TECHNICAL REPORT SUMMARY

SILICA SAND RESOURCES AND RESERVES

OTTAWA OPERATION

LaSalle County, Illinois

Prepared For

U.S. SILICA COMPANY

Katy, Texas

By

John T. Boyd Company

Mining and Geological Consultants

Pittsburgh, Pennsylvania

Report No. 3076.019

FEBRUARY 2023

JOHN T. BOYD COMPANY

JOHN T. BOYD COMPANY Mining and Geological Consultants

February 16, 2023

February 16, 2023

JOHN T. BOYD COMPANY

JOHN T. BOYD COMPANY Mining and Geological Consultants

File: 3076.019

U.S. Silica Company

24275 Katy Freeway, Suite 600

Katy, TX 77494-7271

Attention: Mr. Terry Lackey

Mining Director

Subject: Technical Report Summary

Silica Sand Resources and Reserves

Ottawa Operation

LaSalle County, Illinois

Ladies and Gentlemen:

The John T. Boyd Company (BOYD) was retained by U.S. Silica Company (U.S. Silica) to complete an independent technical assessment of the silica sand resource and reserve estimates for the Ottawa Operation as of December 31, 2022.

This technical report summary: (1) summarizes material technical and geoscientific information for the subject mining property, (2) provides the conclusions of our technical assessment, and (3) provides a statement of silica sand resources and reserves for the Ottawa Operation.

Respectfully submitted,

JOHN T. BOYD COMPANY

By:

John T. Boyd II

President and CEO

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\report\cover letter.docxc

TABLE OF CONTENTS

Page

LETTER OF TRANSMITTAL

TABLE OF CONTENTS

GLOSSARY AND ABBREVIATIONS

1.0 EXECUTIVE SUMMARY 1-1

1.1 Introduction 1-1

1.2 Property Description 1-1

1.3 Geology 1-3

1.4 Exploration 1-3

1.5 Silica Sand Resources and Reserves 1-4

1.6 Operations 1-5

1.6.1 Mining 1-5

1.6.2 Processing 1-6

1.6.3 Other Infrastructure 1-6

1.7 Financial Analysis 1-7

1.7.1 Market Analysis 1-7

1.7.2 Capital and Operating Cost Estimates 1-7

1.7.3 Economic Analysis 1-8

1.8 Permitting Requirements 1-10

1.9 Conclusions 1-10

2.0 INTRODUCTION 2-1

2.1 Registrant 2-1

2.2 Terms of Reference and Purpose 2-1

2.3 Expert Qualifications 2-2

2.4 Principal Sources of Information 2-3

2.5 Personal Inspections 2-3

2.6 Report Version 2-4

2.7 Units of Measure 2-4

3.0 PROPERTY DESCRIPTION 3-1

3.1 Location 3-1

3.2 Property Rights 3-1

3.3 Encumbrances 3-3

3.3.1 Fees and Royalties 3-3

3.3.2 Permitting Requirements 3-3

3.3.3 Mining Restrictions 3-3

3.3.4 Other Significant Factors or Risks 3-4

4.0 PHYSIOGRAPHY, ACCESSIBILITY, AND INFRASTRUCTURE 4-1

4.1 Topography, Elevation, and Vegetation 4-1

4.2 Accessibility 4-1

4.3 Climate 4-2

4.4 Infrastructure Availability and Sources 4-2

TABLE OF CONTENTS - Continued

Page

5.0 HISTORY 5-1

5.1 Reserve Acquisition 5-1

5.2 Exploration and Development 5-1

6.0 GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT 6-1

6.1 Regional Geology 6-1

6.2 Local Geology 6-2

6.2.1 Stratigraphy 6-2

6.2.2 Structural Geology 6-3

6.3 Property Geology 6-4

7.0 EXPLORATION DATA 7-1

7.1 Background 7-1

7.2 Exploration Procedures 7-1

7.2.1 Drilling 7-1

7.2.2 Sand Quality Sampling 7-2

7.2.3 Sand Testing 7-2

7.2.4 Other Exploration Methods 7-3

7.3 Exploration Results 7-4

7.3.1 Summary of Exploration 7-4

7.3.2 Silica Sand Quality 7-6

7.3.3 Grain Size Distribution 7-6

7.3.4 Grain Shape (Sphericity and Roundness) 7-7

7.3.5 Crush Resistance 7-7

7.3.6 Mineralogical Analyses 7-7

7.4 Data Verification 7-8

7.5 Adequacy of Exploration and Sampling 7-8

8.0 SAMPLE PREPARATION, ANALYSIS, AND SECURITY 8-1

9.0 DATA VERIFICATION 9-1

10.0 MINERAL PROCESSING AND METALLURGICAL TESTING 10-1

TABLE OF CONTENTS - Continued

Page

11.0 SILICA SAND RESOURCE ESTIMATE 11-1

11.1 Applicable Standards and Definitions 11-1

11.2 Silica Sand Resources 11-2

11.2.1 Methodology 11-2

11.2.2 Estimation Criteria 11-2

11.2.3 Classification 11-4

11.2.4 Silica Sand Resource Estimate 11-5

11.2.5 Validation 11-5

12.0 SILICA SAND RESERVE ESTIMATE 12-1

12.1 Applicable Standards and Definitions 12-1

12.2 Silica Sand Reserves 12-2

12.2.1 Methodology 12-2

12.2.2 Classification 12-3

12.2.3 Silica Sand Reserve Estimate 12-5

12.2.4 Reconciliation with Previous Estimates 12-6

13.0 MINING METHODS 13-1

13.1 Mining Operation 13-1

13.2 Mine Equipment and Staffing 13-3

13.2.1 Mine Equipment 13-3

13.2.2 Staffing 13-3

13.3 Engineering and Planning 13-4

13.4 Mining Sequence and Production 13-4

14.0 PROCESSING OPERATIONS 14-1

14.1 Overview 14-1

14.1.1 Wet Processing Plant 14-1

14.1.2 Sizing and Fine Sand Plant 14-3

14.1.3 Grinding Mills 14-3

14.1.4 ASTM Circuit 14-3

14.2 Production 14-4

14.3 Conclusion 14-4

15.0 MINE INFRASTRUCTURE 15-1

15.1 Overview 15-1

15.2 Transportation 15-1

15.3 Utilities 15-2

15.4 Tailings Disposal 15-2

15.5 Other Structures 15-3

16.0 MARKET STUDIES 16-1

16.1 Product Specifications 16-1

16.2 Historical Sales 16-1

16.3 Market Outlook 16-2

17.0 PERMITTING AND COMPLIANCE 17-1

17.1 Permitting 17-1

17.2 Compliance 17-3

17.3 Post-Mining Land Use and Reclamation 17-3

17.4 Community Engagement 17-4

TABLE OF CONTENTS - Continued

Page

18.0 CAPITAL AND OPERATING COSTS 18-1

18.1 Historical Financial Performance 18-1

18.2 Estimated Costs 18-2

18.2.1 Projected Capital Expenditures 18-2

18.2.2 Projected Operating Costs 18-3

19.0 ECONOMIC ANALYSIS 19-1

19.1 Approach 19-1

19.2 Assumptions and Limitations 19-2

19.3 Financial Model Results 19-2

19.4 Sensitivity Analysis 19-5

20.0 ADJACENT PROPERTIES 20-1

21.0 OTHER RELEVANT DATA AND INFORMATION 21-1

22.0 INTERPRETATION AND CONCLUSIONS 22-1

22.1 Audit Findings 22-1

22.2 Significant Risks and Uncertainties 22-1

23.0 RECOMMENDATIONS 23-1

24.0 REFERENCES 24-1

25.0 RELIANCE ON INFORMATION PROVIDED BY REGISTRANT 25-1

TABLE OF CONTENTS - Continued

Page

List of Tables

1.1 Ottawa Operation Silica Sand Resources (as of December 31, 2022) 1-4

1.2 Ottawa Operation Silica Sand Reserves (as of December 31, 2022) 1-5

1.3 Financial Results 1-9

1.4 DCF-NPV Analysis 1-9

3.1 Property Ownership 3-1

7.1 Descriptive Statistics, Stratigraphic Interval Thickness 7-4

7.2 Weighted Average Particle Size Distribution 7-6

11.1 Silica Sand Resource Classification Criteria 11-4

11.2 Ottawa Operation Silica Sand Resources (as of December 31, 2022) 11-5

12.1 Ottawa Operation Silica Sand Reserves (as of December 31, 2022) 12-5

13.1 Employees by Classification 13-3

16.1 Historical Sales Data 16-1

18.1 Historical Financials 18-1

18.2 Projected Capital Costs 18-2

19.1 Annual Production and Cash Flow Forecast Ottawa Operation 19-3

19.2 Financial Results 19-4

19.3 DCF-NPV Analysis 19-4

19.4 After-Tax NPV12.5 Sensitivity Analysis ($ millions) 19-5

25.1 Information Relied Upon from Registrant 25-1

TABLE OF CONTENTS - Continued

Page

List of Figures

1.1 General Location Map 1-2

3.1 Map Showing Site Layout Ottawa Operation 3-2

6.1 Generalized Stratigraphic Chart, Ottawa, Illinois 6-2

6.2 Map Showing Silica Sand Thickness Isopaches Ottawa Operation 6-5

6.3 Cross-Section A – A’ Ottawa Operation 6-6

7.1 Map Showing Drill Hole Locations Ottawa Operation 7-5

12.1 Relationship Between Mineral Resources and Mineral Reserves 12-2

12.2 Map Showing Mineral Reserve Classification Ottawa Operation 12-4

13.1 Loading Operations at the Ottawa Operation 13-2

13.2 Recent Historical and LOM Forecasted Mining Production 13-5

13.3 Map Showing Life-of-Mine Plan Ottawa Operation 13-6

14.1 Simplified Flow Sheet Ottawa Operation 14-2

14.2 Recent Historical and LOM Forecasted Processing Plant Production 14-4

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\report\toc.doc

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS

| | | | | | | | | | | |

| 000 | | : | Thousand(s) |

| $ | : | US dollar(s) |

| % | | : | Percent or percentage |

| AMSL | | : | Above mean sea level |

| API | | : | American Petroleum Institute |

| ARO | | : | Asset Retirement Obligations |

| ASP | | : | Average Selling Price |

| ASTM | | : | ASTM International (formerly American Society for Testing and Materials) |

| BNSF | | : | BNSF Railway Company |

| BOYD | | : | John T. Boyd Company |

| CapEx | | : | Capital expenditures |

| Constant Dollar | | : | A monetary measure that is not influenced by inflation and used to compare time periods. Sometimes referred to as “real dollars”. |

| CSX | | : | CSX Transportation |

| DCF | | : | Discounted Cash Flow |

| Discount Rate | | : | A rate of return used to discount future cash flows based on the return investors expect to receive from their investment. |

| EBIT | | : | Earnings before interest and taxes |

| EBITDA | | : | Earnings before interest, taxes, depreciation, and amortization |

| Frac Sand | | : | See “Proppant Sand” |

| ft | | : | Foot/feet |

| HDPE | | : | High-density polyethylene |

| IDNR | | : | Illinois Department of Natural Resources |

2

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued

| | | | | | | | | | | |

| Indicated Silica Sand Resource | | : | That part of a silica sand resource for which quantity and quality are estimated based on adequate geological evidence and sampling. The level of geological certainty associated with an indicated silica sand resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated silica sand resource has a lower level of confidence than the level of confidence of a measured silica sand resource, an indicated silica sand resource may only be converted to a probable silica sand reserve. |

| IEMA | | : | Illinois Emergency Management Agency |

| ILEPA | | : | Illinois Environmental Protection Agency |

| Inferred Silica Sand Resource | | : | That part of a silica sand resource for which quantity and quality are estimated based on limited geological evidence and sampling. The level of geological uncertainty associated with an inferred silica sand resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred silica sand resource has the lowest level of geological confidence of all silica sand resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred silica sand resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a silica sand reserve. |

| IRR | | : | Internal rate-of-return |

| ISO | | | International Organization for Standardization |

| ISP | | : | Industrial and Specialty Products |

| lb | | : | Pound |

| LOM | | : | Life-of-Mine |

| Measured Silica Sand Resource | | : | That part of a silica sand resource for which quantity and quality are estimated based on conclusive geological evidence and sampling. The level of geological certainty associated with a measured silica sand resource is sufficient to allow a qualified person to apply modifying factors, as defined herein, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured silica sand resource has a higher level of confidence than the level of confidence of either an indicated silica sand resource or an inferred silica sand resource, a measured silica sand resource may be converted to a proven silica sand reserve or to a probable silica sand reserve |

| Mesh | | : | A measurement of particle size often used in determining the size distribution of granular material. |

| Mineral Reserve | | : | See “Silica Sand Reserve” |

3

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued

| | | | | | | | | | | |

| Mineral Resource | | : | See “Silica Sand Resource” |

| Modifying Factors | | | The factors that a qualified person must apply to indicated and measured silica sand resources and then evaluate to establish the economic viability of silica sand reserves. A qualified person must apply and evaluate modifying factors to convert measured and indicated silica sand resources to proven and probable silica sand reserves. These factors include but are not restricted to: mining; processing; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| MSHA | | : | Mine Safety and Health Administration. A division of the U.S. Department of Labor |

NPV O&G | | : : | Net Present Value Oil and Gas |

| Probable Silica Sand Reserve | | : | The economically mineable part of an indicated and, in some cases, a measured silica sand resource. |

| Production Stage Property | | : | A property with material extraction of silica sand reserves. |

| Proppant Sand | | : | Proppant (frac) sand is a naturally occurring, high silica content quartz sand, with grains that are generally well rounded and exhibit high compressive strength characteristics relative to other proppant sand. It is utilized as a prop or “proppant” in unconventional shale frac well completions. |

| Proven Silica Sand Reserve | | : | The economically mineable part of a measured silica sand resource which can only result from conversion of a measured silica sand resource. |

| PSI | | : | Pounds per square inch |

| QP | | : | Qualified Person |

4

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued

| | | | | | | | | | | |

| Qualified Person | | : | An individual who is: 1.A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and

2.An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must:

a.Be either: i.An organization recognized within the mining industry as a reputable professional association; or ii.A board authorized by U.S. federal, state, or foreign statute to regulate professionals in the mining, geoscience, or related field; b.Admit eligible members primarily based on their academic qualifications and experience; c.Establish and require compliance with professional standards of competence and ethics; d.Require or encourage continuing professional development; e.Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and f.Provide a public list of members in good standing. |

| ROM | | : | Run-of-Mine. The processing feed material, including silica sand and any inseparable waste, excavated from the mine. |

| SEC | | : | U.S. Securities and Exchange Commission |

| Silica Sand Reserve | | : | Silica sand reserve is an estimate of tonnage and grade or quality of indicated and measured silica sand resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated silica sand resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

5

GLOSSARY OF ABBREVIATIONS AND DEFINITIONS - Continued

| | | | | | | | | | | |

| Silica Sand Resources | | : | Silica sand resource is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A silica sand resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. |

| S-K 1300 | | : | Subpart 1300 and Item 601(b)(96) of the U.S. Securities and Exchange Commission’s Regulation S-K |

| SPCC | | : | Spill Prevention, Controls and Countermeasure |

| Ton | | : | Short Ton. A unit of weight equal to 2,000 pounds |

| U.S. Silica | | : | U.S. Silica Company, its parent company (U.S. Silica Holdings, Inc.) and its consolidated subsidiaries as a combined entity. |

Q:\ENG_WP\3076.019 U.S. Silica - Ottawa\Ottawa Working Draft\Glossary.docx

1.0 EXECUTIVE SUMMARY

1.1 Introduction

U.S. Silica’s Ottawa Operation is an active surface silica sand mining and processing operation that has been in existence for over 100 years.

BOYD prepared this technical report summary for U.S. Silica in support of their disclosure of silica sand reserves for the Ottawa Operation in accordance with Subpart 1300 and Item 601(b)(96) of the SEC's Regulation S-K (S-K 1300). The purpose of this report is threefold: (1) to summarize material technical and geoscientific information for the subject mining property, (2) to provide the conclusions of our technical assessment, and (3) to provide a statement of silica sand resources and/or reserves for the Ottawa Operation.

