- V Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Visa (V) DEF 14ADefinitive proxy

Filed: 9 Dec 24, 6:55am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_______________

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

VISA INC.

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

Shareholder Letter

|  | |

John F. Lundgren Board Chair | Ryan McInerney Chief Executive Officer and Director |

| We are proud of the strong results Visa achieved while delivering on Visa’s purpose to uplift everyone, everywhere by being the best way to pay and be paid. |

Dear Fellow Shareholder,

On behalf of the Board of Directors and the management team, we want to thank you for your investment in Visa and encourage you to vote your shares by proxy at this year’s Annual Meeting. We greatly value the year-round dialogue and engagement we have with our shareholders, which continue to shape the Board’s approach to corporate governance, executive compensation, corporate responsibility, and other matters central to our long-term strategy and success.

Reflecting on 2024, we are proud of the strong results Visa achieved while operating with purpose. Our products and solutions continue to power global commerce and promote long-term value for our shareholders, and we are pleased to provide you with updates on how our Board and management team have delivered on Visa’s purpose over the past year – to uplift everyone, everywhere by being the best way to pay and be paid.

Delivering for clients and growing across business priorities

In 2024, we continued to deliver against our key growth levers with a relentless focus on serving our clients by meeting their needs, innovating, and helping them grow. As athletes and fans around the world came together for the Paris 2024 Olympic and Paralympic Games, we witnessed the power of the Visa brand and the positive impact of our innovative payment solutions. We are finding more ways to enable digital commerce, grow new flows, and drive adoption of our value-added services portfolio. As the payments and technology landscape evolves, we are committed to safely and responsibly integrating capabilities, including generative AI, into our solutions to address the needs of today and the future, and we are confident in our ability to generate value as a leader in payments.

Building the right Board that leads with independent and diverse perspectives

Over the last several years, our Board has deliberately refreshed its composition to create a Board with an appropriate mix of skills, experiences, and perspectives to oversee our company as the industry, ecosystem, and our strategy continue to evolve. We have thoughtfully added new directors who bring impressive expertise across e-commerce, marketing, and cybersecurity, with a focus on building a Board that is diverse in its composition and is accountable to Visa’s various stakeholders.

Advancing our purpose, strategy, and values

We are excited about our programs, policies, and reporting in place across initiatives most impactful to our shareholders and our long-term business success. Last year, we achieved our goals to empower people, communities, and economies, including through our work to digitally enable over 60 million small and micro businesses. We also continue to prioritize cybersecurity and ecosystem security, furthering our goal to be the best and most trusted way to pay and be paid. Our ongoing efforts to invest in our talented, engaged, and diverse global workforce reflect ambitious goals as we strive to be a force for good by operating responsibly and ethically.

Thank you for your support and for your consideration of the important matters covered in this year’s proxy statement. We, along with the rest of the Board and management team, look forward to your continued engagement as we work to connect the world and enable individuals, businesses, and economies to thrive.

|  | |

| John F. Lundgren Board Chair | Ryan McInerney Chief Executive Officer and Director |

| 2025 Proxy Statement | 1 |

Notice of 2025 Annual Meeting of Shareholders

Time Tuesday, January 28, 2025 8:30 a.m. Pacific Time (Log-in begins at 8:15 a.m.) | Voting Holders of our Class A common stock will be entitled to vote on all proposals. On or about December 9, 2024, we released the proxy materials to shareholders and sent to shareholders of our Class A common stock (other than those shareholders who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our fiscal year 2024 Annual Report, and how to vote through the Internet or by telephone. | ||||||

Location Virtual live webcast at: virtualshareholdermeeting.com/V2025 |  | By Mail. Complete, sign, and date each proxy card or voting instruction form received and return it in the prepaid envelope. |  | Via the Internet. Instructions are shown on your Notice of Internet Availability. | |||

| By Telephone. Instructions are shown on your proxy card or voting instruction form. |  | At the Annual Meeting. Instructions will be provided on the meeting website during the Annual Meeting. | ||||

Record Date December 2, 2024 | |||||||

| Items of Business | Board Recommendation | ||||

| 1 | Elect the eleven director nominees named in this proxy statement. |  | FOR | p. 10 | To participate in the virtual meeting, including to submit questions, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. Please refer to the “Attending the Meeting” section of the proxy statement for more details about attending the Annual Meeting online. Your vote is very important. By Order of the Board of Directors,  Kelly Mahon Tullier Vice Chair, Chief People and Corporate Affairs Officer, and Corporate Secretary San Francisco, California December 9, 2024 |

| 2 | Approve, on an advisory basis, the compensation paid to our named executive officers. |  | FOR | p. 54 | |

| 3 | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2025. |  | FOR | p. 100 | |

| 4-7 | Shareholder proposals, each if properly presented at the Annual Meeting. |  | AGAINST | p. 103 | |

| Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. | |||||

| Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting of Shareholders to be held on January 28, 2025. The proxy statement and Visa’s Annual Report for fiscal year 2024 are available at investor.visa.com. |

| 2 |  |

Table of Contents

| 2025 Proxy Statement | 3 |

About Visa

Visa is one of the world’s leaders in digital payments. Our purpose is to uplift everyone, everywhere by being the best way to pay and be paid. We facilitate global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions, and government entities through innovative technologies.

Since Visa’s early days in 1958, we have been in the business of facilitating payments between consumers and businesses. We are focused on extending, enhancing, and investing in our proprietary advanced transaction processing network, VisaNet, to offer a single connection point for facilitating payment transactions to multiple endpoints through cards and other form factors. As a network of networks enabling global movement of money through all available networks, we are working to provide payment solutions and services for everyone, everywhere.

Visa at a Glance

|  |  |  |

San Francisco Bay Area Headquarters | 1958 Founded | NYSE Listed (V) | 135 Global offices and data centers |

200+ countries and territories | ~31,600 Employees | 303B total transactions(1) | 4.6B payment credentials(2) |

| Visa has been recognized for its ethical and sustainable business practices. For some of our corporate recognitions, see page 45. |

Fiscal Year 2024 Performance Highlights

| Net Revenue | GAAP Net Income | Non-GAAP Net Income(3) | ||

$35.9B up 10% from prior year GAAP Earnings Per Share (EPS) | $19.7B up 14% from prior year Non-GAAP EPS(3) | $20.4B up 12% from prior year Dividends & Share Repurchases | ||

$9.73 up 17% from prior year | $10.05 up 15% from prior year | $20.9B up 30% from prior year |

| (1) | For the 12 months ended September 30, 2024; includes payments and cash transactions. |

| (2) | As of June 30, 2024. |

| (3) | For further information, including a reconciliation of our generally accepted accounting principles (GAAP) financial results to non-GAAP financial results, please see Appendix A of this proxy statement. |

| 4 |  |

| About Visa | |

Our Strategy

Visa is executing on our long-term strategy to accelerate revenue growth in consumer payments, new flows, and value-added services, and to fortify the key foundations of our business model.

