- PBF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PBF Energy (PBF) DEF 14ADefinitive proxy

Filed: 13 Apr 22, 4:28pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 |

PBF Energy Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PBF ENERGY INC.

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

DATE

May 26, 2022

at 10:00 A.M. Eastern Daylight Time

|

LOCATION

www.virtualshareholdermeeting.com/PBF2022

|

RECORD DATE

Stockholders of record on March 29, 2022 are entitled to vote at the meeting

| ||||||||||||||||

The 2022 Annual Meeting will be held exclusively online at www.virtualshareholdermeeting.com/PBF2022. Stockholders of record at the close of business on March 29, 2022 may vote at the meeting or any postponements or adjournments of the meeting. To join as a stockholder, you must enter the 16-digit control number on your proxy card, voting instruction form, or Notice of Internet Availability you receive. During the meeting stockholders may ask questions, examine our stockholder list and vote their shares (other than shares held through employee benefit plans, which must be voted prior to the meeting). Other interested parties may join the meeting as a guest, in which case no control number is required. For more information, please see the section entitled “Annual Meeting of Stockholders” in this Proxy Statement. We are making the Proxy Statement and the form of proxy first available beginning on or about April 13, 2022.

At the meeting, stockholders will be asked to vote on:

Items of Business:

| 1. | the election of directors; |

| 2. | the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as independent auditor for 2022; |

| 3. | an advisory vote on the 2021 compensation of the named executive officers; |

| 4. | to further amend the Amended and Restated PBF Energy Inc. 2017 Equity Incentive Plan (the “Equity Incentive Plan”) to, among other things, increase the number of shares reserved for issuance by 3,500,000 shares; and |

| 5. | the transaction of any other business properly brought before the meeting or any adjournment or postponement thereof. |

Information with respect to the above matters is set forth in this Proxy Statement that accompanies this Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, MAY 26, 2022. The Notice of the 2022 Annual Meeting, Proxy Statement and the Annual Report on Form 10-K for the year-ended December 31, 2021 are available on the internet at www.proxyvote.com.

By order of the Board of Directors,

Trecia M. Canty

Senior Vice President, General Counsel and Secretary

April 13, 2022

YOUR VOTE IS IMPORTANT, PLEASE SIGN, DATE AND MAIL THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM PROMPTLY. YOU MAY ALSO VOTE VIA THE INTERNET OR BY TELEPHONE. PLEASE USE THE INTERNET ADDRESS OR TOLL-FREE NUMBER SHOWN ON YOUR PROXY CARD OR VOTING INSTRUCTION FORM.

YOU MAY REVOKE A PROXY AT ANY TIME PRIOR TO ITS EXERCISE BY GIVING WRITTEN NOTICE TO THAT EFFECT TO THE SECRETARY OR BY SUBMISSION OF A LATER-DATED PROXY OR SUBSEQUENT INTERNET OR TELEPHONIC PROXY. IF YOU ATTEND THE MEETING, YOU MAY REVOKE ANY PROXY PREVIOUSLY GRANTED AND VOTE DURING THE MEETING. |  | |||||||

| i | ||||

| v | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

Board Leadership Structure, Lead Director and Meetings of Non-Management Directors | 8 | |||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

2021-2022 Macroeconomic Environment and Key Compensation Committee Actions | 20 | |||

| 21 | ||||

Board Responsiveness to 2020 Say-on-Pay Vote and Stockholder Feedback | 21 | |||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

Payout of Performance Share Units and Performance Units Granted in 2019 | 36 | |||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

Proposal No. 2 – Ratification of Appointment of Independent Auditor | 59 | |||

| 60 | ||||

| 60 | ||||

Proposal No. 3 – Advisory Vote on 2021 Named Executive Officer Compensation | 62 | |||

| 64 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| A-1 | ||||

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Our Board of Directors (the “Board”) is soliciting proxies to be voted at the Annual Meeting of Stockholders on May 26, 2022 (the “Annual Meeting” or the “Meeting”). The accompanying notice describes the time, place, and purposes of the Annual Meeting. Action may be taken at the Annual Meeting or on any date to which the meeting may be adjourned. Unless otherwise indicated the terms “PBF,” “PBF Energy,” “the Company,” “we,” “our,” and “us” are used in this Notice of Annual Meeting and Proxy Statement to refer to PBF Energy Inc., to one or more of our consolidated subsidiaries, or to all of them taken as a whole.

In lieu of this proxy statement and the accompanying notice, we are mailing a Notice of Internet Availability of Proxy Materials (“Internet Availability Notice”) to certain stockholders on or about April 13, 2022. On this date, stockholders will be able to access all of our proxy materials on the website referenced in the Notice.

Record Date, Shares Outstanding, Quorum

Holders of record of our Class A Common Stock, par value $0.001 per share (“Class A Common Stock”) and Class B Common Stock, par value $0.001 per share (“Class B Common Stock”) are entitled to vote as a single class on the matters presented at the Annual Meeting. At the close of business on March 29, 2022 (the “record date”), 120,618,324 shares of Class A Common Stock were issued and outstanding and entitled to one vote per share and the holders of the Class A Common Stock have 99.2% of the voting power. On the record date, 15 shares of Class B Common Stock were issued and outstanding and each share of Class B Common Stock entitled the holder to one vote for each Series A limited liability company membership interest (“PBF LLC Series A Units”) of our subsidiary, PBF Energy Company LLC (“PBF LLC”), held by such holder as of the record date. On the record date, Class B Common Stockholders collectively held 927,990 PBF LLC Series A Units, which entitled them to an equivalent number of votes, representing approximately 0.8% of the combined voting interests of the Class A and Class B Common Stock. See “Corporate Governance—PBF’s Corporate Structure” below for more information.

Stockholders representing a majority of voting power, present in person or represented by properly executed proxy, will constitute a quorum. Abstentions and broker non-votes count as being present or represented for purposes of determining the quorum.

Voting Requirements for the Proposals

Proposal No. 1, Election of Directors — An affirmative vote of the majority of the total number of votes cast “FOR” or “AGAINST” a director nominee is required for the election of a director in an uncontested election. A majority of votes cast means that the number of shares voted “FOR” a director nominee must exceed 50% of the votes cast with respect to that nominee (with “abstentions” and “broker non-votes” not counted as votes cast either “FOR” or “AGAINST” that nominee’s election).

Proposal No. 2, Ratification of Independent Auditors — Ratification by stockholders of the selection of independent public accountants requires the affirmative vote of the majority of the votes cast. Abstentions have no effect on this proposal.

Proposal No. 3, Advisory Vote on 2021 Named Executive Officer Compensation — The affirmative vote of the majority of the votes cast on this non-binding proposal is required for the proposal to pass. A majority of the votes cast means the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Abstentions and broker non-votes have no effect on the vote.

