SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

___________________

Filed by the Registrant x Filed by a party other than the Registrant ☐

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under §240.14a-12

Obalon Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date Filed: |

2020 ANNUAL MEETING OF STOCKHOLDERS

September 16, 2020

OBALON THERAPEUTICS, INC.

5421 AVENIDA ENCINAS, SUITE F, CARLSBAD, CALIFORNIA 92008

August 7, 2020

To Our Stockholders:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Obalon Therapeutics, Inc. at 8:30 a.m. Pacific Time, on Wednesday, September 16, 2020, held virtually at https://web.lumiagm.com/255310521 (password: obln2020).

The Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. You can attend the meeting at https://web.lumiagm.com/255310521 (password: obln2020), where you will be able to submit questions during the meeting. Please see the section called “Who Can Attend the 2020 Annual Meeting of Stockholders?” of the proxy statement for more information about how to attend the virtual meeting.

Whether or not you attend the virtual Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have received our Notice of Internet Availability of Proxy Materials, the instructions regarding how you can access your proxy materials and vote are contained in that notice. If you have received written proxy materials, the instructions regarding how you can access our proxy materials and vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy. If you hold your shares through a bank or broker, you will need a proxy from your bank or broker to vote your shares in person at the Annual Meeting.

Thank you for your support.

Sincerely,

Andrew Rasdal

President and Chief Executive Officer

Carlsbad, California

Notice of Annual Meeting of Stockholders

To Be Held Tuesday, September 16, 2020

OBALON THERAPEUTICS, INC.

5421 AVENIDA ENCINAS, SUITE F, CARLSBAD, CALIFORNIA 92008

The Annual Meeting of Stockholders (the “Annual Meeting”) of Obalon Therapeutics, Inc., a Delaware corporation (the “Company”), will be held virtually at https://web.lumiagm.com/255310521 (password: obln2020) on Wednesday, September 16, 2020, at 8:30 a.m. Pacific Time, for the following purposes:

| |

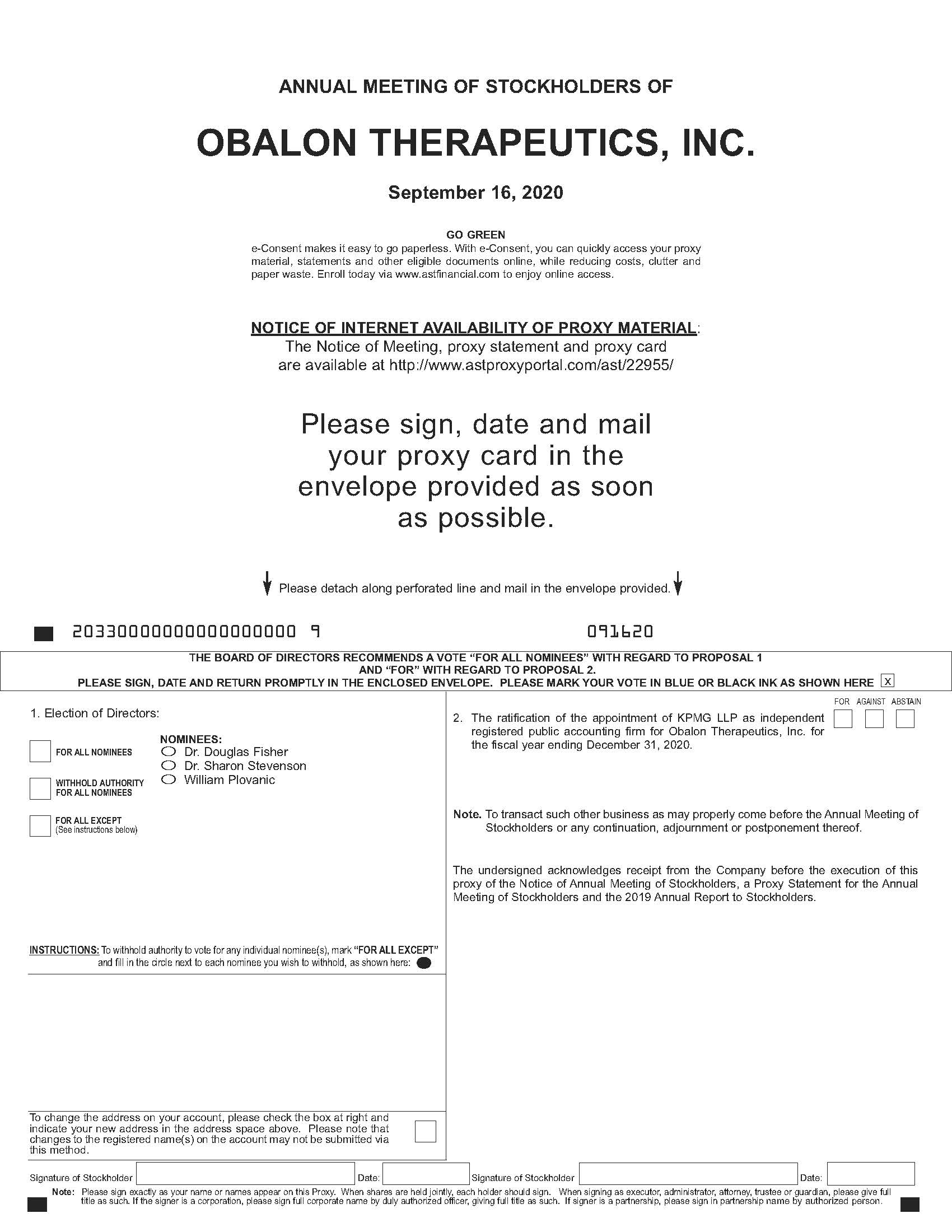

| 1. | To elect three nominees, Dr. Douglas Fisher, Dr. Sharon Stevenson and William Plovanic as Class I Directors to serve for a three-year term expiring at the 2023 Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; |

| |

| 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| |

| 3. | To transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment of the Annual Meeting. |

Holders of record of our common stock as of the close of business on July 28, 2020 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these stockholders will be open for examination by any stockholder on the "Investors" page of our website at www.obalon.com for a period of ten days prior to the Annual Meeting and online during the Annual Meeting at https://web.lumiagm.com/255310521 (password: obln2020). If you wish to review the list of stockholders prior to the 2020 Annual Meeting, please contact our Secretary at our offices at 5421 Avenida Encinas, Suite F, Carlsbad, CA 92008 to make arrangements. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors,

Andrew Rasdal

President and Chief Executive Officer

Carlsbad, California

August 7, 2020

TABLE OF CONTENTS

PROXY STATEMENT

OBALON THERAPEUTICS, INC.

