February 7, 2023 KKR & Co. Inc. Reports First Quarter 2024 Financial Results May 1, 2024

i We had a solid quarter with 20%+ year-over- year growth in Fee Related Earnings, Total Operating Earnings and Adjusted Net Income and raised $31 billion of new capital. We closed on the acquisition of the remaining stake in Global Atlantic and are now reporting our financial results through three segments: Asset Management, Insurance and Strategic Holdings. With three avenues for long-term, sustained growth – as detailed at our April Investor Day – we are well positioned for the years ahead. Conference Call A conference call to discuss KKR's financial results will be held on May 1, 2024 at 10:00 a.m. ET. The conference call may be accessed by dialing +1 (877) 407-0312 (U.S. callers) or +1 (201) 389-0899 (non-U.S. callers); a pass code is not required. Additionally, the conference call will be broadcast live over the Internet and may be accessed through the Investor Center section of KKR's website at https://ir.kkr.com/events- presentations/. A replay of the live broadcast will be available on KKR's website beginning approximately one hour after the live broadcast ends. About KKR KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of The Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR's website at www.kkr.com. For additional information about Global Atlantic Financial Group, please visit Global Atlantic Financial Group's website at www.globalatlantic.com. New York, May 1, 2024 – KKR & Co. Inc. (NYSE: KKR) today reported its first quarter 2024 results. KKR Reports First Quarter 2024 Financial Results Joseph Y. Bae and Scott C. Nuttall Co-Chief Executive Officers

ii KKR Reports First Quarter 2024 Financial Results Investor Relations Craig Larson Phone: +1 (877) 610-4910 in U.S. / +1 (212) 230-9410 investor-relations@kkr.com Media Kristi Huller Phone: +1 (212) 750-8300 media@kkr.com Legal Disclosures This presentation has been prepared by KKR & Co. Inc. solely for informational purposes for its public stockholders in connection with evaluating the business, operations and financial results of KKR & Co. Inc. and its subsidiaries (collectively, “KKR”), which includes The Global Atlantic Financial Group LLC and its subsidiaries (collectively, “Global Atlantic” or “GA”), unless the context requires otherwise. This presentation is not, and shall not be construed, as an offer to purchase or sell, or the solicitation of an offer to purchase or sell any securities of KKR. This presentation may not be distributed, referenced, quoted or linked by website, in whole or in part, except as agreed to in writing by KKR & Co. Inc. The statements contained in this presentation are made as of the date of this presentation, other than financial figures, which are as of March 31, 2024, unless another time is specified in relation to such statements or financial figures, and access to this presentation at any given time shall not give rise to any implication that there has been no change in the facts set forth in this presentation since such date. This presentation contains certain forward-looking statements pertaining to KKR, including with respect to the investment funds, and vehicles and accounts managed by KKR and the Global Atlantic insurance companies. Forward-looking statements relate to expectations, estimates, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. You can identify these forward-looking statements by the use of words such as “opportunity,” “outlook,” “believe,” “think,” “expect,” “feel,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” “visibility,” “positioned,” “path to,” “conviction,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. These forward-looking statements are based on KKR’s beliefs, assumptions and expectations, but these beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to KKR or within its control. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. All forward-looking statements speak only as of the date of this presentation. KKR does not undertake any obligation to update any forward-looking statements to reflect circumstances or events that occur after the date of this presentation except as required by law. Please see the Appendix for additional important information about forward-looking statements, including the assumptions and risks concerning projections and estimates of future performance. This presentation includes certain non-GAAP measures, including adjusted net income (“ANI”), total segment earnings, total investing earnings, total operating earnings (“TOE”), fee related earnings (“FRE”), strategic holdings operating earnings, and total asset management segment revenues. These non-GAAP measures are in addition to, and not a substitute for, measures of financial and operating performance prepared in accordance with U.S. GAAP. While we believe that providing these non-GAAP measures is helpful to investors in assessing the overall performance of KKR’s business, they may not include all items that are significant to an investor’s analysis of our financial results. Please see the Appendix for additional important information about the non-GAAP measures presented herein. Please see the Appendix for other important information. In addition, information about factors affecting KKR, including a description of risks that should be considered when making a decision to purchase or sell any securities of KKR, can be found in KKR & Co. Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 29, 2024, and its other filings with the SEC, which are available at www.sec.gov. From time to time, we may use our website as a channel of distribution of material information. Financial and other material information regarding KKR is routinely posted on and accessible at www.kkr.com. Financial and other material information regarding Global Atlantic is routinely posted on and accessible at www.globalatlantic.com. Information on these websites are not incorporated by reference herein and are not a part of this presentation. Contact Information

KKR & Co. Inc. First Quarter Earnings

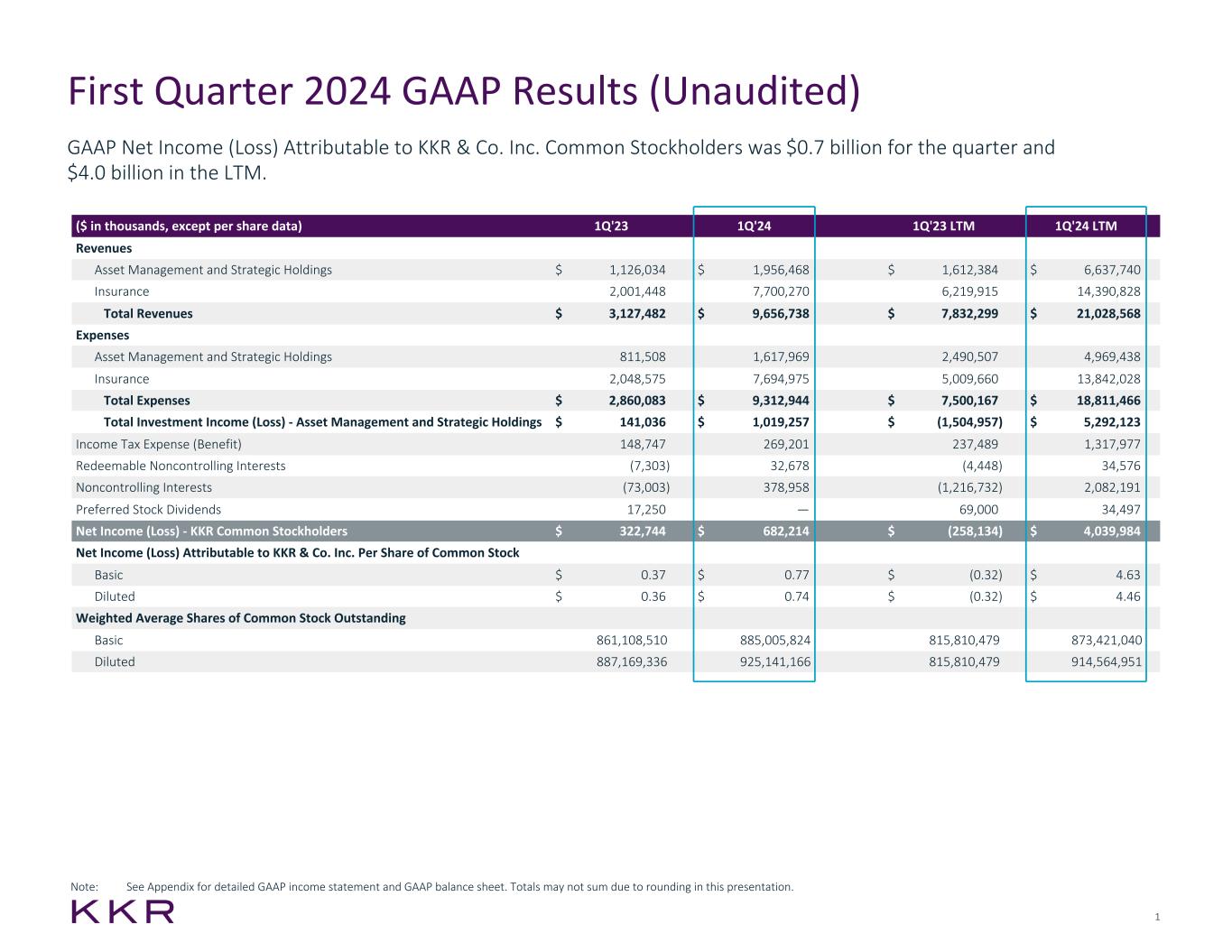

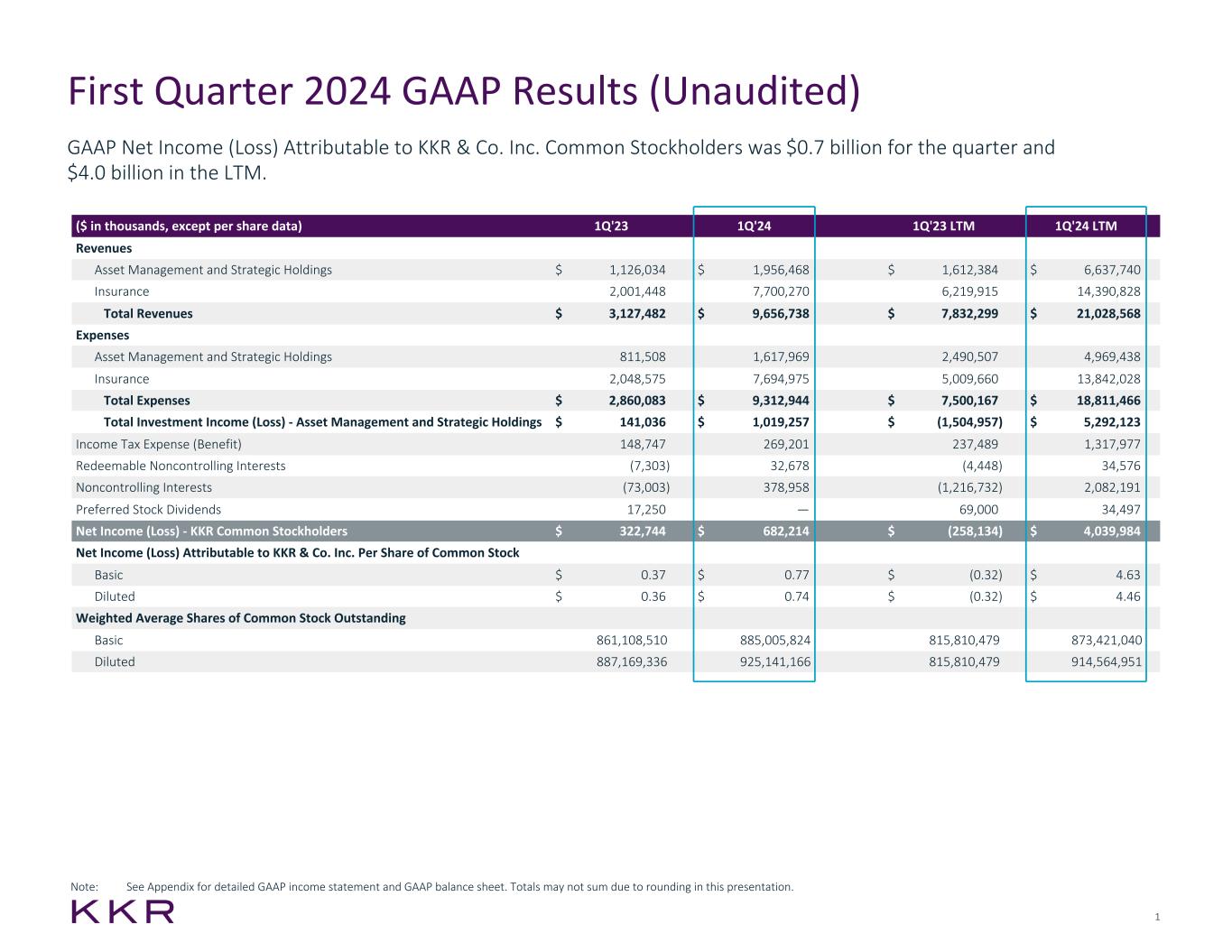

1 First Quarter 2024 GAAP Results (Unaudited) GAAP Net Income (Loss) Attributable to KKR & Co. Inc. Common Stockholders was $0.7 billion for the quarter and $4.0 billion in the LTM. ($ in thousands, except per share data) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Revenues Asset Management and Strategic Holdings $ 1,126,034 $ 1,956,468 $ 1,612,384 $ 6,637,740 Insurance 2,001,448 7,700,270 6,219,915 14,390,828 Total Revenues $ 3,127,482 $ 9,656,738 $ 7,832,299 $ 21,028,568 Expenses Asset Management and Strategic Holdings 811,508 1,617,969 2,490,507 4,969,438 Insurance 2,048,575 7,694,975 5,009,660 13,842,028 Total Expenses $ 2,860,083 $ 9,312,944 $ 7,500,167 $ 18,811,466 Total Investment Income (Loss) - Asset Management and Strategic Holdings $ 141,036 $ 1,019,257 $ (1,504,957) $ 5,292,123 Income Tax Expense (Benefit) 148,747 269,201 237,489 1,317,977 Redeemable Noncontrolling Interests (7,303) 32,678 (4,448) 34,576 Noncontrolling Interests (73,003) 378,958 (1,216,732) 2,082,191 Preferred Stock Dividends 17,250 — 69,000 34,497 Net Income (Loss) - KKR Common Stockholders $ 322,744 $ 682,214 $ (258,134) $ 4,039,984 Net Income (Loss) Attributable to KKR & Co. Inc. Per Share of Common Stock Basic $ 0.37 $ 0.77 $ (0.32) $ 4.63 Diluted $ 0.36 $ 0.74 $ (0.32) $ 4.46 Weighted Average Shares of Common Stock Outstanding Basic 861,108,510 885,005,824 815,810,479 873,421,040 Diluted 887,169,336 925,141,166 815,810,479 914,564,951 Note: See Appendix for detailed GAAP income statement and GAAP balance sheet. Totals may not sum due to rounding in this presentation.