Proposal No. 4, Amendment of the Equity Incentive Plan — The affirmative vote of the majority of the votes participating in the voting on this proposal is required for this proposal to pass. A majority of the votes cast means the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Abstentions and broker non-votes have no effect on the vote.

| 2022 Proxy Statement | i |

Attending the Annual Meeting

Due to continuing concerns relating to COVID-19, we will have a virtual-only annual meeting of stockholders in 2022. The meeting will be conducted exclusively via live audio webcast. You do not have to register in advance to attend the virtual meeting. To participate in the virtual meeting, please visit www.virtualshareholdermeeting.com/PBF2022 and enter the 16-digit control number included in your Notice of Internet Availability, on your proxy card, or on the voting instruction form that accompanied your proxy materials. You may begin to log into the meeting platform beginning at 9:45 a.m. Eastern Daylight Time on May 26, 2022. The meeting will begin promptly at 10:00 a.m. Eastern Daylight Time on May 26, 2022. If you experience any technical difficulties logging into the meeting platform or at any time during the meeting, please call the toll-free technical support number, which will be posted on the meeting website. Technical support will be available beginning at 9:45 a.m. Eastern Daylight Time on May 26, 2022 and will remain available until the meeting has ended.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered in your name directly with the Company or with PBF’s transfer agent, American Stock Transfer & Trust Company, LLC, you are the “stockholder of record” of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying documents have been provided directly to you by PBF.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of those shares, and the Internet Availability Notice has been forwarded to you by your broker, bank, or other holder of record.

As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

Voting Stock Held through a PBF Energy Employee Benefit Plan

If you hold your stock through a PBF Energy employee benefit plan, you must either:

| • | Vote over the internet (instructions are in the email sent to you or on the notice and access form). |

| • | Vote by telephone (instructions are on the notice and access form). |

If you elected to receive a hard copy of your proxy materials, fill out the enclosed voting instruction form, date and sign it, and return it in the enclosed postage-paid envelope. Please pay close attention to the deadline for returning your voting instruction form. The voting deadline is set forth on the voting instruction form.

Voting Stock (Other Than Stock Held Through a PBF Energy Employee Benefit Plan) by Mail, Telephone or Internet or During the Meeting

You may vote using any of the following methods:

By mail

Complete, sign and date the proxy or voting instruction card and return it in the prepaid envelope. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by your proxy card as recommended by the Board of Directors. Mailed proxies must be received no later than the close of business on May 25, 2022 in order to be voted at the Annual Meeting. We urge you to use the other means of voting if there is a possibility your mailed proxy will not be timely received.

By telephone or on the Internet

We have established telephone and Internet voting procedures for stockholders of record. These procedures are designed to authenticate your identity, to allow you to give your voting instructions and to confirm that those instructions have been properly recorded.

| ii | 2022 Proxy Statement |  |

You can vote by calling the toll-free telephone number 1-800-690-6903. Please have your proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded.

The website for Internet voting is www.proxyvote.com for stockholders of record. Please have your proxy card handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you also can request electronic delivery of future proxy materials.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m., Eastern Daylight Time, on May 25, 2022.

The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions in the materials you receive. If you vote by telephone or on the Internet, you do not have to return your proxy or voting instruction card.

At the Annual Meeting

Stockholders of record and “street name” holders at the close of business on March 29, 2022 can attend the meeting by accessing www.virtualshareholdermeeting.com/PBF2022 and entering the 16-digit control number included in the proxy materials previously received. Please note that the www.virtualshareholdermeeting.com/PBF2022 website will not be active until approximately two weeks before the meeting date. If you do not have a 16-digit control number, you may still attend the meeting as a guest in listen-only mode. To attend as a guest, please access www.virtualshareholdermeeting.com/PBF2022 and enter the information requested on the screen to register as a guest. Please note that you will not have the ability to ask questions, vote or examine the list of stockholders during the meeting if you participate as a guest. See “Virtual Meeting Information” below for additional details.

Revocability of Proxies

You may revoke your proxy at any time before it is voted at the Annual Meeting by (i) submitting a written revocation to PBF, (ii) returning a subsequently dated proxy to PBF, or (iii) attending the Annual Meeting requesting that your proxy be revoked and voting at the Annual Meeting. If instructions to the contrary are not provided, shares will be voted as indicated on the proxy card.

Abstentions

Abstentions are counted for purposes of determining whether a quorum is present. Abstentions are not counted in the calculation of the votes “cast” with respect to any of the matters submitted to a vote of stockholders and will have no effect on the vote on any proposal. Directors will be elected by a majority vote of the votes cast at the meeting.

Broker Non-Votes

Brokers holding shares must vote according to specific instructions they receive from the beneficial owners of the stock. If the broker does not receive specific instructions, in some cases the broker may vote the shares in the broker’s discretion. However, the New York Stock Exchange (the “NYSE”) precludes brokers from exercising voting discretion on certain proposals without specific instructions from the beneficial owner. This results in a “broker non-vote” on the proposal. A broker non-vote is treated as “present” for purposes of determining a quorum, has the effect of a negative vote when a majority of the voting power of the issued and outstanding shares is required for approval of a particular proposal, and has no effect when a majority of the voting power of the shares present in person or by proxy and entitled to vote or a majority of the votes cast is required for approval.

The ratification of the appointment of Deloitte as our independent auditor (Proposal No. 2) is deemed to be a routine matter under NYSE rules. A broker or other nominee generally may vote uninstructed shares on routine matters, and therefore no broker non-votes are expected to occur with Proposal No. 2. Proposals 1, 3 and 4 are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore an undetermined number of broker non-votes are expected to occur on these proposals. These broker non-votes will not have any impact on the outcomes for these proposals as it requires the approval of a majority of the votes cast.

| 2022 Proxy Statement | iii |

Solicitation of Proxies

PBF pays for the cost of soliciting proxies and the Annual Meeting. In addition to solicitation by mail, proxies may be solicited by personal interview, telephone, and similar means by directors, officers, or employees of PBF, none of whom will be specially compensated for such activities. Morrow Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902, a proxy solicitation firm, will be assisting us for a fee of approximately $8,500 plus out-of-pocket expenses. PBF also intends to request that brokers, banks, and other nominees solicit proxies from their principals and will pay such brokers, banks, and other nominees certain expenses incurred by them for such activities.

Virtual Meeting Information

How can I ask questions or view the list of stockholders entitled to vote at the annual meeting?

Rules of conduct for the meeting, including rules pertaining to submission of questions, will be posted on the meeting platform website and may be accessed once past the login screen by clicking the “Materials” button. If there are pertinent questions that cannot be answered during the meeting due to time constraints, management expects to post answers to a representative set of such questions (e.g., consolidating repetitive questions) on our website (www.pbfenergy.com in the “Investors” section under “Webcasts and Presentations”) after the meeting.

During the annual meeting, stockholders of record may examine the list of stockholders entitled to vote at the meeting by visiting the meeting platform website and entering their control number. Once past the login screen, click the “Materials” button, followed by the “Registered Shareholder List,” and complete the required attestation form to view the list. To inspect such list prior to the annual meeting, please contact our Investor Relations department at (973) 254-4414 or by email at ir@pbfenergy.com.

Will a recording of the annual meeting be available after the meeting?

Yes. Within 24 hours following the annual meeting, a recording of the meeting, including any question and answer session, will be available on our website for at least 30 days.

| iv | 2022 Proxy Statement |  |

This summary highlights information contained elsewhere in this proxy statement. We encourage you to review the entire proxy statement. This proxy statement and our Annual Report for the year ended December 31, 2021 are first being mailed to the Company’s stockholders and made available on the internet at www.pbfenergy.com on or about April 13, 2022. Website addresses included throughout this proxy statement are for reference only. The information contained on our website is not incorporated by reference into this proxy statement.

