UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22026

The Gabelli SRI Fund, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: March 31

Date of reporting period: September 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | The Report to Shareholders is attached herewith. |

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about The Gabelli SRI Fund, Inc. (the "Fund") for the period of April 1, 2024 to September 30, 2024. The Gabelli SRI (Socially Responsible Investing) Fund seeks to provide capital appreciation while employing certain SRI criteria within a fundamental stock selection process. The Fund will seek to achieve its objective by investing substantially no less than 80% of its assets in common stocks and preferred stocks of companies that meet the Fund’s social guidelines. You can find additional information about the Fund at www.gabelli.com/funds/open_ends. You can also request this information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli SRI Fund, Inc. - Class AAA | $46 | 0.90% |

How did the Fund perform?

During the six months ended September 30, 2024, the Gabelli SRI Fund underperformed its benchmark, the S&P 500. Like other value portfolios, the Fund did not hold significant positions in the largest technology-driven stocks that have recently dominated the returns of the S&P 500. The Fund’s holdings in economically sensitive sectors, including Financial Services, lagged as uncertainty regarding US elections and the direction of the economy was a major theme during the period.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli SRI Fund, Inc. - Class AAA | S&P 500 Index | MSCI ACWI SRI Index |

|---|

| 9/14 | 10,000 | 10,000 | 10,000 |

| 9/15 | 10,110 | 9,939 | 9,382 |

| 9/16 | 11,474 | 11,473 | 10,709 |

| 9/17 | 11,727 | 13,608 | 12,614 |

| 9/18 | 11,869 | 16,045 | 14,189 |

| 9/19 | 12,605 | 16,727 | 14,863 |

| 9/20 | 15,789 | 19,261 | 17,305 |

| 9/21 | 16,887 | 25,039 | 22,166 |

| 9/22 | 13,381 | 21,165 | 17,618 |

| 9/23 | 13,005 | 25,741 | 21,488 |

| 9/24 | 16,398 | 35,098 | 28,104 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli SRI Fund, Inc. - Class AAA | 5.95% | 26.09% | 8.58% | 7.00% |

| S&P 500 Index | 10.42% | 36.35% | 15.98% | 13.38% |

| MSCI ACWI SRI Index | 9.89% | 30.79% | 13.57% | 10.88% |

- Total Net Assets$24,442,488

- Number of Portfolio Holdings139

- Portfolio Turnover Rate15%

- Management Fees$(42,053)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Xylem Inc. | 3.5% |

| NextEra Energy Inc. | 3.3% |

| Nestlé SA | 3.2% |

| Sony Group Corp. | 2.8% |

| CNH Industrial NV | 2.7% |

| S&P Global Inc. | 2.5% |

| Spectrum Brands Holdings Inc. | 2.4% |

| BellRing Brands Inc. | 2.2% |

| ABB Ltd. | 2.1% |

| American Express Co. | 2.0% |

Portfolio Weighting (% of net assets)

| Common Stocks | 97.4% |

| U.S. Government Obligations | 2.1% |

| Other Assets and Liabilities (Net) | 0.5% |

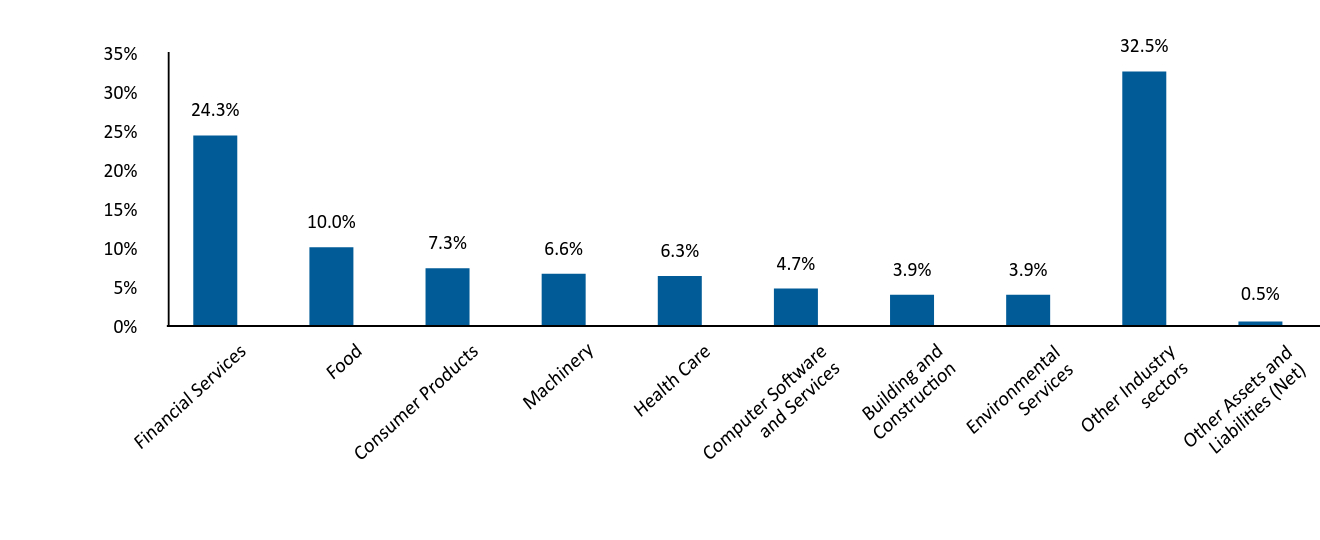

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Financial Services | 24.3% |

| Food | 10.0% |

| Consumer Products | 7.3% |

| Machinery | 6.6% |

| Health Care | 6.3% |

| Computer Software and Services | 4.7% |

| Building and Construction | 3.9% |

| Environmental Services | 3.9% |

| Other Industry sectors | 32.5% |

| Other Assets and Liabilities (Net) | 0.5% |

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about The Gabelli SRI Fund, Inc. (the "Fund") for the period of April 1, 2024 to September 30, 2024. The Gabelli SRI (Socially Responsible Investing) Fund seeks to provide capital appreciation while employing certain SRI criteria within a fundamental stock selection process. The Fund will seek to achieve its objective by investing substantially no less than 80% of its assets in common stocks and preferred stocks of companies that meet the Fund’s social guidelines. You can find additional information about the Fund at www.gabelli.com/funds/open_ends. You can also request this information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli SRI Fund, Inc. - Class C | $46 | 0.90% |

How did the Fund perform?

During the six months ended September 30, 2024, the Gabelli SRI Fund underperformed its benchmark, the S&P 500. Like other value portfolios, the Fund did not hold significant positions in the largest technology-driven stocks that have recently dominated the returns of the S&P 500. The Fund’s holdings in economically sensitive sectors, including Financial Services, lagged as uncertainty regarding US elections and the direction of the economy was a major theme during the period.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli SRI Fund, Inc. - Class C | The Gabelli SRI Fund, Inc. - Class C (includes sales charge) | S&P 500 Index | MSCI ACWI SRI Index |

|---|

| 9/14 | 10,000 | 10,000 | 10,000 | 10,000 |

| 9/15 | 9,285 | 9,192 | 9,939 | 9,382 |

| 9/16 | 9,967 | 9,776 | 11,473 | 10,709 |

| 9/17 | 10,150 | 9,857 | 13,608 | 12,614 |

| 9/18 | 10,195 | 9,802 | 16,045 | 14,189 |

| 9/19 | 10,784 | 10,270 | 16,727 | 14,863 |

| 9/20 | 13,514 | 12,768 | 19,261 | 17,305 |

| 9/21 | 14,449 | 13,524 | 25,039 | 22,166 |

| 9/22 | 11,445 | 10,847 | 21,165 | 17,618 |

| 9/23 | 11,120 | 10,648 | 25,741 | 21,488 |

| 9/24 | 14,025 | 13,322 | 35,098 | 28,104 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli SRI Fund, Inc. - Class C | 5.98% | 26.12% | 8.56% | 6.59% |

| The Gabelli SRI Fund, Inc. - Class C (includes sales charge) | 4.98% | 25.12% | 8.56% | 6.59% |