Accelerate Growth

|  |  |

| Consumer Payments Strengthen Core | New Flows Expand Volumes and Transactions | Value-Added Services Drive Incremental Revenue |

| Grow both sides of the network through the expansion of credentials and acceptance points, and deepen engagement with consumers through key enablers. | Drive digitization and improve the payments and money movement experience across all payment flows, beyond consumer to business, through our network of networks. | Diversify our revenue with products and solutions that help our clients and partners optimize their performance, differentiate their offerings, and create better experiences for their customers. |

Fortify Key Foundations

|  |  |  |  |

| Network of networks | Technology platforms | Security | Brand | Talent |

| The key component of our network of networks strategy is interoperability. We are opening up our network and increasingly using other networks to reach accounts we could not otherwise reach and enabling new types of money movement. | Visa’s leading technology platforms comprise software, hardware, data centers, and a large telecommunications infrastructure. | Our in-depth, multi-layer security approach includes a formal program to devalue sensitive and/or personal data through various cryptographic means; embedded security in the software development lifecycle; identity and access management controls to protect against unauthorized access; and advanced cyber detection and response capabilities. | Visa’s strong brand helps deliver added value to our clients and their customers, financial institutions, merchants, and partners through compelling brand expressions, a wide range of products and services, as well as innovative brand and marketing efforts. | Visa strives to be the premier destination for talent in the payments industry. We aim to create a culture that prioritizes impact, growth, and inclusivity. For more information on talent and human capital management, see page 39. |

| 2025 Proxy Statement | 5 |

Proxy Voting Roadmap

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

| PROPOSAL 1 | |||

| Election of Directors The Board recommends a vote FOR each director nominee. | See page 10 | |

Key Governance Principles and Practices

We are committed to corporate governance practices that promote long-term value and strengthen Board and management accountability to our shareholders, clients, and other stakeholders.

| Independent Oversight | Accountability to Shareholders | Engaged and Effective Oversight | Other Best Practices | |||

| 91% independent director nominees | Annual director elections with majority vote standard | Average attendance of 98% at Board and committee meetings | Demonstrated commitment to Board refreshment with ongoing focus on director succession | |||

| Independent Board Chair | Annual say-on-pay vote | Corporate responsibility and sustainability (CRS) oversight by Board and committees | Annual Board, committee, and director evaluations | |||

| Regular executive sessions of independent directors | Proactive and ongoing engagement with shareholders | Robust Board oversight processes for strategy and risk | Stock ownership guidelines for directors and executive officers | |||

| 100% independent Board committees | Proxy access (3%/3 years) | Political Participation, Lobbying and Contributions Policy | Compensation governance best practices |

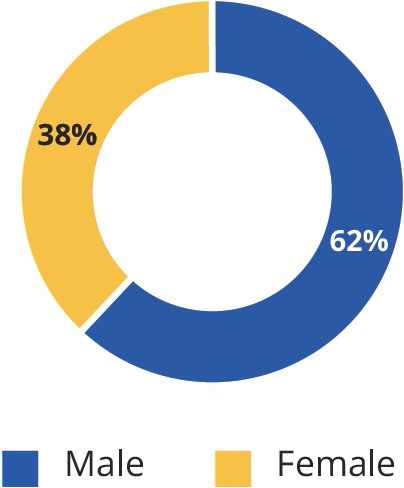

Nominee Demographics

| Age | Diversity | Independence | ||

|  |  | ||

| Tenure | ||||

|

| Average Tenure | 5.9 years | Total Diversity | 73% | |||

| 6 |  |

| Proxy Voting Roadmap | |

Director Nominees

| Lloyd A. Carney, 62 Founder, Chairman & CEO, Carney Global Ventures, LLC Tenure: 9 years Committees: ARC, NCGC Other Public Boards: 2 |  | Kermit R. Crawford, 65 Director Tenure: 2 years Committees: ARC, NCGC Other Public Boards: 2 |  | Francisco Javier Fernández-Carbajal, 69 Director General, Servicios Administrativos Contry SA de CV Tenure: 17 years Committees: CC, FC Other Public Boards: 2 | ||

| Ramon Laguarta, 61 Chairman and CEO, PepsiCo, Inc. Tenure: 5 years Committees: FC, NCGC Other Public Boards: 1 |  | Teri L. List, 61 Director Tenure: 2 years Committees: ARC, CC Other Public Boards: 3 |  | John F. Lundgren, 73 Board Chair Tenure: 7 years Committees: CC, NCGC Other Public Boards: 1 | ||

| Ryan McInerney, 49 Non-Independent CEO, Visa Tenure: 1 year Committees: - Other Public Boards: - |  | Denise M. Morrison, 70 Founder, Denise Morrison & Associates, LLC Tenure: 6 years Committees: ARC, CC Other Public Boards: 2 |  | Pamela Murphy, 51 Director Tenure: 1 year Committees: FC, NCGC Other Public Boards: 1 | ||

| Linda J. Rendle, 46 CEO, The Clorox Company Tenure: 4 years Committees: FC, NCGC Other Public Boards: 1 |  | Maynard G. Webb, Jr., 69 Founder, Webb Investment Network Tenure: 11 years Committees: CC, FC Other Public Boards: 1 |

| Committee Key: | ARC | Audit and Risk Committee | CC | Compensation Committee | FC | Finance Committee | NCGC | Nominating and Corporate Governance Committee |  | Chair |  | Independent |

| (1) | Lloyd A. Carney serves as the chair of the Audit and Risk Committee and will continue to serve as chair until the Annual Meeting. Mr. Crawford is expected to fill this role following the Annual Meeting. |

| (2) | John F. Lundgren serves as the chair of the Nominating and Corporate Governance Committee and will continue to serve as chair until the Annual Meeting. Ms. Morrison is expected to fill this role following the Annual Meeting. |

| (3) | Denise M. Morrison serves as the chair of the Compensation Committee and will continue to serve as chair until the Annual Meeting. Mr. Carney is expected to fill this role following the Annual Meeting. |

| 2025 Proxy Statement | 7 |

| Proxy Voting Roadmap | |

| PROPOSAL 2 | |||

| Approval, on an Advisory Basis, of Compensation Paid to our Named Executive Officers The Board recommends a vote FOR this proposal. | See page 54 | |

Principles of our Compensation Program

| Pay for Performance |

| The foundational principle of our compensation philosophy is pay for performance. We favor variable “at-risk” pay opportunities over fixed pay, with a significant portion of our named executive officers’ (NEO) total compensation determined based on performance against annual and long-term goals and shareholder return. |

| Promote Alignment with Stakeholders’ Interests |

| We reward performance that meets or exceeds the goals that the Compensation Committee establishes with the objective of increasing shareholder value over time, aligning with other stakeholders’ interests, and driving long-term strategic outcomes, including the Company’s broader CRS efforts, while avoiding compensation-related risk to the Company. |

| Attract, Motivate, and Retain Key Talent |

| We design our compensation program to be market competitive, and certain components have multi-year vesting and performance requirements to encourage continued service and retention of key talent. |

2024 CEO Target Compensation Mix

| 8 |  |

| Proxy Voting Roadmap | |

| PROPOSAL 3 | |||

| Ratification of the Appointment of our Independent Registered Public Accounting Firm The Board recommends a vote FOR this proposal. | See page 100 | |

KPMG Appointment

| Independent |

| Independent firm with few ancillary services and reasonable fees. |

| Experienced |

| Significant industry and financial reporting expertise. |

| Reviewed Annually |

| The Audit and Risk Committee conducted its annual evaluation of KPMG LLP and determined that its retention continues to be in the best interests of Visa and its shareholders. |

| PROPOSAL 4-7 | |||

| Shareholder Proposals The Board recommends a vote AGAINST these proposals. | See page 103 | |

●Proposal 4: Shareholder proposal on gender-based compensation gaps and associated risks. ●Proposal 5: Shareholder proposal requesting a report on policy on merchant category codes. ●Proposal 6: Shareholder proposal requesting adoption of a new director election resignation governance guideline. ●Proposal 7: Shareholder proposal on transparency in lobbying. | |||

| 2025 Proxy Statement | 9 |

Board and Governance Matters

| PROPOSAL 1 | |||

| Election of Directors The Board recommends a vote "FOR" each director nominee. | ||

Our Board currently consists of eleven directors, each of whom is nominated for election at our 2025 Annual Meeting, including ten independent directors and our Chief Executive Officer. Each director is elected to serve a one-year term, with all directors subject to annual election. At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following eleven persons to serve as directors for the term beginning at the Annual Meeting on January 28, 2025: Lloyd A. Carney, Kermit R. Crawford, Francisco Javier Fernández-Carbajal, Ramon Laguarta, Teri L. List, John F. Lundgren, Ryan McInerney, Denise M. Morrison, Pamela Murphy, Linda J. Rendle, and Maynard G. Webb, Jr. Unless proxy cards are otherwise marked, the persons named as proxies will vote all executed proxies FOR the election of each nominee named in this section. Proxies submitted to Visa cannot be voted at the Annual Meeting for nominees other than those nominees named in this proxy statement. However, if any director nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee designated by the Board. Alternatively, the Board may reduce the size of the Board. Each nominee has consented to serve as a director if elected, and the Board does not believe that any nominee will be unwilling or unable to serve if elected as a director. Each director will hold office until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal. |