2 Capital Metrics First Quarter 2024 Highlights • Fee Related Earnings (“FRE”) of $669 million ($0.75/adj. share) in the quarter, up 22% year-over-year • FRE was $2.5 billion in the LTM ($2.81/adj. share), up 19% year-over-year • Total Operating Earnings ("TOE") of $962 million ($1.08/adj. share) in the quarter, up 28% year-over-year • TOE was $3.4 billion in the LTM ($3.85/adj. share), up 17% year-over-year • Adjusted Net Income (“ANI”) of $864 million ($0.97/adj. share) in the quarter, up 20% year-over-year • ANI was $3.2 billion in the LTM ($3.58/adj. share), down 2% year-over-year • Assets Under Management (“AUM”) of $578 billion, up 13% year-over-year • Fee Paying Assets Under Management (“FPAUM”) of $471 billion, up 13% year-over- year • New Capital Raised of $31 billion in the quarter and $88 billion in the LTM • Capital Invested of $14 billion in the quarter and $48 billion in the LTM • Regular dividend of $0.175 per share of common stock was declared for the quarter, up 6% on an annualized basis from the 2023 dividend • Strategic Updates • On January 2, 2024, the acquisition of the remaining minority equity interests in Global Atlantic closed • Reporting three segments beginning this quarter, including the new Strategic Holdings segment • Recast of historical financial information and additional detail on reporting changes reflected herein can be found on our website(1) Note: Adj. share refers to adjusted shares. See the Appendix for GAAP reconciliations and other important information. See page 28 for record and payment dates for common stock. (1) See the March 27, 2024 presentation available on our website for more details. Financial Measures Corporate

3 First Quarter 2024 Segment Earnings Note: See Appendix for GAAP reconciliations, endnotes about taxes affecting Adjusted Net Income and other important information. ($ in thousands, except per share data) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Management Fees $ 738,156 $ 815,327 $ 2,769,715 $ 3,107,496 Transaction and Monitoring Fees, Net 142,179 152,084 612,074 730,559 Fee Related Performance Revenues 21,741 19,101 100,355 91,787 Fee Related Compensation (203,094) (172,640) (760,609) (834,882) Other Operating Expenses (150,404) (145,131) (610,528) (591,011) Fee Related Earnings $ 548,578 $ 668,741 $ 2,111,007 $ 2,503,949 Insurance Operating Earnings $ 205,112 $ 272,840 $ 785,927 $ 884,365 Strategic Holdings Operating Earnings $ — $ 20,720 $ 20,316 $ 35,251 Total Operating Earnings $ 753,690 $ 962,301 $ 2,917,250 $ 3,423,565 Net Realized Performance Income 61,389 77,998 678,949 415,558 Net Realized Investment Income 165,120 114,542 813,073 490,863 Total Investing Earnings $ 226,509 $ 192,540 $ 1,492,022 $ 906,421 Total Segment Earnings $ 980,199 $ 1,154,841 $ 4,409,272 $ 4,329,986 Interest Expense, Net and Other (87,866) (74,730) (338,983) (338,733) Income Taxes on Adjusted Earnings (173,057) (216,366) (812,742) (806,691) Adjusted Net Income $ 719,276 $ 863,745 $ 3,257,547 $ 3,184,562 Adjusted Per Share Measures: FRE per Adjusted Share $ 0.62 $ 0.75 $ 2.38 $ 2.81 TOE per Adjusted Share $ 0.85 $ 1.08 $ 3.28 $ 3.85 ANI per Adjusted Share $ 0.81 $ 0.97 $ 3.67 $ 3.58

4 Total Operating Earnings ($ in millions) $2,917 $3,424 LTM 1Q'23 Actual LTM 1Q'24 Actual Total Operating Earnings • In 1Q'24 we introduced Total Operating Earnings ("TOE") as an additional key financial measure • Total Operating Earnings - the sum of Fee Related Earnings, Insurance Operating Earnings and Strategic Holdings Operating Earnings - represents the more recurring portion of KKR's pre-tax earnings. Over time we expect TOE to approximate 70% of Total Segment Earnings • The majority of the increase in TOE, both in the LTM and quarterly periods displayed below, was driven by the growth in Fee Related Earnings. Insurance Operating Earnings for 1Q'24 reflect KKR's 100% ownership of Global Atlantic (the results for the historical periods do not reflect 100% ownership) $754 $962 1Q'23 Actual 1Q'24 Actual Note: TOE approximating 70% of Total Segment Earnings over time is a forward-looking statement. This is estimated based on various assumptions, and there is no guarantee that our expectations will be realized as presented. See Appendix for further information and important information regarding estimates and assumptions and cautionary factors about forward-looking statements.

Asset Management Segment Detail

6 Asset Management Segment ($ in thousands, except per share data) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Management Fees $ 738,156 $ 815,327 $ 2,769,715 $ 3,107,496 Transaction and Monitoring Fees, Net 142,179 152,084 612,074 730,559 Fee Related Performance Revenues 21,741 19,101 100,355 91,787 Fee Related Compensation (203,094) (172,640) (760,609) (834,882) Other Operating Expenses (150,404) (145,131) (610,528) (591,011) Fee Related Earnings $ 548,578 $ 668,741 $ 2,111,007 $ 2,503,949 Realized Performance Income 175,398 271,545 1,742,849 1,161,536 Realized Performance Income Compensation (114,009) (193,547) (1,063,900) (745,978) Net Realized Performance Income $ 61,389 $ 77,998 $ 678,949 $ 415,558 Realized Investment Income 194,834 134,753 924,562 584,950 Realized Investment Income Compensation (29,714) (20,211) (136,314) (94,087) Net Realized Investment Income $ 165,120 $ 114,542 $ 788,248 $ 490,863 Total Investing Earnings $ 226,509 $ 192,540 $ 1,467,197 $ 906,421 Asset Management Segment Earnings $ 775,087 $ 861,281 $ 3,578,204 $ 3,410,370 Additional Financial Measures and Capital Metrics: FRE per Adjusted Share $ 0.62 $ 0.75 $ 2.38 $ 2.81 Total Asset Management Segment Revenues $ 1,272,308 $ 1,392,810 $ 6,149,555 $ 5,676,328 Assets Under Management $ 510,069,000 $ 577,633,000 $ 510,069,000 $ 577,633,000 Fee Paying Assets Under Management $ 415,871,000 $ 470,603,000 $ 415,871,000 $ 470,603,000 New Capital Raised (AUM) $ 11,677,000 $ 30,606,000 $ 66,661,000 $ 88,395,000 Capital Invested $ 9,767,000 $ 14,104,000 $ 59,802,000 $ 48,347,000 Uncalled Commitments $ 106,266,000 $ 97,508,000 $ 106,266,000 $ 97,508,000 Note: See Appendix for GAAP reconciliations and other important information.

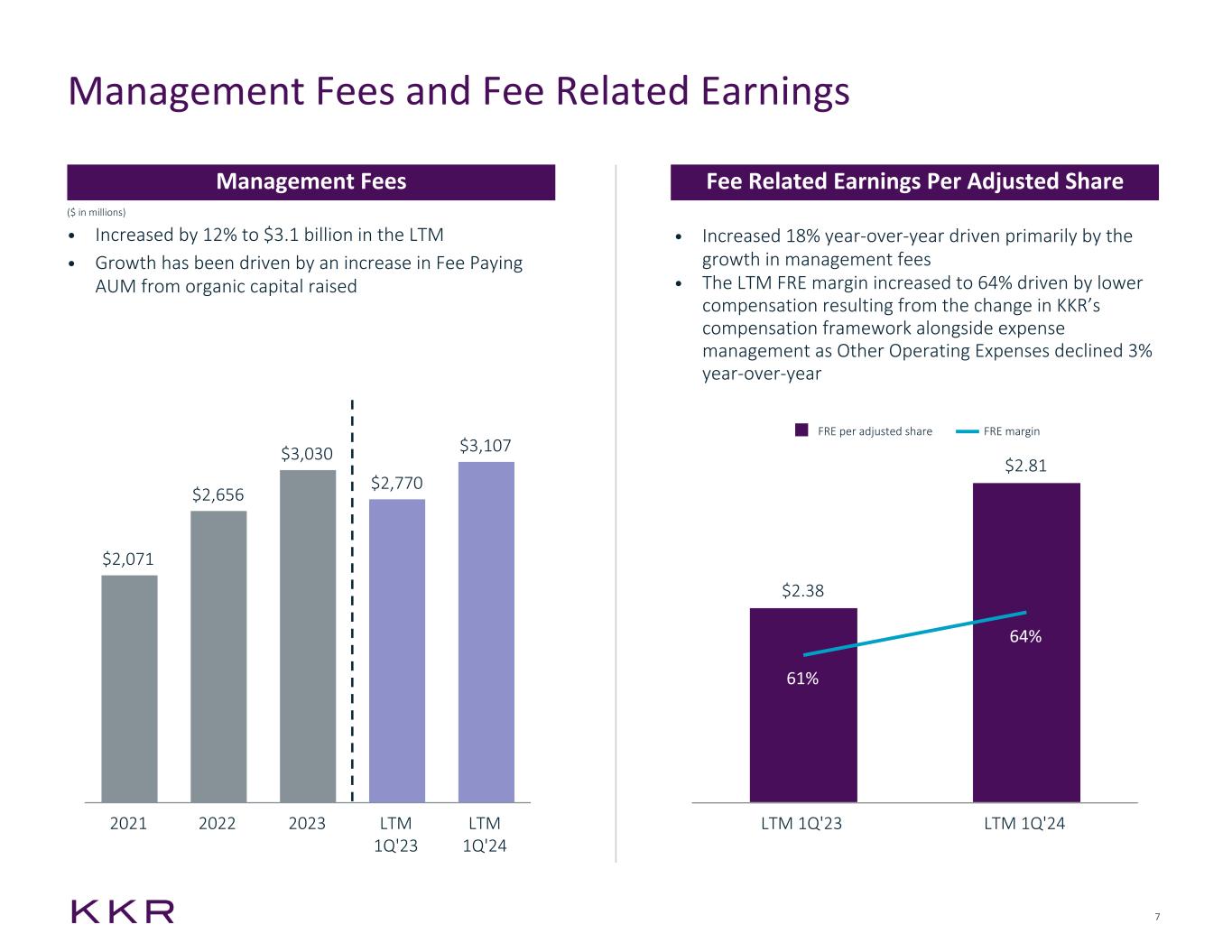

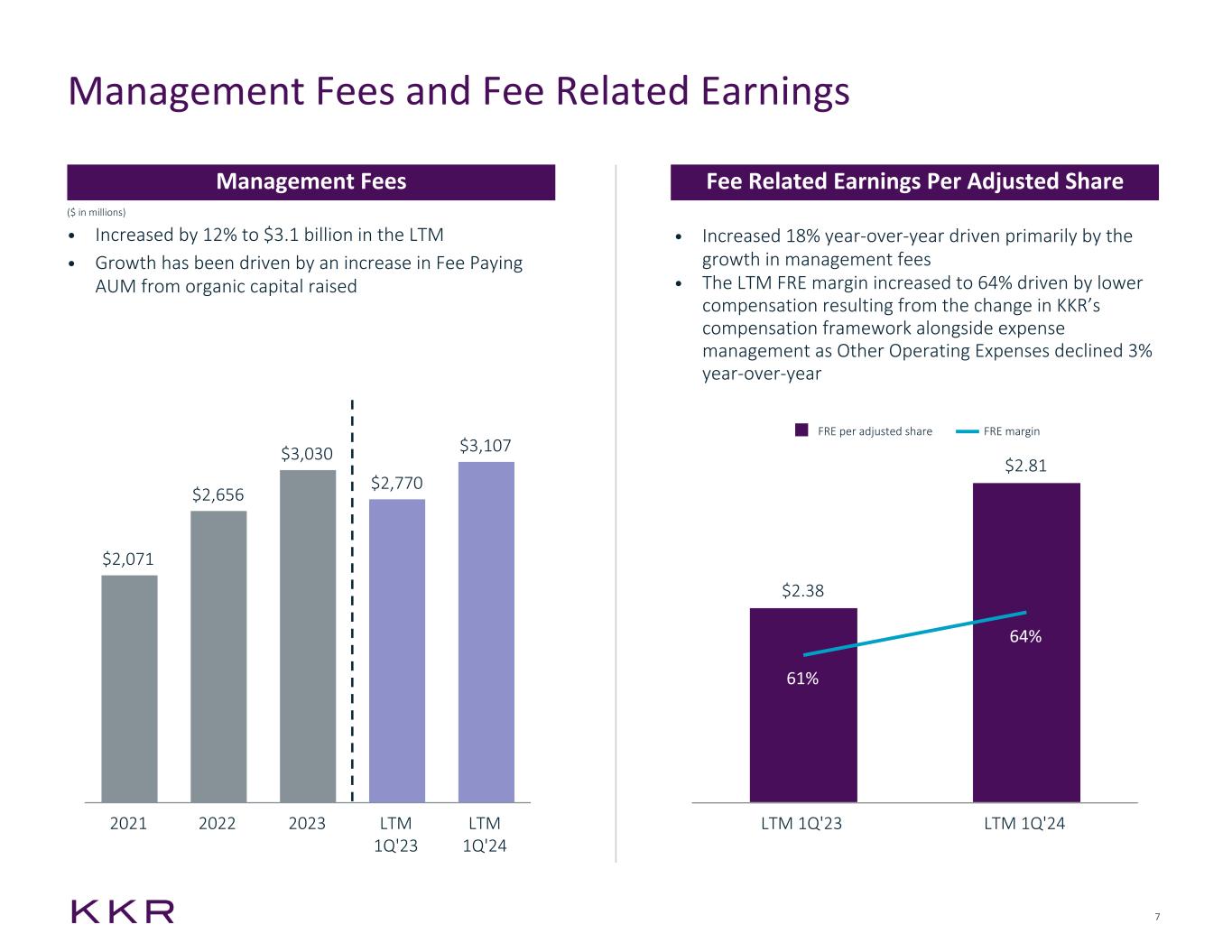

7 Management Fees and Fee Related Earnings Management Fees Fee Related Earnings Per Adjusted Share • Increased by 12% to $3.1 billion in the LTM • Growth has been driven by an increase in Fee Paying AUM from organic capital raised • Increased 18% year-over-year driven primarily by the growth in management fees • The LTM FRE margin increased to 64% driven by lower compensation resulting from the change in KKR’s compensation framework alongside expense management as Other Operating Expenses declined 3% year-over-year ($ in millions) $2.38 $2.81 61% 64% FRE per adjusted share FRE margin LTM 1Q'23 LTM 1Q'24 $2,071 $2,656 $3,030 $2,770 $3,107 2021 2022 2023 LTM 1Q'23 LTM 1Q'24