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING AND BOARD RECOMMENDATION

| 1. | Election of Directors (p. 10) |

| Name | Years of Service | Independent | Board Recommendation | |||||||

Thomas Nimbley | 7 | No | For | |||||||

Spencer Abraham | 9 | Yes | For | |||||||

Wayne Budd | 8 | Yes | For | |||||||

Karen Davis | 2 | Yes | For | |||||||

Paul J. Donahue, Jr. | — | Yes | For | |||||||

S. Eugene Edwards | 8 | Yes | For | |||||||

Robert Lavinia | 6 | Yes | For | |||||||

Kimberly Lubel | 4 | Yes | For | |||||||

George Ogden | 4 | Yes | For | |||||||

2. Ratification of Deloitte & Touche LLP as Independent Auditors (p. 59) | For | |||||||||

3. Advisory Vote on 2021 Named Executive Officer Compensation (p. 62) | For | |||||||||

4. Amendment of Equity Incentive Plan (p. 64) | For | |||||||||

| 2022 Proxy Statement | v |

| | | Proxy Statement Summary |

COMPANY PERFORMANCE

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States, Canada and Mexico and are able to ship products to other international destinations. We own and operate six domestic oil refineries and related assets.

The outbreak of the COVID-19 pandemic negatively impacted worldwide economic and commercial activity and financial markets starting in the first quarter of 2020. The COVID-19 pandemic, the Delta variant and other variants thereof, and the related governmental and consumer responses resulted in significant business and operational disruptions, including business and school closures, supply chain disruptions, travel restrictions, stay-at-home orders and limitations on the availability of workforces and has resulted in significantly lower global demand for refined petroleum and petrochemical products. In 2021, the demand for these products began to rebound as a result of the lifting or easing of governmental restrictions in response to decreasing COVID-19 infection rates and the distribution of COVID-19 vaccines. Throughput across our refineries increased to a range of 800,000 to 900,000 barrel per day for our refining system in 2021 from a range of 700,000 to 800,000 barrel per day in 2020, reflecting increased utilization driven by improved market conditions.

2021 Performance Achievements

$12.1B INCREASE IN REVENUES IN 2021 COMPARED TO 2020 | +$2.4B LIQUIDITY BASED ON CASH AND BORROWING AVAILABILTY AT 12/31/21 | |||||||||||||||||||||||||||||||||||||||||

$329M REDUCTION IN CONSOLIDATED DEBT | $467.4M vs $(895.9)M

2021 vs 2020 ADJUSTED EBITDA* | |||||||||||||||||||||||||||||||||||||||||

| * | Adjusted EBITDA is a non-GAAP financial measure. For an explanation of how we use Adjusted EBITDA and reconciliation to our net income, please see “Non-GAAP Financial Measures” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Form 10-K”). |

| ● | Strengthened our Liquidity and Financial Position. As of December 31, 2021, our operational liquidity was more than $2.4 billion based on approximately $1.3 billion of cash and in excess of $1.1 billion of borrowing availability under our asset-based lending facility. In addition, PBF Logistics LP had $33.9 million in cash and approximately $396.5 million of availability under its revolving credit facility. In the second half of the year, we repurchased a combined total principal amount of approximately $229.0 million of our 6.00% Senior Notes due 2028 (“2028 Senior Notes”) and 7.25% Senior Notes due 2025 (“2025 Senior Notes”) for an aggregate cash amount of approximately $146.8 million. Combined with the $100.0 million of debt repayments made by PBF Logistics LP, consolidated debt for PBF has been reduced by approximately $329.0 million during 2021. |

| ● | Significantly Improved Revenues and Adjusted EBITDA. Our 2021 revenues improved to approximately $27.3 billion compared to $15.1 billion in 2020 and Adjusted EBITDA was approximately $467.4 million in 2021 compared to approximately $(895.9) million in 2020. |

| vi | 2022 Proxy Statement |  |

| Proxy Statement Summary | | |

INVESTOR ENGAGEMENT THROUGH BOARD-LED PROGRAM

Since 2019, we have had an investor engagement program under the leadership of the Chair of our Nominating and Corporate Governance Committee that includes independent director participation to help us better understand the views of our investors on key corporate governance topics. In 2021, this outreach included contacting our 30 largest investors to seek their feedback on our governance programs. In addition to engagement with our largest investors, we have continued our engagement efforts with additional investors and stakeholders to hear their perspectives and help identify focus and priorities for the coming year. We expect the constructive and candid feedback we receive from our investors and other stakeholders during these meetings to inform our priorities as we assess our progress and enhance our corporate governance practices and disclosures each year.

BOARD-LED ENGAGEMENT PROGRAM CONDUCTED YEAR ROUND

Shareholder Engagement Topics – Feedback Shared with the Full Board and Other Board Committees

| • | Board skills and experience and Board matrix |

| • | Board composition, diversity, size, and tenure |

| • | Board oversight of risk, including committee responsibilities |

| • | Board-level engagement and oversight of management |

| • | Executive compensation and compensation metrics |

| • | Environmental, Social, and Governance practices and reporting |

Governance Practices

| • | Actively pursuing Board refreshment, with 44% of the Board having served less than 5 years |

| • | Enhanced Board composition, including diversity, by appointing an additional female director in January 2020 |

| • | Continued to implement formal and thoughtful Board and committee succession plans |

| • | Continued implementation of risk management framework, including enhanced reporting, management level governance committee structure, and escalation in processes in support of Board’s risk oversight |

Enhanced Transparency and Disclosures

| • | Introduced Board qualifications and experience matrix disclosures in 2019 proxy statement, including qualifications and experience identified by the Board as important in light of our Company’s strategy, risk profile, and risk appetite |

| • | In 2020, enhanced Board experience matrix to include gender diversity information as self-identified by Board members |

| • | In 2022, enhanced disclosures to include racial and ethnic diversity information as self-identified by Board members |

| 2022 Proxy Statement | vii |

| | | Proxy Statement Summary |

BOARD OVERVIEW

PBF’s business is managed under the direction of our Board. Our Board has nine members, eight of whom are independent directors and our Chairman of the Board and Chief Executive Officer, Thomas Nimbley. Effective December 31, 2021, one of our directors, William Hantke, who served on the Audit and Compensation Committees, retired as a director of the Company. Effective January 1, 2022, Paul J. Donahue, Jr. was appointed by the Board of Directors as an independent director and a member of the Audit Committee. During 2021, our Board held eight (8) meetings and each member of the Board participated in at least 75% of the meetings held while they were in office. All of the directors then in office participated in the Annual Meeting of Stockholders in 2021. All Board members standing for re-election are expected to attend the 2022 Annual Meeting. The following sets forth certain demographic information regarding the current members of the Board, each of whom is standing for re-election at the Annual Meeting:

| viii | 2022 Proxy Statement |  |

| Proxy Statement Summary | | |

EXECUTIVE COMPENSATION

At our 2021 Annual Meeting, our stockholders approved

our named executive officer compensation with approximately 95.38% of the vote

In 2020, the Compensation Committee implemented a number of temporary changes to our compensation program to align compensation with the Company’s performance in the pandemic-driven challenging macroeconomic environment for our industry and our company. While the overall compensation philosophy and objectives remain unchanged, the Compensation Committee sought to align 2020 compensation with the prevailing environment by temporarily reducing executive salaries, cash bonuses and long-term equity incentives. At our 2021 Annual Meeting of Stockholders, our stockholders approved our NEOs’ 2020 compensation with approximately 95.38% of the vote. The Compensation Committee believes in providing for continuous improvement and further refinement of the program as described below. Stockholder engagement and the outcome of our annual Say-on-Pay vote will continue to inform our future compensation decisions.

