KKR & Co. Inc. Reports First Quarter 2023 Financial Results May 8, 2023

i New York, May 8, 2023 – KKR & Co. Inc. (NYSE: KKR) today reported its first quarter 2023 results. Conference Call A conference call to discuss KKR's financial results will be held on May 8, 2023 at 12:00 p.m. ET. The conference call may be accessed by dialing +1 (877) 407-0312 (U.S. callers) or +1 (201) 389-0899 (non-U.S. callers); a pass code is not required. Additionally, the conference call will be broadcast live over the Internet and may be accessed through the Investor Center section of KKR's website at https://ir.kkr.com/events-presentations/. A replay of the live broadcast will be available on KKR's website beginning approximately one hour after the live broadcast ends. About KKR KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of The Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR's website at www.kkr.com and on Twitter @KKR_Co. “Against a dynamic macroeconomic and market backdrop, our first quarter financial results proved resilient reflecting the breadth and strength of our firm. Over the last 12 months, 95% of the new capital entrusted to us has been outside of our traditional private equity funds reflecting our continued diversification. In our experience, volatility creates opportunity — with over $100 billion of dry powder ready to deploy on behalf of our clients globally, we remain very well positioned.” Joseph Y. Bae and Scott C. Nuttall Co-Chief Executive Officers KKR Reports First Quarter 2023 Financial Results

ii Legal Disclosures This presentation has been prepared by KKR & Co. Inc. solely for informational purposes for its public stockholders in connection with evaluating the business, operations and financial results of KKR & Co. Inc. and its subsidiaries (collectively, “KKR”), which includes The Global Atlantic Financial Group LLC and its subsidiaries (collectively, “Global Atlantic”) as of May 8, 2023. This presentation is not and shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell any securities of KKR & Co. Inc. This presentation may not be distributed, referenced, quoted or linked by website, in whole or in part, except as agreed to in writing by KKR & Co. Inc. The statements contained in this presentation are made as of the date of this presentation (other than financial figures, which are as of quarter end), unless another time is specified in relation to them, and access to this presentation at any given time shall not give rise to any implication that there has been no change in the facts set forth in this presentation since that date. This presentation contains certain forward-looking statements pertaining to KKR, including with respect to the investment funds, vehicles and accounts managed by KKR and the insurance companies managed by Global Atlantic. Forward-looking statements relate to expectations, estimates, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. You can identify these forward-looking statements by the use of words such as "outlook," "believe," “think,” "expect," "potential," "continue," "may," "should," "seek," "approximately," "predict," "intend," "will," "plan," "estimate,“ "anticipate," the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. These forward-looking statements are based on KKR’s beliefs, assumptions and expectations, but these beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to KKR or within its control. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. All forward-looking statements speak only as of the date of this presentation. KKR does not undertake any obligation to update any forward-looking statements to reflect circumstances or events that occur after the date of this presentation except as required by law. Please see the Appendix for additional important information about forward looking statements, including the assumptions and risks concerning projections and estimates of future performance. This presentation includes certain non-GAAP measures, including after-tax distributable earnings (or DE), fee related earnings (or FRE), book value. These non-GAAP measures are in addition to, and not a substitute for, measures of financial and operating performance prepared in accordance with U.S. GAAP. While we believe that providing these non-GAAP measures is helpful to investors in assessing the overall performance of KKR’s business, they may not include all items that are significant to an investor’s analysis of our financial results. Please see the Appendix for additional important information about the non- GAAP measures presented herein and a reconciliation of non-GAAP measures to comparable GAAP measures. Please see the Appendix for other important information. In addition, information about factors affecting KKR, including a description of risks that should be considered when making a decision to purchase or sell any securities of KKR & Co. Inc., can be found in KKR & Co. Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 27, 2023 and its other filings with the SEC, which are available at www.sec.gov. Contact Information Investor Relations Craig Larson Phone: +1 (877) 610-4910 in U.S. / +1 (212) 230-9410 investor-relations@kkr.com Media Kristi Huller Phone: +1 (212) 750-8300 media@kkr.com KKR Reports First Quarter 2023 Financial Results

