- SAVEQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Spirit Airlines (SAVEQ) DEF 14ADefinitive proxy

Filed: 25 Apr 24, 4:35pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 240.14a-12 | |

☒ | No fee required. | |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

SPIRIT AIRLINES, INC.

2800 Executive Way

Miramar, Florida 33025

Notice of Annual Meeting of Stockholders |

To the Stockholders of Spirit Airlines, Inc.:

Notice Is Hereby Given that the Annual Meeting of Stockholders (“Annual Meeting”) of Spirit Airlines, Inc., a Delaware corporation (the “Company”), will be held virtually, via live webcast at www.virtualshareholdermeeting.com/SAVE2024, on June 7, 2024, at 9:00 a.m. Eastern Time, for the following purposes:

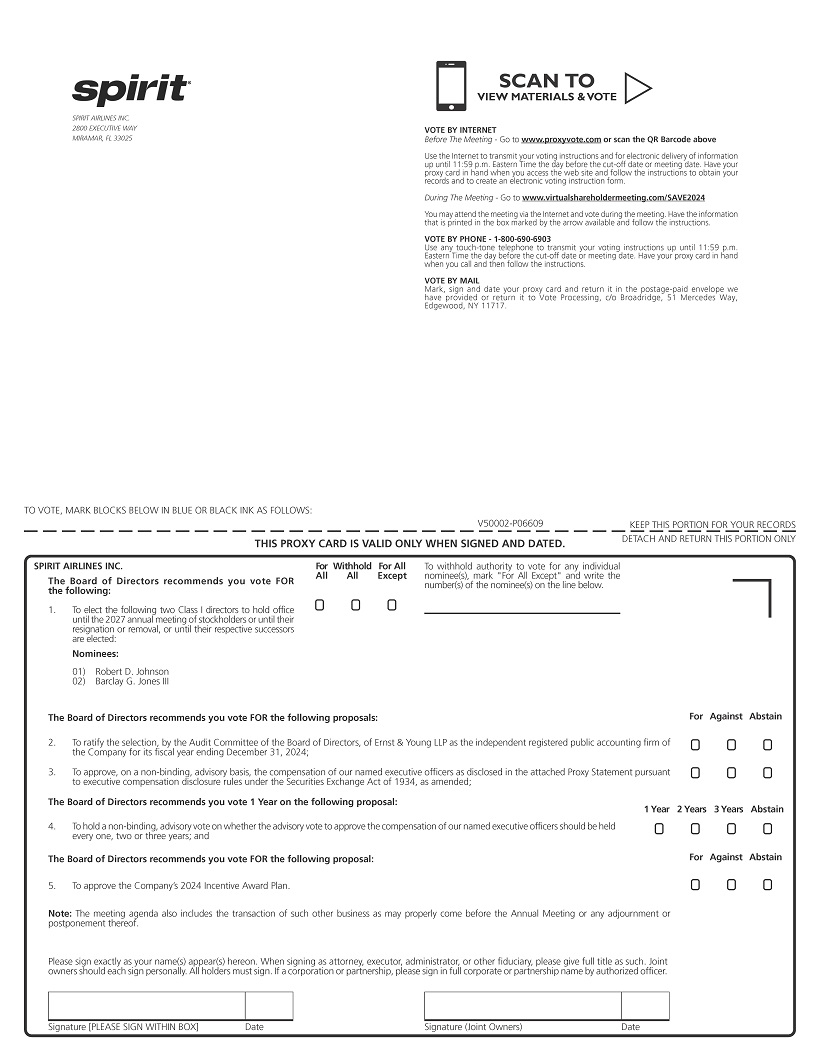

| 1. | To elect the following two Class I directors to hold office until the 2027 annual meeting of stockholders or until their resignation or removal, or until their respective successors are elected: Robert D. Johnson and Barclay G. Jones III; |

| 2. | To ratify the selection, by the Audit Committee of the Board of Directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2024; |

| 3. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the attached Proxy Statement pursuant to executive compensation disclosure rules under the Securities Exchange Act of 1934, as amended; |

| 4. | To hold a non-binding, advisory vote on whether the advisory vote to approve the compensation of our named executive officers should be held every one, two or three years; |

| 5. | To approve the Company’s 2024 Incentive Award Plan; and |

| 6. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

For our Annual Meeting, we have elected to use the internet (the “Internet”) as our primary means of providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and Annual Report on Form 10-K, and for participating and voting via the Internet. The Notice of Internet Availability of Proxy Materials will also provide: (i) information on how stockholders may request, via a toll-free number, an e-mail address or a website, paper copies of our proxy materials (including a proxy card) free of charge; (ii) the date, time and online location of the Annual Meeting; and (iii) the matters to be acted upon at the meeting and the recommendation of the Board of Directors with regard to each matter. The electronic delivery of our proxy materials will significantly reduce our printing and mailing costs and the environmental impact of the proxy materials.

Record Date

Only stockholders who owned our common stock at the close of business on April 12, 2024 (the “Record Date”) can vote at the Annual Meeting or any adjournments or postponements thereof.

Virtual Meeting

Our Annual Meeting will be held virtually, via live webcast at www.virtualshareholdermeeting.com/SAVE2024, on June 7, 2024, at 9:00 a.m. Eastern Time. To attend and participate, stockholders as of Record Date will need a 16-digit control number, which can be found in the Notice of Internet Availability of Proxy Materials. The online format of our Annual Meeting will allow stockholders to submit questions in advance of the meeting via www.proxyvote.com or during the meeting via www.virtualshareholdermeeting.com/SAVE2024.

You are cordially invited to attend our virtual Annual Meeting, but whether or not you expect to attend (via the Internet), you are urged to read our Proxy Statement and to vote and submit your proxy by following the voting procedures described in the Notice of Internet Availability of Proxy Materials or on the proxy card.

By Order of the Board of Directors

/s/ Thomas Canfield

Thomas Canfield

Secretary

Miramar, Florida

April 25, 2024

| Spirit Airlines | 2024 Proxy Statement |

SPIRIT AIRLINES, INC.

2800 Executive Way

Miramar, Florida 33025

Proxy Statement |

For the Annual Meeting of Stockholders |

The Board of Directors of Spirit Airlines, Inc. is soliciting your proxy to vote at the Annual Meeting of Stockholders to be held virtually, via live webcast at www.virtualshareholdermeeting.com/SAVE2024, on June 7, 2024, at 9:00 a.m. Eastern Time, and any adjournment or postponement of that meeting.

In this Proxy Statement, we refer to Spirit Airlines, Inc. as the “Company,” “Spirit,” “we,” “us” or “our” and the Board of Directors as the “Board.” When we refer to Spirit’s fiscal year, we mean the twelve-month period ending December 31 of the stated year. Agreements, plans and other documents referenced to in this Proxy Statement are to be qualified in their entirety by reference to the actual full text of such agreements, plans and other documents.

