UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33977

VISA INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 26-0267673 |

(State or other jurisdiction

of incorporation or organization) | | (IRS Employer

Identification No.) |

| | | |

| P.O. Box 8999 | | 94128-8999 |

| San Francisco, | California | | |

| (Address of principal executive offices) | | (Zip Code) |

(650) 432-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | V | | New York Stock Exchange |

| 1.500% Senior Notes due 2026 | | V26 | | New York Stock Exchange |

| 2.000% Senior Notes due 2029 | | V29 | | New York Stock Exchange |

| 2.375% Senior Notes due 2034 | | V34 | | New York Stock Exchange |

| | | | |

Securities registered pursuant to Section 12(g) of the Act:

Class B-1 common stock, par value $0.0001 per share

Class B-2 common stock, par value $0.0001 per share

Class C common stock, par value $0.0001 per share

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s class A common stock, held by non-affiliates (using the New York Stock Exchange closing price as of March 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $439.3 billion. There is currently no established public trading market for the registrant’s class B-1, B-2 or class C common stock.

As of November 6, 2024, the registrant’s shares of common stock outstanding were as follows.

| | | | | | | | |

| Class | | Shares outstanding |

| Class A common stock | | 1,728,105,021 |

| Class B-1 common stock | | 4,835,384 |

| Class B-2 common stock | | 120,338,948 |

| Class C common stock | | 9,595,774 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2025 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant’s fiscal year ended September 30, 2024.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | | Page |

| | |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 1C | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | |

| | |

| Item 5 | | |

| Item 6 | [Reserved] | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| | |

| | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| |

| |

| Item 15 | | |

| Item 16 | | |

Unless the context indicates otherwise, reference to Visa, we, us, our or the Company refers to Visa Inc. and its subsidiaries.

Visa and our other trademarks referenced in this report are Visa’s property. This report may contain additional trade names and trademarks of other companies. The use or display of other companies’ trade names or trademarks does not imply our endorsement or sponsorship of, or a relationship with, these companies.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, the impact on our future financial position, results of operations and cash flows; prospects, developments, strategies and growth of our business; anticipated expansion of our products in certain countries; size and growth of the total addressable opportunities in consumer payments and new flows and our ability to capture such opportunities; industry developments; anticipated timing and benefits of our acquisitions; expectations regarding litigation matters, investigations and proceedings; timing and amount of stock repurchases; sufficiency of sources of liquidity and funding; effectiveness of our risk management programs; and expectations regarding the impact of recent accounting pronouncements on our consolidated financial statements. Forward-looking statements generally are identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in Item 1, Item 1A, Item 7 and elsewhere in this report. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

PART I

ITEM 1. Business

OVERVIEW

Visa is one of the world’s leaders in digital payments. Our purpose is to uplift everyone, everywhere by being the best way to pay and be paid. We facilitate global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions and government entities through innovative technologies.

Since Visa’s early days in 1958, we have been in the business of facilitating payments between consumers and businesses. We are focused on extending, enhancing and investing in our proprietary advanced transaction processing network, VisaNet, to offer a single connection point for facilitating payment transactions to multiple endpoints through various form factors. As a network of networks enabling global movement of money through all available networks, we are working to provide payment solutions and services for everyone, everywhere.

•We facilitate secure, reliable and efficient money movement among consumers, issuing and acquiring financial institutions and merchants. We have traditionally referred to this structure as the “four-party” model. Please see Our Core Business discussion below. As the payments ecosystem continues to evolve, we have broadened this model to include digital banks, digital wallets and a range of financial technology companies (fintechs), governments and non-governmental organizations (NGOs). We provide transaction processing services (primarily authorization, clearing and settlement) to our financial institution and merchant clients through VisaNet. During fiscal 2024, 303 billion payments and cash transactions with Visa’s brand were processed by Visa or other networks, equating to an average of 829 million transactions per day. Of the 303 billion total transactions, 234 billion were processed by Visa.

•We offer a wide range of Visa-branded payment products that our clients, including nearly 14,500 financial institutions, use to develop and offer payment solutions or services, including credit, debit, prepaid and cash access programs for individual, business and government account holders. During fiscal 2024, Visa’s total payments and cash volume were $16 trillion, and we had 4.6 billion payment credentials, which are issued Visa card accounts, that were available to be used at more than 150 million merchant locations worldwide.(1)

•We take an open partnership approach and seek to provide value by enabling access to our global network, including offering our technology capabilities through application programming interfaces (APIs). We partner with both traditional and emerging players to innovate and expand the payments ecosystem, allowing them to use the resources of our platform to scale and grow their businesses more quickly and effectively.

•We are accelerating the migration to digital payments through our network of networks strategy. We aim to provide a single connection point so that Visa clients can enable money movement for businesses, governments and consumers, regardless of which network is used to start or complete the transaction. This model ultimately helps to unify a complex payments ecosystem. Visa’s network of networks approach creates opportunities by facilitating person-to-person (P2P), business-to-consumer (B2C), business-to-business (B2B) and government-to-consumer (G2C) payments, in addition to consumer to business (C2B) payments.

•We provide value-added services to our clients, including issuing solutions, acceptance solutions, risk and identity solutions, open banking solutions and advisory services.

•We invest in and promote our brand to the benefit of our clients and partners through advertising, promotional and sponsorship initiatives with the International Olympic Committee, the International Paralympic Committee, the National Football League, and the Red Bull Formula One Teams—the Oracle Red Bull Racing Team and the Visa Cash App RB Formula One Team, among others. We also use these sponsorship assets to showcase our payment innovations.

(1) The number includes an estimated 42 million locations through payment facilitators, which are technology providers that provide payment acceptance services to merchants on behalf of acquirers. Data provided to Visa by acquiring institutions and other third parties as of June 30, 2024.

FISCAL 2024 KEY STATISTICS

(1)Please see Item 7 of this report for a reconciliation of our GAAP to non-GAAP financial results.

OUR CORE BUSINESS

In a typical Visa C2B payment transaction, the consumer purchases goods or services from a merchant using a Visa card or payment product. The merchant presents the transaction data to an acquirer, usually a bank or third-party processing firm that supports acceptance of Visa cards or payment products, for verification and processing. Through VisaNet, the acquirer presents the transaction data to Visa, which in turn sends the transaction data to the issuer to check the account holder’s account balance or credit line for authorization. After the transaction is authorized, the issuer posts the transaction to the consumer’s account and effectively pays the acquirer an amount equal to the value of the transaction, minus the interchange reimbursement fee. The acquirer pays the amount of the purchase, minus the merchant discount rate (MDR), to the merchant.

Visa earns revenue by facilitating money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions and government entities through innovative technologies.