KKR & Co. Inc. First Quarter Earnings

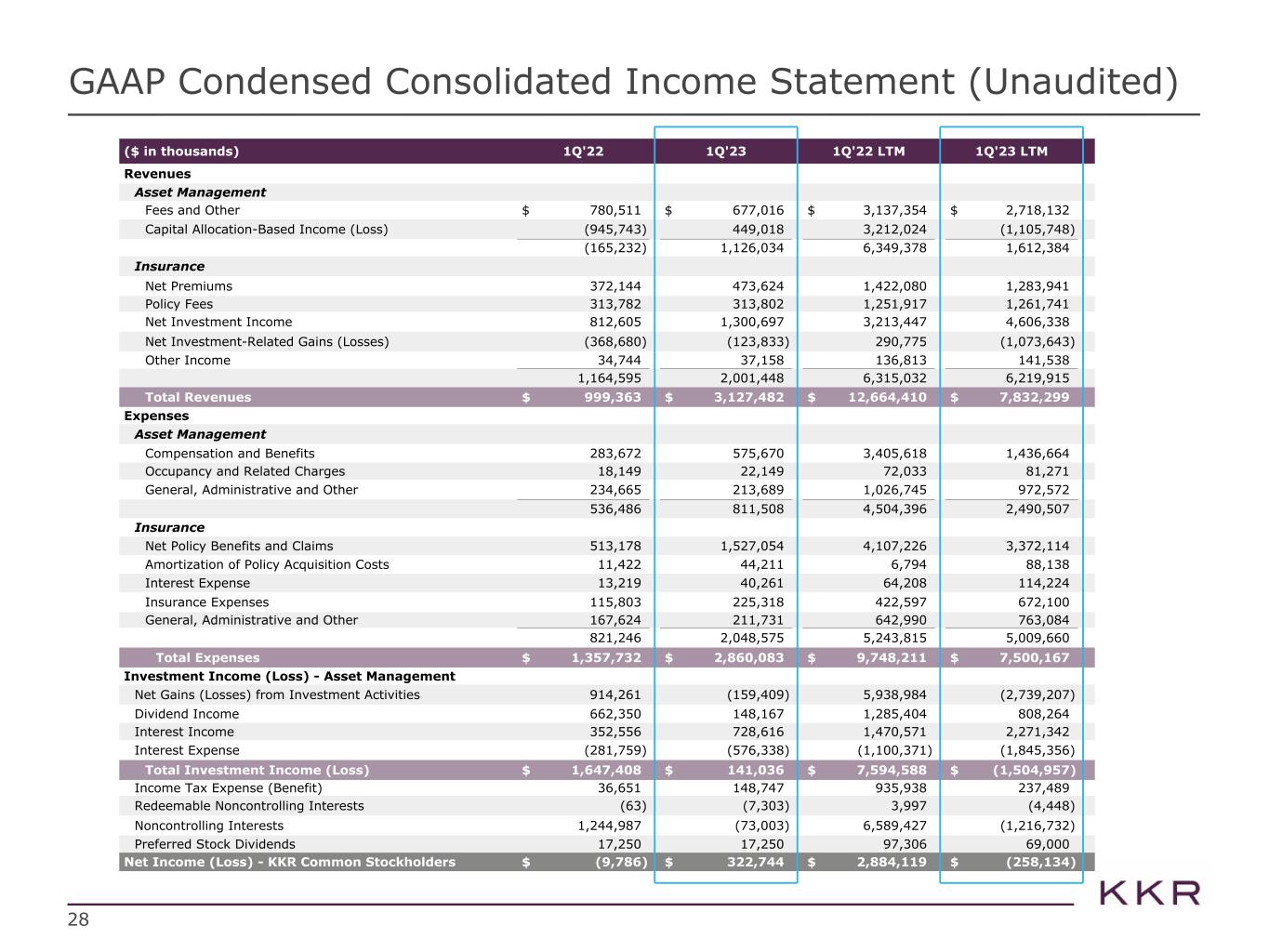

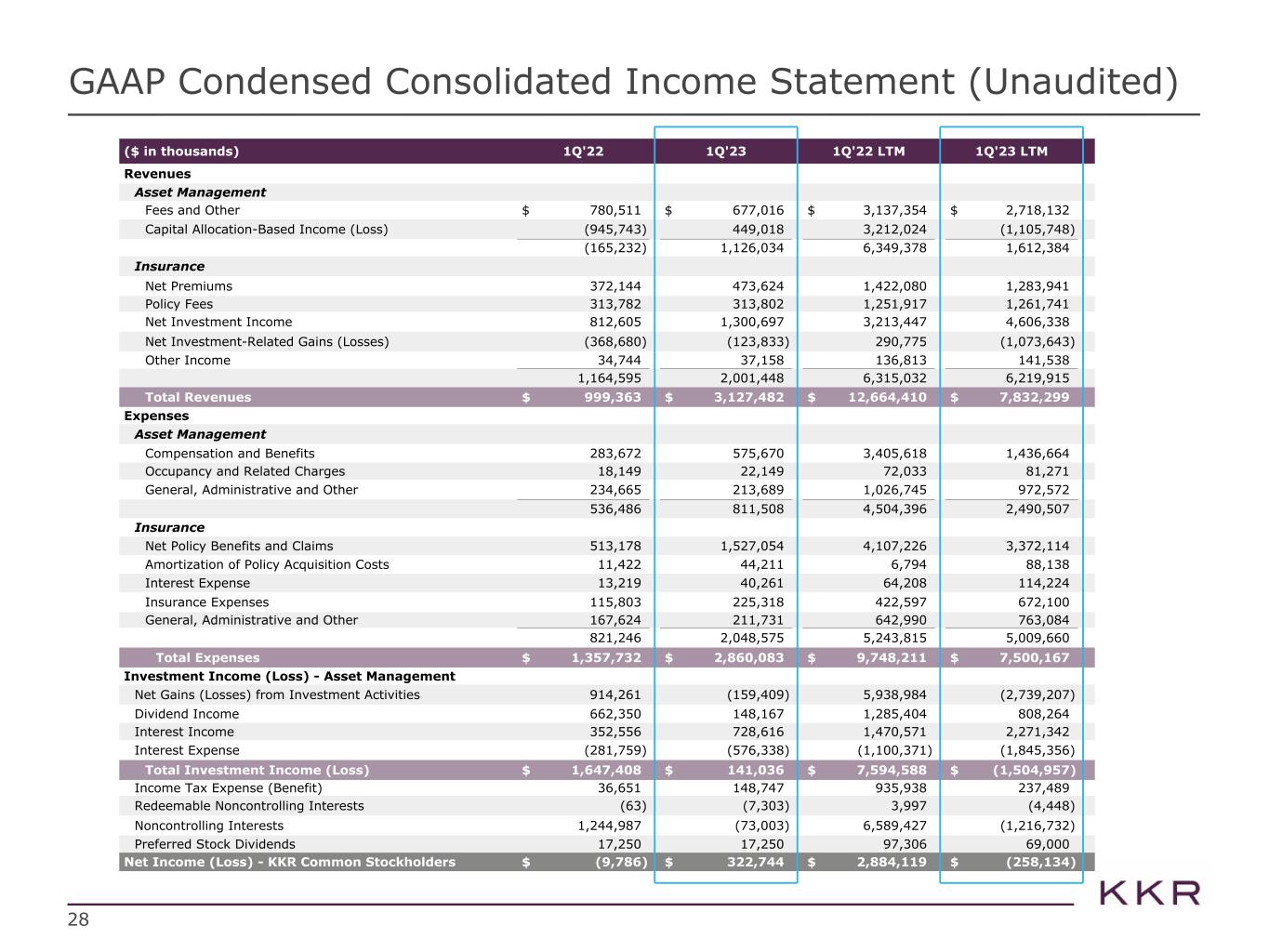

1 • GAAP Net Income (Loss) Attributable to KKR & Co. Inc. Common Stockholders was $322.7 million for the quarter. GAAP Stockholders’ Equity Per Outstanding Share of Common Stock was $21.54 at quarter end. Note: All figures in this presentation are as of March 31, 2023, unless otherwise specifically indicated. See Appendix for GAAP income statement and GAAP balance sheet. Totals may not add due to rounding. As required under GAAP, for the quarter ended March 31, 2022 and for the last twelve months ended March 31, 2023, unvested shares of common stock of KKR & Co. Inc. are excluded from the calculation of diluted earnings per share of common stock because inclusion of such unvested shares of common stock would be antidilutive having the effect of decreasing the loss per share of common stock. ($ in thousands, except per share data) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Revenues Asset Management $ (165,232) $ 1,126,034 $ 6,349,378 $ 1,612,384 Insurance 1,164,595 2,001,448 6,315,032 6,219,915 Total Revenues $ 999,363 $ 3,127,482 $ 12,664,410 $ 7,832,299 Expenses Asset Management 536,486 811,508 4,504,396 2,490,507 Insurance 821,246 2,048,575 5,243,815 5,009,660 Total Expenses $ 1,357,732 $ 2,860,083 $ 9,748,211 $ 7,500,167 Total Investment Income (Loss) - Asset Management $ 1,647,408 $ 141,036 $ 7,594,588 $ (1,504,957) Income Tax Expense (Benefit) 36,651 148,747 935,938 237,489 Redeemable Noncontrolling Interests (63) (7,303) 3,997 (4,448) Noncontrolling Interests 1,244,987 (73,003) 6,589,427 (1,216,732) Preferred Stock Dividends 17,250 17,250 97,306 69,000 Net Income (Loss) - KKR Common Stockholders $ (9,786) $ — $ 322,744 $ 2,884,119 $ (258,134) Net Income (Loss) Attributable to KKR & Co. Inc. Per Share of Common Stock Basic $ (0.02) $ 0.37 $ 4.92 $ (0.32) Diluted $ (0.02) $ 0.36 $ 4.61 $ (0.32) Weighted Average Shares of Common Stock Outstanding Basic 592,202,835 861,108,510 586,074,705 815,810,479 Diluted 592,202,835 887,169,336 640,185,279 815,810,479 4Q'22 1Q'23 KKR & Co. Inc. Stockholders' Equity Per Outstanding Share of Common Stock $ 20.55 $ 21.54 KKR’s First Quarter 2023 GAAP Results (Unaudited)

2 Financial Measures • Fee Related Earnings (“FRE”) of $549 million ($0.62/adj. share) in the quarter, down 9% year-over-year • FRE was $2.1 billion in the LTM ($2.38/adj. share), down 5% year-over-year • After-tax Distributable Earnings (“DE”) of $719 million ($0.81/adj. share) in the quarter, down 26% year-over-year • DE was $3.3 billion in the LTM ($3.67/adj. share), down 23% year-over-year • Book Value Per Adjusted Share (“BVPS”) of $27.65 at quarter end including $19.52 per adj. share of Net Cash and Total Investments Capital Metrics • Assets Under Management (“AUM”) of $510 billion, up 6% year-over-year • Fee Paying Assets Under Management (“FPAUM”) of $416 billion, up 12% year- over-year • Uncalled Commitments of $106 billion, down 7% year-over-year • New Capital Raised of $12 billion in the quarter and $67 billion in the LTM • Capital Invested of $10 billion in the quarter and $60 billion in the LTM Corporate • Regular dividend of $0.165 per share of common stock was declared for the quarter, up 6% on an annualized basis from the 2022 dividend • Beginning this quarter: i) KKR's financial statements reflect the implementation of long duration targeted improvements (LDTI) accounting changes at Global Atlantic; and ii) KKR's Insurance Segment Operating earnings are shown on a pre-tax basis. Within KKR's Segment Earnings, taxes attributable to KKR's Asset Management and Insurance segments are both captured within the "Income Taxes on Operating Earnings" line item. On May 3, 2023, KKR filed a Form 8-K with recast figures for 2021 and 2022 reflecting both of these changes KKR’s First Quarter 2023 Highlights Note: Adj. share refers to adjusted shares. See the Appendix for GAAP reconciliations, endnotes about Net Cash and Total Investments and other important information. See page 26 for record and payment dates for common and preferred stock.

3 Note: See Appendix for GAAP reconciliations, endnotes about taxes affecting After-tax Distributable Earnings and other important information. ($ in thousands, except per share data) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Management Fees $ 624,928 $ 738,156 $ 2,256,628 $ 2,769,715 Transaction and Monitoring Fees, Net 306,038 142,179 1,174,602 612,074 Fee Related Performance Revenues 12,051 21,741 47,607 100,355 Fee Related Compensation (212,220) (203,094) (782,822) (760,609) Other Operating Expenses (125,875) (150,404) (484,869) (610,528) Fee Related Earnings $ 604,922 $ 548,578 $ 2,211,146 $ 2,111,007 Realized Performance Income 609,207 175,398 2,579,494 1,742,849 Realized Performance Income Compensation (383,635) (114,009) (1,512,826) (1,063,900) Realized Investment Income 349,354 198,094 1,501,325 983,159 Realized Investment Income Compensation (52,403) (29,714) (225,206) (136,314) Asset Management Segment Operating Earnings 1,127,445 778,347 4,553,933 3,636,801 Insurance Segment Operating Earnings 143,947 205,112 847,444 785,927 Distributable Operating Earnings 1,271,392 983,459 5,401,377 4,422,728 Interest Expense and Other (77,076) (91,126) (301,046) (352,439) Income Taxes on Operating Earnings (220,279) (173,057) (868,964) (812,742) After-tax Distributable Earnings $ 974,037 $ 719,276 $ 4,231,367 $ 3,257,547 Additional Financial Measures and Capital Metrics: FRE per Adjusted Share $ 0.69 $ 0.62 $ 2.51 $ 2.38 After-tax DE per Adjusted Share $ 1.11 $ 0.81 $ 4.80 $ 3.67 Total Asset Management Segment Revenues $ 1,901,578 $ 1,275,568 $ 7,559,656 $ 6,208,152 Assets Under Management $ 479,032,000 $ 510,069,000 $ 479,032,000 $ 510,069,000 Fee Paying Assets Under Management $ 371,176,000 $ 415,871,000 $ 371,176,000 $ 415,871,000 KKR’s First Quarter 2023 Segment Earnings

4 Management Fees and Fee Related Earnings Fee Related Earnings Per Adjusted ShareManagement Fees • Increased by 23% to $2.8 billion in the LTM • Growth has been driven by an increase in Fee Paying AUM from organic capital raised ($ in millions) • Decreased 5% year-over-year driven primarily by lower capital markets revenues reflecting reduced issuance levels across global equity and leveraged loan markets $1,442 $2,071 $2,656 $2,257 $2,770 2020 2021 2022 LTM 1Q'22 LTM 1Q'23 58% 61% $2.51 $2.38 64% 61% FRE per adjusted share FRE margin LTM 1Q'22 LTM 1Q'23

5 Assets Under Management • AUM increased to $510 billion, up 6% year-over-year, with $12 billion of organic new capital raised in the quarter and $67 billion in the LTM • Fee Paying AUM of $416 billion, up 12% year-over-year, with $13 billion of organic new capital raised in the quarter and $65 billion in the LTM • Perpetual Capital reached $197 billion, up 19% year-over-year driven primarily by the organic growth of Global Atlantic and the acquisition of KJRM. Perpetual capital represents 39% of AUM and 47% of FPAUM AUM Fee Paying AUM Perpetual Capital ($ in billions) ($ in billions) ($ in billions) Note: Perpetual capital is capital of indefinite duration, which may be reduced or terminated under certain conditions. See Appendix for endnotes about perpetual capital and other important information. $479 $510 1Q'22 1Q'23 $371 $416 1Q'22 1Q'23 $165 $197 1Q'22 1Q'23

6 Additional Capital Detail Uncalled Commitments ($ in billions) • Dry Powder: Uncalled commitments of $106 billion are diversified across the firm’s strategies and are down 7% year-over-year • AUM Not Yet Paying Fees: At quarter end, there was $37 billion of committed capital with a weighted average management fee rate of ~100 bps that becomes payable when the capital is invested or enters its investment period, up 3% year-over-year • Carry Eligible AUM: Of the $251 billion of carried interest eligible AUM, $170 billion is above cost and accruing carry • Performance Fee Eligible AUM: $316 billion, up 3% year-over-year Note: See Appendix for endnotes for additional information. $115 $106 1Q'22 1Q'23 Performance Fee Eligible AUM ($ in billions) $308 $316 1Q'22 1Q'23