Notice and Access

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Accordingly, on or about April 25, 2024, we are making the proxy materials, including this Proxy Statement and Annual Report on Form 10-K, available on the Internet and mailing a Notice of Internet Availability of Proxy Materials to stockholders of record as of April 12, 2024 (the “Record Date”). Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All stockholders as of the Record Date will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically, including an option to request paper copies on an ongoing basis, may be found also in the Notice of Internet Availability of Proxy Materials and on the website referred to in the notice. We intend to mail this Proxy Statement, together with the accompanying proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials within three business days of request.

Quorum

The only voting securities of Spirit Airlines, Inc. are shares of common stock, par value $0.0001 per share (the “common stock”), of which there were 109,501,395 shares outstanding as of the Record Date (excluding any treasury shares). We need the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote, present in person or represented by proxy, to hold the Annual Meeting.

Board Voting Recommendations

Our Board of Directors recommends that you vote “FOR” the election of the director nominees named in Proposal No. 1 of the Proxy Statement, “FOR” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm as described in Proposal No. 2 of the Proxy Statement, “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers as described in Proposal No. 3 of the Proxy Statement, for the approval, on a non-binding, advisory basis, of a frequency of every “ONE YEAR” for future advisory votes to approve the compensation of our named executive officers as described in Proposal No. 4 of the Proxy Statement, and “FOR” the approval of the Company’s 2024 Incentive Award Plan as described in Proposal No. 5 of the Proxy Statement.

Virtual Stockholder Meeting

The online format of our Annual Meeting is intended to enhance stockholder access and participation. As stated in the Notice of Annual Meeting of Stockholders, our stockholders as of Record Date will be allowed to communicate with us and ask questions during the meeting. This will increase our ability to engage and communicate effectively with all stockholders, regardless of size, resources or physical location, and will ensure that our stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting.

Other Material

The Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (“SEC”), is available in the “Financials & Filings” section of our website at http://ir.spirit.com. Additionally, if you received a Notice of Internet Availability of Proxy Materials by U.S. or electronic mail, you will not receive a paper copy of the proxy materials unless you request one. If you would like to receive a paper copy of our proxy materials free of charge, please follow the instructions in the Notice.

| Spirit Airlines | 2024 Proxy Statement |

Table of Contents |

| Spirit Airlines | 2024 Proxy Statement |

The Proxy Process and Stockholder Voting |

Questions and Answers About This Proxy Material and Voting |

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 12, 2024 will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 109,501,395 shares of common stock issued and outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on April 12, 2024, your shares were registered directly in your name with the transfer agent for our common stock, Equiniti Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend (via the Internet) the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on April 12, 2024, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend (via the Internet) the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy card from your broker or other agent.

What am I being asked to vote on?

You are being asked to vote “FOR”:

| • | the election of the following two Class I directors to hold office until our 2027 annual meeting of stockholders: Robert D. Johnson and Barclay G. Jones III; |

| • | the ratification of the selection, by the Audit Committee of the Board, of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| • | the approval, on a non-binding, advisory basis, of the compensation of our named executive officers; and |

| • | the approval of our 2024 Incentive Award Plan. |

You are also being asked to vote for ONE YEAR, on a non-binding, advisory basis, as the frequency of future advisory votes to approve the compensation of our named executive officers.

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

How do I vote?

You may vote by mail or follow any alternative voting procedure described on the proxy card or the Notice of Internet Availability of Proxy Materials. To use an alternative voting procedure, follow the instructions on each proxy card that you receive or on the Notice of Internet Availability of Proxy Materials.

For the election of directors, you may either vote “FOR” each of the two nominees or you may withhold your vote for any nominee you specify. For the ratification of the selection of the Company’s independent auditors, the non-binding, advisory vote to approve the compensation of our named executive officers and the approval of our 2024 Incentive Award Plan you may vote “FOR” or “AGAINST” or abstain from voting.

For the non-binding, advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officer, you may vote for “ONE YEAR,” “TWO YEARS,” or “THREE YEARS” or abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Annual Meeting. Alternatively, you may vote by proxy over the Internet or, if you properly request and receive a proxy card by mail or email, by signing, dating and returning the proxy card, over the Internet or by telephone. Whether or not you plan to attend (via the Internet) the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote via the Internet. In such case, your previously submitted proxy will be disregarded.

| • | To vote by proxy over the Internet, follow the instructions provided in the Notice of Internet Availability of Proxy Materials or on the proxy card. |

| • | To vote by telephone, if you properly requested and received a proxy card by mail or email, you may vote by proxy by calling the toll-free number found on the proxy card. |

| • | To vote by mail, if you properly requested and received a proxy card by mail or email, complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply

| Spirit Airlines | 2024 Proxy Statement | 1 |

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING (continued) |

complete and mail the voting instruction card to ensure that your vote is counted. To vote (via the Internet) at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

Who counts the votes?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to tabulate stockholder votes. If you are a stockholder of record, and you choose to vote over the Internet or by telephone, Broadridge will access and tabulate your vote electronically. If you choose to sign and mail your proxy card, your executed proxy card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker (or its agent for tabulating votes of shares held in street name, as applicable) returns one proxy card to Broadridge on behalf of all its clients.

How are votes counted?

With respect to Proposal No. 1, the election of directors, the two nominees receiving the highest number of votes will be elected. With respect to Proposal Nos. 2, 3, 4, and 5, the affirmative vote of the holders of a majority in voting power of the shares of common stock which are present in person or by proxy and entitled to vote on each proposal is required for approval. With respect to Proposal No. 4, the frequency of the advisory vote to approve named executive officer compensation, if none of the frequency alternatives (one year, two years or three years) receives a majority vote, the Company will consider the alternative receiving the greatest number of votes - every year, every two years or every three years - to be the frequency that stockholders approve. However, because this vote is advisory and not binding on us or the Board in any way, the Board may decide that it is in our and our stockholders’ best interests to hold an advisory vote to approve named executive officer compensation more or less frequently than the option approved by our stockholders.

Brokers who hold shares in street name for the accounts of their clients may vote such shares either as directed by their clients or, in the absence of such direction, in their own discretion if permitted by the stock exchange or other organization of which they are members. If your shares are held by a broker on your behalf, and you do not instruct the broker as to how to vote these shares on Proposal No. 2, the broker may exercise its discretion to vote for or against that proposal in the absence of your instruction. With respect to Proposal Nos. 1, 3, 4 and 5, the broker may not exercise discretion to vote on those proposals. This would be a “broker non-vote” and these shares will not be counted as having been voted on the applicable proposal. However, broker non-votes will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present. Please instruct your bank or broker so your vote can be counted.