2021-2022 KEY COMPENSATION COMMITTEE ACTIONS

The macroeconomic environment continued to be challenging for our industry in 2021 as the effects of the COVID-19 global pandemic continued to significantly impact the Company during the first half of the year. The Compensation Committee has reviewed continuously our compensation programs in 2021 and 2022 to ensure pay for performance alignment and implement best practices. Specifically, the Compensation Committee took the following actions:

• NEGATIVE DISCRETIONARY REDUCTION OF 80% IN 2021 NEO CASH BONUSES DESPITE ABOVE TARGET PERFORMANCE

• REVISED 2021 CASH BONUS PROGRAM TO DECREASE THE NEO TARGET PAYOUT TO 100% OF BASE SALARY FROM 150% AND TO INCLUDE A BALANCED MIX OF PERFORMANCE METRICS, INCLUDING ESG METRICS

| • ENHANCED DISCLOSURE OF 2021 CASH BONUS PROGRAM METRICS, WEIGHTING AND TARGETS

• CONTINUED 33-1/3% CEO SALARY AND DIRECTOR RETAINER REDUCTIONS IN 2021

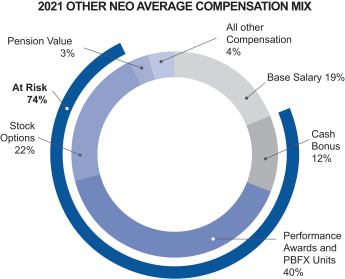

• INCREASED PROPORTION OF AT-RISK LONG-TERM INCENTIVE AWARDS IN 2021 FROM 50% TO 60% | |||||||||||||||||||||||||||||

• INCREASED CEO STOCK OWNERSHIP REQUIREMENT TO 6X SALARY IN 2022

• NEW 1 YEAR STOCK HOLDING REQUIREMENT FOR CERTAIN NEO EQUITY AWARDS UNDER EQUITY INCENTIVE PLAN AMENDMENT | • REVISED PAYOUTS FOR 2022 PERFORMANCE AWARDS TO BETTER ALIGN PAY FOR PERFORMANCE IN THE EVENT PEER GROUP SIZE DECREASES | |||||||||||||||||||||||||||||

| ● | Reduced 2021 Executive Cash Bonuses to 60% of Target Level from 140%: In February 2021, the Compensation Committee made the determination that no cash bonuses would be payable in respect of fiscal year 2020 performance. Due to the continuing impact of the COVID-19 pandemic, the Committee deferred establishment of a new three-year Cash Incentive Plan (“CIP”) following the expiration of the 2018-2020 CIP. At a meeting of the Committee in July 2021, the Committee determined that, while there had been improvement in the Company’s financial performance, it was not a sufficient basis for adopting a new, multi-year CIP and, in lieu of the CIP, the Committee approved a one-year cash bonus program for 2021 (the “2021 COVID-19 Bonus Program”) to provide executives with a bonus opportunity as a percentage of their |

| 2022 Proxy Statement | ix |

| | | Proxy Statement Summary |

| normal base salary based on predetermined financial (including Adjusted EBITDA), operating, environmental, social and governance (“ESG”) and strategic performance metrics, subject to the Committee’s discretion and the Company’s financial condition and liquidity. The target payout under the 2021 COVID-19 Bonus program for the named executive officers was reduced to 100% of their normal base salary from the 150% target under the historic cash bonus program. In February 2022, the Compensation Committee exercised its negative discretion to reduce the cash bonuses payable to executives under the 2021 COVID-19 Bonus Program to 60% of the target level from the achieved level of 140% of the target level. |

| ● | Continued the Temporary Reductions of CEO Salary and Director Cash Retainers: The Compensation Committee proactively temporarily reduced executive salaries and director cash retainers by 50% in June 2020 to reflect the impact of the COVID-19 pandemic on the Company’s performance and financial condition. Although the salary of other executives were restored in October 2020, the salary of our Chief Executive Officer (“CEO”) remained reduced by 33-1/3% until March 1, 2021 and the cash retainer for our independent directors continued to be reduced by 33-1/3% through the second quarter of 2021. |

| ● | Increased Allocation of Performance Awards for NEOs to Improve Alignment with Stockholders: In order to further improve alignment with stockholder interests, the Compensation Committee has increased the percentage of NEO compensation consisting of at-risk awards. In 2021, the long-term incentive awards granted by the Compensation Committee to the executives consisted of 60% performance awards, up from 50% in the prior years and the weighting of the stock options decreased to 40%. The performance awards have a single three-year performance period and are earned based on Total Shareholder Return (“TSR”) as compared to a peer group. An emphasis on the TSR performance metric preserves performance accountability in both strong and weak commodity price environments and is aligned with stockholder interests. In 2022, the Compensation Committee also approved revisions to the forms of the performance award agreements to decrease the target payout opportunities where there are only six companies in the peer group. |

| ● | Implemented Additional Compensation Best Practices: In 2021 and 2022, the Compensation Committee also implemented additional compensation best practices including increasing the stock ownership requirement for the CEO and adding features to the Equity Incentive Plan that, if the Amendment is approved by stockholders, will impose a new one-year stock holding requirement for NEOs for stock options, stock appreciation rights and full-value awards. |

| x | 2022 Proxy Statement |  |

| Proxy Statement Summary | | |

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

In addition to the key compensation actions described-above, the executive compensation program for the named executive officers includes best-practice features that align executive compensation with the interests of our stockholders:

| What We Do | ||||||||||||

✔ Annual Say on Pay Vote

✔ Majority of named executive officer compensation is variable and linked to performance

✔ Long-term incentives are largely contingent on performance

✔ Objective TSR metric underlying the performance-based portion of the long-term incentive award aligned with stockholder interests

✔ Meaningful stock ownership guidelines for executive officers, which were met by all of the NEOs, including after taking into account the increase in 2022 for our CEO from 5x to 6x salary

✔ Change of control payment under employment agreements limited to 2.99 times base salary

| ✔ Grant stock options only at fair market value as of the grant date

✔ Compensation consultant independent from management

✔ One-year minimum vesting for all equity grants and, under the Amendment of the Equity Incentive Plan submitted for stockholder approval, one year stock holding requirement for NEOs after vesting or exercise for stock options, stock appreciation rights and full-value awards

✔ Payout of performance awards is capped at target amount if PBF’s TSR is negative

✔ Under the Amendment of the Equity Incentive Plan submitted for stockholder approval, there is a clawback policy applicable to equity awards granted to NEOs in the event of a material financial restatement, regardless of whether due to fraud or misconduct | |||||||||||

| What We Don’t Do | ||||||||||||

✘ No guaranteed minimum cash bonus payments to any of our executive officers

✘ No repricing of stock options

✘ No hedging or pledging or short selling of PBF Stock

✘ No excessive perquisites

✘ No excise tax gross-ups on any payments at a change of control

|

| ✘ No individual supplemental executive retirement arrangements

✘ No liberal share recycling under the Amendment of the Equity Incentive Plan submitted for stockholder approval | ||||||||||

| 2022 Proxy Statement | xi |

| | | Proxy Statement Summary |

GOVERNANCE HIGHLIGHTS

PBF Energy is committed to meeting high standards of ethical behavior, corporate governance and business conduct in everything we do, every day. This commitment has led us to implement the following practices:

Annual Election of All Directors Our directors are elected annually by vote of our stockholders.

Approximately 89% of Our Directors are Independent Eight of our nine current directors are, and assuming election of the nine director nominees at the Annual Meeting, eight out of nine of the directors will be independent.

Lead Director Our independent directors are led by an independent Lead Director and regularly meet in executive session.