5421 AVENIDA ENCINAS, SUITE F CARLSBAD, CALIFORNIA 92008

General

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Obalon Therapeutics, Inc. (the “Company”) of proxies to be voted at our Annual Meeting of Stockholders to be held on Wednesday, September 16, 2020 (the “Annual Meeting”), virtually at https://web.lumiagm.com/255310521 (password: obln2020) at 8:30 a.m., Pacific Time, and at any continuation, postponement or adjournment thereof. Holders of record of shares of common stock, $0.001 par value per share (“Common Stock”), as of the close of business on July 28, 2020 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof. As of the Record Date, there were 7,731,633 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2019 (the “2019 Annual Report”), or the Notice of Internet Availability of Proxy Materials, as applicable, will be sent on or about August 7, 2020 to our stockholders as of the Record Date.

In this proxy statement, “Obalon,” the “Company,” “we,” “us” and “our” refer to Obalon Therapeutics, Inc.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON WEDNESDAY, SEPTEMBER 16, 2020

This Proxy Statement and our 2019 Annual Report to Stockholders are available at:

http://www.astproxyportal.com/ast/22955/.

At this website, you will find a complete set of the following proxy materials: notice of 2020 Annual Meeting of Stockholders; proxy statement (with sample proxy card); and 2019 Annual Report. You are encouraged to access and review all of the important information contained in the proxy materials before submitting a proxy or voting at the meeting.

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

| |

| 1. | To elect Dr. Douglas Fisher, Dr. Sharon Stevenson and William Plovanic as Class I Directors for a three-year term that expires at the 2023 Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified; |

| |

| 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| |

| 3. | To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the proxy will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted, and the Board recommends that you vote, as follows:

| |

| 1. | FOR the election of Dr. Douglas Fisher, Dr. Sharon Stevenson and William Plovanic as Class I Directors; |

| |

| 2. | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the proxy will vote your shares in accordance with their best judgment.

INFORMATION ABOUT THIS PROXY STATEMENT

Why you received this proxy statement. You are viewing or have received these proxy materials because the Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, we are making this proxy statement and our 2019 Annual Report available to our stockholders electronically via the Internet. On or about August 7, 2020, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 2019 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2019 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single Internet Notice or set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one Internet Notice or one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the Internet Notice or proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the current or future Internet Notice or proxy materials, contact American Stock Transfer & Trust Company (“AST”) at (888) 937-5449, by e-mail at info@astfinancial.com or in writing at American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11219.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future Internet Notices or proxy materials for your household, please contact AST at the above phone number or address.

Questions and Answers about the 2020 Annual Meeting of Stockholders

HOW DO I ATTEND AND PARTICIPATE IN THE ANNUAL MEETING?

The Annual Meeting will be held virtually via a live video webcast. To attend and participate in the virtual annual meeting, go to https://web.lumiagm.com/255310521 (password: obln2020) on Wednesday, September 16, 2020 prior to 8:30 a.m., Pacific Time.

If you are a stockholder of record as of July 28, 2020, the record date for the Annual Meeting, input the 11-digit control number found on your proxy card or Notice of Internet Availability of Proxy Materials you previously received, and enter the password “obln2020” (the password is case sensitive).

If your shares are held in “street name” through a broker, bank or other nominee, in order to participate in the virtual Annual Meeting must first obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of Obalon common stock you held as of the record date, your name and email address. You then must submit a request for registration to American Stock Transfer

& Trust Company, LLC: (1) by email to proxy@astfinancial.com (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as “Legal Proxy” and be received by American Stock Transfer & Trust Company, LLC no later than 5:00 p.m. Eastern time on September 8, 2020.

We believe that a virtual meeting provides expanded stockholder access and participation and improved communications, while affording stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting.

Help and technical support for accessing and participating in the virtual meeting are available on the meeting day at https://go.lumiglobal.com/faq.

Information on how to vote at the meeting is discussed below.

WHO IS ENTITLED TO VOTE ON MATTERS PRESENTED AT THE ANNUAL MEETING?

The Record Date for the Annual Meeting is July 28, 2020. You are entitled to vote on the matters presented at the Annual Meeting if you were a stockholder of record at the close of business on the Record Date. Each outstanding share of Common Stock is entitled to one vote for all matters before the Annual Meeting. At the close of business on the Record Date, there were 7,731,633 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

WHAT IS THE DIFFERENCE BETWEEN BEING A “RECORD HOLDER” AND HOLDING SHARES IN “STREET NAME”?

A record holder holds shares in his or her name, which is registered on our books. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf. The bank or broker is considered to be the record holder of your shares held in "street name".

AM I ENTITLED TO VOTE IF MY SHARES ARE HELD IN “STREET NAME”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials, along with instructions on how to vote your shares, are being provided to you by your bank or brokerage firm. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares in person at the Annual Meeting, unless you obtain, and present at the Annual Meeting, a legal proxy from your bank or brokerage firm.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, by virtual attendance or by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

WHO CAN ATTEND THE 2020 ANNUAL MEETING OF STOCKHOLDERS?

You may attend the Annual Meeting only if you are a record holder or beneficial owner of our Common Stock as of the Record Date. If you are a record holder you are entitled to vote at the Annual Meeting. If you hold your shares in street name you must obtain a valid proxy from your broker or bank to vote at the Annual Meeting. If you would like to attend the virtual Annual Meeting, please visit https://web.lumiagm.com/255310521 (password: obln2020). To participate in the annual meeting, you will need the 11-digit control number included on your notice or the instructions that accompanied your proxy materials.

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?

If a quorum is not present at the scheduled time of the Annual Meeting, (i) the Chairperson of the Annual Meeting or (ii) the holders of a majority of the shares entitled to vote who are present, in person or by proxy, at the Annual Meeting may adjourn the Annual Meeting until a quorum is present or represented.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE INTERNET NOTICE OR MORE THAN ONE SET OF PROXY MATERIALS?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

HOW DO I VOTE?

We recommend that stockholders vote by proxy even if they plan to attend the virtual Annual Meeting. If you are a stockholder of record, there are three ways to vote by proxy:

| |

| • | by Telephone: You can vote by telephone by calling 1-800-776-9437 and following the instructions on the proxy card; |

| |

| • | by Internet: You can vote over the Internet at www.voteproxy.com by following the instructions on the Internet Notice or proxy card; or |

| |

| • | by Mail: If you received a printed proxy, you can vote by mail by signing, dating and mailing the proxy card that accompanied the printed proxy. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on September 15, 2020. Stockholders of record may also vote virtually at the Annual Meeting. To attend the meeting, please visit https://web.lumiagm.com/255310521 (password: obln2020). To participate in the annual meeting, stockholders of record will need the 11-digit control number included on your Internet Notice or the instructions that accompanied your proxy materials.