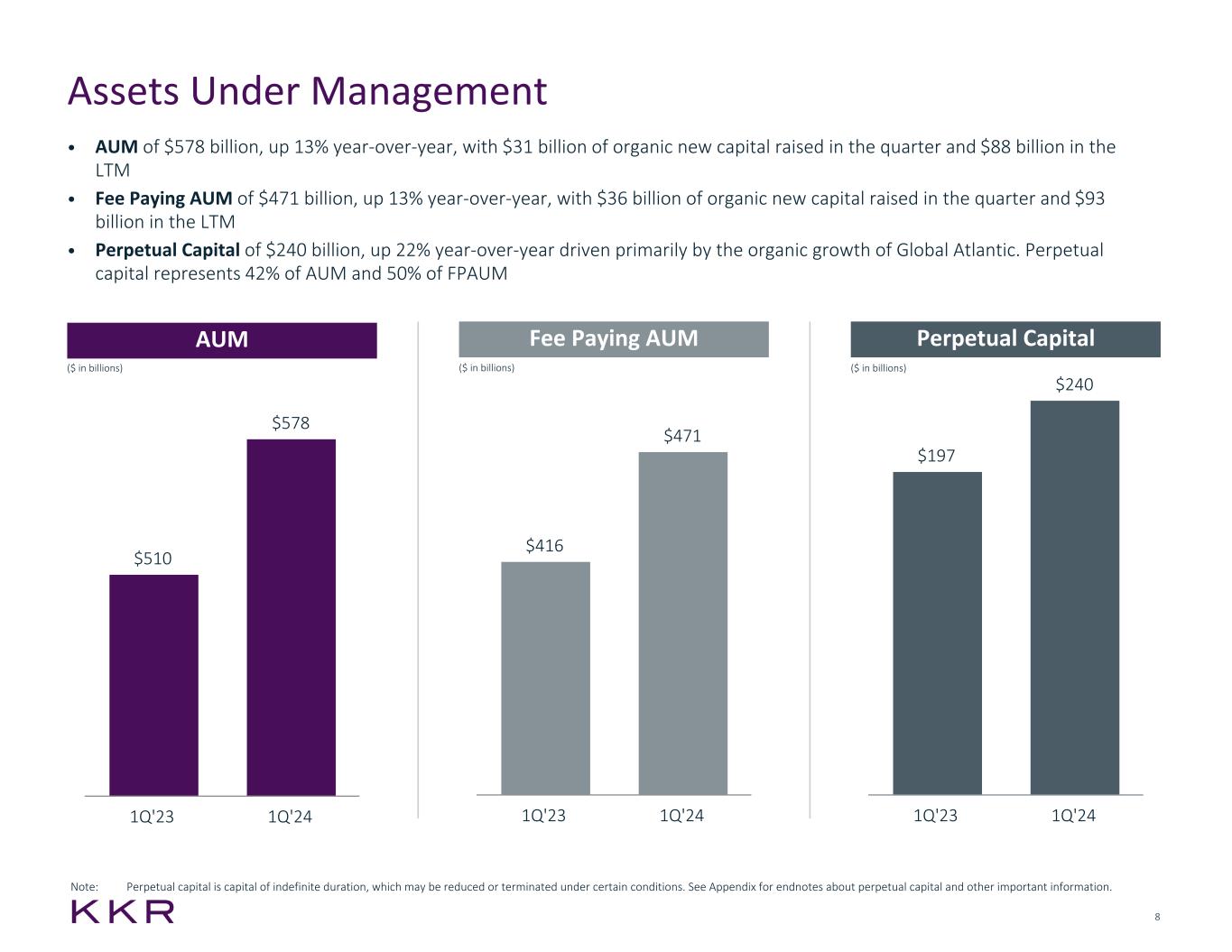

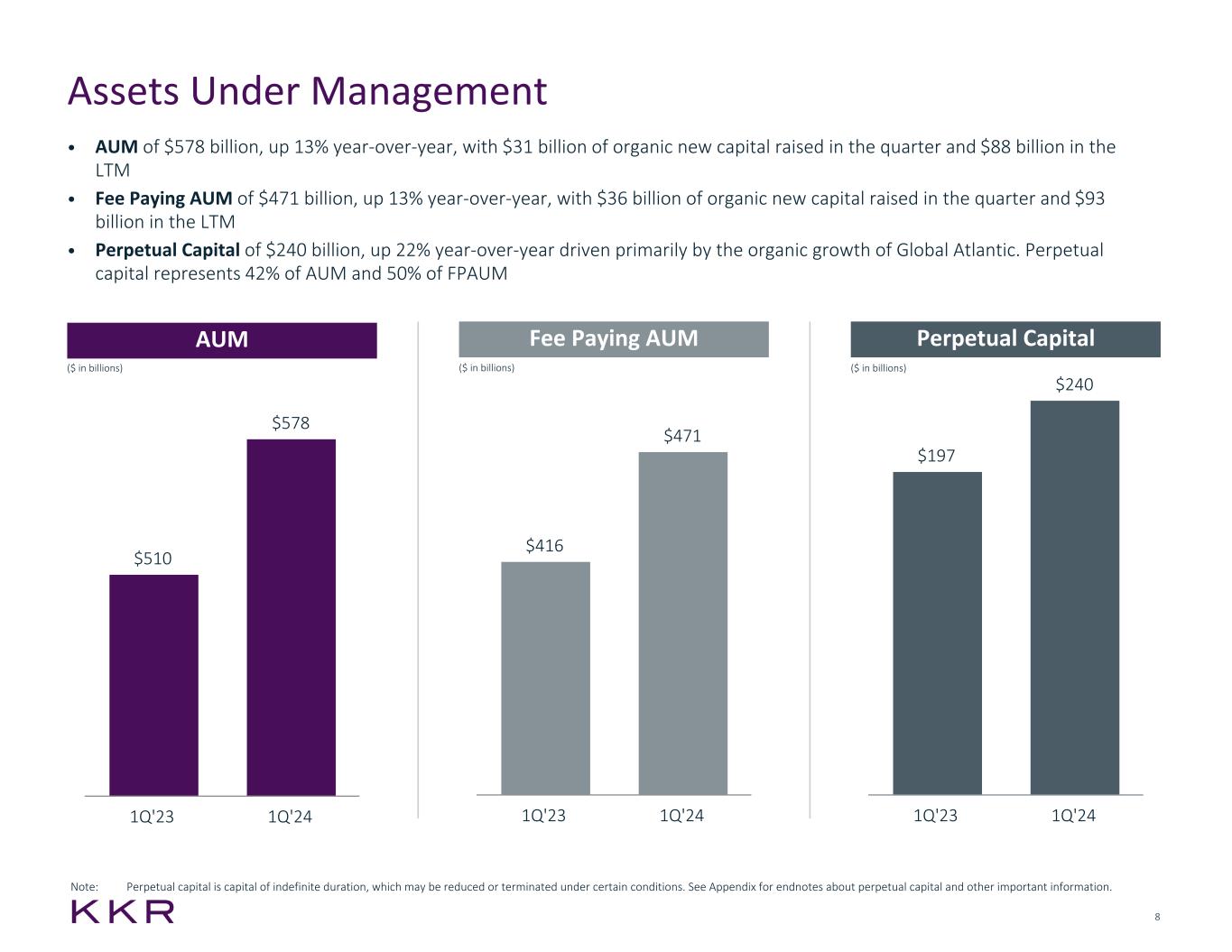

8 Assets Under Management • AUM of $578 billion, up 13% year-over-year, with $31 billion of organic new capital raised in the quarter and $88 billion in the LTM • Fee Paying AUM of $471 billion, up 13% year-over-year, with $36 billion of organic new capital raised in the quarter and $93 billion in the LTM • Perpetual Capital of $240 billion, up 22% year-over-year driven primarily by the organic growth of Global Atlantic. Perpetual capital represents 42% of AUM and 50% of FPAUM AUM Fee Paying AUM Perpetual Capital ($ in billions) ($ in billions) ($ in billions) $510 $578 1Q'23 1Q'24 $416 $471 1Q'23 1Q'24 $197 $240 1Q'23 1Q'24 Note: Perpetual capital is capital of indefinite duration, which may be reduced or terminated under certain conditions. See Appendix for endnotes about perpetual capital and other important information.

9 Additional Capital Detail • Dry Powder: Uncalled commitments of $98 billion remain diversified across the firm’s investment strategies • AUM Not Yet Paying Fees: At quarter end, there was $44 billion of committed capital with a weighted average management fee rate of greater than 90 bps that becomes payable when the capital is either invested or enters its investment period • Carry Eligible AUM: Of the $278 billion of carried interest eligible AUM, $214 billion is above cost and accruing carry • Performance Fee Eligible AUM: $344 billion, up 9% year-over-year Performance Fee Eligible AUM Uncalled Commitments ($ in billions) ($ in billions) $316 $344 1Q'23 1Q'24 $106 $98 1Q'23 1Q'24 Note: See Appendix for endnotes for additional information relating to uncalled commitments.

10 Gross unrealized carried interest totals $6.9 billion as of March 31, 2024 Fund Investment Performance Private Equity Real Assets Infrastructure Portfolio Opportunistic Real Estate Portfolio Credit Alternative Credit Composite Traditional Private Equity Portfolio Leveraged Credit Composite 1Q'24 1% LTM Gross Return 1% 19%5% 13%4% 16%5% 14%3% Note: Traditional private equity does not include core or growth. See Appendix for endnotes explaining composition of the portfolios and composites presented on this page and for other important information. Past performance is no guarantee of future results.

11 • AUM: Increased 4% quarter-over-quarter and increased 10% year-over-year to $183 billion with organic new capital raised of $4 billion in the quarter and $10 billion in the LTM • New capital raised in the quarter was primarily driven by Ascendant and K-Series PE, a private equity product designed for private wealth clients • Realizations: Carried Interest in 1Q driven primarily by core private equity, as well as traditional private equity secondary activity • Capital Invested: $1 billion in the quarter and $12 billion in the LTM. In 1Q, deployment was driven by traditional private equity and health care strategic growth in the U.S. • Performance: The traditional private equity portfolio appreciated 19% in the LTM Asset Management Segment − Private Equity ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Management Fees $ 316,341 $ 342,485 $ 1,222,620 $ 1,312,206 Transaction and Monitoring Fees, Net 34,274 15,805 121,628 96,807 Fee Related Performance Revenues — — — — Fee Related Revenues $ 350,615 $ 358,290 $ 1,344,248 $ 1,409,013 Realized Performance Income $ 163,052 $ 265,297 $ 1,462,809 $ 1,041,035 Capital Metrics: Assets Under Management $ 165,762,000 $ 182,766,000 $ 165,762,000 $ 182,766,000 Fee Paying Assets Under Management $ 102,323,000 $ 116,287,000 $ 102,323,000 $ 116,287,000 New Capital Raised (AUM) $ 349,000 $ 3,590,000 $ 11,825,000 $ 10,142,000 Capital Invested $ 2,863,000 $ 1,150,000 $ 17,304,000 $ 11,816,000 Uncalled Commitments $ 64,067,000 $ 55,017,000 $ 64,067,000 $ 55,017,000 Note: See Appendix for endnotes about our private equity business line and other important information.

12 Asset Management Segment − Real Assets • AUM: Increased 3% quarter-over-quarter and 12% year-over-year to $135 billion with organic new capital raised of $6 billion in the quarter and $19 billion in the LTM • New capital raised in the quarter included activity across opportunistic real estate equity, KJRM (Japanese REIT business), Global Atlantic inflows and K-Series Infrastructure, an infrastructure product designed for private wealth clients • Capital Invested: $5 billion in the quarter and $16 billion in the LTM. In 1Q, deployment was driven primarily by core+ infrastructure across multiple geographies, real estate equity in Asia and real estate credit in the U.S. • Performance: The infrastructure portfolio appreciated 16% and the opportunistic real estate portfolio appreciated 1% in the LTM ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Management Fees $ 193,365 $ 220,087 $ 719,442 $ 852,457 Transaction and Monitoring Fees, Net 5,734 17,373 31,306 32,203 Fee Related Performance Revenues 3,704 1,400 52,570 19,344 Fee Related Revenues $ 202,803 $ 238,860 $ 803,318 $ 904,004 Realized Performance Income $ 9,686 $ 624 $ 123,151 $ 57,956 Capital Metrics: Assets Under Management $ 120,806,000 $ 135,362,000 $ 120,806,000 $ 135,362,000 Fee Paying Assets Under Management $ 105,727,000 $ 115,649,000 $ 105,727,000 $ 115,649,000 New Capital Raised (AUM) $ 2,613,000 $ 5,858,000 $ 21,173,000 $ 19,229,000 Capital Invested $ 4,666,000 $ 5,456,000 $ 23,490,000 $ 16,265,000 Uncalled Commitments $ 27,661,000 $ 24,311,000 $ 27,661,000 $ 24,311,000

13 • AUM: Increased 6% quarter-over-quarter and 16% year-over-year to $260 billion with organic new capital raised of $21 billion in the quarter and $59 billion in the LTM • New capital raised in the quarter was widespread and driven by inflows at Global Atlantic, ABF vehicles, evergreen U.S. direct lending, Asia private credit and CLO formation • AUM comprised of: $130 billion of leveraged credit, $54 billion of asset-based finance, $39 billion of direct lending, $9 billion of strategic investments and $27 billion of liquid strategies • Capital Invested: $7 billion in the quarter and $20 billion in the LTM. In 1Q, deployment was most active in direct lending and asset-based finance • Performance: The leveraged credit composite appreciated 14%, with the alternative credit composite up 13% in the LTM ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Management Fees $ 228,450 $ 252,755 $ 827,653 $ 942,833 Transaction and Monitoring Fees, Net 284 3,188 12,206 10,101 Fee Related Performance Revenues 18,037 17,701 47,785 72,443 Fee Related Revenues $ 246,771 $ 273,644 $ 887,644 $ 1,025,377 Realized Performance Income $ 2,660 $ 5,624 $ 156,889 $ 62,545 Capital Metrics: Assets Under Management $ 223,501,000 $ 259,505,000 $ 223,501,000 $ 259,505,000 Fee Paying Assets Under Management $ 207,821,000 $ 238,667,000 $ 207,821,000 $ 238,667,000 New Capital Raised (AUM) $ 8,715,000 $ 21,158,000 $ 33,663,000 $ 59,024,000 Capital Invested $ 2,238,000 $ 7,498,000 $ 19,008,000 $ 20,266,000 Uncalled Commitments $ 14,538,000 $ 18,180,000 $ 14,538,000 $ 18,180,000 Asset Management Segment − Credit and Liquid Strategies

14 • Transaction Fees: Totaled $116 million in the quarter and $591 million in the LTM • Approximately 65% of transaction fees were originated in North America in the quarter • Traditional private equity and our third party business each generated approximately a third of total fees in the quarter • Approximately 75% of transaction fees were debt product focused Asset Management Segment − Capital Markets • All financial results exclude Strategic Holdings • Realizations: Realized Investment Income of $135 million in the quarter and $585 million in the LTM • Balance Sheet Investment Return: Up 4% in the quarter and up 15% in the LTM • Embedded Gains: $2.8 billion of embedded unrealized gains on the balance sheet at quarter end Asset Management Segment − Principal Activities ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Transaction Fees $ 101,887 $ 115,718 $ 446,934 $ 591,448 ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Net Realized Gains (Losses) $ 112,042 $ 50,555 $ 580,034 $ 188,703 Interest Income and Dividends, Net 82,792 84,198 344,528 396,247 Realized Investment Income $ 194,834 $ 134,753 $ 924,562 $ 584,950