Information used in our assessment was obtained from: (1) files provided by U.S. Silica, (2) discussions with U.S. Silica personnel, (3) records on file with regulatory agencies, (4) public sources, and (5) nonconfidential information in BOYD’s possession.

Unless otherwise noted, the effective date of the information, including estimates of silica sand reserves, is December 31, 2022.

Weights and measurements are expressed in the US customary measurement system throughout this report.

1.2 Property Description

U.S. Silica’s Ottawa Operation is a surface silica sand mining and processing operation located immediately west of the City of Ottawa in LaSalle County, Illinois. The cities of Chicago and Peoria, Illinois, are located approximately 95 miles east-northeast and 75 miles southwest, respectively, of the Ottawa Operation. The general location of the Ottawa Operation is provided in Figure 1.1, following this page.

The property is bisected by the Illinois River into the North Ottawa and South Ottawa sites. The mine offices, maintenance facilities, processing plant, loadout facilities, and former mining pits are located on the North Ottawa site, while the active (South Ottawa Pit) and future mining areas (West Ottawa and Mississippi Sand Pit) are located on the South Ottawa site. A slurry line driven under the Illinois River connects the two sites, and

is used to transport Run-of-Mine (ROM) sand material from South Ottawa to the processing plant.

The Ottawa Operation has mined silica sand exclusively from the St. Peter Sandstone Formation for over 100 years. Within the boundaries of the Ottawa Operation, U.S. Silica wholly owns both surface and mineral rights on all ±2,072 acres. BOYD is not aware of any encumbrances, litigation, or orders which would hinder continued development of the property.

1.3 Geology

The Ottawa Operation’s target silica bearing formation is the St. Peter Sandstone, which is a massive formation in areal extent and thickness. Aerially, it extends from Minnesota to Arkansas and from Illinois into Nebraska and South Dakota. On a regional basis, the St. Peter Sandstone ranges in thickness from a few feet to over 1,200 ft, with a general thickness of 100 ft to 200 ft. In northern Illinois, the thickness can be over 300 ft thick.

At the Ottawa Operation, the St. Peter Sandstone is flat lying with no evidence of faulting, and has been eroded to an average thickness of approximately 90 ft. The formation is a white to buff colored, fine- to medium-grained ortho-quartzite. It contains rounded, clear polished sand quartz grains with minor secondary silica and clay cement.

Grain size distribution and iron-staining drives the mine planning. Iron tends to be concentrated near the surface and is visible in orange staining. Iron also increases at the bottom sandstone contact, occurring mostly as pyrite. The deposit is coarser in its top half. Where the upper part of the formation is eroded, multiple mining faces must operate to ensure adequate sand is available to meet product specifications.

In the defined resource areas, the St. Peter Sandstone is overlain by a thin layer of overburden material consisting of clay, sandy gravel, peat, and limestone cap rock.

1.4 Exploration

The St. Peter Sandstone has been extensively explored and mined on the Ottawa Operation. The North Ottawa site was mined out by 2010, and exploration on the South Ottawa site began in the year 2000. U.S. Silica provided data for 225 drill holes, wells, field measurements, and test holes in and around the South Ottawa site. These data were utilized to define the lateral extent, thickness, particle size distribution, and mineralogy of the remaining St. Peter Sandstone reserves at the Ottawa Operation.

BOYD’s audit indicates that in general: (1) U.S. Silica has performed extensive drilling and sampling work on the subject property, (2) the work completed has been done by competent personnel, and (3) the amount of data available combined with extensive knowledge and historic production of the St. Peter Sandstone, are sufficient to confirm the thickness, lateral extents, and quality characteristics of the South Ottawa silica sand reserves.

1.5 Silica Sand Resources and Reserves

As shown in Table 1.1, below, U.S. Silica owns approximately 88,000 in place tons of inferred silica sand resources, exclusive of silica sand reserves, at the Ottawa Operation, as of December 31, 2022.

While these “additional” silica sand resources have not been included in the Ottawa Operation’s life-of-mine (LOM) plan, they are considered to have prospects for eventual economic extraction by virtue of their similarity—in terms of demonstrated extraction methods and expected finished product qualities—to those converted to silica sand reserves.

U.S. Silica’s estimated surface mineable silica sand reserves for the Ottawa Operation total 78.9 million saleable product tons remaining as of December 31, 2022. The silica sand reserves are fully owned by U.S. Silica and are summarized in Table 1.2, below.

The Ottawa Operation has a well-established history of mining, processing, and selling silica sand products into various markets. BOYD has concluded that sufficient studies have been undertaken to enable the silica sand resources to be converted to silica sand reserves based on proposed operating methods and forecasted costs and revenues.

1.6 Operations

1.6.1 Mining

Current mining at the Ottawa Operation takes place on the South Ottawa site, where the St. Peter Sandstone is excavated using conventional surface mining methods. The thin overlying layer of unconsolidated overburden is scraped off and stockpiled in order to expose the St. Peter Sandstone Formation. The mineable sandstone interval is then drilled and blasted in benches ranging from 40 to 75 ft high. An excavator or front-end loader is then used to load the shot and blasted sandstone into articulated haul trucks. The haul trucks deliver raw sand material to a monitor station, where the material is further broken down via high-pressure water jets, that also create a sand slurry. The sand slurry is then pumped through lines that run under the Illinois River to the processing facilities which are located on the North Ottawa site, where processing of the ROM silica sand begins.

Over the past seven years, the operation has mined over 24 million tons of raw sand. During late 2019 and 2020, production fell to match decreased customer demand due to the COVID-19 pandemic from approximately 4 million tons per year to under 2.5 million tons. U.S. Silica’s Life-of-Mine (LOM) plan forecasts mining 91.2 million tons of ROM silica sand at a nominal rate of 3.8 million tons per year for the remaining life of the operation.

BOYD reviewed the LOM plans for U.S. Silica’s Ottawa Operation to determine whether the plans: (1) utilize generally accepted engineering practices, and (2) align with historical and industry norms. Based on our assessment, it is BOYD’s opinion that the forecasted production levels for the Ottawa Operation are reasonable, logical, and consistent with typical sandstone surface mining practices in the St. Peter Sandstone and historical results achieved by U.S. Silica.

1.6.2 Processing

The Ottawa Operation’s wet and dry processing plants, along with grinding mills, are located on the north shore of the Illinois River, on the Ottawa North site. The processing facilities also include an ASTM circuit, which is used to produce ASTM 20/30 and ASTM C109 compliant sand for cement and abrasion testing. The Ottawa Operation is the world’s only supplier of fully ASTM-compliant sands.

Pumped ROM slurry material from the South Ottawa site arrives at the processing plant, where it is washed to remove fine waste (clay and silt) material, sorted and sized, then dried. At this point, the silica sand is divided into two streams depending on finished product requirements—whole grain sand is sorted and sized again prior to packaging, while ground silica products are milled to produce fine silica powders.

Over its history, the processing plant has been upgraded and expanded several times as needed to meet specific market demands. The plants currently run 24 hours a day, 365 days a year, with a nominal capacity of 3.29 million tons of finished sand per year. Based on our review, it is BOYD’s opinion that the processing methods and existing equipment at the plant will be sufficient for the forecasted production levels over the life of the operation.

1.6.3 Other Infrastructure

The Ottawa Operation is supported by various utilities and transportation networks needed to allow processing and transportation of finished silica sands.

Electricity to the North Ottawa site is delivered through an above-ground network that terminates at a substation on the west end of the processing facility, and from there electricity is distributed via several underground and above-ground powerlines.

Initial makeup water is obtained through a series of wells drilled on the South Ottawa site, and recovered and recycled for reuse whenever possible. Potable water is delivered through the City of Ottawa’s public water system.

Natural gas is supplied via several underground pipelines.