If stockholders abstain from voting, these shares will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present. Abstentions will have no effect with regard to Proposal Nos. 1 and 4, and with regard to Proposal Nos. 2, 3 and 5 will have the same effect as an “AGAINST” vote.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 12, 2024.

How do I vote via Internet or telephone?

You may vote by proxy by following the instructions provided in the Notice of Internet Availability of Proxy Materials or on the proxy card. If you properly request and receive printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card. Please be aware that if you vote over the Internet or by telephone, you may incur costs such as telephone and Internet access charges, as applicable, for which you will be responsible. The Internet and telephone voting facilities for eligible stockholders of record will close at 11:59 p.m. Eastern Time on June 6, 2024. The giving of such a telephonic or Internet proxy will not affect your right to vote should you decide to attend (via the Internet) the Annual Meeting.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

What if I return a proxy card but do not make specific choices?

If we receive a signed and dated proxy card and the proxy card does not specify how your shares are to be voted, your shares will be voted “FOR” the election of each of the two nominees for director, “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, for the approval, on a non-binding, advisory basis, of a frequency of every “ONE YEAR” for future advisory votes to approve the compensation of our named executive officers and “FOR” the approval of our 2024 Incentive Award Plan. If any other matter is properly presented at the Annual Meeting, your proxy (i.e., one of the individuals named on your proxy card) will vote your shares using their best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, and Notice of Internet Availability of Proxy Materials, as applicable, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must follow the instructions for voting on each Notice of Internet Availability of

| 2 |  | Spirit Airlines | 2024 Proxy Statement |

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING (continued) |

Proxy Materials or the proxy card that you receive by mail or email pursuant to your request, which include instructions for voting over the Internet, by telephone or by signing, dating and returning any of such proxy cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| • | You may submit another properly completed proxy over the Internet, by telephone or by mail with a later date. |

| • | You may send a written notice that you are revoking your proxy to our Secretary at (i) 2800 Executive Way, Miramar, Florida 33025 prior to April 29, 2024, or (ii) 1731 Radiant Drive, Dania Beach, Florida 33004 on or after April 29, 2024. |

| • | You may attend (via the Internet) the Annual Meeting and vote online. Simply attending (via the Internet) the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in the proxy materials for next year’s annual meeting, your proposal must be submitted in writing by December 26, 2024, to our Secretary at (i) 2800 Executive Way, Miramar, Florida 33025 prior to April 29, 2024, or (ii) 1731 Radiant Drive, Dania Beach, Florida 33004 on or after April 29, 2024; provided that if the date of that annual meeting is more than thirty (30) days from the first anniversary of the Annual Meeting, the deadline will be a reasonable time before we begin to print and send our proxy materials for next year’s annual meeting. If you wish to submit a proposal that is not to be included in the proxy materials for next year’s annual meeting pursuant to the SEC’s shareholder proposal procedures or to nominate a director, you must do so between February 7, 2025 and March 9, 2025; provided that if the date of that annual meeting is earlier than May 8, 2025 or later than August 6, 2025 you must give notice not earlier than the 120th day prior to the annual meeting date and not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our Amended and Restated Bylaws (“Bylaws”), which contain additional requirements about advance notice of stockholder proposals and director nominations.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, if you intend to solicit proxies in support of director nominees other than the Company’s nominees, you must provide notice that sets forth the information required by Rule 14a-19(b) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such notice must be postmarked or transmitted electronically to our Secretary at (i) 2800 Executive Way, Miramar, Florida 33025 prior to April 29, 2024, or (ii) 1731 Radiant Drive, Dania Beach, Florida 33004 on or after April 29, 2024, no later than February 24, 2025, provided that if the date of that annual meeting is earlier than May 8, 2025 or later than July 7, 2025 you must give notice no later than the 60th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were 109,501,395 shares outstanding and entitled to vote. Accordingly, not less than 54,750,699 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present via the Internet or represented by proxy, may adjourn the Annual Meeting to another time or place.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

| Spirit Airlines | 2024 Proxy Statement | 3 |

Proposal No. 1: Election of Directors |

The Board is currently comprised of eight members. In accordance with our Amended and Restated Certificate of Incorporation, the Board is divided into three classes with staggered three-year terms. At each annual general meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election or until his or her successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Our directors are divided among the three classes as follows:

| • | Class I directors: Robert D. Johnson, Barclay G. Jones III and Dawn M. Zier, whose terms will expire at the Annual Meeting; |

| • | Class II directors: H. McIntyre Gardner and Myrna M. Soto, whose terms will expire at the annual meeting of the stockholders to be held in 2025; and |

| • | Class III directors: Edward M. Christie III, Mark B. Dunkerley and Christine P. Richards, whose terms will expire at the annual meeting of the stockholders to be held in 2026. |

Any additional directorships resulting from an increase in the number of directors would be distributed among the three classes so that, as nearly as possible, each class would consist of one-third of the directors.

The division of the Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Robert D. Johnson and Barclay G. Jones III, have been nominated, and have consented to being named in this Proxy Statement and to serve as Class I directors upon their election at the Annual Meeting. Dawn M. Zier, a Class I director, has informed the Company that she does not intend to stand for re-election, and accordingly her term will end at the conclusion of the Annual Meeting. The Board has resolved to reduce the size of the Board from eight to seven members, effective as of the conclusion of the Annual Meeting. Each director to be elected will hold office until the third subsequent annual meeting of stockholders or until their successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Directors are elected by a plurality of the votes cast at the meeting. Pursuant to the Company’s corporate governance guidelines, any director nominee who receives a greater number of votes withheld from their election than votes for such election must submit their resignation for consideration by the Nominating and Corporate Governance Committee. The Board will then act after considering the Nominating and Corporate Governance Committee’s recommendation.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR

THE ELECTION OF EACH NAMED NOMINEE.

| 4 |  | Spirit Airlines | 2024 Proxy Statement |

PROPOSAL NO. 1: ELECTION OF DIRECTORS (continued) |

The following table sets forth, for the Class I directors standing for election at the Annual Meeting and our other current directors, information with respect to their ages and position/office held with the Company:

Name | Age | Position/Office Held With the Company | ||||

Class I Directors for election at the 2024 Annual Meeting of Stockholders | ||||||

Robert D. Johnson (1) (4) | 76 | Director, Chair of the Audit Committee | ||||

Barclay G. Jones III (2) (3) | 63 | Director, Chair of the Compensation Committee | ||||

Class II Directors whose terms expire at the 2025 Annual Meeting of Stockholders | ||||||

H. McIntyre Gardner (1) | 62 | Director, Chairman of the Board | ||||

Myrna M. Soto (2) (4) | 55 | Director | ||||

Class III Directors whose terms expire at the 2026 Annual Meeting of Stockholders | ||||||

Edward M. Christie III | 53 | President, Chief Executive Officer and Director | ||||

Mark B. Dunkerley (1) (4) | 60 | Director, Chair of the Safety, Security and Operations Committee | ||||