Insurance Segment Detail

16 • Net Investment Income: Net Investment Income of $1.5 billion in the quarter reflects higher yields and growth in the investment portfolio attributable to strong net inflows. Investment portfolio yields in the quarter reflect higher levels of cash and more liquid investments transferred during recent block reinsurance transactions • Net Cost of Insurance: Net Cost of Insurance totaled $1.0 billion in the quarter, driven primarily by new business growth and the associated higher funding costs, as well the routine run off of older business that was originated in a lower cost environment • Highlights: • Global Atlantic AUM totals $177 billion, of which $137 billion is Credit AUM • The Manulife block reinsurance transaction closed in the quarter, adding $10 billion to AUM • KKR owned 100% of Global Atlantic beginning 1Q'24. The financial results for all other quarters reflect KKR's ~63% ownership Insurance Segment ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Net Investment Income $ 1,271,255 $ 1,486,419 $ 4,521,085 $ 5,592,981 Net Cost of Insurance (750,612) (1,003,327) (2,563,875) (3,535,724) General, Administrative and Other (196,714) (210,252) (688,576) (818,647) Pre-tax Operating Earnings 323,929 272,840 1,268,634 1,238,610 Pre-tax Operating Earnings Attributable to Noncontrolling Interests (118,817) — (482,707) (354,245) Insurance Operating Earnings $ 205,112 $ 272,840 $ 785,927 $ 884,365 Additional Financial Measure: Global Atlantic Book Value $ 4,391,813 $ 8,068,171 $ 4,391,813 $ 8,068,171 Note: See Appendix for endnotes explaining certain terms. 1Q'24 Net Investment Income only included income related to asset/liability matching investment strategies. 1Q'24 LTM Net Investment Income includes $37 million ($17 million of insurance operating earnings) of realized gains and losses not related to asset/liability matching investment strategies. 1Q'23 Net Investment Income only included income related to asset/liability matching investment strategies. 1Q'23 LTM Net Investment Income included $73 million ($33 million of insurance operating earnings) of realized gains and losses not related to asset/liability matching investment strategies.

Strategic Holdings Segment Detail

18 Strategic Holdings Segment • Strategic Holdings Segment Earnings: Driven by dividends from our Core PE businesses • Highlights: • Expect Strategic Holdings Operating Earnings will be modest in 2024, $300+ million by 2026, $600+ million by 2028 and $1+ billion by 2030 • KKR's share of the businesses' 4Q'23 LTM Adjusted Revenues is $3.6 billion and 4Q'23 LTM Adjusted EBITDA is $0.9 billion • Capital Invested in Strategic Holdings was $0.9 billion over the LTM ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Dividends, Net $ — $ 20,720 $ 20,316 $ 35,251 Strategic Holdings Operating Earnings $ — $ 20,720 $ 20,316 $ 35,251 Net Realized Investment Income $ — $ — $ 24,825 $ — Strategic Holdings Segment Earnings $ — $ 20,720 $ 45,141 $ 35,251 LTM Adjusted EBITDA by Geography (KKR's Share) LTM Adjusted EBITDA by Industry (KKR's Share) Americas 65% Europe 29% Asia Pacific 5% Business Services 33% Consumer 29% Infrastructure 13% TMT 13% Health Care 13% Note: See Appendix for endnotes for additional information relating to LTM Adjusted Revenues, LTM Adjusted EBITDA, and Capital Invested. Expectations about Strategic Holdings Operating Earnings over time are forward-looking statements. These are estimated based on various assumptions, and there is no guarantee that our expectations will be realized as presented. See Appendix for further information and important information regarding estimates and assumptions and cautionary factors about forward-looking statements.

Supplemental Information

20 Duration of Capital Growth in Strategic & Perpetual Capital Assets Under Management Perpetual Capital Long-Dated Strategic Investor Partnerships Perpetual Capital Long-Dated Strategic Investor Partnerships 8+ Year Duration at Inception Other ($ in billions) $258 $304 $197 $240 $61 $64 1Q'23 1Q'24 92% of AUM is perpetual capital or has a duration of at least 8 years at inception 8% 42% 11% 39% 53% of AUM is perpetual capital or long-dated strategic investor partnerships Note: Perpetual capital is capital of indefinite duration, which may be materially reduced or terminated under certain conditions. See Appendix for endnotes and other important information.

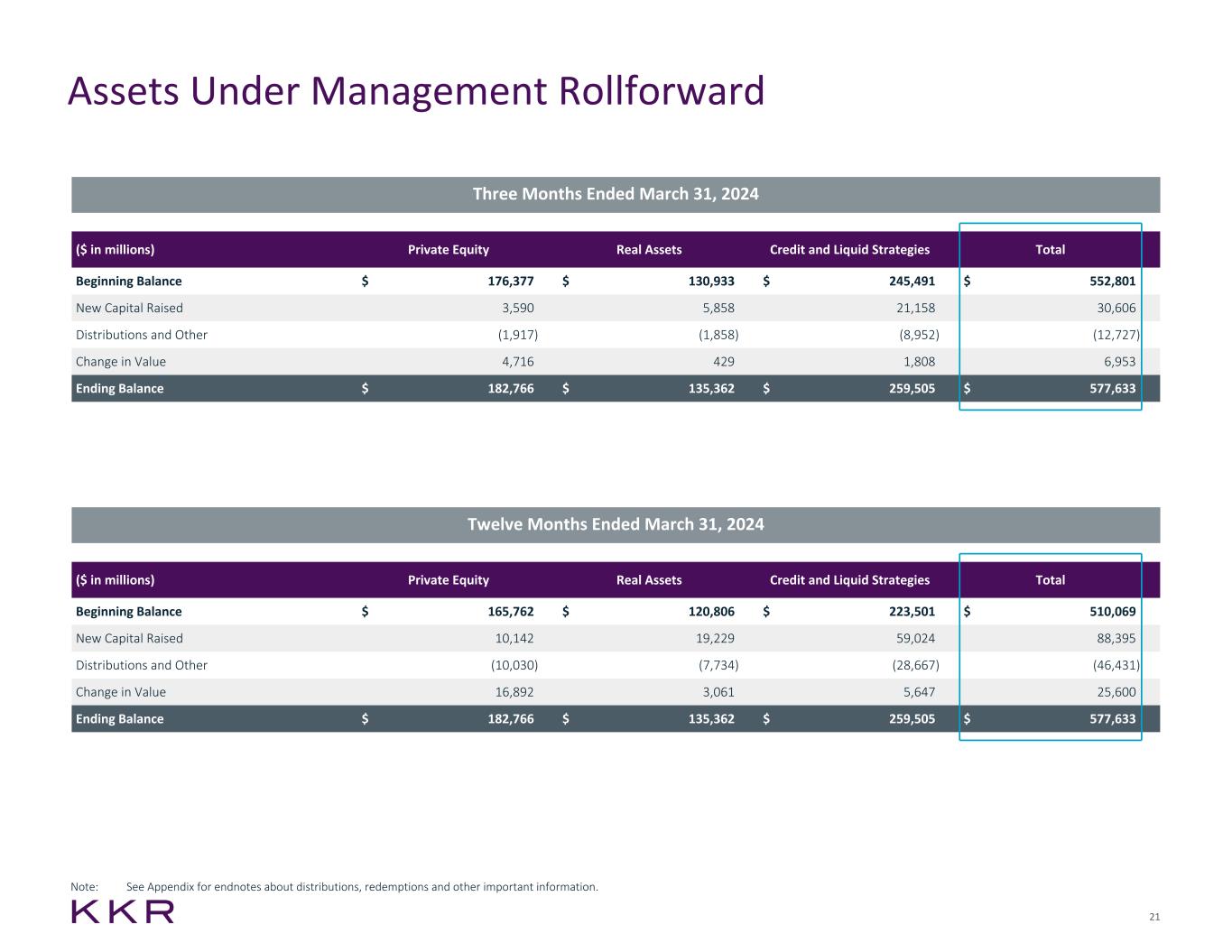

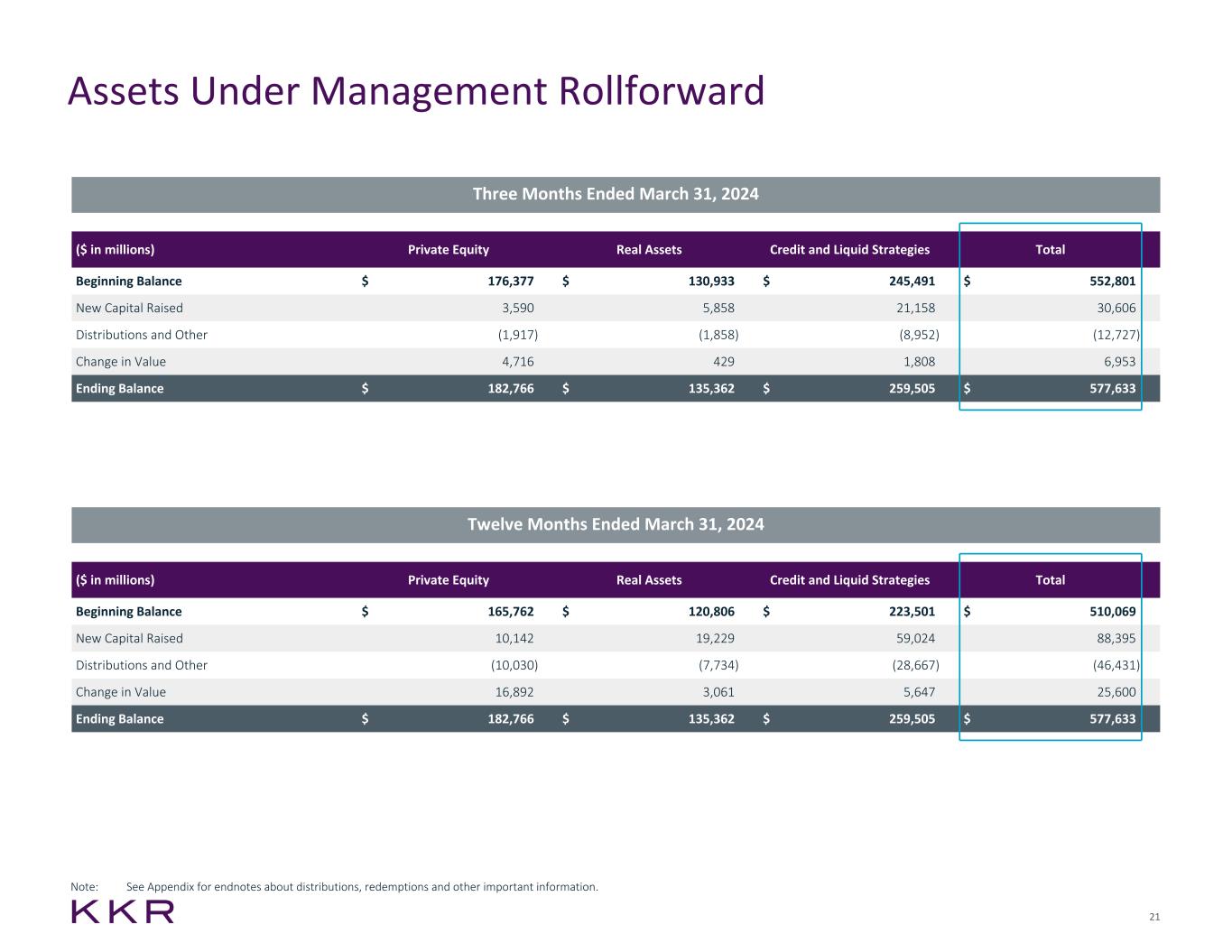

21 Assets Under Management Rollforward Twelve Months Ended March 31, 2024 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 165,762 $ 120,806 $ 223,501 $ 510,069 New Capital Raised 10,142 19,229 59,024 88,395 Distributions and Other (10,030) (7,734) (28,667) (46,431) Change in Value 16,892 3,061 5,647 25,600 Ending Balance $ 182,766 $ 135,362 $ 259,505 $ 577,633 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 176,377 $ 130,933 $ 245,491 $ 552,801 New Capital Raised 3,590 5,858 21,158 30,606 Distributions and Other (1,917) (1,858) (8,952) (12,727) Change in Value 4,716 429 1,808 6,953 Ending Balance $ 182,766 $ 135,362 $ 259,505 $ 577,633 Three Months Ended March 31, 2024 Note: See Appendix for endnotes about distributions, redemptions and other important information.

22 Fee Paying Assets Under Management Rollforward ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 107,726 $ 112,254 $ 226,428 $ 446,408 New Capital Raised 9,475 6,277 19,891 35,643 Distributions and Other (986) (2,068) (9,022) (12,076) Change in Value 72 (814) 1,370 628 Ending Balance $ 116,287 $ 115,649 $ 238,667 $ 470,603 ($ in millions) Private Equity Real Assets Credit and Liquid Strategies Total Beginning Balance $ 102,323 $ 105,727 $ 207,821 $ 415,871 New Capital Raised 18,601 19,488 55,363 93,452 Distributions and Other (5,068) (8,600) (28,916) (42,584) Change in Value 431 (966) 4,399 3,864 Ending Balance $ 116,287 $ 115,649 $ 238,667 $ 470,603 Twelve Months Ended March 31, 2024 Three Months Ended March 31, 2024 Note: See Appendix for endnotes about distributions, redemptions and other important information.