Tailings from processing consist generally of clays, silts, and very fine sands, which are typically disposed of in old mining pit impoundments. The tailings ponds are currently located east of the processing plant, and are designed to accommodate rejects produced during the next five to ten years of production. At that time, it is expected that mining in the South Ottawa site will have advanced to the West Ottawa Pit, and the mined out South Ottawa Pit will be used for tailings.

Infrastructure to transport finished sand product include three different systems currently in-place at the Ottawa Operation: (1) the Illinois Railway, a former BNSF short line, transports rail cars to and from a CSX interchange located in the City of Ottawa; access from there is then available to several Class 1 railroads – BNSF, Union Pacific, and Norfolk Southern; (2) numerous local, county, and state roadways and highways that are within four miles of the processing facilities; and (3) U.S. Silica also maintains access to several third-party owned barge terminals, which are located on the north shore of the Illinois River, and are all situated on land owned by U.S. Silica.

1.7 Financial Analysis

1.7.1 Market Analysis

The Ottawa Operation is U.S. Silica’s largest “blended” operation, supplying various grades of silica sand to both the Oil and Gas (O&G) and the Industrial and Specialty Products (ISP) markets. Their finished silica sand products are used in variety of industrial applications by a large customer base.

U.S. Silica’s product sales were materially impacted by the COVID-19 pandemic, with sales dropping precipitously in 2019 due to decreased customer demand. However, their sales volumes and revenues have recovered substantially, and continued growth is expected over the long-term.

1.7.2 Capital and Operating Cost Estimates

The Ottawa Operation’s financial performance over the last years is summarized as follows:

•Average realization (selling price) for finished silica sand products increased from $36.91 per ton sold in 2020 to $42.37 per ton sold in 2022.

•Total cash cost of sales also increased from $29.48 per ton sold in 2020 to $32.85 per ton sold in 2022.

•EBITDA margin increased slightly from 20.1% in 2020 to 22.5% in 2022.

•Capital expenditures totaled almost $9.5 million over the last three years, averaging $1.27 per ton sold.

Forward-looking production and unit cost estimates are based on actual past performance and subject to U.S. Silica’s customary internal budget review and approvals process. In BOYD’s opinion, operating volumes are well-defined and understood, as are mining and processing productivities.

The Ottawa Operation and related facilities are fully developed and should require no near-term major capital investment to maintain full commercial production. Historically, the timing and amount of capital expenditures has been largely discretionary and within U.S. Silica’s control. Their budgetary allocations for sustaining and discretionary capital expenditures over the next three years totals $8.3 million. Thereafter, capital expenditures are expected to rise 3% year-over-year from 2025’s $2.2 million. BOYD considers the near-term detailed capital expenditure schedule as presented by U.S. Silica to be reasonable and representative of the capital necessary to operate the Ottawa Operation.

Operating cost estimates were developed based on recent actual costs and considering specific operational activity levels and cost drivers. In the near-term, U.S. Silica expects their unit operating costs to stay relatively level (on an uninflated basis). As such, the projected total cash cost of sales over the life of the mine is $32.85 per ton sold. As the operation is in a steady state, BOYD considers the future operating cost estimates to be reasonable and appropriate.

1.7.3 Economic Analysis

An economic analysis of the Ottawa Operation was prepared in-house by U.S. Silica as part of their annual budgeting process. The financial model forecasts future free cash flow from silica sand production and sales over the life cycle of the Ottawa Operation using the annual forecasts of production, sales revenues, and operating and capital costs.

Table 1.3, below, provides a summary of the estimated financial results for remaining life of the Ottawa Operation.

Table 1.4 summarizes the results of the pre-tax and after-tax discounted cash flows (DCF) and net present value (NPV) analyses for the Ottawa Operation.

The NPV estimate was made for purposes of confirming the economic viability of the reported silica sand reserves and not for purposes of valuing the U.S. Silica, Ottawa Operation, or its assets. Internal rate-of-return (IRR) and project payback were not calculated, as there was no initial investment considered in the financial analysis.

BOYD reviewed the financial model and its inputs in detail, and opined that the model provides a reasonable and accurate reflection of the Ottawa Operation’s expected economic performance based on the assumptions and information available at the time of our review.

1.8 Permitting Requirements

Numerous permits are required by federal and state law for mining, processing, and related activities at the Ottawa Operation, which U.S. Silica reports are in place or pending approval. New permits or permit revisions may be necessary from time to time to facilitate future operations. Given sufficient time and planning, U.S. Silica should be able to secure new permits, as required, to maintain its planned operations within the context of current regulations.

U.S. Silica reports having an extensive environmental management and compliance process designed to follow or to exceed industry standards.

Mine safety is regulated by the U.S. Department of Labor’s Mine Safety and Health Administration (MSHA). MSHA inspects the facilities a minimum of twice yearly. U.S. Silica’s safety record compares favorably with its regional peers.

BOYD is not aware of any regulatory violation or compliance issue which would materially impact the silica sand reserve estimate.

1.9 Conclusions

It is BOYD’s overall conclusion that U.S. Silica’s estimates of silica sand reserves, as reported herein: (1) were prepared in conformance with accepted industry standards and practices, and (2) are reasonably and appropriately supported by technical evaluations, which consider all relevant modifying factors.

Given the lengthy operating history and status of evolution, residual uncertainty (future risk) for this operation is considered minor under the current and foreseeable operating environment.

It is BOYD’s opinion that extraction of the silica sands reported herein is technically, legally, and economically achievable after the consideration of potentially material modifying factors. The ability of U.S. Silica, or any mine operator, to recover all of the reported silica sand reserves is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future silica sand prices, etc. Unforeseen changes in regulations could also impact performance.

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\report\ch-1 - executive summary.docx

2.0 INTRODUCTION

2.1 Registrant

U.S. Silica is a US-based mining company headquartered in Katy, Texas. The company’s common stock is listed on the New York Stock Exchange (NYSE:SLCA). U.S. Silica is actively engaged in the production and marketing of commercial silica sand and performance materials (diatomaceous earth, calcium bentonite clay, calcium montmorillonite clay, and perlite products). Their whole grain silica products are used as frac (proppant) sand for oil and natural gas recovery, and in the manufacture of glass, foundry, and building products. U.S. Silica’s performance materials are used in: (1) filtration for foods and beverages, pharmaceuticals, and swimming pools; (2) as additives in paint and coatings, plastics and rubber, and agriculture products; and (3) for bleaching, catalysis and adsorption in edible oil processing, aromatics purification, and industrial and chemical applications. Additional information regarding U.S. Silica can be found on their website: www.ussilica.com.

2.2 Terms of Reference and Purpose

U.S. Silica retained BOYD to complete an independent technical assessment of their internally-prepared silica sand resource and reserve estimates and supporting information for the Ottawa Operation.

BOYD prepared this technical report summary for U.S. Silica in support of their disclosure of silica sand reserves for the Ottawa Operation in accordance with S-K 1300. The purpose of this report is threefold: (1) to summarize material technical and geoscientific information for the subject mining property, (2) to provide the conclusions of our technical assessment, and (3) to provide a statement of silica sand resources and/or reserves for the Ottawa Operation.

BOYD’s findings are based on our detailed examination of the supporting geologic and other scientific, technical, and economic information provided by U.S. Silica, as well as our assessment of the methodology and practices applied by U.S. Silica in formulating the estimates of silica sand resources and reserves disclosed in this report. We did not independently estimate silica sand resources or reserves from first principles.

We used standard engineering and geoscience methods, or a combination of methods, that we considered to be appropriate and necessary to establish the conclusions set forth herein. As in all aspects of mining property evaluation, there are uncertainties

inherent in the interpretation of engineering and geoscience data; therefore, our conclusions necessarily represent only informed professional judgment.

The ability of U.S. Silica, or any mine operator, to recover all of the estimated silica sand reserves presented in this report is dependent on numerous factors that are beyond the control of, and cannot be anticipated by, BOYD. These factors include mining and geologic conditions, the capabilities of management and employees, the securing of required approvals and permits in a timely manner, future sand prices, etc. Unforeseen changes in regulations could also impact performance. Opinions presented in this report apply to the site conditions and features as they existed at the time of BOYD’s investigations and those reasonably foreseeable.