Christine P. Richards (2) (3) | 69 | Director | ||||

| (1) | Member of the Audit Committee of the Board |

| (2) | Member of the Compensation Committee of the Board |

| (3) | Member of the Nominating and Corporate Governance Committee of the Board |

| (4) | Member of the Safety, Security and Operations Committee of the Board |

Board Composition Highlights*

Size

| Diversity

| Independence

| ||||||||||||||

7

| Directors

| 2

| Female

| 6 | Independent

| |||||||||||

1

| Hispanic

| |||||||||||||||

Board Refreshment

| Age Distribution

| |||||||

2 | New Directors over

| 62 | Average Age of our Directors Age Range: 53 -76

| |||||

Average Tenure

|

| * | Dawn M. Zier, a current Class I director, has informed the Company that she does not intend to stand for re-election, and accordingly her term will end at the conclusion of the Annual Meeting. The Board has resolved to reduce the size of the Board from eight to seven members, effective as of the conclusion of the Annual Meeting. Assuming no other changes in the Board, and the election of the nominated Class I candidates, following the Annual Meeting the Board will consist of seven members, six of whom are independent, and the average age and tenure of the Board will be 62 years and 10 years, respectively. |

| Spirit Airlines | 2024 Proxy Statement | 5 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS (continued) |

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

2024 Nominees for Election to a Three-Year Term Expiring at the 2027 Annual Meeting of Stockholders

Robert D. Johnson has been a member of the Board since July 2010. Mr. Johnson retired in 2008 as Chief Executive Officer of Dubai Aerospace Enterprise (DAE), a global aerospace engineering and services company. In 2005, prior to DAE, Mr. Johnson was Chairman of Honeywell Aerospace, a leading global supplier of aircraft engines, equipment, systems and services, where he also served prior to 2005 as President and Chief Executive Officer. Prior to Honeywell Aerospace, Mr. Johnson held management positions at various aviation and aerospace companies. He served on the board of directors of Ariba, Inc., a publicly traded software company, from 2005 to 2012, and currently serves on the board of directors of Spirit Aerosystems, a publicly traded aerospace components company that is not affiliated with Spirit Airlines, Roper Industries, Inc., a publicly traded diversified industrial company, and Elbit Systems of America, LLC, a U.S.-based wholly owned subsidiary, with no registered securities, of Elbit Systems Ltd., a leading global source of innovative, technology based systems for diverse defense and commercial applications. The Board has concluded that Mr. Johnson should continue to serve on

the Board and on the Audit and Safety, Security and Operations Committees because of his experience in the aviation and aerospace industries, his financial expertise and his general business knowledge.

Barclay G. Jones III has been a member of the Board since 2006. Since March 2022, Mr. Jones has been a Managing Director at the Carlyle Group Inc., a multinational private equity, alternative asset management and financial services corporation. Prior to the Carlyle Group, from March 2000 to March 2022, Mr. Jones served as the Executive Vice President of Investments for iStar Financial Inc., a publicly traded finance company focused on the commercial real estate industry. Prior to iStar, Mr. Jones was at W.P. Carey & Co., an investment management company, where he served in a variety of capacities, including Vice Chairman and Chief Acquisitions Officer. The Board has concluded that Mr. Jones should continue to serve on the Board and on the Compensation and Nominating and Corporate Governance Committees based on his financial expertise and his general business experience.

Directors Continuing in Office Until the 2025 Annual Meeting of Stockholders

H. McIntyre Gardner has been a member of the Board since July 2010 and Chairman of the Board since August 2013. Mr. Gardner retired in 2008 from Merrill Lynch & Co., Inc. as the Head of Americas Region and Global Bank Group, Global

Private Client. Prior to joining Merrill Lynch in July 2000, Mr. Gardner was the President and Chief Operating Officer of Helen of Troy Limited, a personal care products manufacturer. From February 2017 to September 2019, he served on the board of Blucora, Inc., a publicly traded technology-enabled financial solutions company. The Board has concluded that Mr. Gardner should continue to serve on the Board as Chairman and on the Audit Committee, based on his financial and business expertise and extensive corporate finance experience.

Myrna M. Soto has been a member of the Board since March 2016. Since June 2021, Ms. Soto serves as Founder & CEO of Apogee Executive Advisors, a boutique advisory firm focused on technology risk, cybersecurity, technology integrations and capital investments. She is also a Senior Investment Advisor to several Private Equity firms. She formerly served as Chief Strategy and Trust Officer of Forcepoint, a subsidiary of Raytheon Technologies which provided cybersecurity technology services. From March 2019 to May 2020, she served as Chief Operating Officer of Digital

Hands, a managed security services provider. Since April 2018, Ms. Soto was a partner at ForgePoint Capital, a venture capital firm concentrating on cyber security-related companies, and since March 2019, an investment advisor at the same firm. Prior to that, from August 2015 to March 2018, Ms. Soto served as Senior Vice President, Global, and Chief Information Security Officer of Comcast Corporation (“Comcast”), a worldwide media and technology company. From September 2009 to August 2015, she served as Comcast’s Senior Vice President and Chief Infrastructure and Information Security Officer. Prior to these roles, from 2005 until 2009, Ms. Soto served as Vice President of Information Technology Governance and Chief Information Security Officer of MGM Resorts International, a global hospitality company. She has been a director of CMS Energy Corporation, a publicly traded energy company, and its principal subsidiary, Consumers Energy Corporation, since January 2015, a director of Popular, Inc., a financial services conglomerate, since July 2018 and a director of TriNet, a professional employer organization since May of 2021. The Board has concluded that Ms. Soto should continue to serve on the Board and on the Compensation and Safety, Security and Operations Committees based on her experience in information technology and security matters, leadership expertise and general business experience.

Directors Continuing in Office Until the 2026 Annual Meeting of Stockholders

Edward M. Christie, III has been a member of the Board since January 2018 and has served as our President and Chief Executive Officer since January 2019. Prior to that, Mr. Christie served as our President from October 2018 to December 2018, and as our President and Chief Financial Officer from January 2018 to October

2018. From January 2017 to December 2017, he served as our Executive Vice President and Chief Financial Officer. From April 2012 to December 2016, Mr. Christie served as our Senior Vice President and Chief Financial Officer. Prior to joining Spirit, Mr. Christie served as Vice President and Chief Financial Officer of

| 6 |  | Spirit Airlines | 2024 Proxy Statement |

PROPOSAL NO. 1: ELECTION OF DIRECTORS (continued) |

Pinnacle Airlines Corp. from July 2011 to March 2012. Prior to that, Mr. Christie was a partner in the management consulting firm of Vista Strategic Group LLC from May 2010 to July 2011. Mr. Christie served in various positions from 2002 to 2010 at Frontier Airlines, including as Chief Financial Officer from June 2008 to January 2010, as Senior Vice President, Finance from February 2008 to June 2008, as Vice President, Finance from May 2007 to February 2008, and before that in several positions, including Corporate Financial Administrator, Director of Corporate Financial Planning, and Senior Director of Corporate Financial Planning and Treasury. Since November 2023, Mr. Christie has served on the board of directors of Encompass Health Corporation. The Board has concluded that Mr. Christie should continue to serve on the Board based on his business skills, leadership experience in the airline industry, financial expertise, general business knowledge and due to his position as President and CEO.

