UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ___ )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

The Honest Company, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

12130 Millennium Drive, #500

Los Angeles, CA 90094

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 22, 2024

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of The Honest Company, Inc., a Delaware corporation (the “Company”). The meeting will be held on Wednesday, May 22, 2024 at 9:00 a.m. Pacific Time through a live webcast at www.virtualshareholdermeeting.com/HNST2024. The meeting will be conducted in a virtual format only with no in-person attendance. The meeting will be held for the following purposes:

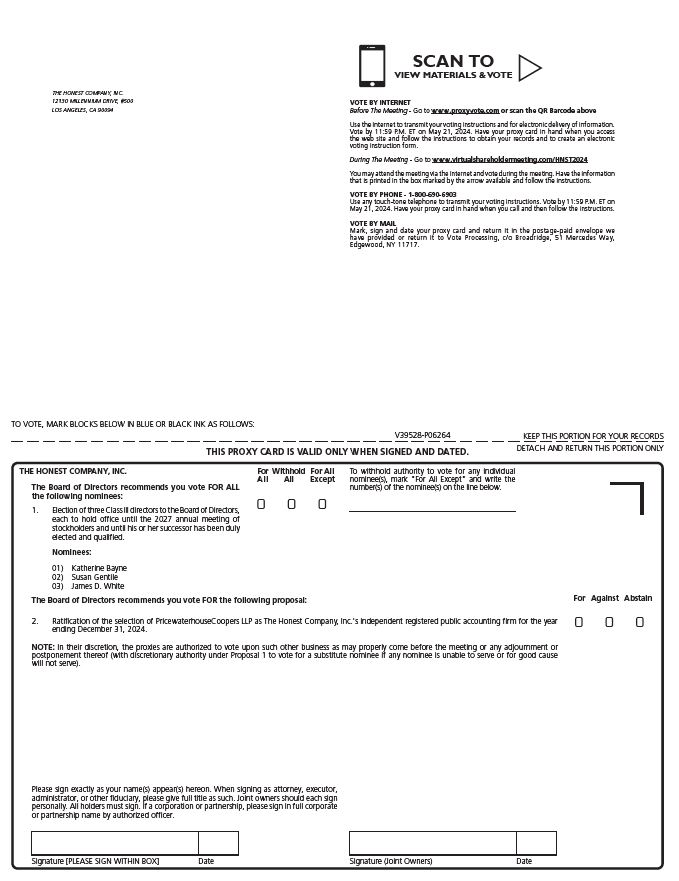

1. To elect the Board’s three nominees for director listed in the accompanying Proxy Statement, until the 2027 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified.

2. To ratify the selection by the Audit Committee of the Board of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2024.

3. To conduct any other business properly brought before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice.

This year's Annual Meeting will be held virtually through a live webcast. You will be able to attend the Annual Meeting, submit questions and vote during the live webcast by visiting www.virtualshareholdermeeting.com/HNST2024 and entering the 16-digit Control Number included in your Notice of Internet Availability, proxy card, or in the instructions that you received via email. Please refer to the additional logistical details and recommendations in the accompanying Proxy Statement. You may log-in beginning at 8:45 a.m. Pacific Time, on Wednesday, May 22, 2024.

The record date for the Annual Meeting is March 25, 2024. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors,

Brendan Sheehey

General Counsel & Corporate Secretary

Los Angeles, California

April 10, 2024

| | |

| YOUR VOTE IS IMPORTANT. Whether or not you expect to attend the meeting, please complete, date, sign and return the proxy card mailed to you if one was mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote online if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you may need to obtain a proxy issued in your name from that record holder. Please contact your broker, bank or other nominee for information about specific requirements if you would like to vote your shares at the meeting. |

| | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on Wednesday, May 22, 2024 at 9:00 a.m. Pacific Time online at www.virtualshareholdermeeting.com/HNST2024 The Proxy Statement and 2023 Annual Report to Stockholders are available at www.proxyvote.com. |

THE HONEST COMPANY, INC.

12130 Millennium Drive, #500

Los Angeles, CA 90094

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

May 22, 2024

MEETING AGENDA

| | | | | | | | | | | |

| Proposals | Page | Voting Standard | Board Recommendation |

| Election of Directors named herein | | Plurality | For each director nominee |

| Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2024 | | Majority of the voting power of the shares present virtually or represented by proxy and voting affirmatively or negatively (excluding abstentions and broker non-votes) on the matter | For |

This page intentionally left blank

TABLE OF CONTENTS

| | | | | |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Forward-Looking Statements

This proxy statement contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this proxy statement, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. Such statements may address the Company’s expectations regarding our ability to achieve profitability and build shareholder value and our plans to improve margin structure through cost savings and other strategic initiatives. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning building upon the distinctive elements of the Honest brand, our path to profitability, the strategic elements supporting our ongoing cost structure improvements, the growth potential of the Honest brand, our focus on driving shareholder value, and the advancement of Honest's mission.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this proxy statement primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results.