Current Board members. Seated left to right: Ramon Laguarta, Francisco Javier Fernández-Carbajal, and Lloyd A. Carney. Standing left to right: Maynard G. Webb, Jr., Pamela Murphy, Kermit R. Crawford, John F. Lundgren, Teri L. List, Ryan McInerney, Linda J. Rendle, and Denise M. Morrison.

| 10 |  |

| Board and Governance Matters | |

Our Board of Directors

Qualifications and Background of Board Nominees

| Qualifications |  |  |  |  |  |  |  |  |  |  |  | |

| Payments Seasoned payments expert with a nuanced understanding of the sector. |  |  |  | ||||||||

| Technology Leader in a technology-oriented role or company. |  |  |  |  | |||||||

| Senior Leadership Notable experience serving as a senior leader within a business. |  |  |  |  |  |  |  |  |  |  |  |

| Public Company Boards Extensive experience serving on the board of a public company. |  |  |  |  |  |  |  |  |  |  |  |

| Financial Deep understanding of the financial side of the business. |  |  |  |  |  |  |  |  |  |  |  |

| Global Markets Has maintained a global presence having operated worldwide. |  |  |  |  |  |  |  |  |  |  | |

| Marketing/Brand Strategic experience with marketing and branding of a business. |  |  |  |  |  |  | |||||

| Risk Tenured professional with deep expertise in multiple areas of risk. |  |  |  |  |  |  |  |  |  | ||

| Government/Geo-Political Brings notable exposure navigating a regulatory environment. |  |  |  | ||||||||

| E-Commerce/Mobile Leader in digital channel and e-commerce delivery. |  |  |  |  |  | ||||||

| Background | ||||||||||||

| Gender Diversity |  |  |  |  | |||||||

| African-American/Black |  |  | ||||||||||

| Latino/Spanish Heritage |  |  | ||||||||||

| Independence | ||||||||||||

| 91% of director nominees are independent. |  |  |  |  |  |  |  |  |  |  | |

| Tenure | ||||||||||||

| Years on Board | 9 | 2 | 17 | 5 | 2 | 7 | 1 | 6 | 1 | 4 | 11 |

| 2025 Proxy Statement | 11 |

| Board and Governance Matters | |

| Lloyd A. Carney | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Held senior leadership roles at Juniper Networks, Inc., a networking equipment provider, Nortel Networks Inc., a former telecommunications and data networking equipment manufacturer, and Bay Networks, Inc., a computer networking products manufacturer Technology and Global Markets As former Chief Executive Officer for Brocade and prior to that for multiple technology companies, he has extensive experience with information technology, strategic planning, finance, and risk management. He was responsible for design, implementation, and monitoring of large information security networks. He provides consulting and advisory services on information security to government and private institutions Public Company Boards, Financial, and Risk As a current and former director of several publicly-traded and private companies, he has experience with corporate governance, financial reporting and controls, risk management, and business strategy and operations | |||

| Independent Age: 62 Director Since: June 2015 Board Committees: ●Audit and Risk Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights Jamaica ●Ambassador/Special Investment Envoy for Technology (since May 2023) University of Technology, a public university in Jamaica ●Chancellor (since August 2022) Carney Global Ventures, LLC, an early round investor ●Chairman and Chief Executive Officer (since March 2007) Brocade Communications Systems, Inc., a global supplier of networking hardware and software ●Chief Executive Officer and director (from January 2013 to November 2017) Xsigo Systems, an information technology and hardware company ●Chief Executive Officer and director (from 2008 to 2012) Micromuse, Inc., a networking management software company, acquired by IBM ●Chief Executive Officer and Chairman of the Board (from 2003 to 2006) | ||||

Other Public Company Directorships Current Public Company Boards: ●Grid Dynamics Holdings Inc. (Chairman) ●Vertex Pharmaceuticals Previous Public Company Boards: ●Nuance Communications, Inc. (Chairman) ●Brocade Communications Systems, Inc. ●Cypress Semiconductor Corporation ●Micromuse, Inc. (Chairman) | Educational Background B.S. degree in Electrical Engineering Technology; Honorary PhD from the Wentworth Institute of Technology; Honorary PhD in engineering from the University of Technology, Kingston, Jamaica; and M.S. degree in Applied Business Management from Lesley College | |||

| Skills | |||||||||||||||||||

| Technology |  | Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Risk |  | Government/ Geo-Political | ||||||

| 12 |  |

| Board and Governance Matters | |

| Kermit R. Crawford | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership and Marketing/Brand A seasoned executive with over 30 years of senior leadership and operating experience at trusted national brands with a deep understanding of consumer experiences and insights Strong track record of developing strategy, delivering performance, and effecting operational change in highly competitive, global, and consumer-focused service businesses Public Company Boards and Risk As a current and former director of publicly-traded and private companies, he has accumulated extensive experience with corporate governance, business strategy and operations, and risk management and controls | |||

| Independent Age: 65 Director Since: October 2022 Board Committees: ●Audit and Risk Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights Rite Aid Corporation, a retail drugstore chain ●President and Chief Operating Officer (from October 2017 to March 2019) Sycamore Partners, a private equity firm specializing in consumer, distribution, and retail-related investments ●Operating Partner, Retail and Healthcare (from 2015 to 2017) Walgreens Boots Alliance Inc., a holding company that owns retail pharmacy chains Walgreens and Boots ●Executive Vice President and President, Pharmacy, Health and Wellness (from 2011 to 2014) ●Executive Vice President, Pharmacy Services (from 2010 to 2011) ●Senior Vice President, Pharmacy Services (from 2007 to 2010) ●Executive Vice President, Pharmacy Benefit Management Services (from 2004 to 2007) ●Operational Vice President, Store Operations (from 2000 to 2004); and ●Positions of increasing responsibility in Retail Pharmacy and Store Operations (from 1983 to 2000) | ||||

Other Public Company Directorships Current Public Company Boards: ●C.H. Robinson Worldwide, Inc. ●The Allstate Corporation Previous Public Company Boards: ●TransUnion | Educational Background B.S. degree from The College of Pharmacy and Health Sciences at Texas Southern University | |||

| Skills | |||||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Marketing/Brand |  | Risk | ||||

| 2025 Proxy Statement | 13 |

| Board and Governance Matters | |

| Francisco Javier Fernández-Carbajal | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Substantial payment systems, financial services, and leadership experience from his tenure with Grupo Financiero BBVA Bancomer, for which he served in a variety of senior executive roles, including Chief Executive Officer of the Corporate Development Division, President, and Chief Financial Officer Payments and Risk His background and career in the payments and financial services industry in Mexico enable him to bring a global perspective to the Board and to provide relevant insights regarding Visa’s strategies, operations, and management. In addition, he chaired the BBVA Bancomer’s Assets and Liabilities Committee, Credit Committee, and Operational Risk Committee, which enhanced his understanding of risk management of large, complex organizations Global Markets, Financial, and Government/Geo-Political As the Chief Financial Officer of a large publicly-traded company, and through his board and committee membership with several large companies in Mexico, he has accumulated extensive experience in corporate finance and accounting, financial reporting and internal controls, human resources, and compensation, which contributes to his service on our Compensation Committee and Finance Committee | |||

| Independent Age: 69 Director Since: October 2007 Board Committees: ●Compensation Committee ●Finance Committee | |||

Career Highlights Consultant and Wealth Management Advisor ●Public and private investment transactions (since January 2002) Servicios Administrativos Contry S.A. de C.V., a privately held company that provides central administrative and investment management services ●Chief Executive Officer (since June 2005) Grupo Financiero BBVA Bancomer, S.A., a Mexico-based banking and financial services company that owns BBVA Bancomer, one of Mexico’s largest banks ●Chief Executive Officer of the Corporate Development Division (from July 2000 to January 2002) ●President (from October 1999 to July 2000) ●Chief Financial Officer (from October 1995 to October 1999) ●Other senior executive positions (from September 1991 to October 1995) | ||||