Christine P. Richards has been a member of the Board since September 2019. Ms. Richards served as Executive Vice President, General Counsel and Secretary of FedEx from 2005 until her retirement in September 2017. Prior to that, as part of a 33-year career at FedEx, she had responsibility in diverse areas including strategic transactions, fleet and supply chain, customer support and government and regulatory matters. Before joining FedEx, Ms. Richards was in private law practice. She serves on several non-profit boards including the Tennessee State Collaborative on Reforming Education. She is a Commissioner on the Tennessee Public Charter School Commission and serves on the Shelby County Tennessee Retirement Board. She also serves in a

compensated position as a Director of the West Tennessee Megasite Authority which oversees the regional site of the Ford Motor Company Blue Oval City plant in Lauderdale and Fayette Counties in West Tennessee. The Board has concluded that Ms. Richards should continue to serve on the Board and on the Compensation and Nominating and Corporate Governance Committees based on her experience in the aviation industry, her legal and governance expertise and her general business knowledge.

Mark B. Dunkerley has been a member of the Board since September 2019. From 2002 to February 2018, Mr. Dunkerley served as President and Chief Executive Officer of Hawaiian Holdings, Inc., the parent company of Hawaiian Airlines. Prior to Hawaiian, he was Chief Operating Officer at Sabena Airlines Group, the parent company of Sabena, a former airline in Europe, and Executive Vice President at the Washington-based aviation consultancy, Roberts Roach & Associates. Prior to that, Mr. Dunkerley was President and Chief Operating Officer of Worldwide Flight Services, a leading multinational ground handling business and held various senior positions over 10 years at British Airways PLC. Since April 16, 2020, Mr. Dunkerley serves on the board of directors of Airbus SE. He also serves on the board of directors of Volotea Airlines, a low-cost carrier operating in Europe. The Board has concluded that Mr. Dunkerley should continue to serve on the Board and on the Audit and Safety, Security and Operations Committees based on his leadership expertise, knowledge of the aviation industry, experience in operational matters, and general business experience.

Executive Officers

The following is biographical information for our current executive officers, other than Mr. Christie who is addressed above.

Name | Age | Position(s) | ||||

Scott M. Haralson | 51 | Executive Vice President and Chief Financial Officer | ||||

John Bendoraitis | 60 | Executive Vice President and Chief Operating Officer | ||||

Matthew H. Klein | 50 | Executive Vice President and Chief Commercial Officer | ||||

Thomas C. Canfield | 68 | Senior Vice President, General Counsel and Secretary | ||||

Melinda C. Grindle | 50 | Senior Vice President and Chief Human Resources Officer | ||||

Rocky B. Wiggins | 65 | Senior Vice President and Chief Information Officer | ||||

Brian J. McMenamy | 65 | Vice President and Controller | ||||

K. Blake Vanier | 42 | Vice President, Financial Planning and Analysis | ||||

Scott M. Haralson has served as our Executive Vice President and Chief Financial Officer since February 1, 2023. He served as our Senior Vice President and Chief Financial Officer from October 2018 to January 31, 2023. He served as our Vice President, Financial Planning and Analysis and Corporate Real Estate from August 2017 to October 2018 and, prior to that, as our Vice President, Financial Planning and Analysis since August 2012. From January 2010 to August 2012, Mr. Haralson served as the Director of Finance for Dish Network and from January 2009 to January 2010, as the Director of Financial Planning and Analysis for Frontier Airlines. He also served as Chief Financial Officer at Guardian Gaming from March 2008 to January 2009 and at Swift Aviation from July 2006 to March 2008.

From August 2000 to July 2006, Mr. Haralson served in various financial management positions at America West and US Airways.

John Bendoraitis has served as our Executive Vice President and Chief Operating Officer since December 2017. From October 2013 to December 2017, he served as our Senior Vice President and Chief Operating Officer. Prior to joining Spirit, Mr. Bendoraitis served as Chief Operating Officer of Frontier Airlines from March 2012 to October 2013. Previously, from 2008 to 2012, he served as President of Comair Airlines. From 2006 to 2008, he served as President of Compass Airlines, where he was responsible for the certification and launch of the airline. Mr. Bendoraitis began his

| Spirit Airlines | 2024 Proxy Statement | 7 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS (continued) |

aviation career in 1984 at Northwest Airlines, where over a 22-year span he worked his way up from aircraft technician to vice president of base maintenance operations.

Matthew H. Klein has served as our Executive Vice President and Chief Commercial Officer since December 2019. From August 2016 to December 2019, he served as our Senior Vice President and Chief Commercial Officer. Prior to that, Mr. Klein served as the Chief Commercial Officer at lastminute.com from December 2013 to December 2015 and as Vice President, Global Airline Relations at Travelocity, an online travel agency, from October 2012 to November 2013. From September 2011 to September 2012 and from January 2016 to July 2016, he worked in various consulting capacities in the travel industry. Mr. Klein also served in various pricing, revenue management, forecasting and distribution planning positions at AirTran Airways from September 1999 to September 2011, and in various other roles in domestic pricing at US Airways from 1995 to 1999. Mr. Klein served on the board of the Airlines Reporting Corporation, an air travel intelligence and commerce company, from September 2010 to September 2011.

Thomas C. Canfield has served as our Senior Vice President, General Counsel and Secretary since October 2007. From September 2006 to October 2007, Mr. Canfield served as General Counsel & Secretary of Point Blank Solutions, Inc., a manufacturer of antiballistic body armor. Prior to Point Blank, from 2004 to 2007, he served as CEO and Plan Administrator of AT&T Latin America Corp., a public company formerly known as FirstCom Corporation, which developed high-speed fiber networks in 17 Latin American cities. Mr. Canfield also served as General Counsel & Secretary at AT&T Latin America Corp from 1999 to 2004. Previously, Mr. Canfield was Counsel in the New York office of Debevoise & Plimpton LLP. Mr. Canfield serves on the board and on the audit and nominating and corporate governance committees of Iridium Communications Inc., a satellite communications company.

Melinda C. Grindle has served as our Senior Vice President and Chief Human Resources Officer since January 2022. Ms. Grindle joined Spirit after 17 years of service with UnitedHealth Group, a multinational healthcare and insurance company, where she held various roles of progressive responsibility in Human Capital, with

the last three years serving as the Chief Talent Officer of Optum, a health services and innovation company that is part of UnitedHealth Group.