| S&P 500 Index | 10.42% | 36.35% | 15.98% | 13.38% |

| MSCI ACWI SRI Index | 9.89% | 30.79% | 13.57% | 10.88% |

- Total Net Assets$24,442,488

- Number of Portfolio Holdings139

- Portfolio Turnover Rate15%

- Management Fees$(42,053)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Xylem Inc. | 3.5% |

| NextEra Energy Inc. | 3.3% |

| Nestlé SA | 3.2% |

| Sony Group Corp. | 2.8% |

| CNH Industrial NV | 2.7% |

| S&P Global Inc. | 2.5% |

| Spectrum Brands Holdings Inc. | 2.4% |

| BellRing Brands Inc. | 2.2% |

| ABB Ltd. | 2.1% |

| American Express Co. | 2.0% |

Portfolio Weighting (% of net assets)

| Common Stocks | 97.4% |

| U.S. Government Obligations | 2.1% |

| Other Assets and Liabilities (Net) | 0.5% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Financial Services | 24.3% |

| Food | 10.0% |

| Consumer Products | 7.3% |

| Machinery | 6.6% |

| Health Care | 6.3% |

| Computer Software and Services | 4.7% |

| Building and Construction | 3.9% |

| Environmental Services | 3.9% |

| Other Industry sectors | 32.5% |

| Other Assets and Liabilities (Net) | 0.5% |

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about The Gabelli SRI Fund, Inc. (the "Fund") for the period of April 1, 2024 to September 30, 2024. The Gabelli SRI (Socially Responsible Investing) Fund seeks to provide capital appreciation while employing certain SRI criteria within a fundamental stock selection process. The Fund will seek to achieve its objective by investing substantially no less than 80% of its assets in common stocks and preferred stocks of companies that meet the Fund’s social guidelines. You can find additional information about the Fund at www.gabelli.com/funds/open_ends. You can also request this information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli SRI Fund, Inc. - Class I | $46 | 0.90% |

How did the Fund perform?

During the six months ended September 30, 2024, the Gabelli SRI Fund underperformed its benchmark, the S&P 500. Like other value portfolios, the Fund did not hold significant positions in the largest technology-driven stocks that have recently dominated the returns of the S&P 500. The Fund’s holdings in economically sensitive sectors, including Financial Services, lagged as uncertainty regarding US elections and the direction of the economy was a major theme during the period.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli SRI Fund, Inc. - Class I | S&P 500 Index | MSCI ACWI SRI Index |

|---|

| 9/14 | 10,000 | 10,000 | 10,000 |

| 9/15 | 9,330 | 9,939 | 9,382 |

| 9/16 | 10,069 | 11,473 | 10,709 |

| 9/17 | 10,307 | 13,608 | 12,614 |

| 9/18 | 10,462 | 16,045 | 14,189 |

| 9/19 | 11,124 | 16,727 | 14,863 |

| 9/20 | 13,942 | 19,261 | 17,305 |

| 9/21 | 14,908 | 25,039 | 22,166 |

| 9/22 | 11,812 | 21,165 | 17,618 |

| 9/23 | 11,473 | 25,741 | 21,488 |

| 9/24 | 14,471 | 35,098 | 28,104 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli SRI Fund, Inc. - Class I | 5.95% | 26.13% | 8.59% | 7.14% |

| S&P 500 Index | 10.42% | 36.35% | 15.98% | 13.38% |

| MSCI ACWI SRI Index | 9.89% | 30.79% | 13.57% | 10.88% |

- Total Net Assets$24,442,488

- Number of Portfolio Holdings139

- Portfolio Turnover Rate15%

- Management Fees$(42,053)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Xylem Inc. | 3.5% |

| NextEra Energy Inc. | 3.3% |

| Nestlé SA | 3.2% |

| Sony Group Corp. | 2.8% |

| CNH Industrial NV | 2.7% |

| S&P Global Inc. | 2.5% |

| Spectrum Brands Holdings Inc. | 2.4% |

| BellRing Brands Inc. | 2.2% |

| ABB Ltd. | 2.1% |

| American Express Co. | 2.0% |

Portfolio Weighting (% of net assets)

| Common Stocks | 97.4% |

| U.S. Government Obligations | 2.1% |

| Other Assets and Liabilities (Net) | 0.5% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Financial Services | 24.3% |

| Food | 10.0% |

| Consumer Products | 7.3% |

| Machinery | 6.6% |

| Health Care | 6.3% |

| Computer Software and Services | 4.7% |

| Building and Construction | 3.9% |

| Environmental Services | 3.9% |

| Other Industry sectors | 32.5% |

| Other Assets and Liabilities (Net) | 0.5% |

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about The Gabelli SRI Fund, Inc. (the "Fund") for the period of April 1, 2024 to September 30, 2024. The Gabelli SRI (Socially Responsible Investing) Fund seeks to provide capital appreciation while employing certain SRI criteria within a fundamental stock selection process. The Fund will seek to achieve its objective by investing substantially no less than 80% of its assets in common stocks and preferred stocks of companies that meet the Fund’s social guidelines. You can find additional information about the Fund at www.gabelli.com/funds/open_ends. You can also request this information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli SRI Fund, Inc. - Class A | $46 | 0.90% |

How did the Fund perform?

During the six months ended September 30, 2024, the Gabelli SRI Fund underperformed its benchmark, the S&P 500. Like other value portfolios, the Fund did not hold significant positions in the largest technology-driven stocks that have recently dominated the returns of the S&P 500. The Fund’s holdings in economically sensitive sectors, including Financial Services, lagged as uncertainty regarding US elections and the direction of the economy was a major theme during the period.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli SRI Fund, Inc. - Class A | The Gabelli SRI Fund, Inc. - Class A (includes sales charge) | S&P 500 Index | MSCI ACWI SRI Index |

|---|

| 9/14 | 10,000 | 10,000 | 10,000 | 10,000 |

| 9/15 | 10,110 | 9,528 | 9,939 | 9,382 |

| 9/16 | 10,888 | 9,672 | 11,473 | 10,709 |

| 9/17 | 11,137 | 9,324 | 13,608 | 12,614 |

| 9/18 | 11,271 | 8,894 | 16,045 | 14,189 |

| 9/19 | 11,962 | 8,897 | 16,727 | 14,863 |

| 9/20 | 14,988 | 10,505 | 19,261 | 17,305 |

| 9/21 | 16,031 | 10,590 | 25,039 | 22,166 |

| 9/22 | 12,698 | 7,906 | 21,165 | 17,618 |

| 9/23 | 12,331 | 7,235 | 25,741 | 21,488 |

| 9/24 | 15,554 | 8,602 | 35,098 | 28,104 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli SRI Fund, Inc. - Class A | 5.96% | 26.14% | 8.59% | 7.00% |

| The Gabelli SRI Fund, Inc. - Class A (includes sales charge) | (0.14)% | 18.89% | 7.31% | 6.37% |

| S&P 500 Index | 10.42% | 36.35% | 15.98% | 13.38% |

| MSCI ACWI SRI Index | 9.89% | 30.79% | 13.57% | 10.88% |

- Total Net Assets$24,442,488

- Number of Portfolio Holdings139

- Portfolio Turnover Rate15%

- Management Fees$(42,053)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Xylem Inc. | 3.5% |

| NextEra Energy Inc. | 3.3% |

| Nestlé SA | 3.2% |

| Sony Group Corp. | 2.8% |

| CNH Industrial NV | 2.7% |

| S&P Global Inc. | 2.5% |

| Spectrum Brands Holdings Inc. | 2.4% |

| BellRing Brands Inc. | 2.2% |

| ABB Ltd. | 2.1% |

| American Express Co. | 2.0% |

Portfolio Weighting (% of net assets)

| Common Stocks | 97.4% |

| U.S. Government Obligations | 2.1% |

| Other Assets and Liabilities (Net) | 0.5% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Financial Services | 24.3% |

| Food | 10.0% |

| Consumer Products | 7.3% |

| Machinery | 6.6% |

| Health Care | 6.3% |

| Computer Software and Services | 4.7% |

| Building and Construction | 3.9% |

| Environmental Services | 3.9% |

| Other Industry sectors | 32.5% |

| Other Assets and Liabilities (Net) | 0.5% |

The Gabelli SRI Fund, Inc.