Majority Voting for Uncontested Director Elections We have adopted majority voting for uncontested elections of directors, which requires that our directors must be elected by a majority of the votes cast with respect to such elections. | Independent Compensation Consultant Our Compensation Committee uses an independent compensation consultant, which performs no consulting or other services for the Company.

Absence of Rights Plan We do not have a shareholder rights plan, commonly referred to as a “poison pill.”

Chief Executive Officer Succession Planning Succession planning, which is conducted at least annually by our Board of Directors, addresses both an unexpected loss of our CEO and longer-term succession.

| Transactions in Company Securities Our insider trading policy prohibits all directors and employees from engaging in short sales and hedging or pledging transactions relating to our common stock.

Stock Ownership and Stock Holding Requirements In October 2016, we adopted stock ownership guidelines for our officers and directors. All of our executive officers and eight of our directors in 2021 met their stock ownership requirements. In 2022, the Board approved a new one-year stock holding requirement for our NEOs following the vesting or exercise of stock options, stock appreciation rights and full-value awards that will be effective if the Amendment is approved.

No Significant Related Party Transactions None of the directors or officers have been involved in any significant related party transactions.

|

| xii | 2022 Proxy Statement |  |

| Proxy Statement Summary | | |

SUSTAINABILITY HIGHLIGHTS

PBF Energy is committed to conservation of energy, continuous reduction of waste generated at our facilities, and ensuring that each of its facilities is in compliance with all applicable local, state, and federal environmental laws and standards.

All of our facilities utilize state of the art pollution control equipment to reduce emissions compared to historical rates. This equipment includes wet gas scrubbers, carbon monoxide boilers, and tail gas treating units on sulfur recovery units. In addition, PBF Energy has a robust internal team of technical professionals in our Health, Safety and Environment department, including numerous chemical and environmental engineers, located at our corporate headquarters and each of our major facilities.

Our Board provides oversight of all of our environmental efforts through the Health, Safety and Environment Committee, whose charter is posted on our website. Through the use of state-of-the-art equipment, environmental professionals, and strong Board and management oversight, PBF is able to continue on its path of ongoing improvement in the area of environmental protection and our results reflect the effectiveness of our environmental strategy.

Pursuit of Strategic Renewable Initiatives. In 2021, in addition to focusing on the safety and reliability of our core refining operations, we announced a potential project for a renewable fuels production facility intended to be co-located at the Chalmette refinery. The project is expected to use certain idled assets, including an idle hydrocracker, along with a newly-constructed pre-treatment unit to establish a 20,000 barrel per day renewable diesel production facility. As the project is still in development, there can be no assurance that the production facility will be completed.

HUMAN CAPITAL HIGHLIGHTS

PBF Energy believes that our people are our most important asset. We strive to provide our employees with a collaborative, supportive and inclusive work environment where they can maximize their personal and professional potential.

PBF Energy is dedicated to establishing a culture of diversity and inclusion where each employee is afforded the opportunity to excel and is valued for their unique background, experience, and point of view. Our commitment to this culture of inclusion is reflected in our recruiting efforts and the opportunities afforded to PBF Energy employees. For example, PBF Energy recently became a member of the Corporate Partnership Council of the Society of Women Engineers, which focuses on sharing best practices, addressing retention and advancement issues, and partnering on diversity initiatives. PBF Energy engineers have participated in the Corporate Partnership Council of the Society of Women Engineer’s annual conference.

PBF Energy is committed to the equal treatment of all people, regardless of race, creed, color, national origin, or economic level and PBF Energy supports the goals and principles set forth in the United Nations Universal Declaration of Human Rights. Our commitment to recognizing the value of all people is reflected in our core values and key policies, which touch upon business ethics and conduct; health, safety and environmental protection; and inclusion and diversity.

| 2022 Proxy Statement | xiii |

PBF Energy is a holding company whose primary asset is a controlling equity interest in PBF LLC. PBF LLC is a holding company for the companies that directly or indirectly own and operate our business. PBF Holding Company LLC (“PBF Holding”) is a wholly-owned subsidiary of PBF LLC and is the parent company for our refining operations. We own and operate six domestic oil refineries and related assets and are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States and Canada, and are able to ship products to other international destinations.

We are the sole managing member of PBF LLC and operate and control all of the business and affairs of PBF LLC. We consolidate the financial results of PBF LLC and its subsidiaries and record a noncontrolling interest in our consolidated financial statements representing the economic interests of the members of PBF LLC other than PBF Energy. In addition to PBF Holding, PBF Energy, through its ownership of PBF LLC, also consolidates the financial results of PBF Logistics LP (“PBFX” or the “Partnership”), a fee-based, growth-oriented, publicly traded Delaware master limited partnership formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined petroleum products terminals, pipelines, storage facilities and similar logistics assets. As of March 29, 2022, PBF LLC held a 47.9% limited partner interest (consisting of 29,953,631 common units) in PBFX, with the remaining 52.1% limited partner interest held by the public unit holders. PBF LLC also owns a non-economic general partner interest in PBFX through its wholly-owned subsidiary, PBF GP, the general partner of PBFX.

The outbreak of the COVID-19 pandemic negatively impacted worldwide economic and commercial activity and financial markets starting in the first quarter of 2020. The COVID-19 pandemic, the Delta variant and other variants thereof, and the related governmental and consumer responses resulted in significant business and operational disruptions, including business and school closures, supply chain disruptions, travel restrictions, stay-at-home orders and limitations on the availability of workforces and has resulted in significantly lower global demand for refined petroleum and petrochemical products. In 2021, the demand for these products began to rebound as a result of the lifting or easing of governmental restrictions in response to decreasing COVID-19 infection rates and the distribution of COVID-19 vaccines. Throughput across our refineries increased to a range of 800,000 to 900,000 barrel per day for our refining system in 2021 from a range of 700,000 to 800,000 barrel per day in 2020, reflecting increased utilization driven by improved market conditions.

2021 Performance Achievements

$12.1B INCREASE IN REVENUES IN 2021 COMPARED TO 2020 | +$2.4B LIQUIDITY BASED ON CASH AND BORROWING AVAILABILTY AT 12/31/21 | |||||||||||||||||||||||||||||||||||||

$329M REDUCTION IN CONSOLIDATED DEBT | $467.4M vs $(895.9)M

2021 vs 2020 ADJUSTED EBITDA* | |||||||||||||||||||||||||||||||||||||

| * | Adjusted EBITDA is a non-GAAP financial measure. For an explanation of how we use Adjusted EBITDA and reconciliation to our net income, please see “Non-GAAP Financial Measures” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2021 Form 10-K. |

| • | Strengthened our Liquidity and Financial Position. As of December 31, 2021, our operational liquidity was more than $2.4 billion based on approximately $1.3 billion of cash and in excess of $1.1 billion of borrowing availability under our asset-based lending facility. In addition, PBF Logistics LP had $33.9 million in cash and approximately $396.5 million of availability under its revolving credit facility. In the second half of the year, we repurchased a combined total principal amount of approximately $229.0 million of our 2028 Senior Notes and 2025 Senior Notes for an aggregate cash amount of approximately $146.8 million. Combined with the $100.0 million of debt repayments made by PBF Logistics LP, consolidated debt for PBF has been reduced by approximately $329.0 million. |

| 2022 Proxy Statement | 1 |

| | | About PBF Energy |

| • | Significantly Improved Revenues and Adjusted EBITDA. Our 2021 revenues improved to approximately $27.3 billion compared to $15.1 billion in 2020 and Adjusted EBITDA was approximately $467.4 million in 2021 compared to approximately $(895.9) million in 2020. |

In December 2012, we completed an initial public offering (“IPO”) of our Class A Common Stock, which is listed on the NYSE. We have another class of common stock, Class B Common Stock, which has no economic rights but entitles the holder, without regard to the number of shares of Class B Common Stock held, to a number of votes on matters presented to our stockholders that is equal to the aggregate number of PBF LLC Series A Units held by such holder. The Class A Common Stock and the Class B Common Stock are referred to as our “common stock.” We were initially sponsored and controlled by funds affiliated with The Blackstone Group L.P., or Blackstone, and First Reserve Management, L.P., or First Reserve (collectively referred to as “our former sponsors”).