Rocky B. Wiggins has served as our Senior Vice President and Chief Information Officer since September 2016. Prior to joining Spirit, from June 2014 to September 2016, Mr. Wiggins served as Executive Vice President and Chief Information Officer at WestJet Airlines. From September 2011 to May 2014, he served as Chief Information Officer at Sun Country Airlines and from September 2000 to July 2011 as Chief Information Officer of AirTran Airways. Prior to that, he served in various information technology leadership positions at US Airways for almost 20 years.

Brian J. McMenamy has served as our Vice President and Controller since November 2017. Mr. McMenamy served in various positions from 1984 to 2017 at American Airlines, including as Vice President of Finance from April 2014 to October 2017 and as Vice President, FP&A and Controller from April 2006 to March 2014. He also served as Senior Vice President of Finance and Chief Financial Officer of TWA Airlines, a then subsidiary of AMR Corporation (parent company of American Airlines), from March 2001 to September 2001 and as Vice President of Financial Planning and Analysis of Canadian Airlines, a then affiliate of AMR Corporation, from March 1998 to March 2000. Mr. McMenamy has previously served in private-industry Board positions with ARC Corporation and Texas Aero Engine Services from 2006 to 2013 and 2007 to 2011, respectively.

K. Blake Vanier has served as our Vice President, Financial Planning and Analysis since March 2020. Mr. Vanier served in various positions from June 2012 to March 2020 at Domino’s, including as Vice President of Global Financial Planning and Analysis from December 2018 to March 2020 and as Director of Global Financial Planning and Analysis from September 2016 to December 2018. From 2010 to 2012, he served as a Finance Manager at GTB, a global advertising agency. Prior to that, Mr. Vanier held various roles of increasing responsibility in Corporate Finance, Financial Planning and Analysis, as well as Investor Relations, at U.S Airways (now American Airlines) and JetBlue Airways.

| 8 |  | Spirit Airlines | 2024 Proxy Statement |

Board of Directors, Committees and Corporate Governance |

Independence of the Board of Directors

As required under the NYSE Listed Company Manual, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the NYSE, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firm, the Board has affirmatively determined that, with the exception of Mr. Christie, all the members of the Board are independent directors, in each case within the meaning of the applicable NYSE listing standards. Mr. Christie currently serves as the Company’s President and Chief Executive Officer.

As required under the NYSE rules, our independent directors meet regularly in executive sessions at which only independent directors are present. Mr. Gardner, Chairman of the Board, presides at all of these executive sessions.

There are no family relationships among any of our directors or executive officers.

Board Responsibilities; Risk Oversight

Under our bylaws and corporate governance guidelines, the Board is responsible for, among other things, overseeing the conduct of our business; reviewing and, where appropriate, approving our major financial objectives, plans and actions; and reviewing the performance of our CEO and other members of management based on, among other things, reports from the Compensation Committee. Following the end of each year, the Nominating and Corporate Governance Committee oversees the Board’s annual self-evaluation, which includes a review of any areas in which the Board or management believes the Board can make a better contribution to our corporate governance, as well as a review of Board composition, the structure and membership of Board committees, and an assessment of the Board’s compliance with corporate governance principles. In fulfilling the Board’s responsibilities, directors have full access to our management and independent advisors.

With respect to the Board’s role in our risk oversight, our Audit Committee discusses with management our policies with respect to risk assessment and risk management and our significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures, while our Safety, Security and Operations Committee reviews our activities, programs and procedures on safety, security and airline operations matters and routinely assesses related risk. Moreover, the Safety, Security, and Operations Committee, which exercises oversight over the Company’s management of cybersecurity matters, receives regular updates from management regarding cybersecurity matters, including the description of risks, protections and procedures. Our Nominating and Corporate Governance Committee reviews the Company’s environmental and social strategy and practices, in coordination with the Audit Committee’s oversight of related risks. Our Audit, Nominating and Corporate Governance, and Safety, Security, and Operations Committees report to the full Board with respect to the foregoing matters, among others. Lastly, our Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and periodically reports to the entire Board about such risks.

The Company’s management is responsible for the day-to-day management of the risks facing the Company, including macroeconomic, financial, strategic, operational, public reporting, legal, regulatory, environmental, social, political, cybersecurity, compliance and reputational risks. Management carries out this risk management responsibility through a coordinated effort among the various risk management functions within the Company.

Leadership Structure

We have historically separated the roles of CEO and Chairman of the Board in recognition of the differences between the two roles. The CEO is responsible for setting our strategic direction and our day-to-day leadership and performance, while the Chairman of the Board provides general guidance to the CEO and sets the agenda for Board meetings and presides over meetings of the full Board. Mr. Gardner currently serves as our Chairman of the Board and Mr. Christie currently serves as our CEO. Our bylaws provide that the independent directors may appoint a lead director from among them to perform such duties as may be assigned by the Board. In his capacity as Chairman of the Board, Mr. Gardner generally performs the functions of a lead director.

| Spirit Airlines | 2024 Proxy Statement | 9 |

BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE (continued) |

Board Committees

The Board has the following standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Safety, Security and Operations Committee. The composition and responsibilities of each committee are described below. Members serve on these

committees until their resignation or until otherwise determined by the Board. The Board also has provided for an ad hoc Finance Committee, which may be constituted from time to time by the Board. A copy of the Finance Committee charter is available on the Company’s website at http://ir.spirit.com. Below is the membership of standing committees as of April 25, 2024:

Director | Independent (Y/N) | Audit | Compensation | Nominating and Corporate Governance | Safety, Security and Operations | |||||

Edward M. Christie III (1) | N | |||||||||

Mark B. Dunkerley | Y | X | Chair | |||||||

H. McIntyre Gardner (1) | Y | X | ||||||||

Robert D. Johnson | Y | Chair | X | |||||||

Barclay G. Jones III | Y | Chair | X | |||||||

Christine P. Richards | Y | X | X | |||||||

Myrna M. Soto | Y | X | X | |||||||

Dawn M. Zier (2) | Y | X | Chair | |||||||

(1) Messrs. Christie and Gardner regularly participate in standing committee meetings.

(2) Dawn M. Zier has decided not to stand for re-election, and her term will end at the conclusion of the Annual Meeting.

Audit Committee

Our Audit Committee oversees our corporate accounting and financial reporting process. Among other matters, the Audit Committee evaluates the independent auditors’ qualifications, independence and performance; determines the engagement of the independent auditors; reviews and approves the scope of the annual audit and the audit fee; discusses with management and the independent auditors the results of the annual audit and the review of our quarterly financial statements; approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on the Company’s engagement team as required by law; reviews our critical accounting policies and estimates; oversees our internal audit function and annually reviews the Audit Committee charter and the committee’s performance. The Audit Committee performs other functions as set forth in the Audit Committee charter, which satisfies the applicable standards of the SEC and the NYSE. A copy of the Audit Committee charter is available on the Company’s website at http://ir.spirit.com.