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

Not applicable

| Item 3. | Audit Committee Financial Expert. |

Not applicable

| Item 4. | Principal Accountant Fees and Services. |

Not applicable.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| (a) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file its most recent annual or semi-annual financial statements required, and for the periods specified, by Regulation S-X. |

The semi-annual financial statements are attached herewith.

Gabelli SRI Fund, Inc.

Semiannual Report — September 30, 2024

(Y)our Portfolio Management Team

| |  | |  | |  |

Christopher J. Marangi

Co-Chief Investment Officer

BA, Williams College

MBA, Columbia

Business School | | Kevin V. Dreyer

Co-Chief Investment Officer

BSE, University of

Pennsylvania

MBA, Columbia

Business School | | Ian Lapey

Portfolio Manager

BA, Williams College

MS, Northeastern

University

MBA, New York

University | | Melody Prenner Bryant

Portfolio Manager

BA, Binghamton University |

To Our Shareholders,

For the six months ended September 30, 2024, the net asset value (NAV) total return per Class AAA Share of the Gabelli SRI Fund was 6.0% compared with a total return of 10.4% for the Standard & Poor’s (S&P) 500 Index. Other classes of shares are available.

Enclosed are the financial statements, including the schedule of investments, as of September 30, 2024.

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of September 30, 2024:

The Gabelli SRI Fund, Inc.

| Financial Services | | | 24.3 | % |

| Food | | | 10.0 | % |

| Consumer Products | | | 7.3 | % |

| Machinery | | | 6.6 | % |

| Health Care | | | 6.3 | % |

| Computer Software and Services | | | 4.7 | % |

| Building and Construction | | | 3.9 | % |

| Environmental Services | | | 3.9 | % |

| Entertainment | | | 3.8 | % |

| Energy and Utilities | | | 3.7 | % |

| Automotive | | | 3.1 | % |

| Semiconductors | | | 2.9 | % |

| Diversified Industrial | | | 2.6 | % |

| U.S. Government Obligations | | | 2.1 | % |

| Retail | | | 2.0 | % |

| Business Services | | | 1.8 | % |

| Consumer Services | | | 1.5 | % |

| Equipment and Supplies | | | 1.5 | % |

| Cable and Satellite | | | 1.5 | % |

| Computer Hardware | | | 1.5 | % |

| Broadcasting | | | 1.4 | % |

| Specialty Chemicals | | | 0.7 | % |

| Beverage | | | 0.6 | % |

| Automotive: Parts and Accessories | | | 0.6 | % |

| Real Estate Investment Trust | | | 0.4 | % |

| Telecommunications | | | 0.3 | % |

| Electronics | | | 0.3 | % |

| Transportation | | | 0.2 | % |

| Other Assets and Liabilities (Net) | | | 0.5 | % |

| | | | 100.0 | % |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

Gabelli SRI Fund, Inc.

Schedule of Investments — September 30, 2024 (Unaudited)

| Shares | | | | | Cost | | | Market

Value | |

| | | | | COMMON STOCKS — 97.4% | | | | | | | | |

| | | | | Automotive — 3.1% | | | | | | | | |

| | 8,641 | | | Daimler Truck Holding AG | | $ | 228,506 | | | $ | 323,478 | |

| | 1,900 | | | Mercedes-Benz Group AG | | | 89,035 | | | | 122,754 | |

| | 1,700 | | | Toyota Motor Corp., ADR | | | 202,218 | | | | 303,569 | |

| | | | | | | | 519,759 | | | | 749,801 | |

| | | | | Automotive: Parts and Accessories — 0.6% | | | | | | | | |

| | 1,000 | | | Genuine Parts Co. | | | 136,015 | | | | 139,680 | |

| | | | | | | | | | | | | |

| | | | | Beverage — 0.6% | | | | | | | | |

| | 1,000 | | | Danone SA | | | 64,474 | | | | 72,733 | |

| | 1,135 | | | The Coca-Cola Co. | | | 52,865 | | | | 81,561 | |

| | | | | | | | 117,339 | | | | 154,294 | |

| | | | | Broadcasting — 1.4% | | | | | | | | |

| | 4,001 | | | Sirius XM Holdings Inc. | | | 105,465 | | | | 94,618 | |

| | 15,000 | | | TEGNA Inc. | | | 239,214 | | | | 236,700 | |

| | | | | | | | 344,679 | | | | 331,318 | |

| | | | | Building and Construction — 3.9% | | | | | | | | |

| | 1,500 | | | Arcosa Inc. | | | 122,100 | | | | 142,140 | |

| | 13,550 | | | Canfor Corp.† | | | 156,557 | | | | 170,621 | |

| | 1,020 | | | Cavco Industries Inc.† | | | 201,514 | | | | 436,805 | |

| | 1,780 | | | Johnson Controls International plc | | | 56,565 | | | | 138,146 | |

| | 375 | | | Lennar Corp., Cl. A | | | 69,183 | | | | 70,305 | |

| | | | | | | | 605,919 | | | | 958,017 | |

| | | | | Business Services — 1.8% | | | | | | | | |

| | 205 | | | Aon plc, Cl. A | | | 60,711 | | | | 70,928 | |

| | 212 | | | Mastercard Inc., Cl. A | | | 78,279 | | | | 104,686 | |

| | 500 | | | UL Solutions Inc., Cl. A | | | 14,000 | | | | 24,650 | |

| | 5,000 | | | Vestis Corp. | | | 63,876 | | | | 74,500 | |

| | 600 | | | Visa Inc., Cl. A | | | 128,130 | | | | 164,970 | |

| | | | | | | | 344,996 | | | | 439,734 | |

| | | | | Cable and Satellite — 1.5% | | | | | | | | |

| | 8,760 | | | Comcast Corp., Cl. A | | | 188,613 | | | | 365,905 | |

| | | | | | | | | | | | | |

| | | | | Computer Hardware — 1.5% | | | | | | | | |

| | 755 | | | Apple Inc. | | | 140,166 | | | | 175,915 | |

| | 830 | | | International Business Machines Corp. | | | 102,501 | | | | 183,496 | |

