0001463000 ifrs-full:Level2OfFairValueHierarchyMember ifrs-full:FinancialAssetsAtAmortisedCostMember 2023-10-31

As submitted to the Securities and Exchange Commission on December 12, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Grown Rogue International Inc.

(Exact name of registrant as specified in its charter)

| Ontario, Canada | | 2833 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

550 Airport Road

Medford, Oregon 97504

(458) 226-2100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Copies to:

Vanessa Schoenthaler, Esq.

Adam Fayne, Esq. Saul Ewing LLP 1270 Avenue of the America, Suite 2800 New York, New York 10020 (212) 980-7208 | | Obie Strickler Chief Executive Officer Grown Rogue International Inc. 550 Airport Road Medford, Oregon 97504 (458) 226-2100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a an emerging growth company in Rule 405 of the Securities Act of 1933.

Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

(Subject to Completion)

Dated December 12, 2024

GROWN ROGUE INTERNATIONAL INC.

$50,000,000

Subordinate Voting Shares

Warrants

Subscription Rights

Debt Securities

Convertible Securities

Units

From time to time, Grown Rogue International Inc. (the “Company,” “Grown Rogue,” “we,” “us” or “our”) may offer and sell any combination of the securities described in this prospectus in one or more offerings for an aggregate offering price not to exceed $50,000,000.

We may offer and sell our securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis.

This prospectus describes some of the general terms that may apply to the securities that we may offer and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest.

Our subordinate voting shares trade on the OTC Markets and the Canadian Securities Exchange (the “CSE”) under the symbol “GRIN.” The last reported price of our subordinate voting shares on the OTCQB on December [●], 2024 was $[●], and the closing price of our subordinate voting shares on the CSE on December [●], 2024 was CAD$[●], which is equivalent to approximately $[●] at an exchange rate of CAD$[●] to $1.00.

We are an “emerging growth company” and a “foreign private issuer,” each as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11.

The date of this prospectus is December [●], 2024

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not making an offer to sell our securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any securities.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

We are incorporated in Ontario, Canada, under the Business Corporations Act (Ontario) (the “OBCA”) and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission (the “SEC”) we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Through and including , 2024 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus.

Use of Industry and Market Data

This prospectus includes market and industry data that we have obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this prospectus are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates only and there will usually be differences between the prospective and actual results, because events and circumstances frequently do not occur as expected, and those differences may be material. Also, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

This prospectus summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and the related notes thereto that are included elsewhere in this prospectus, before making an investment decision. Unless otherwise stated:

| ● | references to “we,” “us,” “our,” “Company” or “Grown Rogue” refer to Grown Rogue International, Inc., a corporation organized under the laws of the Province of Ontario, Canada, and our subsidiaries, taken together, unless the context requires otherwise; |

| ● | references to “Canopy” refer to our indirect wholly owned subsidiary Canopy Management, LLC, a Michigan limited liability company; |

| ● | references to “Federal CSA” refer to the United States Controlled Substances Act of 1970, as amended; |

| ● | references to “Golden Harvests” refer to our indirect majority owned subsidiary Golden Harvests, LLC, a Michigan limited liability company; |

| ● | references to “GR Distribution” refer to our indirect wholly owned subsidiary Grown Rogue Distribution, LLC, an Oregon limited liability company; |

| ● | references to “GR Gardens” refer to our indirect wholly owned subsidiary Grown Gardens, LLC, an Oregon limited liability company; |

| ● | references to “GR Michigan” refer to our indirect majority owned subsidiary GR Michigan, LLC, a Michigan limited liability company; |

| ● | references to “GR Michigan” refer to our indirect majority owned subsidiary GR Michigan, LLC, a Michigan limited liability company; |

| ● | references to “GR Retail” refer to our indirect wholly owned subsidiary Grown Rogue Retail Ventures, LLC, a Delaware limited liability company; |

| ● | references to “GR West NY” refer to our indirect minority owned subsidiary Grown Rogue West New York, LLC, a New Jersey limited liability company; |

| ● | references to “GRIP” refer to our indirect wholly owned subsidiary GRIP, LLC, an Oregon limited liability company; |

| ● | references to “GRUP” refer to our indirect wholly owned subsidiary GRU Properties, LLC, an Oregon limited liability company; |

| ● | references to “Rogue EBC” refer to our indirect majority owned subsidiary Rogue EBC, LLC, an Illinois limited liability company; |

| ● | references to “CAD$” refers to the Canada dollar; and |

| ● | references to “$,” “US$,” “U.S. dollars” or “USD” refers to the United States dollar. |

Except as otherwise noted, our functional currency is the Canadian dollar, and the functional currency of our subsidiaries is the U.S. dollar. Our consolidated financial statements are presented in U.S. dollars. We use U.S. dollars as the reporting currency in our consolidated financial statements and in this prospectus.

Overview

We are a multi-state cannabis company with a focus on cultivating and distributing high-quality cannabis products. Originally established as a Canadian corporation with roots in mining and energy, the company has undergone several transformations, ultimately transitioning into the cannabis industry through a strategic reverse takeover in 2018 (the “Transaction”). Grown Rogue now operates as a seed-to-retail company, with significant cultivation and processing facilities in Oregon, Michigan, and New Jersey, three states that have legalized both medical and recreational marijuana. The company is committed to producing premium cannabis flower and flower-based products, leveraging its strategic location in the renowned Emerald Triangle to offer low-cost, high-quality products to consumers. With an emphasis on best-in-class production methods and a strong market presence, Grown Rogue aims to position itself as a leader in the cannabis industry, particularly in the flower product category, which remains the most popular among consumers.

Oregon Operations

Grown Rogue, through its wholly owned subsidiary, Grown Rogue Gardens, LLC (“GR Gardens”), operates four cultivation facilities in Oregon, comprising approximately 95,000 square feet of flowering cultivation canopy, that currently service the Oregon recreational marijuana market: two outdoor sungrown farms called “Foothill” and “Ross Lane”, and two state-of-the-art indoor facilities (“Rossanley” and “Airport”). GR Gardens currently holds five producer licenses in Oregon from the Oregon Liquor Control Commission (“OLCC”), two wholesaler licenses, and two processor licenses.

During the year ended October 31, 2023, we executed a two-year lease which includes an option to purchase Ross Lane, an Oregon property which includes 35 acres, 3 tax lots and an additional OLCC producer license. Subsequent to the balance sheet date on January 12, 2024, the Company executed on this purchase option for total consideration of $1,525,000 comprised of a promissory note of $1,285,000 with the remaining consideration consisting of down payment and credit for prepaids rents.

Grown Rogue’s Oregon business is headquartered in the world-renowned Emerald Triangle, which is known world-wide for the quality of its cannabis. The Emerald Triangle includes the southern part of Oregon and northern part of California. The company capitalizes on this ideal outdoor growing environment to produce high-quality, low-cost cannabis flower. The two sungrown farms produce one crop per year per farm, which is planted in June and harvested in October.