The current members of our Audit Committee are Messrs. Gardner, Dunkerley, and Johnson, with Mr. Johnson serving as the chair of the committee. All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. The Board has determined that all members of the Audit Committee are financial experts as defined under the applicable rules of the SEC and thereby have the accounting and financial management expertise required under the applicable rules and regulations of the NYSE. All three members of the Audit Committee are independent directors as defined under the applicable rules and regulations of the SEC and the NYSE.

Compensation Committee

Our Compensation Committee reviews and approves, and in some instances makes recommendations with respect to, the Company’s policies, practices and plans relating to compensation and benefits of our officers and other management level employees. The Compensation Committee (i) reviews and approves performance goals and objectives relevant to compensation of our CEO and other executive officers; (ii) evaluates the performance of our CEO in light of those goals and objectives and other factors and determines and approves our CEO’s compensation based on such evaluation; (iii) with input from our CEO, evaluates the performance of other officers, and sets their compensation based on such evaluations after taking into account the recommendations of our CEO; (iv) determines the base salaries of our officers, and also administers the issuance of restricted stock units, performance share units and other equity-based and cash-based awards under our compensation plan documents as well as the awarding of annual cash bonus opportunities under our short-term incentive plans; (v) reviews and discusses pay equity on an annual basis; (vi) reviews, and makes recommendations to the Board with respect to, the form and amount of compensation of non-employee directors of the Company; (vii) reviews and evaluates, at least annually, the performance of the Compensation Committee and its members, including compliance of the Compensation Committee with its charter and corporate governance principles; (viii) approves the peer group companies used to benchmark Company performance and executive officer compensation; and (ix) periodically reviews, in consultation with its independent compensation consultant, the Company’s executive compensation philosophy and target competitive positioning for reasonableness and appropriateness. The Compensation Committee monitors compliance with Company’s stock ownership guidelines and also oversees risk assessment with respect to the

| 10 |  | Spirit Airlines | 2024 Proxy Statement |

BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE (continued) |

Company’s executive compensation policies and practices. It also periodically reviews, and when appropriate makes recommendations with respect to, the severance and change in control benefits afforded to our executive officers and other members of management. The Compensation Committee performs other functions as set forth in the Compensation Committee charter. A copy of the Compensation Committee charter is available on the Company’s website at http://ir.spirit.com.

During fiscal year 2023, the Compensation Committee engaged and appointed Korn Ferry as the Compensation Committee’s independent compensation consultant (the “Compensation Consultant”) and retained external legal counsel during 2023, as more fully described in the “Compensation Discussion and Analysis” section of this Proxy Statement.

The current members of our Compensation Committee are Mr. Jones and Mses. Richards, Soto and Zier, with Mr. Jones serving as the chair of the committee. The Board has affirmatively determined that each of Mr. Jones and Mses. Richards, Soto and Zier meets the definition of “independent director” for purposes of the NYSE listing rules.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for making recommendations regarding candidates for directorships, the size and composition of the Board and committee memberships. In addition, the Nominating and Corporate Governance Committee is responsible for reviewing and making recommendations to the Board concerning our corporate governance guidelines and other corporate governance matters. The committee is also responsible for reviewing environmental, social, and governance matters (ESG), and human capital management (HCM), including diversity review, employee engagement and succession planning with respect to our leadership team.

The Nominating and Corporate Governance Committee reviews candidates for directors in the context of the current composition, skills and expertise of the Board, the operating requirements of the Company and the interests of stockholders. It also takes into consideration applicable laws and regulations (including the NYSE listing standards), diversity, skills, experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business and business environment, willingness and availability to devote adequate time and effort to Board responsibilities and other relevant factors. The Nominating and Corporate Governance Committee may also engage, if it deems appropriate, a professional search firm to identify candidates that possess the desired characteristics and skills. During each search, the Nominating and Corporate Governance Committee (i) assesses the Board’s needs and functions; (ii) develops search specifications which are reported to, and concurred by, the full Board; (iii) convenes a search sub-committee (which generally includes all members of the Nominating and Corporate Governance Committee, the Chairman of the Board and the CEO) to conduct recruitment efforts and interviews with the director candidates; (iv) performs appropriate and necessary screenings and inquiries into the backgrounds and qualifications of possible director candidates; and lastly (v) may recommend a nominee(s) to the Board, which subsequently votes to elect the nominee(s).

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders in accordance with, and pursuant to, the advance notice procedures for nominations of directors as set forth in the Company’s amended and restated bylaws. The Board believes that the procedures set forth in the Company’s amended and restated bylaws are currently sufficient and that the establishment of a formal policy is not necessary.

Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering, along with any updates or supplements required by the Company’s amended and restated bylaws, a written recommendation, c/o the Company’s Secretary, to the following address: Spirit Airlines, Inc., (i) 2800 Executive Way, Miramar, Florida 33025 prior to April 29, 2024, or (ii) 1731 Radiant Drive, Dania Beach, Florida 33004 on or after April 29, 2024, not earlier than the 120th day prior to and not later than the 90th day prior to the first anniversary of the Company’s annual meeting of stockholders for the preceding year; provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, such recommendation shall be delivered not earlier than the 120th day prior to the Company’s annual meeting and not later than the 90th day prior to such annual meeting, or, if later, the 10th day following the day on which public disclosure of the date of such annual meeting was first made. Submissions must include the required information and follow the specified procedures set forth in the Company’s amended and restated bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. The Nominating and Corporate Governance Committee will evaluate any director candidates that are properly recommended by stockholders in the same manner as it evaluates all other director candidates, as described above.

The Nominating and Corporate Governance Committee is currently comprised of Mr. Jones and Mses. Richards and Zier, with Ms. Zier serving as the chair of the committee. The Board has affirmatively determined that each of Mr. Jones and Mses. Richards and Zier meets the definition of “independent director” for purposes of the NYSE listing rules. A copy of the Nominating and Corporate Governance Committee charter is available on the Company’s website at http://ir.spirit.com.