As of the March 29, 2022 record date, certain of our current and former executive officers, directors and employees and their affiliates beneficially owned 927,990 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC Series A Units as “pre-IPO owners” of PBF LLC). Each of the pre-IPO owners of PBF LLC holds one share of Class B Common Stock entitling the holder to one vote for each PBF LLC Series A Unit they hold.

INFORMATION REGARDING THE BOARD OF DIRECTORS

PBF’s business is managed under the direction of our Board. As of December 31, 2021, our Board had nine members, including our Chief Executive Officer, Thomas Nimbley. During 2021, one of our directors, William Hantke, who served on the Audit and Compensation Committees, retired as a director of the Company as of December 31, 2021. Effective January 1, 2022, Paul J. Donahue, Jr. was appointed by the Board of Directors as an independent director and a member of the Audit Committee.

Our Board conducts its business through meetings of its members and its committees. During 2021, our Board held eight (8) meetings and each member of the Board participated in at least 75% of the meetings held while they were in office. All of the directors then in office participated in the Annual Meeting of Stockholders in 2021. All Board members standing for re-election are expected to attend the 2022 Annual Meeting.

The Board’s Audit Committee, Compensation Committee, Health, Safety and Environment Committee and Nominating and Corporate Governance Committee are composed entirely of directors who meet the independence requirements of the NYSE listing standards and any applicable regulations of the Securities and Exchange Commission, or the SEC.

Under the NYSE’s listing standards, no director qualifies as independent unless the Board affirmatively determines that he or she has no material relationship with PBF. Based upon information requested from and provided by our directors concerning their background, employment, and affiliations, including commercial, banking, consulting, legal, accounting, charitable, and familial relationships, the Board has determined that, other than being a director and/or stockholder of PBF, each of the independent directors named below has either no relationship with PBF, either directly or as a partner, stockholder, or officer of an organization that has a relationship with PBF, or has only immaterial relationships with PBF, and is independent under the NYSE’s listing standards.

In accordance with NYSE listing standards, the Board has adopted categorical standards or guidelines to assist the Board in making its independence determinations regarding its directors. These standards are published in Article I of our Corporate Governance Guidelines and are available on our website at www.pbfenergy.com under the “Corporate Governance” tab in the “Investors” section. Under NYSE’s listing standards, immaterial relationships that fall within the guidelines are not required to be disclosed in this proxy statement. An immaterial relationship falls within the guidelines if it:

| • | is not a relationship that would preclude a determination of independence under Section 303A.02(b) of the NYSE Listed Company Manual; |

| 2 | 2022 Proxy Statement |  |

| About PBF Energy | | |

| • | consists of charitable contributions, grants or endowments by PBF to an organization in which a director is an executive officer and does not exceed the greater of $1 million or 2% of the organization’s gross revenue in any of the last three years; |

| • | consists of charitable contributions, grants or endowments to any organization with which a director, or any member of a director’s immediate family, is affiliated as an officer, director, or trustee pursuant to a matching gift program of PBF and made on terms applicable to employees and directors; or is in amounts that do not exceed $1 million per year; and |

| • | is not required to be, and it is not otherwise, disclosed in this proxy statement. |

The Board has determined that all of the 2022 non-management director nominees meet the independence requirements of the NYSE listing standards as set forth in the NYSE Listed Company Manual: Spencer Abraham, Wayne Budd, Karen Davis, Paul J. Donahue, Jr., S. Eugene Edwards, Robert Lavinia, Kimberly Lubel and George Ogden. Mr. Edwards serves as the Lead Director.

| 2022 Proxy Statement | 3 |

| | | About PBF Energy |

In 2021, PBF had and continues to have these standing committees of the Board:

| • | Audit Committee; |

| • | Compensation Committee; |

| • | Nominating and Corporate Governance Committee; and |

| • | Health, Safety and Environment Committee (the “HS&E Committee”). |

We have adopted a charter setting forth the responsibilities of each of the committees. The committee charters are available on our website at www.pbfenergy.com under the “Corporate Governance” tab in the “Investors” section. The members of each committee in 2021, including the Chairperson, as well as the number of meetings held in 2021 is set forth in the table below:

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Health, Safety and Environment Committee | ||||

| Spencer Abraham |  | l | ||||||

| Wayne Budd | l |  | ||||||

| Karen Davis |  | |||||||

| S. Eugene-Edwards | l | l | ||||||

| Robert Lavinia | l | |||||||

| William Hantke (1) | l | l | ||||||

| Kimberly Lubel | l |  | ||||||

| George Ogden | l | |||||||

| # of Meetings Held in 2021 | 4 | 4 | 5 | 4 | ||||

Chairperson 🌑 Member

Chairperson 🌑 Member

| (1) | Mr. Hantke retired from the Board effective December 31, 2021. Effective January 1, 2022, Paul J. Donahue, Jr. joined the Board and the Audit Committee. |

Audit Committee

The Audit Committee reviews and reports to the Board on various auditing and accounting matters, including the quality, objectivity, and performance of our internal and external accountants and auditors, the adequacy of our financial controls, and the reliability of financial information reported to the public. In 2021, the members of the Audit Committee were Karen Davis (Chairperson), William Hantke and George Ogden. Ms. Davis and Messrs. Hantke and Ogden were each determined by the Board to be an “Audit Committee financial expert” (as defined by the SEC). Currently, Ms. Davis and Mr. Ogden continue to serve on the Audit Committee along with Paul J. Donahue, Jr. who was appointed to the Audit Committee effective January 1, 2022 and each has been determined by the Board to be an “Audit Committee financial expert”.

In 2021, the Audit Committee met four (4) times and each meeting was attended by all of the members. The “Report of the Audit Committee for Fiscal Year 2021” appears in this proxy statement following the disclosures related to Proposal No. 2.

| 4 | 2022 Proxy Statement |  |

| About PBF Energy | | |

Compensation Committee

The Compensation Committee reviews and reports to the Board on matters related to compensation strategies, policies, and programs, including certain personnel policies and policy controls, management development, management succession, and benefit programs. The Compensation Committee also approves and administers our equity incentive compensation plan and cash incentive plan. The Compensation Committee’s duties are described more fully in the “Compensation Discussion and Analysis” section below.

In 2021, the members of the Compensation Committee were Spencer Abraham (Chairperson), Wayne Budd, William Hantke and Kimberly Lubel. Currently, the Compensation Committee consists of Messrs. Abraham and Budd and Ms. Lubel and each of the members qualifies as independent under applicable SEC rules and regulations and the rules of the NYSE, as an “outside director” for the purposes of Section 162(m) of the Internal Revenue Code (the “Code”), as in effect in 2021, and as a “non-employee director” for the purposes of Rule 16b-3 under the Exchange Act.

In 2021, the Compensation Committee met four (4) times and the meetings were attended by all of the then members. The “Compensation Committee Report” for Fiscal Year 2021 appears in this proxy statement immediately following “Executive Compensation”.