GR Gardens is responsible for the production of recreational marijuana using outdoor and indoor production methodologies. Foothill and Ross Lane are outdoor farms with 40,000 square feet of flowering canopy each, for a total of 80,000 square feet, sitting on a combined land package of approximately 135 acres. Our “Trail’s End” outdoor property ceased production in 2023, and we transferred the Trail’s End license to Ross Lane for production in 2024 to streamline operational efficiencies by centralizing production facilities.

Rossanley, an approximately 17,000 square-foot indoor facility, with approximately 5,600 square feet of flowering bench space, produces high-quality indoor flower through controlled environment agriculture (“CEA”) operations. By carefully controlling temperature, humidity, carbon dioxide levels, and other criteria, we produce a year-round supply of high-quality cannabis flower with multiple harvests per month. Rossanley has eight dedicated flower rooms, which allows for an average of nearly four harvests per month resulting in approximately 4,000 pounds annually.

Airport, acquired in 2022, is a 30,000 square foot indoor growing facility adding 30,000 square feet of CEA indoor production space and 9,152 square feet of flowering bench space. Airport is a short distance from Rossanley, which is a benefit to operating efficiency, and it is equipped with state-of-the-art equipment which facilitates the implementation of best practices developed at Rossanley.

The total annual production capacity for Grown Rogue’s Oregon operations, based on the current constructed capacity, will range between 20,000 and 24,000 pounds, depending upon various factors including sungrown seasonality and strain performance.

Michigan Operations

We acquired a 60% controlling interest in Golden Harvests in May 2021. In May 2024, we acquired an additional 20% in Golden Harvests, taking our total ownership to 80%. Golden Harvests operates a single, 80,000 square feet facility that currently serves the Michigan recreational and medical market. Golden Harvests currently holds two medical Class C licenses and 4 recreational class C licenses, allowing for 3,000 and 8,000 plants, respectively.

The Golden Harvests facility is approximately 65% constructed, with approximately 50,000 square feet in operation, including approximately 14,550 square feet of flowering bench space, in addition to all the ancillary support space, including office and administration to support the operations The facility produces high quality indoor flower CEA, with fourteen individual flowering rooms in operation. Harvested pounds in Michigan in 2023 totaled approximately 10,000 pounds; while for the nine months ending September 30, 2024, harvested pounds totaled approximately 8,985 pounds. Golden Harvests produces bulk flower, packaged flower, and manufactures pre-rolls on site.

New Jersey Operations

In October 2023, the Company signed two purchase options along with a promissory note (the “First ABCO note”) with ABCO Garden State, LLC, (“ABCO”) a licensed operator in New Jersey. The purchase options allow for the Company to acquire: (1) up to 49% of the ownership interests in ABCO (the “First ABCO Option”); and (2) the remaining unacquired interest, totaling 70% of the ownership interests in ABCO (the “Second ABCO Option”). The initial promissory note totaled $4.0 million and is secured by all available assets of ABCO.

ABCO operates a 50,000 square foot indoor cultivation facility, which is currently approximately 60% built out. The first phase of operation will include approximately 9,000 square feet of flowering bench space, with a second phase of expansion to take the total flowering bench space to 15,000 square feet. Phase 1 is expected to generate approximately 1,000 pounds per month of harvested flower.

In May 2024, the Company executed the First ABCO Option, acquiring 44% of the outstanding ownership interests in ABCO for a total consideration of $1,257,142. The Second ABCO Option remains outstanding, allowing the Company to acquire the remaining 26% of the outstanding ownership of ABCO for a total consideration of $742,857.

In June 2024, the Company extended an additional $400,000 to ABCO in the form of a bridge note (the “ABCO Bridge Note”. The Bridge Note carries a one-year term and accrues interest at the rate of 18% per annum. The Company and ABCO also executed a promissory note with a face value of $3,000,000 (the “Second ABCO note”). The Second ABCO Note carries a one-year term with respect to each advance and accrues interest at the rate of 10.5% per annum. As of September 30, 2024, the outstanding balance under the Second ABCO Note was $2,500,000 and the accrued interest was $39,521.

In October 2024, the Company and ABCO executed a convertible promissory note with a face value of $1,050,000 (the “ABCO Convertible Note”). The ABCO Convertible Note carries a three-year term and is not prepayable without the Company’s permission. The ABCO Convertible Note accrues interest at the rate of 15% per annum. As of November 13, 2024, the Company has funded a total of $700,000 under the ABCO Convertible Note.

Consulting Services

On May 24, 2023, GR Unlimited entered into an independent contractor consulting agreement (the “Consulting Agreement”) with Vireo Growth Inc. (CSE: VREO; OTCQX: VREOF) (formerly Goodness Growth Holdings, Inc.) (“Vireo Growth”). Under the Consulting Agreement, GR Unlimited will support Vireo Growth in the optimization of its cannabis flower products, with a particular focus on improving the quality and yield of top-grade “A” cannabis flower across its various operating markets, starting with Maryland and Minnesota.

Under the initial term of the Consulting Agreement, which expires on June 30, 2025, Vireo Growth will provide compensation to GR Unlimited for sustained consulting support, including input on systems and processes, and recommendations to improve Vireo Growth’s cultivation operations. GR Unlimited will be entitled to receive additional incentive compensation if our services result in improved cash flow performance as compared to Vireo Growth’s baseline expectations over the term of the agreement. Our cooperation in the agreement will be on an exclusive basis to Vireo Growth within the markets in which Vireo Growth operates. The agreement will automatically extend for up to two additional two-year terms, unless terminated by Vireo Growth or the Company.

A termination fee of at least $5,000,000 is payable to GR Unlimited in the event that Vireo Growth is acquired, sells all or substantially all of its assets, or is merged into another entity and is not the surviving entity of such merger. In addition, a termination fee of at least $2,500,000 is payable to GR Unlimited in the event that the Consulting Agreement terminates for certain other conditions.

As part of this strategic agreement, Vireo Growth issued 10,000,000 warrants to purchase 10,000,000 subordinate voting shares of Vireo Growth to the Company, with a strike price equal to CAD$0.317 (U.S.$0.233), being a 25% premium to the 10-day volume weighted average price (“VWAP”) of Vireo Growth’s subordinate voting shares prior to the effective date of the Consulting Agreement. Similarly, the Company issued 8,500,000 warrants to purchase 8,500,000 subordinate voting shares of the Company to Vireo Growth, with a strike price equal to CAD$0.225 (U.S.$0.166), being a 25% premium to the 10-day VWAP of the Company’s subordinate voting shares prior to the effective date of the Consulting Agreement. These warrants were issued on October 5, 2023.