If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker.

You must follow their instructions in order for your shares to be voted. Telephone and Internet voting is generally offered to stockholders owning shares through banks and brokers. If you own common stock in street name and do not either provide voting instructions to your broker or vote during the Annual Meeting, the institution that holds your shares may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2020, but cannot vote your shares on any other matters being considered at the meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote virtually at the Annual Meeting by obtaining a legal proxy from your bank or broker reflecting the number of shares of Obalon common stock you held as of the record date, your name and email address. Submit a request for registration to American Stock Transfer & Trust Company, LLC: (1) by email to proxy@astfinancial.com (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as “Legal Proxy” and be received by American Stock Transfer & Trust Company, LLC no later than 5:00 p.m. Eastern time on September 8, 2020. Upon receipt the legal proxy will be processed and an 11-digit control number will be provided to allow access to the virtual meeting and allow the investor to cast the vote.

CAN I CHANGE MY VOTE AFTER I SUBMIT MY PROXY?

Yes.

If you are a record holder, you may revoke your proxy and change your vote any time before the proxy is voted at the Annual Meeting:

| |

| • | by submitting a duly executed proxy bearing a later date than your prior proxy; |

| |

| • | by granting a subsequent proxy through the Internet or telephone; |

| |

| • | by giving written notice of revocation to the Secretary of Obalon prior to or at the Annual Meeting; or |

| |

| • | by voting virtually at the Annual Meeting. |

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your virtual attendance at the Annual Meeting by itself will not revoke your proxy.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote virtually at the Annual Meeting by obtaining a legal proxy from your broker, bank or other nominee reflecting the number of shares of Obalon common stock you held as of the record date, your name and email address. You then must submit a request for registration to American Stock Transfer & Trust Company, LLC: (1) by email to proxy@astfinancial.com (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as “Legal Proxy” and be received by American Stock Transfer & Trust Company, LLC no later than 5:00 p.m. Eastern time on September 8, 2020. An

AST control number will be assigned. Once the control number is assigned, you may vote via the internet, telephone or virtually at the Annual Meeting.

WHO WILL COUNT THE VOTES?

Our transfer agent, AST, is expected to tabulate the votes and an employee of the Company is expected to be our inspector of election and will certify the votes.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED?

If you are a record holder and submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 1 of this proxy statement, along with the description of each proposal in this proxy statement.

WHAT ARE BROKER NON-VOTES AND DO THEY COUNT FOR DETERMINING A QUORUM?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote those shares on a particular matter. A broker has discretionary power to vote shares without instruction from the beneficial owner on routine matters, such as the ratification of the appointment of KPMG LLP as our independent registered public accounting firm. Thus, broker non-votes are not expected on that proposal. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes on the election of directors will have no effect, as the three directors that receive the highest number of votes will be elected. Broker non-votes count for purposes of determining whether a quorum is present.

WHAT IS AN ABSTENTION AND HOW WILL VOTES WITHHELD AND ABSTENTIONS BE TREATED?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regarding the ratification of the appointment of KPMG LLP, represents a stockholder's affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors, and abstentions have no effect on the ratification of the appointment of KPMG LLP.

HOW MANY VOTES ARE REQUIRED FOR THE APPROVAL OF THE PROPOSALS TO BE VOTED UPON AND HOW WILL ABSTENTIONS AND BROKER NON-VOTES BE TREATED?

|

| | |

Proposal | Votes Required | Effect of Votes Withheld /

Abstentions and Broker Non-Votes |

| Proposal 1: Election of Directors | The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors. | Votes withheld and broker non-votes will have no effect. |

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the votes cast for or against the matter. | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE ANNUAL MEETING?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

WHERE CAN I FIND THE VOTING RESULTS OF THE 2020 ANNUAL MEETING OF STOCKHOLDERS?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

Proposals To Be Voted On

PROPOSAL 1 - ELECTION OF DIRECTORS

At the Annual Meeting, three (3) Class I Directors are to be elected to hold office for a three-year term expiring at the Annual Meeting of Stockholders to be held in 2023 and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. Based on the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated Dr. Douglas Fisher, Dr. Sharon Stevenson and William Plovanic as Class I Directors at the Annual Meeting. William Plovanic was appointed President and a Class I director effective as of May 20, 2019, and Chief Executive Officer on October 19, 2019. Mr. Plovanic resigned as President and Chief Executive Officer on June 19, 2020 and Andrew Rasdal was appointed President and Chief Executive Officer as of the same date. On June 29, 2020, Kim Kamdar was appointed Chairperson of the Board of Directors, a role previously held by Mr. Rasdal. Mr. Rasdal will continue to serve as a director of the Company. On June 30, 2020 David Moatazedi resigned from our Board. Mr. Moatazedi's resignation was not due to a disagreement with the Board or the Company on any matter relating to the Company’s operations, policies or practices.

Our Charter and Amended and Restated Bylaws (the “Bylaws”) provide that the authorized number of directors shall be fixed from time to time exclusively by resolution adopted by a majority of the Board. We currently have seven (7) authorized directors on our Board. As set forth in our Charter, the Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The following table summarizes the class, independence and committee membership of our directors:

|

| | | | |

| Name | Age | Position | Independent | Committee Membership |

| CLASS I DIRECTORS - Nominated for Re-election with a Term to Expire at the 2023 Annual Meeting |

| Douglas Fisher, M.D. | 44 | Director | X | Nominating and Corporate Governance |

| Sharon Stevenson, DVM Ph.D. | 70 | Director | X | Audit |

| William Plovanic | 51 | Director | | |

| CLASS III DIRECTORS - Terms to Expire at the 2022 Annual Meeting |

| Kim Kamdar, Ph.D. | 53 | Chairperson of the Board of Directors | X | Nominating and Corporate Governance (Chair) Compensation |

| Andrew Rasdal | 62 | President, Chief Executive Officer, and Director | | |

| CLASS II DIRECTORS - Terms to Expire at the 2021 Annual Meeting |

| Raymond Dittamore | 77 | Director | X | Audit Compensation (Chair) |

| Les Howe | 76 | Director | X | Nominating and Corporate Governance Audit (Chair) |

The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause and only by the affirmative vote of the holders of at least two-thirds of the voting power of the then-outstanding shares of capital stock entitled to vote in the election of directors.

There are no family relationships among any of our executive officers or directors.

All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute

nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

The Board unanimously recommends a vote FOR the election of the below three Class I Director nominees.