Our net revenue in fiscal 2024 consisted of the following:

| | | | | | | | | | | |

| SERVICE REVENUE Earned for services provided in support of client usage of Visa payment services | | OTHER REVENUE Consist mainly of value-added services related to advisory, marketing and certain card benefits; license fees for use of the Visa brand or technology; and fees for account holder services, certification and licensing |

| DATA PROCESSING REVENUE Earned for authorization, clearing and settlement; value-added services related to issuing, acceptance, and risk and identity solutions; network access; and other maintenance and support services that facilitate transaction and information processing among our clients globally |

| CLIENT INCENTIVES Paid to financial institution clients, merchants and other business partners to grow payments volume; increase Visa product acceptance; encourage merchant acceptance and use of Visa payment services; and drive innovation

|

| INTERNATIONAL TRANSACTION REVENUE Earned for cross-border transaction processing and currency conversion activities |

Please see Item 7 and Note 1—Summary of Significant Accounting Policies to our consolidated financial statements included in Item 8 of this report, which include disclosures on how we earn and recognize our revenue.

Visa provides payment processing for both non-Visa-branded and Visa-branded card transactions. In the context of non-Visa-branded card transactions, we facilitate payment processing by providing gateway routing services to other payment networks. At the client’s request, we may provide authorization, clearing or settlement services on our network before or after we route the transaction to the other payments network. In those instances, Visa may earn data processing revenue for the specific services provided. In the context of Visa-branded card transactions on our network, we provide authorization, clearing and settlement services and may earn service, data processing, international transaction or other revenue. Depending on applicable regulations, some payment processors may or may not use our network to process Visa-branded card transactions. If they use our network, we may earn service revenue and data processing revenue. If they do not use our network, we earn only service revenue.

Visa is not a financial institution. We do not issue cards, extend credit or set rates and fees for account holders of Visa products nor do we earn revenue from, or bear credit risk with respect to, any of these activities. Interchange reimbursement fees reflect the value merchants receive from accepting our products and play a key role in balancing the costs and benefits that account holders and merchants derive from participating in our payments network. Generally, interchange reimbursement fees are paid by acquirers to issuers. We establish default interchange reimbursement fees that apply absent other established settlement terms. These default interchange reimbursement fees are set independently from the revenue we receive from issuers and acquirers. Our acquiring clients are responsible for setting the fees they charge to merchants for the MDR and for soliciting merchants. Visa sets fees to acquirers independently from any fees that acquirers may charge merchants. Therefore, the fees we receive from issuers and acquirers are not derived from interchange reimbursement fees or MDRs.

Visa’s strategy is to accelerate our revenue growth in consumer payments, new flows and value-added services, and fortify the key foundations of our business model.

We seek to accelerate revenue growth in three primary areas — consumer payments, new flows and value- added services.

Consumer Payments

On an annual basis, we see more than $20 trillion(2) of opportunity globally, excluding Russia and China, to convert cash, check, Automated Clearing House (ACH), domestic schemes, and other forms of electronic payment into cards and digital accounts on Visa’s network. We aim to grow consumer payments through expansion of credentials and acceptance points and deepening engagement with consumers through key enablers. We are focused on developing innovative digital solutions and products across face-to-face and ecommerce payments, providing consumers and merchants around the world the best ways to pay and be paid.

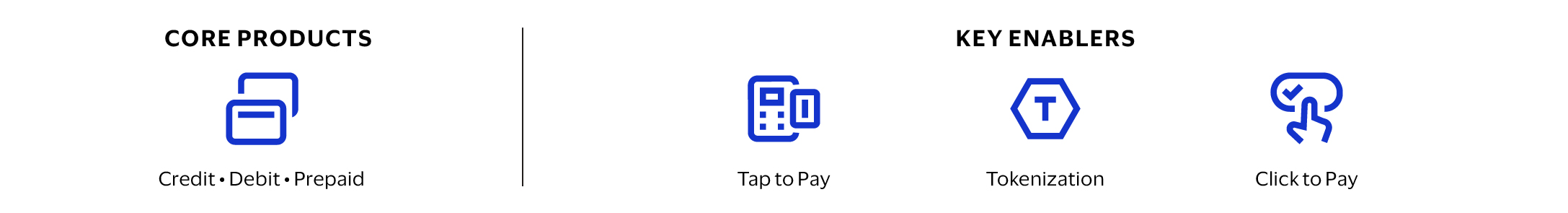

Core Products

Visa’s growth has been driven by the strength of our core products — credit, debit and prepaid.

Credit: Credit cards and digital credentials allow consumers and businesses to access credit to pay for goods and services. Credit cards are affiliated with programs operated by financial institution clients, co-brand partners, fintechs and affinity partners.

Debit: Debit cards and digital credentials allow consumers and small businesses to purchase goods and services using funds held in their deposit accounts. Debit cards enable account holders to transact in person, online or via mobile without needing cash or checks and without accessing a line of credit. The Visa/PLUS Global ATM network also provides debit, credit and prepaid account holders with cash access, and other

(2) Visa analysis based on third party studies.

banking capabilities, in more than 200 countries and territories worldwide through issuing and acquiring partnerships with both financial institutions and independent automated teller machine (ATM) operators.

Prepaid: Prepaid cards and digital credentials draw from a designated balance funded by individuals, businesses or governments. Prepaid cards address many use cases and needs, including general purpose reloadable, payroll, government and corporate disbursements, healthcare, gift and travel. Visa-branded prepaid cards also play an important part in financial inclusion, bringing payment solutions to those with limited or no access to traditional banking products.

Key Enablers

We enable consumer payments and help our clients grow as digital commerce, new technologies and new participants continue to transform the payments ecosystem. Some examples include:

Tap to Pay

Since we introduced Tap to Pay technology over ten years ago, it has emerged as a preferred way to pay in the face-to-face environment among consumers in many countries around the world. Tap to Pay adoption is growing and many consumers have come to expect this seamless payment experience.

Tap to Pay has become the default way Visa cardholders pay in nearly 60 countries and territories, with more than 90 percent penetration of Visa face-to-face transactions, and in over 125 countries and territories, Tap to Pay comprises more than 50 percent of our face-to-face transactions. Excluding the U.S., over 80 percent of face-to-face Visa transactions globally were contactless in fiscal 2024. In the U.S., Visa has surpassed 50 percent contactless penetration and more than 535 million Tap to Pay-enabled Visa cards have been issued. In addition, we have activated more than 870 contactless public transport projects worldwide. We processed more than 2.0 billion contactless transactions on global transit systems in fiscal 2024, surpassing the number of transactions in 2023.

Tokenization

Visa Token Service (VTS) brings trust to digital commerce innovation. As consumers increasingly rely on digital transactions, VTS is designed to enhance the digital ecosystem through improved authorization, reduced fraud and improved consumer experience. VTS helps protect digital transactions by replacing 16-digit Visa account numbers with a token that includes a surrogate account number, cryptographic information and other data to protect the underlying account information. This security technology can work for a variety of in person or online payment transactions. As of September 30, 2024, Visa has provisioned 11.5 billion network tokens.

Click to Pay

Click to Pay provides a simplified and more consistent cardholder checkout experience online by removing time-consuming key entry of personal information and enabling consumer and transaction data to be passed securely between payments network participants. Based on the EMV® Secure Remote Commerce industry standard, Click to Pay brings a standardized and streamlined approach to online checkout and meets the needs of consumers shopping across a growing number of connected devices. The goal of Click to Pay is to make online payments as secure, reliable and interoperable as the in-person checkout experience.