On October 11, 2024, Grown Rogue and Vireo Growth announced the termination of the Consulting Agreement effective immediately. As consideration for the early termination, Vireo Growth forfeited and returned for cancellation 4,500,000 of the 8,500,000 share purchase warrants in the Company, which were held by Vireo Growth at a CAD$0.225 strike price and paid the Company $800,000 in cash. The Company will also receive its full fee for the work performed in the third quarter of 2024 and retained its 10,000,000 warrants in Vireo Growth.

Product Offerings

Grown Rogue produces a range of cultivars for consumers to enjoy, which are traditionally classified as indicas, sativas, and hybrids. Grown Rogue has a mix of “core” and “limited” strains to provide consumers with consistent and unique purchasing options at their local dispensary. Grown Rogue flower has won multiple awards in Oregon, which is one of the most competitive cannabis production environments in the world, including the prestigious Growers Cup competition on two occasions. Grown Rogue won 1st place for highest THC content, 1st place for highest terpene content, and 3rd place in the grower’s choice category. In addition, we believe we achieved an outdoor production potency record, at the time, in the state of Oregon, when its Monkey Train cultivar tested at a THC potency of 35.13%. In 2023, Grown Rogue won 3rd place in the Oregon Grower’s Cup Outdoor category for its Sour Grape Strain. Consumers can enjoy bulk flower in both Oregon and Michigan. In the Michigan market we also offer our innovative nitrogen sealed 3.5 gram flower jars, our patented nitrogen sealed pre-rolls, 3.5 gram flower bags, and regularly packaged pre-rolls.

We recently launched a new line of strain-specific prepackaged flower, coupled with proprietary genetics, in Michigan, and launched a new branded pre-roll pack product in Oregon in 2023. In addition, the Company launched a new brand of pre-rolls, a rapidly growing category, called Yeti in 2023. According to LeafLink’s MarketScape data, Grown Rogue was the #1 flower producer in Oregon and a top 5 indoor flower wholesaler in Michigan in 2022 and in 2023.

Genetics and Research

We are committed to developing unique, proprietary genetics as long-term genetic diversity will be a major factor in establishing brand differentiation with consumers. We have allocated research and development space to develop new strains, while also phenotype hunting to identify new and exciting strain options that will resonate with consumers. Grown Rogue has developed a compelling mix of proprietary strains, along with a library of “fan favorites” to ensure that consumer and dispensary demand will remain strong for its flower and flower-derived products. All Grown Rogue genetics are rigorously tested to establish the genetic makeup of each strain in its portfolio. We continue to focus on bringing new unique genetics to bring a steady flow of innovative flower and flower products to market. Currently we carry more than 50 unique cultivars in our genetic library and are continually adding to the library as we trial new genetics.

Distribution and Sales Strategy

Grown Rogue uses a multi-channel distribution strategy that includes direct-to-retail delivery and third-party delivery (Michigan regulations mandate independent third-party delivery); wholesalers, who have their own distribution channels; and processors, who utilize Grown Rogue products (e.g., trim) to create retail-ready products.

Regarding the direct-to-retail channel, Grown Rogue’s sales team works closely with dispensary owners and intake managers to provide consistent product, competitive prices, and personalized service using sales techniques from other industries such as pharmaceutical and liquor. Grown Rogue’s goal is to establish and maintain the client relationship as we continue to expand our footprint in the states in which we operate.

Grown Rogue has developed end user product marketing collateral and other educational information regarding Grown Rogue products as part of all sales with dispensaries that include strain type, testing results, information on the product and other necessary information to clearly articulate the product being provided. Each product is uniquely packaged while maintaining brand consistency across the product suite.

Grown Rogue works with dispensary owners to develop promotional opportunities for the retail customers and bud tenders. Grown Rogue provides detailed tutorials to the staff and owners of the dispensaries around the product and how it is grown, processed, cured and packaged so that they are intimately familiar with the Grown Rogue process. Grown Rogue also invites dispensary owners and operators to Grown Rogue’s operating facilities so they can see first-hand the methods and processes used to create the product.

Based upon information from MarketScape, which is part of the sales analytics tool utilized by LeafLink, which handles all of our sales and invoicing, we are the largest producer in Oregon and a top five indoor flower producer in Michigan.

Branding Strategy

Developing compelling branding that engages, inspires, and creates transparency and trust with consumers is one of the most important aspects of building a successful cannabis company. Cannabis product branding has been evolving from promising high-quality flower, to providing descriptions of the effect a consumer should expect from a particular product.

While other brands have shifted into the “one word” product description, Grown Rogue has leveraged consumer insights and product feedback to evolve the messaging to provide significantly more detail so consumers can make a more informed choice about which Grown Rogue products will optimally enhance their experience.

In order to grow the Grown Rogue community and spread knowledge of its products, Grown Rogue leverages social media and other digital platforms. Grown Rouge aspires to eliminate the “dark mystery” historically associated with cannabis by empowering consumers to learn about the plant and then “enhance experiences” as they desire. The transition from prohibition to legal cannabis has provided the cannabis community with an opportunity to welcome a large group of new members and it is vital that product education is completed in an authentic and informative manner to ensure that everyone’s first cannabis experience is not only positive but also as expected.

Marketing and Advertising

Grown Rogue’s marketing channels include a comprehensive, fully responsive (mobile) interactive website. The website has been search-engine optimized (“SEO”) and includes calls to action that encourage consumers to become part of the Grown Rogue community by following the company on social media.

Grown Rogue is focused on providing education to new and existing consumers through Grown Rogue’s website but even more hands on through retail partners. We provide vendor and budtender education days where we spend one on one time with the budtenders educating them about everything Grown Rogue.

Grown Rogue strategically leverages the narrative at retail through digital and physical retail assets to further educate consumers about Grown Rogue.

Grown Rogue has established a social media presence that includes Facebook, Twitter, Instagram, LinkedIn, TikTok and YouTube. Grown Rogue’s social identity will be defined by delivering fresh content and keeping interaction with followers/fans prompt and positive. Grown Rogue intends to attract existing cannabis industry participants as well as people not familiar with the industry by creating a positive, inclusive environment where dialogue is encouraged. The goal is to change existing stereotypes and overcome the stigmas associated with the cannabis industry.

Licenses and Intellectual Property

Grown Rogue is dependent upon its ability (and the abilities of its subsidiaries) to obtain and maintain state and local licenses required to conduct its marijuana business in Oregon, California, and Michigan. Failure to obtain or maintain any such licenses would have a material adverse effect on the Company’s business.

Trademarks and Patents

Grown Rogue actively seeks to protect its brand and intellectual property. Grown Rogue currently has one registered U.S. trademark:

| ● | Grown Rogue – Registration No. 5537240 |

Grown Rogue filed a patent for its nitrogen sealed glass containers on February 15, 2018 with the United States Patent and Trademark Office (“USPTO”). The nitrogen sealed glass containers preserve the freshness of the flower and essential terpenes to improve the “entourage effect.” The USPTO issued Grown Rogue United States Patent Number 10,358,282 on July 23, 2019. Several third parties have contacted us to request licensing information on this technology. We have introduced nitrogen sealed jars and pre-rolls in Michigan and plan on launching them as we enter additional new markets and may license the technology to third parties operating in markets in which Grown Rogue is not currently licensed.