7 1Q'23 9% Private Equity Real Assets Opportunistic Real Estate Portfolio Infrastructure Portfolio Credit Alternative Credit Composite • Gross unrealized carried interest totals $4.5 billion as of March 31, 2023 Traditional Private Equity Portfolio LTM Gross Return 7% -9%2% 2%2% -9%-3% Note: Traditional Private Equity does not include Core or Growth. See Appendix for endnotes explaining composition of the portfolios and composites presented on this page and for other important information. Past performance is no guarantee of future results. Leveraged Credit Composite 2%4% Fund Investment Performance

Segment Detail

9 Asset Management Segment − Private Equity • AUM: Remained flat quarter-over-quarter and decreased 5% year-over-year to $166 billion with organic new capital raised of $0.3 billion in the quarter and $12 billion in the LTM • Europe VI held its final close in 1Q bringing the total fund size, including employee commitments, to $8 billion, ~20% larger than its predecessor • Realizations: Carried Interest in 1Q driven largely by Core Private Equity and realizations from the Growth Equity portfolio • Capital Invested: $3 billion in the quarter and $17 billion in the LTM. In 1Q, deployment was driven by Traditional Private Equity and Core Private Equity across all geographies • Performance: The Traditional PE portfolio declined 9% in the LTM ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Management Fees $ 282,184 $ 316,341 $ 1,037,396 $ 1,222,620 Transaction and Monitoring Fees, Net 33,056 34,274 135,546 121,628 Fee Related Performance Revenues — — — — Fee Related Revenues $ 315,240 $ 350,615 $ 1,172,942 $ 1,344,248 Carried Interest $ 579,767 $ 163,003 $ 2,057,585 $ 1,453,297 Incentive Fees 24,056 49 62,051 9,512 Realized Performance Income $ 603,823 $ 163,052 $ 2,119,636 $ 1,462,809 Capital Metrics: Assets Under Management $ 174,406,000 $ 165,762,000 $ 174,406,000 $ 165,762,000 Fee Paying Assets Under Management $ 94,812,000 $ 102,323,000 $ 94,812,000 $ 102,323,000 Capital Invested $ 4,384,000 $ 2,863,000 $ 20,077,000 $ 17,304,000 Uncalled Commitments $ 70,362,000 $ 64,067,000 $ 70,362,000 $ 64,067,000

10 Asset Management Segment − Real Assets • AUM: Increased 2% quarter-over-quarter and 29% year-over-year to $121 billion with organic new capital raised of $3 billion in the quarter and $21 billion in the LTM • New capital raised in the quarter driven by multiple Real Estate equity and credit strategies • Realizations: Carried Interest in 1Q driven by Global Infrastructure • Capital Invested: $5 billion in the quarter and $23 billion in the LTM. In 1Q, deployment was driven primarily by Infrastructure across both Europe and Asia, as well as Real Estate Credit and Asia Real Estate equity • Performance: The Infrastructure portfolio appreciated 9% and the Opportunistic Real Estate portfolio declined 9% in the LTM ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Management Fees $ 153,813 $ 193,365 $ 515,774 $ 719,442 Transaction and Monitoring Fees, Net 7,630 5,734 25,843 31,306 Fee Related Performance Revenues 2,317 3,704 9,833 52,570 Fee Related Revenues $ 163,760 $ 202,803 $ 551,450 $ 803,318 Carried Interest $ — $ 9,686 $ 93,834 $ 123,151 Incentive Fees — — — — Realized Performance Income $ — $ 9,686 $ 93,834 $ 123,151 Capital Metrics: Assets Under Management $ 93,807,000 $ 120,806,000 $ 93,807,000 $ 120,806,000 Fee Paying Assets Under Management $ 77,260,000 $ 105,727,000 $ 77,260,000 $ 105,727,000 Capital Invested $ 9,020,000 $ 4,666,000 $ 28,273,000 $ 23,490,000 Uncalled Commitments $ 33,123,000 $ 27,661,000 $ 33,123,000 $ 27,661,000

11 • AUM: Increased 2% quarter-over-quarter and 6% year-over-year to $224 billion with organic new capital raised of $9 billion in the quarter and $34 billion in the LTM • New capital raised in the quarter came from a diverse set of Leveraged Credit and Private Credit strategies • Capital Invested: $2 billion in the quarter and $19 billion in the LTM. 1Q deployment was most active in asset-based finance and direct lending • Performance: The Leveraged Credit composite appreciated 2%, with the Alternative Credit composite up 2% in the LTM Asset Management Segment − Credit and Liquid Strategies ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Management Fees $ 188,931 $ 228,450 $ 703,458 $ 827,653 Transaction and Monitoring Fees, Net 10,096 284 23,247 12,206 Fee Related Performance Revenues 9,734 18,037 37,774 47,785 Fee Related Revenues $ 208,761 $ 246,771 $ 764,479 $ 887,644 Carried Interest $ — $ — $ 15,336 $ 10,334 Incentive Fees 5,384 2,660 350,688 146,555 Realized Performance Income $ 5,384 $ 2,660 $ 366,024 $ 156,889 Capital Metrics: Assets Under Management $ 210,819,000 $ 223,501,000 $ 210,819,000 $ 223,501,000 Fee Paying Assets Under Management $ 199,104,000 $ 207,821,000 $ 199,104,000 $ 207,821,000 Capital Invested $ 7,972,000 $ 2,238,000 $ 39,452,000 $ 19,008,000 Uncalled Commitments $ 11,351,000 $ 14,538,000 $ 11,351,000 $ 14,538,000

12 • Transaction Fees: Totaled $102 million in the quarter and $447 million in the LTM • 1Q fees by geography and transaction type: • 45% originated in Europe with 41% and 14% from North America and Asia, respectively • Core Private Equity was the largest fee generating strategy with 35% of total fees, followed by Traditional Private Equity generating 32% • Approximately half of transaction fees were equity focused Asset Management Segment − Capital Markets • Realizations: Realized Investment Income of $198 million in the quarter and $983 million in the LTM • Realizations in the quarter primarily driven by activity relating to Growth Equity • Balance Sheet Investment Return: Flat in the quarter and down 5% in the LTM • Embedded Gains: $4.6 billion of embedded unrealized gains on the balance sheet at quarter end Asset Management Segment − Principal Activities ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Transaction Fees $ 255,256 $ 101,887 $ 989,966 $ 446,934 ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Net Realized Gains (Losses) $ 76,136 $ 91,907 $ 902,430 $ 546,055 Interest Income and Dividends 273,218 106,187 598,895 437,104 Realized Investment Income $ 349,354 $ 198,094 $ 1,501,325 $ 983,159

13 Note: See Appendix for endnotes explaining certain terms. 1Q'23 Net Investment Income only included income related to asset/liability matching investment strategies. 1Q'23 LTM Net Investment Income includes $73 million ($33 million of segment operating earnings), of realized gains and losses not related to asset/liability matching investments strategies. 1Q'22 and 1Q'22 LTM Net Investment Income included $15 million ($7 million of segment operating earnings), and $543 million ($307 million of segment operating earnings), respectively, of realized gains and losses not related to asset/liability matching investments strategies. • As detailed within a Form 8-K filed on May 3, 2023, KKR has restated its Insurance Segment results to reflect the impacts of LDTI. All of the results below reflect these restated results. In addition, to enhance comparability to other alternative asset managers, KKR now reports its Insurance Segment Operating Earnings on a pre-tax basis • Net Investment Income: Net Investment Income of $1,271 million in the quarter was driven primarily by an increase in invested assets from new business growth and higher yields • Global Atlantic AUM totals $142 billion, of which $109 billion is Credit AUM • Net Cost of Insurance: Net Cost of Insurance totaled $751 million in the quarter, driven primarily by new business growth and the associated higher funding costs Insurance Segment ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Net Investment Income $ 862,414 $ 1,271,255 $ 3,746,086 $ 4,521,085 Net Cost of Insurance (481,870) (750,612) (1,793,494) (2,563,875) General, Administrative and Other (146,412) (196,714) (571,333) (688,576) Pre-tax Operating Earnings 234,132 323,929 1,381,259 1,268,634 Pre-tax Operating Earnings Attributable to Noncontrolling Interests (90,185) (118,817) (533,815) (482,707) Insurance Segment Operating Earnings $ 143,947 $ 205,112 $ 847,444 $ 785,927 Additional Financial Measures: Global Atlantic Book Value $ 3,609,751 $ 4,391,813 $ 3,609,751 $ 4,391,813

14 • Book Value Per Adjusted Share: Declined 4% year-over-year • Net Cash and Total Investments of $19.52 per adjusted share at 1Q'23, compared to $22.42 at 1Q'22 • Total Cash and Investments: $25 billion at quarter end • Global Atlantic Book Value: Reflects our 63% economic ownership Book Value Book Value Per Adjusted Share Note: Total Cash and Investments is calculated as Cash and Short-term Investments, plus Investments and Global Atlantic Book Value. See Appendix for GAAP reconciliations, endnotes about book value, investments and other important information. ($ in millions, except per share data) 4Q'22 1Q'23 (+) Cash and Short-term Investments $ 3,257 $ 2,766 (+) Investments 17,628 17,955 (+) Net Unrealized Carried Interest 2,510 2,629 (+) Other Assets, Net 6,979 7,311 (+) Global Atlantic Book Value 4,410 4,392 (-) Debt Obligations - KKR 6,958 6,778 (-) Debt Obligations - KFN 949 949 (-) Tax Liabilities, Net 1,649 1,771 (-) Other Liabilities 912 900 (-) Noncontrolling Interests 33 29 Book Value $ 24,284 $ 24,626 Book Value Per Adjusted Share $ 27.27 $ 27.65 $15.57 $19.24 $23.09 $28.87 $27.27 $28.66 $27.65 4Q'18 4Q'19 4Q'20 4Q'21 4Q'22 1Q'22 1Q'23