Compensation Committee Interlocks and Insider Participation

There are no Compensation Committee interlocking relationships. None of the members of the Compensation Committee has served as an officer or employee of PBF or had any relationship requiring disclosure by PBF under Item 404 of the SEC’s Regulation S-K, which addresses related person transactions.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee evaluates policies on the size and composition of the Board and criteria and procedures for director nominations and considers and recommends candidates for election to the Board. The committee also evaluates, recommends, and monitors corporate governance guidelines, policies, and procedures, including our codes of business conduct and ethics. The three members of the Nominating and Corporate Governance Committee are Wayne Budd (Chairperson), Spencer Abraham, and S. Eugene Edwards. The Nominating and Corporate Governance Committee met five (5) times in 2021 and the meetings were attended by all members.

The Nominating and Corporate Governance Committee recommended to the Board each presently serving director of PBF as nominees for election as directors at the Annual Meeting. The Nominating and Corporate Governance Committee also considered and recommended the appointment of a Lead Director (described below under “Board Leadership Structure, Lead Director and Meetings of Non-Management Directors”) to preside at meetings of the independent directors without management, and recommended assignments for the Board’s committees. The full Board approved the recommendations of the Nominating and Corporate Governance Committee and adopted resolutions approving the slate of director nominees to stand for election at the Annual Meeting, the appointment of a Lead Director, and Board committee assignments.

Health, Safety and Environment Committee

The HS&E Committee assists the Board of Directors in fulfilling its oversight responsibilities by assessing the effectiveness of programs and initiatives that support the Health, Safety and Environment and sustainability, innovation, and technology policies and programs of the Company. Kimberly Lubel is the chairperson of the HS&E Committee and Messrs. Edwards and Lavinia are also members. In 2021, the Health, Safety and Environment Committee met four (4) times and the meetings were attended by all members.

The Board is committed to striking a balance between retaining directors with deep knowledge of the Company and seeking fresh perspectives in its recruiting efforts. Our Board and individual director evaluation process supports this objective.

| 2022 Proxy Statement | 5 |

| | | About PBF Energy |

The Board has welcomed 3 of its 9 current directors since 2018. These new directors were deliberately selected for their relevant skill sets and their ability to guide our strategy, provide effective oversight and effectively represent our stockholders’ interests. The average tenure of our current directors is 5.3 years.

SELECTION OF DIRECTOR NOMINEES

The Nominating and Corporate Governance Committee solicits recommendations for Board candidates from a number of sources, including our directors, our officers and individuals personally known to the members of the Board. Mr. Donahue was appointed as a director by action of the Board of Directors following the recommendation of the Nominating and Corporate Governance Committee. In connection with filling the vacancy arising from Mr. Hantke’s retirement, the Nominating and Corporate Governance Committee interviewed several diverse candidates recommended by members of the Board and management. The Nominating and Corporate Governance Committee will consider candidates submitted by stockholders when submitted in accordance with the procedures described in this proxy statement under the caption “Miscellaneous– Stockholder Nominations and Proposals.” The Nominating and Corporate Governance Committee will consider all candidates identified through the processes described above and will evaluate each of them on the same basis. The level of consideration that the Nominating and Corporate Governance Committee will extend to a stockholder’s candidate will be commensurate with the quality and quantity of information about the candidate that the nominating stockholder makes available to the Nominating and Corporate Governance Committee.

Evaluation of Director Candidates

The Nominating and Corporate Governance Committee is charged with assessing the skills, characteristics and diversity of background and experience (including gender, race, ethnicity and age) that candidates for election to the Board should possess and with determining the composition of the Board as a whole. The assessments include qualifications under applicable independence standards and other standards applicable to the Board and its committees, as well as consideration of the skills, expertise and diversity that should be added to complement the composition and experience of the existing Board of Directors.

In evaluating each candidate, the Nominating and Corporate Governance Committee may consider among other factors it may deem relevant:

| • | whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships with the Company, its management or their affiliates; |

| • | whether or not the person serves on boards of, or is otherwise affiliated with, competing companies; |

| • | whether or not the person is willing to serve as, and willing and able to commit the time necessary for the performance of the duties of, a director of the Company; |

| • | the contribution which the person can make to the Board and the Company, with consideration being given to the person’s business and professional experience, education and such other factors as the Nominating and Corporate Governance Committee may consider relevant; |

| • | the diversity in gender, ethnic background, and professional experience of a candidate; and |

| • | the integrity, strength of character, independent mind, practical wisdom, and mature judgment of the person. |

Based on this initial evaluation, the Nominating and Corporate Governance Committee will determine whether to interview a proposed candidate and, if warranted, will recommend that one or more of its members, other members of the Board, or senior management, as appropriate, interview the candidate. After completing this process, the Nominating and Corporate Governance Committee ultimately determines its list of nominees and submits the list to the full Board for consideration and approval.

| 6 | 2022 Proxy Statement |  |

| About PBF Energy | | |

Director Skills and Experience

In addition to the factors considered during the nominating process, the Nominating and Corporate Governance Committee has identified a number of key skills and areas of expertise it believes should be represented on the board for the reasons shows below:

Executive Leadership

Directors with prior experience in executive leadership positions bring the qualifications and skills to develop and oversee our strategy, to create and drive long-term value, and to identify, motivate, and retain individual leaders. | ||||||||||||||||

9 of 9 Directors | ||||||||||||||||

Public Company Governance

Directors who have served on other public company boards have experience overseeing and providing insight and guidance to management and bring critical knowledge of governance to our organization. | ||||||||||||||||

9 of 9 Directors | ||||||||||||||||

Industry Expertise

Directors with leadership and/or operational experience in industries relevant to our business bring practical understanding of our business and effective oversight of implementation of strategy. | ||||||||||||||||

9 of 9 Directors | ||||||||||||||||

Strategy

Directors with a background in strategy bring a practical understanding of developing, implementing, and addressing our business strategy and development plan. | ||||||||||||||||

9 of 9 Directors | ||||||||||||||||

Health, Safety, Environmental, Corporate Governance and Social Responsibility

Directors with experience overseeing, operating, or advising on matters of the environment, sustainable energy, corporate and social responsibility, health, and safety provide effective oversight over these matters and support our commitment to social responsibility and creating long-term shared value with our stakeholders. | ||||||||||||||||

7 of 9 Directors | ||||||||||||||||

Accounting and Audit

Financial and audit expertise, particularly knowledge of finance and financial reporting processes, is critical to understanding and evaluating our capital structure and overseeing the preparation of our financial statements and internal controls over financial reporting. | ||||||||||||||||

5 of 9 Directors | ||||||||||||||||

Risk Management

Directors with experience managing risk bring skills critical to the Board’s oversight of our risk assessment and risk management programs. | ||||||||||||||||

5 of 9 Directors | ||||||||||||||||

Government, Regulatory and Public Policy

Directors with experience or background relating to governmental, regulatory or public policy matters governmental affairs bring knowledge helpful to navigating complex regulatory frameworks. | ||||||||||||||||