The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” in the Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on March 8, 2024, and subsequent filings with the Securities and Exchange Commission. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. We undertake no obligation to update any forward-looking statements made in this proxy statement to reflect events or circumstances after the date of this proxy statement or to reflect new information or the occurrence of unanticipated events, except as required by law.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board”) of The Honest Company, Inc. (sometimes referred to as the “Company” or “Honest”) is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 10, 2024 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after April 20, 2024.

How do I attend the Annual Meeting?

The Annual Meeting will be held through a live webcast at www.virtualshareholdermeeting.com/HNST2024. The meeting will be conducted in a virtual format only with no in-person attendance. If you attend the Annual Meeting online, you will be able to vote and submit questions, at www.virtualshareholdermeeting.com/HNST2024.

You are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on March 25, 2024, the record date, or hold a valid proxy for the meeting. To be admitted to the Annual Meeting, you will need to visit www.virtualshareholdermeeting.com/HNST2024 and enter the 16-digit Control Number found next to the label “Control Number” on your Notice of Internet Availability, proxy card if one was mailed to you or in the email sending you the Proxy Statement. If you are a beneficial stockholder, you should contact the bank, broker or other institution where you hold your account well in advance of the meeting if you have questions about obtaining your control number/proxy to vote.

Whether or not you participate in the Annual Meeting, it is important that you vote your shares.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately fifteen minutes before the meeting on May 22, 2024.

What if I cannot find my Control Number?

Please note that if you do not have your Control Number and you are a registered stockholder, you will be able to login as a guest. To view the meeting webcast, visit www.virtualshareholdermeeting.com/HNST2024 and register as a guest. If you login as a guest, you will not be able to vote your shares or ask questions during the meeting.

If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other holder of record), you will need to contact that bank, broker or other holder of record to obtain your Control Number prior to the Annual Meeting.

Will a list of record stockholders as of the record date be available?

For the ten days ending the day prior to the Annual Meeting, a list of our record stockholders as of the close of business on the record date will be available for examination by any stockholder of record for a legally valid purpose at our corporate headquarters during regular business hours. To access the list of record stockholders beginning May 12, 2024 and until the meeting, stockholders should email Legal@thehonestcompany.com.

Where can we get technical assistance?

If you have difficulty accessing the meeting, please use the technical assistance phone number displayed on the virtual meeting registration page at www.virtualshareholdermeeting.com/HNST2024 where technicians will be available to help you.

For the Annual Meeting, how do we ask questions of management and the Board?

We plan to have a Q&A session at the Annual Meeting and will include as many stockholder questions as the allotted time permits. Stockholders may submit questions that are relevant to our business during the Annual Meeting. If you are a stockholder, you may submit a question during the Annual Meeting through www.virtualshareholdermeeting.com/HNST2024.

We will post answers to stockholders’ questions that are relevant to our business received before and during the Annual Meeting on our Investor Relations website shortly after the meeting.

If I miss the Annual Meeting, will there be a copy posted online?

Yes, a replay of the Annual Meeting webcast will be available at our Investor Relations website at investors.honest.com and remain for at least one year.

Who can vote at the Annual Meeting?

Only stockholders of record or beneficial owners of shares of our common stock at the close of business on March 25, 2024 will be entitled to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the record date. If on March 25, 2024, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. If on March 25, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm bank or other similar organization, then you are a beneficial owner of shares held in “street name.” See “How do I vote?” below on how to vote your shares depending on if you are a stockholder of record or a beneficial owner of shares held in “street name.” On the record date, there were 97,032,787 shares of common stock outstanding and entitled to vote.

What am I voting on?

There are two matters scheduled for a vote:

•Election of three directors as listed herein (Proposal 1); and

•Ratification of selection by the Audit Committee of the Board of PricewaterhouseCoopers LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2024 (Proposal 2).

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For the other matter to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting depend on whether your shares are registered in your name or are held by a bank, broker or nominee:

Stockholder of Record: Shares Registered in Your Name

If on March 25, 2024, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. If you are a stockholder of record, you may vote at the Annual Meeting, or you may vote by proxy over the telephone, through the internet or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote at the meeting even if you have already voted by proxy.

•To vote during the Annual Meeting, if you are a stockholder of record as of the record date, follow the instructions at www.virtualshareholdermeeting.com/HNST2024. You will need to enter the 16-digit

Control Number found on your Notice, or proxy card if one was mailed to you or in the email sending you the Proxy Statement.

•To vote prior to the Annual Meeting (until 11:59 p.m. Eastern Time on May 21, 2024), you may vote via the Internet at www.proxyvote.com; by telephone; or by completing and returning their proxy card if one was mailed to you, as described below.

•To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and Control Number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on May 21, 2024 to be counted.

•To vote through the internet prior to the meeting, go to www.proxyvote.com and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide the company number and Control Number from the Notice. Your internet vote must be received by 11:59 p.m. Eastern Time on May 21, 2024 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If on March 25, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm bank or other similar organization, then you are a beneficial owner of shares held in “street name” and you should have received a Notice containing voting instructions from that organization rather than from Honest. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account.