Social and Environmental Policies

Grown Rogue employs sustainable business models in all of its operations. In cultivation, Grown Rogue maintains the highest standards of environmental stewardship. This includes sustainable water sources with reclamation and recapture as much as possible from runoff and recycling of water input. Grown Rogue uses only natural and sustainable products in all applications, from nutrients to integrated pest management. Grown Rogue maintains the highest level of sustainable cannabis practices through its focus on sustainable and natural cultivation methods.

Grown Rogue hires and pays living wage to all of its team members and is very involved in each of the communities where it operates.

Plans for Expansion and Economic Outlook

Grown Rogue continues to focus on taking its learnings and experience from Oregon, Michigan and New Jersey into new markets across the US. During the last two years, Grown Rogue has established a platform that excels at licensing, compliance, high-quality and low-cost production, understanding consumer purchasing preferences, and product innovation. This platform places Grown Rogue in a superior position to capitalize on new markets compared to our competitors. Oregon is arguably the most competitive cannabis market in the world, and we have excelled by implementing standard business practices that make the Company well suited for entering and building successful brand presence in newly legalized cannabis markets.

The expansion into Airport and acquisition of an 80% interest in Golden Harvests represent execution of management’s strategy of growth through high quality, low-cost flower production. As other growth opportunities arise under favorable financial terms, management can activate known and repeatable systems into new assets.

We believe that the future of the cannabis industry is in branded products and that the leading brands are being developed on the west coast, which is well known for high quality cannabis. Unlike many current multi-state operators who prefer to obtain just a few licenses in a large volume of states, Grown Rogue is focused on establishing a larger number of licenses in fewer states to capitalize on the economies of scale we view as optimal to maximize profits. Over the next twelve months, Grown Rogue is focused on furthering our footprints and flower market shares in the Oregon and Michigan markets, scaling our burgeoning operation in New Jersey, continuing to add new products to our portfolio, and exploring and executing on strategic opportunities in new states.

With the recent shift in political landscape, Grown Rogue has also begun analyzing the potential for federal de-regulation and the subsequent ability to export cannabis products across state lines. We believe Oregon will be a large export state. Being located in the Emerald Triangle also provides a unique product differentiator due to the ability to produce high-quality, low-cost, sungrown flower due to the environmental conditions that occur naturally in Southern Oregon. Our strategy to take advantage of what is projected to be a multi-billion dollar export business is developing, and we are excited to begin implementation of this business plan over the coming years.

[Intentionally left blank.]

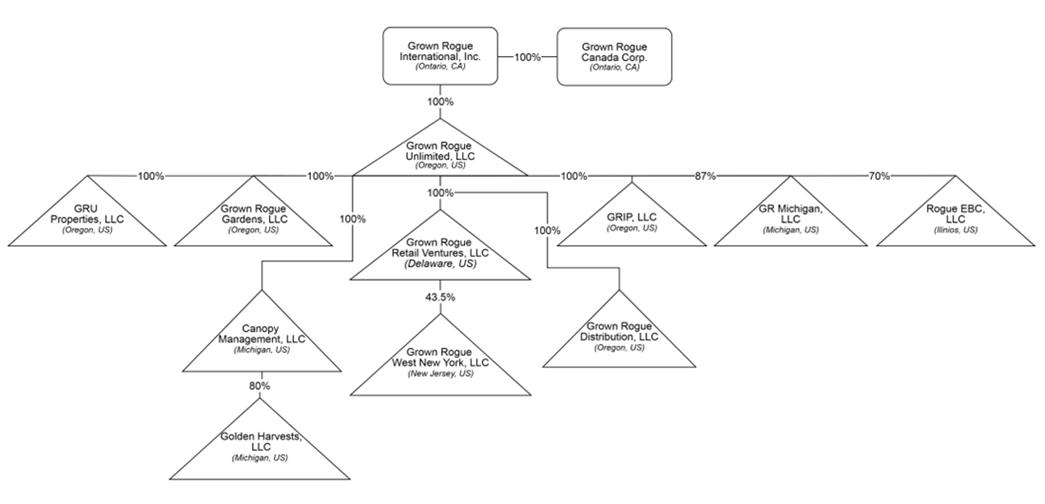

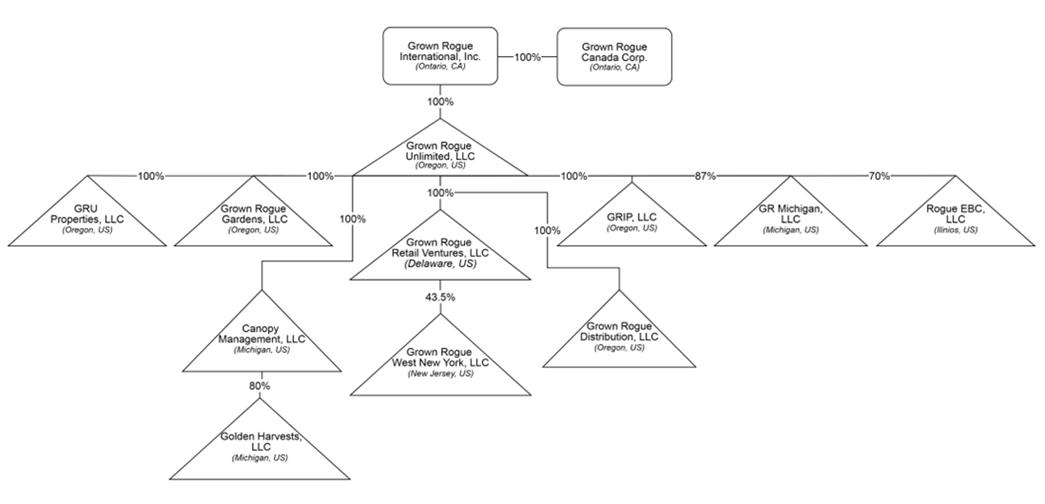

Organizational Structure

The following chart shows our current ownership structure:

Risks Related To Our Business and Industry

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our securities. These risks are discussed more fully in “Risk Factors” beginning on page 11. These risks include, but are not limited to, the following:

| ● | Our business is illegal under U.S. federal law |

| ● | We have a limited operating history and the challenges of a new business in a competitive industry may hinder our ability to achieve profitability. |

| ● | Compliance with other laws and regulations may be costly and could adversely affect our business |

| ● | Our operations are subject to various hazards and risks, and our insurance coverage may be inadequate to protect us from potential losses. |

| ● | Our participation in the marijuana industry may lead to litigation and enforcement actions that could adversely affect our financial condition and operations. |

| ● | Our success depends on obtaining and maintaining marijuana licenses, and failure to do so could have a material adverse effect on our business. |

| ● | We may manufacture and sell food and other products for human consumption, which may cause injury or illness, exposing us to product liability claims and regulatory actions. |

| ● | We are unable to deduct many normal business expenses. |

| ● | Our cannabis production and sales strategy is subject to numerous external factors, many of which are beyond our control. |

| ● | Our success depends on our ability to anticipate and respond to rapidly changing consumer preferences and industry trends. |

| ● | Our ability to manage rapid growth and implement effective controls may impact our success. |

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to publicly traded entities that are not emerging growth companies. These exemptions include:

| ● | the ability to include only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended; |

| ● | to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation; and |

| ● | an exemption from compliance with the requirement that the Public Company Accounting Oversight Board has adopted regarding a supplement to the auditor’s report providing additional information about the audit and the financial statements. |

As a result, the information contained in this prospectus may be different from the information you receive from other public companies in which you hold shares.