New Flows

Our new flows business is focused on driving digitization and improving the payments and money movement experience across all payment flows, beyond C2B, through our network of networks. These include P2P, B2C, B2B and G2C payments, which provide some of the largest payment opportunities in the world. Representing a total addressable opportunity of approximately $200 trillion(3) of payment flows annually, excluding Russia and China, this pillar of our business aims to make payments and money movement easier for businesses, consumers, and governments, using both Visa’s global network and connectivity to other networks around the world.

We have two key objectives in this business area.

The first objective is to grow B2B payments volume through our Visa Commercial Solutions. This part of the business focuses on addressing the $145 trillion of opportunity in B2B payment flows around the world annually, excluding Russia and China. We believe around 15% of the annual opportunity, or $20 trillion, could be addressed

(3) Visa analysis based on third party studies.

by our card and virtual products, which we are continuously evolving for more use cases. Another $105 trillion of the annual opportunity is in the accounts payable and accounts receivable space that largely relies on check, ACH, and wires. Lastly, cross-border volumes, which are addressable by our Visa Commercial Solutions and Visa Direct Platform, represent $20 trillion of opportunity on an annual basis.

The second objective is to put the power of money movement in our clients’ hands, enabling them to move money around the world. This part of the business focuses on addressing $20 trillion in B2C, $20 trillion in P2P, and $15 trillion in G2C opportunities annually, excluding Russia and China, as well as the cross-border B2B opportunity. These flows are largely addressed through our Visa Direct Platform, encompassing a broad network of eligible cards, bank accounts, and digital wallets, as well as our Visa B2B Connect network.

Visa Commercial Solutions

As a long-time participant in the B2B ecosystem, we have been supporting small businesses, large and middle market companies, and governments with their payments needs. We continue to see opportunity for growth as businesses seek simple digital experiences, similar to those available to consumers. Visa offers a holistic suite of tailored solutions for businesses – providing payment, reconciliation, and data to help manage working capital and drive efficiency, set spend controls, manage expenses, and automate payment processes.

Our portfolio of commercial payments solutions includes small business cards, corporate (travel) cards, purchasing cards, virtual cards and digital credentials. Businesses look to optimize processes and effectively manage working capital by utilizing our commercial payments solutions. To support small businesses we expanded the small business supplier matching webtool so that it is directly accessible to small and medium size businesses, enhancing their ability to use their cards for business payments. For large business spend, we have been expanding our presence in specific commercial spend verticals, such as fleet and fuel, travel and agriculture. We have also extended our products and capabilities specifically for accounts receivable and accounts payable spend, through either embedded finance capabilities, or new solutions like our Accounts Receivable Manager virtual card automation solution in the U.S.

Visa Direct Platform

We facilitate domestic and cross-border money movement, enabling clients to collect, convert, hold and send funds across our network, which has the potential to reach more than 11 billion cards, bank accounts and digital wallets. Visa Direct enables P2P payments and account-to-account (A2A) transfers, business and government payouts to individuals or small businesses, merchant settlements and refunds, among other use cases, across more than 195 countries and territories.

Visa Direct utilizes more than 75 domestic payment schemes, more than 15 real-time payments schemes, more than 15 card-based networks and more than five payment gateways, with the potential to reach more than 11.0 billion endpoints, through 4.0 billion cards, 3.5 billion bank accounts and 3.5 billion digital wallets. In fiscal 2024, Visa Direct processed nearly 10 billion transactions for more than 550 partners.

Visa B2B Connect is a key part of our value proposition and considered part of the Visa Direct platform. It is a multilateral B2B cross-border payments network designed to facilitate reliable, secure and cost-effective transactions from the bank of origin directly to the beneficiary bank, helping streamline settlement and optimize payments for financial institutions’ corporate clients. Visa B2B Connect continues to scale and is available in more than 100 countries and territories.

The Visa Direct platform now also includes Visa Cross-Border Solutions and our digitally native Currencycloud capabilities that service new flows and our established cross-border consumer payments businesses with capabilities such as providing real-time foreign exchange rates, virtual accounts, and enhanced liquidity and settlement.

In addition, our Visa+ solution provides interoperability for our clients. In fiscal 2023, we announced the launch of Visa+, which enables transfers between participating P2P apps. Visa+ is now fully live for eligible users of PayPal and Venmo in the U.S. In addition to bringing reach, flexibility and convenience to P2P payment experiences, Visa+

can help merchants improve the process of disbursing funds to their users, also known as B2C payouts, which is live with DailyPay.

Value-Added Services

Value-added services represent an opportunity for us to diversify our revenue with products and solutions that help our clients and partners optimize their performance, differentiate their offerings and create better experiences for their customers. Our comprehensive suite of value-added services spans five categories — Issuing Solutions, Acceptance Solutions, Risk and Identity Solutions, Open Banking Solutions and Advisory Services.

Our value-added services strategy has three areas of focus: (1) provide services for Visa transactions; (2) deliver network-agnostic services for non-Visa transactions; and (3) provide services that go beyond payments. We have made significant progress across each of these areas and offer more than 200 products and services as of September 30, 2024, many of which are designed to work together to deliver high impact business outcomes.

Issuing Solutions

Visa DPS is a large issuer processor of Visa debit transactions. In addition to multi-network transaction processing, Visa DPS also provides a wide range of value-added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions and contact center services. Our capabilities in API-based issuer processing solutions, like DPS Forward, allow our clients to create new payments use cases and provide them with modular capabilities for digital payments.

In early 2024, Visa completed its acquisition of Pismo, a global, cloud-native issuer processing and core banking platform with operations in Latin America, Asia Pacific and Europe. Pismo’s technology platform expands Visa’s offerings to include core banking and card-issuer processing capabilities across credit, debit and prepaid cards via cloud native APIs and also helps enable Visa to provide support and connectivity for emerging payment frameworks and real-time payments (RTP) networks for financial institution clients.

We provide a range of other services and digital solutions to issuers, such as account controls, digital issuance and branded consumer experiences. In addition, Visa offers loyalty and benefits solutions to issuers aimed at creating compelling and differentiated cardholder experiences, as well as Buy Now, Pay Later (BNPL) capabilities, which allow shoppers the flexibility to pay for a purchase in equal payments over a defined period of time. Visa is investing in installments as a payments strategy — by offering Visa credentials and BNPL solutions to issuers and fintechs.

Acceptance Solutions

Visa Acceptance Solutions provide modular, value-added services in addition to the traditional gateway function of connecting merchants to payment processing. Using the Visa Acceptance Platform, acquirers, payment service providers, independent software vendors and merchants can improve the way their consumers engage and transact; help to mitigate fraud and lower operational costs; and adapt to changing business requirements. They can also connect with other fintechs through a global payment management platform to use their services. Using an omnichannel solution with a cloud-based architecture, Visa Acceptance Solutions capabilities, which includes Cybersource and Authorize.net, provide new and enhanced payment integrations with ecommerce platforms, enabling sellers and acquirers to provide tailored commerce experiences with payments seamlessly embedded.