15 Investments Detail Investment Holdings by Asset Class Note: Investments is a term used solely for purposes of financial presentation of a portion of KKR’s balance sheet. See Appendix for endnotes and other important information. ($ in millions) 1Q'23 Investments Fair Value Traditional Private Equity $ 3,391 Core Private Equity 5,701 Growth Equity 876 Private Equity Total 9,968 Energy 842 Real Estate 1,874 Infrastructure 1,363 Real Assets Total 4,079 Leveraged Credit 1,066 Alternative Credit 900 Credit Total 1,966 Other 1,942 Total Investments $ 17,955 ($ in millions) 1Q'23 Top 5 Investments Fair Value Fair Value as % of Total Investments USI, Inc. $ 1,300 7% PetVet Care Centers, LLC 1,143 6% Heartland Dental, LLC 770 4% Exact Holding B.V. 569 3% Arnott's Biscuits Limited 469 3% Top 5 Investments 4,251 24% Other Investments 13,704 76% Total Investments $ 17,955 100% Traditional Private Equity 19% Core Private Equity 32% Growth Equity 5% Energy 5% Real Estate 10% Infrastructure 8% Leveraged Credit 6% Alternative Credit 5% Other 11%

Capital Detail

17 Assets Under Management Note: Perpetual capital is capital of indefinite duration, which may be materially reduced or terminated under certain conditions. See Appendix for endnotes and other important information. Duration of Capital Strategic & Perpetual Capital 91% of AUM is perpetual capital or has a duration of at least 8 years at inception Perpetual Capital Long-Dated Strategic Investor Partnerships 8+ Year Duration at Inception Other 51% of AUM is perpetual capital or long-dated strategic investor partnerships ($ in billions) $221 $258 $165 $197 $56 $61 1Q'22 1Q'23 Perpetual Capital 39% 12% 40% 9% Long-Dated Strategic Investor Partnerships

18 Twelve Months Ended March 31, 2023 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 174,406 $ 93,807 $ 210,819 $ 479,032 New Capital Raised 11,825 21,173 33,663 66,661 Acquisitions and Other(2) — 13,779 7,997 21,776 Distributions and Other(3) (14,611) (6,420) (22,229) (43,260) Change in Value (5,858) (1,533) (6,749) (14,140) Ending Balance $ 165,762 $ 120,806 $ 223,501 $ 510,069 Assets Under Management Rollforward (1) Includes $79 million of redemptions by fund investors in Real Assets and $2,533 million of redemptions by fund investors in Credit and Liquid Strategies. (2) Reflects the AUM of KJRM at closing of $12,730 million within Real Assets and represents an adjustment reflecting a change in the fee base of Global Atlantic's management fees from market value to book value. (3) Includes $79 million of redemptions by fund investors in Real Assets and $6,630 million of redemptions by fund investors in Credit and Liquid Strategies. Three Months Ended March 31, 2023 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 165,147 $ 118,592 $ 220,158 $ 503,897 New Capital Raised 349 2,613 8,715 11,677 Distributions and Other(1) (1,227) (1,547) (6,558) (9,332) Change in Value 1,493 1,148 1,186 3,827 Ending Balance $ 165,762 $ 120,806 $ 223,501 $ 510,069

19 Fee Paying Assets Under Management Rollforward (1) Includes $79 million of redemptions by fund investors in Real Assets and $2,533 million of redemptions by fund investors in Credit and Liquid Strategies. (2) Reflects the FPAUM of KJRM at closing of $12,730 million within Real Assets and represents an adjustment reflecting a change in the fee base of Global Atlantic's management fees from market value to book value. (3) Includes net changes in fee base of certain Private Equity funds of $255 million and Real Assets funds of $1,125 million. Includes $79 million of redemptions by fund investors in Real Assets and $6,630 million of redemptions by fund investors in Credit and Liquid Strategies. Three Months Ended March 31, 2023 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 102,261 $ 103,532 $ 206,130 $ 411,923 New Capital Raised 1,407 3,434 8,496 13,337 Distributions and Other(1) (1,401) (1,350) (7,761) (10,512) Change in Value 56 111 956 1,123 Ending Balance $ 102,323 $ 105,727 $ 207,821 $ 415,871 Twelve Months Ended March 31, 2023 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 94,812 $ 77,260 $ 199,104 $ 371,176 New Capital Raised 12,316 22,668 30,481 65,465 Acquisitions and Other(2) — 13,779 7,997 21,776 Distributions and Other(3) (3,996) (5,894) (23,364) (33,254) Change in Value (809) (2,086) (6,397) (9,292) Ending Balance $ 102,323 $ 105,727 $ 207,821 $ 415,871

Supplemental Information

21 Investment Vehicle Summary ($ in millions) Investment Period Amount Start Date End Date Commitment Uncalled Commitments Percentage Committed by General Partner Invested Realized Remaining Cost Remaining Fair Value PRIVATE EQUITY BUSINESS LINE North America Fund XIII 8/2021 8/2027 $ 18,400 $ 12,250 3% $ 6,150 $ — $ 6,150 $ 6,572 Americas Fund XII 5/2017 5/2021 13,500 1,579 4% 12,419 5,788 11,042 17,941 North America Fund XI 11/2012 1/2017 8,718 156 3% 10,024 22,643 2,798 3,584 2006 Fund(1) 9/2006 9/2012 17,642 247 2% 17,309 37,415 19 19 Millennium Fund(1) 12/2002 12/2008 6,000 — 3% 6,000 14,123 — 6 European Fund VI 6/2022 6/2028 7,326 7,326 3% — — — — European Fund V 7/2019 2/2022 6,327 1,025 2% 5,372 917 5,213 6,101 European Fund IV 2/2015 3/2019 3,512 5 6% 3,637 5,122 1,848 2,851 European Fund III(1) 3/2008 3/2014 5,504 144 5% 5,360 10,625 590 81 European Fund II(1) 11/2005 10/2008 5,751 — 2% 5,751 8,507 — 34 Asian Fund IV 7/2020 7/2026 14,735 9,768 4% 5,008 41 4,940 5,805 Asian Fund III 8/2017 7/2020 9,000 1,373 6% 8,057 5,031 6,787 11,043 Asian Fund II 10/2013 3/2017 5,825 — 1% 7,316 6,467 3,081 2,156 Asian Fund(1) 7/2007 4/2013 3,983 — 3% 3,974 8,728 110 5 China Growth Fund(1) 11/2010 11/2016 1,010 — 1% 1,010 1,065 322 170 Next Generation Technology Growth Fund III 11/2022 11/2028 2,524 2,524 8% — — — — Next Generation Technology Growth Fund II 12/2019 5/2022 2,088 273 7% 2,012 496 1,812 2,417 Next Generation Technology Growth Fund 3/2016 12/2019 659 5 22% 668 1,036 322 899 Health Care Strategic Growth Fund II 5/2021 5/2027 3,789 3,331 4% 458 — 458 473 Health Care Strategic Growth Fund 12/2016 4/2021 1,331 225 11% 1,236 207 1,106 1,633 Global Impact Fund II 6/2022 6/2028 2,094 2,094 7% — — — — Global Impact Fund 2/2019 3/2022 1,242 266 8% 1,150 324 1,010 1,506 Co-Investment Vehicles and Other Various Various 17,471 5,149 Various 12,593 7,980 8,853 11,012 Core Investment Vehicles Various Various 24,759 12,313 30% 13,070 872 12,712 21,343 Unallocated Commitments(2) N/A N/A 3,914 3,914 Various — — — — Total Private Equity $ 187,104 $ 63,967 $ 128,574 $ 137,387 $ 69,173 $ 95,651 Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) The “Invested” and “Realized” columns do not include the amounts of any realized investments that restored the unused capital commitments of the fund investors, if any. (2) Represents unallocated commitments from our strategic investor partnerships.

22 Investment Vehicle Summary (cont’d) ($ in millions) Investment Period Amount Start Date End Date Commitmen t Uncalled Commitments Percentage Committed by General Partner Invested Realized Remaining Cost Remaining Fair Value REAL ASSETS BUSINESS LINE Energy Income and Growth Fund II 8/2018 8/2022 $ 994 $ — 20% $ 1,189 $ 229 $ 1,003 $ 1,586 Energy Income and Growth Fund 9/2013 6/2018 1,974 — 13% 1,974 1,061 1,001 520 Natural Resources Fund(1) Various Various 887 — Various 887 132 171 37 Global Energy Opportunities Various Various 915 62 Various 520 190 319 185 Global Infrastructure Investors IV 8/2021 8/2027 16,564 9,688 2% 6,964 88 6,899 7,226 Global Infrastructure Investors III 7/2018 6/2021 7,161 1,197 4% 6,230 1,614 5,432 6,564 Global Infrastructure Investors II 12/2014 6/2018 3,039 127 4% 3,164 4,723 1,101 1,605 Global Infrastructure Investors 9/2010 10/2014 1,040 — 5% 1,050 2,228 — — Asia Pacific Infrastructure Investors II 9/2022 9/2028 5,720 5,720 6% — — — — Asia Pacific Infrastructure Investors 1/2020 9/2022 3,792 1,540 7% 2,536 450 2,275 2,648 Diversified Core Infrastructure Fund 12/2020 (2) 8,641 2,065 6% 6,616 244 6,616 6,878 Real Estate Partners Americas III 1/2021 1/2025 4,253 1,801 5% 2,529 190 2,431 2,356 Real Estate Partners Americas II 5/2017 12/2020 1,921 233 8% 1,924 2,489 606 653 Real Estate Partners Americas 5/2013 5/2017 1,229 135 16% 1,023 1,408 94 55 Real Estate Partners Europe II 3/2020 3/2024 2,055 755 10% 1,444 368 1,277 1,181 Real Estate Partners Europe 8/2015 12/2019 706 111 9% 673 707 231 258 Asia Real Estate Partners 7/2019 7/2023 1,682 990 15% 699 19 671 805 Real Estate Credit Opportunity Partners II 8/2019 6/2023 950 151 5% 821 140 821 804 Real Estate Credit Opportunity Partners 2/2017 4/2019 1,130 122 4% 1,008 440 1,008 1,009 Property Partners Americas 12/2019 (2) 2,569 46 19% 2,523 159 2,523 2,823 Co-Investment Vehicles & Other Various Various 6,234 2,045 Various 4,245 1,615 3,788 3,437 Total Real Assets $ 73,456 $ 26,788 $ 48,019 $ 18,494 $ 38,267 $ 40,630 Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) The “Invested” and “Realized” columns do not include the amounts of any realized investments that restored the unused capital commitments of the fund investors, if any. (2) Open ended fund.