| | | | | | | | 242,667 | | | | 359,411 | |

| | | | | Computer Software and Services — 4.7% | | | | | | | | |

| | 1,505 | | | Alphabet Inc., Cl. A | | | 83,447 | | | | 249,604 | |

| | 145 | | | Cadence Design Systems Inc.† | | | 27,056 | | | | 39,300 | |

| | 2,060 | | | Cisco Systems Inc. | | | 92,278 | | | | 109,633 | |

| | 1,500 | | | Dassault Systemes SE | | | 57,159 | | | | 59,492 | |

| | 1,200 | | | Gen Digital Inc. | | | 20,827 | | | | 32,916 | |

| | 5,000 | | | Hewlett Packard Enterprise Co. | | | 64,974 | | | | 102,300 | |

| | 404 | | | Microsoft Corp. | | | 53,398 | | | | 173,841 | |

| Shares | | | | | Cost | | | Market

Value | |

| | 570 | | | Oracle Corp. | | $ | 60,850 | | | $ | 97,128 | |

| | 218 | | | Palo Alto Networks Inc.† | | | 59,638 | | | | 74,513 | |

| | 200 | | | Rockwell Automation Inc. | | | 47,134 | | | | 53,692 | |

| | 330 | | | Salesforce Inc. | | | 62,714 | | | | 90,324 | |

| | 605 | | | Snowflake Inc., Cl. A† | | | 95,023 | | | | 69,490 | |

| | | | | | | | 724,498 | | | | 1,152,233 | |

| | | | | Consumer Products — 7.3% | | | | | | | | |

| | 3,000 | | | Church & Dwight Co. Inc. | | | 277,886 | | | | 314,160 | |

| | 5,000 | | | Edgewell Personal Care Co. | | | 204,292 | | | | 181,700 | |

| | 7,140 | | | Sony Group Corp., ADR | | | 166,776 | | | | 689,510 | |

| | 6,200 | | | Spectrum Brands Holdings Inc. | | | 514,190 | | | | 589,868 | |

| | | | | | | | 1,163,144 | | | | 1,775,238 | |

| | | | | Consumer Services — 1.5% | | | | | | | | |

| | 570 | | | Amazon.com Inc.† | | | 101,279 | | | | 106,208 | |

| | 4,000 | | | API Group Corp.† | | | 147,615 | | | | 132,080 | |

| | 7,000 | | | Resideo Technologies Inc.† | | | 64,629 | | | | 140,980 | |

| | | | | | | | 313,523 | | | | 379,268 | |

| | | | | Diversified Industrial — 2.6% | | | | | | | | |

| | 9,050 | | | ABB Ltd., ADR | | | 219,065 | | | | 524,176 | |

| | 290 | | | Eaton Corp. plc | | | 46,575 | | | | 96,118 | |

| | 500 | | | Flex Ltd.† | | | 6,356 | | | | 16,715 | |

| | | | | | | | 271,996 | | | | 637,009 | |

| | | | | Electronics — 0.3% | | | | | | | | |

| | 135 | | | Thermo Fisher Scientific Inc. | | | 75,429 | | | | 83,507 | |

| | | | | | | | | | | | | |

| | | | | Energy and Utilities — 3.7% | | | | | | | | |

| | 9,500 | | | NextEra Energy Inc. | | | 366,492 | | | | 803,035 | |

| | 1,170 | | | Sempra | | | 87,652 | | | | 97,847 | |

| | | | | | | | 454,144 | | | | 900,882 | |

| | | | | Entertainment — 3.8% | | | | | | | | |

| | 7,000 | | | Atlanta Braves Holdings Inc., Cl. C† | | | 249,941 | | | | 278,600 | |

| | 1,520 | | | Madison Square Garden Sports Corp.† | | | 250,817 | | | | 316,555 | |

| | 1,025 | | | The Walt Disney Co. | | | 113,604 | | | | 98,595 | |

| | 18,000 | | | Vivendi SE | | | 208,753 | | | | 207,981 | |

| | 2,400 | | | Vivendi SE, ADR | | | 25,046 | | | | 27,600 | |

| | | | | | | | 848,161 | | | | 929,331 | |

| | | | | Environmental Services — 3.9% | | | | | | | | |

| | 650 | | | Ecolab Inc. | | | 99,267 | | | | 165,964 | |

| | 565 | | | Veralto Corp. | | | 41,197 | | | | 63,201 | |

| | 2,250 | | | Waste Connections Inc. | | | 65,922 | | | | 402,345 | |

| | 1,500 | | | Waste Management Inc. | | | 238,255 | | | | 311,400 | |

| | | | | | | | 444,641 | | | | 942,910 | |

| | | | | Equipment and Supplies — 1.5% | | | | | | | | |

| | 10,000 | | | Mueller Water Products Inc., Cl. A | | | 32,736 | | | | 217,000 | |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Schedule of Investments (Continued) — September 30, 2024 (Unaudited)

| Shares | | | | | Cost | | | Market

Value | |

| | | | | COMMON STOCKS (Continued) | | | | | | | | |

| | | | | Equipment and Supplies (Continued) | | | | | | | | |

| | 133 | | | Parker-Hannifin Corp. | | $ | 15,242 | | | $ | 84,032 | |

| | 250 | | | Valmont Industries Inc. | | | 51,295 | | | | 72,488 | |

| | | | | | | | 99,273 | | | | 373,520 | |

| | | | | Financial Services — 24.3% | | | | | | | | |

| | 20,730 | | | Aegon Ltd. | | | 85,429 | | | | 133,100 | |

| | 3,410 | | | Ally Financial Inc. | | | 90,233 | | | | 121,362 | |

| | 1,800 | | | American Express Co. | | | 158,001 | | | | 488,160 | |

| | 2,150 | | | Axis Capital Holdings Ltd. | | | 116,014 | | | | 171,161 | |

| | 32,700 | | | Banco Bilbao Vizcaya Argentaria SA | | | 176,679 | | | | 353,371 | |

| | 18,500 | | | Barclays plc | | | 35,635 | | | | 55,539 | |

| | 1,170 | | | Capital One Financial Corp. | | | 107,599 | | | | 175,184 | |

| | 4,135 | | | Citigroup Inc. | | | 209,634 | | | | 258,851 | |

| | 25,000 | | | Commerzbank AG | | | 174,434 | | | | 459,870 | |

| | 4,296 | | | Credit Agricole SA | | | 45,820 | | | | 65,634 | |

| | 42,100 | | | Daiwa Securities Group Inc. | | | 206,712 | | | | 294,385 | |

| | 116 | | | Diamond Hill Investment Group Inc. | | | 17,891 | | | | 18,747 | |

| | 3,200 | | | First American Financial Corp. | | | 175,617 | | | | 211,232 | |

| | 135 | | | First Citizens BancShares Inc., Cl. A | | | 185,394 | | | | 248,528 | |

| | 1,650 | | | Flushing Financial Corp. | | | 19,324 | | | | 24,057 | |

| | 18,200 | | | ING Groep NV | | | 139,137 | | | | 329,700 | |

| | 645 | | | Intercontinental Exchange Inc. | | | 78,675 | | | | 103,613 | |

| | 1,900 | | | Janus Henderson Group plc | | | 51,141 | | | | 72,333 | |

| | 520 | | | KKR & Co. Inc. | | | 49,260 | | | | 67,902 | |

| | 525 | | | Lineage Inc., REIT | | | 45,895 | | | | 41,149 | |

| | 2,750 | | | Moelis & Co., Cl. A | | | 97,695 | | | | 188,403 | |

| | 760 | | | Morgan Stanley | | | 59,757 | | | | 79,222 | |

| | 20,400 | | | NatWest Group plc | | | 58,511 | | | | 93,795 | |

| | 3,026 | | | NN Group NV | | | 116,655 | | | | 150,837 | |

| | 1,630 | | | PayPal Holdings Inc.† | | | 83,320 | | | | 127,189 | |

| | 1,170 | | | S&P Global Inc. | | | 389,720 | | | | 604,445 | |

| | 2,950 | | | Shinhan Financial Group Co. Ltd., ADR | | | 79,487 | | | | 124,992 | |

| | 19,000 | | | Standard Chartered plc | | | 117,134 | | | | 201,438 | |

| | 2,750 | | | State Street Corp. | | | 148,280 | | | | 243,293 | |

| | 2,450 | | | The Bank of New York Mellon Corp. | | | 101,967 | | | | 176,057 | |

| | 1,425 | | | The Charles Schwab Corp. | | | 93,206 | | | | 92,354 | |

| | 4,800 | | | TrustCo Bank Corp. NY | | | 146,426 | | | | 158,736 | |

| | | | | | | | 3,660,682 | | | | 5,934,639 | |

| | | | | Food — 10.0% | | | | | | | | |

| | 9,000 | | | BellRing Brands Inc.† | | | 404,342 | | | | 546,480 | |

| | 5,000 | | | Campbell Soup Co. | | | 222,459 | | | | 244,600 | |

| | 300 | | | Lamb Weston Holdings Inc. | | | 24,172 | | | | 19,422 | |

| Shares | | | | | Cost | | | Market

Value | |

| | 5,000 | | | Mondelēz International Inc., Cl. A | | $ | 141,610 | | | $ | 368,350 | |