Follow the instructions from your broker, bank or other agent regarding how to vote the shares in your account.

| | |

| Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 25, 2024.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card if one was mailed to you, by telephone, through the internet or online at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of the three nominees for director and “For” the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024. If any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under stock exchange rules, brokers, banks and other securities intermediaries may use their discretion to

vote your “uninstructed” shares with respect to matters considered to be “routine” under such rules, but not with respect to “non-routine” matters. Proposal 1 is considered to be “non-routine” under such rules, meaning that your broker may not vote your shares on this proposal in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under such rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

If you are a beneficial owner of shares held in street name, and you do not plan to attend the meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to Honest’s Secretary at 12130 Millennium Drive, #500, Los Angeles, CA 90094

•You may attend the Annual Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 11, 2024, to The Honest Company, Inc., Attn: Secretary, 12130 Millennium Drive, #500, Los Angeles, CA 90094 and comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (“Rule 14a-8”).

With respect to proposals (including director nominations) not to be included in next year’s proxy materials pursuant to Rule 14a-8, including nominations subject to Rule 14a-19, our amended and restated bylaws provide that your proposal must be submitted in writing between January 22, 2025 and February 21, 2025 to The Honest Company, Inc., Attn: Secretary, 12130 Millennium Drive, #500, Los Angeles, CA 90094 and comply with the requirements in our amended and restated bylaws, provided, however, that if our 2025 Annual Meeting of Stockholders is held before April 22, 2025 or after June 21, 2025, then the proposal must be received by us no earlier than 120 days prior to such Annual Meeting and no later than the later of (i) 90 days prior to the date of such meeting or (ii) the 10th day following the day on which public announcement of the date of such meeting is first made by us.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and for the proposal to ratify the Audit Committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions are not applicable with respect to Proposal 1 and will not affect the vote for Proposal 2. Withhold votes will not affect the vote for Proposal 1. Broker non-votes on Proposal 1 will have no effect and will not be counted towards the vote total for that proposal. As discussed below, we do not expect broker non-votes on Proposal 2.

What are “broker non-votes”?

A “broker non-vote” occurs when your broker submits a proxy for the meeting with respect to “routine” matters but does not vote on “non-routine” matters because you did not provide voting instructions on these matters. These un-voted shares with respect to the “non-routine” matters are counted as “broker non-votes.” Proposal 1 is considered to be “non-routine” under stock exchange rules and we therefore expect broker non-votes to exist in connection with this proposal. However, because Proposal 2 is considered “routine” under such rules, we do not expect broker non-votes on this proposal because if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank, or other agent has discretionary authority to vote your shares on Proposal 2.

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How many votes are needed to approve each proposal?

For the election of directors, the three nominees receiving the most “For” votes from the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” will affect the outcome. There is no cumulative voting.

To be approved, Proposal No. 2, ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year ending December 31, 2024, must receive “For” votes from the holders of a majority of the voting power of the shares present virtually or represented by proxy and voting affirmatively or negatively (excluding abstentions and broker non-votes) on the matter. If you “Abstain” from voting, it will have no effect on the vote for Proposal No. 2.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares of stock entitled to vote are present at the meeting virtually or represented by proxy. On the record date, there were 97,032,787 shares outstanding and entitled to vote. Thus, the holders of 48,516,394 shares must be present virtually or represented by proxy at the meeting to have a quorum.

Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Proposal 1

Election Of Directors

Classified Board

Our Board is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has nine members. There are three directors in the class whose term of office expires in 2024. The Nominating and Corporate Governance Committee has recommended each of Katherine Bayne, Susan Gentile and James D. White for election as a Class III Director at the Annual Meeting. Ms. Bayne, Ms. Gentile and Mr. White are each currently a director of the Company and were previously elected by our stockholders prior to our initial public offering pursuant to the provisions of a voting agreement between us and several of our stockholders. If elected at the Annual Meeting, each of these nominees would serve until the 2027 Annual Meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is the Company’s policy to invite and encourage directors and nominees for director to attend the Annual Meeting. All of our directors, apart from Mr. Hartung, attended our 2023 annual meeting of stockholders.

Directors are elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. We have no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by Honest, or alternatively, the Board may leave a vacancy on the Board or reduce the size of the Board. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

The biographies of each of our nominees for election to the Board as Class III directors, and all other directors are set forth below, including the offices held, other business directorships and the class and term of each director nominee and director. Each of the biographies highlights specific experience, qualifications, attributes, and skills that led us to conclude that such person should serve as a director. We believe that, as a whole, our Board possesses the requisite skills and characteristics, leadership traits, work ethic, and independence to provide effective oversight. No director or executive officer is related by blood, marriage, or adoption to any other director or executive officer. No arrangements or understandings exist between any director and any other person pursuant to which such person was selected as a director or nominee.