In addition, Visa Acceptance Solutions provide secure, reliable services for merchants and acquirers that reduce friction and drive acceptance. Examples include Token Management Service, which helps simplify network token adoption, access and management for merchant and acquiring clients, provides a single integration point into major card networks and is used standalone or easily integrated into other payment solutions (please see the Tokenization discussion above); Global Urban Mobility, which supports transit operators to accept Visa contactless payments in addition to closed-loop payment solutions; and Account Updater, which provides updated account information for merchants to help strengthen customer relationships and retention. Visa also offers Dispute

Management Services, including a network-agnostic solution from Verifi that enables merchants to prevent and resolve disputes with a single connection.

Risk and Identity Solutions

Visa’s Risk and Identity Solutions transform data into insights for near real-time decisions and facilitate account holder authentication to help financial institution and merchant clients prevent fraud and protect account holder data. With the increasing popularity of omnichannel commerce and digital payments among consumers, fraud prevention helps increase trust in digital payments. The Visa Protect suite of solutions include a range of products that empower financial institutions and merchants with tools that facilitate automation, simplify fraud prevention and enhance payment security, such as: Visa Consumer Authentication Service, Visa Protect Authentication Intelligence, and Visa Provisioning Intelligence. These offerings highlight our artificial intelligence (AI) and machine learning capabilities, for example, Visa Protect Authentication Intelligence uses machine learning algorithms to identify fraud for Visa Secure authentication requests and Visa Provisioning Intelligence is an AI-based product designed to prevent tokens from being fraudulently provisioned.

In March 2024, Visa announced three new products as part of the end-to-end Visa Protect suite that are designed to reduce fraud across immediate A2A and card not present (CNP) payments, as well as transactions both on and off Visa’s network. Visa Deep Authorization is an AI-powered transaction risk scoring solution tailored to better manage CNP payments, which strengthens the protection of Visa’s transactions through transaction risk scoring. Visa Protect for A2A Payments is our first fraud prevention solution built specifically for real-time non-card payments. Finally, Visa Risk Manager with scheme agnostic Visa Advanced Authorization is a comprehensive AI-powered fraud risk management solution. Visa’s value-added fraud prevention tools layer on top of a suite of our network programs that protect the safety and integrity of the payment ecosystem, help to prevent, detect and mitigate threats.

Open Banking Solutions

Since our acquisition of Tink AB, an open banking platform, we continue to accelerate the development and adoption of open banking securely and at scale. Visa’s open banking capabilities range from data access use cases, such as account verification, balance check and personal finance management, to payment initiation capabilities, such as A2A transactions and merchant payments. These capabilities can help our partner businesses deliver valuable services to their customers.

In fiscal 2024, we expanded our presence in Europe and began expanding into the U.S. with a suite of product offerings that enable users to connect accounts and provide trusted parties with access to their financial data, including digitizing and streamlining the A2A payments experience. In fiscal 2025, we plan to launch Visa A2A in the UK, an open system bringing standards, rules and a dispute management service to eligible banks and businesses, enabling them to provide consumers with a more streamlined bill payment experience. Key features will include increased protection, more optionality by allowing consumers to pay directly from their bank accounts and enhanced controls over payment permissions.

Advisory Services

Visa Advisory Services offers deep payments expertise through a global consulting practice, proprietary analytics models, data scientists and economists, marketing services and managed services to deliver insights for issuers, acquirers, merchants, fintechs and other partners that help them make better business decisions and scale their operations.

Operating as the payments consulting arm of Visa, Visa Consulting and Analytics (VCA) utilizes our payments expertise and economic intelligence to identify actionable insights, make recommendations and help implement solutions. VCA is comprised of specialized advisory practices such as: strategy and commercial money movement, portfolio optimization, digital, AI, risk and implementation support, which drive measurable outcomes for our clients. VCA Managed Services embeds teams within client organizations to help execute key initiatives.

Visa Marketing Services provides clients with unique activation opportunities with Visa’s sponsorships and utilizes our data analytics and understanding of customers’ transactional behavior to provide marketing solutions designed to deliver effective results, drive brand preference and influence consumer behavior.

We are fortifying the key foundations of our business model, which consist of becoming a network of networks, our technology platforms, security, brand and talent.

Network of Networks

Our network of networks strategy means moving money to all endpoints and to all form factors, using all available networks and being a single connection point for our partners and providing our value-added services on all transactions, no matter the network. The key component of our network of networks strategy is interoperability. We are opening up our network and increasingly using other networks to reach accounts we could not otherwise reach and enabling new types of money movement. Visa B2B Connect, Visa Direct and Visa+ are examples of our strategy. Visa has invested more than $3 billion in AI and data infrastructure over the last 10 years.

Technology Platforms

Visa’s leading technology platforms comprise software, hardware, data centers and a large telecommunications infrastructure. Visa’s four data centers are a critical part of our global processing environment and have a high redundancy of network connectivity, power and cooling designed to provide continuous availability of systems. Together, these systems deliver the secure, convenient and reliable service that our clients and consumers expect from the Visa brand.

Security

Our in-depth, multi-layer security approach includes a formal program to devalue sensitive and/or personal data through various cryptographic means; embedded security in the software development lifecycle; identity and access management controls to protect against unauthorized access; and advanced cyber detection and response capabilities. We use information security tools that help keep our clients and consumers safe and invest significantly in our comprehensive approach to cybersecurity. We deploy information security technologies to protect data confidentiality, the integrity of our network and service availability and to strengthen our core cybersecurity capabilities to minimize risk. Our payments ecosystem risk and control team continually monitors threats to the payments ecosystem to help ensure attacks are detected and prevented efficiently and effectively through pairing our AI capabilities with our security experts.

Brand

Visa’s strong brand helps deliver added value to our clients and their customers, financial institutions, merchants and partners through compelling brand expressions, a wide range of products and services as well as innovative brand and marketing efforts. In line with our commitment to an expansive and diverse range of partnerships for the benefit of our stakeholders, Visa is a sponsor of top entertainment and sports properties including the FIFA World Cup 2026TM, the Olympic and Paralympic Games, the National Football League, the Red Bull Formula One Teams—the Oracle Red Bull Racing Team and the Visa Cash App RB Formula One Team.

Talent

Attracting, developing and advancing the best talent globally is critical to our continued success. This year, we grew our total workforce from approximately 28,800 in fiscal 2023 to approximately 31,600 employees in fiscal 2024, an increase of 10 percent year over year. Voluntary workforce turnover (rolling 12-month attrition) was 5 percent as of September 30, 2024. Visa employees are located in more than 80 countries and territories, with 57 percent located outside the U.S. At the end of fiscal 2024, Visa’s global workforce was 58 percent men and 42 percent women, and women represented 38 percent of Visa’s leadership (defined as vice president level and above). In the U.S., ethnicity of our workforce was 42 percent Asian, 8 percent Black, 13 percent Hispanic, 3

percent Other and 34 percent White. For our U.S. leadership, the breakdown was 19 percent Asian, 5 percent Black, 13 percent Hispanic, 3 percent Other and 59 percent White.