NOMINEES FOR CLASS I DIRECTORS (TERMS TO EXPIRE AT THE 2023 ANNUAL MEETING)

The principal occupations and business experience, for at least the past five years, of each Class I Nominee for election at the 2020 Annual Meeting are as follows:

Douglas Fisher, M.D. has served as a member of our Board since May 2012. Dr. Fisher is currently an Executive in Residence at InterWest Partners LLC, a venture capital firm, where he has worked since March 2009. Dr. Fisher also serves as the Chief Business Officer at Sera Prognostics, Inc., a biotechnology company, where he has worked since January 2015. Prior to joining InterWest, Dr. Fisher served as Vice President of New Leaf Venture Partners LLC, a private equity and venture capital firm, from January 2006 to March 2009. Prior to joining New Leaf, Dr. Fisher was a project leader with The Boston Consulting Group, Inc., a global management consulting firm, from November 2003 to February 2006. Dr. Fisher currently serves on the board of private companies Gynesonics, Inc. and Indi Molecular, Inc and public company Precipio Diagnostics. Dr. Fisher previously served on the board of QuatRx Pharmaceuticals Company, Cardiac Dimensions, PMV Pharmaceuticals, Inc. and Sera Prognostics, Inc. Dr. Fisher holds an A.B. and a B.S. from Stanford University, an M.D. from the University of Pennsylvania School of Medicine and an M.B.A. from The Wharton School of the University of Pennsylvania. Our Board believes that Dr. Fisher’s extensive experience in the medical device industry qualifies him to serve on our Board.

Sharon Stevenson, DVM Ph.D. has served as a member of our Board since January 2008. Dr. Stevenson is currently a Co-Founder and Managing Director of Okapi Venture Capital, a venture capital company, where she has worked since 2005. Prior to founding Okapi, Dr. Stevenson was the Senior Vice President of Technology and Planning for SkinMedica, Inc. (acquired by Allergan, Inc.) from 2003 to 2004. Prior to SkinMedica, Dr. Stevenson was a Principal with Domain Associates, LLC from 2000 to 2003. While at Domain, Dr. Stevenson also served as President and Chief Financial Officer of Volcano Corporation. Dr. Stevenson currently serves on the board of private companies WiserCare, Inc., and BioTrace Medical, Inc., and has previously served on the board of directors of private companies OrthAlign, Inc. from 2008 to 2014, PathCentral, Inc from 2010 through 2013, Helixis, Inc. before its acquisition by Illumina in 2010, and Focal Therapeutics, Inc. before its acquisition by Hologic Corporation in 2018. Dr. Stevenson holds a Master of Science in Veterinary Pathology and Doctor of Veterinary Medicine from The Ohio State University, an M.B.A from the UCLA Anderson Graduate School of Management and a Ph.D. in Comparative Pathology from the University of California, Davis. Our Board believes that Dr. Stevenson’s extensive industry experience and experience advising medical aesthetic companies qualifies her to serve on our Board.

William Plovanic has served as a Class I director since his appointment in May 2019. Mr. Plovanic is currently Managing Director, Equity Research at Canaccord Genuity Inc., an investment bank. Previously, Mr. Plovanic served as Chief Executive Officer from October 2019 to June 2020. Mr. Plovanic has also served our Chief Financial Officer from March 2016 to October 2019. Previously, Mr. Plovanic served as Managing Director, Medical Technology Equity Research at Canaccord Genuity Inc. from February 2007 to March 2016. Prior to Canaccord Genuity, Mr. Plovanic served in various roles at First Albany Capital Inc. from February 2001 to February 2007, including as Managing Director, Equity Research. Mr. Plovanic holds a B.S. from Bradley University and is a CFA Charterholder. Our Board believes that Mr. Plovanic's extensive experience in the medical technology industry qualifies him to serve on our Board.

CONTINUING MEMBERS OF THE BOARD OF DIRECTORS:

CLASS II DIRECTORS (TERMS TO EXPIRE AT THE 2021 ANNUAL MEETING)

The principal occupations and business experience, for the past five years, of each Class II Director are as follows:

Raymond Dittamore has served as a member of our Board since March 2016. Mr. Dittamore retired in June 2001 as a partner of Ernst & Young LLP, an international public accounting firm, after 35 years of service. Mr. Dittamore served on the board of directors of QUALCOMM Incorporated, a semiconductor and telecommunications equipment company from December 2002 to March 2017. Mr. Dittamore also served on the board of directors of Life Technologies Corporation from 2001 until its acquisition by Thermo Fisher in 2014. Previously, Mr. Dittamore served on the board of directors of Gen-Probe Incorporation and Digirad Corporation. Mr. Dittamore holds a B.S. degree in accounting from San Diego State University. Our Board believes that Mr. Dittamore’s extensive

auditing and accounting experience as well as his industry knowledge qualifies him to serve on our Board.

Les Howe has served as a member of our Board since January 2016. Mr. Howe served as the Chief Executive Officer of Consumer Networks LLC, an internet marketing and promotions company, from December 2001 until the company was sold in 2007. From July 1967 to September 1997, Mr. Howe held several positions at KPMG Peat Marwick LLP, an international auditing and accounting firm, and served as area managing partner/managing partner of their Los Angeles office from May 1994 to September 1997. Mr. Howe served on the board of directors of NuVasive, Inc., from 2014 to 2018. Mr. Howe previously served on the board of directors of Volcano Corporation from 2005 through 2015, and Jamba, Inc. from 2007 through 2016. Mr. Howe also previously served on the board of djo Orthopedics, Inc., and P.F. Chang's China Bistro, Inc. Mr. Howe holds a B.S. and B.A. from the University of Arkansas. Our Board believes that Mr. Howe’s extensive executive leadership experience and auditing and accounting experience qualifies him to serve on our Board.

CLASS III DIRECTORS (TERMS TO EXPIRE AT THE 2022 ANNUAL MEETING)

The principal occupations and business experience, for the past five years, of each Class III Director are as follows:

Kim Kamdar, Ph.D. has served as a member of our Board since January 2008, and as Chairperson since June 2020. Dr. Kamdar is currently a partner at Domain Associates, LLC, a venture capital firm, where she has worked since 2005. Prior to Domain, Dr. Kamdar was a Kauffman Fellow with MPM Capital, as well as a research director at Novartis International AG. Dr. Kamdar is currently chair of the board and Chief Executive Officer of Aspen Neuroscience, a private company that is developing personalized regenerative medicine, a position she has held since October 2018. Dr. Kamdar currently serves on the board of several private companies including: Epic Sciences, Inc., Omniome, Inc., ROX Medical, Inc., Sera Prognostics, Inc., and Singular Genomics Systems, and Truvian Sciences (chairperson). Dr. Kamdar also serves on the board of EvoFem Biosciences, a public company. Dr. Kamdar also previously served on the board of directors of Ariosa Diagnostics, Inc., a molecular diagnostics company, from 2010 until it was sold to Roche in January 2015. Dr. Kamdar serves as an advisory board member of Scripps Medicine and of Evolvence India Life Sciences Fund. She is also a board member of San Diego’s CONNECT Foundation. Dr. Kamdar holds a B.A. from Northwestern University and a Ph.D. from Emory University. Our Board believes that Dr. Kamdar’s extensive experience advising medical device companies qualifies her to serve on our Board.