Class III Directors - Nominees for Election for a Three-year Term Expiring at the 2027 Annual Meeting

Katherine Bayne, age 57

Katherine Bayne has served as a member of our Board since October 2018. Since February 2019, Ms. Bayne has served as a Senior Advisor with Guggenheim Securities, the investment banking and capital markets division of Guggenheim Partners, LLC, a global investment and advisory financial services firm. Since March 2018, Ms. Bayne has also served as founder and President of Bayne Advisors, an advisory firm that helps brands and businesses find their strategic identities, drive sustained consumer engagement and innovate for transformative results. Prior to serving in her current roles, from 1989 to 2018, Ms. Bayne served in numerous roles at The Coca-Cola Company, a beverage company, focused on consumer strategy, retail marketing and consumer marketing in the United States, Australia and globally, most recently serving as the company’s President, North America Brands, from 2013 to 2015 and Senior Vice President, Global Center, from 2015 to 2018. Ms. Bayne previously served as a member of the board of directors for Ascena Retail Group, Inc., Ann Inc., Beazer Homes USA Inc., Acreage Holdings, Inc., and Eargo, Inc. Ms. Bayne is also a member of the board of visitors for the Fuqua School of Business at Duke University, and serves on the board of directors of the Cox School of Business at Southern Methodist University. Ms. Bayne holds a B.A. in Psychology from Duke University and an M.B.A. from Duke University’s Fuqua School of Business. We believe that Ms. Bayne is qualified to serve on our Board due to her strong background in consumer strategy, retail and consumer marketing and brand management.

Susan Gentile, age 57

Susan Gentile has served on our Board since May 2021. Ms. Gentile is the Managing Director and Chief Financial Officer at Advent International, a private equity firm. Prior to joining Advent International in August 2022, Ms. Gentile was the Chief Financial and Administrative Officer at H.I.G. Capital Management, LLC, a global alternative asset investment firm. Prior to joining H.I.G. Capital Management in May 2018, Ms. Gentile served as Managing Director and Chief Accounting Officer at Oaktree Capital Management, a global alternative investment firm, from October 2013 to March 2018. Ms. Gentile also held various management roles at The Clorox Company from March 2006 to September 2013. Prior to joining The Clorox Company, Ms. Gentile served in roles at Levi Strauss & Co., Motorola, Inc. and Deloitte & Touche LLP. Ms. Gentile holds a B.S.B.A. in Finance from Boston University and is a Certified Public Accountant. We believe that Ms. Gentile is qualified to serve on our Board due to her financial expertise and experience working with consumer product brands.

James D. White, age 63

James D. White has served as Chair of our Board since May 2021. From 2008 to 2016, Mr. White served as the Chair, President and Chief Executive Officer of Jamba, Inc., a restaurant company. Mr. White also served as Senior Vice President and General Manager of Safeway, Inc., a U.S. supermarket chain, from 2005 to 2008. From 1983 to 2005, Mr. White held management roles at The Gillette Company, Inc., Nestlé S.A. and The Coca-Cola Company. Additionally, Mr. White currently serves on the board of directors of Schnucks Markets, Inc. and on the board of directors of the following public companies: Affirm Holdings Inc., The Simply Good Foods Company, and CAVA Group, Inc. Mr. White previously served on the board of directors of Medallia, Inc., Adtalem Global Education Inc., Panera Bread Company, Callidus Software Inc., and Hillshire Brands Company. Mr. White’s non-profit board experience includes Directors Academy, where he is a founding member and chair of the board of directors, as well as Fair Trade USA, where he previously served as chair of the board of directors. Mr. White previously served on the non-profit boards of directors of the Nasdaq Entrepreneurial Center, The Organic Center and the Network of Executive Women. Mr. White received a B.S. degree, with a major in marketing, from The University of Missouri and an M.B.A. from Fontbonne University. Mr. White is also a graduate of the Cornell University Food Executive Program and was a Stanford University Distinguished Careers Institute Fellow in 2018. We believe that Mr. White is qualified to serve on our Board due to his experience as a public company director and his experience as a consumer products executive.

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

Class I Directors Continuing in Office Until the 2025 Annual Meeting

Michael Barkley, age 57

Michael Barkley has served on our Board since December 2023. Since May 2023, Mr. Barkley has served as an independent private equity advisor for MJB Advisory LLC, a management consulting company focused on the needs of high growth food and beverage brands. Mr. Barkley served as the former Chief Executive Officer of KIND LLC (“KIND”), a snack food company, from 2018 to 2021 and is currently a board member of the Ignatian Solidarity Network. Prior to KIND, Mr. Barkley served as President of Boulder Brands, a food company, and Chief Marketing Officer of Pinnacle Foods, Inc., a packaged foods company. Mr. Barkley earned a BS in Commerce at the University of Virginia and an MBA at the University of North Carolina. We believe that Mr. Barkley is qualified to serve on our Board due to his significant experience in consumer-packaged goods and as a purpose-driven executive leader.