Other Public Company Directorships Current Public Company Boards: ●ALFA S.A.B. de C.V. ●CEMEX S.A.B. de C.V. ●Fomento Economica Mexicano S.A.B. de C.V. (Alternate Director) Previous Public Company Boards: ●Fomento Economico Mexicano, S.A.B. de C.V. ●El Puerto de Liverpool, S.A.B. de C.V. ●Fresnillo, plc ●Grupo Aeroportuario del Pacifico, S.A.B. de C.V. ●Grupo Bimbo, S.A.B. de C.V. ●Grupo Gigante, S.A.B. de C.V. ●Grupo Lamosa, S.A.B. de C.V. ●IXE Grupo Financiero S.A.B. de C.V. | Educational Background Degree in Mechanical and Electrical Engineering from the Instituto Tecnológico y de Estudios Superiores de Monterrey and an M.B.A. degree from Harvard Business School | |||

| Skills | |||||||||||||||||||

| Payments |  | Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Risk |  | Government/ Geo-Political | ||||||

| 14 |  |

| Board and Governance Matters | |

| Ramon Laguarta | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership and Public Company Boards Strong leadership skills and extensive consumer packaged goods experience gained from over 25 years in a variety of senior operational and executive roles and as a director at PepsiCo enable him to provide valuable market and consumer insights Global Markets His numerous international senior management positions, including leading PepsiCo Europe and leading PepsiCo’s Europe Sub-Saharan Africa division, which has operations that span three continents and is composed of developed, developing, and emerging markets, provide an invaluable perspective on the global marketplace and sustainability. He speaks multiple languages including English, Spanish, French, German, and Greek His deep experience and strong understanding of the key strategic challenges and opportunities of running a large global business make him well-positioned to oversee strategic planning, operations, marketing, brand development, and logistics | |||

| Independent Age: 61 Director Since: November 2019 Board Committees: ●Finance Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights PepsiCo, Inc., a multinational food, snack, and beverage corporation Several senior positions for over 25 years, including: ●Chief Executive Officer and Director (since October 2018) and Chairman of the Board (since February 2019) ●President (from 2017 to 2018) ●Chief Executive Officer, Europe Sub-Saharan Africa (from 2015 to 2017) ●Chief Executive Officer, PepsiCo Europe (2015) ●President, Developing and Emerging Markets, PepsiCo Europe (from 2012 to 2015) ●President, Eastern Europe, PepsiCo Europe (from 2008 to 2012) ●Commercial Vice President, Snacks and Beverages, PepsiCo Europe (from 2006 to 2008) ●General Manager, Iberia Snacks and Juices (from 2003 to 2006) ●General Manager, Spain Snacks (2001 to 2003) ●General Manager, Greece and Cyprus (from 1999 to 2001) ●Vice President, Marketing, Spain Snacks (from 1998 to 1999) ●Vice President, Business Development, Spain Snacks (from 1996 to 1998) Chupa Chups, S.A., a Spanish leading confectionery company ●General Manager, United States (from 1992 to 1996) ●Business Director, Far East (from 1989 to 1992) ●Business Director, Middle East (from 1988 to 1989) | ||||

Other Public Company Directorships Current Public Company Boards: ●PepsiCo, Inc. (Chairman) Previous Public Company Boards: None | Educational Background M.B.A. degree in international business from ESADE Business School in Spain and a Master’s in International Management from Thunderbird School of Global Management at Arizona State University | |||

| Skills | ||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets | |||

| 2025 Proxy Statement | 15 |

| Board and Governance Matters | |

| Teri L. List | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Highly accomplished executive with decades of financial and leadership experience in dealing with complex finance and accounting matters across multiple industries enables her to provide the board with diverse perspectives and expertise on risk management, strategic planning, and financial oversight Public Company Boards, Financial, and Risk Having served as the Chief Financial Officer of large publicly-traded companies, and through her current and former public company board and committee memberships, she has extensive experience in corporate finance and accounting, financial reporting and internal controls, risk management, human resources, and compensation, which contributes to her service on our Audit and Risk and Compensation Committees | |||

| Independent Age: 61 Director Since: April 2022 Board Committees: ●Audit and Risk Committee ●Compensation Committee | |||

Career Highlights Gap Inc., a global clothing retailer ●Executive Vice President and Chief Financial Officer (from January 2017 until her retirement in June 2020) Dick’s Sporting Goods, Inc., a sporting goods retail company ●Executive Vice President and Chief Financial Officer (from August 2015 to August 2016) Kraft Foods Group Inc., a food and beverage company ●Advisor (from March 2015 to May 2015) ●Executive Vice President and Chief Financial Officer (from December 2013 to February 2015) ●Senior Vice President, Finance (from September 2013 to December 2013) The Procter & Gamble Company, a multinational consumer goods corporation ●Senior Vice President and Treasurer (from 2009 to 2013) ●Vice President, Finance, Global Operations (from 2007 to 2009) ●Vice President, Finance, Fabric Care and Vice President, Finance, Household Care (from 2005 to 2007) ●Vice President, Corporate Accounting (from 1999 to 2004) ●Various positions of increasing authority (from 1994 to 1999) Deloitte LLP, an auditing, consulting, tax, and advisory services firm ●Senior Manager (from 1985 to 1994) | ||||

Other Public Company Directorships Current Public Company Boards: ●Danaher Corporation ●Microsoft Corporation ●lululemon athletica, inc. Previous Public Company Boards: ●Double Verify Holdings ●Oscar Health, Inc. | Educational Background Bachelor’s degree in accounting from Northern Michigan University; and a certified public accountant | |||

| Skills | ||||||||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Risk |  | E-Commerce/Mobile | |||||

| 16 |  |

| Board and Governance Matters | |

| John F. Lundgren | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Substantial executive leadership and brand experience from having served for over 12 years as Chief Executive Officer and Chairman of Stanley Black & Decker and The Stanley Works Global Markets Gained knowledge and experience with consumer markets in Europe from having served as President, European Consumer Products of Georgia Pacific Corporation, Fort James Corporation, and James River Corporation for over 10 years Financial and Risk Currently serves as a member of the Audit Committee of Topgolf Callaway Brands Corp, providing him with experience in the areas of corporate finance, accounting, internal controls and procedures for financial reporting, risk management oversight, and other audit committee functions Public Company Boards As a current and former director of other public companies, he has experience with corporate governance, risk management, and business strategy and operation As Visa’s Board Chair and previously Lead Independent Director, he has developed strong working relationships with his fellow directors and gained their respect and trust, demonstrating effective leadership and functioning of the Board | |||

| Independent Age: 73 Director Since: April 2017 Board Committees: ●Compensation Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights Visa ●Board Chair (since January 2024) and Lead Independent Director (April 2019 to January 2024) Stanley Black & Decker, Inc., a manufacturer of industrial tools and household hardware ●Chief Executive Officer (from March 2010 until his retirement in July 2016) ●Chairman (until December 2016) The Stanley Works, a worldwide supplier of consumer products, industrial tools, and security solutions for professional, industrial, and consumer use ●Chairman and Chief Executive Officer (from March 2004 until its merger with Black & Decker in March 2010) Georgia-Pacific Corporation, manufacturer and distributor of tissue, pulp, paper, packaging, building products, and related chemicals ●President (from January 2000 to February 2004) Fort James Corporation, pulp and paper company ●President of European Consumer Products (from 1997 to 2000 until its acquisition by Georgia-Pacific) James River Corporation, pulp and paper company ●President of European Consumer Products (from 1995 to 1997) | ||||