23 Investment Vehicle Summary (cont’d) & Additional AUM Detail ($ in millions) Investment Period Amount Start Date End Date Commitment Uncalled Commitments Percentage Committed by General Partner Invested Realized Remaining Cost Remaining Fair Value CREDIT AND LIQUID STRATEGIES BUSINESS LINE(1) Dislocation Opportunities Fund 8/2019 11/2021 $ 2,967 $ 587 14% $ 2,380 $ 898 $ 1,842 $ 1,907 Special Situations Fund II 2/2015 3/2019 3,525 284 9% 3,241 2,278 1,449 1,346 Special Situations Fund 1/2013 1/2016 2,274 1 12% 2,273 1,775 600 410 Mezzanine Partners 7/2010 3/2015 1,023 33 4% 990 1,165 256 142 Asset-Based Finance Partners 10/2020 7/2025 2,059 1,295 7% 764 41 764 815 Private Credit Opportunities Partners II 12/2015 12/2020 2,245 412 2% 1,833 784 1,357 1,260 Lending Partners III 4/2017 11/2021 1,498 607 2% 891 611 741 757 Lending Partners II 6/2014 6/2017 1,336 157 4% 1,179 1,192 189 86 Lending Partners 12/2011 12/2014 460 40 15% 420 458 29 11 Lending Partners Europe II 5/2019 9/2023 837 158 7% 679 95 679 685 Lending Partners Europe 3/2015 3/2019 848 184 5% 662 391 313 234 Asia Credit 1/2021 5/2025 1,084 736 9% 348 2 348 387 Other Alternative Credit Vehicles Various Various 14,588 7,201 Various 7,541 5,953 3,806 3,898 Total Credit and Liquid Strategies $ 34,744 $ 11,695 $ 23,201 $ 15,643 $ 12,373 $ 11,938 Total Eligible To Receive Carried Interest $ 295,304 $ 102,450 $ 199,794 $ 171,524 $ 119,813 $ 148,219 ($ in millions) Uncalled Commitments Remaining Fair Value Total Carried Interest Eligible $ 102,450 $ 148,219 $ 250,669 Incentive Fee Eligible — 65,147 65,147 Total Performance Fee Eligible 102,450 213,366 315,816 Private Equity and Real Assets 973 41,942 42,915 Credit and Liquid Strategies 2,843 148,495 151,338 Total Assets Under Management $ 106,266 $ 403,803 $ 510,069 Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) The "Commitment" and "Uncalled Commitments" columns include income that is eligible to be reinvested if permitted under the terms of the investment vehicle agreements.

24 Stock Summary From December 31, 2022 through May 5, 2023, KKR used a total of approximately $32 million to retire equity awards representing 0.6 million shares that otherwise would have been issued to participants under KKR's equity incentive plans. During this period, retirements were made at an average cost of $52.52 per share. Common Stock Repurchase Activity (Amounts in millions, except per share amounts) Inception to Date(1) Open Market Share Repurchases 61.9 Reduction of Shares for Retired Equity Awards(2) 24.4 Total Repurchased Shares and Retired Equity Awards 86.3 Total Capital Used $2,237 Average Price Paid Per Share $25.90 Remaining Availability under Share Repurchase Plan $468 Adjusted Shares 2Q'22 3Q'22 4Q'22 1Q'23 Common Stock(3) 859,833,444 859,833,444 861,110,478 861,104,000 Exchangeable Securities and Other(4) 29,288,380 29,288,380 29,517,712 29,517,712 Adjusted Shares(5) 889,121,824 889,121,824 890,628,190 890,621,712 (1) KKR & Co. Inc.'s initial repurchase authorization was announced on October 27, 2015. Information is through May 5, 2023. (2) Refers to the retirement of equity awards issued pursuant to KKR & Co. Inc.’s equity incentive plans. (3) Includes 8.5 million of KKR & Co. Inc. shares that were issued to the limited partners of KKR Holdings upon the completion of the Reorganization Mergers on May 31, 2022. Please see endnotes for more information about the Reorganization Mergers. (4) Includes (i) the number of shares of common stock of KKR & Co. Inc. assumed to be issuable upon conversion of the Series C Mandatory Convertible Preferred Stock and (ii) certain securities exchangeable into shares of common stock of KKR & Co. Inc. (5) Amounts exclude unvested shares granted under the equity incentive plans.

25 Investments Detail – Core Private Equity Background on Core Private EquityGrowth in Balance Sheet Fair Value ($ in billions) • Core Private Equity is a long duration investment strategy with a more modest risk return profile compared to traditional PE; we are seeking mid- to-high teens gross IRRs in businesses that we believe can grow and compound value for more than a decade • Core Private Equity AUM totals $34 billion • KKR receives management fees on third party invested capital, with an opportunity to earn annual performance income as well as capital markets fees 58% 61% Core Private Equity on the Balance Sheet • The chart to the left shows the Fair Value of KKR's Core Private Equity balance sheet investments since 2018 • The $5.7 billion of fair value compares to $2.7 billion of cost for a 2.1x MOIC • Since inception, KKR's balance sheet Core Private Equity investments have generated a 21% IRR • In the quarter and in the LTM, the Core Private Equity balance sheet portfolio was -1% and +4%, respectively • Core Private Equity represents the largest allocation on KKR's balance sheet • 32% of balance sheet investments • Global portfolio comprised of 19 companies across multiple industries$1.2 $1.8 $2.0 $2.5 $2.7 $2.7 $1.4 $2.5 $3.2 $5.2 $5.7 $5.7 2018 2019 2020 2021 2022 1Q'23 Cost Embedded Gains

26 Dividends The declaration and payment of any future dividends on preferred or common stock will be subject to the discretion of the board of directors of KKR & Co. Inc. based on a number of factors, including KKR’s future financial performance and other considerations that the board deems relevant, the terms of KKR & Co. Inc.'s certificate of incorporation and applicable law. There can be no assurance that future dividends will be made as intended or at all or that any particular dividend policy for common stock will be maintained. Common Stock A dividend of $0.165 per share of common stock of KKR & Co. Inc. has been declared for the first quarter of 2023, which will be paid on June 6, 2023 to holders of record of common stock as of the close of business on May 22, 2023. Series C Mandatory Convertible Preferred Stock A dividend of $0.75 per share of Series C Mandatory Convertible Preferred Stock has been declared and set aside for payment on June 15, 2023 to holders of record of Series C Mandatory Convertible Preferred Stock as of the close of business on June 1, 2023.

Appendix

28 GAAP Condensed Consolidated Income Statement (Unaudited) ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Revenues Asset Management Fees and Other $ 780,511 $ 677,016 $ 3,137,354 $ 2,718,132 Capital Allocation-Based Income (Loss) (945,743) 449,018 3,212,024 (1,105,748) (165,232) 1,126,034 6,349,378 1,612,384 Insurance Net Premiums 372,144 473,624 1,422,080 1,283,941 Policy Fees 313,782 313,802 1,251,917 1,261,741 Net Investment Income 812,605 1,300,697 3,213,447 4,606,338 Net Investment-Related Gains (Losses) (368,680) (123,833) 290,775 (1,073,643) Other Income 34,744 37,158 136,813 141,538 1,164,595 2,001,448 6,315,032 6,219,915 Total Revenues $ 999,363 $ 3,127,482 $ 12,664,410 $ 7,832,299 Expenses Asset Management Compensation and Benefits 283,672 575,670 3,405,618 1,436,664 Occupancy and Related Charges 18,149 22,149 72,033 81,271 General, Administrative and Other 234,665 213,689 1,026,745 972,572 536,486 811,508 4,504,396 2,490,507 Insurance Net Policy Benefits and Claims 513,178 1,527,054 4,107,226 3,372,114 Amortization of Policy Acquisition Costs 11,422 44,211 6,794 88,138 Interest Expense 13,219 40,261 64,208 114,224 Insurance Expenses 115,803 225,318 422,597 672,100 General, Administrative and Other 167,624 211,731 642,990 763,084 821,246 2,048,575 5,243,815 5,009,660 Total Expenses $ 1,357,732 $ 2,860,083 $ 9,748,211 $ 7,500,167 Investment Income (Loss) - Asset Management Net Gains (Losses) from Investment Activities 914,261 (159,409) 5,938,984 (2,739,207) Dividend Income 662,350 148,167 1,285,404 808,264 Interest Income 352,556 728,616 1,470,571 2,271,342 Interest Expense (281,759) (576,338) (1,100,371) (1,845,356) Total Investment Income (Loss) $ 1,647,408 $ 141,036 $ 7,594,588 $ (1,504,957) Income Tax Expense (Benefit) 36,651 148,747 935,938 237,489 Redeemable Noncontrolling Interests (63) (7,303) 3,997 (4,448) Noncontrolling Interests 1,244,987 (73,003) 6,589,427 (1,216,732) Preferred Stock Dividends 17,250 17,250 97,306 69,000 Net Income (Loss) - KKR Common Stockholders $ (9,786) $ 322,744 $ 2,884,119 $ (258,134)

29 GAAP Condensed Consolidated Balance Sheet (Unaudited) ($ in thousands) 4Q'22 1Q'23 Assets Asset Management Cash and Cash Equivalents $ 6,705,325 $ 5,576,121 Investments 92,375,463 97,949,918 Other Assets 7,114,360 7,057,818 106,195,148 110,583,857 Insurance Cash and Cash Equivalents 6,118,231 3,713,382 Investments 124,199,176 129,401,394 Other Assets 38,834,081 38,911,956 169,151,488 172,026,732 Total Assets $ 275,346,636 $ 282,610,589 Liabilities and Equity Asset Management Debt Obligations 40,598,613 42,519,776 Other Liabilities 6,937,832 8,228,017 47,536,445 50,747,793 Insurance Debt Obligations 2,128,166 2,157,283 Other Liabilities 170,311,335 172,582,137 172,439,501 174,739,420 Total Liabilities $ 219,975,946 $ 225,487,213 Redeemable Noncontrolling Interests 152,065 144,126 Stockholders' Equity Stockholders' Equity - Series C Mandatory Convertible Preferred Stock 1,115,792 1,115,792 Stockholders' Equity - Common Stock 17,691,975 18,546,889 Noncontrolling Interests 36,410,858 37,316,569 Total Equity $ 55,218,625 $ 56,979,250 Total Liabilities and Equity $ 275,346,636 $ 282,610,589