This report is intended for use by U.S. Silica, subject to the terms and conditions of its professional services agreement with BOYD. We also consent to U.S. Silica filing this report as a technical report summary with the SEC pursuant to S-K 1300. Except for the purposes legislated under US securities law, any other uses of or reliance on this report by any third party is at that party’s sole risk.

2.3 Expert Qualifications

BOYD is an independent consulting firm specializing in mining-related engineering and financial consulting services. Since 1943, BOYD has completed over 4,000 projects in the United States and more than 60 other countries. Our full-time staff comprises mining experts in: civil, environmental, geotechnical, and mining engineering; geology; mineral economics; and market analysis. Our extensive experience in silica sand resource and reserve estimation combined with our knowledge of the subject property, provides BOYD an informed basis on which to opine on the reasonableness of the estimates provided by U.S. Silica. An overview of BOYD can be found on our website at www.jtboyd.com.

The individuals primarily responsible for completing this technical assessment and the preparation of this report are by virtue of their education, experience, and professional association considered qualified persons (QPs) as defined in S-K 1300.

Neither BOYD nor its staff employed in the preparation of this report have any beneficial interest in U.S. Silica, and are not insiders, associates, or affiliates of U.S. Silica. The results of our assessment were not dependent upon any prior agreements concerning the conclusions to be reached, nor were there any undisclosed understandings concerning any future business dealings between U.S. Silica and BOYD. This report was prepared in return for fees based upon agreed commercial rates, and the payment for

our services was not contingent upon our opinions regarding the project or approval of our work by U.S. Silica and its representatives.

2.4 Principal Sources of Information

Information used in this assignment was obtained from: (1) files provided by U.S. Silica, (2) discussions with U.S. Silica personnel, (3) records on file with regulatory agencies, (4) public sources, and (5) nonconfidential information in BOYD’s possession.

The following information was provided by U.S. Silica:

•Year-end reserve statements and reports for 2021 and 2022.

•Exploration records (e.g., drilling logs and lab sheets).

•Geologic databases of lithology and sand quality.

•Computerized geologic models.

•Mapping data, with:

-Land ownership boundaries.

-Infrastructure locations.

-Easement and right-of-way boundaries.

-Surveyed topography (surface elevation).

•Mine plans, production schedules, and supporting data.

•Overview of processing operations and detailed flow sheets.

•Copies of mining and operating permits.

•Historical information, including:

-Production reports.

-Financial statements.

-Product sales and pricing.

Information from sources external to BOYD and/or U.S. Silica are referenced accordingly.

The data and work papers used in the preparation of this report are on file in our offices.

2.5 Personal Inspections

A site visit and inspection of the Ottawa Operation was completed on October 18, 2022,

by BOYD’s QPs responsible for the preparation of this report. The site visit included: (1) observation of the active mining operations, (2) a tour of the mine site’s surface infrastructure, and (3) a tour of the process plant and truck loadouts. BOYD’s representatives were accompanied by senior U.S. Silica engineering and management personnel who openly and cooperatively answered questions regarding, but not limited

to: site history; deposit geology; mining and processing operations; near- and long-range mining plans; and silica sand marketing.

2.6 Report Version

The silica sand resources and reserves presented in this Technical Report Summary are effective as of December 31, 2022. The effective (i.e., “as of”) date of the report is December 31, 2022.

This is the third Technical Report Summary filed by U.S. Silica for the Ottawa Operation and supersedes the following previously filed reports:

Westward Environmental; February 2022; Technical Report Summary Ottawa Site, Lasalle County, Illinois.

Westward Environmental; September 2022; Technical Report Summary Ottawa Site, Lasalle County, Illinois.

The user of this document should ensure that this is the most recent disclosure of silica sand resources and reserves for the Ottawa Operation as it is no longer valid if more recent estimates have been issued.

2.7 Units of Measure

The US customary measurement system has been used throughout this report. Tons are short tons of 2,000 pounds-mass. Unless otherwise stated, currency is expressed in US Dollars ($). Historic prices and costs are presented in nominal (unadjusted) dollars. Future dollars values are expressed on a constant (unescalated) basis.

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\ch-2 - introduction.docx

3.0 PROPERTY DESCRIPTION

3.1 Location

U.S. Silica’s Ottawa Operation is a surface silica sand mining and processing operation located immediately west of the City of Ottawa in LaSalle County, Illinois. The cities of Chicago and Peoria, Illinois, are located approximately 95 miles east-northeast and 75 miles southwest, respectively, of the Ottawa Operation.

The property is bisected by the Illinois River into the North Ottawa and South Ottawa sites. The mine offices, maintenance facilities, processing plant, loadout facilities, and former mining pits are located on the North Ottawa site, while the active and future mining areas are located on the South Ottawa site. The South Ottawa site includes three defined pits: South Ottawa, where current mining is taking place, and the West Ottawa Pit and the Mississippi Sand Pit (future mining areas). A slurry line driven under the Illinois River connects the two sites, and feeds ROM sand material from South Ottawa to the processing plant.

Geographically, the Ottawa Operation’s processing plant is located at approximately 41° 20' 45.19" N latitude and 88° 52' 33.11" W longitude. Figures 1.1 (page 1-2) and 3.1, on the following page, illustrate the location and general layout of the Ottawa Operation.

3.2 Property Rights

U.S. Silica and its predecessors purchased the parcels of land—both surface and mineral rights—that currently comprise the Ottawa Operation at various times in its history to underpin their long-term operational goals. Currently, the Ottawa Operation comprises 68 parcels totaling approximately 2,072 acres of surface and minerals rights fully owned by U.S. Silica, as shown in Table 3.1.

3.3 Encumbrances

3.3.1 Fees and Royalties

To maintain ownership of the Ottawa Operation properties, U.S. Silica must pay property taxes to the local government in LaSalle County. To BOYD’s knowledge there are no liens against the properties.

It is BOYD’s understanding that there are no royalties, overriding or limited royalties, working interests, production payments, net profit interests, or other mineral interests in the Ottawa Operation properties.

3.3.2 Permitting Requirements

Mining and processing activities on the Ottawa Operation properties are regulated by several federal and state laws. As mandated by these laws and regulations, numerous permits are required for mining, processing, and other incidental activities. U.S. Silica reports that necessary permits are in place or applied for to support immediate operations. New permits or permit revisions may be necessary from time to time to facilitate future operations. Given sufficient time and planning, U.S. Silica should be able to secure new permits, as required, to maintain its planned operations within the context of the current regulations. Permitting and permitting conditions are discussed further in Chapter 17 of this report.

In BOYD’s opinion, U.S. Silica has demonstrated their ability and cooperation to align their operating plans with any permitting requirements that may be encountered during the normal course of business.

BOYD is not aware of any current material violations or fines imposed by regulators on the Ottawa Operation.

3.3.3 Mining Restrictions

Several natural and man-made features have been identified in and around the South Ottawa site which may limit the mineable areas of the property. As of this report, these features include:

•Setbacks from neighboring properties.

•Illinois Route 71 right-of-way.

•East 1251st Road (Catlin Park Road) right-of-way.

•Catlin Salt Marsh.

•Ernat Salt Marsh.

•Brown’s Brook.

•Jurisdictional wetlands and tributaries.

•Archeologically significant sites.

U.S. Silica has included suitable setbacks in their mining plans to avoid disturbing these sensitive areas. As such, these areas have been excluded from the estimates of silica sand resources and reserves presented herein.

3.3.4 Other Significant Factors or Risks

To the extent known to BOYD, there are no other significant factors and risks that may affect access, title, or the right or ability to perform work on the Ottawa Operation property that are not discussed in this report. However, the reported silica sand resources and reserves may be materially impacted by: U.S. Silica’s failure to comply with permit conditions and rules; delays in obtaining required government or other regulatory approvals or permits; U.S. Silica’s inability to obtain such required approvals or permits; or unforeseen changes in governmental regulations.

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\ch-3 - property description.docx

4.0 PHYSIOGRAPHY, ACCESSIBILITY, AND INFRASTRUCTURE

4.1 Topography, Elevation, and Vegetation

The Ottawa Operation lies within the Bloomington Ridged Plain division of the Till Plains Section physiographic province of Illinois. This region is generally characterized by low, broad, gently sloping ridges formed by glacial moraines, intertwined with wide regions of relatively flat grasslands.