Andrew Rasdal has served as our President and Chief Executive Officer since June 2020, and as a member of our Board since June 2008. Previously, he served as Executive Chairman of our Board from January 2019 to June 2020. Mr. Rasdal also served as our President and Chief Executive Officer from June 2008 to January 2019. Previously, Mr. Rasdal was the President and Chief Executive Officer at DexCom, Inc., a medical device company, from January 2002 until June 2007. Prior to DexCom, Mr. Rasdal served as President of Vascular and Senior Vice President for Medtronic, Inc., a medical technology development company, from 1999 to 2002. Prior to Medtronic, Mr. Rasdal served as Vice President of Marketing at Arterial Vascular Engineering, Inc. (acquired by Medtronic), a coronary stent company, from 1997 to 1999. Mr. Rasdal has also served in various senior positions at EP Technologies, Inc., SCIMED Life Systems, Inc. and Advanced Cardiovascular Systems, Inc. Mr. Rasdal holds a B.S. from San Jose State University and an M.M. from the Kellogg School of Management at Northwestern University. Our Board believes that Mr. Rasdal should serve as a director due to his deep understanding of our company and products and his significant experience in the medical technology industry.

PROPOSAL 2 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Our Board has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of KPMG LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

KPMG LLP also served as our independent registered public accounting firm for each of the fiscal years ended since December 31, 2016. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit services. A representative of KPMG LLP is expected to attend the Annual Meeting, and to have an opportunity to make a statement if they intend to do so and will be available to respond to appropriate questions from stockholders.

In the event that the appointment of KPMG LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent registered public accounting firm for the fiscal year ending December 31, 2020. Even if the appointment of

KPMG LLP is ratified, the Audit Committee retains the discretion to appoint a different independent registered public accounting firm at any time if it determines that such a change is in the interests of the Company.

The Board unanimously recommends a vote FOR the Ratification of the Appointment of KPMG LLP as our Independent Registered Public Accounting Firm.

Report of the Audit Committee of the Board

The Audit Committee has reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2019 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by statement on Auditing Standards No. 1301 (Communications with Audit Committees), as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from Obalon Therapeutics, Inc. The Audit Committee also considered whether the independent registered public accounting firm’s provision of certain other non-audit related services to the Company is compatible with maintaining such firm’s independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

Audit Committee

Les Howe, Chair

Raymond Dittamore

Sharon Stevenson, DVM Ph.D.

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of KPMG LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

|

| | |

| | Fiscal Year Ended December 31, |

| Fee Category | 2019 | 2018 |

| Audit Fees | $627,500 | $534,575 |

| Audit-Related Fees | — | — |

| Tax Fees | — | — |

| All Other Fees | 1,780 | 1,780 |

| Total Fees | $629,280 | $536,355 |

Audit fees consist of fees for the audit of our consolidated financial statements, the review of the unaudited interim financial statements included in our quarterly reports on Form 10-Q, the issuance of consents for 2019 and 2018, and comfort letters in connection with registration statements.

For 2019 and 2018, All Other Fees represent fees for a subscription to KPMG's accounting research tool.

AUDIT FEES

Audit fees consist of fees for the audit of our consolidated financial statements, the review of the unaudited interim financial statements included in our quarterly reports on Form 10-Q, the issuance of consents for 2019 and 2018, and comfort letters in connection with registration statements.

AUDIT COMMITTEE PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES

The Audit Committee pre-approves all audit and non-audit services provided by the independent registered public accounting firm, including all audit services, audit-related services, tax services, and all other services. The Audit Committee pre-approves the engagement of the independent registered accounting firm and the provision of audit services and audit-related services on an annual basis and pre-approves the particular tax and all other services on a case-by-case basis and does not delegate approval to management. The Audit Committee has authorized its Chair to pre-approve individual expenditures of audit and non-audit services. Any pre-approval decision by the Audit Committee Chair must be reported to the Audit Committee at the next regularly scheduled Audit Committee meeting. All of the services of KPMG LLP for 2019 and 2018 described above were pre-approved by the Audit Committee.

Executive Officers

The following table identifies our executive officers as of July 28, 2020:

|

| | | | | |

| Name | | Age | | Position |

| Andrew Rasdal | | 62 |

| | President, Chief Executive Officer and Director |

| Nooshin Hussainy | | 62 |

| | Chief Financial Officer |

William Plovanic resigned from his positions as President and Chief Executive Officer as June 19, 2020. Mark Brister and Amy Vandenberg resigned on June 30, 2020 from their positions of Chief Technology Officer and Chief Quality Assurance, Clinical and Regulatory Affairs Officer, respectively, and have each since transitioned to consultants to the Company. The following is biographical information for our executive officers other than Mr. Rasdal, whose biographical information is included under "Proposal 1 - Election of Directors.”

Nooshin Hussainy has served as our Chief Financial Officer since October 2019. Previously Ms. Hussainy served as Vice President of Finance from December 2011 until October 2019. Prior to joining us, Ms. Hussainy served as the Vice President of Accounting and Corporate Controller at GenMark Diagnostics, Inc., a molecular diagnostics company, from April 2010 to September 2011. Prior to GenMark Diagnostics, Ms. Hussainy served as the Vice President of Accounting and Corporate Controller at ACTIVE Network, LLC, a worldwide registration software and advertising company, from 2008 to 2010. Ms. Hussainy previously served as the Corporate Controller at DexCom from 2003 to 2008 and at Entropia, Inc. from 2001 to 2003. Ms. Hussainy has also served as the Assistant Controller at Thermolase Corporation. Ms. Hussainy holds a B.A. from National University.

Corporate Governance

GENERAL

Our Board has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics in the “Governance” section of the “Investors” page of our website located at www.obalon.com, or by writing to our Secretary at our offices at 5421 Avenida Encinas, Suite F, Carlsbad, CA 92008.

BOARD COMPOSITION

Our Board currently consists of seven members: William Plovanic, Andrew Rasdal, Kim Kamdar, Ph.D., Raymond Dittamore, Douglas Fisher, M.D., Les Howe, and Sharon Stevenson, DVM Ph.D. As set forth in our Charter, the Board is currently divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve until the third annual meeting following election. Our Charter and Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The classification of our Board may have the effect of delaying or preventing a change of our management or a change in control of our company. Our directors may be removed only for cause and only by the affirmative vote of the holders of at least two-thirds of the voting power of the then-outstanding capital stock entitled to vote in the election of directors.