30 Reconciliation of GAAP to Non-GAAP Shares (Unaudited) 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 GAAP Shares of Common Stock Outstanding 590,472,444 859,833,444 859,833,444 861,110,478 861,104,000 Adjustments: KKR Holdings Units 258,726,163 — — — — Exchangeable Securities and Other 28,199,255 29,288,380 29,288,380 29,517,712 29,517,712 Adjusted Shares 877,397,862 889,121,824 889,121,824 890,628,190 890,621,712 Unvested Shares of Common Stock and Exchangeable Securities(1) 39,551,313 35,294,649 35,300,207 35,457,274 35,317,288 1Q'22 1Q'23 Weighted Average GAAP Shares of Common Stock Outstanding - Basic 592,202,835 861,108,510 Adjustments: Weighted Average KKR Holdings Units 258,726,163 — Weighted Average Exchangeable Securities and Other 28,199,255 29,517,712 Weighted Average Adjusted Shares 879,128,253 890,626,222 (1) Excludes equity awards that have not met their market-price based vesting conditions.

31 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (1) Represents equity-based compensation expense in connection with non-dilutive share grants from outstanding units of KKR Holdings. (2) Amounts represent the portion allocable to KKR. ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Net Income (Loss) - KKR Common Stockholders $ (9,786) $ 322,744 $ 2,884,119 $ (258,134) Preferred Stock Dividends 17,250 17,250 97,306 69,000 Net Income (Loss) Attributable to Noncontrolling Interests 1,244,924 (80,306) 6,593,424 (1,221,180) Income Tax Expense (Benefit) 36,651 148,747 935,938 237,489 Income (Loss) Before Tax (GAAP) $ 1,289,039 $ 408,435 $ 10,510,787 $ (1,172,825) Impact of Consolidation and Other (1,307,942) 93,511 (4,960,311) 1,007,026 Equity-based Compensation - KKR Holdings(1) 19,821 — 164,670 100,013 Preferred Stock Dividends — — (10,860) — Income Taxes on Operating Earnings (220,279) (173,057) (868,964) (812,742) Asset Management Adjustments: Unrealized (Gains) Losses 322,269 99,327 (951,367) 1,779,140 Unrealized Carried Interest 1,290,033 (202,659) (644,084) 2,738,667 Unrealized Carried Interest Compensation (Carry Pool) (513,987) 83,830 341,018 (1,155,579) Strategic Corporate Related Charges 19,898 6,807 40,176 81,538 Equity-based Compensation 55,111 59,017 188,450 214,662 Equity-based Compensation - Performance based 57,953 67,273 121,627 248,249 Insurance Adjustments(2): (Gains) Losses from Investments(2) 129,032 131,114 291,367 381,729 Non-operating Changes in Policy Liabilities and Derivatives(2) (192,201) 106,491 (91,782) (285,803) Strategic Corporate Related Charges(2) 3,079 — 15,924 12,136 Equity-based and Other Compensation(2) 19,498 36,393 73,564 110,403 Amortization of Acquired Intangibles(2) 2,713 2,794 11,152 10,933 After-tax Distributable Earnings $ 974,037 $ 719,276 $ 4,231,367 $ 3,257,547 Interest Expense 69,460 85,500 262,098 331,229 Preferred Stock Dividends — — 10,860 — Net Income Attributable to Noncontrolling Interests 7,616 5,626 28,088 21,210 Income Taxes on Operating Earnings 220,279 173,057 868,964 812,742 Distributable Operating Earnings $ 1,271,392 $ 983,459 $ 5,401,377 $ 4,422,728 Insurance Segment Operating Earnings (143,947) (205,112) (847,444) (785,927) Realized Performance Income (609,207) (175,398) (2,579,494) (1,742,849) Realized Performance Income Compensation 383,635 114,009 1,512,826 1,063,900 Realized Investment Income (349,354) (198,094) (1,501,325) (983,159) Realized Investment Income Compensation 52,403 29,714 225,206 136,314 Fee Related Earnings $ 604,922 $ 548,578 $ 2,211,146 $ 2,111,007

32 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (cont’d) ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Fee Related Earnings $ 604,922 $ 548,578 $ 2,211,146 $ 2,111,007 Insurance Segment Operating Earnings 143,947 205,112 847,444 785,927 Realized Performance Income 609,207 175,398 2,579,494 1,742,849 Realized Performance Income Compensation (383,635) (114,009) (1,512,826) (1,063,900) Realized Investment Income 349,354 198,094 1,501,325 983,159 Realized Investment Income Compensation (52,403) (29,714) (225,206) (136,314) Depreciation and Amortization 7,565 10,434 27,341 36,678 Adjusted EBITDA $ 1,278,957 $ 993,893 $ 5,428,718 $ 4,459,406 ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Total GAAP Revenues $ 999,363 $ 3,127,482 $ 12,664,410 $ 7,832,299 Insurance GAAP Revenues (1,164,595) (2,001,448) (6,315,032) (6,219,915) Impact of Consolidation and Other 189,750 154,848 838,441 737,625 Capital Allocation-Based Income (Loss) (GAAP) 945,743 (449,018) (3,212,024) 1,105,748 Realized Carried Interest 579,767 172,689 2,166,755 1,586,782 Realized Investment Income 349,354 198,094 1,501,325 983,159 Insurance Segment Management Fees 58,984 108,270 194,739 350,607 Capstone Fees (15,485) (19,805) (86,812) (90,985) Expense Reimbursements (41,303) (15,544) (192,146) (77,168) Total Asset Management Segment Revenues $ 1,901,578 $ 1,275,568 $ 7,559,656 $ 6,208,152

33 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (cont’d) ($ in thousands, except share and per share amounts) 4Q'18 4Q'19 4Q'20 4Q'21 4Q'22 1Q'22 1Q'23 KKR & Co. Inc. Stockholders' Equity - Common Stock $ 8,167,056 $ 10,324,936 $ 12,118,472 $ 16,542,643 $ 17,691,975 $ 14,962,912 $ 18,546,889 Series C Mandatory Convertible Preferred Stock — — 1,115,792 1,115,792 1,115,792 1,115,792 1,115,792 Impact of Consolidation and Other 188,056 310,380 520,710 (1,048,569) 399,318 (997,841) 398,751 KKR Holdings and Exchangeable Securities 4,625,448 5,728,634 6,512,382 8,630,662 128,850 8,117,329 205,668 Accumulated Other Comprehensive Income and Other (Insurance) — — — 240,773 4,948,100 1,946,695 4,358,747 Book Value $ 12,980,560 $ 16,363,950 $ 20,267,356 $ 25,481,301 $ 24,284,035 $ 25,144,887 $ 24,625,847 Adjusted Shares 833,938,476 850,388,924 877,613,164 882,589,036 890,628,190 877,397,862 890,621,712 Book Value per Adjusted Share $ 15.57 $ 19.24 $ 23.09 $ 28.87 $ 27.27 $ 28.66 $ 27.65

34 KKR’s First Quarter 2023 Segment Earnings – Detailed View ($ in thousands) 1Q'22 1Q'23 1Q'22 LTM 1Q'23 LTM Management Fees $ 624,928 $ 738,156 $ 2,256,628 $ 2,769,715 Transaction and Monitoring Fees, Net 306,038 142,179 1,174,602 612,074 Fee Related Performance Revenues 12,051 21,741 47,607 100,355 Fee Related Compensation (212,220) (203,094) (782,822) (760,609) Other Operating Expenses (125,875) (150,404) (484,869) (610,528) Fee Related Earnings 604,922 548,578 2,211,146 2,111,007 Realized Carried Interest 579,767 172,689 2,166,755 1,586,782 Incentive Fees 29,440 2,709 412,739 156,067 Realized Performance Income Compensation (383,635) (114,009) (1,512,826) (1,063,900) 225,572 61,389 1,066,668 678,949 Net Realized Gains (Losses) 76,136 91,907 902,430 546,055 Interest Income and Dividends 273,218 106,187 598,895 437,104 Realized Investment Income Compensation (52,403) (29,714) (225,206) (136,314) 296,951 168,380 1,276,119 846,845 Asset Management Segment Operating Earnings 1,127,445 778,347 4,553,933 3,636,801 Insurance Segment Operating Earnings 143,947 205,112 847,444 785,927 Distributable Operating Earnings 1,271,392 983,459 5,401,377 4,422,728 Interest Expense (69,460) (85,500) (262,098) (331,229) Preferred Dividends — — (10,860) — Net Income Attributable to Noncontrolling Interests (7,616) (5,626) (28,088) (21,210) Income Taxes on Operating Earnings (220,279) (173,057) (868,964) (812,742) After-tax Distributable Earnings $ 974,037 $ 719,276 $ 4,231,367 $ 3,257,547