Surface elevations in and around the property range from approximately 460 ft above mean sea-level (AMSL) near the Illinois River, to over 610 ft AMSL on the southern-most extents of the South Ottawa site where it abuts the Illinois River bluff.

Various streams and waterways are present in the immediate area, which drain into the Illinois River. The Ottawa South site contains several wetlands and almost all areas north of the bluff are located within the flood plain of the Illinois River.

Land cover in the immediate area consists predominantly of a mixture of forest, crop/pastureland, and medium density rural areas outside of the city of Ottawa—which is characterized as a medium-to-high density urban area.

4.2 Accessibility

General access to the Ottawa Operation is via a well-developed network of primary and secondary roads serviced by state and local governments. These roads provide direct access to the mine site and processing facilities and are generally open year-round.

A dedicated rail spur connects the Ottawa Operation to BNSF and CXS Class 1 rail lines located to the north and east of the property. Union Pacific and Norfolk Southern rail lines can be accessed utilizing truck transloading, if necessary.

Due to the operation’s location along the Illinois River, U.S. Silica also leases property to a privately-owned barge terminal, which may also be utilized for transporting finished goods.

4.3 Climate

Climate in and around the Ottawa Operation is characteristic for the midwestern US, with four seasons ranging from very cold and snowy winters to hot and humid summers, with generally milder falls and springs. The average daily high temperatures typically reach above freezing all 12 months of the year, while the low temperatures typically drop below freezing during 7 months of the year. Winter temperatures typically range from 18 degrees Fahrenheit (° F) to 36° F, while summer temperatures usually range from 60° F to 84° F. Average annual precipitation for the area is approximately 37 inches of rain and 21 inches of snow.

In general, the operating season for the Ottawa Operation is year-round. Adverse weather conditions seldom limit mining, processing, and loading operations; however, extreme weather conditions may temporarily impact operations. Periodic flooding is possible during heavy rainfall.

4.4 Infrastructure Availability and Sources

The Ottawa Operation lies within a well-developed region of north-central Illinois and has been operating for over 100 years in a region of mixed industrial and suburban development. The City of Ottawa has a population of almost 19,000 and over 500,000 people live in LaSalle County and the surrounding counites, according to 2021 US Census data.

Finished silica sand products from the Ottawa Operation are mainly transported to customer by rail and supported by U.S. Silica’s extensive on-site rail-car loading, storage, and handling facility. Access to a well-maintained network of roads and a barge terminal provide alternative transportation options.

Several regional airports are located within an hour’s drive from the Ottawa Operation, and the Chicago O’Hare and Midway international airports are less than two hours away by car.

Reliable sources of electrical power, water, supplies, and materials are readily available. Electrical power is provided to the operation by regional utility companies. Water is supplied by public water services, surface impoundments, or water wells. The Ottawa Operation has an abundance of recycled slurry water and processing water available.

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\ch-4 -physiography access infrastructure.docx

5.0 HISTORY

5.1 Reserve Acquisition

The United States Silica Sand Company, a separate entity from U.S. Silica, established the first large-scale silica sand mining operation near the town of Ottawa, on the southern side of the Illinois River in 1894. This company mined the St. Peter Sandstone using a combination of blasting and hydraulic mining, in very much the same manner that the formation is mined today.

Edmund B. Thornton, a competitor to the United States Silica Sand Company, began a local silica sand mining operation on the present day North Ottawa site in 1900 under the name Ottawa Silica Company. By the 1920’s, the Ottawa Silica Company had taken over most of the silica sand production in the area, eventually resulting in the Thornton family buying out the United States Silica Sand Company in 1928. The Thornton family continued to own and operate the Ottawa Silica Company until 1986, when the company was sold to Rio Tinto Zinc, a large mining conglomerate based in London.

Rio Tinto Zinc merged the newly acquired Ottawa Silica Company with their Berkely Springs, West Virgina-based Pennsylvania Glass Sand Company in January 1987, forming what is now U.S. Silica.

5.2 Exploration and Development

The Ottawa Silica Company was formed over 100 years ago to meet the demands of a small and local market segment. As industry and mass production grew and evolved, the operation did as well, and it began selling silica sand into additional markets, such as glass making, foundry casting, abrasives, building materials, and other segments over the years.

The grinding plant was built in the 1940’s to produce ground silica products. This plant utilizes dry ball mills to reduce silica sand grains into fine-ground silica powders for use in various specialty markets for composite glasses, adhesives, fillers, sealants, ceramics, and epoxies.

A significant example of changing markets affecting the Ottawa Operation occurred in the late 1990’s and early 2000’s, as the use of silica sand in hydraulic fracturing of shales for oil and gas production began to increase drastically. Seeing demands for silica sand shift in their market base and noting what looked to be a growing segment at the

time, U.S. Silica shifted their production strategies to accommodate this market segment. In 2008, development of the Marcellus Shale, and the subsequent additional demand for proppant sands resulted in various expansions being undertaken by U.S. Silica. In order to be able to meet growing demand for proppant sands, the Ottawa Operation expanded its production capacity by 500 thousand tons per year in 2009. Demand for proppant sands continued to increase, and U.S. Silica again expanded the Ottawa operations in 2011 by another 900 thousand tons per year, reaching the present-day production capacity of 3.3 million product tons per year.

Exploration on the South Ottawa site began in 2000 as U.S. Silica began developing strategies in anticipation of having to move production to the south side of the Illinois River. There is no record of any exploration being performed prior to 2000 on the South Ottawa site. Exploration data for the mined-out areas in the North Ottawa site were not reviewed for this report.

The North Ottawa Pit was depleted of mineable sand by 2010, at which time mining operations were moved to the South Ottawa Pit. A slurry line was driven from the eastern portion of the South Ottawa Pit area, under the Illinois River, and to the existing processing plant which is located on the North Ottawa site. Operations continue in the original South Ottawa Pit today.

Again, considering future mine planning needs, U.S. Silica initiated a reserve expansion project in the spring of 2016, with the objective of extending the life of the Ottawa Operation. To this end, U.S. Silica acquired a 314-acre parcel, known as the Mississippi Sand Mine, located adjacent to the western border of the South Ottawa site.

U.S. Silica notes they have continually renovated and updated their facilities in order to improve operational efficiency and better respond to changing market demands. These continuous process improvements have resulted in the operation’s ability to produce multiple types of products using various processing methods (washing, hydraulic sizing, grinding, screening, and blending).

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\report\ch-5 -history.docx

6.0 GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT

6.1 Regional Geology

The Ottawa Operation mines and processes material from the St. Peter Sandstone, which is a massive formation in areal extent and thickness. The formation is found principally in the area drained by the Mississippi River and its tributaries, spanning north to south from Minnesota to Arkansas and east to west from Illinois into Nebraska and South Dakota. On a regional basis, the St. Peter Sandstone ranges in thickness from a few feet to over 1,200 ft, with a general thickness of 100 ft to 200 ft. Depths of the sandstone range from a few feet to greater than 10,000 ft.

The St. Peter Sandstone is Middle Ordovician in age (around 460 million years old) and was deposited in an advancing marine shoreline dominated by eolian dune and beach processes. Since the deposition, the formation has experienced several episodes of subsidence and uplift.

Except where it has been removed by erosion, the St. Peter Sandstone covers most of the Illinois Basin at depths varying from a few feet to almost 7,000 ft. The formation outcrops in four principal areas of northern Illinois: (1) the Ottawa-Utica-Millington area, where it outcrops along the Illinois and Fox rivers; (2) the Oregon-Dixon area; (3) the Brookville-Harper area; and (4) the Calhoun County area. In northern Illinois, the thickness of the formation can reach over 300 ft; however, it generally occurs as a 100 ft to 200 ft thick bed. Variations in the thickness of the St. Peter Sandstone are due to post depositional erosion and its highly irregular lower boundary.