5 of 9 Directors | ||||||||||||||||

| 2022 Proxy Statement | 7 |

| | | About PBF Energy |

The following table sets forth additional criteria and more specific skills we use to evaluate nominees, as well as the qualifications of our director nominees:

| Director / Nominee | ||||||||||||||||||||||||||||||||||||

| Skill, Experience and Expertise | Spencer Abraham | Wayne Budd | Karen Davis | Paul J. Donahue, Jr. | S. Eugene Edwards | Robert Lavinia | Kimberly Lubel | Thomas Nimbley | George Ogden | |||||||||||||||||||||||||||

| Finance | ||||||||||||||||||||||||||||||||||||

Risk Management | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||

Accounting/Auditing | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||

Capital Markets | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||

| CEO Experience | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||||

| Legal | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||||

| Strategy | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||

Strategic Transactions (M&A) | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||||||||||||||||

| Human Resources | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||||||||||||||||||

| Health, Safety and Environmental | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||

| Corporate Governance and Social Responsibility | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||

| Executive Leadership | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||

| Regulatory/Public Policy | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||||

| Industry Knowledge | ||||||||||||||||||||||||||||||||||||

Refining/Manufacturing | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||

Logistics | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||||

Supply Chain | ✔ | ✔ | ||||||||||||||||||||||||||||||||||

Energy | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||||||||||||||

| Public Board Experience | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||||||||||||||||

Our Nominating and Corporate Governance Committee oversees an annual Board and committee self-evaluation process providing each member of the Board the opportunity to complete detailed surveys designed to assess the effectiveness of both the Board as a whole and each of its committees. The surveys seek feedback on, among other things, Board and committee composition and organization, the frequency and content of Board and committee meetings, the quality of management presentations to the Board and its committees, the Board’s relationship to senior management and the performance of the Board and its committees in light of the responsibilities of each body as established in our Corporate Governance Guidelines and the respective committee charters.

Our Chairman and CEO and Lead Director lead a discussion of survey results with all of the directors as a group, and each committee chair leads a discussion of committee results within a committee meeting setting. Our Nominating and Corporate Governance Committee believes this process, which combines the opportunity for each director to individually reflect on Board and committee effectiveness with a collaborative discussion on performance, provides a meaningful assessment tool and a forum for discussing areas for improvement.

BOARD LEADERSHIP STRUCTURE, LEAD DIRECTOR AND MEETINGS OF NON-MANAGEMENT DIRECTORS

Following the retirement of our Executive Chairman in 2016, our Board of Directors determined that the most effective leadership structure at this time is to have a Chairman of the Board who is also the CEO. The Board may modify this structure in the future to ensure that the Board leadership structure for the Company remains effective and advances the best interests of our stockholders.

| 8 | 2022 Proxy Statement |  |

| About PBF Energy | | |

Our Board appoints a “Lead Director” whose responsibilities include leading the meetings of our non-management directors outside the presence of management. S. Eugene Edwards is currently our Lead Director. The Lead Director acts as the chair of all non-management director meetings sessions and is responsible for coordinating the activities of the other outside directors, as required by our Corporate Governance Guidelines and the NYSE listing standards. The Lead Director, working with committee chairpersons, sets agendas and leads the discussion of regular meetings of the Board outside the presence of management, provides feedback regarding these meetings to the Chairman, and otherwise serves as a liaison between the independent directors and the Chairman. The Lead Director is also responsible for receiving, reviewing, and acting upon communications from stockholders or other interested parties when those interests should be addressed by a person independent of management. The independent directors, to the extent not identical to the non-management directors, are required to meet in executive session as appropriate matters for their consideration arise, but, in any event, at least once a year. The agenda of these executive sessions includes such topics as the participating directors shall determine. Our independent directors typically meet in executive session prior to every Board meeting.

The Board considers oversight of PBF’s risk management efforts, including cyber security risks, to be a responsibility of the full Board. The Board’s role in risk oversight includes receiving regular reports from members of senior management on areas of material risk to PBF, or to the success of a particular project or endeavor under consideration, including operational, financial, legal, regulatory, strategic, and reputational risks. The full Board (or the appropriate Board committee) receives reports from management to enable the Board (or committee) to assess PBF’s risk identification, risk management and risk mitigation strategies. When a report is vetted at the committee level, the chairperson of that committee thereafter reports on the matter to the full Board. This enables the Board and its committees to coordinate the Board’s risk oversight role. The Board also believes that risk management is an integral part of PBF’s annual strategic planning process, which addresses, among other things, the risks and opportunities facing PBF.

| 2022 Proxy Statement | 9 |

(Item 1 on the Proxy Card)

All of PBF’s directors are subject to election each year at the annual meeting of stockholders. If elected at the Annual Meeting, all of the nominees for director listed below will serve a one-year term expiring at the 2022 Annual Meeting of Stockholders. On the proxy card, PBF has designated certain persons who will be voting the proxies submitted for the Annual Meeting and these persons will vote as directed by your proxy card. If your proxy card does not provide voting instructions, these persons will vote for the election of each of these nominees.

✓ | The Board recommends a vote “FOR” all nominees

|

Under our bylaws, each director to be elected under this Proposal No. 1 must be elected by the vote of the majority of the votes cast “For” or “Against” the nominee. With respect to each nominee, the director must be elected by a majority vote, that means the number of shares voted “For” a director nominee must exceed 50% of the votes cast with respect to that nominee (with “abstentions” and “broker non-votes” not counted as votes cast either “for” or “against” that nominee’s election).

If a director is not elected by a majority vote, such director must promptly offer to tender his or her irrevocable resignation to the Board. The Nominating and Governance Committee, or such other committee designated by the Board, will recommend to the Board whether to accept or reject the resignation. The Board will act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within ninety (90) days following the date of the certification of the election results.

If any nominee is unavailable as a candidate at the time of the Annual Meeting, either the number of directors constituting the full Board will be reduced to eliminate the resulting vacancy, or the persons named as proxies will use their best judgment in voting for an alternative nominee.

INFORMATION CONCERNING NOMINEES AND DIRECTORS

Our directors, each of whom is a nominee for election as a director at the Annual Meeting, are listed in the following table. The table sets forth certain information regarding our directors as of the date of this proxy statement. If elected, each director will hold office until a successor is elected and qualified or until his or her earlier death, resignation or removal.

| 10 | 2022 Proxy Statement |  |

| Proposal No. 1 – Election of Directors | | |

THOMAS J. NIMBLEY

Chairman of the Board and Chief Executive Officer

Age: 70

Director Since: 2014 |

| Biography:

Mr. Nimbley has served as Chairman of the Board since June 30, 2016. He has served as our Chief Executive Officer since June 2010 and was our Executive Vice President, Chief Operating Officer from April 2010 through June 2010. In his capacity as PBF Energy Inc.’s Chief Executive Officer, Mr. Nimbley also serves as a director and the Chief Executive Officer of its subsidiaries, including PBF GP, the general partner of PBFX, of which he is also Chairman of the Board. Prior to joining PBF Energy, Mr. Nimbley served as a Principal for Nimbley Consultants LLC from June 2005 to March 2010, where he provided consulting services and assisted on the acquisition of two refineries. He previously served as Senior Vice President and head of Refining for Phillips and subsequently Senior Vice President and head of Refining for ConocoPhillips’ domestic refining system (13 locations) following the merger of Phillips and Conoco. Before joining Phillips at the time of its acquisition of Tosco in September 2001, Mr. Nimbley served in various positions with Tosco and its subsidiaries starting in April 1993.

Qualifications:

Mr. Nimbley’s extensive experience in and knowledge of the refining industry, as well as his proven leadership skills and management experience provides the Board with valuable leadership and, for these reasons, PBF believes Mr. Nimbley is a valuable member of its Board of Directors.

| ||||

SPENCER ABRAHAM

Director

Age: 69

Director Since: 2012

Committees:

• Compensation Committee (Chair)

• Nominating and Corporate Governance Committee | Biography: