| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fellow Shareholders, | | | | | | | | October 30, 2024 |

We delivered strong results in Q3, our first quarter of more than $1 billion in Total net revenue, with Platform revenue up 15% YoY. We achieved our fifth straight quarter of positive Adjusted EBITDA and Free Cash Flow (TTM), and we also grew Streaming Hours on The Roku Channel 80% YoY. With our intuitive Home Screen and UI (user interface), our viewers can easily find what to watch; our content partners can attract, engage, and retain audiences; and our advertisers can reach consumers and grow their businesses. As we look forward, we remain focused on growing Platform revenue. Our key initiatives include innovating our Home Screen to expand monetization, growing ad demand through deeper third-party platform integrations, and growing Roku-billed subscriptions.

Q3 2024 Key Results

•Total net revenue was $1.062 billion, up 16% year over year (YoY)

•Platform revenue was $908 million, up 15% YoY

•Gross profit was $480 million, up 30% YoY; up 10% YoY excluding Q3 2023 restructuring charges1

•Streaming Households were 85.5 million, a net increase of 2.0 million from Q2 2024

•Streaming Hours were 32.0 billion, up 5.3 billion hours YoY

•Average Revenue Per User (ARPU) was $41.10 on a trailing 12-month basis (TTM), flat YoY

•Fifth consecutive quarter of positive Adjusted EBITDA and Free Cash Flow (TTM)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Performance Metrics | Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 | | Q3 24 | | YoY % |

| Streaming Households (millions) | 75.8 | | | 80.0 | | | 81.6 | | | 83.6 | | | 85.5 | | | 13 | % |

| Streaming Hours (billions) | 26.7 | | | 29.1 | | | 30.8 | | | 30.1 | | | 32.0 | | | 20 | % |

| ARPU ($ TTM) | $ | 41.03 | | | $ | 39.92 | | | $ | 40.65 | | | $ | 40.68 | | | $ | 41.10 | | | 0 | % |

| | | | | | | | | | | |

| Summary Financials ($ in millions) | Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 | | Q3 24 | | YoY % |

| Platform revenue | $ | 786.8 | | | $ | 828.9 | | | $ | 754.9 | | | $ | 824.3 | | | $ | 908.2 | | | 15 | % |

| Devices revenue | 125.2 | | | 155.6 | | | 126.5 | | | 143.8 | | | 154.0 | | | 23 | % |

| Total net revenue | 912.0 | | | 984.4 | | | 881.5 | | | 968.2 | | | 1,062.2 | | | 16 | % |

| Platform gross profit | 378.2 | | | 458.5 | | | 394.4 | | | 439.9 | | | 491.8 | | | 30 | % |

| Devices gross profit (loss) | (9.4) | | | (20.5) | | | (6.1) | | | (15.2) | | | (11.7) | | | (24) | % |

| Total gross profit | 368.8 | | | 437.9 | | | 388.3 | | | 424.7 | | | 480.1 | | | 30 | % |

| Platform gross margin % | 48.1 | % | | 55.3 | % | | 52.2 | % | | 53.4 | % | | 54.2 | % | | 6.1 | pts |

| Devices gross margin % | (7.5) | % | | (13.2) | % | | (4.8) | % | | (10.6) | % | | (7.6) | % | | (0.1) | pts |

| Total gross margin % | 40.4 | % | | 44.5 | % | | 44.1 | % | | 43.9 | % | | 45.2 | % | | 4.8 | pts |

| Research and development | 282.2 | | | 183.8 | | | 180.5 | | | 175.5 | | | 178.8 | | | (37) | % |

| Sales and marketing | 307.7 | | | 264.6 | | | 202.1 | | | 221.7 | | | 237.0 | | | (23) | % |

| General and administrative | 128.7 | | | 93.7 | | | 77.7 | | | 98.8 | | | 100.0 | | | (22) | % |

| Total operating expenses | 718.6 | | | 542.1 | | | 460.3 | | | 495.9 | | | 515.8 | | | (28) | % |

| Loss from operations | (349.8) | | | (104.2) | | | (72.0) | | | (71.2) | | | (35.8) | | | 90 | % |

Adjusted EBITDA A | 43.4 | | | 47.7 | | | 40.9 | | | 43.6 | | | 98.2 | | | 126 | % |

| Adjusted EBITDA margin % | 4.8 | % | | 4.8 | % | | 4.6 | % | | 4.5 | % | | 9.2 | % | | 4.5 | pts |

| Cash flow from operations (TTM) | 246.9 | | 255.9 | | 456.0 | | 332.3 | | 155.1 | | (37) | % |

Free Cash Flow (TTM) A | 100.8 | | 175.9 | | 426.8 | | 317.9 | | 157.3 | | 56 | % |

| | | | | | | | | | | |

| Outlook ($ in millions) | Q4 2024E | | A - Refer to the reconciliation of Net loss to Adjusted EBITDA and Cash flow from operations to Free Cash Flow in the non-GAAP information at the end of this Letter. |

| Total net revenue | $ | 1,140 | | |

| Total gross profit | $ | 465 | | | B - Q4 2024E reconciling items between net loss and non-GAAP Adjusted EBITDA consist of stock-based compensation of approx. $100 million, depreciation and amortization of approx. $15 million, and other income of approx. $20 million. |

| Net income (loss) | $ | (65) | | |

Adjusted EBITDA B | $ | 30 | | |

1 Refer to the Reconciliation of Gross Profit to Non-GAAP Gross Profit in the Non-GAAP information at the end of this Letter.

| | |

| Roku Q3 2024 Shareholder Letter |

1

Market-Leading Devices

Roku continues to benefit from our devices’ simplicity, value, and delight. The Roku operating system (OS) has been the #1 selling TV OS in the U.S. for more than five years. In Q3, sales of TV units powered by the Roku OS were greater than those of the #2 and #3 selling TV operating systems combined2. The Roku OS was also the #1 selling TV OS in Mexico and Canada,3 where we continue to grow scale. We have broad retail distribution of Roku streaming devices, including Roku-branded TVs, which are available from popular national retailers such as Amazon, Best Buy, Sam’s Club, Target, and Walmart.

Our world-class teams are always working to improve the streaming experience our devices deliver. In September, we launched our most powerful streaming player to date: the 2024 Roku Ultra. This premium streaming player comes bundled with the Voice Remote Pro (2nd edition), our most advanced remote. Tom’s Guide said, “From the new backlit buttons to being able to charge via USB-C, Roku’s latest remote is now almost perfect.”4 The 2024 Roku Ultra has a new quad core processor that delivers 30% faster performance, quicker streaming app launches, and upgraded Wi-Fi 6 radio architecture. CNET referred to the new Ultra as “undoubtedly the best Roku yet.”5

Driving Viewer Engagement

Globally, our users streamed 32.0 billion hours in Q3, up 20% YoY. We also grew engagement per household globally, with average Streaming Hours per Streaming Household per day of 4.1 hours in Q3 2024, up from 3.9 hours in Q3 2023. On traditional TV, average viewing time per U.S. household per day was 7.0 hours (Nielsen), highlighting the significant opportunity for us to continue to grow our engagement.

Viewer Experience

The Roku experience begins with our Home Screen. Its powerful position as the lead-in to TV drives engagement that benefits our viewers, content partners, advertisers, and therefore Roku.

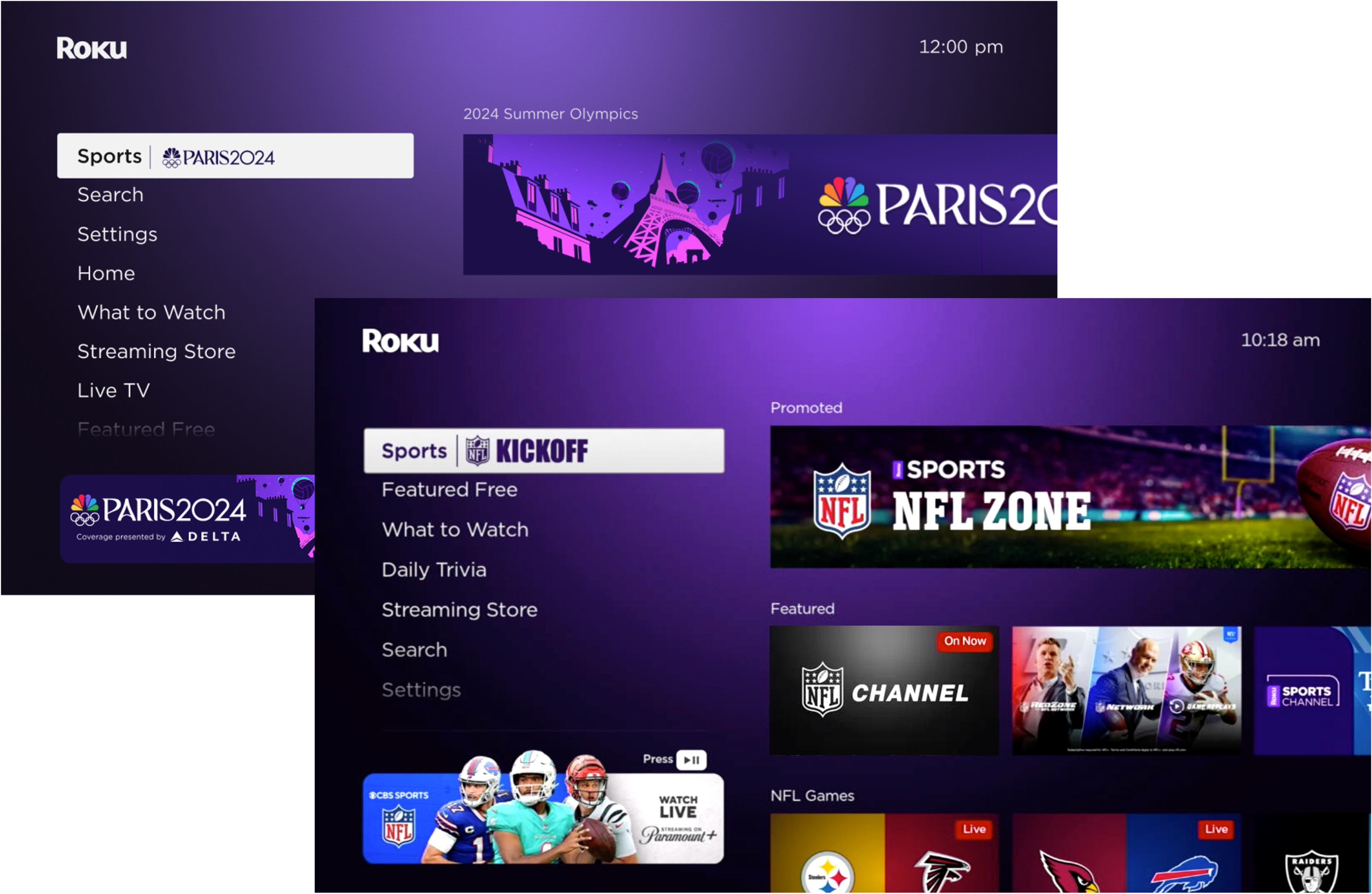

For example, the Roku Sports Zone is a feature on our Home Screen that aggregates and organizes sports programming across our platform into a single destination. As Q3 was a busy season for sports fans, we worked to make finding what games to watch easier for them. Within the Roku Sports Zone, we created designated zones for the MLB, the Olympics, and the NFL. We also surfaced events in our UI outside of the Sports Zone in features like What to Watch. In Q3, households that started streaming from one of these Sports Zone features increased 68% QoQ, and the number of Streaming Hours attributed to these features doubled QoQ.

In September, the popular NFL Zone returned to Roku timed for the kickoff of the 2024-25 season, creating a valuable opportunity for advertisers to activate their brand within the NFL Zone. Viewers can once again find where to watch live and upcoming NFL games, League highlights, and other great NFL content – all from a single destination. This is particularly useful for fans to discover where to stream their favorite teams across direct-to-consumer, TVE apps, and NFL+, the League’s direct-to-consumer service. Similar to the Olympics, the NFL Zone had prominent placement in our Home Screen Menu for the first time to further highlight the NFL Zone for fans.

2 Source: Circana, LLC, Retail Tracking Service, US, TV, Software Service, Unit Sales, January 2019 – September 2024 and Q3 2024

3 Source: Circana, LLC, Retail Tracking Service, TV, Software Service, Unit Sales, 3 Months Ending September 2024

4 Tom’s Guide

5 CNET

| | |

| Roku Q3 2024 Shareholder Letter |

2

The Olympics and NFL Kickoff Weekend highlighted in the Roku Home Screen Menu for the first time

The Roku Channel

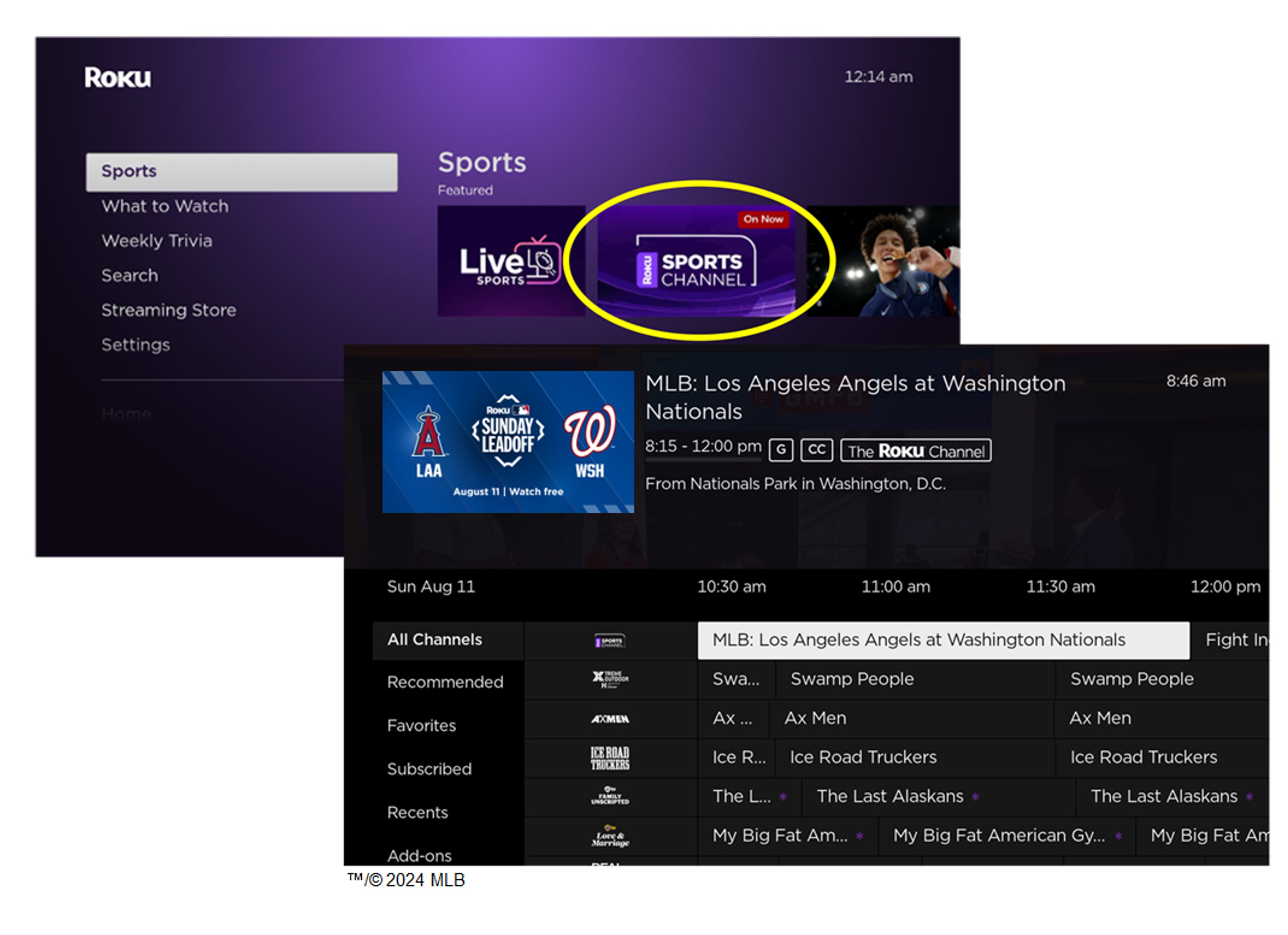

In Q3, The Roku Channel was the #3 app on our platform by both reach and engagement for the third straight quarter, with Streaming Hours up 80% YoY. Additionally, The Roku Channel hit an all-time high on Nielsen’s The Gauge™ ranking for August, representing 4.1% of all TV streaming time in the U.S.6 Our position as the lead-in to TV continues to drive significant growth.

Our audience turns to The Roku Channel for both its vast on-demand and linear options as well as live events, like sports and news. We continue to expand our offering, while making it easy for viewers to find the programming they are looking for. In August, we launched the Roku Sports Channel, our always-on FAST channel that leads viewers through the wide variety of free sports content available on The Roku Channel. We also expanded our talk series offerings on The Roku Channel, with the addition of Good Morning Football: Overtime, a new extension series of NFL Network’s long-running Good Morning Football.

6 Nielsen The Gauge™, August 2024

| | |

| Roku Q3 2024 Shareholder Letter |

3

The Roku Sports Channel leads viewers through free sports content available

on The Roku Channel, including MLB Sunday Leadoff games.

As they do with sports, viewers are streaming more news programming as they cut the cord. During the U.S. presidential debate on June 27, The Roku Channel’s FAST offering achieved its highest day for both reach and engagement. For the U.S. presidential debate on September 10, we made it easy for viewers to find the debate by highlighting it on our Home Screen in the Spotlight Ad and in the Content Row. During the debate, more than half of Roku Channel viewers in the U.S. watched on one of the live channels.

We offer our audience a broad variety of free sports, news, and entertainment on The Roku Channel. We recently expanded our partnership with Disney to include new FAST channels for Extreme Makeover: Home Edition, Nat Geo Sharks, Wicked Tuna, and ESPN the Ocho (US). We also launched over 70 FAST channels from Paramount, which includes programming for younger audiences like The Jersey Shore Channel and The Challenge Channel.

The Roku Channel also provides free original programming from Roku. In addition to providing exclusive content for viewers, Roku Originals create opportunities for brands to integrate into original storytelling, connecting with consumers through content that is relevant to the advertiser’s products. This is deeply immersive and valued by TV ad buyers accustomed to buying ads against specific content. For example, Ally Bank wanted to increase favorability and consideration for its services. In partnership with Reese Witherspoon’s Hello Sunshine, we worked with Ally to create Side Hustlers, a series about the unique challenges women face when starting their own businesses. In doing so Ally aligned its brand with messages of financial empowerment and well-being. The show drove a significant lift in brand favorability and program viewership increased the likelihood a viewer would open an Ally account7.

7 Sampled over 600 people ages 25-54 to compare those who viewed Side Hustlers vs. those who didn’t

| | |

| Roku Q3 2024 Shareholder Letter |

4

Ally partnered with Roku and Hello Sunshine

to reach women with messages of financial empowerment.

Growing Monetization

We generate Platform revenue primarily from the sale of advertising (including direct and programmatic video advertising, ads integrated into our UI, sponsorships, and related ad products and services), as well as streaming services distribution (including subscription and transactional revenue, the sale of Premium Subscriptions, and the sale of branded app buttons on remote controls).

In Q3, we grew Platform revenue to $908 million, with Platform gross margin of 54%, which is up 80 basis points QoQ. While Platform revenue was up 15% YoY, ARPU of $41.10 (TTM) was relatively flat YoY. This reflects an increasing share of Streaming Households in international markets, where we are currently focused on scale and engagement. Additionally, each country is at a different stage of monetization, and each has different economic characteristics. For example, Mexico is one of our fastest growing countries, and we have significant penetration of broadband households. However, we are in the early stages of monetization, and our ARPU in Mexico is currently a fraction of our ARPU in the U.S.

Streaming Services Distribution

In Q3, streaming services distribution activities grew faster than Platform revenue overall, due primarily to price increases for subscription-based services on our platform. We continue to focus on growing the share of subscriptions billed through Roku Pay, our payments and billing service that makes it easy for both our viewers and content partners to transact subscriptions. In the NBC Olympic Zone, viewers could use Roku Pay to subscribe to Peacock – an easy way to begin watching the games immediately. The NBC Olympic Zone helped to drive Peacock sign-ups, and a significant portion were first-time subscribers8.

Advertising

In Q3, the YoY growth of advertising activities across the Roku platform – excluding M&E (media & entertainment) – outperformed both the overall ad market and the OTT ad market in the U.S.9 The YoY growth of Political, Retail, and Consumer Packaged Goods ad verticals, among others, were up on the Roku platform, while the M&E and Health & Wellness ad verticals were pressured. Due to our many growth initiatives and focused efforts to diversify ad demand, M&E is a significantly smaller percentage of our overall Platform business now versus the last several years.

We continue to leverage the power of our Home Screen to grow monetization and diversify revenue across ad verticals. The NBC Olympic Zone, featured on our Home Screen, was sponsored by leading brands across a diverse

8 Users that had been exposed to the Zone and then signed-up for a subscription within 3 days of the exposure

9 3Q24 SMI data; OTT: over-the-top

| | |

| Roku Q3 2024 Shareholder Letter |

5

array of verticals including Retail, Transportation, Telecom, and Auto. In September, we partnered with the Television Academy to present The Emmys Collection, a dedicated destination for Emmy-nominated and winning titles. The collection was sponsored by a large specialty beauty retailer in the U.S. These viewer destinations drive engagement while broadening the sponsorship portfolio we offer to advertisers. As a result, ad spend on our Home Screen from non-M&E brands has grown in each of the last three quarters.

The Emmys Collection, a dedicated destination for nominated and winning titles

We continue to drive new sources of ad demand. In Q3, we expanded our ad offering to better serve small and medium-sized businesses (SMBs). Roku Ads Manager is our new, self-service CTV advertising solution, providing performance features like advanced targeting, conversion optimization and measurement, and even shoppable ad formats. This solution builds upon our growing list of ad offerings that provide advertisers more choices for how they buy Roku Media – whether it be through direct IO (insertion order), a preferred DSP (demand-side platform) partner, or now through self service. This allows us to serve a diverse array of advertisers, across verticals and business-sizes, from SMBs to enterprise companies.

We also continue to deepen our relationships with third-party platforms to better serve advertisers’ programmatic needs. We have partnered with The Trade Desk (TTD) so that TTD customers can leverage Roku Media and audience data programmatically, and we have integrated Unified ID 2.0, TTD’s identity solution. This represents our deepest integration to date with a third-party DSP, and we are beginning to see positive impacts. We’ll continue to do more integrations that expand our ability to serve the entire demand curve at multiple price points and in doing so, we expect to drive incremental revenue over time.

Key Performance Metric Update

Since our IPO in 2017, the streaming industry has evolved meaningfully, with Americans now spending significantly more TV time streaming than watching cable10. Our business has also grown and evolved, and we are now primarily focused on growing Platform revenue and profitability. As a result, we will be updating our Key Performance Metrics (KPMs) to better align with these priorities.

Beginning with our Q1 2025 earnings results, we will no longer report quarterly updates on Streaming Households and, by extension, ARPU. Our KPMs will be Streaming Hours, Platform revenue, Adjusted EBITDA, and Free Cash Flow, and we remain committed to growing all these metrics over time.

10 Nielsen The Gauge™, September 2024

| | |

| Roku Q3 2024 Shareholder Letter |

6

As noted earlier in this Letter, our various markets are in different stages of monetization and have different economics. While a large portion of our Streaming Household growth is in our international markets, the majority of our Platform revenue is currently generated in the U.S. Therefore, as we continue to grow internationally, Streaming Household growth is not representative of Platform revenue growth.

We expect to continue to grow Streaming Households in all our locations, including the U.S. We will provide updates on our scale as we achieve certain milestones, such as 100 million Streaming Households, which we expect to reach in the next 12-18 months.

Outlook

We are pleased with the execution of our monetization initiatives. We expect these initiatives, including the early positive impacts from our deeper integration with The Trade Desk, along with tailwinds from Political ad spend to continue in Q4. We estimate Q4 Total net revenue of $1.140 billion growing 16% YoY, with Platform revenue growing 14% YoY and Devices revenue growing 25% YoY. We estimate Q4 Total gross profit of $465 million and Adjusted EBITDA of $30 million. We expect Sales and Marketing to be more seasonal this year than in the prior year. As a result, we expect OpEx to be up 9% YoY in Q4. However, Sales and Marketing and total OpEX will be slightly down for the full year 2024, reflecting our ongoing operational discipline. Our expectations for both Q4 and 2024 OpEx YoY growth rates exclude one-time restructuring charges from 2023.

We remain confident in our ability to grow Platform revenue in 2025 and beyond as we grow ad demand, lean into our Home Screen as the lead-in for TV, and grow Roku-billed subscriptions.

Thank you for your support, and Happy Streaming™!

Anthony Wood, Founder and CEO, and Dan Jedda, CFO

Conference Call Webcast – Oct. 30, 2024, at 2 p.m. PT

The Company will host a webcast of its conference call to discuss the Q3 2024 results at 2 p.m. Pacific Time / 5 p.m. Eastern Time on Oct. 30, 2024. Participants may access the live webcast in listen-only mode on the Roku investor relations website at www.roku.com/investor. An archived webcast of the conference call will also be available at www.roku.com/investor after the call.

About Roku, Inc.

Roku pioneered streaming on TV. We connect users to the content they love, enable content publishers to build and monetize large audiences, and provide advertisers with unique capabilities to engage consumers. Roku TV™ models, Roku streaming players, and TV-related audio devices are available in various countries around the world through direct retail sales and/or licensing arrangements with TV OEM brands. Roku-branded TVs and Roku Smart Home products are sold exclusively in the United States. Roku also operates The Roku Channel, the home of free and premium entertainment with exclusive access to Roku Originals. The Roku Channel is available in the United States, Canada, Mexico, and the United Kingdom. Roku is headquartered in San Jose, Calif., U.S.A.

Roku, Roku TV, Happy Streaming, the Roku logo and other trade names, trademarks or service marks of Roku appearing in this shareholder letter are the property of Roku. Trade names, trademarks and service marks of other companies appearing in this shareholder letter are the property of their respective holders. This shareholder letter includes several citations to website addresses. The information on these websites is not incorporated by reference.

| | | | | |

Investor Relations Conrad Grodd cgrodd@roku.com | Media Jack Evans jackevans@roku.com |

| | |

| Roku Q3 2024 Shareholder Letter |

7

Use of Non-GAAP Measures

In addition to financial information prepared in accordance with generally accepted accounting principles in the United States (GAAP), this shareholder letter includes certain non-GAAP financial measures. These non-GAAP measures include Adjusted EBITDA and Free Cash Flow (FCF). In order for our investors to be better able to compare our current results with those of previous periods, we have included a reconciliation of GAAP to non-GAAP financial measures in the tables at the end of this letter. The Adjusted EBITDA reconciliation excludes other income (expense), net, stock-based compensation expense, depreciation and amortization, restructuring charges, and income tax (benefit)/expense from net income (loss), and the FCF reconciliation excludes purchases of property and equipment and effects of exchange rates on cash from the cash flows from operating activities, in each case where applicable. We believe these non-GAAP financial measures are useful as a supplement in evaluating our ongoing operational performance and enhancing an overall understanding of our past financial performance. However, these non-GAAP financial measures have limitations, and should not be considered in isolation or as a substitute for our GAAP financial information, such as GAAP net income (loss) and cash flows from operating activities. In addition, these non-GAAP financial measures may not be comparable to similarly titled metrics of other companies due to differences in methods of calculation.

Forward-Looking Statements

This shareholder letter contains “forward-looking” statements within the meaning of the federal securities laws. Statements contained herein that are not historical facts are considered forward-looking statements and can be identified by terms such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “may,” "plan,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Such forward-looking statements are based on our current beliefs, assumptions and information available to us and involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from any future results expressed or implied by the forward-looking statements. These statements include those related to the features, benefits and opportunities of the Roku Home Screen and UI; the growth of our scale and engagement and corresponding platform revenue growth; the breadth of our retail distribution; our international expansion; the benefits of the Roku Sports Zone; The Roku Channel’s growth and expanded entertainment offering; our ability to grow subscriptions billed through Roku Pay; diversifying the Home Screen beyond M&E; our expanding ad offering; our relationships with third-party advertising platforms; the growth of our ad revenue; our operational discipline; our execution of monetization initiatives; our use of KPMs; our financial outlook for the fourth quarter of 2024 and full year 2024; our additional qualitative color on our business for 2025 and beyond; and our overall business trajectory. Important risks and factors related to such statements are contained in the reports we have filed with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. Except as required by law, we assume no obligation to update these forward-looking statements as the result of new information, future events or otherwise.

| | |

| Roku Q3 2024 Shareholder Letter |

8

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Net Revenue: | | | | | | | |

| Platform | $ | 908,175 | | | $ | 786,785 | | | $ | 2,487,443 | | | $ | 2,165,238 | |

| Devices | 154,028 | | | 125,233 | | | 424,408 | | | 334,956 | |

| Total net revenue | 1,062,203 | | | 912,018 | | | 2,911,851 | | | 2,500,194 | |

| Cost of Revenue: | | | | | | | |

| Platform (1) | 416,396 | | | 408,554 | | | 1,161,416 | | | 1,057,151 | |

| Devices (1) | 165,732 | | | 134,641 | | | 457,369 | | | 358,352 | |

| Total cost of revenue | 582,128 | | | 543,195 | | | 1,618,785 | | | 1,415,503 | |

| Gross Profit (Loss): | | | | | | | |

| Platform | 491,779 | | | 378,231 | | | 1,326,027 | | | 1,108,087 | |

| Devices | (11,704) | | | (9,408) | | | (32,961) | | | (23,396) | |

| Total gross profit | 480,075 | | | 368,823 | | | 1,293,066 | | | 1,084,691 | |

| Operating Expenses: | | | | | | | |

| Research and development (1) | 178,798 | | | 282,201 | | | 534,738 | | | 694,673 | |

| Sales and marketing (1) | 237,047 | | | 307,694 | | | 660,827 | | | 768,805 | |

| General and administrative (1) | 99,993 | | | 128,717 | | | 276,543 | | | 309,422 | |

| Total operating expenses | 515,838 | | | 718,612 | | | 1,472,108 | | | 1,772,900 | |

| Loss from Operations | (35,763) | | | (349,789) | | | (179,042) | | | (688,209) | |

| Other income, net | 30,880 | | | 22,902 | | | 84,955 | | | 65,317 | |

| Loss Before Income Taxes | (4,883) | | | (326,887) | | | (94,087) | | | (622,892) | |

| Income tax expense (benefit) | 4,147 | | | 3,184 | | | (249) | | | 8,378 | |

| Net Loss | $ | (9,030) | | | $ | (330,071) | | | $ | (93,838) | | | $ | (631,270) | |

| | | | | | | |

| Net loss per share — basic and diluted | $ | (0.06) | | | $ | (2.33) | | | $ | (0.65) | | | $ | (4.47) | |

| | | | | | | |

| | | | | | | |

| Weighted-average common shares outstanding — basic and diluted | 144,862 | | | 141,877 | | | 144,319 | | | 141,087 | |

| | | | | | | |

(1) Stock-based compensation was allocated as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenue, platform | $ | 366 | | | $ | 368 | | | $ | 1,062 | | | $ | 1,056 | |

| Cost of revenue, devices | 163 | | | 810 | | | 1,201 | | | 2,426 | |

| Research and development | 38,502 | | | 37,314 | | | 109,457 | | | 110,801 | |

| Sales and marketing | 36,401 | | | 34,421 | | | 100,353 | | | 99,785 | |

| General and administrative | 24,664 | | | 18,392 | | | 71,051 | | | 63,288 | |

| Total stock-based compensation | $ | 100,096 | | | $ | 91,305 | | | $ | 283,124 | | | $ | 277,356 | |

| | |

| Roku Q3 2024 Shareholder Letter |

9

ROKU, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

(unaudited)

| | | | | | | | | | | |

| As of |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 2,126,974 | | | $ | 2,025,891 | |

| | | |

| Accounts receivable, net of allowances of $38,143 and $34,127 as of | 729,911 | | | 816,337 | |

| September 30, 2024 and December 31, 2023, respectively | | | |

| Inventories | 191,213 | | | 92,129 | |

| Prepaid expenses and other current assets | 138,332 | | | 138,585 | |

| Total current assets | 3,186,430 | | | 3,072,942 | |

| Property and equipment, net | 222,999 | | | 264,556 | |

| Operating lease right-of-use assets | 314,326 | | | 371,444 | |

| Content assets, net | 247,379 | | | 257,395 | |

| Intangible assets, net | 31,026 | | | 41,753 | |

| Goodwill | 161,519 | | | 161,519 | |

| Other non-current assets | 139,737 | | | 92,183 | |

| Total Assets | $ | 4,303,416 | | | $ | 4,261,792 | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 327,038 | | | $ | 385,330 | |

| Accrued liabilities | 820,165 | | | 788,040 | |

| Deferred revenue, current portion | 93,405 | | | 102,157 | |

| Total current liabilities | 1,240,608 | | | 1,275,527 | |

| Deferred revenue, non-current portion | 23,267 | | | 24,572 | |

| Operating lease liability, non-current portion | 535,378 | | | 586,174 | |

| Other long-term liabilities | 43,653 | | | 49,186 | |

| Total Liabilities | 1,842,906 | | | 1,935,459 | |

| Stockholders’ Equity: | | | |

| Common stock, $0.0001 par value | 15 | | | 14 | |

| Additional paid-in capital | 3,851,967 | | | 3,623,747 | |

| Accumulated other comprehensive income (loss) | (47) | | | 159 | |

| Accumulated deficit | (1,391,425) | | | (1,297,587) | |

| Total stockholders’ equity | 2,460,510 | | | 2,326,333 | |

| Total Liabilities and Stockholders’ Equity | $ | 4,303,416 | | | $ | 4,261,792 | |

| | |

| Roku Q3 2024 Shareholder Letter |

10

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| Cash flows from operating activities: | | | |

| Net Loss | $ | (93,838) | | | $ | (631,270) | |

| Adjustments to reconcile net loss to net cash from operating activities: | | | |

| Depreciation and amortization | 47,629 | | | 53,047 | |

| Stock-based compensation expense | 283,124 | | | 277,356 | |

| Amortization of right-of-use assets | 35,674 | | | 45,137 | |

| Amortization and write-off of content assets | 158,892 | | | 154,801 | |

| Foreign currency remeasurement losses | 674 | | | 3,469 | |

| Change in fair value of strategic investment in convertible promissory notes | (6,978) | | | (3,734) | |

| Impairment of assets | 29,118 | | | 235,165 | |

| Provision for doubtful accounts | 2,081 | | | 1,977 | |

| Other items, net | (2,224) | | | (872) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 83,828 | | | 38,416 | |

| Inventories | (99,084) | | | 1,373 | |

| Prepaid expenses and other current assets | (40,952) | | | 16,003 | |

| Content assets and liabilities, net | (141,345) | | | (191,481) | |

| Other non-current assets | (19,996) | | | 5,448 | |

| Accounts payable | (57,937) | | | 174,784 | |

| Accrued liabilities | 14,044 | | | 70,217 | |

| Operating lease liabilities | (45,766) | | | (14,301) | |

| Other long-term liabilities | 1,866 | | | (910) | |

| Deferred revenue | (10,057) | | | 4,904 | |

| Net cash provided by operating activities | 138,753 | | | 239,529 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (2,603) | | | (79,099) | |

| Purchase of strategic investments | (20,000) | | | (10,000) | |

| Net cash used in investing activities | (22,603) | | | (89,099) | |

| Cash flows from financing activities: | | | |

| Repayments of borrowings | — | | | (80,000) | |

| Issuance costs related to credit agreement | (1,829) | | | — | |

| Proceeds from equity issued under incentive plans | 8,981 | | | 14,699 | |

| Taxes paid related to net share settlement of equity awards | (63,884) | | | — | |

| Net cash used in financing activities | (56,732) | | | (65,301) | |

| Net increase in cash, cash equivalents and restricted cash | 59,418 | | | 85,129 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 2,774 | | | (2,964) | |

| Cash, cash equivalents and restricted cash —beginning of period | 2,066,604 | | | 1,961,956 | |