Other Public Company Directorships Current Public Company Boards: ●Topgolf Callaway Brands Corp (Chairman) Previous Public Company Boards: ●Stanley Black & Decker, Inc. ●Staples, Inc. | Educational Background B.A. degree from Dartmouth College and an M.B.A. degree from Stanford University | |||

| Skills | ||||||||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Marketing/Brand |  | Risk | |||||

| 2025 Proxy Statement | 17 |

| Board and Governance Matters | |

| Ryan McInerney | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership As Visa’s Chief Executive Officer and previous President, he brings significant senior leadership and direct knowledge and experience in Visa’s culture, business development, strategy, growth, and long-term success Payments, Global Markets, and Risk A seasoned industry veteran with deep expertise in payments, global financial services, and mobile technology Technology and E-Commerce/Mobile Gained extensive consumer and mobile banking service experience from serving in various senior management roles, including as Chief Executive Officer and Chief Operating Officer of divisions of a global financial services firm | |||

| Age: 49 Director Since: February 2023 Board Committees: None | |||

Career Highlights Visa ●Chief Executive Officer, Visa Inc. (since February 2023) ●President (from May 2013 to January 2023) JPMorgan Chase, a global financial services firm ●Chief Executive Officer of Consumer Banking (from 2010 to 2013) ●Chief Operating Officer for Home Lending (from 2009 to 2010) ●Chief Risk Officer for Consumer Businesses (from 2008 to 2009) ●Head of Product and Marketing for Consumer Banking (from 2005 to 2008) McKinsey & Company, a global management consulting firm ●Principal in the firm’s retail banking and payments practices (from 1997 to 2005) | ||||

Other Public Company Directorships Current Public Company Boards: None Previous Public Company Boards: None | Educational Background Bachelor’s degree in Finance from the University of Notre Dame | |||

| Skills | |||||||||||||

| Payments |  | Technology |  | Senior Leadership |  | Public Company Boards |  | Financial | ||||

| Global Markets |  | Marketing/Brand |  | Risk |  | Government/Geo-Political |  | E-Commerce/Mobile | ||||

| 18 |  |

| Board and Governance Matters | |

| Denise M. Morrison | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Her extensive executive leadership experience provides her with a strong understanding of the key strategic challenges and opportunities of running a large, complex business, including financial management, operations, risk management, talent management, and succession planning, which contributes to her service on our Board Global Markets Distinguished record of building strong businesses and growing iconic brands, having served over 15 years as Chief Executive Officer and in other senior management roles at The Campbell’s Company, whose products are sold in over 120 countries around the world Public Company Boards and Marketing/Brand Her prior experience in sales, marketing, operations, and business development in leading consumer product companies add to her deep understanding of the consumer and retail market. Her current and former board and committee service with public and private companies provide her with a strong understanding of the effective functioning of corporate governance structures | |||

| Independent Age: 70 Director Since: August 2018 Board Committees: ●Audit and Risk Committee ●Compensation Committee | |||

Career Highlights Denise Morrison & Associates, LLC, a consulting firm ●Founder (since October 2018) The Campbell’s Company, a food and beverage company ●President and Chief Executive Officer (from August 2011 to May 2018) ●Board member (from October 2010 to May 2018) ●Executive Vice President and Chief Operating Officer (from October 2010 to July 2011) ●Senior Vice President, President of North America Soup, Sauces and Beverages (from October 2007 to September 2010) ●President, Campbell USA (from June 2005 to September 2007) ●President, Global Sales and Chief Customer Officer (from April 2003 to May 2005) Kraft Foods, Inc., a food and beverage company ●Executive Vice President and General Manager, Snacks Division (from 2001 to 2003) ●Executive Vice President and General Manager, Confections Division (in 2001) ●Senior Vice President and General Manager, Nabisco Down the Street Division (in 2000) ●Senior Vice President, Nabisco Sales and Integrated Logistics (from 1998 to 2000) ●Vice President, Nabisco Foods Sales and Integrated Logistics (from 1997 to 1998) ●Area Vice President, West, Nabisco Sales and Integrated Logistics (from 1995 to 1997) Nestle SA ●Senior marketing and sales positions (from 1984 to 1995) PepsiCo, Inc. ●Business Development manager (from 1982 to 1984) The Procter & Gamble Company ●Manager and sales positions (from 1975 to 1982) | ||||

Other Public Company Directorships Current Public Company Boards: ●MetLife, Inc. ●Quest Diagnostics Inc. Previous Public Company Boards: ●The Campbell’s Company | Educational Background B.S. degrees in Economics and Psychology from Boston College | |||

| Skills | |||||||||||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Marketing/Brand |  | Risk |  | E-Commerce/ Mobile | ||||||

| 2025 Proxy Statement | 19 |

| Board and Governance Matters | |

| Pamela Murphy | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Over 20 years of experience in the software and technology industries that includes senior leadership positions at global companies of scale Technology and Global Markets Extensive background and expertise in leading technology companies with wide range of responsibilities for global operational and financial functions provide additional depth to her role on the Board Public Company Boards and Risk Her experience as Chief Executive Officer of a cybersecurity software company and as a current and former board member of publicly-traded companies contributes to the Board’s oversight of Visa’s strategies, operations, systems security, and risk management | |||

| Independent Age: 51 Director Since: April 2023 Board Committees: ●Finance Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights Imperva, Inc., a cybersecurity software and services provider ●Chief Executive Officer (from 2020 to 2024) Infor, Inc., an enterprise software company ●Chief Operating Officer (from 2011 to 2019) ●Senior Vice President, Corporate Operations (from 2010 to 2011) Oracle Corporation, a computer technology corporation ●Vice President for Global Business Units Finance and Global Sales Operations (from 2008 to 2010) ●Vice President, Finance (from 2007 to 2008) ●Director, Consulting Business Operations EMEA (from 2002 to 2007) ●Senior Manager, EMEA Finance (from 2000 to 2002) Arthur Andersen LLP, an Accounting and Business Advisory firm ●Senior Manager, Business Consulting (from 1997 to 2000) ●Auditor (from 1995 to 1997) | ||||

Other Public Company Directorships Current Public Company Boards: ●Rockwell Automation, Inc. Previous Public Company Boards: ●MeridianLink, Inc. | Educational Background Bachelor of Commerce in Accounting and Finance from the University of Cork, Ireland, and a Fellow of the Institute of Chartered Accountants in Ireland | |||

| Skills | ||||||||||||||||

| Technology |  | Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Risk | |||||

| 20 |  |

| Board and Governance Matters | |

| Linda J. Rendle | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Strong track record of outstanding business results and values-led leadership, gained from over 20 years spent in a variety of senior operational and executive roles across many of Clorox’s businesses, provide her with a diverse perspective on global sales, product innovation, and business strategy Global Markets and Marketing/Brand As Chief Executive Officer of a global company, her extensive experience and instrumental role in developing key corporate strategies provide important insights and perspectives with respect to global product development, growth, and long-range planning | |||

| Independent Age: 46 Director Since: November 2020 Board Committees: ●Finance Committee ●Nominating and Corporate Governance Committee | |||

Career Highlights The Clorox Company, a global consumer products company ●Board Chair (since January 2024) ●Chief Executive Officer (since September 2020) ●President (from May 2020 to September 2020) ●EVP, Global Operations & Strategy, Cleaning and International (from July 2019 to May 2020) ●EVP, Global Operations & Strategy, International, Better Health (from January 2019 to July 2019) ●EVP and General Manager, Cleaning, Professional Products and Strategy (from June 2018 to January 2019) ●SVP and General Manager, Cleaning and Professional Products (from April 2017 to June 2018) ●SVP and General Manager, Cleaning (from August 2016 to April 2017) ●VP and General Manager, Home Care (from October 2014 to August 2016) ●VP, Sales, Cleaning (from April 2012 to October 2014) ●VP, Sales, Director of Sales Planning and Senior Sales Analyst (from January 2003 to April 2012) Procter & Gamble, a global consumer products company ●Several positions in sales management (from August 2000 to December 2002) | ||||

Other Public Company Directorships Current Public Company Boards: ●The Clorox Company (Chair) Previous Public Company Boards: None | Educational Background Bachelor’s degree in Economics from Harvard University | |||

| Skills | |||||||||||||||||||

| Senior Leadership |  | Public Company Boards |  | Financial |  | Global Markets |  | Marketing/Brand |  | Risk |  | E-Commerce/ Mobile | ||||||

| 2025 Proxy Statement | 21 |

| Board and Governance Matters | |

| Maynard G. Webb, Jr. | Specific Qualifications, Experience, Attributes, and Skills Senior Leadership Substantial leadership and operational experience, having served as the Chief Executive Officer of LiveOps, Chief Operating Officer of eBay, Inc., President of eBay Technologies, and as Chief Information Officer of Gateway and Bay Networks Technology and Payments Significant experience in developing, managing, and leading high-growth technology companies, both from his roles as an investor and as a senior executive of LiveOps and eBay Financial and E-Commerce/Mobile His experience and expertise in engineering and information technology, as well as his prior and current service on the boards of several large, publicly-traded technology companies, enable him to contribute to the Board’s understanding and oversight of Visa’s management, operations, systems, and strategies | |||

| Independent Age: 69 Director Since: January 2014 Board Committees: ●Compensation Committee ●Finance Committee | |||

Career Highlights Webb Investment Network, an early stage investment firm ●Founder (since 2010) LiveOps, Inc., a cloud-based call center ●Chairman of the Board (from 2008 to 2013) ●Chief Executive Officer (from December 2006 to July 2011) eBay, Inc., a global commerce and payments provider ●Chief Operating Officer (from June 2002 to August 2006) ●President of eBay Technologies (from August 1999 to June 2002) Gateway, Inc., a computer manufacturer ●Senior Vice President and Chief Information Officer (from July 1998 to August 1999) Bay Networks, Inc., a computer networking products manufacturer ●Vice President and Chief Information Officer (from February 1995 to July 1998) | ||||

Other Public Company Directorships Current Public Company Boards: ●Salesforce, Inc. Previous Public Company Boards: ●Extensity, Inc. ●Gartner, Inc. ●Hyperion Solutions Corporation ●Niku Corporation ●Yahoo! Inc. | Educational Background Bachelor of Applied Arts degree from Florida Atlantic University | |||

| Skills | ||||||||||

| Payments |  | Technology |  | Senior Leadership |  | Public Company Boards | |||

| Financial |  | Global Markets |  | Marketing/Brand |  | E-Commerce/Mobile | |||

| 22 |  |

| Board and Governance Matters | |

Board Composition and Refreshment

In addition to executive and management succession, the Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of the Board to cultivate a mix of skills, experience, tenure, and diversity that promotes and supports the Company’s long-term strategy. In doing so, the Nominating and Corporate Governance Committee takes into consideration the overall needs, composition, and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications, which are described in the section entitled Assess Candidates Against Skills and Qualifications Needed on Board. Individuals identified by the Nominating and Corporate Governance Committee as qualified to become directors are then recommended to the Board for nomination or election.

Process for Nomination of Director Candidates

As part of its assessment, the Nominating and Corporate Governance Committee considers directors’ and candidates’ independence, as well as directors’ and candidates’ other time commitments and experience. After an in-depth review of the candidates, the Nominating and Corporate Governance Committee recommends candidates to the Board in accordance with its charter, our Certificate of Incorporation and Bylaws, our Corporate Governance Guidelines, and the criteria adopted by the Board regarding director candidate qualifications. After careful review and consideration, the Board nominates candidates for election, or reelection, at our annual meeting of shareholders. The Board may appoint a director to the Board during the year to serve until the next meeting of shareholders.

| 2025 Proxy Statement | 23 |

| Board and Governance Matters | |

| 1 | Consider Nominations from Various Sources We receive recommendations for new directors from an independent search firm, our independent directors, management, and shareholders. The primary functions served by the search firm include identifying potential candidates who meet the key attributes, experience, and skills described below, as well as compiling information regarding each candidate’s attributes, experience, skills, and independence and conveying the information to the Nominating and Corporate Governance Committee. Shareholders may recommend a director candidate to be considered for nomination by the Nominating and Corporate Governance Committee by providing the information specified in our Corporate Governance Guidelines to our Corporate Secretary within the timeframe specified for shareholder nominations of directors in our Bylaws. For additional information regarding the process for proposing director candidates to the Nominating and Corporate Governance Committee for consideration, please see our Corporate Governance Guidelines. Shareholders who wish to nominate a person for election as a director at an annual meeting of shareholders must follow the procedure described under Other Information – Shareholder Nominations and Proposals for 2026 Annual Meeting of this proxy statement. For additional information regarding this process, please see our Bylaws. The Nominating and Corporate Governance Committee applies the same standards in considering director candidates submitted by shareholders as it does in evaluating other candidates, including incumbent directors. | |

| 2 | Assess Candidates Against Skills and Qualifications Needed on Board The identification and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors and is significantly influenced by the needs of the Board from time to time. As a result, there is no specific set of minimum qualifications, qualities, or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory, and New York Stock Exchange (NYSE) listing requirements and the provisions of our Certificate of Incorporation, Bylaws, Corporate Governance Guidelines, and charters of the Board’s committees. However, the Nominating and Corporate Governance Committee and the Board have identified the ten skills and qualifications listed below as important factors for membership on the Board. |

|  |  |  |  | ||||

| Payments | Technology | Senior Leadership | Public Company Boards | Financial |

|  |  |  |  | ||||

Global Markets | Marketing & Brand | Risk | Government & Geo-Political | E-Commerce & Mobile |

New candidates meet with our directors, and the Board screens their qualifications to assess how the candidates may further enhance the composition of our Board.

| 24 |  |

| Board and Governance Matters | |

| 3 | Assess Director Time Commitment and Engagement Our Board’s evaluation process assesses individual director performance to confirm appropriateness of continued Board service. See page 33 for a description of the Board’s evaluation processes. Our Board also considers appropriate limits for our directors’ outside public board service and annually assesses directors’ other time commitments. Through the Nominating and Corporate Governance Committee, the Board annually reviews the Corporate Governance Guidelines, which include limitations on directors’ ability to serve on the boards of other companies. The Nominating and Corporate Governance Committee considers many factors when assessing the continued appropriateness of our polices with respect to outside public board service, including the following: ●time commitment required by Visa in conjunction with Board and committee meeting attendance; ●the scope of responsibilities of individual committees; ●individual contributions at our Board and committee meetings, taking into account the director’s general engagement, effectiveness, and preparedness; ●peer review feedback from directors throughout the year and the results of the annual Board evaluation; ●whether the director is currently employed or retired from full-time employment; ●the number of other boards on which the director is a member and the role of the director on these boards with consideration given to public company board leadership positions; ●any industry or other commonalities between outside boards that aid in the director’s efficiencies serving on such boards; ●input from our shareholders during engagement; and ●the corporate governance guidelines adopted by our peers and other significant public companies. Our Corporate Governance Guidelines establish the following limits on our directors serving on publicly-traded company boards and audit committees: |

| Director Category | Limit on publicly traded company board and committee service, including Visa | |

| Directors generally | 4 boards | |

| Directors who are executives of a publicly-traded company | 2 boards | |

| Directors who serve on our Audit and Risk Committee | 3 audit committees |

The Nominating and Corporate Governance Committee may grant exceptions to the limits on a case-by-case basis after taking into consideration the facts and circumstances of the request. Our Corporate Governance Guidelines provide that prior to accepting an invitation to serve on the board or audit committee of another publicly-traded company, a director should advise our Corporate Secretary of the invitation. The Corporate Secretary will review the matter with the Board Chair, the Chair of the Nominating and Corporate Governance Committee, and the Chief Executive Officer, so that the Board, through the Nominating and Corporate Governance Committee, has the opportunity to review the director’s ability to continue to fulfill his or her responsibilities as a member of the Company’s Board or Audit and Risk Committee. When reviewing such a request, the Nominating and Corporate Governance Committee considers a number of factors, including the director’s other time commitments and leadership positions on boards, record of attendance at Board and committee meetings, potential conflicts of interest and other legal considerations, and the impact of the proposed directorship or audit committee service on the director’s availability.

