Exhibit 99.1

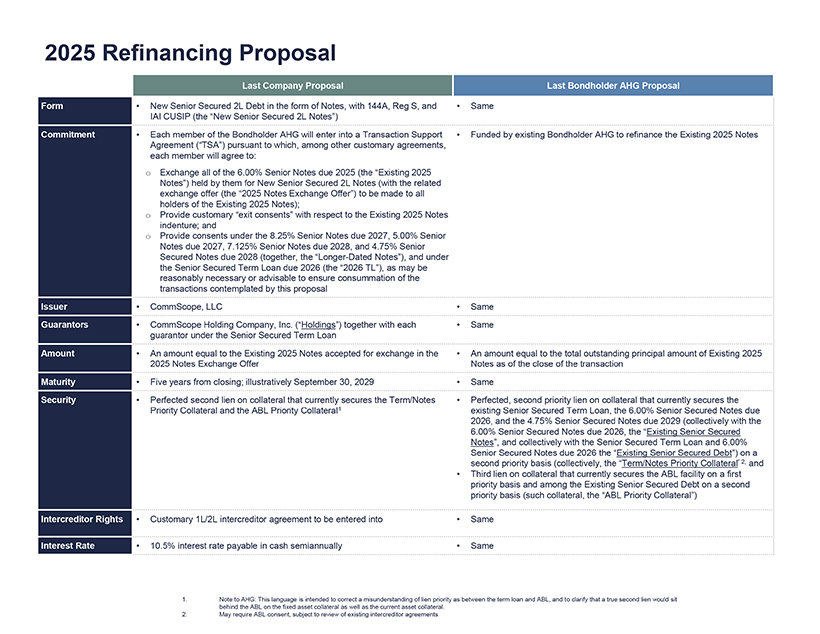

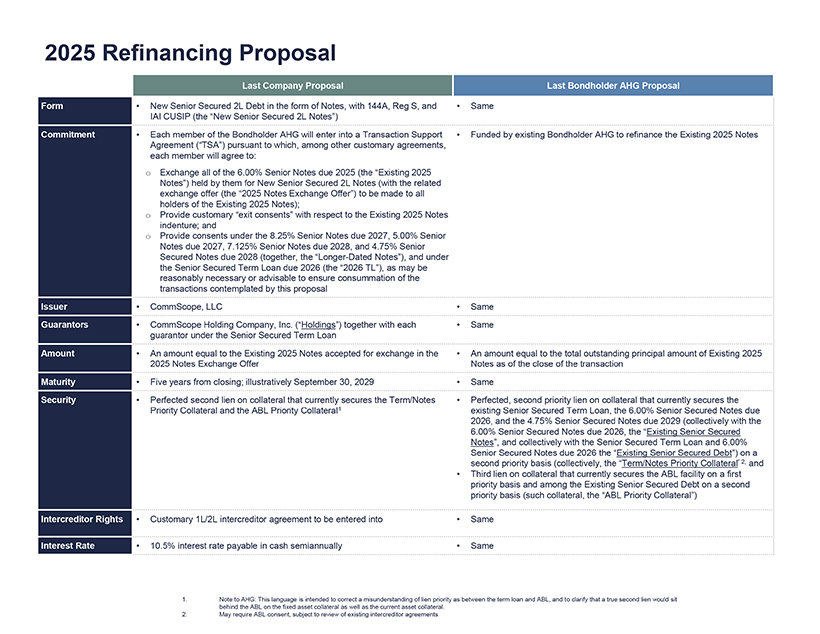

2025 Refinancing Proposal Last Company Proposal Last Bondholder AHG Proposal Form New Senior Secured 2L Debt in the form of Notes, with 144A, Reg S, and IAI CUSIP (the “New Senior Secured 2L Notes”) Same Commitment Each member of the Bondholder AHG will enter into a Transaction Support Agreement (“TSA”) pursuant to which, among other customary agreements, each member will agree to: Funded by existing Bondholder AHG to refinance the Existing 2025 Notes Exchange all of the 6.00% Senior Notes due 2025 (the “Existing 2025 Notes”) held by them for New Senior Secured 2L Notes (with the related exchange offer (the “2025 Notes Exchange Offer”) to be made to all holders of the Existing 2025 Notes); Provide customary “exit consents” with respect to the Existing 2025 Notes indenture; and Provide consents under the 8.25% Senior Notes due 2027, 5.00% Senior Notes due 2027, 7.125% Senior Notes due 2028, and 4.75% Senior Secured Notes due 2028 (together, the “Longer-Dated Notes”), and under the Senior Secured Term Loan due 2026 (the “2026 TL”), as may be reasonably necessary or advisable to ensure consummation of the transactions contemplated by this proposal Issuer CommScope, LLC Same Guarantors CommScope Holding Company, Inc. (“Holdings”) together with each guarantor under the Senior Secured Term Loan Same Amount An amount equal to the Existing 2025 Notes accepted for exchange in the 2025 Notes Exchange Offer An amount equal to the total outstanding principal amount of Existing 2025 Notes as of the close of the transaction Maturity Five years from closing; illustratively September 30, 2029 Same Security Perfected second lien on collateral that currently secures the Term/Notes Priority Collateral and the ABL Priority Collateral1 Perfected, second priority lien on collateral that currently secures the existing Senior Secured Term Loan, the 6.00% Senior Secured Notes due 2026, and the 4.75% Senior Secured Notes due 2029 (collectively with the 6.00% Senior Secured Notes due 2026, the “Existing Senior Secured Notes”, and collectively with the Senior Secured Term Loan and 6.00% Senior Secured Notes due 2026 the “Existing Senior Secured Debt”) on a second priority basis (collectively, the “Term/Notes Priority Collateral” 2, and Third lien on collateral that currently secures the ABL facility on a first priority basis and among the Existing Senior Secured Debt on a second priority basis (such collateral, the “ABL Priority Collateral”) Intercreditor Rights Customary 1L/2L intercreditor agreement to be entered into Same Interest Rate 10.5% interest rate payable in cash semiannually Same 1. Note to AHG: This language is intended to correct a misunderstanding of lien priority as between the term loan and ABL, and to clarify that a true second lien would sit behind the ABL on the fixed asset collateral as well as the current asset collateral. 2. May require ABL consent, subject to review of existing intercreditor agreements