John R. (Jack) Hartung, age 66

John R. (Jack) Hartung has served on our Board since May 2022. Mr. Hartung has served as Chief Financial Officer of Chipotle Mexican Grill, Inc. (“Chipotle”), a restaurant company, since 2002, and beginning in 2022, as Chief Financial and Administrative Officer of Chipotle. Prior to joining Chipotle, Mr. Hartung worked for 18 years at McDonald’s Corp., where he held a variety of management positions, most recently as Vice President and Chief Financial Officer of its Partner Brands Group. Mr. Hartung has a Bachelor of Science degree in accounting and economics as well as an M.B.A. from Illinois State University. We believe that Mr. Hartung is qualified to serve on our board because of his expertise overseeing financial and reporting functions at multiple public companies, and as a chief financial officer at a public company, along with his extensive public company leadership experience.

Carla Vernón, age 53

Carla Vernón joined Honest as Chief Executive Officer on January 9, 2023 and has served on our Board since January 25, 2023. Prior to joining Honest, Ms. Vernón served as the Vice President of Consumables Categories at Amazon.com, Inc. (“Amazon”), an e-commerce company, from January 2021 to December 2022 where she had Profit and Loss (“P&L”) responsibility for Household Essentials, Wellness, Beauty, Baby, Food and Beverage categories on Amazon.com as well as responsibility for technology development for those categories. Prior to joining Amazon, Ms. Vernón spent more than two decades in various P&L leadership roles at General Mills, Inc. (“General Mills”), a food manufacturing company. Most recently at General Mills, Ms. Vernón served as a Corporate Officer and the Operating Unit President of the Natural & Organic Division from July 2017 to April 2020. In this role, she had full management and P&L responsibility for a $900M portfolio of highly regulated ESG (Environmental, Social and Governance) brands including Annie's Organic, Cascadian Farm, Epic Provisions, and Muir Glen as well as leadership for establishing General Mills' leadership in regenerative agriculture. Ms. Vernón serves on the Board of Trustees for both Princeton University and The Smithsonian National Museum of the American Latino. Ms. Vernón holds a B.A. degree in Ecology and Evolutionary Biology from Princeton and a Master of Business Administration from Texas McCombs School of Business. We believe that Ms. Vernón is qualified to serve on our Board because of her leadership experience at prior consumer product companies and focus on technology development, as well as her role as Chief Executive Officer of the Company which provides valuable insight into the day-to-day operations at the Company.

Class II Directors - Continuing in Office Until the 2026 Annual Meeting

Jessica Alba, age 42

Jessica Alba is one of our founders and has served as our Chief Creative Officer since our incorporation in July 2011 and as Chair of our Board from May 2018 to May 2021. Ms. Alba is a globally recognized and influential Mexican-American business leader, entrepreneur, advocate, actress and New York Times bestselling author. Ms. Alba serves on the board of directors of Baby2Baby, a charitable organization that provides diapers, clothes and other basic necessities to children living in poverty. She also serves on the board of directors of LA28, the Los Angeles Olympics board, and Yahoo! Inc., a media company. We believe that Ms. Alba is qualified to serve on our Board due to her knowledge and insights in founding and developing our Company in addition to her industry experience and knowledge.

We refer to Jessica Warren, our founder, Chief Creative Officer and member of our board of directors, as Jessica Alba in this Proxy Statement.

Alissa Hsu Lynch, age 55

Alissa Hsu Lynch has served on our Board since December 2023. Ms. Lynch served as the Global Head of MedTech Strategy and Solutions for Google Cloud Platform, offered by Google LLC, a technology company, from 2020 to 2023, where she worked with Fortune 500 customers to transform healthcare through technology. Previously, Ms. Lynch spent 20 years at Johnson & Johnson, a pharmaceutical and medical technologies company, working in consumer marketing, strategy, and general management roles, and most recently, from 2016 to 2020 served as Vice President, Medical Devices. Before joining Johnson & Johnson, Ms. Lynch was a professional modern dancer for six years. Ms. Lynch served as a board member of Pulmonx Corporation from July 2021 and will no longer be serving as a director at such company following its annual meeting in May 2024. Also, she is a member of the Board of Trustees of American Ballet Theatre and is a Henry Crown Fellow of The Aspen Institute. Ms. Lynch holds an M.B.A in General Management from Columbia University and an A.B. in English from Princeton University. We believe that Ms. Hsu Lynch is qualified to serve on our Board due to her significant experience in technology, consumer marketing, and her executive leadership experience.

Andrea Turner, age 60

Andrea Turner has served on our Board since December 2023. Ms. Turner served as Senior Vice President, Global Customer Service and Logistics at Mondelēz International, Inc., a confectionery, food, holding, beverage and snack food company, from 2020 to 2023, where she strategized and led logistics during the COVID-19 pandemic for the $25 billion supply chain across 80 countries. Ms. Turner was also responsible for driving teams to solve complex supply chain problems at General Mills from 2008 to 2020 and Merck & Co., Inc., a pharmaceutical company, from 1998 to 2009, delivering improved productivity and accelerating growth. She previously served as the Chair of the 2016 Minneapolis Martin Luther King Celebration, the largest fundraising event in Minneapolis and currently serves on the boards of directors of GS1, People Serving People, and Mainstreet School of the Arts. Ms. Turner received a Bachelor of Industrial Engineering from Georgia Institute of Technology and a Bachelor of Science in Mathematics

from Spelman College. We believe that Ms. Turner is qualified to serve on our Board due to her extensive experience in consumer-packaged goods and global supply chain and operations, and her executive leadership experience.