As Visa strives to achieve our purpose and our growth objectives, we have focused on enhancing our employees’ expertise across our business. We offer unique career pathways for employees and provide them with tools and support to build on their leadership impact and develop their careers. Along with learning support from Visa University and our educational assistance program, employees are encouraged to broaden their knowledge and develop new skills through alternative career pathways and talent development programs including our global technology apprenticeship, military talent and mentorship programs. Visa’s commitment to fostering a culture of innovation and collaboration also is demonstrated through our employees’ adoption of generative AI tools for content generation, productivity and business automation, including an internal, secure version of ChatGPT and our Ask People Team Portal.

We are committed to providing benefits that support our employees. As part of our inclusive “whole person” approach to benefits, Visa offers a robust package of curated tools, resources, and benefits for our employees. While some programs may vary by location, some of our financial benefits include our 401(k) match, employee stock purchase plan and financial wellbeing sessions and resources. In addition to our enhanced mental well-being benefits, we began offering mental health first aid training for employees and are piloting a peer-to-peer ambassador network to create an employee support system.

Based on our latest employee engagement survey, 91% of employees would recommend Visa as a great place to work. We strive to put our people first, and this is exemplified by prioritizing investments to create spaces that encourage collaboration, inspire creativity and reflect our brand in our office locations and data centers worldwide. In 2024, Visa opened the Mission Rock market support center in San Francisco, forming a unified, complementary campus with our Foster City location.

This year, we also recommitted to ensuring that employees feel closely connected to one another and to our business at large. To support this effort, Visa activated Viva Engage, our new internal social network, as a place for all employees to collaborate, share information and connect with company leadership in real time, every day. Since our launch of Viva Engage, 97% of employees had visited the platform at least once, with 82% accessing the platform at least twice a week on average.

We also are dedicated to ensuring that employees feel valued in their day-to-day work. In recent years, Visa has prioritized and invested in employee recognition, which in turn drives engagement and innovation. Our UPLIFT program is designed to drive engagement and innovation by enabling employees to recognize, appreciate and celebrate each other, no matter their role or level. The UPLIFT program also drives Visa’s culture by grounding the recognition categories in Visa’s Leadership Principles – further reinforcing that at Visa, it is not only about what you achieve, but how you do it. For fiscal 2024, active UPLIFT platform users as a percentage of all users was 78%, while the number of recognitions sent nearly doubled, from approximately 130,000 to nearly 248,000 since the prior year.

For additional information regarding our human capital management, please see the section titled “Talent and Human Capital Management” in Visa’s 2024 Proxy Statement as well as our website at visa.com/crs, which includes our 2023 Consolidated EEO-1 Report and our 2023 Corporate Responsibility and Sustainability (CRS) Report. See Available Information below.

FINTECH AND DIGITAL PARTNERSHIPS

Fintechs are a vital growth engine for Visa and a key driver in realizing our purpose—to uplift everyone, everywhere by being the best way to pay and be paid. Fintechs are key enablers of new payment experiences and new flows. Our work with fintechs is one of our greatest opportunities and has opened new points of acceptance, extended credit at the point of sale, made cross-border money flows more efficient, moved B2B payments volume onto Visa’s network, expedited payroll and provided digital wallet customers access to our services. Our portfolio of fintech partners is diverse and continues to grow and scale. In fiscal 2024, we signed over 650 commercial partnerships with fintechs globally, from early-stage companies to growing and mature players, an increase of 30 percent year over year.

To better serve fintechs, Visa has a suite of streamlined commercial programs and digital onboarding tools. Fintech Fast Track, our flagship program for fintechs, is designed to help launch new financial features quickly, such as launching a new card program or enabling the movement of money with Visa Direct. We provide streamlined

onboarding and turnkey access to hundreds of ecosystem partners. The program has welcomed hundreds of fintechs who are actively engaged in the program.

Visa Ready, our certification program, helps technology companies build and launch payment solutions that meet Visa’s global standards around security and functionality. With our startup engagement programs, like the Visa Everywhere Initiative, early-stage companies can build payment solutions based on our capabilities. Visa also manages programs including She’s Next, Empowered by Visa, a global women’s entrepreneurship initiative, and the Africa Fintech Accelerator Program to uplift underrepresented communities.

MERGERS AND ACQUISITIONS, JOINT VENTURES AND STRATEGIC INVESTMENTS

Visa continually explores opportunities to augment our capabilities and provide meaningful value to our clients. Mergers and acquisitions, joint ventures and strategic investments complement our internal development and enhance our partnerships to align with Visa’s priorities. Visa applies a rigorous business analysis to our acquisitions, joint ventures and investments to ensure they will differentiate our network, provide value-added services and accelerate growth.

In fiscal 2024, we completed our acquisition of Pismo, and entered into definitive agreements to acquire a majority interest in Prosa, a leading payments processor in Mexico, and to acquire Featurespace, a developer of real-time AI payments protection technology that prevents and mitigates payments fraud and financial crime risks. After closing, Prosa will continue to operate as an independent company. The Prosa and Featurespace acquisitions are both subject to customary closing conditions, including applicable regulatory approvals.

CORPORATE RESPONSIBILITY AND SUSTAINABILITY

Visa is committed to operating as a responsible, ethical, inclusive and sustainable company. As one of the global leaders in digital payments, Visa strives to join with clients, partners and other stakeholders to empower people, businesses and communities to thrive, to be an industry leader in addressing the CRS topics most significant to our role as a payments technology company, and to meet and exceed our expectations for performance and transparency. Visa’s purpose is to uplift everyone, everywhere by being the best way to pay and be paid. We believe deeply in our purpose, and we are focused on empowering people and economies, securing commerce and protecting customers, investing in our workforce, protecting the planet and operating responsibly. Our 2023 CRS Report, as well as other CRS-related resources are available on our website at visa.com/crs. See Available Information below.

INTELLECTUAL PROPERTY

We own and manage the Visa brand, which stands for acceptance, security, convenience, speed and reliability. Our portfolio of Visa-owned trademarks is important to our business. Generally, trademark registrations are valid indefinitely as long as they are in use and/or maintained. We give our clients access to these assets through agreements with our issuers and acquirers, which authorize the use of our trademarks in connection with their participation in our payments network. Additionally, we own a number of patents and patent applications related to our business and continue to pursue patents in emerging technologies that may have applications in our business. We rely on a combination of patent, trademark, copyright and trade secret laws in the U.S. and other jurisdictions, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology.