The St. Peter Sandstone is a super-mature quartz arenite (≈99% quartz) that consists primarily of well-sorted, fine- to medium-sized, well-rounded quartz grains that are friable or weakly cemented and generally free from clay, carbonates, and heavy minerals. On a regional basis, the formation exhibits grain size that generally ranges from coarser in the upper section to finer in the lower section. As a rule, the lower portion of the formation is fine-grained with iron, alumina, and carbonate contamination increasing with depth.

The St. Peter Formation is an important aquifer as well as a source of high purity silica sand.

6.2 Local Geology

6.2.1 Stratigraphy

Ordovician and Pennsylvanian sedimentary strata comprise the uppermost stratigraphic units underlying the soils in and around the Ottawa Operation. These units primarily include bedrock of, in ascending stratigraphic order, the Prairie du Chien, Ancell, Platteville, and Galena groups of the Ordovician series, and the Pennsylvanian Carbondale Formation. The stratigraphic relationship between these groups is presented in Figure 6.1 as follows.

The following text discusses the strata encountered near Ottawa in ascending depositional order.

Shakopee

The Shakopee Dolomite of the Prairie du Chien Group is composed of argillaceous to pure, very fine-grained dolomite with some thin beds of medium-grained, cross-bedded sandstone, medium-grained dolomite, green to light gray shale, and buff siltstone.

St. Peter

The St. Peter Sandstone unconformably overlies the Shakopee Dolomite formation, and is composed of three members. The lower unit, the Kress Member, consists of chert conglomerate with beds of red and green shale and medium- to coarse-grained sandstone. The remainder of the St. Peter Sandstone is composed of well-rounded, well-sorted, medium- to coarse-grained sandstone of the Tonti and Starved Rock Members,

in depositional order. Locally, the upper part of the St. Peter Sandstone can be poorly consolidated, becoming more consolidated with depth.

Glenwood

The Glenwood Formation is a highly varied unit of poorly sorted sandstone, impure dolomite, and green shale overlying the St. Peter Sandstone. The sandstones have a distinctive bimodal, or “pudding stone,” texture, with medium grains of well-rounded quartz sand, like those of the St. Peter Sandstone, but contained in a matrix of very fine sand and coarse silt. The Glenwood sandstones also contain a variety of heavy minerals, including abundant garnet. This unit is generally not present in the immediate vicinity of the Ottawa Operation but can be found south of the property.

Platteville and Galena

The Platteville and Galena Formations are often combined due to consisting mainly of carbonate sequences of limestone and dolomite. These formations are present south of the Ottawa Operation, but not in the immediate vicinity.

Tradewater and Carbondale

These Pennsylvanian strata are predominantly clastic and contain subordinate amounts of coal and limestone. While this formation is not found at the Ottawa Operation, it comprises the primary near-surface bedrock strata south of the bluffs that border the Illinois River Valley.

Undifferentiated Quaternary Alluvium

Surface geology consists of what is mapped as the Quaternary Age Cahokia Alluvium, an unconsolidated interval of poorly sorted silts, clays, and sand and gravels. Thickness of this unit varies greatly in the region but is very thin within the Illinois River Valley.

6.2.2 Structural Geology

The St. Peter Sandstone at Ottawa lies very near the surface (thereby creating favorable mining conditions) primarily for two reasons. Firstly, one of the most prominent structural features in the Illinois Basin, the La Salle Anticlinorium, has uplifted the sandstone formation from its original depositional position. Secondly, glacial floodwaters of the Late Wisconsin Episode carved the upper reaches of the Illinois River Valley, removing most of strata overlying the St. Peter Sandstone, leaving the sandstone near the land surface as a bedrock bench that is easily identifiable.

On the south bank of the Illinois River, the St. Peter Sandstone forms bluffs and outcrops in the valleys incident to the bluffs from Ottawa to Little Rock, Illinois. In this area, the

overlying formations are principally Pennsylvanian beds, though locally, as at the edge of the bluff in Starved Rock State Park and near Little Rock, the sandstone is bare or is covered with a thin mantle of soil or glacial till.

6.3 Property Geology

The St. Peter Sandstone is the only strata of economic interest at the Ottawa Operation, and is very uniform in depositional nature and continuity throughout much of the surrounding region. BOYD considers the subject silica sand deposit to be of low geologic complexity. Furthermore, the geology of the St. Peter Sandstone is well understood after a lengthy history of commercial operations at Ottawa.

Within the defined resource boundaries, the St. Peter Sandstone exhibits: (1) low depth of cover, (2) lateral continuity, (3) a minimum thickness of 70 ft, (4) gentle dipping, and (5) minimal faulting. Figure 6.2, following this page, provides a map of the St. Peter Sandstone thickness. A cross-section through the deposit is provided in Figure 6.3.

The two members of the St. Peter Sandstone—the coarser-grained upper Starved Rock and finer-grained lower Tonti members—are easily identifiable and separable during mining and can be blended as required to meet product specifications. Deleterious materials such as iron (which manifests as orange staining) are easily removed during mining and processing. The sandstone unit is covered by a thin layer of overburden that is generally less than 20 ft thick.

The Ottawa Operation’s sands are generally characterized by a high silica content, high roundness and sphericity, white coloration, and lack of deleterious material. The sandstone is very weakly cemented, allowing it to be mined hydraulically without the need for crushing, which retains the well-rounded grain shape. Because of the monocrystalline structure, these sands have superior grain strength when compared to other silica sands and are suitable for pressure applications generally up to the 9,000-pounds per square inch (psi) range. These characteristics are responsible for the market popularity of the Ottawa Operation’s silica sand products.

q:\eng_wp\3076.019 u.s. silica - ottawa\wp\ch-6 - geology.docx

7.0 EXPLORATION DATA

7.1 Background

The Ottawa Operation has an extensive history, over 100 years, of mining and producing of finished silica sand from the St. Peter Sandstone. The Ottawa North site was depleted of silica sand reserves by 2010, by which time operations had commenced at the Ottawa South site. All of the silica sand reserves reported herein are contained within the planned mining areas of the Ottawa South site.

BOYD was provided source records (drilling logs, testing results, and core photographs) and a database compiling the results 225 drill holes, wells, field measurements, and test holes located in and around the South Ottawa site. Records indicate that these exploration data were collected between 2000 and 2014.

An overview of U.S. Silica’s exploration and sampling standardized procedures was also provided, which summarizes methodologies and techniques utilized during the various exploration programs completed at the Ottawa Operation.

7.2 Exploration Procedures

7.2.1 Drilling

Drill holes on the Ottawa South site were completed using various drilling procedures based on specific goals and data needs at various stages of planning and developing the Ottawa Mine. Drilling methods utilized to delineate the sub-surface geology include diamond core drilling, rotosonic drilling, and rotary auger drilling techniques. The various exploration campaigns completed, in addition to outcrop mapping, site surveys, and review of United States Geological Survey and Illinois State Geological Survey mapping, serve as the basis for evaluating the extents and geologic continuity of the St. Peter Sandstone underlying the Ottawa South site.

BOYD’s review of the reported methodologies and procedures indicate the exploration data obtained and utilized by U.S. Silica for the South Ottawa site were carefully and professionally collected, prepared, and documented, conforming with general industry standards, and are appropriate for use of evaluating and estimating silica sand resources and reserves.

7.2.2 Sand Quality Sampling

The Ottawa Operation’s sand quality sampling procedures followed standard industry practices, based on the information provided and discussions held with U.S. Silica personnel. With a preference to utilize diamond core drilling methodologies, the general procedures for sampling during any of the exploration programs, are as follows:

•Recovered drill cores are placed into core boxes and labeled with drill hole name, down hole footage, and recorded thicknesses for each recovered core.

•Cores are geologically logged and photographed, with characteristics of the overall stratigraphy recorded while being boxed. This allowed U.S. Silica to alter pre-determined drilling depths as the program progressed, in order to ensure the entire target strata were sampled and collected.

•Boxed core samples were transported by U.S. Silica to one of their two internal laboratories—located in Berkeley Springs, WV and Katy, TX—where they were checked in and split into 5-ft sample intervals for preparation and testing.