DIRECTOR INDEPENDENCE

Our Board has determined that all of our directors, other than Andrew Rasdal and William Plovanic, qualify as “independent” in accordance with the listing requirements of The NASDAQ Global Select Market (“NASDAQ”). The NASDAQ independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by NASDAQ rules, our Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. Mr. Rasdal is not independent because he currently serves as President and Chief Executive Officer. Mr. Plovanic is not independent because he is a former employee of Obalon. He will remain ineligible to serve as an independent director for the three years following the termination of his employment, which was effective June 19, 2020. There are no family relationships among any of our directors or executive officers.

DIRECTOR CANDIDATES

The Nominating and Corporate Governance Committee is primarily responsible for identifying, considering and recruiting qualified candidates for Board membership. When formulating its Board membership recommendations, the Nominating and Corporate Governance Committee may also consider advice and recommendations from stockholders, management and others as it deems appropriate. The Board’s policy is to encourage selection of directors who will contribute to the Company’s overall corporate goals. The Nominating and Corporate Governance Committee may from time to time review and recommend to the Board the desired qualifications, expertise and characteristics of directors, including such factors as business experience, diversity and personal skills in or relevant to the medical device industry, finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board. Exceptional candidates who do not meet all of these criteria may still be considered. In evaluating potential candidates for the Board, the Nominating and Corporate Governance Committee considers these factors in the light of the specific needs of the Board at that time. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee may also consider the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the Nominating and Corporate Governance Committee, c/o Secretary, Obalon Therapeutics, Inc., 5421

Avenida Encinas, Suite F, Carlsbad, CA 92008. Assuming that appropriate biographical and background material has been provided on a timely basis, the Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

COMMUNICATIONS FROM STOCKHOLDERS

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Our Secretary is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Secretary and Chairperson of the Board consider to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications. Stockholders who wish to send communications on any topic to the Board should address such communications to the Board in writing: c/o Secretary, Obalon Therapeutics, Inc., 5421 Avenida Encinas, Suite F, Carlsbad, CA 92008.

BOARD LEADERSHIP STRUCTURE-- SEPARATE CHAIRPERSON

Our Bylaws and Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chairperson of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. In January 2019, the Board determined that the Company's and its stockholders' best interests are served by Andrew Rasdal, former President and Chief Executive Officer, serving as Executive Chairman of the Board. On June 29, 2020, the Board appointed Kim Kamdar, an independent director, as Chairperson of the Board. Ms. Kamdar assumes the role previously held by Andrew Rasdal, who was recently appointed President and Chief Executive Officer of the Company. Mr. Rasdal will continue to serve as a director of the Company. Our Board has concluded that our current leadership structure is appropriate as it allows our current President and Chief Executive Officer, Andrew Rasdal, to focus primarily on strategy, operations, organizational issues and business prospects and Ms. Kamdar to focus on management oversight, board leadership, risk oversight and governance related issues. However, our Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

RISK OVERSIGHT

Risk assessment and oversight are an integral part of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through our three standing committees of the Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, and our Audit Committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. Our Nominating and Corporate Governance Committee monitors the effectiveness of the Corporate Governance Guidelines and our annual Board assessment. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

ANNUAL BOARD EVALUATION

Our Corporate Governance Guidelines require the Nominating and Corporate Governance Committee to oversee an annual assessment by the Board of the Board’s performance. As provided in our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee is responsible for establishing the evaluation criteria and implementing the process for such evaluation. The annual evaluation includes an evaluation of the Audit, Compensation and Nominating and Corporate Governance Committees.

CODE OF ETHICS

We have a written Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the code on our investor relations section of our website at www.obalon.com.

In addition, we intend to post on our website all disclosures that are required by law or the listing standards of NASDAQ concerning any amendments to, or waivers from, any provision of the code.

ATTENDANCE BY MEMBERS OF THE BOARD OF DIRECTORS AT MEETINGS

There were eighteen meetings of the Board during the fiscal year ended December 31, 2019. During the fiscal year ended December 31, 2019, each director attended at least 75% of the aggregate of all meetings of the Board and meetings of the committees on which such director served during the period in which he or she served as a director.

Pursuant to our Corporate Governance Guidelines, directors are invited and encouraged to attend the Company’s annual stockholder meetings. Five of the eight directors attended (in person or telephonically) our 2019 Annual Meeting of Stockholders.

COMMITTEES OF THE BOARD

Our Board has established three standing committees - Audit, Compensation and Nominating and Corporate Governance - each of which operates under a written charter that has been approved by our Board. All of the members of each of the Board’s three standing committees are independent as defined under the NASDAQ rules. In addition, all members of the Audit Committee meet the independence requirements for Audit Committee members under Rule 10A-3 under the Securities Exchange Act of 1934, or the Exchange Act, and all members of the Compensation Committee meet the standards for independence specific to members of a compensation committee under the NASDAQ rules.

The charters of our standing board committees are available on our website at http://investor.obalon.com/. The current members of each of the Board committees and committee Chairs are set forth in the following chart.

|

| | | |

Name of Independent Director | Audit | Compensation | Nominating and Corporate Governance |

| Kim Kamdar, Ph.D | | X | C |

Raymond Dittamore † | X | C | |

| Douglas Fisher, M.D. | | | X |

Les Howe † | C | | X |

| Sharon Stevenson, DVM Ph.D. | X | | |

AUDIT COMMITTEE

Our Audit Committee is responsible for, among other things:

| |

| • | overseeing our accounting and financial reporting processes, including our financial statement audits and the integrity of our financial statements; |

| |

| • | overseeing our compliance with legal and regulatory requirements; |

| |

| • | reviewing and approving related-person transactions; |

| |

| • | selecting, hiring and determining the compensation of our independent registered public accounting firm; |

| |

| • | the qualifications, independence and performance of our independent auditors; and |

| |

| • | the preparation of the audit committee report to be included in our annual proxy statement. |

The members of the Audit Committee are Messrs. Dittamore and Howe and Dr. Stevenson, who are all independent directors. Mr. Howe serves as the Chairperson of the committee. The members of our Audit Committee meet the requirements for financial literacy under the applicable rules of the SEC and NASDAQ. Our Board has determined that Messrs. Dittamore and Howe are “audit committee financial experts” as defined by Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee met four times in 2019.

COMPENSATION COMMITTEE

Our Compensation Committee reviews and approves policies relating to the compensation and benefits of our officers and recommends to the Board of Directors policies relating to the compensation and benefits of our directors. At least annually, the Compensation Committee reviews corporate goals and objectives relevant to the compensation of our Chief Executive Officer, as well as, the performance of the Compensation Committee and its members, including compliance with its charter.