COMPETITION

The global payments industry continues to undergo dynamic and rapid change. Existing and emerging competitors compete with Visa’s network and payment solutions for consumers and for participation by financial institutions and merchants. Technology and innovation are shifting consumer habits and driving growth opportunities in ecommerce, mobile payments, blockchain technology and digital currencies. These advances are enabling new entrants, many of which depart from traditional network payment models. In certain countries, the evolving regulatory landscape is creating local networks or enabling additional processing competition.

We compete against all forms of payment. These include paper-based payments, primarily cash and checks, and all forms of electronic payments. Our electronic payment competitors principally include:

Global or Multi-regional Networks: These networks typically offer a range of branded, general purpose card payment products that consumers can use at millions of merchant locations around the world. Examples include American Express, Diners Club/Discover, JCB, Mastercard and UnionPay. These competitors may be more concentrated in specific geographic regions, such as Discover in the U.S. and JCB in Japan, or have a leading

position in certain countries, such as UnionPay in China. See Item 1A—Regulatory Risks—Government-imposed obligations and/or restrictions on international payments systems may prevent us from competing against providers in certain countries, including significant markets such as China and India. Based on available data, Visa is one of the largest retail electronic funds transfer networks used throughout the world.

The following chart compares our network with certain network competitors for calendar year 2023(1):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Visa | | American Express | | Diners Club / Discover | | JCB | | Mastercard |

| Payments Volume ($B) | 12,620 | | | 1,665 | | | 256 | | | 321 | | | 7,344 | |

Total Volume ($B)(2) | 15,114 | | | 1,680 | | | 272 | | | 329 | | | 9,029 | |

| Total Transactions (B) | 284 | | | 12 | | | 4 | | | 7 | | | 184 | |

| Cards (M) | 4,484 | | | 141 | | | 72 | | | 156 | | | 2,948 | |

(1)American Express, Diners Club / Discover, JCB and Mastercard data sourced from The Nilson Report issue 1264 (May 2024). Includes all consumer, small business and commercial credit, debit and prepaid cards. American Express, Diners Club / Discover, and JCB include business from third-party issuers. JCB figures include other payment-related products and some figures are estimates. Mastercard excludes Maestro and Cirrus figures.

(2)Total volume is the sum of payments volume and cash volume. Cash volume generally consists of cash access transactions, balance access transactions, balance transfers and convenience checks.

Local and Regional Networks: Operated in many countries, these networks often have the support of government influence or mandate. In some cases, they are owned by financial institutions or payment processors. These networks typically focus on debit payment products, and may have strong local acceptance, and recognizable brands. Examples include NYCE, Pulse and STAR in the U.S.; Interac in Canada; and eftpos in Australia.

Alternative Payments Providers: These providers, such as closed commerce ecosystems, BNPL solutions and cryptocurrency platforms, often have a primary focus of enabling payments through ecommerce and mobile channels; however, they are expanding or may expand their offerings to the physical point of sale. These companies may process payments using in-house account transfers between parties, electronic funds transfer networks like the ACH, global or local networks like Visa, or some combination of the foregoing. In some cases, these entities can be both a partner and a competitor to Visa.

RTP Networks: RTP networks have launched in at least 80 countries and continue to be driven by strong government sponsorship and regulatory initiatives to enable and drive adoption (e.g., FedNow in the U.S., PIX in Brazil and United Payments Interface (UPI) in India), increasing their position as an alternative to payment card schemes. These networks primarily focus on domestic transactions, with adoption varying by use cases and geographies. However, with linkages such as PayNow in Singapore and UPI in India, cross-border RTP networks are advancing and will compete with our cross-border business. RTP networks can compete with Visa on consumer payments and other payment flows (e.g., B2B and P2P) but can also be customers for value-added services, such as risk management.

Digital Wallet Providers: They continue to expand payment capabilities in person and online for consumers and merchants and provide consumers with additional ways to pay. While digital wallets can help drive Visa volumes, they can also be funded by non-card payment options. Digital wallet providers who utilize RTP networks provide additional competition.

Payment Processors: Payment processors may perform processing services on third-party payments networks on behalf of issuers or acquirers. We compete with payment processors for the processing of Visa transactions. These processors may benefit from mandates requiring them to handle processing under local regulation. For example, as a result of regulation in Europe under the Interchange Fee Regulation (IFR), we may face competition from other networks, processors and other third parties who could process Visa transactions directly with issuers and acquirers.

New Flows Providers: We compete with alternative solutions to our new flows (e.g., Visa Direct and Visa B2B Connect) such as ACH, RTP and wires. We compete with other global and local card networks for commercial card portfolios. Additionally, we may face competition from financial institution clients who are experimenting with B2B blockchain payments.

Value-Added Service Providers: We face competition from companies that provide alternatives to our value-added services. These include a wide range of players, such as technology companies, information services and consulting firms, governments and merchant services companies. The integration of technology like generative AI can create new and better offerings that compete with our value-added services, such as strengthened risk monitorization and managing digital identification. Regulatory initiatives could also lead to increased competition in these areas.

We believe our fundamental value proposition of security, convenience, speed and reliability as well as the number of credentials and our acceptance footprint help us to succeed. In addition, we understand the needs of the individual markets in which we operate and partner with local financial institutions, merchants, fintechs, governments, NGOs and business organizations to provide tailored and innovative solutions. We will continue to utilize our network of networks strategy to facilitate the movement of money. We believe Visa is well-positioned competitively due to our global brand, our broad set of payment products, new flows offerings and value-added services and our proven track record of processing payment transactions securely and reliably.

GOVERNMENT REGULATION

As a global payments technology company, we are subject to complex and evolving global regulations in the various jurisdictions in which our products and services are used. The most significant government regulations that impact our business are discussed below. For further discussion of how global regulations may impact our business, see Item 1A—Regulatory Risks.

Anti-Corruption, Anti-Money Laundering, Anti-Terrorism and Sanctions: We are subject to anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act (FCPA), the UK Bribery Act and other laws that generally prohibit the making or offering of improper payments to foreign government officials and political figures for the purpose of obtaining or retaining business or to gain an unfair business advantage. We are also subject to anti-money laundering and anti-terrorist financing laws and regulations, including the U.S. Bank Secrecy Act. In addition, we are subject to economic and trade sanctions programs administered by the Office of Foreign Assets Control (OFAC) in the U.S. Therefore, we do not permit financial institutions or other entities that are domiciled in countries or territories subject to comprehensive OFAC trade sanctions (currently, Cuba, Iran, North Korea, Syria, Crimea and the Donetsk People’s Republic and Luhansk People’s Republic regions of Ukraine), or that are included on OFAC’s list of Specially Designated Nationals and Blocked Persons, to issue or acquire Visa cards or engage in transactions using our products and services.

Government-imposed Market Participation Restrictions: Certain governments, including China, India, Indonesia, Thailand and Vietnam, have taken actions to promote domestic payments systems and/or certain issuers, payments networks or processors, by imposing regulations that favor domestic providers, impose local ownership requirements on processors, require data localization or mandate that domestic processing be done in that country.