23 Investment Vehicle Summary ($ in thousands) 4Q'21 4Q'22 FY'21 FY'22 Net Investment Income $ 1,352,187 $ 1,230,677 $ 3,329,570 $ 4,112,244 Net Cost of Insurance (490,115) (751,332) (1,566,681) (2,415,996) General, Administrative and Other (162,085) (164,923) (500,410) (637,718) Pre-tax Insurance Operating Earnings 699,987 314,422 1,262,479 1,058,530 Income Taxes (135,947) (45,817) (199,095) (171,744) Net Income Attributable to Noncontrolling Interests (217,263) (103,464) (410,833) (341,582) Insurance Segment Operating Earnings $ 346,777 $ 165,141 $ 652,551 $ 545,204 Additional Financial Measures: Global Atlantic Book Value $ 3,372,498 $ 3,929,710 $ 3,372,498 $ 3,929,710 ($ in millions) Investment Period Amount Start Date End Date Commitment Uncalled Commitments Invested Realized Remaining Cost Remaining Fair Value PRIVATE EQUITY BUSINESS LINE North America Fund XIII 8/2021 8/2027 $ 18,400 $ 8,219 $ 10,181 $ — $ 10,181 $ 11,710 Americas Fund XII 5/2017 5/2021 13,500 1,616 12,490 9,835 9,301 18,800 North America Fund XI 11/2012 1/2017 8,718 142 10,055 22,858 2,571 3,356 2006 Fund(1) 9/2006 9/2012 17,642 — 17,309 37,423 — — Millennium Fund(1) 12/2002 12/2008 6,000 — 6,000 14,123 — 4 Ascendant Fund 6/2022 6/2028 3,549 3,549 — — — — European Fund VI 6/2022 6/2028 7,431 5,855 1,576 — 1,576 1,153 European Fund V 7/2019 2/2022 6,339 658 5,751 922 5,572 7,452 European Fund IV 2/2015 3/2019 3,512 21 3,643 5,726 1,621 2,659 European Fund III(1) 3/2008 3/2014 5,506 146 5,360 10,625 586 28 European Fund II(1) 11/2005 10/2008 5,751 — 5,751 8,507 — 25 Asian Fund IV 7/2020 7/2026 14,735 8,322 6,965 552 6,810 9,055 Asian Fund III 8/2017 7/2020 9,000 1,329 8,192 6,611 6,624 12,670 Asian Fund II 10/2013 3/2017 5,825 — 7,494 6,694 2,697 2,073 Asian Fund(1) 7/2007 4/2013 3,983 — 3,974 8,728 — — Next Generation Technology Growth Fund III 11/2022 11/2028 2,740 2,321 419 — 419 477 Next Generation Technology Growth Fund II 12/2019 5/2022 2,088 104 2,181 548 1,937 3,062 Next Generation Technology Growth Fund 3/2016 12/2019 659 4 670 1,148 276 1,017 Health Care Strategic Growth Fund II 5/2021 5/2027 3,789 2,812 977 — 977 1,102 Health Care Strategic Growth Fund 12/2016 4/2021 1,331 137 1,324 283 1,134 1,861 Global Impact Fund II 6/2022 6/2028 2,704 1,888 816 — 816 726 Global Impact Fund 2/2019 3/2022 1,242 223 1,195 474 1,018 1,625 Co-Investment Vehicles and Other Various Various 20,763 3,358 17,973 10,274 12,473 15,419 Core Investors II 8/2022 8/2027 11,814 8,963 2,851 — 2,851 3,049 Core Investors I 2/2018 8/2022 8,500 44 9,311 1,038 8,411 15,951 Other Core Vehicles Various Various 5,131 1,251 3,951 1,432 3,487 5,894 Unallocated Commitments(2) N/A N/A 3,989 3,989 — — — — Total Private Equity $ 194,641 $ 54,951 $ 146,409 $ 147,801 $ 81,338 $ 119,168 Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) The “Invested" and “Realized” columns do not include the amounts of any realized investments that restored the unused capital commitments of the fund investors, if any. (2) Represents unallocated commitments from our strategic investor partnerships.

24 Investment Vehicle Summary (cont’d) Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) Open ended fund. ($ in millions) Investment Period Amount Start Date End Date Commitment Uncalled Commitments Invested Realized Remaining Cost Remaining Fair Value REAL ASSETS BUSINESS LINE Global Infrastructure Investors IV 8/2021 8/2027 $ 16,590 $ 6,860 $ 10,062 $ 332 $ 9,856 $ 11,618 Global Infrastructure Investors III 7/2018 6/2021 7,166 1,096 6,335 1,993 5,478 7,862 Global Infrastructure Investors II 12/2014 6/2018 3,040 130 3,166 5,386 711 1,115 Global Infrastructure Investors 9/2010 10/2014 1,040 — 1,050 2,228 — — Asia Pacific Infrastructure Investors II 9/2022 9/2028 6,348 5,444 904 — 904 963 Asia Pacific Infrastructure Investors 1/2020 9/2022 3,792 691 3,385 847 2,879 3,385 Diversified Core Infrastructure Fund 12/2020 (1) 9,800 1,073 8,803 639 8,737 9,275 Real Estate Partners Americas III 1/2021 1/2025 4,253 1,544 2,818 229 2,655 2,656 Real Estate Partners Americas II 5/2017 12/2020 1,921 244 1,960 2,692 444 440 Real Estate Partners Americas 5/2013 5/2017 1,229 135 1,024 1,416 54 31 Real Estate Partners Europe II 3/2020 12/2023 2,061 510 1,755 431 1,451 1,421 Real Estate Partners Europe 8/2015 12/2019 707 99 687 775 200 197 Asia Real Estate Partners 7/2019 7/2023 1,682 401 1,288 23 1,245 1,470 Property Partners Americas 12/2019 (1) 2,571 48 2,523 159 2,523 2,250 Real Estate Credit Opportunity Partners II 8/2019 6/2023 950 — 976 257 976 938 Real Estate Credit Opportunity Partners 2/2017 4/2019 1,130 122 1,008 531 1,008 992 Energy Related Vehicles Various Various 4,385 62 4,188 1,929 1,241 1,709 Co-Investment Vehicles & Other Various Various 11,413 5,147 6,304 1,687 5,893 5,841 Total Real Assets $ 80,078 $ 23,606 $ 58,236 $ 21,554 $ 46,255 $ 52,163

25 Investment Vehicle Summary (cont’d) & Additional AUM Detail ($ in millions) Uncalled Commitments Remaining Fair Value Total Carried Interest Eligible $ 93,102 $ 185,185 $ 278,287 Incentive Fee Eligible — 66,181 66,181 Total Performance Fee Eligible 93,102 251,366 344,468 Private Equity and Real Assets 771 50,350 51,121 Credit and Liquid Strategies 3,635 178,409 182,044 Total Assets Under Management $ 97,508 $ 480,125 $ 577,633 ($ in millions) Investment Period Amount Start Date End Date Commitment Uncalled Commitments Invested Realized Remaining Cost Remaining Fair Value CREDIT AND LIQUID STRATEGIES BUSINESS LINE(1) Opportunities Fund II 11/2021 1/2026 $ 2,336 $ 1,627 $ 709 $ 12 $ 709 $ 782 Dislocation Opportunities Fund 8/2019 11/2021 2,967 450 2,517 1,534 1,456 1,618 Special Situations Fund II 2/2015 3/2019 3,525 284 3,241 2,412 1,134 1,191 Special Situations Fund 1/2013 1/2016 2,274 1 2,273 1,804 426 320 Mezzanine Partners 7/2010 3/2015 1,023 33 990 1,166 184 154 Asset-Based Finance Partners 10/2020 7/2025 2,059 894 1,165 105 1,165 1,266 Private Credit Opportunities Partners II 12/2015 12/2020 2,245 354 1,891 902 1,240 1,202 Lending Partners IV 3/2022 9/2026 1,150 518 632 43 633 680 Lending Partners III 4/2017 11/2021 1,498 540 958 832 701 708 Lending Partners II 6/2014 6/2017 1,336 157 1,179 1,198 151 82 Lending Partners 12/2011 12/2014 460 40 420 458 23 11 Lending Partners Europe II 5/2019 9/2023 837 210 627 280 519 548 Lending Partners Europe 3/2015 3/2019 848 184 662 470 184 176 Asia Credit 1/2021 5/2025 1,084 506 578 24 578 657 Other Alternative Credit Vehicles Various Various 14,687 8,747 7,798 6,167 4,110 4,459 Total Credit and Liquid Strategies $ 38,329 $ 14,545 $ 25,640 $ 17,407 $ 13,213 $ 13,854 Total Eligible To Receive Carried Interest $ 313,048 $ 93,102 $ 230,285 $ 186,762 $ 140,806 $ 185,185 Note: Past performance is no guarantee of future results. See Appendix for endnotes about investment period start and end dates. (1) The “Commitment” and “Uncalled Commitments” columns include income that is eligible to be reinvested if permitted under the terms of the investment vehicle agreements.

26 • Represents Asset Management Segment investments, corporate cash, short-term investments and debt. Investments presented here excludes the Insurance and Strategic Holdings Segments • Cash and Investments total $14.6 billion at 1Q'24 • Embedded Gains total $2.8 billion at 1Q'24 • KKR maintains a strong financial profile • KKR & Co. Inc. is 'A' rated by both S&P and Fitch • Average maturity of debt is approximately 16 years with a weighted average fixed coupon of 3% after-tax • $1.5 billion of undrawn corporate credit revolver capacity Net Cash & Investments Highlights ($ in millions) 1Q'24 Cash and Short-term Investments $ 4,015 Investments - Asset Management 10,571 Cash and Investments $ 14,586 Outstanding Debt (at par)(1) 8,057 Net Cash and Investments $ 6,529 Gross Unrealized Performance Income(2) 6,931 Note: See Appendix for GAAP reconciliations, endnotes about investments and other important information. (1) Outstanding Debt (at par) includes $7,109 million and $949 million of KKR and KFN debt, respectively. (2) Assuming a 75% compensation accrual (using the mid-point of the guided range) on gross unrealized performance income, net unrealized performance income would be $1.7 billion. Investment Holdings by Asset Class (Fair Value) Traditional Private Equity 26% Growth Equity 11% Real Estate 13% Energy 6% Infrastructure 6% Leveraged Credit 12% Alternative Credit 8% Other 18%

27 Stock Summary From December 31, 2023 through April 26, 2024, KKR used a total of $93 million to retire equity awards representing 0.9 million shares that otherwise would have been issued to participants under KKR's equity incentive plans. During this period, retirements were made at an average cost of $100.58 per share Common Stock Repurchase Activity (Amounts in millions, except per share amounts) Inception to Date(1) Open Market Share Repurchases 67.3 Reduction of Shares for Retired Equity Awards(2) 25.5 Total Repurchased Shares and Retired Equity Awards 92.8 Total Capital Used $2,604 Average Price Paid Per Share $28.05 Remaining Availability under Share Repurchase Plan $101 Adjusted Shares 4Q'23 1Q'24 Common Stock 885,005,588 885,010,967 Exchangeable Securities(3) 4,463,644 5,768,290 Adjusted Shares(4) 889,469,232 890,779,257 (1) KKR & Co. Inc.'s initial repurchase authorization was announced on October 27, 2015. Information is through April 26, 2024. (2) Refers to the retirement of equity awards issued pursuant to KKR & Co. Inc.’s equity incentive plans. (3) Includes certain securities exchangeable into shares of common stock of KKR & Co. Inc. (4) Excludes unvested shares granted under the equity incentive plans.

28 Dividends The declaration and payment of any future dividends on common stock will be subject to the discretion of the board of directors of KKR & Co. Inc. based on a number of factors, including KKR’s future financial performance and other considerations that the board deems relevant, the terms of KKR & Co. Inc.'s certificate of incorporation and applicable law. There can be no assurance that future dividends will be made as intended or at all or that any particular dividend policy for common stock will be maintained. Common Stock A dividend of $0.175 per share of common stock of KKR & Co. Inc. has been declared for the first quarter of 2024, which will be paid on May 28, 2024 to holders of record of common stock as of the close of business on May 13, 2024. Dividends & Other Corporate Information

Appendix

30 GAAP Condensed Consolidated Income Statement (Unaudited) ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Revenues Asset Management and Strategic Holdings Fees and Other $ 677,016 $ 693,526 $ 2,718,132 $ 2,980,379 Capital Allocation-Based Income (Loss) 449,018 1,262,942 (1,105,748) 3,657,361 1,126,034 1,956,468 1,612,384 6,637,740 Insurance Net Premiums 473,624 6,036,522 1,283,941 7,538,573 Policy Fees 313,802 328,947 1,261,741 1,275,394 Net Investment Income 1,300,697 1,519,902 4,606,338 5,734,107 Net Investment-Related Gains (Losses) (123,833) (241,486) (1,073,643) (352,915) Other Income 37,158 56,385 141,538 195,669 2,001,448 7,700,270 6,219,915 14,390,828 Total Revenues $ 3,127,482 $ 9,656,738 $ 7,832,299 $ 21,028,568 Expenses Asset Management and Strategic Holdings Compensation and Benefits 575,670 1,316,448 1,436,664 3,753,465 Occupancy and Related Charges 22,149 23,540 81,271 94,782 General, Administrative and Other 213,689 277,981 972,572 1,121,191 811,508 1,617,969 2,490,507 4,969,438 Insurance Net Policy Benefits and Claims 1,527,054 7,261,069 3,372,114 12,096,272 Amortization of Policy Acquisition Costs 44,211 (3,752) 88,138 39,312 Interest Expense 40,261 54,567 114,224 188,189 Insurance Expenses 225,318 199,236 672,100 799,916 General, Administrative and Other 211,731 183,855 763,084 718,339 2,048,575 7,694,975 5,009,660 13,842,028 Total Expenses $ 2,860,083 $ 9,312,944 $ 7,500,167 $ 18,811,466 Investment Income (Loss) - Asset Management and Strategic Holdings Net Gains (Losses) from Investment Activities (159,409) 638,162 (2,739,207) 3,822,954 Dividend Income 148,167 245,057 808,264 888,050 Interest Income 728,616 890,102 2,271,342 3,530,933 Interest Expense (576,338) (754,064) (1,845,356) (2,949,814) Total Investment Income (Loss) $ 141,036 $ 1,019,257 $ (1,504,957) $ 5,292,123 Income Tax Expense (Benefit) 148,747 269,201 237,489 1,317,977 Redeemable Noncontrolling Interests (7,303) 32,678 (4,448) 34,576 Noncontrolling Interests (73,003) 378,958 (1,216,732) 2,082,191 Preferred Stock Dividends 17,250 — 69,000 34,497 Net Income (Loss) - KKR Common Stockholders $ 322,744 $ 682,214 $ (258,134) $ 4,039,984

31 GAAP Condensed Consolidated Balance Statement (Unaudited) ($ in thousands) 4Q'23 1Q'24 Assets Asset Management and Strategic Holdings Cash and Cash Equivalents $ 8,393,892 $ 7,083,931 Investments 98,634,801 100,693,987 Other Assets 6,538,674 6,546,455 113,567,367 114,324,373 Insurance Cash and Cash Equivalents 11,954,675 8,524,962 Investments 141,370,323 157,747,170 Other Assets 50,401,829 59,177,422 203,726,827 225,449,554 Total Assets $ 317,294,194 $ 339,773,927 Liabilities and Equity Asset Management and Strategic Holdings Debt Obligations 44,886,870 45,053,639 Other Liabilities 8,256,514 9,311,591 53,143,384 54,365,230 Insurance Debt Obligations 2,587,857 3,086,113 Other Liabilities 203,184,041 225,410,734 205,771,898 228,496,847 Total Liabilities $ 258,915,282 $ 282,862,077 Redeemable Noncontrolling Interests 615,427 922,093 Stockholders' Equity Stockholders' Equity - Common Stock 22,858,694 21,421,193 Noncontrolling Interests 34,904,791 34,568,564 Total Equity $ 57,763,485 $ 55,989,757 Total Liabilities and Equity $ 317,294,194 $ 339,773,927

32 Reconciliation of GAAP to Non-GAAP Shares (Unaudited) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Weighted Average GAAP Shares of Common Stock Outstanding - Basic 861,108,510 885,005,824 815,810,479 873,421,040 Adjustments: Weighted Average KKR Holdings Units — — 43,222,533 — Weighted Average Exchangeable Securities and Other 29,517,712 5,739,616 29,397,871 16,777,674 Weighted Average Adjusted Shares 890,626,222 890,745,440 888,430,883 890,198,714 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 GAAP Shares of Common Stock Outstanding 861,104,000 857,987,641 884,585,205 885,005,588 885,010,967 Adjustments: Exchangeable Securities and Other 29,517,712 30,804,276 3,909,477 4,463,644 5,768,290 Adjusted Shares 890,621,712 888,791,917 888,494,682 889,469,232 890,779,257 Unvested Shares of Common Stock and Exchangeable Securities(1) 35,317,288 31,110,978 30,327,497 41,660,450 53,466,767 (1) Excludes equity awards that have not met their market-price based vesting conditions.