Board Diversity

The Board Diversity Matrix, below, provides the diversity statistics for our Board. We included last year's diversity statistics for our Board of Directors in our proxy statement for our 2023 annual meeting of stockholders filed with the SEC on April 13, 2023.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 10, 2024) |

| Total Number of Directors | 9 |

| Female | Male | Non- Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 6 | 3 | - | - |

| Part II: Demographic Background | | | | |

| African American or Black | 2 | 1 | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | 1 | - | - | - |

| Hispanic or Latinx | 2 | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 2 | 2 | - | - |

| Two or More Races or Ethnicities | 1 | - | - | - |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | - |

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Independence of The Board

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board must qualify as “independent,” as affirmatively determined by the Board. Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning her or his background, employment and affiliations, our Board has determined that none of our current directors, other than Carla Vernón and Jessica Alba, and none of our former directors who served as a director during 2023, other than Nikolaos Vlahos, has any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Nasdaq listing standards. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-employee director and the transactions described in the section titled “Transactions with Related Persons and Indemnification.”

Board Leadership Structure

Our Board has an independent chair, Mr. White, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape the work of the Board. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor and assess the Company's risk exposure and whether management’s actions are in the

best interests of the Company and its stockholders. The Company believes that Mr. White's prior experience as a Board Chair at Jamba Inc. and current role as a Lead Independent Director at Affirm Holdings, Inc. provides the Board with experience in risk identification and oversight of the business. The Board Chair also leads executive sessions, without management present, at every regularly scheduled Board meeting. These executive sessions are also held by each of the Board's committees at each regularly scheduled committee meeting. As a result, the Company believes that having an independent Board Chair can enhance the effectiveness of the Board as a whole.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements and receives updates from the Company's General Counsel on any pending litigation and whistleblower hotline complaints. The Audit Committee reviews and approves any related party transactions. Our Board addresses the Company’s cybersecurity risk management as part of its general oversight function and is responsible for overseeing the Company’s cybersecurity risk management processes, including oversight of mitigation of risks from cybersecurity threats. The Audit Committee is responsible for reviewing the Company's financial reporting of cybersecurity risks and incidents in accordance with SEC rules. The Audit Committee receives regular reports from the Vice President of Technology concerning the Company’s significant cybersecurity threats and risk and the processes the Company has implemented to address them. The Audit Committee also has access to various reports, summaries or presentations related to cybersecurity threats, risk and mitigation. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Nominating and Corporate Governance Committee also reviews potential conflicts of interest, evaluates the Board's leadership structure and management succession, and oversees the Company's ESG activities, including the work of the Company's ESG Council. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Typically, the entire Board meets with the Company’s employees responsible for risk management at least annually, and the applicable Board committees meet at least annually with the employees responsible for risk management in the committees’ respective areas of oversight. Both the Board as a whole and the various standing committees receive periodic reports from the employees responsible for risk management, as well as incidental reports as matters may arise. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. The General Counsel coordinates between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

Board and Committee Self Assessments

On an annual basis, the Board, the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee conduct self-assessments to ensure effective performance and to identify opportunities for improvement. As part of the self-assessment process, directors respond to a comprehensive questionnaire that asks them to consider various topics related to board and committee composition, structure, effectiveness and responsibilities and an oral evaluation is also conducted to gather feedback from the directors. Each committee, as well as the Board as a whole, then reviews and assesses the responses from this assessment and any recommendations to the Board. The results of the assessments are then discussed by the Board with a view toward taking action to address any issues presented.

Meetings of The Board

The Board met five times during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

Information Regarding Committees of the Board

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 2023 for each of the Board committees:

| | | | | | | | | | | |

| Name | Audit | Compensation | Nominating and Corporate Governance |

Mr. Michael Barkley(1)(3) | | X | X |

| Ms. Katherine Bayne | X | X* | |

| Ms. Susan Gentile | X* | X | |

| Mr. John R. (Jack) Hartung | X | | X |

Ms. Alissa Hsu Lynch(1)(2) | X | | X |

Ms. Andrea Turner(2)(3) | X | X | |

| Mr. James D. White | | | X* |

| Total meetings in fiscal 2023 | 4 | 6 | 4 |

* Committee Chairperson________________

(1) Ms. Lynch and Mr. Barkley were appointed to the Nominating & Corporate Governance Committee in December 2023 in connection with their appointments to the Board.

(2) Ms. Lynch and Ms. Turner were appointed to the Audit Committee in December 2023 in connection with their appointments to the Board.

(3) Mr. Barkley and Ms. Turner were appointed to the Compensation Committee in December 2023 in connection with their appointments to the Board.