Interchange Rates and Fees: An increasing number of jurisdictions around the world regulate or influence debit and credit interchange reimbursement rates in their regions. For example, the U.S. Dodd-Frank Wall Street Reform and Consumer Act (Dodd-Frank Act) limits interchange reimbursement rates for certain debit card transactions in the U.S.; the European Union (EU) IFR limits interchange rates in the European Economic Area (EEA) (as discussed below); and the Reserve Bank of Australia (RBA) regulates average permissible levels of interchange.

Internet Transactions: Many jurisdictions have adopted regulations that require payments system participants to monitor, identify, filter, restrict or take other actions with regard to certain types of payment transactions on the Internet, such as gambling, digital currencies, the purchase of cigarettes or alcohol and other controversial transaction types.

Network Exclusivity and Routing: In the U.S., the Dodd-Frank Act limits network exclusivity and restrictions on merchant routing choice for the debit and prepaid market segments. Other jurisdictions impose similar limitations, such as the IFR’s prohibition in Europe on restrictions that prevent multiple payment brands or functionality on the same card.

No-surcharge Rules: We have historically enforced rules that prohibit merchants from charging higher prices to consumers who pay using Visa products instead of other means. However, merchants’ ability to surcharge varies by geographic market as well as Visa product type, and continues to be impacted by litigation, regulation and legislation.

Privacy, Data Use, AI and Cybersecurity: Aspects of our operations or business are subject to increasingly complex and fragmented data-related regulations, including with respect to privacy, data use, AI and cybersecurity, which impact the way we collect, use and handle data, operate our products and services and even impact our ability to offer a product or service. In addition, legislatures and regulators globally are proposing new laws or regulations on these topics that could require Visa to adopt more restrictive data collection and processing practices; expand cybersecurity requirements; limit cross-border data flows; impact the adoption of advanced AI systems; and impose increased obligations on companies handling personal data.

Supervisory Oversight of the Payments Industry: Visa is subject to financial sector oversight and regulation in substantially all of the jurisdictions in which we operate. In the U.S., for example, the Federal Banking Agencies (FBA) (formerly known as the Federal Financial Institutions Examination Council) has supervisory oversight over Visa under applicable federal banking laws and policies as a technology service provider to U.S. financial institutions. The federal banking agencies comprising the FBA are the Federal Reserve Board, the Comptroller of the Currency, the Federal Deposit Insurance Corporation and the National Credit Union Administration. Visa may also be separately examined by the Consumer Financial Protection Bureau (CFPB) as a service provider to the banks that issue Visa-branded consumer credit and debit card products. Central banks in other countries/regions, including Canada, Europe, India, Ukraine and the UK (as discussed below), have recognized or designated Visa as a retail payment system under various types of financial stability regulations. Visa is also subject to oversight by banking and financial sector authorities in other jurisdictions, such as Brazil and Hong Kong.

European and United Kingdom Regulations and Supervisory Oversight: Visa in Europe continues to be subject to complex and evolving regulation in the EEA and the UK.

There are a number of EU regulations that impact our business. As discussed above, the IFR regulates interchange rates within the EEA, requires Visa Europe to separate its payment card scheme activities from processing activities for accounting, organization and decision-making purposes within the EEA, and imposes limitations on network exclusivity and routing. National competent authorities in the EEA are responsible for monitoring and enforcing the IFR in their markets. We are also subject to regulations governing areas such as privacy and data protection, anti-bribery, anti-money laundering, anti-terrorism and sanctions. Other regulations in Europe, such as the second Payment Services Directive (PSD2), require, among other things, that our financial institution clients provide certain customer account access rights to emerging non-financial institution players. PSD2 also includes strong customer authentication requirements for certain transactions that could impose both operational complexity on Visa and impact consumer payment experiences. Visa Europe is also subject to supervisory oversight by the European Central Bank and certain competent authorities in Europe.

In the UK, Visa Europe is designated as a Recognized Payment System, bringing it within the scope of the Bank of England’s supervisory powers and subjecting it to various requirements, including on issues such as governance and risk management designed to maintain the stability of the UK’s financial system. Visa Europe is also regulated by the UK’s Payment Systems Regulator (PSR), which has wide-ranging powers and authority to review our business practices, systems, rules and fees with respect to promoting competition and innovation in the UK, and ensuring payment systems take care of, and promote, the interests of service-users. The PSR recently established a supervisory team to specifically oversee payment system operators like Visa in the aforementioned areas. Post-Brexit, the UK has adopted various European regulations, including regulations that impact the payments ecosystem, such as the IFR and PSD2. The PSR is responsible for monitoring Visa Europe’s compliance with the IFR as adopted in the UK.

Corporate Responsibility and Sustainability: Certain governments around the world are adopting laws and regulations pertaining to corporate responsibility and sustainability performance, transparency and reporting. Regulations may include mandated corporate reporting (e.g., Corporate Sustainability Reporting Directive) or in individual areas, such as mandated reporting on climate-related financial disclosures.

Additional Regulatory Developments: Various regulatory agencies across the world also continue to examine a wide variety of other issues, including mobile payment transactions, tokenization, access rights for non-financial institutions, money transfer services, identity theft, account management guidelines, disclosure rules, security and marketing that could affect our financial institution clients and our business. Furthermore, following the passage of PSD2 in Europe, several countries, including Australia, Brazil, Canada, Hong Kong and Mexico, are contemplating granting or have already granted various types of access rights to third-party processors, including access to consumer account data maintained by our financial institution clients. In October 2024, the CFPB in the United States issued a final rule on personal financial data rights that would provide consumers (and third parties

authorized by consumers) with access to consumers’ financial data. These changes have the potential to change the competitive landscape, which would present new challenges and opportunities to our business.

AVAILABLE INFORMATION

Our corporate website is visa.com/ourbusiness. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, proxy statements and any amendments to those reports filed or furnished pursuant to the U.S. Securities Exchange Act of 1934 can be viewed at sec.gov and our investor relations website at investor.visa.com as soon as reasonably practicable after these materials are electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). In addition, we routinely post financial and other information, which could be deemed to be material to investors, on our investor relations website. Information regarding our corporate responsibility and sustainability initiatives is also available on our website at visa.com/crs. The content of any of our websites referred to in this report is not incorporated by reference into this report or any other filings with the SEC.

ITEM 1A. Risk Factors

Regulatory Risks

We are subject to complex and evolving global regulations that could harm our business and financial results.

As a global payments technology company, we are subject to complex and evolving regulations that govern our operations. See Item 1—Government Regulation for more information on the most significant areas of regulation that affect our business. The impact of these regulations on us, our clients, and other third parties could limit our ability to enforce our payments system rules; require us to adopt new rules or change existing rules; affect our existing contractual arrangements; increase our compliance costs; and require us to make our technology or intellectual property available to third parties, including competitors, in an undesirable manner. As discussed in more detail below, we may face differing rules and regulations in matters like interchange reimbursement rates, preferred routing, domestic processing and localization requirements, currency conversion, point-of-sale transaction rules and practices, privacy, data use and protection, licensing requirements, and associated product technology. As a result, the Visa operating rules and our other contractual commitments may differ from country to country, state to state, or by products. Complying with these and other regulations increases our costs and operational complexity, and reduces our revenue opportunities.