•Details on the expansion property exploration sampling techniques were not provided by Mississippi Sands to U.S. Silica. However, available archival core samples were examined by U.S. Silica personnel, and the 5-ft sample intervals examined seemed to be representative of the local geology. These samples were originally tested at a third-party (Bowser-Morner, Inc.) laboratory in Dayton, Ohio. U.S. Silica obtained samples of the available archival drilling cores and transported and performed their own testing at one of their internal laboratories prior to finalizing the acquisition of the Mississippi Sands property.

U.S. Silica maintained control of exploration core samples throughout the entirety of each drilling campaign, from the point of logging and boxing of recovered cores in the field, to transportation and delivery of core samples to their internal laboratories, through performing preparation and analyses on each of the samples.

Available testing results were reviewed by BOYD during our assessment, and our review of the field and sampling procedures noted above showed that the general description and sampling work were conducted to appropriate standards. Based on the stated standards, both in the field and in the laboratory, BOYD considers the sample preparation and analytical procedures were adequate for the purposes of evaluating and estimating silica sand resources and reserves at the Ottawa Operation.

7.2.3 Sand Testing

Samples obtained from the exploration campaigns completed at the Ottawa Operation were taken to one of the company’s in-house laboratories, where they were prepared and analyzed for particle size distribution analyses. Samples were split and prepared

following standardized company procedures—U.S. Silica’s ISO 9001 Quality System of Corporate Analytical Procedures—to ensure analytical consistency throughout each of the various exploration campaigns. These procedures are designed to closely match the operational capabilities of the Ottawa Operation’s processing plant.

Preparation of each sample consisted of initially splitting the recovered core in half using a chisel and hammer. One half of the core is placed back into the core boxes which are then stored for archival purposes, while the other half of the core is further prepared and processed for lab testing purposes.

Analysis samples were then crushed, quartered, and mixed to create a uniform and representative mixture of the core interval, and are then divided into 1,000-to-5,000-gram samples, depending on the type and amount of testing to be performed. The desired sample size is then run through various crushing techniques to disaggregate the sand grains and fine materials as much as possible before beginning the washing and scrubbing procedures.

An approximately 1,500-gram sample is then obtained and washed before being run through a scalping procedure to remove coarse (+16-mesh size for proppant sand product testing; +30-mesh size for industrial product testing) particles. This process primarily removes the oversize “coarse waste” size fraction, leaving behind the material that would typically be washed in the wet processing plant. The remaining material is weighed and labeled as a “washed sample”.

The washed sample is further prepared by simulating the wet processing plant conditions, which consist of placing a sample into scrubbers for three minutes, rinsing and decanting, and then drying to arrive at a “scrubbed sample”, which represents material that the wet processing plant would prepare before being run through a drying plant.

The scrubbed samples are then dried and analyzed following API/ISO standards for particle size distribution analysis and then API RP 19C/ISO-13503-2 standard testing for proppant materials used in fracturing and gravel-packing operations.

7.2.4 Other Exploration Methods

There were not any other methods of exploration (such as airborne or ground geophysical surveys) reported for the Ottawa Operation.

7.3 Exploration Results

7.3.1 Summary of Exploration

A total of 225 drill holes were completed in and around the South Ottawa area. The distribution of these drill holes is shown on Figure 7.1, on the next page.

As mentioned, the 225 drill holes include a variety of drill holes, wells, field measurements, and test holes. BOYD’s review determined that 102 holes penetrated the full depth of the St. Peters Sandstone and were supported by suitable lithologic and sand quality records. Lithologic data from many of the shorter holes (i.e., those which did not penetrate the entire thickness of the sandstone strata), we used to estimate the thickness of the overburden material over the South Ottawa site.

General descriptive statistics for the St. Peter Sandstone, and overburden material are provided in Table 7.1, below.

These data confirm the generally uniform nature of the deposit underlying the South Ottawa site and support the interpretation of the sandstone’s thickness illustrated in Figure 6.2 (page 6-5).

7.3.2 Silica Sand Quality

The Ottawa Operation produces a wide variety of proppant sand and specialty silica sands products for numerous customers. While not all of the finished products must adhere to a published set of specifications, U.S. Silica utilizes samples obtained during exploration to ascertain the suitability of the mineable sandstone for producing the various materials it supplies to customers.

Particle size distribution and iron content are noted as the primary drivers of mine planning at the Ottawa Operation. Particle size distribution within the sandstone, necessitates the concurrent mining of multiple areas of the mine to ensure supply of appropriately sized material to the processing plant. Similarly, as iron content increases near the top and bottom of the sandstone, this material must be discarded or blended with higher quality sand before processing.

U.S. Silica performs testing at their laboratories for API/ISO specifications; however, no data were made available for our review. Historically, API RP 19C/ISO 13503-2 proppant sand characteristics were strictly used to determine the suitability of a sand product for use during fracking stages of oil and gas well development. Over time, these specifications have become merely guidelines and the suitability of a proppant sand product is now determined by the end user. Indeed, many end users test the products that they purchase to determine if they meet their own internal specifications. BOYD notes that U.S. Silica has demonstrated commercial success in producing and marketing their finished silica sand products; as such, it is BOYD’s opinion that sand quality data provided are representative and suitable for the estimation of silica sand resources and reserves.

7.3.3 Grain Size Distribution

Grain size distribution was analyzed according to API RP 19C/ISO 13503-2, Section 6.

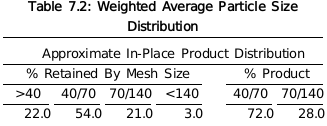

A table of weighted average grain size distribution of the in-situ sand deposit, based on laboratory testing results, is shown in Table 7.2, below.

The preceding table highlights the relative fineness of the sand found within the Ottawa South Property, indicating a majority of the sand particles are concentrated between the “passing 40-mesh” and “retained 140-mesh” size fraction. Accordingly, the predominant marketable proppant sand product consists of the 40/140-mesh sand.

7.3.4 Grain Shape (Sphericity and Roundness)

Grain shape is defined under ISO 13503-2/API RP19C, Section 7. Under this standard, recommended sphericity and roundness values for proppants are 0.6 or greater. As part of the grain shape analysis, the presence of grain clusters (weakly cemented grain aggregates) and their approximate proportion in the sample are reported.

While individual sample testing results for the Ottawa Operation’s deposit were not available for review at the time of this report, it is important to note that the St. Peter Sandstone is well studied and widely known to consistently exhibit the general characteristics of being a fine-to-medium grained, well-rounded, and well-sorted sandstone comprised primarily of weakly cemented and extraordinarily pure quartz grains that contain little-to-no deleterious materials within the sandstone matrix.

U.S. Silica has also produced and sold sand into various oil and gas basins, where ultimately the sand has been shown to meet customer specifications.

7.3.5 Crush Resistance

Crush resistance is a key test that determines the amount of pressure a sand grain can withstand under laboratory conditions for a two-minute duration. It is analyzed according to ISO 13503-2/API RP19C, Section 11. Under this standard, the highest stress level (psi) in which the proppant produces no more than 10% crushed fine material is rounded down to the nearest 1,000 psi and reported as the “K-value” of the material.

The Ottawa Operation’s silica sand products are noted for exhibiting high crush strengths.

7.3.6 Mineralogical Analyses

Mineralogical analyses were performed via x-ray fluorescence to determine the concentrations of various minerals present within the sandstone matrix. Testing determined that the minerals present in the sandstone matrix will generally be removed during processing of the mined silica sand. Mineralogical testing was conducted on a composited interval of the entire mineable interval from a given drill hole.

7.4 Data Verification

For purposes of this report, BOYD did not verify historic drill hole data by conducting independent drilling. It is customary in preparing similar mining resource and reserve estimates to accept basic drilling and sample quality data as provided by the client subject to the reported results being judged representative and reasonable.

BOYD’s efforts to judge the appropriateness and reasonability of the source exploration data included reviewing representative samples of provided drilling logs, sampling procedures, sand quality testing results, and discussing aspects of developing the operation with U.S. Silica personnel during our site visit. Reviewed drilling records were compared with their corresponding database records for transcription errors; of which none were found. Lithologic and sand quality data points were compared via visual and statistical inspection with geologic mapping and cross-sections.

7.5 Adequacy of Exploration and Sampling