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards applicable to public companies. This provision allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. This transition period is only applicable under generally accepted accounting principles in the United States (“U.S. GAAP”). As a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required or permitted by the International Accounting Standards Board (“IASB”).

We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (2) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (3) the date on which we have, during the preceding three-year period, issued more than US$1.0 billion in non-convertible debt; or (4) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if we have been a public company for at least 12 months and the market value of our subordinate voting shares that are held by non-affiliates exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act as discussed above.

Foreign Private Issuer

We are a “foreign private issuer,” as defined by the under the Exchange Act. As a result, we are exempt from certain requirements imposed on U.S. domestic reporting companies. For example:

| ● | we are exempt from the requirement to file quarterly reports on Form 10-Q or provide current reports on Form 8-K disclosing significant events within four days of their occurrence, we also have four months following the end of each fiscal year to file our annual reports with the SEC; |

| ● | our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act; |

| ● | we are not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act, related to selective disclosures of material information; |

| ● | we are exempt from the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and |

| ● | we are not required to provide individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. |

These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to shareholders of U.S. domestic reporting companies. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. reporting company.

Corporate Information

Our principal executive office is located at 550 Airport Road, Medford, Oregon. Our telephone number is (458) 226-2100. Our registered office in Ontario, Canada is located at 40 King St W Suite 5800, Toronto, ON M5H 3S1, Canada.

Investors should submit any inquiries to the address and telephone number of our principal executive offices. Our principal website is located at www.grownrogue.com. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risks, and all of the other information contained in this prospectus, before deciding whether to invest in our securities. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment in our securities. Some statements in this prospectus, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Operations

Our business is illegal under U.S. federal law.

The Company, through its subsidiaries, engages in the medical and adult-use marijuana industry in the United States where local state law permits such activities. Producing, manufacturing, processing, possessing, distributing, selling, and using marijuana is a federal crime in the United States. The United States federal government regulates drugs through the Controlled Substances Act (the “Federal CSA”), which places controlled substances, including cannabis, on one of five schedules. Cannabis is currently classified as a Schedule I controlled substance, which is viewed as having a high potential for abuse and having no currently accepted medical use in treatment in the United States. No prescriptions may be written for Schedule I substances, and such substances are subject to production quotas imposed by the United States Drug Enforcement Administration (the “DEA”). Schedule I drugs are the most tightly restricted category of drugs under the Federal CSA. State and territorial laws that allow the use of medical cannabis or legalize cannabis for adult recreational use are in conflict with the Federal CSA, which makes cannabis use and possession illegal at the federal level. Because cannabis is a Schedule I controlled substance, the development of a legal cannabis industry under the laws of these states is in conflict with the Federal CSA, which makes cannabis use and possession illegal on a national level. Additionally, the Supremacy Clause of the United States Constitution establishes that the Constitution, federal laws made pursuant to the Constitution, and treaties made under the Constitution’s authority constitute the supreme law of the land. The Supremacy Clause provides that state courts are bound by the supreme law; in case of conflict between federal and state law, including Oregon, Michigan, and other state law legalizing certain cannabis uses, the federal law must be applied.

Until Congress amends the Federal CSA with respect to marijuana production, processing, distribution, and use, there is a risk that federal authorities may enforce current federal law against companies such as the Company for violation of federal law or they may seek to bring an action or actions against the Company and/or its investors for violation of federal law or otherwise, including, but not limited to, a claim against investors for aiding and abetting another’s criminal activities. The US federal aiding and abetting statute provides that anyone who commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal. Additionally, even if the U.S. federal government does not prove a violation of the Federal CSA, the U.S. federal government may seize, through civil asset forfeiture proceedings, certain assets such as equipment, real estate, moneys and proceeds, or your assets as an investor in the Company, if the U.S. federal government can prove a substantial connection between these assets or your investment and marijuana distribution or cultivation.

On the federal legislative side, a number of bills (some bi-partisan) have been introduced in Congress over the years in an attempt to address and perhaps reconcile the tension between state-legal cannabis programs and federal illegality, including the Strengthening the Tenth Amendment Through Entrusting States (STATES) Act, the Marijuana Opportunity Reinvestment and Expungement Act (MORE) Act, the Cannabis Administration and Opportunity (CAOA) Act, the Secure and Fair Enforcement (SAFE) Banking Act, the Preparing Regulators Effectively for a Post-Prohibition Adult-Use Regulated Environment (PREPARE) Act, and the Small Business Tax Equity (SBTE) Act. Congress has not passed any material marijuana reform legislation in decades.

There has, however, been activity with respect to cannabis from the administrative branch. In 2013, then United States Department of Justice Deputy Attorney General James M. Cole issued a memorandum (the “Cole Memorandum”) for all United States Attorneys providing updated guidance to federal prosecutors concerning marijuana enforcement under the Federal CSA. The Cole Memorandum applied to all Department of Justice federal enforcement activity, including civil enforcement, criminal investigations, and prosecutions concerning marijuana in all states. However, the Cole Memorandum was rescinded by Attorney General Jeff Sessions on January 4, 2018. Notably, the Biden administration has tacitly reverted to the guidance provided in the Cole Memorandum. Although current Attorney General Merrick Garland has not officially reinstated the Cole Memorandum, he advised in written testimony in early 2021 that he did not “think it the best use of the Department’s limited resources to pursue prosecutions of those who are complying with the laws in states that have legalized and are effectively regulating marijuana.” The Department of the Treasury adopted recommendations based on the standards set forth in the Cole Memorandum in its guidance (the “FinCen Guidance”) provided in 2014. Despite the repeal of the Cole Memorandum, the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) has confirmed that the FinCEN Guidance remains in effect and the Department of Treasury indicated it will remain in place.