35 Notes to page 2 – KKR's First Quarter 2023 Highlights • Net Cash and Total Investments is calculated as Cash and Short-term Investments, less Debt Obligations – KKR and KFN, plus Investments and Global Atlantic Book Value. Please see the endnote for page 15 for information about the term "investments." Notes to page 3 – KKR’s First Quarter 2023 Segment Earnings • The amount of tax benefit from equity-based compensation for 1Q'23 and 1Q'22 was $13.7 million and $11.8 million, respectively, and for 1Q'23 LTM and 1Q'22 LTM was $67.3 million and $91.9 million, respectively. Its inclusion in After-tax Distributable Earnings had the effect of increasing this metric for 1Q'23 and 1Q'22 by 2% and 1%, respectively, and for 1Q'23 LTM and 1Q'22 LTM both by 2%. Notes to page 5 – Assets Under Management • Perpetual capital refers to a component of AUM that has an indefinite term and for which there is no predetermined requirement to return invested capital to investors upon the realization of investments. Perpetual capital includes the AUM of our registered funds, certain unregistered funds, listed companies, and insurance companies, and it excludes our traditional private equity funds, similarly structured investment funds, and hedge fund partnerships. Investors should not view this component of our AUM as being permanent without exception, because it can be subject to material reductions and even termination. Perpetual capital is subject to material reductions from changes in valuation and withdrawals by or payments to investors, clients and policyholders (including through elections by investors to redeem their fund investments, periodic dividends, and payment obligations under insurance policies and reinsurance agreements) as well as termination by a client of, or failure to renew, its investment management agreement with KKR. Notes to page 6 – Additional Capital Detail • KKR’s portion of Uncalled Commitments to its investment funds includes $6.5 billion, $2.0 billion and $1.2 billion to its Private Equity, Real Assets and Credit and Liquid Strategies business lines, respectively. Notes to page 7 – Fund Investment Performance • Traditional Private Equity Portfolio refers to the portfolio of investments held by all KKR’s private equity flagship funds. This portfolio does not include investments from KKR’s growth equity (including impact) funds or core investments. • Opportunistic Real Estate Portfolio refers to the portfolio of investments held by KKR’s flagship opportunistic real estate equity funds. This portfolio does not include investments from KKR's core plus real estate funds or real estate credit funds. • Infrastructure Portfolio refers to the portfolio of investments held by KKR’s flagship core plus infrastructure equity funds. This portfolio does not include investments from KKR’s core infrastructure fund, KKR Diversified Core Infrastructure. • The Leveraged Credit Composite refers to the composite of certain investment portfolios made in KKR’s collateralized loan obligations and U.S. and European leveraged credit strategies including leveraged loans, high-yield bonds and opportunistic credit. • The Alternative Credit Composite refers to the composite of certain investment portfolios made in KKR's private credit strategy, including direct lending (including our business development company), asset-based finance and junior capital, and in the Strategic Investments Group ("SIG") strategy. Funds and separately managed accounts in liquidation or discontinued strategies are excluded. • For a list of our carry paying funds, see the Investment Vehicle Summary on pages 21 to 23. See also “Important Information – Other Legal Disclosures” regarding past performance and investment returns. Important Information − Endnotes

36 Notes to page 13 – Insurance Segment • Net investment income represents income earned on invested assets, net of investment-related expenses, including investment management fees paid to KKR. • Net cost of insurance represents the net cost of funding institutional and individual products – interest credited or incurred, benefits incurred, the associated insurance expenses, net of any premiums, fees and other income earned. Notes to page 14 – Book Value • KKR owns 63.3% of Global Atlantic. • Assuming that we had paid (i) 65% of the unrealized carried interest earned by the funds that allocate 40% and 43% to the carry pool and (ii) 15% of the unrealized gains in our Principal Activities business line (in each case at the mid-point of the ranges above), our book value as of March 31, 2023 would have been reduced by approximately $1.45 per adjusted share, compared to our reported book value of $27.65 per adjusted share on such date. • Please see the endnote for page 15 for information about the term "investments." Notes to page 15 – Investments Detail • Investments is a term used solely for purposes of financial presentation of a portion of KKR’s balance sheet and includes majority ownership of subsidiaries that operate KKR’s asset management, broker-dealer and other businesses, including the general partner interests of KKR’s investment funds and the Global Atlantic insurance companies. Investments presented are principally the assets measured at fair value that are held by KKR's asset management segment, which, among other things, does not include the underlying investments held by Global Atlantic and Marshall Wace. • Private Equity includes KKR private equity funds, co-investments alongside such KKR sponsored private equity funds, and other opportunistic investments. Equity investments in other asset classes, such as core, growth, energy, real estate, infrastructure, leveraged credit and alternative credit appear in these other asset classes. • Top 5 Investments include the top five investments based on their fair values as of March 31, 2023. Top 5 Investments exclude (i) investments expected to be syndicated, (ii) investments expected to be transferred in connection with a new fundraising, (iii) investments in funds and other entities that are owned by one or more third parties and established for the purpose of making investments, and (iv) the portion of any investment that may be held through collateralized loan obligations or levered multi-asset investment vehicles, if any. Accordingly, this list of Top 5 Investments should not be relied upon as a substitute for the “Investment Holdings by Asset Class" pie chart on page 15 for information about the asset class exposure of KKR's balance sheet. The investments in this list do not deduct fund or vehicle level debt, if any, incurred in connection with funding the investment. The fair value figures include the co-investment and the limited partner and/or general partner interests held by KKR in the underlying investment, if applicable. Important Information − Endnotes (cont’d)

37 Notes to page 17 – Duration of Capital • Please see endnote for page 5 for information about the term "perpetual capital." • "Other" in the chart primarily includes hedge fund partnerships and certain leveraged credit funds. Notes to pages 21 to 23 – Investment Vehicle Summary • The start date represents the start of the fund's investment period as defined in the fund's governing documents and may or may not be the same as the date upon which management fees begin to accrue. • The end date represents the end of the fund's investment period as defined in the fund's governing documents and is generally not the date upon which management fees cease to accrue. For funds that initially charge management fees on the basis of committed capital, the end date is generally the date on or after which the management fees begin to be calculated instead on the basis of invested capital and may, for certain funds, begin to be calculated using a lower rate. Notes to page 24 – Stock Summary • On October 8, 2021, KKR & Co. Inc. entered into a Reorganization Agreement (the "Reorganization Agreement") pursuant to which the parties agreed to undertake a series of integrated transactions to effect a number of transformative structural and governance changes, some of which were completed on May 31, 2022, and other which will be completed in the future. On May 31, 2022, KKR & Co. Inc. completed the merger transactions ("Reorganization Mergers") contemplated by the Reorganization Agreement. Important Information − Endnotes (cont’d)

38 Important Information – Non-GAAP and Other Measures Non-GAAP and Segment Measures The key non-GAAP and other operating and performance measures that follow are used by management in making operational and resource deployment decisions as well as assessing the performance of KKR's business. They include certain financial measures that are calculated and presented using methodologies other than in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures, including after-tax distributable earnings (“DE”), distributable operating earnings, fee related earnings (“FRE”), total asset management segment revenues and book value, are presented prior to giving effect to the allocation of income (loss) among KKR & Co. Inc. and holders of certain securities exchangeable into shares of common stock of KKR & Co. Inc. and as such represent the entire KKR business in total. In addition, these non-GAAP measures are presented without giving effect to the consolidation of the investment funds and collateralized financing entities (“CFEs”) that KKR manages. We believe that providing these non-GAAP measures on a supplemental basis to our GAAP results is helpful to stockholders in assessing the overall performance of KKR's business. These non-GAAP measures should not be considered as a substitute for financial measures calculated in accordance with GAAP. Reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, where applicable, are included under the “Reconciliation of GAAP to Non-GAAP Measures" section of this Appendix. We also caution readers that these non-GAAP financial measures may differ from the calculations made by other investment managers, and as a result, may not be directly comparable to similarly titled financial measures presented by other investment managers. • After-tax Distributable Earnings is a non-GAAP performance measure of KKR’s earnings, which is derived from KKR’s reported segment results. After- tax distributable earnings is used to assess the performance of KKR’s business operations and measures the earnings potentially available for distribution to its equity holders or reinvestment into its business. After-tax distributable earnings is equal to Distributable Operating Earnings less Interest Expense, Net Income Attributable to Noncontrolling Interests and Income Taxes on Operating Earnings. Series C Mandatory Convertible Preferred Stock dividends have been excluded from After-tax Distributable Earnings, because the definition of Adjusted Shares used to calculate After-tax Distributable Earnings per Adjusted Share assumes that all shares of Series C Mandatory Convertible Preferred Stock have been converted to shares of common stock of KKR & Co. Inc. Income Taxes on Operating Earnings represents the (i) amount of income taxes that would be paid assuming that all pre-tax Asset Management distributable earnings were allocated to KKR & Co. Inc. and taxed at the same effective rate, which assumes that all securities exchangeable into shares of common stock of KKR & Co. Inc. were exchanged and (ii) the amount of income taxes on Insurance Segment Operating Earnings. Income taxes on Insurance Segment Operating Earnings represent the total current and deferred tax expense or benefit on income before taxes adjusted to eliminate the impact of the tax expense or benefit associated with the non-operating adjustments. Income Taxes on Operating Earnings includes the benefit of tax deductions arising from equity-based compensation, which reduces operating income taxes during the period. Equity based compensation expense is excluded from After-tax Distributable Earnings, because (i) KKR believes that the cost of equity awards granted to employees does not contribute to the earnings potentially available for distributions to its equity holders or reinvestment into its business and (ii) excluding this expense makes KKR’s reporting metric more comparable to the corresponding metric presented by other publicly traded companies in KKR’s industry, which KKR believes enhances an investor’s ability to compare KKR’s performance to these other companies. If tax deductions from equity-based compensation were to be excluded from Income Taxes on Operating Earnings, KKR’s After-tax Distributable Earnings would be lower and KKR’s effective tax rate would appear to be higher, even though a lower amount of income taxes would have actually been paid or payable during the period. KKR separately discloses the amount of tax deduction from equity-based compensation for the period reported and the effect of its inclusion in After-tax Distributable Earnings for the period. KKR makes these adjustments when calculating After-tax Distributable Earnings in order to more accurately reflect the net realized earnings that are expected to be or become available for distribution to KKR’s equity holders or reinvestment into KKR’s business. However, After-tax Distributable Earnings does not represent and is not used to calculate actual dividends under KKR’s dividend policy, which is a fixed amount per period, and After-tax Distributable Earnings should not be viewed as a measure of KKR’s liquidity. .