The Compensation Committee also grants stock options and other awards under our equity plans. In addition, the Compensation Committee periodically reviews and recommends to the Board compensation for service on the Board and any committees of the Board. The Compensation Committee may delegate its authority under its charter to one or more subcommittees as it deems appropriate from time to time as further described in its charter. The Compensation Committee may also delegate to the Chief Executive Officer (either alone or acting together with another officer) the authority to grant or amend equity awards to certain employees, as further described in its charter and subject to the terms of our equity plans.

The Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in carrying out its responsibilities. The Compensation Committee did not engage any compensation consultants in 2019.

The two independent members of our Compensation Committee are Mr. Dittamore and Dr. Kamdar, who are both independent directors. Mr. Dittamore serves as the Chairperson of the committee. The Compensation Committee met three times in 2019.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The Nominating and Corporate Governance Committee is responsible for, among other things, identifying, considering, recruiting and recommending to the Board qualified nominees candidates for Board membership, developing and overseeing a process for evaluation of the performance of the Board, evaluating and making recommendations to the Board regarding the independence of our directors, and advising the Board on other corporate governance matters.

The members of our Nominating and Corporate Governance Committee are Drs. Kamdar and Fisher and Mr. Howe, who are all independent directors. Dr. Kamdar serves as the Chairperson of the committee. The Nominating and Corporate Governance Committee met once in 2019.

EQUITY INCENTIVE COMMITTEE

The Compensation Committee has delegated authority to our Chief Executive Officer to grant to certain employees' stock options and restricted stock under the Company’s 2016 Equity Incentive Plan covering up to 500,000 shares of stock options and 415,000 shares of restricted stock awards in the aggregate. Under this authority, an individual stock option cannot cover more than 25,000 shares and an individual restricted stock award cannot cover more than 25,000 shares. Under this authority Messrs. Huang and Plovanic, our Chief Executive Officers in 2019, granted 34,836 shares of stock options and no shares of restricted stock in 2019.

Executive and Director Compensation

The following tables and accompanying narrative disclosure set forth information about the compensation provided to our Named Executive Officers during the year ended December 31, 2019, who were:

| |

| • | William Plovanic, President and Chief Executive Officer; |

| |

| • | Andrew Rasdal, Executive Chairman of the Board, and Former Chief Executive Officer; |

| |

| • | Mark Brister, Chief Technology Officer; |

| |

| • | Kelly Huang, Former President and Chief Executive Officer; and |

| |

| • | Amy Vandenberg, Chief Quality Assurance, Clinical and Regulatory Affairs Officer. |

Effective January 2, 2019, Mr. Rasdal transitioned to Executive Chairman of the Board and Dr. Huang was appointed as our Chief Executive Officer. On May 20, 2019, Dr. Huang resigned as our Chief Executive Officer and Mr. Plovanic was promoted to President, Chief Financial Officer and was appointed to serve as a director on the Board. On October 19, 2019, Mr. Plovanic was promoted to Chief Executive Officer and retained his title as President and continued to serve as a director of the Board. Dr. Huang served as a consultant to the Company from his resignation in May 2019 until May 2020.

On March 24, 2020, we announced a furlough with a temporary reduction in hours worked by 25% for all employees, including our Named Executive Officers: William Plovanic, Andrew Rasdal, Mark Brister and Amy Vandenberg. The furlough was effective as of March 30, 2020. In addition, on May 11, 2020, we announced a further reduction in the annual base salaries of Messrs. Plovanic and Rasdal, as well as Mr. Brister and Ms. Vandenberg, in each case, to $100,000, effective May 1, 2020. Effective June 18, 2020, Mr. Rasdal agreed to further reduce his annual base salary to approximately $55,000.

Effective June 19, 2020, Mr. Plovanic resigned from his position as President, and Chief Executive Officer, but continues to serve as a director of the Board and Mr. Rasdal was appointed as our President and Chief Executive Officer following the effective date of Mr. Plovanic’s resignation.

On June 30, 2020, Mr. Brister resigned from his position as Chief Technology Officer and Ms. Vandenberg resigned from her position as Chief Quality Assurance, Clinical and Regulatory Affairs Officer. Since their resignation, Mr. Brister and Ms. Vandenberg each has continued to serve as a consultant to the Company.

To the extent applicable, all disclosed share amounts reflect the 2.9-to-1 reverse stock split effected by the Company on September 23, 2016 and the 10-to-1 reverse stock split affected by the Company on July 24, 2019.

SUMMARY COMPENSATION TABLE

The following table presents summary information regarding the total compensation that was awarded to, earned by or paid to our Named Executive Officers for services rendered during the years ended December 31, 2019 and December 31, 2018. Mr. Brister and Ms. Vandenberg were not named executive officers for the year ended December 31, 2018, and therefore information in the table below is provided only with respect to their 2019 services.

|

| | | | | | | | |

| Name and principal position | Year | Salary ($) | Bonus ($)(1)(2) | Stock Awards ($)(3) | Option Awards ($)(4) | Non-equity incentive plan compensation | All other compensation ($)(5) | Total ($) |

| William Plovanic | 2019 | 422,917 | 241,000(5) | — | 290,708 | — | 994 | 955,619 |

| President and Chief Executive Officer | 2018 | 400,000 | 155,000 | 127,350 | 381,710 | — | 949 | 1,065,009 |

| Andrew Rasdal | 2019 | 325,000 | — | 200,001 | — | — | 994 | 525,995 |

| (6) Officer | 2018 | 650,000 | 520,000 | — | 1,145,130 | — | 978 | 2,316,108 |

Mark Brister Chief Technology Officer

| 2019 | 367,500 | 35,000 | — | 139,180 | — | 994 | 542,674 |

Kelly Huang

| 2019 | 202,331 | — | — | 376,560 | — | 277,491 | 856,382 |

| Former President and Chief Executive Officer | 2018 | 432,000 | — | 183,950 | 305,368 | 199,800 | 4,242 | 1,125,360 |