The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions. The principal duties and responsibilities of our Audit Committee include, among other things:

•overseeing our accounting and financial reporting processes, systems of internal control, financial statement audits and the quality and integrity of our financial statements;

•managing the selection, engagement terms, fees, qualifications, independence and performance of a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•maintaining and fostering an open avenue of communication between management and the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end operating results;

•developing procedures for employees to submit concerns anonymously about accounting or audit matters;

•overseeing the review and assessment of our risk management, risk assessment and major risk exposures with respect to financial, accounting, operational, tax, privacy and cybersecurity and information technology risks;

•reviewing and approving related party transactions;

•obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes its internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and

•approving (or, as permitted, pre-approving) all audit and all permissible non-audit services to be performed by the independent registered public accounting firm.

The Audit Committee is composed of five directors: Ms. Bayne, Ms. Gentile, Mr. Hartung, Ms. Lynch and Ms. Turner. Ms. Gentile serves as the chair of our Audit Committee. The Audit Committee met four times during 2023. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at investors.honest.com.

The Board reviews the Nasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards).

The Board has also determined that Ms. Gentile and Mr. Hartung each qualify as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Ms. Gentile’s and Mr. Hartung's level of knowledge and experience based on a number of factors, including their respective formal education and experience in financial and executive roles.

Report of the Audit Committee of the Board*

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2023 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Susan Gentile, Chair

Katherine Bayne

John R. (Jack) Hartung

Alissa Hsu Lynch

Andrea Turner

* The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Exchange Act of 1934, as amended (the “Securities Act of 1933”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation Committee

The Compensation Committee is composed of four directors: Mr. Barkley, Ms. Bayne, Ms. Gentile and Ms. Turner. Ms. Bayne serves as the chair of our Compensation Committee. All members of the Company’s Compensation Committee are independent (as independence is currently defined in Rule 5605(d)(2) of the Nasdaq listing standards). The Compensation Committee met six times during 2023. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Company’s website at investors.honest.com.

The Compensation Committee of the Board acts on behalf of the Board to review, recommend for adoption and oversee the Company’s compensation strategy, policies, plans and programs, including:

•assisting the Board in its oversight of the Company's compensation policies, plans and programs, and overall compensation philosophy;

•reviewing and determining the compensation to be paid or awarded to our executive officers, other members of senior management (in the Compensation Committee's discretion) and non-employee directors;

•reviewing and approving, or making recommendations to the Board for approval of the compensation and other terms of employment of our Chief Executive Officer, and evaluating the Chief Executive Officer’s performance in achieving corporate performance goals and objectives;

•reviewing and discussing with management our compensation disclosures;

•administering our equity and non-equity incentive plans and other benefit plans;

•reviewing our practices and policies of employee compensation as they relate to risk management and risk-taking incentives;

•approving the retention of compensation consultants and outside service providers and advisors; and

•assisting the Board in its oversight of the Company's policies and strategies relating to human capital management.

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets at least two times annually and with greater frequency if necessary. The agenda for each meeting is developed by the Chair of the Compensation Committee, in consultation with the Chief People Officer and the Corporate Secretary. The Compensation Committee meets regularly in executive session. From time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not and does not participate in, and is not present during, any deliberations or determinations of the Compensation Committee regarding his or her compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company. In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

During the past fiscal year, after taking into consideration the six factors prescribed by the SEC and Nasdaq described above, the Compensation Committee engaged Semler Brossy as compensation consultants. The Compensation Committee requested that Semler Brossy:

•evaluate the efficacy of the Company’s existing compensation strategy and practices in supporting and reinforcing the Company’s long-term strategic goals; and

•assist in refining the Company’s compensation strategy and in developing and implementing an executive compensation program to execute that strategy.

As part of its engagement, Semler Brossy was requested by the Compensation Committee to perform analyses of competitive performance and compensation levels for a comparative group of companies created by Semler Brossy and to develop an executive compensation program and company-wide equity grant budget that aligns with the Company’s compensation strategy. At the request of the Compensation Committee, Semler Brossy also conducted individual interviews with certain members of senior management to learn more about the Company’s business operations and strategy, key performance metrics and strategic goals, as well as the labor markets in which the

Company competes. Semler Brossy ultimately developed recommendations that were presented to the Compensation Committee for its consideration. Following active dialogue with Semler Brossy, the Compensation Committee approved a compensation program based on the recommendations of Semler Brossy.