The Nominating and Corporate Governance Committee conducted a review of director commitments for our 2025 director nominees and affirmed that all nominees, with the exception of Ms. List (as discussed below), are compliant with our board limit policy, and believes that all directors currently have sufficient capacity to effectively serve as members of the Visa Board. Ms. List serves on three public company audit committees in addition to being a member of our Audit and Risk Committee. The Nominating and Corporate Governance Committee and the Board considered Ms. List’s service on four public company audit committees, including her professional qualifications, former experience as a public company chief financial officer, and the nature of and time involved in her service on other boards. Following this review, the Board determined that such simultaneous service would not impair the ability of Ms. List to effectively serve on the Company’s Audit and Risk Committee and waived the limit for service on the Audit and Risk Committee.

| 2025 Proxy Statement | 25 |

| Board and Governance Matters | |

| 4 | Consider Diversity of Candidates The Board, through the Nominating and Corporate Governance Committee, strives to be a board that reflects the diversity of our key stakeholders around the world (clients, customers, employees, business partners, and shareholders). While the Board does not have a formal policy on diversity, the Board’s practice in assembling the Board is to have wide diversity in terms of business experiences, functional skills, gender, race, ethnicity, and cultural backgrounds. To support this objective, the Nominating and Corporate Governance Committee instructs any search firm that is engaged to identify director candidates to include women and candidates from underrepresented groups in the pool from which the Nominating and Corporate Governance Committee considers director candidates. The Nominating and Corporate Governance Committee assesses its effectiveness in balancing these considerations in connection with its annual evaluation of the composition of the Board. Six diverse directors have been added in the past six years. | |

| 5 | Review Independence and Potential Conflicts The NYSE’s listing standards and our Corporate Governance Guidelines provide that a majority of our Board and every member of the Audit and Risk, Compensation, and Nominating and Corporate Governance committees must be “independent.” Our Certificate of Incorporation further requires that at least 58% of our Board be independent. Of the Board nominees, 91% are independent. Under the NYSE’s listing standards, our Corporate Governance Guidelines, and our Certificate of Incorporation, no director will be considered to be independent unless our Board affirmatively determines that such director has no direct or indirect material relationship with Visa or our management. Our Board reviews the independence of its members annually and has adopted guidelines to assist it in making its independence determinations, including categorical standards of director independence that describe certain relationships that are deemed to be not material when assessing director independence and therefore shall not disqualify any director or nominee from being considered independent. In the event a director or nominee has a relationship with the Company that is relevant to his or her independence and is not addressed by the categorical independence standards, the Board determines in its judgment whether such relationship is material. For details, see our Corporate Governance Guidelines, which can be found on the Investor Relations page of our website at investor.visa.com under “Corporate Governance.” In October 2024, with the assistance of legal counsel, our Board conducted its annual review of director independence taking into account the NYSE listing standards and our independence guidelines set forth in our Corporate Governance Guidelines. As a result of its review, the Board (upon recommendation of the Nominating and Corporate Governance Committee) affirmatively determined that each of our non-employee directors (Lloyd A. Carney, Kermit R. Crawford, Francisco Javier Fernández-Carbajal, Ramon Laguarta, Teri L. List, John F. Lundgren, Denise M. Morrison, Pamela Murphy, Linda J. Rendle, and Maynard G. Webb, Jr.) is “independent” as that term is defined in the NYSE’s listing standards, our independence guidelines, and our Certificate of Incorporation. In addition, the Board previously determined that Alfred F. Kelly, Jr., who retired from the Board at our 2024 Annual Meeting of Shareholders, was not “independent” while he served on the Board during fiscal year 2024 due to his former service as our Executive Chairman. In addition, the Board determined that each member of the Audit and Risk Committee and the Compensation Committee meets the additional, heightened independence criteria applicable to such committee members under the NYSE rules. | |

| 6 | Selection of Candidates and Board Refreshment The Nominating and Corporate Governance Committee’s work on director succession and refreshment have resulted in seven new directors being added to the Board since 2018. This intentional and planned approach has resulted in a mix of skills, experience, tenure, and diversity that promotes and supports the Company’s long-term strategy. |

| 26 |  |

| Board and Governance Matters | |

Board Refreshment Timeline

| 2025 Proxy Statement | 27 |

| Board and Governance Matters | |

Corporate Governance

Members of our Board oversee our business through discussions with our Chief Executive Officer; Chief Financial Officer; Vice Chair, Chief People and Corporate Affairs Officer, and Corporate Secretary; General Counsel; Chief Risk and Client Services Officer; President, Technology; Chief Information Security Officer; and other officers and employees, and by reviewing materials provided to them and participating in regular meetings of the Board and its committees.

The Board regularly monitors our corporate governance policies and profile to confirm we meet or exceed the requirements of applicable laws, regulations and rules, and the listing standards of the NYSE. We have instituted a variety of practices to foster and maintain responsible corporate governance, which are described in this section. To learn more about Visa’s corporate governance and to view our Corporate Governance Guidelines, Code of Business Conduct and Ethics, and the charters of each of the Board’s committees, please visit the Investor Relations page of our website at investor.visa.com under “Corporate Governance.”

Board Structure and Operations

| Mr. Lundgren, as independent Board Chair, has all the duties of the Board Chair, as well as the duties of the Lead Independent Director to the extent applicable, including: | ||

Mr. Lundgren Independent Board Chair Elected as of January 2024 | ●chairing Board meetings; ●providing feedback to the Chief Executive Officer on corporate and Board policies and strategies and acting as a liaison between the Board and the Chief Executive Officer; ●facilitating communication among directors and between the Board and management; ●advising on the agenda, schedule, and materials for Board meetings and strategic planning sessions based on input from directors; ●coordinating with the Chair of the Compensation Committee to support the independent directors’ evaluation of Chief Executive Officer performance and compensation; ●communicating with shareholders and other stakeholders; and ●carrying out such other duties as are requested by the Board or any of its committees from time to time. | |

In addition, independent directors chair each of the Board’s four standing committees: the Audit and Risk Committee, chaired by Lloyd A. Carney; the Compensation Committee, chaired by Denise M. Morrison; the Finance Committee, chaired by Maynard G. Webb, Jr.; and the Nominating and Corporate Governance Committee, chaired by John F. Lundgren. In their capacities as independent committee chairs, Mr. Carney, Mr. Lundgren, Ms. Morrison, and Mr. Webb each have responsibilities that contribute to the Board’s independent oversight of management, as well as facilitating communication among the Board and management.

All committees are fully independent. Shareholders and other interested parties may communicate with the independent Board leaders or other directors at board@visa.com. |

| 28 |  |

| Board and Governance Matters | |

Audit and Risk Committee

| “In light of the challenges of 2024, including ongoing geopolitical tensions, we continued our focus on Visa’s operational resiliency and key risks, such as competition, credit settlement, data security, cybersecurity, ecosystem, acquired entities, fraud prevention, regulatory compliance, legal, and third-party risks.” – Lloyd A. Carney, Audit and Risk Committee Chair | Committee members: Lloyd A. Carney,* Chair Kermit R. Crawford Teri L. List* Denise M. Morrison* *Audit Committee Financial Expert Number of meetings in fiscal year 2024: 7 |

| ● | Monitored the integrity of our financial statements, our compliance with legal and regulatory requirements, our internal controls over financial reporting, and the performance of our internal audit function and KPMG LLP, our independent registered public accounting firm; |

| ● | Discussed the qualifications and independence of KPMG and recommended their re-appointment for fiscal year 2024; |

| ● | Selected, approved the compensation of, and oversaw the work of KPMG, including the scope of and plans for the audit for fiscal year 2025; |

| ● | Reviewed and discussed with management the disclosures required to be included in our registration statement on Form S-3, Annual Report on Form 10-K, and our quarterly reports on Form 10-Q, including the Company’s significant accounting policies and areas subject to significant judgment and estimates; |

| ● | Discussed with KPMG their critical audit matters; |

| ● | Approved fees for KPMG for fiscal year 2024 and all audit, audit-related, and non-audit fees and services consistent with our pre-approval policy; |