If widely varying regulations come into existence worldwide, we may have difficulty rapidly adjusting our products, services, fees and other important aspects of our business to comply with the regulations. Our compliance programs and policies are designed to support our compliance with a wide array of regulations and laws, such as regulations regarding anti-money laundering, anti-corruption, competition, money transfer services, privacy, and sanctions, and we continually adjust our compliance programs as regulations evolve. However, we cannot guarantee that our practices will be deemed compliant by all applicable regulatory authorities. In the event our controls should fail or we are found to be out of compliance for other reasons, we could be subject to monetary damages, civil and criminal penalties, litigation, investigations and proceedings, and damage to our global brands and reputation. Furthermore, the evolving and increased regulatory focus on the payments industry could negatively impact or reduce the number of Visa products our clients issue, the volume of payments we process, our net revenue, our brands, our competitive positioning, our ability to use our intellectual property to differentiate our products and services, the quality and types of products and services we offer, the countries in which our products are used, and the types of consumers and merchants who can obtain or accept our products, all of which could harm our business and financial results.

Increased scrutiny and regulation of the global payments industry, including with respect to interchange reimbursement fees, merchant discount rates, operating rules, risk management protocols and other related practices, could harm our business.

Regulators around the world have been establishing or increasing their authority to regulate various aspects of the payments industry. See Item 1—Government Regulation for more information. In the U.S. and many other jurisdictions, we have historically set default interchange reimbursement fees. Even though we generally do not receive any revenue related to interchange reimbursement fees in a payment transaction (in the context of credit and debit transactions, those fees are paid by the acquirers to the issuers; the reverse is true for certain transactions like ATM), interchange reimbursement fees are a factor on which we compete with other payments providers and are therefore an important determinant of the volume of transactions we process. Consequently, changes to these fees, whether voluntarily or by mandate, can substantially affect our overall payments volumes and net revenue.

Interchange reimbursement fees, certain operating rules and related practices continue to be subject to increased government regulation globally, and regulatory authorities and central banks in a number of jurisdictions have reviewed or are reviewing these fees, rules, and practices. For example:

•Regulations adopted by the U.S. Federal Reserve cap the maximum U.S. debit interchange reimbursement rate received by large financial institutions at 21 cents plus 5 basis points per transaction, plus a possible fraud adjustment of 1 cent. Additionally, the Dodd-Frank Act limits issuers’ and payment networks’ ability to adopt network exclusivity and preferred routing in the debit and prepaid area, which also impacts our business. In response to merchant requests, the Federal Reserve has recently taken actions to revisit its regulations that implement these aspects of the Dodd-Frank Act. For example, in October 2022, the Federal Reserve published a final rule effectively requiring issuers to ensure that at least two unaffiliated networks

are available for routing CNP debit transactions by July 1, 2023. In October 2023, the Federal Reserve issued a proposal for comment which would further lower debit interchange rates, with a mechanism for automatic adjustment every two years. Separately, there continues to be interest in regulation of credit interchange fees and routing practices by members of Congress and state legislators in the U.S. In June 2023, legislation was reintroduced in the U.S. House of Representatives and Senate, which among other things, would require large issuing banks to offer a choice of at least two unaffiliated networks over which electronic credit transactions may be processed. Similar legislation was introduced in the previous Congress in 2022 but failed to advance. The current legislation has additional bipartisan support, and while the ultimate outcome of the legislation remains unclear, its sponsors continue to strongly advocate for its passage. Finally, some states in the U.S. have passed or are considering passing laws that regulate how interchange can be assessed. For example, in May 2024, Illinois passed a law that restricts the assessment of interchange on the state tax and gratuity portions of a transaction, and restricts financial institutions and payment networks, among others, from using payment transaction data for any purpose other than facilitating or processing a transaction. Such laws may also impose significant technical and compliance burdens on our business. In Europe, the EU’s IFR places an effective cap on consumer credit and consumer debit interchange fees for both domestic and cross-border transactions within the EEA (30 basis points and 20 basis points, respectively). EU member states have the ability to further reduce these interchange levels within their territories. The European Commission has announced its intention to conduct another impact assessment of the IFR, which could result in even lower caps on interchange rates and the expansion of regulation to other types of products, services and fees.

•Several countries in Latin America continue to explore regulatory measures against payments networks and have either adopted or are exploring interchange caps, including Argentina, Brazil, Chile and Costa Rica. In Asia Pacific, the Reserve Bank of Australia (RBA) which already regulates interchange, continues to monitor issues related to the cost of acceptance, the potential merits of mandating merchant choice routing on dual network debit cards and competition in digital wallet payments. In 2022, the New Zealand Parliament passed legislation capping domestic interchange rates for debit and credit products, and the government remains focused on lowering costs of digital payments to businesses and consumers. Interchange is also regulated in certain countries in the Central and Eastern Europe, Middle East and Africa region, including the United Arab Emirates. Finally, many governments, including but not limited to governments in India, Costa Rica, and Turkey, are using regulation to further drive down MDR, which could negatively affect the economics of our transactions.

•While the focus of interchange and MDR regulation has primarily been on domestic rates historically, there are several examples of increasing focus on cross-border rates in recent years. For example, in 2019, we agreed to limit certain cross-border interchange rates in a settlement with the European Commission. That agreement has been extended through 2029. In 2020, Costa Rica became the first country to formally regulate cross-border interchange rates by regulation. Cross-border MDR is also regulated in Costa Rica and Turkey. In June 2022, the UK’s PSR initiated a market review focusing on post-Brexit increases in interchange rates for transactions between the UK and Europe.

•As referenced above, with increased lobbying by merchants and other industry participants, we are also beginning to see regulatory interest in network fees. For example, the UK’s PSR is conducting a market review into scheme and processing fees. In its interim report, the PSR indicated that it is reviewing possible remedies, any of which, if adopted, could impose additional complexity and burdens on our business in the UK. Other regulators, for example, in Australia, the EU, and Chile, have expressed an interest in network fees, including issues related to transparency. Finally, in 2024, the Greek Parliament limited acquirer fees for certain small ticket transactions in some merchant categories for a period of three years.

•In addition, industry participants in some countries, including Argentina, Colombia, the Dominican Republic, Paraguay, Peru and South Africa have sought intervention from competition regulators or filed claims relating to certain network rules, including Visa’s restrictions on cross-border acquiring. The Central Bank of Chile recently enacted regulation that will permit cross-border acquiring for CNP transactions under certain conditions. Other countries, like Brazil, have adopted regulations that require us to seek government pre-approval for certain of our network rules, which could also impact the way we operate in certain markets.

•Government regulations or pressure may also impact our rules and practices and require us to allow other payments networks to support Visa products or services, to have the other networks’ functionality or brand marks on our products, or to share our intellectual property with other networks. In addition, the EU’s

requirement to separate scheme and processing adds costs and impacts the execution of our commercial, innovation and product strategies.