| Cash, cash equivalents and restricted cash —end of period | $ | 2,128,796 | | | $ | 2,044,121 | |

| | |

| Roku Q3 2024 Shareholder Letter |

11

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| Cash, cash equivalents and restricted cash at end of period: | | | |

| Cash and cash equivalents | $ | 2,126,974 | | | $ | 2,003,408 | |

| Restricted cash, current | 1,822 | | | 40,713 | |

| | | |

| Cash, cash equivalents and restricted cash —end of period | $ | 2,128,796 | | | $ | 2,044,121 | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 106 | | | $ | 886 | |

| Cash paid for income taxes | $ | 13,235 | | | $ | 5,027 | |

| Supplemental disclosures of non-cash investing and financing activities: | | | |

| Unpaid portion of property and equipment purchases | $ | 169 | | | $ | 1,129 | |

| | |

| Roku Q3 2024 Shareholder Letter |

12

NON-GAAP INFORMATION

(in thousands)

(unaudited)

Reconciliation of Net loss to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Net Loss | $ | (9,030) | | | $ | (330,071) | | | $ | (93,838) | | | $ | (631,270) | |

| Other income, net | (30,880) | | | (22,902) | | | (84,955) | | | (65,317) | |

| Stock-based compensation | 100,096 | | | 91,305 | | | 283,124 | | | 277,356 | |

| Depreciation and amortization | 15,349 | | | 18,866 | | | 47,629 | | | 53,047 | |

Restructuring charges (1) | 18,521 | | | 283,048 | | | 30,999 | | | 314,364 | |

| Income tax expense (benefit) | 4,147 | | | 3,184 | | | (249) | | | 8,378 | |

| Adjusted EBITDA | $ | 98,203 | | | $ | 43,430 | | | $ | 182,710 | | | $ | (43,442) | |

(1) Restructuring charges for the three months ended September 30, 2024 primarily include asset impairment charges of $17.6 million. Restructuring charges for the nine months ended September 30, 2024 primarily include asset impairment charges of $29.1 million.

Restructuring charges for the three months ended September 30, 2023 include severance and related charges of $50.4 million, asset impairment charges of $230.8 million, and facilities exit costs of $1.9 million. Restructuring charges for the nine months ended September 30, 2023 include severance and related charges of $75.7 million, asset impairment charges of $235.2 million, and facilities exit costs of $3.5 million.

Reconciliation of Cash flow from operations to Free Cash Flow (TTM):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 | | Q3 24 |

| Net cash provided by operating activities | $ | 246,882 | | | $ | 255,856 | | | $ | 455,951 | | | $ | 332,304 | | | $ | 155,080 | |

| Less: Purchases of property and equipment | (144,477) | | | (82,619) | | | (29,048) | | | (11,850) | | | (6,123) | |

| Add/(Less): Effect of exchange rate changes on cash, cash equivalents and restricted cash | (1,599) | | | 2,654 | | | (149) | | | (2,537) | | | 8,392 | |

| Free Cash Flow (TTM) | $ | 100,806 | | | $ | 175,891 | | | $ | 426,754 | | | $ | 317,917 | | | $ | 157,349 | |

Reconciliation of Gross Profit to Non-GAAP Gross Profit:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| September 30, 2024 | | September 30, 2023 | | Change $ | | Change % |

| Total gross profit | $ | 480,075 | | | $ | 368,823 | | | $ | 111,252 | | | 30 | % |

| Restructuring charges in Total gross profit | — | | | 65,966 | | | (65,966) | | | nm |

| Non-GAAP Total gross profit | $ | 480,075 | | | $ | 434,789 | | | $ | 45,286 | | | 10 | % |

| Non-GAAP Total gross margin % | 45.20 | % | | 47.67 | % | | | | |

| Non-GAAP Total gross margin % change YoY (in bps) | (250) | | | | | | | |

| | |

| Roku Q3 2024 Shareholder Letter |

13

Reconciliation of Platform Gross Profit to Non-GAAP Platform Gross Profit:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| September 30, 2024 | | September 30, 2023 | | Change $ | | Change % |

| Platform gross profit | $ | 491,779 | | | $ | 378,231 | | | $ | 113,548 | | | 30 | % |

| Restructuring charges in Cost of revenue, platform | — | | | 62,760 | | | (62,760) | | | nm |

| Non-GAAP Platform gross profit | $ | 491,779 | | | $ | 440,991 | | | $ | 50,788 | | | 12 | % |

| Non-GAAP Platform gross margin % | 54.15 | % | | 56.05 | % | | | | |

| Non-GAAP Platform gross margin % change YoY (in bps) | (190) | | | | | | | |

Reconciliation of Devices Gross Loss to Non-GAAP Devices Gross Loss:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| September 30, 2024 | | September 30, 2023 | | Change $ | | Change % |

| Devices gross loss | $ | (11,704) | | | $ | (9,408) | | | $ | (2,296) | | | (24) | % |

| Restructuring charges in Cost of revenue, devices | — | | | 3,206 | | | (3,206) | | | nm |

| Non-GAAP Devices gross loss | $ | (11,704) | | | $ | (6,202) | | | $ | (5,502) | | | (89) | % |

| Non-GAAP Devices gross margin % | (7.60) | % | | (4.95) | % | | | | |

| Non-GAAP Devices gross margin % change YoY (in bps) | (260) | | | | | | | |

| | |

| Roku Q3 2024 Shareholder Letter |

14