33 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (1) Represents equity-based compensation expense in connection with non-dilutive share grants from outstanding units in KKR Holdings. (2) Amounts represent the portion allocable to KKR. ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Net Income (Loss) - KKR Common Stockholders $ 322,744 $ 682,214 $ (258,134) $ 4,039,984 Preferred Stock Dividends 17,250 — 69,000 34,497 Net Income (Loss) Attributable to Noncontrolling Interests (80,306) 411,636 (1,221,180) 2,116,767 Income Tax Expense (Benefit) 148,747 269,201 237,489 1,317,977 Income (Loss) Before Tax (GAAP) $ 408,435 $ 1,363,051 $ (1,172,825) $ 7,509,225 Impact of Consolidation and Other 93,511 (191,519) 1,007,026 (1,854,621) Equity-based Compensation - KKR Holdings(1) — — 100,013 — Income Taxes on Adjusted Earnings (173,057) (216,366) (812,742) (806,691) Asset Management Adjustments: Unrealized (Gains) Losses 119,934 (399,078) 2,134,675 (1,362,639) Unrealized Carried Interest (202,659) (946,816) 2,738,667 (2,401,131) Unrealized Carried Interest Compensation 83,830 757,452 (1,155,579) 1,466,380 Strategic Corporate Related Charges and Other 6,807 61,675 81,538 86,673 Equity-based Compensation 59,017 73,777 214,662 245,618 Equity-based Compensation - Performance based 67,273 80,568 248,249 285,253 Strategic Holdings Adjustments: Unrealized (Gains) Losses (20,607) (73,257) (355,535) (743,957) Insurance Adjustments(2): (Gains) Losses from Investments(2) 131,114 246,917 381,729 479,759 Non-operating Changes in Policy Liabilities and Derivatives(2) 106,491 73,863 (285,803) 196,301 Strategic Corporate Related Charges(2) — — 12,136 7,347 Equity-based and Other Compensation(2) 36,393 29,066 110,403 64,252 Amortization of Acquired Intangibles(2) 2,794 4,412 10,933 12,793 Adjusted Net Income $ 719,276 $ 863,745 $ 3,257,547 $ 3,184,562 Interest Expense, Net 82,240 72,807 317,773 316,486 Net Income Attributable to Noncontrolling Interests 5,626 1,923 21,210 22,247 Income Taxes on Adjusted Earnings 173,057 216,366 812,742 806,691 Total Segment Earnings $ 980,199 $ 1,154,841 $ 4,409,272 $ 4,329,986 Net Realized Performance Income (61,389) (77,998) (678,949) (415,558) Net Realized Investment Income (165,120) (114,542) (813,073) (490,863) Total Operating Earnings $ 753,690 $ 962,301 $ 2,917,250 $ 3,423,565 Strategic Holdings Operating Earnings — (20,720) (20,316) (35,251) Insurance Operating Earnings (205,112) (272,840) (785,927) (884,365) Fee Related Earnings $ 548,578 $ 668,741 $ 2,111,007 $ 2,503,949

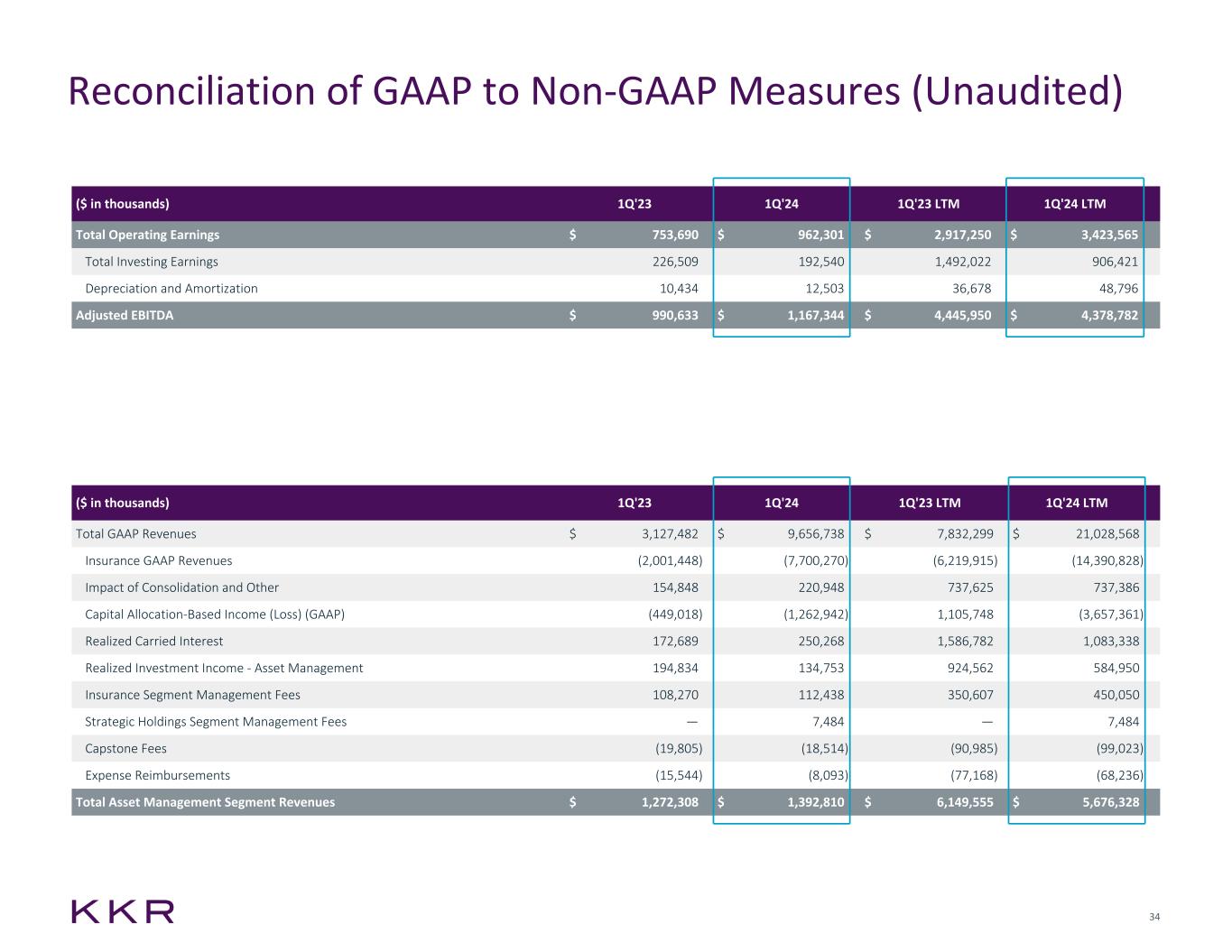

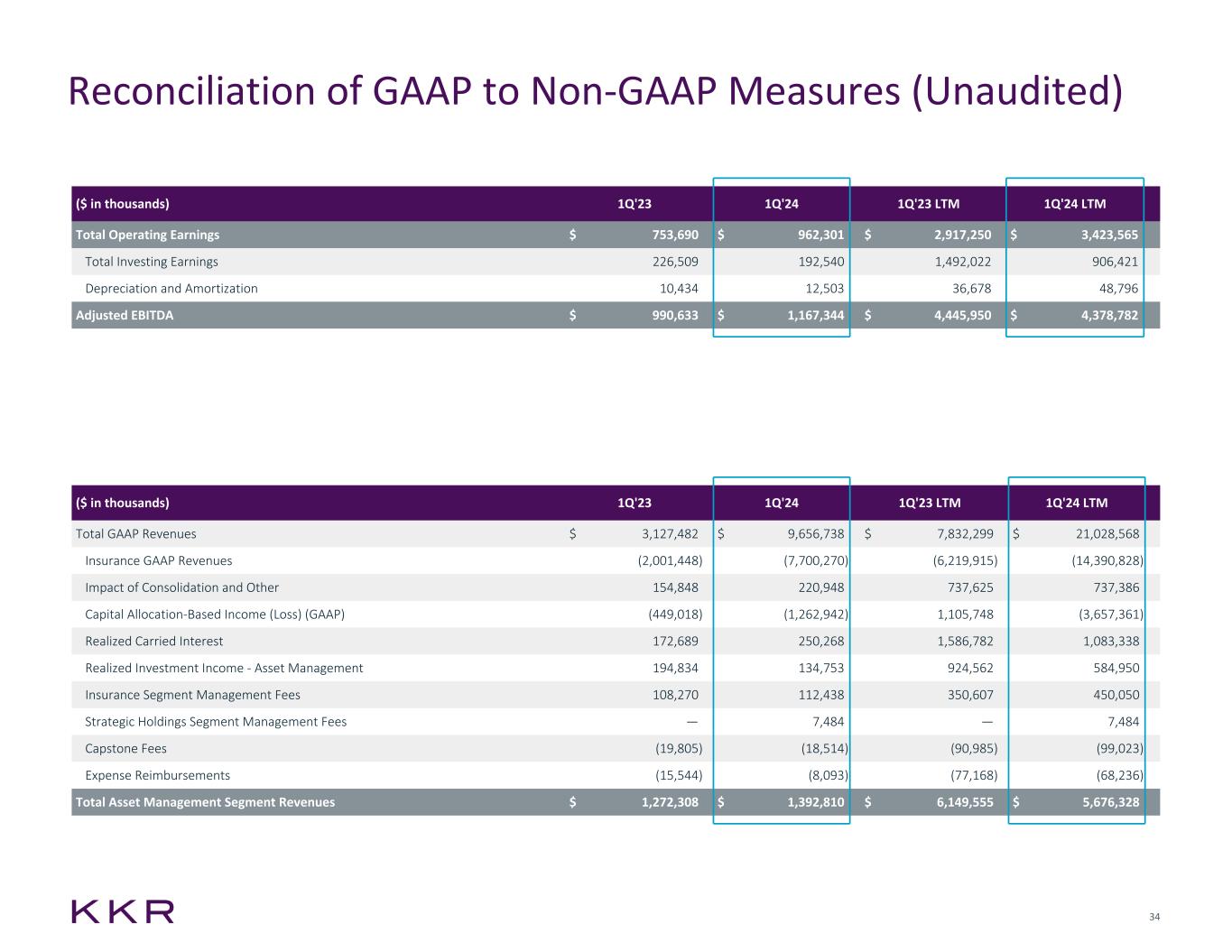

34 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Total Operating Earnings $ 753,690 $ 962,301 $ 2,917,250 $ 3,423,565 Total Investing Earnings 226,509 192,540 1,492,022 906,421 Depreciation and Amortization 10,434 12,503 36,678 48,796 Adjusted EBITDA $ 990,633 $ 1,167,344 $ 4,445,950 $ 4,378,782 ($ in thousands) 1Q'23 1Q'24 1Q'23 LTM 1Q'24 LTM Total GAAP Revenues $ 3,127,482 $ 9,656,738 $ 7,832,299 $ 21,028,568 Insurance GAAP Revenues (2,001,448) (7,700,270) (6,219,915) (14,390,828) Impact of Consolidation and Other 154,848 220,948 737,625 737,386 Capital Allocation-Based Income (Loss) (GAAP) (449,018) (1,262,942) 1,105,748 (3,657,361) Realized Carried Interest 172,689 250,268 1,586,782 1,083,338 Realized Investment Income - Asset Management 194,834 134,753 924,562 584,950 Insurance Segment Management Fees 108,270 112,438 350,607 450,050 Strategic Holdings Segment Management Fees — 7,484 — 7,484 Capstone Fees (19,805) (18,514) (90,985) (99,023) Expense Reimbursements (15,544) (8,093) (77,168) (68,236) Total Asset Management Segment Revenues $ 1,272,308 $ 1,392,810 $ 6,149,555 $ 5,676,328