Safety, Security and Operations Committee

Our Safety, Security and Operations Committee oversees the Company’s activities, programs and procedures with respect to safety, security and airline operations. Among other matters, the Safety, Security and Operations Committee reviews the Company’s safety programs, policies and procedures; reviews the Company’s policies, procedures and investments, and monitors the Company activities, with respect to physical and information security; and reviews other aspects of airline operations such as reliability, organization and staffing. The current members of our Safety, Security and Operations Committee are Messrs. Dunkerley and Johnson, and Ms. Soto, with Mr. Dunkerley serving as the chair of the committee. Non-committee members of the Board regularly attend meetings of the Safety, Security and Operations Committee. The Safety, Security and Operations Committee operates under a written charter, a copy of which is available on the Company’s website at http://ir.spirit.com.

| Spirit Airlines | 2024 Proxy Statement | 11 |

Other Corporate Governance Matters |

Meetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

Our Board has regularly scheduled meetings and an annual meeting of stockholders each year, in addition to special meetings scheduled as appropriate. The Board met five times during 2023. Each of the five regularly scheduled Board meetings included an executive session, consisting of only independent directors and in some cases external legal counsel. Mr. Gardner, Chairman of the Board, presided at all of these executive sessions. The Audit Committee of the Board met six times, the Compensation Committee of the Board met five times, the Nominating and Corporate Governance Committee met four times, and the Safety, Security and Operations Committee of the Board met four times during 2023. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which they served during 2023. While committee meetings are scheduled for the members of each committee, it is the Company’s practice to allow any director to attend any committee meeting. Meetings of the Safety, Security and Operations Committee are regularly attended by all directors. We encourage all of our directors and nominees for director to attend our annual meeting of stockholders; however, attendance is not mandatory. All of our then-serving directors attended our annual meeting of stockholders in 2023.

Stockholder and Other Interested Parties Communications with the Board of Directors

Should stockholders or other interested parties wish to communicate with the Board or any specified independent directors, such correspondence should be sent to the attention of the Secretary, at (i) 2800 Executive Way, Miramar, Florida 33025 prior to April 29, 2024, or (ii) 1731 Radiant Drive, Dania Beach, Florida 33004 on or after April 29, 2024. The Secretary will forward the communication to the Board or to the individual director(s), as appropriate.

Compensation Committee Interlocks and Insider Participation

None of the current members of our Compensation Committee is or has at any time during the past year been an officer or employee of ours. None of our executive officers currently serves or in the past year has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Executive Pay-for-Performance

We seek to ensure a pay-for-performance culture with well-balanced and transparent compensation policies and practices that are designed to drive shareholder returns as well as attract, motivate and retain superior executives, as more fully described in the “Compensation Discussion and Analysis” section of this Proxy Statement.

Perquisites

Perquisites are not a significant part of our executive compensation program. As is common in the airline industry, senior executives and non-employee directors, and their respective immediate families, are entitled to certain travel privileges on our flights, which may be on a positive space basis. In addition, retired non-employee directors who meet certain criteria are eligible for lifetime post-retirement positive-space air travel on our airline, as more fully described in the “Non-Employee Director Compensation” section of this Proxy Statement.

Stock Ownership Guidelines for Non-employee Directors and Executives

We maintain stock ownership guidelines applicable to non-employee directors and executives, as more fully described in the “Non-Employee Director Compensation” and “Compensation Discussion and Analysis” sections of this Proxy Statement. Non-employee directors and executives are expected to meet their ownership guidelines within five years of becoming subject to the guidelines. Due to the recent decline of our stock price, none of our non-employee directors and executive officers who have served at least five years are currently in compliance with the guidelines.

Anti-Hedging/Pledging Policy

We do not allow our directors and executive officers to enter into put and call options and other hedging transactions in the Company’s stock, nor to pledge the Company’s stock as collateral to secure loans. We believe that these prohibitions further align directors’ interests with those of our stockholders.

Clawback Policies

We maintain robust clawback policies pursuant to which we can seek recovery of certain cash or equity-based incentive compensation from our executive officers. The Clawback Policy is described in the “Compensation Discussion and Analysis” section of this Proxy Statement.

Retirement and Pension Practices

We do not provide a defined benefit pension plan or any supplemental executive retirement plan or other form of non-qualified retirement plan for our executive officers.

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines to assist it in the exercise of its responsibilities and to serve the interests of the Company and its stockholders. The guidelines address areas such as Board and committee size and composition, director qualification standards and interaction with institutional investors.

| 12 |  | Spirit Airlines | 2024 Proxy Statement |

OTHER CORPORATE GOVERNANCE MATTERS (continued) |

A copy of our corporate governance guidelines is available to security holders on the Company’s website at http://ir.spirit.com.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to all members of the Board, officers and employees, including our Chief Executive Officer, Chief Financial Officer and principal accounting officer. The Code of Business Conduct and Ethics addresses, among other things, issues relating to conflicts of interests, including internal reporting of violations and disclosures, and compliance with applicable laws, rules and regulations. The purpose of the Code of Business Conduct and Ethics is to deter wrongdoing, to promote honest and ethical conduct and to ensure to the greatest possible extent that our business is conducted in a legal and ethical manner. We intend to promptly disclose on our website (1) the nature of any substantive amendment to our Code of Business Conduct and Ethics that applies to our directors, officers or other principal financial officers, (2) the nature of any waiver, including an implicit waiver, from a provision of our Code of Business Conduct and Ethics that is granted to one of these specified directors, officers or other principal financial officers, and (3) the name of each person who is granted such a waiver and the date of the waiver. A copy of the Code of Business Conduct and Ethics is available on the Company’s website at http://ir.spirit.com.

Related Party Transactions

The Board monitors and reviews any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which the Company is to be a participant, the amount involved exceeds $120,000 and a related party had or will have a direct or indirect material interest, including purchases of goods or services by or from the related party or entities in which the related party has a material interest, indebtedness, guarantees of indebtedness and employment by us of such related party. Furthermore, the Company’s directors and executive officers complete an annual questionnaire that requires them to identify and describe, among other items, any transactions that they or their respective related parties may have with the Company. For more information, see “Certain Relationships and Related Transactions” elsewhere in this Proxy Statement.

Limitation of Liability and Indemnification Related Party Transactions

Our amended and restated certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

| • | any breach of the director’s duty of loyalty to us or our stockholders; |

| • | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| • | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or |

| • | any transaction from which the director derived an improper personal benefit. |

Our amended and restated certificate of incorporation provides that we may indemnify our directors and executive officers, in each case to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we are obligated to indemnify our directors and executive officers to the fullest extent permitted by Delaware law and advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of their actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under the provisions of Delaware law. We have entered into agreements to indemnify our directors, executive officers and other employees as determined by the Board. For more information, see “Certain Relationships and Related Transactions - Indemnification” elsewhere in this Proxy Statement. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We believe these limitations of liability provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers. We also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our amended and restated certificate of incorporation, amended and restated bylaws and indemnification agreements may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. Our amended and restated certificate of incorporation provides that any such lawsuit must be brought in the Court of Chancery of the State of Delaware. The foregoing provisions may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and officers as required by these indemnification provisions. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. At present, there is no pending litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought, and we are not aware of any threatened litigation that is expected to result in claims for indemnification.

| Spirit Airlines | 2024 Proxy Statement | 13 |

Environmental, Social and Governance (ESG) Matters |

Commitment