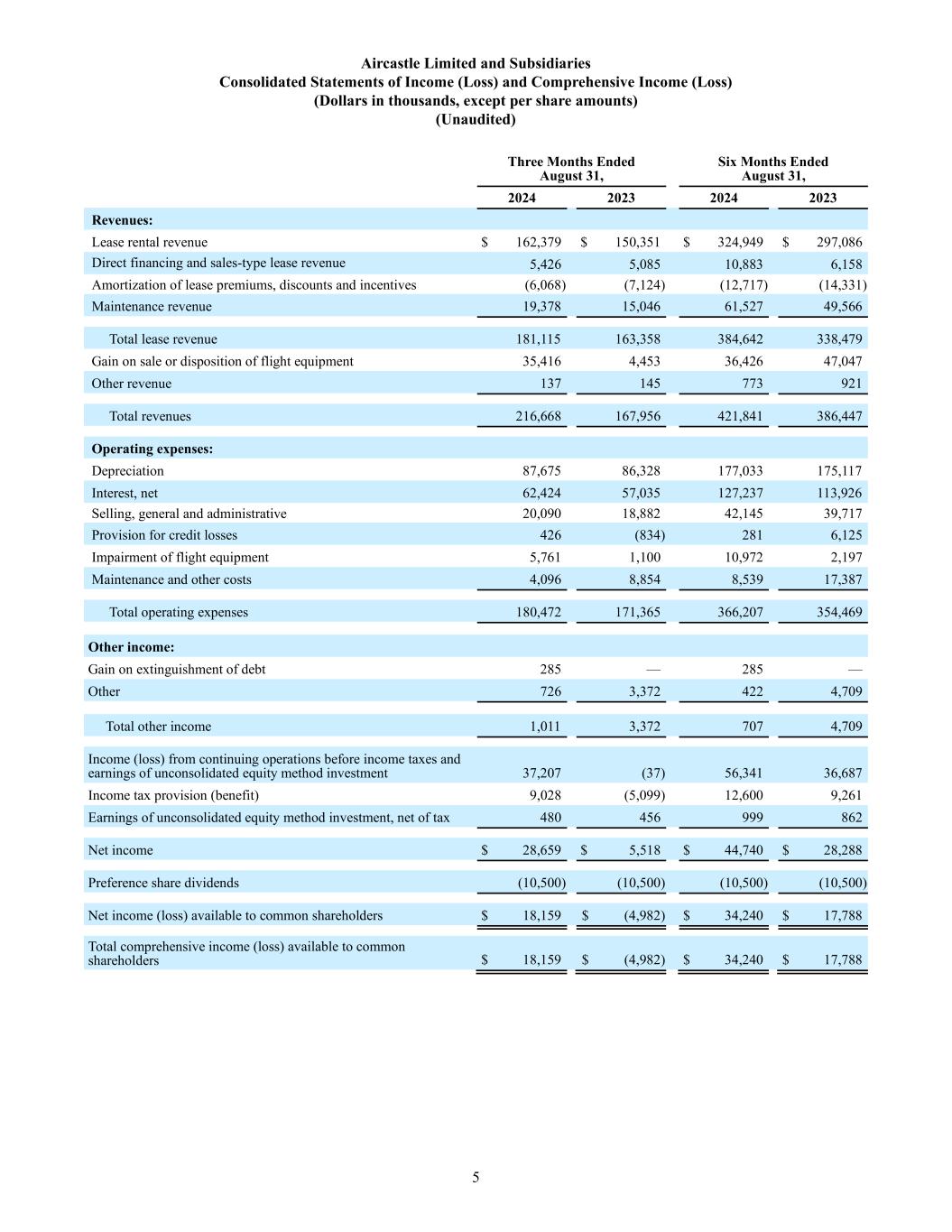

5 Aircastle Limited and Subsidiaries Consolidated Statements of Income (Loss) and Comprehensive Income (Loss) (Dollars in thousands, except per share amounts) (Unaudited) Three Months Ended August 31, Six Months Ended August 31, 2024 2023 2024 2023 Revenues: Lease rental revenue $ 162,379 $ 150,351 $ 324,949 $ 297,086 Direct financing and sales-type lease revenue 5,426 5,085 10,883 6,158 Amortization of lease premiums, discounts and incentives (6,068) (7,124) (12,717) (14,331) Maintenance revenue 19,378 15,046 61,527 49,566 Total lease revenue 181,115 163,358 384,642 338,479 Gain on sale or disposition of flight equipment 35,416 4,453 36,426 47,047 Other revenue 137 145 773 921 Total revenues 216,668 167,956 421,841 386,447 Operating expenses: Depreciation 87,675 86,328 177,033 175,117 Interest, net 62,424 57,035 127,237 113,926 Selling, general and administrative 20,090 18,882 42,145 39,717 Provision for credit losses 426 (834) 281 6,125 Impairment of flight equipment 5,761 1,100 10,972 2,197 Maintenance and other costs 4,096 8,854 8,539 17,387 Total operating expenses 180,472 171,365 366,207 354,469 Other income: Gain on extinguishment of debt 285 — 285 — Other 726 3,372 422 4,709 Total other income 1,011 3,372 707 4,709 Income (loss) from continuing operations before income taxes and earnings of unconsolidated equity method investment 37,207 (37) 56,341 36,687 Income tax provision (benefit) 9,028 (5,099) 12,600 9,261 Earnings of unconsolidated equity method investment, net of tax 480 456 999 862 Net income $ 28,659 $ 5,518 $ 44,740 $ 28,288 Preference share dividends (10,500) (10,500) (10,500) (10,500) Net income (loss) available to common shareholders $ 18,159 $ (4,982) $ 34,240 $ 17,788 Total comprehensive income (loss) available to common shareholders $ 18,159 $ (4,982) $ 34,240 $ 17,788