| | 7,820 | | | Nestlé SA | | | 444,431 | | | | 785,003 | |

| | 6,000 | | | The Kraft Heinz Co. | | | 233,540 | | | | 210,660 | |

| | 4,000 | | | The Simply Good Foods Co.† | | | 141,520 | | | | 139,080 | |

| | 2,100 | | | Unilever plc, ADR | | | 66,683 | | | | 136,416 | |

| | | | | | | | 1,678,757 | | | | 2,450,011 | |

| | | | | Health Care — 6.3% | | | | | | | | |

| | 3,700 | | | AbCellera Biologics Inc.† | | | 14,592 | | | | 9,620 | |

| | 880 | | | AstraZeneca plc, ADR | | | 69,120 | | | | 68,561 | |

| | 300 | | | Becton Dickinson & Co. | | | 67,538 | | | | 72,330 | |

| | 950 | | | Bristol-Myers Squibb Co. | | | 42,681 | | | | 49,153 | |

| | 400 | | | Cytokinetics Inc.† | | | 22,237 | | | | 21,120 | |

| | 75 | | | Eli Lilly & Co. | | | 42,785 | | | | 66,445 | |

| | 1,850 | | | Guardant Health Inc.† | | | 42,563 | | | | 42,439 | |

| | 213 | | | HCA Healthcare Inc. | | | 22,136 | | | | 86,570 | |

| | 2,000 | | | Henry Schein Inc.† | | | 117,234 | | | | 145,800 | |

| | 490 | | | Illumina Inc.† | | | 51,717 | | | | 63,901 | |

| | 1,220 | | | Merck & Co. Inc. | | | 107,465 | | | | 138,543 | |

| | 2,650 | | | Pfizer Inc. | | | 73,879 | | | | 76,691 | |

| | 102 | | | Regeneron Pharmaceuticals Inc.† | | | 88,775 | | | | 107,226 | |

| | 1,365 | | | Solventum Corp.† | | | 86,505 | | | | 95,168 | |

| | 725 | | | The Cigna Group | | | 166,067 | | | | 251,169 | |

| | 205 | | | Vertex Pharmaceuticals Inc.† | | | 57,166 | | | | 95,341 | |

| | 765 | | | Zoetis Inc. | | | 37,101 | | | | 149,466 | |

| | | | | | | | 1,109,561 | | | | 1,539,543 | |

| | | | | Machinery — 6.6% | | | | | | | | |

| | 230 | | | Caterpillar Inc. | | | 33,839 | | | | 89,957 | |

| | 60,850 | | | CNH Industrial NV | | | 476,577 | | | | 675,435 | |

| | 6,290 | | | Xylem Inc. | | | 121,101 | | | | 849,339 | |

| | | | | | | | 631,517 | | | | 1,614,731 | |

| | | | | Real Estate Investment Trust — 0.4% | | | | | | | | |

| | 795 | | | Prologis Inc. | | | 95,124 | | | | 100,393 | |

| | | | | | | | | | | | | |

| | | | | Retail — 2.0% | | | | | | | | |

| | 1,435 | | | Lowe’s Companies Inc. | | | 142,723 | | | | 388,670 | |

| | 945 | | | NIKE Inc., Cl. B | | | 82,899 | | | | 83,538 | |

| | 140 | | | Target Corp. | | | 18,840 | | | | 21,820 | |

| | | | | | | | 244,462 | | | | 494,028 | |

| | | | | Semiconductors — 2.9% | | | | | | | | |

| | 180 | | | ARM Holdings plc, ADR† | | | 15,865 | | | | 25,742 | |

| | 605 | | | Broadcom Inc. | | | 31,209 | | | | 104,363 | |

| | 1,800 | | | Intel Corp. | | | 74,748 | | | | 42,228 | |

| | 595 | | | Micron Technology Inc. | | | 66,597 | | | | 61,707 | |

| | 914 | | | NVIDIA Corp. | | | 6,717 | | | | 110,996 | |

| | 465 | | | QUALCOMM Inc. | | | 65,737 | | | | 79,073 | |

| | 563 | | | Teradyne Inc. | | | 49,930 | | | | 75,403 | |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Schedule of Investments (Continued) — September 30, 2024 (Unaudited)

| | | | | | | | | Market | |

| Shares | | | | | Cost | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | | | | | |

| | | | | Semiconductors (Continued) | | | | | | | | |

| | 965 | | | Texas Instruments Inc. | | $ | 190,430 | | | $ | 199,340 | |

| | | | | | | | 501,233 | | | | 698,852 | |

| | | | | Specialty Chemicals — 0.7% | | | | | | | | |

| | 280 | | | Air Products and Chemicals Inc. | | | 71,625 | | | | 83,367 | |

| | 920 | | | DuPont de Nemours Inc. | | | 74,343 | | | | 81,981 | |

| | | | | | | | 145,968 | | | | 165,348 | |

| | | | | Telecommunications — 0.3% | | | | | | | | |

| | 360 | | | American Tower Corp., REIT | | | 74,298 | | | | 83,722 | |

| | | | | | | | | | | | | |

| | | | | Transportation — 0.2% | | | | | | | | |

| | 240 | | | Union Pacific Corp. | | | 54,816 | | | | 59,155 | |

| | | | | | | | | | | | | |

| | | | | TOTAL COMMON STOCKS | | | 15,091,214 | | | | 23,812,480 | |

| Principal | | | | | | | | | |

| Amount | | | | | | | | | |

| | | | | U.S. GOVERNMENT OBLIGATIONS — 2.1% | | | | | | | |

| $ | 510,000 | | | U.S. Treasury Bills, | | | | | | | |

| | | | | 4.789% to 5.260%††, 10/10/24 to 12/12/24 | | | 506,654 | | | 506,909 | |

| | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.5% | | $ | 15,597,868 | | | 24,319,389 | |

| | | | | | | | | | | | |

| | | | | Other Assets and Liabilities (Net) — 0.5% | | | | | | 123,099 | |

| | | | | | | | | | | | |

| | | | | NET ASSETS — 100.0% | | | | | $ | 24,442,488 | |

| † | Non-income producing security. |

| †† | Represents annualized yields at dates of purchase. |

| | |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Statement of Assets and Liabilities

September 30, 2024 (Unaudited)

| Assets: | | | | |

| Investments, at value (cost $15,597,868) | | $ | 24,319,389 | |

| Cash | | | 66,675 | |

| Deposit at brokers | | | 1,716 | |

| Receivable for investments sold | | | 25,608 | |

| Receivable for Fund shares sold | | | 411 | |

| Receivable from Adviser | | | 26,436 | |

| Dividends and interest receivable | | | 74,217 | |

| Prepaid expenses | | | 21,913 | |

| Total Assets | | | 24,536,365 | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 8,060 | |

| Payable for investment advisory fees | | | 19,741 | |

| Payable for distribution fees | | | 3,027 | |

| Payable for payroll expenses | | | 643 | |

| Payable for legal and audit fees | | | 27,897 | |

| Payable for shareholder communications | | | 15,834 | |

| Other accrued expenses | | | 18,675 | |

| Total Liabilities | | | 93,877 | |

| Commitments and Contingencies (See Note 3) | | | | |

Net Assets

(applicable to 1,693,595 shares outstanding) | | $ | 24,442,488 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 13,094,505 | |

| Total distributable earnings | | | 11,347,983 | |

| Net Assets | | $ | 24,442,488 | |

| | | | | |

| Shares of Capital Stock, each at $0.001 par value: | | | | |

| Class AAA: | | | | |

| Net Asset Value, offering, and redemption price per share ($6,042,994 ÷ 424,140 shares outstanding) | | $ | 14.25 | |

| Class A: | | | | |

| Net Asset Value and redemption price per share ($7,863,154 ÷ 552,627 shares outstanding) | | $ | 14.23 | |

| Maximum offering price per share (NAV ÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | $ | 15.10 | |

| Class C: | | | | |

| Net Asset Value and redemption price per share ($263,787 ÷ 21,258 shares outstanding) | | $ | 12.41 | |

| Class I: | | | | |

| Net Asset Value, offering, and redemption price per share ($10,272,553 ÷ 695,570 shares outstanding) | | $ | 14.77 | |