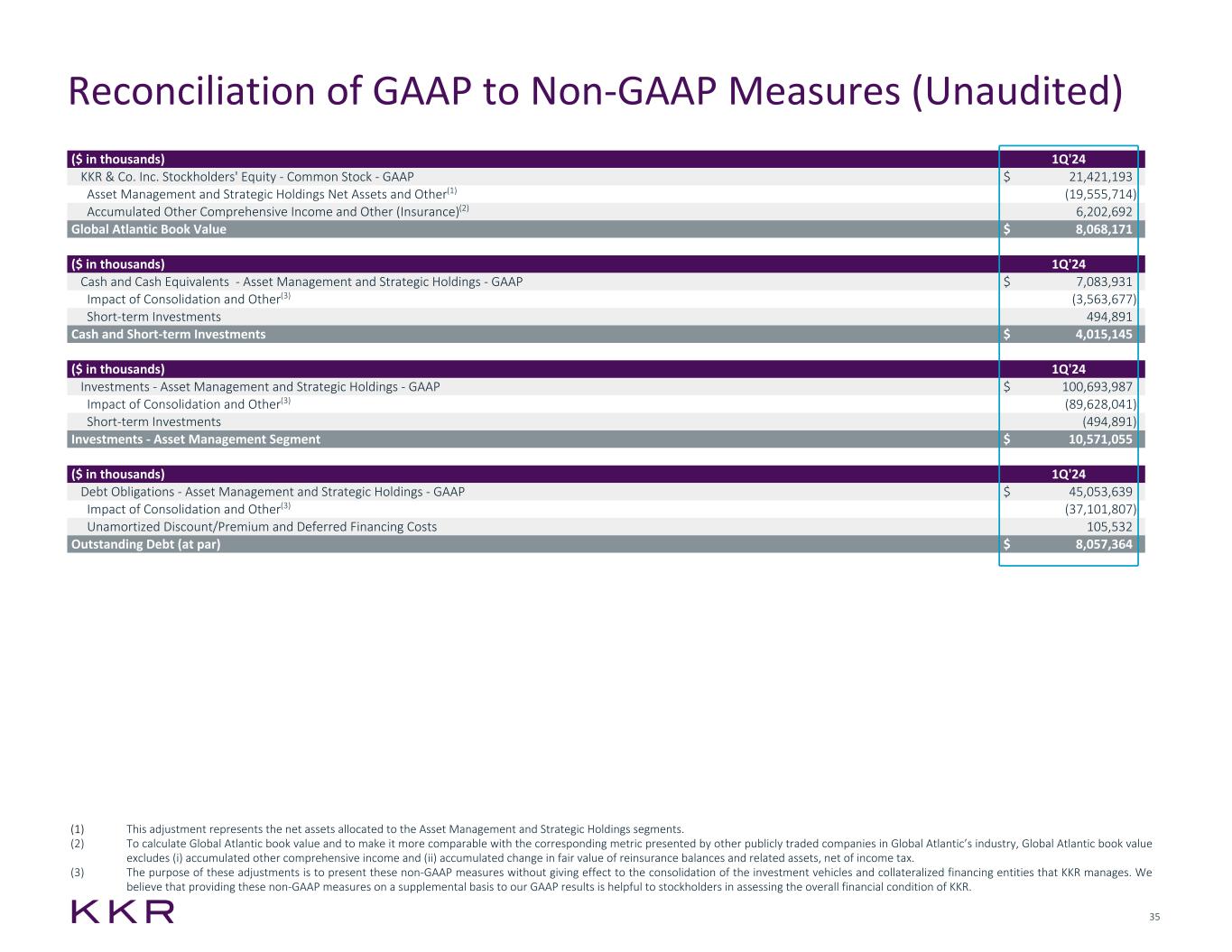

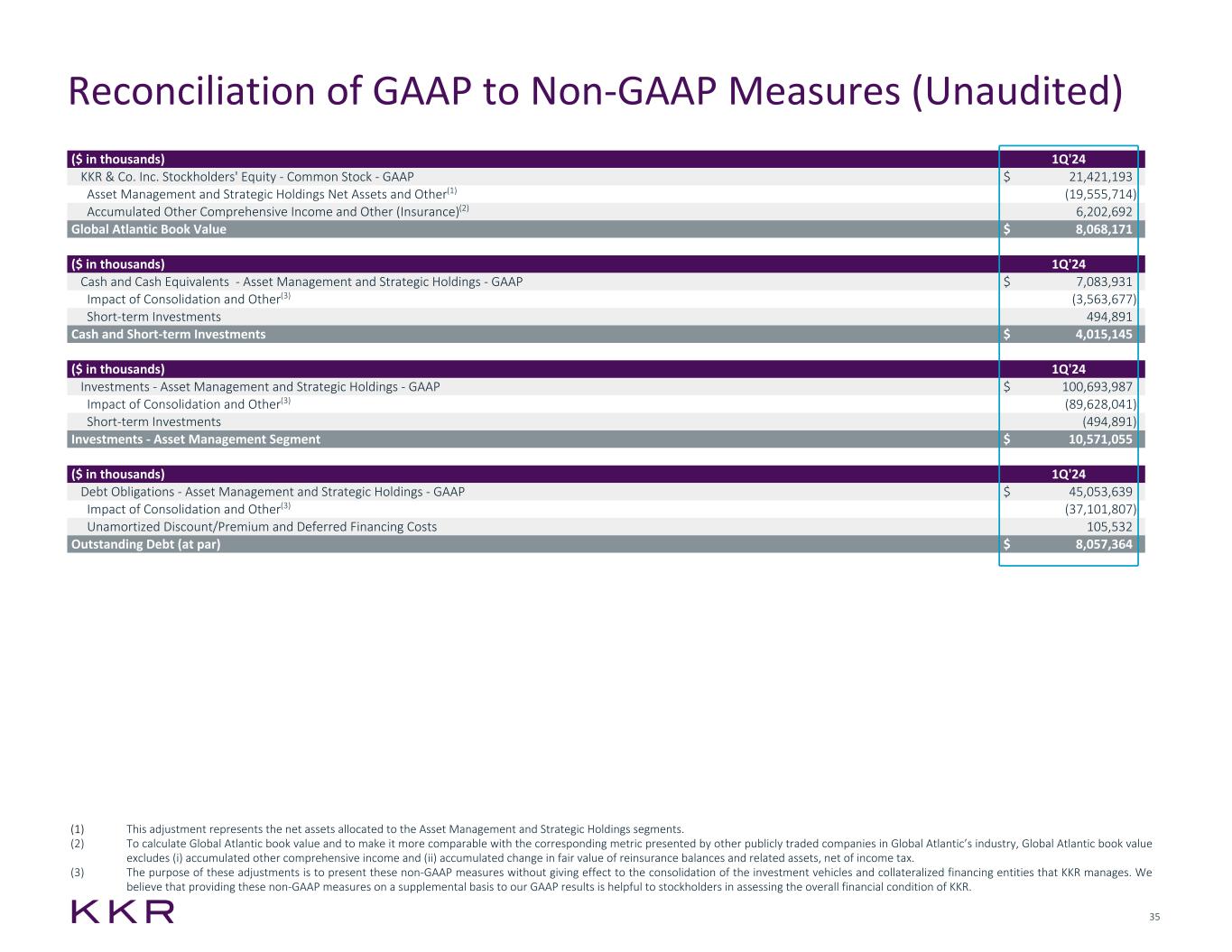

35 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) ($ in thousands) 1Q'24 KKR & Co. Inc. Stockholders' Equity - Common Stock - GAAP $ 21,421,193 Asset Management and Strategic Holdings Net Assets and Other(1) (19,555,714) Accumulated Other Comprehensive Income and Other (Insurance)(2) 6,202,692 Global Atlantic Book Value $ 8,068,171 ($ in thousands) 1Q'24 Cash and Cash Equivalents - Asset Management and Strategic Holdings - GAAP $ 7,083,931 Impact of Consolidation and Other(3) (3,563,677) Short-term Investments 494,891 Cash and Short-term Investments $ 4,015,145 ($ in thousands) 1Q'24 Investments - Asset Management and Strategic Holdings - GAAP $ 100,693,987 Impact of Consolidation and Other(3) (89,628,041) Short-term Investments (494,891) Investments - Asset Management Segment $ 10,571,055 ($ in thousands) 1Q'24 Debt Obligations - Asset Management and Strategic Holdings - GAAP $ 45,053,639 Impact of Consolidation and Other(3) (37,101,807) Unamortized Discount/Premium and Deferred Financing Costs 105,532 Outstanding Debt (at par) $ 8,057,364 (1) This adjustment represents the net assets allocated to the Asset Management and Strategic Holdings segments. (2) To calculate Global Atlantic book value and to make it more comparable with the corresponding metric presented by other publicly traded companies in Global Atlantic’s industry, Global Atlantic book value excludes (i) accumulated other comprehensive income and (ii) accumulated change in fair value of reinsurance balances and related assets, net of income tax. (3) The purpose of these adjustments is to present these non-GAAP measures without giving effect to the consolidation of the investment vehicles and collateralized financing entities that KKR manages. We believe that providing these non-GAAP measures on a supplemental basis to our GAAP results is helpful to stockholders in assessing the overall financial condition of KKR.

36 • The leveraged credit composite refers to the composite of certain investment portfolios made in KKR’s collateralized loan obligations and U.S. and European leveraged credit strategies including leveraged loans, high-yield bonds and opportunistic credit. • The alternative credit composite refers to the composite of certain investment portfolios made in KKR's private credit strategy, including direct lending (including our business development company), asset-based finance and junior capital, and in the Strategic Investments Group ("SIG") strategy. Funds and separately managed accounts in liquidation or discontinued strategies are excluded. • For a list of our carry paying funds, see the Investment Vehicle Summary on pages 23 to 25. See also “Important Information – Other Legal Disclosures” regarding past performance and investment returns. Note to Page 11 – Asset Management Segment – Private Equity • Except as otherwise noted, amounts referencing the private equity business line include amounts related to core private equity, including KKR's participation through the Strategic Holdings segment. Notes to Page 16 – Insurance Segment • Net investment income represents income earned on invested assets, net of investment-related expenses, including investment management fees paid to KKR. • Net cost of insurance represents the net cost of funding institutional and individual products – interest credited or incurred, benefits incurred, the associated insurance expenses, net of any premiums, fees and other income earned. . Note to All Pages • All figures in this presentation are as of March 31, 2024, unless otherwise specifically indicated. • References to LTM means last twelve months. Note to Page 3 – First Quarter 2024 Segment Earnings • The amount of tax benefit from equity-based compensation for 1Q'24 and 1Q'23 was $26.2 million and $13.7 million, respectively, and for 1Q'24 LTM and 1Q'23 LTM was $63.8 million and $67.3 million, respectively. Its inclusion in Adjusted Net Income had the effect of increasing this metric for 1Q'24 and 1Q'23 by 3% and 2%, respectively, and for 1Q'24 LTM and 1Q'23 LTM both by 2%. Note to Page 8 – Assets Under Management • Perpetual capital refers to a component of AUM that has an indefinite term and for which there is no predetermined requirement to return invested capital to investors upon the realization of investments. Perpetual capital includes the AUM of our registered funds, certain unregistered funds, listed companies, and insurance companies, and it excludes our traditional private equity funds, similarly structured investment funds, collateralized loan obligations, hedge fund partnerships and certain other investment vehicles. Investors should not view this component of our AUM as being permanent without exception, because it can be subject to material reductions and even termination. Perpetual capital is subject to material reductions from changes in valuation and withdrawals by or payments to investors, clients and policyholders (including through elections by investors to redeem their fund investments, periodic dividends, and payment obligations under insurance policies and reinsurance agreements) as well as termination by a client of, or failure to renew, its investment management agreement with KKR. Note to Page 9 – Additional Capital Detail • KKR’s portion of Uncalled Commitments to its investment funds includes $4.6 billion, $2.2 billion and $1.2 billion to its Private Equity, Real Assets and Credit and Liquid Strategies business lines, respectively. Notes to Page 10 – Fund Investment Performance • Traditional private equity portfolio refers to the portfolio of investments held by all KKR’s private equity flagship funds. This portfolio does not include investments from KKR’s growth equity or core private equity. • Opportunistic real estate portfolio refers to the portfolio of investments held by KKR’s flagship opportunistic real estate equity funds. This portfolio does not include investments from KKR's core plus real estate funds or real estate credit funds. • Infrastructure portfolio refers to the portfolio of investments held by KKR’s flagship core plus infrastructure equity funds. This portfolio does not include investments from KKR’s core infrastructure fund, KKR Diversified Core Infrastructure. Important Information − Endnotes

37 Notes to Page 18 – Strategic Holdings Segment • The adjusted revenue and adjusted EBITDA information represents the measures management currently uses to monitor the operating performance of the businesses. • The Capital Invested for Strategic Holdings segment is included in Private Equity Capital Invested within the Asset Management segment and relates to Core Private Equity. • LTM Adjusted EBITDA is shown based on the geographic location of the businesses' headquarters. • LTM Adjusted revenue and EBITDA represents KKR’s look-through ownership percentage for each of these companies in the aggregate as a result of the firm's investments in these companies through its participation in our core private equity strategy multiplied by the revenue and EBITDA of each portfolio company, respectively. Non-U.S. dollar businesses have been converted at the period-ending foreign exchange rate. The calculation reflects the underlying revenue or EBITDA growth of investments made in the preceding periods, assuming those businesses were owned for the full acquisition year and are shown on a constant currency / constant ownership percentage basis. We believe this is helpful to the investor to show a steady state growth profile of the underlying portfolio on an organic basis. • A reconciliation of the forecasts for certain non-GAAP measures, including Strategic Holdings Operating Earnings to their corresponding GAAP measures has not been provided due to the unreasonable efforts it would take to provide such a reconciliation Notes to Page 20 – Duration of Capital • Please see endnote for page 8 for information about the term "perpetual capital." • "Other" in the chart primarily includes hedge fund partnerships and certain leveraged credit funds. Notes to Page 21 – Assets Under Management Rollforward • For the three months ended March 31, 2024, Distributions and Other includes $128 million of redemptions by fund investors in Real Assets and $2,893 million of redemptions by fund investors in Credit and Liquid Strategies. • For the twelve months ended March 31, 2024, Distributions and Other includes $360 million of redemptions by fund investors in Real Assets and $8,396 million of redemptions by fund investors in Credit and Liquid Strategies. Notes to Page 22 – Fee Paying Assets Under Management Rollforward • For the three months ended March 31, 2024, Distributions and Other includes $128 million of redemptions by fund investors in Real Assets and $2,893 million of redemptions by fund investors in Credit and Liquid Strategies. Important Information − Endnotes (cont’d) • For the twelve months ended March 31, 2024, Distributions and Other includes net changes in fee base of certain Real Assets funds of $805 million, $360 million of redemptions by fund investors in Real Assets, and $8,396 million of redemptions by fund investors in Credit and Liquid Strategies. Notes to Pages 23 to 25 – Investment Vehicle Summary • The start date represents the start of the fund's investment period as defined in the fund's governing documents and may or may not be the same as the date upon which management fees begin to accrue. • The end date represents the end of the fund's investment period as defined in the fund's governing documents and is generally not the date upon which management fees cease to accrue. For funds that initially charge management fees on the basis of committed capital, the end date is generally the date on or after which the management fees begin to be calculated instead on the basis of invested capital and may, for certain funds, begin to be calculated using a lower rate. • This table includes investment vehicles which are not investment funds. The terms investments and investment vehicles are terms used solely for purposes of financial presentation. Note to Page 26 – Net Cash & Investments Highlight • The Investment amounts do not include KKR's ownership of the Global Atlantic insurance companies through KKR's insurance segment or KKR's participation in the core private equity strategy through KKR's Strategic Holdings segment. • The term “investments” has been presented solely for purposes of demonstrating the financial performance of certain assets contained on KKR’s balance sheet, including majority ownership of subsidiaries that operate KKR’s asset management, insurance businesses, broker-dealer and other businesses, including the general partner interests of KKR’s investment funds. • Traditional private equity includes KKR traditional private equity funds, co-investments alongside such KKR sponsored private equity funds, and other opportunistic investments. Equity investments in other asset classes, such as growth equity, energy, real estate, infrastructure, leveraged credit and alternative credit appear in these other asset classes.