On October 6, 2022, President Biden, among other things, asked the Secretary of Health and Human Services and the Attorney General to initiate the administrative process to review expeditiously how marijuana is scheduled under federal law. On or about August 29, 2023, Deputy Secretary of Health and Human Services (HHS) Rachel Levine transmitted a letter to the head of the Drug Enforcement Agency (DEA), Anne Milgram, recommending that cannabis and its derivatives be removed from Schedule I of the CSA. HHS’s recommendation is to reschedule cannabis to Schedule III. Schedule III substances are deemed to have medicinal value and have potential for abuse but less than substances in Schedules I or II, and abuse that may lead to moderate or low physical dependence or high psychological dependence. HHS’s recommendation remains pending and the Department of Justice (DOJ), specifically the DEA, is in the process of assessing it. If DOJ accepts the recommendation, it will then promulgate rules to effectuate the reschedule.

There is no guarantee that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned. Unless and until the United States amends the Federal CSA with respect to marijuana, there is a risk that federal authorities may enforce current federal law. If the federal government begins to enforce federal law, or if existing applicable state laws are repealed or curtailed, Grown Rogue’s business, results of operations, financial condition, and prospects would be materially adversely affected. There thus remains a risk that federal authorities may enforce current federal law against companies such as Grown Rogue for violation of federal law or they may seek to bring an action or actions against Grown Rogue and/or its investors for violation of federal law or otherwise, including, but not limited to, a claim against investors for aiding and abetting another’s criminal activities.

In light of the uncertainty surrounding the treatment of United States cannabis-related activities, including the rescission of the Cole Memorandum, the Canadian Securities Administrators published a Staff Notice 51-352 (Revised) – Issuers with U.S. Marijuana-Related Activities (“Staff Notice 51-352”) on February 8, 2018 setting out certain disclosure expectations for issuers with United States cannabis-related activities. Staff Notice 51-352 includes additional disclosure expectations that apply to all issuers with United States cannabis-related activities, including those with direct and indirect involvement in the cultivation and distribution of cannabis, as well as issuers that provide goods and services to third parties involved in the United States cannabis industry.

Certain Grown Rogue subsidiaries are directly engaged in the cultivation, manufacture, possession, sale, or distribution of cannabis in the recreational cannabis marketplace in the State of Oregon and in the medical and recreational marketplaces in the State of Michigan. Pending regulatory approval, certain Grown Rogue subsidiaries expect to be directly engaged in the cultivation, manufacture, possession, sale, or distribution of cannabis in the recreational cannabis marketplace in New Jersey and Illinois. In accordance with Staff Notice 51-352, Grown Rogue will evaluate, monitor and reassess this disclosure, and any related risks, on an ongoing basis and the same will be supplemented and amended to investors in public filings, including in the event of government policy changes or the introduction of new or amended guidance, laws, or regulations regarding marijuana regulation. Any non-compliance, citations or notices of violation which may have an impact on Grown Rogue’s licenses, business activities, or operations will be promptly disclosed by Grown Rogue.

Compliance with other laws and regulations may be costly and could adversely affect our business.

The industry in which GR Unlimited operates could require the Company and/or GR Unlimited to comply with a myriad of other federal, state and local laws and regulations, which could include, among others, laws and regulations relating to cannabis, personally identifiable information, wage and hour restrictions, health and safety matters, consumer protection and environmental matters. Compliance with such laws and regulations may be costly and a failure to comply with such laws and regulations could result in fines, penalties, litigation and other liability that could materially adversely affect the Company.

The Company’s business and products are and will continue to be regulated by the Oregon Liquor Control Commission (the “OLCC”), the Cannabis Regulatory Agency (the “CRA”) of Michigan, and other regulatory bodies as applicable laws continue to change and develop. Pending regulatory approval, Grown Rogue, through its subsidiaries, expects to participate in Illinois’s and New Jersey’s adult-use markets over the coming year. Regulatory compliance with the OLCC, CRA, and other regulatory bodies, and the process of obtaining regulatory approvals, can be costly and time-consuming. Further, the Company cannot predict what kind of regulatory requirements its business will be subject to in the future. Any delays in obtaining, or failure to obtain, regulatory approvals would significantly delay the development of markets and products and could have a material adverse effect on the Company.

Local, state and U.S. federal laws and enforcement policies concerning marijuana-related conduct are changing rapidly and will continue to do so for the foreseeable future. Changes in applicable law are unpredictable and could have a material adverse effect on the Company. Changes in applicable laws or regulations could significantly diminish the Company’s prospects. The Company has little or no control over potential changes to laws or regulations that may affect its business, including the business of GR Unlimited.

Additionally, governmental regulations affect taxes and levies, healthcare costs, energy usage and labor issues, all of which may have a direct or indirect effect on the Company’s business and its customers or suppliers. Changes in these laws or regulations, or the introduction of new laws or regulations, could increase the costs of doing business for the Company, or its customers or suppliers, or restrict the Company’s actions, causing the Company to be materially adversely affected.

We may manufacture and sell food and other products for human consumption, which may cause injury or illness, exposing us to product liability claims and regulatory actions.

The Company may manufacture and sell food and other products for human consumption which involves the risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, other agents, or residues introduced during the growing, storage, handling or transportation phases. Even though the Company intends to grow and sell products that are safe, it has potential product liability risk from the consuming public. The Company could be party to litigation based on consumer claims, product liability or otherwise that could result in significant liability for the Company and adversely affect its financial condition and operations. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that the Company’s products caused illness or injury could adversely affect its reputation with existing and potential customers and its corporate and brand image.

The U.S. Food and Drug Administration (the “FDA”) may now or in the future regulate the material content of the Company’s products pursuant to the Federal Food, Drug and Cosmetic Act and the Consumer Product Safety Commission (the “CPSC”), which regulates certain aspects of certain products intended for human consumption pursuant to various U.S. federal laws, including the Consumer Product Safety Act and the Poison Prevention Packaging Act. The FDA and the CPSC can require the manufacturer of defective products to repurchase or recall these products and may also impose fines or penalties on the manufacturer. Similar laws exist in some states, cities and other countries in which the Company sells or intends to sell its products. In addition, certain state laws restrict the sale of packaging with certain levels of heavy metals and impose fines and penalties for noncompliance. A recall of any of the Company’s products or any fines and penalties imposed in connection with noncompliance could have a materially adverse effect on its business.

Our operations are subject to various hazards and risks, and our insurance coverage may be inadequate to protect us from potential losses.

The Company will be affected by a number of operational risks and it may not be adequately insured for certain risks, including: labor disputes; catastrophic accidents; fires; blockades or other acts of social activism; changes in the regulatory environment; impact of non-compliance with laws and regulations; natural phenomena, such as inclement weather conditions, floods, earthquakes and ground movements. There is no assurance that the foregoing risks and hazards will not result in damage to, or destruction of, the Company’s properties, grow facilities and extraction facilities, personal injury or death, environmental damage, adverse impacts on the Company’s operations, potential legal liability, and adverse governmental action, any of which could have an adverse impact on the Company’s future cash flows, earnings and financial condition. Also, the Company may be subject to or affected by liability or sustain loss for certain risks and hazards against which the Company cannot insure or which it may elect not to insure because of the cost. This lack of insurance coverage could have a material adverse effect on the Company.