| ● | On a quarterly basis, reviewed audit results and findings prepared by Internal Audit; |

| ● | Discussed the Company’s tax strategy; |

| ● | Reviewed and recommended that the Board approve amendments to our Audit and Risk Committee charter, reviewed and recommended that the Board approve amendments to our Code of Business Conduct and Ethics, monitored compliance with our Code of Business Conduct and Ethics, and reviewed the implementation and effectiveness of the Company’s compliance and ethics program, including anti-money laundering/anti-terrorist financing and trade sanctions programs; |

| ● | Reviewed and discussed with management the Company’s top risks, and steps taken to monitor and control those exposures, including our corporate risk profile, and updates on risk programs for ecosystem risk, ecosystem integrity risk, credit settlement risk, and our acquired entities’ risk profiles; |

| ● | Monitored the Company’s technology and cybersecurity risks, operational resilience, and privacy and data protection; |

| ● | Reviewed and approved amendments to our Risk Appetite Framework, Third Party Lifecycle Management Policy, Related Person Transaction Policy, Whistleblower Policy, fiscal year 2024 internal audit plan, and the Global Operational Resilience Program requirements; |

| ● | Reviewed the internal audit charter, incident response escalation plans, and the M&A framework; |

| ● | Reviewed with the General Counsel legal and regulatory matters; and |

| ● | Reviewed the Company’s insurance coverage and programs, and tax audits. |

| 2025 Proxy Statement | 29 |

| Board and Governance Matters | |

Compensation Committee

| “Following a year of leadership changes, in 2024 we maintained continuity in our compensation principles and design, and we set rigorous performance goals to drive results consistent with Visa’s corporate strategy. These compensation decisions reflect the Compensation Committee’s view that Visa’s executive officers demonstrate the ability to lead the Company and deliver results for shareholders in an increasingly complex business landscape.” – Denise M. Morrison, Compensation Committee Chair | Committee members: Francisco Javier Fernández-Carbajal Teri L. List John F. Lundgren Denise M. Morrison, Chair Maynard G. Webb, Jr. Number of meetings in fiscal year 2024: 6 |

| ● | Reviewed the overall executive compensation philosophy for the Company; |

| ● | Reviewed and approved corporate goals and objectives relevant to our Chief Executive Officer’s and other NEOs’ compensation, including annual financial, strategic, corporate responsibility and sustainability, and individual performance objectives; |

| ● | Evaluated the performance of our Chief Executive Officer and other NEOs considering preestablished goals and objectives, and based on this evaluation, determined, approved, and reported to the Board the annual compensation of our Chief Executive Officer and other NEOs, including salary, annual incentives, long-term equity, and other benefits; |

| ● | Reviewed and recommended to the independent members of the Board the form and amount of compensation of our non-employee directors; |

| ● | Oversaw administration and regulatory compliance related to the Company’s incentive and equity-based compensation plans; |

| ● | Reviewed the operations of the Company’s executive compensation program to determine whether they are properly coordinated and achieving their intended purposes; |

| ● | Reviewed an annual compensation risk assessment report and confirmed that the Company’s compensation program does not create risks that are reasonably likely to have a material adverse effect on the Company; |

| ● | Reviewed the Company’s pay equity processes and related disclosures; |

| ● | Reviewed the Company’s stock ownership guidelines for directors and NEOs, as well as individual compliance; |

| ● | Reviewed and recommended that the Board approve our Compensation Committee charter; |

| ● | Reviewed and discussed with management the compensation disclosures required to be included in the Company’s annual filings; |

| ● | Oversaw the Company’s submission of the annual advisory vote on executive compensation (Say-on-Pay); |

| ● | Reviewed the results of shareholder votes on executive compensation matters; |

| ● | Selected an appropriate peer group for executive pay and performance comparisons; and |

| ● | Received and reviewed updates on regulatory and compensation trends and compliance. |

| 30 |  |

| Board and Governance Matters | |

Finance Committee

| “We took a holistic view of Visa’s M&A activity, emphasizing priority areas and long-term strategic goals, as well as evaluating the integration efforts and the performance of prior acquisitions. We also assessed how to best optimize Visa’s capital structure.” – Maynard G. Webb, Jr., Finance Committee Chair | Committee members: Francisco Javier Fernández-Carbajal Ramon Laguarta Pamela Murphy Linda J. Rendle Maynard G. Webb, Jr., Chair Number of meetings in fiscal year 2024: 5 |

| ● | Reviewed potential M&A transactions and strategic investments and discussed M&A priority areas; |

| ● | Reviewed the financial and operational performance of prior acquisitions, including integration progress and scorecards; |

| ● | Reviewed and recommended that the Board declare the Company’s quarterly dividend and authorize the Class A share repurchase program; |

| ● | Reviewed the Company’s capital structure and financial condition, including target leverage ratio and credit ratings; |

| ● | Reviewed certain new investments; |

| ● | Discussed the Class B common stock exchange program; |

| ● | Reviewed insurance coverage and programs; |

| ● | Discussed the Company’s treasury activities and strategy; |

| ● | Reviewed potential capital investments in advance of budget approval; |

| ● | Reviewed the signature authority policy and guidelines; and |

| ● | Reviewed and recommended that the Board approve the Finance Committee charter. |

| 2025 Proxy Statement | 31 |

| Board and Governance Matters | |

Nominating and Corporate Governance Committee

| “Thinking about Visa’s strategy and path ahead, we assessed how to best optimize the board structure for independent oversight, which skills and characteristics are crucial for the Board, and the rotation of committee positions to best utilize the unique skills and experiences of each director.” – John F. Lundgren, Chair | Committee members: Lloyd A. Carney Kermit R. Crawford Ramon Laguarta John F. Lundgren, Chair Pamela Murphy Linda J. Rendle Number of meetings in fiscal year 2024: 5 |

| ● | Reviewed the director skills and qualifications criteria used to identify individuals who are qualified to become directors to confirm that the criteria capture the appropriate skills and qualifications for Visa board membership; |

| ● | Regularly discussed Board refreshment and reviewed director candidates considering our director skills and qualification criteria, current business needs, and long-term strategy; |

| ● | Reviewed and recommended that the Board approve the Nominating and Corporate Governance Committee’s charter and amendments to the Company’s Corporate Governance Guidelines; |

| ● | Reaffirmed the Board’s categorical director independence standards and reviewed the qualifications and determined the independence of the members of the Board and its committees; |

| ● | Discussed Board committee composition and recommended changes to the full board; |

| ● | Reviewed each director’s compliance with the requirements of the Corporate Governance Guidelines relating to service on other boards or audit committees of publicly-traded companies; |

| ● | Reviewed succession and development plans for management, including in the event of an emergency or retirement; |

| ● | Oversaw the annual evaluation of the Board, its committees, and directors; |

| ● | Reviewed shareholder proposals and company responses; |

| ● | Oversaw our shareholder engagement program on environmental, social, and corporate governance matters; |

| ● | Reviewed shareholder correspondence and feedback from shareholder engagement meetings; |

| ● | Reviewed and approved the 2024 corporate political contribution plan and oversaw the Company’s political contributions and lobbying activities; and |

| ● | Reviewed the Company’s corporate responsibility and sustainability developments and oversaw the Company’s charitable giving. |

| 32 |  |

| Board and Governance Matters | |

Director Engagement

Attendance at Board, Committee, and Annual Shareholder Meetings

Our Board and its committees meet throughout the year on a set schedule, hold special meetings as needed, and act by written consent from time to time. The Board met six times during fiscal year 2024. No director attended fewer than 75% or more of the aggregate of: (i) the total number of meetings of the Board held during the period in fiscal year 2024 for which he or she served as a director, and (ii) the total number of meetings held by all committees of the Board on which such director served as a member during the period in fiscal year 2024. The total number of meetings held by each committee is listed above, under Committees of the Board of Directors. It is our policy that all members of the Board should endeavor to attend the annual meeting of shareholders. All eleven of our directors attended the 2024 Annual Meeting of Shareholders.

Executive Sessions of the Board of Directors