Statement of Operations

For the Six Months Ended September 30, 2024 (Unaudited)

| Investment Income: | | | | |

| Dividends (net of foreign withholding taxes of $24,707) | | $ | 253,123 | |

| Interest | | | 13,334 | |

| Total Investment Income | | | 266,457 | |

| Expenses: | | | | |

| Investment advisory fees | | | 119,638 | |

| Distribution fees - Class AAA | | | 7,509 | |

| Distribution fees - Class A | | | 9,511 | |

| Distribution fees - Class C | | | 1,843 | |

| Legal and audit fees | | | 42,657 | |

| Registration expenses | | | 30,190 | |

| Shareholder communications expenses | | | 23,741 | |

| Shareholder services fees | | | 8,985 | |

| Directors’ fees | | | 8,000 | |

| Custodian fees | | | 7,175 | |

| Payroll expenses | | | 1,087 | |

| Interest expense | | | 285 | |

| Miscellaneous expenses | | | 9,854 | |

| Total Expenses | | | 270,475 | |

| Less: | | | | |

| Expense reimbursements by Adviser (See Note 3) | | | (161,691 | ) |

| Expenses paid indirectly by broker (See Note 6) | | | (825 | ) |

| Total credits and reimbursements | | | (162,516 | ) |

| Net Expenses | | | 107,959 | |

| Net Investment Income | | | 158,498 | |

| | | | | |

| Net Realized and Unrealized Gain on Investments and Foreign Currency: | | | | |

| Net realized gain on investments | | | 1,132,592 | |

| Net realized gain on foreign currency transactions | | | 5,074 | |

| Net realized gain on investments and foreign currency transactions | | | 1,137,666 | |

| Net change in unrealized appreciation/depreciation: | | | | |

| on investments | | | 73,369 | |

| on foreign currency translations | | | 562 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | 73,931 | |

| Net Realized and Unrealized Gain on Investments and Foreign Currency | | | 1,211,597 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 1,370,095 | |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Statement of Changes in Net Assets

| | | Six Months Ended

September 30,

2024

(Unaudited) | | | Year Ended

March 31,

2024 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 158,498 | | | $ | 336,952 | |

| Net realized gain on investments and foreign currency transactions | | | 1,137,666 | | | | 1,999,971 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | 73,931 | | | | 1,148,709 | |

| Net Increase in Net Assets Resulting from Operations | | | 1,370,095 | | | | 3,485,632 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Accumulated earnings | | | | | | | | |

| Class AAA | | | — | | | | (269,758 | ) |

| Class A | | | — | | | | (277,473 | ) |

| Class C | | | — | | | | (26,127 | ) |

| Class I | | | — | | | | (350,754 | ) |

| Total Distributions to Shareholders | | | — | | | | (924,112 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Class AAA | | | (560,841 | ) | | | (2,253,323 | ) |

| Class A | | | (195,960 | ) | | | (661,024 | ) |

| Class C | | | (376,666 | ) | | | (231,021 | ) |

| Class I | | | (349,739 | ) | | | (1,689,552 | ) |

| Net Decrease in Net Assets from Capital Share Transactions | | | (1,483,206 | ) | | | (4,834,920 | ) |

| | | | | | | | | |

| Net Decrease in Net Assets | | | (113,111 | ) | | | (2,273,400 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 24,555,599 | | | | 26,828,999 | |

| End of period | | $ | 24,442,488 | | | $ | 24,555,599 | |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Financial Highlights

Selected data for a share of capital stock outstanding throughout each period:

| | | | | | | Income (Loss) from Investment Operations | | | Distributions | | | | | | | | | | | | | Ratios to Average Net Assets/Supplemental Data | |

| Year Ended March 31 | | Net Asset Value,

Beginning

of Year | | | Net Investment Income(a) | | | Net Realized

and Unrealized

Gain (Loss) on

Investments | | | Total from Investment Operations | | | Net Investment Income | | | Net Realized Gain on Investments | | | Total

Distributions | | | Redemption Fees(a) | | | Net Asset Value,

End of Period | | | Total

Return† | | | Net Assets, End of Period (in 000’s) | | | Net Investment Income | | | Operating Expenses Before Reimbursement(b) | | | Operating Expenses

Net of Reimbursement | | | Portfolio Turnover

Rate | |

| Class AAA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025(c) | | $ | 13.45 | | | $ | 0.09 | | | $ | 0.71 | | | $ | 0.80 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 14.25 | | | | 5.95 | % | | $ | 6,043 | | | | 1.33 | %(d) | | | 2.35 | %(d) | | | 0.90 | %(d) | | | 15 | % |

| 2024 | | | 12.11 | | | | 0.17 | | | | 1.65 | | | | 1.82 | | | | (0.17 | ) | | | (0.31 | ) | | | (0.48 | ) | | | — | | | | 13.45 | | | | 15.67 | | | | 6,265 | | | | 1.38 | | | | 2.59 | | | | 0.90 | | | | 27 | |

| 2023 | | | 13.63 | | | | 0.13 | | | | (1.07 | ) | | | (0.94 | ) | | | (0.23 | ) | | | (0.35 | ) | | | (0.58 | ) | | | — | | | | 12.11 | | | | (6.77 | ) | | | 7,818 | | | | 1.09 | | | | 2.19 | | | | 0.90 | | | | 25 | |

| 2022 | | | 15.25 | | | | 0.08 | | | | 0.44 | | | | 0.52 | | | | (0.23 | ) | | | (1.91 | ) | | | (2.14 | ) | | | — | | | | 13.63 | | | | 2.53 | | | | 9,982 | | | | 0.52 | | | | 1.85 | | | | 0.90 | | | | 34 | |

| 2021 | | | 10.40 | | | | 0.19 | | | | 5.73 | | | | 5.92 | | | | (0.09 | ) | | | (0.98 | ) | | | (1.07 | ) | | | — | | | | 15.25 | | | | 58.17 | | | | 10,547 | | | | 1.42 | | | | 1.91 | | | | 0.90 | | | | 18 | |

| 2020 | | | 14.03 | | | | 0.16 | (e) | | | (1.59 | ) | | | (1.43 | ) | | | (0.09 | ) | | | (2.11 | ) | | | (2.20 | ) | | | 0.00 | (f) | | | 10.40 | | | | (13.50 | ) | | | 7,530 | | | | 1.13 | (e) | | | 1.92 | | | | 1.14 | | | | 18 | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025(c) | | $ | 13.43 | | | $ | 0.09 | | | $ | 0.71 | | | $ | 0.80 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 14.23 | | | | 5.96 | % | | $ | 7,863 | | | | 1.30 | %(d) | | | 2.35 | %(d) | | | 0.90 | %(d) | | | 15 | % |

| 2024 | | | 12.10 | | | | 0.16 | | | | 1.66 | | | | 1.82 | | | | (0.17 | ) | | | (0.32 | ) | | | (0.49 | ) | | | — | | | | 13.43 | | | | 15.60 | | | | 7,620 | | | | 1.33 | | | | 2.59 | | | | 0.90 | | | | 27 | |

| 2023 | | | 13.61 | | | | 0.13 | | | | (1.06 | ) | | | (0.93 | ) | | | (0.23 | ) | | | (0.35 | ) | | | (0.58 | ) | | | — | | | | 12.10 | | | | (6.71 | ) | | | 7,507 | | | | 1.10 | | | | 2.19 | | | | 0.90 | | | | 25 | |

| 2022 | | | 15.23 | | | | 0.09 | | | | 0.43 | | | | 0.52 | | | | (0.23 | ) | | | (1.91 | ) | | | (2.14 | ) | | | — | | | | 13.61 | | | | 2.54 | | | | 10,647 | | | | 0.54 | | | | 1.85 | | | | 0.90 | | | | 34 | |

| 2021 | | | 10.39 | | | | 0.19 | | | | 5.72 | | | | 5.91 | | | | (0.09 | ) | | | (0.98 | ) | | | (1.07 | ) | | | — | | | | 15.23 | | | | 58.13 | | | | 11,335 | | | | 1.41 | | | | 1.91 | | | | 0.90 | | | | 18 | |

| 2020 | | | 14.02 | | | | 0.15 | (e) | | | (1.58 | ) | | | (1.43 | ) | | | (0.09 | ) | | | (2.11 | ) | | | (2.20 | ) | | | 0.00 | (f) | | | 10.39 | | | | (13.51 | ) | | | 7,455 | | | | 1.11 | (e) | | | 1.92 | | | | 1.13 | | | | 18 | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025(c) | | $ | 11.71 | | | $ | 0.11 | | | $ | 0.59 | | | $ | 0.70 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 12.41 | | | | 5.98 | % | | $ | 264 | | | | 1.87 | %(d) | | | 3.10 | %(d) | | | 0.90 | %(d) | | | 15 | % |