Historically, the Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first quarter of the year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his or her performance is conducted by the Compensation Committee, which determines any adjustments to his or her compensation as well as awards to be granted. As part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive compensation paid at other companies identified by the consultant.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee are currently, or have been at any time, one of our executive officers or employees. None of our executive officers currently serve, or have served during the last year, as a member of the Board or Compensation Committee of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is composed of four directors: Mr. Barkley, Mr. Hartung, Ms. Lynch and Mr. White. Mr. White serves as the chair of our Nominating and Corporate Governance Committee. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee met four times during 2023. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Company’s website and investors.honest.com. The Nominating and Corporate Governance Committee’s responsibilities include, among other things:

•identifying, reviewing evaluating, communicating with and recommending that our Board approve, candidates qualified to become Board members or nominees for directors of the Board consistent with criteria approved by the Board;

•considering and making recommendations to our Board regarding the composition of our Board and its committees;

•reviewing and assessing the Company’s corporate governance functions and developing a set of corporate governance guidelines applicable to the Company and monitoring compliance with such guidelines;

•overseeing the Company’s environmental, social and governance activities;

•reviewing and evaluating with the Board and the Chief Executive Officer the Company’s management succession plans; and

•overseeing the evaluation of the Board and its committees.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as (i) possessing relevant expertise upon which to be able to offer advice and guidance to management; (ii) having sufficient time to devote to the affairs of the Company; (iii) demonstrating

excellence in his or her field; (iv) having the ability to exercise sound business judgment; (v) experience as a board member or executive officer of another publicly held company; (vi) having a diverse personal background, perspective and experience; and (vii) having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the Company’s operating requirements and the long-term interests of the Company’s stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, including diversity of a candidate’s perspective, background, nationality, age and other demographics.

The Nominating and Corporate Governance Committee appreciates the value of thoughtful Board refreshment, and regularly identifies and considers qualities, skills and other director attributes that would enhance the composition of the Board. In the case of incumbent directors whose terms of office are set to expire, the Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Committee will also take into account the results of the Board’s self-evaluation. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 12130 Millennium Drive, #500, Los Angeles, CA 90094 not less than 90 days nor more than 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last Annual Meeting of Stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of the Company’s stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Environmental, Social and Governance

The Nominating and Corporate Governance Committee oversees the Company’s Environmental, Social and Governance (“ESG”) activities and makes recommendations to the Company to further its ESG goals. The Nominating and Corporate Governance Committee may appoint and oversee the activities of an ESG Steering Committee, composed of company leaders from across the Company and/or directors of the Company, to advance the Company’s ESG goals. In late 2021, the Company formed an ESG Council made up of cross-functional leaders within the Company to strategize and prioritize ESG goals. In 2022, the Company engaged a third-party vendor to assist with its key strategic ESG objectives, including the publication of an Investor ESG tear sheet covering key metrics prescribed under the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) frameworks. The Company has made several improvements to the ESG section of its Investor Relations website, including the disclosure of key business and information technology policies, the publication of the Investor ESG tear sheet, as well as working directly with ESG rating agencies to understand and improve ratings. This year, we plan to publish our first Corporate Social Responsibility report for the 2022-2023 period, which will be available on our investor relations website.

Stockholder Communications with the Board

The Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders of the Company wishing to communicate with the Board or an individual director may send a written communication to the Board or such director c/o The Honest Company, Inc., 12130 Millennium Drive, #500, Los Angeles, CA, 90094, Attn: Secretary. The Secretary will review each communication. The Secretary will forward such communication to the Board or to any individual director to whom the communication is addressed

unless the communication contains advertisements or solicitations or is unduly hostile, threatening or similarly inappropriate, in which case the Secretary shall discard the communication or inform the proper authorities, as may be appropriate.

Code of Business Conduct and Ethics

The Company has adopted The Honest Company, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on the Company’s website at investors.honest.com. If the Company ever were to amend or waive any provision of its Code of Business Conduct and Ethics that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer or any person performing similar functions, the Company intends to satisfy its disclosure obligations, if any, with respect to any such waiver or amendment by posting such information on its website set forth above rather than by filing a Current Report on Form 8-K. In the case of a waiver for an executive officer or a director, the disclosure required under applicable Nasdaq listing standards also will be made available on our website.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to assure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed and to make decisions that are independent of the Company’s management. The guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to (i) Board composition and selection including diversity, (ii) Board meetings and involvement of senior management, (iii) Chief Executive Officer performance evaluation and succession planning, and (iv) Board committees and compensation. The Corporate Governance Guidelines, as well as the charters for each committee of the Board, may be viewed at investors.honest.com.

Hedging and Pledging Policy

As part of our Insider Trading Policy, all employees, including our executive officers, non-employee directors and designated consultants are prohibited from engaging in short sales of our securities, establishing margin accounts, pledging our securities as collateral for a loan, buying or selling puts or calls on our securities or otherwise engaging in hedging transactions involving our securities.

Proposal 2

Ratification of Selection of Independent Registered Public Accounting Firm

The Audit Committee of the Board has selected PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited the Company’s financial statements since 2012. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the voting power of the shares present virtually or represented by proxy and voting affirmatively or negatively (excluding abstentions and broker non-votes) on the matter at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP.

Principal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 2023 and 2022, by PricewaterhouseCoopers LLP, the Company’s principal accountant.

| | | | | | | | | | | |

| For the year ended December 31, |

| 2023 | | 2022 |

| (In thousands) | | | |

Audit Fees(1) | $ | 1,382 | | | $ | 1,587 | |

| Audit-related Fees | — | | | — | |

Tax Fees(2) | 135 | | | 90 | |

All Other Fees(3) | 252 | | | 111 | |