38 Important Information − Non-GAAP and Other Measures • Adjusted Net Income is a performance measure of KKR’s earnings, which is derived from KKR’s reported segment results. ANI is used to assess the performance of KKR’s business operations and measures the earnings potentially available for distribution to its equity holders or reinvestment into its business. ANI is equal to Total Segment Earnings less Interest Expense, Net and Other and Income Taxes on Adjusted Earnings. Interest Expense, Net and Other includes interest expense on debt obligations not attributable to any particular segment net of interest income earned on cash and short- term investments. Income Taxes on Adjusted Earnings represents the (i) amount of income taxes that would be paid assuming that all pre-tax Asset Management and Strategic Holdings segment earnings were allocated to KKR & Co. Inc. and taxed at the same effective rate, which assumes that all securities exchangeable into shares of common stock of KKR & Co. Inc. were exchanged and (ii) amount of income taxes on Insurance Operating Earnings. Income taxes on Insurance Operating Earnings represent the total current and deferred tax expense or benefit on income before taxes adjusted to eliminate the impact of the tax expense or benefit associated with the non-operating adjustments. Equity based compensation expense is excluded from ANI, because (i) KKR believes that the cost of equity awards granted to employees does not contribute to the earnings potentially available for distributions to its equity holders or reinvestment into its business and (ii) excluding this expense makes KKR’s reporting metric more comparable to the corresponding metric presented by other publicly traded companies in KKR’s industry, which KKR believes enhances an investor’s ability to compare KKR’s performance to these other companies. Income Taxes on Adjusted Earnings includes the benefit of tax deductions arising from equity-based compensation, which reduces Income Taxes on Adjusted Earnings during the period. If tax deductions from equity- based compensation were to be excluded from Income Taxes on Adjusted Earnings, KKR’s ANI would be lower and KKR’s effective tax rate would appear to be higher, even though a lower amount of income taxes would have actually been paid or payable during the period. KKR separately discloses the amount of tax deduction from equity- based compensation for the period reported and the effect of its inclusion in ANI for the period. KKR makes these adjustments when calculating ANI in order to more accurately reflect the net realized earnings that are expected to be or become available for distribution to KKR’s equity holders or reinvestment into KKR’s business. However, ANI does not represent and is not used to calculate actual dividends under KKR’s dividend policy, which is a fixed amount per period, and ANI should not be viewed as a measure of KKR’s liquidity. Non-GAAP and Segment Measures The key non-GAAP and other operating and performance measures that follow are used by management in making operational and resource deployment decisions as well as in assessing the performance of KKR's business. They include certain financial measures that are calculated and presented using methodologies other than in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures, including adjusted net income (“ANI”), total segment earnings, total investing earnings, total operating earnings (“TOE”), fee related earnings (“FRE”), strategic holdings operating earnings, and total asset management segment revenues, are presented prior to giving effect to the allocation of income (loss) among KKR & Co. Inc. and holders of certain securities exchangeable into shares of common stock of KKR & Co. Inc. and, as such, represent the entire KKR business in total. In addition, these non-GAAP measures are presented without giving effect to the consolidation of the investment vehicles and collateralized financing entities (“CFEs”) that KKR manages. These measures described above have the definitions given to them below. We believe that providing these non-GAAP measures on a supplemental basis to our GAAP results is helpful to stockholders in assessing the overall performance of KKR's business. These non-GAAP measures should not be considered as a substitute for financial measures calculated in accordance with GAAP. “Non-operating adjustments” as used in these non- GAAP definitions refers to adjustments made which are not adjustments or exclusions of normal, recurring cash operating expenses necessary for business operations. Reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, where applicable, are included under the “Reconciliation of GAAP to Non-GAAP Measures" section of this Appendix. We also caution readers that these non-GAAP measures may differ from the calculations made by other investment managers, and as a result, may not be directly comparable to similarly titled measures presented by other investment managers.

39 Non-GAAP and Segment Measures (cont’d) • Total Segment Earnings is a performance measure that KKR believes is useful to stockholders as it provides a supplemental measure of our operating performance without taking into account items that KKR does not believe arise from or relate directly to KKR's operations. Total Segment Earnings excludes: (i) equity-based compensation charges, (ii) amortization of acquired intangibles, (iii) strategic corporate related charges, and (iv) non-recurring items, if any. Strategic corporate related charges arise from corporate actions and consist primarily of (i) impairments, (ii) transaction costs from strategic acquisitions, and (iii) depreciation on real estate that KKR owns and occupies. Inter-segment transactions are not eliminated from segment results when management considers those transactions in assessing the results of the respective segments. These transactions include (i) management fees earned by our Asset Management segment as the investment adviser for Global Atlantic insurance companies, (ii) management and performance fees earned by our Asset Management segment for acquiring and managing the companies included in our Strategic Holdings Segment, and (iii) interest income and expense based on lending arrangements where our Asset Management segment borrows from our Insurance segment to finance its operations. All these inter-segment transactions are recorded by each segment based on the applicable governing agreements. Total Segment Earnings represents the total segment earnings of KKR’s Asset Management, Insurance and Strategic Holdings segments. • Asset Management Segment Earnings is the segment profitability measure used to make operating decisions and to assess the performance of the Asset Management segment. This measure is presented before income taxes and is comprised of: (i) Fee Related Earnings, (ii) Realized Performance Income, (iii) Realized Performance Income Compensation, (iv) Realized Investment Income, and (v) Realized Investment Income Compensation. The non-operating adjustments made to derive Asset Management Segment Earnings excludes the impact of: (i) unrealized gains (losses) on investments, (ii) unrealized carried interest, and (iii) unrealized carried interest compensation. Management fees earned by KKR as the adviser, manager or sponsor for its investment funds, vehicles and accounts, including its Global Atlantic insurance companies and Strategic Holdings segment, are included in Asset Management Segment Earnings. All inter-segment transactions are recorded by each segment based on the applicable governing agreements. • Insurance Operating Earnings is the segment profitability measure used to make operating decisions and to assess the performance of the Insurance segment. This measure is presented before income taxes and is comprised of: (i) Net Investment Income, (ii) Net Cost of Insurance, and (iii) General, Administrative, and Other Expenses. The non-operating adjustments made to derive Insurance Operating Earnings excludes the impact of: (i) investment gains (losses) which include realized gains (losses) related to asset/liability matching investment strategies and unrealized investment gains (losses) and (ii) non-operating changes in policy liabilities and derivatives which includes (a) changes in the fair value of market risk benefits and other policy liabilities measured at fair value and related benefit payments, (b) fees attributed to guaranteed benefits, (c) derivatives used to manage the risks associated with policy liabilities, and (d) losses Important Information − Non-GAAP and Other Measures (cont’d) at contract issuance on payout annuities. Insurance Operating Earnings includes (i) realized gains and losses not related to asset/liability matching investment strategies and (ii) the investment management costs that are earned by our Asset Management segment as the investment adviser of the Global Atlantic insurance companies. • Strategic Holdings Segment Earnings is the segment profitability measure used to make operating decisions and to assess the performance of the Strategic Holdings segment. This measure is presented before income taxes and is comprised of: Dividends, Net and Realized Investment Income, Net. The non-operating adjustment made to derive Strategic Holdings Segment Earnings excludes the impact of unrealized gains (losses) on investments. • Fee Related Earnings is a performance measure used to assess the Asset Management segment’s generation of earnings from revenues that are measured and received on a more recurring basis as compared to KKR’s investing earnings. KKR believes this measure is useful to stockholders as it provides additional insight into the profitability of our fee generating asset management and capital markets businesses. FRE equals (i) Management Fees, including fees paid by the Insurance and Strategic Holdings segments to the Asset Management segment and fees paid by certain insurance co- investment vehicles, (ii) Transaction and Monitoring Fees, Net and (iii) Fee Related Performance Revenues, less (x) Fee Related Compensation, and (y) Other Operating Expenses. • Fee Related Performance Revenues refers to the realized portion of performance fees from certain AUM that has an indefinite term and for which there is no immediate requirement to return invested capital to investors upon the realization of investments. Fee related performance revenues consists of performance fees (i) expected to be received from our investment funds, vehicles and accounts on a recurring basis, and (ii) that are not dependent on a realization event involving investments held by the investment fund, vehicle or account. • Fee Related Compensation refers to the compensation expense, excluding equity- based compensation, paid from (i) Management Fees, (ii) Transaction and Monitoring Fees, Net, and (iii) Fee Related Performance Revenues. • Other Operating Expenses represents the sum of (i) occupancy and related charges and (ii) other operating expenses. • Strategic Holdings Operating Earnings is a performance measure used to assess the firm’s earnings from companies and businesses reported through its Strategic Holdings segment. Strategic Holdings Operating Earnings currently consists of earnings derived from dividends that the firm receives from businesses acquired through the firm’s participation in our Core Private Equity strategy. Strategic Holdings Operating Earnings currently equals dividends less management fees that are earned by our Asset Management segment. This measure is used by management to assess the Strategic Holdings segment’s generation of earnings from revenues that are measured and received on a more recurring basis than, and are not dependent on, realizations from investment activities.

40 Non-GAAP and Segment Measures (cont’d) • Total Operating Earnings is a performance measure that represents the sum of (i) FRE, (ii) Insurance Operating Earnings, and (iii) Strategic Holdings Operating Earnings. KKR believes this measure is useful to stockholders as it provides additional insight into the profitability of the most recurring forms of earnings from each of KKR’s segments. • Total Investing Earnings is a performance measure that represents the sum of (i) Net Realized Performance Income and (ii) Net Realized Investment Income. KKR believes this measure is useful to stockholders as it provides additional insight into the earnings of KKR’s segments from the realization of investments. • Total Asset Management Segment Revenues is a performance measure that represents the realized revenues of the Asset Management segment (which excludes unrealized carried interest and unrealized gains (losses) on investments) and is the sum of (i) Management Fees, (ii) Transaction and Monitoring Fees, Net, (iii) Fee Related Performance Revenues, (iv) Realized Performance Income, and (v) Realized Investment Income. Asset Management Segment Revenues excludes Realized Investment Income earned based on the performance of businesses presented in the Strategic Holdings segment. KKR believes that this performance measure is useful to stockholders as it provides additional insight into all forms of realized revenues generated by our Asset Management segment. Other Terms and Capital Metrics • Adjusted shares represents shares of common stock of KKR & Co. Inc. outstanding under GAAP adjusted to include certain securities exchangeable into shares of common stock of KKR & Co. Inc. • Assets Under Management (“AUM”) represent the assets managed, advised or sponsored by KKR from which KKR is entitled to receive management fees or performance income (currently or upon a future event), general partner capital, and assets managed, advised or sponsored by our strategic BDC partnership and the hedge fund and other managers in which KKR holds an ownership interest. We believe this measure is useful to stockholders as it provides additional insight into the capital raising activities of KKR and its hedge fund and other managers and the overall activity in their investment funds and other managed or sponsored capital. KKR calculates the amount of AUM as of any date as the sum of: (i) the fair value of the investments of KKR's investment funds and certain co-investment vehicles; (ii) uncalled capital commitments from these funds, including uncalled capital commitments from which KKR is currently not earning management fees or performance income; (iii) the asset value of the Global Atlantic insurance companies; (iv) the par value of outstanding CLOs; (v) KKR's pro rata portion of the AUM of hedge fund and other managers in which KKR holds an ownership interest; (vi) all of the AUM of KKR's strategic BDC partnership; (vii) the acquisition cost of invested assets of certain non-US real estate investment trusts and (viii) the value of other assets managed or sponsored by KKR. The pro rata portion of the AUM of hedge fund and other managers is calculated based on KKR’s percentage Important Information − Non-GAAP and Other Measures (cont’d) ownership interest in such entities multiplied by such entity’s respective AUM. KKR's definition of AUM (i) is not based on any definition of AUM that may be set forth in the governing documents of the investment funds, vehicles, accounts or other entities whose capital is included in this definition, (ii) includes assets for which KKR does not act as an investment adviser, and (iii) is not calculated pursuant to any regulatory definitions. • Capital Invested is the aggregate amount of capital invested by (i) KKR’s investment funds (including core private equity) and Global Atlantic insurance companies, (ii) KKR's Principal Activities business line as a co-investment, if any, alongside KKR’s investment funds, and (iii) KKR's Principal Activities business line in connection with a syndication transaction conducted by KKR's Capital Markets business line, if any. Capital invested is used as a measure of investment activity at KKR during a given period. We believe this measure is useful to stockholders as it provides a measure of capital deployment across KKR’s business lines. Capital invested includes investments made using investment financing arrangements like credit facilities, as applicable. Capital invested excludes (i) investments in certain leveraged credit strategies, (ii) capital invested by KKR’s Principal Activities business line that is not a co-investment alongside KKR’s investment funds, and (iii) capital invested by KKR’s Principal Activities business line that is not invested in connection with a syndication transaction by KKR’s Capital Markets business line. Capital syndicated by KKR's Capital Markets business line to third parties other than KKR’s investment funds or Principal Activities business line is not included in capital invested. • Fee Paying AUM (“FPAUM”) represents only the AUM from which KKR is entitled to receive management fees. We believe this measure is useful to stockholders as it provides additional insight into the capital base upon which KKR earns management fees. FPAUM is the sum of all of the individual fee bases that are used to calculate KKR's and its hedge fund and BDC partnership management fees and differs from AUM in the following respects: (i) assets and commitments from which KKR is not entitled to receive a management fee are excluded (e.g., assets and commitments with respect to which it is entitled to receive only performance income or is otherwise not currently entitled to receive a management fee) and (ii) certain assets, primarily in its private equity funds, are reflected based on capital commitments and invested capital as opposed to fair value because fees are not impacted by changes in the fair value of underlying investments. • Uncalled Commitments is the aggregate amount of unfunded capital commitments that KKR’s investment funds and carry-paying co-investment vehicles have received from partners to contribute capital to fund future investments, and the amount of uncalled commitments is not reduced by capital invested using borrowings under an investment fund’s subscription facility until capital is called from our fund investors. We believe this measure is useful to stockholders as it provides additional insight into the amount of capital that is available to KKR’s investment funds and carry paying co- investment vehicles to make future investments. Uncalled commitments are not reduced for investments completed using fund-level investment financing arrangements or investments we have committed to make but remain unfunded at the reporting date.