39 Important Information – Non-GAAP and Other Measures (cont’d) Non-GAAP and Segment Measures (cont’d) • Book Value is a non-GAAP performance measure of the net assets of KKR and is used by management primarily in assessing the unrealized value of KKR’s net assets presented on a basis that (i) excludes the net assets that are allocated to investors in KKR’s investment funds and other noncontrolling interest holders, (ii) includes the net assets that are attributable to certain securities exchangeable into shares of common stock of KKR & Co. Inc., and (iii) includes KKR’s ownership of the net assets of Global Atlantic. We believe this measure is useful to stockholders as it provides additional insight into the net assets of KKR excluding those net assets that are allocated to investors in KKR’s investment funds and other noncontrolling interest holders. KKR's book value includes the net impact of KKR's tax assets and liabilities as calculated under GAAP. Series C Mandatory Convertible Preferred Stock has been included in book value, because the definition of adjusted shares used to calculate book value per adjusted share assumes that all shares of Series C Mandatory Convertible Preferred Stock have been converted to shares of common stock of KKR & Co. Inc. To calculate Global Atlantic book value and to make it more comparable with the corresponding metric presented by other publicly traded companies in Global Atlantic’s industry, Global Atlantic book value excludes (i) accumulated other comprehensive income and (ii) accumulated change in fair value of reinsurance balances and related assets, net of income tax. • Distributable Operating Earnings is a non-GAAP performance measure that KKR believes is useful to stockholders as it provides a supplemental measure of our operating performance without taking into account items that KKR does not believe arise from or relate directly to KKR's operations. Distributable Operating Earnings excludes: (i) equity-based compensation charges, (ii) amortization of acquired intangibles, (iii) strategic corporate related charges and (iv) non-recurring items, if any. Strategic corporate related charges arise from corporate actions and consist primarily of (i) impairments, (ii) transaction costs from strategic acquisitions, and (iii) depreciation on real estate that KKR owns and occupies. Inter-segment transactions are not eliminated from segment results when management considers those transactions in assessing the results of the respective segments. These transactions include (i) management fees earned by KKR as the investment adviser for Global Atlantic insurance companies and (ii) interest income and expense based on lending arrangements where one or more KKR subsidiaries borrow from a Global Atlantic insurance subsidiary. Inter-segment transactions are recorded by each segment based on the definitive documents that contain arms' length terms and comply with applicable regulatory requirements. Distributable Operating Earnings represents operating earnings of KKR’s Asset Management and Insurance segments. • Asset Management Segment Operating Earnings is the segment profitability measure used to make operating decisions and to assess the performance of the Asset Management segment and is comprised of: (i) Fee Related Earnings, (ii) Realized Performance Income, (iii) Realized Performance Income Compensation, (iv) Realized Investment Income, and (v) Realized Investment Income Compensation. Asset Management Segment Operating Earnings excludes the impact of: (i) unrealized gains (losses) on investments, (ii) unrealized carried interest, and (iii) related unrealized carried interest compensation (i.e. the carry pool). Management fees earned by KKR as the adviser, manager or sponsor for its investment funds, vehicles and accounts, including its Global Atlantic insurance companies, are included in Asset Management Segment Operating Earnings. • Insurance Segment Operating Earnings is the segment profitability measure used to make operating decisions and to assess the performance of the Insurance segment. This measure is presented before income taxes and is comprised of: (i) Net Investment Income, (ii) Net Cost of Insurance, (iii) General, Administrative, and Other Expenses, and (iv) Net Income Attributable to Noncontrolling Interests. The non-operating adjustments made to derive Insurance Segment Operating Earnings excludes the impact of: (i) investment gains (losses) which include realized gains (losses) related to asset/liability matching investments strategies and unrealized investment gains (losses) and (ii) non-operating changes in policy liabilities and derivatives which includes (a) changes in the fair value of market risk benefits and other policy liabilities measured at fair value and related benefit payments, (b) fees attributed to guaranteed benefits, (c) derivatives used to manage the risks associated with policy liabilities, and (d) losses at contract issuance on payout annuities. Insurance Segment Operating Earnings includes (i) realized gains and losses not related to asset/liability matching investments strategies and (ii) the investment management costs that are earned by KKR as the investment adviser of the Global Atlantic insurance companies.

40 Important Information – Non-GAAP and Other Measures (cont’d) Non-GAAP and Segment Measures (cont’d) • Fee Related Earnings (“FRE”) is a performance measure used to assess the Asset Management segment’s generation of profits from revenues that are measured and received on a recurring basis and are not dependent on future realization events. KKR believes this measure is useful to stockholders as it provides additional insight into the profitability of KKR’s fee generating asset management and capital markets businesses and other recurring revenue streams. FRE equals (i) Management Fees, including fees paid by the Insurance segment to the Asset Management segment and fees paid by certain insurance co-investment vehicles, (ii) Transaction and Monitoring Fees, Net and (iii) Fee Related Performance Revenues, less (x) Fee Related Compensation, and (y) Other Operating Expenses. • Fee Related Performance Revenues refers to the realized portion of Incentive Fees from certain AUM that has an indefinite term and for which there is no immediate requirement to return invested capital to investors upon the realization of investments. Fee related performance revenues consists of performance fees (i) to be received from our investment funds, vehicles and accounts on a recurring basis, and (ii) that are not dependent on a realization event involving investments held by the investment fund, vehicle or account. • Fee Related Compensation refers to the compensation expense, excluding equity-based compensation, paid from (i) Management Fees, (ii) Transaction and Monitoring Fees, Net, and (iii) Fee Related Performance Revenues. • Other Operating Expenses represents the sum of (i) occupancy and related charges and (ii) other operating expenses. Total Asset Management Segment Revenues is a performance measure that represents the realized revenues of the Asset Management segment (which excludes unrealized carried interest and unrealized net gains (losses) on investments) and is the sum of (i) Management Fees, (ii) Transaction and Monitoring Fees, Net, (iii) Fee Related Performance Revenues, (iv) Realized Performance Income, and (v) Realized Investment Income. KKR believes that this performance measure is useful to stockholders as it provides additional insight into the realized revenues generated by KKR's asset management segment. Other Terms and Capital Metrics • Adjusted shares represents shares of common stock of KKR & Co. Inc. outstanding under GAAP adjusted to include (i) the number of shares of common stock of KKR & Co. Inc. assumed to be issuable upon conversion of the Series C Mandatory Convertible Preferred Stock and (ii) certain securities exchangeable into shares of common stock of KKR & Co. Inc. Weighted average adjusted shares is used in the calculation of After-tax Distributable Earnings per Adjusted Share, and Adjusted Shares is used in the calculation of Book Value per Adjusted Share. • Assets Under Management (“AUM”) represent the assets managed, advised or sponsored by KKR from which KKR is entitled to receive management fees or performance income (currently or upon a future event), general partner capital, and assets managed, advised or sponsored by our strategic BDC partnership and the hedge fund and other managers in which KKR holds an ownership interest. We believe this measure is useful to stockholders as it provides additional insight into the capital raising activities of KKR and its hedge fund and other managers and the overall activity in their investment funds and other managed or sponsored capital. KKR calculates the amount of AUM as of any date as the sum of: (i) the fair value of the investments of KKR's investment funds and certain co-investment vehicles; (ii) uncalled capital commitments from these funds, including uncalled capital commitments from which KKR is currently not earning management fees or performance income; (iii) the asset value of the Global Atlantic insurance companies; (iv) the par value of outstanding CLOs; (v) KKR's pro rata portion of the AUM of hedge fund and other managers in which KKR holds an ownership interest; (vi) all of the AUM of KKR's strategic BDC partnership; (vii) the acquisition cost of invested assets of certain non-US real estate investment trusts and (viii) the value of other assets managed or sponsored by KKR. The pro rata portion of the AUM of hedge fund and other managers is calculated based on KKR’s percentage ownership interest in such entities multiplied by such entity’s respective AUM. KKR's definition of AUM (i) is not based on any definition of AUM that may be set forth in the governing documents of the investment funds, vehicles, accounts or other entities whose capital is included in this definition, (ii) includes assets for which KKR does not act as an investment adviser, and (iii) is not calculated pursuant to any regulatory definitions.

41 Important Information – Non-GAAP and Other Measures (cont’d) Other Measures and Terms (cont’d) • Capital Invested is the aggregate amount of capital invested by (i) KKR’s investment funds and Global Atlantic insurance companies, (ii) KKR's Principal Activities business line as a co-investment, if any, alongside KKR’s investment funds, and (iii) KKR's Principal Activities business line in connection with a syndication transaction conducted by KKR's Capital Markets business line, if any. Capital invested is used as a measure of investment activity at KKR during a given period. We believe this measure is useful to stockholders as it provides a measure of capital deployment across KKR’s business lines. Capital invested includes investments made using investment financing arrangements like credit facilities, as applicable. Capital invested excludes (i) investments in certain leveraged credit strategies, (ii) capital invested by KKR’s Principal Activities business line that is not a co-investment alongside KKR’s investment funds, and (iii) capital invested by KKR’s Principal Activities business line that is not invested in connection with a syndication transaction by KKR’s Capital Markets business line. Capital syndicated by KKR's Capital Markets business line to third parties other than KKR’s investment funds or Principal Activities business line is not included in capital invested. • Fee Paying AUM (“FPAUM”) represents only the AUM from which KKR is entitled to receive management fees. We believe this measure is useful to stockholders as it provides additional insight into the capital base upon which KKR earns management fees. FPAUM is the sum of all of the individual fee bases that are used to calculate KKR's and its hedge fund and BDC partnership management fees and differs from AUM in the following respects: (i) assets and commitments from which KKR is not entitled to receive a management fee are excluded (e.g., assets and commitments with respect to which it is entitled to receive only performance income or is otherwise not currently entitled to receive a management fee) and (ii) certain assets, primarily in its private equity funds, are reflected based on capital commitments and invested capital as opposed to fair value because fees are not impacted by changes in the fair value of underlying investments. • Uncalled Commitments is the aggregate amount of unfunded capital commitments that KKR’s investment funds and carry-paying co-investment vehicles have received from partners to contribute capital to fund future investments and the amount of uncalled commitments is not reduced by capital invested using borrowings under an investment fund’s subscription facility until capital is called from our fund investors. We believe this measure is useful to stockholders as it provides additional insight into the amount of capital that is available to KKR’s investment funds and carry paying co-investment vehicles to make future investments. Uncalled commitments are not reduced for investments completed using fund-level investment financing arrangements or investments we have committed to make but remain unfunded at the reporting date.