6 Aircastle Limited and Subsidiaries Consolidated Statements of Cash Flows (Dollars in thousands) (Unaudited) Six Months Ended August 31, 2024 2023 Cash flows from operating activities: Net income $ 44,740 $ 28,288 Adjustments to reconcile net income to net cash and cash equivalents provided by operating activities: Depreciation 177,033 175,117 Amortization of deferred financing costs 8,590 8,321 Amortization of lease premiums, discounts and incentives 12,717 14,331 Deferred income taxes 9,438 6,179 Collections on net investment in leases 3,477 1,598 Security deposits and maintenance payments included in earnings (9,914) (9,895) Gain on sale or disposition of flight equipment (36,426) (47,047) Gain on extinguishment of debt (285) — Impairment of flight equipment 10,972 2,197 Provision for credit losses 281 6,125 Other (1,008) (845) Changes in certain assets and liabilities: Accounts receivable (3,201) 1,437 Other assets (4,690) (9,723) Accounts payable, accrued expenses and other liabilities (19,235) (3,833) Lease rentals received in advance 12,414 14,165 Net cash and cash equivalents provided by operating activities 204,903 186,415 Cash flows from investing activities: Acquisition and improvement of flight equipment (335,410) (379,349) Proceeds from sale or disposition of flight equipment 329,288 126,011 Aircraft purchase deposits and progress payments, net of returned deposits and aircraft sales deposits (1,069) 6,852 Other (293) (4,026) Net cash and cash equivalents used in investing activities (7,484) (250,512) Cash flows from financing activities: Proceeds from issuance of common shares 300,000 200,000 Proceeds from secured and unsecured debt financings 1,048,200 1,273,709 Repayments of secured and unsecured debt financings (1,289,386) (963,507) Debt extinguishment costs 285 — Deferred financing costs (4,961) (7,536) Security deposits and maintenance payments received 73,206 77,006 Security deposits and maintenance payments returned (11,676) (10,508) Dividends paid (10,500) (10,500) Net cash and cash equivalents provided by financing activities 105,168 558,664 Net increase in cash and cash equivalents 302,587 494,567 Cash and cash equivalents at beginning of period 129,977 231,861 Cash and cash equivalents at end of period $ 432,564 $ 726,428

7 Aircastle Limited and Subsidiaries Reconciliation of GAAP to Non-GAAP Measures EBITDA and Adjusted EBITDA Reconciliation (Dollars in thousands) (Unaudited) Three Months Ended August 31, Six Months Ended August 31, 2024 2023 2024 2023 Net income $ 28,659 $ 5,518 $ 44,740 $ 28,288 Depreciation 87,675 86,328 177,033 175,117 Amortization of lease premiums, discounts and incentives 6,068 7,124 12,717 14,331 Interest, net 62,424 57,035 127,237 113,926 Income tax provision (benefit) 9,028 (5,099) 12,600 9,261 EBITDA $ 193,854 $ 150,906 $ 374,327 $ 340,923 Adjustments: Impairment of flight equipment 5,761 1,100 10,972 2,197 Gain on extinguishment of debt (285) — (285) — Adjusted EBITDA $ 199,330 $ 152,006 $ 385,014 $ 343,120 We define EBITDA as income (loss) from continuing operations before income taxes, interest expense, and depreciation and amortization. We use EBITDA to assess our consolidated financial and operating performance, and we believe this non- U.S. GAAP measure is helpful in identifying trends in our performance. This measure provides an assessment of controllable expenses and affords management the ability to make decisions which are expected to facilitate meeting current financial goals, as well as achieving optimal financial performance. It provides an indicator for management to determine if adjustments to current spending decisions are needed. EBITDA provides us with a measure of operating performance because it assists us in comparing our operating performance on a consistent basis as it removes the impact of our capital structure (primarily interest charges on our outstanding debt) and asset base (primarily depreciation and amortization) from our operating results. Accordingly, this metric measures our financial performance based on operational factors that management can impact in the short-term, namely the cost structure, or expenses, of the organization. EBITDA is one of the metrics used by senior management and the Board of Directors to review the consolidated financial performance of our business. We define Adjusted EBITDA as EBITDA (as defined above) further adjusted to give effect to adjustments required in calculating covenant ratios and compliance as that term is defined in the indenture governing our senior unsecured notes. Adjusted EBITDA is a material component of these covenants.