GR Unlimited has a limited operating history and the challenges of a new business in a competitive industry may hinder our ability to achieve profitability.

GR Unlimited has a limited operating history and had no record of prior performance as a separate enterprise prior to the reverse take-over of the Company by GR Unlimited. GR Unlimited faces the general risks associated with any new business operating in a competitive industry, including the ability to fund operations from unpredictable cash flow and capital-raising transactions. There can be no assurance that GR Unlimited or the Company will achieve its anticipated investment objectives or operate profitably. The Company’s business must be considered in light of the risks, expenses, and problems frequently encountered by companies in their early stages of development. Specifically, such risks may include, among others:

| ● | inability to fund operations from unpredictable cash flows; |

| ● | failure to anticipate and adapt to developing markets; |

| ● | inability to attract, retain and motivate qualified personnel; and |

| ● | failure to operate profitably in a competitive industry. |

There can be no assurance that the Company will be successful in addressing these risks. To the extent it is unsuccessful in addressing these risks, the Company may be materially and adversely affected. There can be no assurance that the Company will sustain profitability.

The Company will not be able to deduct many normal business expenses.

Under Section 280E of the U.S. Internal Revenue Code (the “IRC”), many normal business expenses incurred in the trafficking of marijuana are not deductible in calculating its U.S. federal income tax liability. A result of IRC Section 280E is that an otherwise profitable business may in fact operate at a loss, after taking into account its U.S. federal income tax expenses. Although the Company has accounted for IRC Section 280E in its financial projections and models, the application of IRC Section 280E may have a material adverse effect on the Company.

Our cannabis production and sales strategy is subject to numerous external factors, many of which are beyond our control.

The Company’s business strategy includes commercial scale production and sales of cannabis. The success of this strategy is subject to numerous external factors, such as the availability of suitable land packages, the Company’s ability to attract, train and retain qualified personnel, the ability to access capital, the ability to obtain required state and local permits and licenses, the prevailing laws and regulatory environment of each jurisdiction in which the Company may operate, which are subject to change at any time, the degree of competition within the industries and markets in which the Company operates and its effect on the Company’s ability to retain existing and attract new customers. Some of these factors are beyond the Company’s control.

Our ability to manage rapid growth and implement effective controls may impact our success.

The rapid execution necessary for the Company to successfully implement its business strategy requires an effective planning and management process. The Company will be required to continually improve its financial and management controls, reporting systems and procedures on a timely basis, and to expand, train and manage its personnel. There can be no assurance that the Company’s procedures or controls will be adequate to support operations. If the Company is unable to manage growth effectively, it could suffer a material adverse effect.

Our success depends on our ability to anticipate and respond to rapidly changing consumer preferences and industry trends.

The industry in which the Company operates could be subject to rapid changes, including, among others, changes in consumer requirements and preferences. There can be no assurance that the demand for any products or services offered by the Company will continue, or that the mix of the Company’s future product and service offerings will satisfy evolving consumer preferences. The success of the Company will be dependent upon its ability to develop, introduce and market products and services that respond to such changes in a timely fashion. Consumer preferences change from time to time and can be affected by a number of different and unexpected trends. The Company’s failure to anticipate, identify or react quickly to these changes and trends, and to introduce new and improved products on a timely basis, could result in reduced demand for the Company’s products, which in turn cause a material adverse impact to the Company.

Our reliance on information technology systems exposes us to potential disruptions that could adversely affect our business operations.

The Company relies on information technology systems. All of these systems are dependent upon computer and telecommunications equipment, software systems and Internet access. The temporary or permanent loss of any component of these systems through hardware failures, software errors, the vulnerability of the Internet, operating malfunctions or otherwise could interrupt the Company’s business operations and materially adversely affect the Company.

Our inability to register marijuana trademarks under federal law may limit our intellectual property protection and adversely affect our business.

Because producing, manufacturing, processing, possessing, distributing, selling, and using marijuana is a crime under the Federal CSA, the U.S. Patent and Trademark Office will not permit the registration of any trademark that identifies marijuana products. As a result, the Company likely will be unable to protect the marijuana product trademarks beyond the geographic areas in which the Company conducts business. The use of GR Unlimited trademarks by one or more other persons could have a material adverse effect on the Company.

Even if the Company obtains federal, state or international trademark or copyright registrations for any products or services it develops, such registrations may not provide adequate protection. The Company may also rely on federal, state and international trade secret, trademark and copyright laws, as well as contractual obligations with employees and third parties, to protect intellectual property. Such laws and contracts may not provide adequate protection. Despite the efforts to protect its intellectual property, unauthorized parties may attempt to copy aspects of the Company’s products or services, or obtain and use information that the Company regards as proprietary. The Company’s efforts to protect its intellectual property from third-party discovery and infringement may be insufficient and third parties may independently develop products or services similar to the Company or duplicate their products or services. In addition, third parties may assert that the Company’s products or services infringe their intellectual property.

Our marijuana growing operations’ significant energy consumption makes us vulnerable to rising energy costs that could adversely impact our profitability.

The Company’s marijuana growing operations consume considerable energy, making the Company vulnerable to rising energy costs. Rising or volatile energy costs may adversely impact the business of the Company and its ability to operate profitably. Increased energy costs would result in higher transportation, freight and other operating costs, including increases in the cost of ingredients and supplies. The Company’s future operating expenses and margins could be dependent on its ability to manage the impact of such cost increases. If energy costs increase, there is no guarantee that such costs can be fully passed along to consumers through increased prices.

The agricultural nature of our cannabis cultivation exposes us to inherent risks that could adversely affect our production and results of operations.

Since the Company’s business revolves mainly around the cultivation of cannabis, an agricultural product, the risks inherent with agricultural businesses will apply. Such risks may include plant and other diseases, insect pests, adverse weather (including but not limited to drought, high winds, earthquakes and/or wildfire) and growing conditions, and new government regulations regarding farming and the marketing of agricultural products, among others. There is a risk that these and other natural elements will have a material adverse effect on the production of the Company’s products, which in turn could have a material adverse effect on its results of operations.

Our business premises are targets for theft, and breaches in security could have a material adverse impact on our operations and financial condition.

The business premises of GR Unlimited are a target for theft. While the Company has implemented security measures and continues to monitor and improve its security measures, its cultivation and processing facilities could be subject to break-ins, robberies and other breaches in security. If there was a breach in security and the Company fell victim to a robbery or theft, the loss of cash, cannabis plants, cannabis oils, cannabis flowers and cultivation and processing equipment could have a material adverse impact on the business, financial condition and results of operation of the Company.

Our participation in the marijuana industry may lead to litigation and enforcement actions that could adversely affect our financial condition and operations.

The Company’s participation in the marijuana industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities. Litigation, complaints, and enforcement actions could consume considerable amounts of financial and other corporate resources, which could have an adverse effect on the Company’s future cash flows, earnings, results of operations and financial condition.