| 2024 | | | 10.57 | | | | 0.15 | | | | 1.43 | | | | 1.58 | | | | (0.17 | ) | | | (0.27 | ) | | | (0.44 | ) | | | — | | | | 11.71 | | | | 15.63 | | | | 628 | | | | 1.37 | | | | 3.34 | | | | 0.90 | | | | 27 | |

| 2023 | | | 11.93 | | | | 0.12 | | | | (0.94 | ) | | | (0.82 | ) | | | (0.23 | ) | | | (0.31 | ) | | | (0.54 | ) | | | — | | | | 10.57 | | | | (6.76 | ) | | | 793 | | | | 1.13 | | | | 2.94 | | | | 0.90 | | | | 25 | |

| 2022 | | | 13.59 | | | | 0.10 | | | | 0.38 | | | | 0.48 | | | | (0.23 | ) | | | (1.91 | ) | | | (2.14 | ) | | | — | | | | 11.93 | | | | 2.55 | | | | 1,679 | | | | 0.70 | | | | 2.59 | | | | 0.90 | | | | 34 | |

| 2021 | | | 9.35 | | | | 0.17 | | | | 5.14 | | | | 5.31 | | | | (0.09 | ) | | | (0.98 | ) | | | (1.07 | ) | | | — | | | | 13.59 | | | | 58.18 | | | | 3,040 | | | | 1.44 | | | | 2.66 | | | | 0.90 | | | | 18 | |

| 2020 | | | 12.80 | | | | 0.08 | (e) | | | (1.42 | ) | | | (1.34 | ) | | | — | | | | (2.11 | ) | | | (2.11 | ) | | | 0.00 | (f) | | | 9.35 | | | | (13.93 | ) | | | 4,022 | | | | 0.60 | (e) | | | 2.67 | | | | 1.68 | | | | 18 | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025(c) | | $ | 13.94 | | | $ | 0.09 | | | $ | 0.74 | | | $ | 0.83 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 14.77 | | | | 5.95 | % | | $ | 10,272 | | | | 1.32 | %(d) | | | 2.10 | %(d) | | | 0.90 | %(d) | | | 15 | % |

| 2024 | | | 12.55 | | | | 0.17 | | | | 1.72 | | | | 1.89 | | | | (0.17 | ) | | | (0.33 | ) | | | (0.50 | ) | | | — | | | | 13.94 | | | | 15.63 | | | | 10,043 | | | | 1.37 | | | | 2.34 | | | | 0.90 | | | | 27 | |

| 2023 | | | 14.11 | | | | 0.14 | | | | (1.11 | ) | | | (0.97 | ) | | | (0.23 | ) | | | (0.36 | ) | | | (0.59 | ) | | | — | | | | 12.55 | | | | (6.73 | ) | | | 10,711 | | | | 1.09 | | | | 1.94 | | | | 0.90 | | | | 25 | |

| 2022 | | | 15.72 | | | | 0.08 | | | | 0.45 | | | | 0.53 | | | | (0.23 | ) | | | (1.91 | ) | | | (2.14 | ) | | | — | | | | 14.11 | | | | 2.52 | | | | 13,477 | | | | 0.52 | | | | 1.60 | | | | 0.90 | | | | 34 | |

| 2021 | | | 10.70 | | | | 0.19 | | | | 5.90 | | | | 6.09 | | | | (0.09 | ) | | | (0.98 | ) | | | (1.07 | ) | | | — | | | | 15.72 | | | | 58.13 | | | | 13,618 | | | | 1.41 | | | | 1.66 | | | | 0.90 | | | | 18 | |

| 2020 | | | 14.38 | | | | 0.19 | (e) | | | (1.64 | ) | | | (1.45 | ) | | | (0.12 | ) | | | (2.11 | ) | | | (2.23 | ) | | | 0.00 | (f) | | | 10.70 | | | | (13.32 | ) | | | 9,995 | | | | 1.30 | (e) | | | 1.67 | | | | 0.97 | | | | 18 | |

| † | Total return represents aggregate total return of a hypothetical investment at the beginning of the year and sold at the end of the period including reinvestment of distributions and does not reflect the applicable sales charges. Total return for a period of less than one year is not annualized. |

| (a) | Per share amounts have been calculated using the average shares outstanding method. |

| (b) | The Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. For all periods presented, there was no impact on the expense ratios. |

| (c) | For the six months ended September 30, 2024, unaudited. |

| (d) | Annualized. |

| (e) | Includes income resulting from special dividends. Without these dividends, the per share income amounts would have been $0.13 (Class AAA and Class A), $0.05 (Class C), and $0.16 (Class I), respectively, and the net investment income ratio would have been 0.94% (Class AAA), 0.92% (Class A), 0.42% (Class C), and 1.12% (Class I), respectively. |

| (f) | Amount represents less than $0.005 per share. |

See accompanying notes to financial statements.

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited)

1. Organization. The Gabelli SRI Fund, Inc. was incorporated on March 1, 2007 in Maryland. The Fund is a diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund’s primary objective is to seek capital appreciation. The Fund seeks to achieve its objective by investing substantially all, and in any case no less than 80%, of its assets in common stocks and preferred stocks of companies that meet the Fund’s guidelines for social responsibility at the time of investment. The Fund commenced investment operations on June 1, 2007.

Gabelli Funds, LLC (the “Adviser”), with its principal offices located at One Corporate Center, Rye, New York 10580-1422, serves as investment adviser to the Fund. The Adviser makes investment decisions for the Fund and continuously reviews and administers the Funds’ investment program and manages the operations of each Fund under the general supervision of the Company’s Board of Directors (the Board).

2. Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the Adviser).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt obligations for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted on such day, the security is valued using the closing bid price, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Certain securities are valued principally using dealer quotations. Futures contracts are valued at the closing settlement price of the exchange or Board of trade on which the applicable contract is traded. OTC futures and options on futures for which market quotations are readily available will be valued by quotations received from a pricing service or, if no quotations are available from a pricing service, by quotations obtained from one of more dealers in the instrument in question by the Adviser.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S.

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)

dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| ● | Level 1 — quoted prices in active markets for identical securities; |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| ● | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of September 30, 2024 is as follows:

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable

Inputs | | | Total

Market Value

at 09/30/24 | |

| INVESTMENTS IN SECURITIES: | | | | | | | | | | | | |

| ASSETS (Market Value): | | | | | | | | | | | | |

| Common Stocks (a) | | $ | 23,812,480 | | | | — | | | $ | 23,812,480 | |

| U.S. Government Obligations | | | — | | | $ | 506,909 | | | | 506,909 | |

| TOTAL INVESTMENTS IN SECURITIES – ASSETS | | $ | 23,812,480 | | | $ | 506,909 | | | $ | 24,319,389 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

Additional Information to Evaluate Qualitative Information.

General. The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser – to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds are ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation. Fair valued securities may be common or preferred equities, warrants, options, rights, or fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. When fair valuing a security, factors to consider include recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)

significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These may include backtesting the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Investments in other Investment Companies. The Fund may invest, from time to time, in shares of other investment companies (or entities that would be considered investment companies but are excluded from the definition pursuant to certain exceptions under the 1940 Act) (the Acquired Funds) in accordance with the 1940 Act and related rules. Shareholders in the Fund would bear the pro rata portion of the periodic expenses of the Acquired Funds in addition to the Fund’s expenses. During the six months ended September 30, 2024, the Fund did not incur periodic expenses charged by Acquired Funds.

Securities Sold Short. The Fund may enter into short sale transactions. Short selling involves selling securities that may or may not be owned and, at times, borrowing the same securities for delivery to the purchaser, with an obligation to replace such borrowed securities at a later date. The proceeds received from short sales are recorded as liabilities and the Fund records an unrealized gain or loss to the extent of the difference between the proceeds received and the value of an open short position on the day of determination. The Fund records a realized gain or loss when the short position is closed out. By entering into a short sale, the Fund bears the market risk of an unfavorable change in the price of the security sold short. Dividends on short sales are recorded as an expense by the Fund on the ex-dividend date and interest expense is recorded on the accrual basis. The broker retains collateral for the value of the open positions, which is adjusted periodically as the value of the position fluctuates.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at current exchange rates. Purchases and sales of investment securities, income, and expenses are translated at the exchange rate prevailing on the respective dates of such transactions. Unrealized gains and losses that result from changes in foreign exchange rates and/or changes in market prices of securities have been included in unrealized appreciation/depreciation on investments and foreign currency translations. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gain/(loss) on investments.

Foreign Securities. The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate funds, less complete financial information about companies, and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)

Foreign Taxes. The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Restricted Securities. The Fund may invest up to 15% of its net assets in securities for which the markets are restricted. Restricted securities include securities whose disposition is subject to substantial legal or contractual restrictions. The sale of restricted securities often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than the sale of securities eligible for trading on national securities exchanges or in the over-the-counter markets. Restricted securities may sell at a price lower than similar securities that are not subject to restrictions on resale. Securities freely saleable among qualified institutional investors under special rules adopted by the SEC may be treated as liquid if they satisfy liquidity standards established by the Board. The continued liquidity of such securities is not as well assured as that of publicly traded securities, and accordingly the Board will monitor their liquidity. At September 30, 2024, the Fund did not hold any restricted securities.

Securities Transactions and Investment Income. Securities transactions are accounted for on the trade date with realized gain/(loss) on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on an accrual basis. Premiums and discounts on debt securities are amortized using the effective yield to maturity method or amortized to earliest call date, if applicable. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities that are recorded as soon after the ex-dividend date as the Fund becomes aware of such dividends.

Determination of Net Asset Value and Calculation of Expenses. Certain administrative expenses are common to, and allocated among, various affiliated funds. Such allocations are made on the basis of each fund’s average net assets or other criteria directly affecting the expenses as determined by the Adviser pursuant to procedures established by the Board.

In calculating the NAV per share of each class, investment income, realized and unrealized gains and losses, redemption fees, and expenses other than class specific expenses are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day. Distribution expenses are borne solely by the class incurring the expense.

Distributions to Shareholders. Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities and foreign currency transactions held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Distributions from net investment income for federal income tax purposes include net realized gains on foreign currency transactions. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, adjustments are made to the appropriate capital accounts in the period when the differences arise. These reclassifications have no impact on the NAV of the Fund.

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)

The tax character of distributions paid during the fiscal year ended March 31, 2024 was as follows:

| Distributions paid from: | | | |

| Ordinary income | | $ | 319,588 | |

| Net long term capital gains | | | 604,524 | |

| Total distributions paid | | $ | 924,112 | |

Provision for Income Taxes. The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

The following summarizes the tax cost of investments and the related net unrealized appreciation at September 30, 2024:

| | | Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation | |

| Investments | | $ | 15,656,458 | | | $ | 8,894,172 | | | $ | (231,241 | ) | | $ | 8,662,931 | |

The Fund is required to evaluate tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Income tax and related interest and penalties would be recognized by the Fund as tax expense in the Statement of Operations if the tax positions were deemed not to meet the more-likely-than-not threshold. During the six months ended September 30, 2024, the Fund did not incur any income tax, interest, or penalties. As of September 30, 2024, the Adviser has reviewed all open tax years and concluded that there was no impact to the Fund’s net assets or results of operations. The Fund’s federal and state tax returns for the prior three fiscal years remain open, subject to examination. On an ongoing basis, the Adviser will monitor the Fund’s tax positions to determine if adjustments to this conclusion are necessary.

3. Investment Advisory Agreement and Other Transactions. The Fund has entered into an investment advisory agreement (the Advisory Agreement) with the Adviser which provides that the Fund will pay the Adviser a fee, computed daily and paid monthly, at the annual rate of 1.00% of the value of its average daily net assets. In accordance with the Advisory Agreement, the Adviser provides a continuous investment program for the Fund’s portfolio, oversees the administration of all aspects of the Fund’s business and affairs, and pays the compensation of all Officers and Directors of the Fund who are affiliated persons of the Adviser.

The Adviser amended its contractual agreement with respect to each share class of the Fund to waive its investment advisory fees and/or to reimburse expenses to the extent necessary to maintain the annualized total operating expenses of the Fund (excluding brokerage costs, acquired fund fees and expenses, interest, taxes, and extraordinary expenses) until at least July 29, 2025 at no more than 0.90% of the value of the Fund’s average daily net assets for each share class of the Fund. During the six months ended September 30, 2024, the Adviser reimbursed the Fund in the amount of $161,691. In addition, the Fund has agreed, during the three year period following any waiver or reimbursement by the Adviser, to repay such amount to the extent, that after giving effect to the repayment, such adjusted annualized total operating expenses of the Fund would not exceed

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)

0.90% of the value of the Fund’s average daily net assets for each share class of the Fund. The arrangement is renewable annually. At September 30, 2024, the cumulative amount which the Fund may repay the Adviser, subject to the terms above, is $878,662:

| For the fiscal year ended March 31, 2022, expiring March 31, 2025 | | $ | 354,198 | |

| For the fiscal year ended March 31, 2023, expiring March 31, 2026 | | | 362,773 | |

| For the six months ended September 30, 2024, expiring March 31, 2027 | | | 161,691 | |

| | | $ | 878,662 | |

4. Distribution Plan. The Fund’s Board has adopted a distribution plan (the Plan) for each class of shares, except for Class I Shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Class AAA, Class A, and Class C Share Plans, payments are authorized to G.distributors, LLC (the Distributor), an affiliate of the Adviser, at annual rates of 0.25%, 0.25%, and 1.00%, respectively, of the average daily net assets of those classes, the annual limitations under each Plan. Such payments are accrued daily and paid monthly.

5. Portfolio Securities. Purchases and sales of securities during the six months ended September 30, 2024, other than short term securities and U.S. Government obligations, aggregated $3,610,877 and $4,938,357, respectively.

6. Transactions with Affiliates and Other Arrangements. During the six months ended September 30, 2024, the Fund paid $746 in brokerage commissions on security trades to G.research, LLC, an affiliate of the Adviser. Additionally, the Distributor retained a total of $97 from investors representing commissions (sales charges and underwriting fees) on sales and redemptions of Fund shares.

During the six months ended September 30, 2024, the Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. The amount of such expenses paid through this directed brokerage arrangement during this period was $825.

The cost of calculating the Fund’s NAV per share is a Fund expense pursuant to the Advisory Agreement. Under the sub-administration agreement with Bank of New York Mellon, the fees paid include the cost of calculating the Fund’s NAV. The Fund reimburses the Adviser for this service. The Adviser did not seek a reimbursement during the six months ended September 30, 2024.

The Corporation pays retainer and per meeting fees to Directors not affiliated with the Adviser, plus specified amounts to the Lead Director and Audit Committee Chairman. Directors are also reimbursed for out of pocket expenses incurred in attending meetings. Directors who are directors or employees of the Adviser or an affiliated company receive no compensation or expense reimbursement from the Corporation.

7. Capital Stock. The Fund offers three classes of shares – Class AAA Shares, Class A Shares, and Class I Shares. Effective January 27, 2020, the Fund’s Class AAA, Class A, and Class C Shares were “closed to purchases from new investors”. “Closed to purchases from new investors” means (i) with respect to the Class AAA and Class A Shares, no new investors may purchase shares of such classes, but existing shareholders may continue to purchase additional shares of such classes after the Effective Date, and (ii) with respect to Class C Shares, neither new investors nor existing shareholders may purchase any additional shares of such class after the Effective Date. These changes will have no effect on existing shareholders’ ability to redeem shares of the Fund as described in the Fund’s Prospectus. Additionally on the Effective Date, Class I Shares of the Fund became available to investors with a minimum initial investment amount of $1,000 and purchasing

Gabelli SRI Fund, Inc.

Notes to Financial Statements (Unaudited) (Continued)