Amy Vandenberg Chief Quality Assurance, Clinical and Regulatory Affairs Officer

| 2019 | 367,500 | 35,000 | — | 136,028 | — | 994 | 539,522 |

_________

| |

| (1) | Amounts represent cash incentives paid in 2020 with respect to 2019 performance, as determined by our Compensation Committee in its discretion. In addition, for Mr. Plovanic, includes a $200,000 bonus paid in connection with his promotion to Chief Executive Officer. |

| |

| (2) | Amounts for 2018 represent cash incentives paid in January 2019 with respect to 2018 performance under our 2018 bonus plan. |

| |

| (3) | The amounts shown represent the full grant date fair value of restricted stock awards and restricted stock unit awards granted to the Named Executive Officer in the applicable year, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, rather than the amounts paid to or realized by the Named Executive Officer. For a discussion of valuation assumptions used in the calculations, see Notes 2 and 7 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019 and filed with the SEC on February 27, 2020. There can be no assurance that unvested awards will vest (and, absent vesting, no value will be realized by the executive for the award). |

| |

| (4) | The amounts shown represent the aggregate grant date fair value of stock options granted to each Named Executive Officer in the applicable year, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. For a discussion of valuation assumptions used in the calculations, see Notes 2 and 7 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019 and filed with the SEC on February 27, 2020. Note that the amounts reported in this column reflect the accounting cost for these stock options, and do not correspond to the actual economic value that may be received by our Named Executive Officers from the options. There can be no assurance that unvested awards will vest (and, absent vesting and exercise, no value will be realized by the executive for the award). |

| |

| (5) | Amounts represent company-paid life insurance premiums and long-term disability benefits for Messrs. Plovanic, Rasdal and Brister, Dr. Huang and Ms. Vandenberg. In addition, with respect to Mr. Huang, includes consulting fees payable pursuant to his consulting agreement. |

| |

| (6) | In 2019, Mr. Rasdal served as our Chief Executive Officer until January 2, 2019, when he transitioned to Executive Chairman of the Board for the remainder of 2019. As mentioned above, on June 20, 2020 Mr. Rasdal became our President and Chief Executive Officer. |

NARRATIVE DISCLOSURE TO SUMMARY COMPENSATION TABLE

Base Salaries

We pay our Named Executive Officers a base salary to compensate them for the satisfactory performance of services rendered to our Company. The base salary payable to each Named Executive Officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role and responsibilities. Base salaries for our Named Executive Officers have generally been set at levels deemed necessary to attract and retain individuals with superior talent.

As of January 1, 2019, the base salaries for Messrs. Plovanic, Rasdal and Brister, Dr. Huang and Ms. Vandenberg were $400,000, $650,000, $367,500, $432,000, and $367,500, respectively.

In connection with Mr. Rasdal’s transition to Executive Chairman of the Board and Dr. Huang’s promotion to Chief Executive Officer, Mr. Rasdal’s base salary decreased from $650,000 to $325,000 and Dr. Huang’s base salary was increased to $475,000, each effective January 2, 2019. Further, effective October 19, 2019, Mr. Plovanic’s base salary was increased from $400,000 to $510,000, in connection with his promotion to serve as Chief Executive Officer of the Company.

In addition, in light of the uncertainties related to the COVID-19 pandemic, in March 2020, we temporarily reduced the base salaries of Messrs. Plovanic, Rasdal and Brister and Ms. Vandenberg by 25%. In May 2020, we announced a further reduction in the annual base salaries of Messrs. Plovanic and Rasdal, as well as Mr. Brister and Ms. Vandenberg, in each case, to $100,000, effective May 1, 2020. In June 2020, Mr. Rasdal agreed to further reduce his annual base salary to approximately $55,000.

We expect that base salaries for the Named Executive Officers will be reviewed periodically by our Compensation Committee, with adjustments expected to be made generally in accordance with the considerations described above and to maintain base salaries at competitive levels.

Cash Incentive Payments

Annual Cash Incentive Program. In 2019, Messrs. Plovanic and Brister and Ms. Vandenberg were eligible to participate in our annual cash incentive compensation program under which cash incentive payments were awarded based on our corporate performance. For 2019, each had a target cash incentive opportunity equal to 45% of such executive’s base salary. In connection with Dr. Huang’s resignation as our Chief Executive Officer and Mr. Rasdal’s transition to Executive Chairman of the Board, neither executive was eligible to participate in the Company's 2019 executive bonus program.

Our 2019 bonus program was designed to provide bonus opportunities for our executive officers based on the achievement of corporate performance objectives. In 2019, these objectives included (i) financial, (ii) clinical and regulatory, and (iii) product quality metrics. The first goal was weighted at 50%, while the other two were weighted at 25% each.

Each performance goal had both a target measure and an “upside” measure; if the “upside” measure was attained then the executive was eligible to receive an increase in cash incentive payment equal to 10% of the executive’s base salary with respect to that measure.

Based on our 2019 performance, the corporate performance objectives were not achieved. However, our Compensation Committee decided to award discretionary cash bonuses to Messrs. Plovanic and Brister and Ms. Vandenberg to compensate them for their overall performance and efforts on behalf of the Company in 2019. The discretionary bonus amounts were $41,000 for Mr. Plovanic and $35,000 for each of Mr. Brister and Ms. Vandenberg; each is approximately 22% of the executive’s target bonus opportunity for 2019.

Promotion Bonus. In addition, in connection with his promotion to Chief Executive Officer in 2019, Mr. Plovanic received a one-time $200,000 bonus.

Equity Awards

We award stock options and stock awards to our employees, including Named Executive Officers, as the long-term incentive component of our compensation program. Awards granted since our initial public offering in September 2016 were granted under the Obalon Therapeutics, Inc. 2016 Equity Incentive Plan (the “2016 Plan”); prior to our initial public offering, awards were granted under the Obalon Therapeutics, Inc. 2008 Equity Incentive Plan (the “2008 Plan”).

We typically grant equity awards to new hires upon their commencing employment with us and from time to time thereafter. Our stock options allow employees to purchase shares of our common stock at a price per share equal to the fair market value of our common stock on the date of grant and may or may not be intended to qualify as “incentive stock options” for U.S. federal income tax purposes. Generally, the stock options we grant vest over a four-year period, subject to the employee’s continued service with us on the vesting date, either in equal monthly installments over the four-year period or as to 25% of the total number of option shares on the first anniversary of the date of grant and in equal monthly installments over the following 36 months. Stock option grants that were made prior to our initial public offering under the 2008 Plan generally allow employees the opportunity to “early exercise” unvested stock options by purchasing shares underlying the unvested portion of an option subject to our right to repurchase any unvested shares for the lesser of the exercise price paid for the shares and the fair market value of the shares on the date of the holder’s termination of service if the employee’s service with us terminates prior to the date on which the option vests.

The following table sets forth the number of options granted to our Named Executive Officers in 2019.

|

| | | |

| Name | Grant Date | Number of Options (#) | Option Exercise Price ($) |

| William Plovanic | 1/2/2019 | 10,000(1) | $23.00 |

| William Plovanic | 7/23/2019 | 30,000(2) | $9.60 |

| William Plovanic | 10/25/2019 | 10,000(3) | $1.75 |

| Kelly Huang | 1/2/2019 | 30,000(1) | $23.00 |