Our success depends on obtaining and maintaining marijuana licenses, and failure to do so could have a material adverse effect on our business.

The Company’s success depends on its ability to obtain and maintain marijuana licenses from state and local authorities including the OLCC and CRA. If the Company fails to obtain or maintain one or more marijuana production licenses from the OLCC, CRA, or other applicable state or local government authorities, its business will be limited to Oregon’s medical marijuana market only, which may not be a viable long-term business model. The Company’s failure to obtain and maintain a marijuana license from the OLCC, CRA, or other applicable state or local governmental authorities will have a material adverse effect on the Company and possibly require it to cease operations.

Our customer base is limited to state-licensed marijuana businesses within Oregon and Michigan, and price volatility in these markets could adversely affect our business.

The customers of the Company’s cannabis production business will be limited to other state-licensed marijuana businesses that the Company operates in, which currently includes Oregon and Michigan. The Company currently may not sell its products to any business or person located outside Oregon and Michigan. Generally, the Company will not be able to sell any of its products outside of the state of production. Consequently, the Company’s customer base is limited to the jurisdictions it operates in for any cannabis based products, which currently includes Oregon and Michigan. The retail and wholesale prices in Oregon and Michigan have demonstrated significant volatility over time. Price declines, if sustained, will have a material adverse effect on the Company.

Local government restrictions and zoning laws could limit or ban our cannabis operations, adversely affecting our business.

Although legal under Oregon and Michigan state law, local governments have the ability to limit, restrict, and ban medical or recreational cannabis businesses from operating within their jurisdiction. Land use, zoning, local ordinances, and similar laws could also be adopted or changed, and have a material adverse effect on the Company.

Federal prohibition under the CSA may render our contracts unenforceable and expose our property to seizure.

As the U.S. Federal CSA currently prohibits the production, processing and use of marijuana, contracts with third parties (suppliers, vendors, landlords, etc.) pertaining to the production, processing, or selling of marijuana-related products, including any leases for real property, may be unenforceable. In addition, if the U.S. federal government begins strict enforcement of the Federal CSA, any property (personal or real) used in connection with a marijuana-related business may be seized by and forfeited to the federal government. In this case, the Company’s inability to enforce contracts or any loss of business property (whether the Company’s or its vendors’) will have a material adverse effect on the Company.

Third party service providers to the Company may withdraw or suspend their service.

Because under U.S. federal law the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia is illegal, and any such acts are criminal acts under federal law, companies that provide goods and/or services to companies engaged in cannabis-related activities may, under threat of federal civil and/or criminal prosecution, suspend or withdraw their services. Any suspension of service and inability to procure goods or services from an alternative source, even on a temporary basis, that causes interruptions in the Company’s operations could have a material adverse effect on the Company.

The Company’s business is highly regulated and it may not be issued necessary licenses, permits, and cards.

The Company’s business and products are and will continue to be regulated as applicable laws continue to change and develop. Regulatory compliance and the process of obtaining regulatory approvals can be costly and time-consuming. Even if the Company obtains one or more licenses from the OLCC, CRA, or other applicable state or local governmental authorities, no assurance can be given that it will receive all of the other licenses and permits that will be required to operate. Further the Company cannot predict what kind of regulatory requirements its business will be subject to in the future.

The marijuana industry faces significant opposition in the United States. It is believed by many that large well-funded businesses may have strong economic opposition to the marijuana industry. The pharmaceutical industry is well funded with a strong and experienced lobby that eclipses the funding of the medical marijuana industry. Any inroads the pharmaceutical industry could make in halting or impeding the development of the marijuana industry could have a material adverse effect on the Company.

The size of the target market is difficult to quantify. Because the cannabis industry is in an early stage with uncertain boundaries, there is a lack of information about comparable companies, and few, if any, established companies whose business model the Company can follow or upon whose success the Company can build. Accordingly, there can be no assurance that the Company’s estimates are accurate or that the market size is sufficiently large for its business to grow as projected, which may negatively impact its financial results.

The Company has numerous competitors. Its marijuana production business is not, by itself, unique. The Company has numerous competitors throughout Oregon, Michigan, and other states utilizing a substantially similar business model. Excessive competition may impact sales and may cause the Company to reduce prices. Any material reduction in prices could have a material adverse effect on the Company. We are operating in a highly competitive industry where we may compete with numerous other companies in the marijuana industry, who may have far greater resources, more experience, and personnel perhaps more qualified than we do. There can be no assurance that we will be able to successfully compete against these other entities. To remain competitive, we will require a continued high level of investment in research and development, marketing, sales and client support. We may not have sufficient resources to maintain research and development, marketing, sales and client support efforts on a competitive basis which could materially and adversely affect our business, financial condition and results of operations.

The Company may not be able to obtain or maintain a bank account. Because producing, manufacturing, processing, possessing, distributing, selling, and using marijuana is a crime under the Federal CSA, most banks and other financial institutions are unwilling to provide banking services to marijuana businesses due to concerns about criminal liability under the Federal CSA as well as concerns related to federal money laundering rules under the U.S. Bank Secrecy Act. In February 2014, the Financial Crimes Enforcement Network (“FinCEN”) bureau of the U.S. Treasury Department issued guidance (which is not law) with respect to financial institutions providing banking services to cannabis business, including burdensome due diligence expectations and reporting requirements. This guidance does not provide any safe harbors or legal defenses from examination or regulatory or criminal enforcement actions by the DOJ, FinCEN or other federal regulators. Thus, most banks and other financial institutions do not appear to be comfortable providing banking services to cannabis-related businesses, or relying on this guidance, which can be amended or revoked at any time. In addition to the foregoing, banks may refuse to process debit card payments and credit card companies generally refuse to process credit card payments for cannabis-related businesses. As a result, many cannabis businesses still operate on an all-cash basis. Operating on an all-cash or predominantly-cash basis makes it difficult for the Company to manage its business, pay its employees and pay its taxes, and may create serious safety issues for the Company, its employees and its service providers. Although the Company currently has several bank accounts, its inability to maintain those bank accounts, or obtain and maintain other bank accounts, could have a material adverse effect on the Company.

The protections of U.S. bankruptcy law may be unavailable. As discussed above, the use of marijuana is illegal under U.S. federal law. Therefore, it may be argued that the federal bankruptcy courts cannot provide relief for parties who engage in marijuana or marijuana-related businesses. Recent bankruptcy court rulings have denied bankruptcies for dispensaries upon the justification that businesses cannot violate federal law and then claim the benefits of federal bankruptcy for the same activity. In addition, some courts have reasoned that courts cannot ask a bankruptcy trustee to take possession of and distribute marijuana assets as such action would violate the Federal CSA. Therefore, the Company may not be able to seek the protection of the bankruptcy courts for the equal protection of creditors or debtor-in-possession financing or obtain credit from federal-charted financial institutions.